If you are looking for a free and secure cryptocurrency wallet/payment solution provider, consider Citowise. This multi-currency crypto wallet premiered as a free digital wallet software and supported various platforms that allow easy use of cryptocurrencies. Citowise is also regarded as very secure, providing a transparent payment method for e-commerce.

Citowise crypto wallet is designed to offer private and business customers an easy way to empower the mainstream adoption of cryptocurrency. It is beginner-friendly and requires no technical knowledge to operate. Simply download your wallet, set up your account, and begin using existing platforms to sell and purchase supported cryptocurrencies.

The wallet was launched back in 2016 with one mission in mind: to create a secure blockchain infrastructure and ensure ordinary users understand the technology. One of the founders fell victim to a crypto hack while the other wasn’t awarded deserved coins after participating in an ICO. The third founder encountered problems sending crypto to a relative—the three set their sight on creating a solution that covered these and more challenges crypto users face daily.

Key Features:

Multiplatform:

Citowise provides free crypto wallets for both Android and iOS platforms, which are the most popular phones in the market. It is also compatible with Linux and Mac platforms and provides full support for Ledger cold storages and TREZOR.

Export/backup:

You can export or backup your digital wallet, which is recommended for security purposes. To do this, open your Citowise wallet through your phone or PC and navigate to the Wallet screen. Click on the wallet and select Export from the menu that comes up. Follow the remaining prompts to finish exporting your wallet.

Import wallet:

You can import your wallet back to Citowise and continue from where you left. Go to your Citowise wallet and navigate to the Wallet screen. Click on the button with a + sign appearing on the bottom right corner and follow the remaining prompts to import your wallet.

Integrated exchange:

Citowise provides a user-friendly interface that allows you to convert one crypto to another within the wallet. You get to pick your preferred integrated exchange, and the platform supports quite a number. Citowise can also transfer all your ERC20 tokens out-of-the-box.

Buy Cryptocurrency:

Within the Citowise simple user interface, there’s a feature for purchasing cryptos at the lowest market prices, directly from the wallet. This complements the integrated exchanges you pick for your crypto transactions. You don’t need any technical knowledge about blockchain networks to buy cryptocurrencies.

ICO:

This section offers a unique experience for users that want to claim coins from ICO campaigns. It comes with its set of features and possibilities.

Security features:

i) Password: Citowise requires each wallet owner to use a strong password that is hard to guess. Without a strong password, people with access to your devices can export the wallet and access the funds using another device. You can use the recommended Citowise password or create one with a variety of characters.

ii) Encrypted channels: Data processed by Citowise use encrypted channels to prevent external breaches. This ensures transactions are secure and accurate. The platform uses the latest cryptography technologies and security algorithms to keep hackers at bay. No history of a breach has been reported since launch. SSL certificates and regular scans also add a layer of security.

iii) Ad-Hoc payments: Citowise dispenses payments on a discretionary basis, ensuring investor and trader confidence. Ad-Hoc payments also guarantee privacy. However, users must ensure safe practices to prevent others from accessing their details and passwords.

iv) Instant notifications: Users will get timely information for any changes that occur in the network, so you can react quickly in case of anything. You can also request a report on your statement for personal audits.

v) Encrypted hardware: The Citowise hardware wallet features the latest encryption technology to keep hackers at bay. All you need to do is set up a strong password for your account.

Citowise user-friendly interface:

Citowise employs advanced technologies to provide a sleek, user-friendly interface with all the features you need within a click’s reach. The simple design appeals to both new users and older folks with little to no background in crypto wallets. Wallet users have total monetary control and can enjoy fast transactions and customer service. The site also includes links to various resources with more insights regarding the wallet. The hardware wallet is also secured using advanced encryption and very easy to use.

