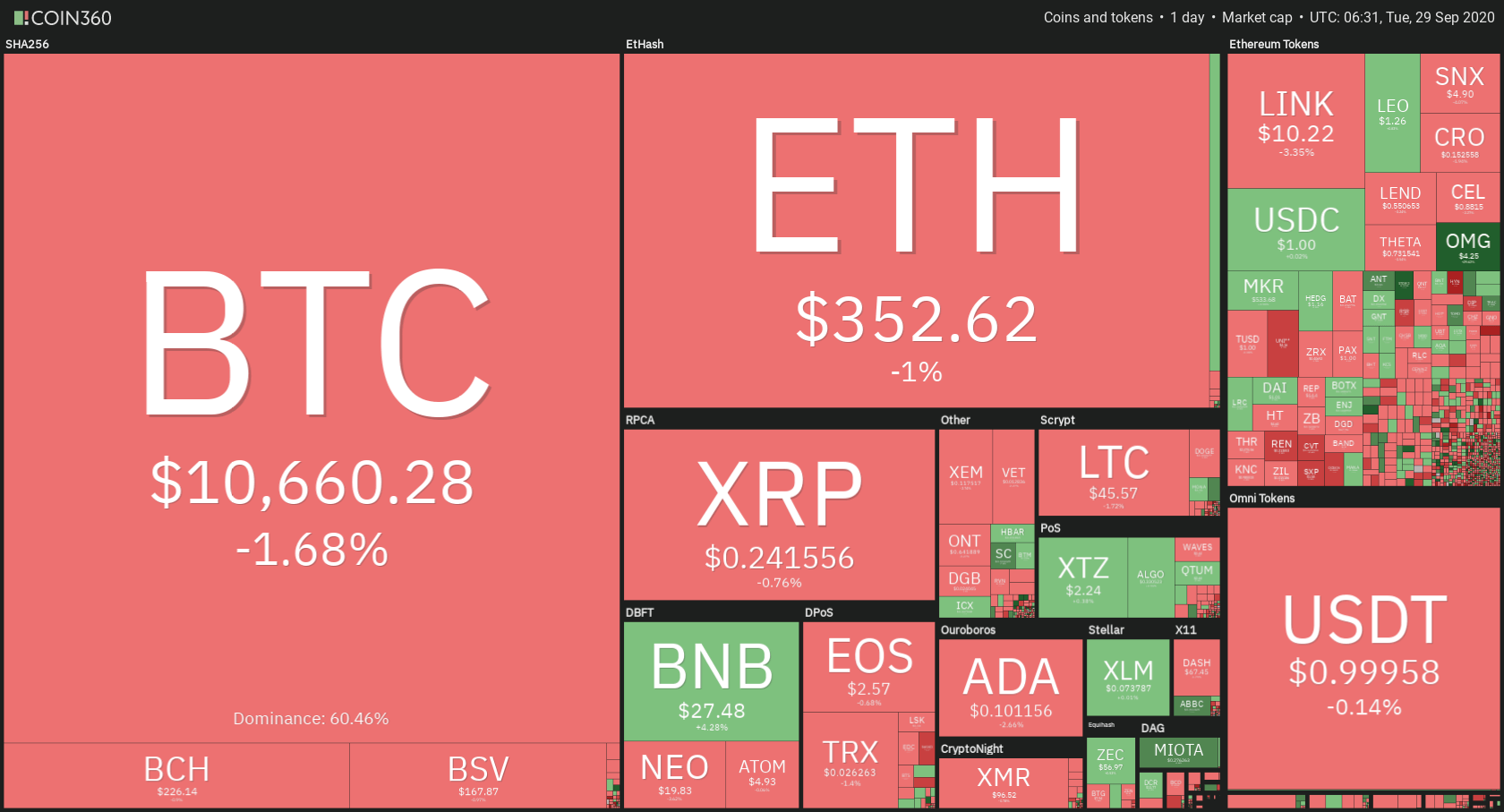

While brokers have always offered the ability to trade in most major and minor currency pairs, the cryptocurrency boom that occurred in 2010 caused many brokers to make the decision to add the most popular currency pairs like Bitcoin, Ethereum, Tether, and Ripple to their offerings. This opens up a world of opportunities to traders that want to invest in both while remaining convenient where you can open one trading account and access both options through most brokers. However, some traders may not completely understand the difference between currency pairs and the somewhat newly introduced cryptocurrency options. Online myths even suggest that cryptocurrency has no real value, which causes some traders to stay away. Regardless of what you’ve heard, you might be wondering which is better to invest in for the year 2021 – the timeless forex pairs, or the newer cryptocurrency options.

What is Forex?

The forex market is a global online foreign exchange market where the exchange rate of two different currencies is quoted and traded against each other. Major currencies include options like the US dollar, the Euro, the Japanese Yen, and the British Pound. When the US dollar is crossed with the Japanese Yen, it is written as USDJPY, while the US dollar crossed with the Euro is written as EURUSD, and so on. You can also trade minor currency pairs, which include any major pair that is not paired with the US dollar, along with exotic pairs from less established countries. Here are a few examples of exotic currencies:

- The Norwegian Krone

- The Hungarian Forint

- The Russian Ruble

- The South African Rand

When it comes to trading forex, there are pros and cons to think about. Forex involves fiat currencies that are managed by central banks, which typically aim to keep stable exchange rates for their currencies where possible. This makes the forex market less volatile, but traders also need to remember that prices are highly affected by global events. Elections, economic data releases, changes to central bank policy, and macroeconomic events can cause the market to become more volatile. While the forex market is more stable than the cryptocurrency market, it is still unpredictable at times.

Forex trading is also considered to be attractive because brokers are able to offer their services for a relatively low trading cost. Typically, brokers make their profits by charging spread and/or commission on a round trip trade. The average cost of trading the benchmark pair EURUSD is usually around 1 to 1.5 pips, making the cost to trade around 0.08% of the value of the asset being traded. This is significantly lower than the cost of trading cryptocurrency.

The forex market is also widely available for trading, as market sessions generally go from Monday morning until Friday evening. This is divided into three major sessions:

- American

- European

- Asian

The wide market hours offer traders greater flexibility when it comes to trading opportunities, although it’s important to remember that the sessions dominated by New York, Tokyo, and London are considered to present the greatest opportunities to trade.

What is Cryptocurrency?

