Starfinex is a China-based ECN forex and a spread-betting broker. There are a few areas that they have decided to focus on which are offering personalized customer service, reliability, the safety of funds, competitive spreads and commission, technology & tools, speed of execution and alignment of interests with the clients. Starfinex was founded by traders so they are bringing that experience and desire to the broker world. Throughout this review, we will outline the services being offered to try and help you decide if they are the right broker for you.

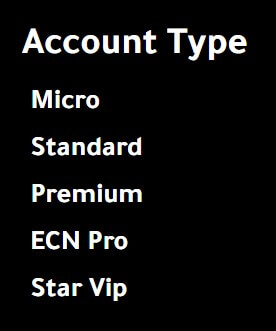

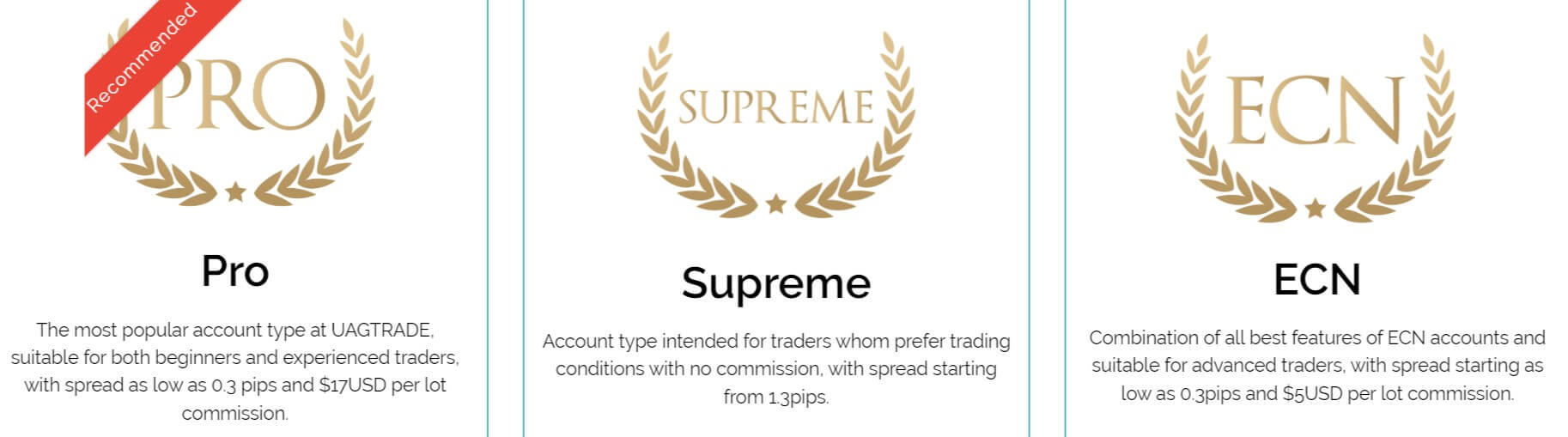

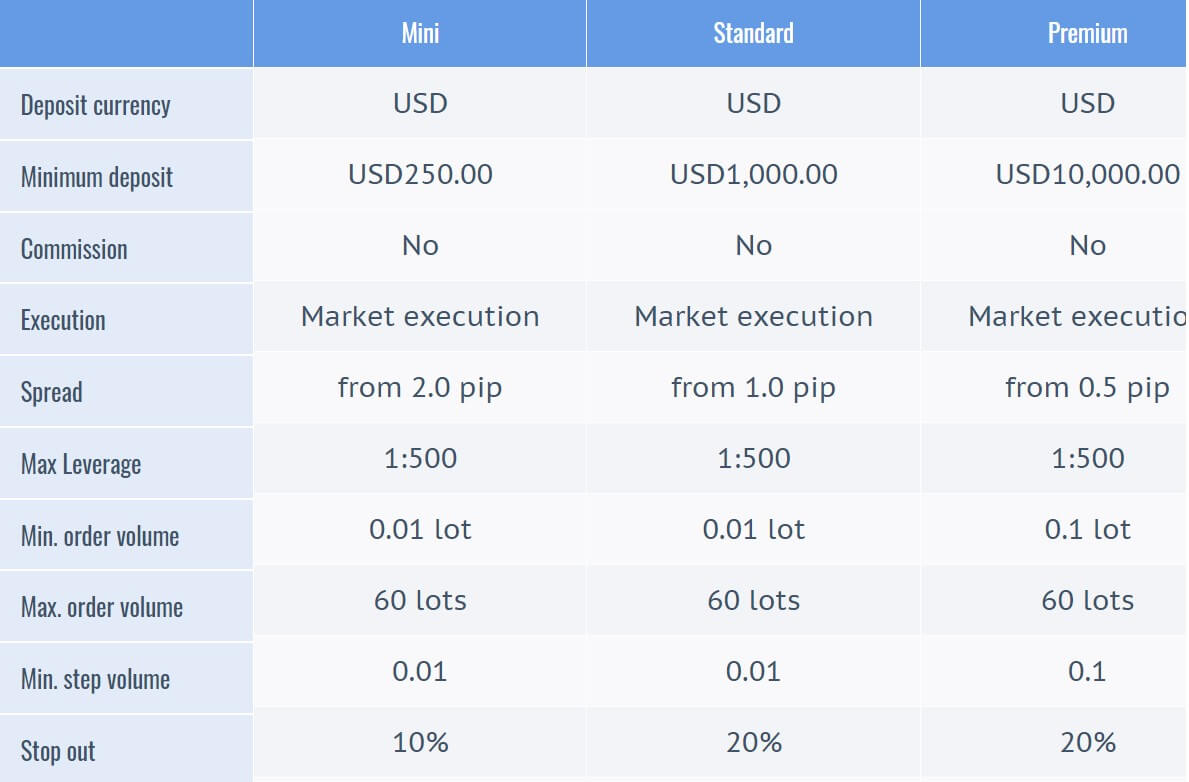

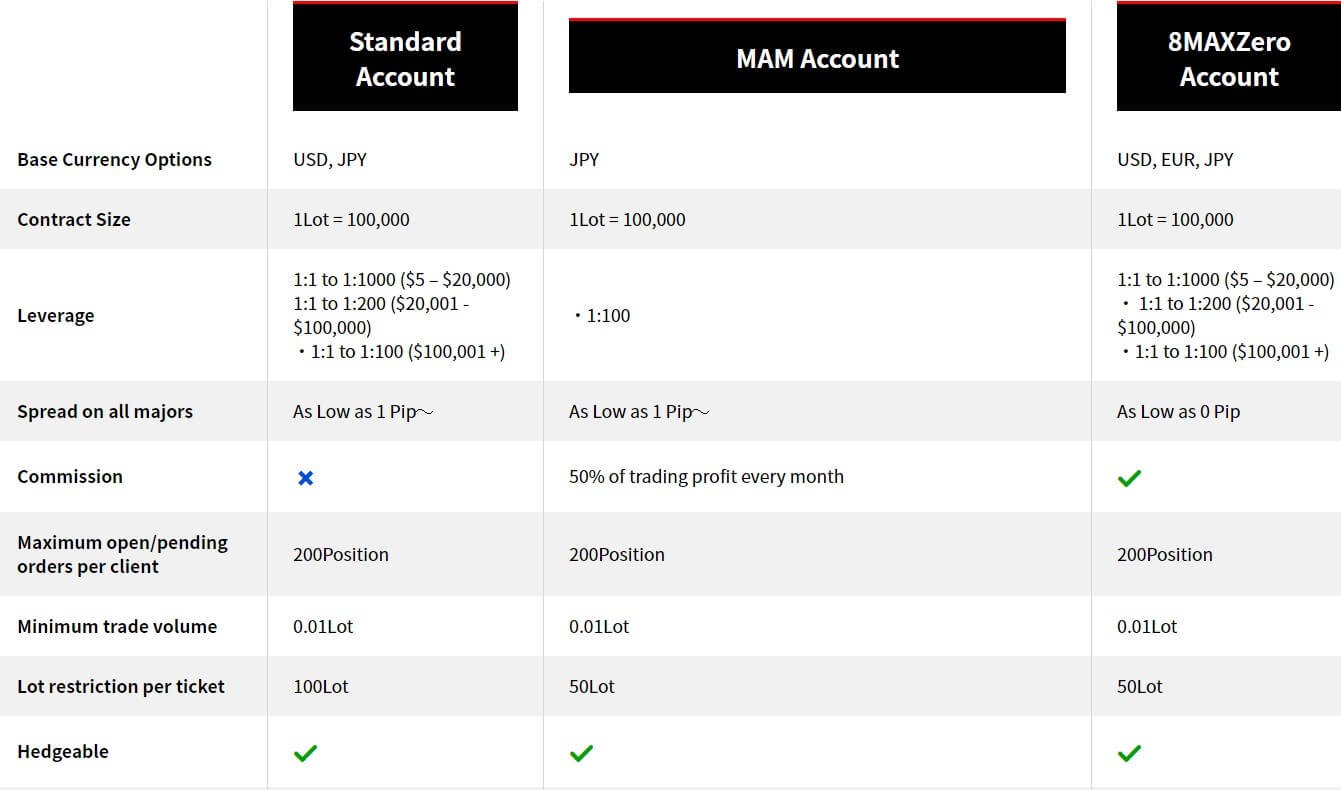

Account Types

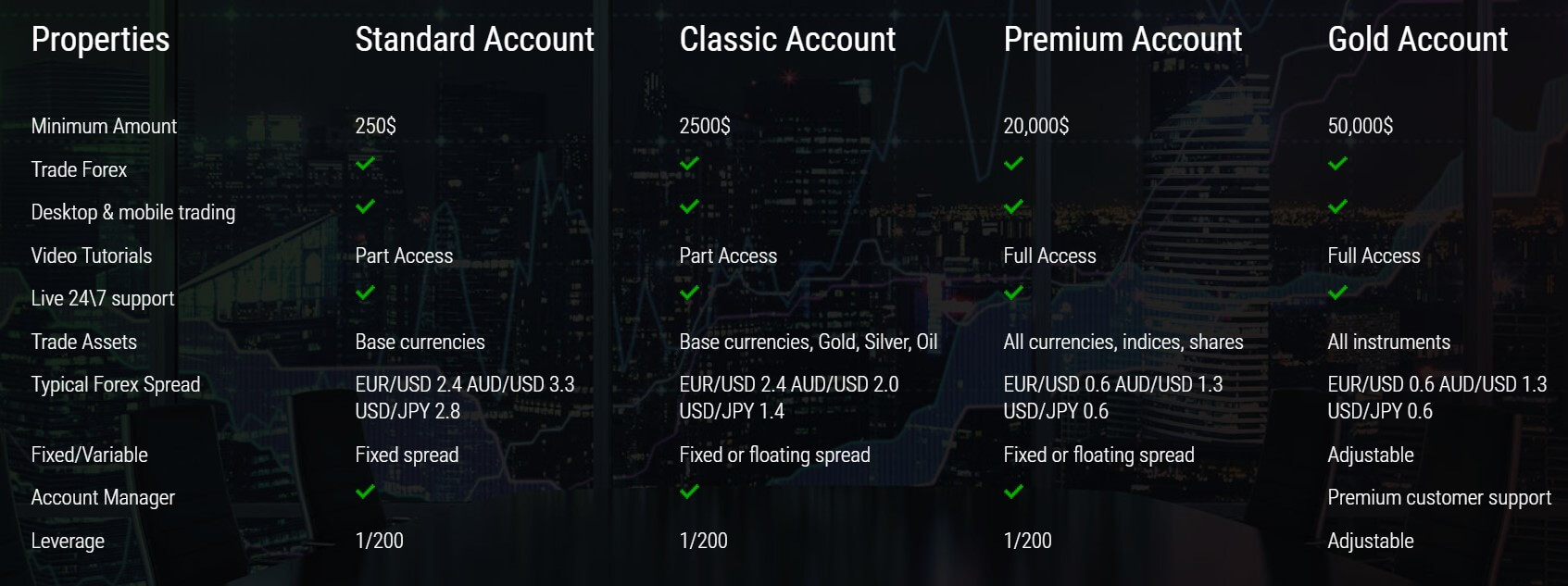

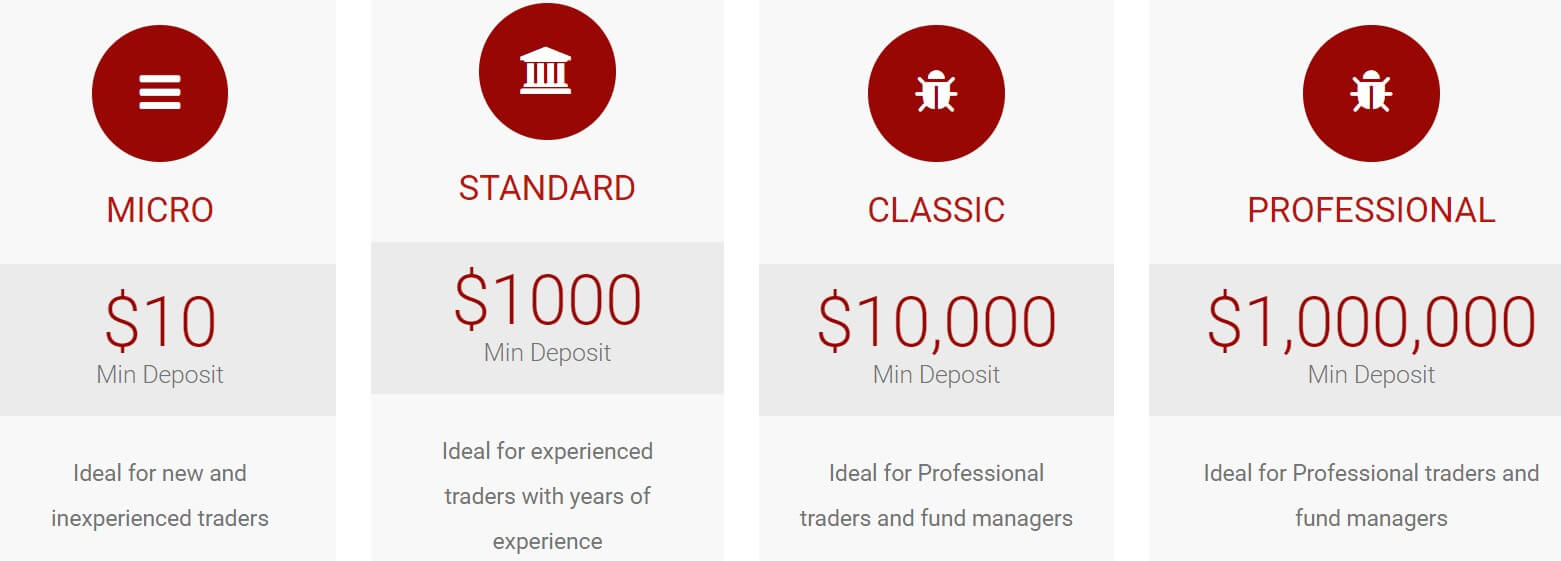

Should you decide to sign up with Starfinex, the first thing you will need to do is decide which of the 5 accounts you want to use, we will briefly outline them so you can see what they offer.

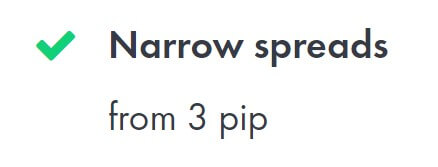

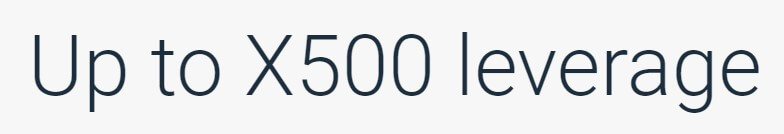

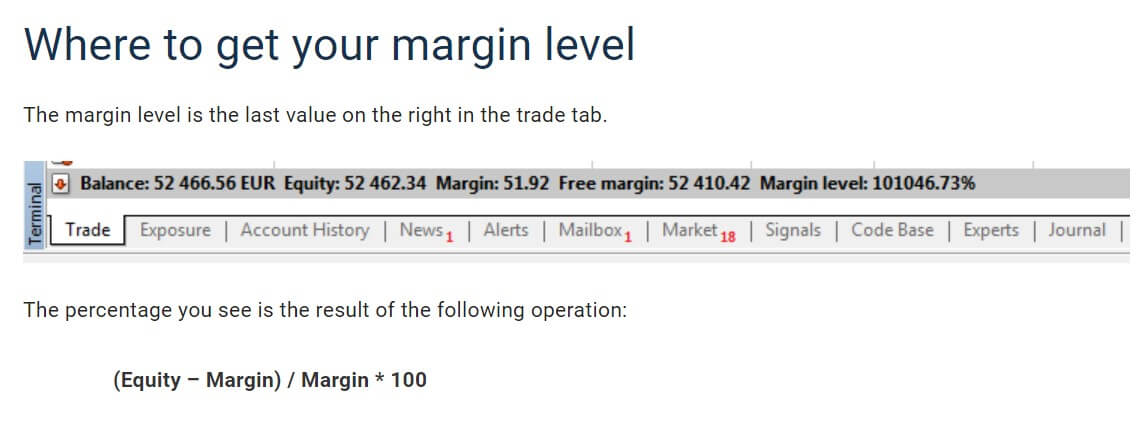

Micro Account: This account requires a minimum deposit of just $5, it can use MetaTrader 4 or MetaTrader 5 as its trading platforms. The account has variable spreads starting from 3 pips and can be leveraged up to 1:500. Trade sizes start at 0.01 lots and go up in increments of 0.01 lots up to a maximum of 20 lots. The margin call level is set at 200% and stop out level at 30%.

Standard Account: The standard account requires a minimum deposit of $50, it has variable spreads starting from around 2 pips, it can use MetaTrader 4 or MetaTrader 5 and trade sizes start at 0.01 lots with a maximum trade size of 80 lots. Leverage on the account can go up to 1:400, the account is able to trade forex, CFDs, indices, metals, and energies and it has a margin call level set at 150% and stop out at 30%.

Standard Account: The standard account requires a minimum deposit of $50, it has variable spreads starting from around 2 pips, it can use MetaTrader 4 or MetaTrader 5 and trade sizes start at 0.01 lots with a maximum trade size of 80 lots. Leverage on the account can go up to 1:400, the account is able to trade forex, CFDs, indices, metals, and energies and it has a margin call level set at 150% and stop out at 30%.

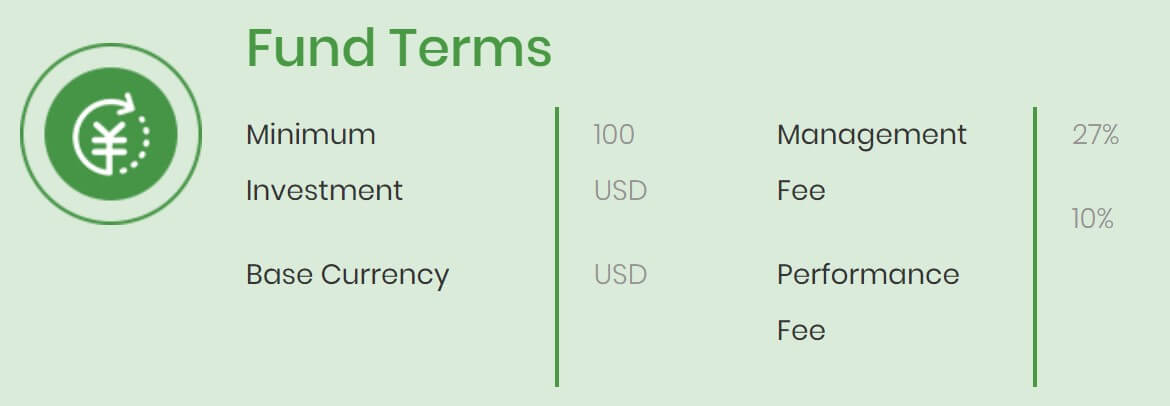

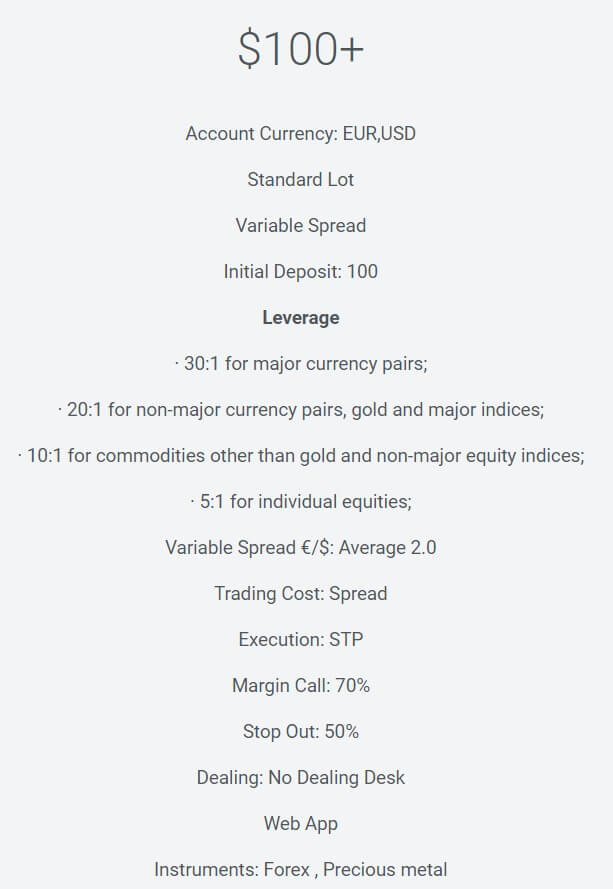

Premium Account: The minimum deposit for this account increases up to $100, the account must be in USD as a base currency. MetaTrader 4 and MetaTrader 5 are both available to use and the account has a variable spread starting at 1.6 pips. There are forex pairs, indices, metals and, energies available to trade with leverage up to 1:300. The accounts trading stats at 0.01 lots and go up in increments of 0.01 all the way up to 200 lots as a maximum. The account has a margin call level set at 1090% and stops out at 30%.

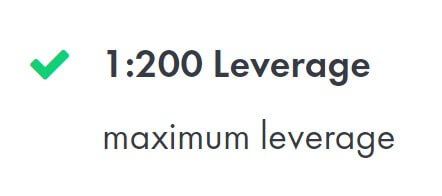

ECN Pro Account: The ECN Pro account requires a deposit of $100, it is available on MetaTrader 4 and 5 and can trade forex, CFDs, metals and, energies. As it is an ECN account the spreads start as low as 0 pips (variable) and due to this, there is an added commission of $6 per lot on the account. Maximum leverage of 1:200 is available and trading starts from 0.01 lots and goes up in increments of 0.01 up to 200 lots. The margin call is set at 100% and stop out 30%, the account must be in USD as a base currency.

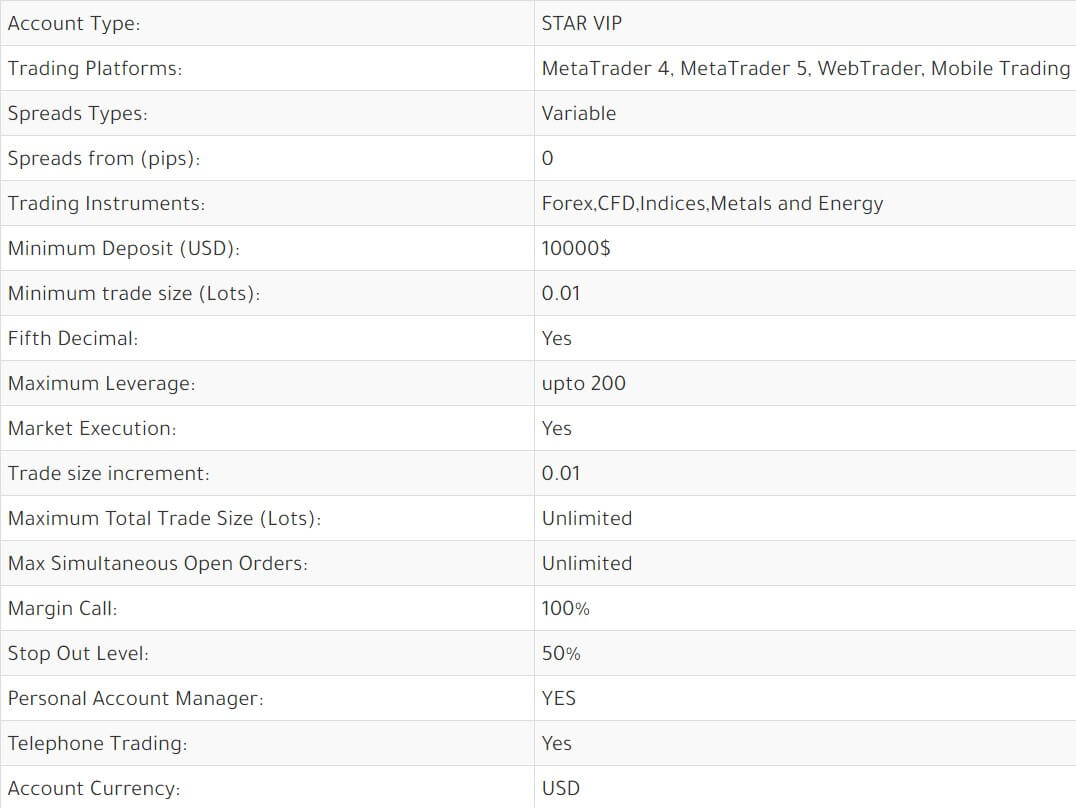

Star VIP: This is the top-tier account and so requires a larger minimum deposit of $10,000. It can be used with both MetaTrader 4 and MetaTrader 5 and comes with a variable spread starting at 0 pips, due to this there is an added commission of $16 per mission traded. Trade sizes start at 0.01 lots and go up in increments of 0.01 lots, there is no maximum trade size. The account can be leveraged up to 1:200 and has a margin call level at 100% and a stop out level at 50%. The account also comes with a personal account manager and personalized services.