Supported currencies and countries

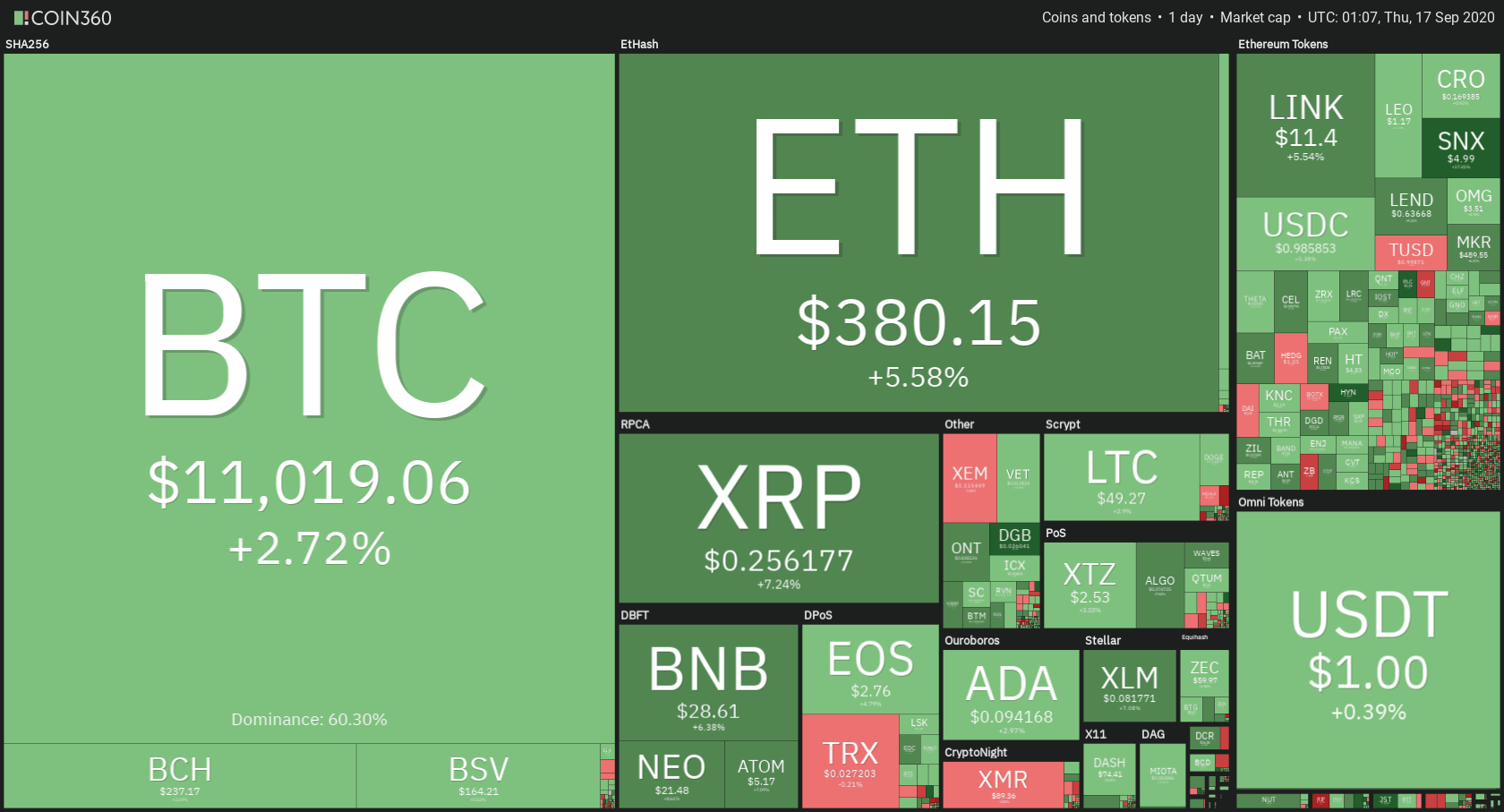

Citowise supports numerous cryptocurrencies and tokens than most crypto wallets. The platform accommodates all the 55,000+ tokens compatible with ERC20 standards. The most popular coins include BTC, ETH, LTC, BCH, VEN, EOS, TRX, and OMG.

Citowise also supports more than 1000 ETC coins and is available as a mobile app. The platform has offered financial solutions for 23 million+ companies in over 200 countries. All countries in the Eurozone are supported, and the number of currencies keeps growing, so it is advisable to check the information on the official site.

Citowise cost and fees

Setting up your Citowise wallet won’t cost a cent as the platform is free. No fee is charged for installing the wallet or using any integrated feature. Citowise is generally considered one of the budget-friendly digital wallets and charge the lowest fees in the market. The platform also scans all exchanges to minimize transaction costs.

While Citowise is free to use, network miners that verify and confirm transactions have their fees based on the network, transaction volume, speed of confirmation, and other factors. For instance, if you want speedy transactions from a system known to provide swift confirmations, you may pay a higher fee. The networks also have other restrictions, including limits on maximum and minimum transactions.

Customer support

Citowise offers various customer support channels to assist users in navigating all challenges they encounter using the wallet. A resourceful FAQ section provides insights concerning common questions, and the contact tab allows you to send an email describing your issue. Response time is fast compared to other wallets, and you can also reach the support team via social networks.

Setting up the Citowise crypto wallet

Step 1: Download and Install the Citowise app

To use Citowise, you need to download and install the wallet on your device. Citowise comes as a mobile app you can install on Android and iOS platforms. Head to the respective stores (Google Play and App Store) to download the wallet. They are also available on the homepage.

Step 2: Set up the wallet

Once you have the app installed on your device, launch it to set up your wallet. Like most crypto wallets, Citowise will require a unique wallet name and password. Enter and follow the prompts to create a wallet. You will be asked to back up the wallet, but this is optional, and you can do it later. However, it takes less than a minute to complete the backup.

Step 3: Enjoy Citowise

Once created, your Citowise wallet is ready for use. You can buy/sell cryptocurrencies, send and receive funds, and enjoy all the functionalities provided in the app. Citowise gives you total monetary control, so there’s a lot you can do with your account.

How to send currencies with Citowise

Step 1: Launch your Citowise app and log in. Click on balance on the bottom of the screen to see how much crypto you have.

Step 2: Click on the crypto balance you have and then Send Payments. Clicking on the Send icon that’s beside the Balance icon will also take you to the same page.

Step 3: Choose the recipient of the funds you are sending. You can do this by clicking on a contact list, using a QR code, or typing the wallet URL. Click Proceed.

Step 4: Enter the amount you wish to transfer in the To Pay section and click Proceed.

Step 5: Check if everything is okay and click the blue Send Payment button to send cryptocurrency. If you entered the wrong amount or address, click the back arrow to correct before submitting it.

How to receive currencies with Citowise

Step 1: Launch your Citowise mobile app and log in. Click on the Request icon on the bottom of the screen.

