Airbitz bitcoin wallet app recently underwent a major rebranding that saw its name to Edge wallet. In addition to the open-sourced crypto mobile app, it was also subjected to massive structural changes that aim at making it the most secure and easy to use the wallet.

The most visible changes include its shift from a Bitcoin-only to a multi-blockchain wallet and a more intuitive user interface. The Edge development team has also integrated several operational and security features to the highly versatile mobile wallet.

This Airbitz/Edge crypto wallet app review seeks to highlight all these features and examine their effectiveness in making it the most secure wallet. We will also be addressing its ease of use, supported currencies and compare it with other multi-currency wallets before telling you if it really is the most secure crypto wallet app available.

AIRBITZ key features:

Versatile mobile app: Edge is a highly versatile mobile wallet app. It is not only available for the popular Android and iOS smartphone operating systems but is also available for Windows phones.

Inbuilt exchange: Edge features an inbuilt crypto exchange. Therefore, you don’t have to leave the wallet to buy, sell, or exchange cryptocurrencies, which saves time and eliminates unnecessary transaction fees.

Support for fiat purchases: Edge wallet app doesn’t just let you store, buy, and sell cryptos within the app but also lets you make crypto purchases using fiat currencies through either bank wire transfers to the wallet or via credit card.

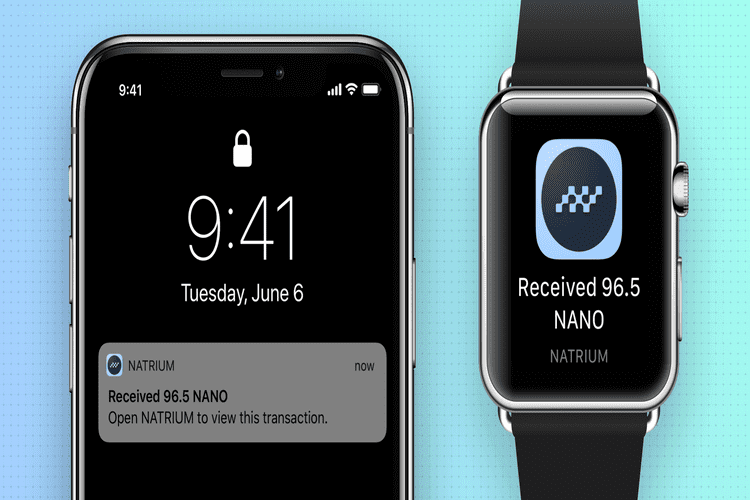

Bluetooth transactions: Edge crypto wallet app supports Bluetooth Low Energy (BLE), which means you don’t need to be online to initiate a transaction. BLE allows you to send cryptocurrencies to other individuals via Bluetooth.

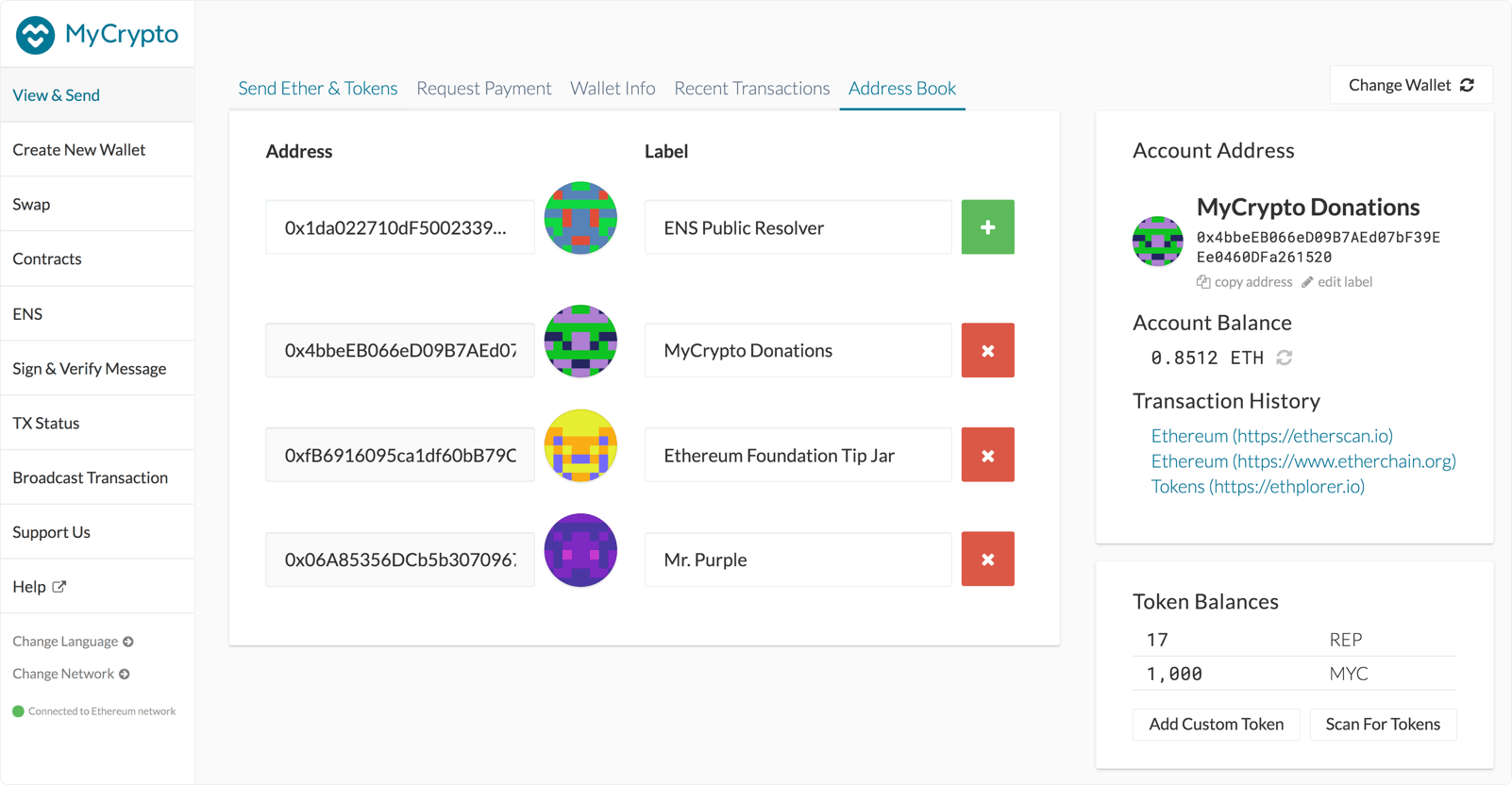

Address book: The wallet seeks to eliminate the risk of sending funds to the wrong wallet by introducing the in-app address book where you can save a crypto recipient’s address, name, and photo for easy access when sending them digital coins.

AIRBITZ security features

Password and Biometrics: Edge embraces a multi-layered wallet protection feature. When creating a user account, you will first be required to set a strong multi-character password for the wallet. You are then required to set a four-digit passcode for regular logins. Additionally, you have the option of adding the fingerprint or face ID login option.

Open source: Edge is also built on an open-sourced technology and allows for scrutiny from both wallet app users and blockchain experts. The code can be downloaded from the official Edge wallet app website or GitHub.

Hierarchically deterministic: The wallet app is also hierarchically deterministic, implying that the public wallet address is auto-generated for every new transaction, which furthers the wallet’s commitment to user privacy.

Automated wallet backup: Unlike other crypto wallets that require you to save and memorize a lengthy recovery seed, your passphrase for the Edge wallet doubles up as your recovery seed.

Client-side encryption: Client-side encryption implies that any data that your wallet shares with the Edge wallet servers or third party systems is encrypted before it leaves your wallet app, effectively safeguarding it against possible man-in-the-middle attacks.

Anonymous registration: Edge crypto wallet app doesn’t ask for personal information like name or address when creating a user account. Neither does it collect or store any personal information when you use the wallet app.

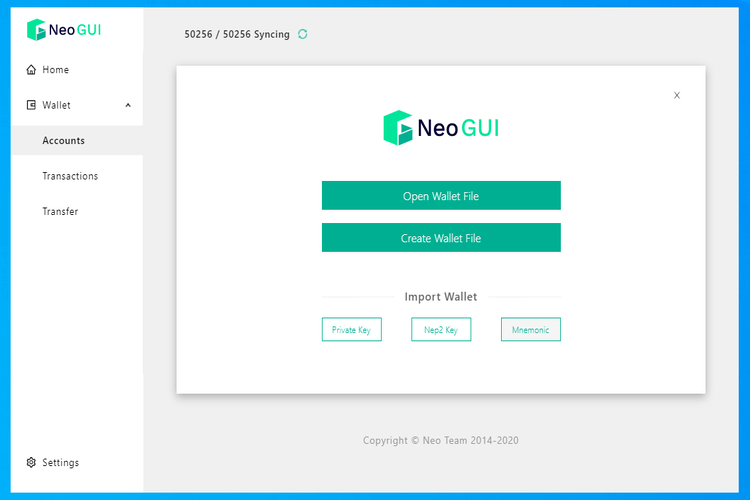

How to set and activate the AIRBITZ wallet

Step 1: Download and install the Edge crypto wallet app compatible with your phone’s operating system.

Step 2: Once installed, launch the app and create a username

Step 3: Create a unique and multi-character password (with a minimum of 10-characters)

Step 4: Set a four-digit passcode that you will be using for regular on-device logins

Step 5: The wallet will request that you write down this information (username, password, and passcode) on a piece of paper and save it offline

Step 6: Read and agree to the crypto wallet app’s terms of use

Step 7: Clicking finish takes you to your account’s user dashboard, an indication that the wallet is active and ready for use.

How to add/receive Crypto into your AIRBITZ wallet

Step 1: Log in to your edge wallet and click the “Request” button

Step 2: Select the wallet address where you would like the coins deposited and enter the number of coins you wish to receive

Step 3: Copy this information and forward it to the party sending you cryptos.

Step 4: Alternatively, hit the share button if you want to share this information with the individual sending cryptos via SMS or email

Step 5: Wait for the funds to reflect in your wallet.

How to send Crypto from your AIRBITZ wallet

Step 1: Log in to your Edge crypto wallet and app and on the user dashboard, tap on the “Send” icon

Step 2: If you have multiple digital assets stored therein, select the wallet from whence you would like to send the coins

Step 3: On the transfer window, enter the recipient’s wallet address and the number of coins you wish to send

Step 4: Confirm that the transaction details are accurate.

Step 5: Slide the authorization button to authorize the transfer

AIRBITZ wallet ease of use

Edge crypto has a relatively straightforward onboarding process. The processes of sending and receiving cryptos are also easy and straightforward. The user dashboard is also easily navigable and specially designed for both the experienced and beginner crypto investors.

The user interface is also highly customizable and allows you to tweak most of the basic features, including its theme. It also integrates a map of all BTC-accepting stores in your neighborhood.