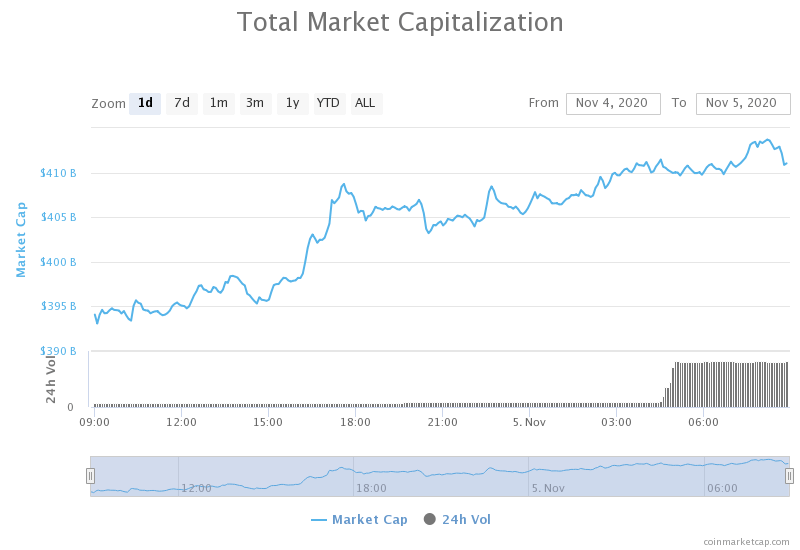

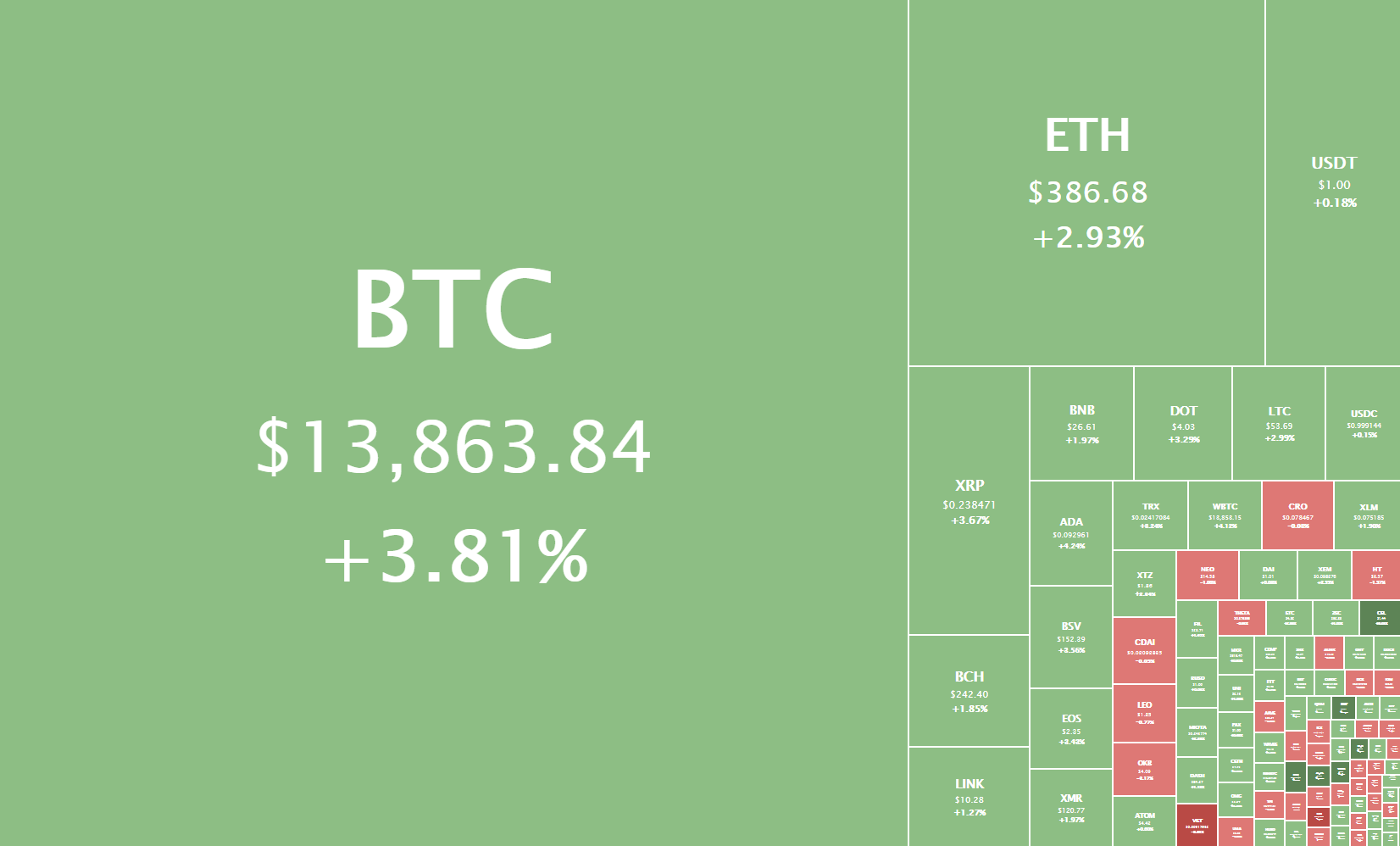

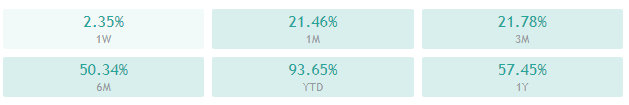

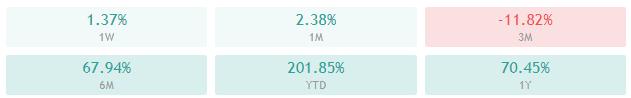

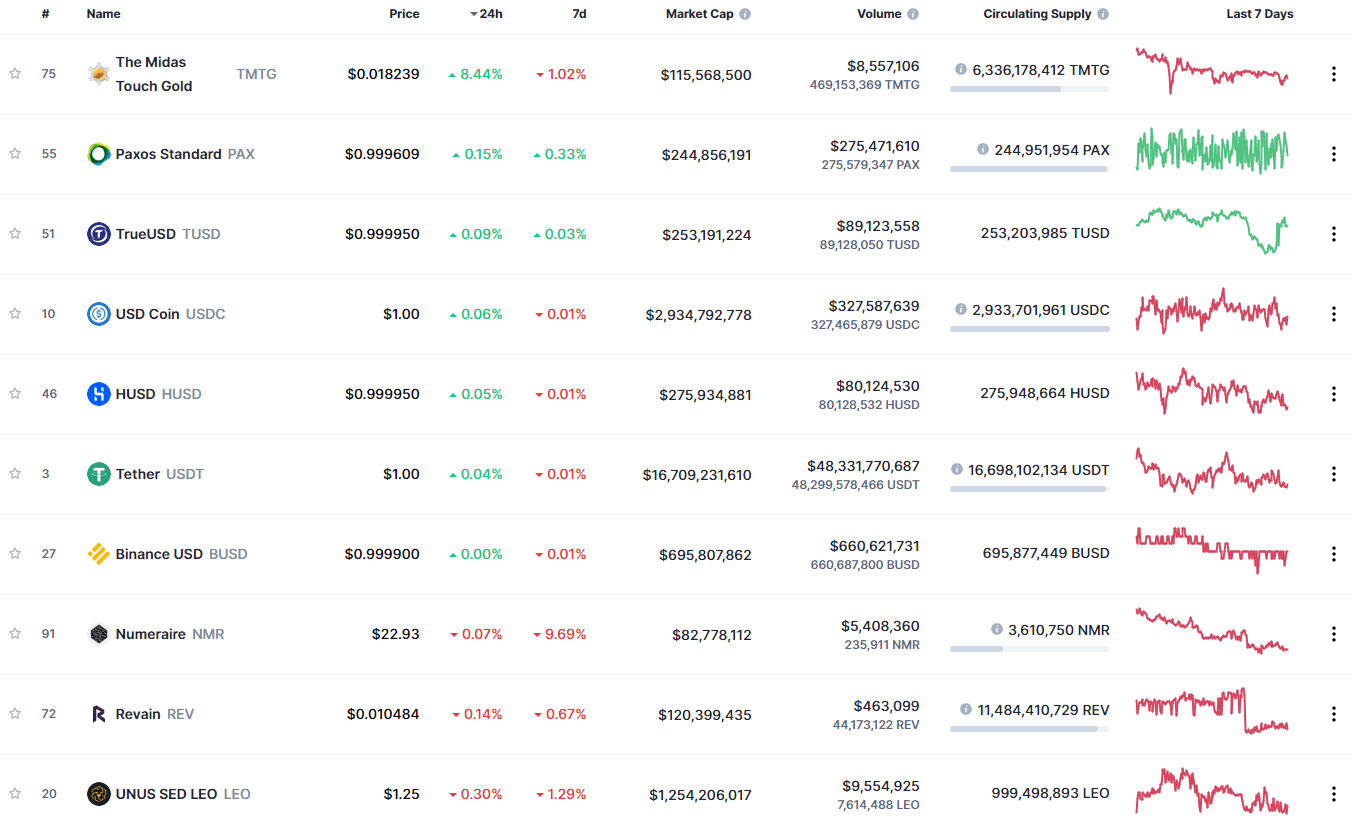

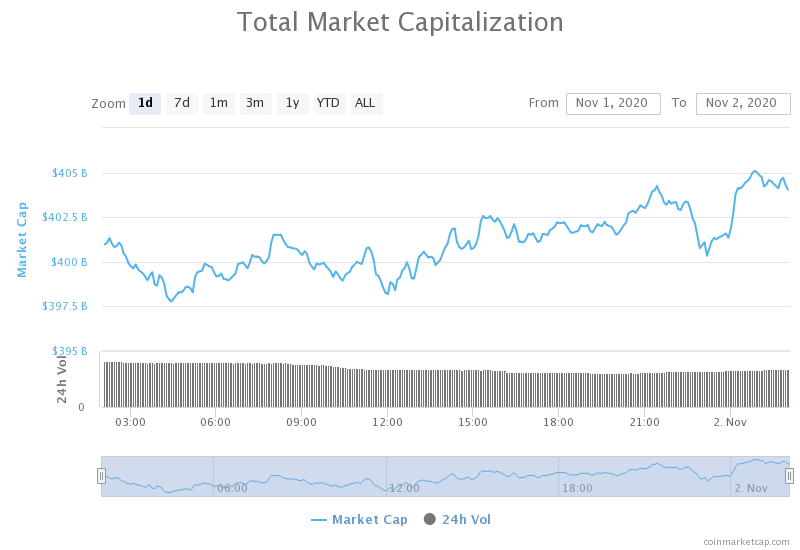

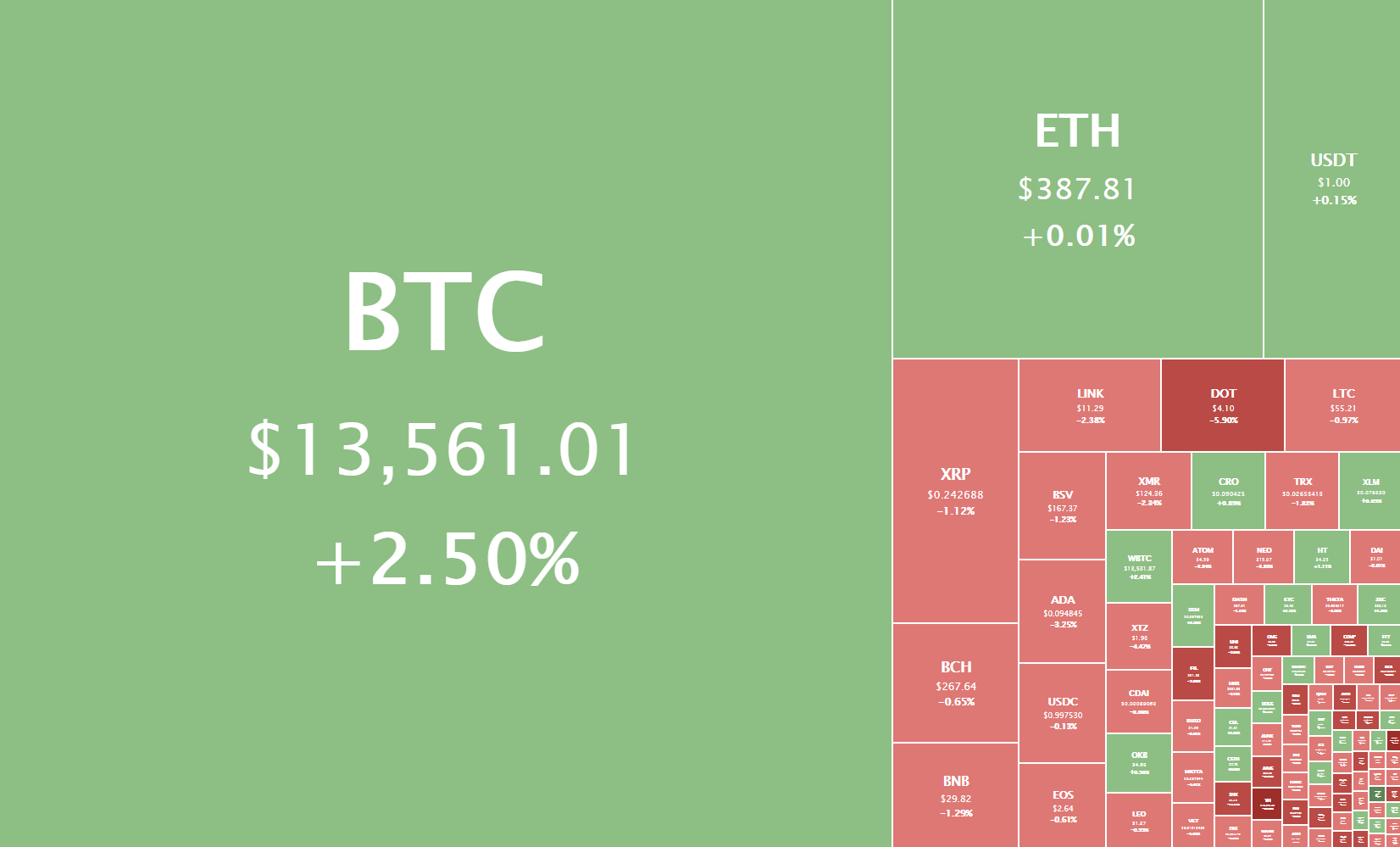

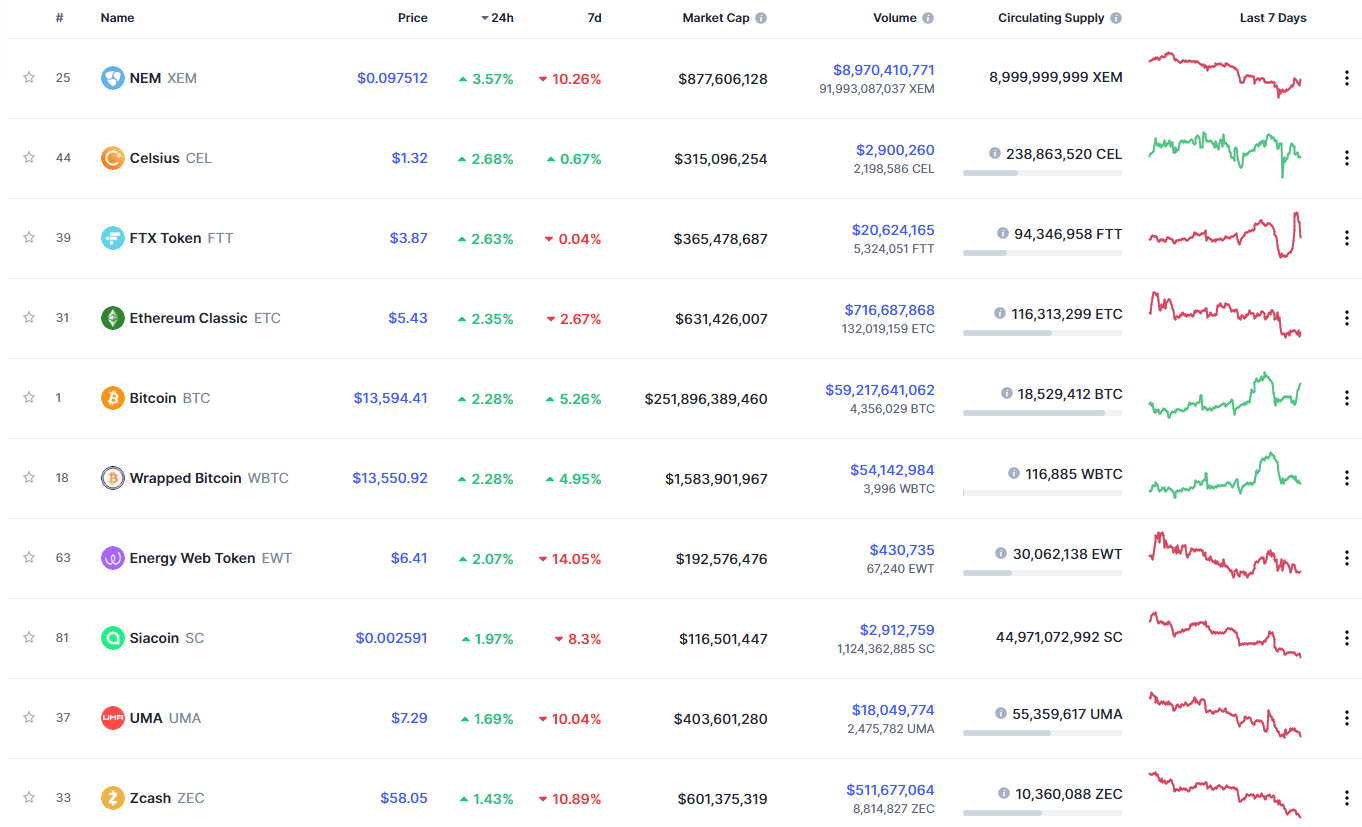

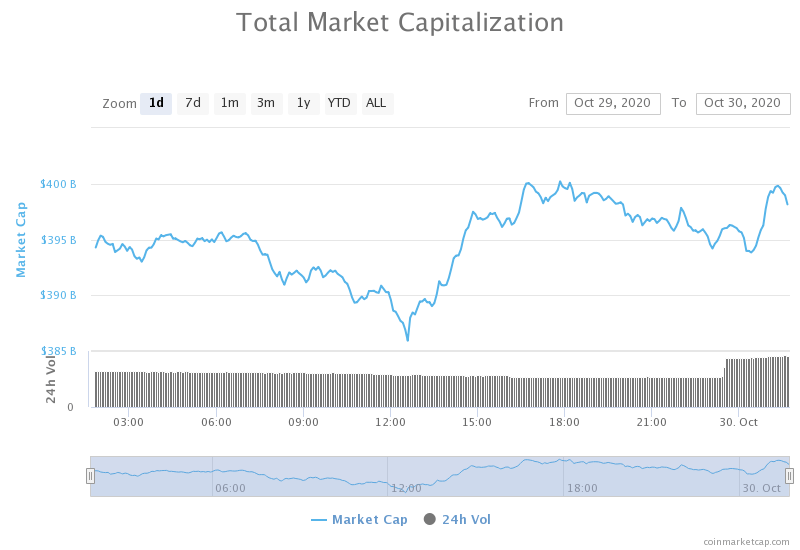

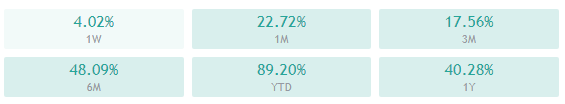

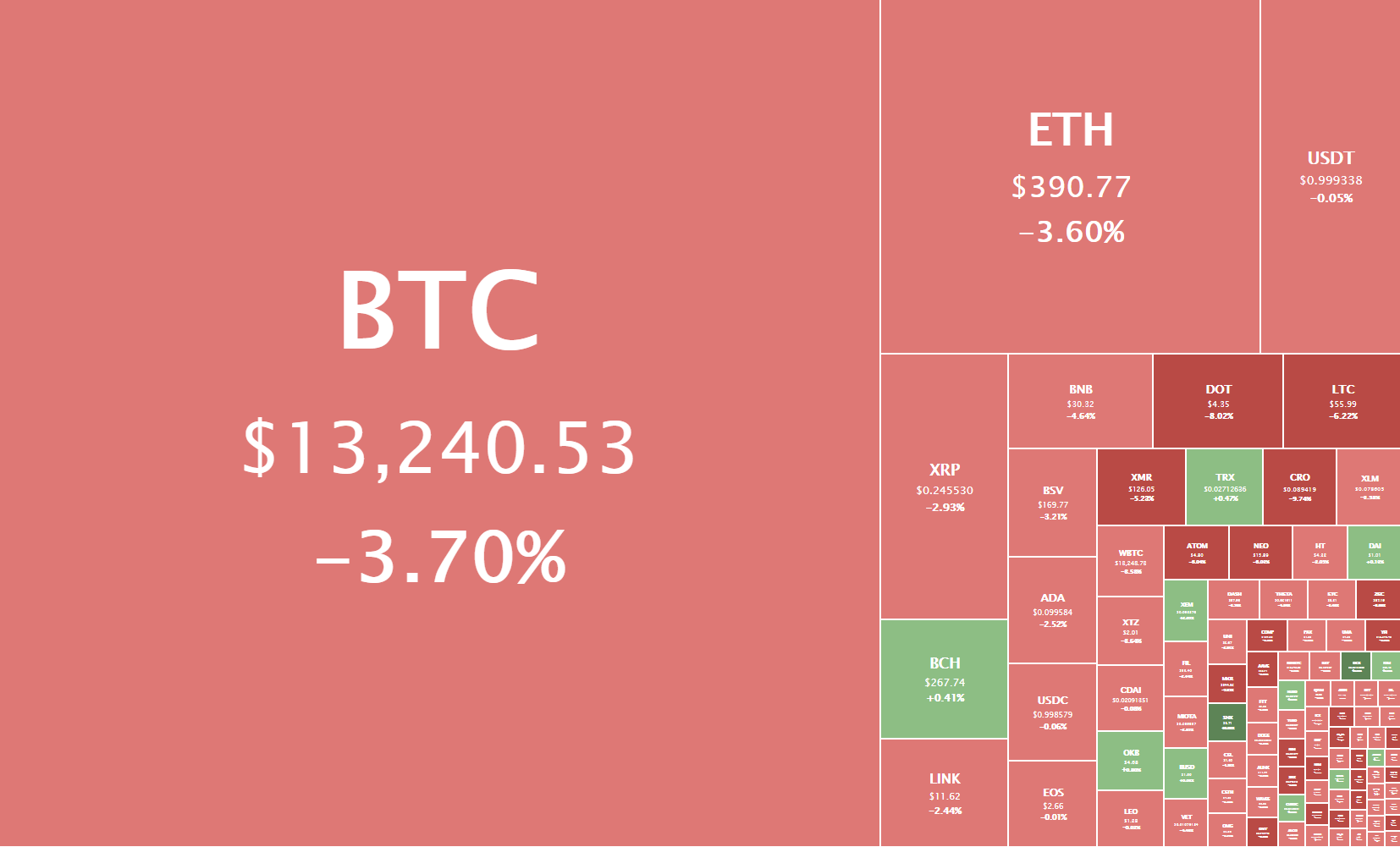

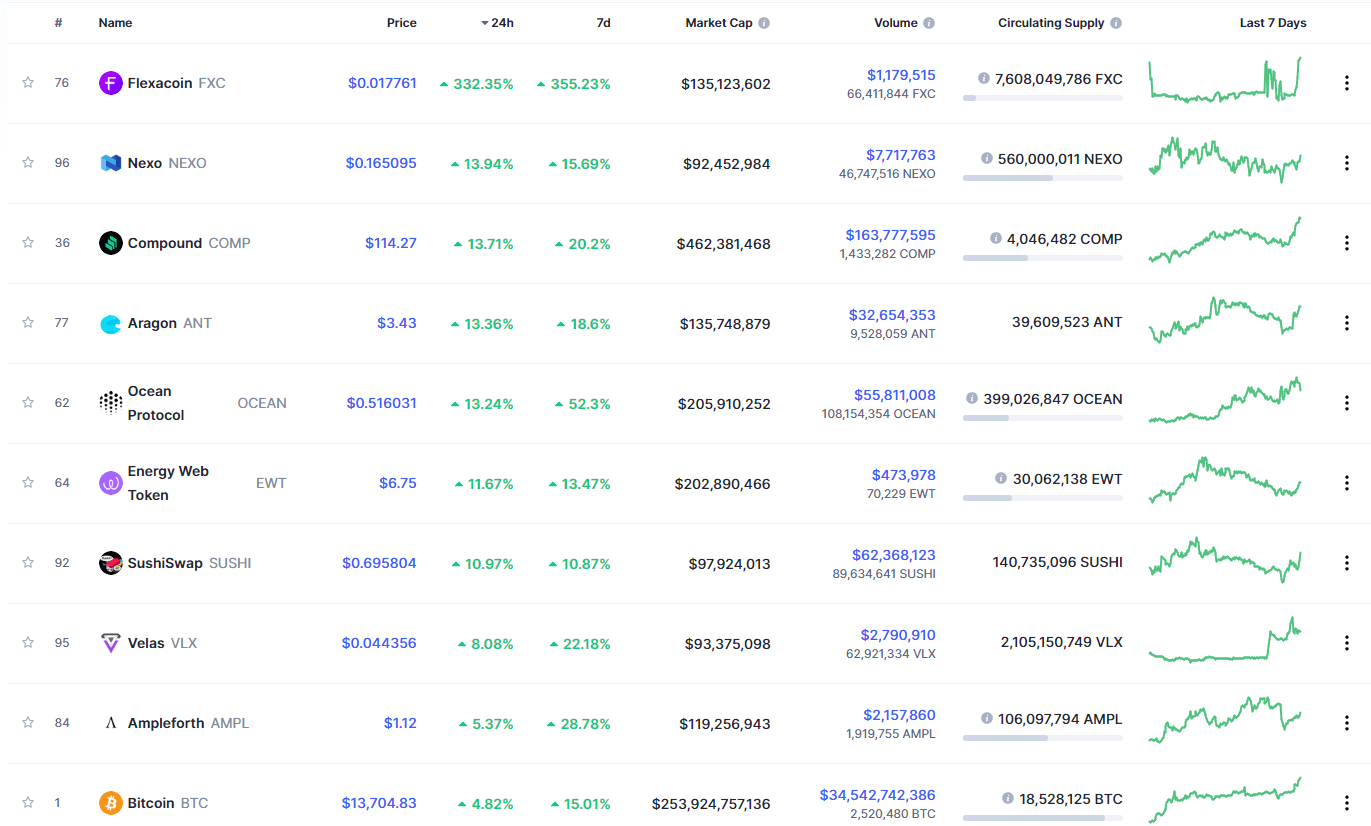

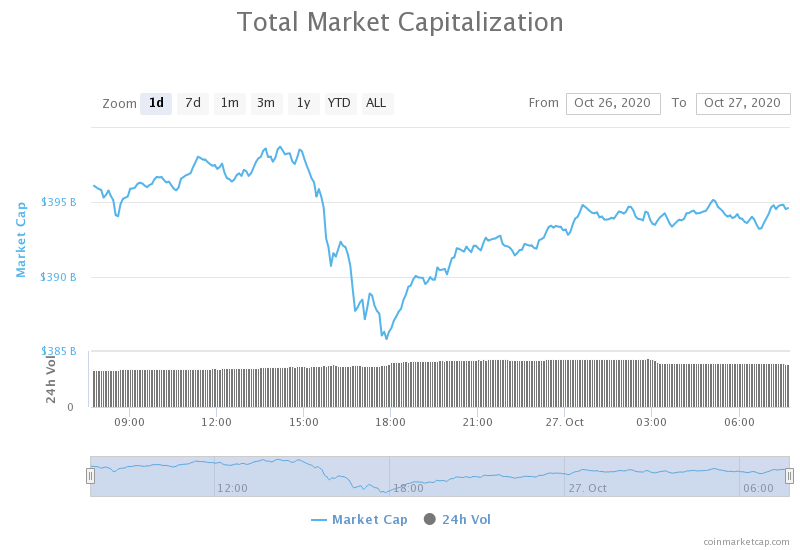

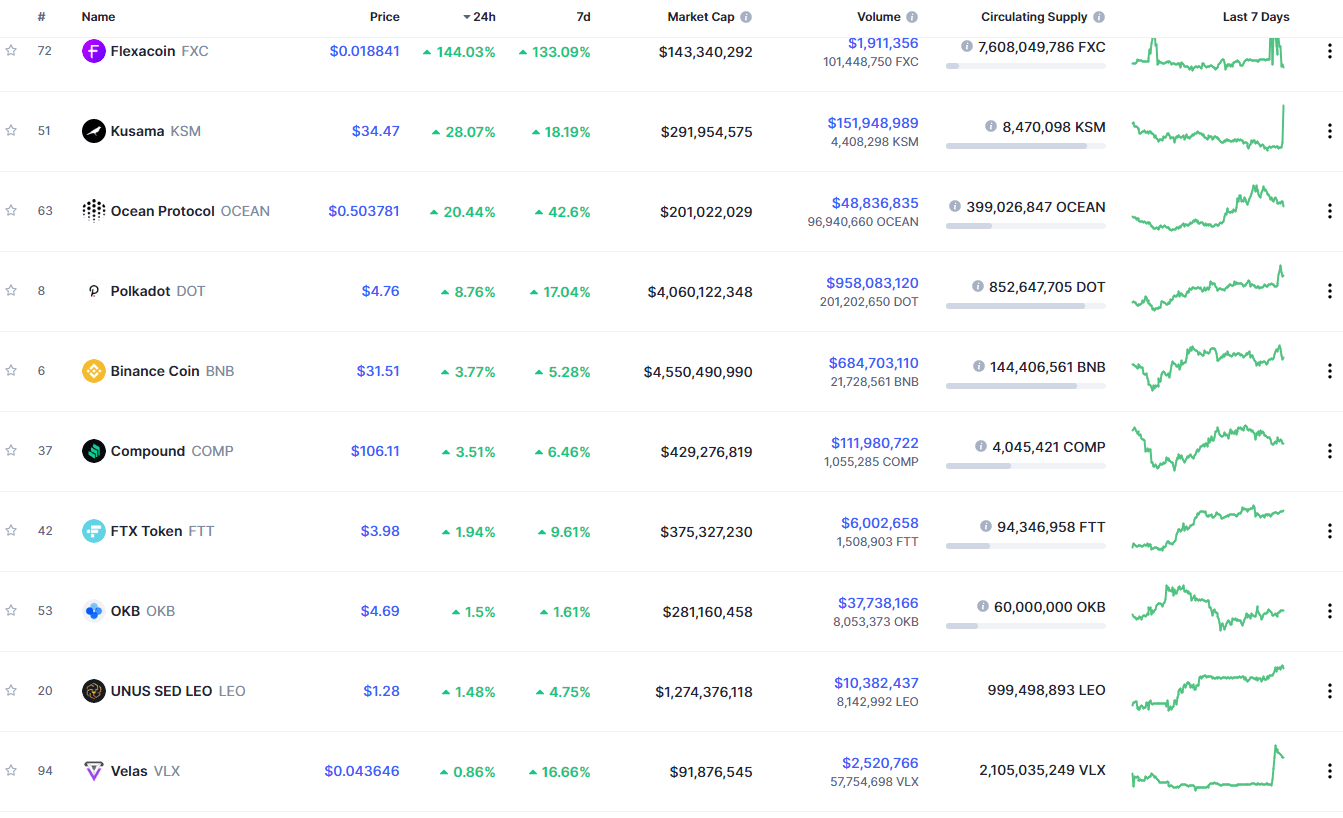

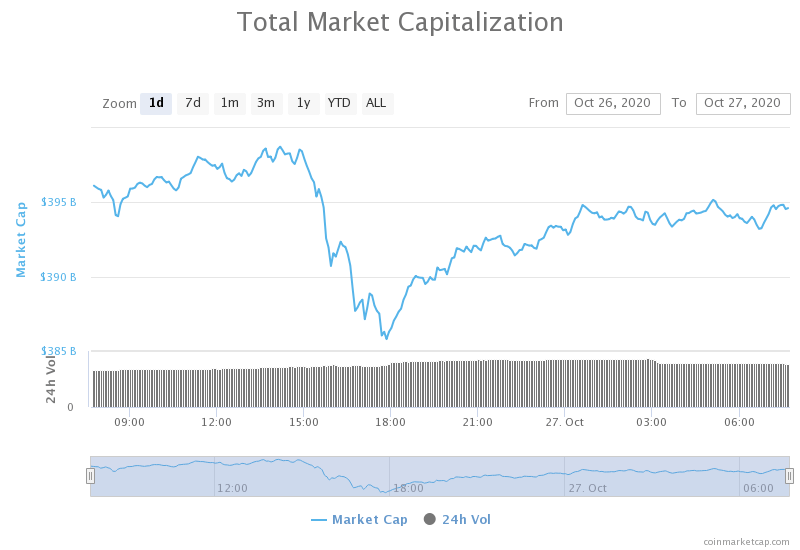

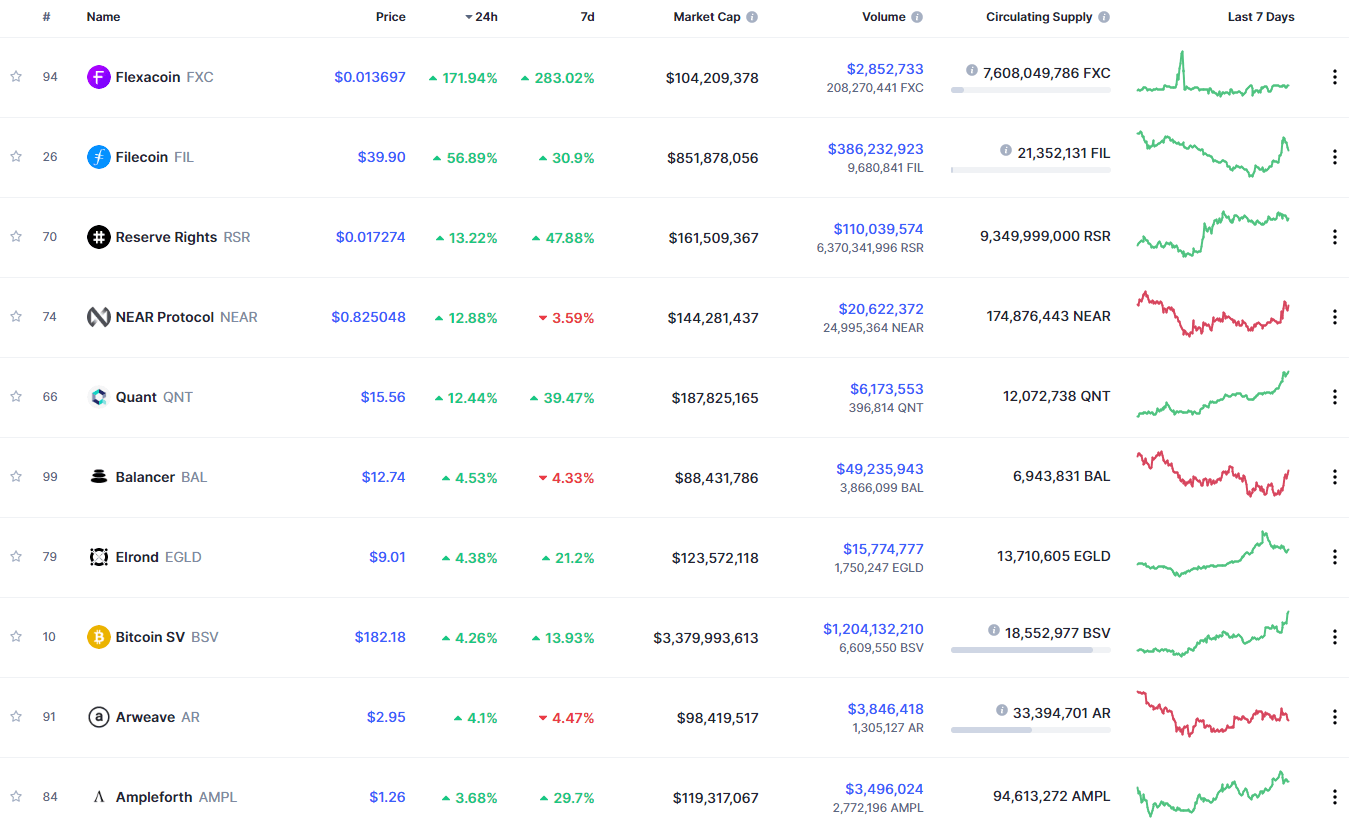

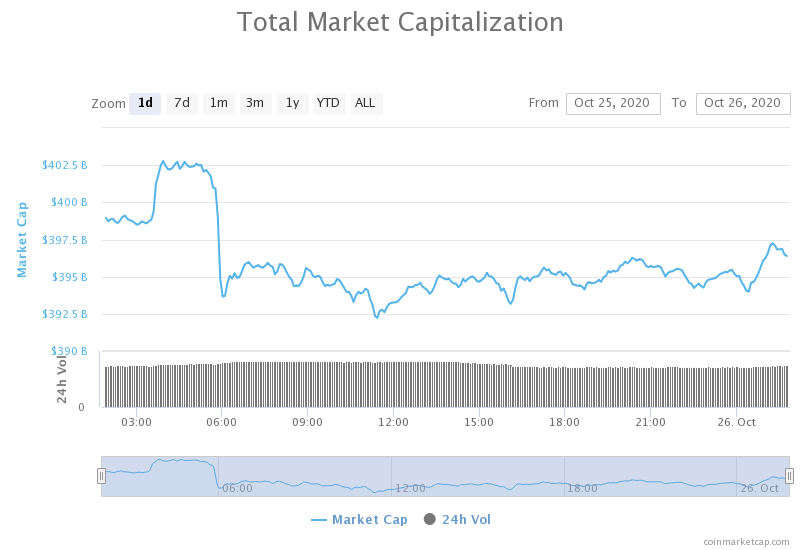

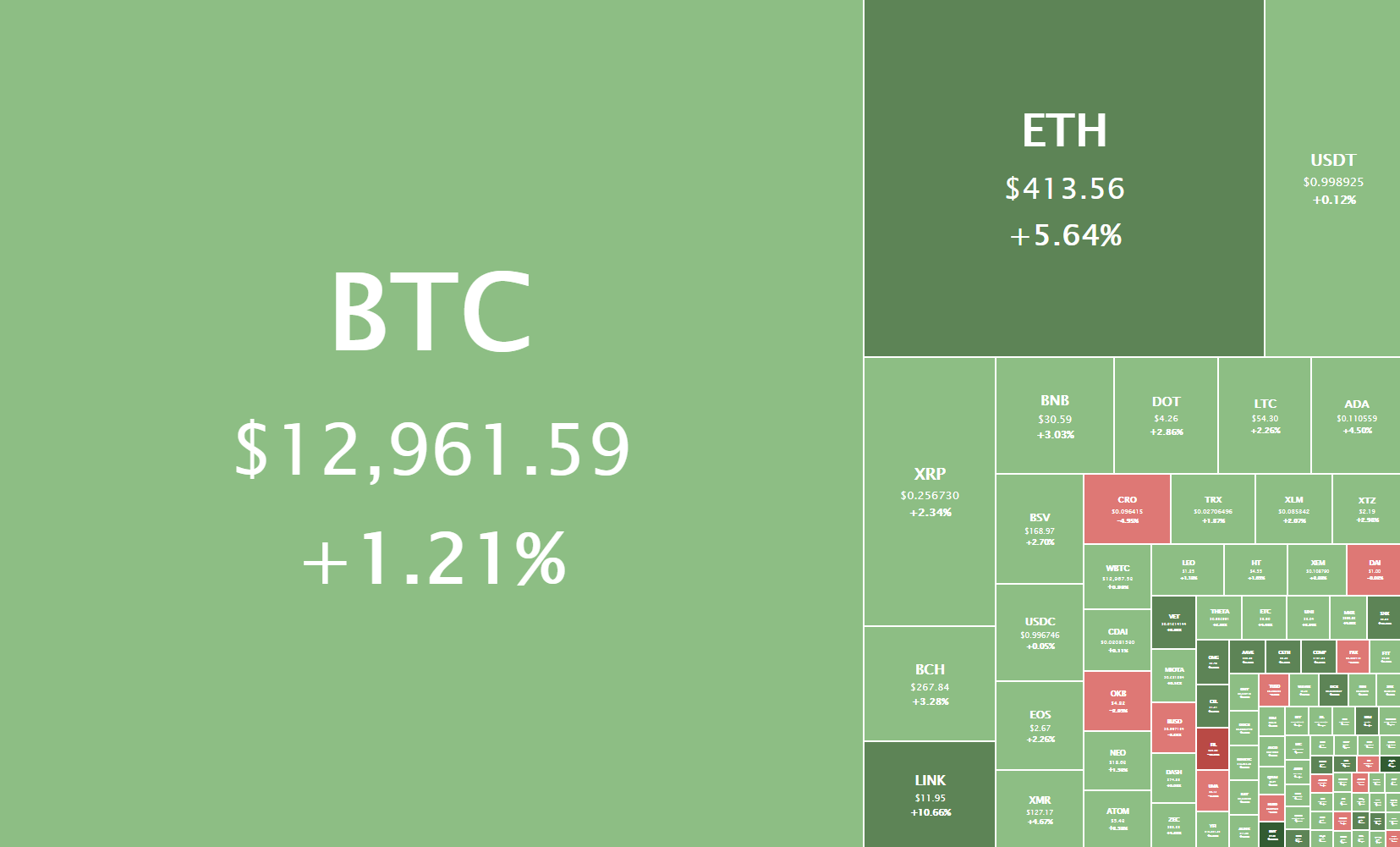

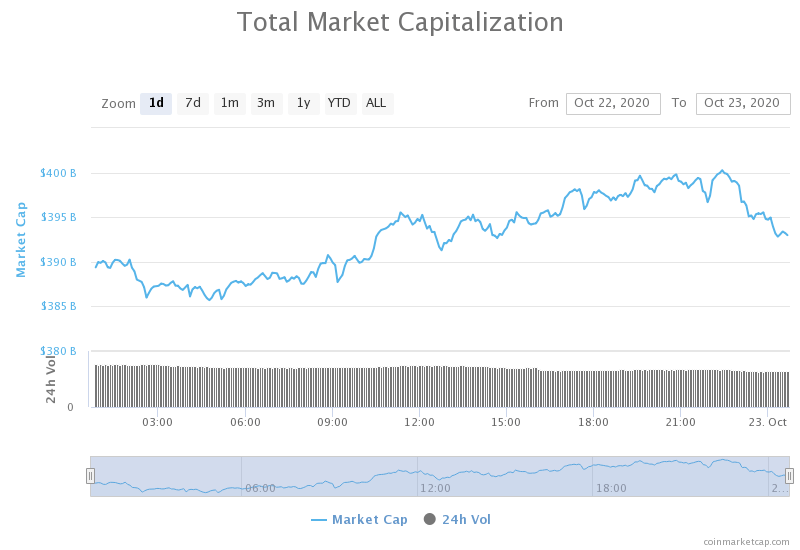

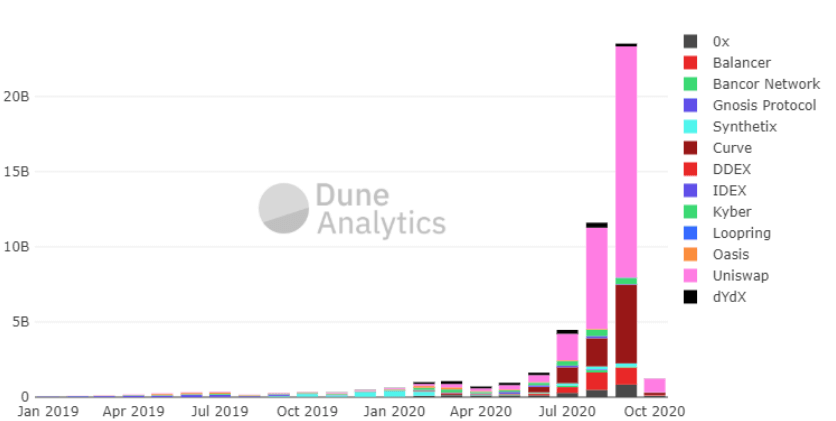

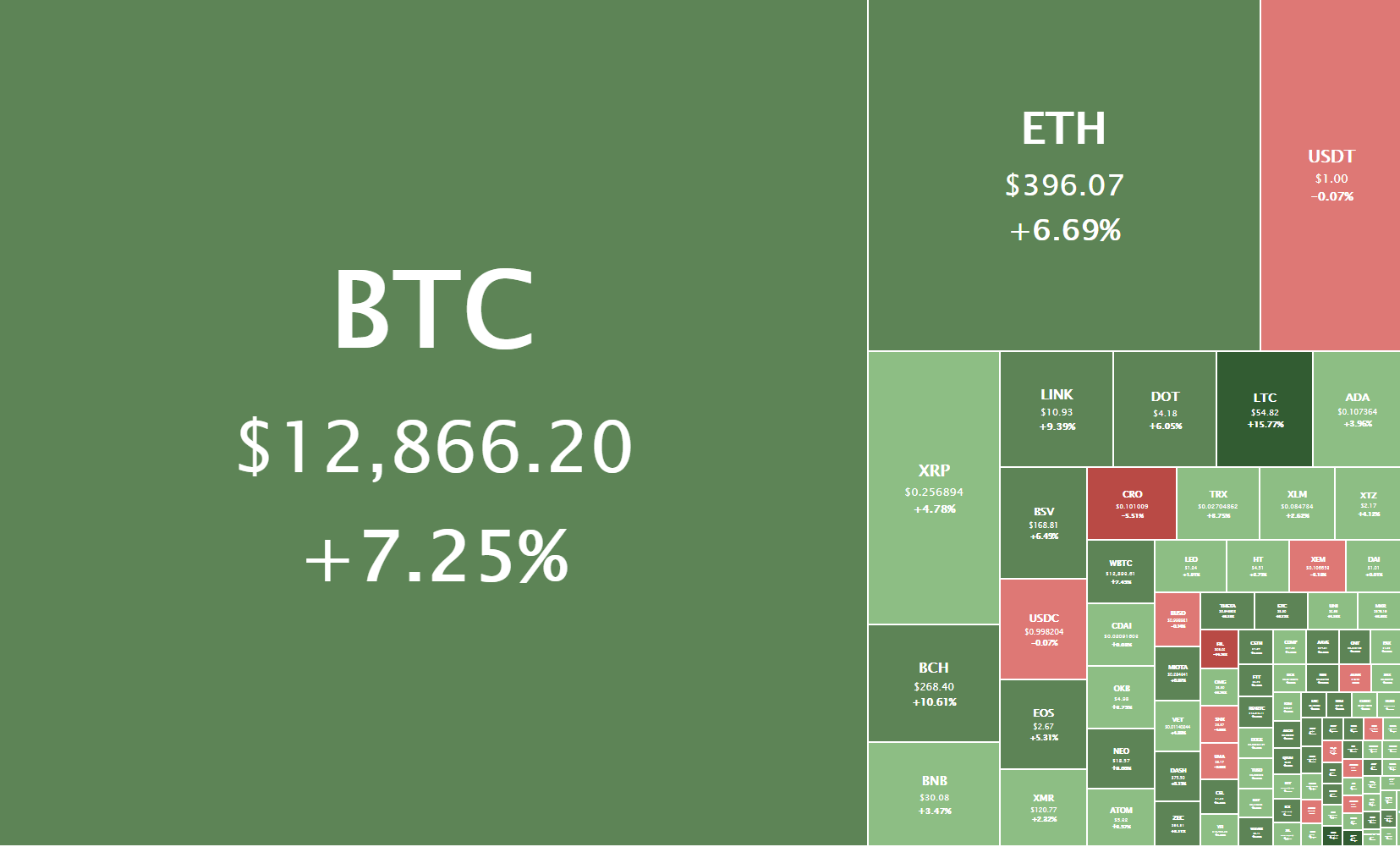

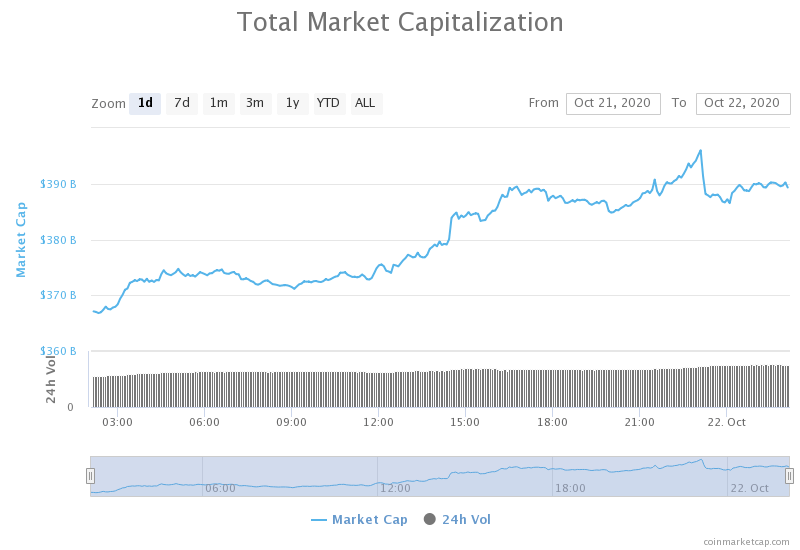

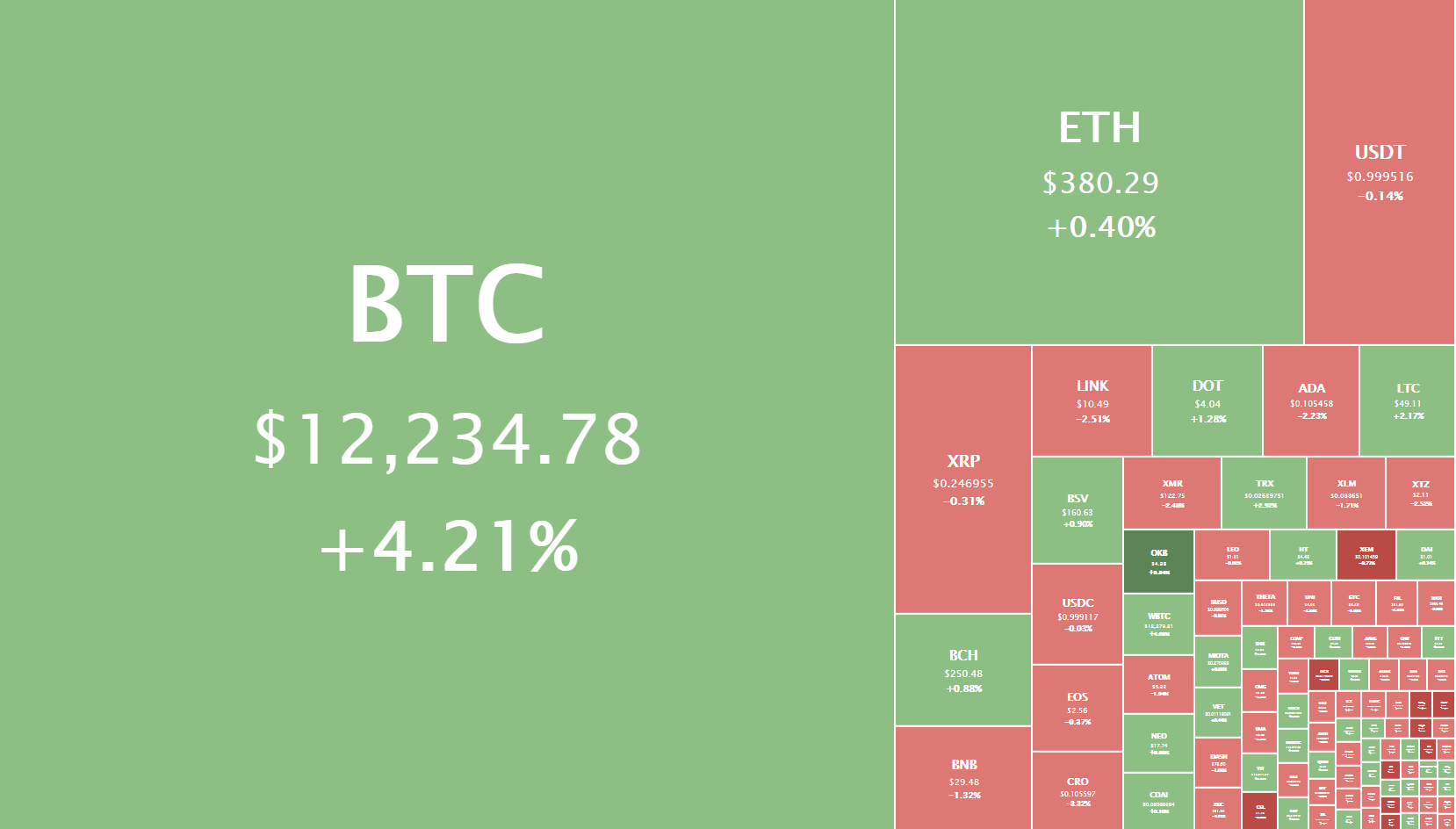

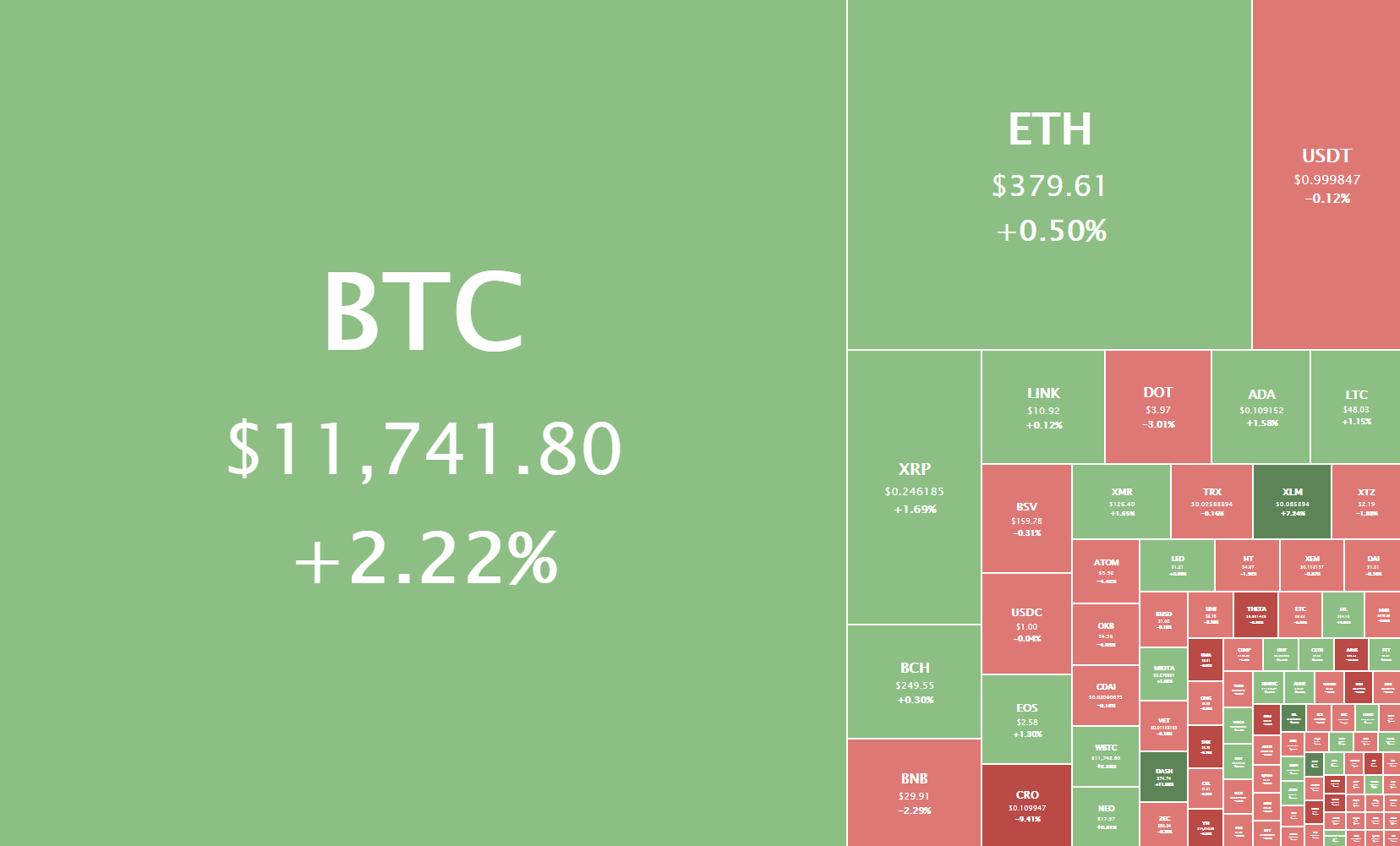

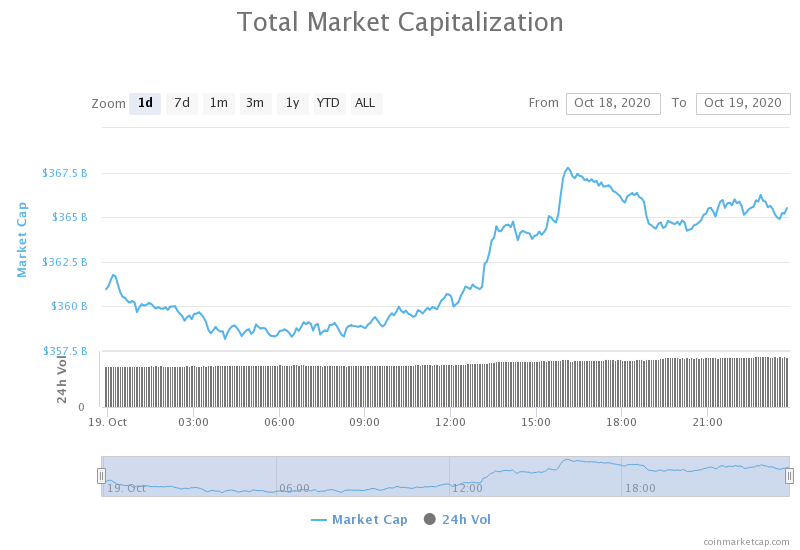

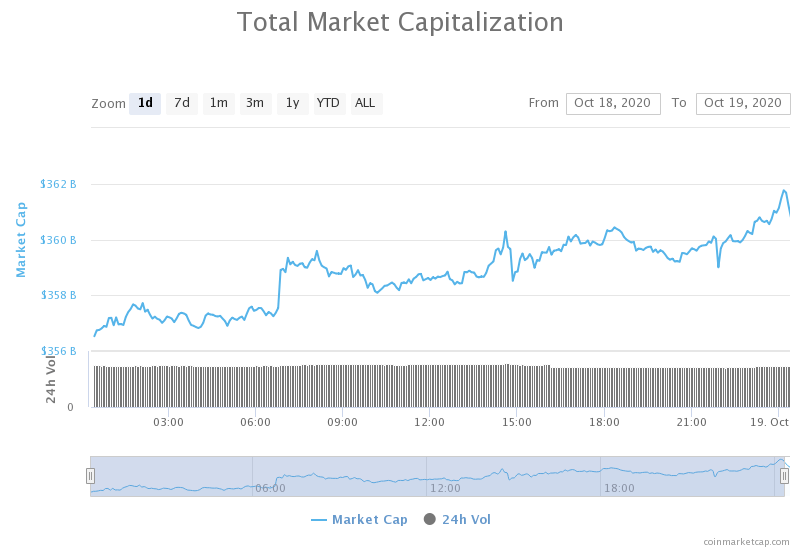

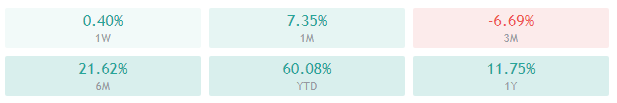

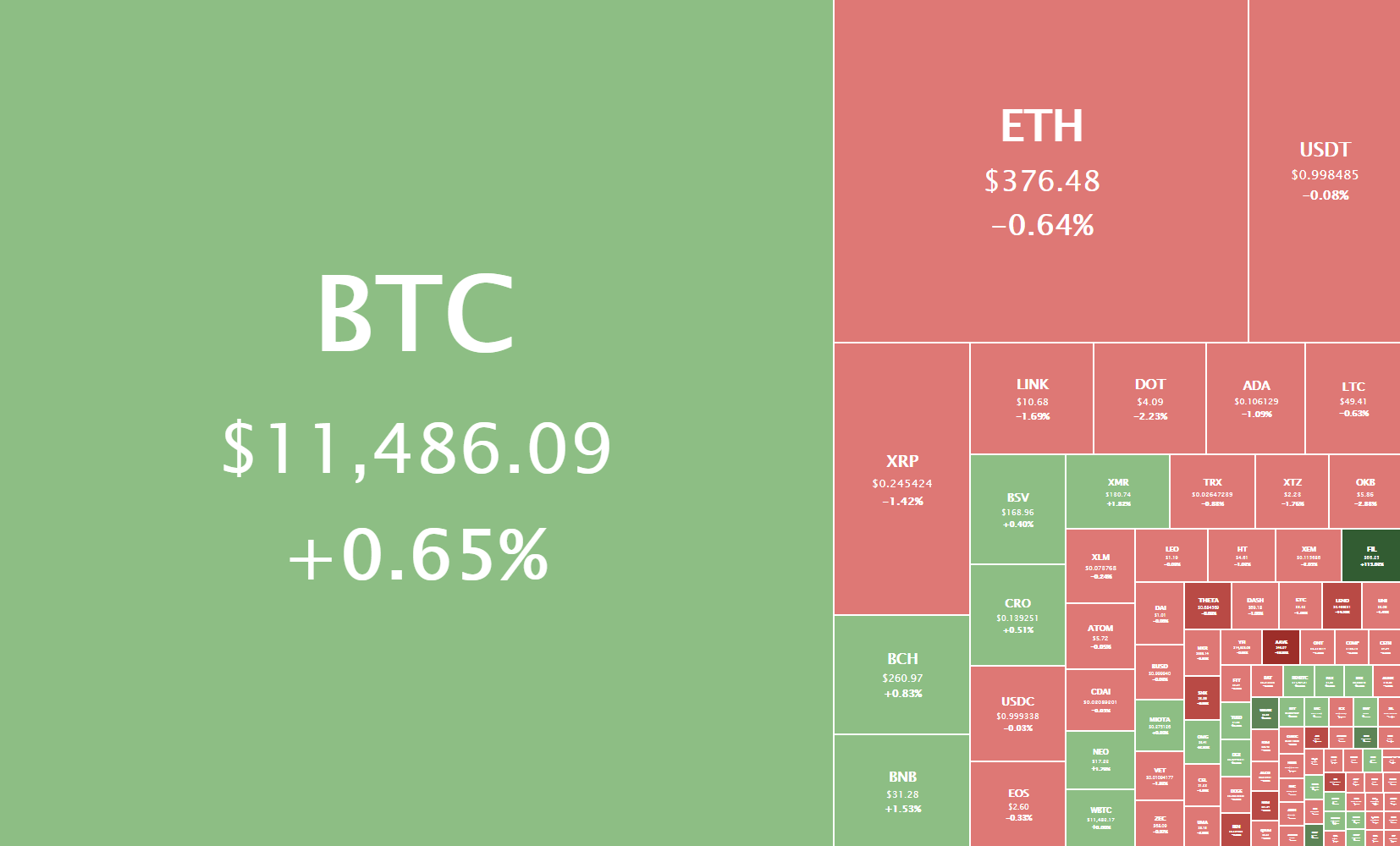

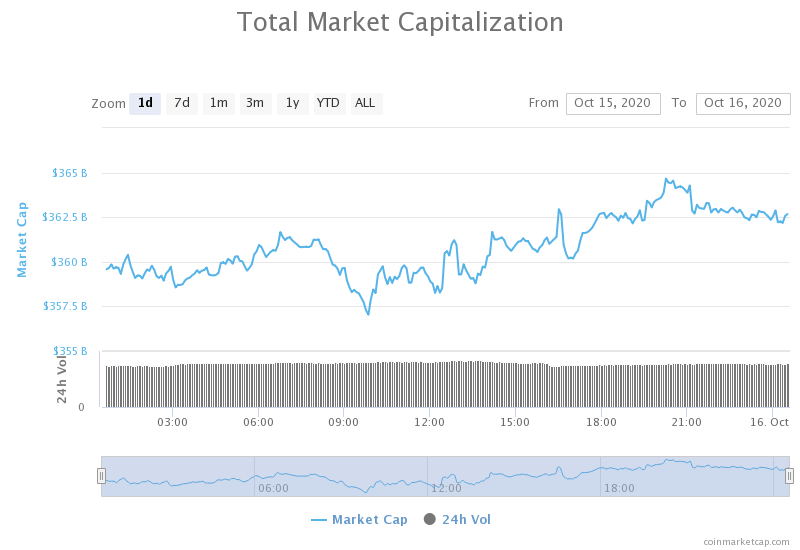

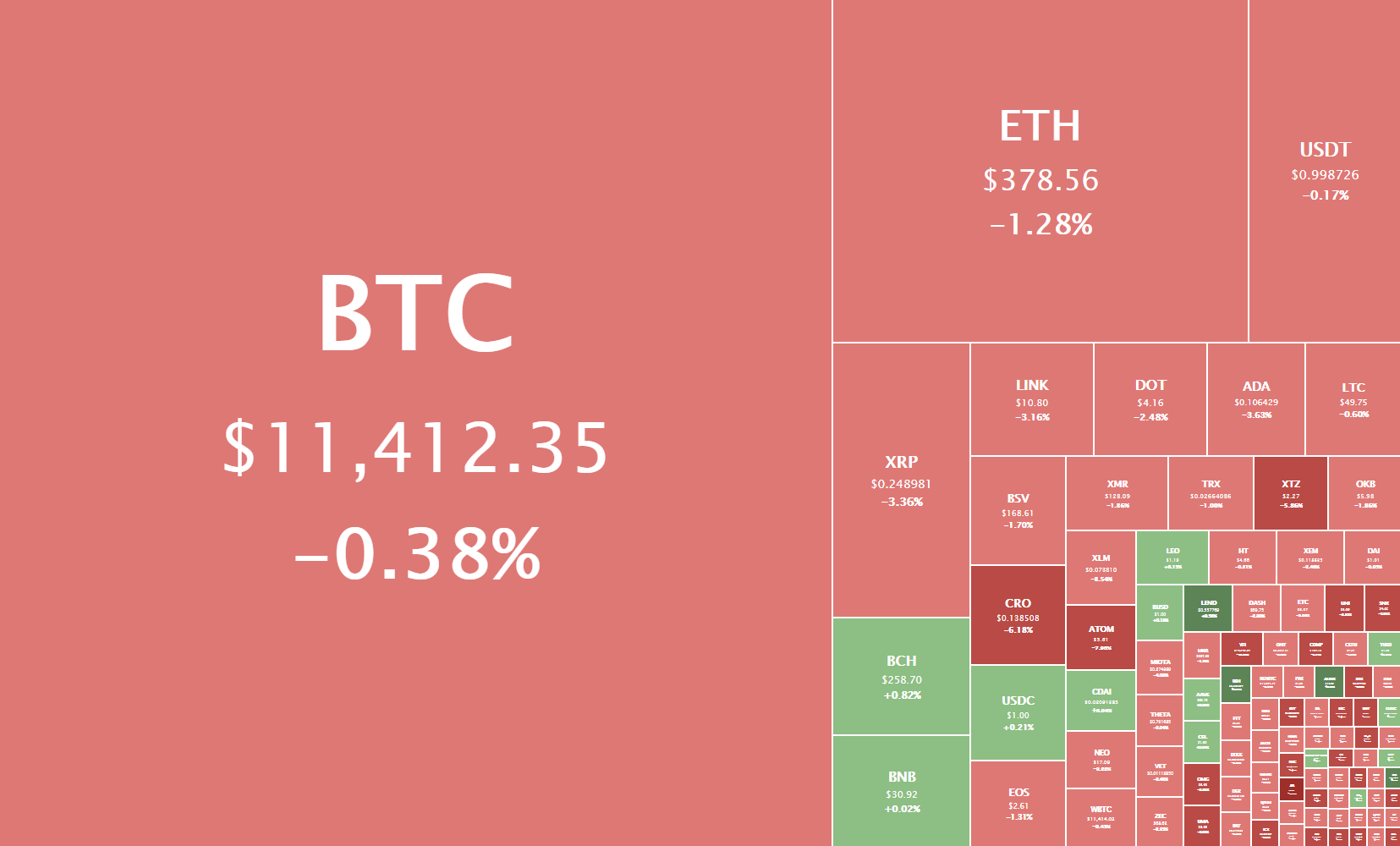

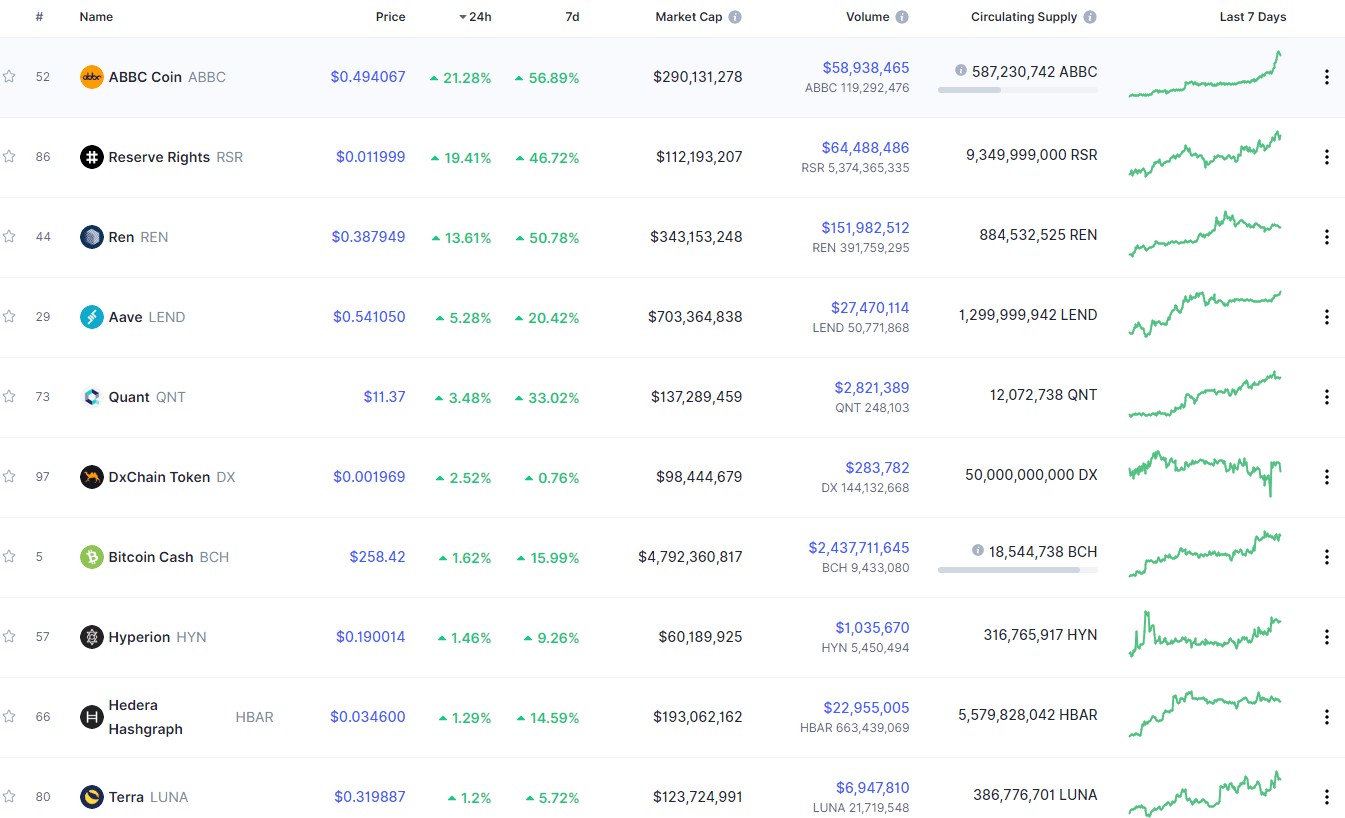

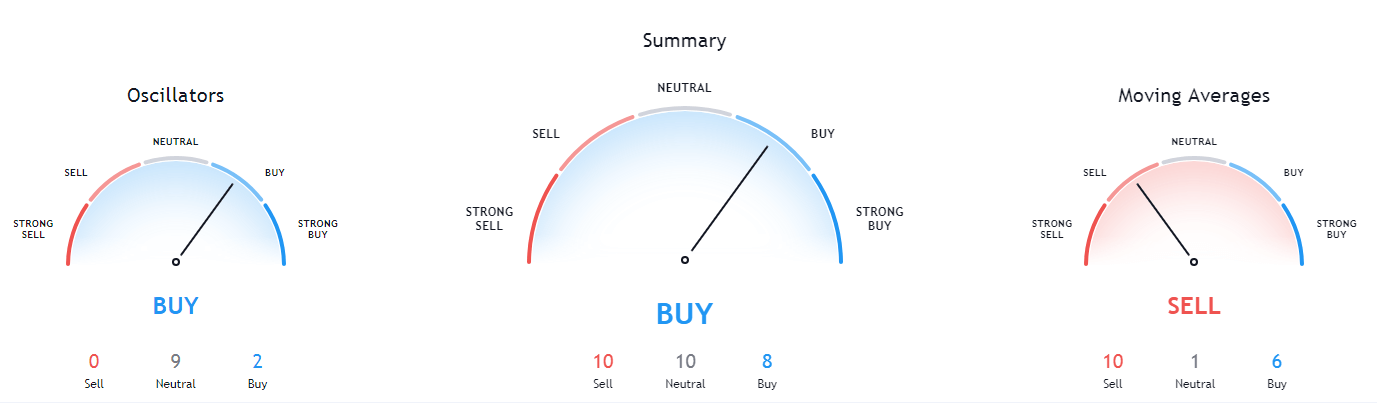

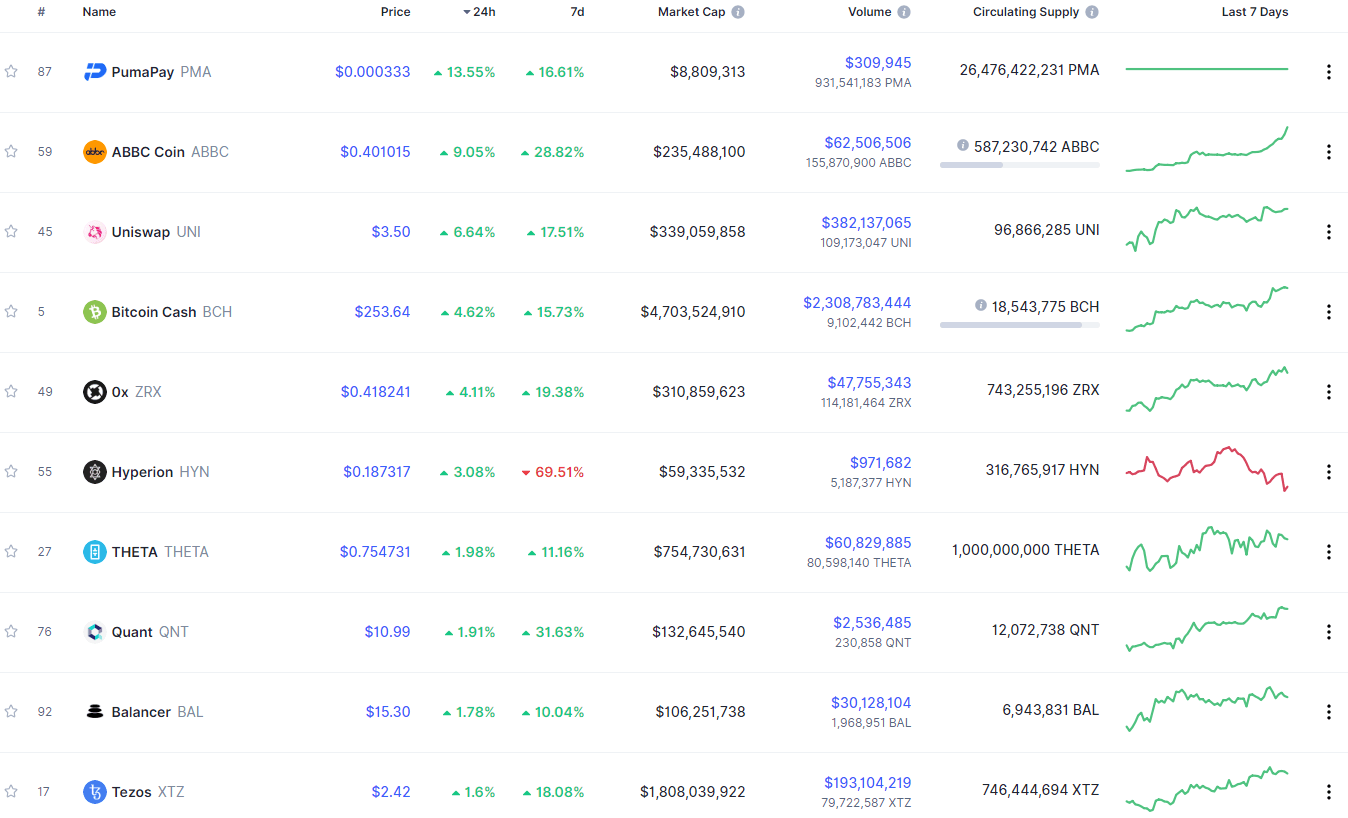

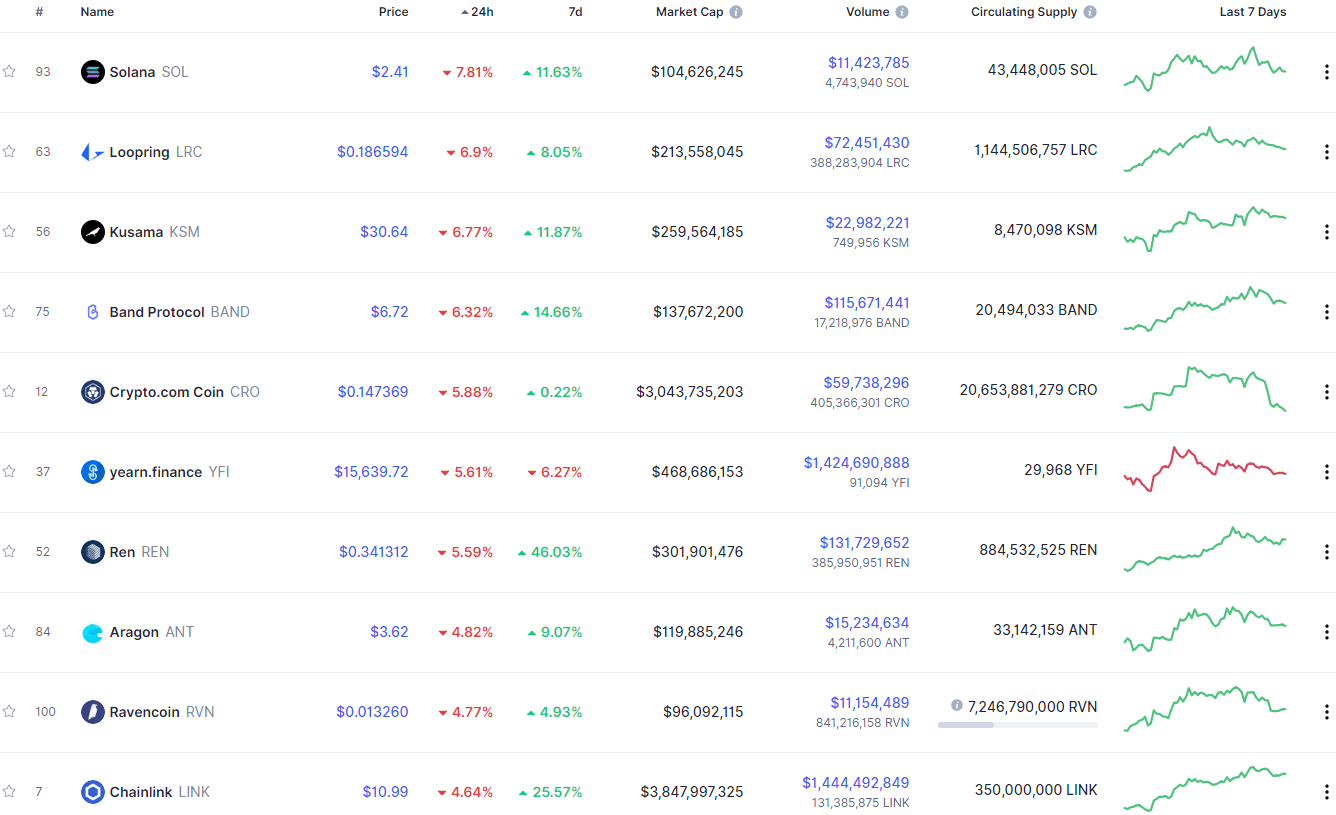

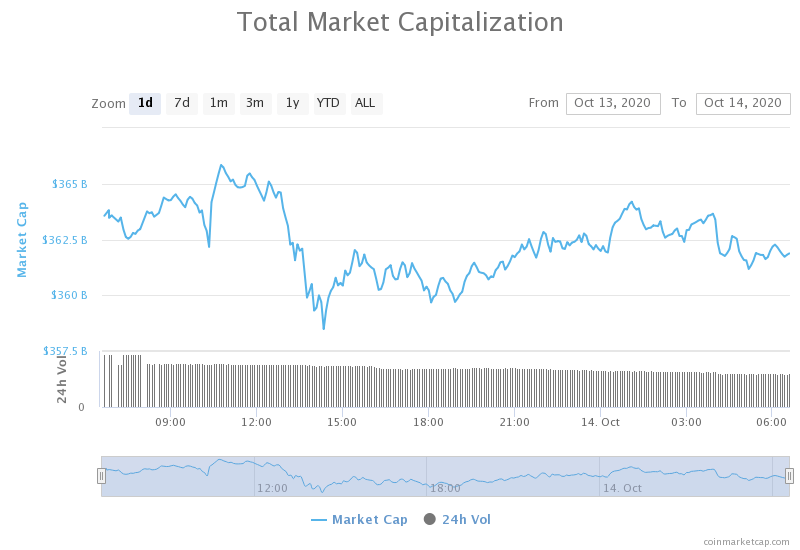