Step 2: In the request payment window, enter the amount you want to receive. You can change the cryptocurrency by clicking on the small arrow beside the current crypto. Converter and Setup Hint buttons also offer extra functionality on the window. Fill the description section for the request and input the wallet URL (the wallet you are requesting payments from). You can also request using QR code or sharing your URL.

Step 3: Check if all details are correct and click on Request Payment to ask for funds. Once the request is sent, the recipient will get a prompt notification on their app, and funds are added automatically when they pay.

Citowise supported currencies

Citowise supports various cryptocurrencies, but you will only have a few options to choose from during the account setup. The popular currencies supported include:

- Bitcoin

- Litecoin

- Ethereum Classic

- Ether

- Bitcoin Cash

- POA

- Citowise Token

The wallet also supported various fiat currencies, including the Dollar (Canadian, Australian, and the US), Euro, British Pound, Swiss Franc, Chinese Yuan, Japanese Yen, Indian Rupee, Korean Won, and Russian Ruble.

Buying and selling crypto with Citowise

Citowise allows users to buy and sell cryptocurrencies, taking advantage of the best rates in the market. To buy and sell crypto, simply click on the three-row lines appearing on the top right corner and select Buy/Sell Crypto. This will open a service page where you can choose the preferred option. Some providers buy crypto while others sell, so choose accordingly. Specify the amount you want to buy or sell and trigger the request following the prompts given. Ensure you select the correct currency before buying or selling crypto.

How does Citowise compare with other wallets?

Citowise vs. eToro

Both Citowise and eToro are great crypto wallets you can use to accomplish various transactions. Citowise offers a simple interface and navigation. They also provide impressive ICO campaigns. Concerning features and functionality, Citowise and eToro don’t reflect much difference. However, eToro supports 120 different cryptos, which is way above the seven options available on Citowise. The wallets are both secure and relatively cheap, compared to other top-rated options.

Citowise vs CoolWallet S

CoolWallet S is a premium crypto wallet with advanced security features. Like Citowise, a hardware wallet is available for interested users. This obviously comes at a fee, but you get to enjoy top-notch security. CoolWallet S supports 22 cryptocurrencies, which is still above Citowise. However, this is nothing compared to wallets such as Ledger Nano S, which supports more than 1000 cryptos.

Pros and Cons of Citowise crypto wallet

Pros

- Free secure crypto wallet available for mobile users

- No transaction charges or subscriptions

- Participate in ICO campaigns

- Send, receive, buy or sell crypto easily

- Choose from a wide variety of exchanges

- Supports FIAT currency and in-app conversions

- User-friendly interface appealing to both beginner and experienced crypto-traders

Cons

- Supports fewer cryptocurrencies than most wallets

- Very few service providers in the Buy/Sell Crypto section

- Only available for mobile platforms

Final words

Citowise is an excellent mobile wallet you can use to facilitate various transactions. It allows you to exchange and convert cryptocurrencies and permits buying and selling of the same. You can also access popular FIAT currencies, pay for goods and services, or request invoice payments.

As a payment method, Citowise is safe and convenient to use, boasting a sleek interface with beginner-friendly navigation. Every important feature is within a click’s reach, and the mobile app is light on your device. If you are looking for a reliable, secure mobile crypto wallet, Citowise is worth a try. However, the platform could do better with support for more cryptocurrencies. Currently, users can only access a few popular options.