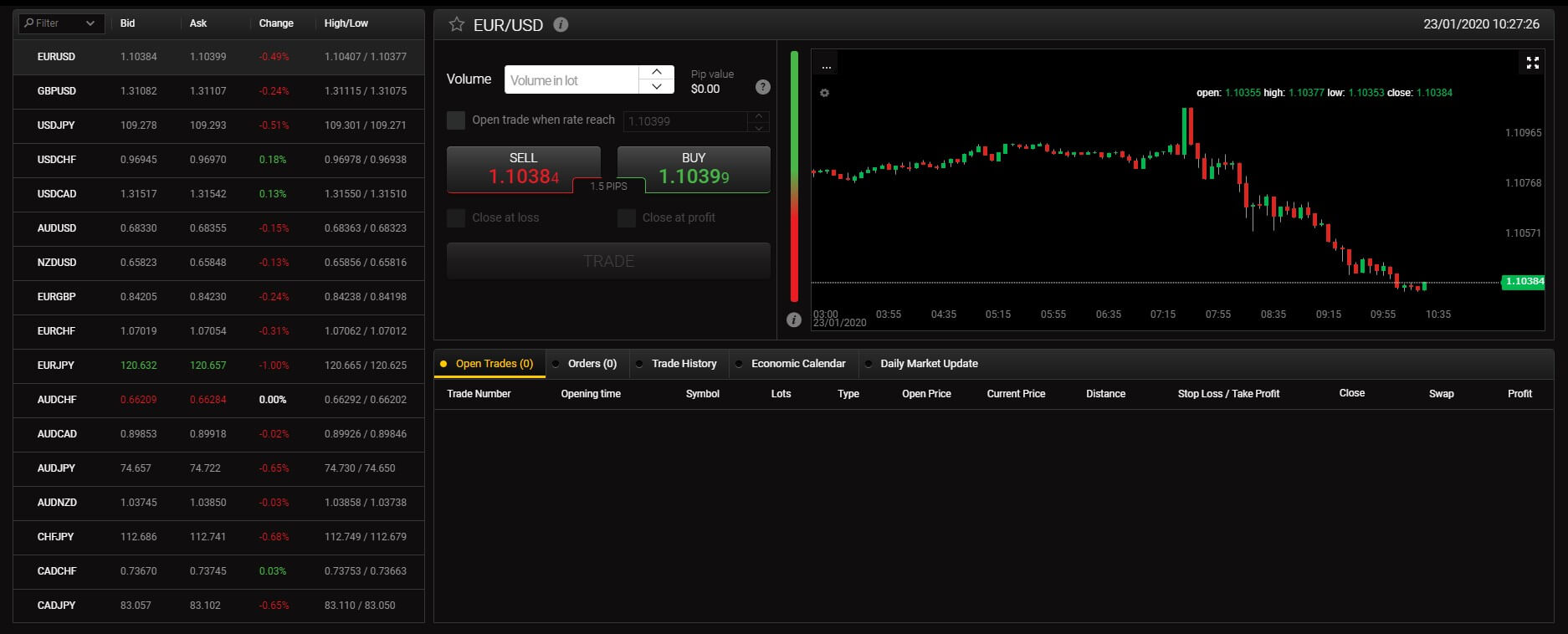

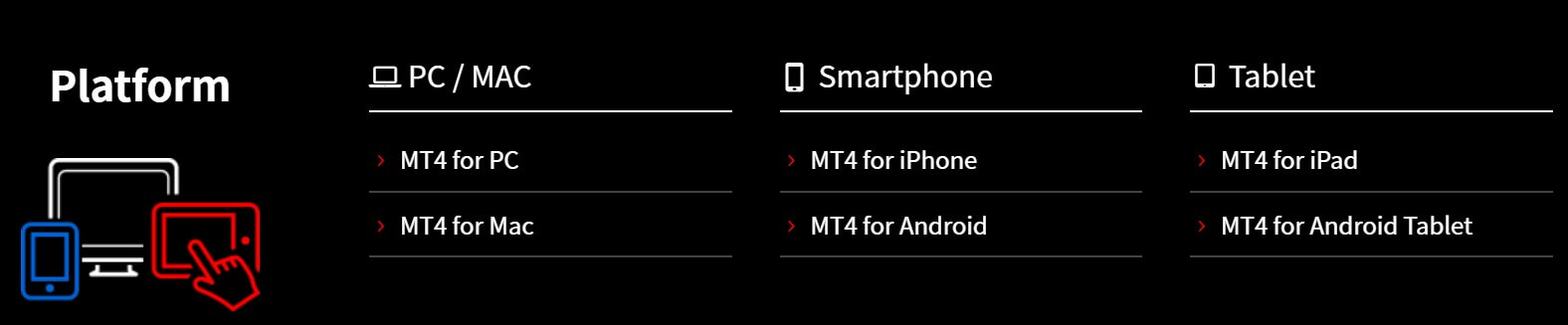

Platforms

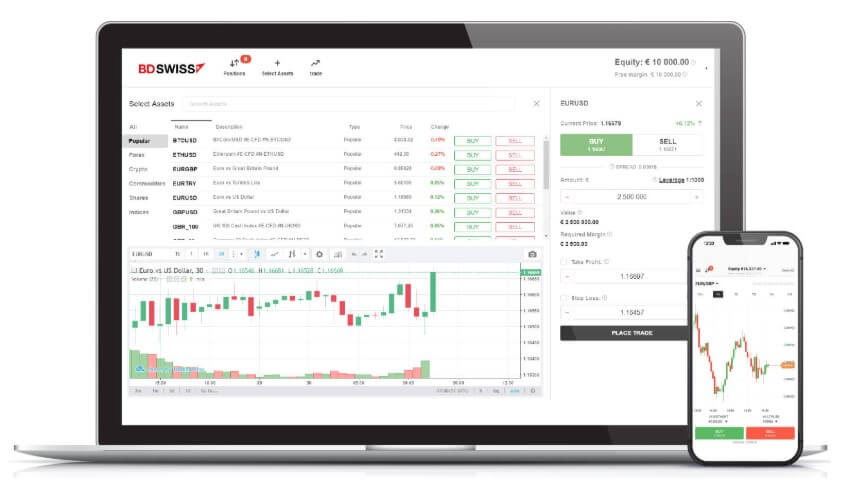

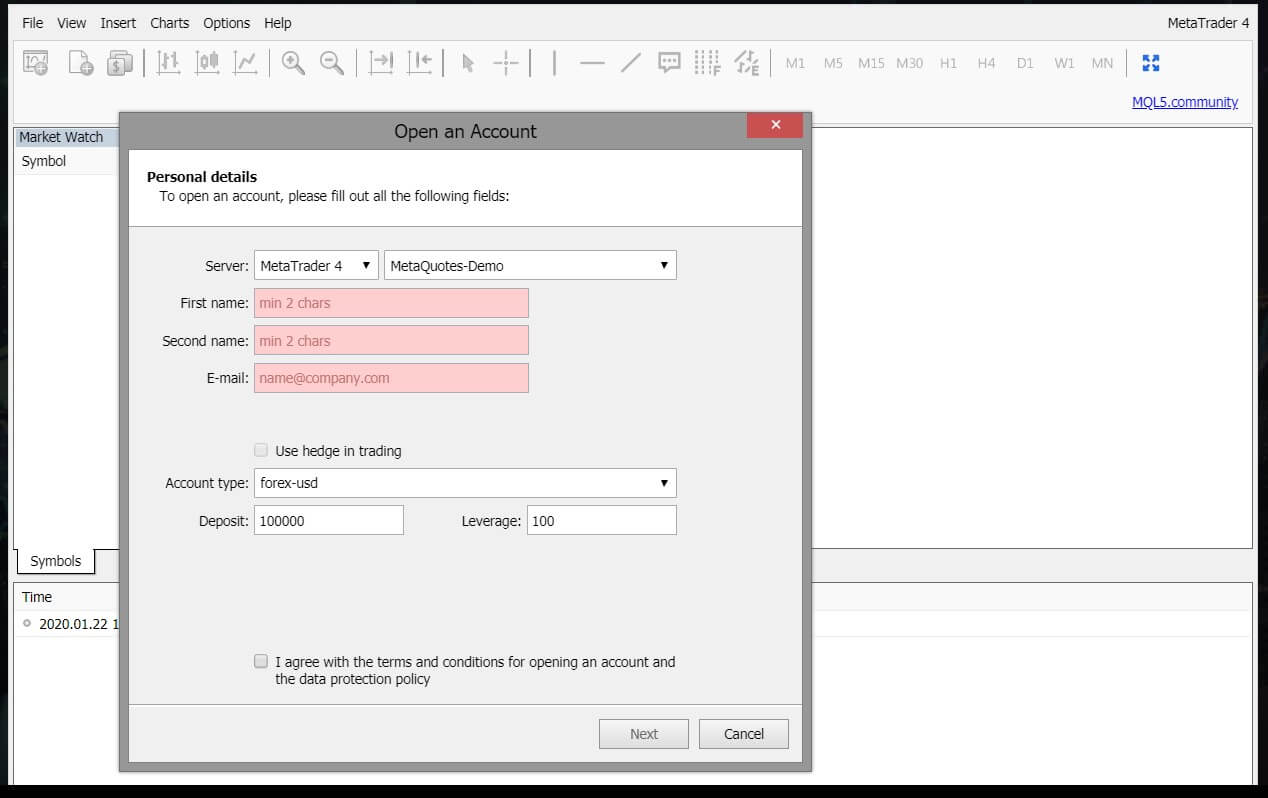

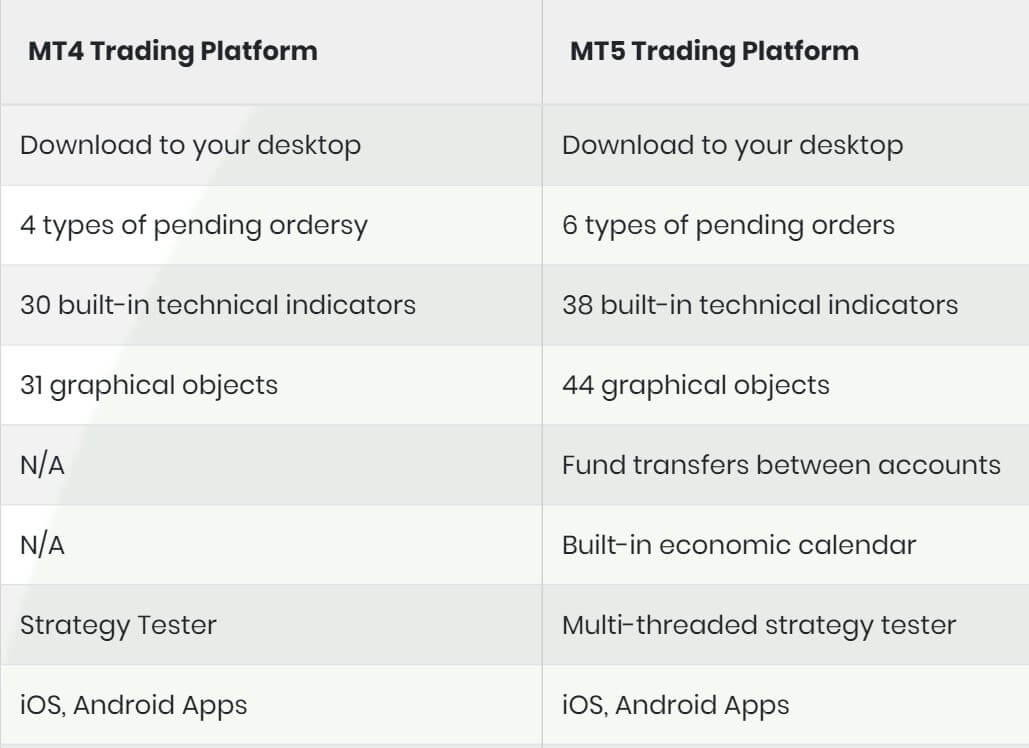

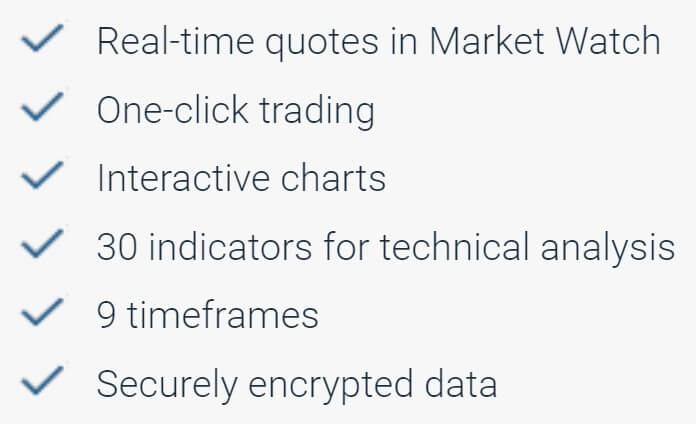

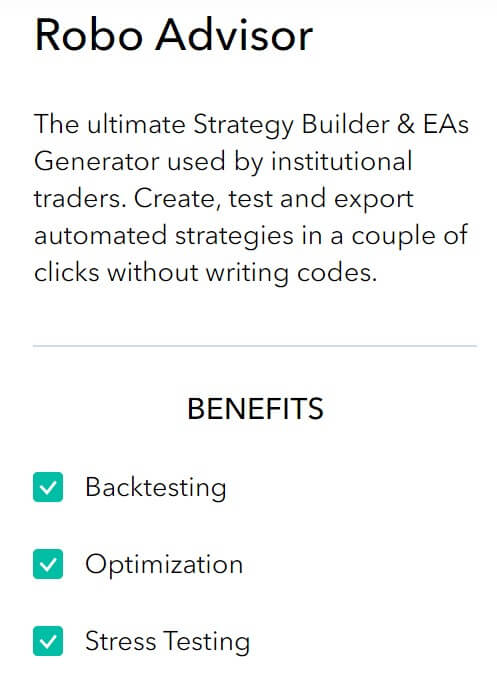

As seen in the accounts overview, there are two different platforms available to trade with. These include both MetaTrader 4 and MetaTrader 5. There are no 3rd party bridges nor any automated account syncs when trading with Starfinex. They offer a wide variety of features to help upgrade your MetaTrader 4 trading experience. The platform is offered for desktop, Android, and iOS. Metatrader 4 is very easy to customize and includes charting tools, scripts and Expert Advisors, market indicators, risk management, real-time market analysis and more.

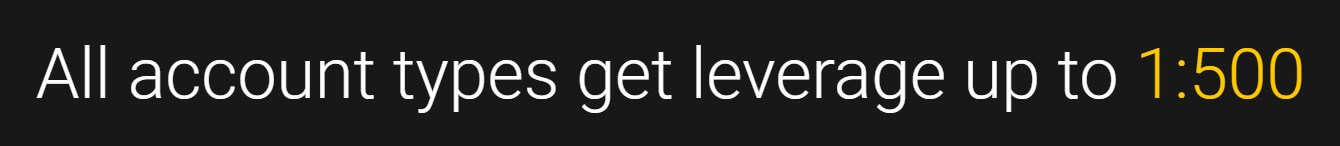

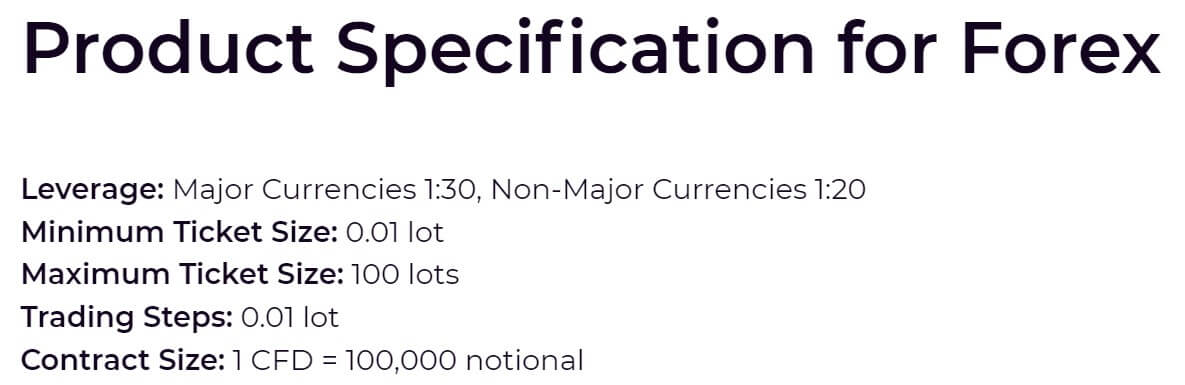

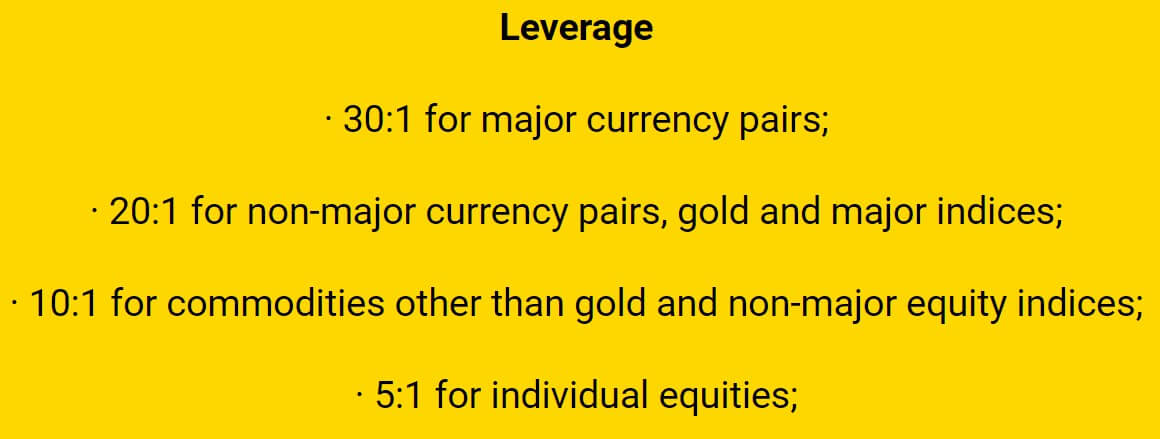

Leverage

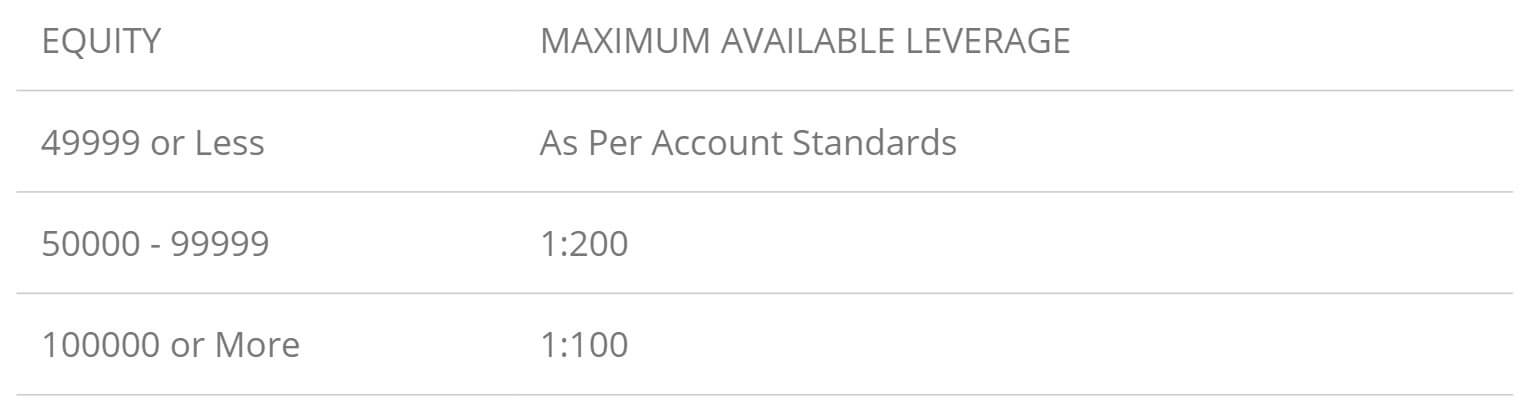

The maximum leverage that you get depends on the account you are using, we have outlined them below.

- Micro: 1:500

- Standard: 1:400

- Premium Account: 1:300

- ECN Pro: 1:200

- Star VIP: 1:200

You can select which leverage you want when opening up an account, once an account is open, should you wish to change the leverage on it you will need to send your request to the customer service team.

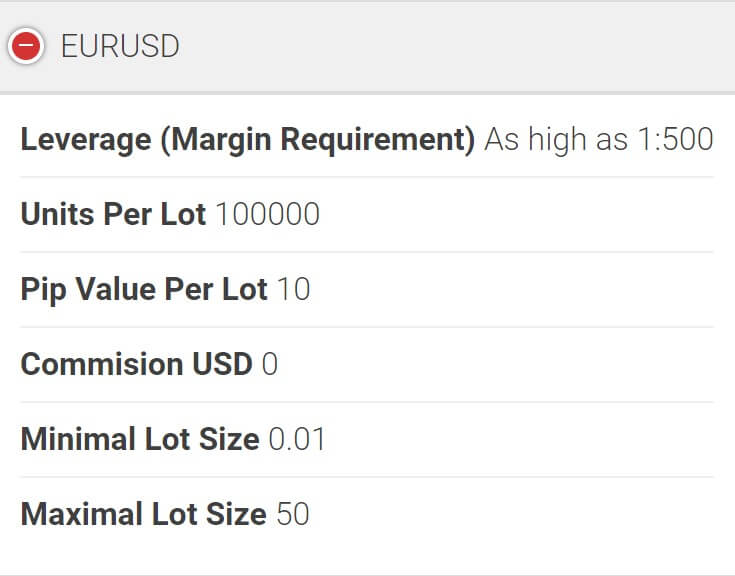

Trade Sizes

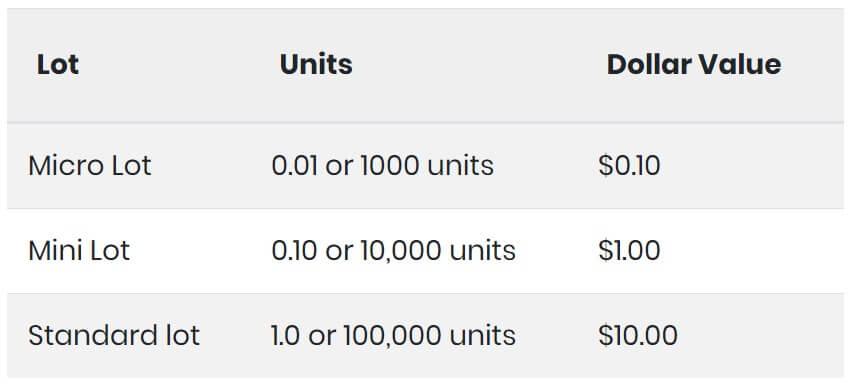

Trade sizes on all accounts start from 0.01 lots which are also known as a micro lot, the trades then go up in increments of 0.01 lots so the next trade would be 0.02 lots and the en 0.03 lots. The maximum trade size available depends on the account that you use. We have outlined the maximum single trade and overall open trades below.

- Micro: Single trade is 20 lots, overall open trades is 150 lots

- Standard: Single trade is 80 lots, overall open trades is 200 lots

- Premium: Single trade is 200 lots, overall open trades are 250 lots

- ECN Pro: No limit to a single trade or overall open positions

- Star VIP: No limit to a single trade or overall open positions

While some of the lot sizes go quite high, we would not recommend trading over 50 lots in a single trade due to difficulties executing the trade quickly and without any slippage.

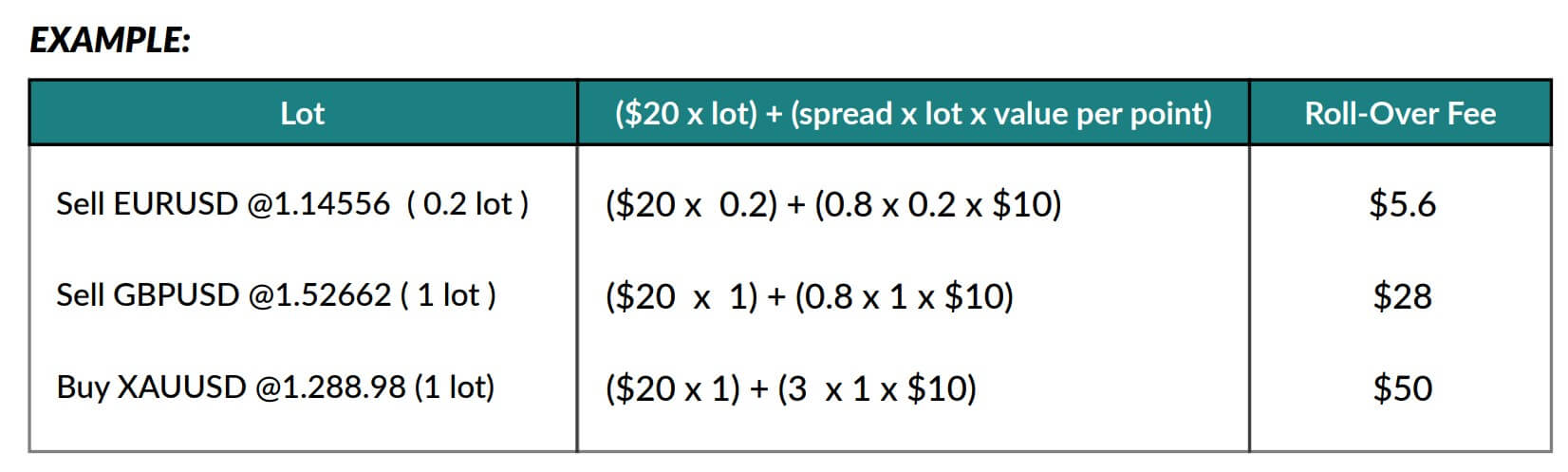

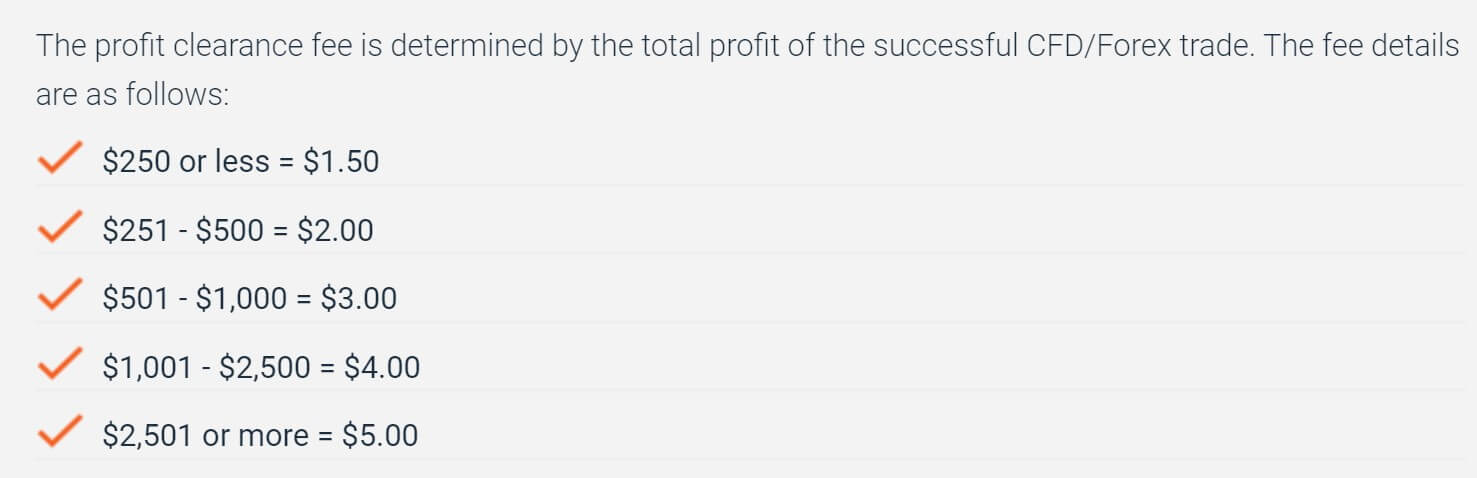

Trading Costs

The ECN Pro and Star VIP account both come with commissions due to their low spreads, the ECN Pro account has a commission of $6 per lot traded which is in line with the industry standard of $6 per lot. The Star VIP account has a commission of $16 per million traded which is around $1.6 per lot traded, well below the industry standard. The other accounts use a spread based system that we will look at later in this review.

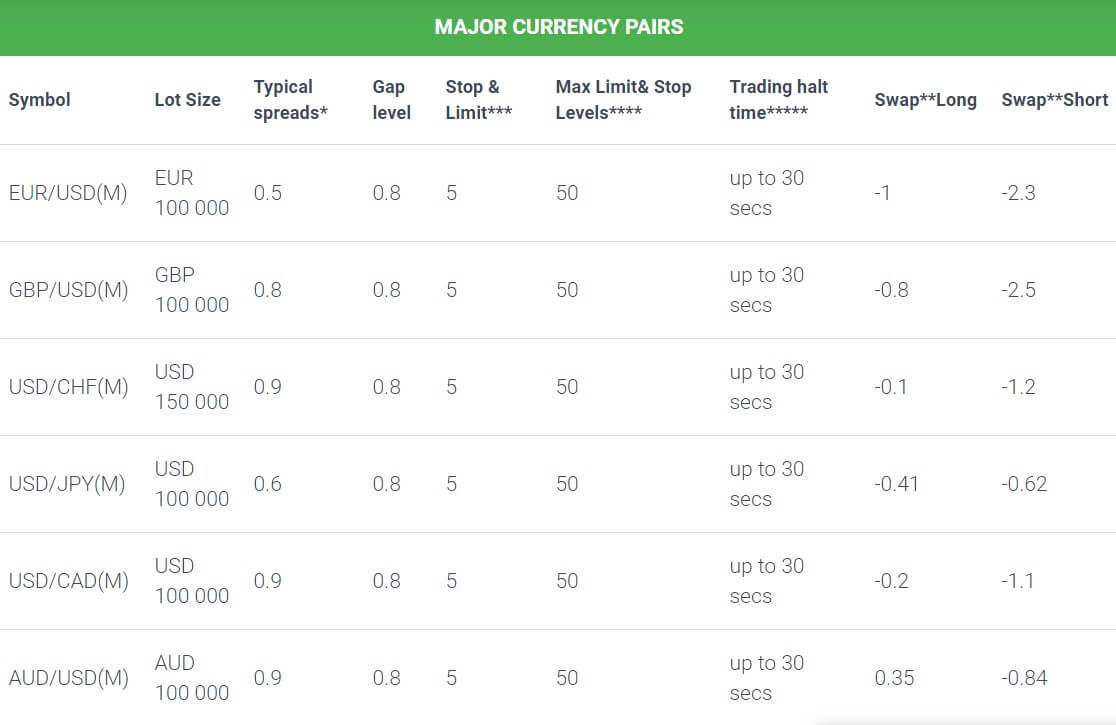

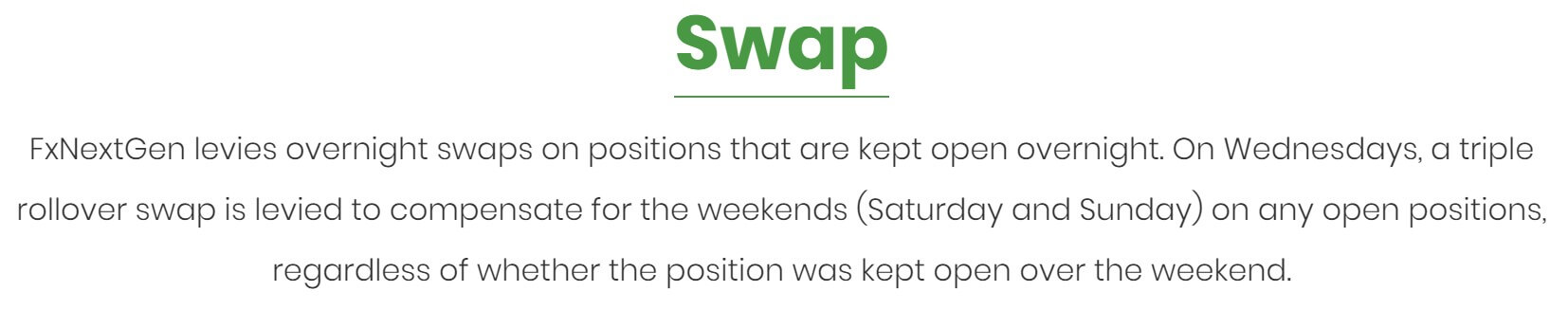

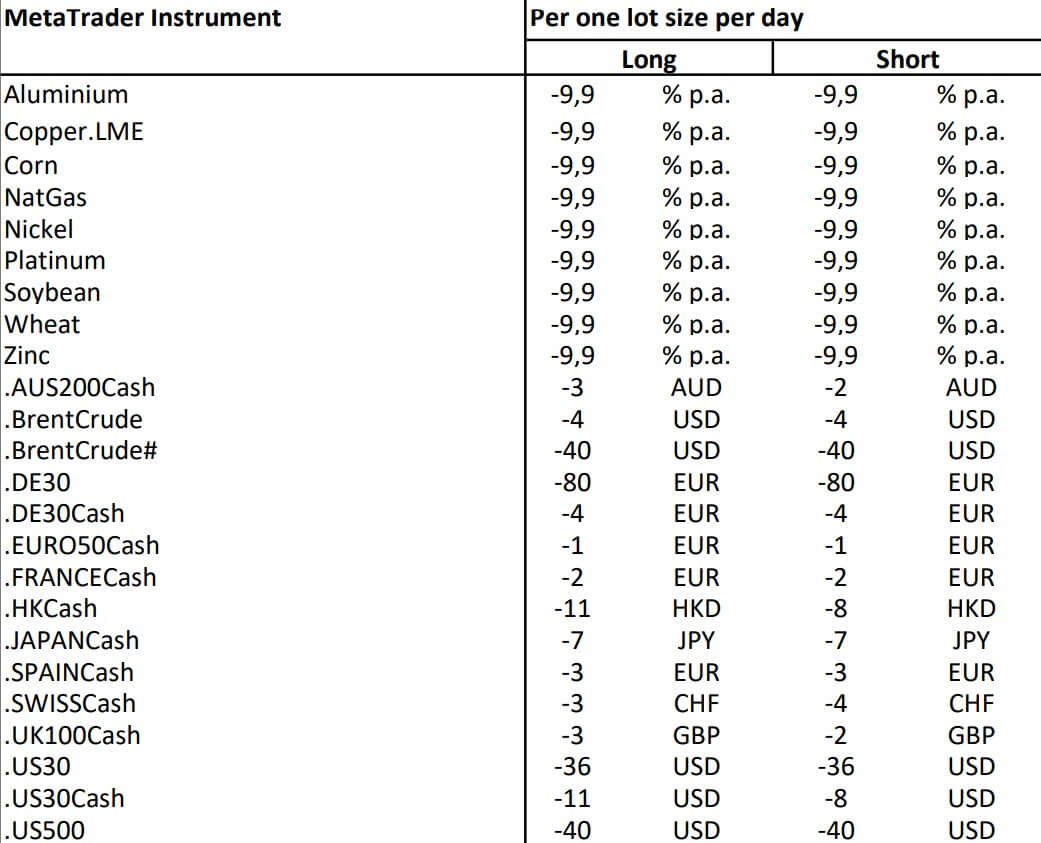

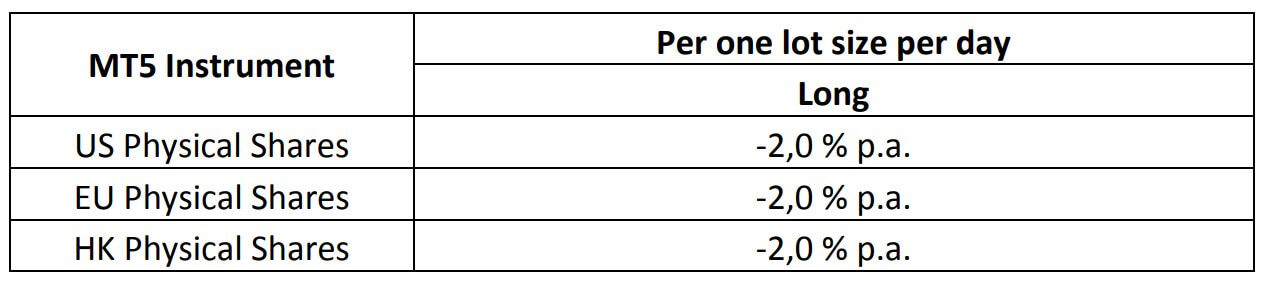

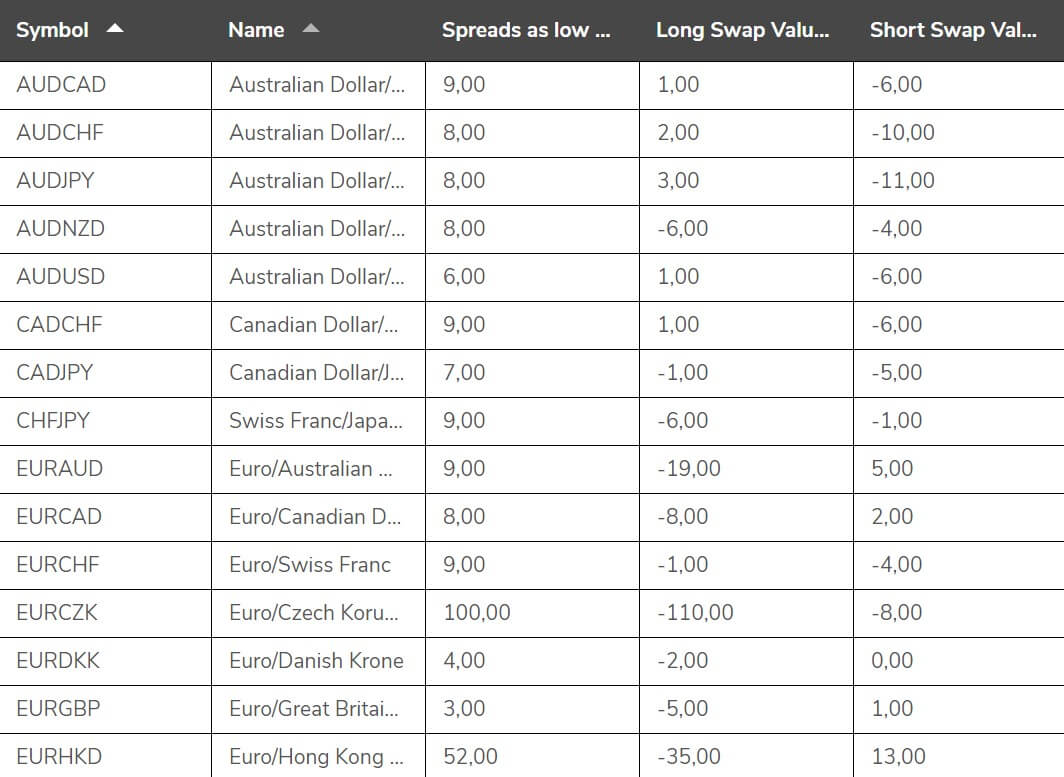

There are also swap charges, these are interests that are either positive or negative and are paid for holding trades overnight, they can be viewed within the trading platform of choice. Islamic account sare available and if using one, there are no swap charges added to the account.