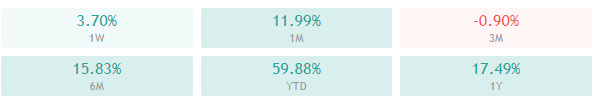

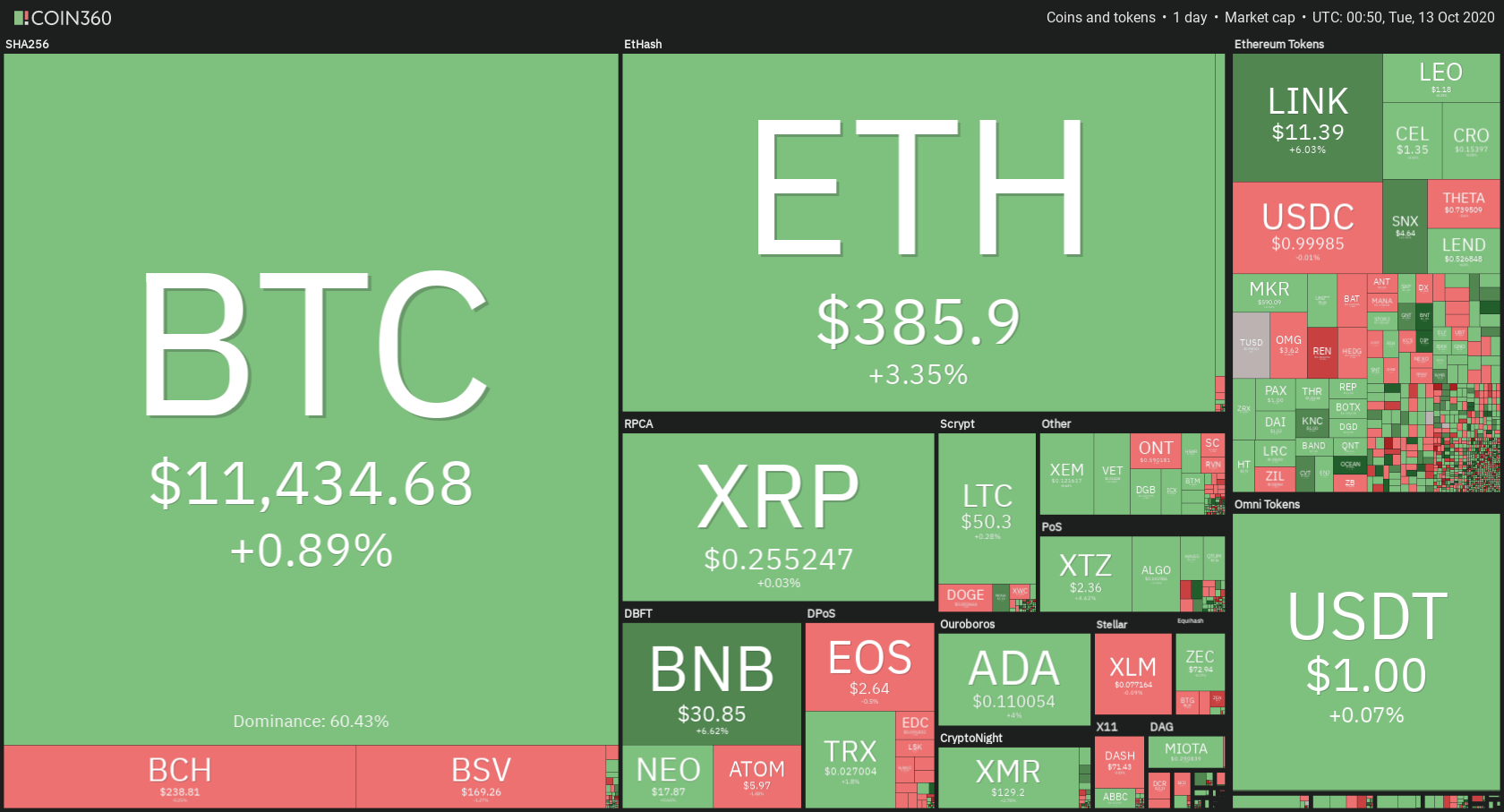

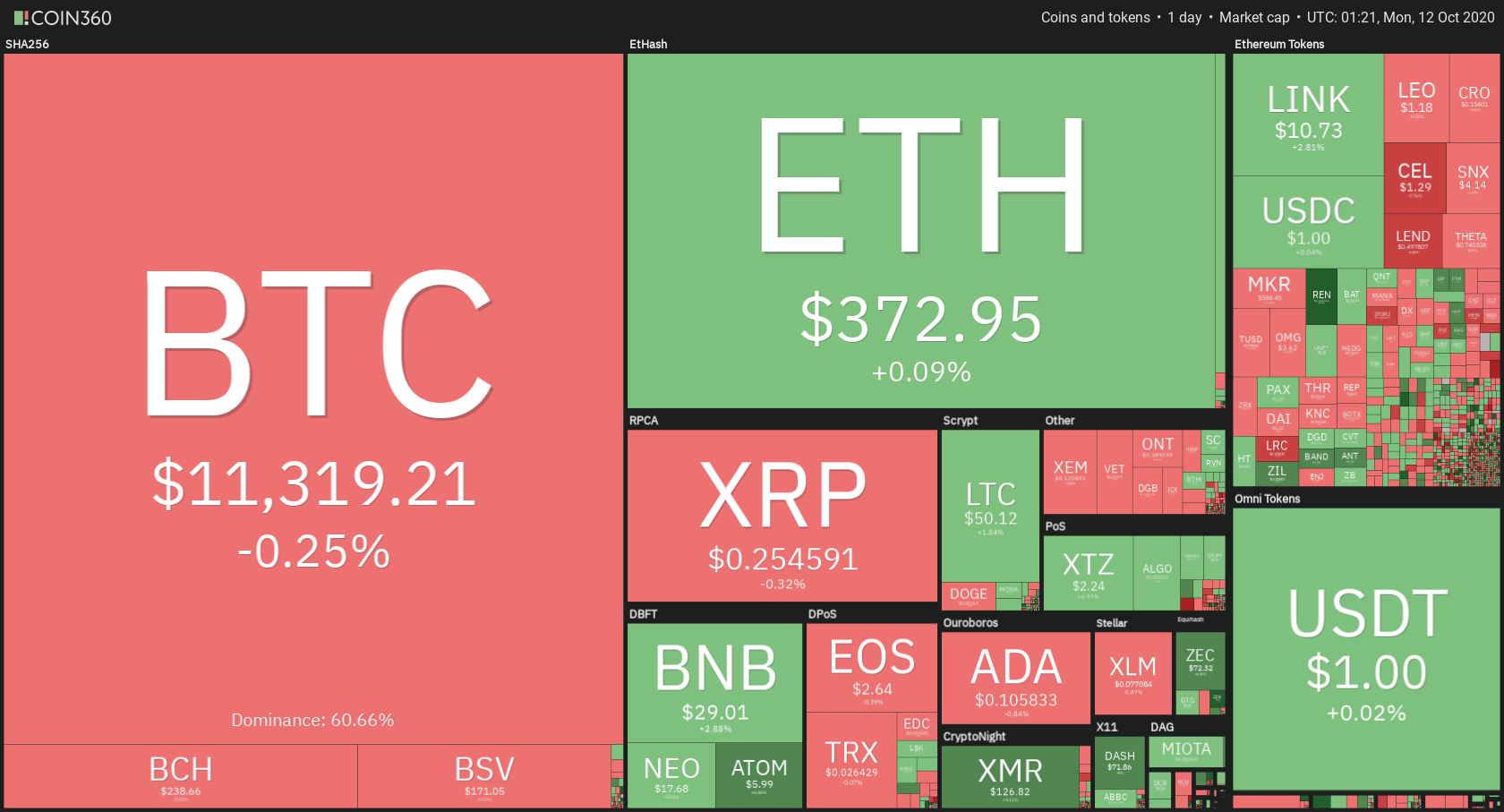

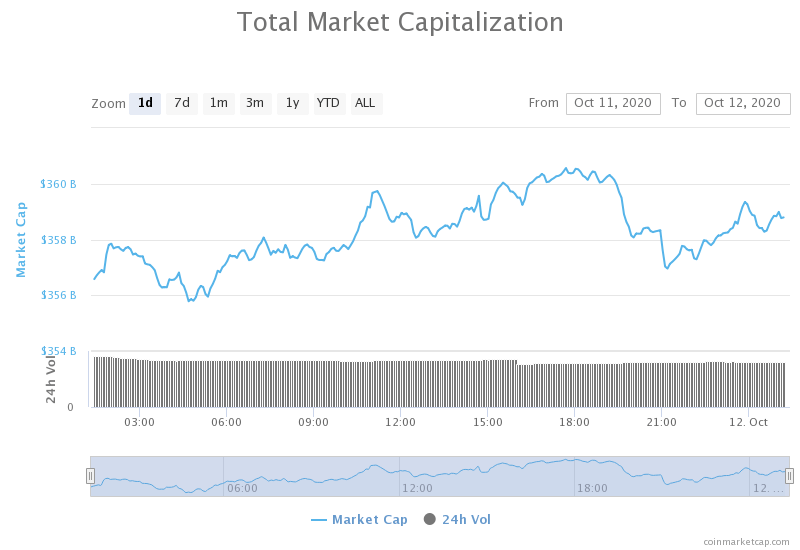

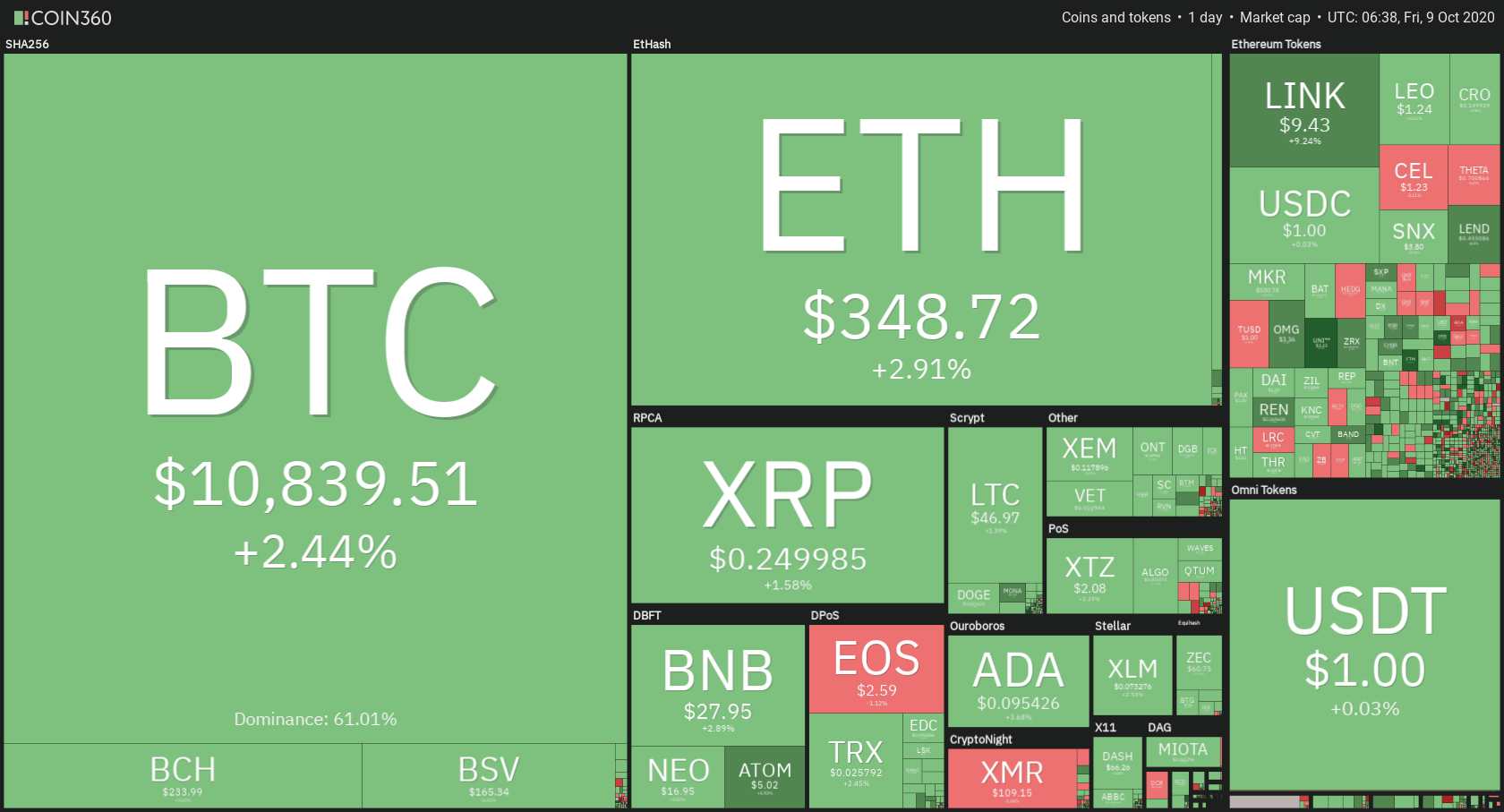

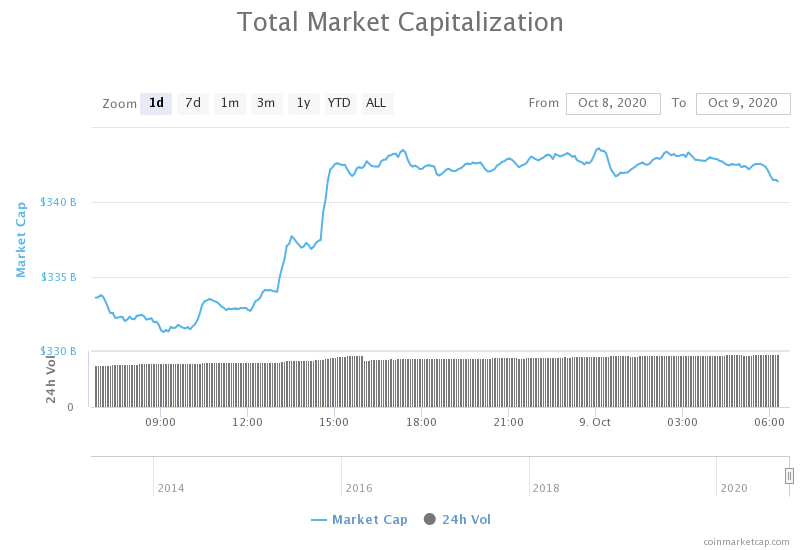

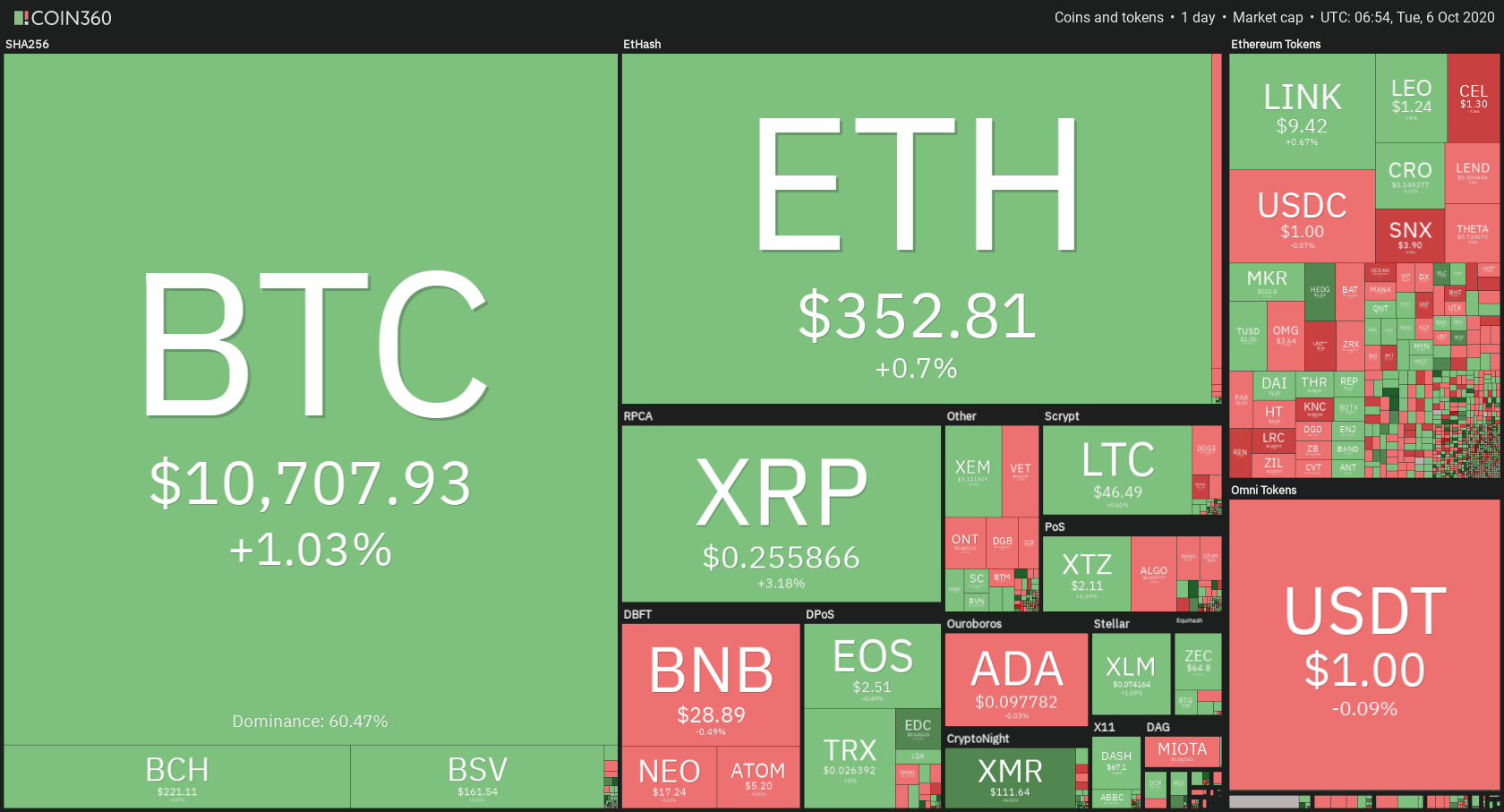

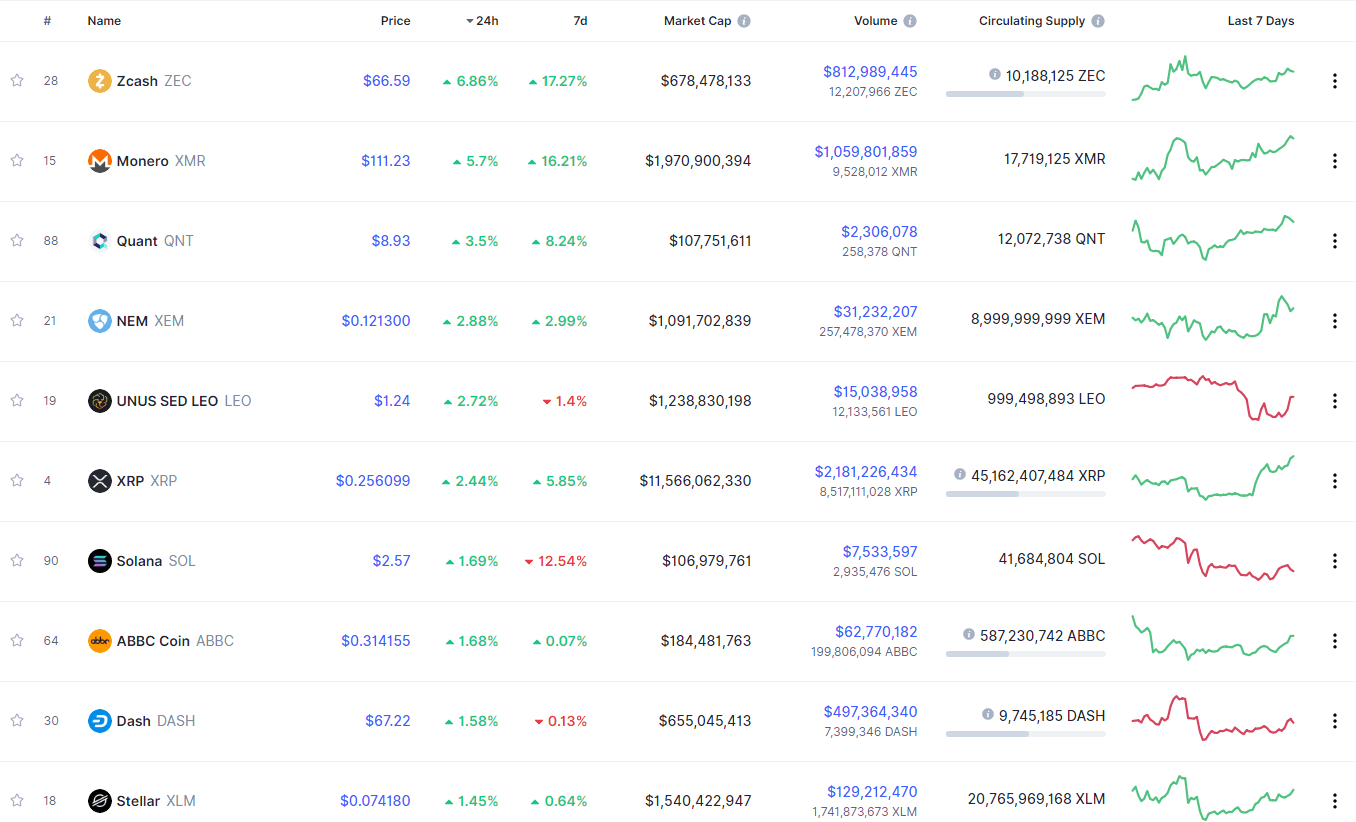

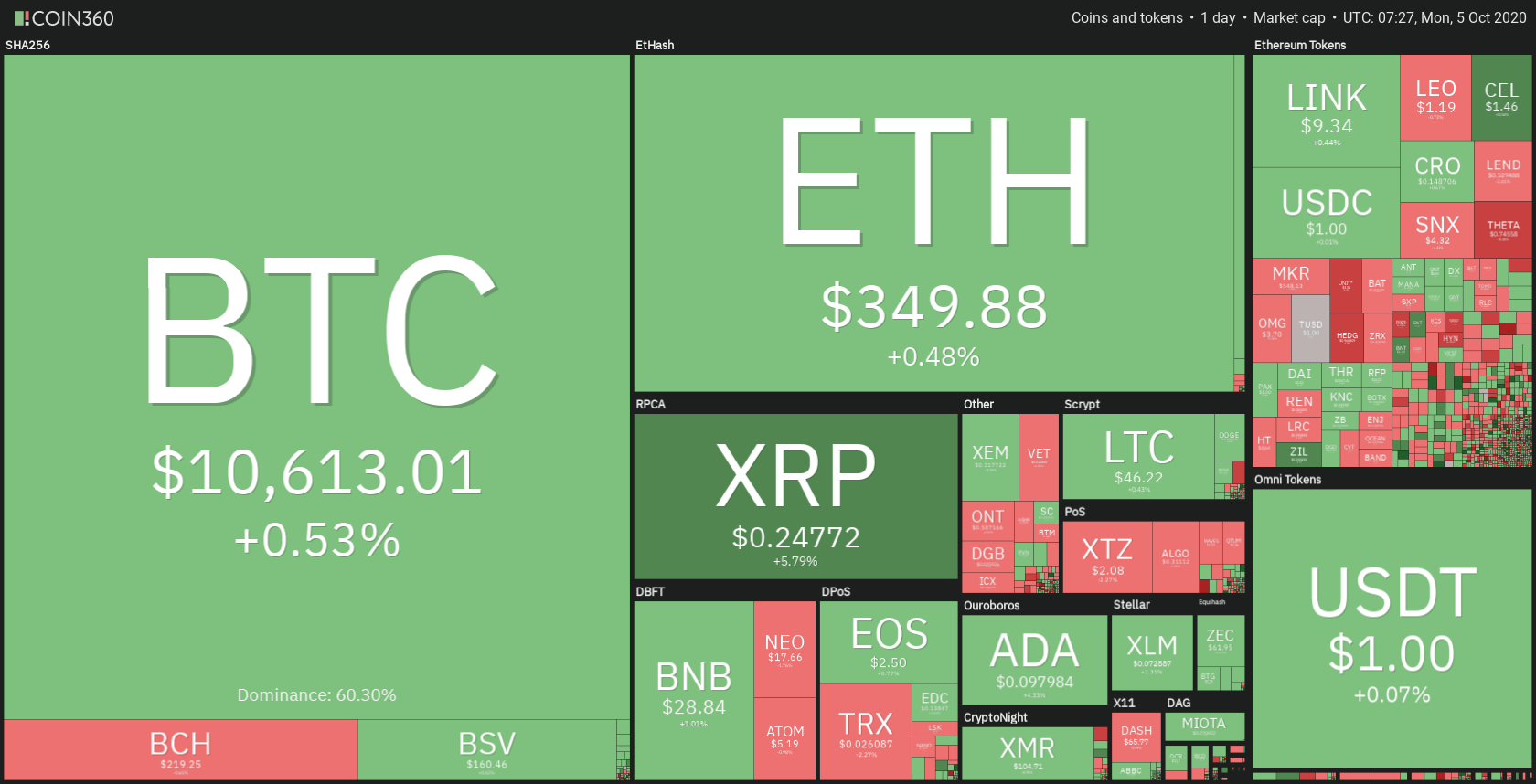

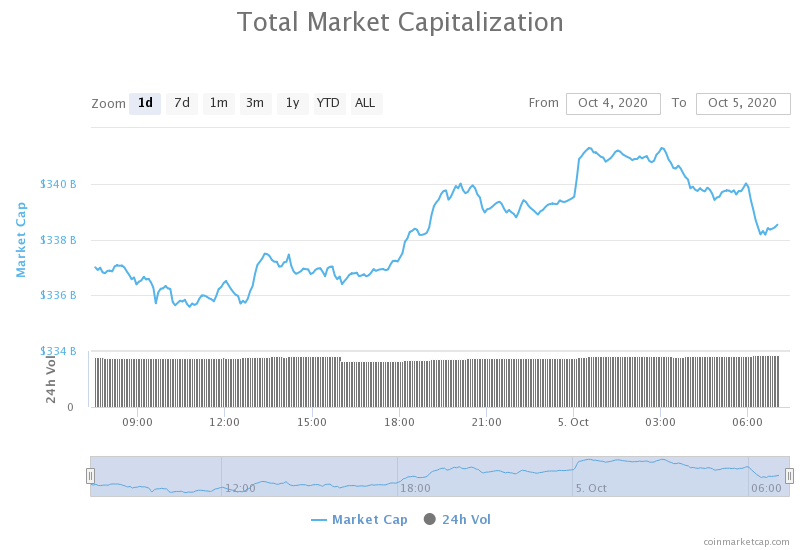

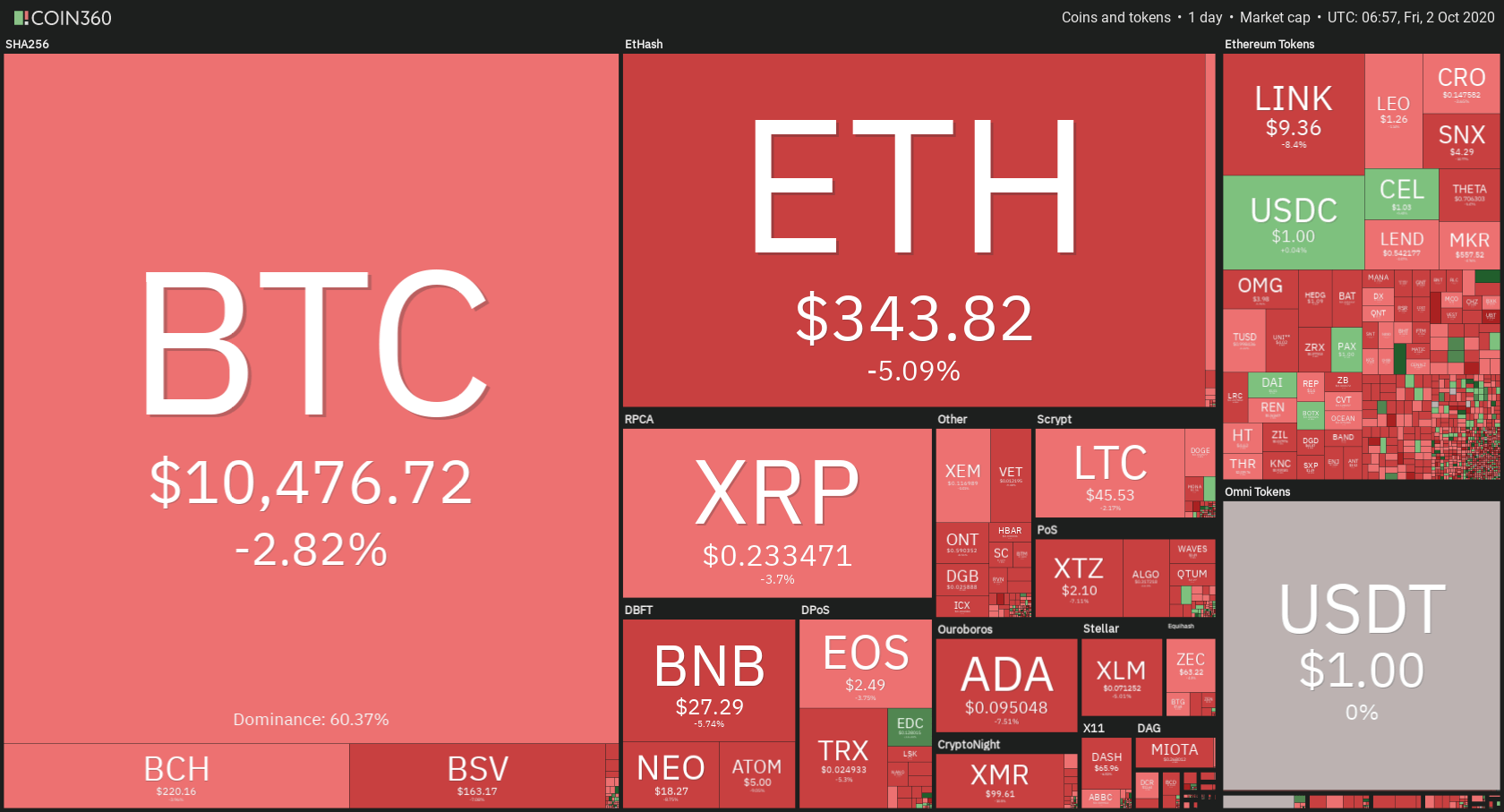

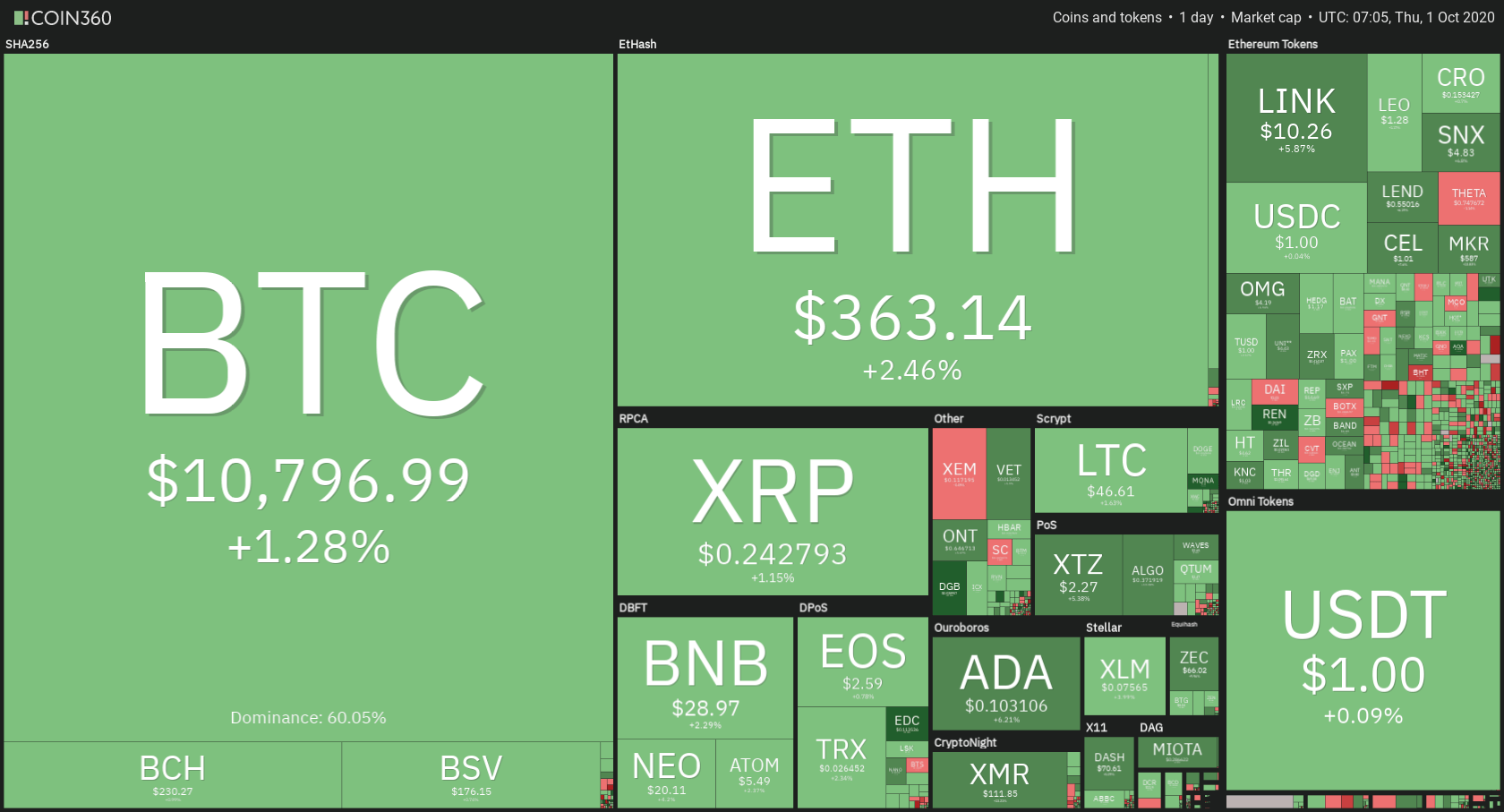

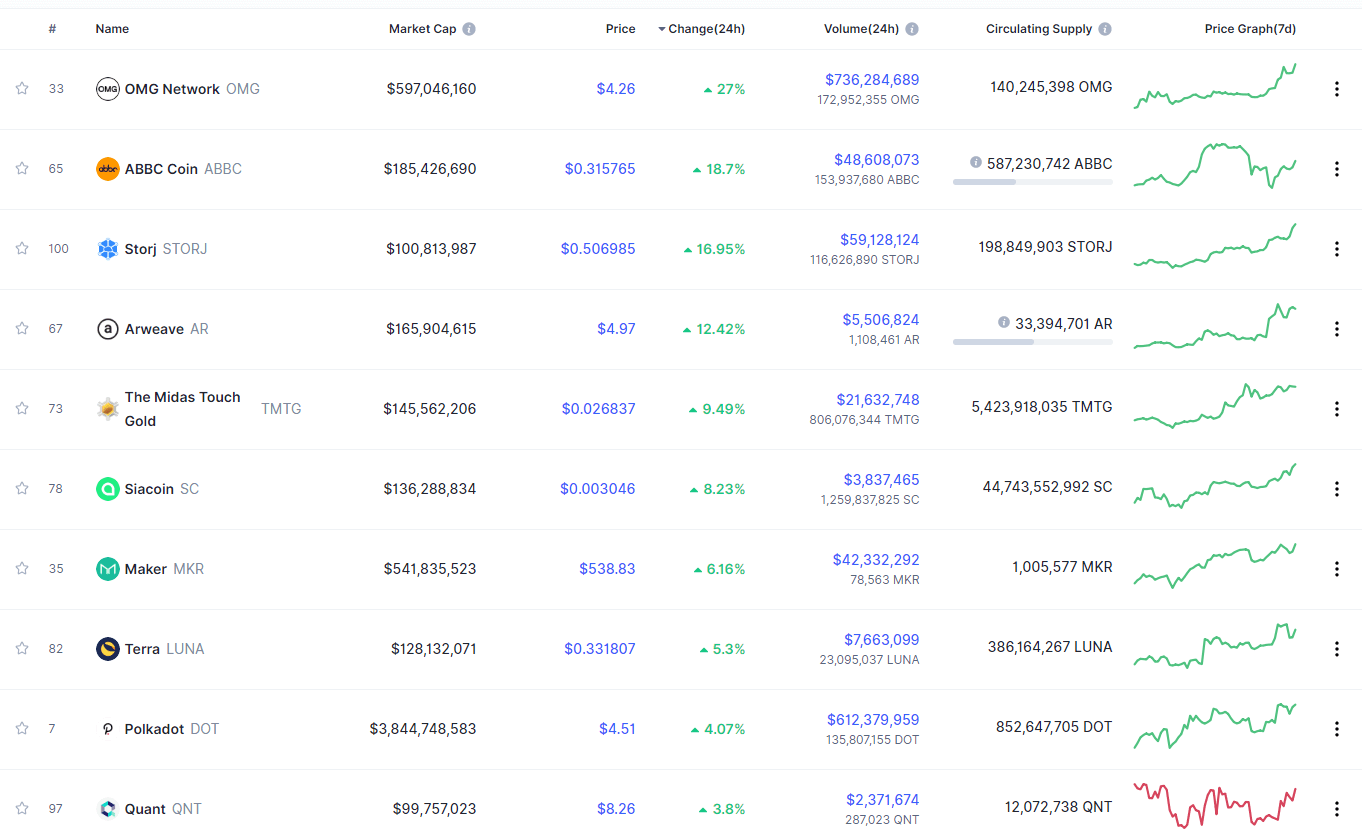

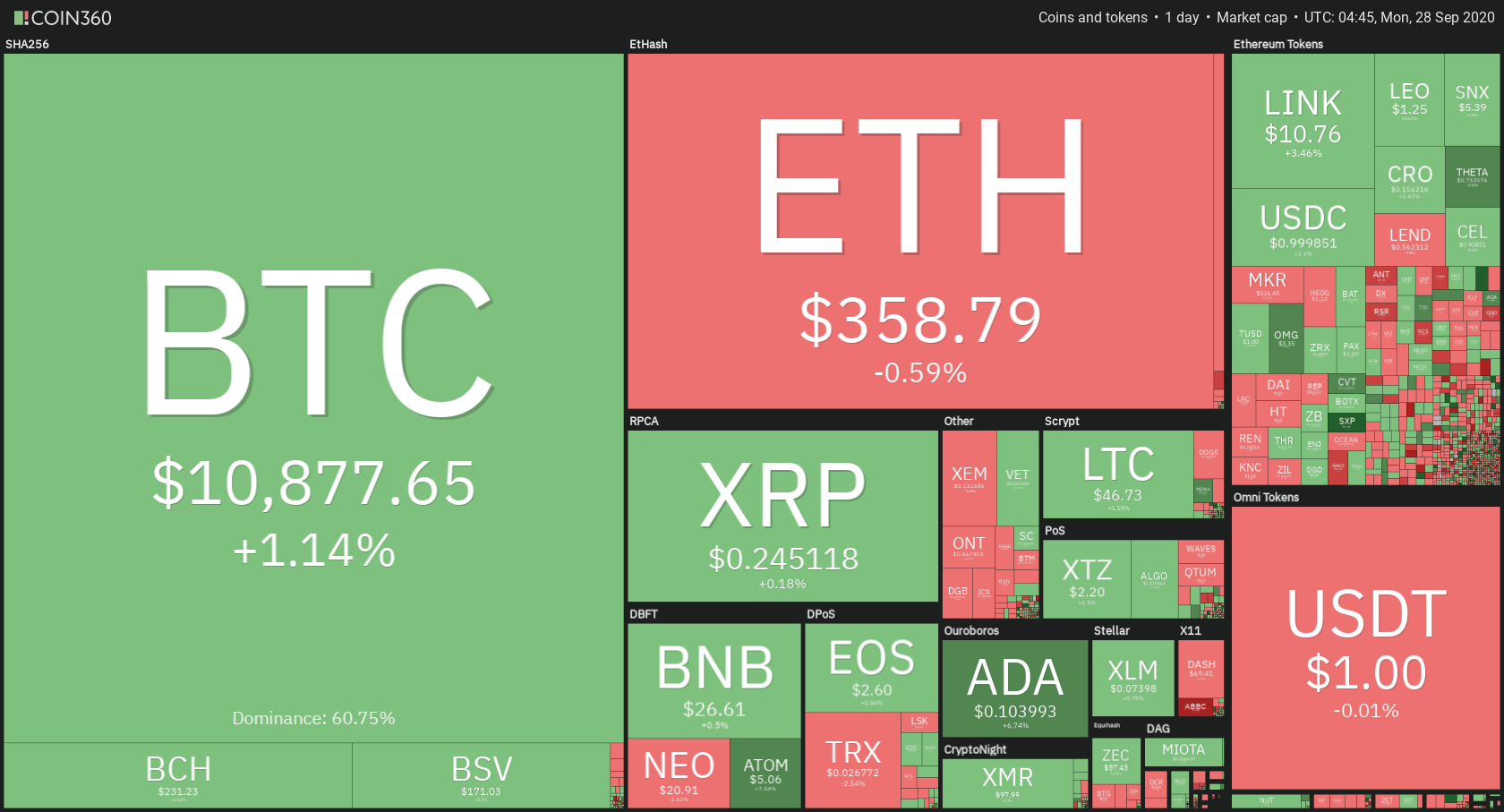

Cryptocurrency includes online digital currencies that work differently than real money does. While you can’t exchange cryptocurrency for goods or services the way that you can with cash, the digital currency holds value and can be exchanged for real money that can then be used to purchase those goods and services. Some examples of the most popular cryptocurrencies include Bitcoin, Ethereum, Tether, and Ripple. Some of these are created by private individuals, while we can thank banks and other companies for the creation of some cryptocurrency as well. Satoshi Nakamoto created the most well-known cryptocurrency Bitcoin in 2009 to provide a decentralized payment network that could offer peer to peer payments without relying on central banks. While there is still some speculation about whether cryptocurrency is a good investment, it’s important to know that the crypto market is approximately two-thirds the size of the forex market and growing. As we head towards the future, more individuals and banks will likely invest in it.

