Multis is a crypto bank for corporates. The crypto bank is a new, evolving class of financial institutions (also known as neo banks) that offer a lot of the services proffered by traditional banks, but with a few key differences. For starters, crypto banks deal primarily with cryptocurrencies. Secondly, unlike traditional banks, crypto banks are decentralized in nature.

This means that the bulk of their services run on your device, as opposed to a remote server. In doing so, they eliminate the possibility of there being a single point of failure. The third and probably most glaring difference is that this new breed of financial institutions does not hold your funds; they merely allow you to securely access them.

Multis Wallet Key Features

As already established, Multis primarily targets companies. It is the first bank of its kind and allows companies and organizations to, among other things, buy and store cryptocurrency, manage their team’s access to the funds, accrue interest from idle assets, make payments in crypto (yes, including recurring ones such as electricity bills), get paid in crypto, and natively exchange crypto tokens.

Team/Multi-Access Features

You can interact with your company’s Multis wallet via a beautiful dashboard. The layout is logically arranged, with clearly defined roles for all team members.

You can easily authorize different members of your team to access funds, make payments, or perform transactions on behalf of the organization. In the same manner, you can deny certain members access if, for instance, you’d like only admins to be able to initiate transactions.

Secure Storage of Funds

As mentioned above, Multis does not store your funds but rather relies on the underlying Ethereum network to handle this function. Because of this, every user is assured of the full suite of security features offered by the Ethereum Network and its supportive tools. Much like traditional accounts, idle funds in Multis wallets accrue interest.

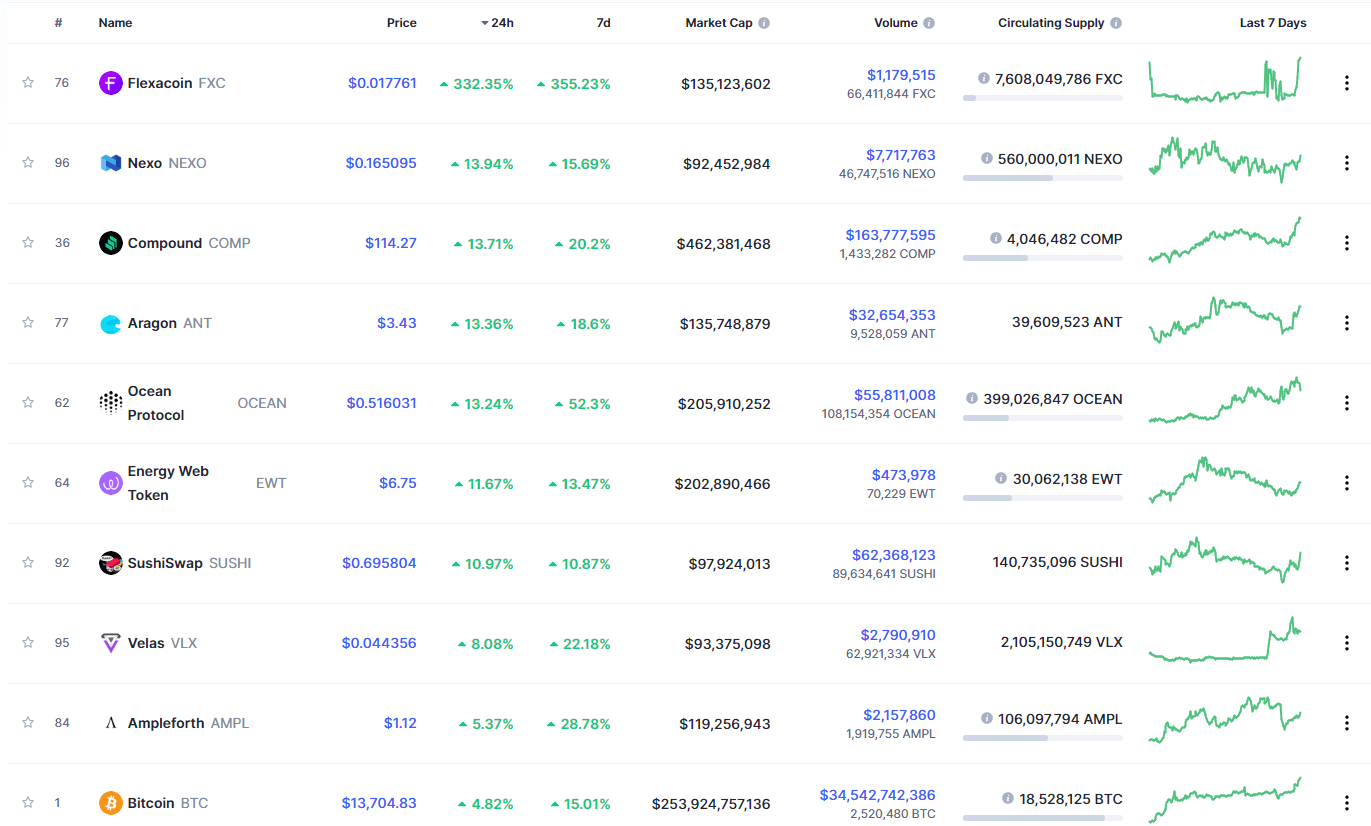

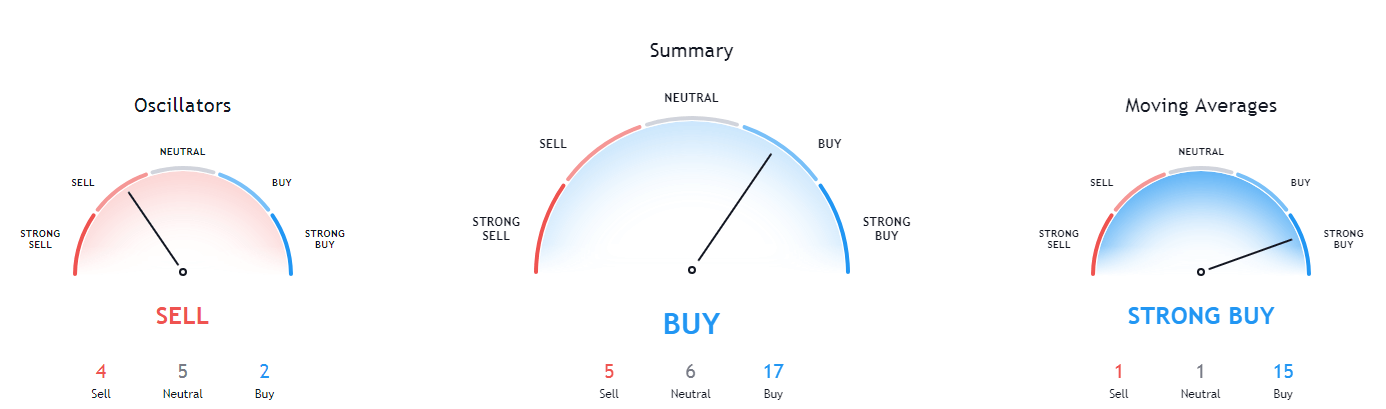

Multis leverages the compound protocol to allow for interest. The compound protocol also makes it easy for Multis users to act as lenders. You can lend crypto to almost anyone, and the interest accrued will be calculated in the same fashion and will be withdrawable at any time.