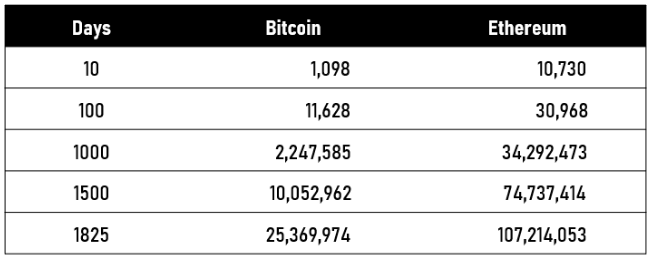

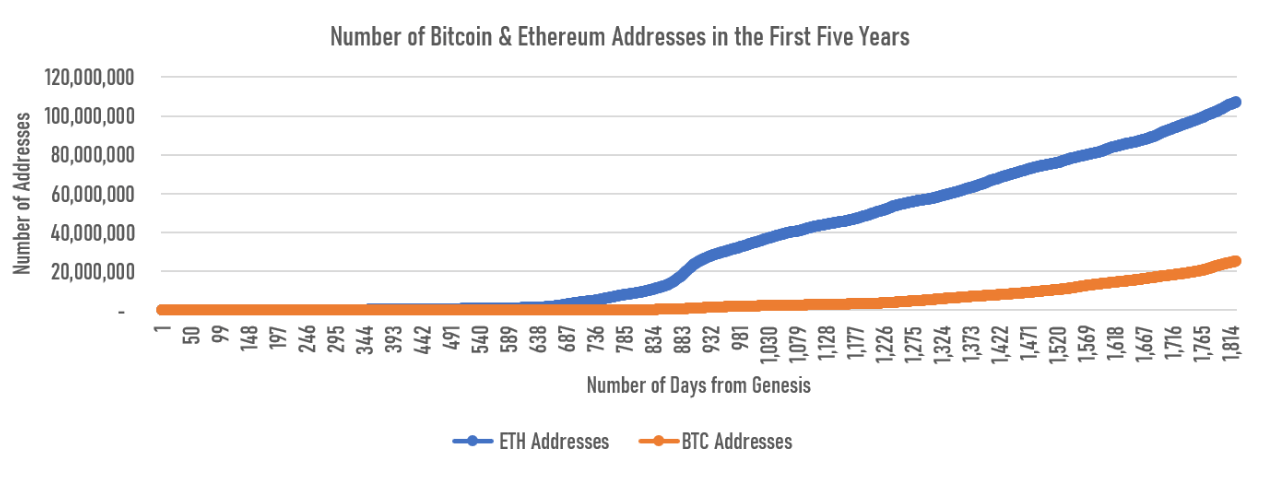

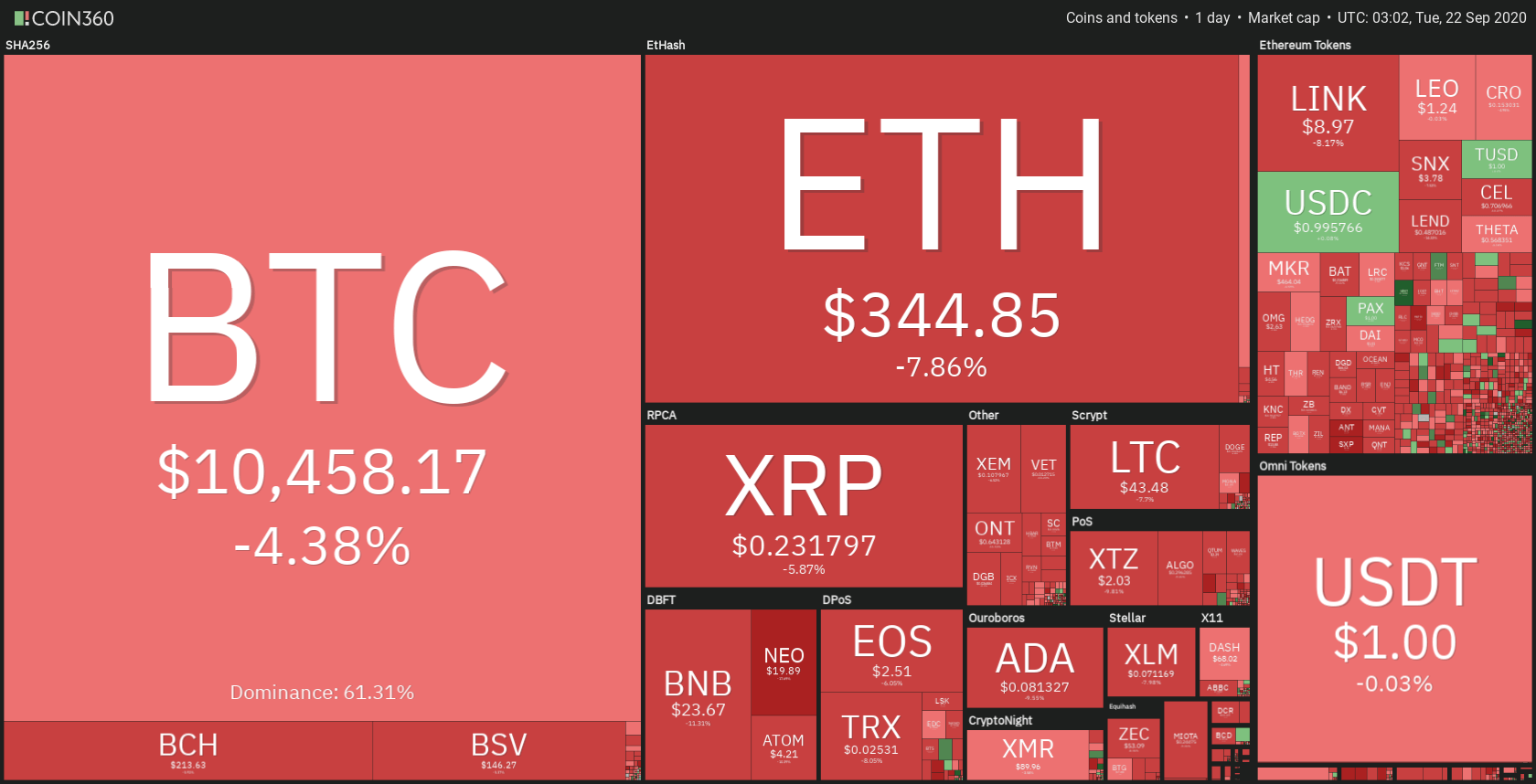

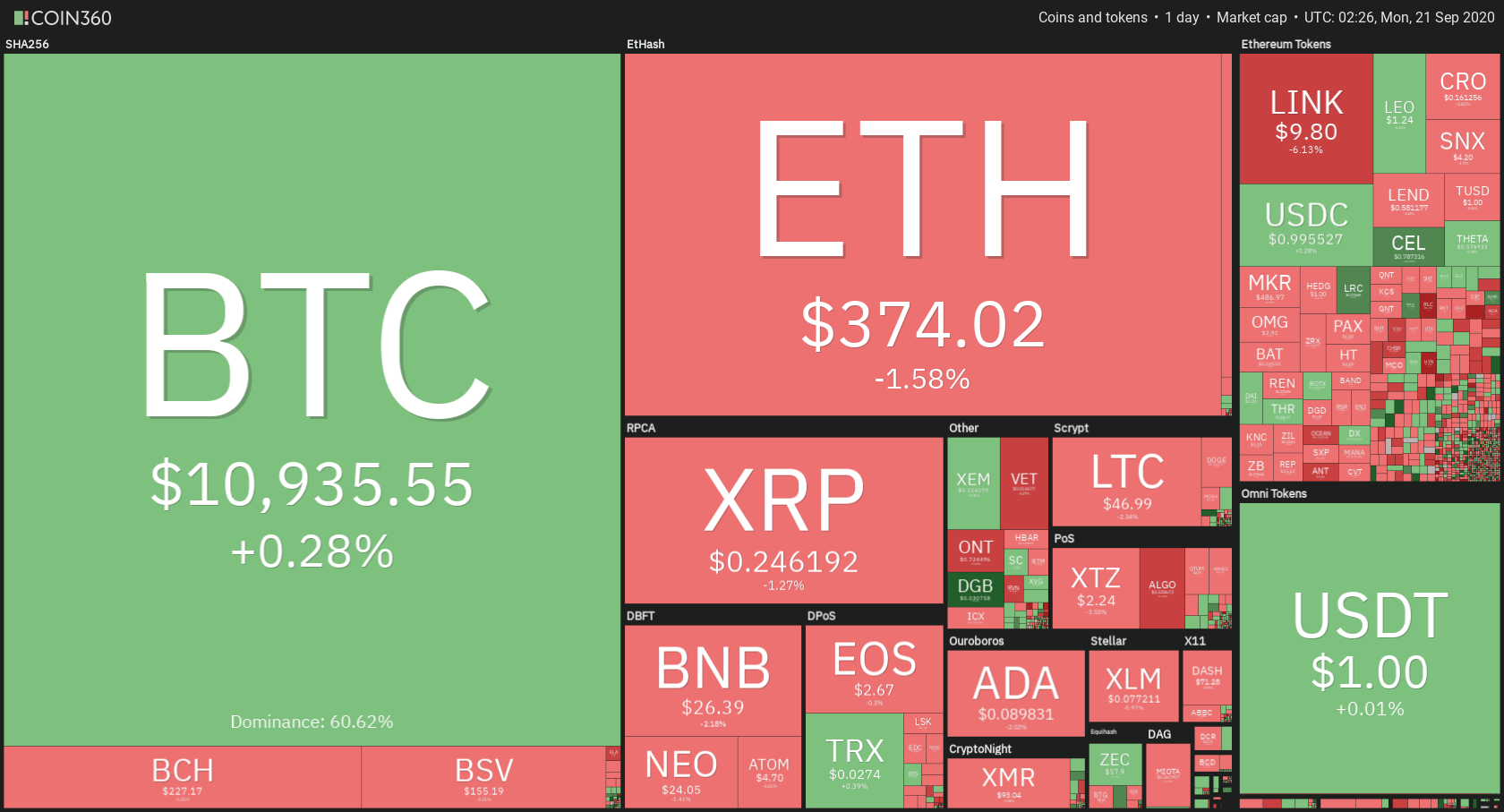