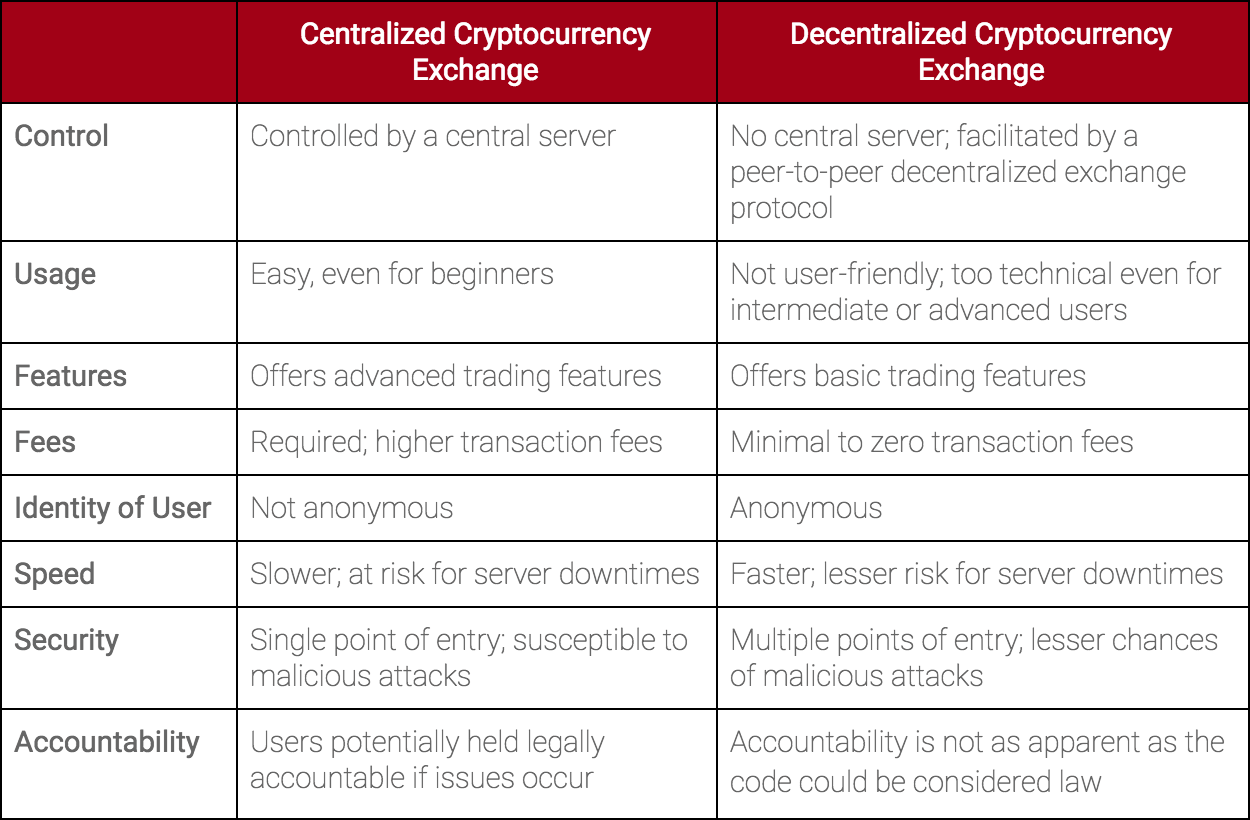

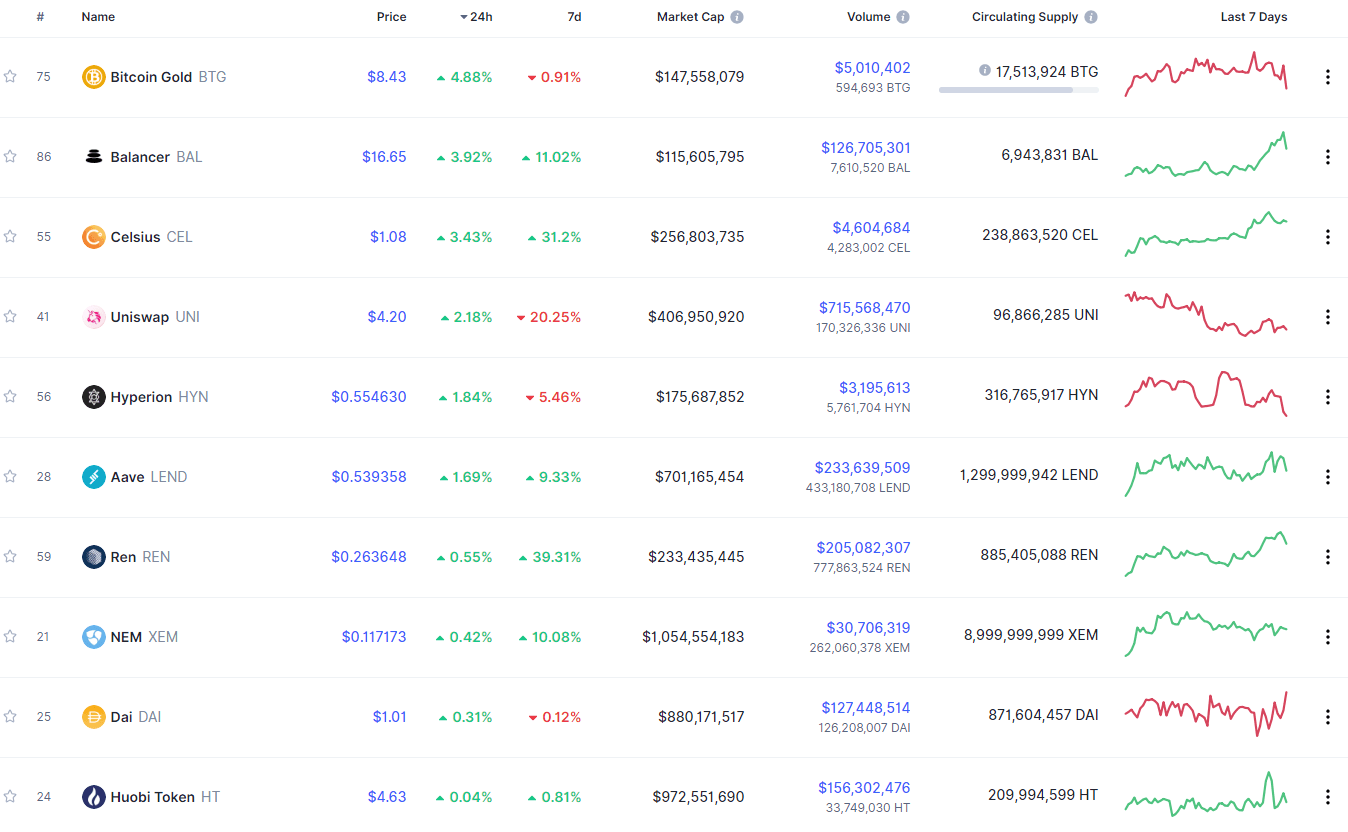

When it comes to investing in cryptocurrency, you have two options: you can use a major cryptocurrency exchange like Coinbase to buy a real cryptocurrency and hold onto it, or you can invest in cryptocurrency through most major brokers. If you purchase the cryptocurrency through an exchange, you’ll probably wind up paying commissions and fees, while you’ll have to worry about swap fees for holding crypto positions overnight if you choose to invest through your broker. If you want to make a long-term investment, it would be better to do so through an exchange.

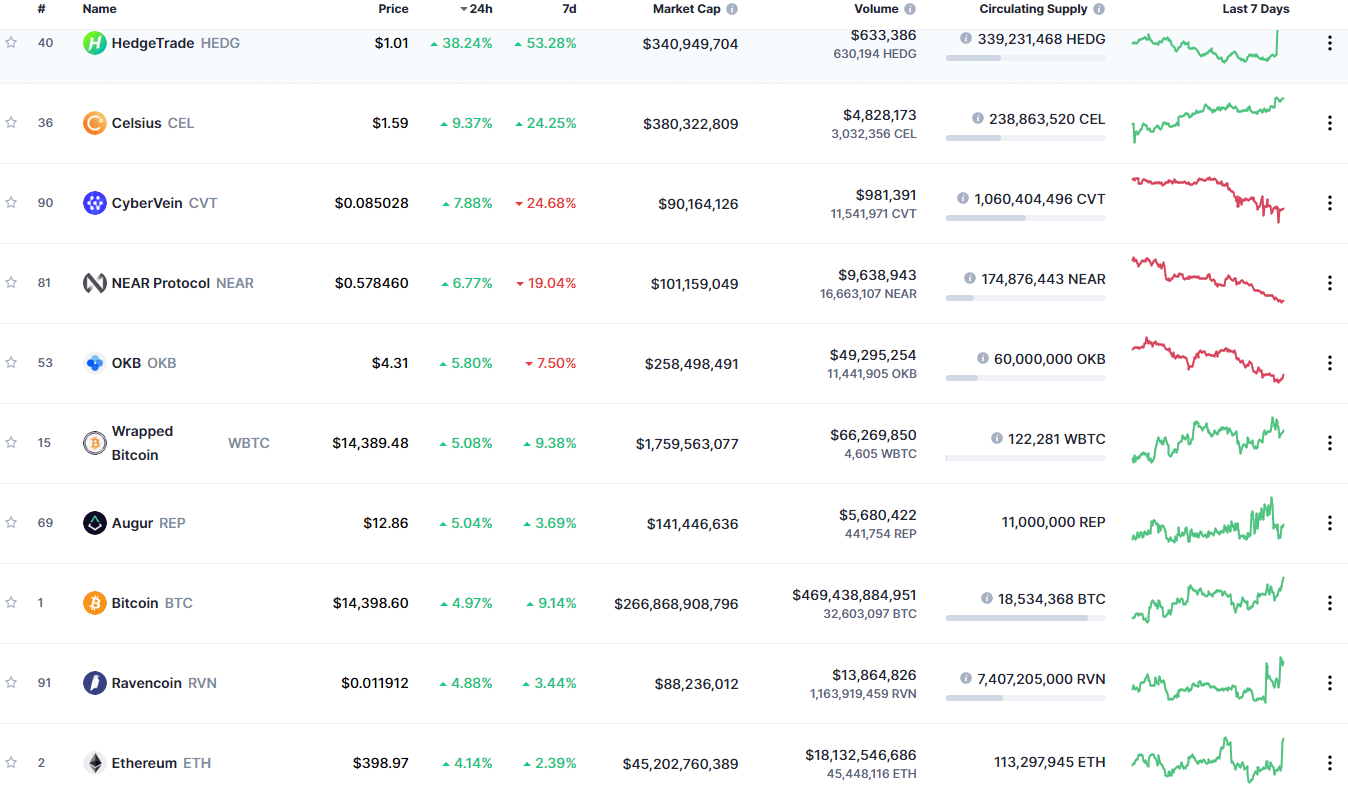

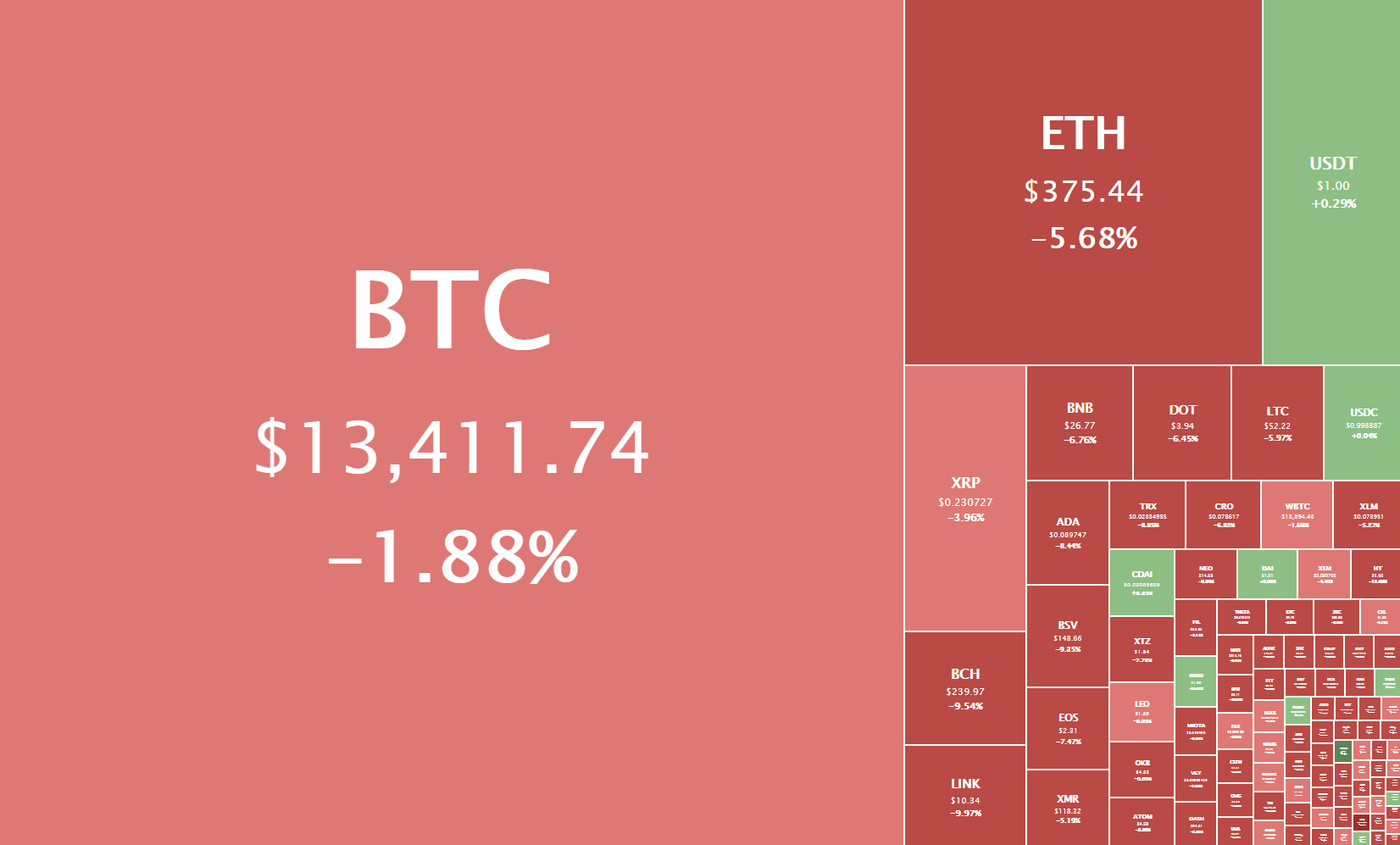

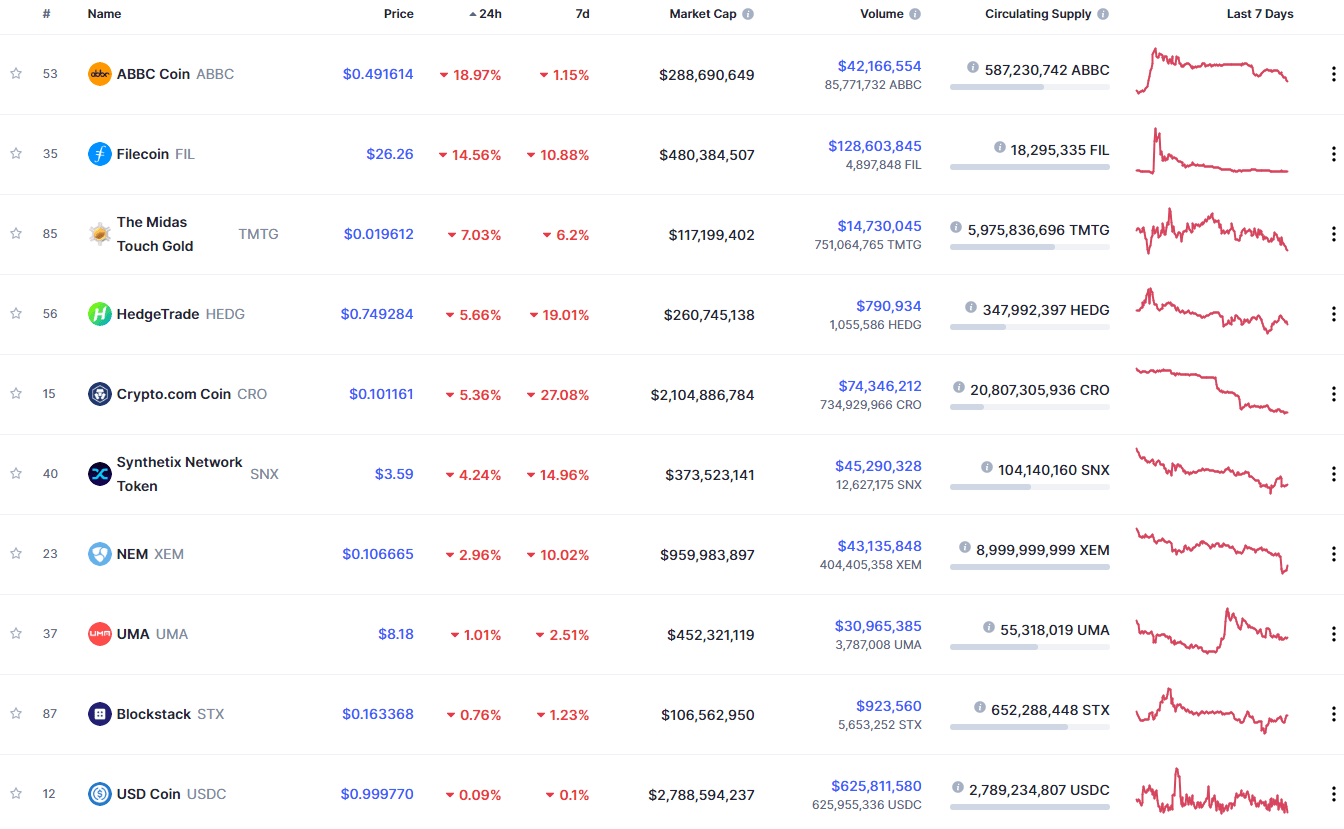

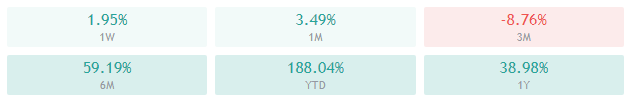

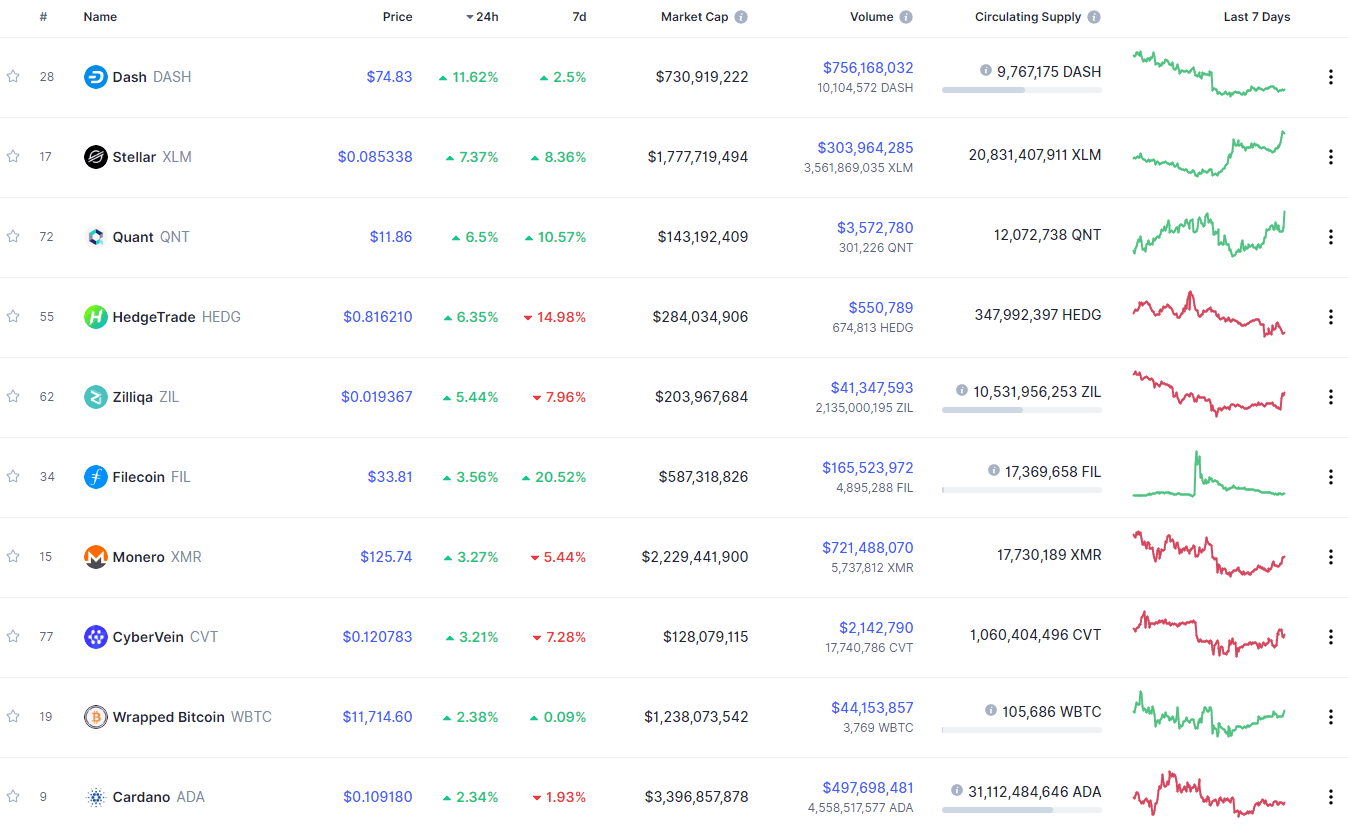

Wondering if there are any major downsides to investing in cryptocurrency? Unfortunately, it does cost more to trade cryptocurrency as opposed to forex. Remember when we talked about the average price of trading the pair EURUSD? It costs about five times as much to trade the major cryptocurrency Bitcoin, which has an average exchange rate of 0.40% versus the 0.08% we mentioned earlier.