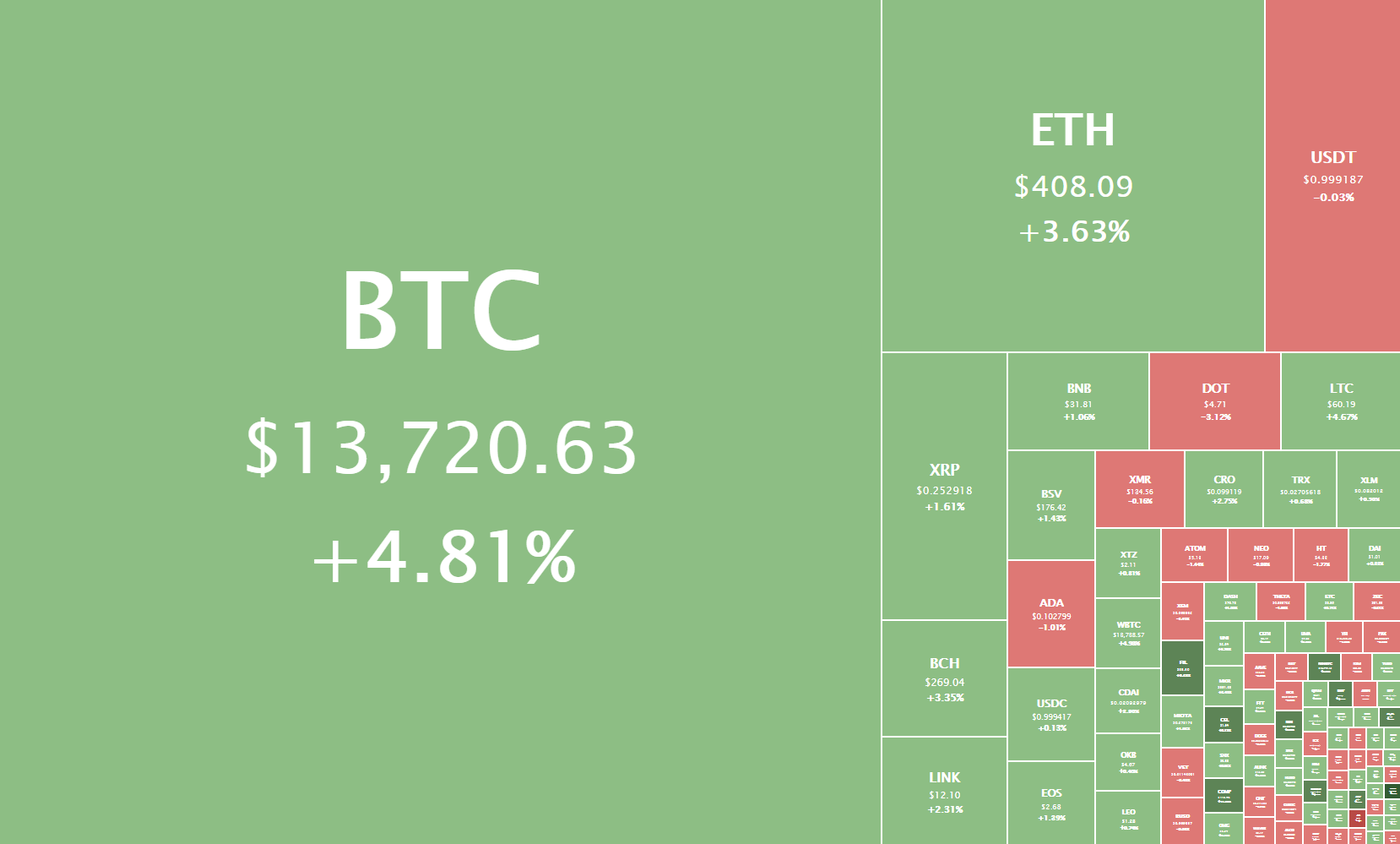

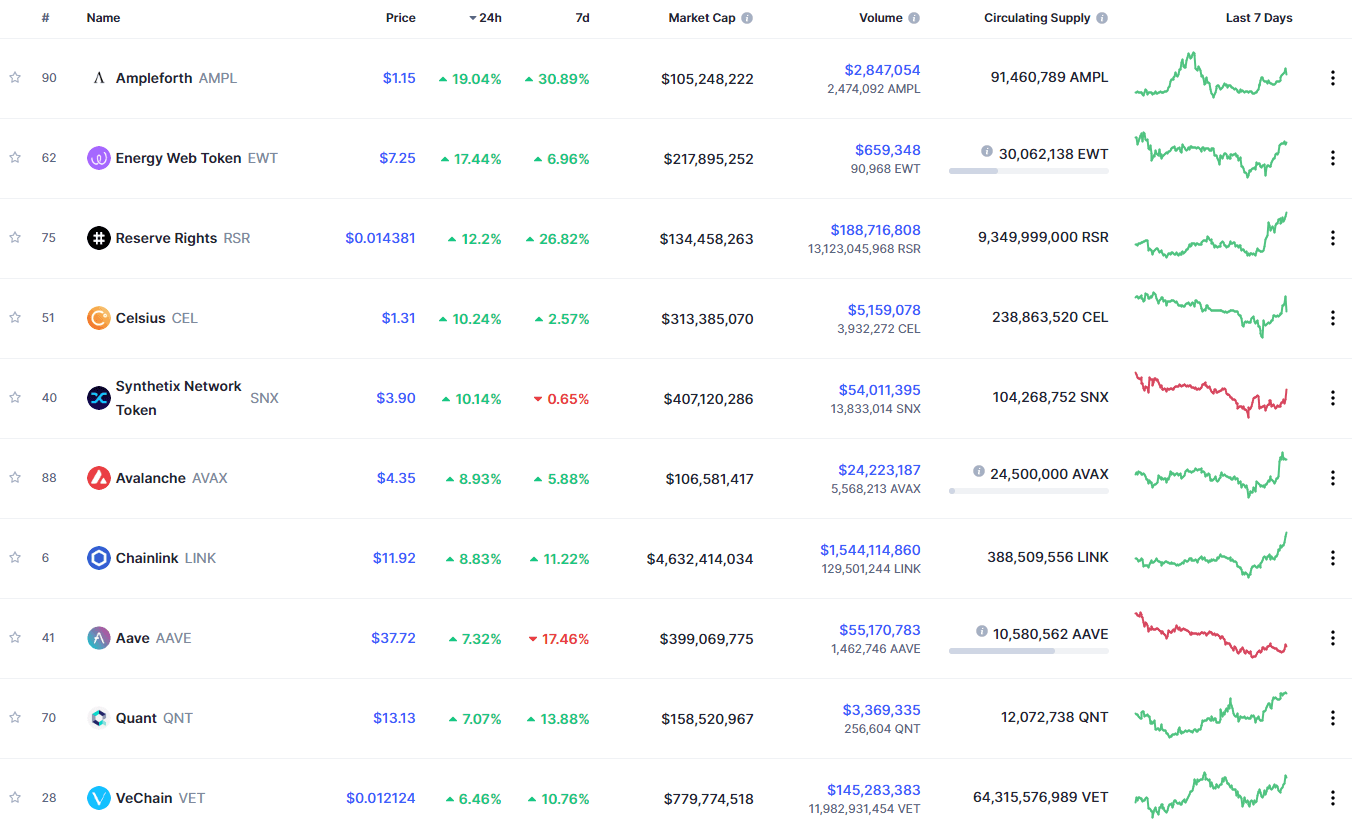

Native exchange of Tokens

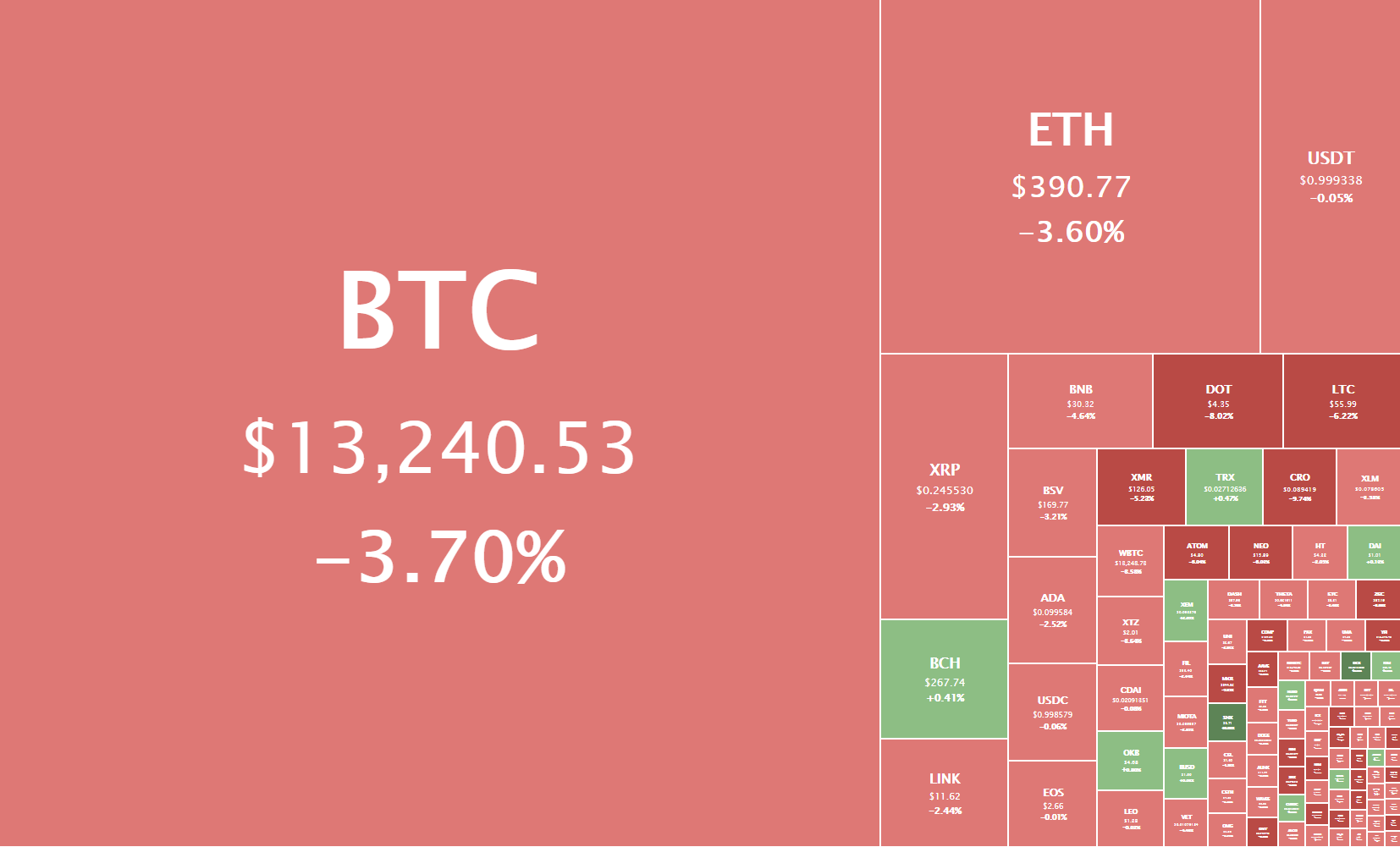

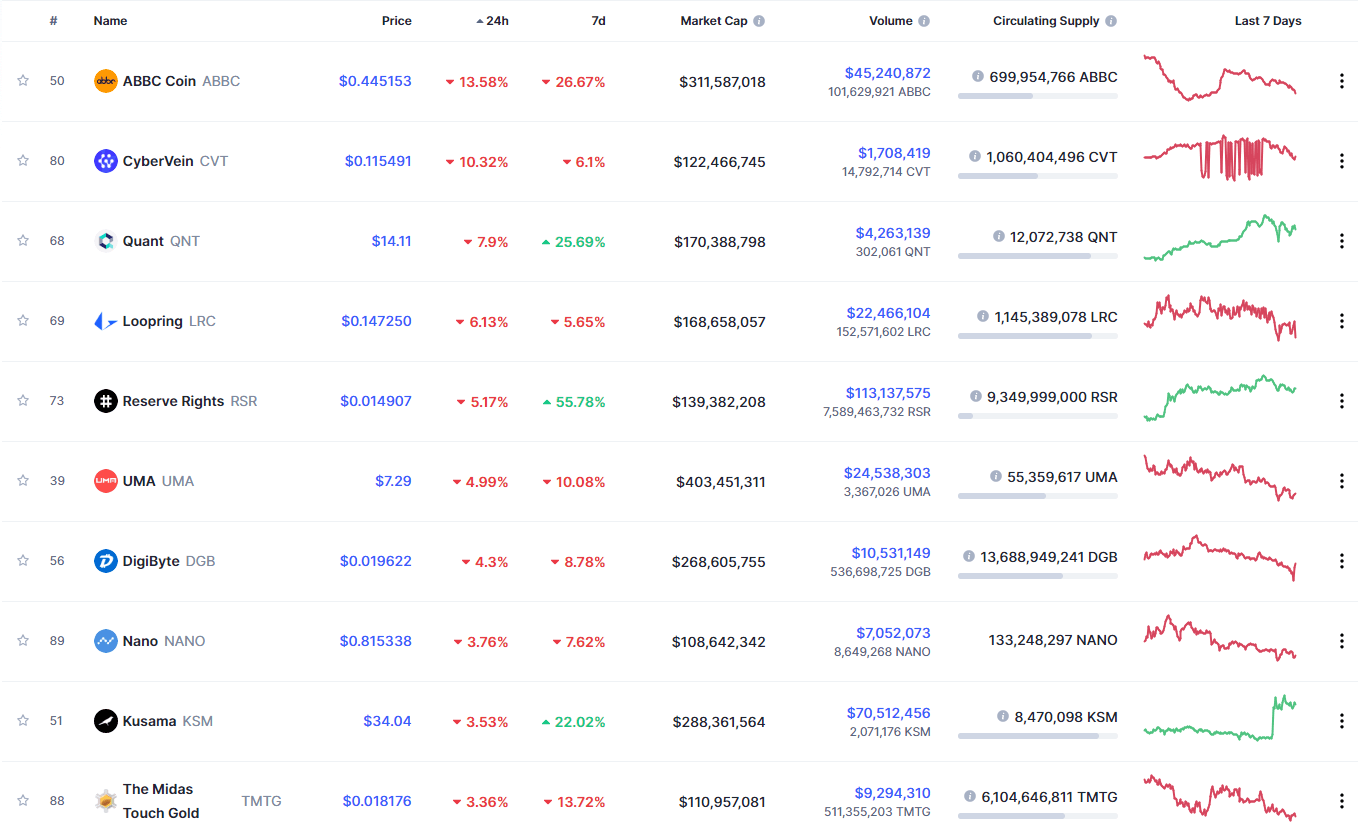

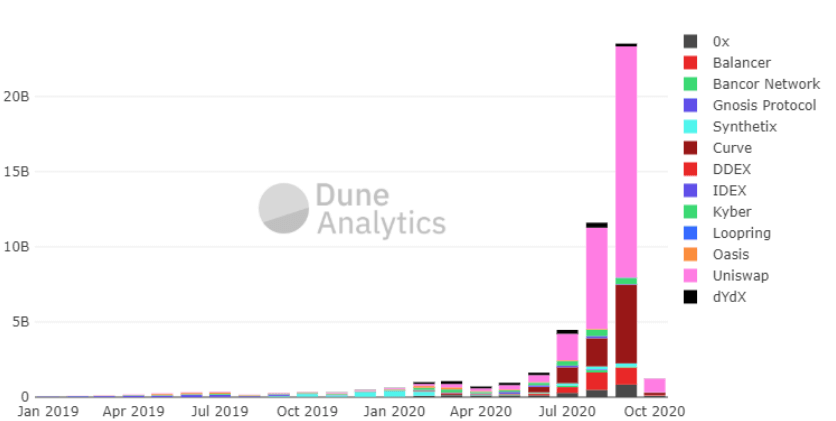

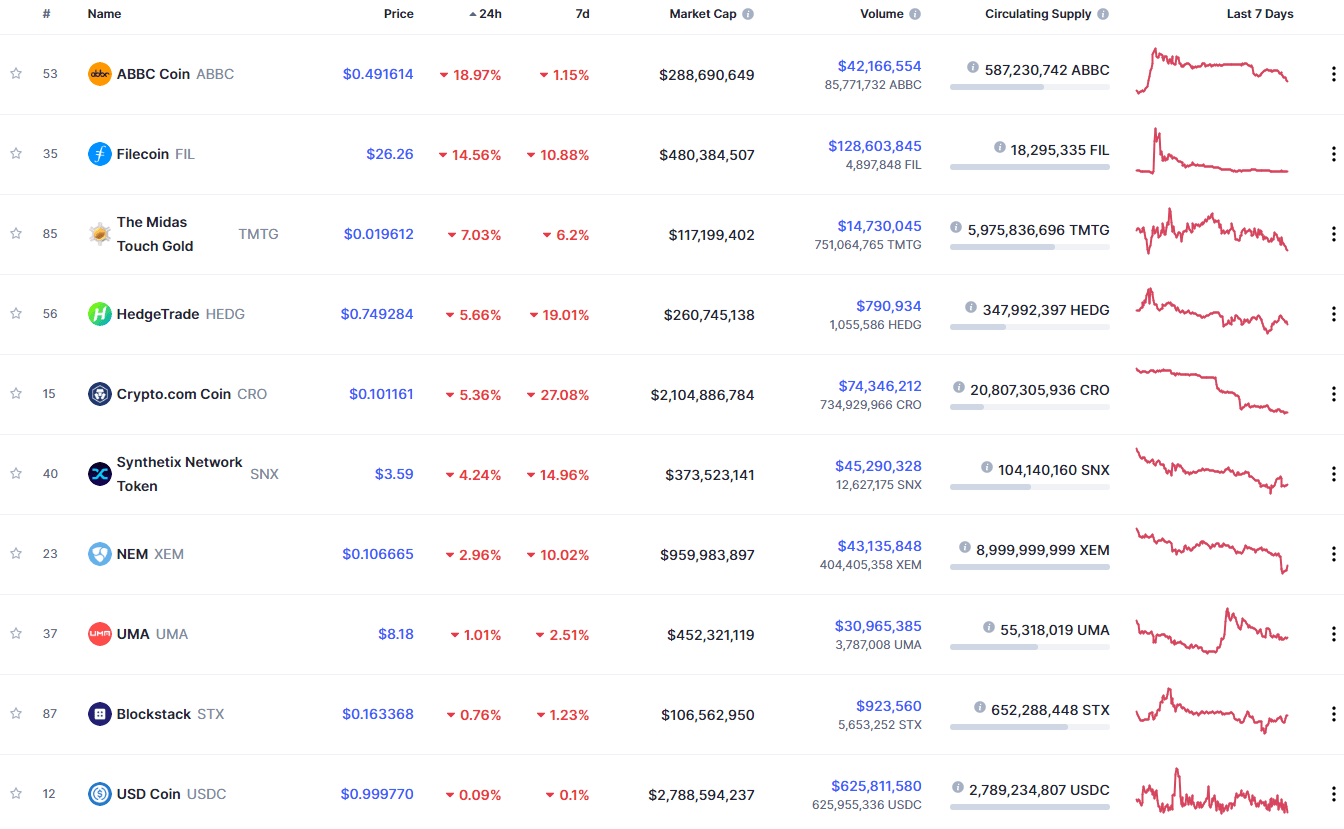

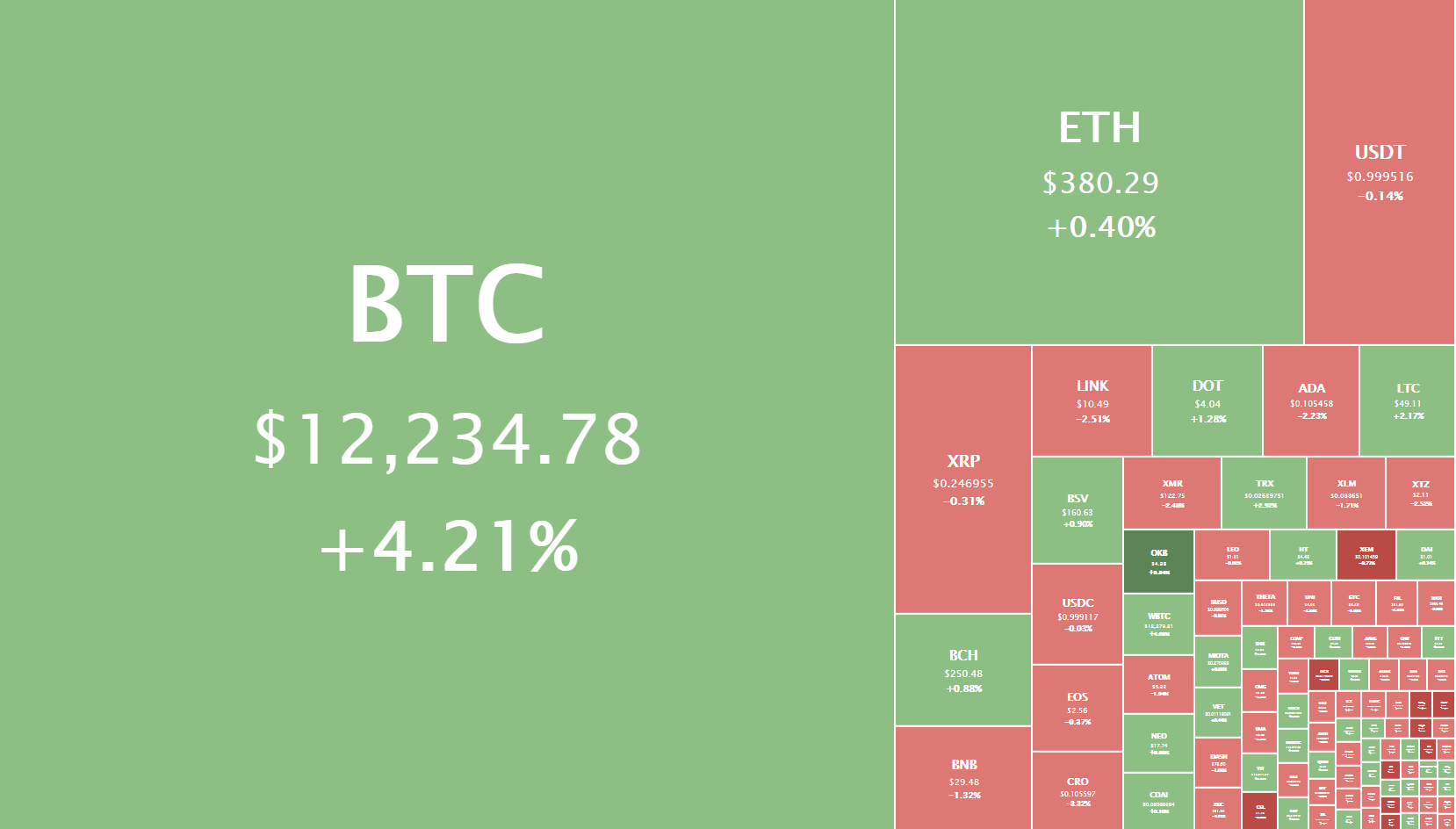

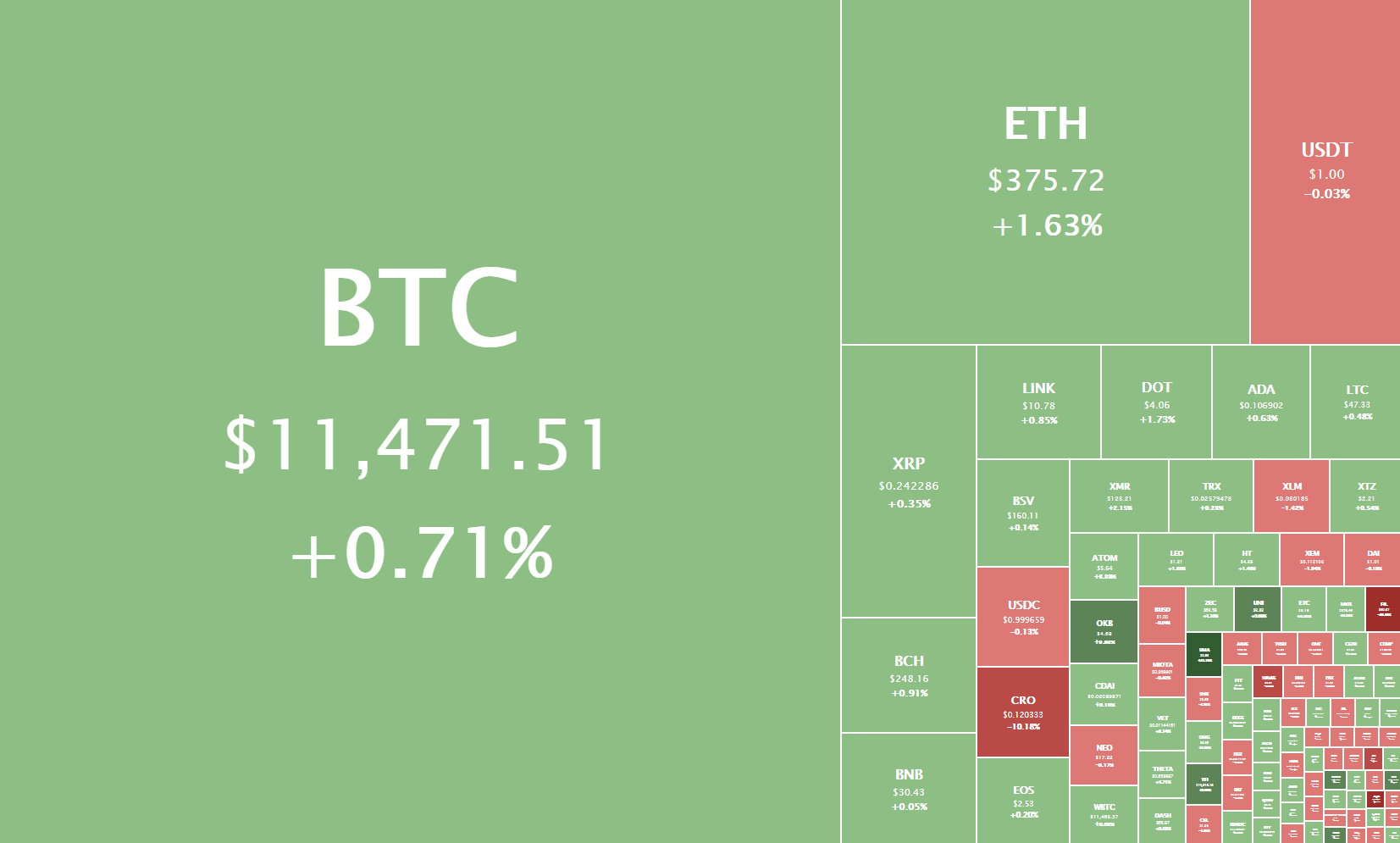

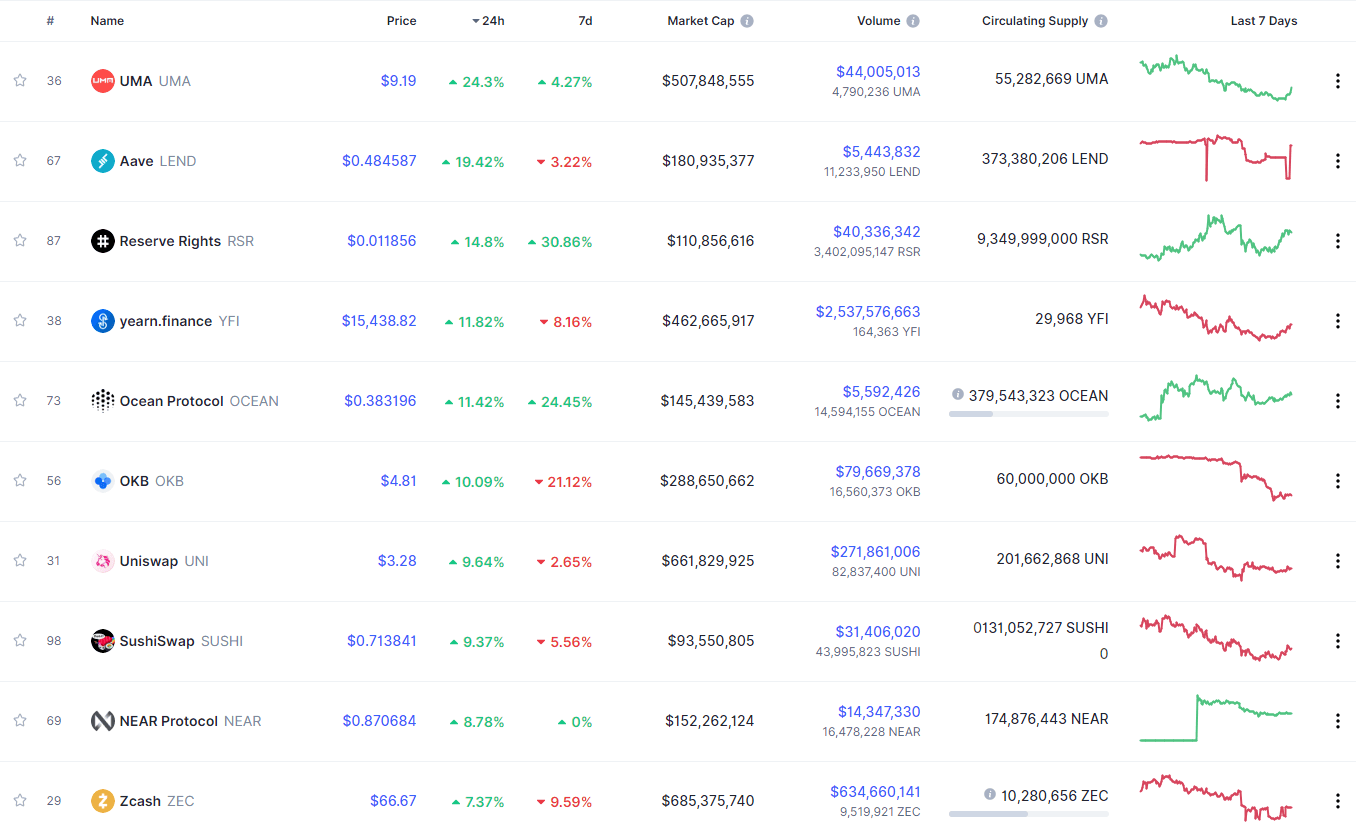

Multis allows you to easily exchange one cryptocurrency for another. It supports more than 70 cryptocurrencies and, incredibly, also allows you to exchange crypto for USD or EUR. Multis leverages the Kyber protocol for this, which is a blockchain-based protocol that allows for instant and secure crypto token exchange in decentralized apps and wallets.

Transaction History and Exports

All Multis users have access to records of every transaction that they’ve engaged in. You can easily see the value of the transaction, the balance as of that transaction, the other party (their wallet addresses rather since we’re dealing with crypto), and the date of the transaction. It is worth noting that these crypto transactions cannot be canceled, reversed, altered, or intercepted in any way after confirmation.

Security and Privacy Features