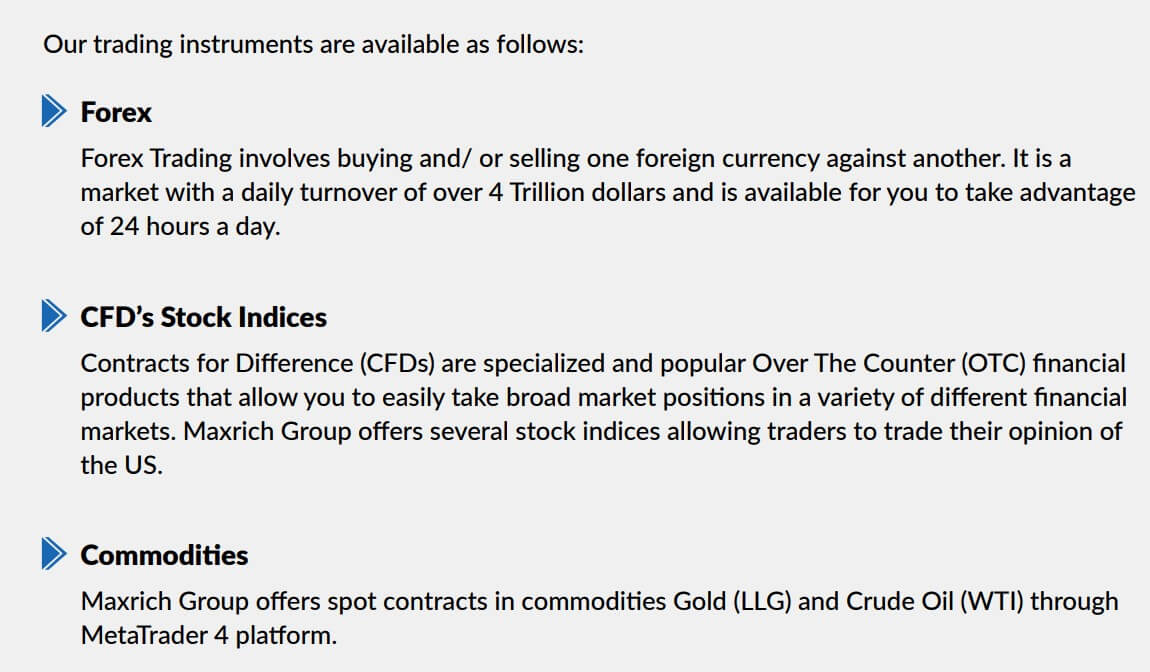

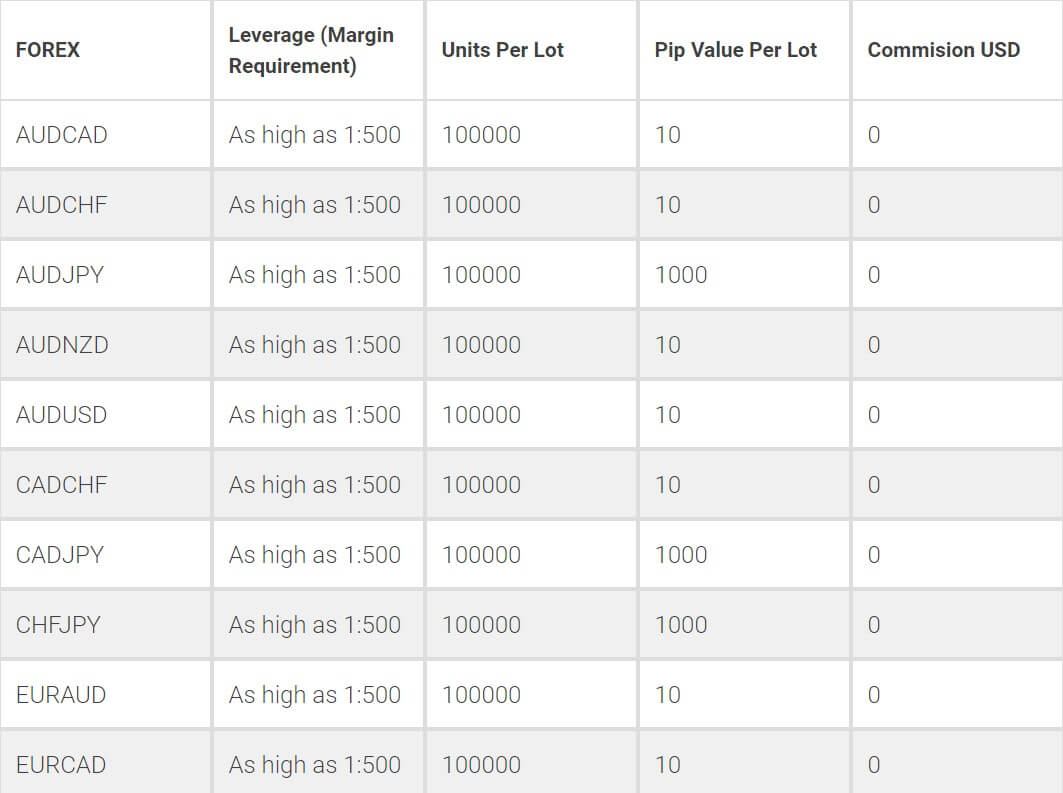

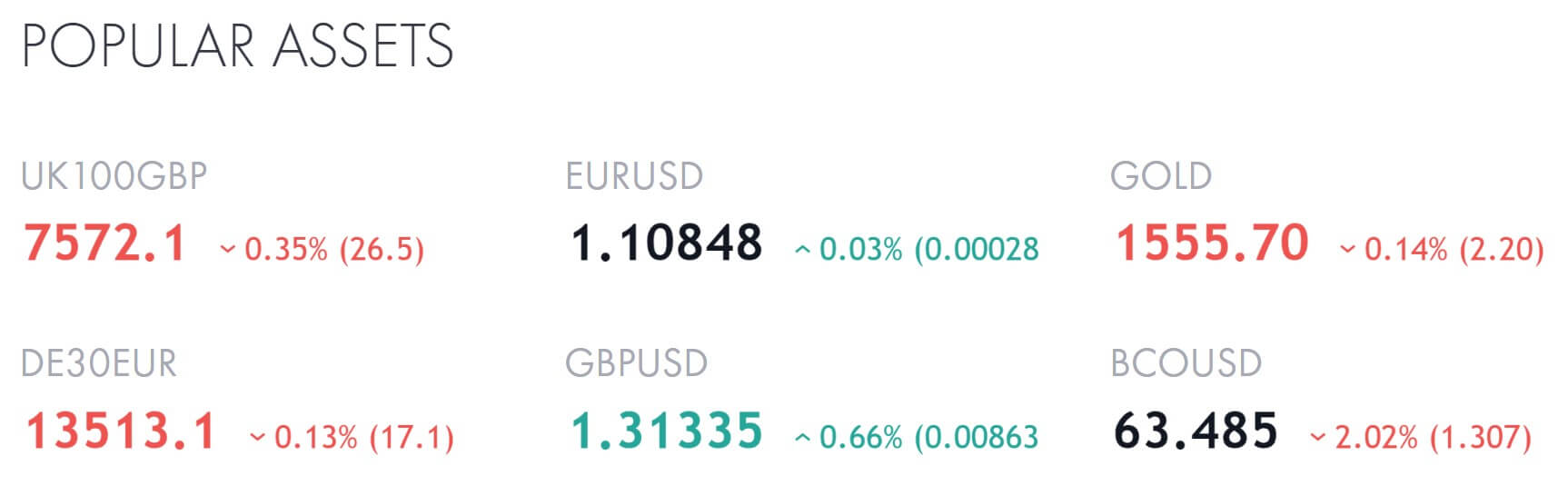

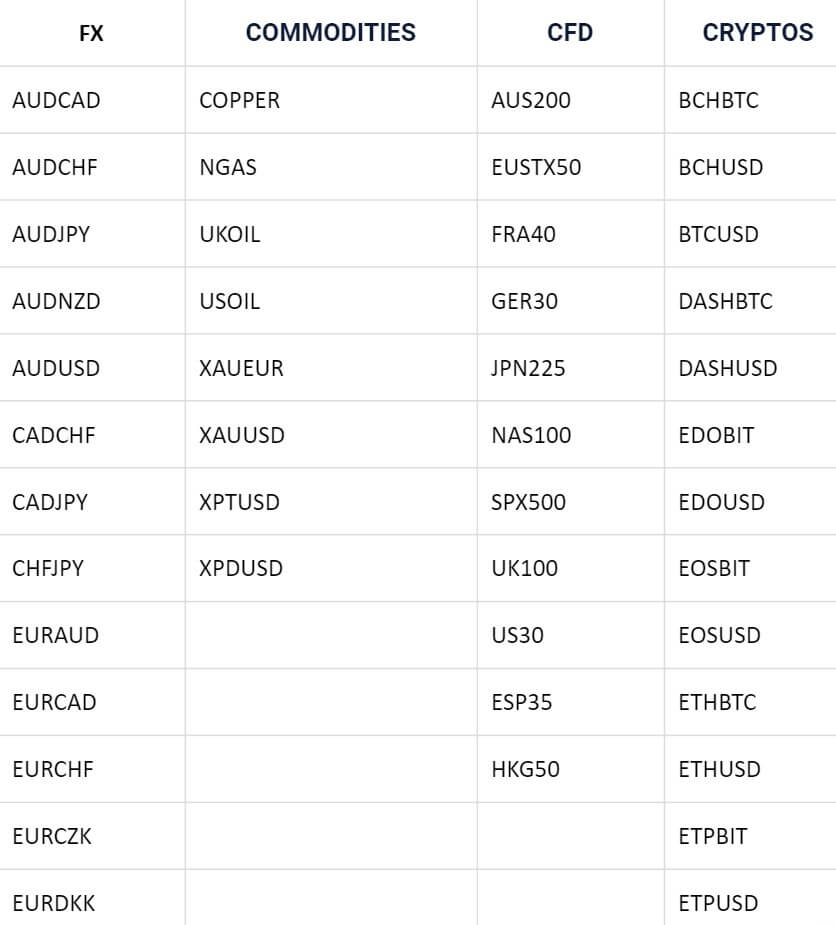

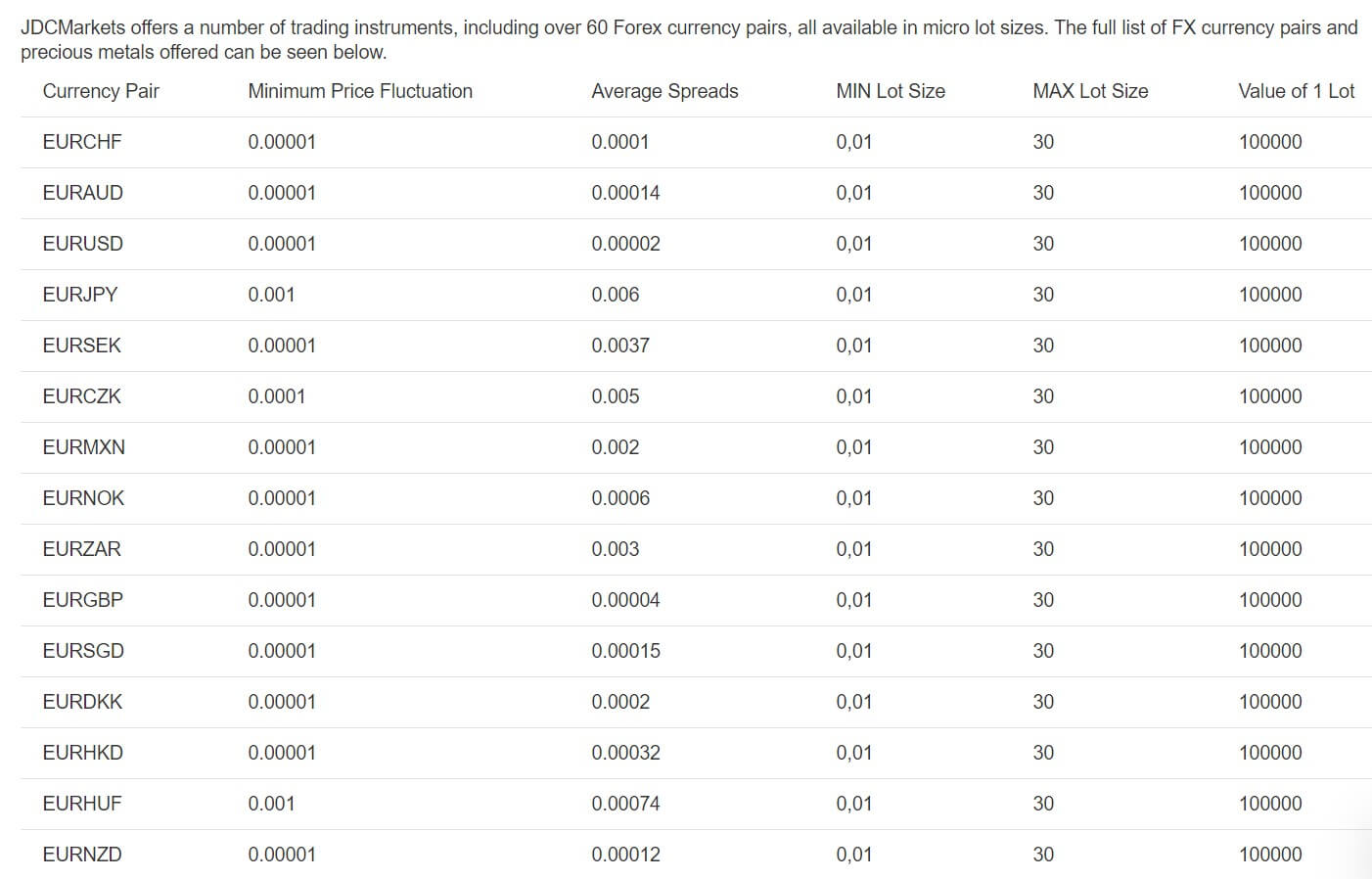

Assets

There aren’t actually that many assets to trade, they have all be lumped into a single list so we have separated them out into different categories for you to easily see what is available.

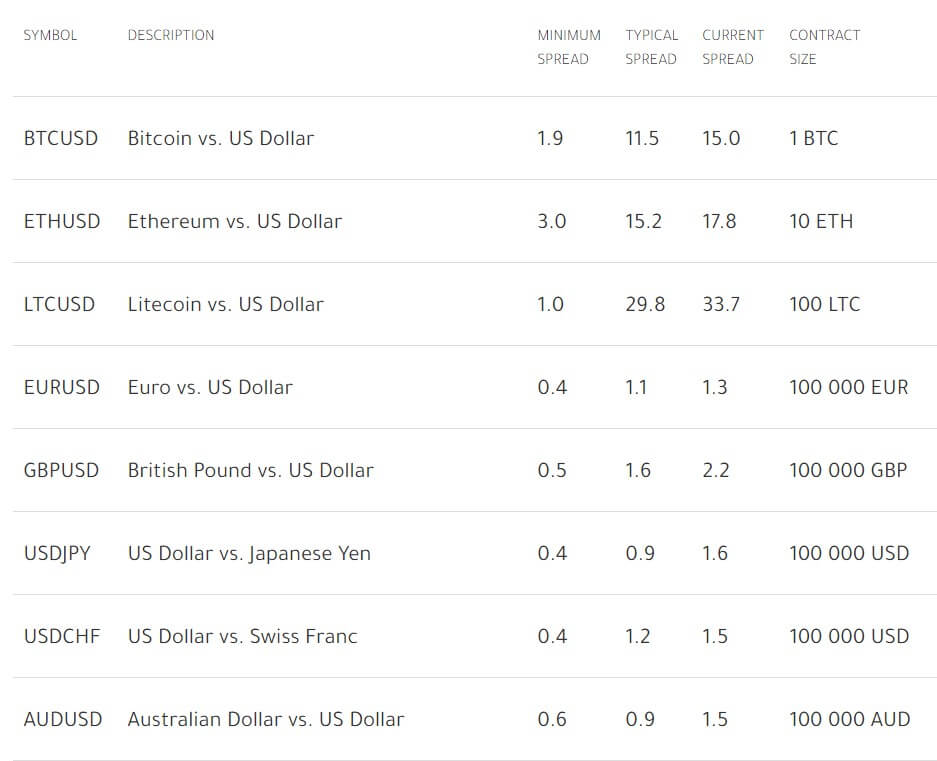

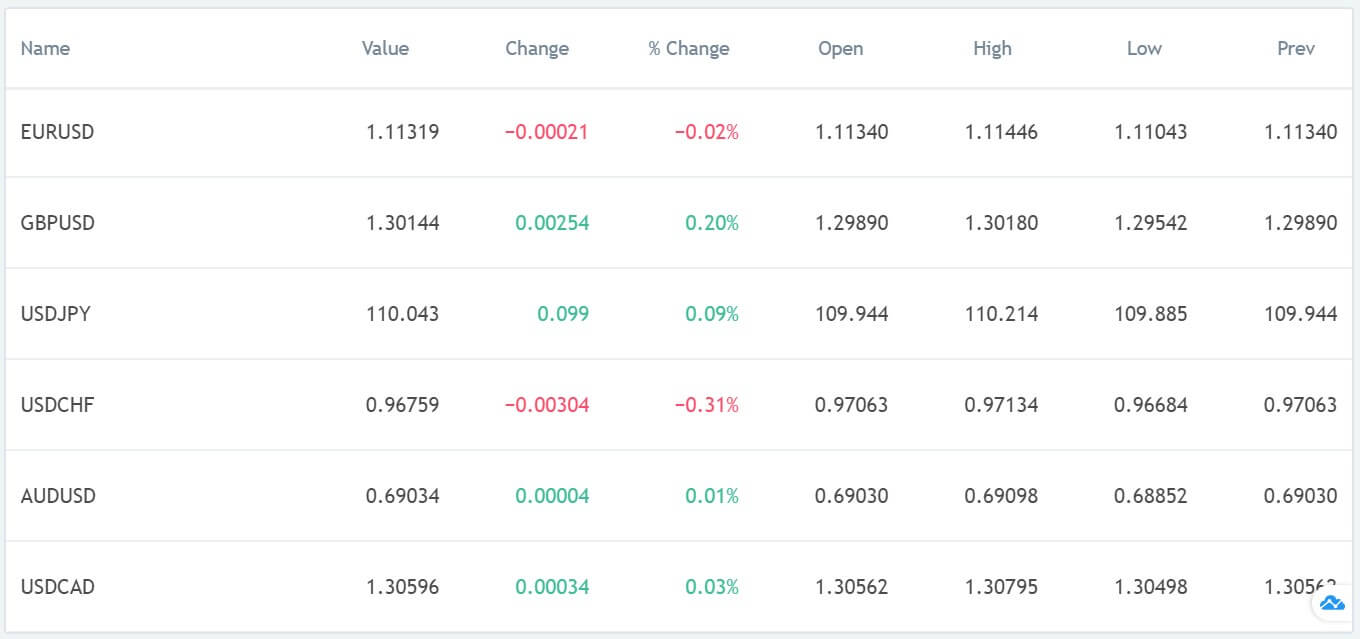

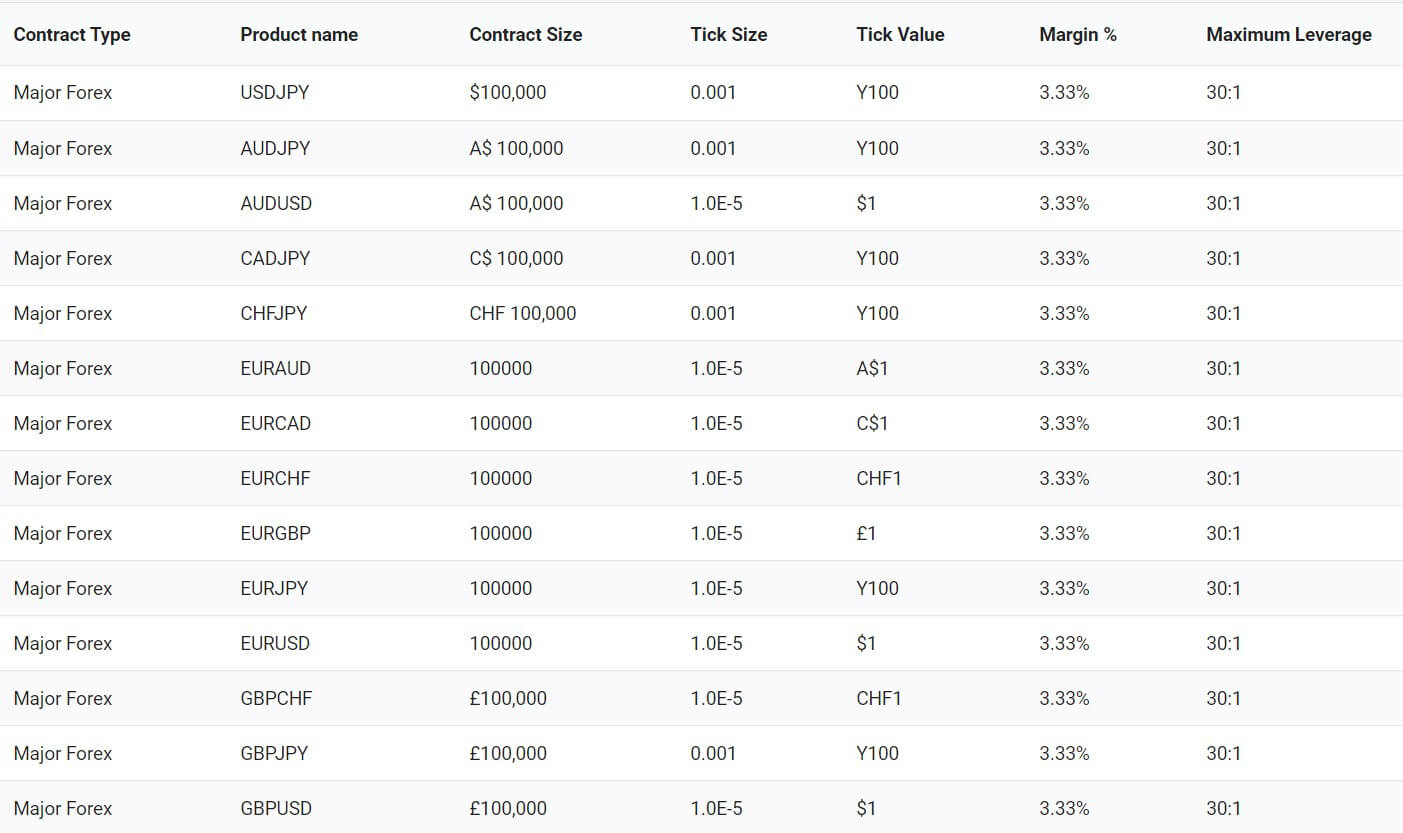

Forex: EURUSD, GBPUSD, USDJPY, USDCHF, AUDUSD, NZDUSD, USDCAD, EURGBP, EURJPY, EURCHF, EURAUD, EURNZD, EURCAD, GBPJPY, GBPCHF, GBPAUD, GBPNZD, GBPCAD, CHFJPY, AUDJPY, AUDCHF, AUDNZD, AUDCAD, NZDJPY, NZDCHF, NZDCAD, CADJPY, CADCHF.

Crypto: BTCUSD (Bitcoin), ETHUSD (Ethereum), LTCUSD ()Litecoin).

Metals: XAGUSD (Silver), XAUUSD (Gold.

Indices: Australia 200, German 30, Nasdaq 100 and, Dow Jones 30.