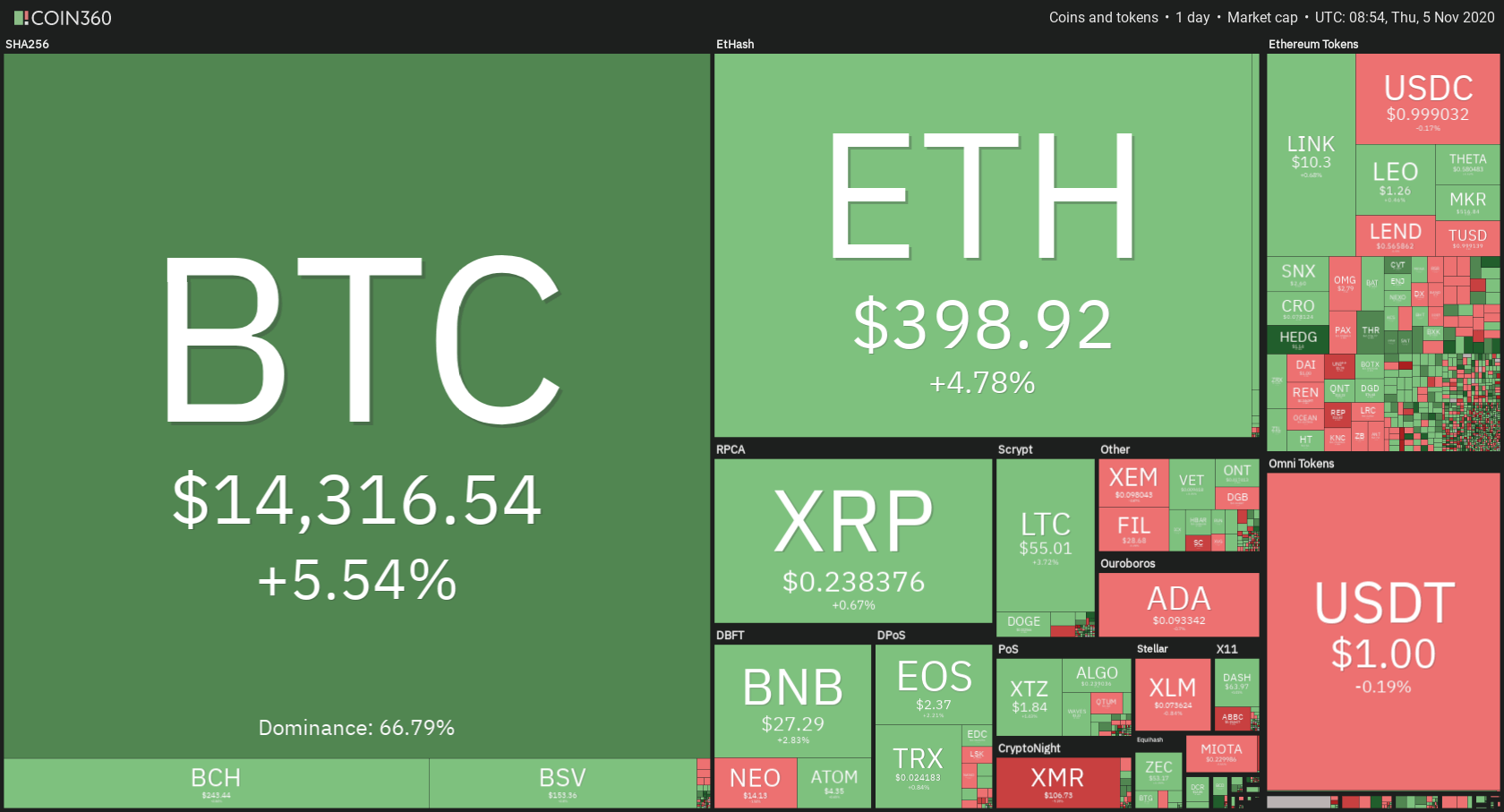

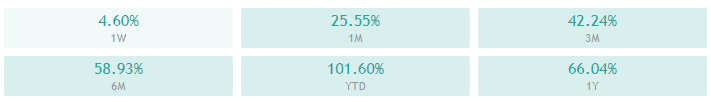

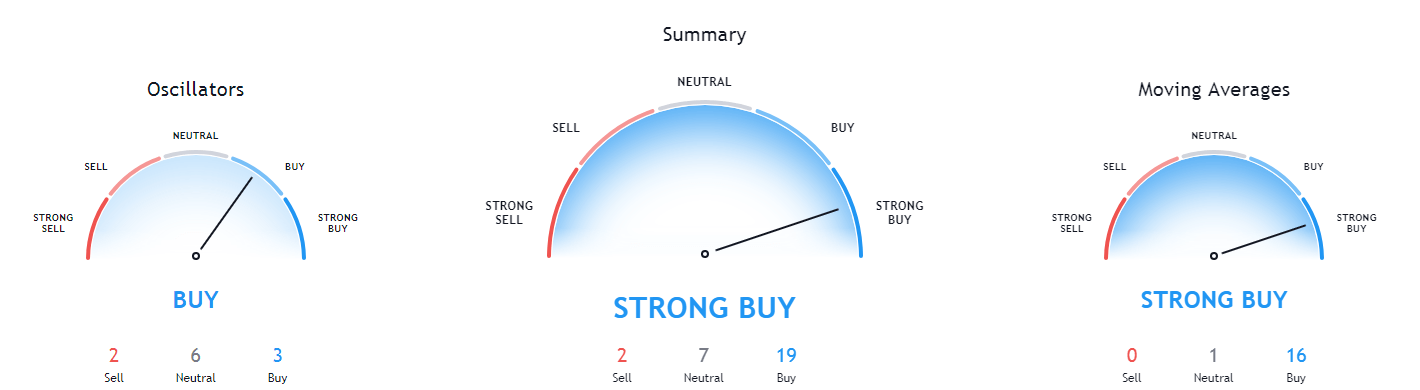

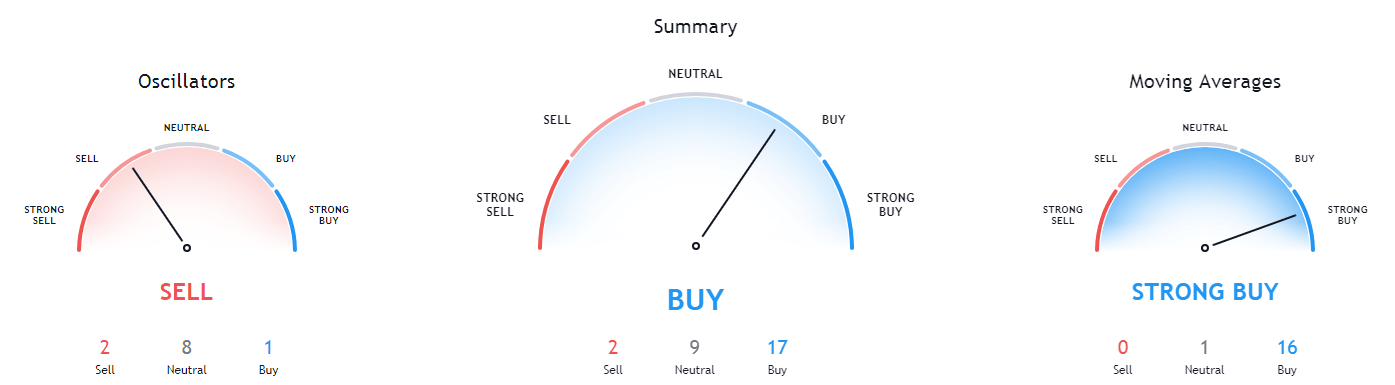

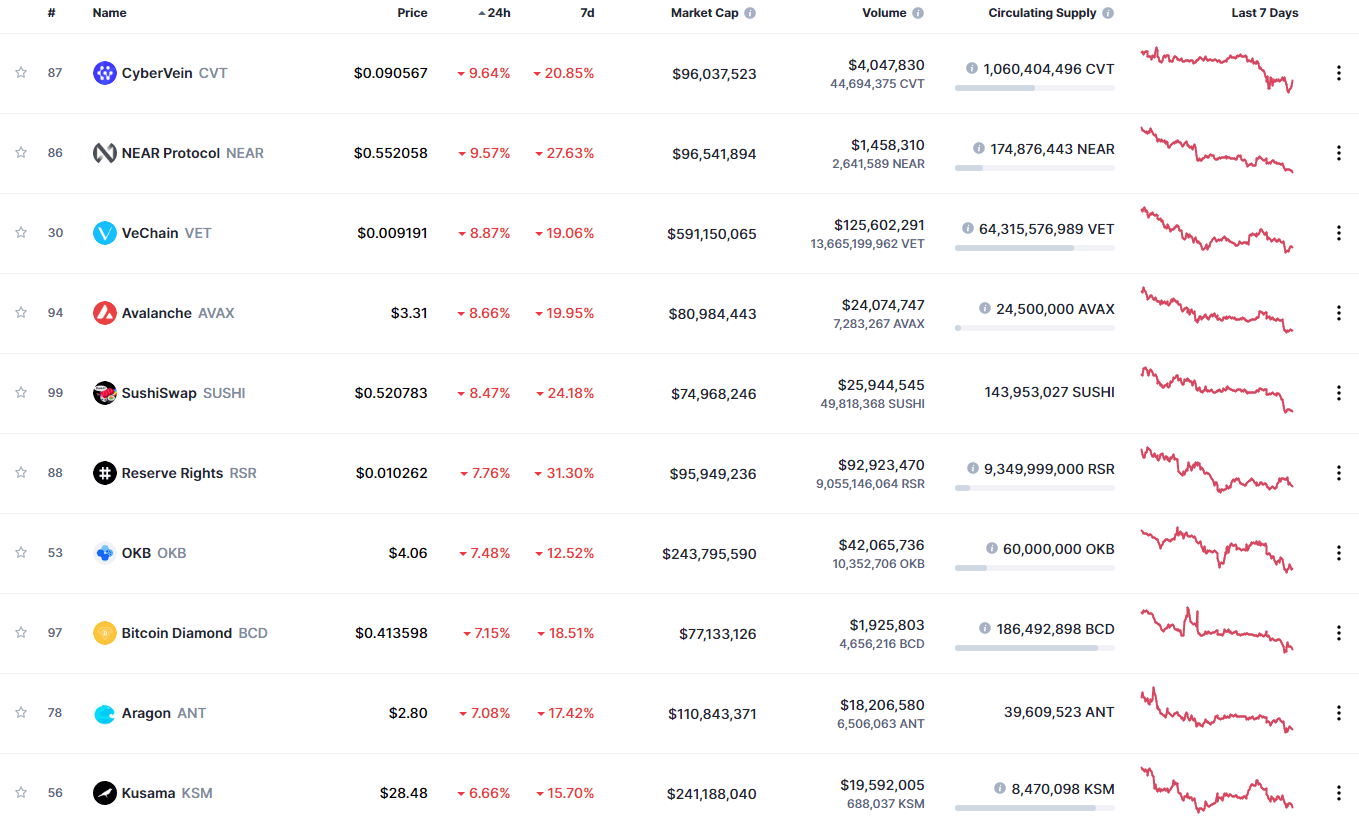

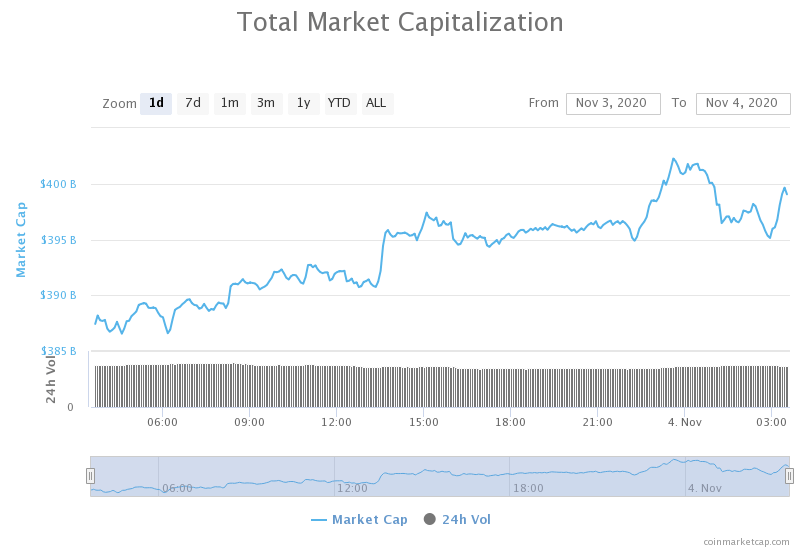

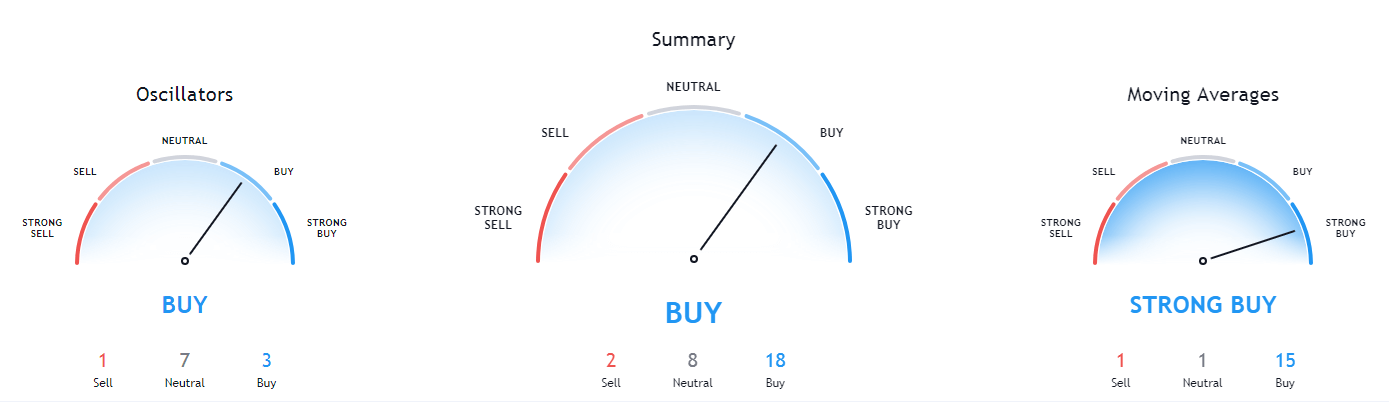

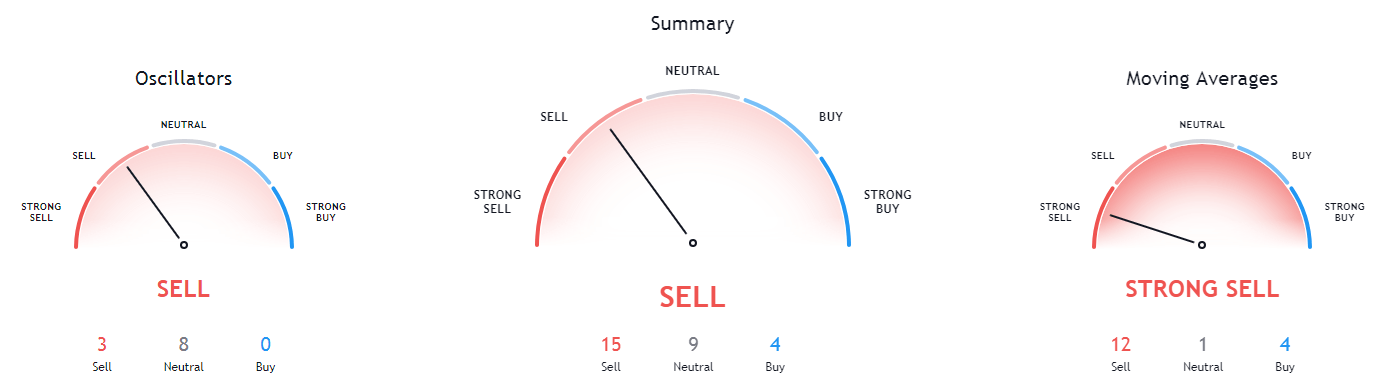

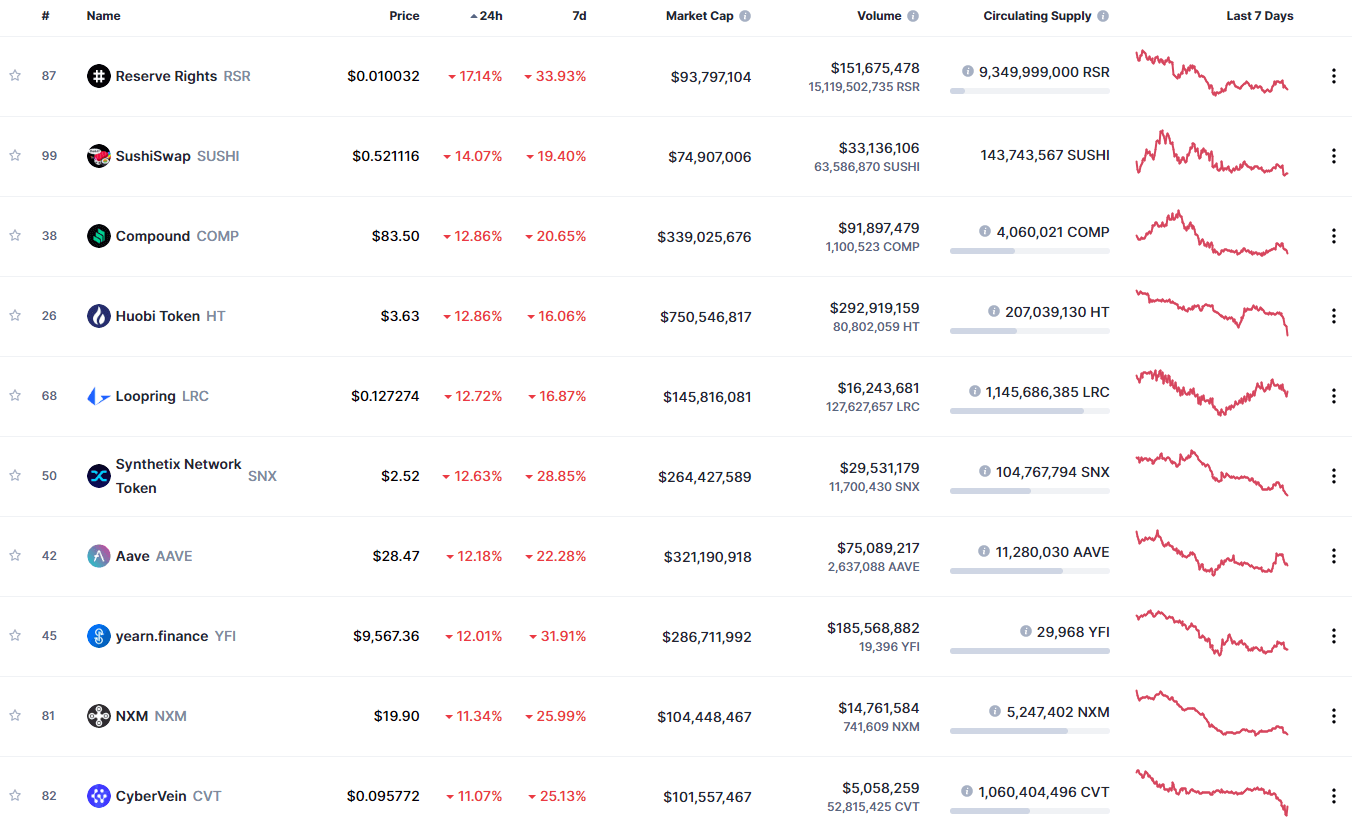

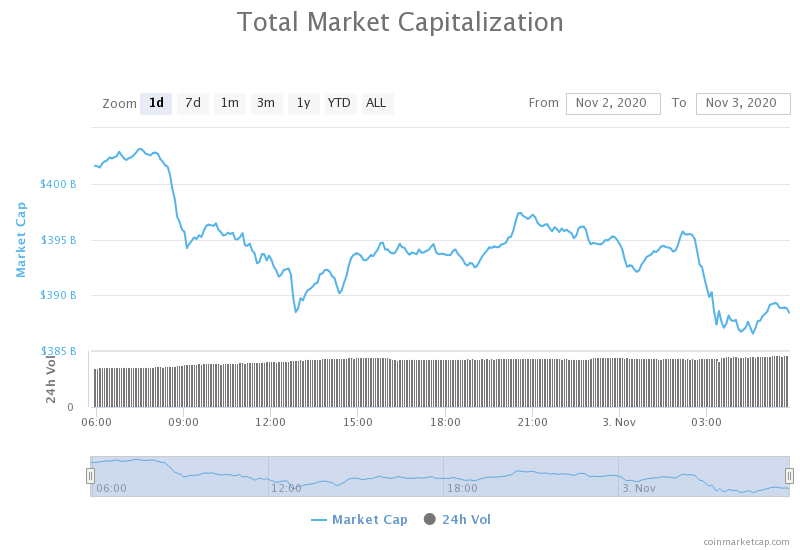

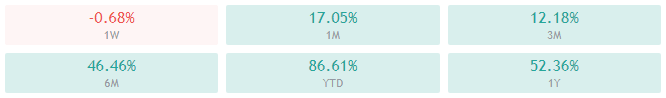

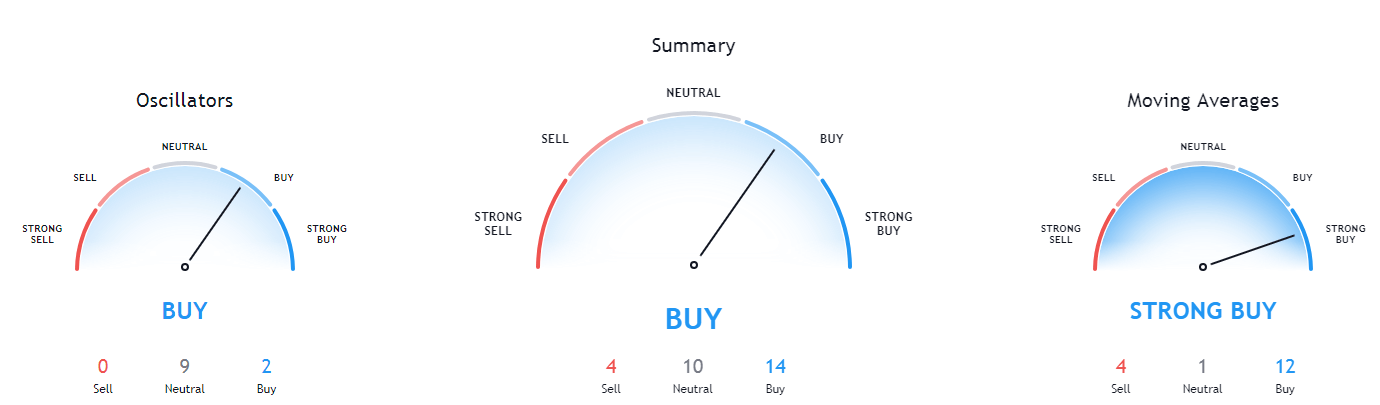

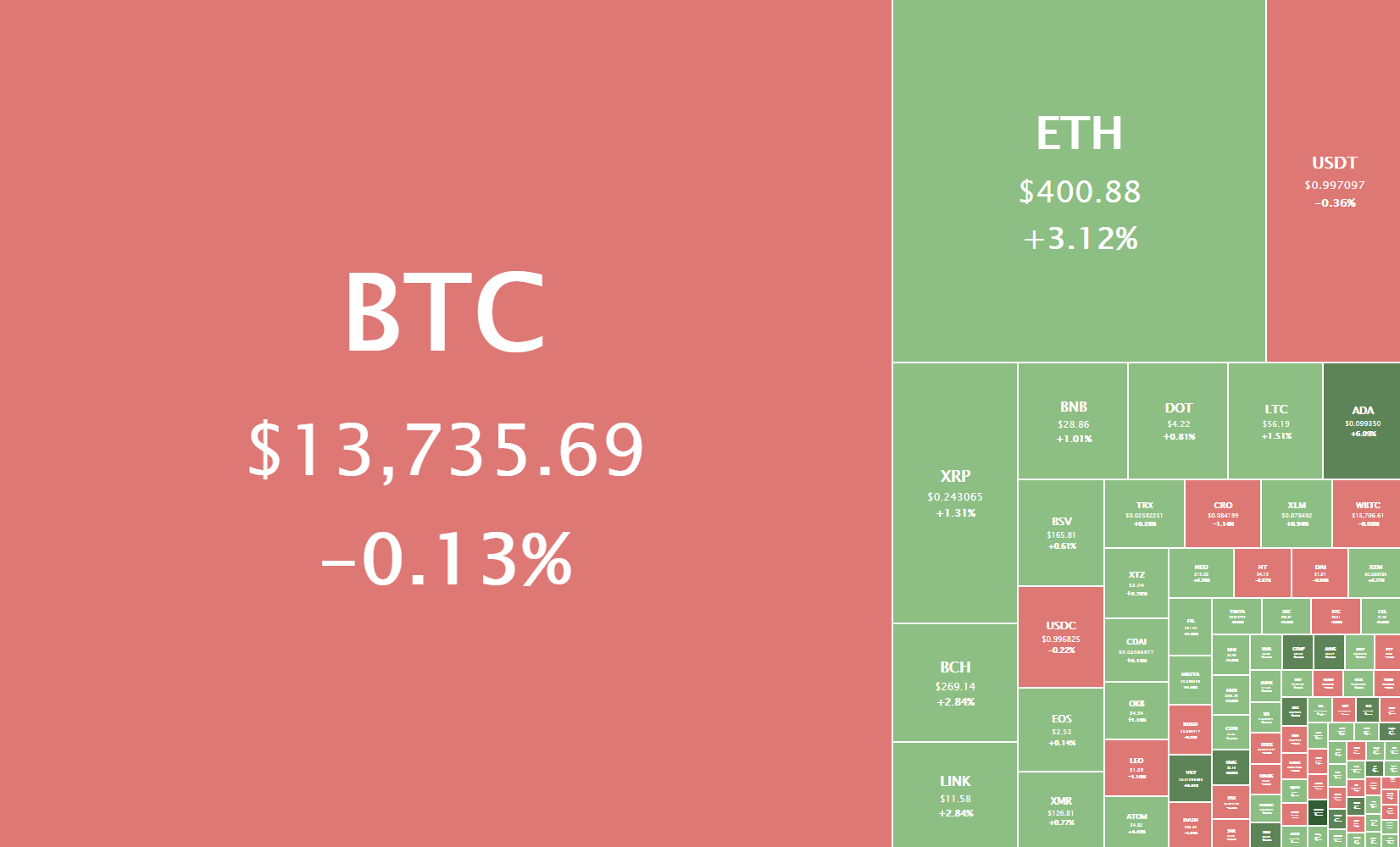

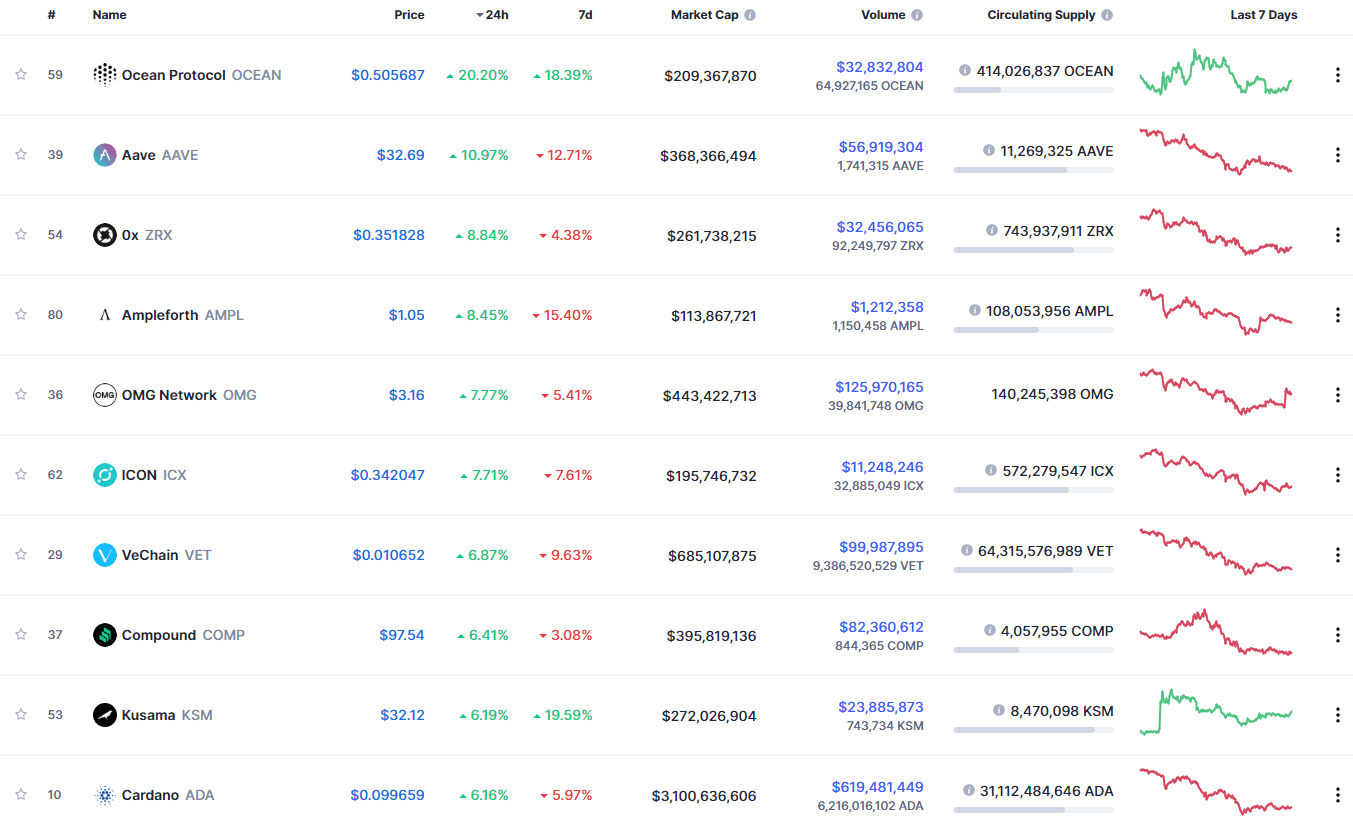

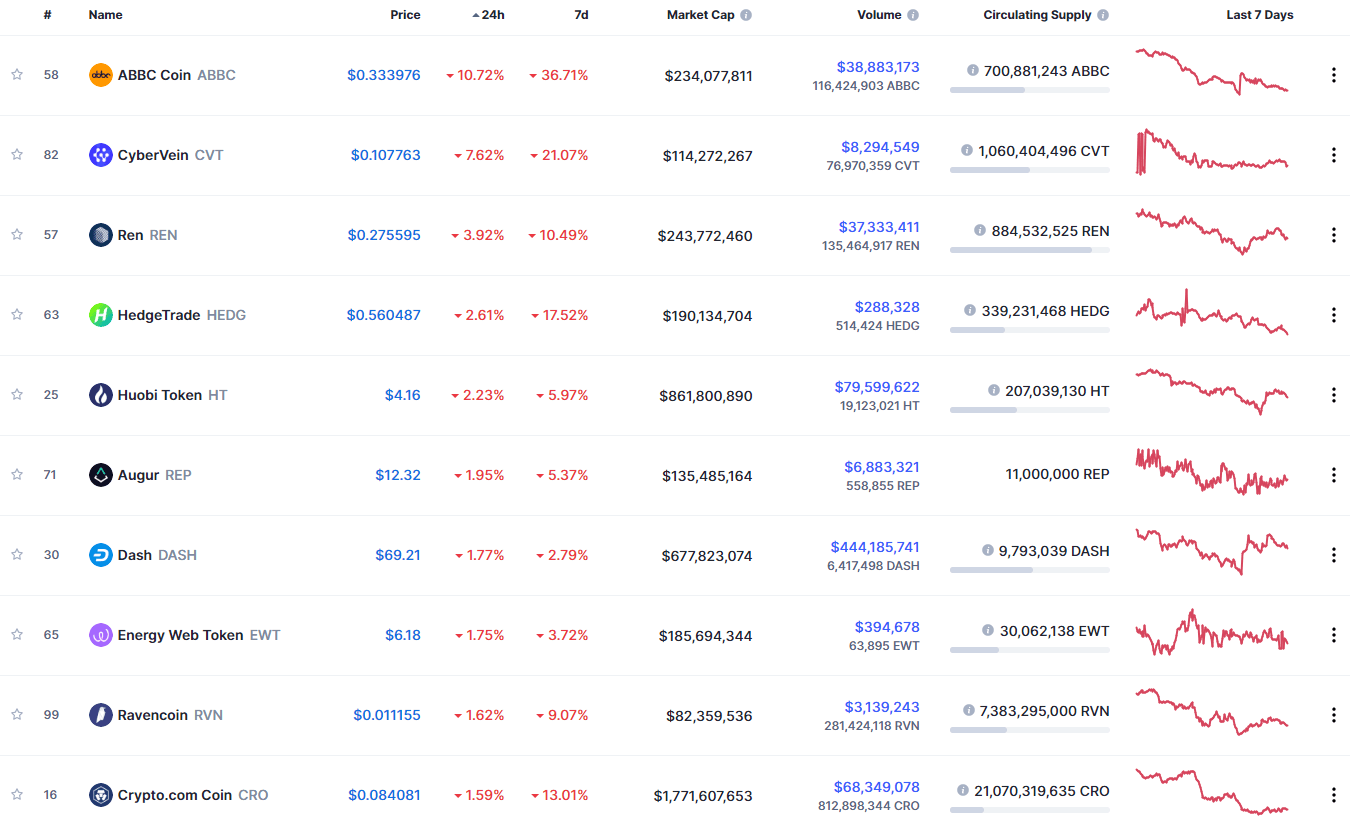

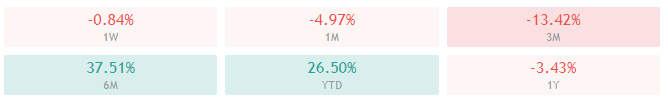

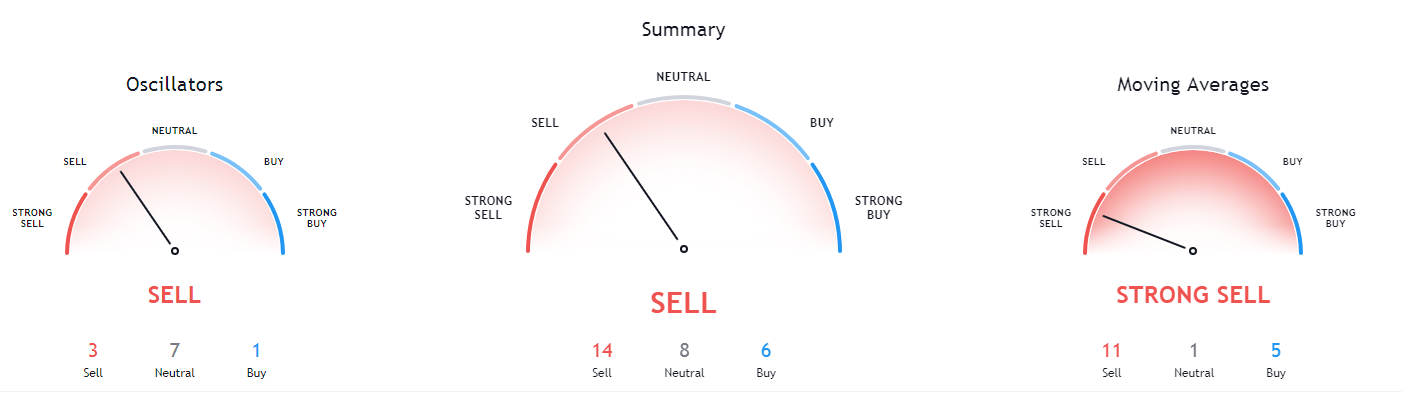

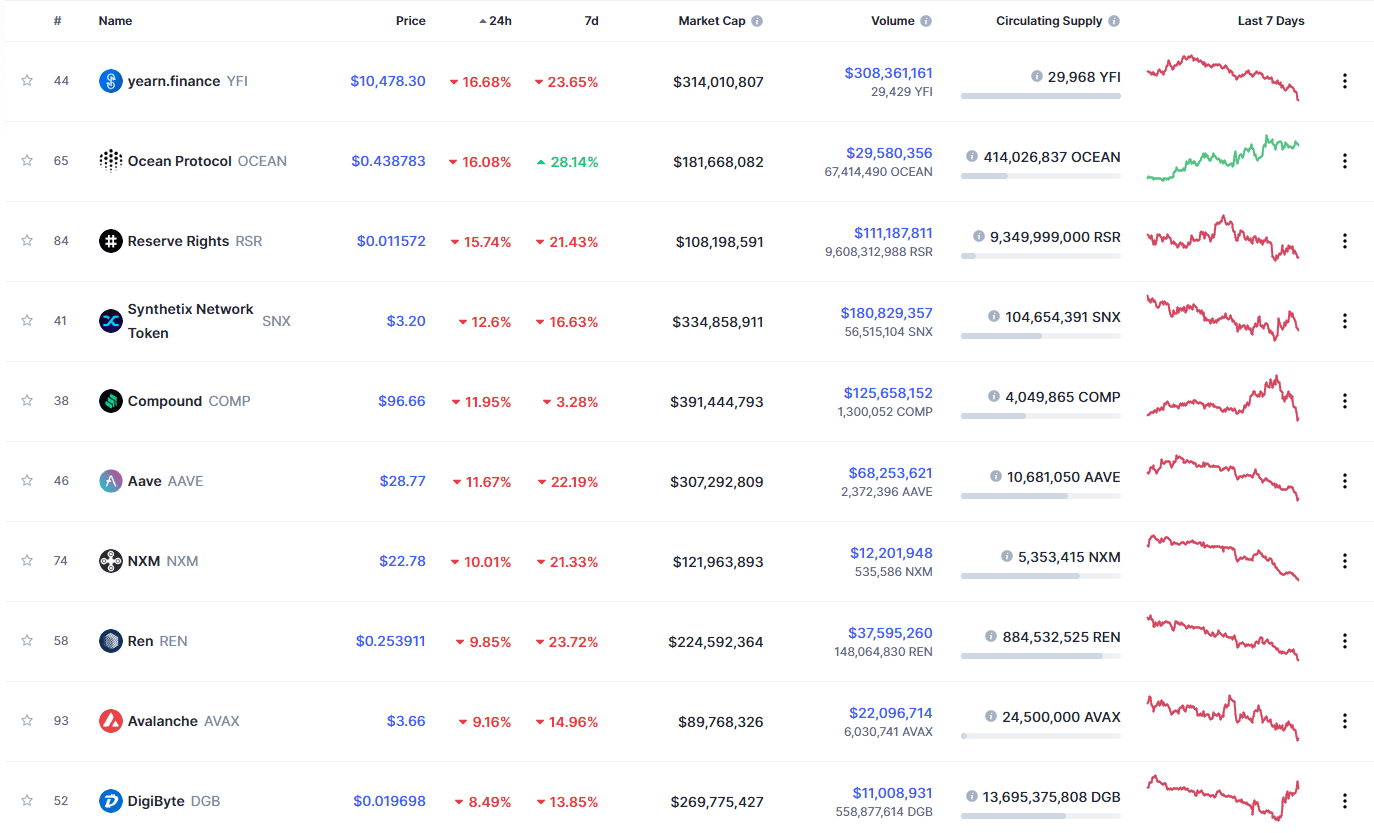

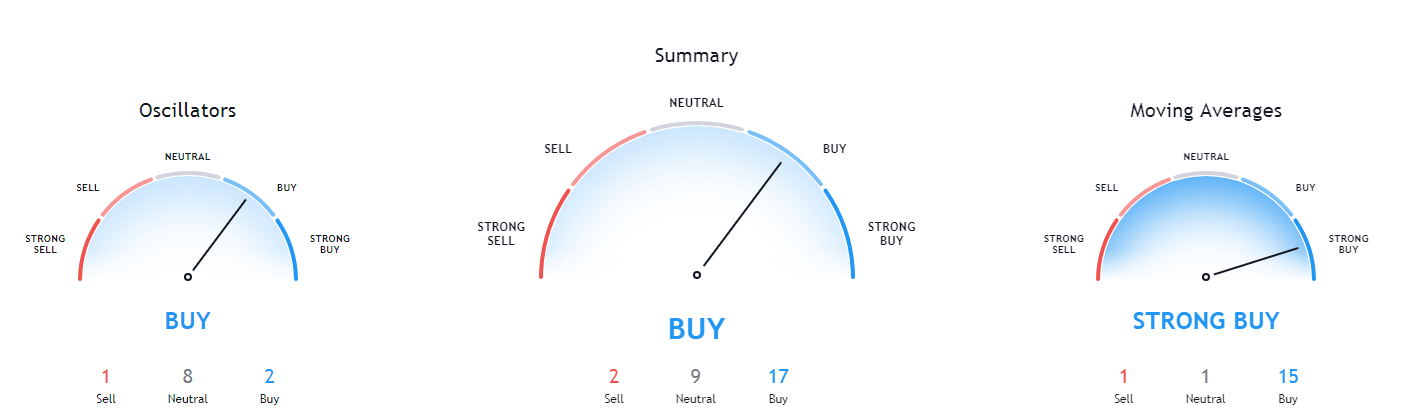

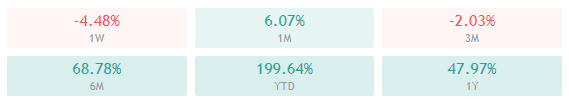

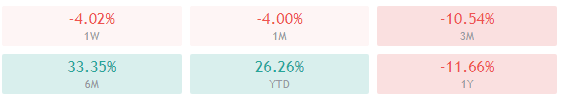

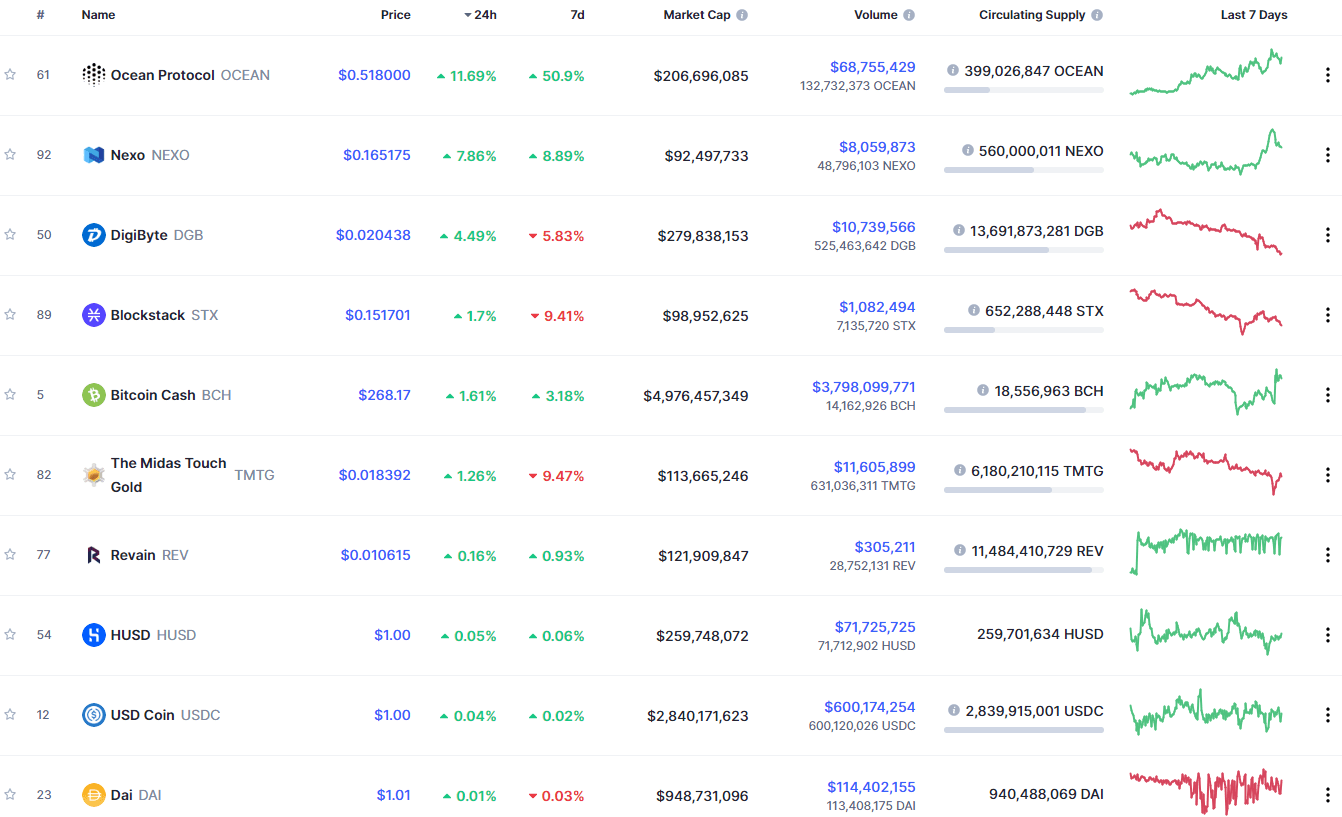

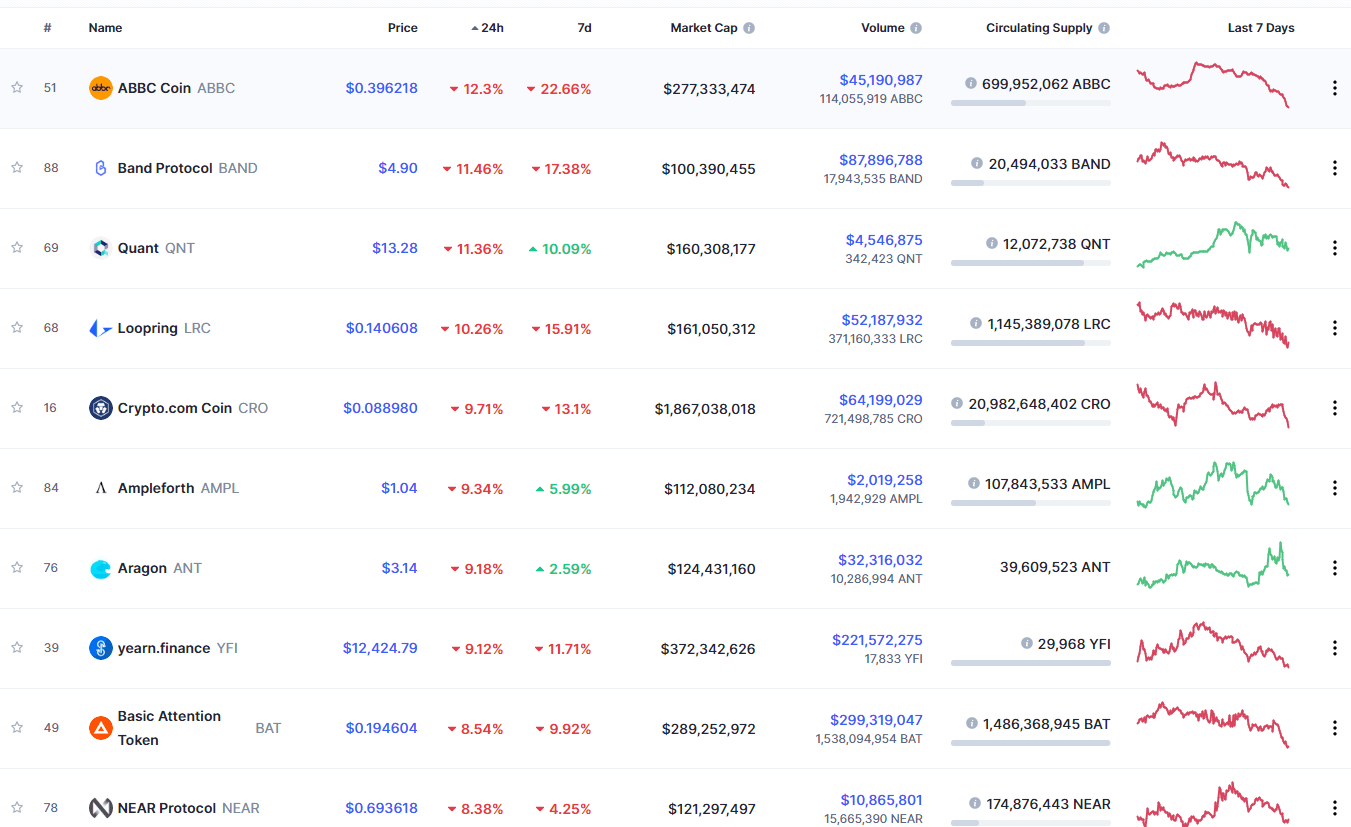

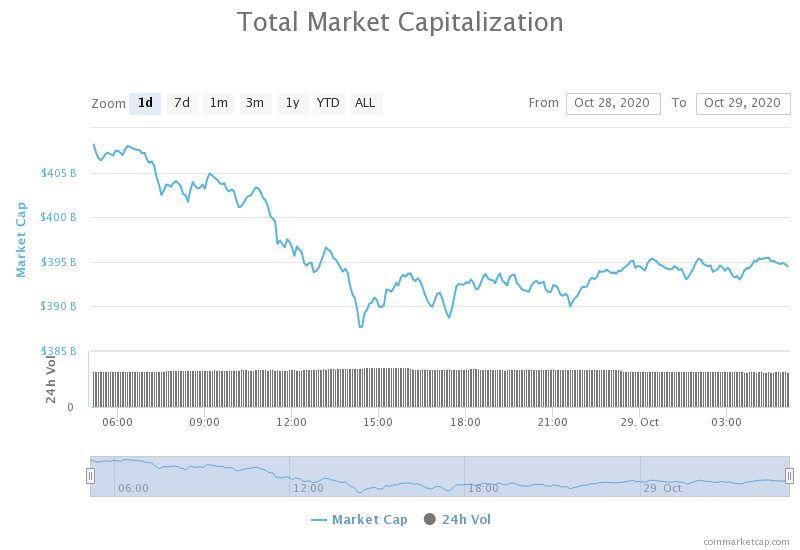

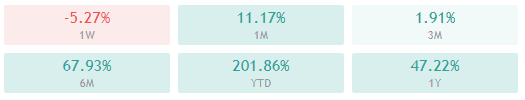

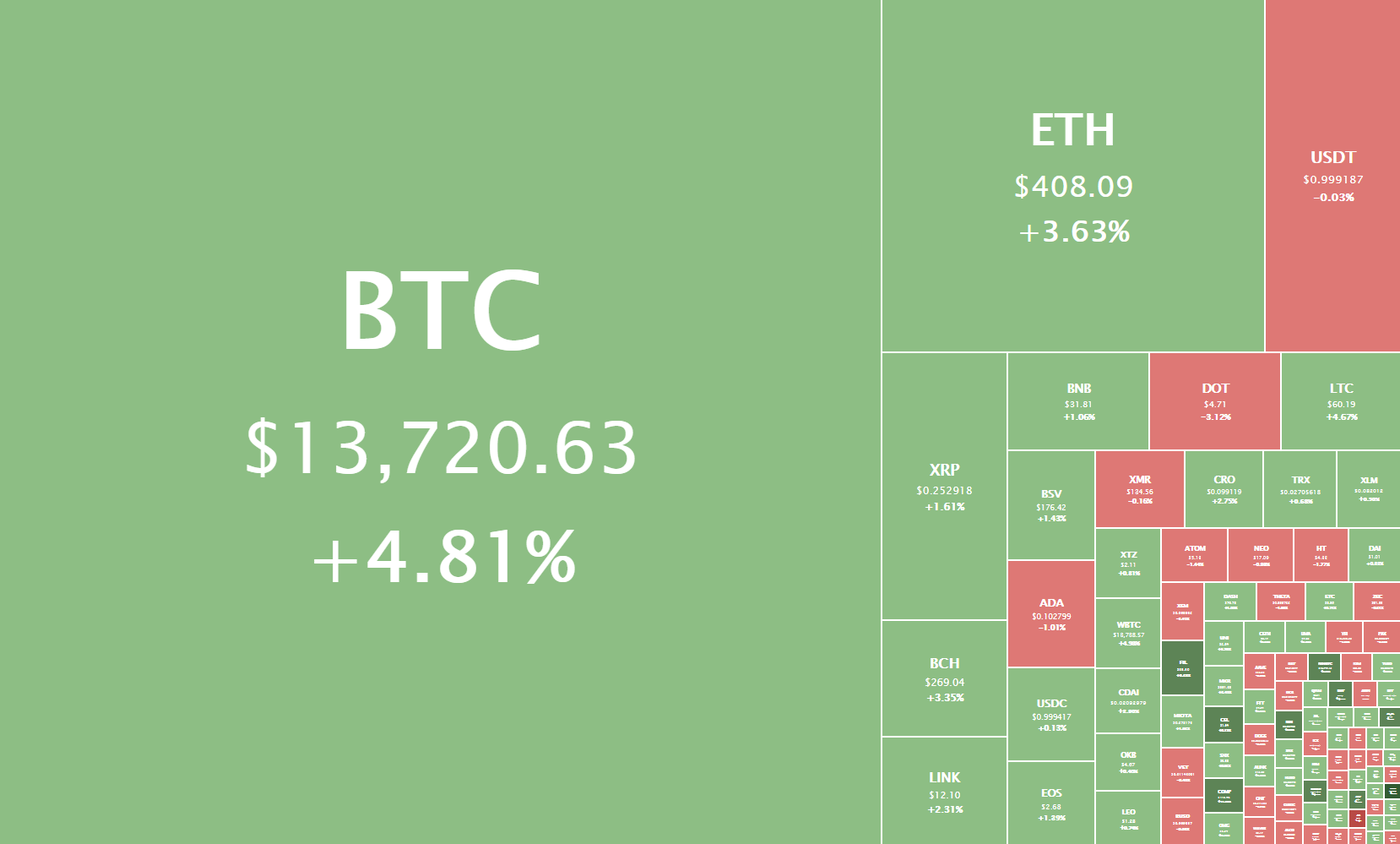

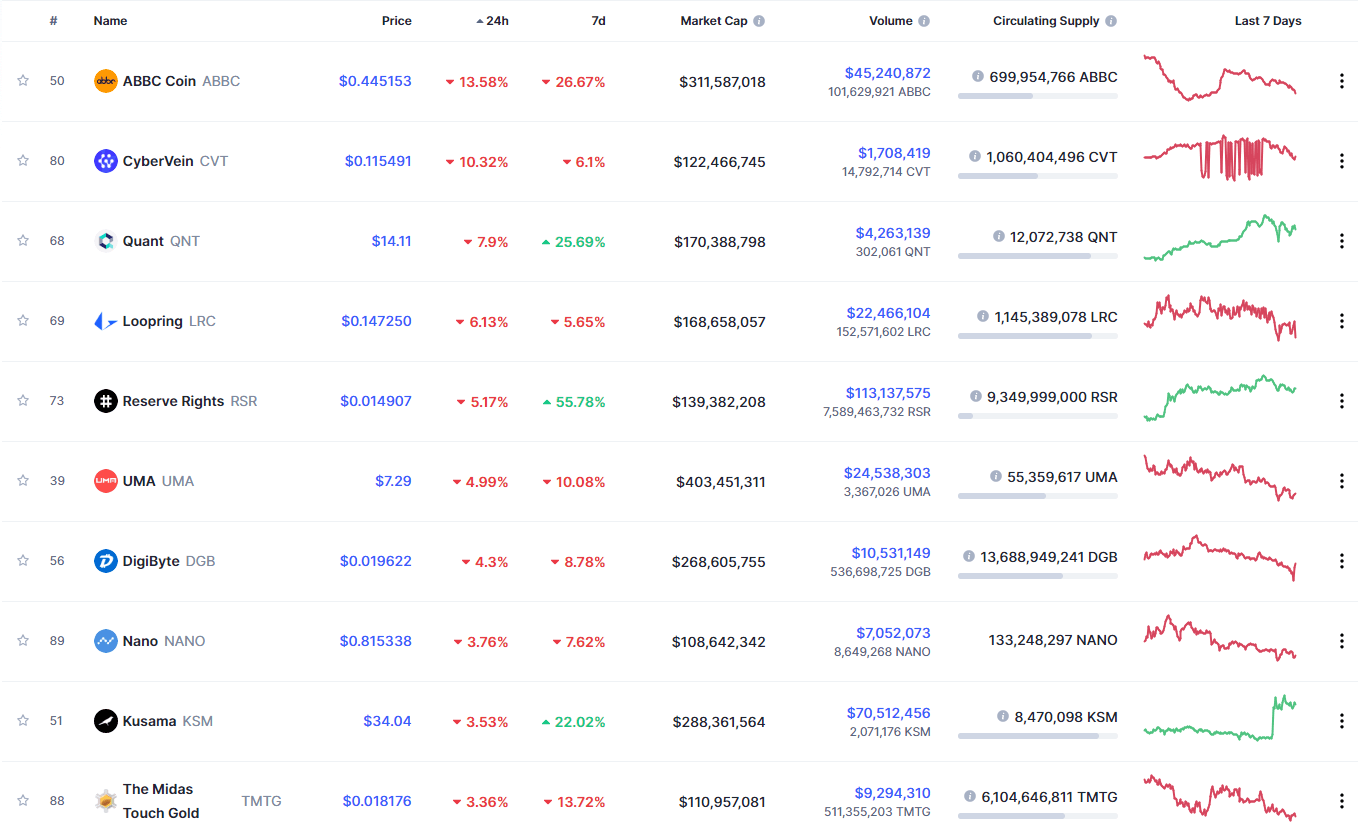

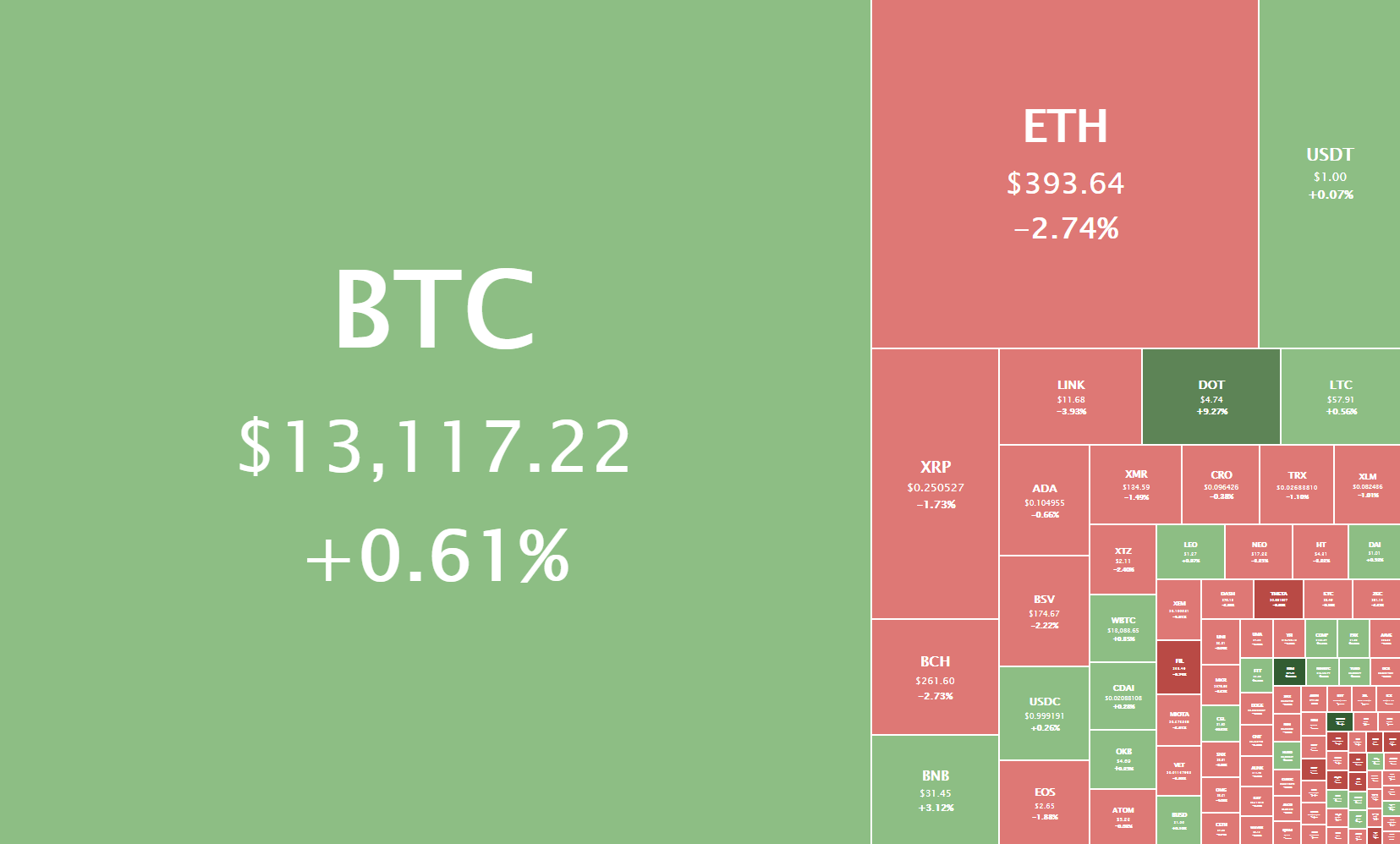

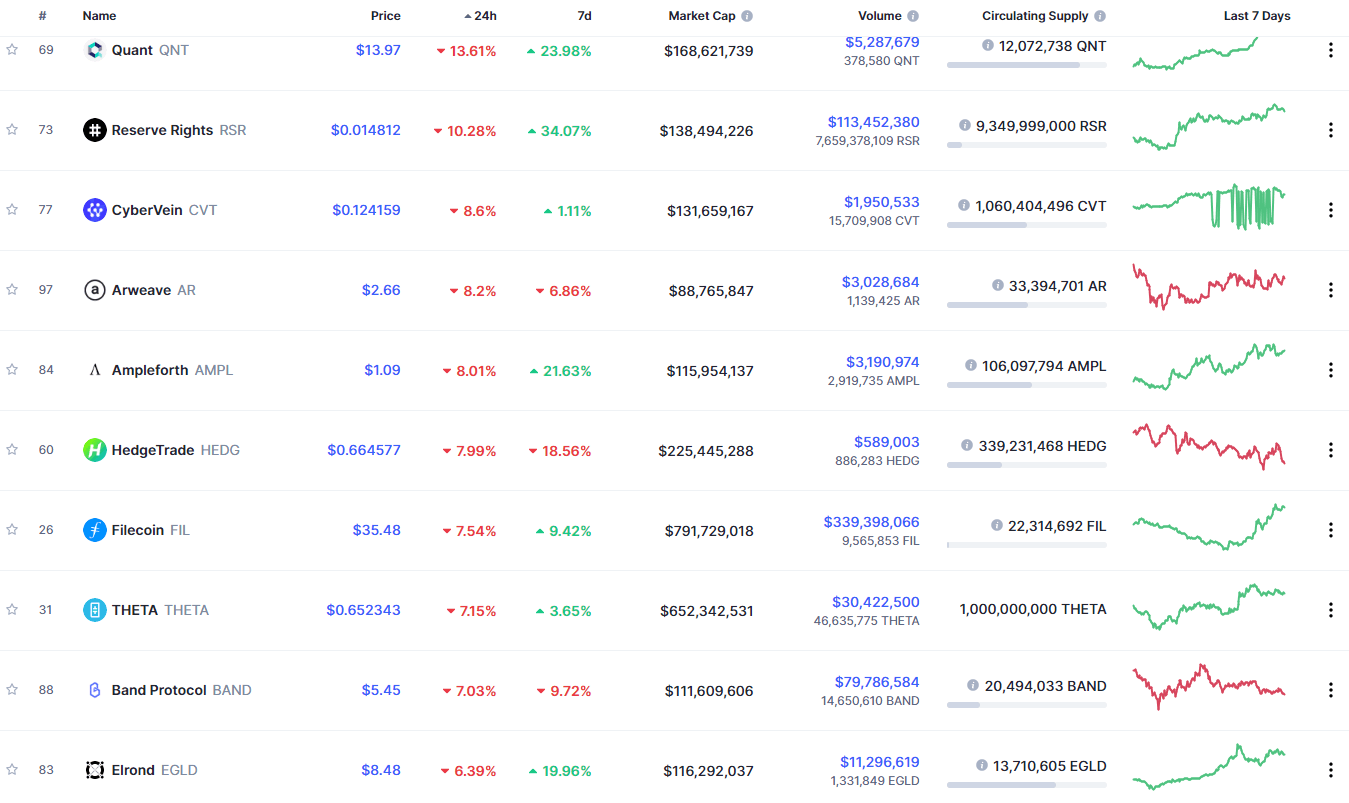

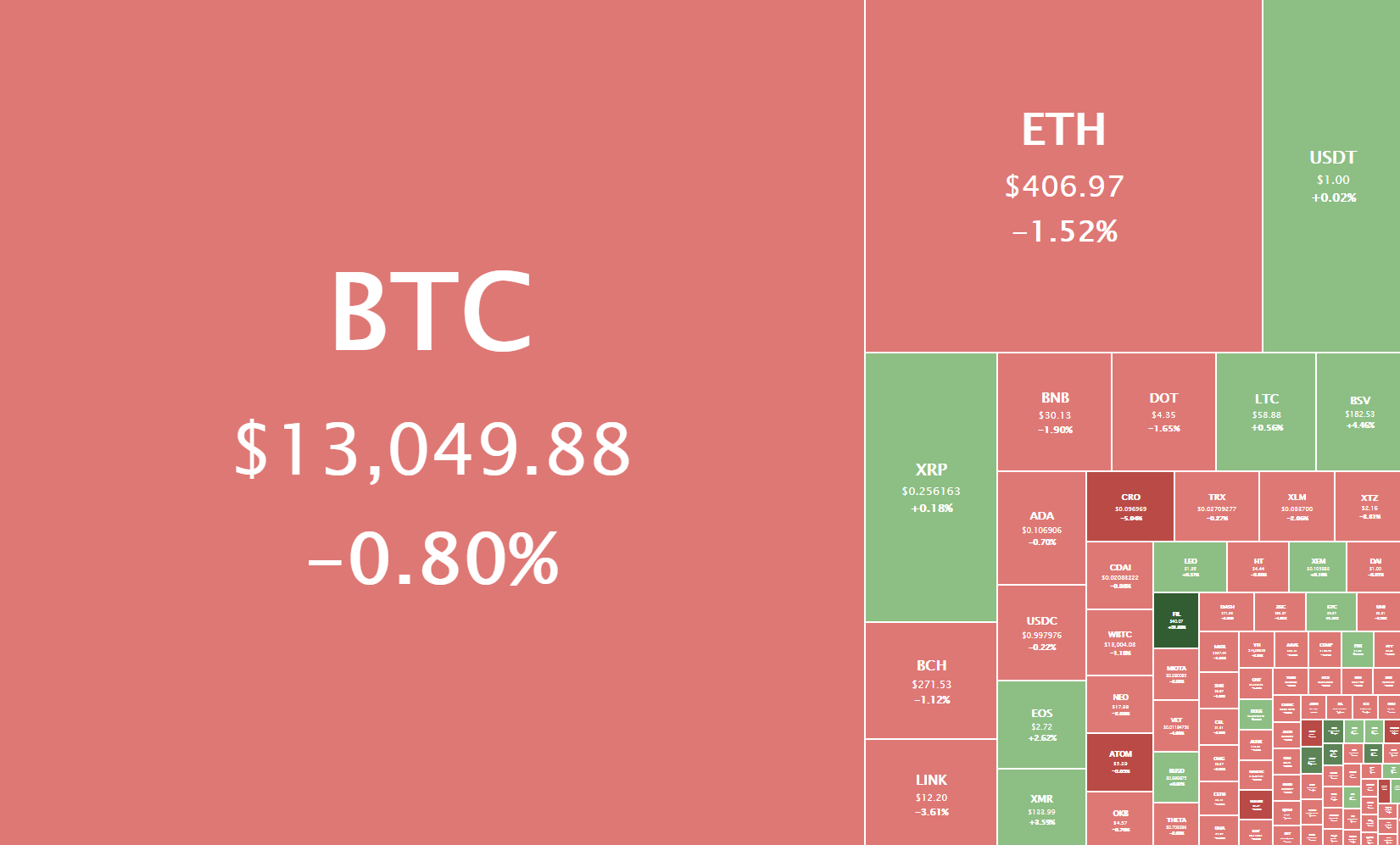

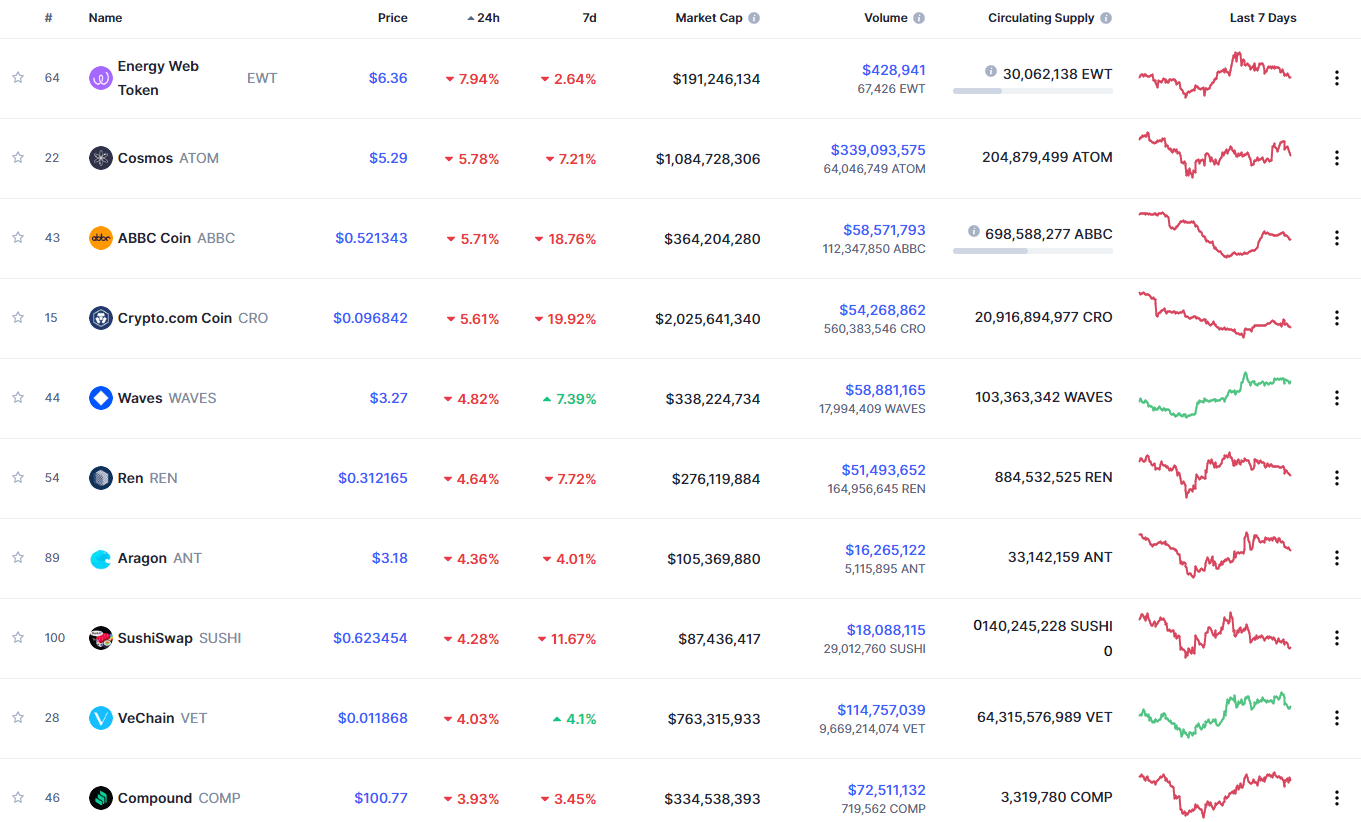

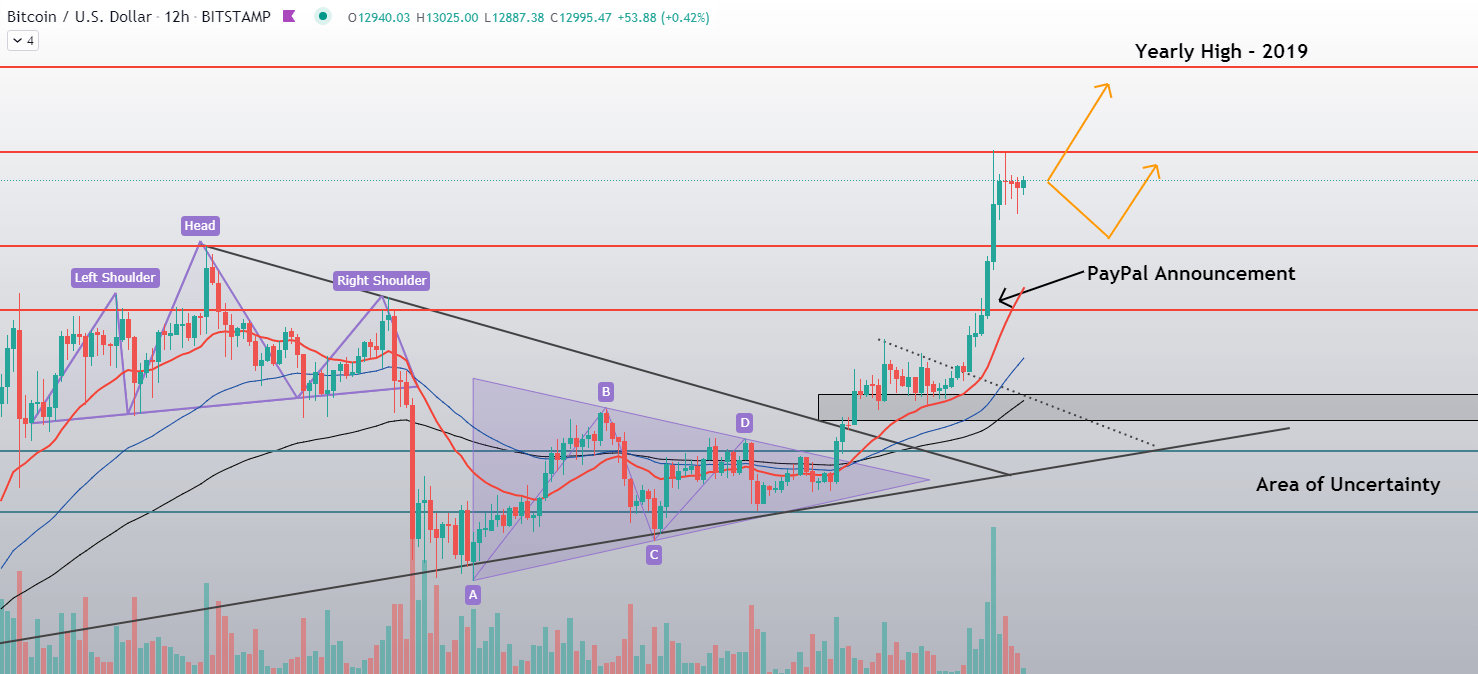

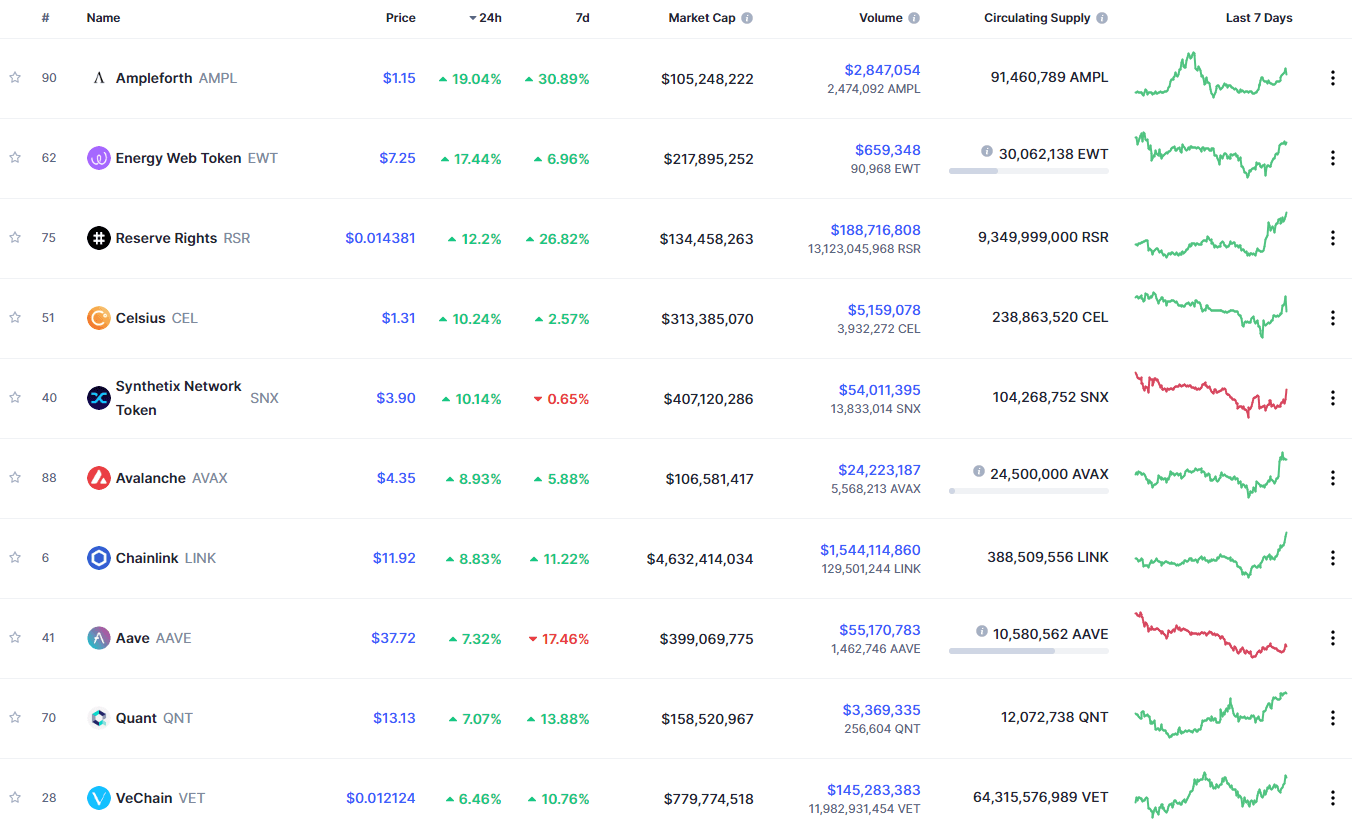

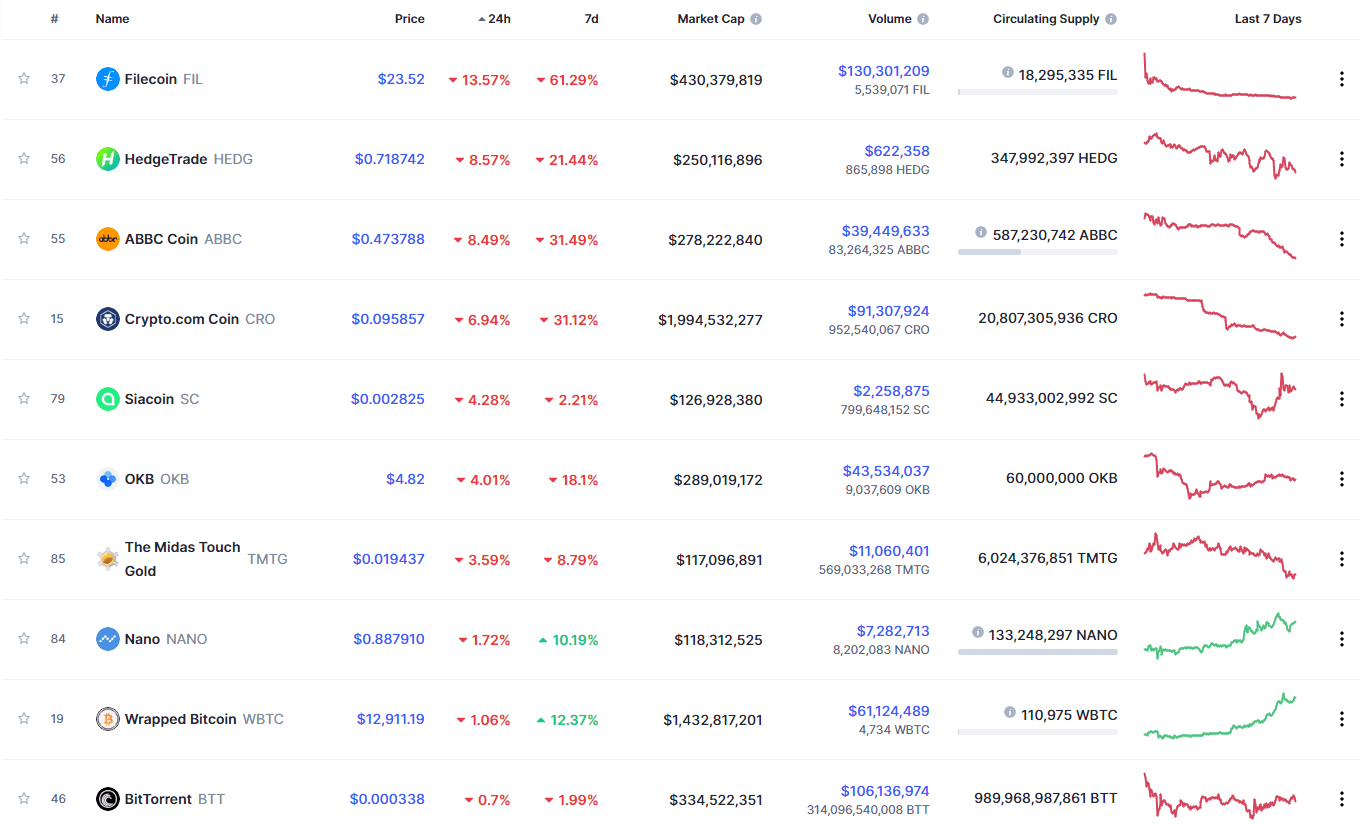

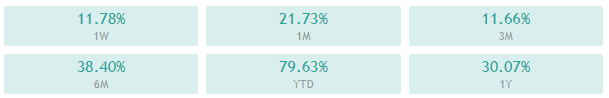

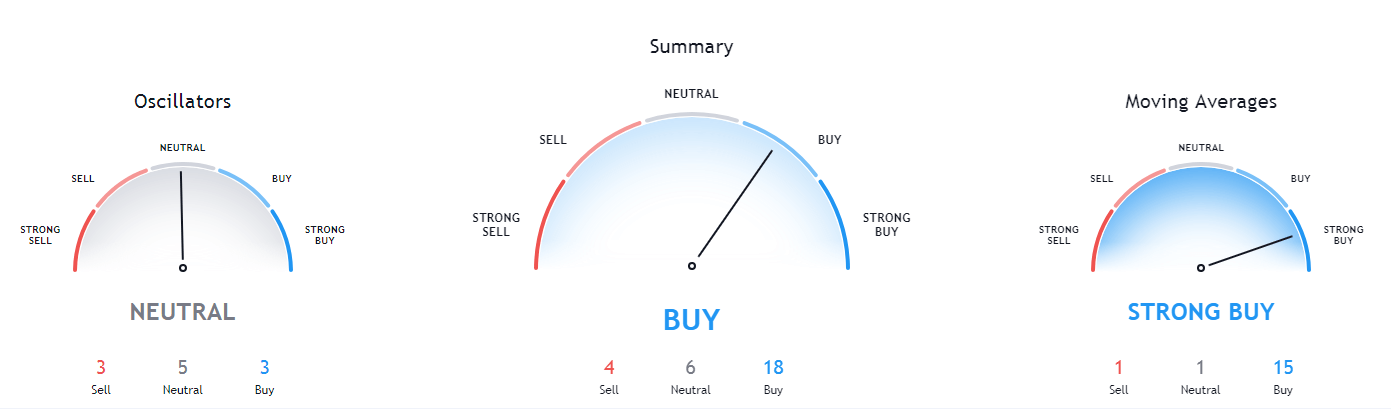

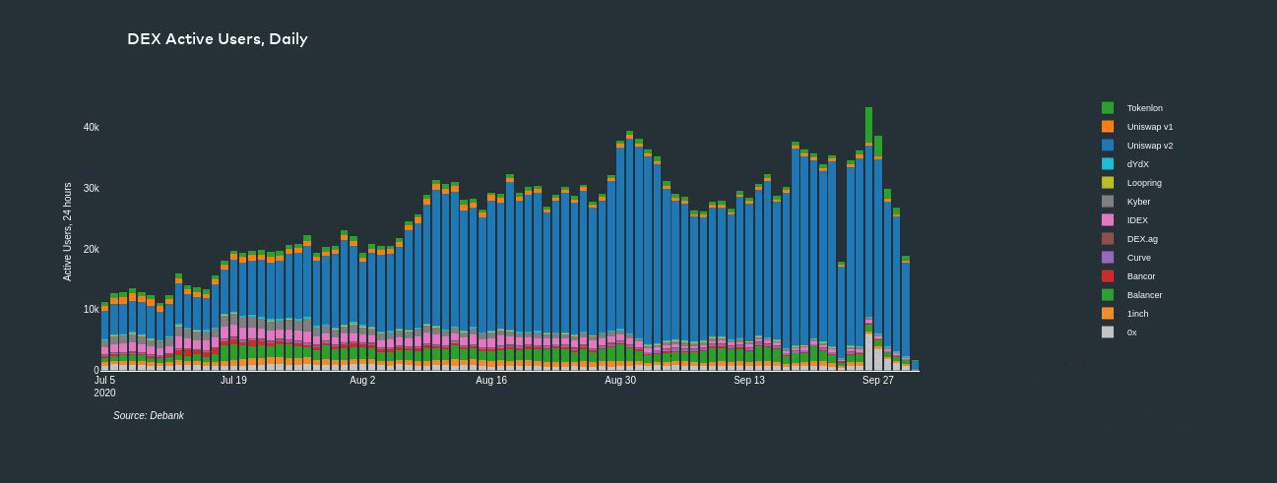

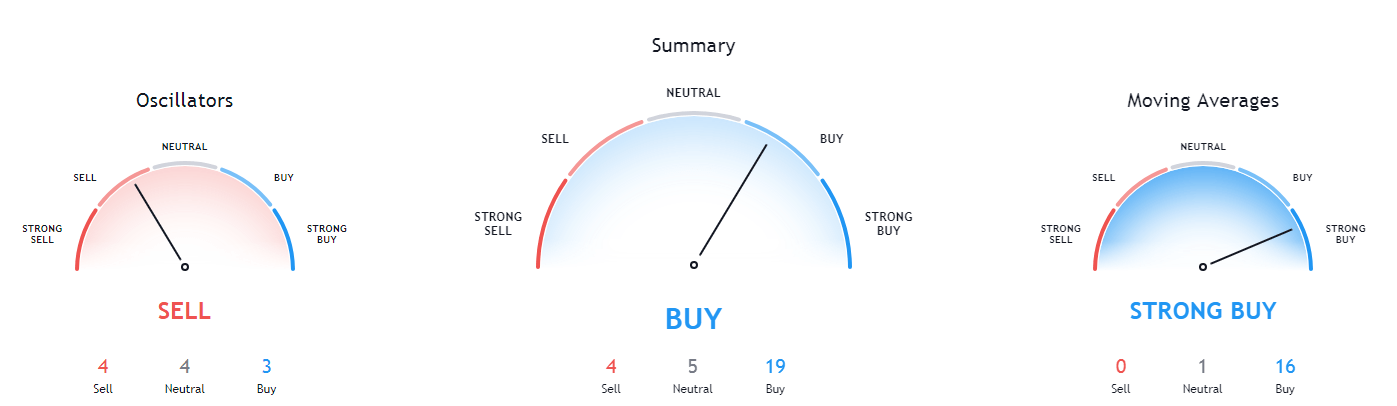

