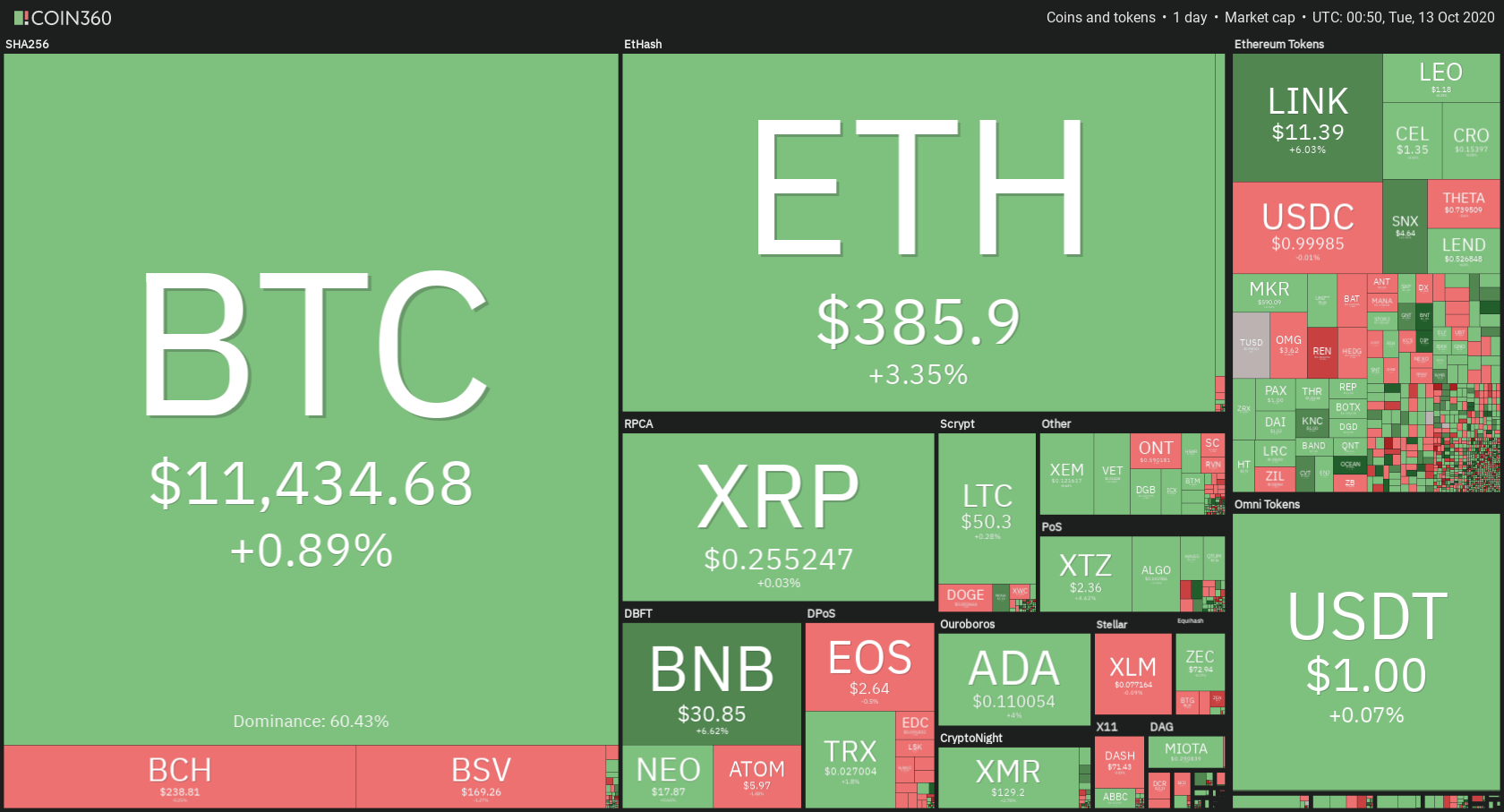

The cryptocurrency sector has experienced another surge as Bitcoin moved away from $11,300 and closer to $11,500. Bitcoin is currently trading for $11,434, representing an increase of 0.89% on the day. Meanwhile, Ethereum gained 3.35% on the day, while XRP gained 0.03%.