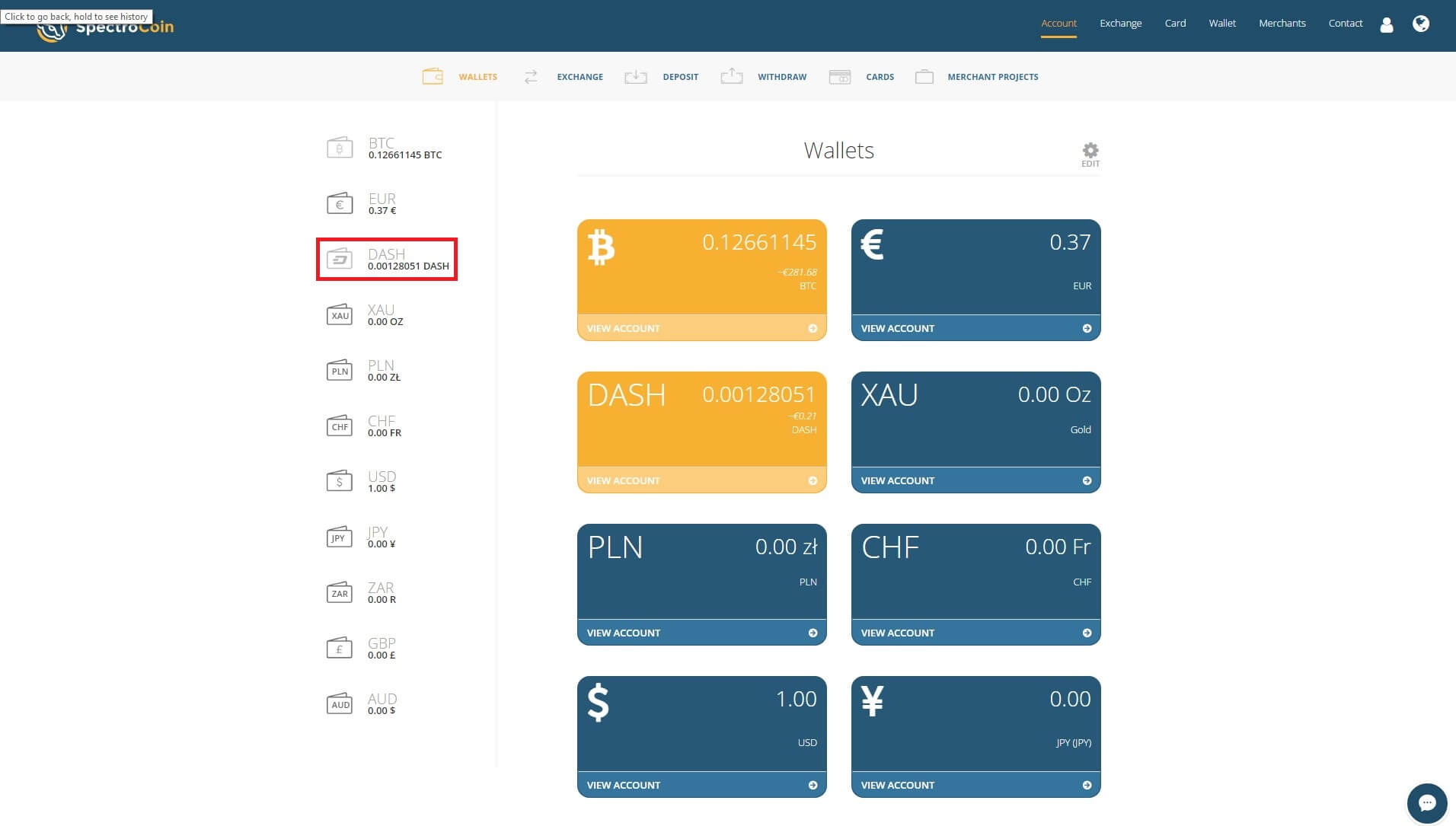

AIRBITZ wallet supported currencies and countries

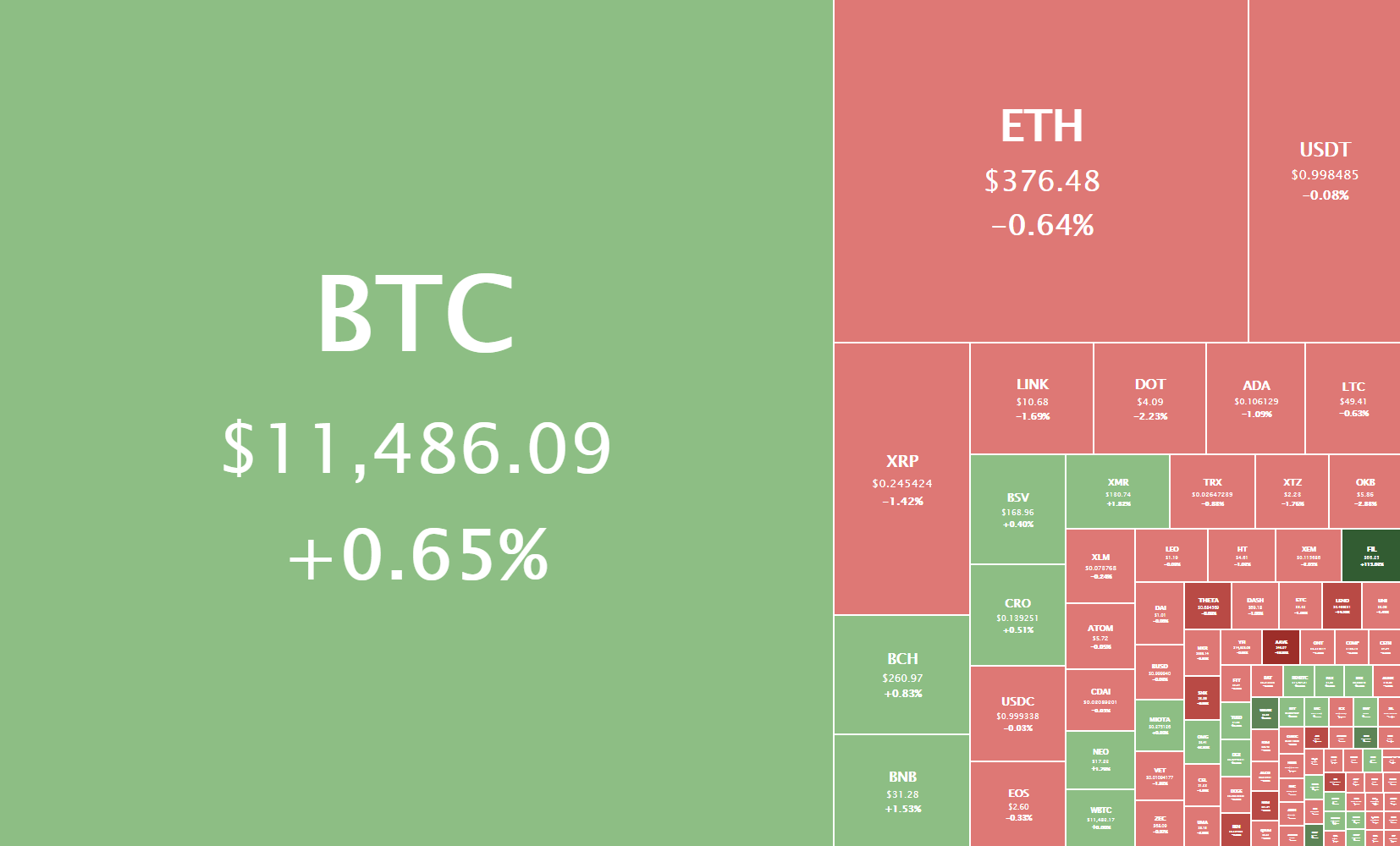

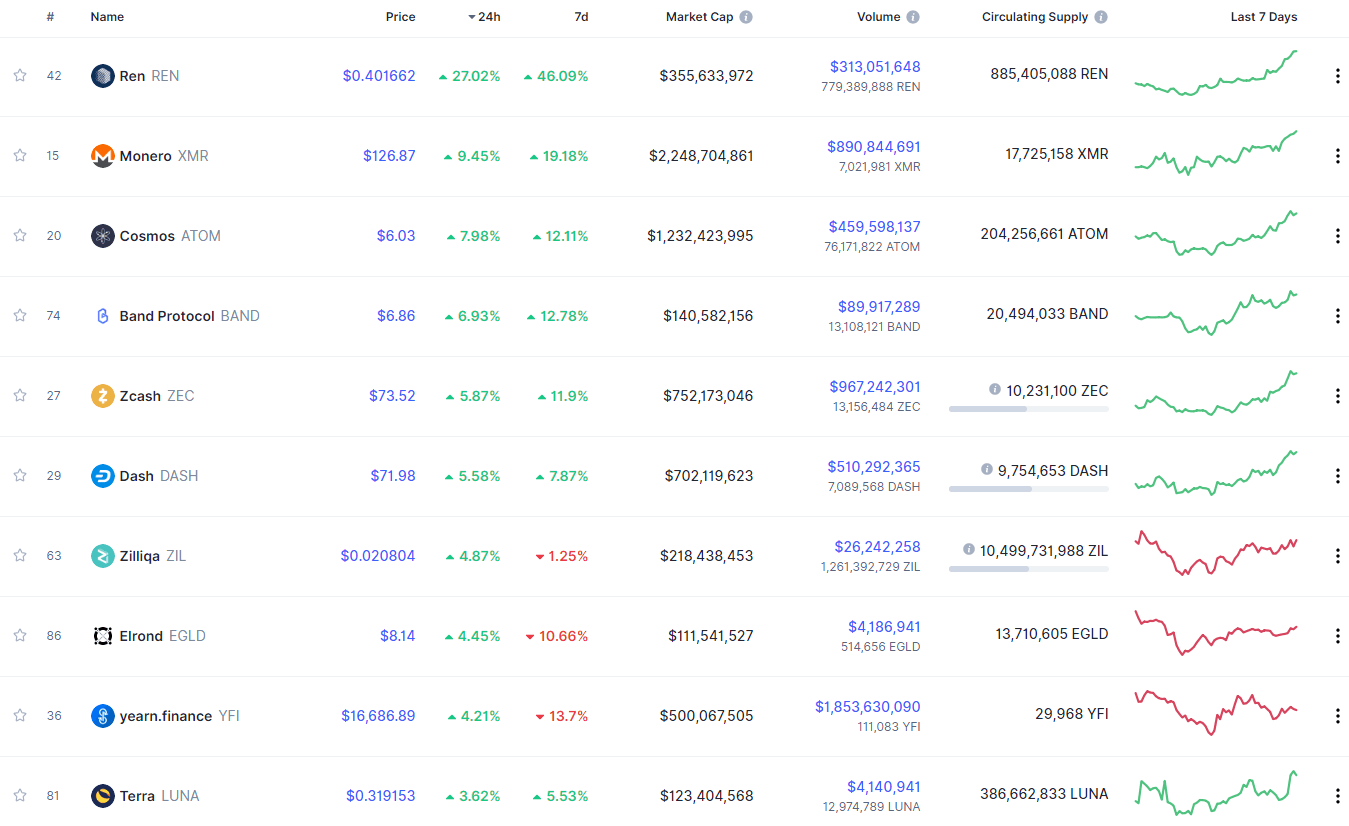

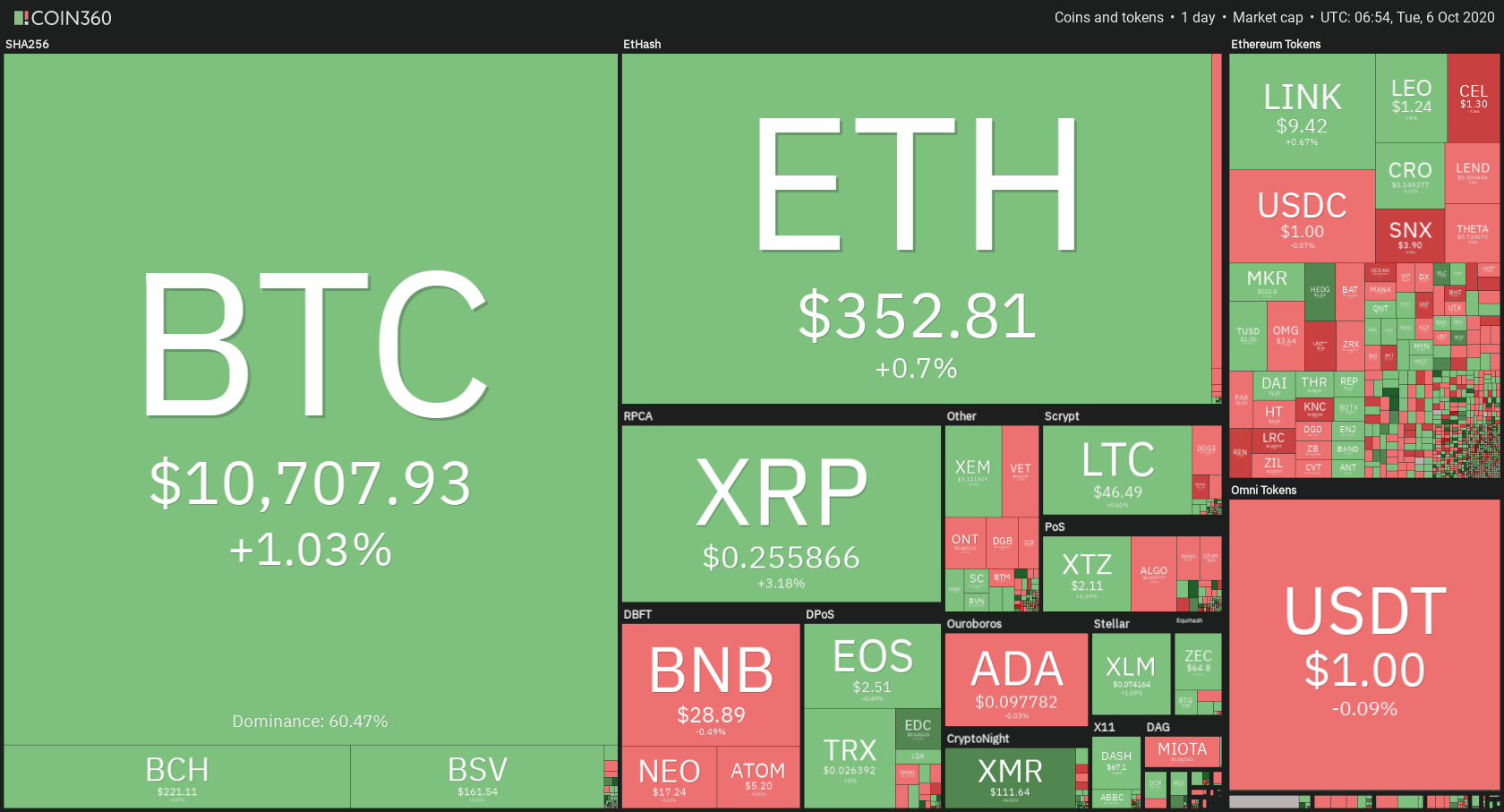

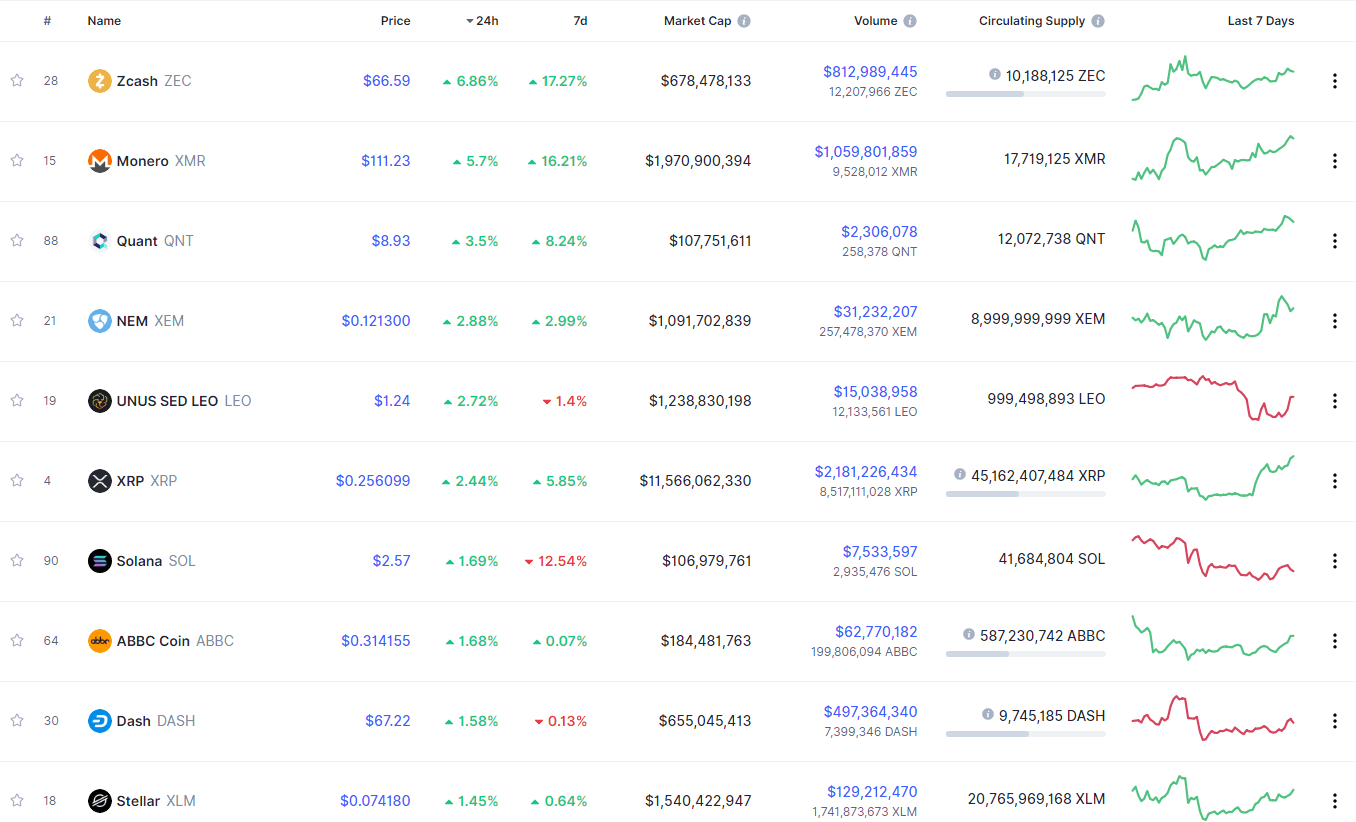

Edge is a multi-blockchain and multi-currency wallet for all popular cryptos, including Bitcoin, Ethereum. Litecoin, Ripple, Monero, Bitcoin Cash, Dash, Bitcoin Gold, Dogecoin, and all ERC-20 tokens.

AIRBITZ wallet cost and fees

Installing the Edge crypto wallet is free. However, you will pay a competitive transaction processing fee every time you send cryptocurrencies to another wallet or exchange. This fee is collected by the different blockchain miners and administrators and not the Edge wallet.

What are the pros and cons of using the AIRBITZ wallet?

Pros:

- Edge is built on an open-sourced technology and also supports two-factor authentication.

- The wallet app is highly intuitive and beginner-friendly

- Edge is a multi-currency wallet supporting 40+ cryptocurrencies and tokens.

- The wallet gives you absolute control of your private keys and password while simplifying the wallet backup process.

- The wallet features an in-app exchange and integrates a crypto exchange.

Cons:

- One may still consider the number of supported cryptocurrencies to be limited.

- It is a mobile app and not available for desktop or online (web) access.

- It is not a multi-signature wallet.

Comparing AIRBITZ wallet with other Multiblockchain wallets

AIRBITZ wallet vs. BRD wallet

Edge is similar to BRD (also known as Bread wallet). They both started as bitcoin-only wallets before structural upgrades saw them appreciate and store other altcoins. Both are also easy to use, feature an inbuilt exchange, and have a highly intuitive user interface designed to appeal to experienced and beginner crypto traders. The recent update to the Edge wallet has, however, seen it incorporate more operational and security features when compared to BRD. One may also consider the Edge wallet app’s user interface to be user-friendlier.

Verdict: Is the AIRBITZ wallet safe?

Yes, Airbitz – now Edge – crypto wallet app has incorporated a wide range of security features to keep your private keys safe and within your control. These are highly effective and start with keeping all your sensitive information within the wallet and out of anyone’s (including their servers) reach. This data is also subjected to military-grade client-side encryption. The app’s equally effective security features include hierarchically deterministic address generation, biometrics support, and the all-important two-factor authentication.