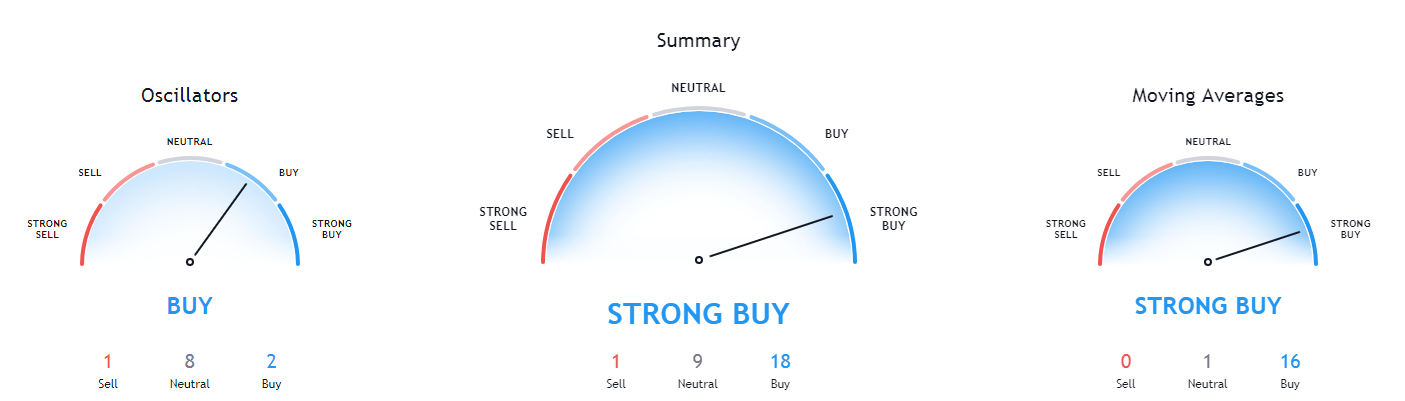

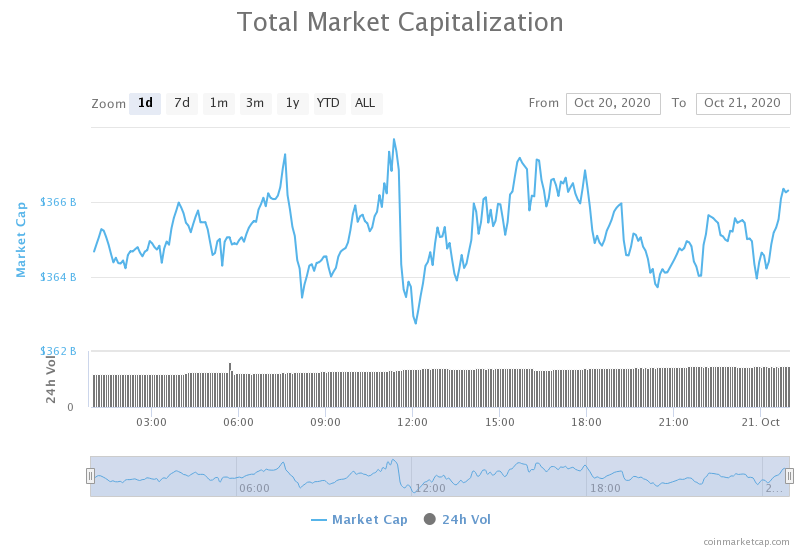

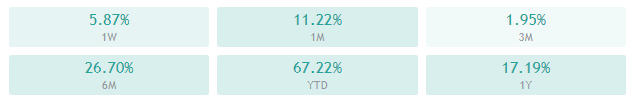

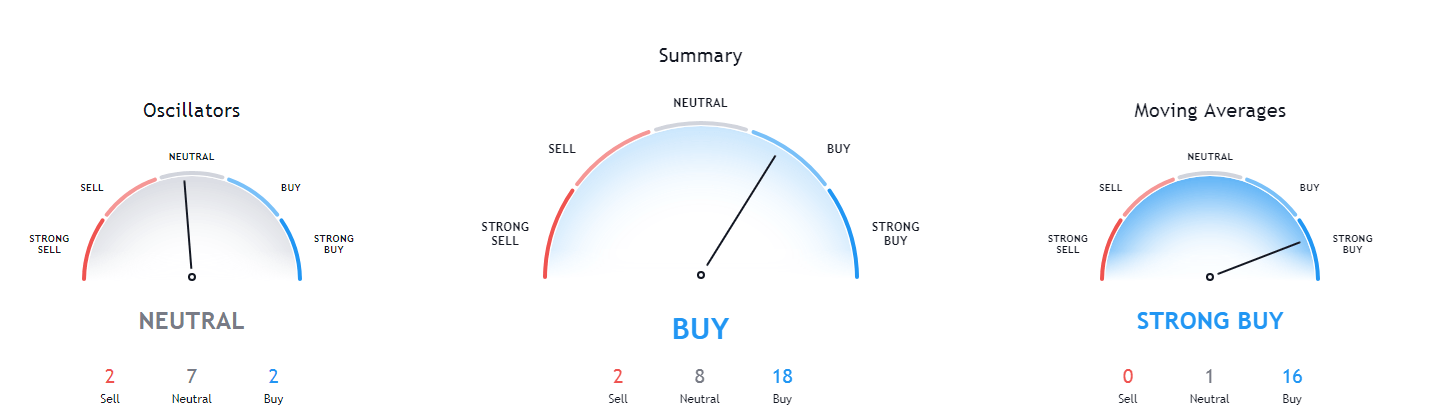

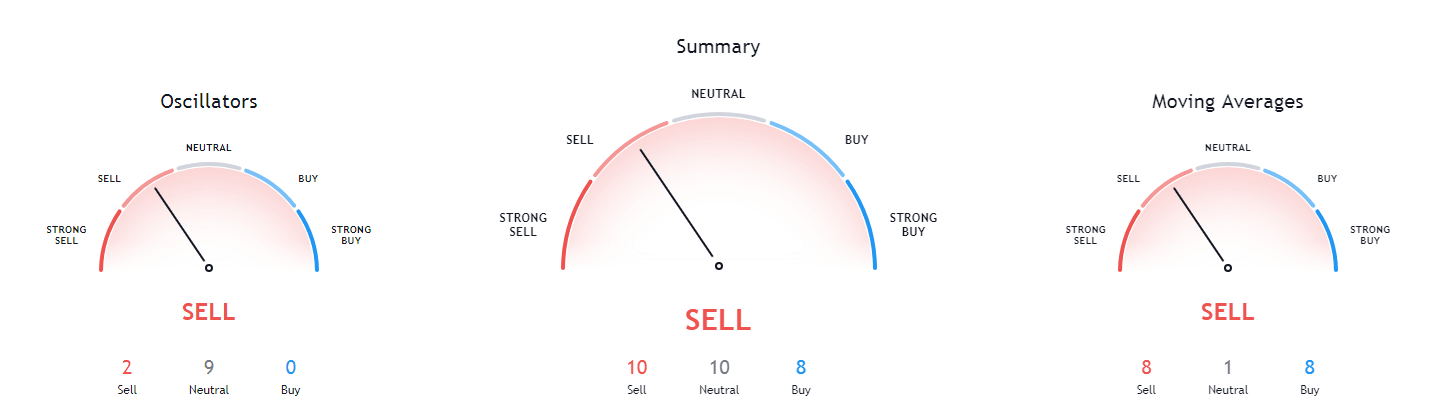

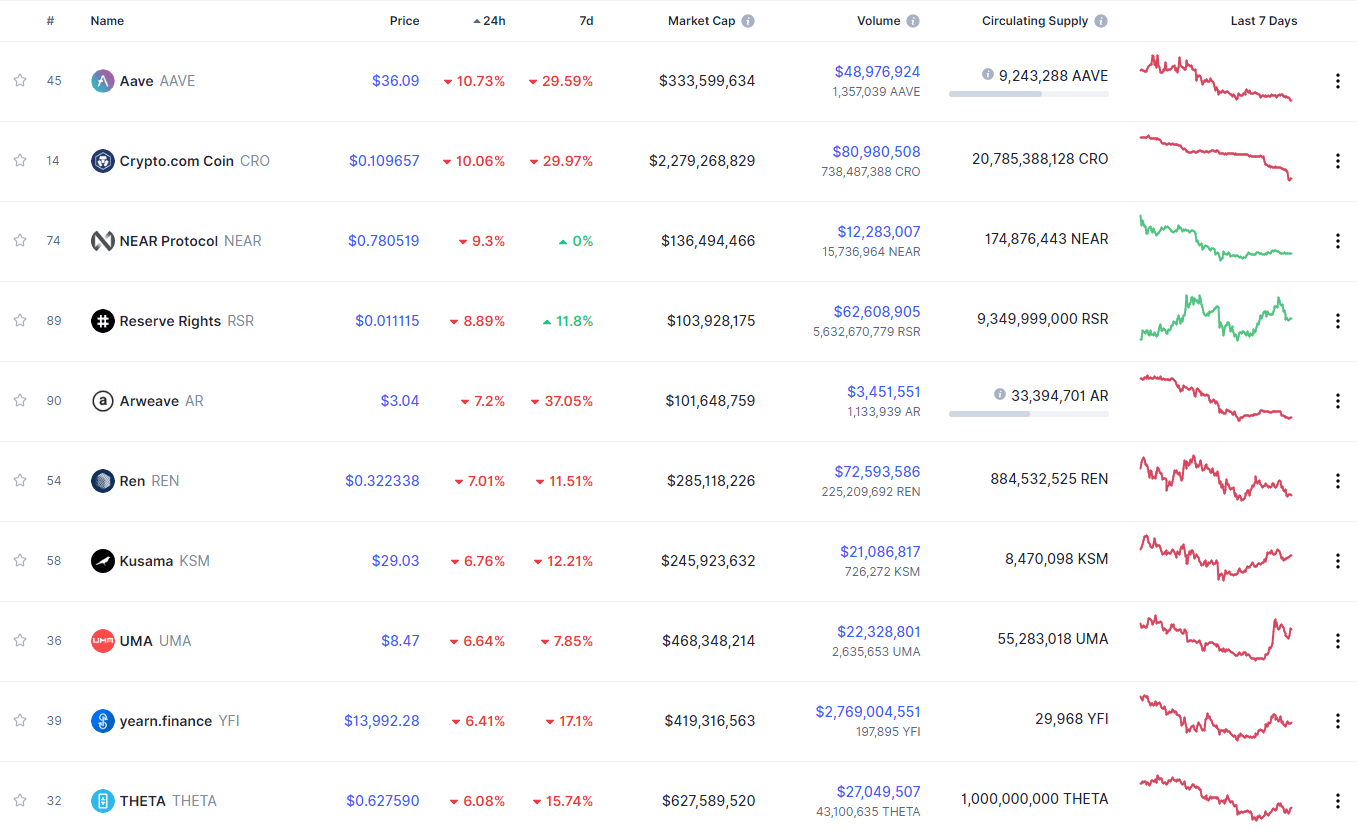

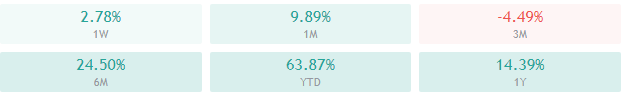

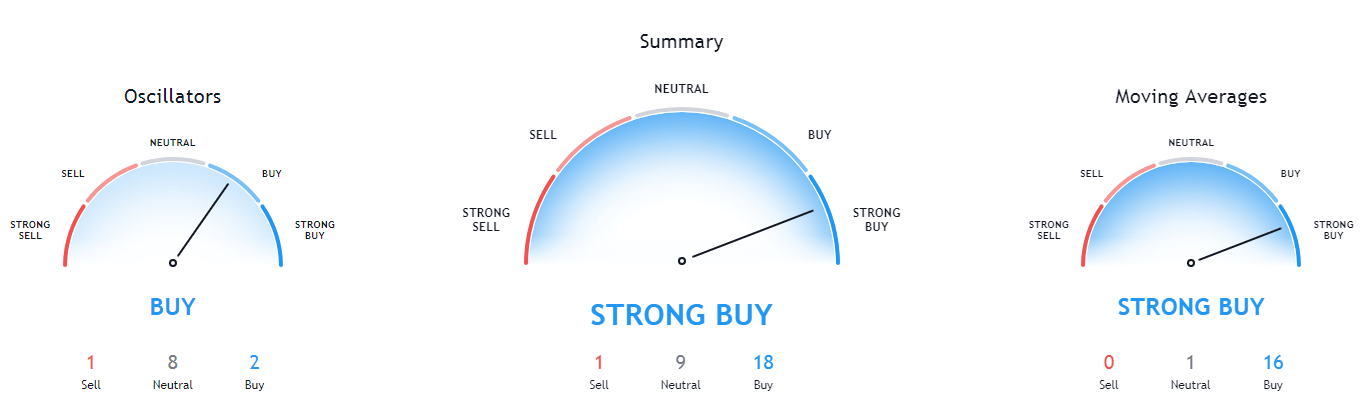

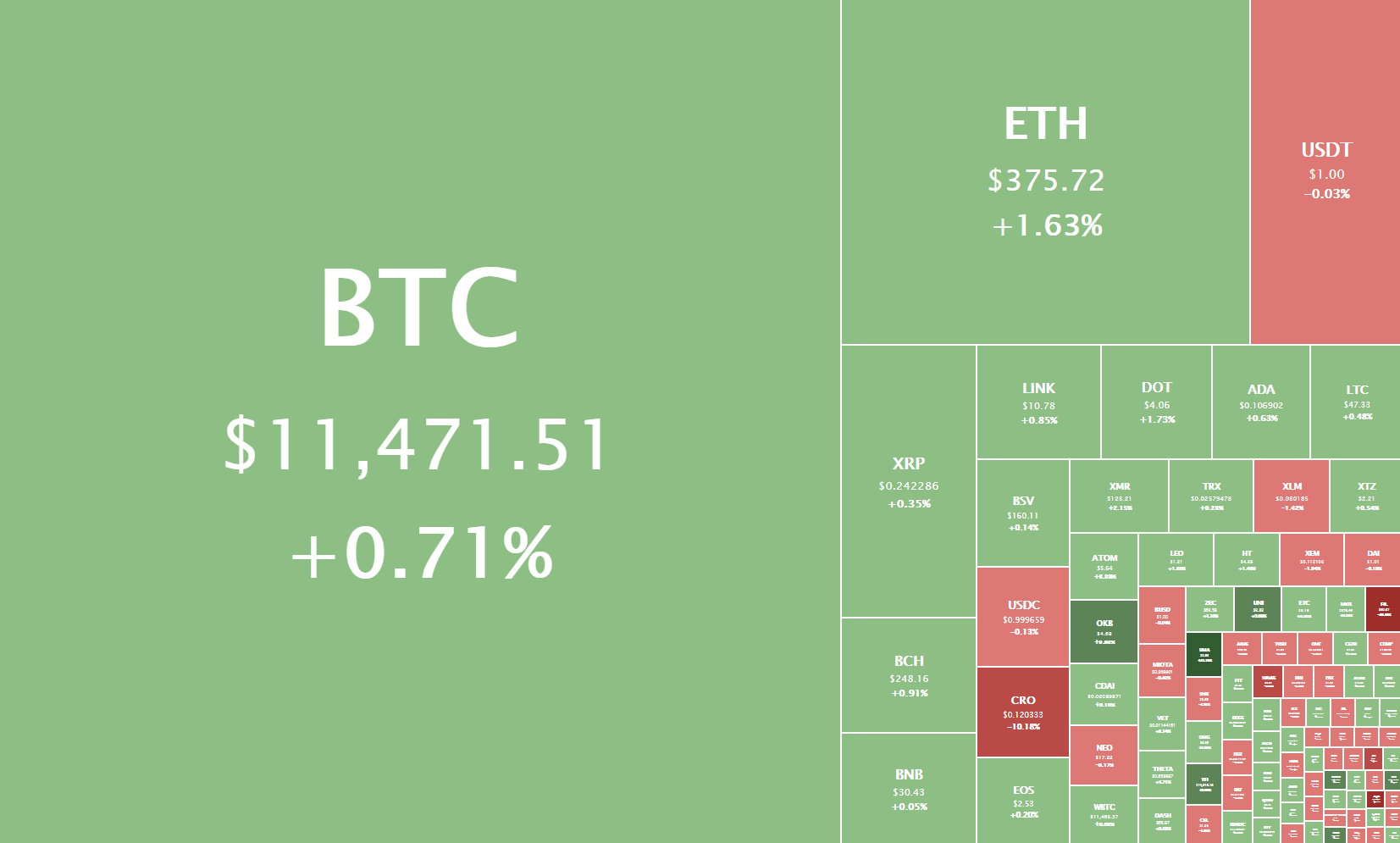

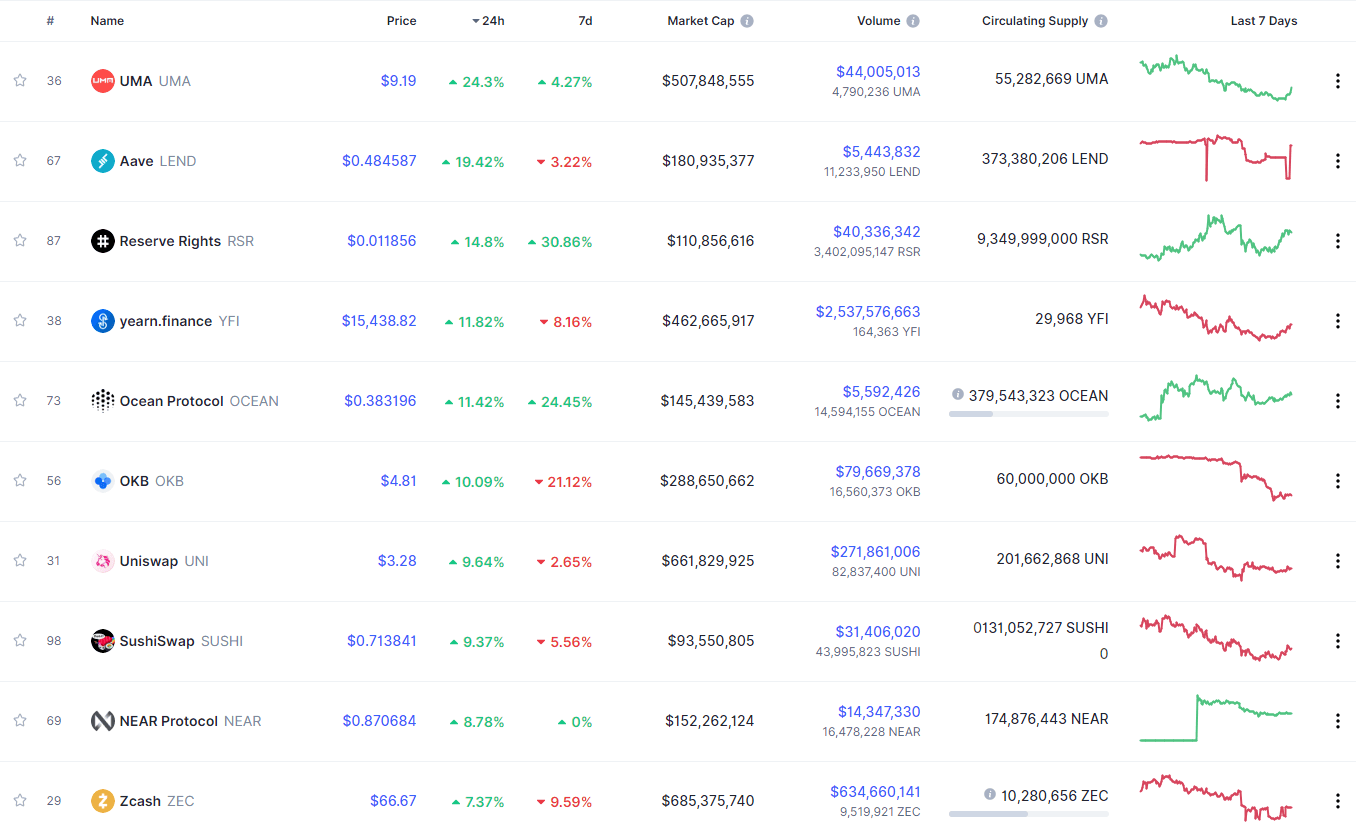

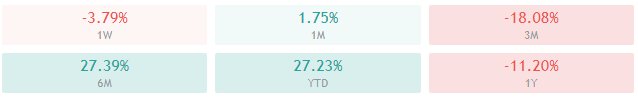

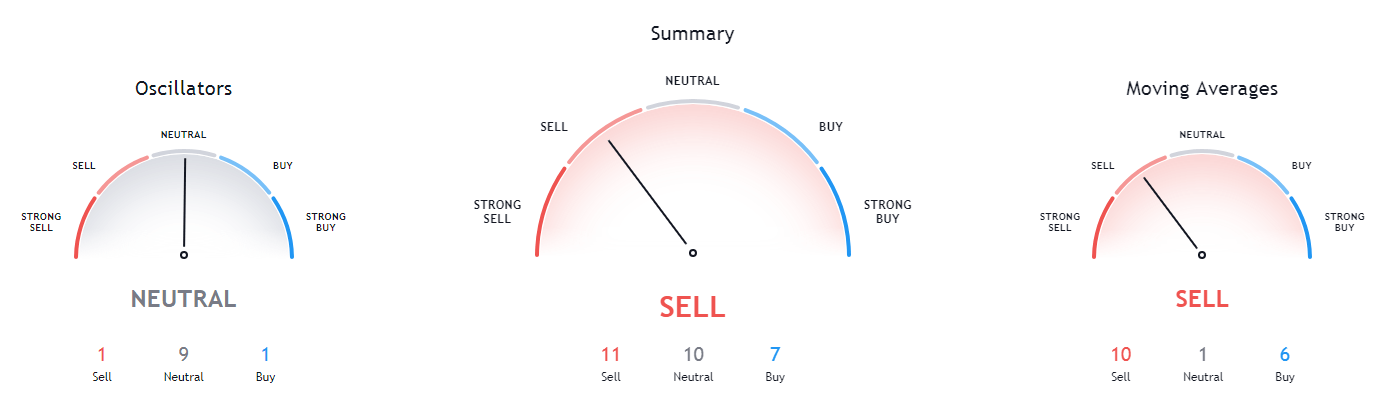

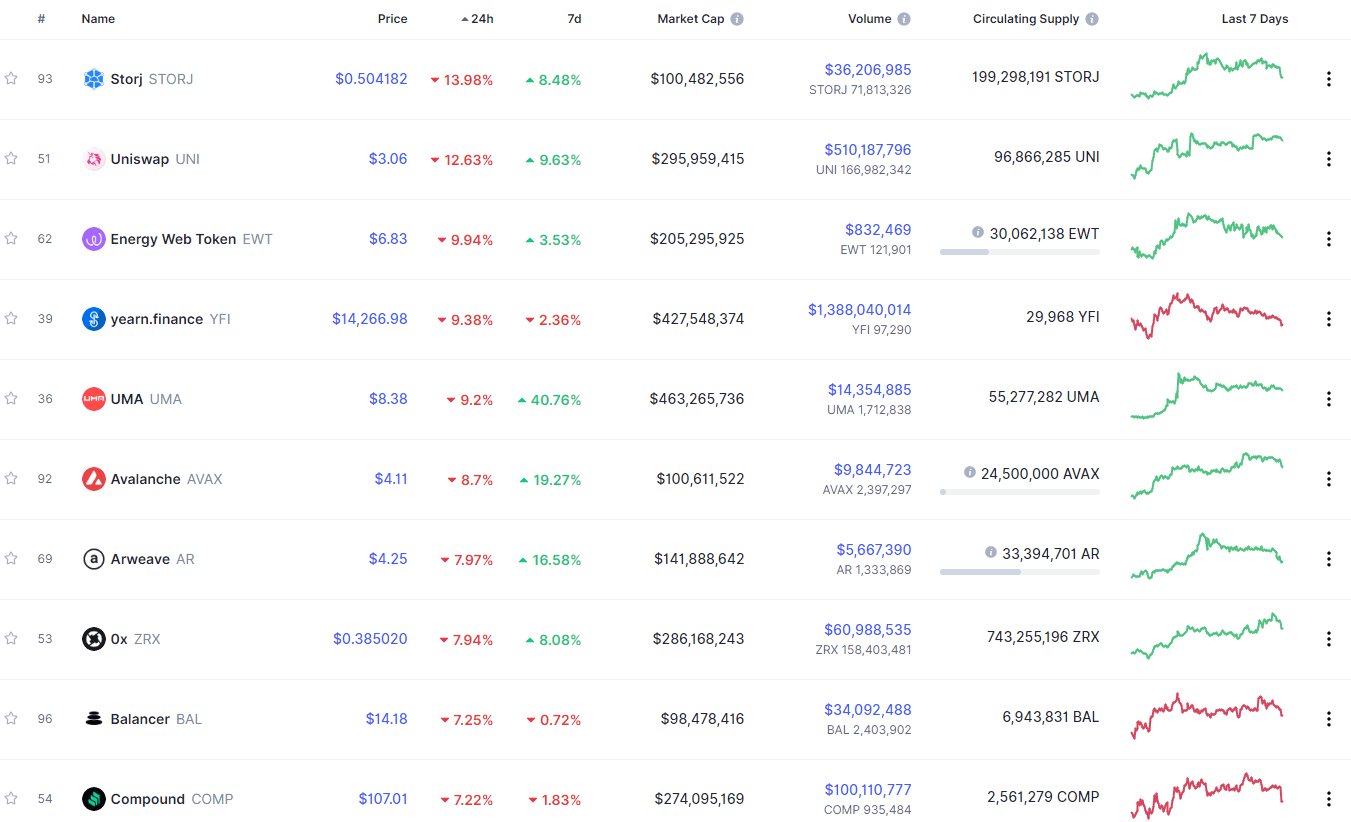

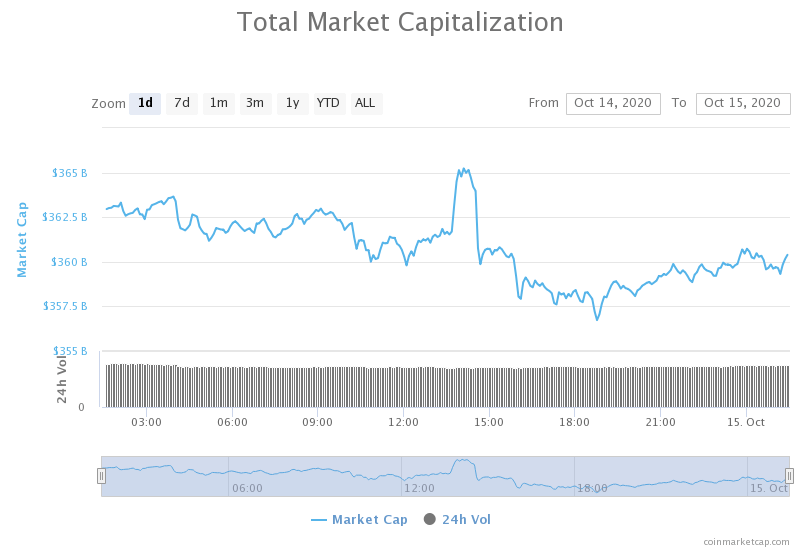

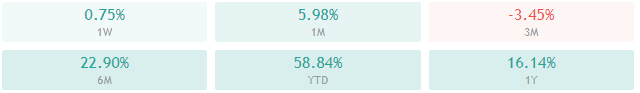

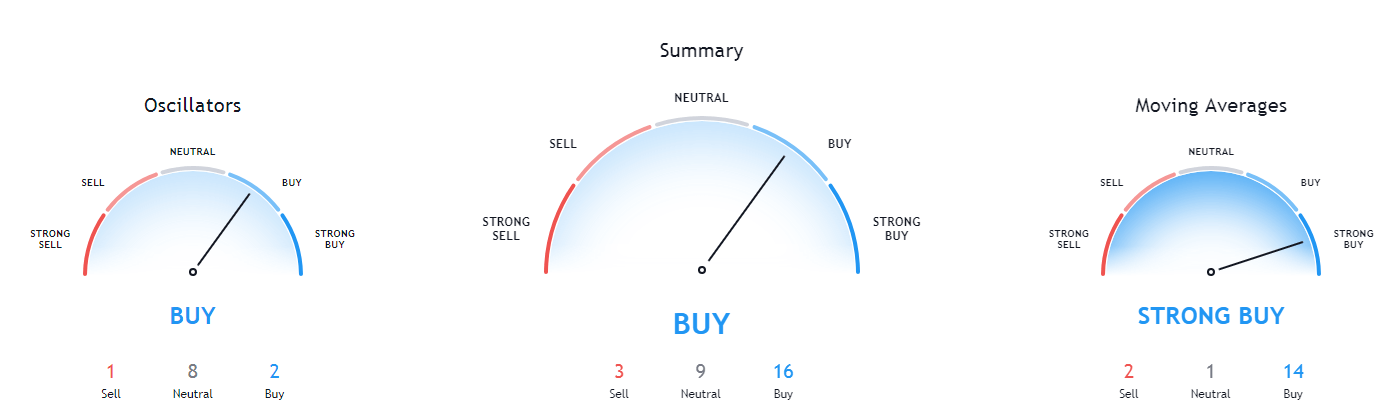

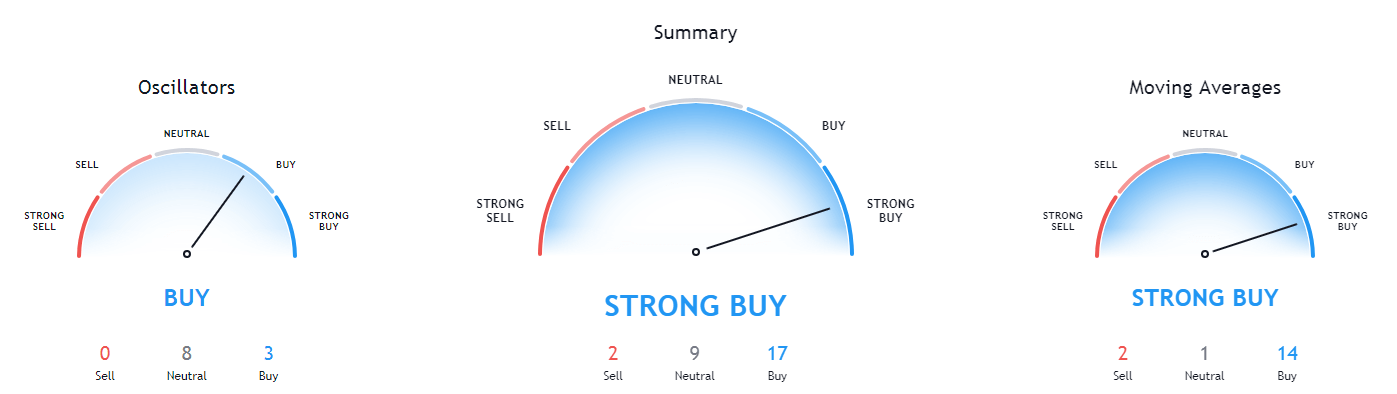

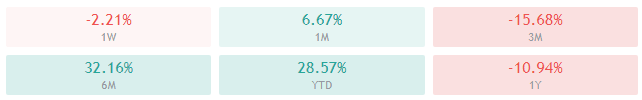

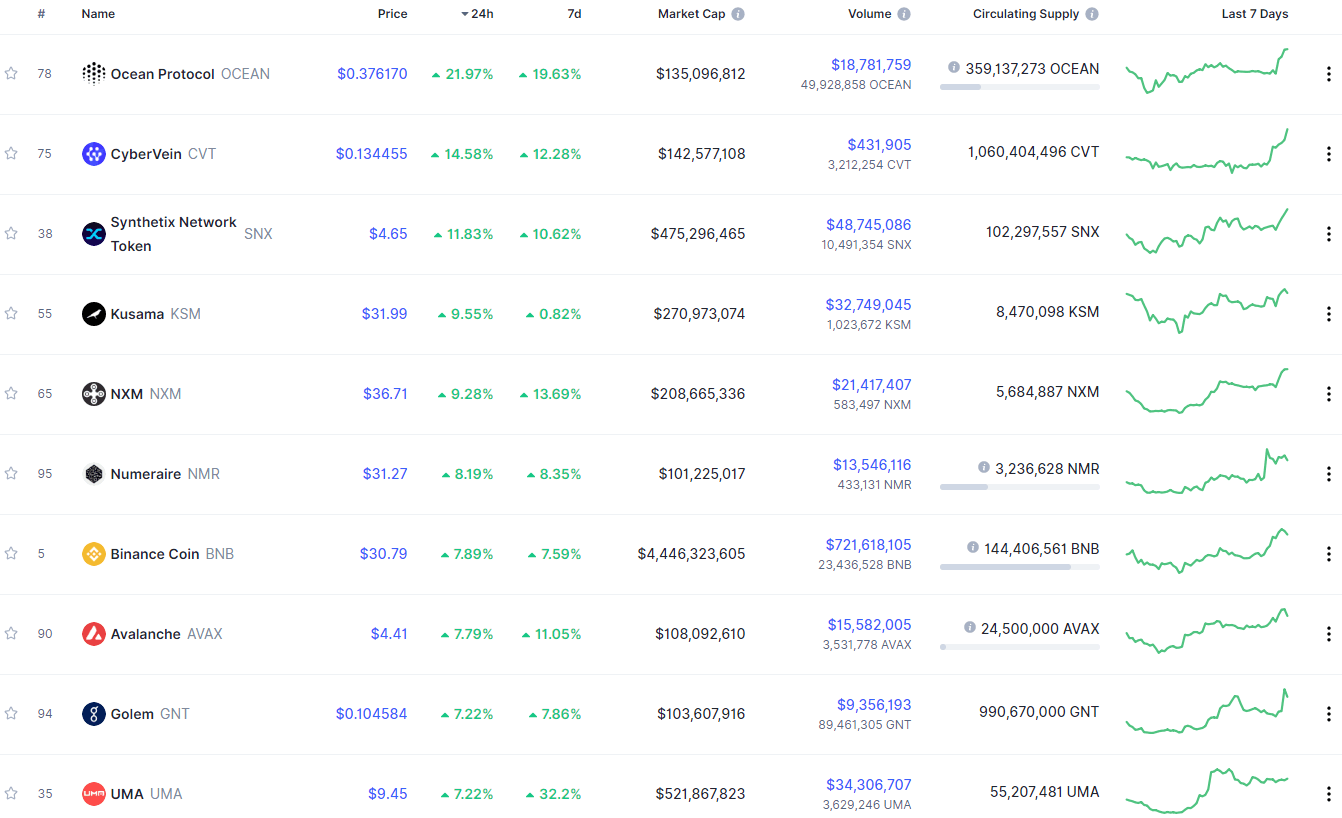

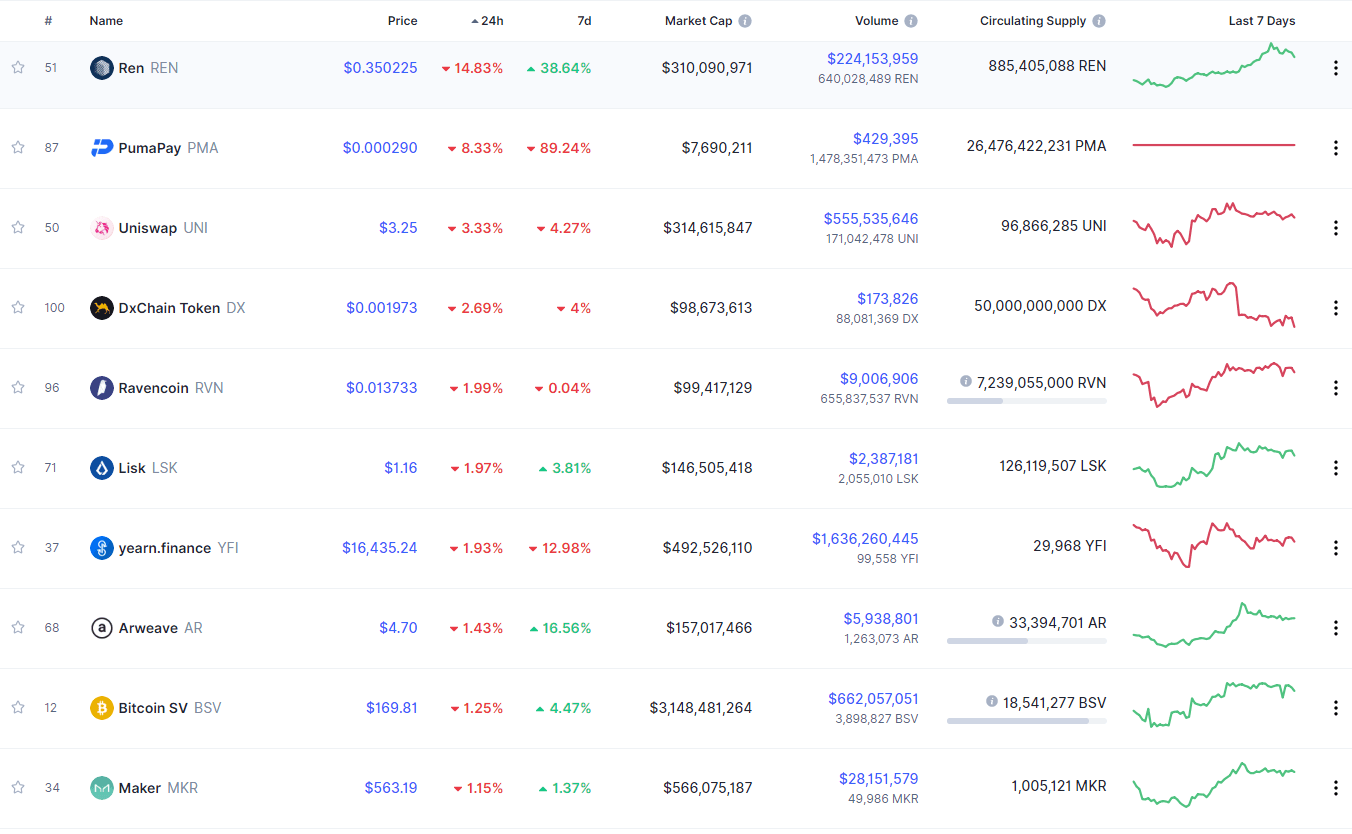

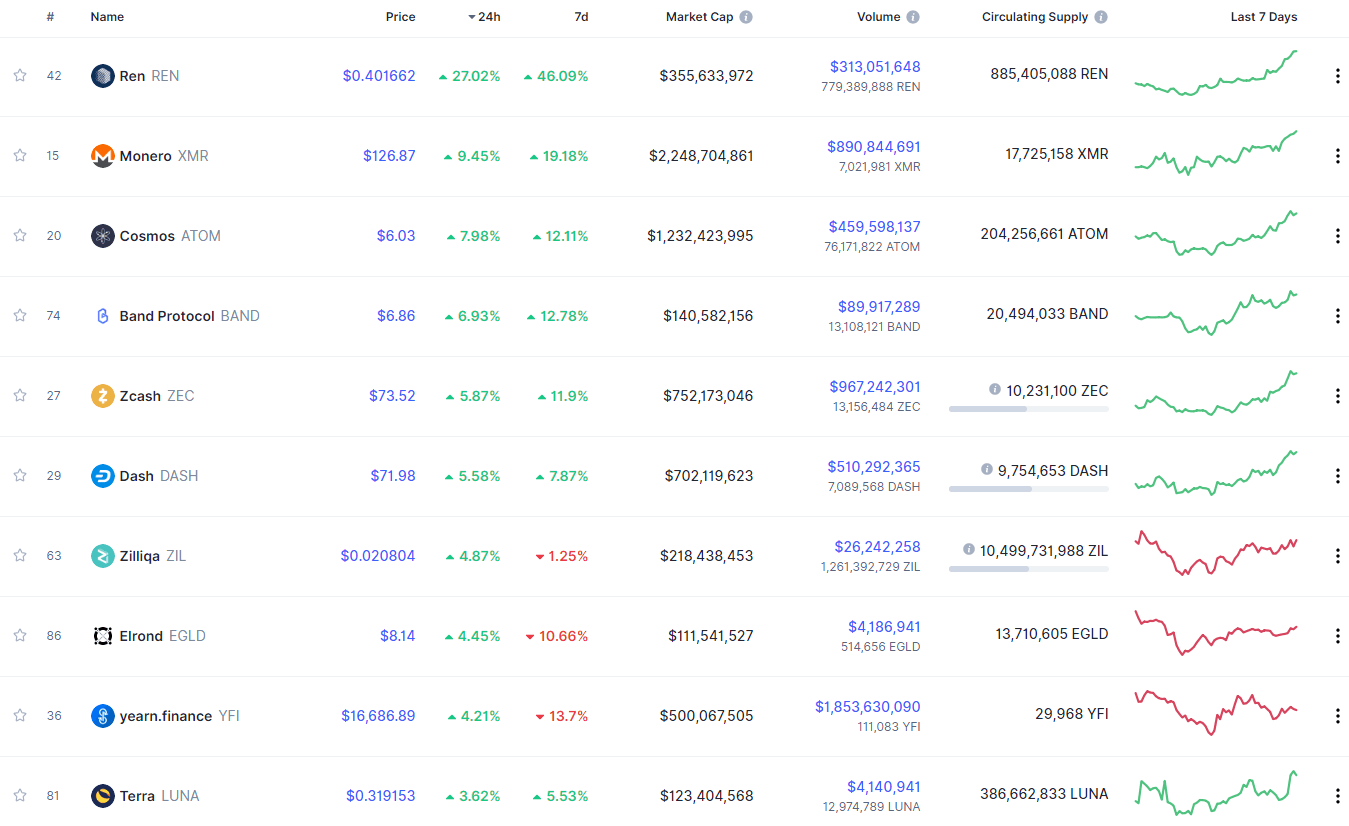

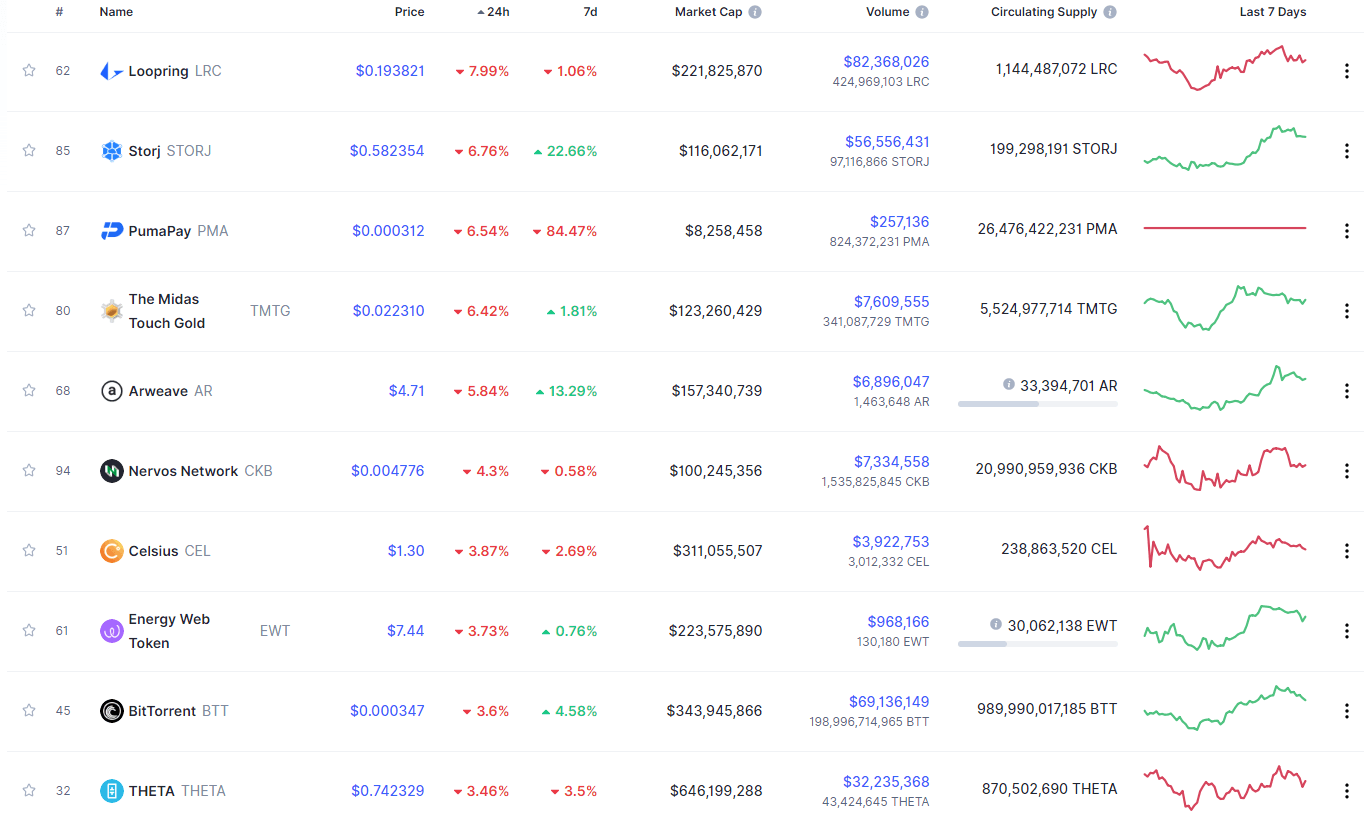

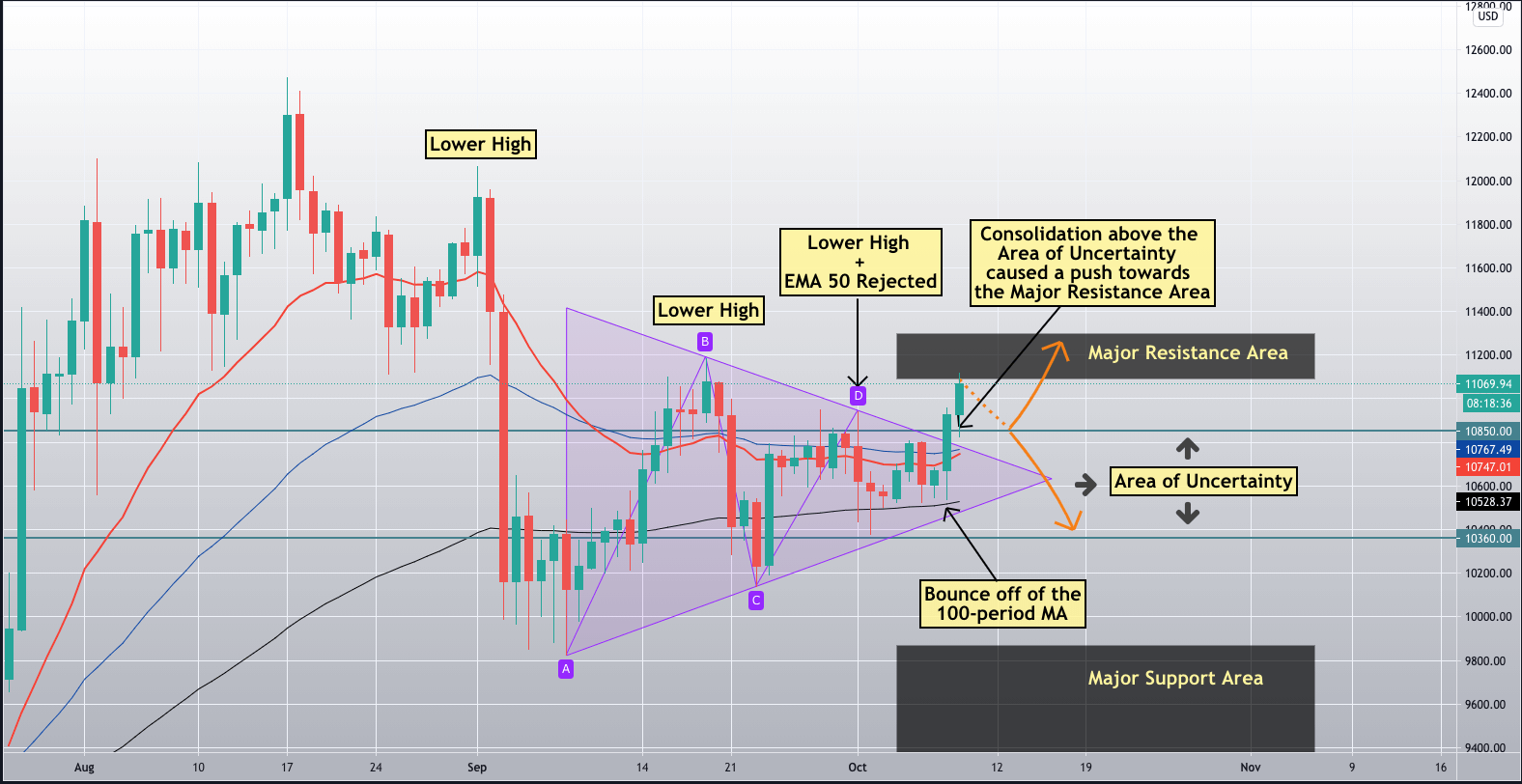

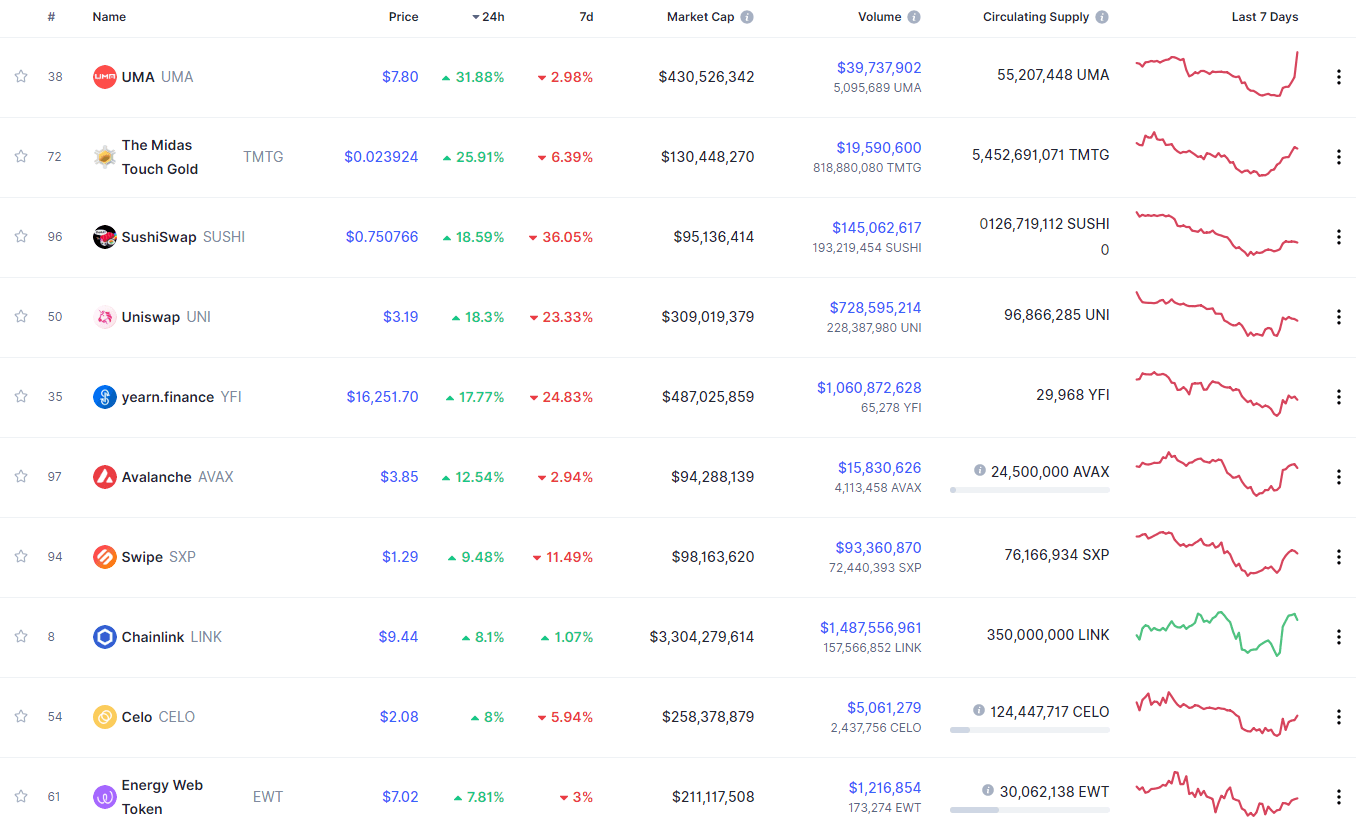

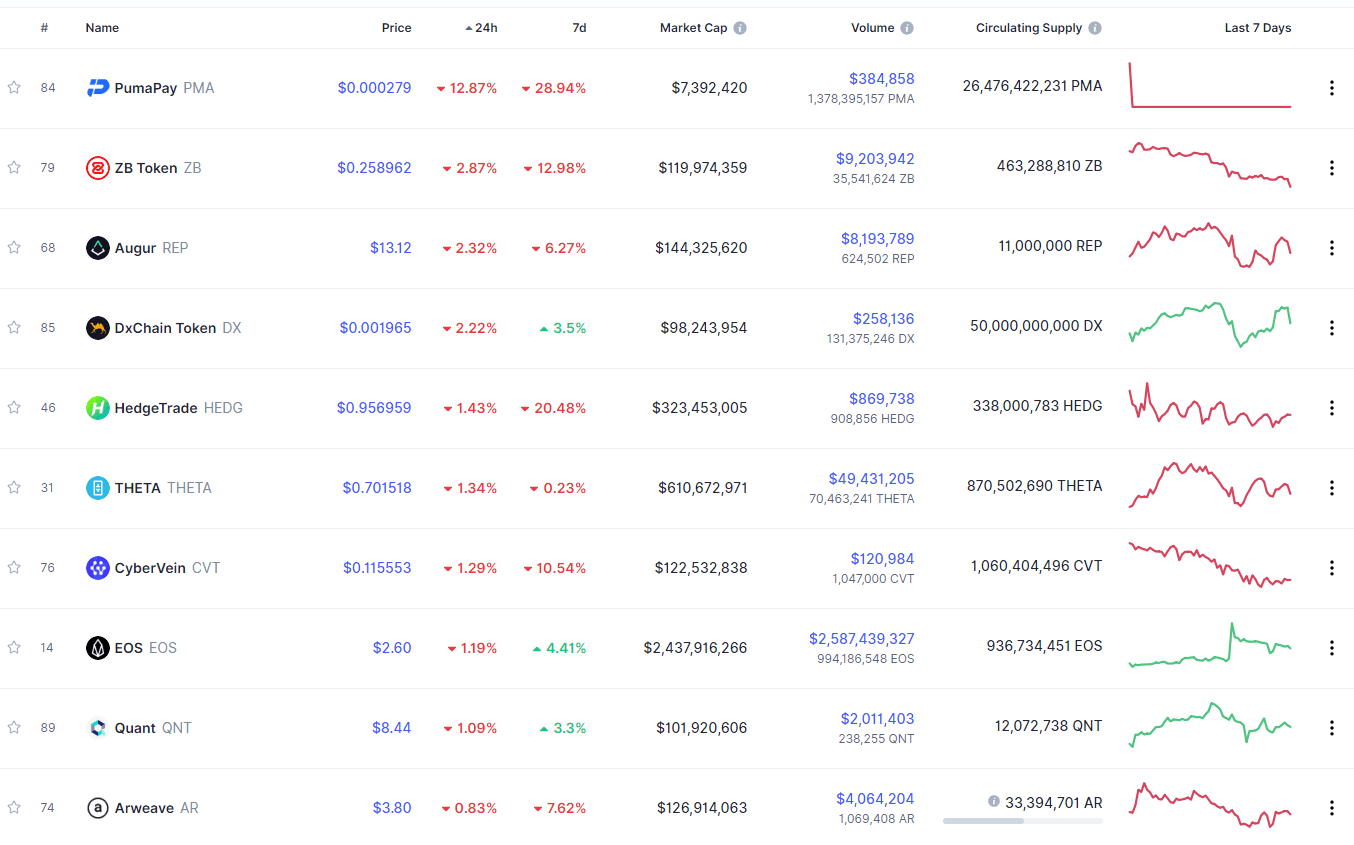

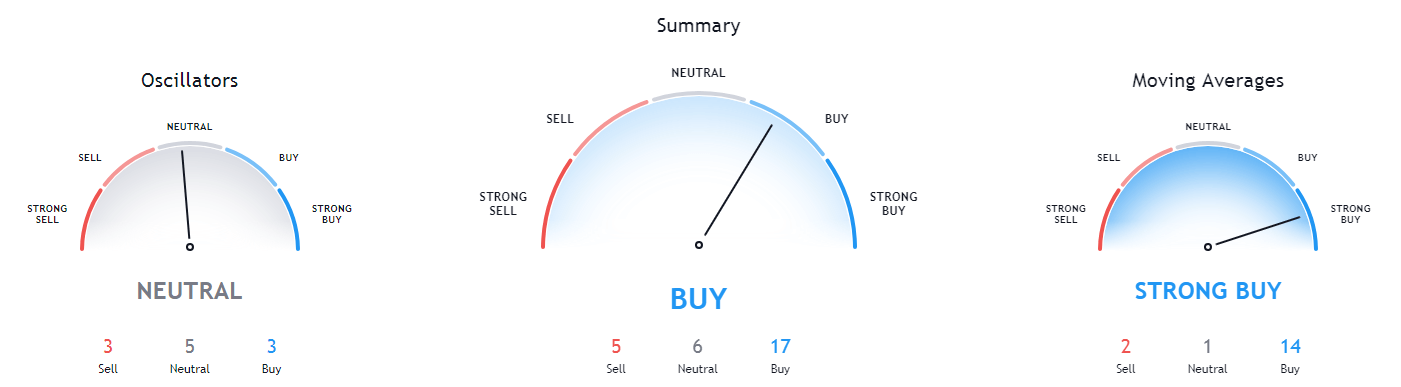

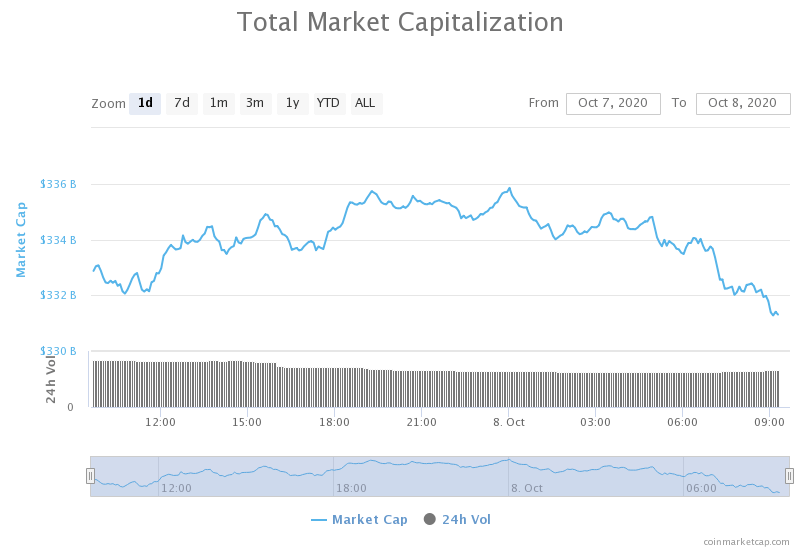

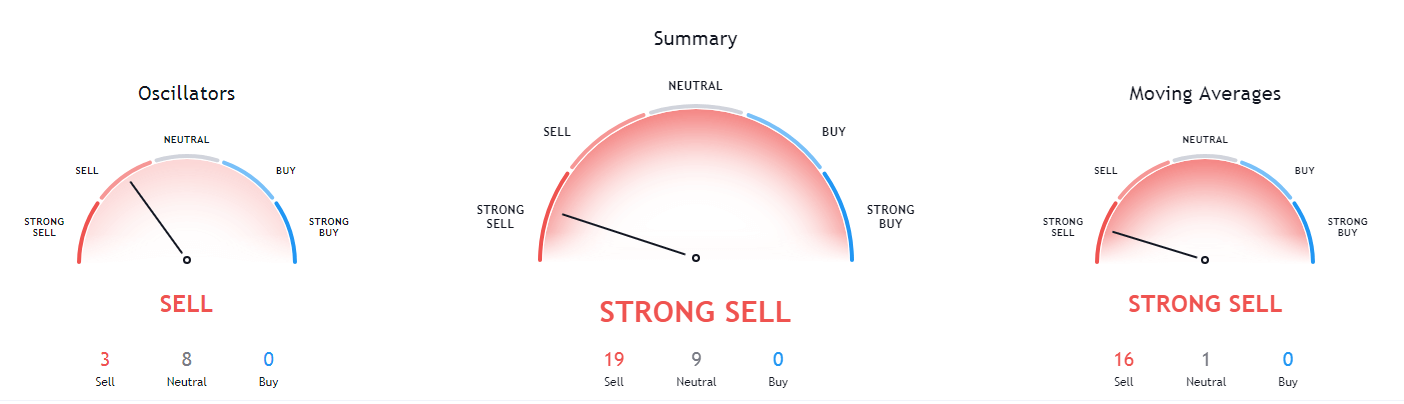

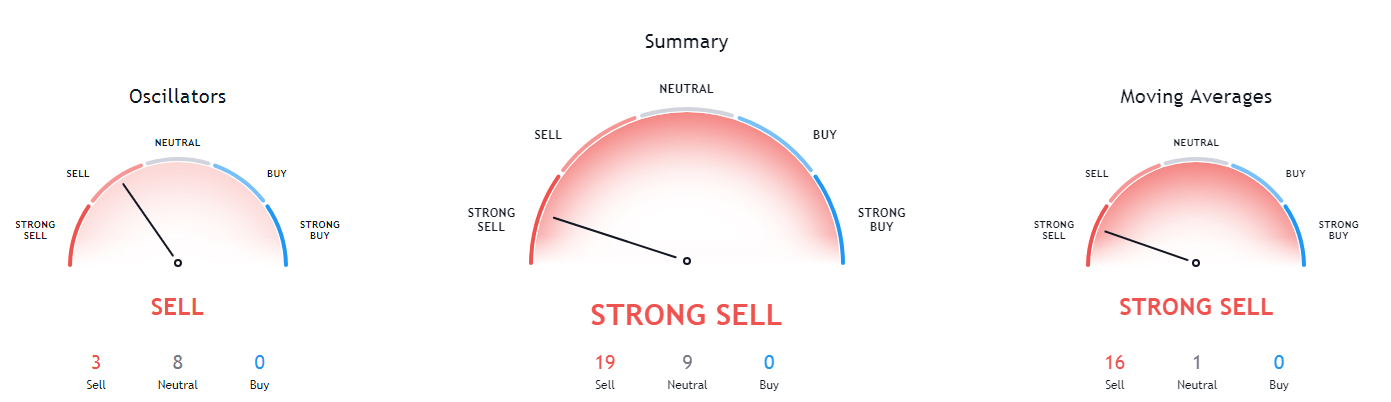

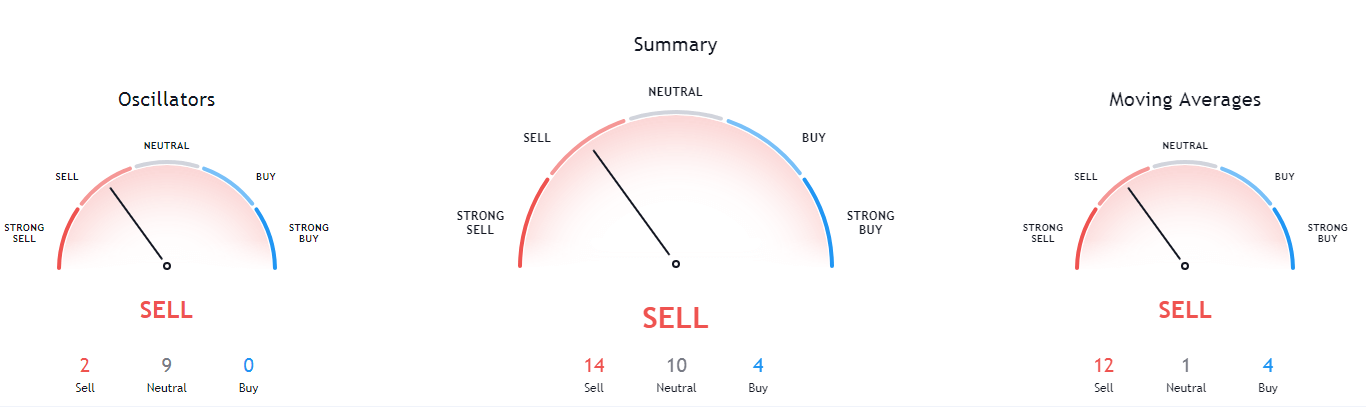

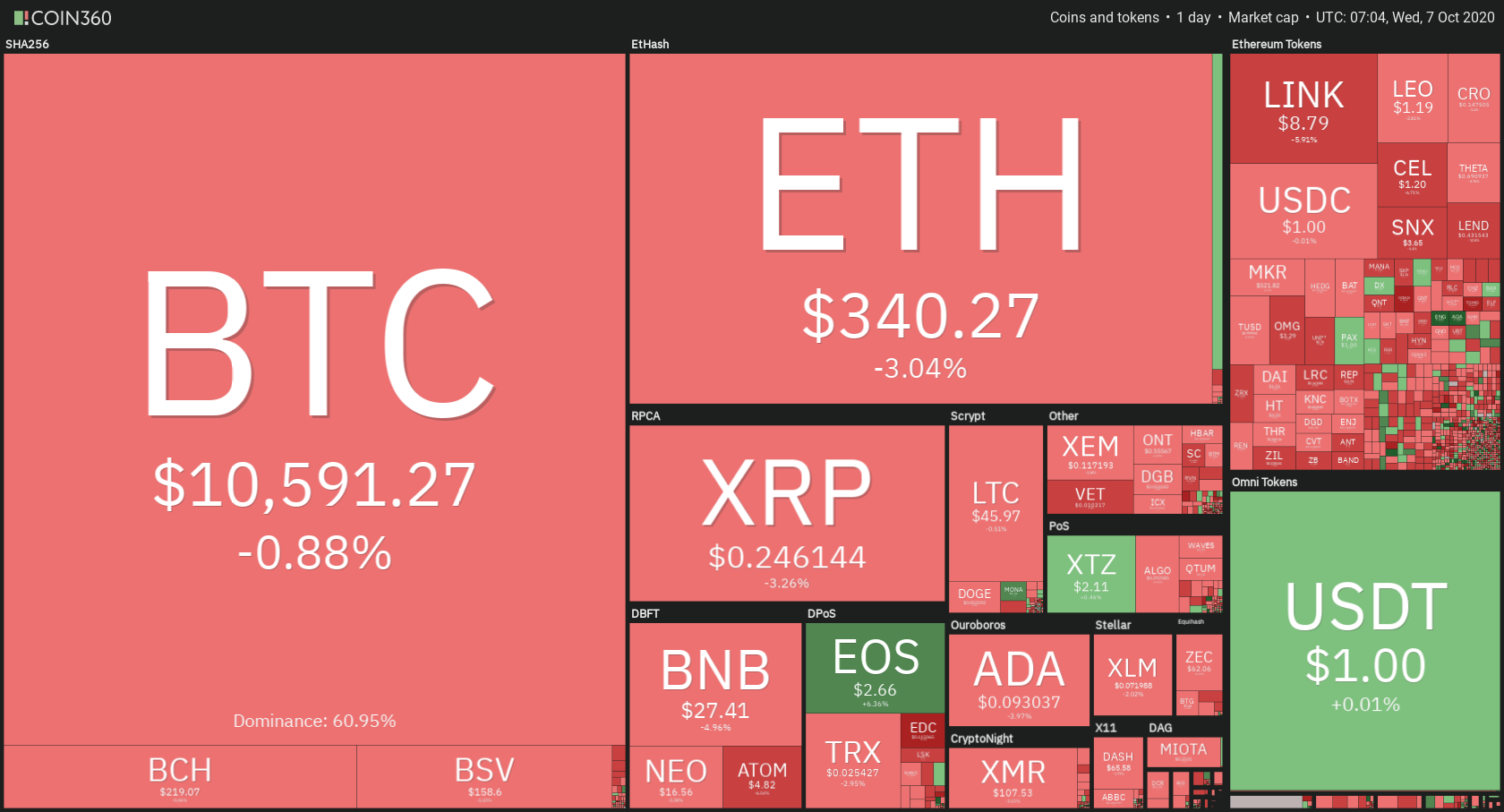

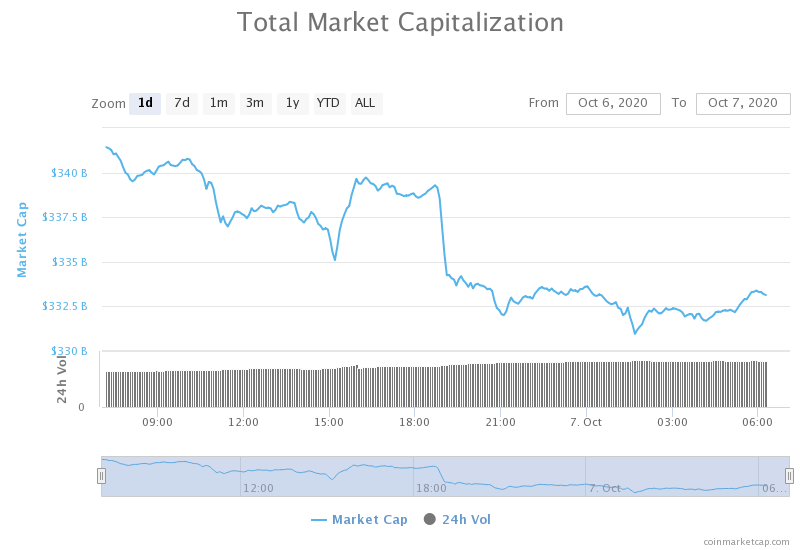

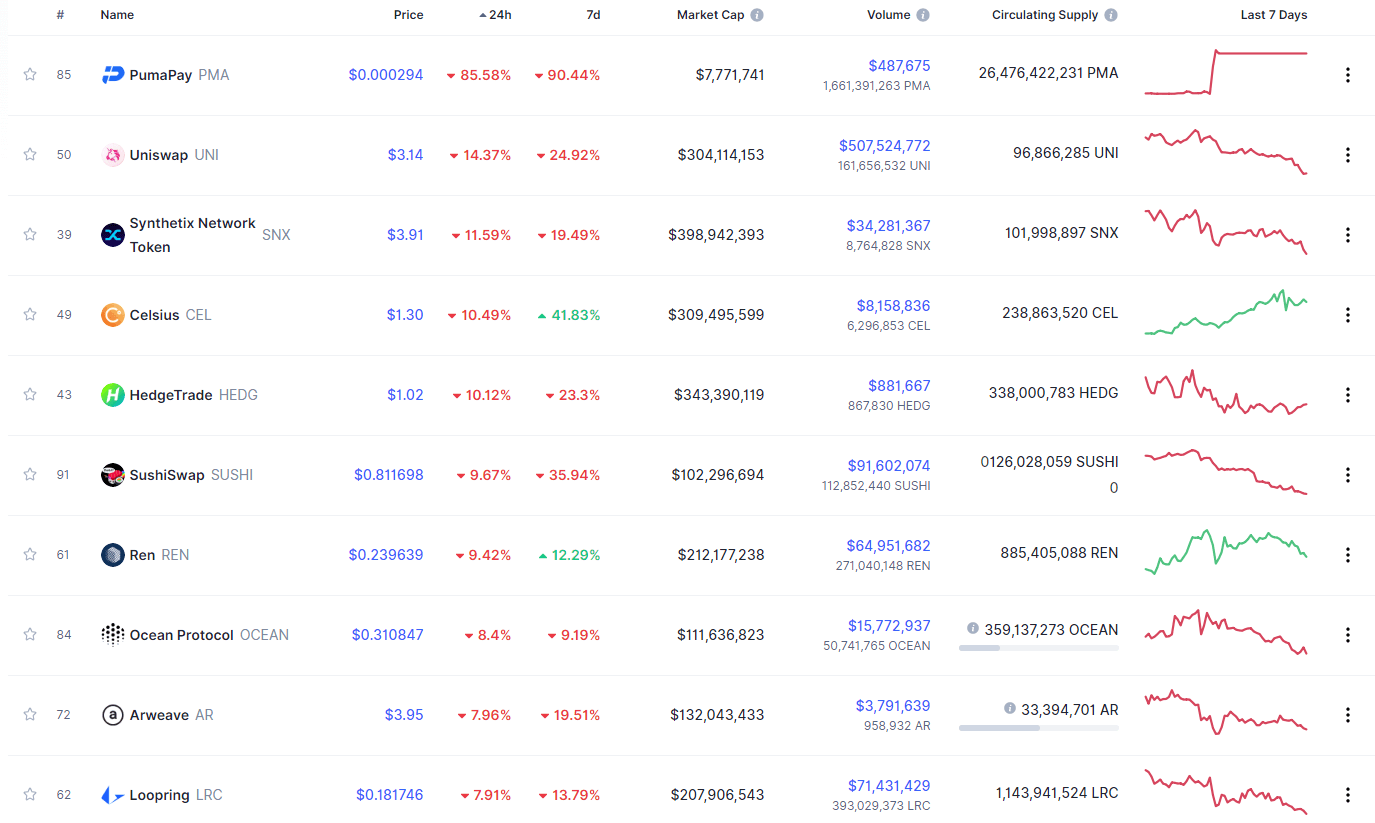

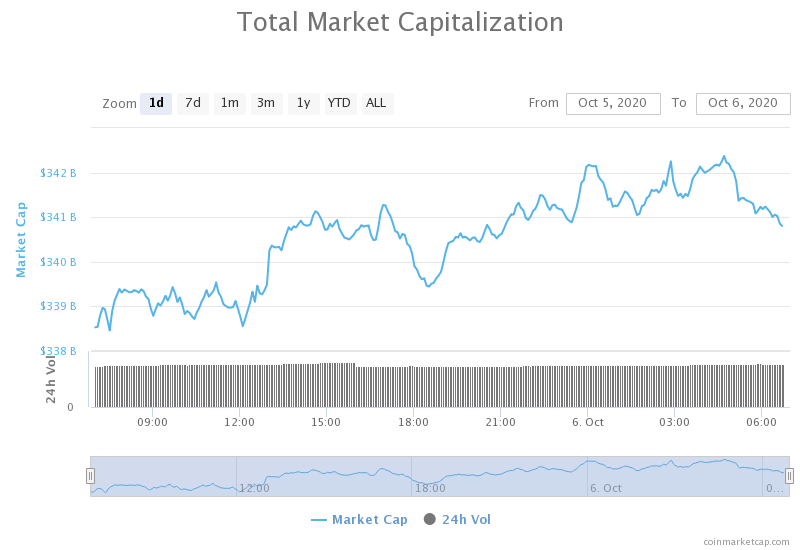

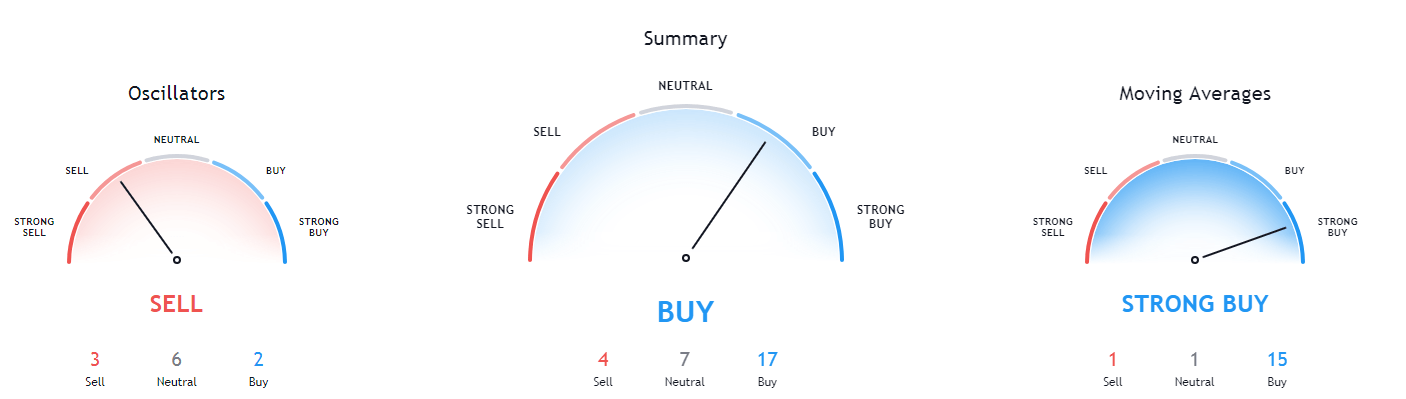

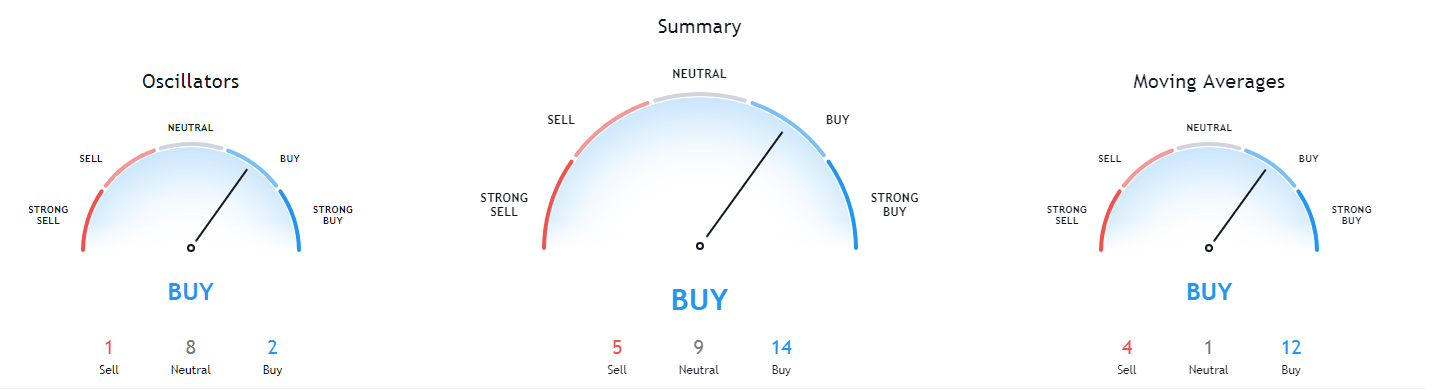

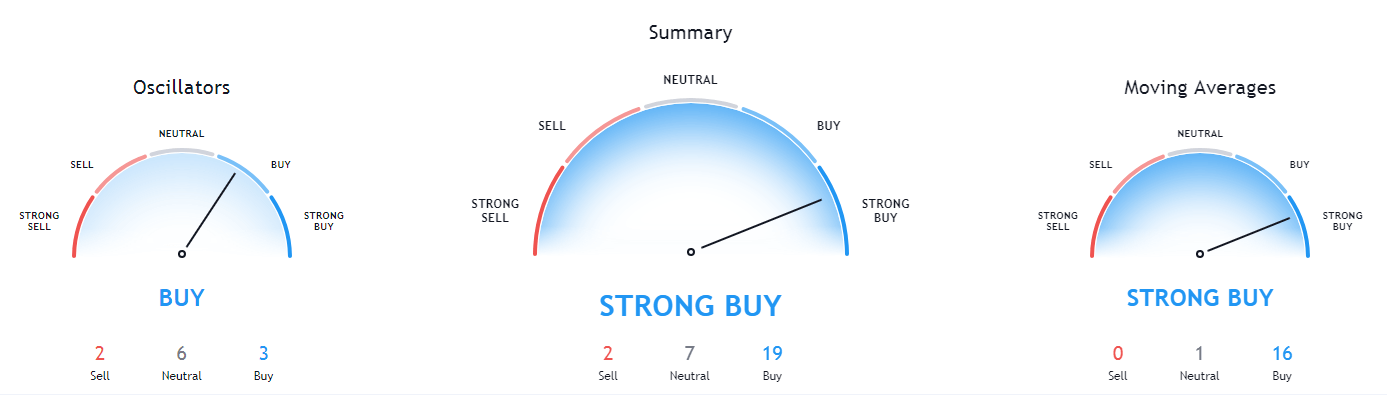

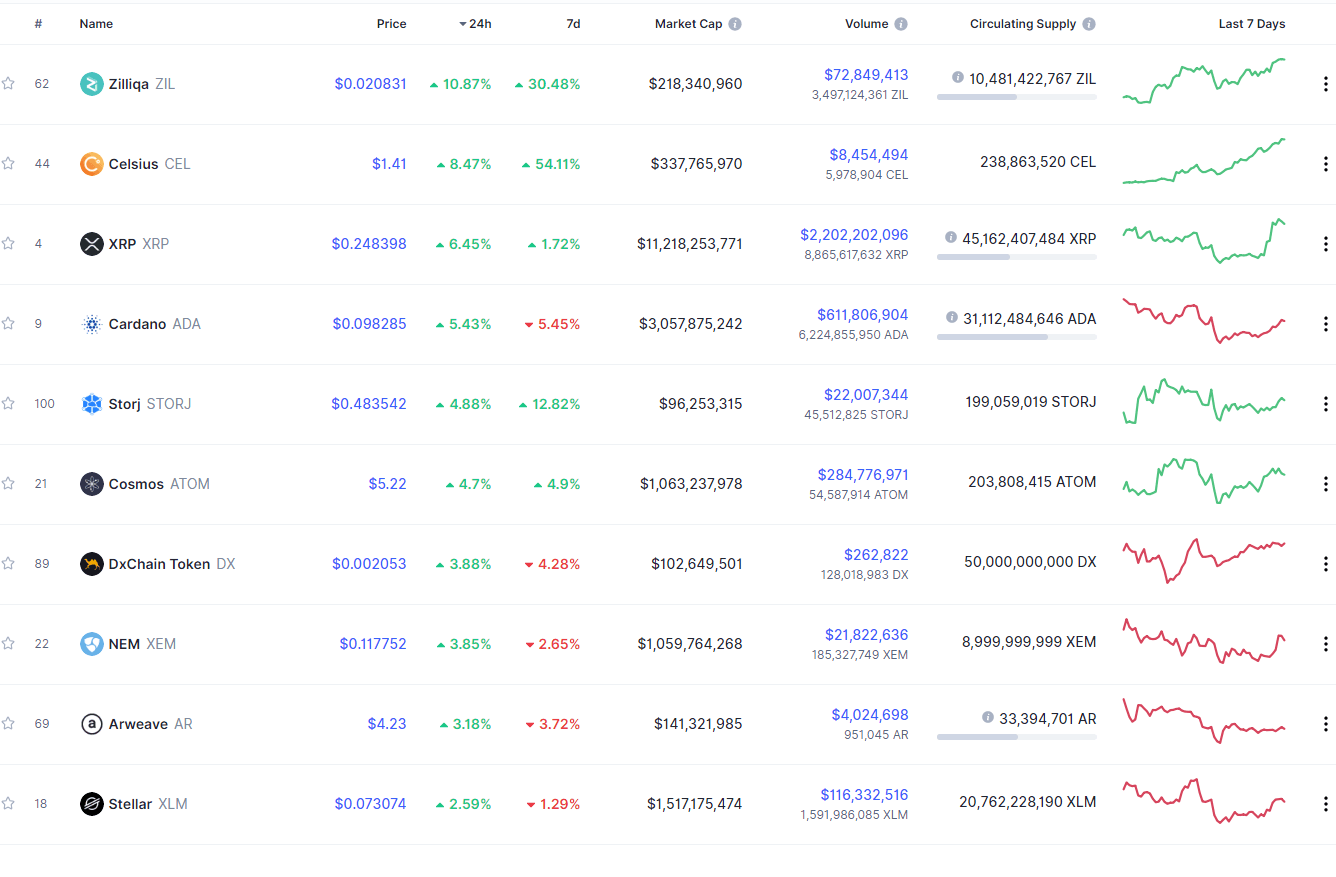