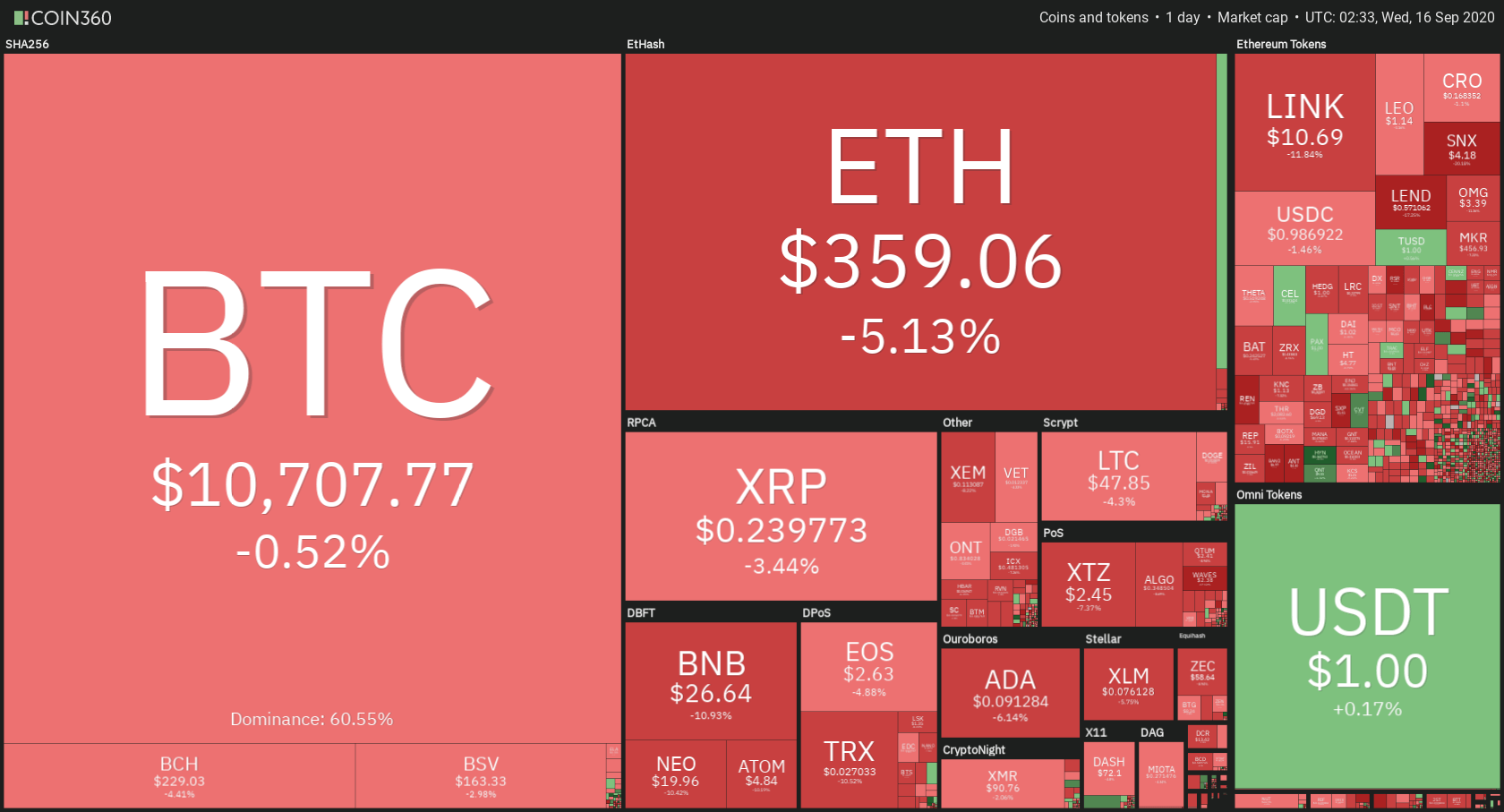

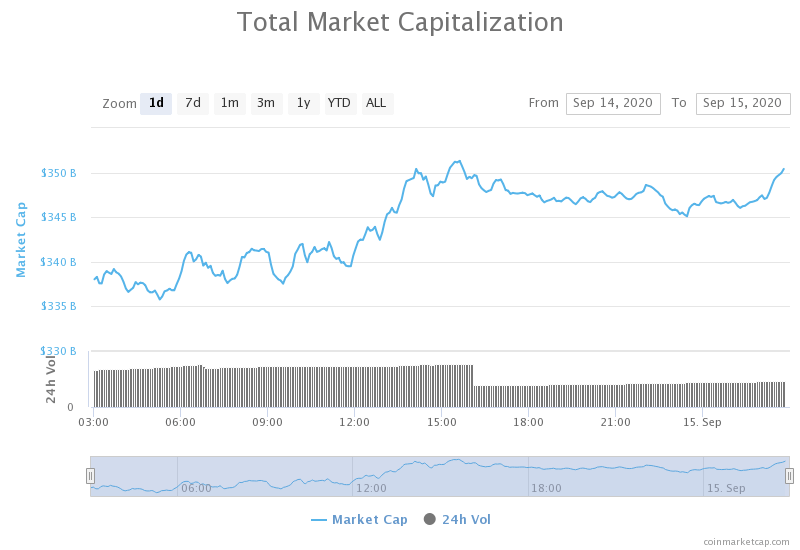

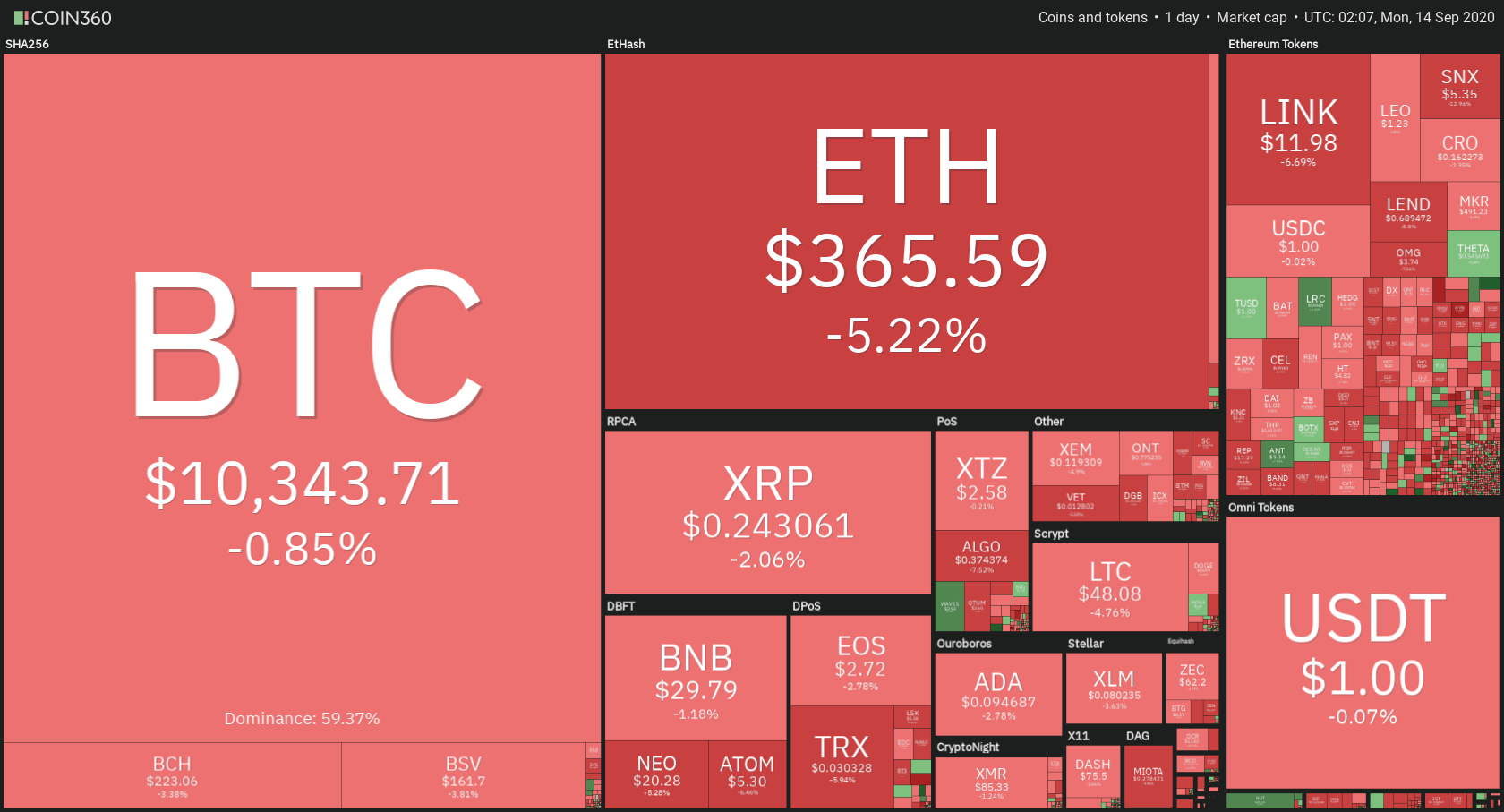