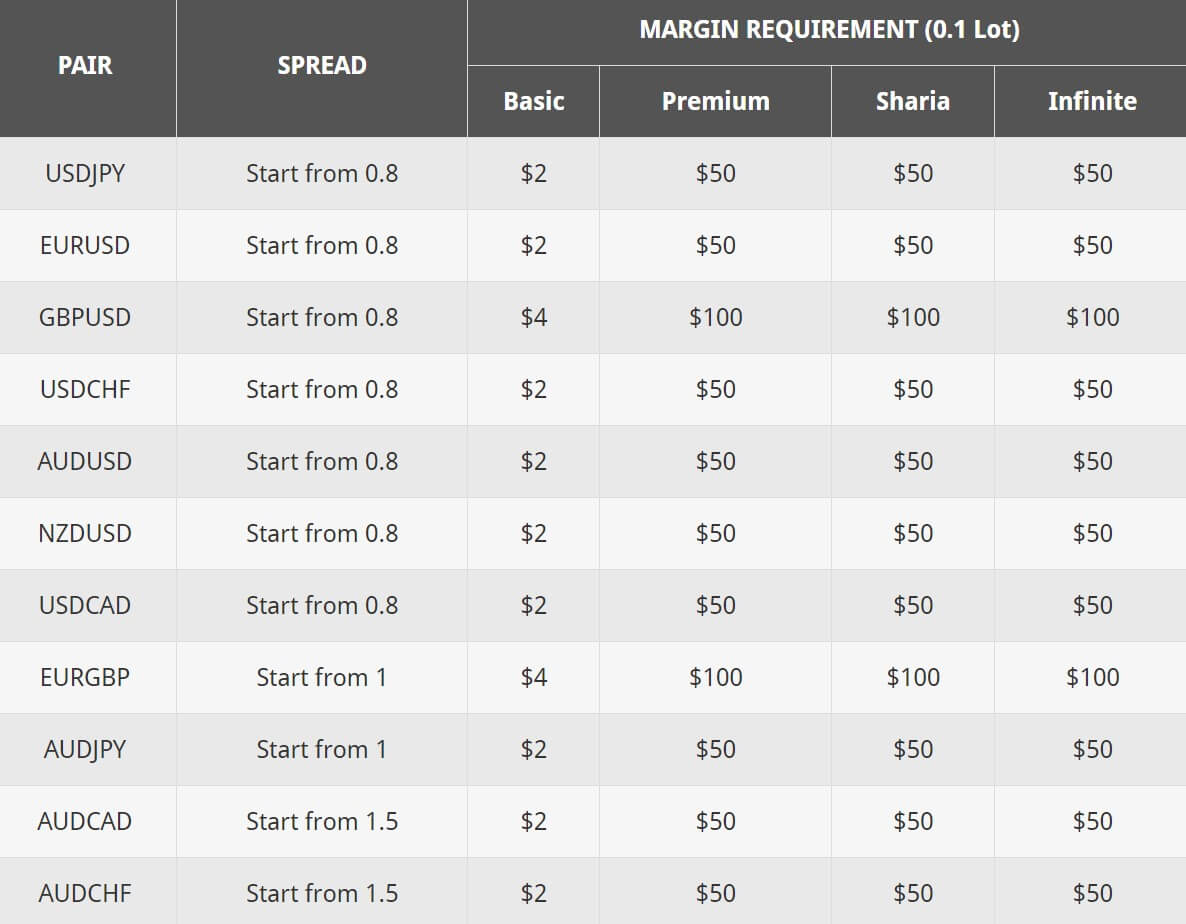

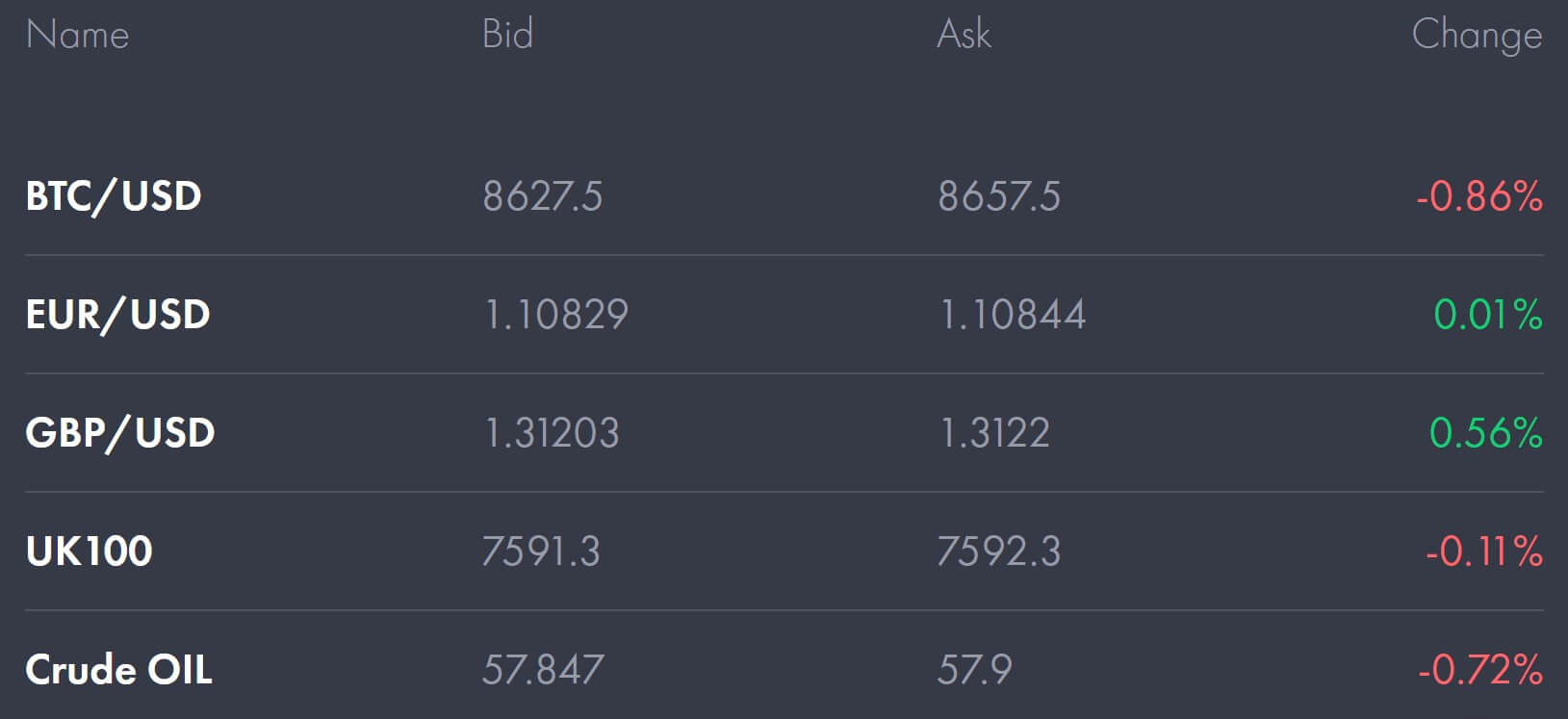

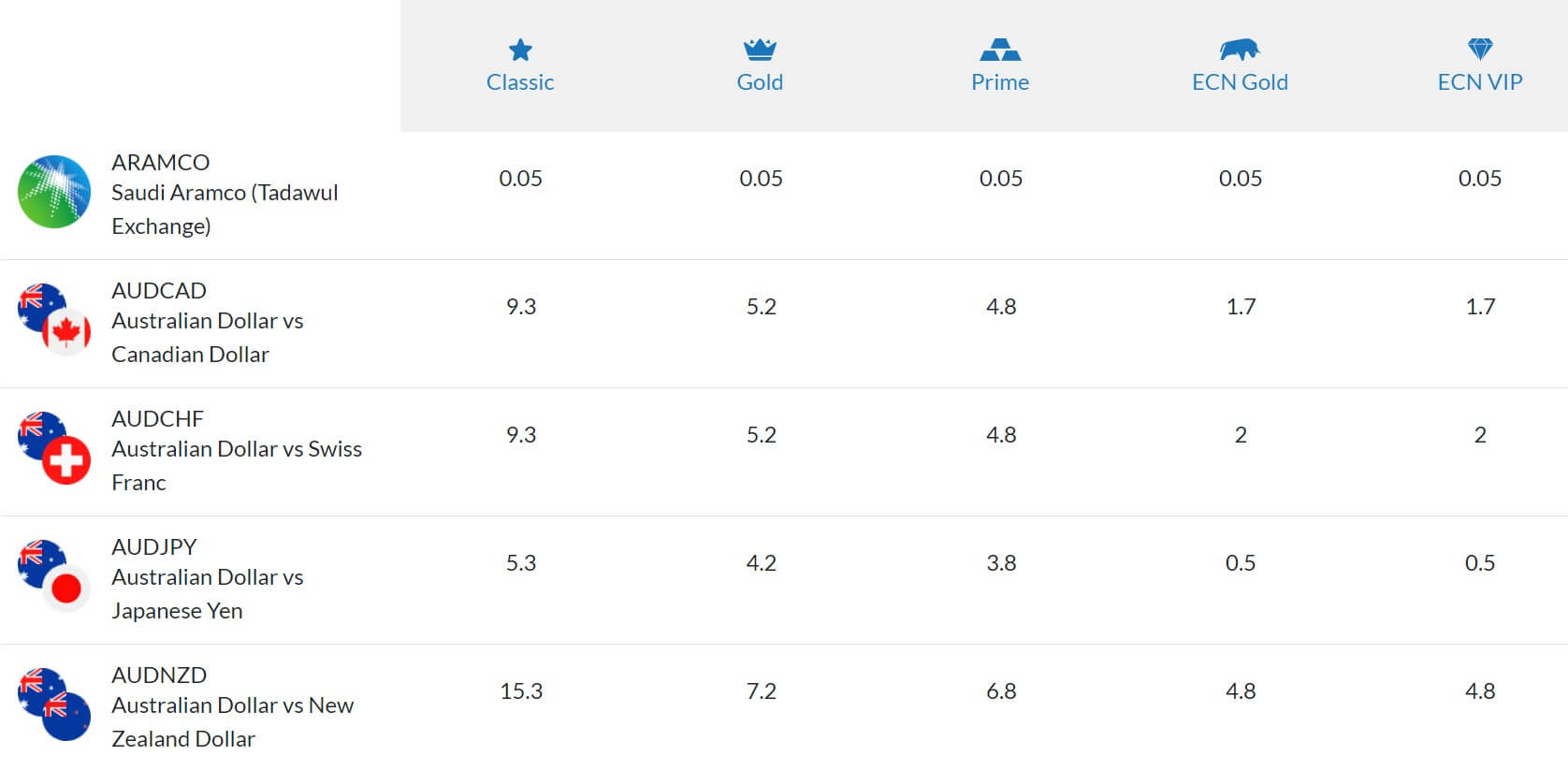

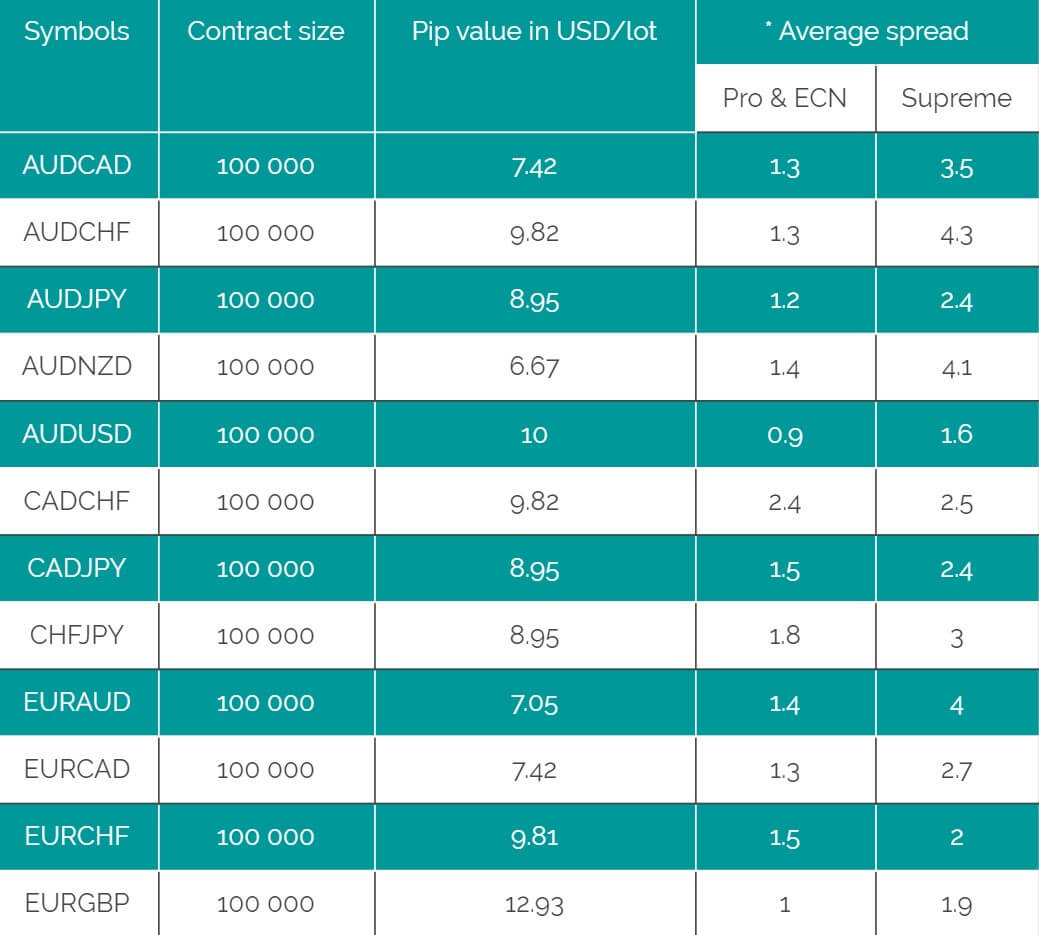

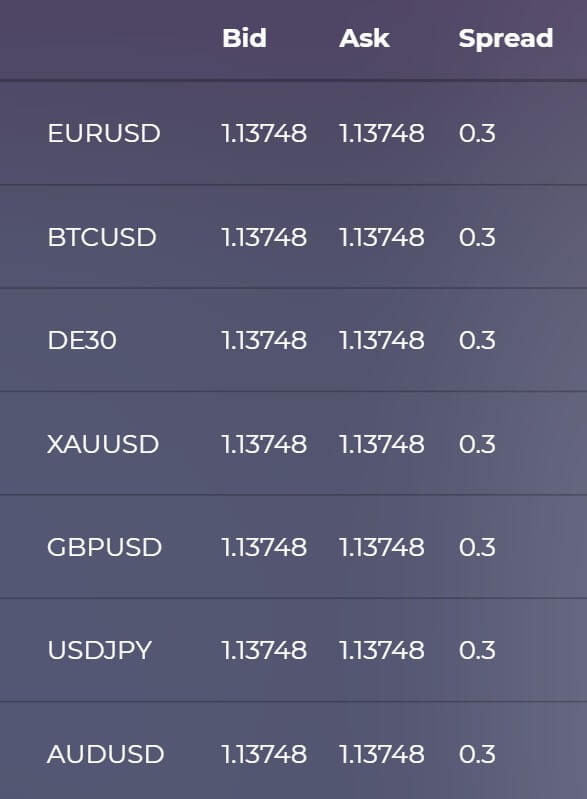

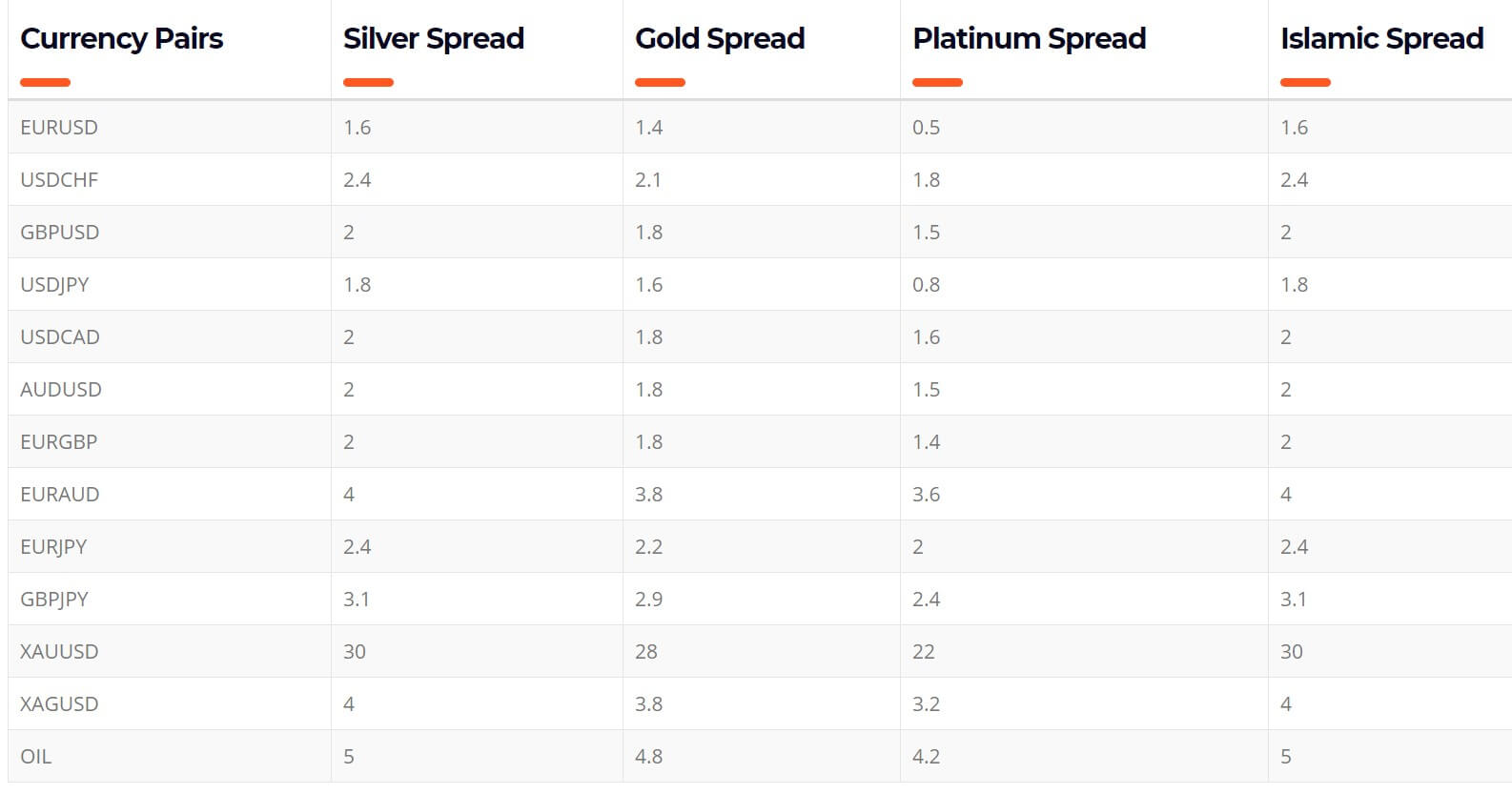

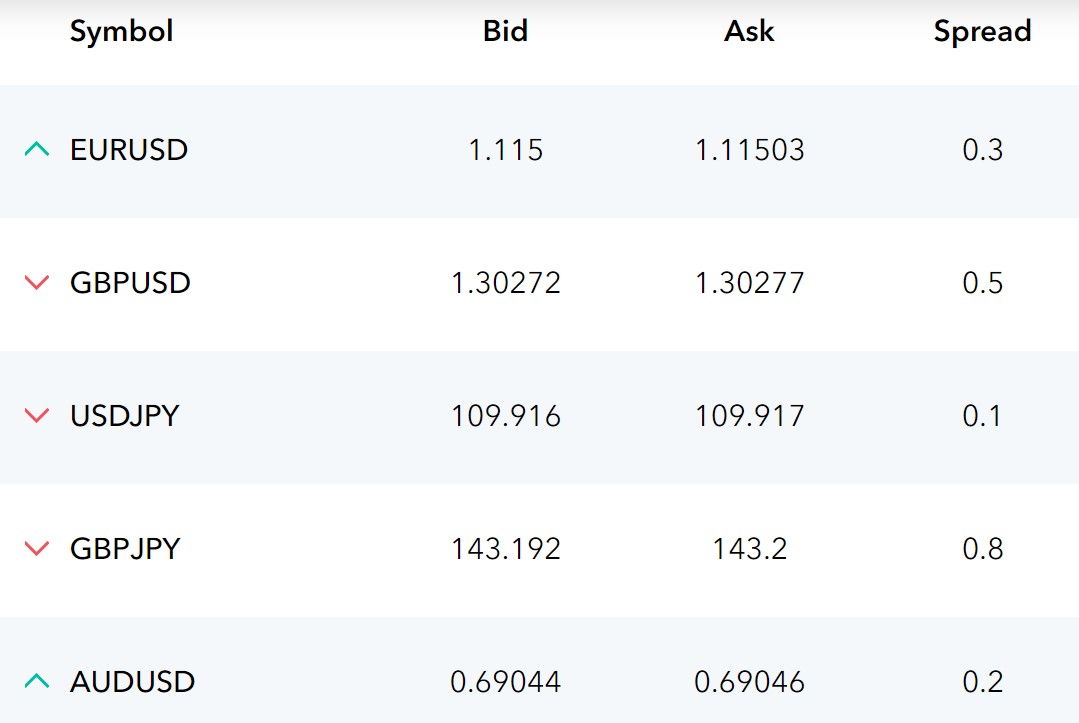

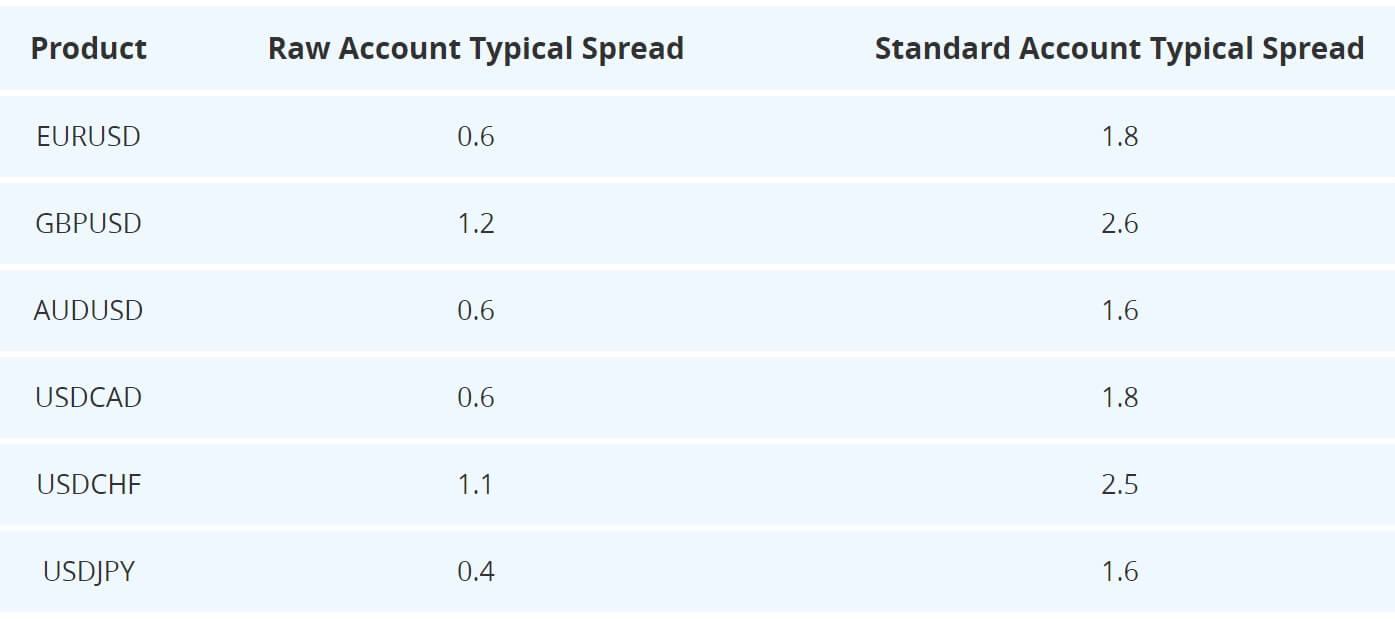

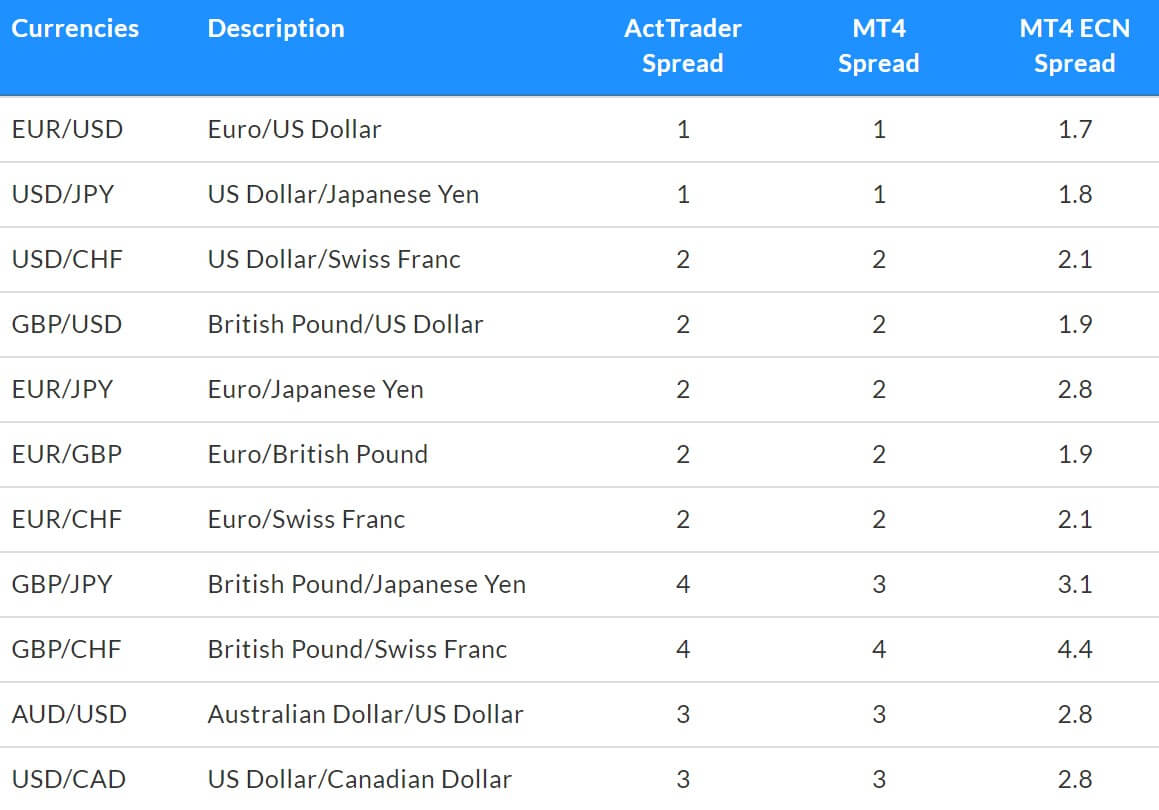

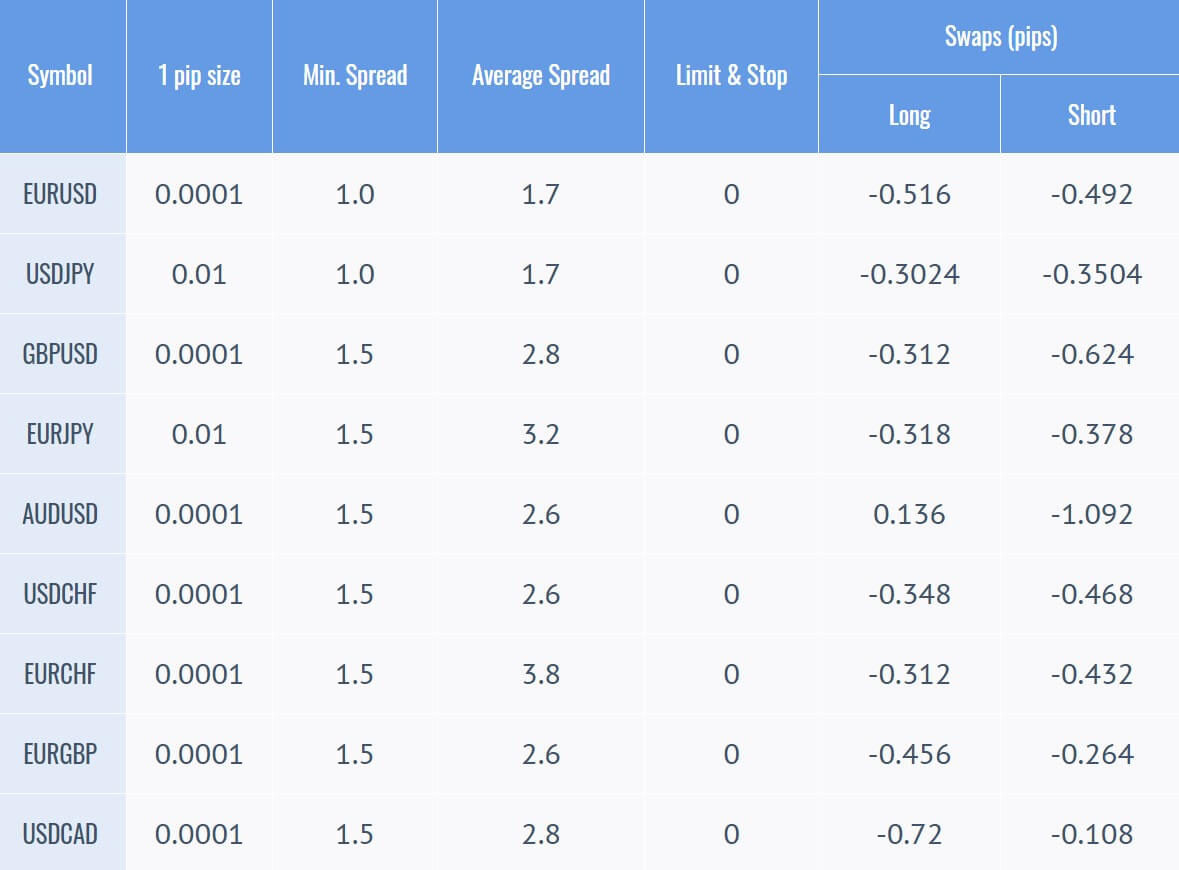

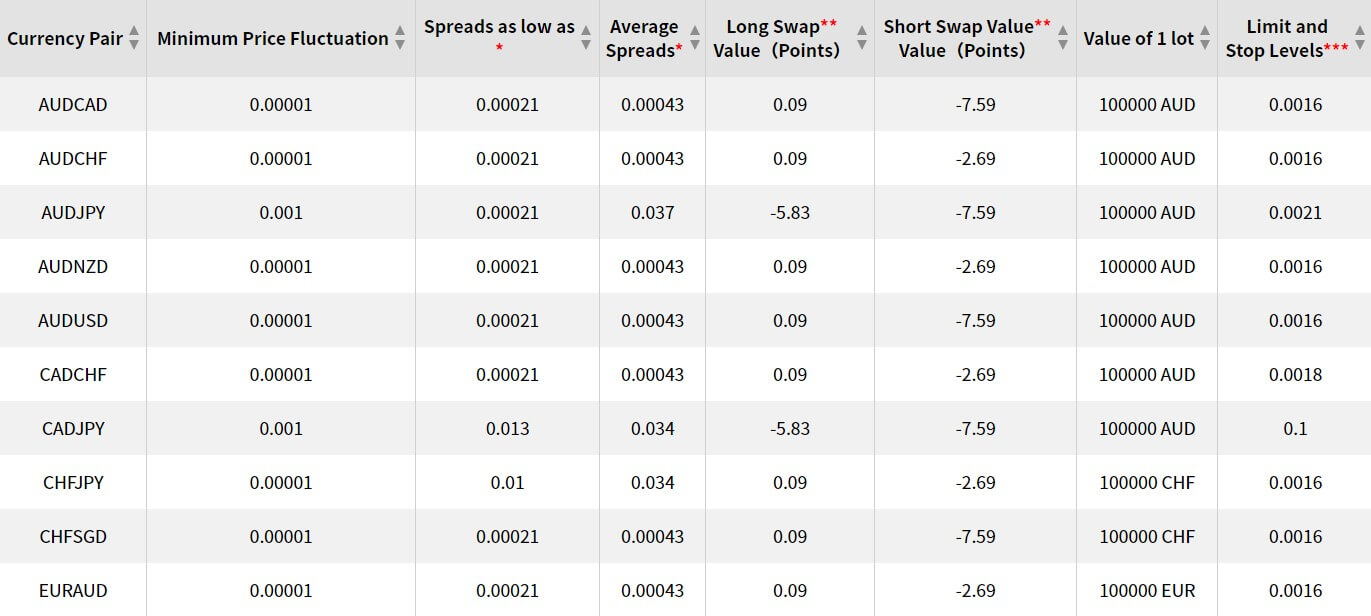

Spreads

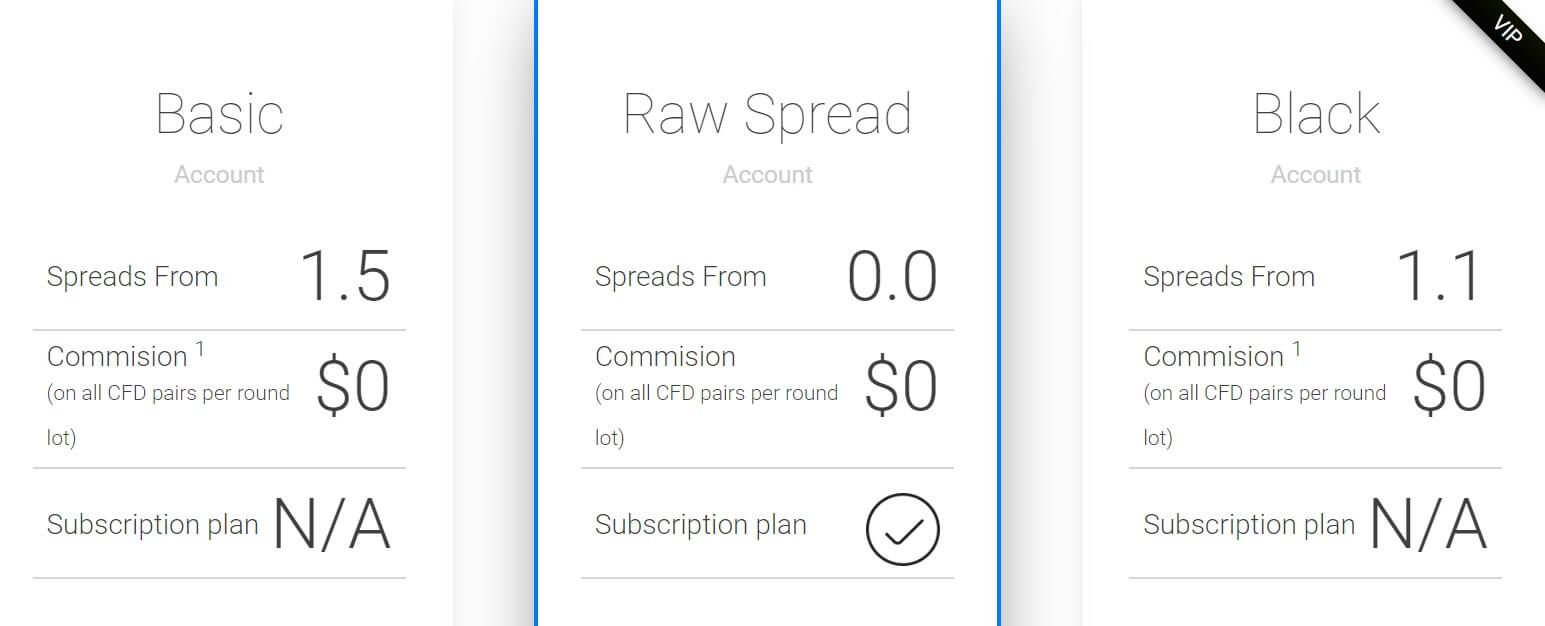

Just like most things, this depends on the account you are using, we have outlined the minimums below.