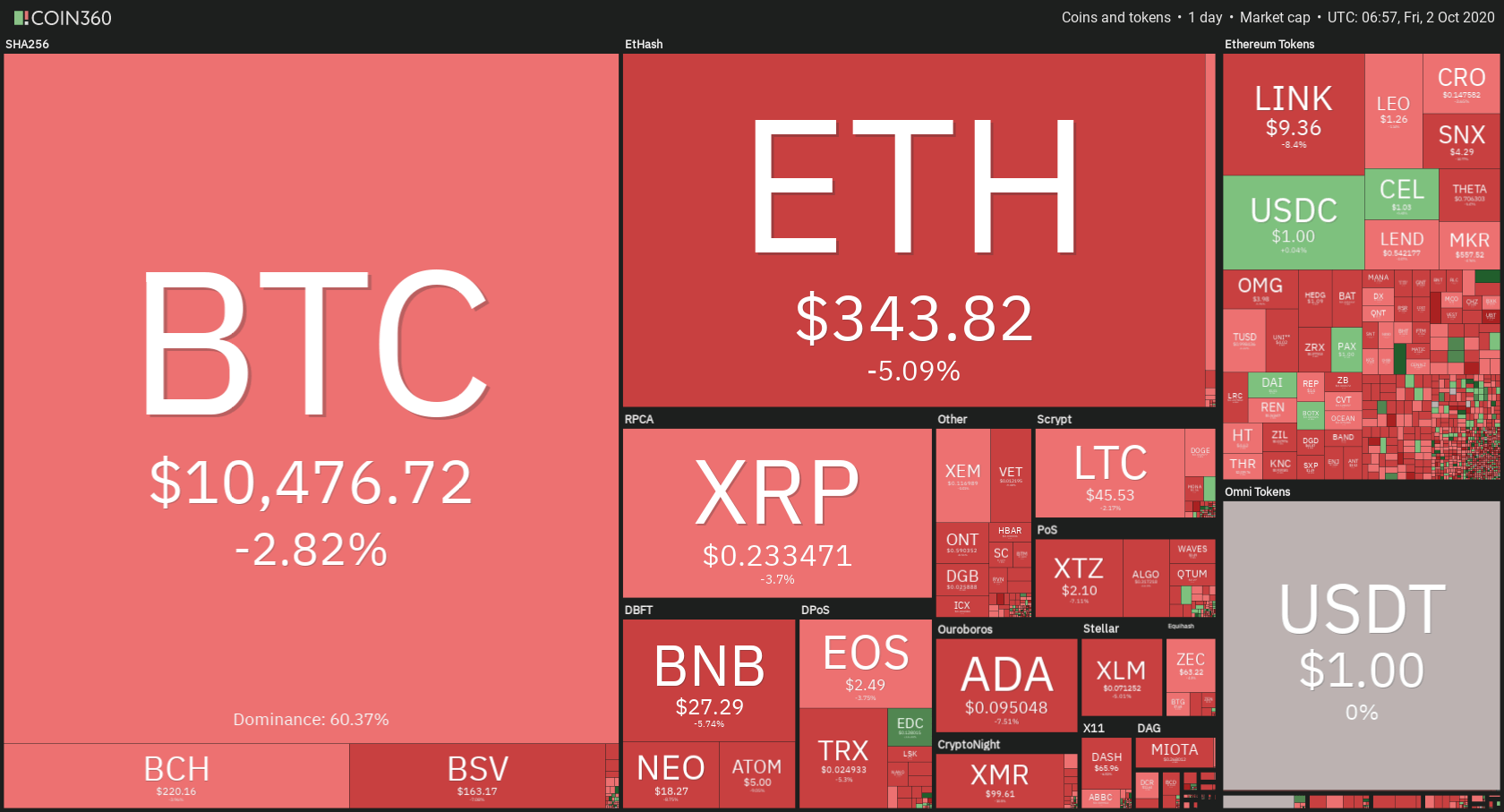

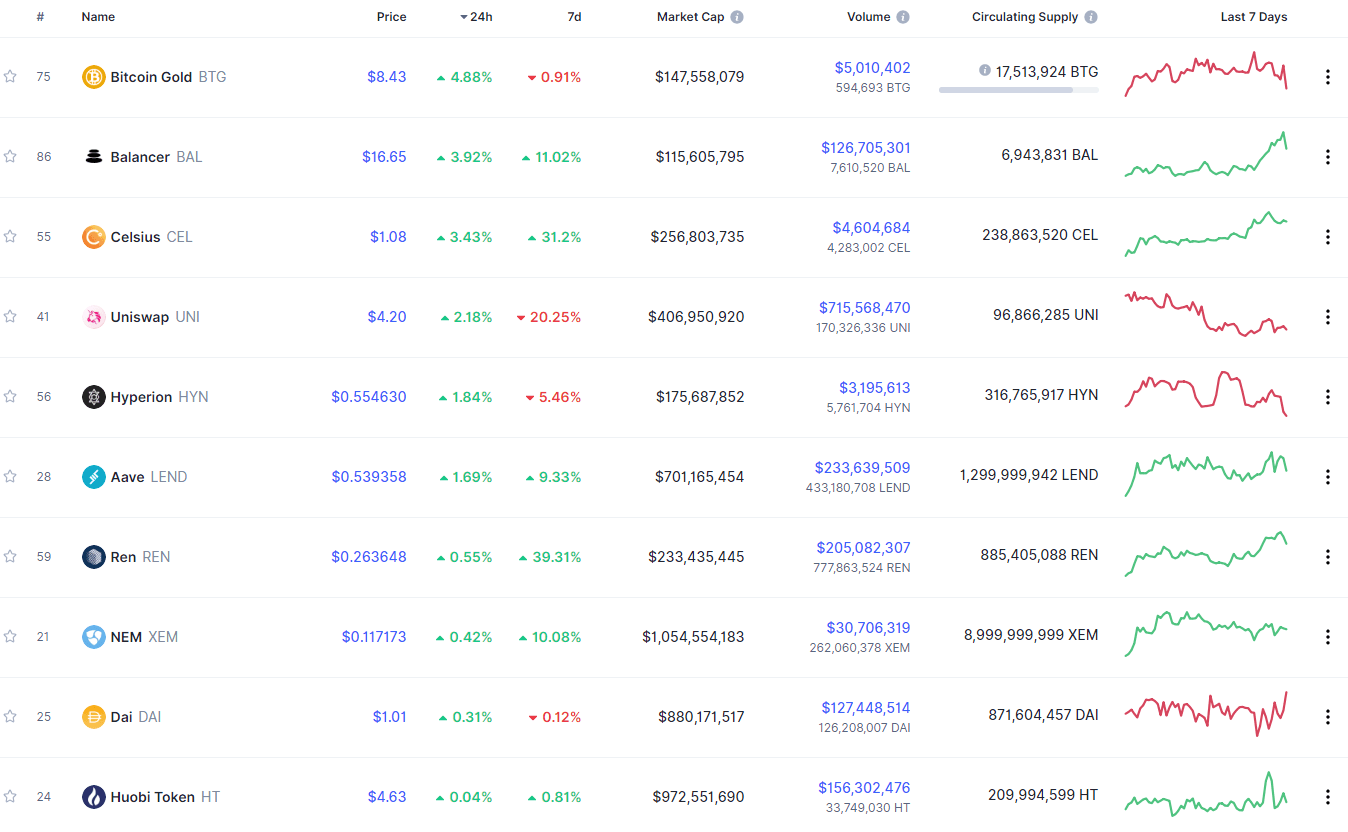

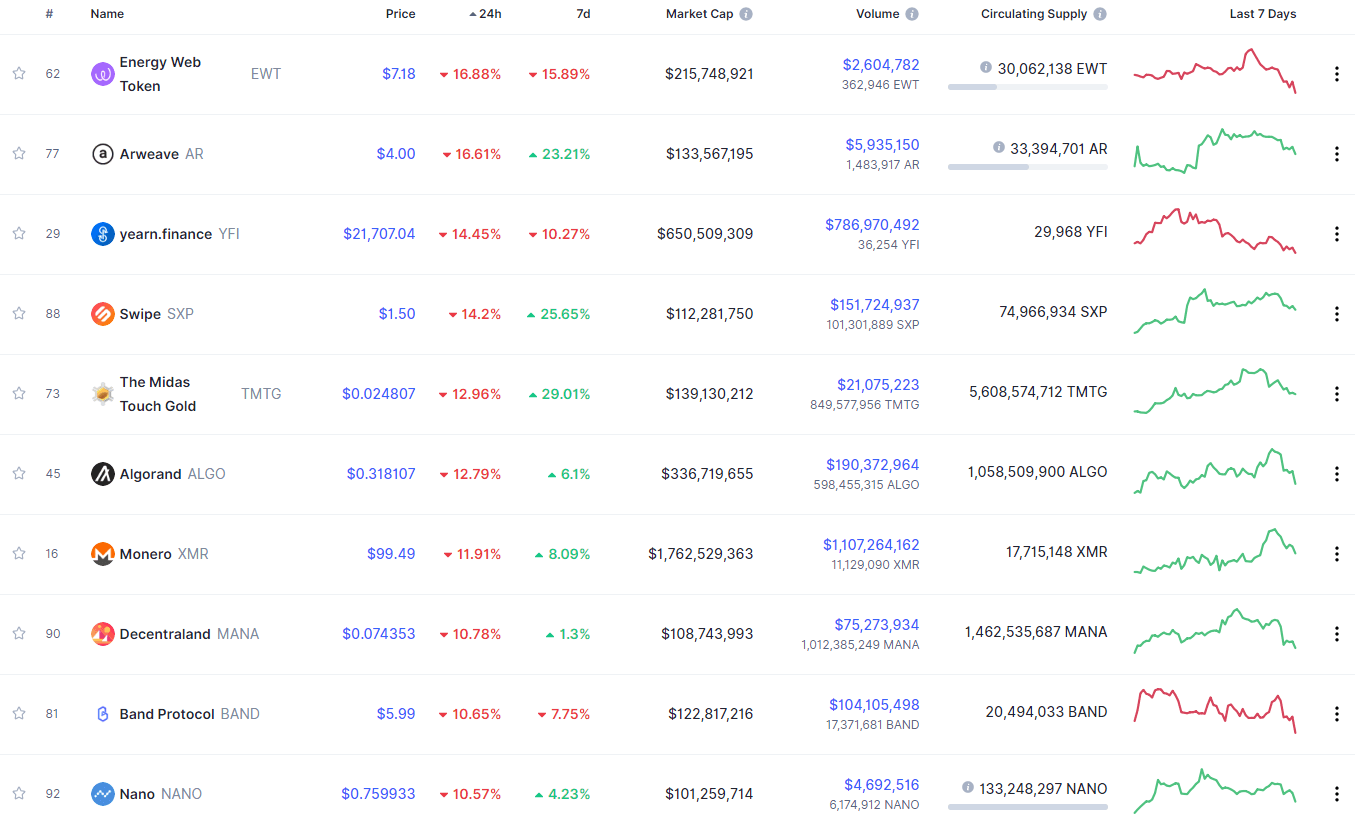

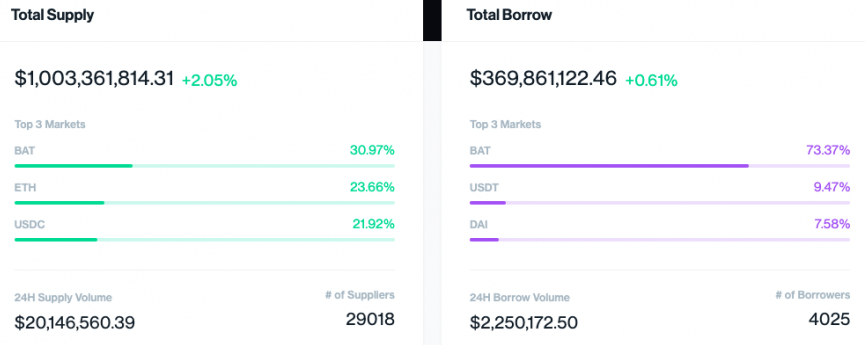

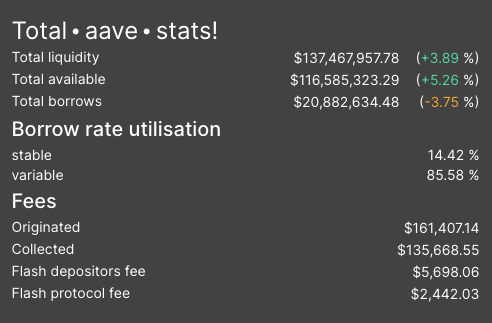

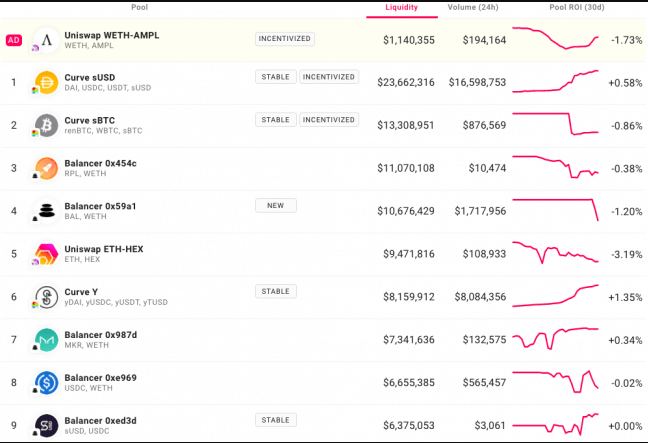

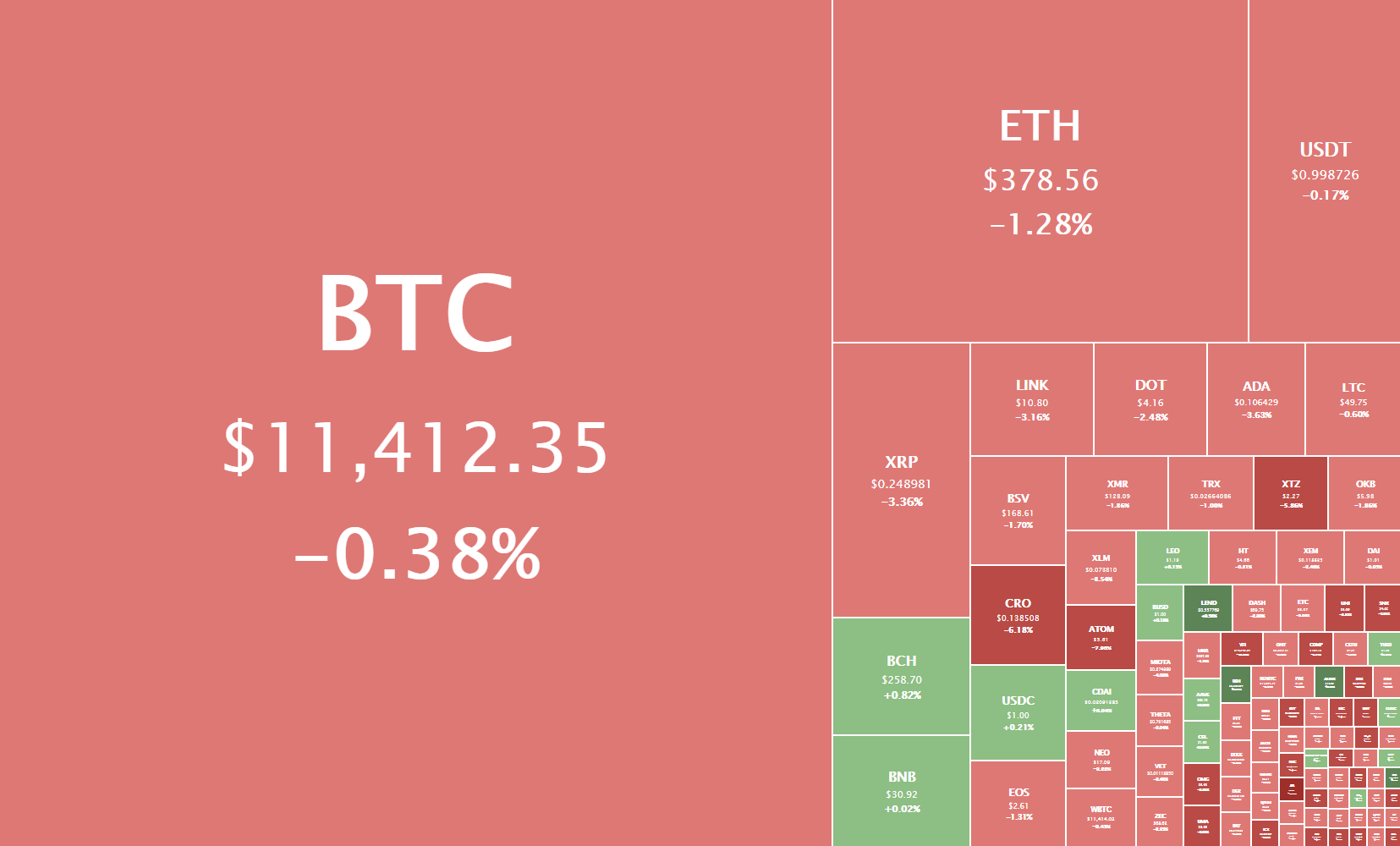

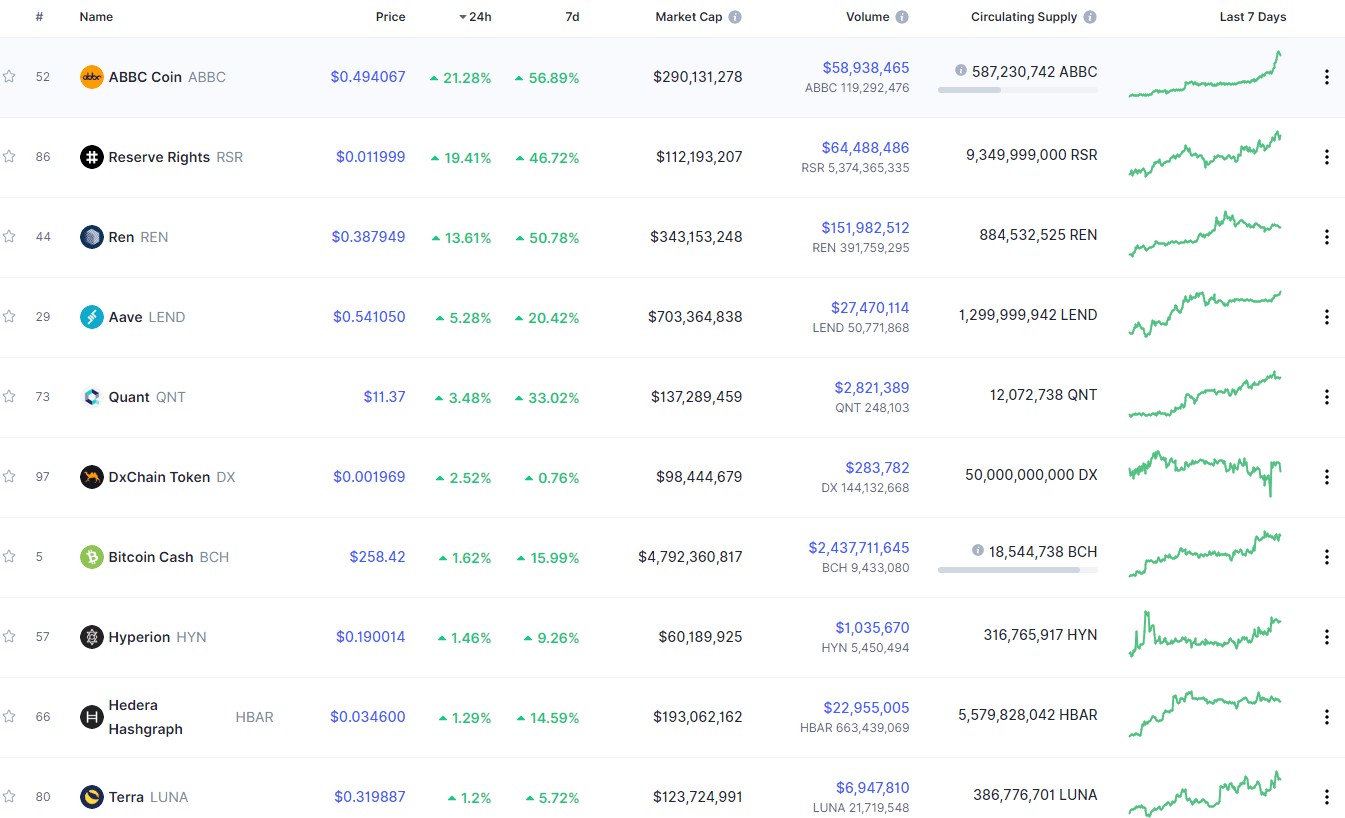