Daily Crypto Sector Heat Map

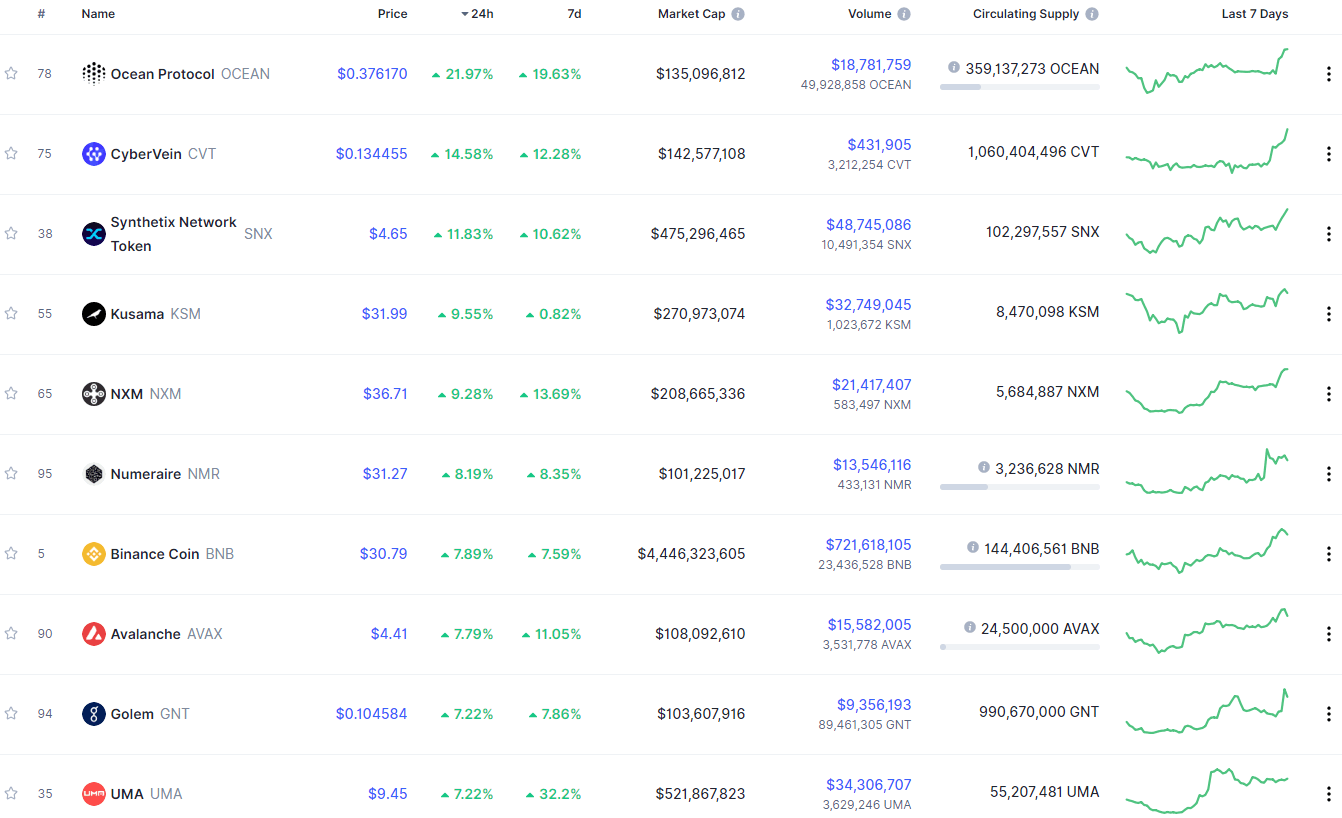

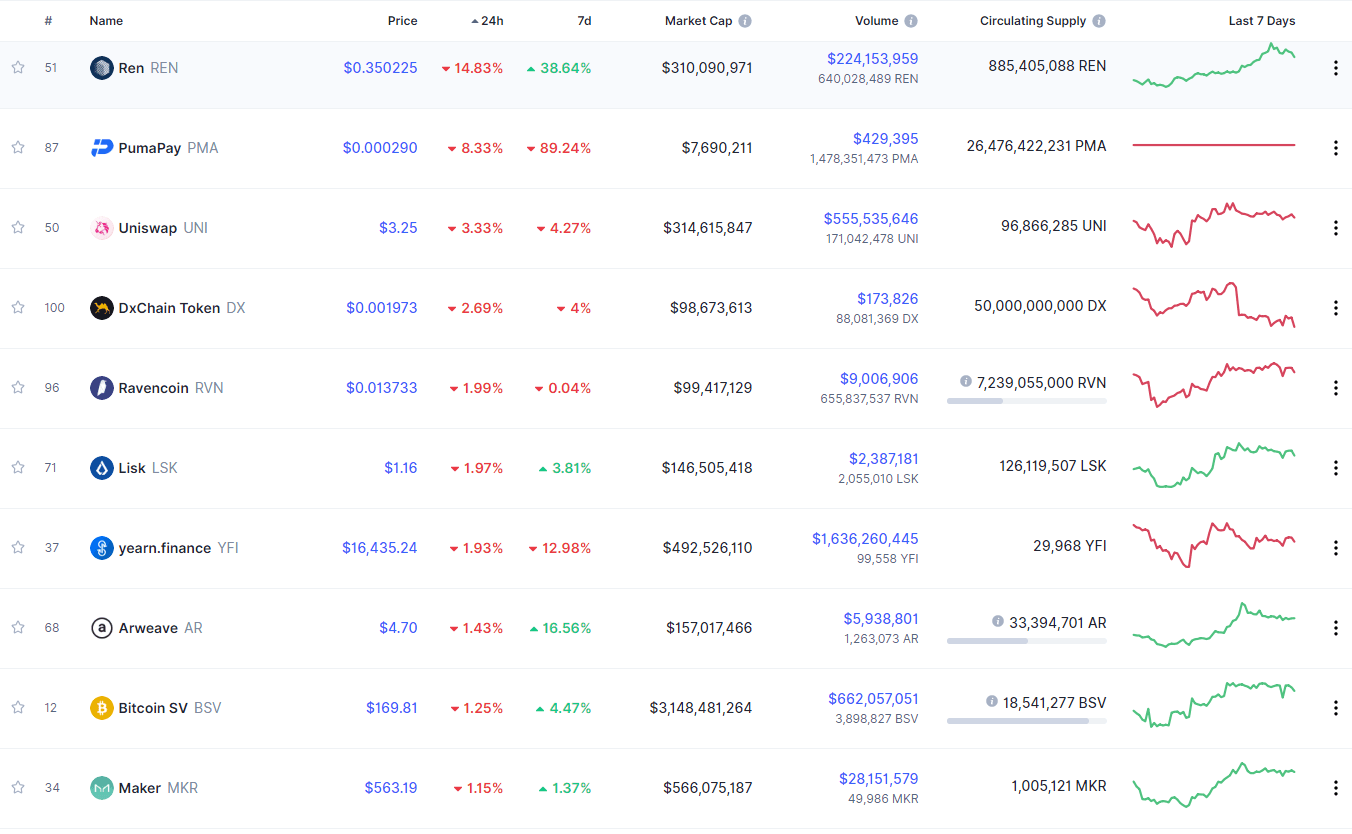

Taking a look at the top 100 cryptocurrencies, we can see that Ocean Protocol gained 21.97% in the past 24 hours, making it the top daily gainer. CyberVein (14.58%) and Synthetix Network Token (11.83%) also did great. On the other hand, Ren lost 14.83%, making it the most prominent daily loser. It is followed by PumaPay’s loss of 8.33% and Uniswap’s loss of 3.33%.

Top 10 24-hour Performers (Click to enlarge)

Bottom 10 24-hour Performers (Click to enlarge)

Bitcoin’s market dominance level has decreased slightly since our last report, with its value currently being 60.40%. This value represents a 0.26% difference to the downside when compared to when we last reported.