On its own, Blockchain is renowned for its pseudonymous nature, and it’s being a ‘giant, public ledger.’ These two features are some of blockchain’s greatest strengths, lending it its security and the ability to reject any falsified transactions. Multis builds on this security and has already earned smart contract security certification.

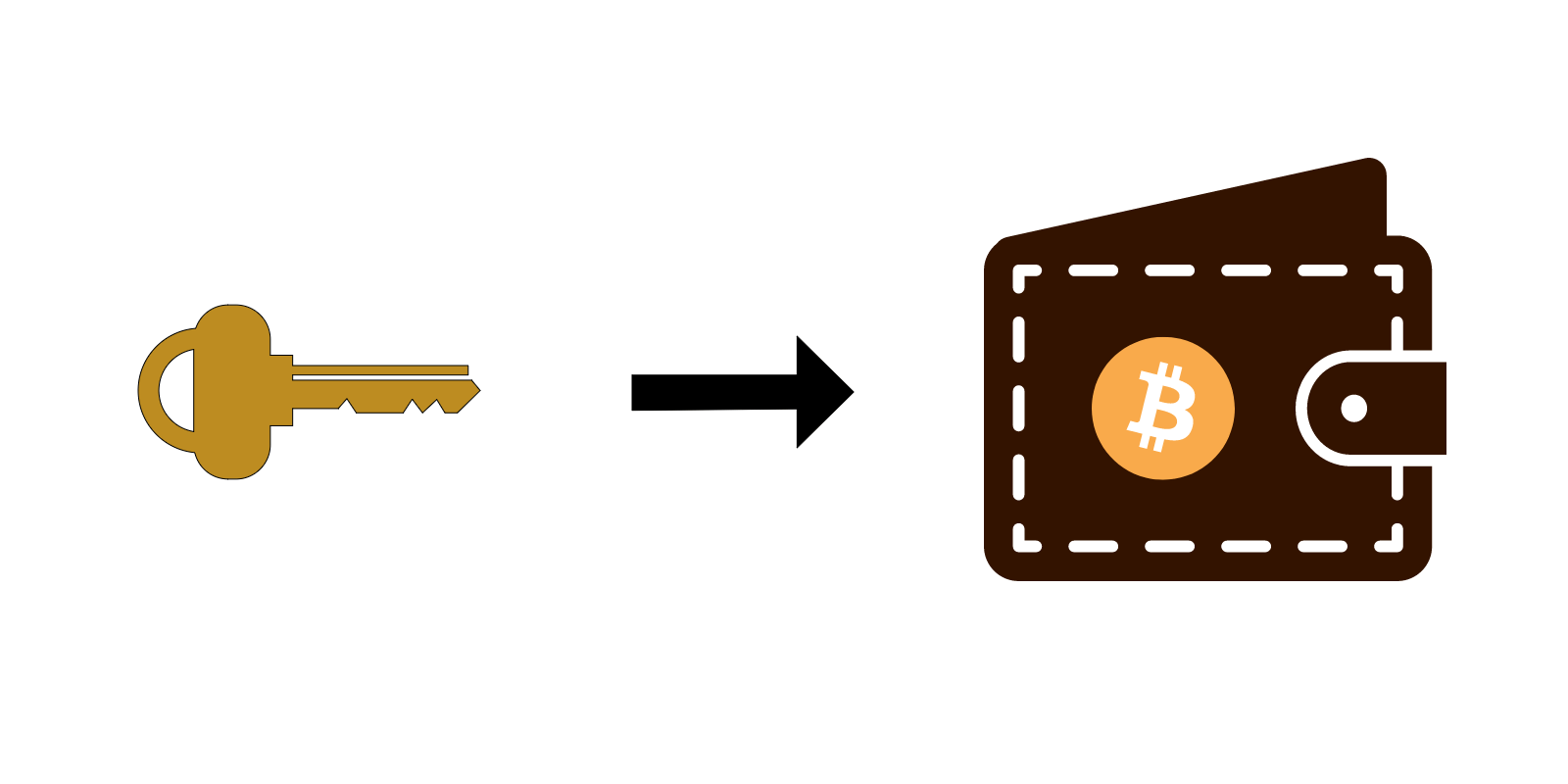

Non-Custodial

There are two main ways of keeping your cryptocurrency safe; keeping it in a custodial wallet or using a non-custodial wallet. Most coin brokerages, exchanges, and crypto platforms are custodial, which means that they, to a large degree, control the access to your wallet and the funds within. Non-custodial wallets, on the other hand, gives you full access and control of your funds by way of private keys.

In the cryptocurrency community, it is commonly said that if you do not have access to your private keys, you don’t own the crypto. Multis, being non-custodial, not only gives you access to your private keys but, as mentioned above, do not have access to your funds. Multis allows you to store your private keys, making you wholly accountable for every single action performed on your account.

Lightweight

Regular apps rely on a database to store data. To access, update, and store new data, the app needs to request the server to perform the required action and return a response. All these layers (the server, database, and request layers) could potentially have security vulnerabilities that malicious parties could exploit.

Multis, being reliant on blockchain-based tools and services and being a dApp (decentralized app), deploys only a simple static page, drastically reducing the attack surface available to malicious parties. Additionally, Multis runs on a serverless platform. Servers are still used, but code is run in response to events, and the vendor maintains the underlying infrastructure (and its security).

Battle Tested

Multis builds on the lauded Gnosis multi-signature wallet protocol. The Gnosis protocol is a permission-less, fully decentralized exchange that allows for peer-to-peer cryptocurrency exchange without the need for users to transfer their assets to the exchange. This drastically reduces the risk of asset loss through hacking of the exchange.

Multis has further improved upon the Gnosis platform, and has, as mentioned above, had its modifications thoroughly audited. It has consequently acquired the Quanstamp smart contract security certification.