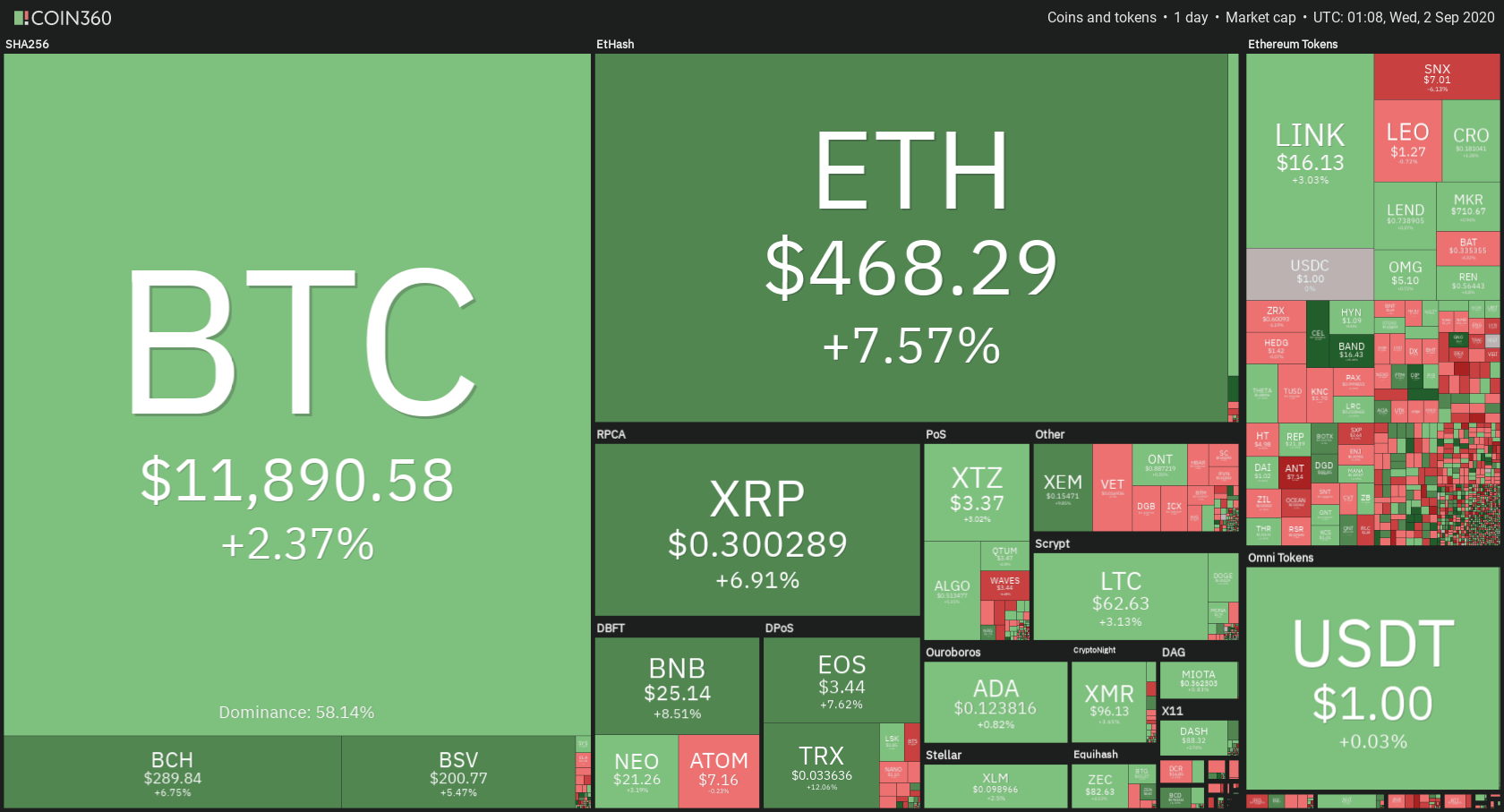

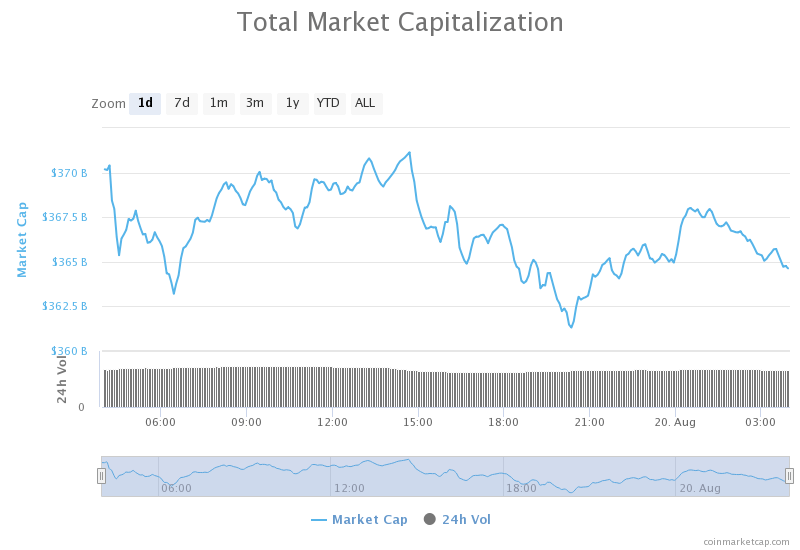

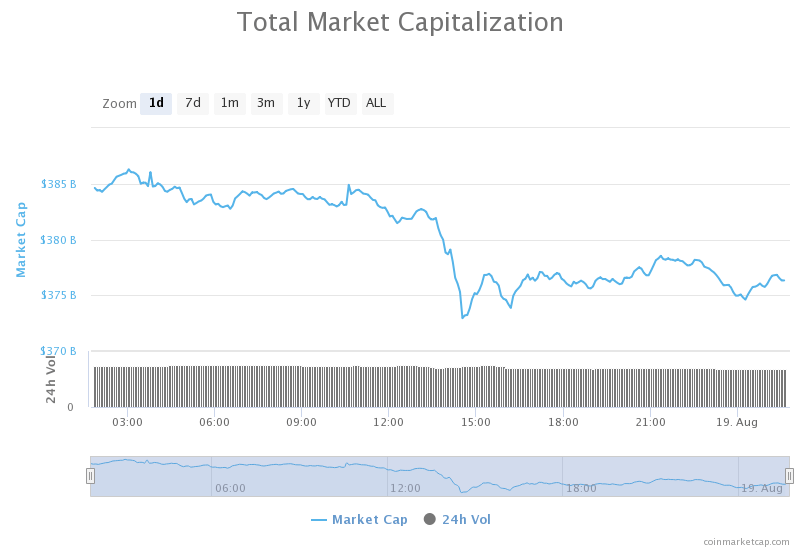

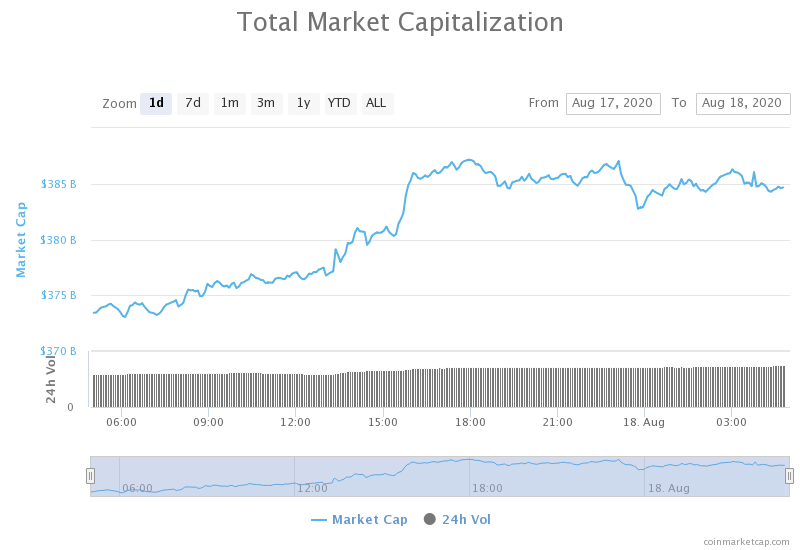

One key metric suggests that Ethereum has enjoyed a much faster adoption rate as well as the growth rate in the first five years of its existence than Bitcoin.

One key metric suggests that Ethereum has enjoyed a much faster adoption rate as well as the growth rate in the first five years of its existence than Bitcoin.