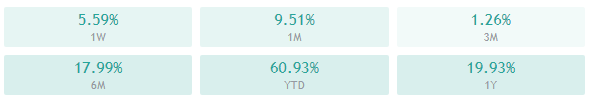

Daily Crypto Market Cap Chart

The crypto sector capitalization has a bit more value over the course of the past 24 hours. Its current value is $366.13 billion, representing an increase of $7.71 billion compared to our previous report.

_______________________________________________________________________

What happened in the past 24 hours?

_______________________________________________________________________

- Grayscale’s Ethereum Trust joins GBTC as SEC-registered reporting company (The Block)

- Report: G7 financial leaders say they will oppose Libra until it is ‘adequately’ regulated (The Block)

- Another CME Gap? Why Bitcoin Traders Should Care (Cryptobriefing)

- Ethereum Gets Privacy-Focused Layer-2 Scaling Solution with Aztec 2.0 (Cryptobriefing)

- Aave Raises $25 Million in the Round Led by Blockchain.com (Cryptobriefing)

- Why investors are optimistic after “painful” DeFi correction despite YFI plunge (Cryptoslate)

- With China’s central bank digital asset gaining steam, Bitcoin is stronger than ever (Cryptoslate)

- Short the dollar: How Goldman’s bearish stance uplifts Bitcoin Q4 sentiment (Cointelegraph)

- Ledger wants to help MicroStrategy secure its $400m Bitcoin treasury (Cointelegraph)

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

The largest cryptocurrency by market cap has continued its push towards the upside, getting past $11,500 and even close to the $12,000 mark. The move died out when it approached $11,750. Bitcoin is now in the pullback phase, where its price has breached $11,500 to the downside and is testing how low it can go until the bulls step in again.

Traders should pay attention to how Bitcoin handles the $11,300-$11,500 level when looking for their next trade.

BTC/USD 4-hour Chart

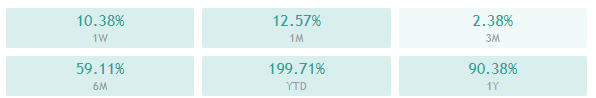

Bitcoin’s technical overview on all time-frames is tilted towards the buy-side, with longer time-frames showing an extremely strong bull overview.

BTC/USD 1-day Technicals

Technical factors (4-hour Chart):

- Price is above both its 50-period EMA and 21-period EMA

- Price descending from the top Bollinger band

- RSI is descending from almost-overbought levels (62.46)

- Volume is above-average

Key levels to the upside Key levels to the downside

1: $11,500 1: $11,300

2: $11,630 2: $11,180

3: $12,000 3: $11,000

Ethereum

Ethereum has had another bull-run in the past 24 hours, with its price reaching as high as $396. However, the second-largest cryptocurrency by market cap couldn’t reach past the $400 mark, triggering bull exhaustion, and ultimately a pullback. With volume and RSI dropping, we may expect Ethereum to look for a price to consolidate a bit lower than its current price, and possibly test the $371 support level.