- Micro: Variable spread from 3 pips

- Standard: Variable spread from 2 pips

- Premium: Variable spread from 1.6 pips

- ECN Pro: Variable spread from 0 pips

- Star VIP: Variable spread from 0 pips

The spreads are variable which means that they are constantly changing and during times of high volatility they can be seen a lot higher than the stated number. It should also be noted that different currency pairs will have different spreads, as an example EURGBP currently has a spread of 2.4 pips while EURNZD has a spread of 5.7 pips.

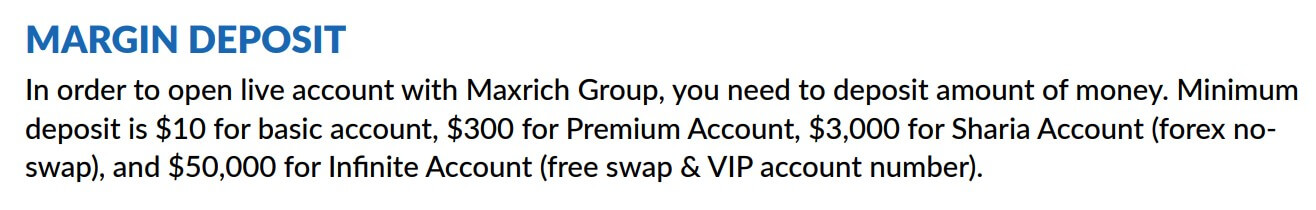

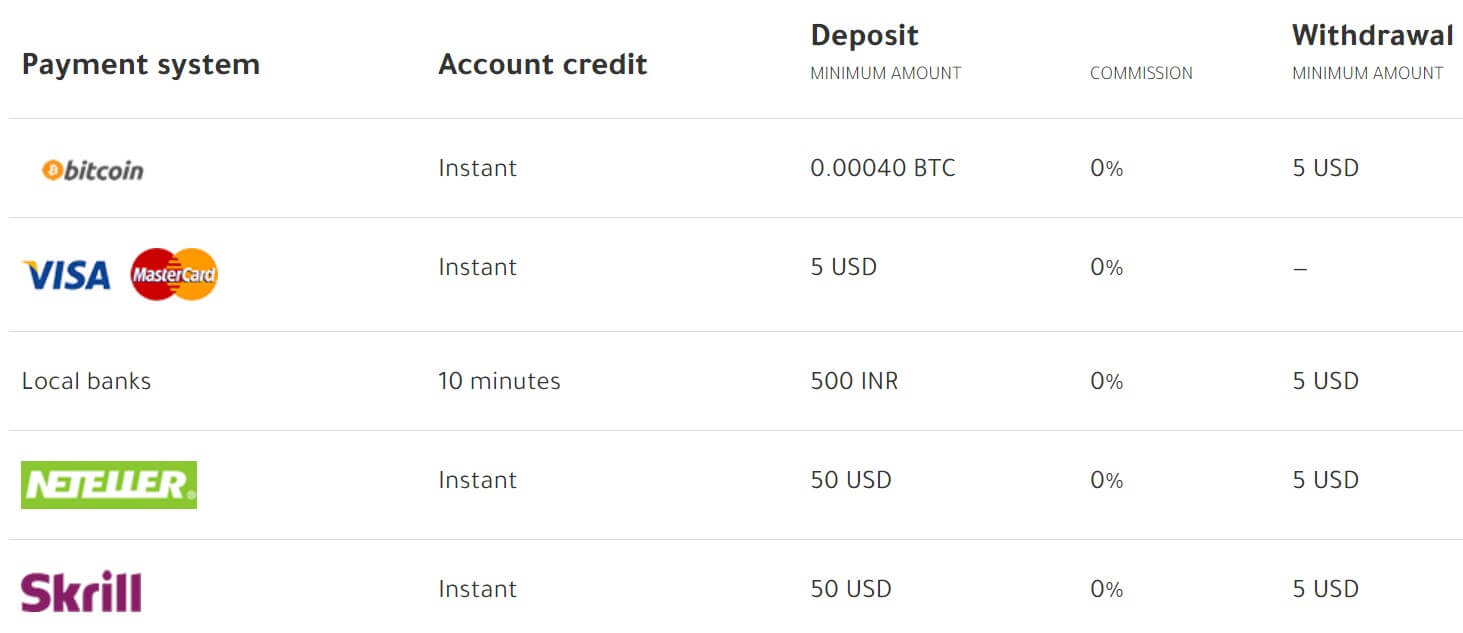

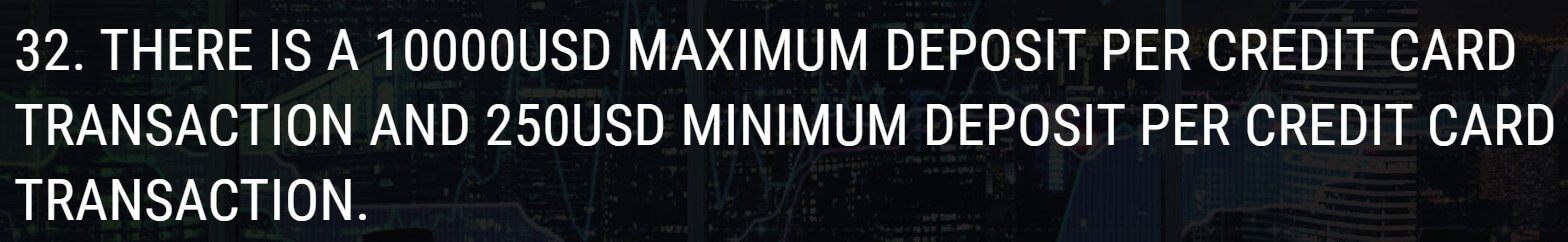

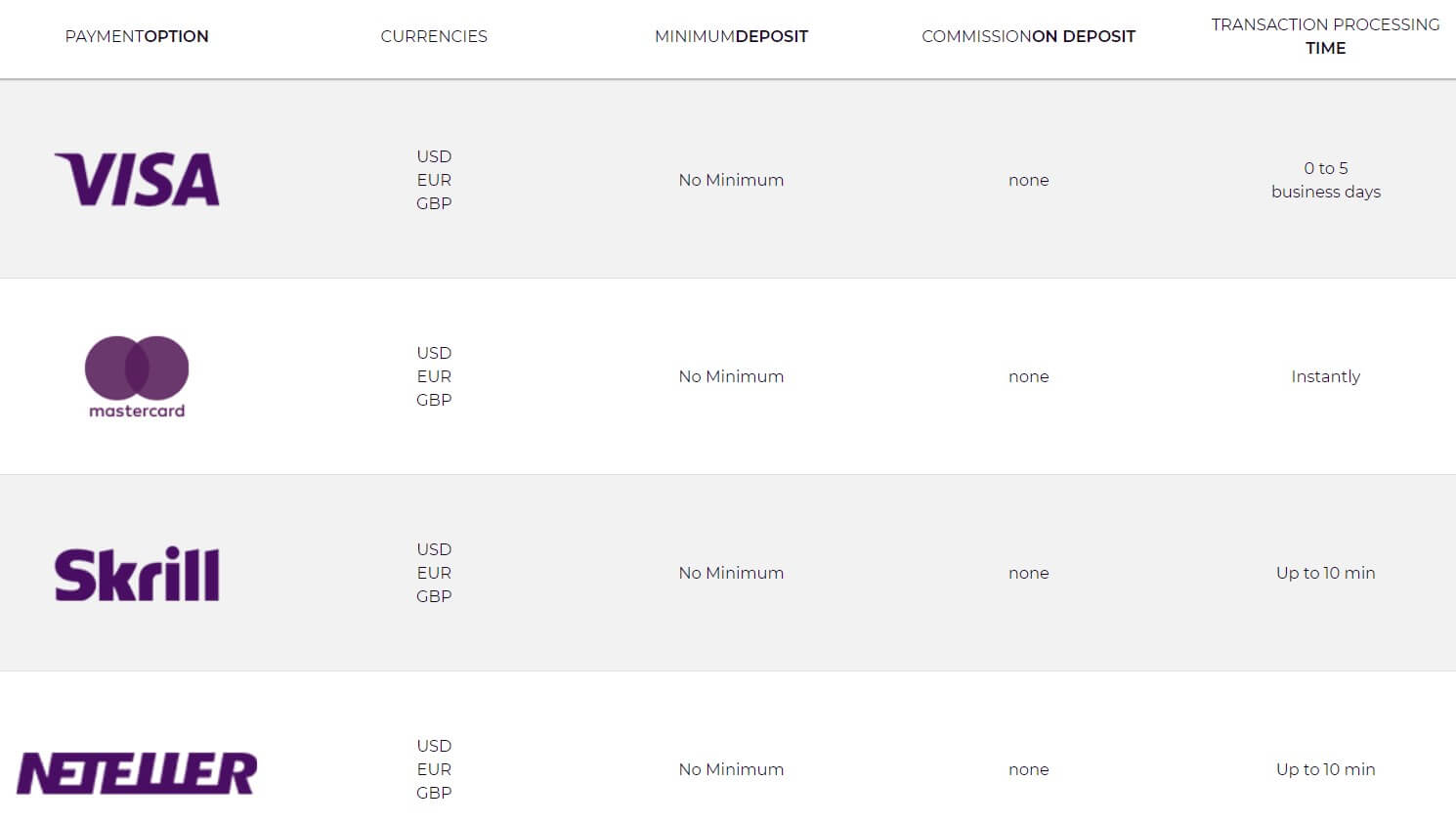

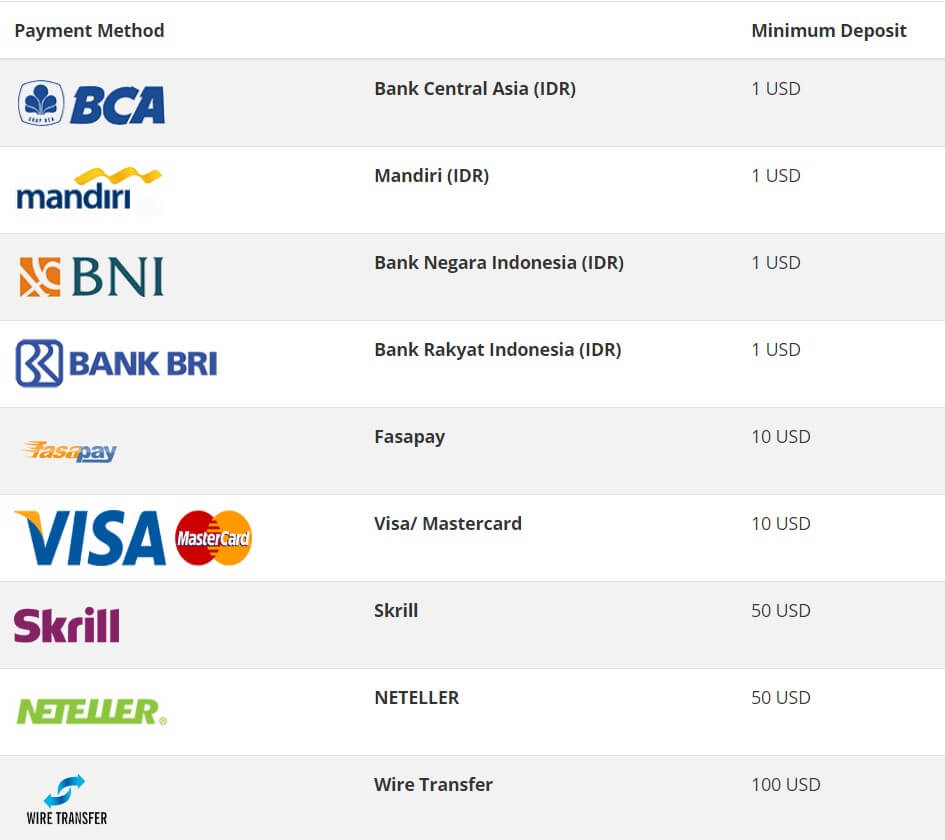

Minimum Deposit

The minimum requirement to open an account is $5 which will get you the Micro account, once any of the accounts are open, the minimum amount to top up is set at $5. Different payment methods have different minimum deposits though. The minimum deposits are as follows:

- Bitcoin: 0.00040 BTC

- Visa / MasterCard: 5 USD

- Local Banks: 500 INR

- Neteller: 50 USD

- Skrill: 50 USD

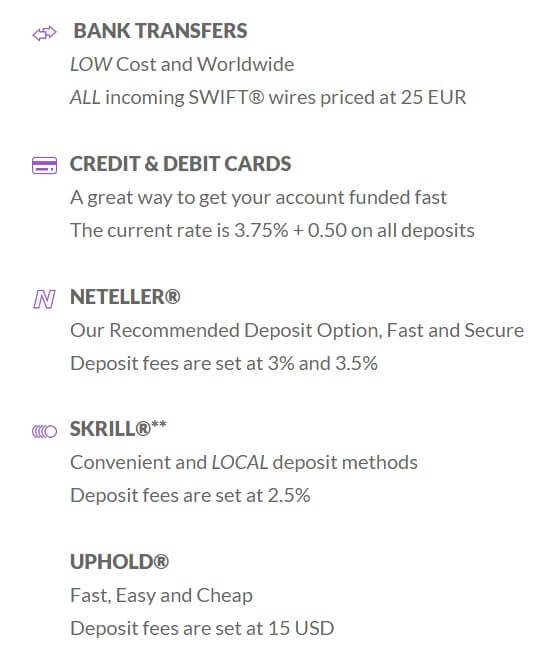

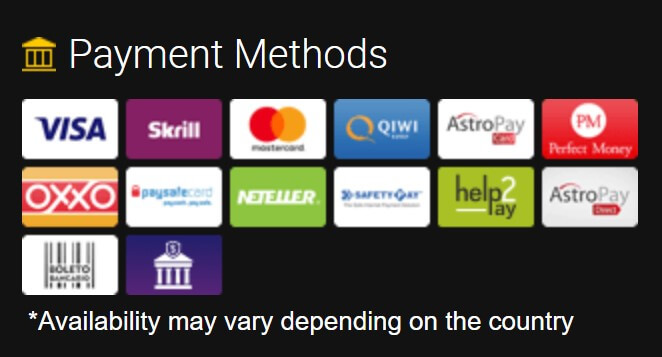

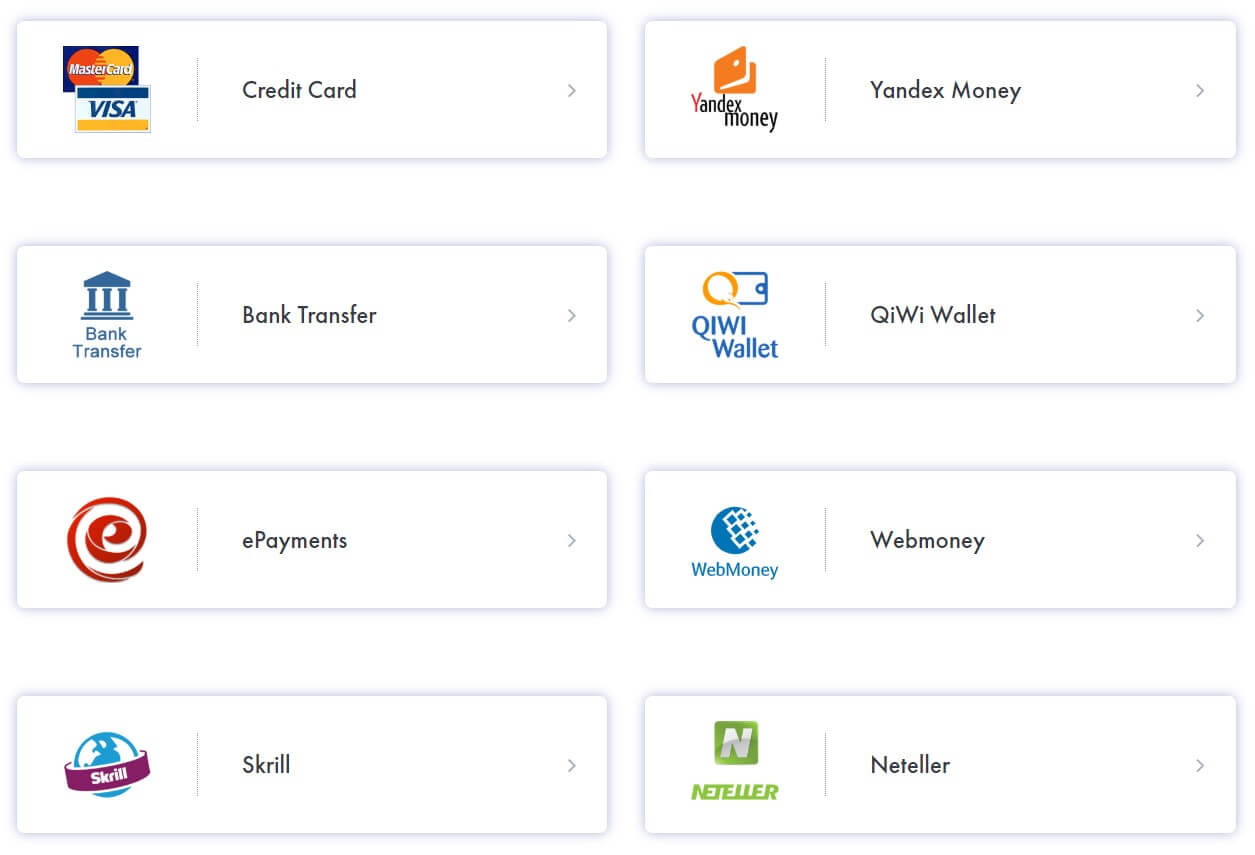

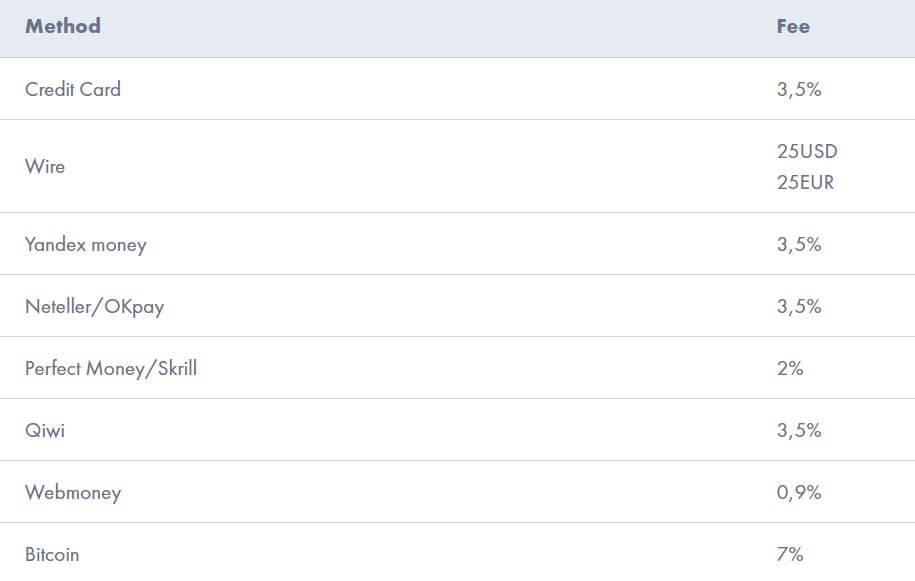

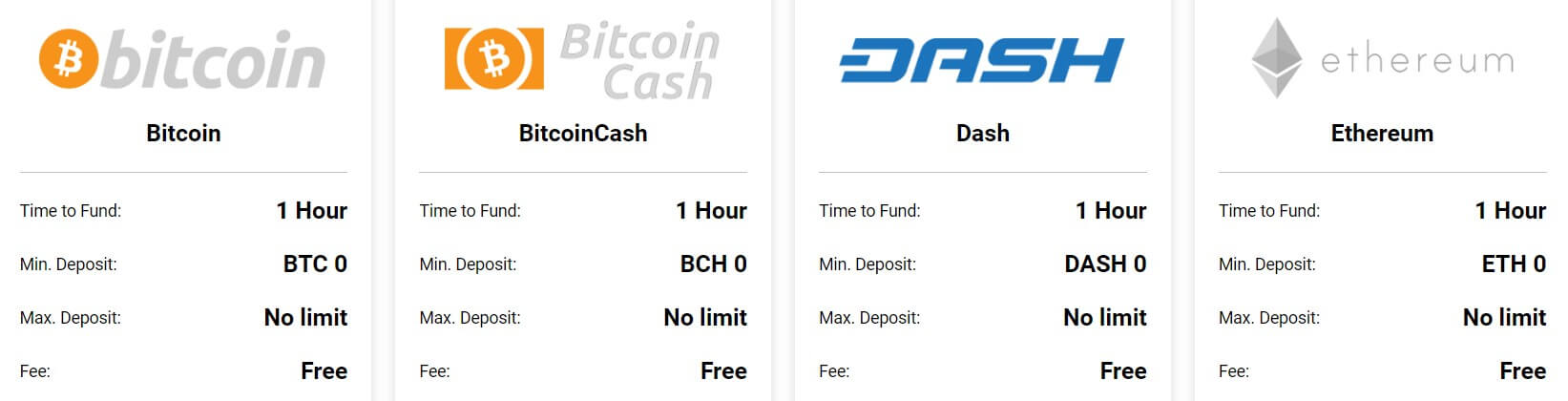

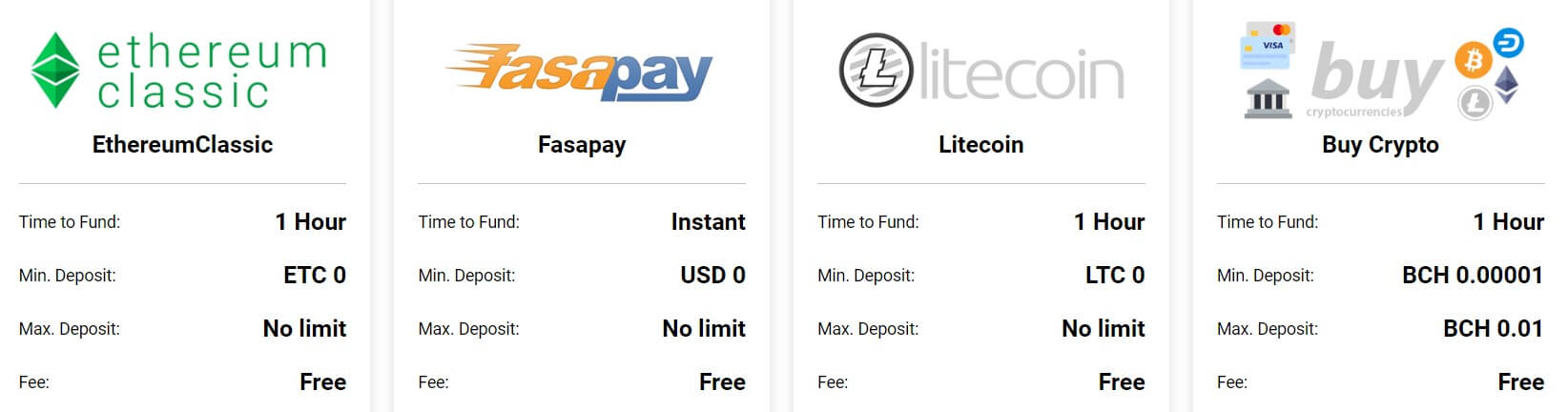

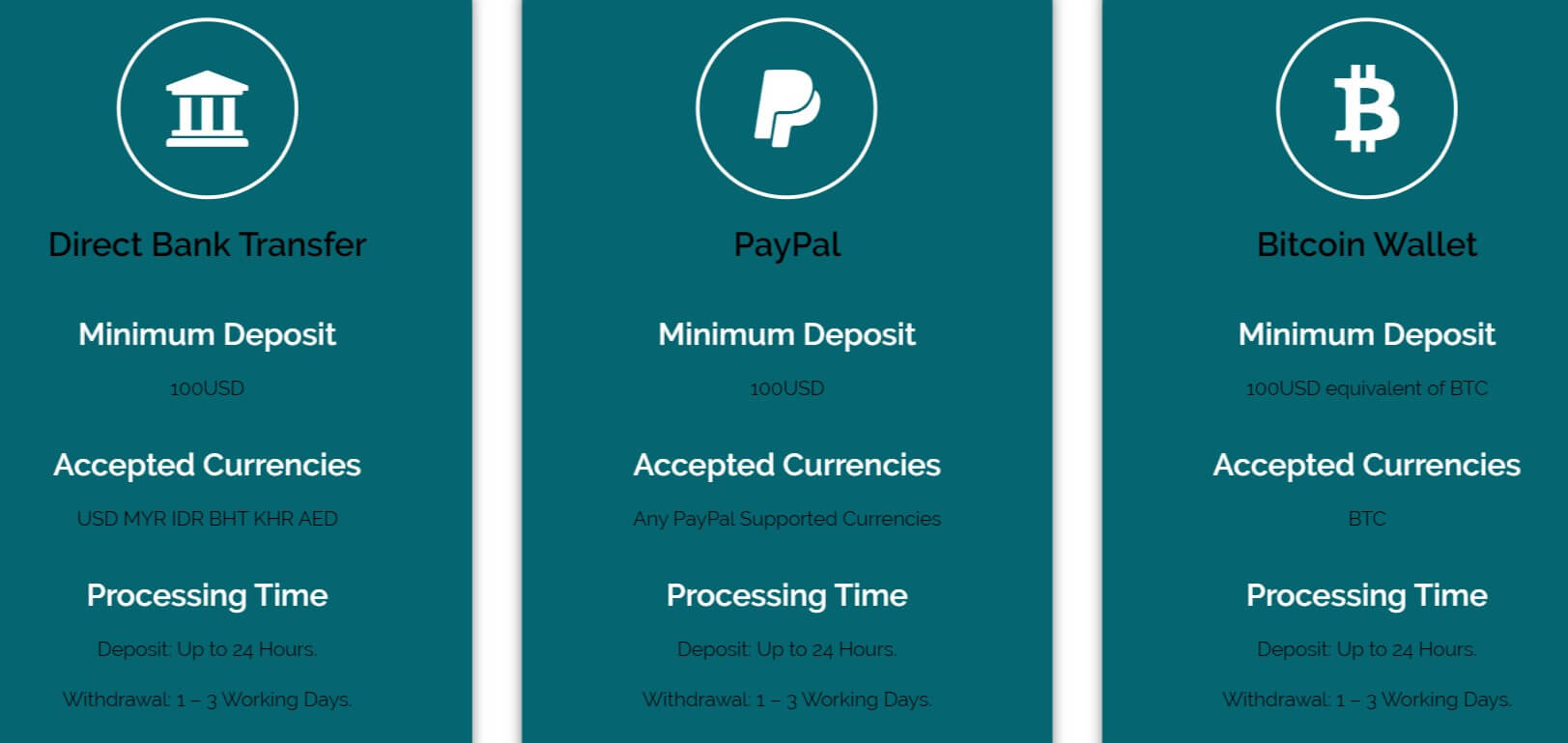

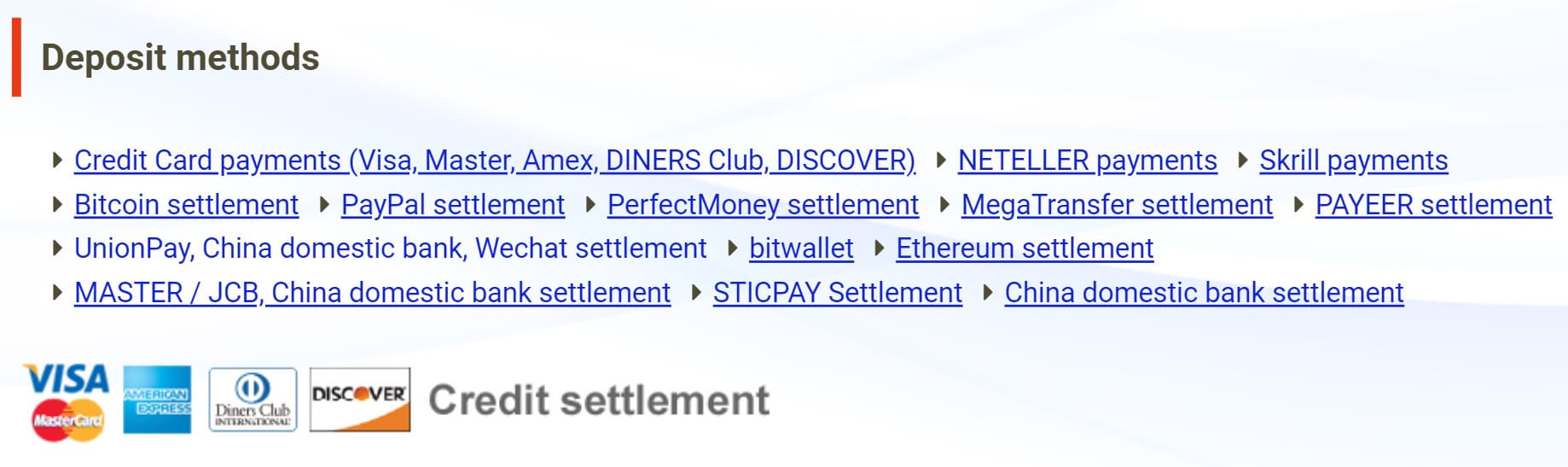

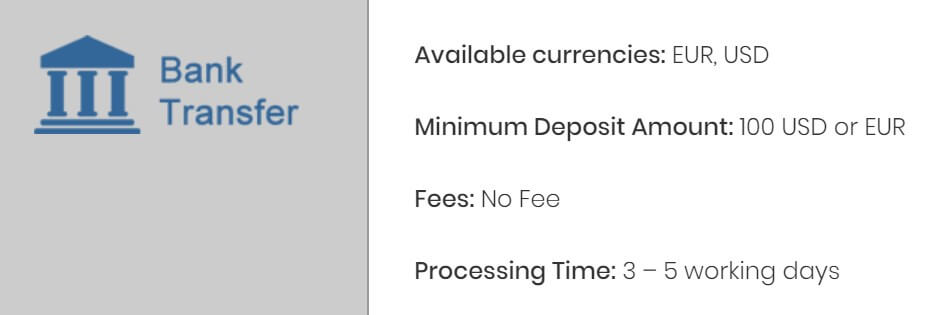

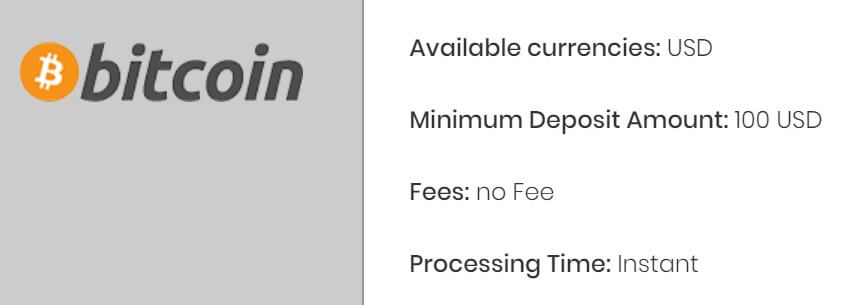

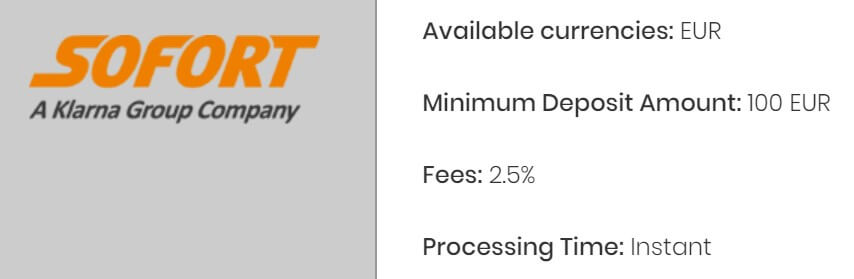

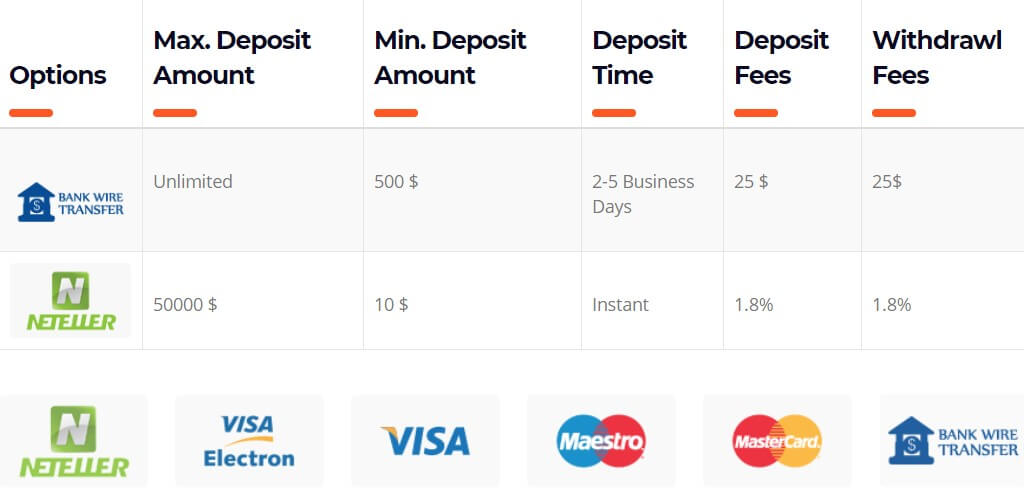

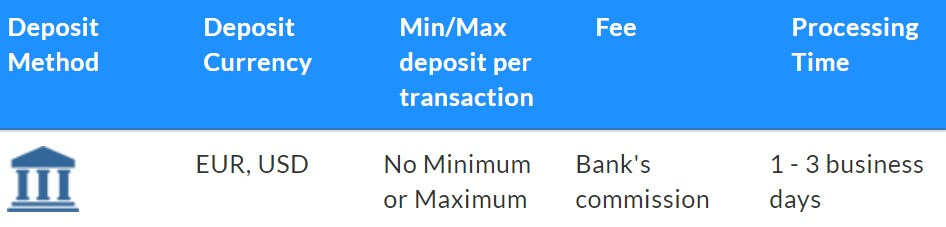

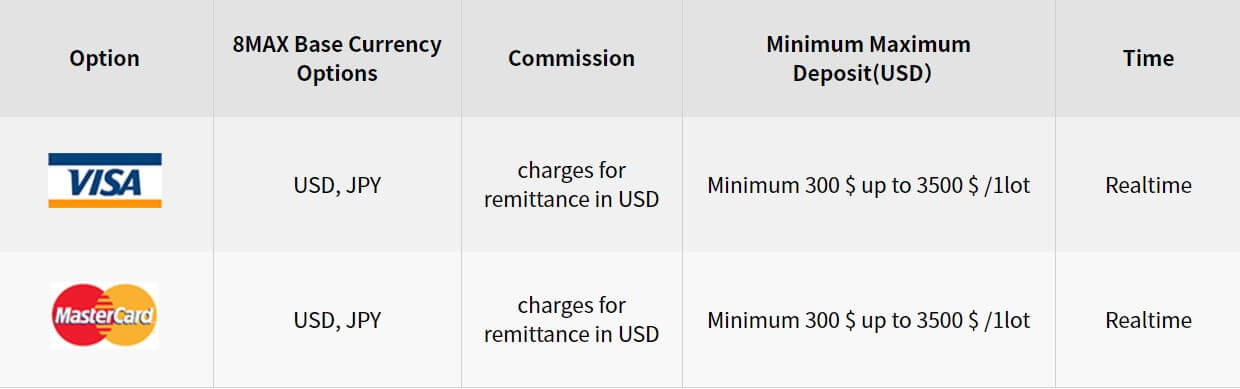

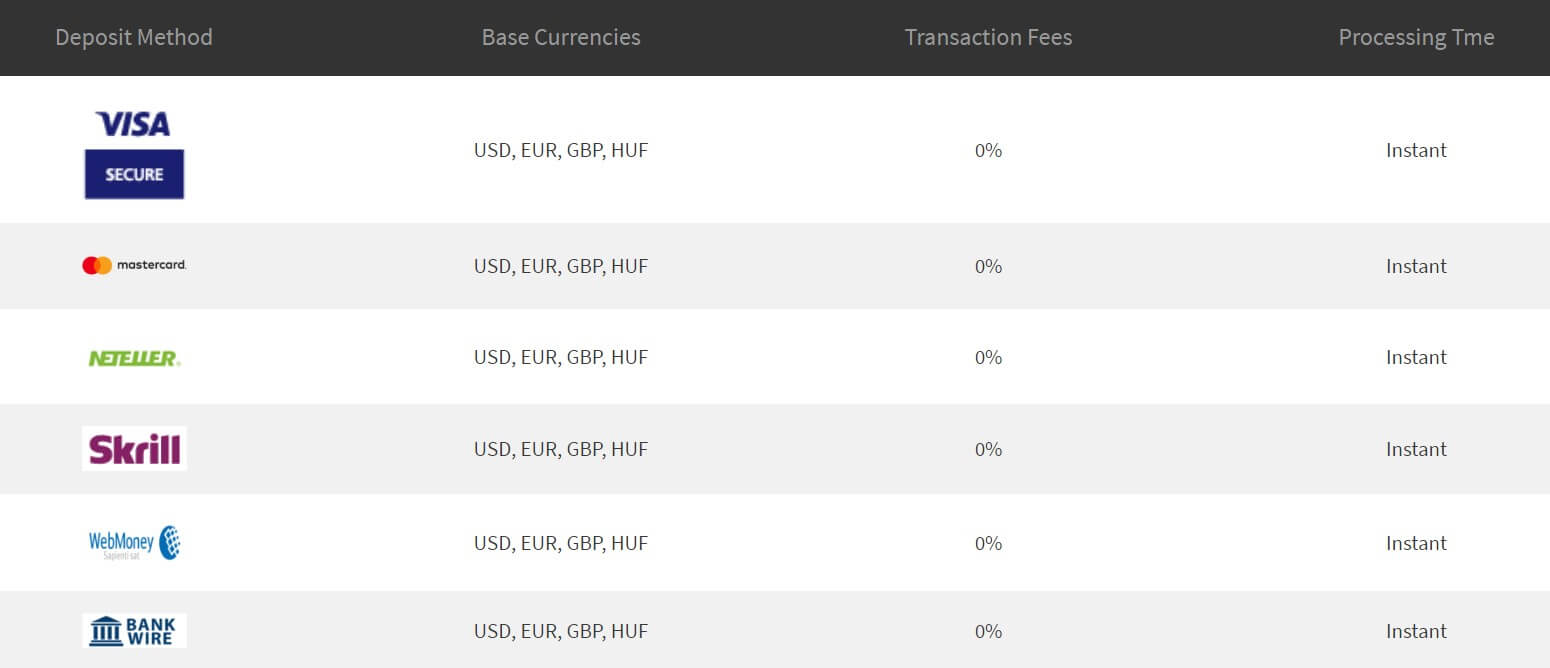

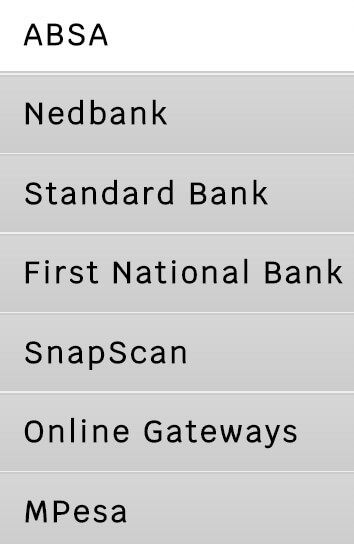

Deposit Methods & Costs

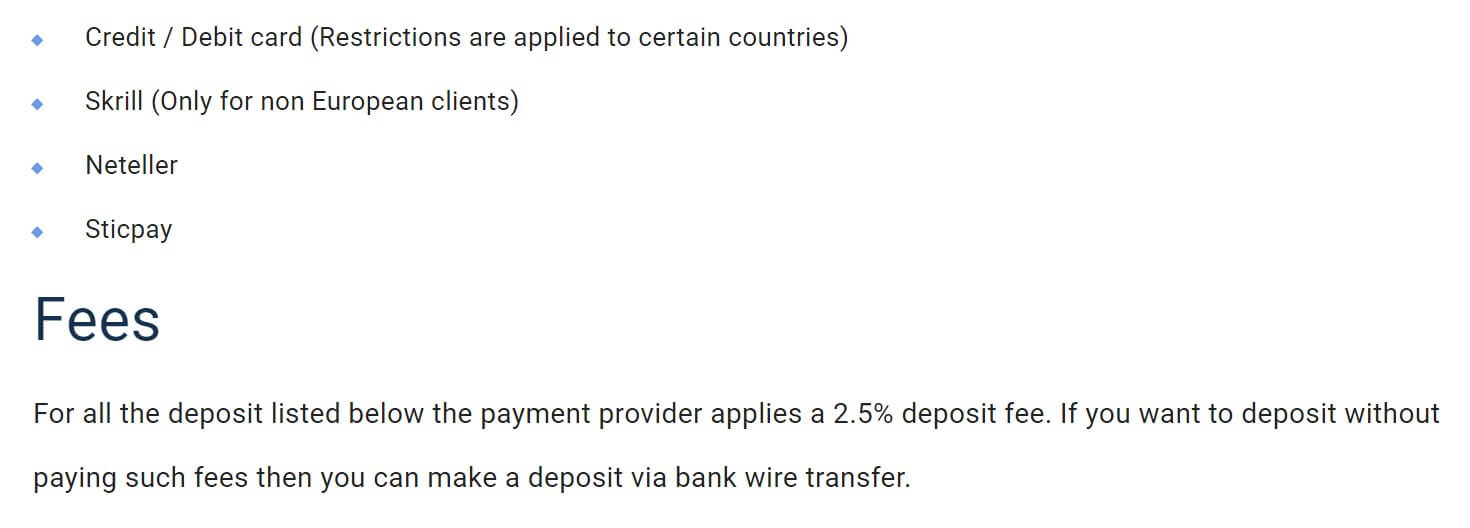

There are a few ways to get your funds into Starfinex, you can use Bitcoin, Visa and MasterCard Credit / Debit, Local Banks, Neteller and Skrill. There are no added fees when using any of the deposits, but when using Credit / Debit Cards or Bank Transfer be sure to check with the bank or card processor to see if they have any added transfer fees of their own.

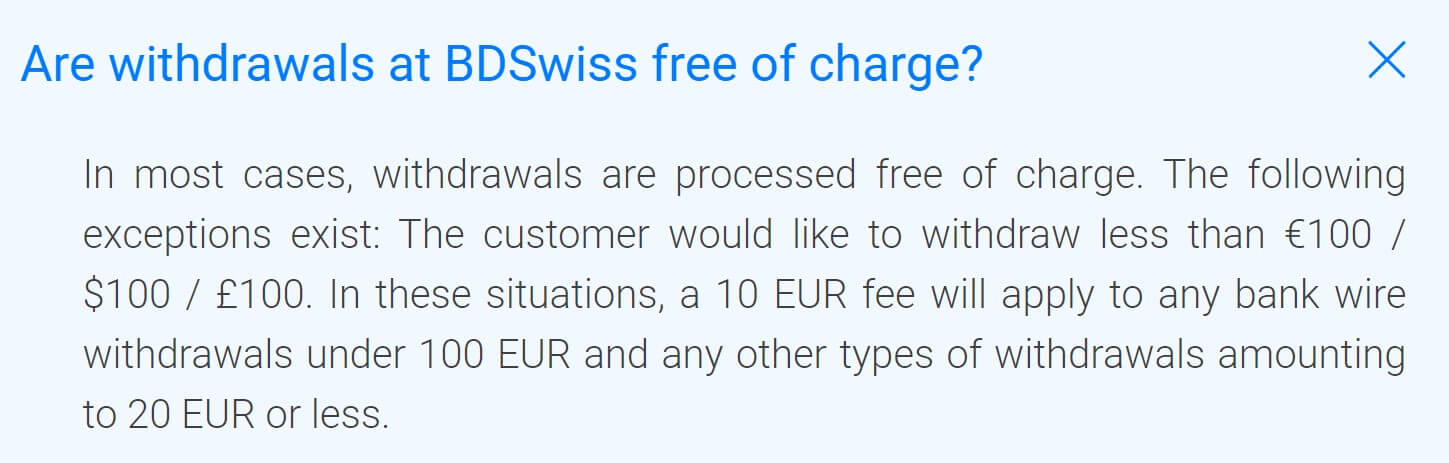

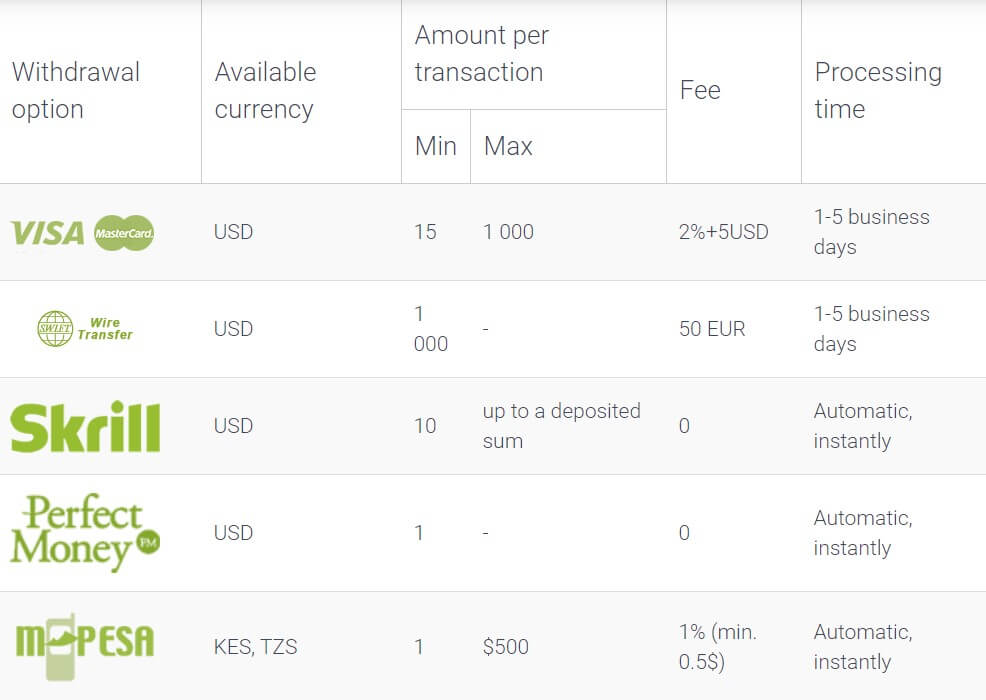

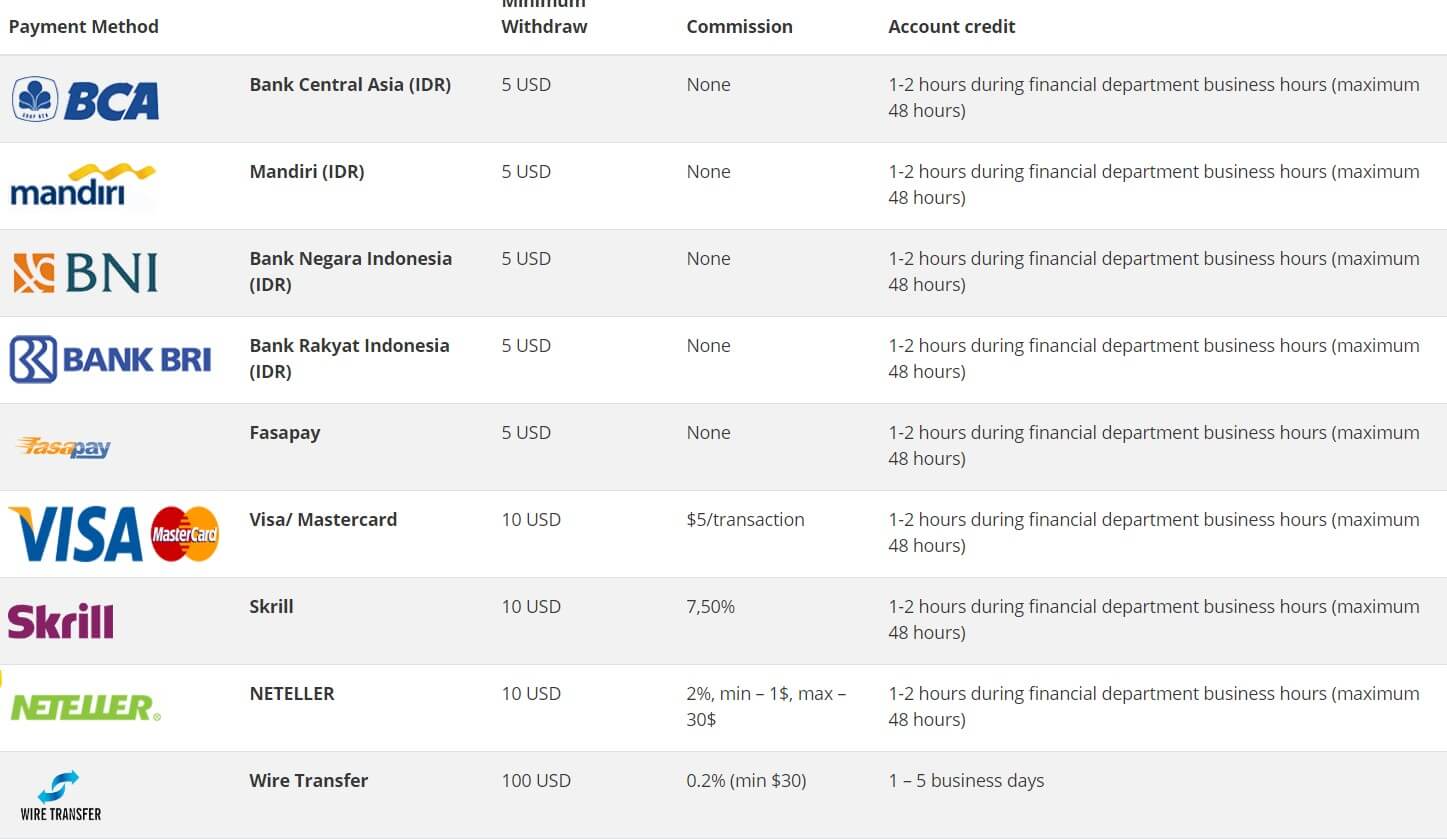

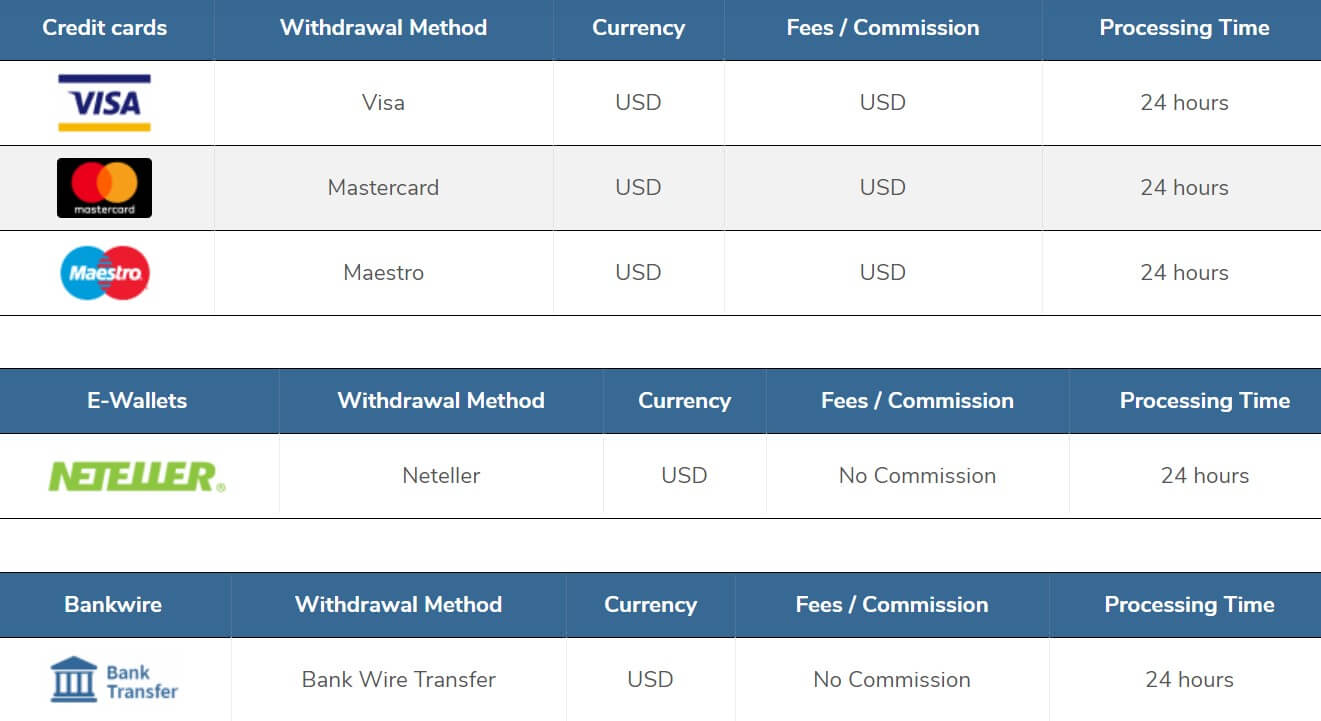

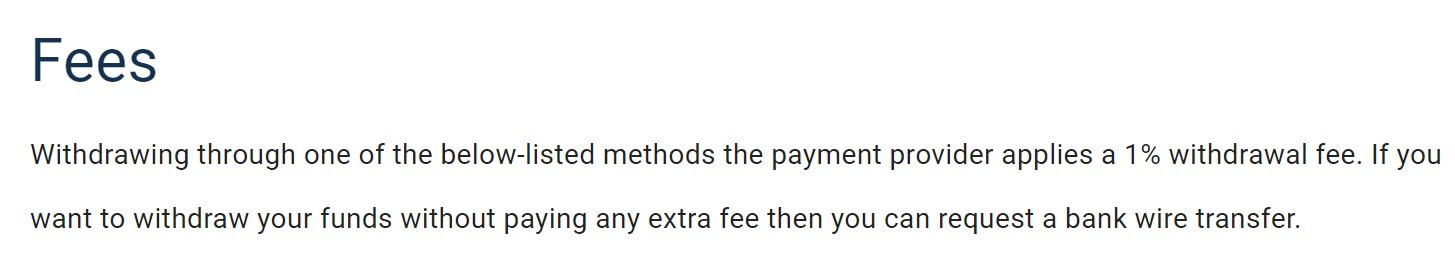

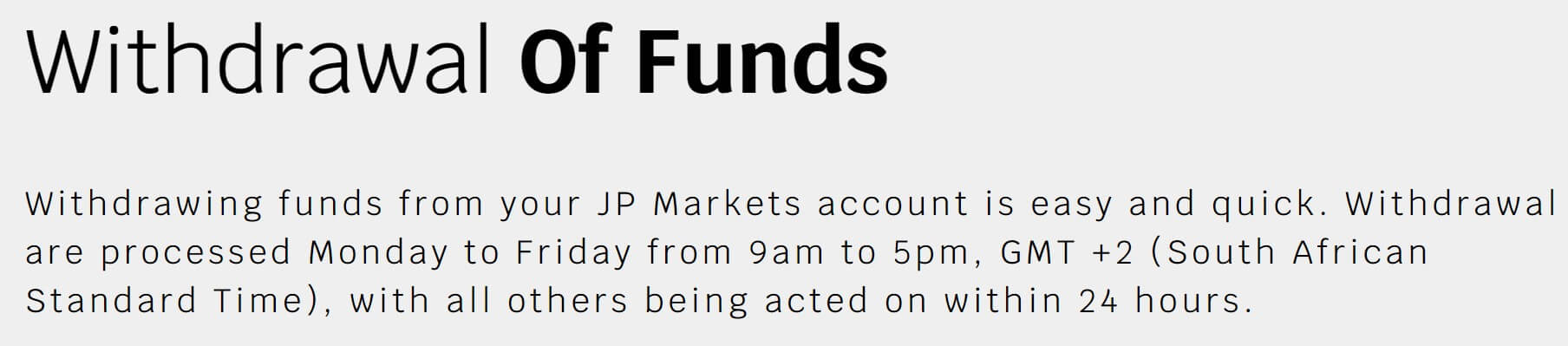

Withdrawal Methods & Costs

You are able to withdraw using Bitcoin, Local Banks, Neteller and Skrill, you are not able to withdraw using Credit or Debit card. The minimum withdrawal amount is $5 for all the methods and there is no added commission or fees from Starfinex, as usual, check with your bank or processor to see if they will charge any incoming transfer fees.

Withdrawal Processing & Wait Time

We did not locate any information relating to withdrawal or processing times, however, depending on the method you are using you can expect withdrawals to take between 1 to 5 business days to fully process.

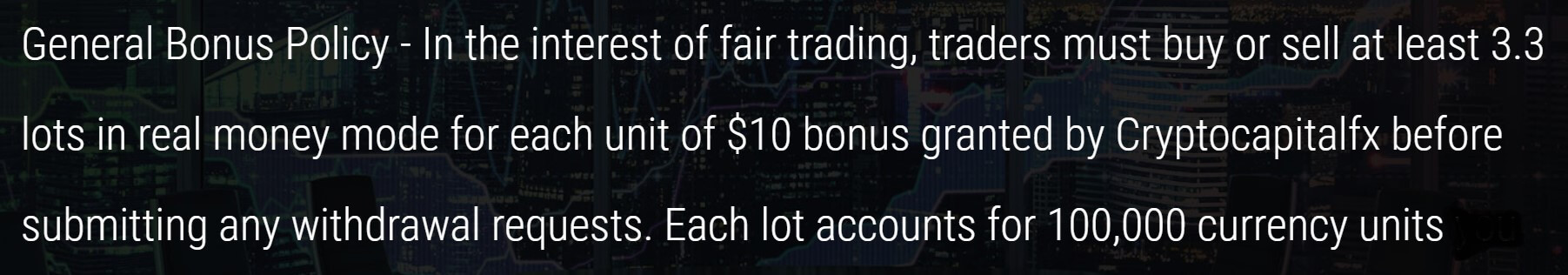

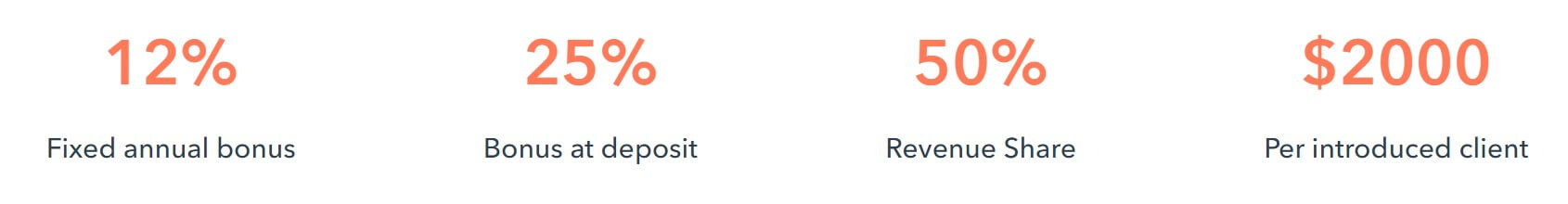

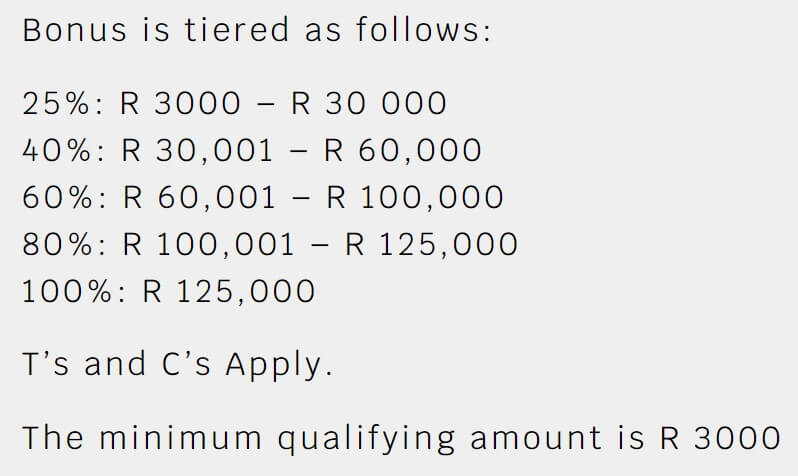

Bonuses & Promotions

When looking through the accounts pages, it is clear that there are no bonuses or promotions related to these accounts as they all state that there are no flexible bonuses available to the accounts, there are however a few different promotions going on, we will only briefly touch on them as they are not 100% relevant to the accounts we are looking at.

There are two demo contests, however, the pages for them are not loading so we are not able to comment on the conditions or prizes. There is a 20% bonus for people investing in a MAM account, we won’t go into this as we are not focusing on this type of investment in this review.