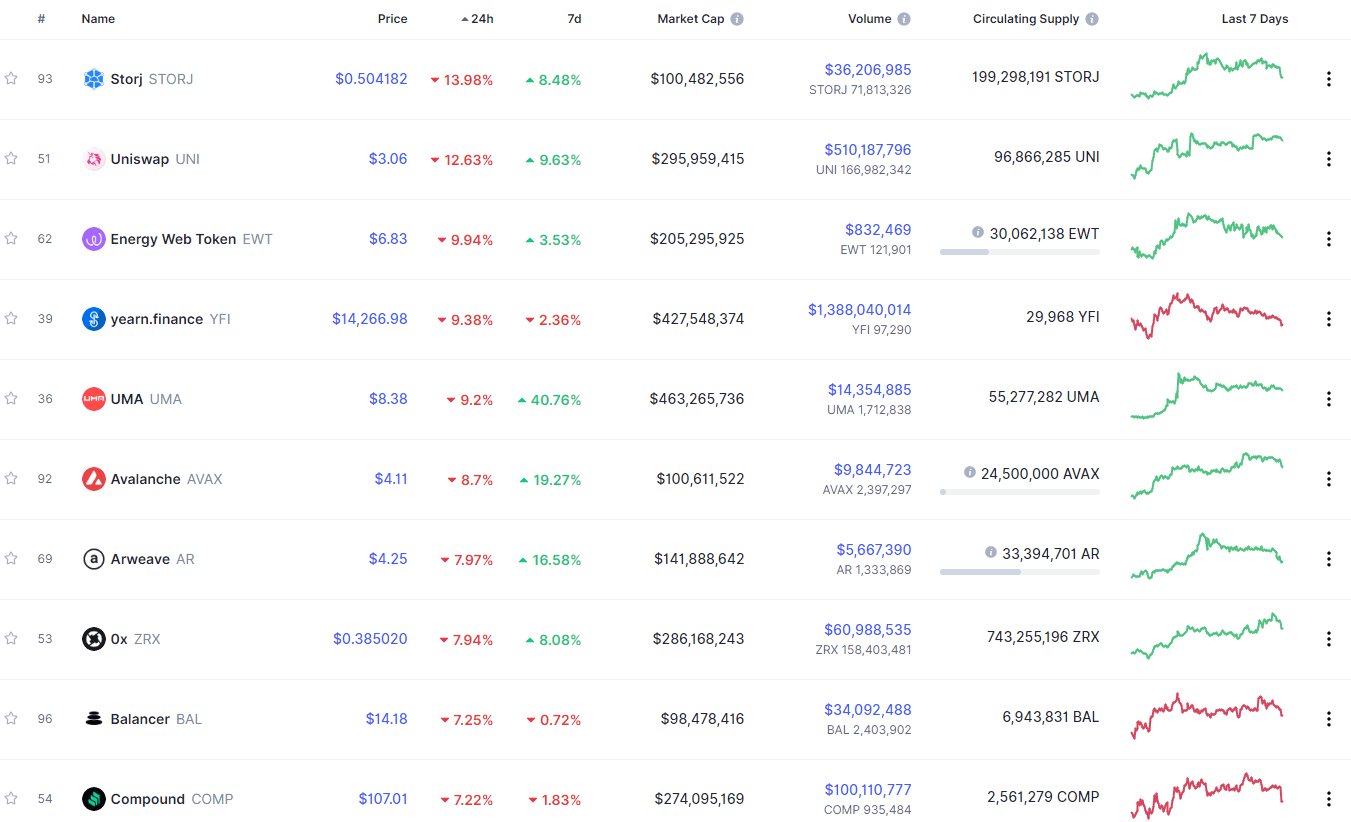

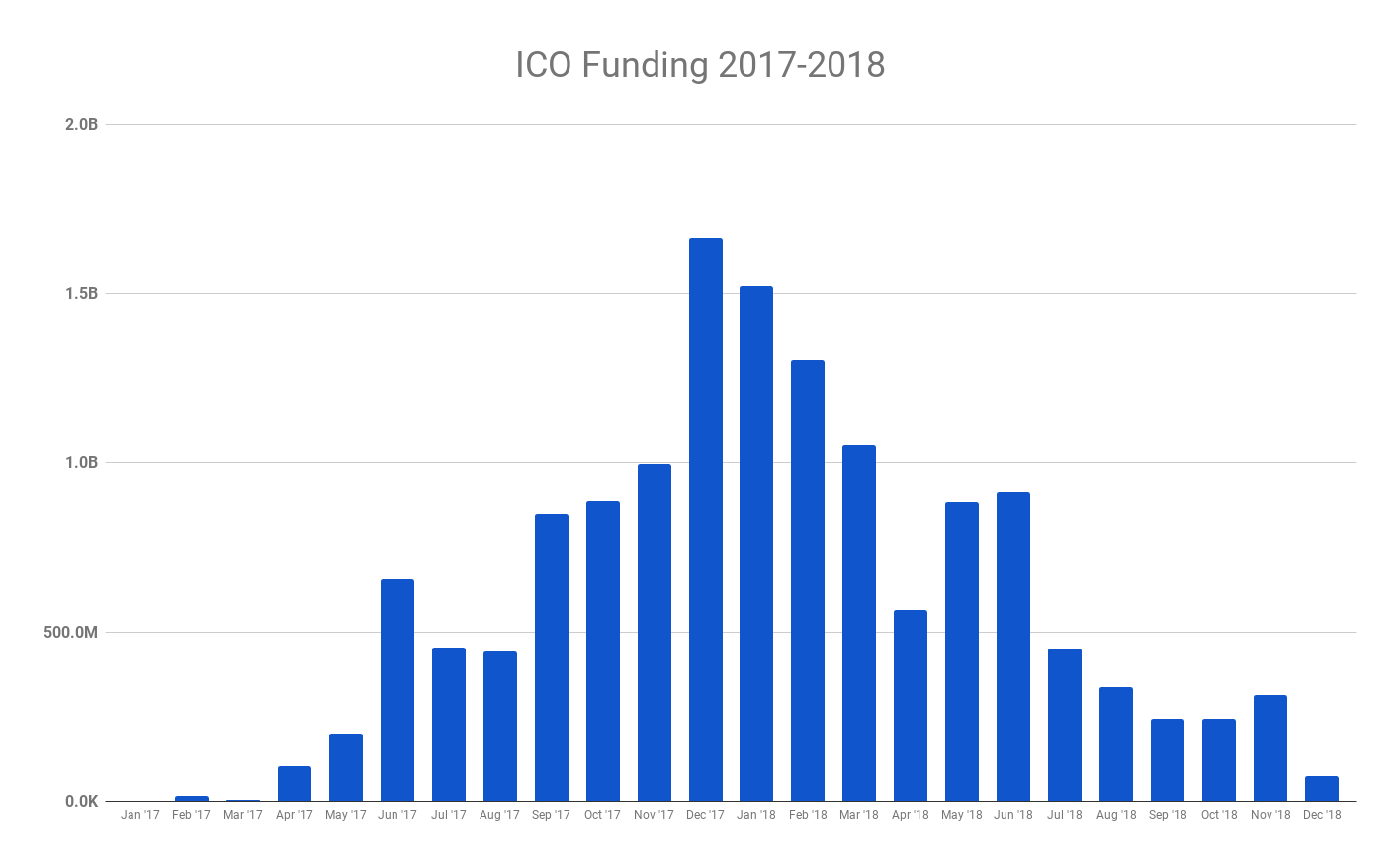

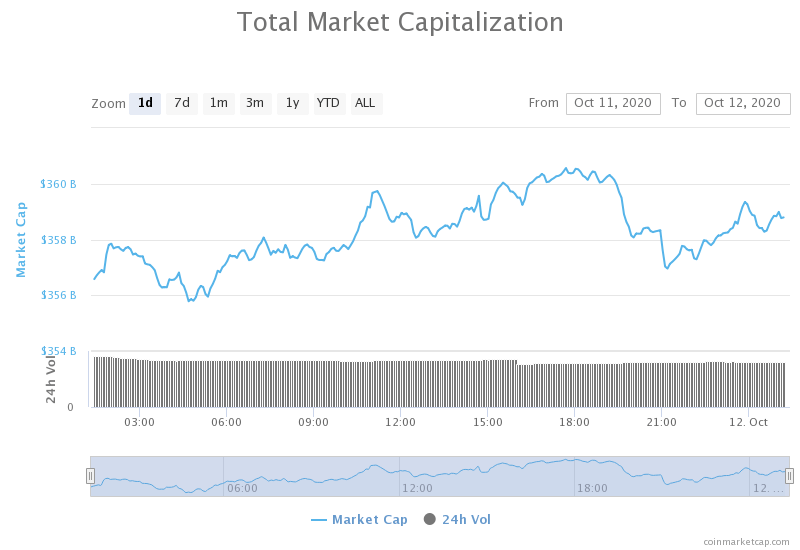

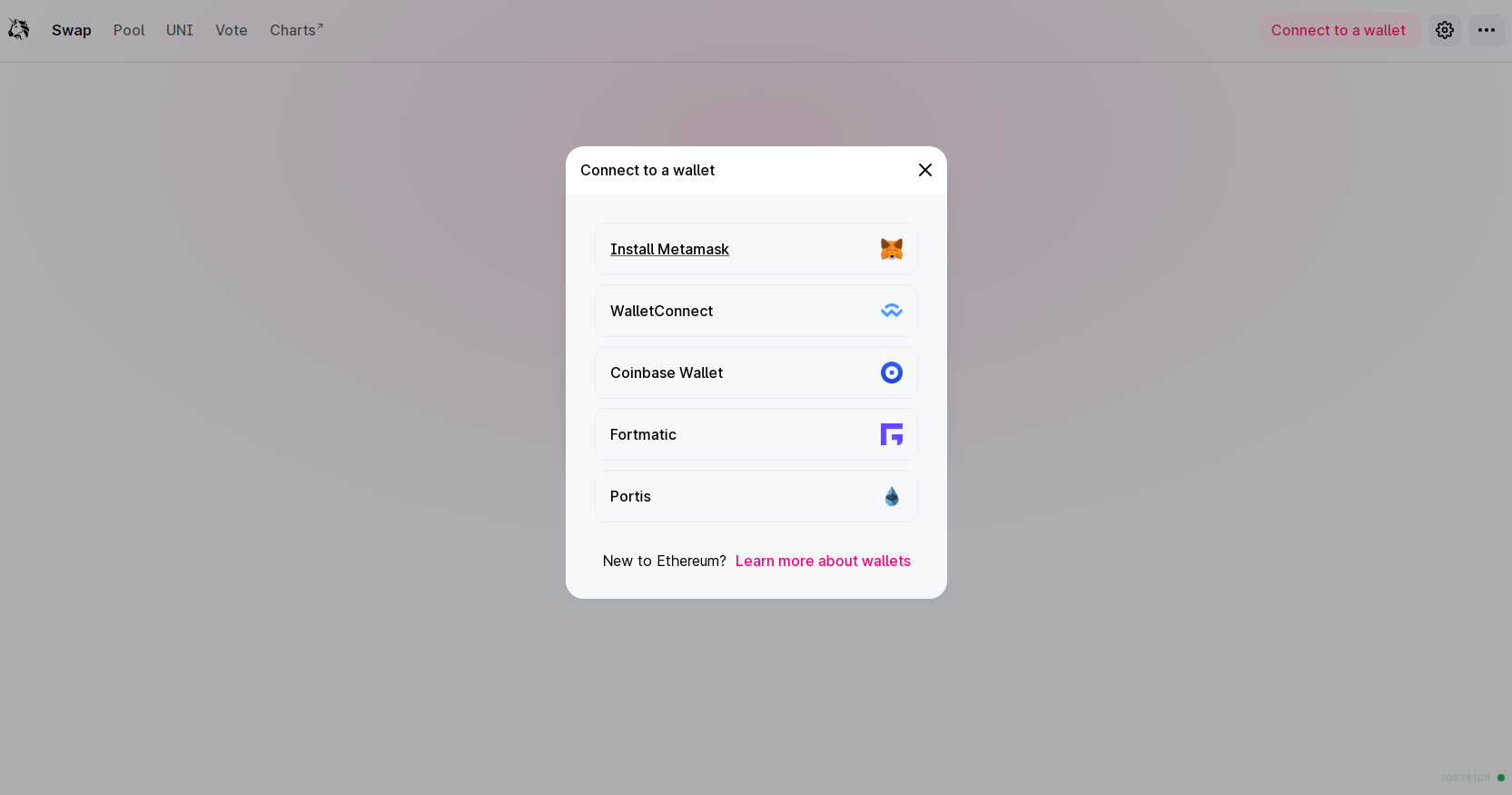

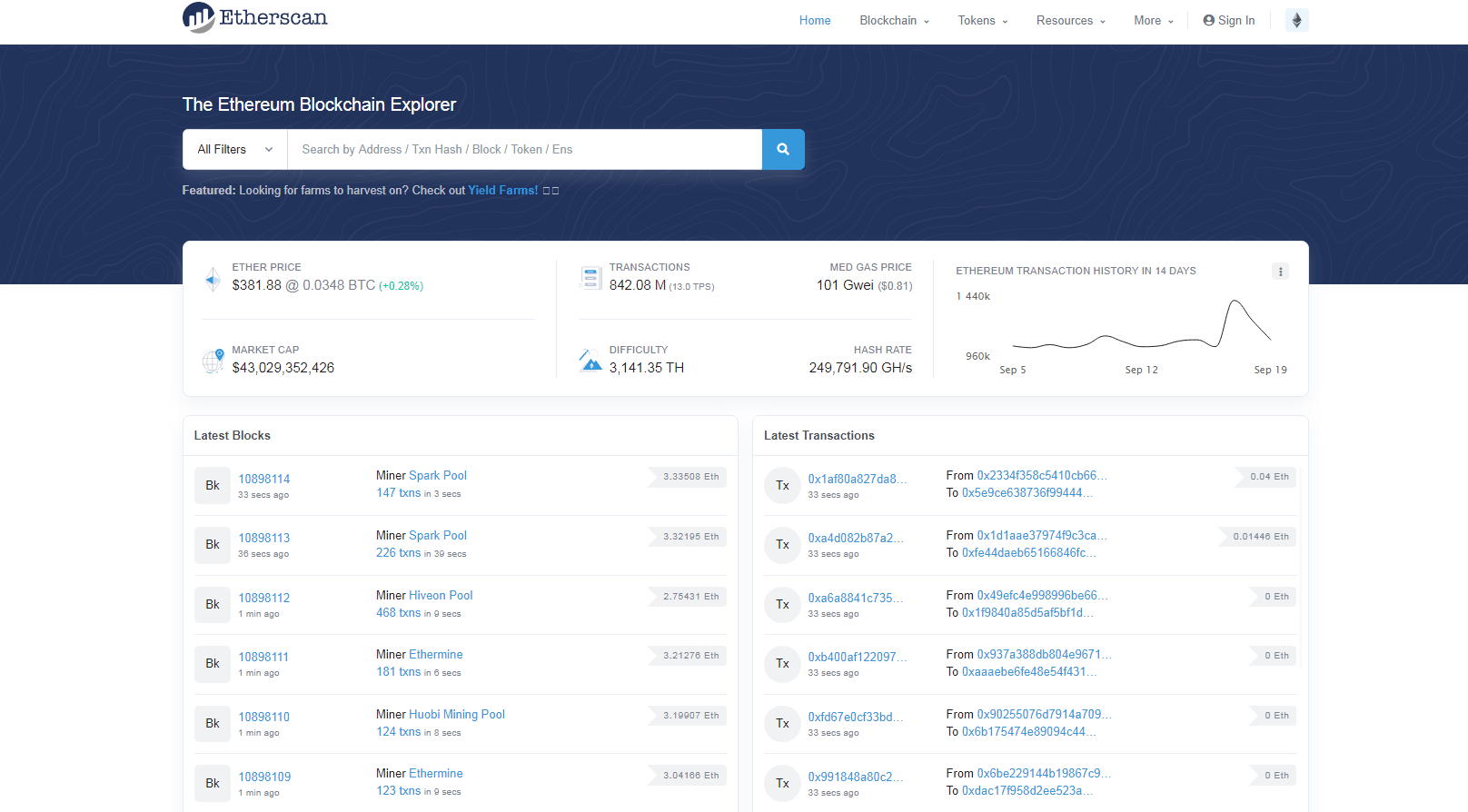

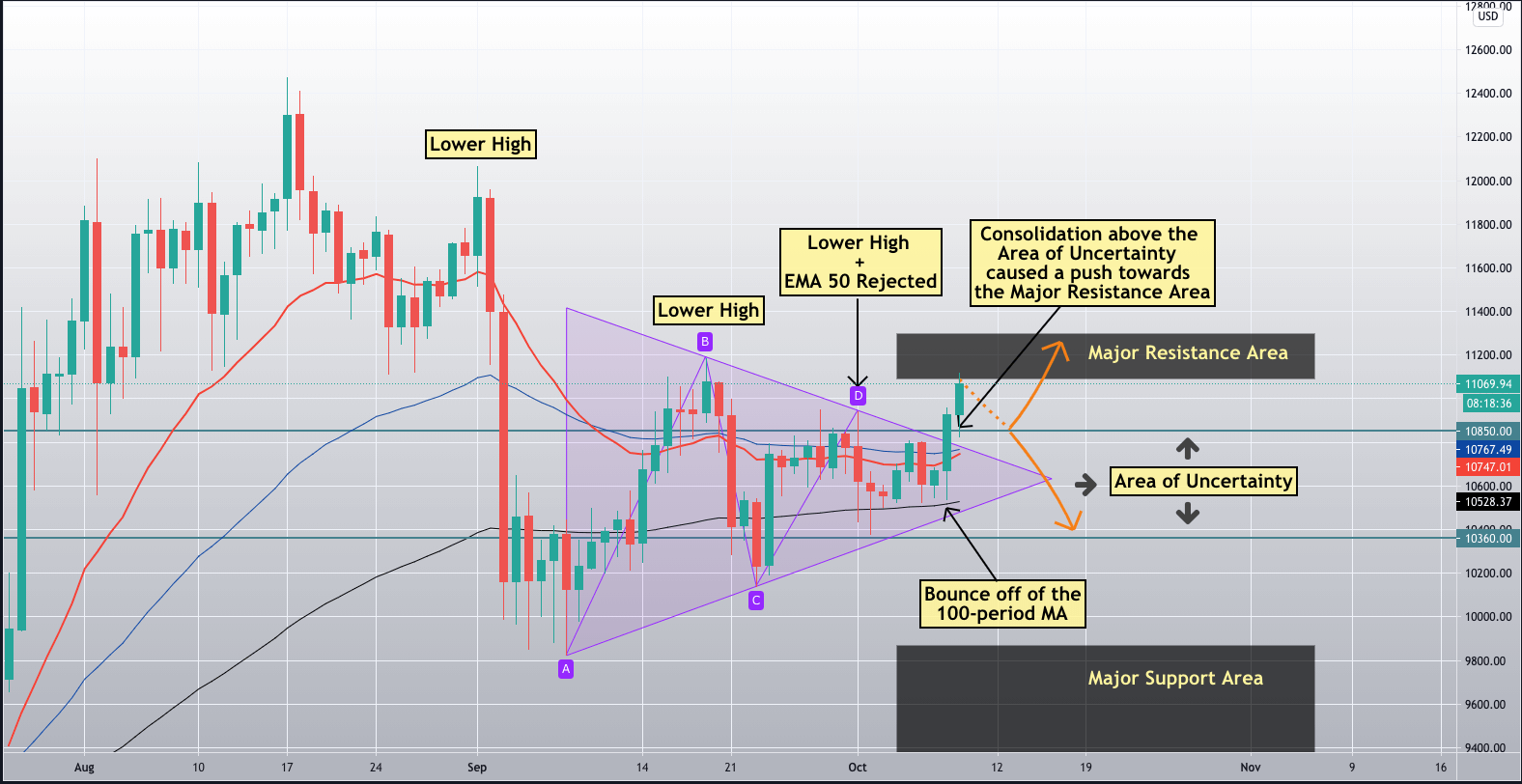

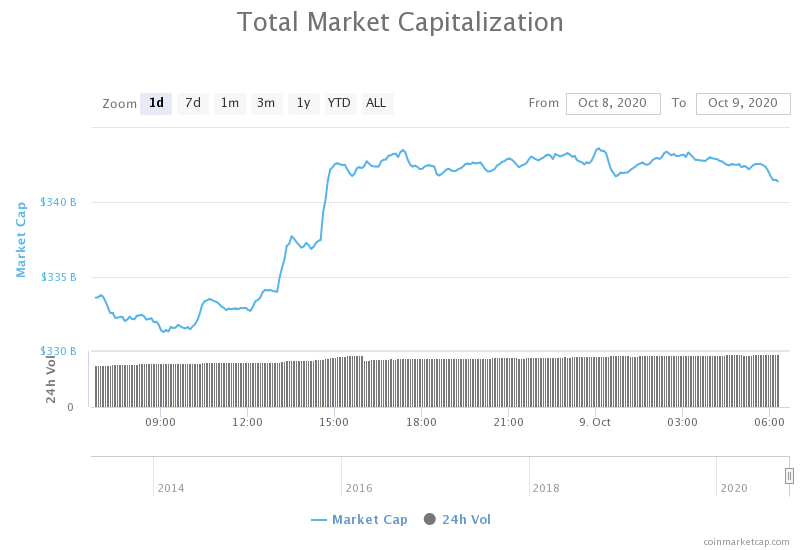

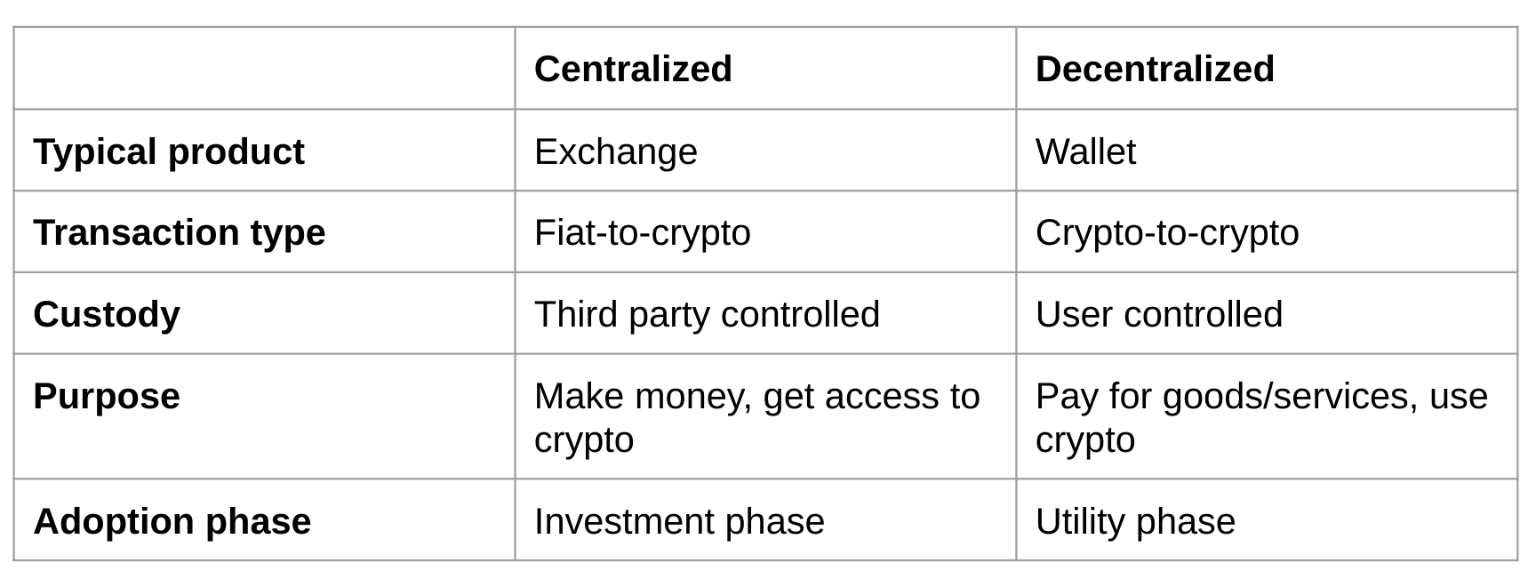