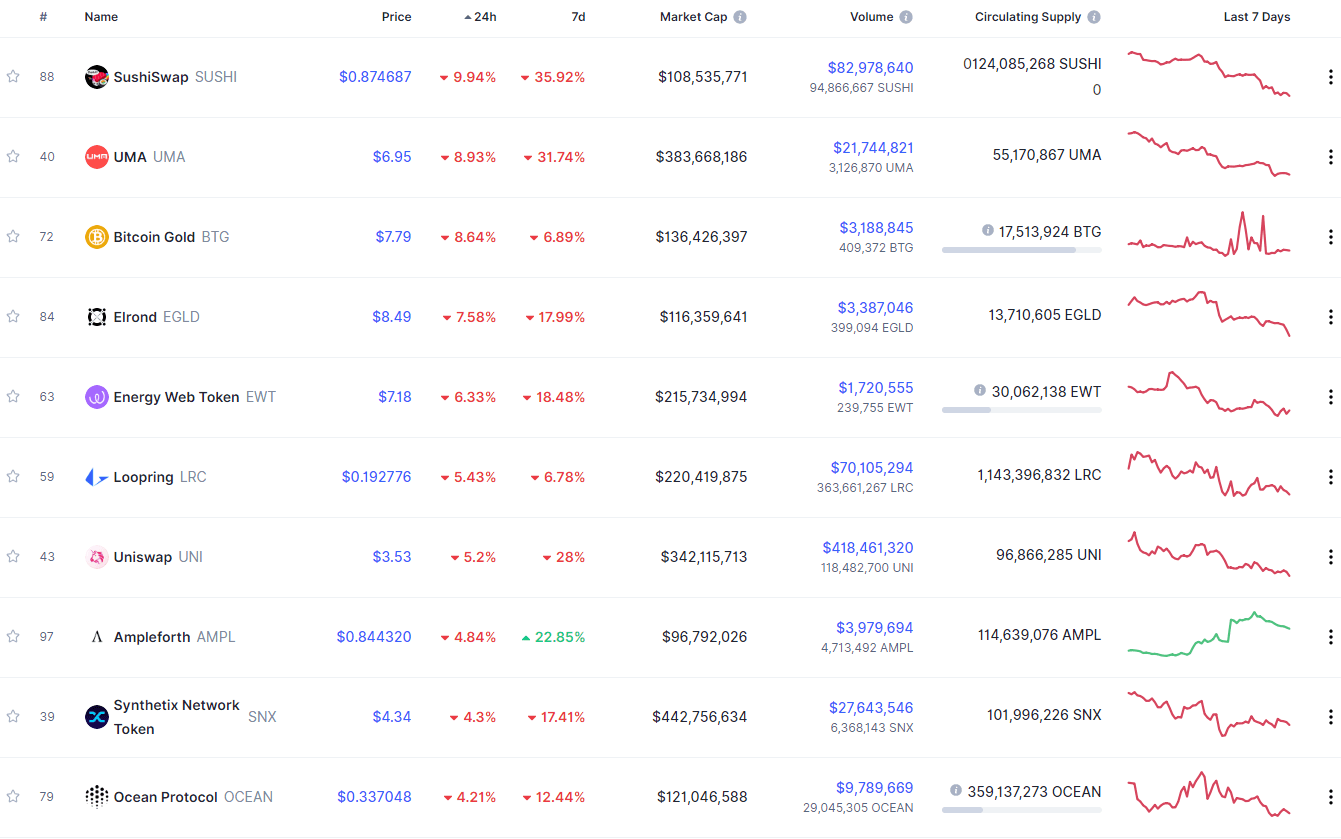

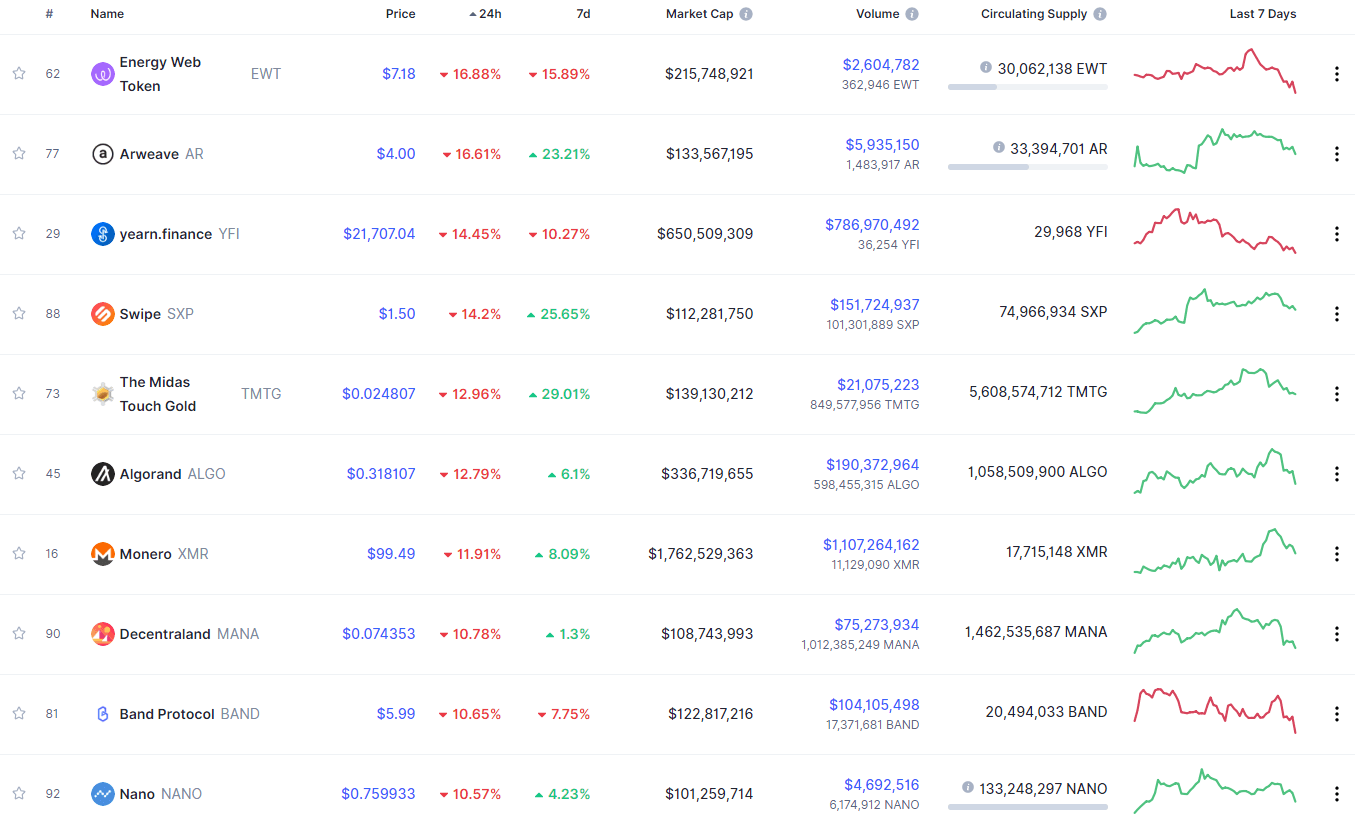

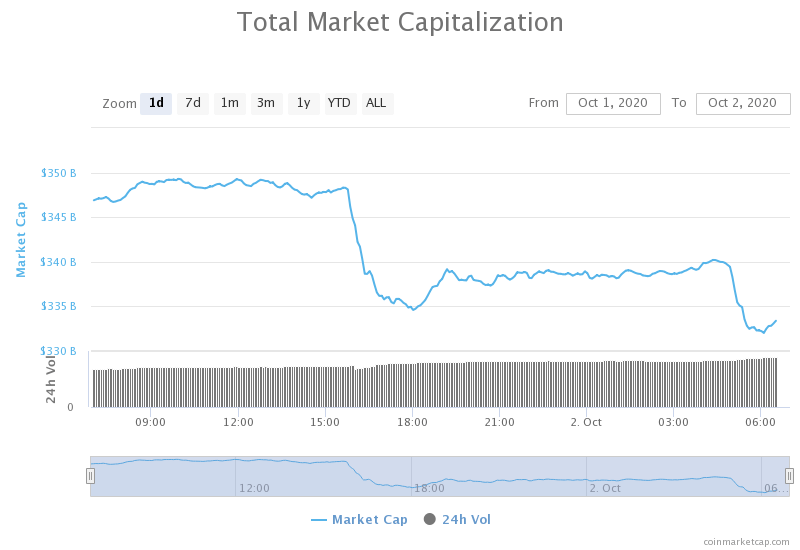

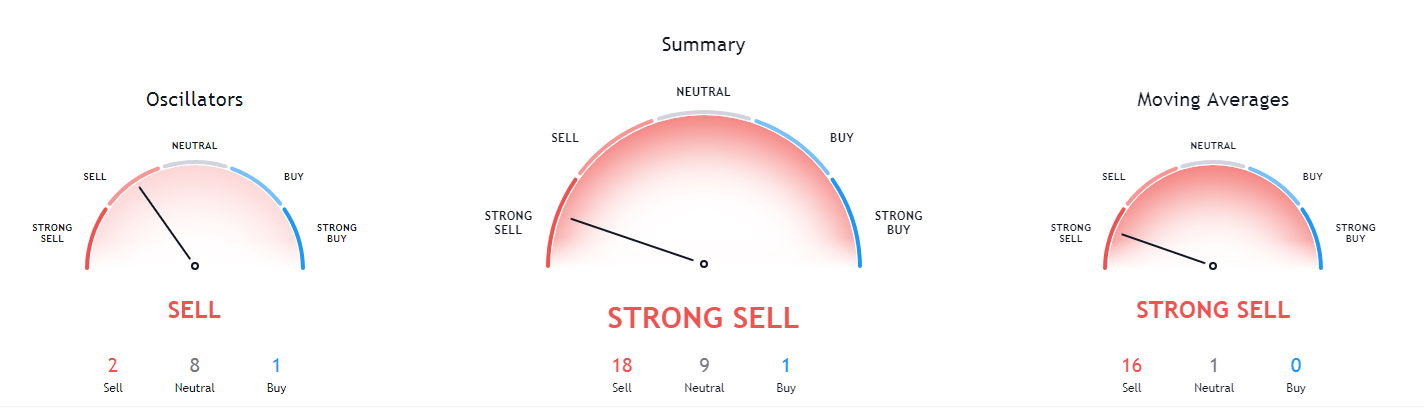

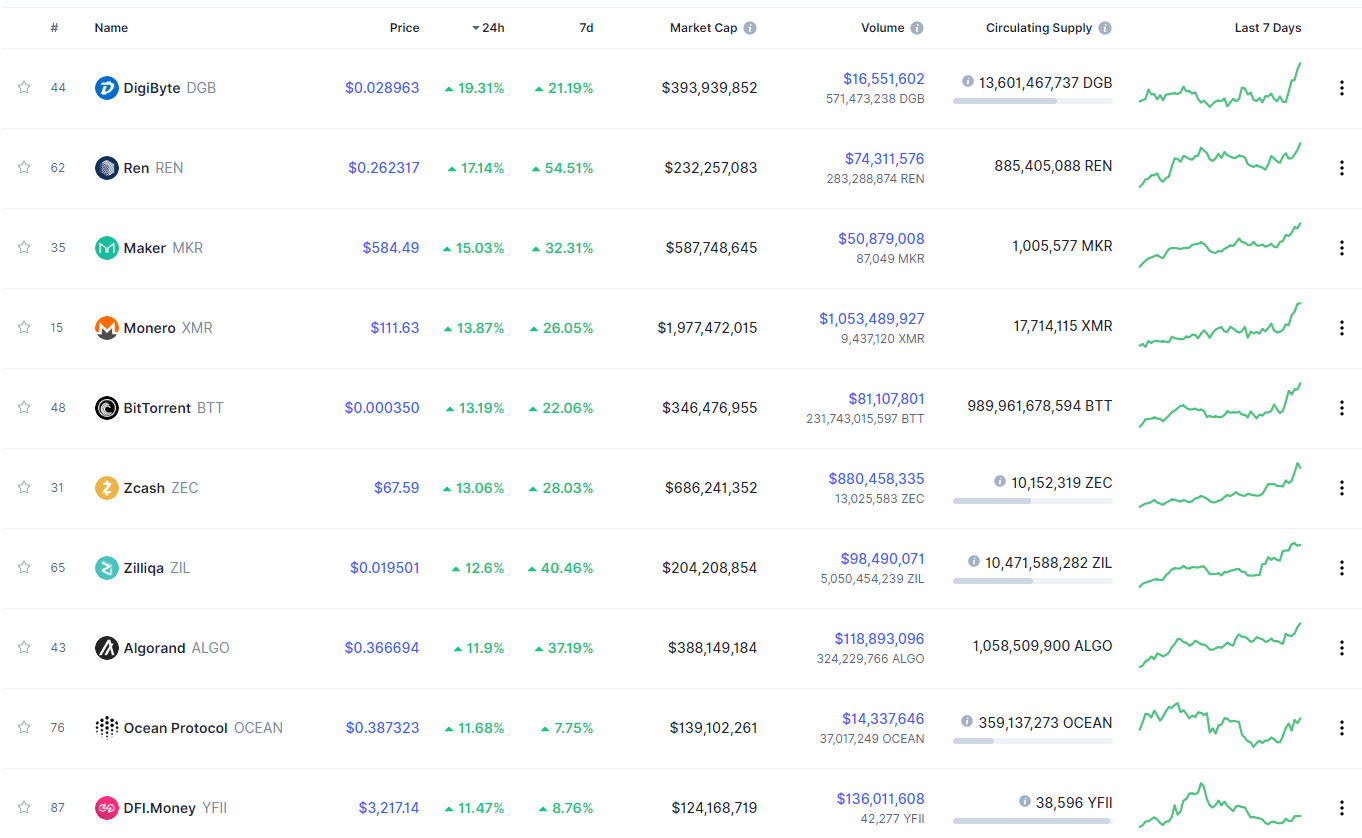

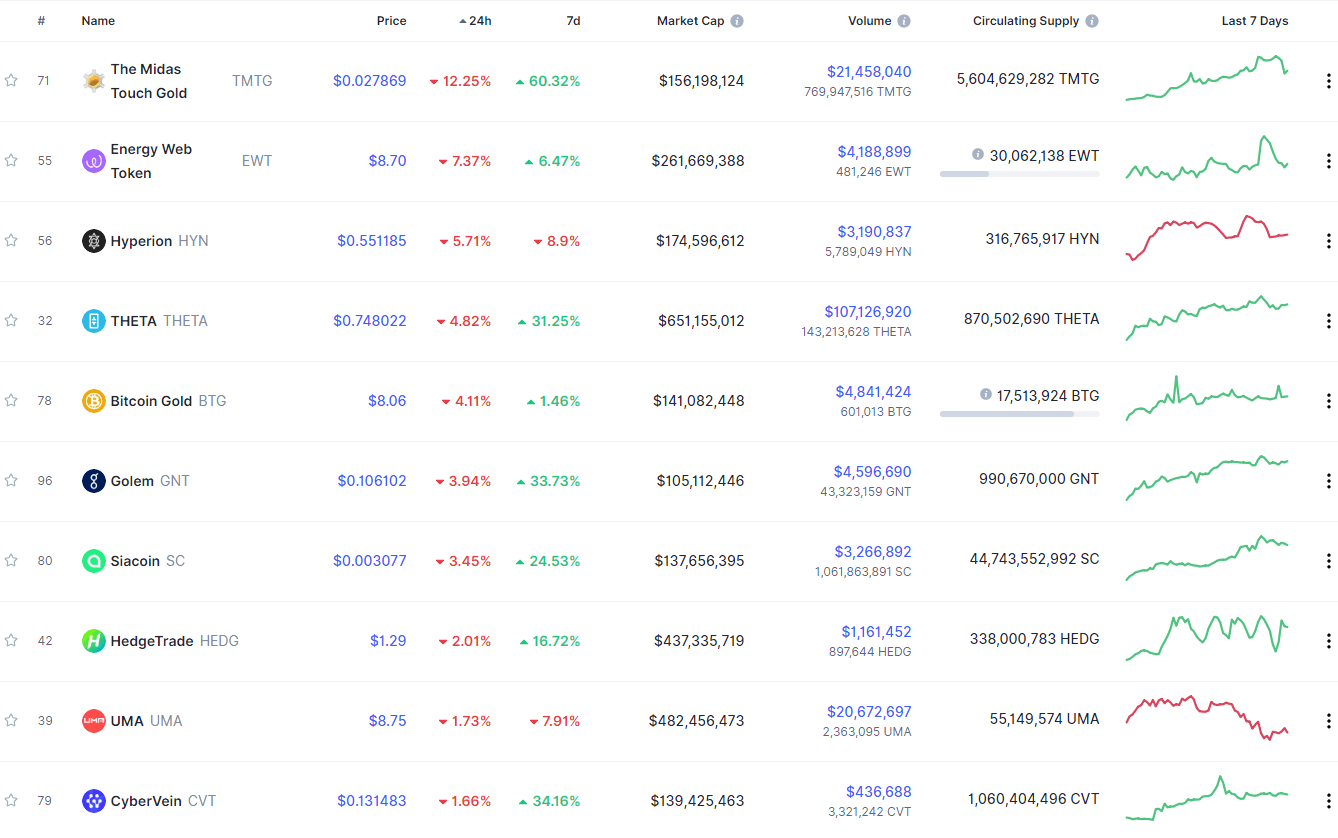

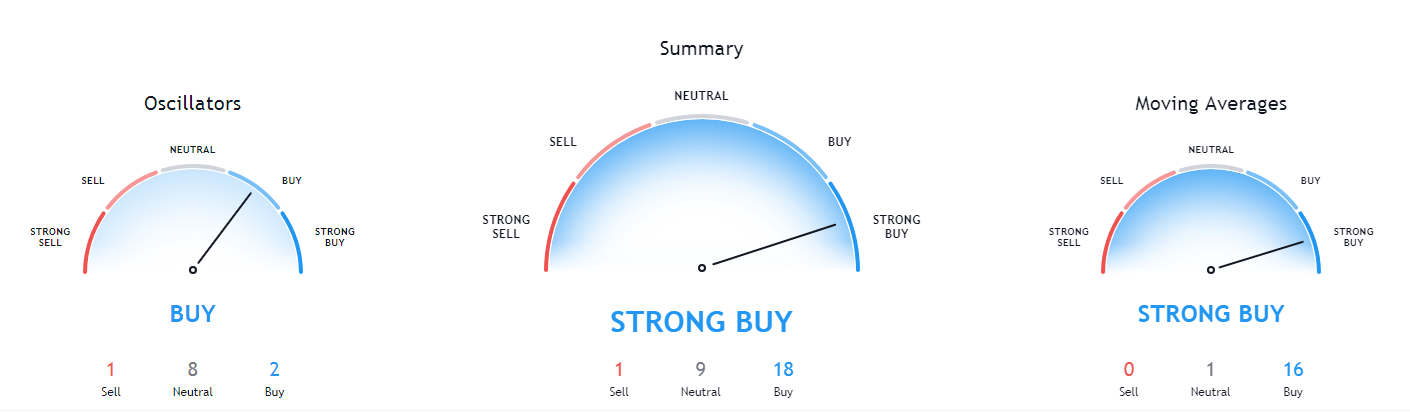

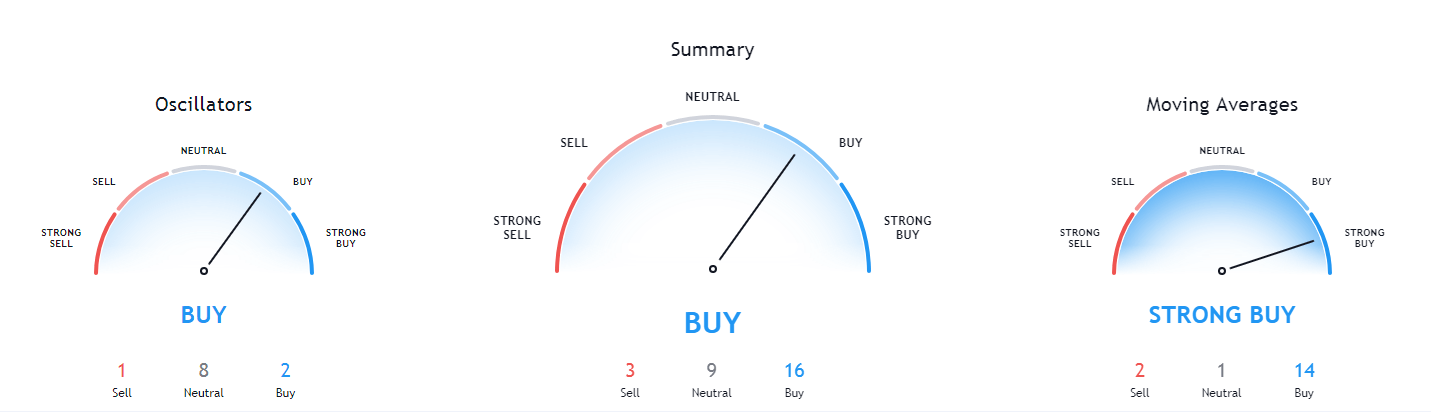

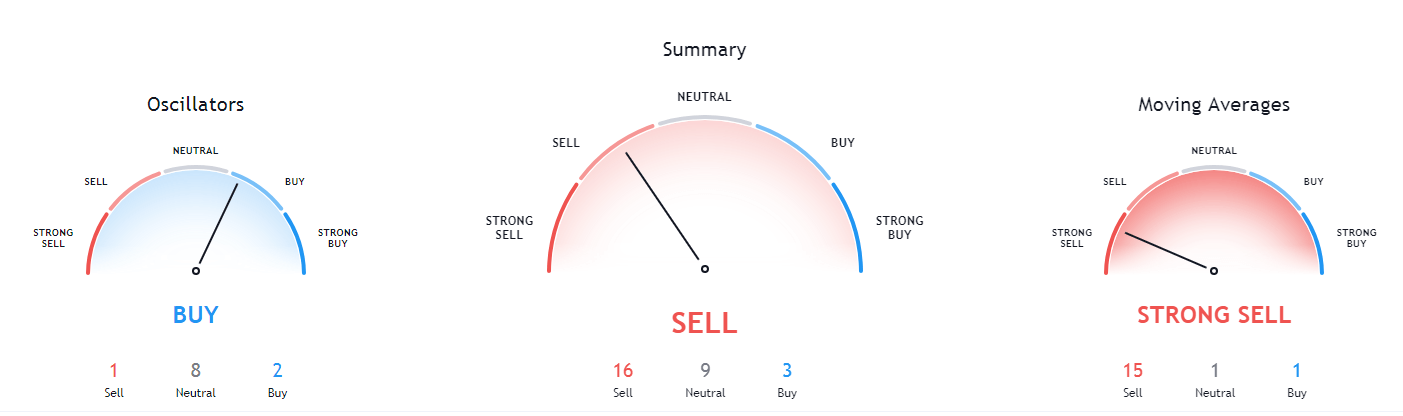

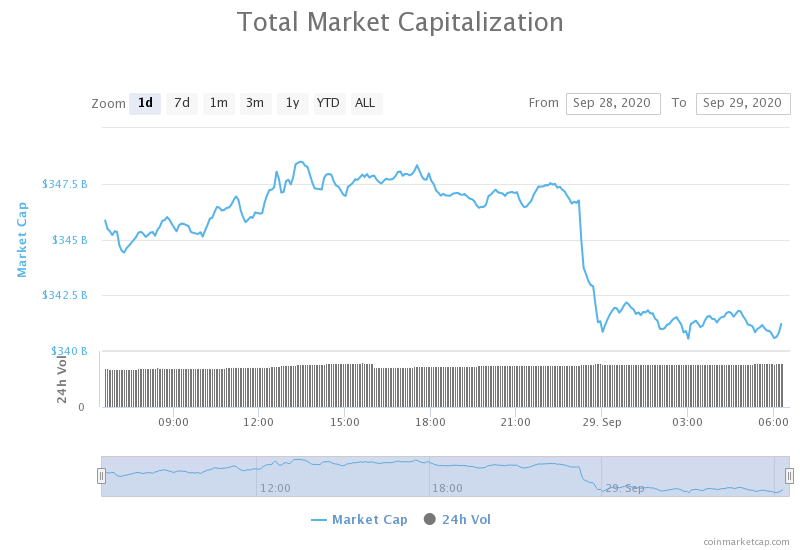

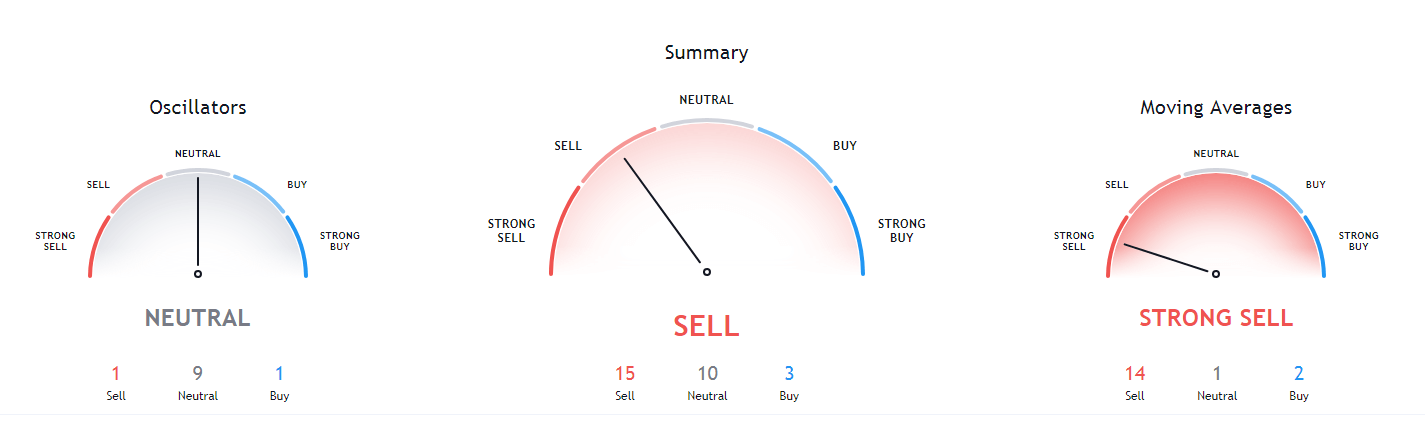

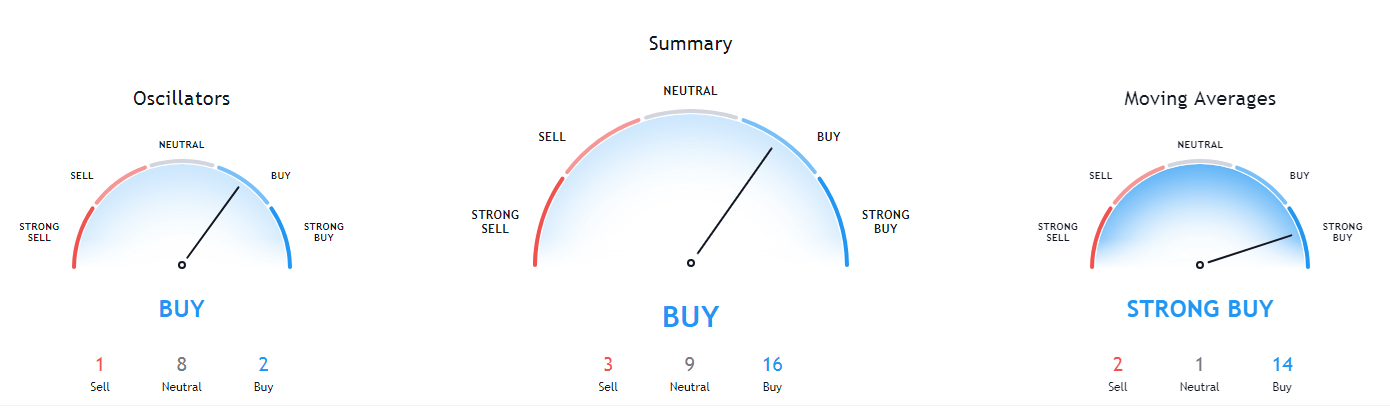

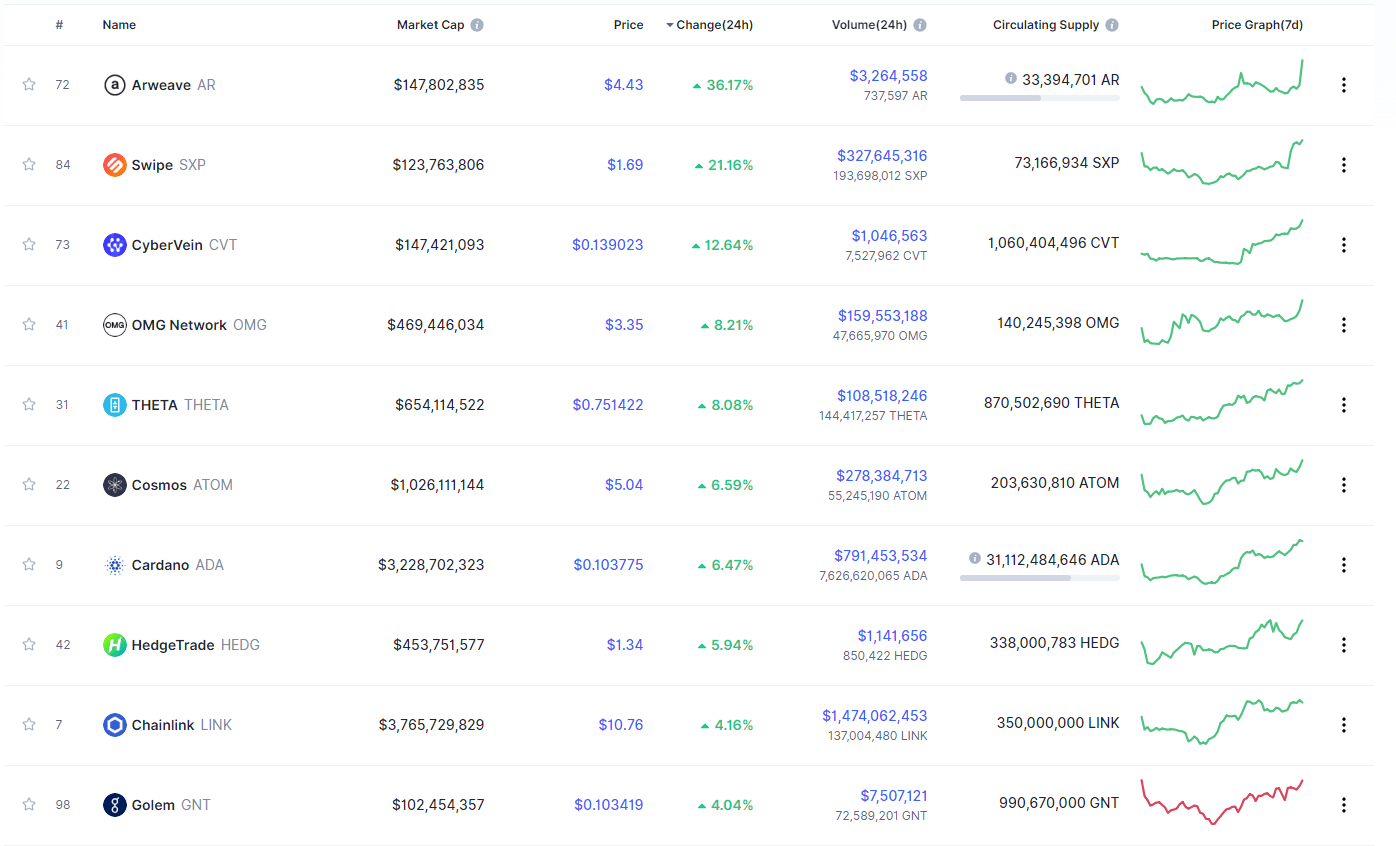

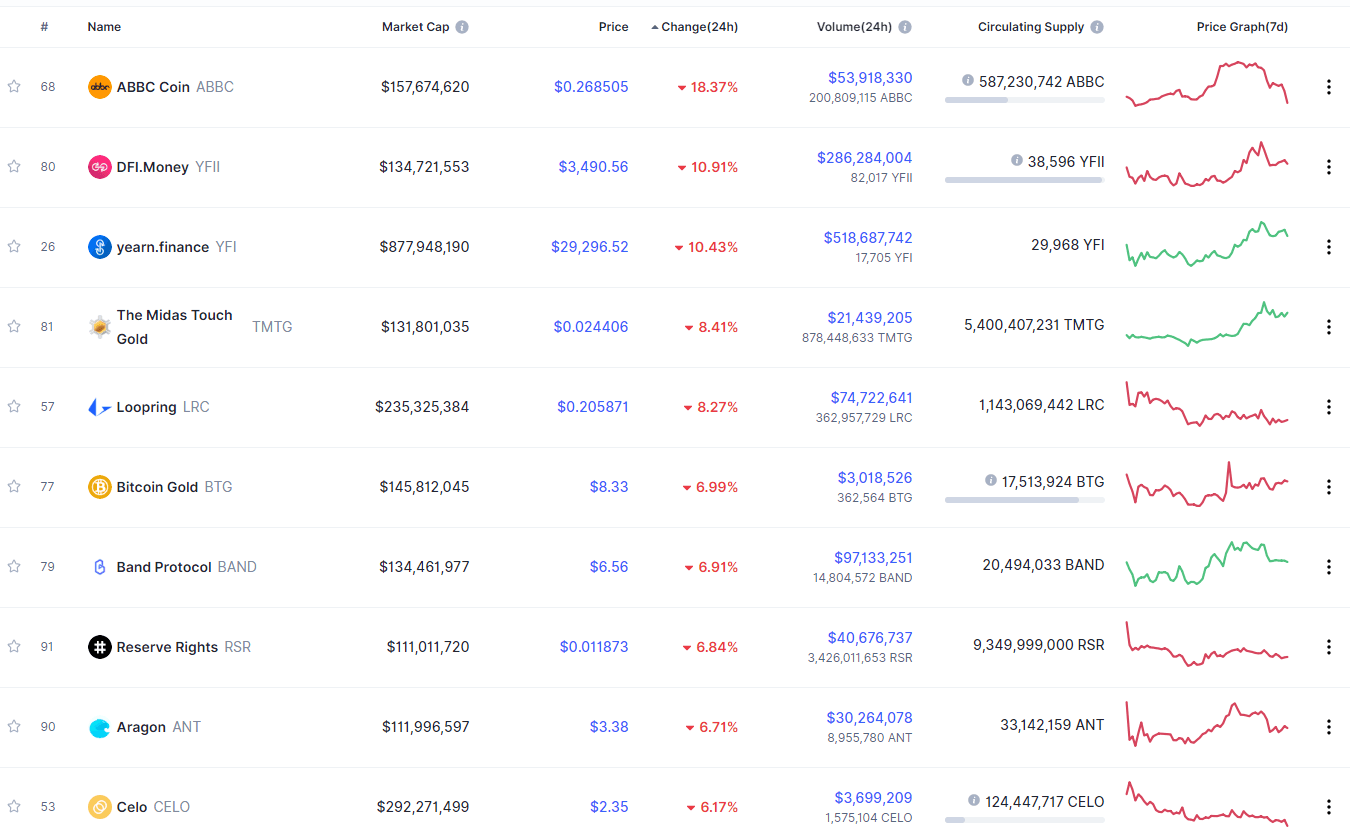

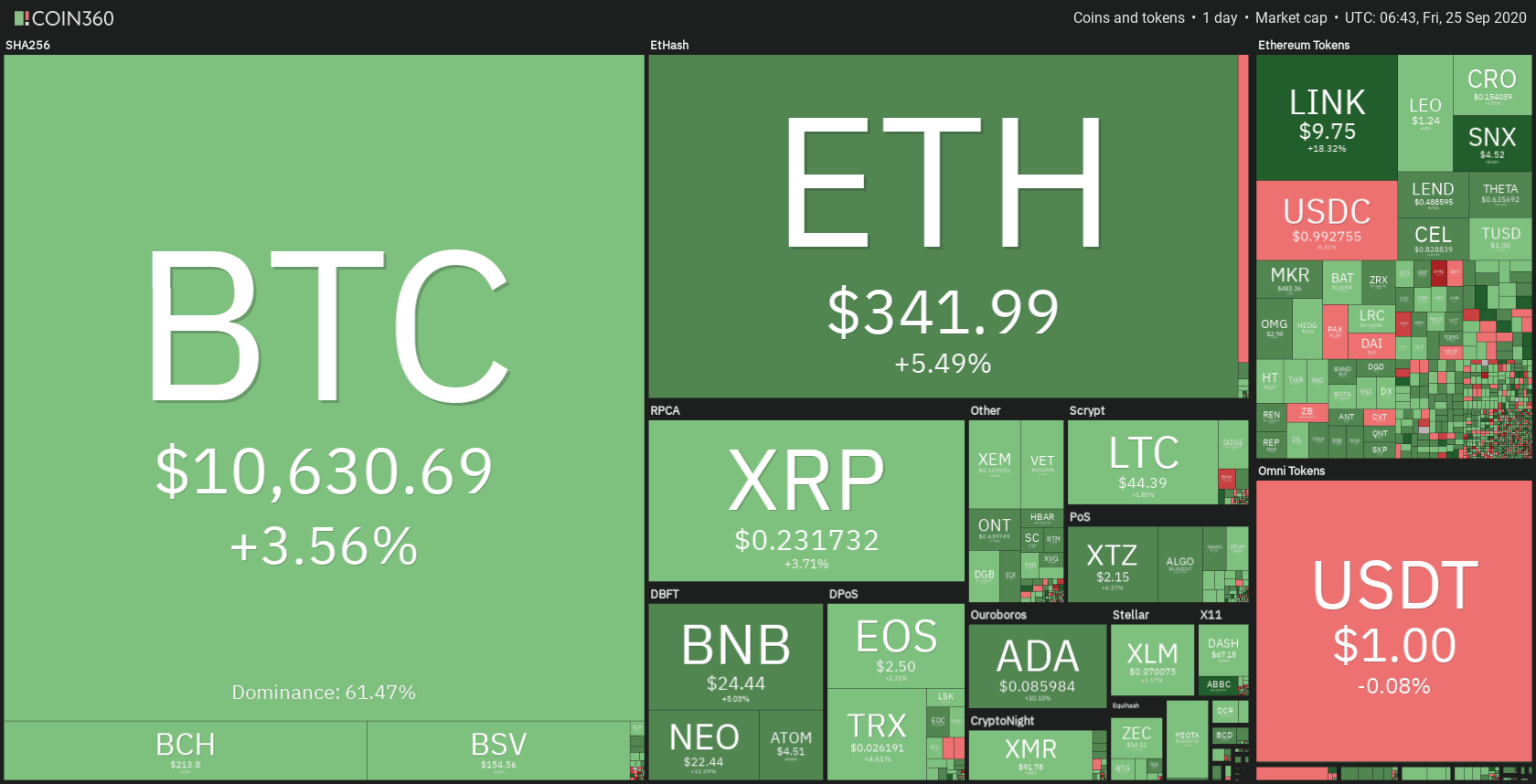

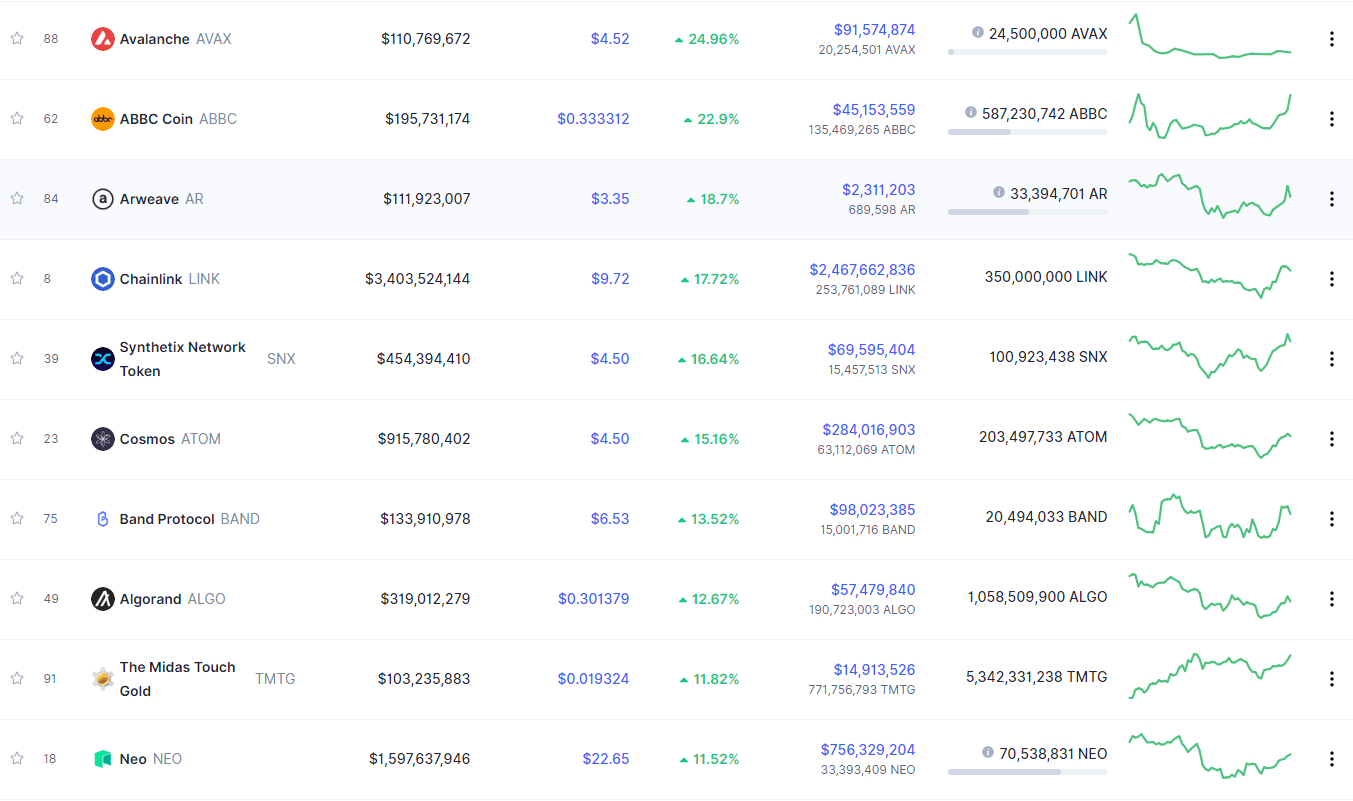

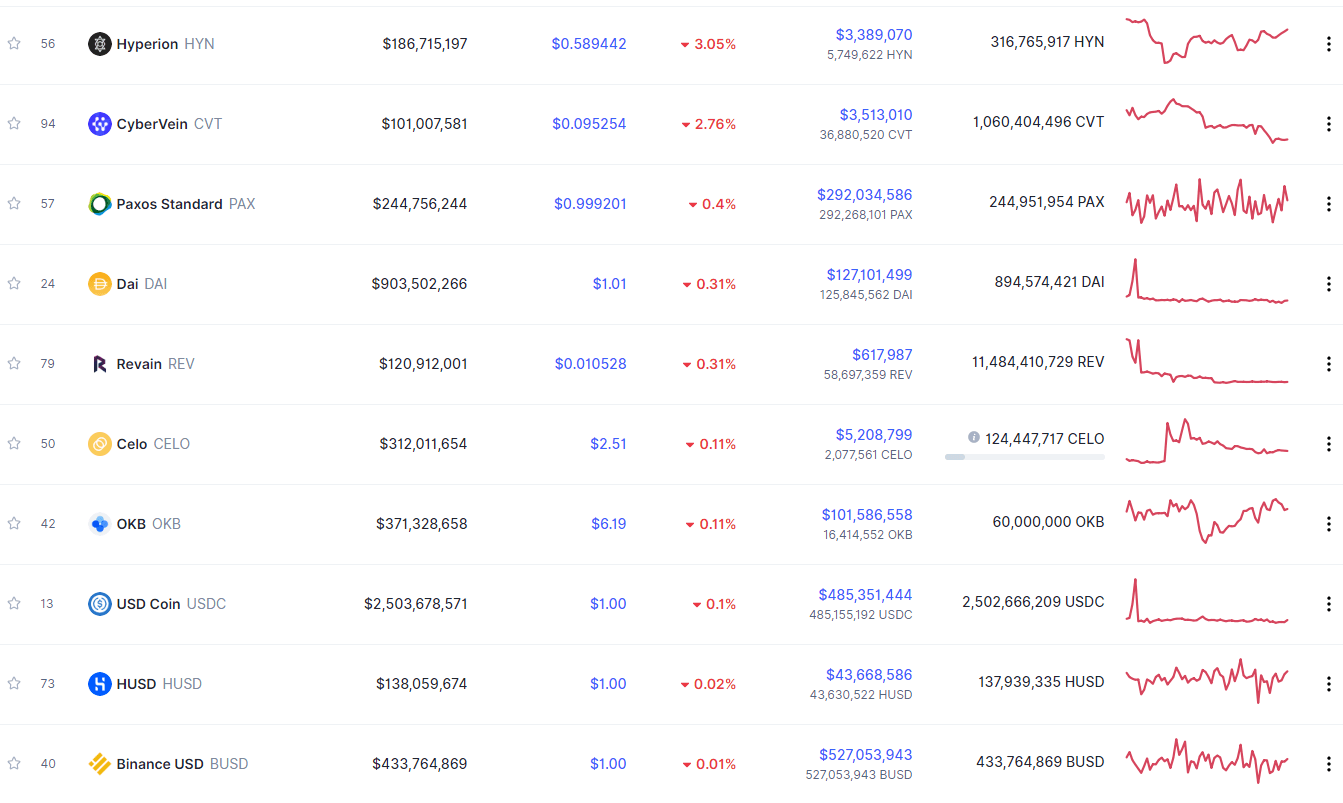

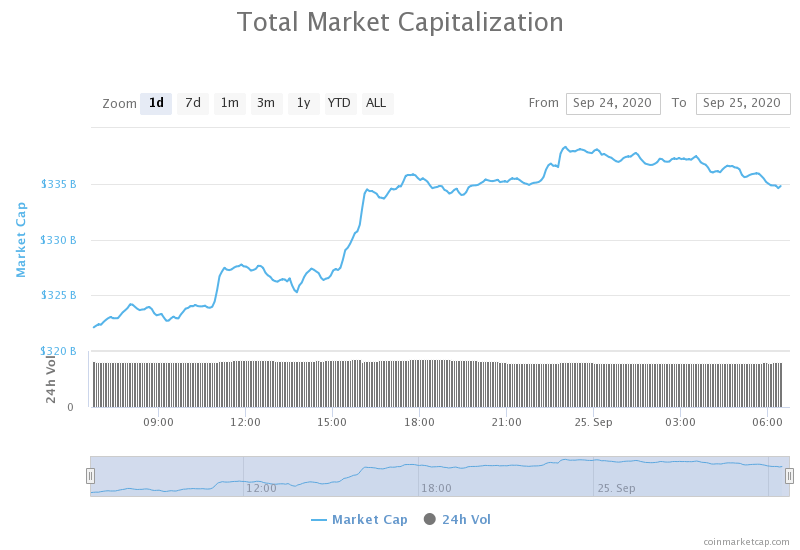

Cryptocurrency can also be more susceptible to volatility in the market. In addition to being affected by global events, they are also at high risk of volatility from events that occur in their own market. For example, the Bitcoin halving effect had a major impact on the market. These wide price fluctuations can work for you or against you – as they offer an opportunity to make a large profit, but the risk can be dangerous. Many brokers limit the leverage that can be used when trading crypto pairs to 1:2 because of the high risk associated with trading them. Another plus to trading cryptocurrency comes in the form of more flexible market hours, with trading opportunities on the weekend as opposed to typical weekdays.

The Bottom Line: Which is Better?

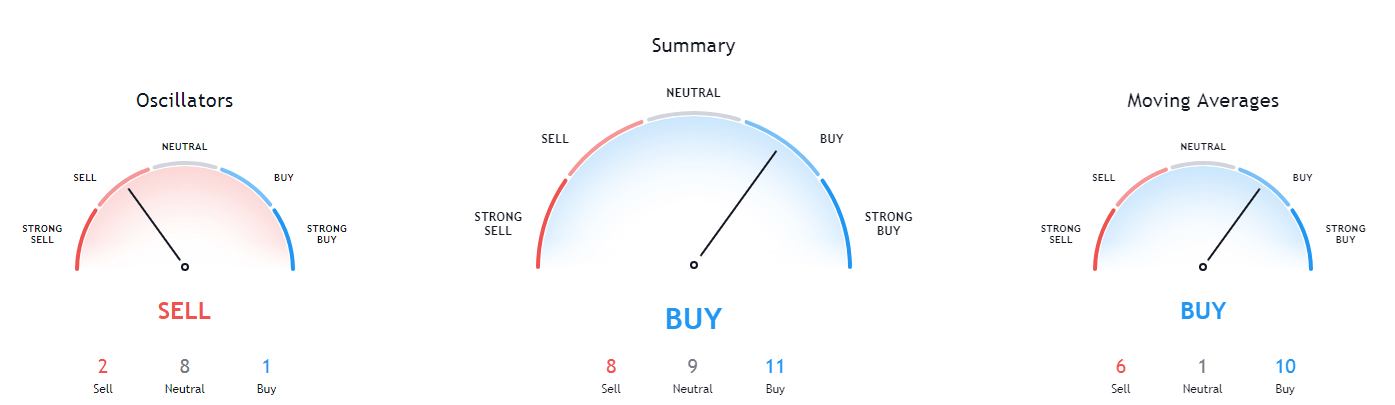

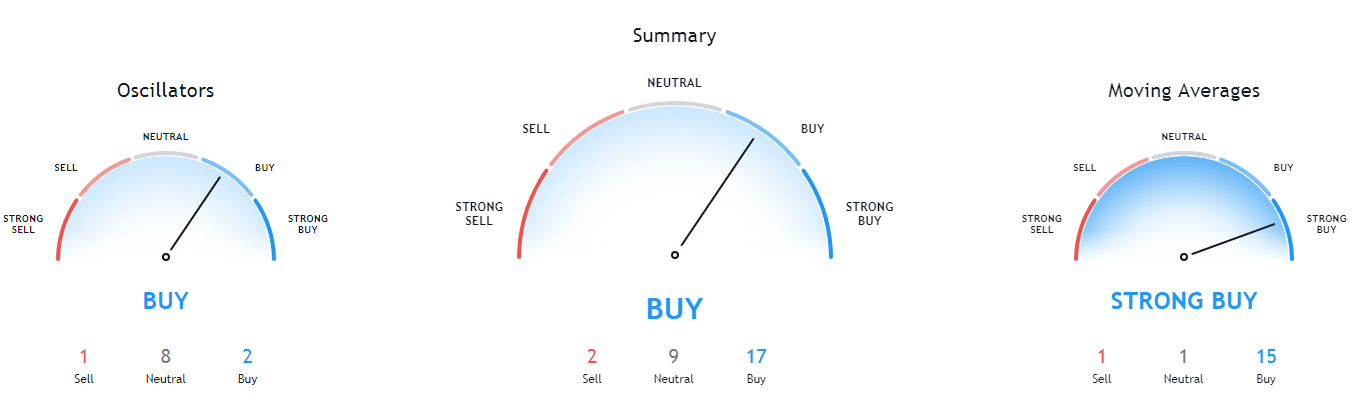