How to Set Up and Activate the Multis Wallet

Getting started with Multis is fairly straightforward. Here are the six main steps you need to follow

Step 1: Sign in to Multis

Visit app.multis.co. If you aren’t already signed in to a Multis account on that browser, you’ll be prompted to enter your email address. Multis will then send you an email with a verification link. Verify your email address, and you’ll be signed in. You will then be required to key in your company name and select the type of account you’d like. There are three types to choose from.

The first is ‘account with no fees.’ As the name implies, all fees are covered by Multis. The second is ‘account with fees’, where you go old school and directly use Gnosis multisig (multi-signature). The third is ‘import existing account,’ which you should only use if you already have a multisig wallet created elsewhere. You’ll notice the dearth of password fields in this sign-up sheet- it’s because of Multis’ blockchain roots.

Step 2: Connect with Portis

To proceed, hit ‘connect with portis.’ Portis is a non-custodial blockchain wallet that runs on your browser. It lets you store your private keys on your device and connect to the Ethereum blockchain network using your email address. You cannot skip this step as Multis never holds your keys for you.

Step 3: Open Account

Once you have received an email confirmation of the connection to Portis, log back into Multis. Hit the ‘request access’ button, and you’ll immediately be requested to connect and sign the transaction. Upon confirmation, this transaction will create your smart wallet.

Step 4: Invite Owners

You’ve successfully created an account and wallet. On dApps that serve individuals, you’d be done with the setup. Since Multis focuses on teams, however, you still need to invite your team members. Doing this also helps further secure your transactions, as your co-owners will need to confirm transactions. Go to the ‘company settings’ section, choose the user, and you’ll see the option to send email invites.

The users you invite will need to follow the above three steps, namely creating a Multis account, connecting with Portis, and instead of opening an account, joining yours. Additionally, you will need to appoint them as owners after joining them to get the same account access privileges as you. It is recommended that you invite two owners (in addition to yourself) to maximize security.

Step 5: Set up Permissions and Limits

Under company settings, go to the ‘policies’ section and choose how many owners need to confirm a transaction before it is executed. If, for example, your account has a total of three owners, ideally, two should confirm the transaction for it to be executed.

You can also set a daily transaction limit. The limit is set in ETH, but a convenient USD /EUR field shows you the amount in the respective fiat currency. It is important to note that all sensitive operations, such as adding owners, making payments, and changing account policy, will require co-owner confirmation.

How to Send and Receive Coins using the Multis Wallet

After the initial set up process, sending and receiving funds on your Multis account is very easy. You just need to go to your company account dashboard, initiate a transaction to another entity (usually identified by their wallet address) and await your co-owners to confirm the transaction.

Better still, Multis leverages the ENS (Ethereum Name Service), so you don’t have to use long, random, unmemorable strings of text to identify other entities or their wallets. The ENS assigns a short name to represent wallets, much like a DNS (Domain Name Server) assigns websites memorable names in place of complex IP addresses.

Multis Wallet Ease of Use

Multis is extremely easy to use. It abstracts away the complex, fragmented aspects of crypto banking (Gnosis, Ethereum, Kyber, Compound, ENS, and Portis) behind a responsive, great looking interface. Multis also builds upon these powerful technologies, in the process of exposing all the functionality you’d expect of a banking app, such as deposits, payments, interest, and currency conversion.