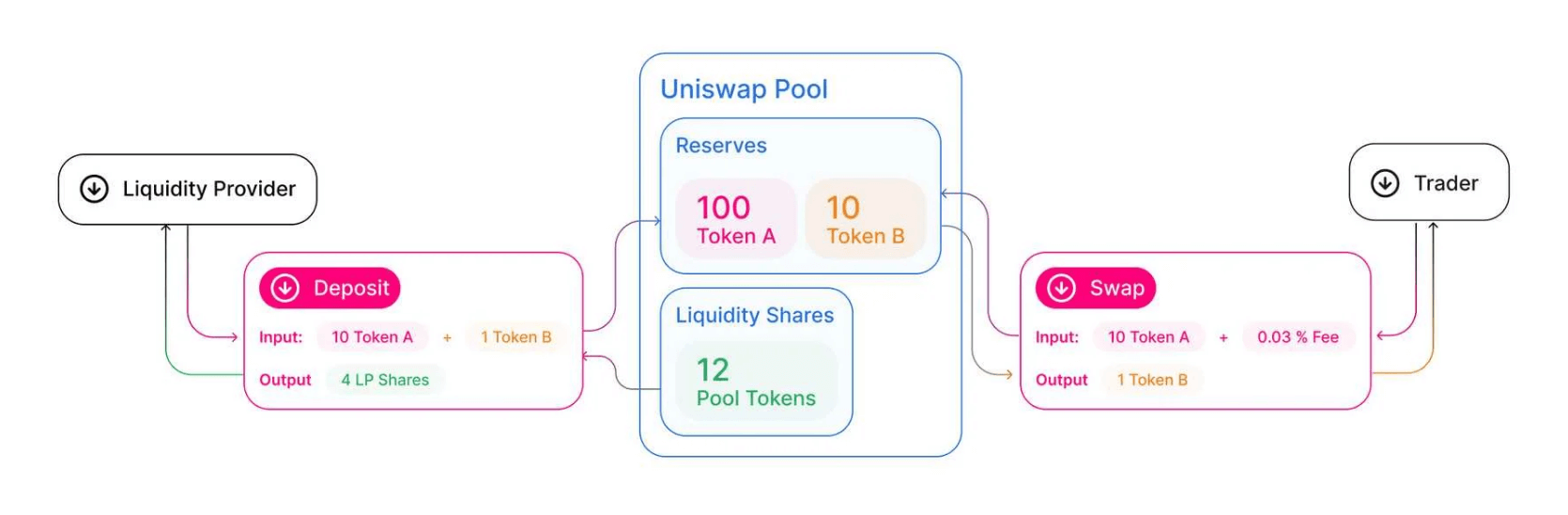

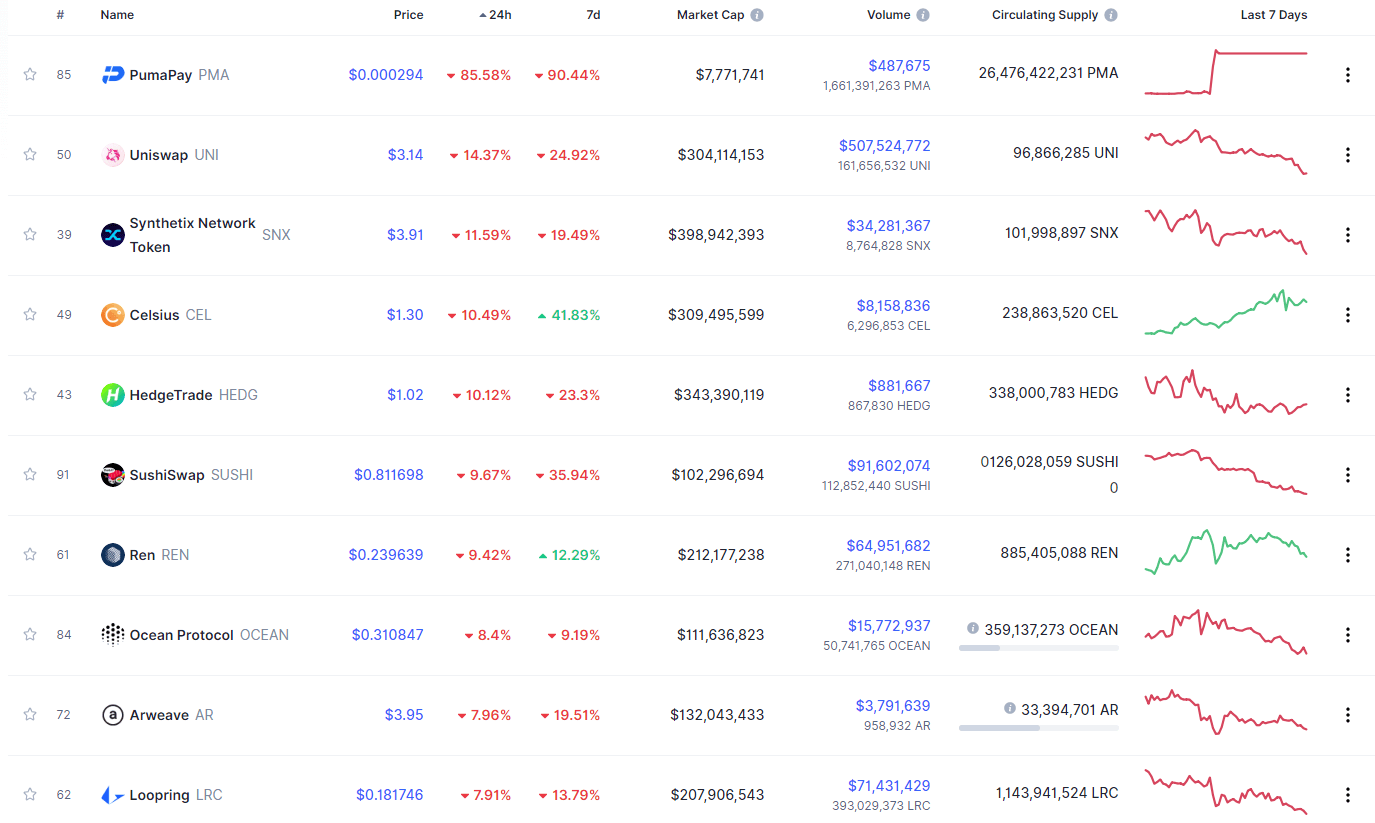

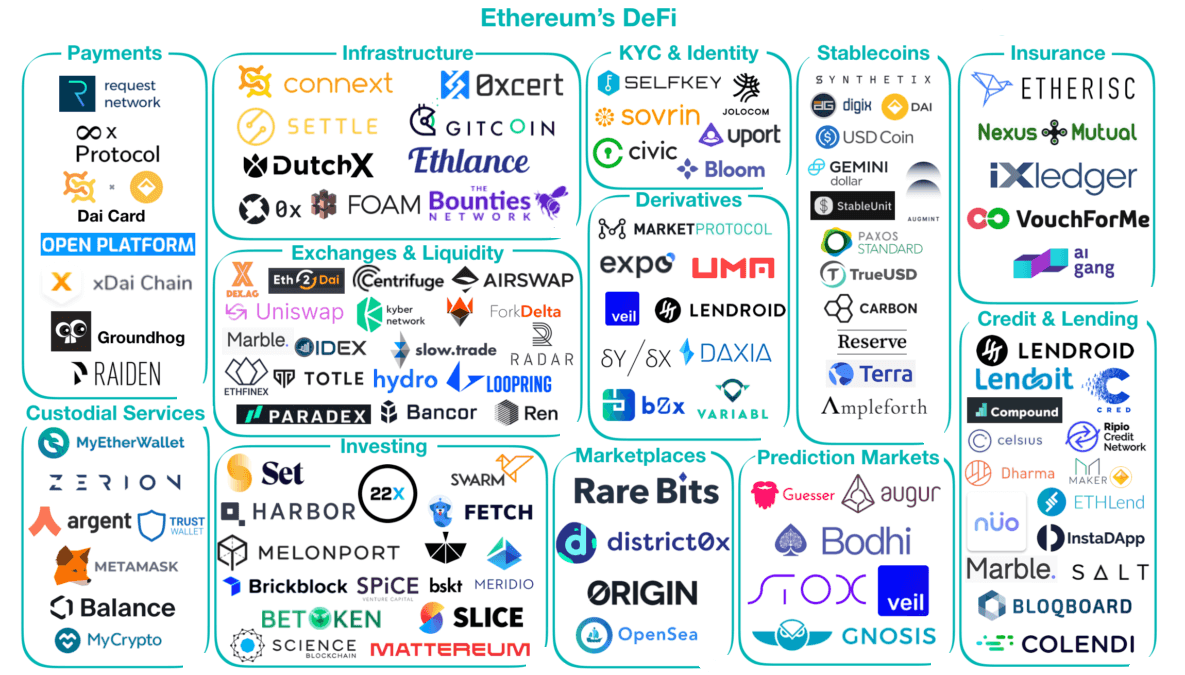

The crypto and DeFi sectors are growing exponentially, and there are currently more DeFi apps than ever. These projects are already saving businesses and customers both time and money. In fact, DeFi platforms started to emerge across nearly every branch of the financial sector. As the DeFi sector expands, it is important to understand what characteristics all DeFi applications have in common, and what they offer.

The crypto and DeFi sectors are growing exponentially, and there are currently more DeFi apps than ever. These projects are already saving businesses and customers both time and money. In fact, DeFi platforms started to emerge across nearly every branch of the financial sector. As the DeFi sector expands, it is important to understand what characteristics all DeFi applications have in common, and what they offer.