ETH/USD 4-hour Chart

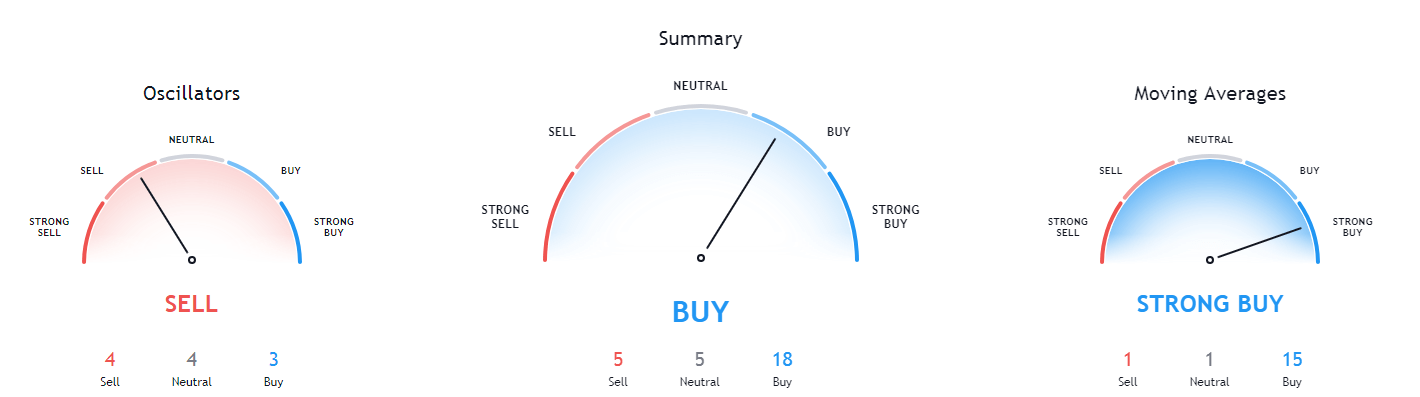

Ethereum’s 1-day and monthly overviews show some signs of doubt in the bullish sentiment, while its 4-hour and weekly overviews are completely bullish.

ETH/USD 1-day Technicals

Technical Factors (4-hour Chart):

- The price is above both its 50-period and its 21-period EMA

- The price at its top Bollinger band

- RSI is flat and nearly overbought (66.74)

- Volume is elevated

Key levels to the upside Key levels to the downside

1: $378 1: $371

2: $400 2: $360

3: $415 3: $334

Ripple

Unlike Bitcoin and Ethereum, which both had a strong bull presence today, XRP has been trading sideways for most of the day. Its inability to reach past the $0.26 level has proven to be a problem, and we may expect XRP’s price to collide with the ascending trend line very soon. There is a small probability that XRP will reach past $0.26 and get close to $0.266, but it will most likely happen with Bitcoin’s help (though it is more likely that XRP will face the ascending line first).

XRP/USD 4-hour Chart

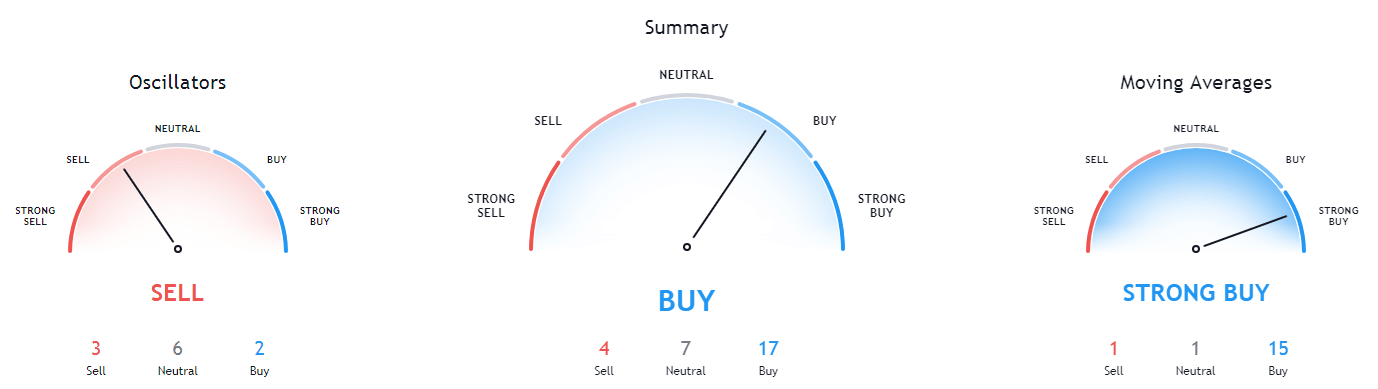

XRP’s 1-day technicals show a hint of doubt in its short-term bullish sentiment, while the 4-hour and weekly overviews are completely bullish. However, XRP’s monthly overview is still completely tilted towards the sell-side.

XRP/USD 1-day Technicals

Technical factors (4-hour Chart):

- The price is above its 50-period EMA as well as its 21-period EMA

- Price is at its middle Bollinger band

- RSI is flat (55.33)

- Volume is average but descending

Key levels to the upside Key levels to the downside

1: $0.266 1: $0.2454

2: $0.27 2: $0.235

3: $0.273 3: $0.227