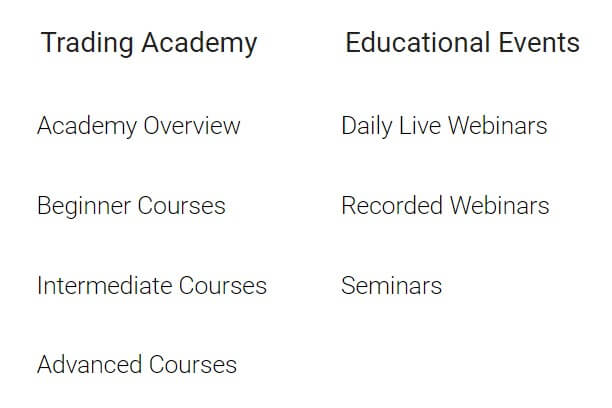

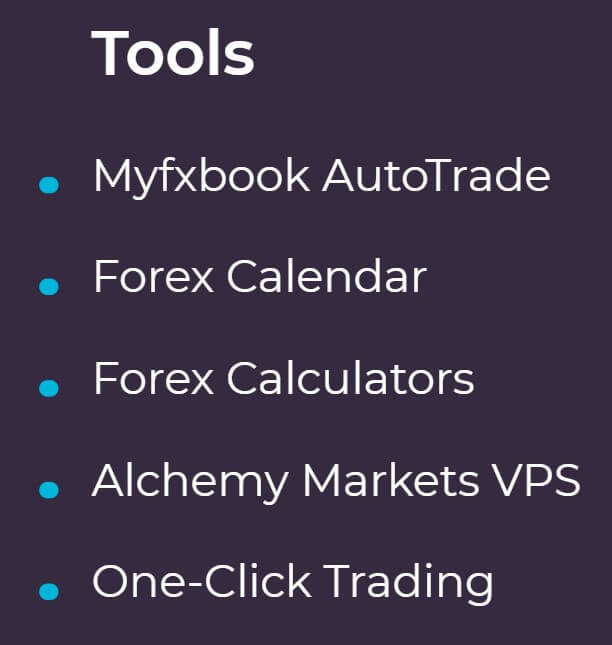

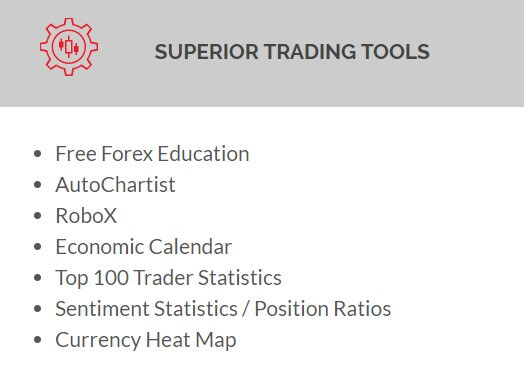

Educational & Trading Tools

There is an education and also a tools section of the site, the education section ahs some basic information however at the moment the pages don’t seem to be loading properly and are just coming up blank, so we are not able to comment on the quality of the educational material.

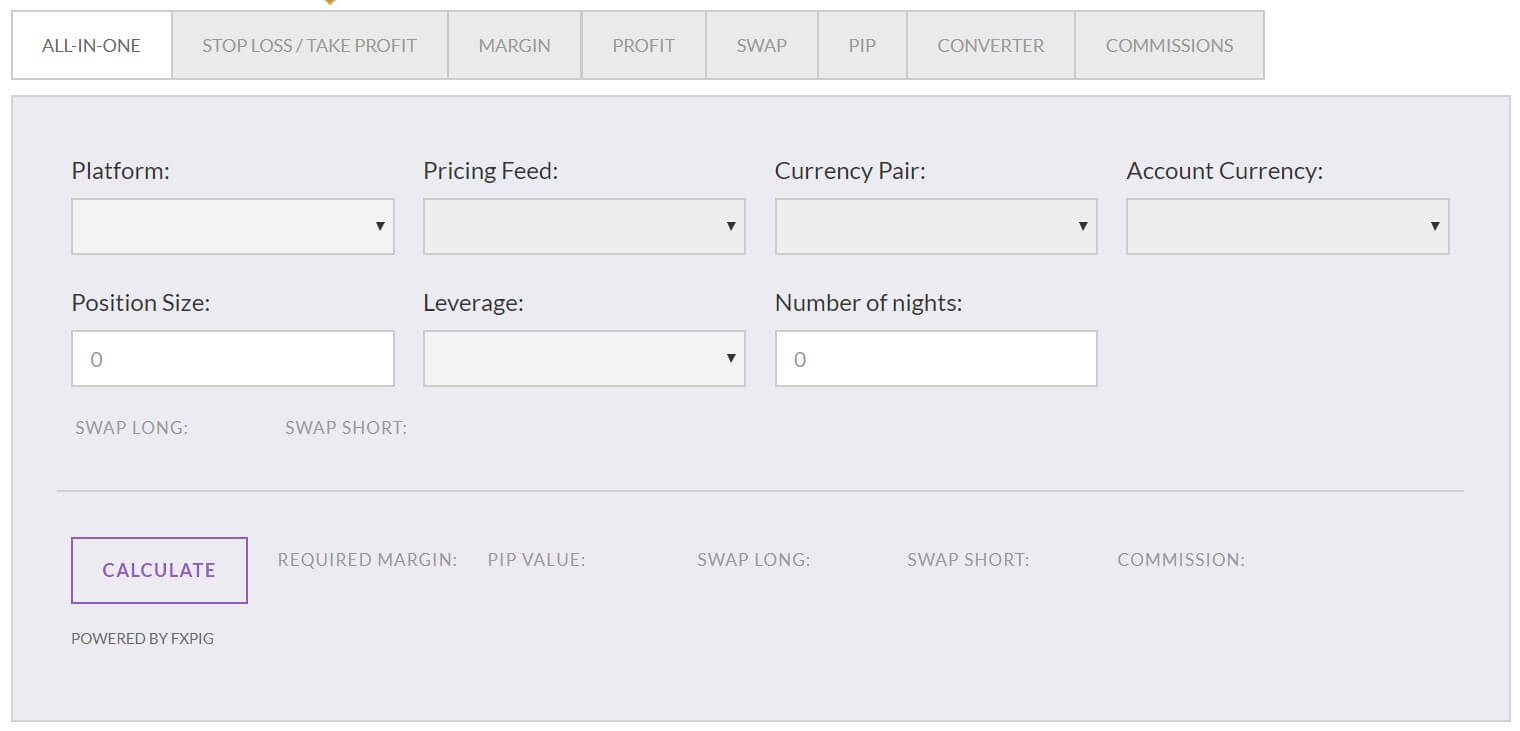

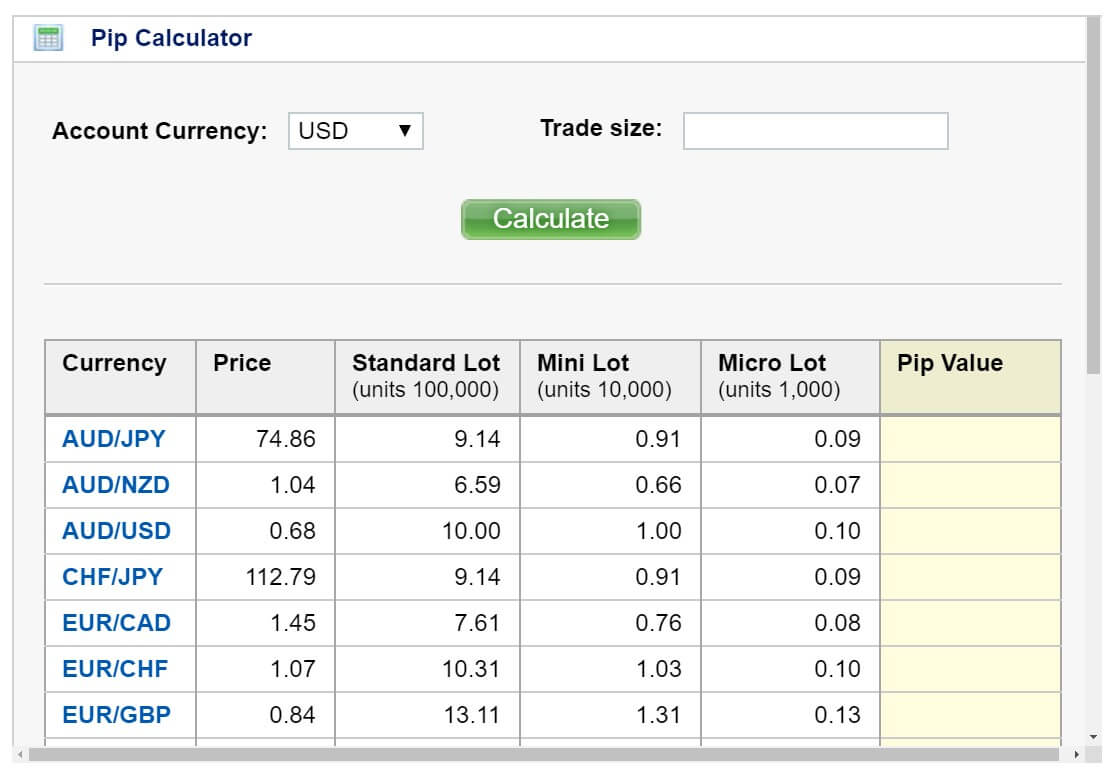

In terms of tools, there are some basic ones available, there is an economic calendar to show upcoming news as well as what markets they may affect, there is also a news section and then some calculators such as profit and trading calculators. Free FX trading signals are also provided, which is excellent (provided that they are highly accurate).

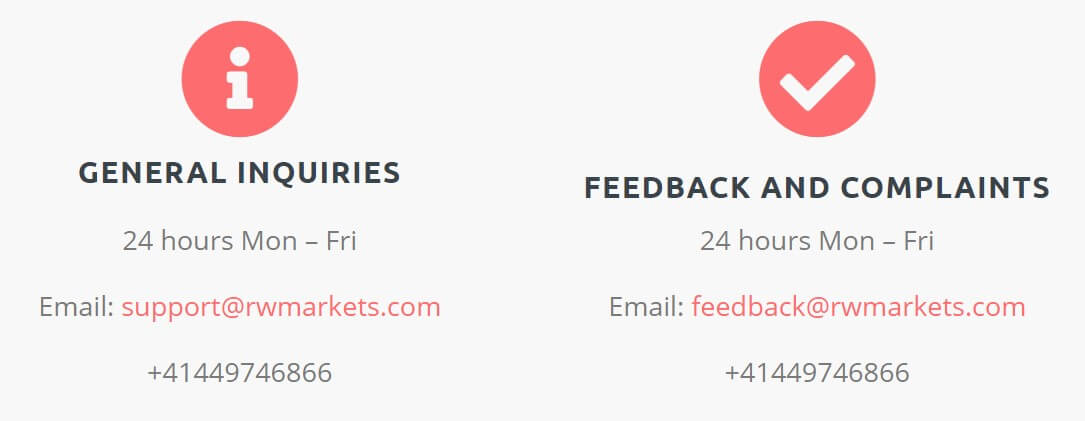

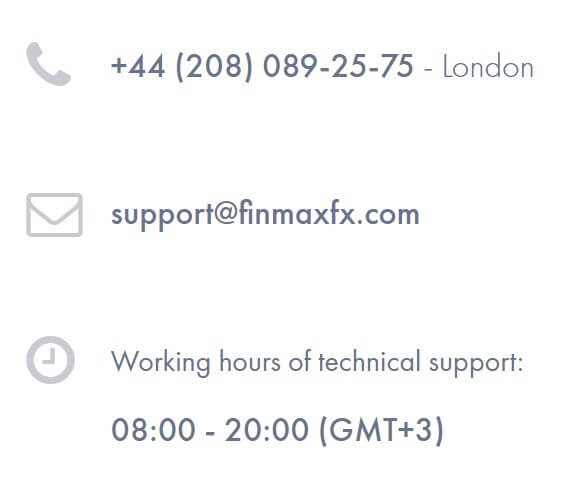

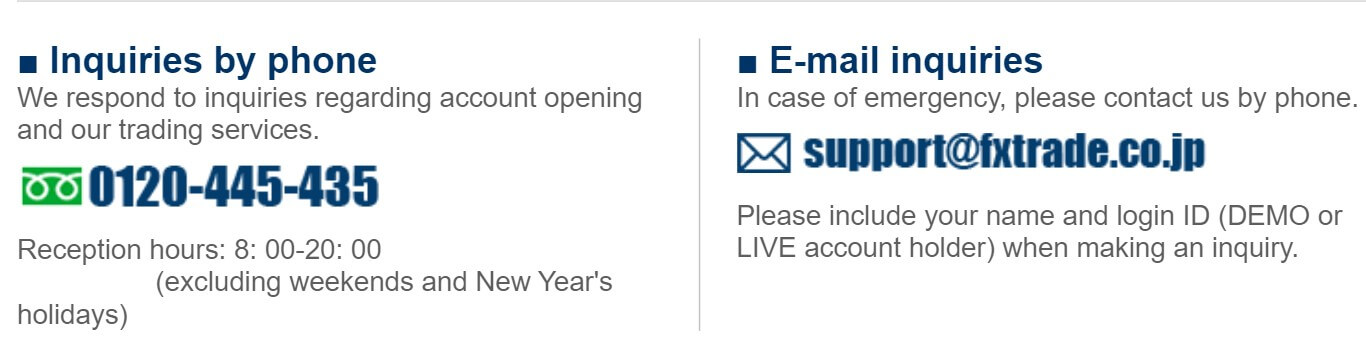

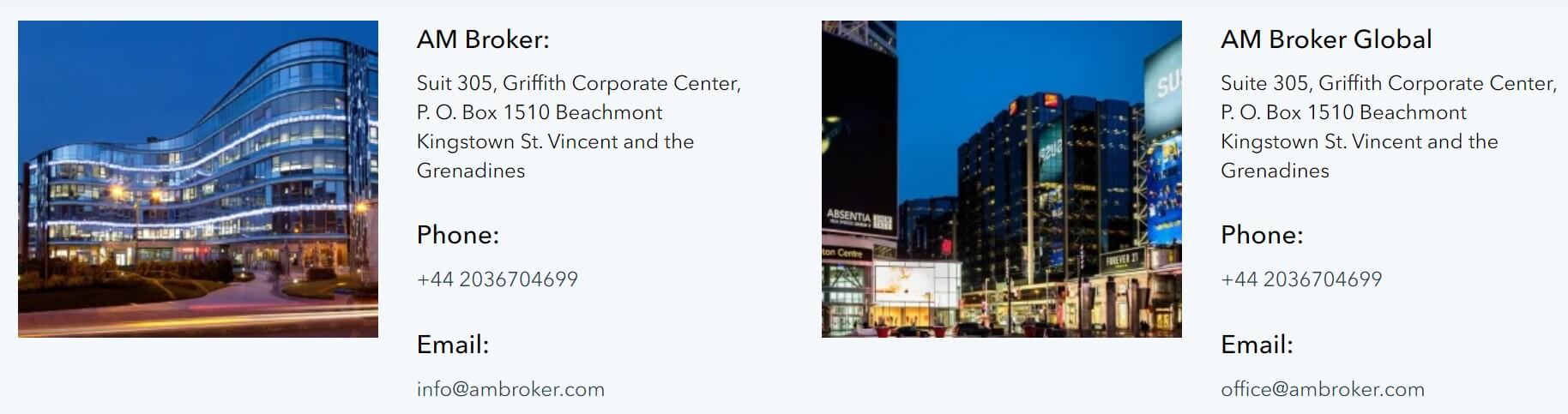

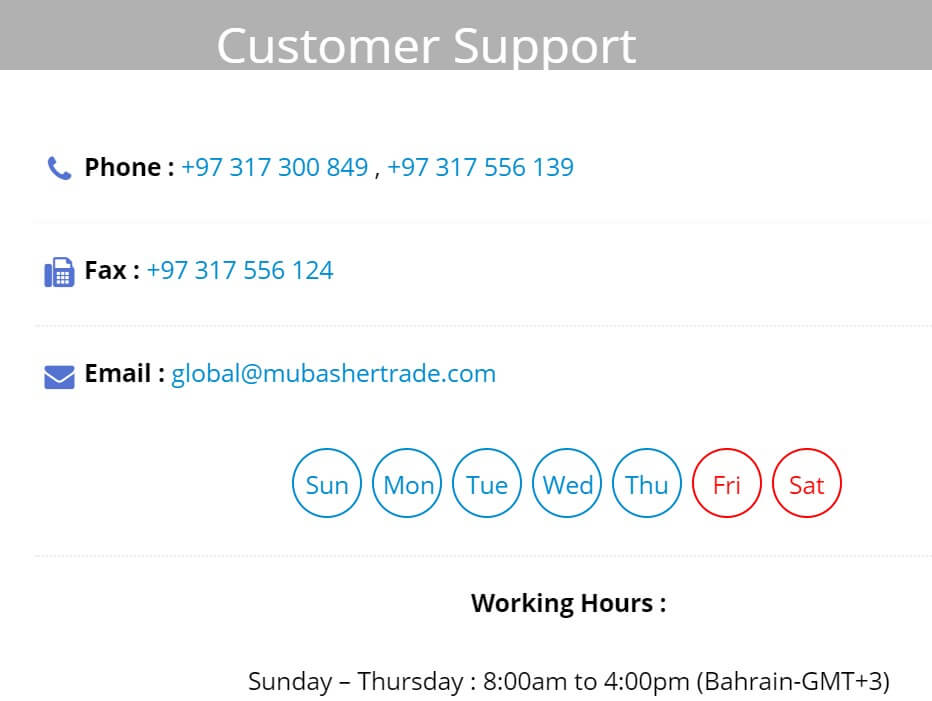

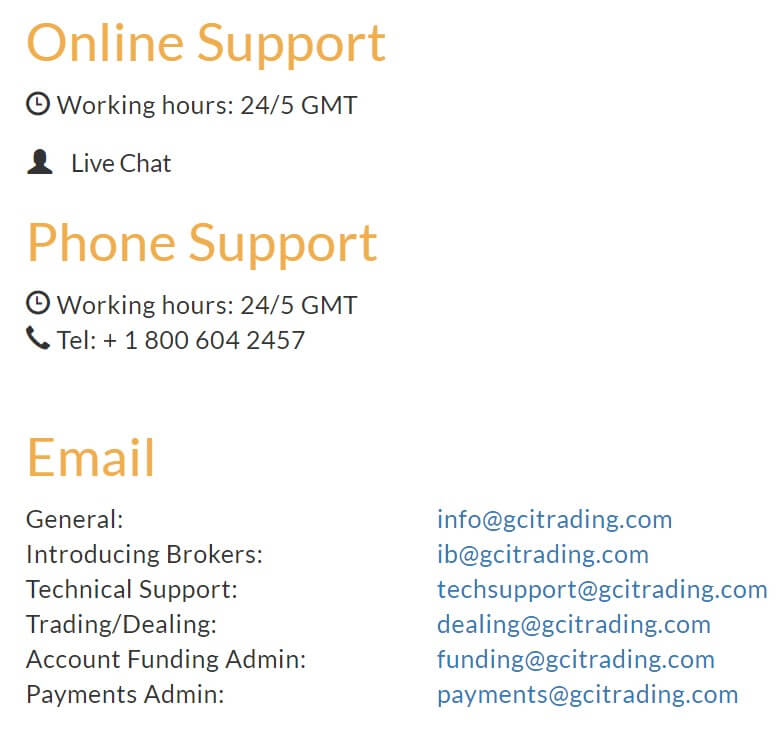

Customer Service

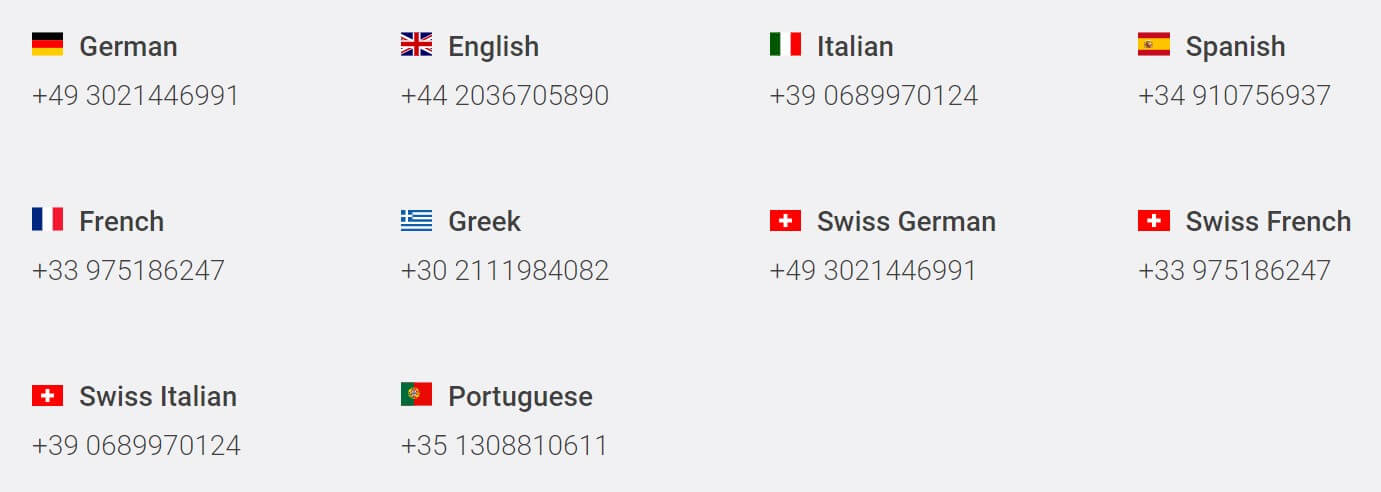

If you feel the need to contact Stargfinex, you can do so in a number of different ways, the opening times of the support are not specified however we would expect them to be closed over the weekends and bank holidays just as the markets are. You can use the online submission to fill in your query and you should then get a reply via email, there is also a postal address along with a number of emails.

Address: 9th floor, Kham Thien Building,195 Kham Thien, Dong Da, HaNoi

Emails:

[email protected]

[email protected]

[email protected]

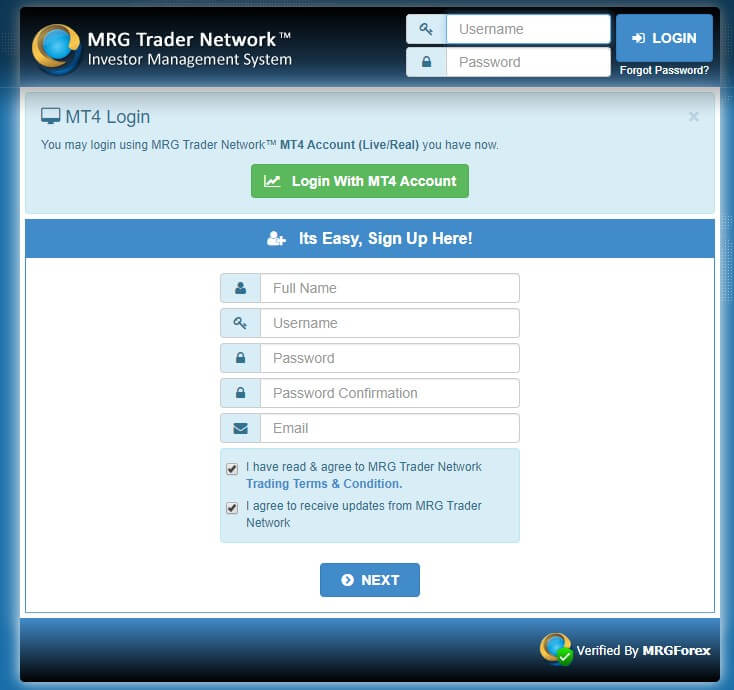

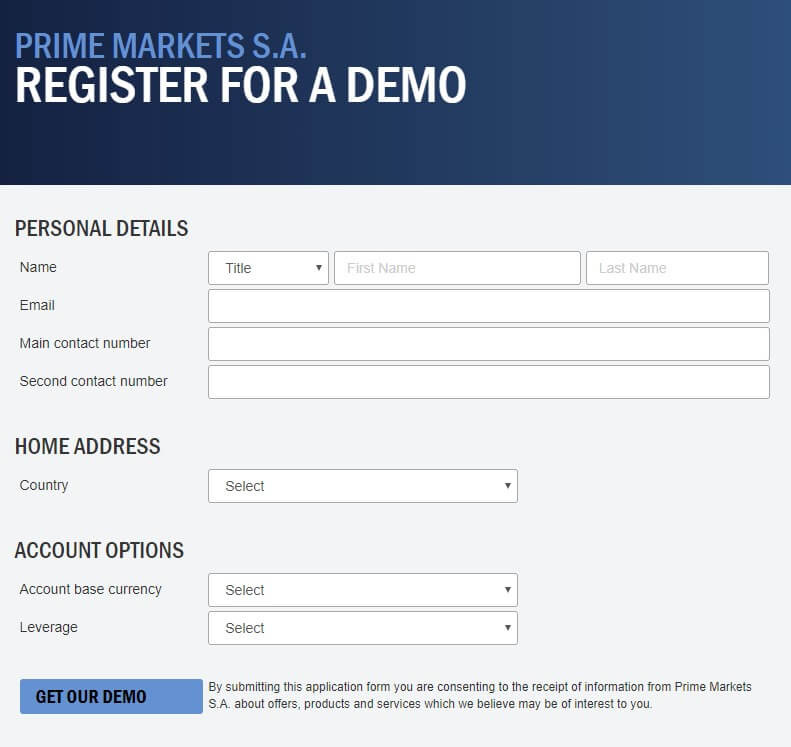

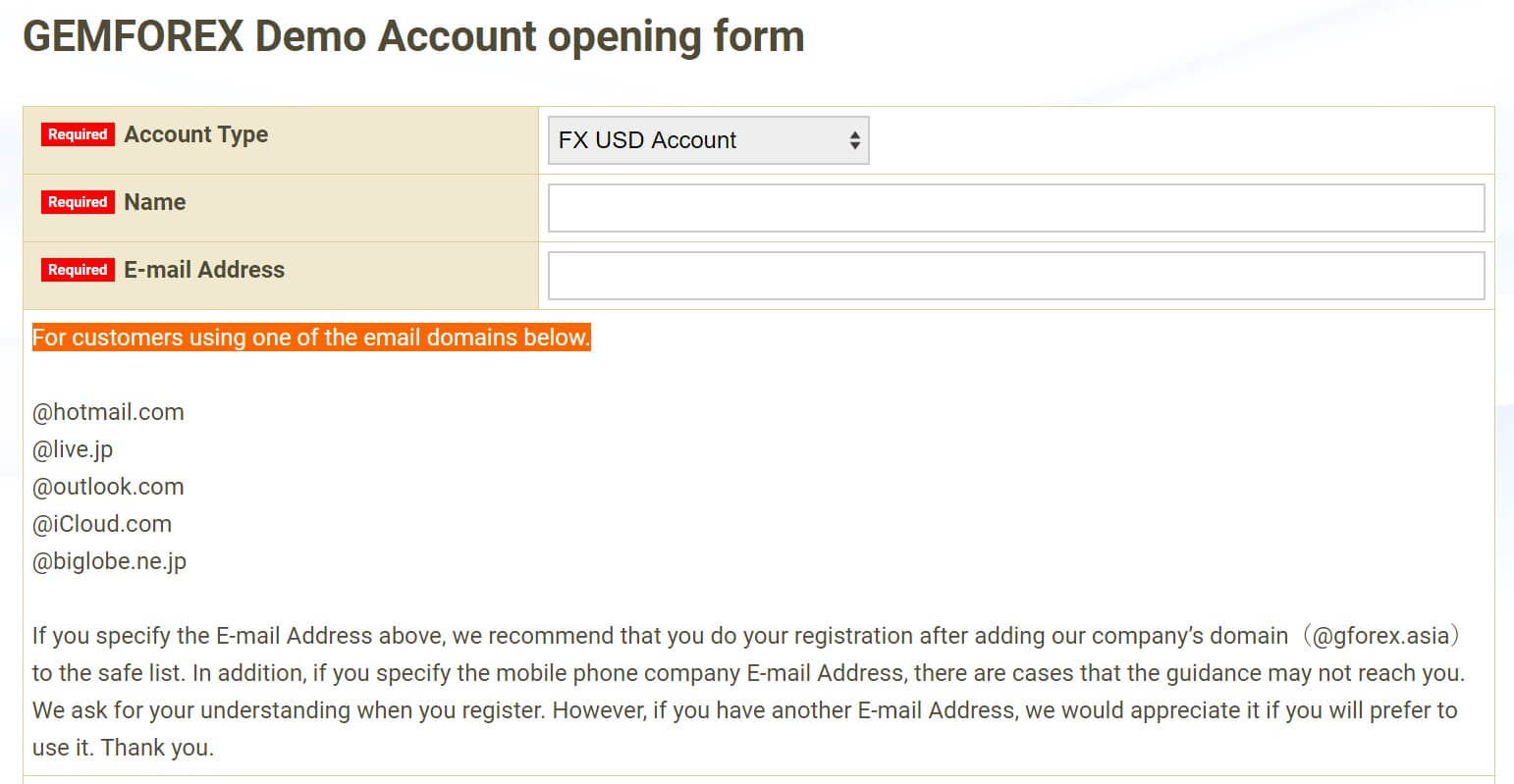

Demo Account

Demo accounts are available, you can sign up for one using a simple sign up form. When opening an account you can choose a few different options, the base currency of EUR, USD or GBP, although the main account sonly have USD available, you can then select leverage up to 1:1000, again the main accounts only go as high as 1:400. You can then select a balance between 100 and 5,000 units. We do not know which of the accounts the trading conditions mimic and we also do not know if there is an expiration on the demo account.

Demo accounts are great as they usually allow new traders to test the markets and conditions while allowing existing traders to test new strategies without risking their own capital.

Countries Accepted

The following statement is present on the Starfinex website: “Forex Trading is not allowed in some countries, before investing your money, make sure whether your country is allowing this or not.” This isn’t the most helpful of information so if you are interested in signing up we would recommend getting in contact with the customer service team to see if you are eligible for an account before signing up.

Conclusion

Starfinex offers a wide range of accounts each with varying trading conditions, the conditions in the first couple accounts are a little expensive with spreads starting from 3 pips, however, as the accounts go up in tiers their costs come down to an acceptable ECN and VIP account. There is a slight lack in tradable assets, it would be good to see some additional ones added, in terms of deposits and withdrawals there are enough methods to allow most traders to participate and there are no added fees for depositing or withdrawing which is good. The main concern is the fact that some pages of the site are not loading properly, apart from that they seem like a competent broker.