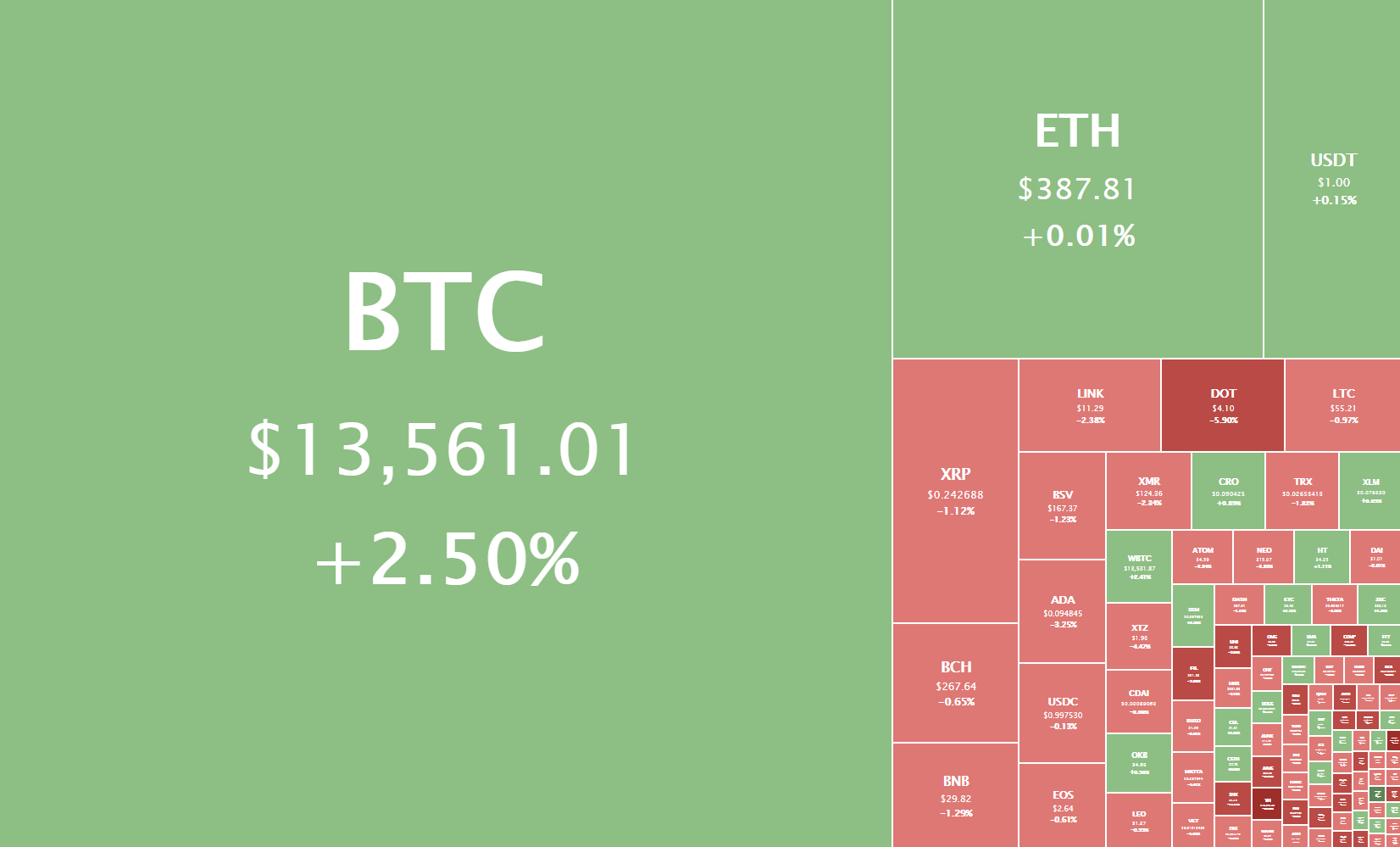

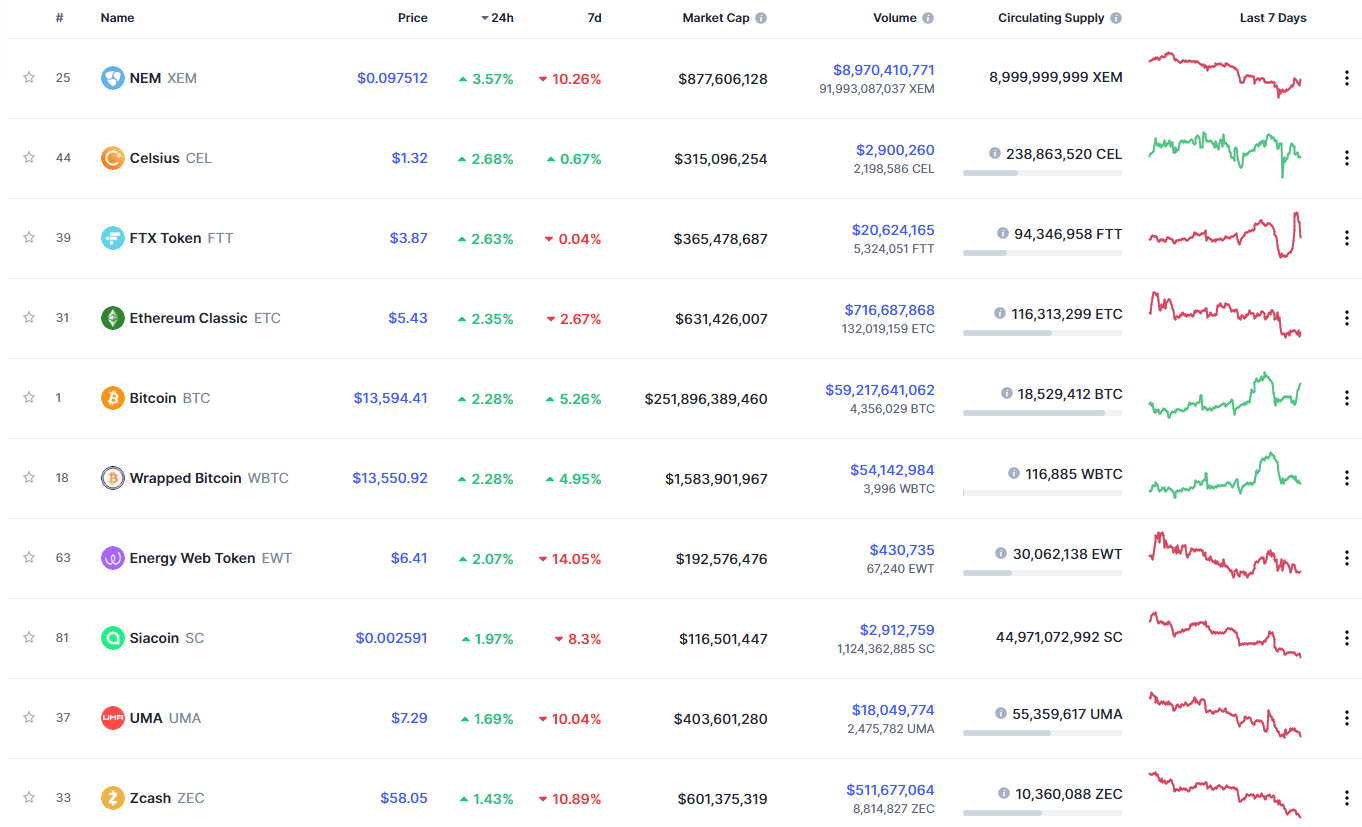

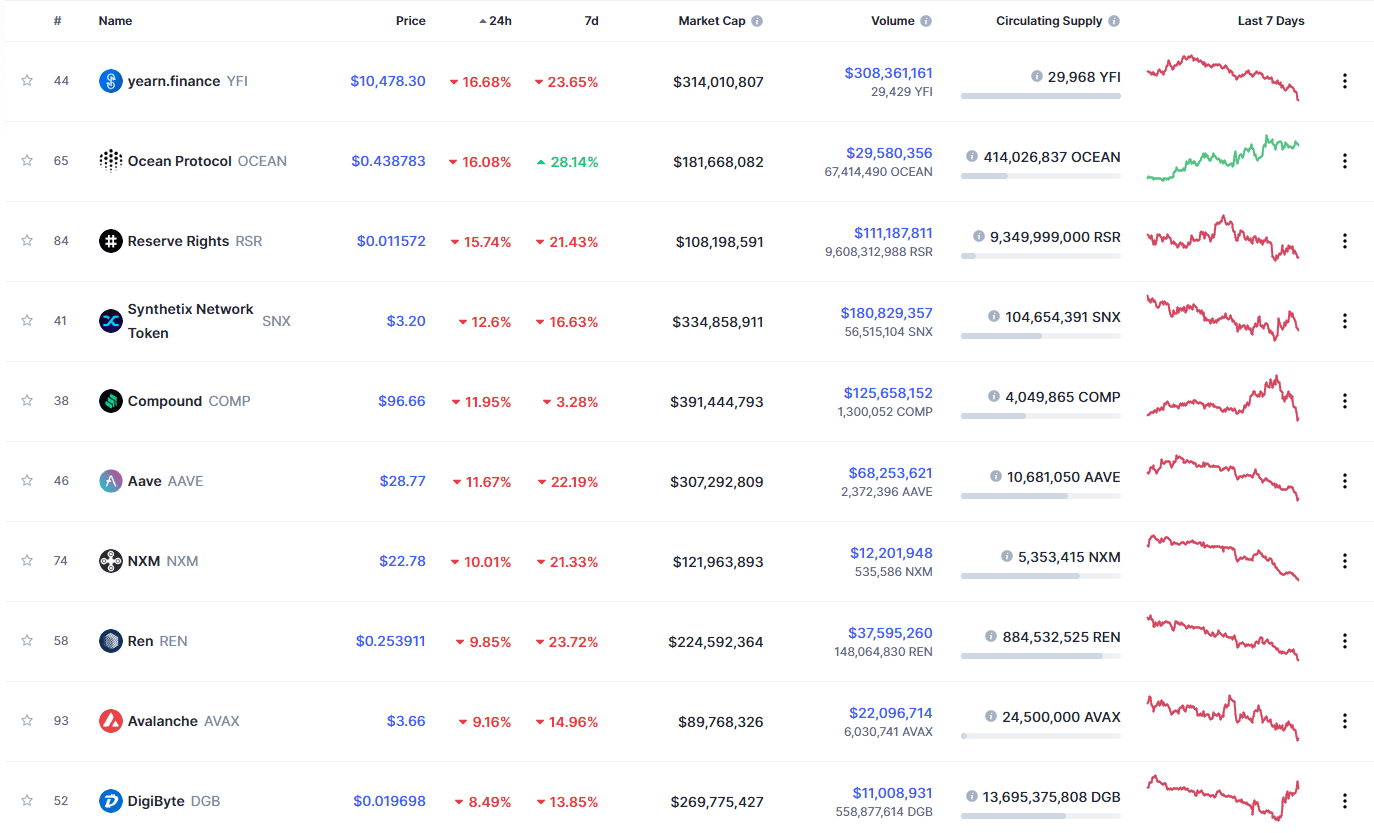

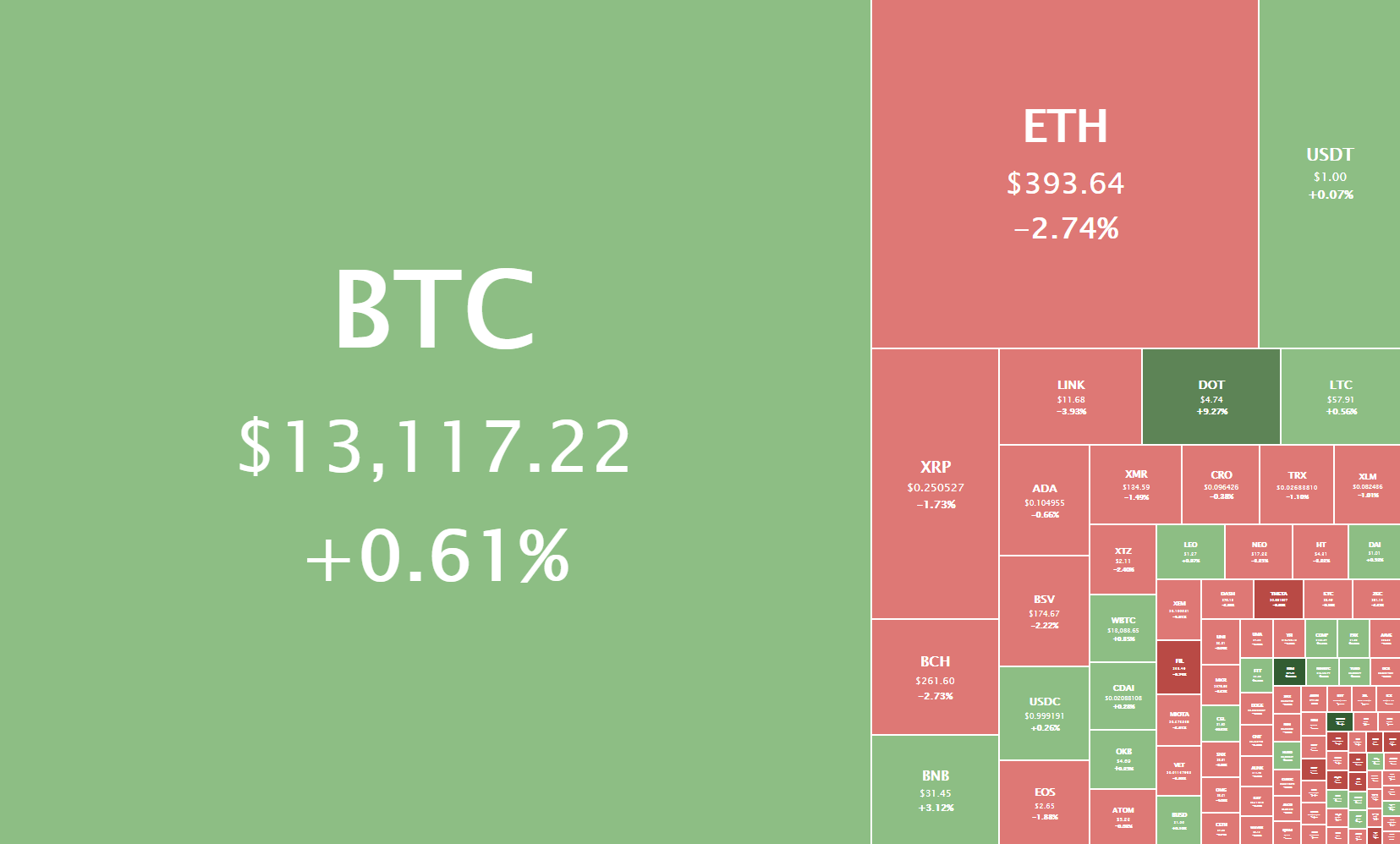

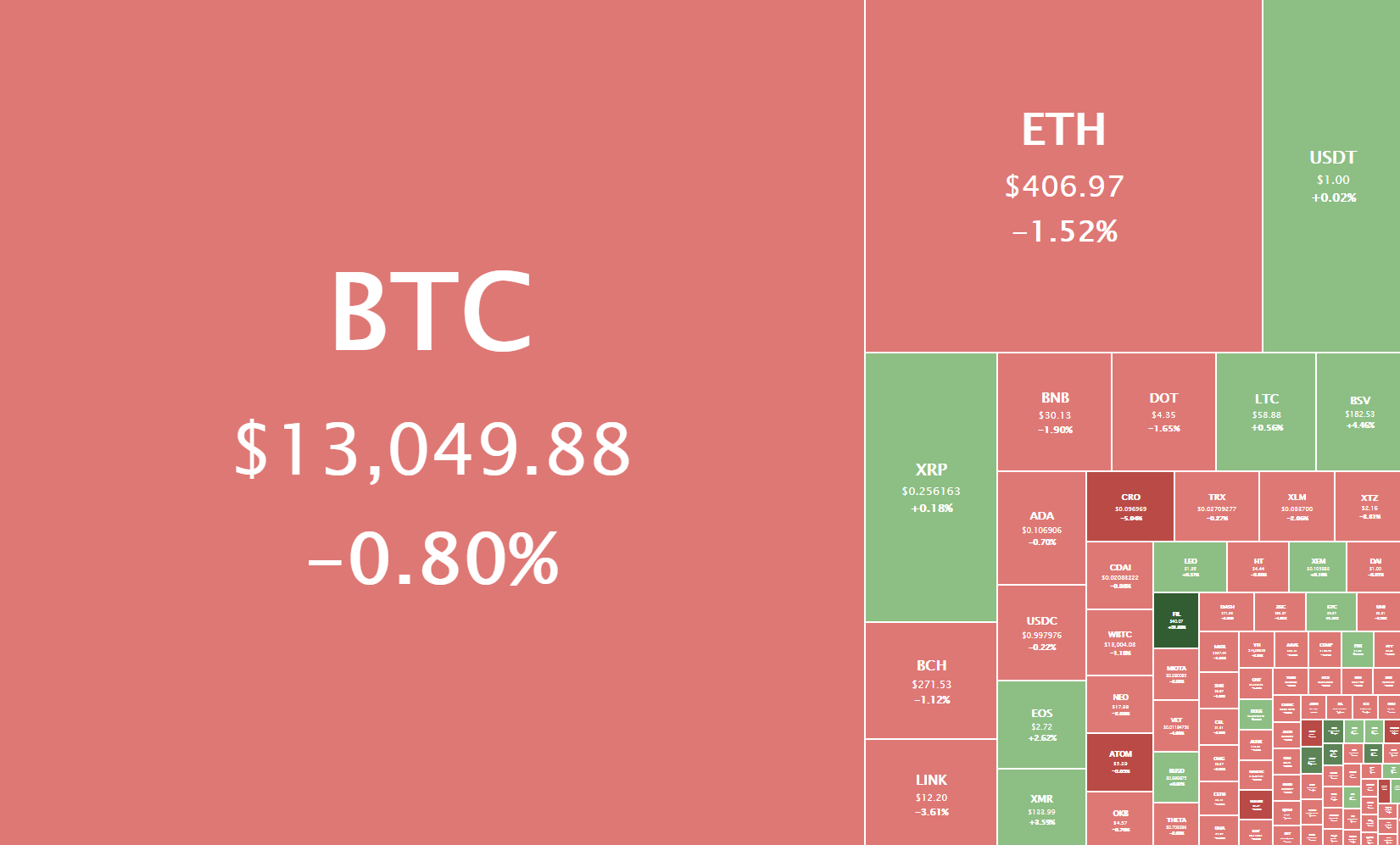

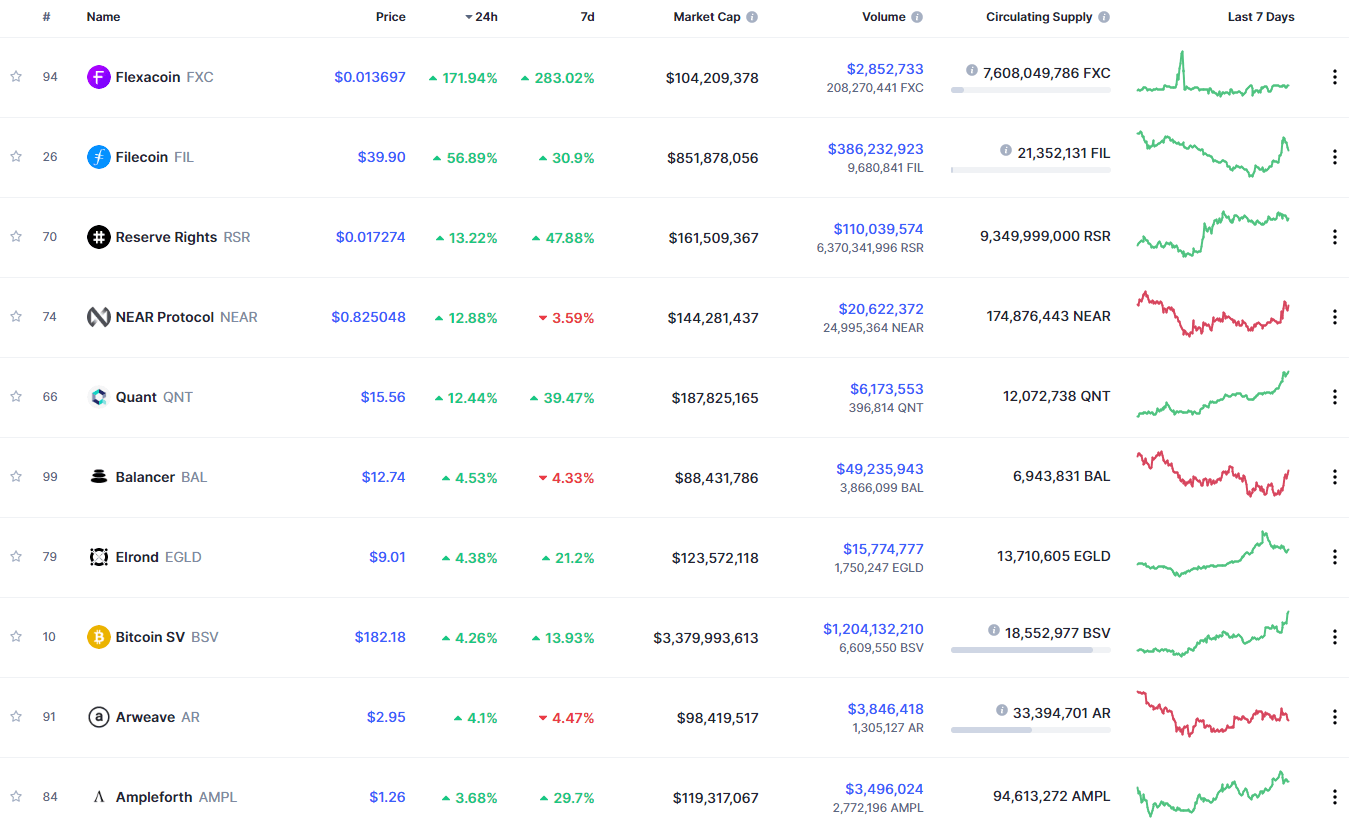

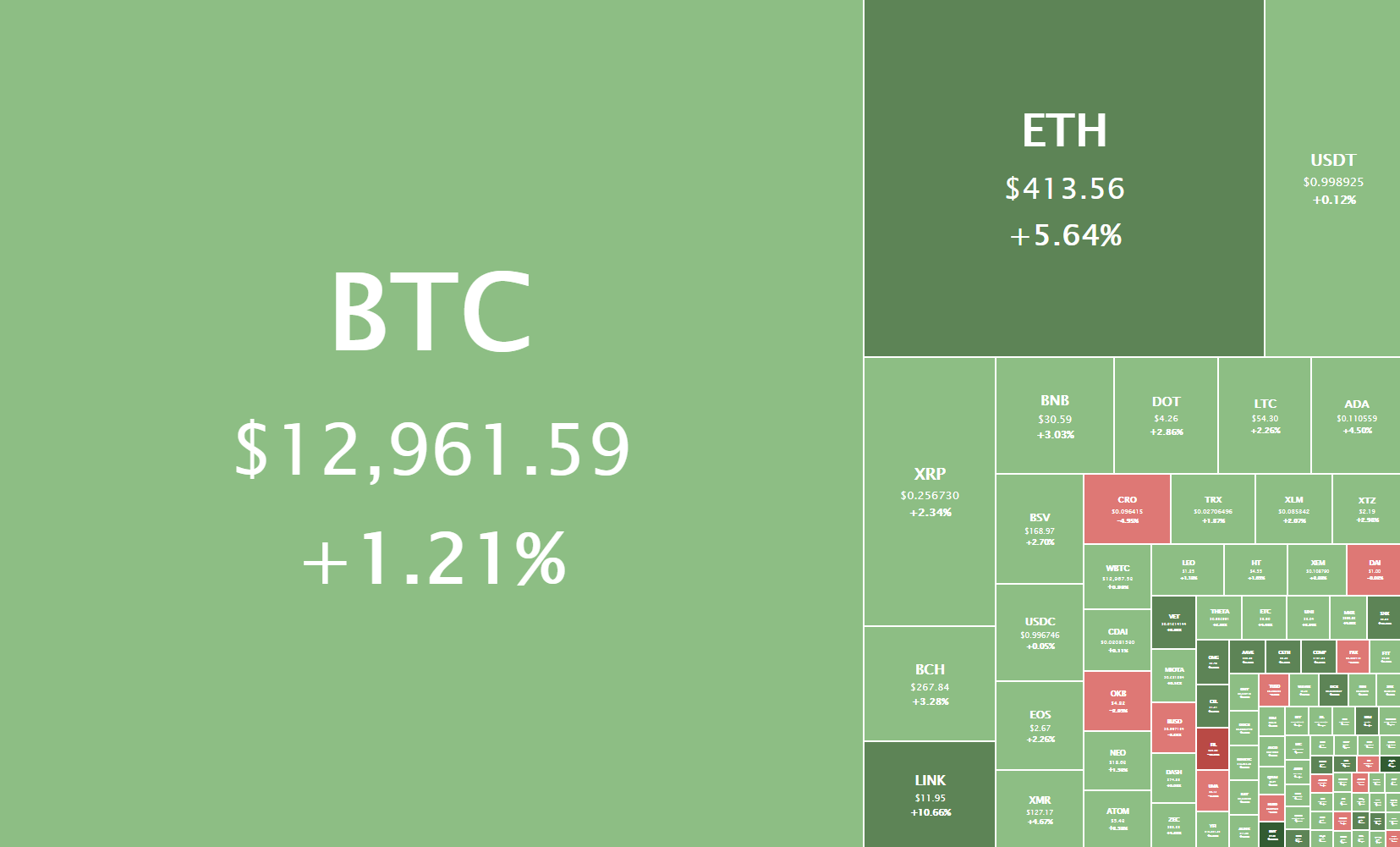

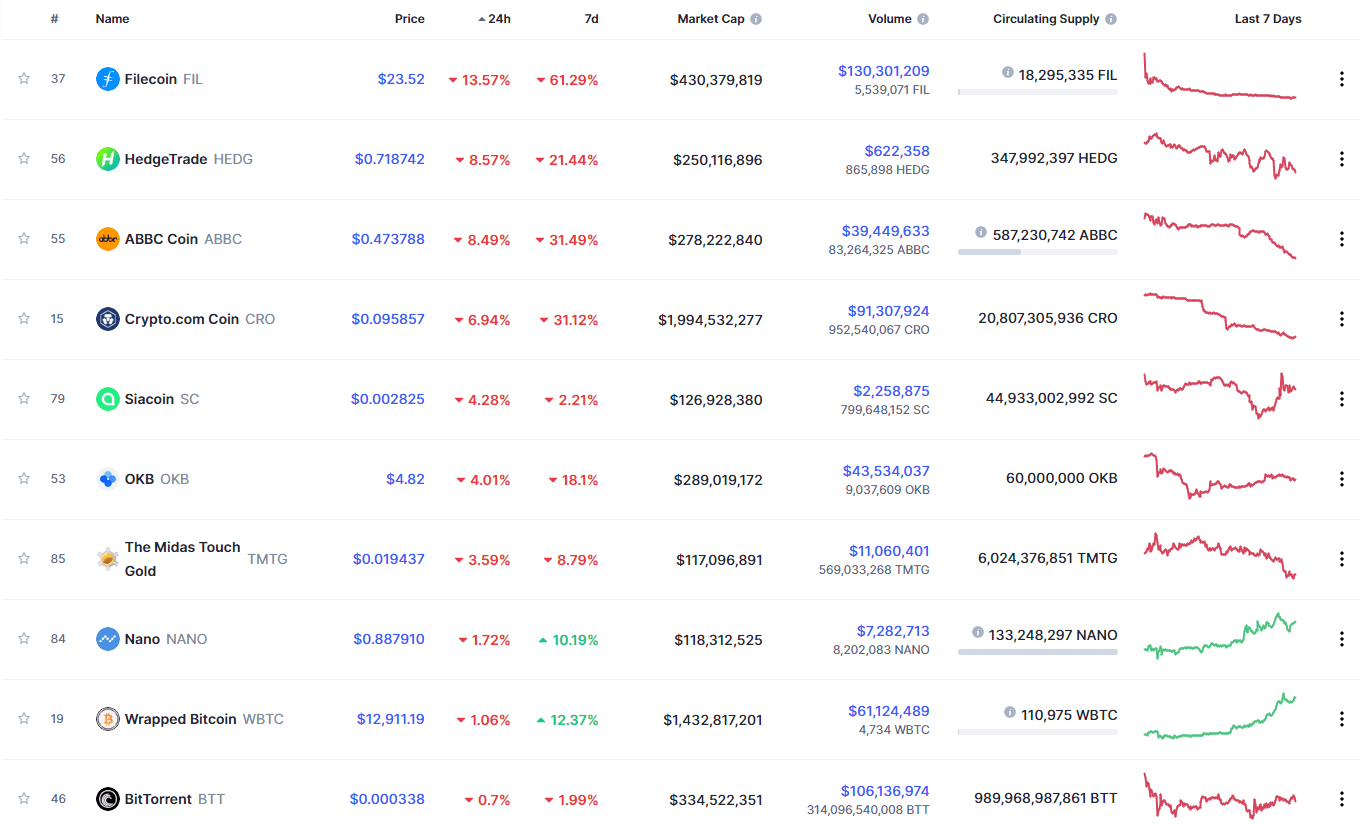