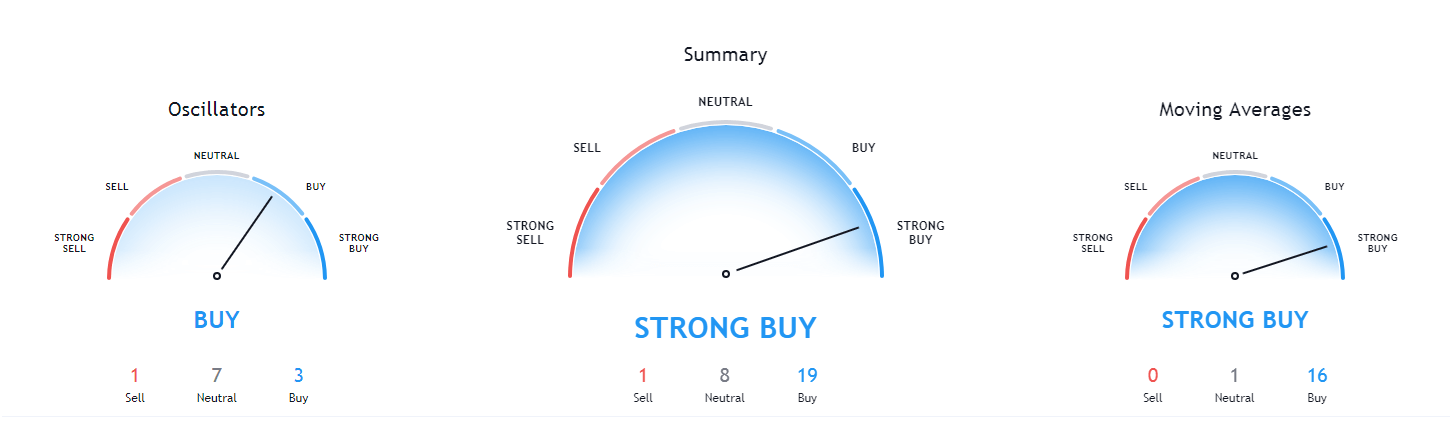

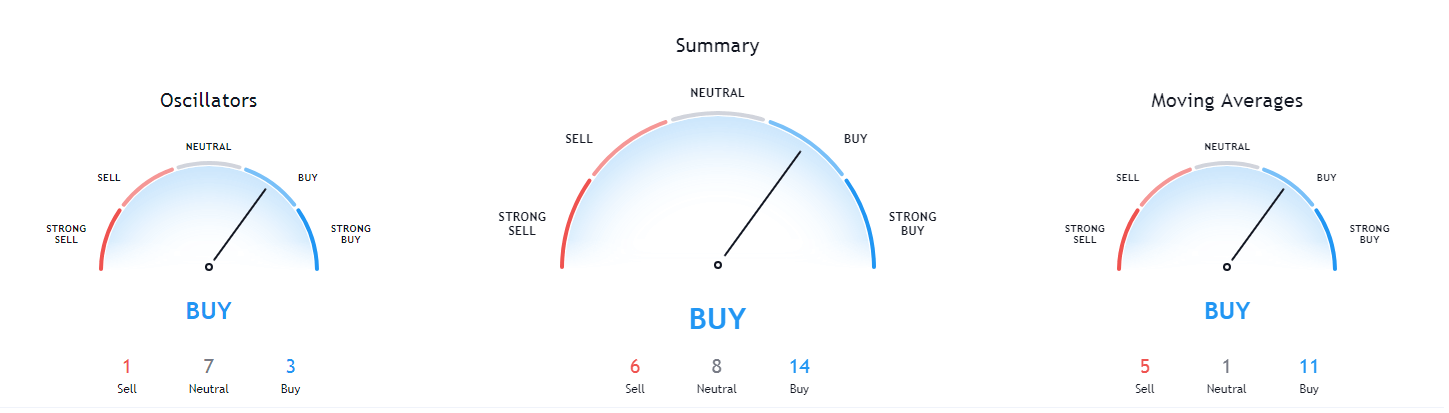

Above, we explained the most important points for forex and cryptocurrency. Below, we will break it all down into categories so that you can personally decide which is better to trade.

- When it comes to the cost of trading, forex wins by a landslide. While it costs about 0.08% of the value of EURUSD to trade, you’ll pay approximately 5 times as much to trade Bitcoin.

- Bitcoin offers more flexible market hours, including weekdays and weekends, while forex traders can’t trade on the weekend. It’s also better to trade forex during certain market sessions.

- Most brokers offer all major currency pairs, along with a good selection of minors and sometimes exotics. Lately, more brokers have added cryptocurrencies to their offers, but you may be limited to the most popular options.

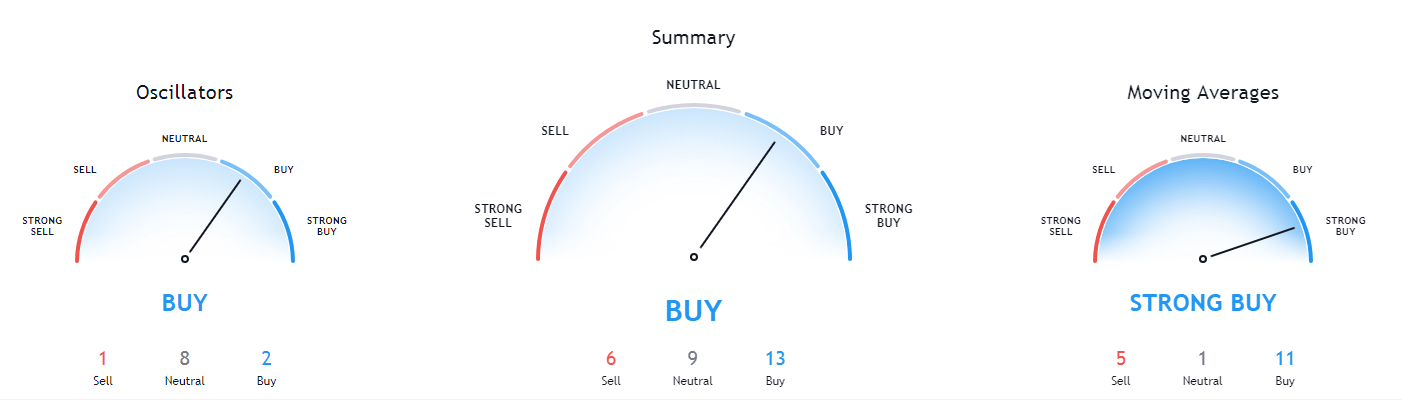

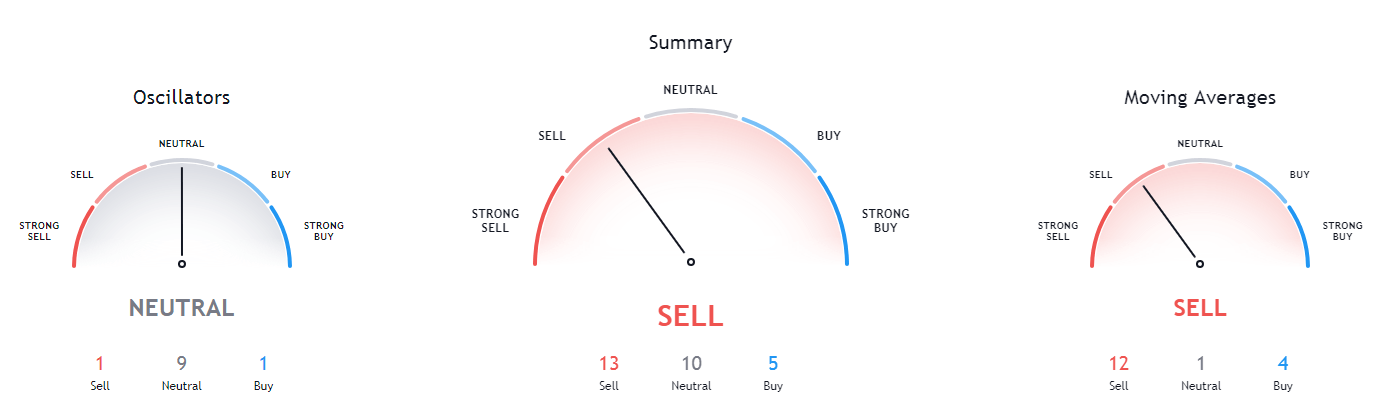

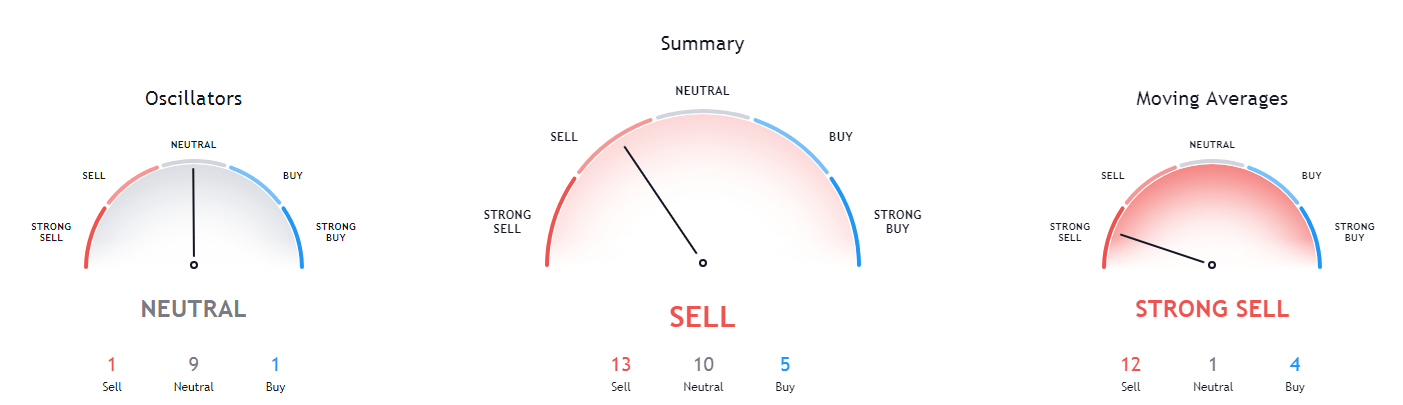

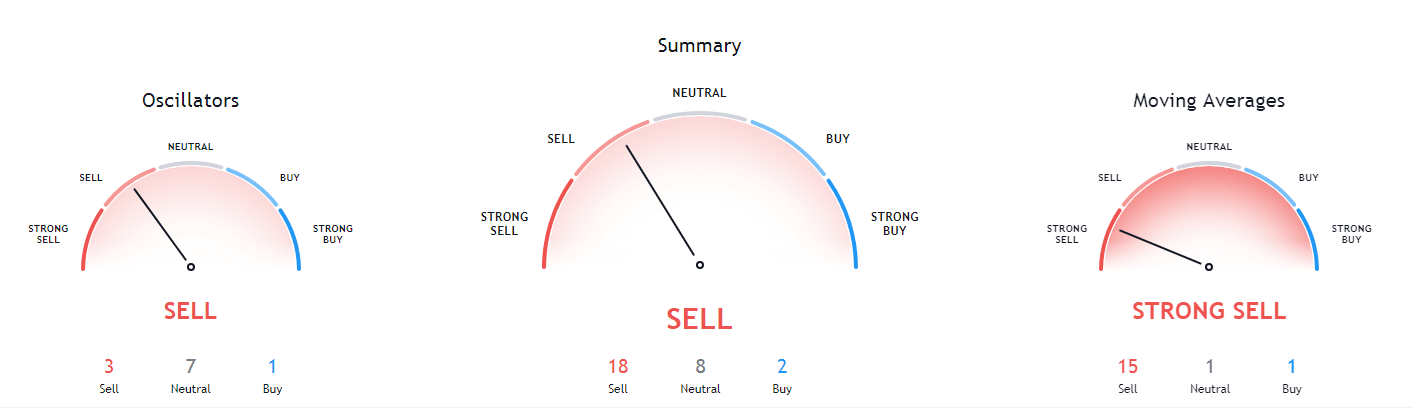

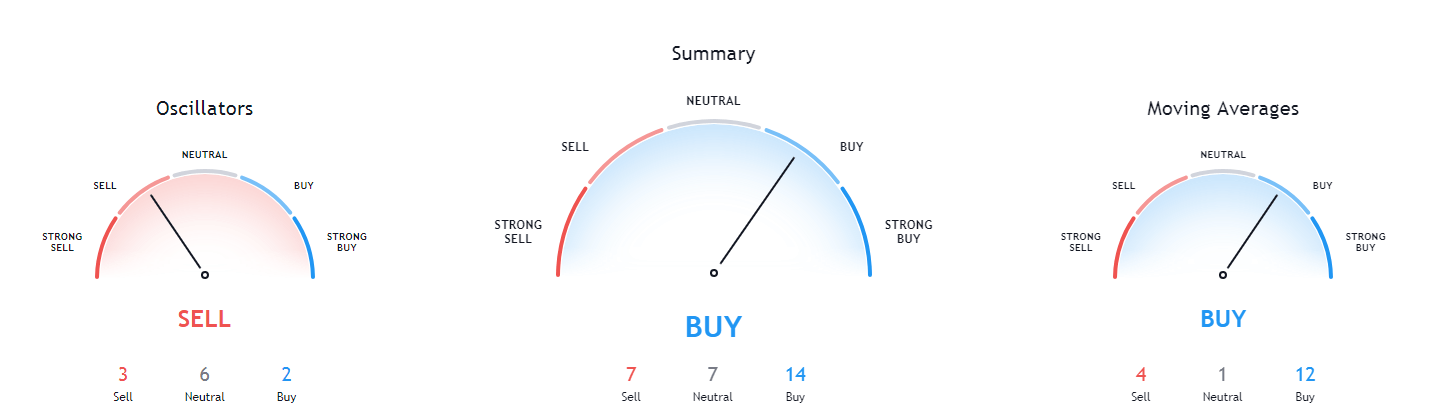

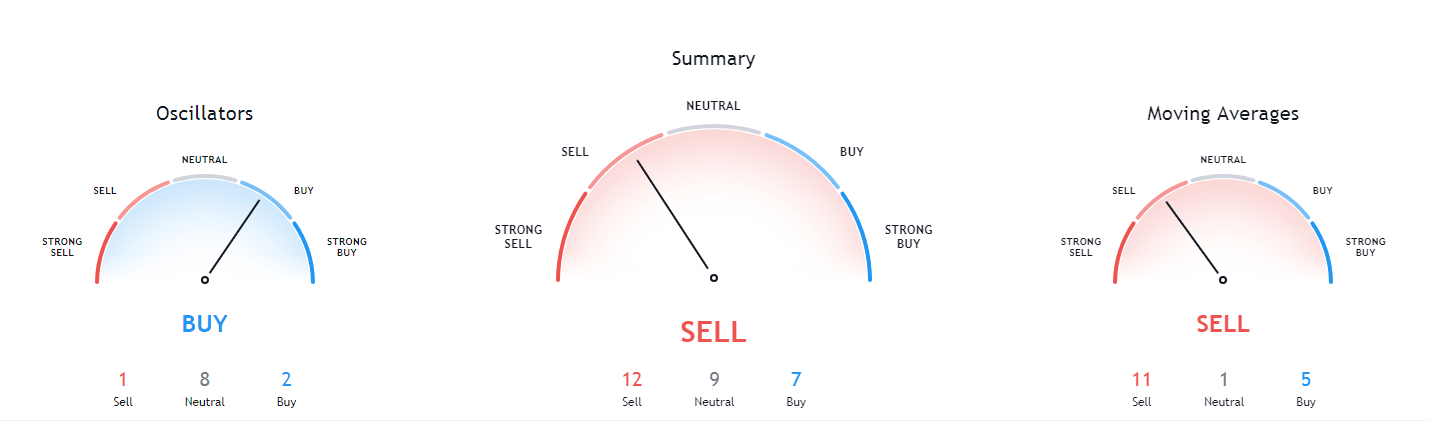

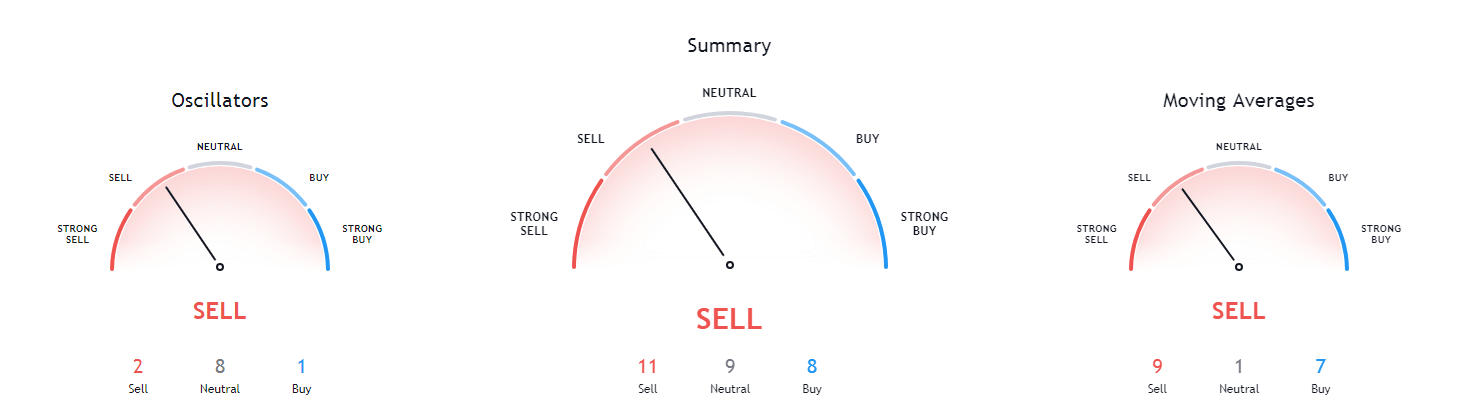

- Both forex and crypto have prices that are driven by microeconomic factors, but crypto is far more volatile because it is also affected by issues within its own market.

- Forex traders can access much higher leverage than crypto traders because brokers consider forex pairs to be much more stable. Some brokers offer leverage as high as 1:1000 or more, while crypto traders are often limited to a 1:2 leverage.