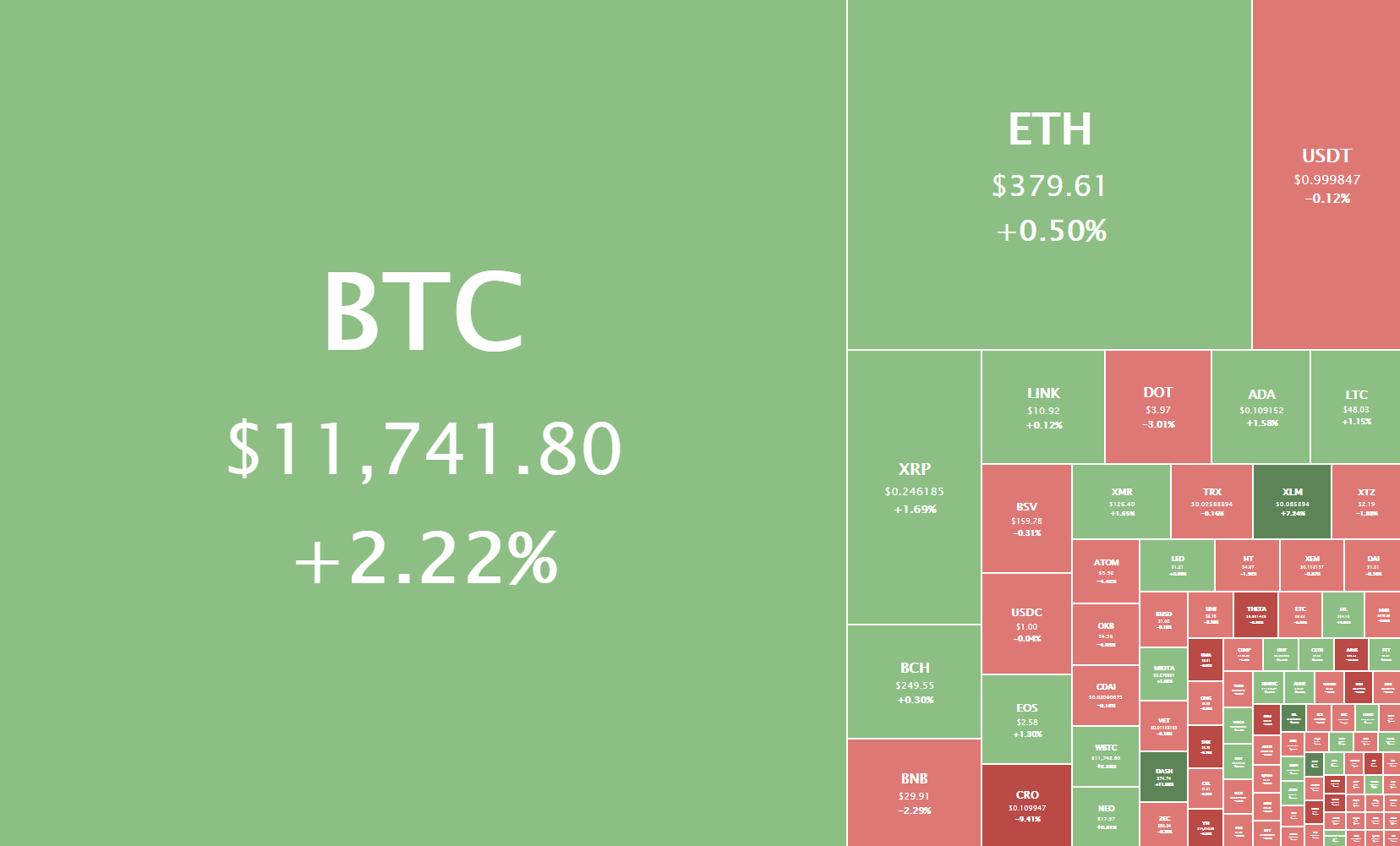

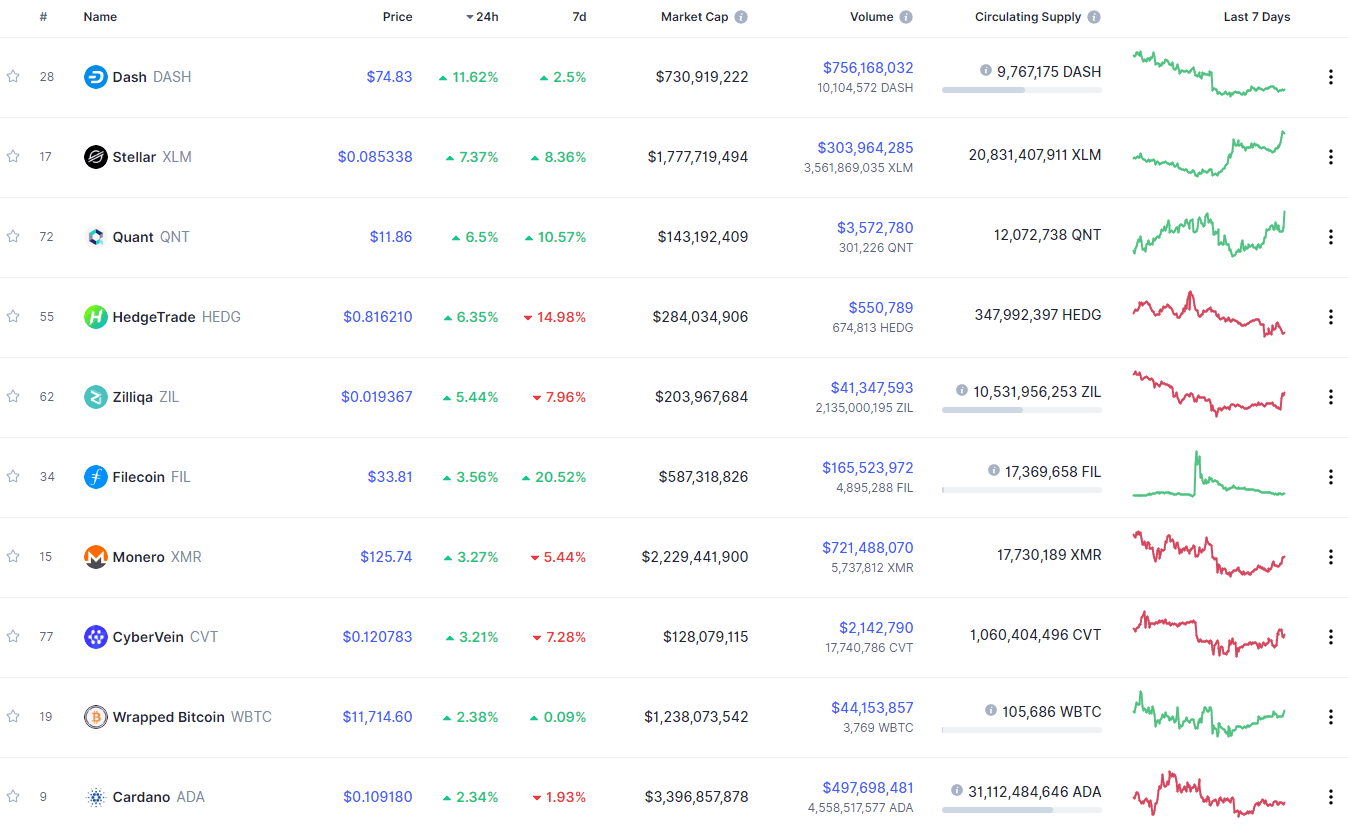

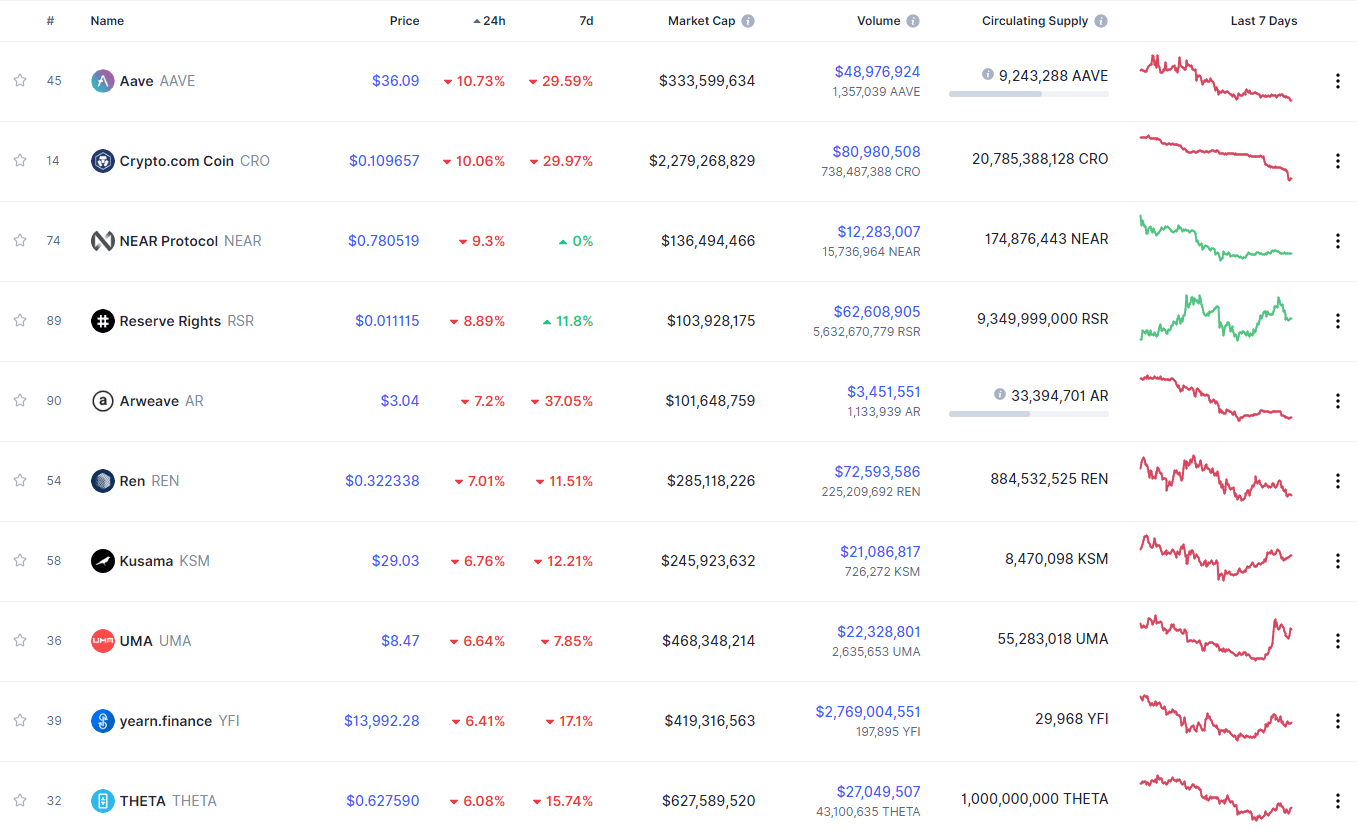

Multis Wallet Supported Currencies

Multis supports over 70 ERC20 cryptocurrencies. The ERC20 standard applies to ETH currencies that are fungible; that is, currencies whose tokens each have the same value. Additionally, Multis also supports conversions to USD and EUR.

Verdict

Multis builds upon the blockchain network, integrating many different services into a single useable product. It is also non-custodial, meaning that you are in full control of your funds. It is an extremely secure way of transacting and is a very good option for organizations seeking to go bankless.