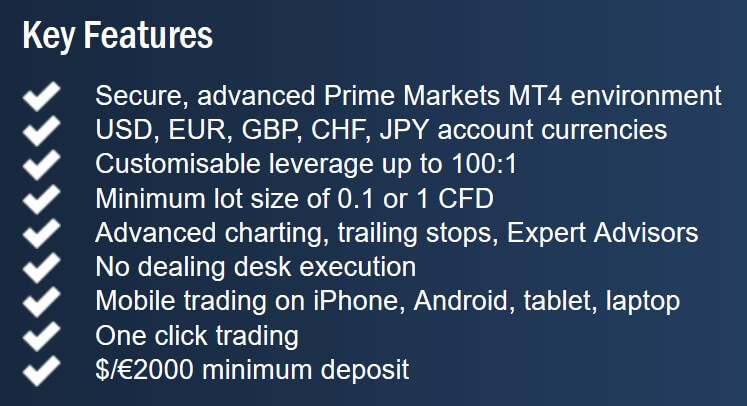

Key Features:

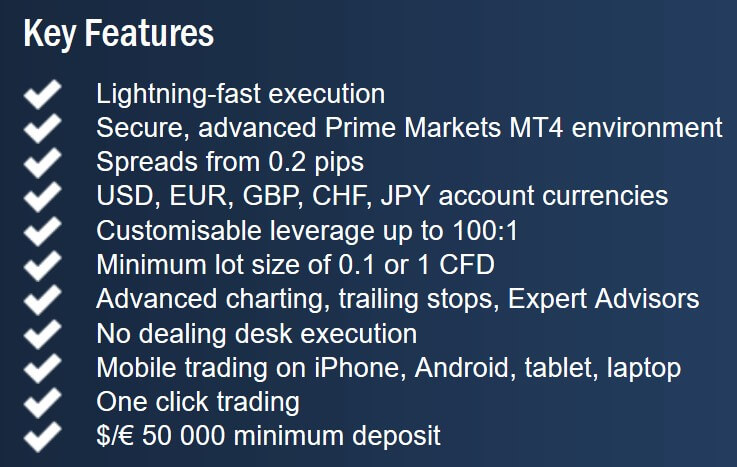

Key Features:

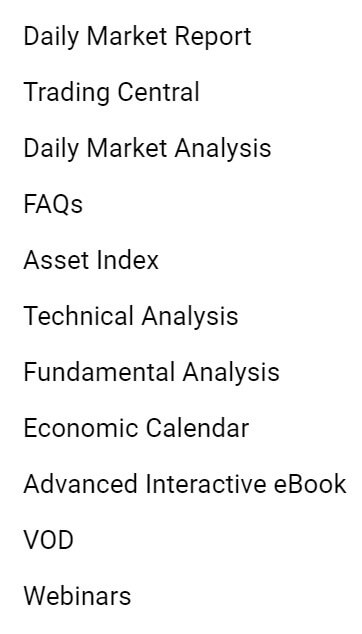

Aside from the mentioned tools integrated into the 24Optoin web platform, there is a dedicated Educational section and an Assets calculator. The Educational section contains the Daily Market report, Trading Central, Daily Market Analysis, FAQs, Asset Index, Technical Analysis, Fundamental Analysis, Economic Calendar, Advanced Interactive Ebook, VOD and Webinars. One of the most useful sections is the Daily Market Report which contains a nice overview of global markets across categories, with short descriptive content but without any backstories.

Aside from the mentioned tools integrated into the 24Optoin web platform, there is a dedicated Educational section and an Assets calculator. The Educational section contains the Daily Market report, Trading Central, Daily Market Analysis, FAQs, Asset Index, Technical Analysis, Fundamental Analysis, Economic Calendar, Advanced Interactive Ebook, VOD and Webinars. One of the most useful sections is the Daily Market Report which contains a nice overview of global markets across categories, with short descriptive content but without any backstories.

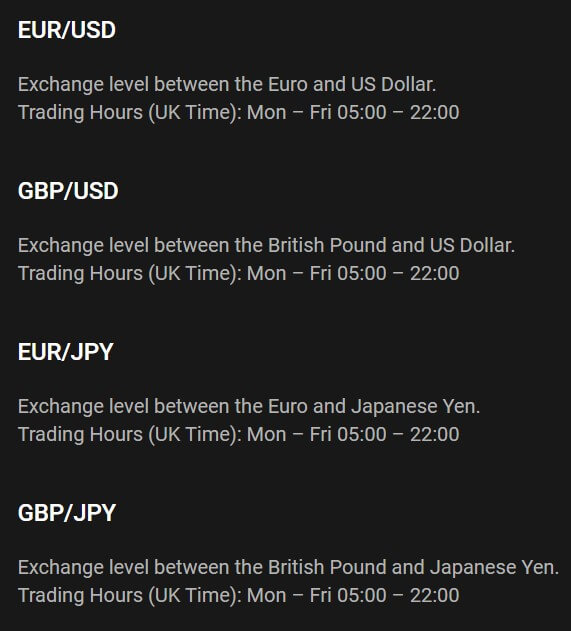

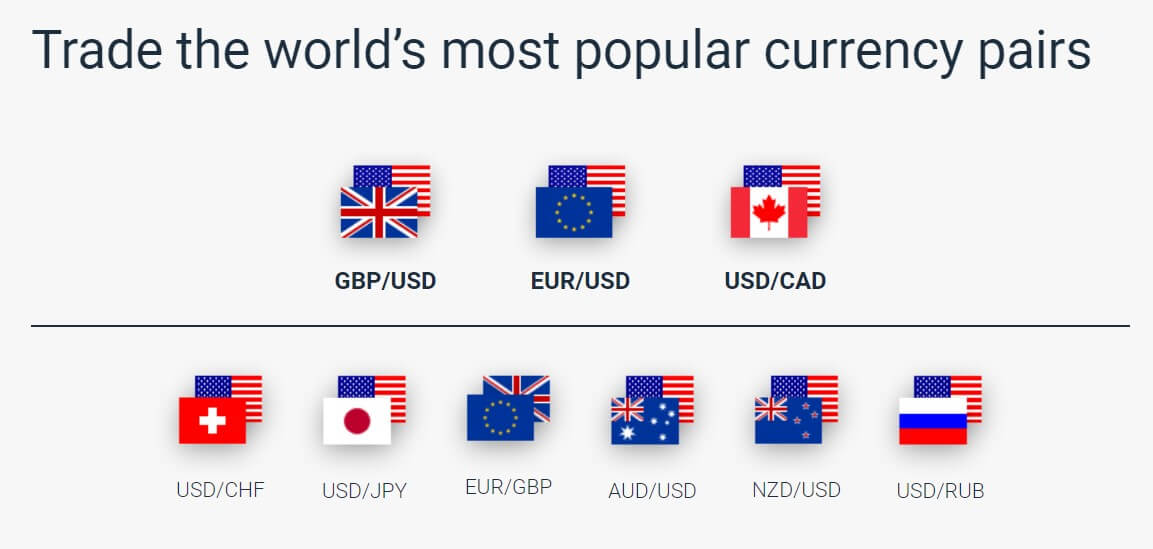

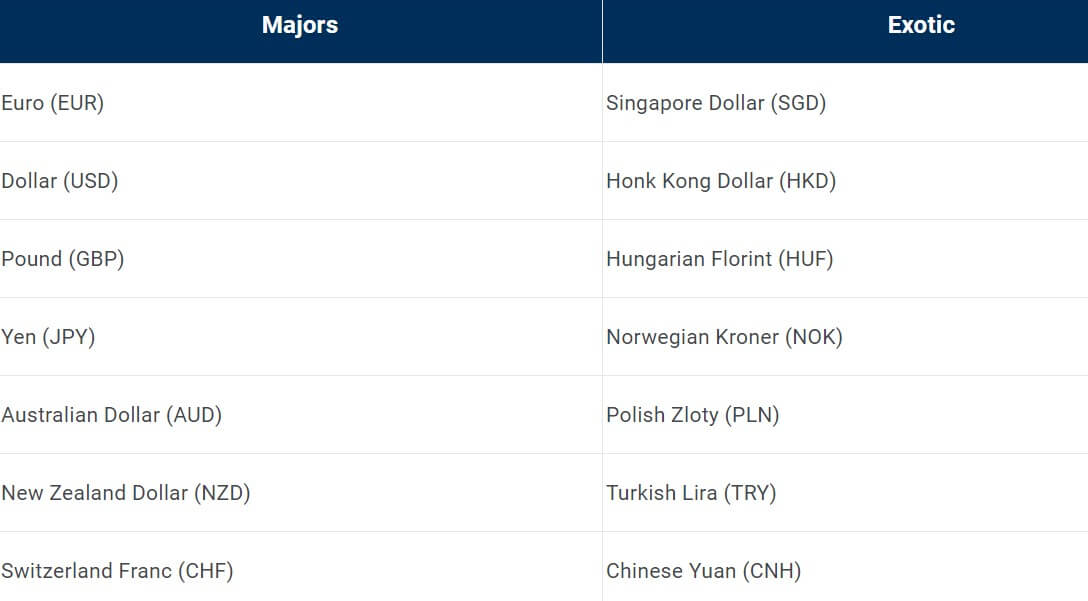

Forex Pairs: 50+ pairs in total which include major pairs, minor pairs and a selection of exotics, some examples are GBP/USD, EUR/JPY., EUR/USD and EUR/CHF.

Forex Pairs: 50+ pairs in total which include major pairs, minor pairs and a selection of exotics, some examples are GBP/USD, EUR/JPY., EUR/USD and EUR/CHF.

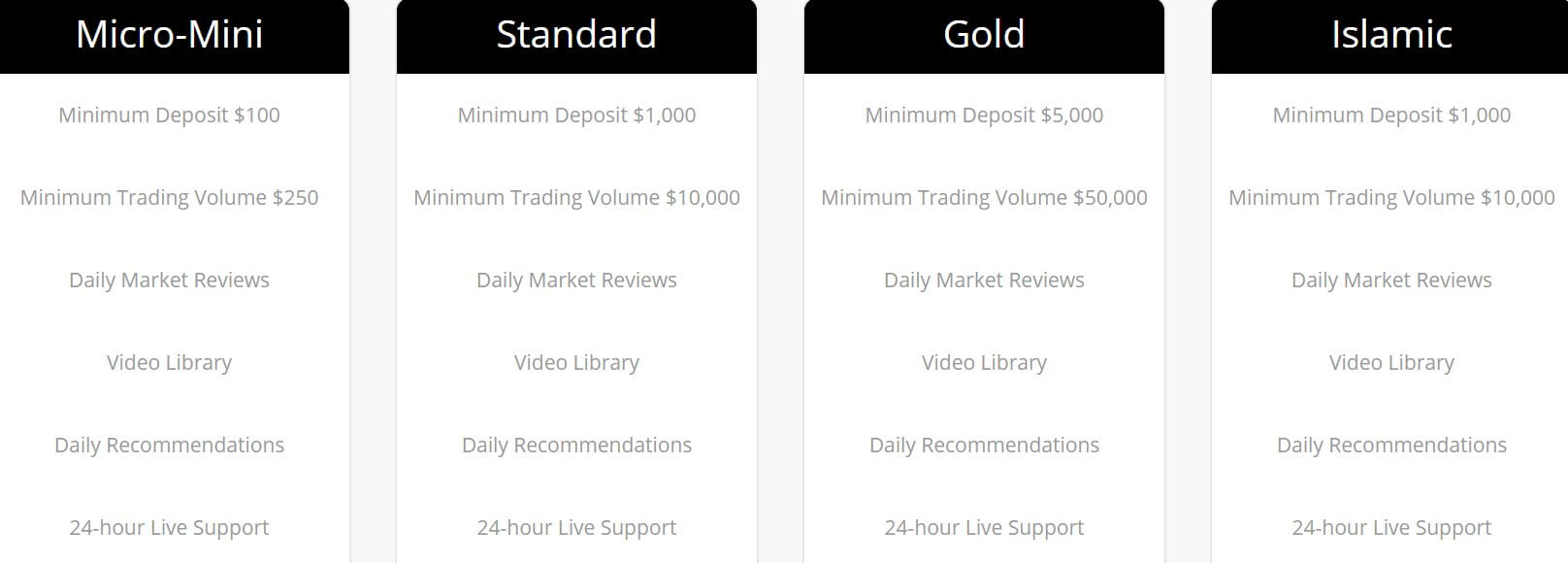

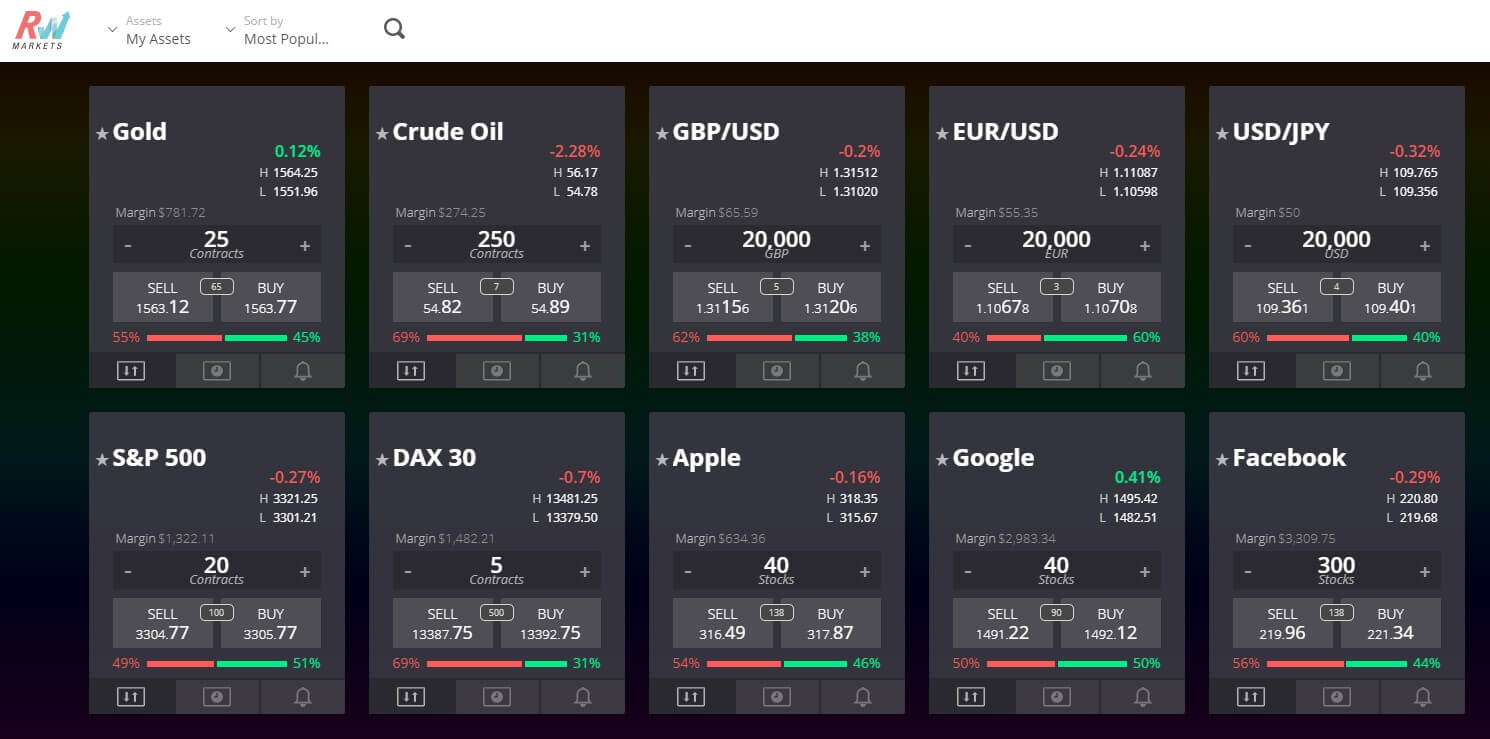

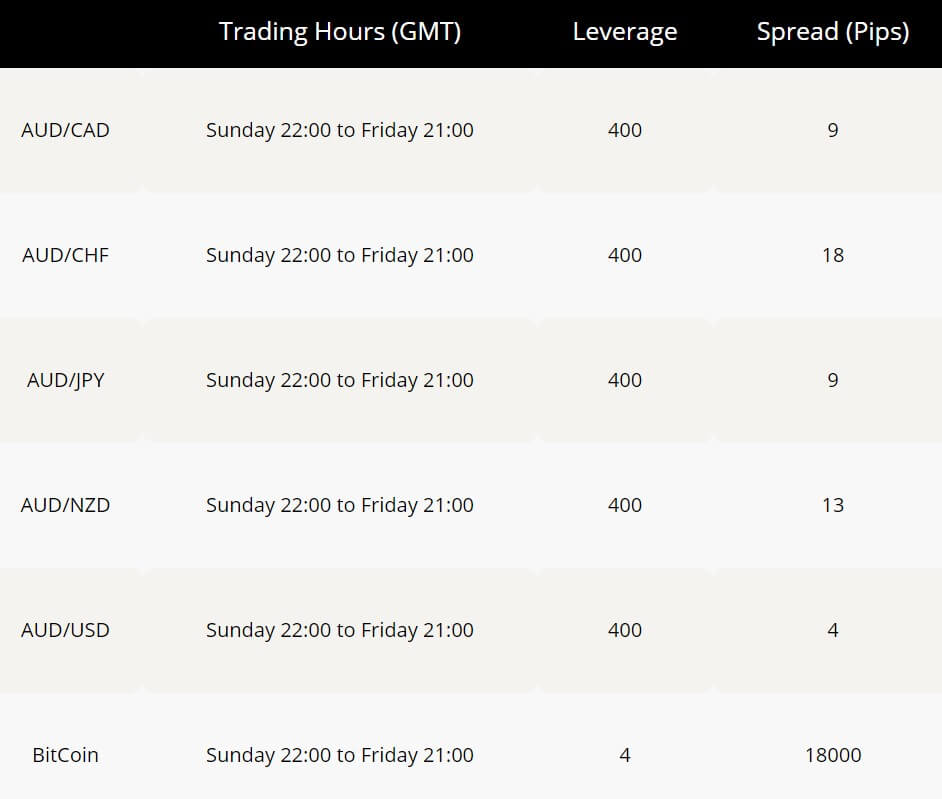

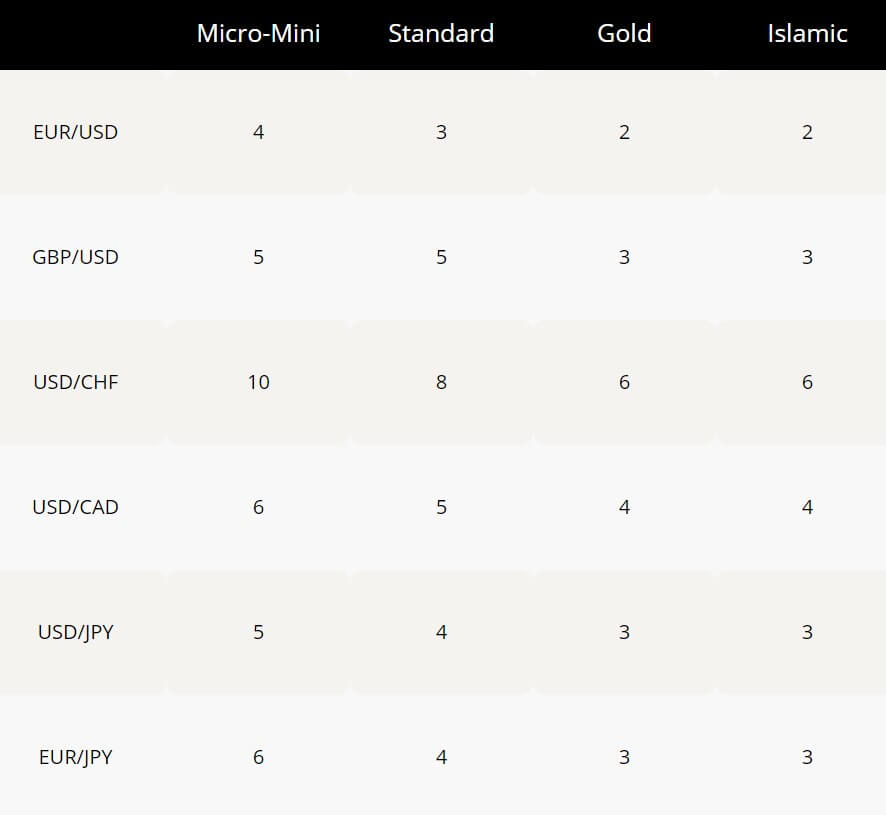

RW Markets have broken down their assets into a number of different categories.

RW Markets have broken down their assets into a number of different categories.

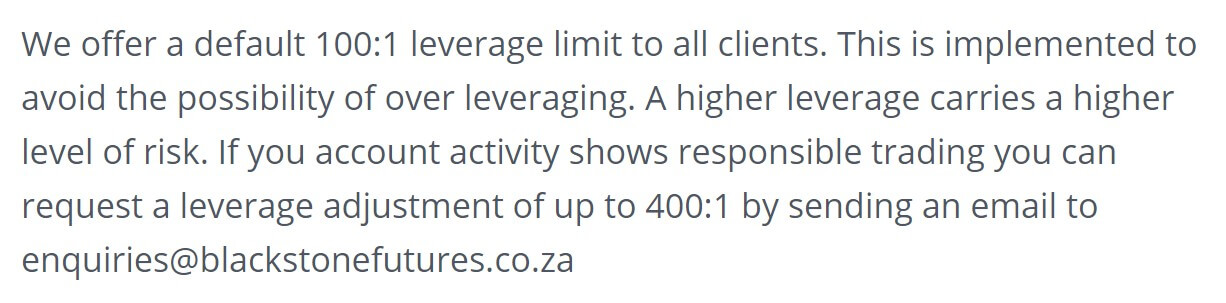

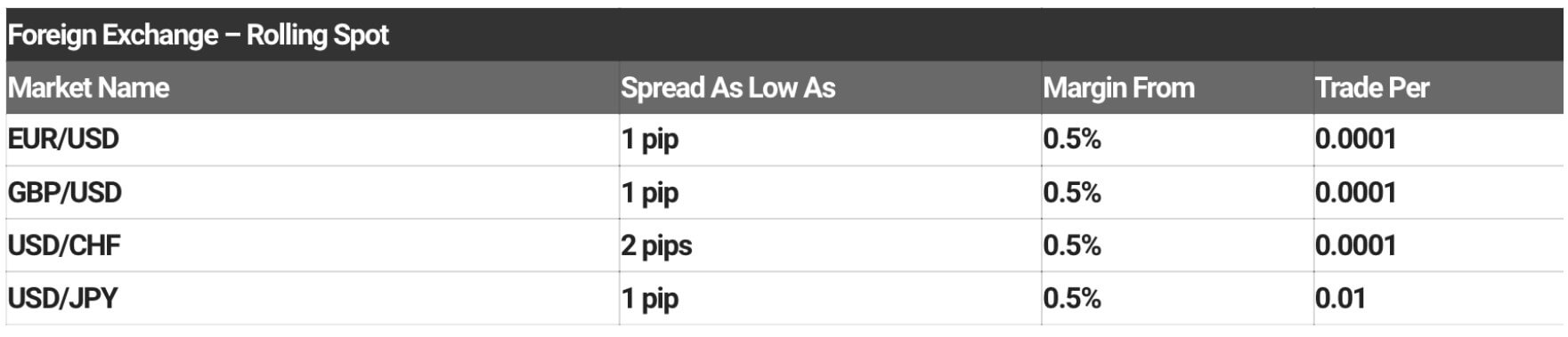

BlackStone Futures have quite a large number of assets available for trading, and you can find a full list on their Market Information Sheets. If you want to trade Indices, you can choose between the 19 available ones including; Euro Stocks 50, France 40, Germany 30 and US Tech 100 (Daily Rolling Cash) just to mention a few.

BlackStone Futures have quite a large number of assets available for trading, and you can find a full list on their Market Information Sheets. If you want to trade Indices, you can choose between the 19 available ones including; Euro Stocks 50, France 40, Germany 30 and US Tech 100 (Daily Rolling Cash) just to mention a few.

BlackStone Futures have an extensive education segment on their website. They have a Knowledge Base section which includes a number of articles and videos that should allow beginner traders to get a good basic understanding of the MT4 as well as their own Cloud Trade platform to make educated decisions when trading. Another number of articles and videos are dedicated to helping clients garner a broader understanding of how the market works and how they can implement indicators alongside

BlackStone Futures have an extensive education segment on their website. They have a Knowledge Base section which includes a number of articles and videos that should allow beginner traders to get a good basic understanding of the MT4 as well as their own Cloud Trade platform to make educated decisions when trading. Another number of articles and videos are dedicated to helping clients garner a broader understanding of how the market works and how they can implement indicators alongside

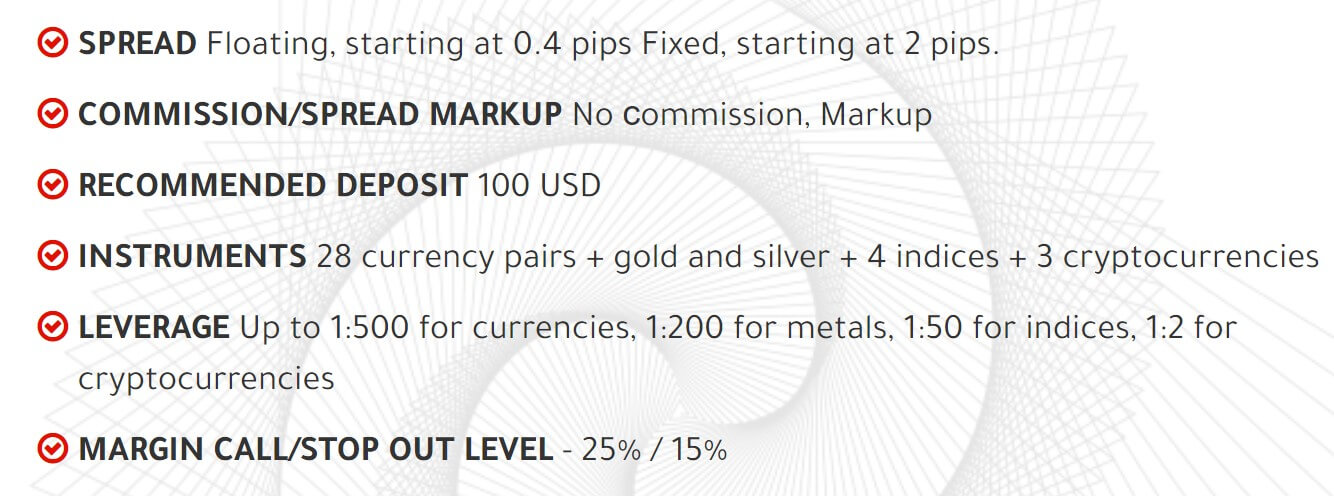

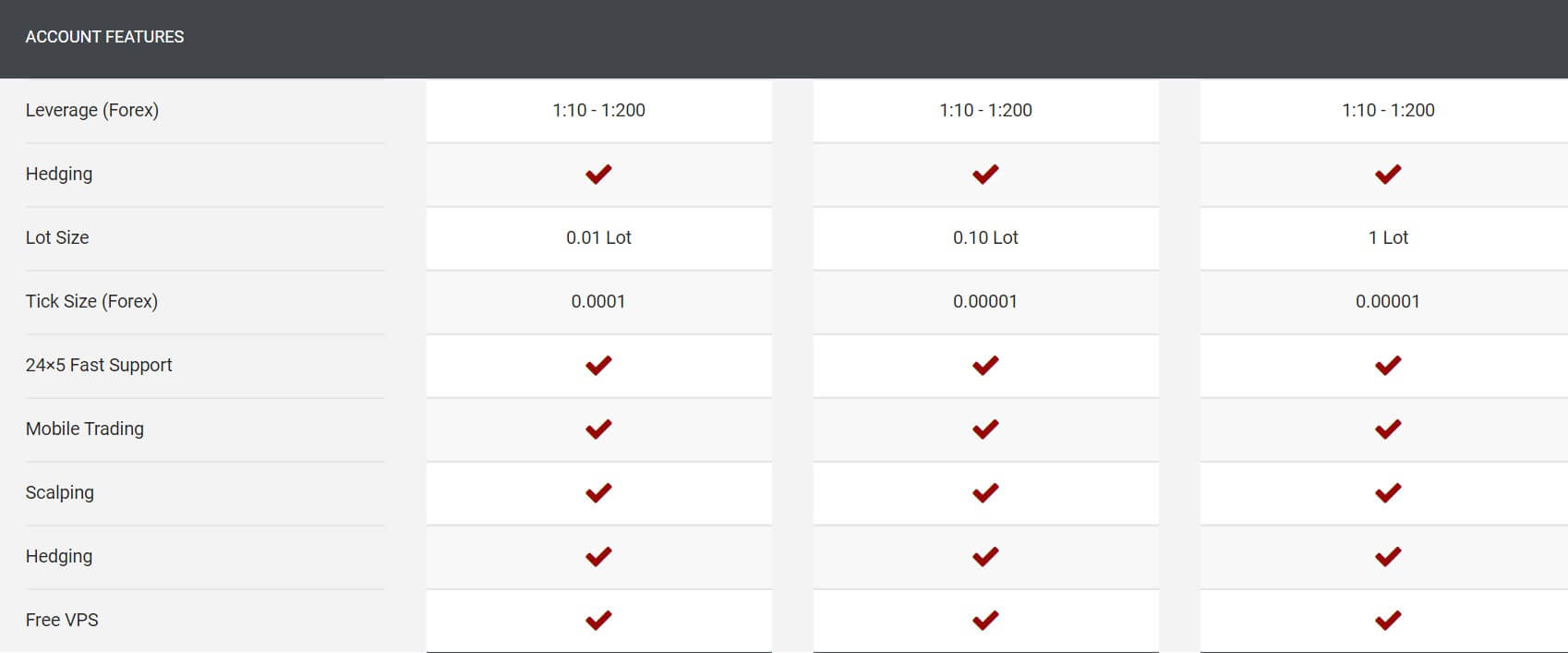

Leverage options range from 1:10 up to 1:200, regardless of which account has been chosen. The leverage cap is set at a different level on separate instruments. For example, most currency pairs allow the maximum cap, while some of the exotic options have a limit of 1:25 or 1:50. Leverage on cryptocurrencies goes up to 1:2 and options on stocks is set at 1:10. On commodities, the leverage cap is 1:100, except on Rice. Options vary more widely on indexes and metals. The leverage on all bonds goes as high as 1:100. Overall, we must say that the maximum cap offered by the broker is somewhat restrictive when compared to other options.

Leverage options range from 1:10 up to 1:200, regardless of which account has been chosen. The leverage cap is set at a different level on separate instruments. For example, most currency pairs allow the maximum cap, while some of the exotic options have a limit of 1:25 or 1:50. Leverage on cryptocurrencies goes up to 1:2 and options on stocks is set at 1:10. On commodities, the leverage cap is 1:100, except on Rice. Options vary more widely on indexes and metals. The leverage on all bonds goes as high as 1:100. Overall, we must say that the maximum cap offered by the broker is somewhat restrictive when compared to other options.

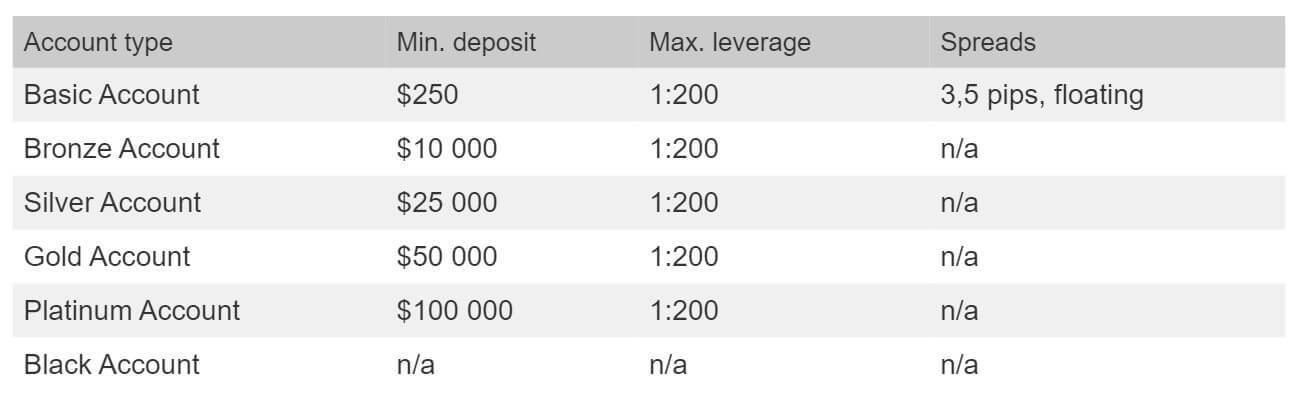

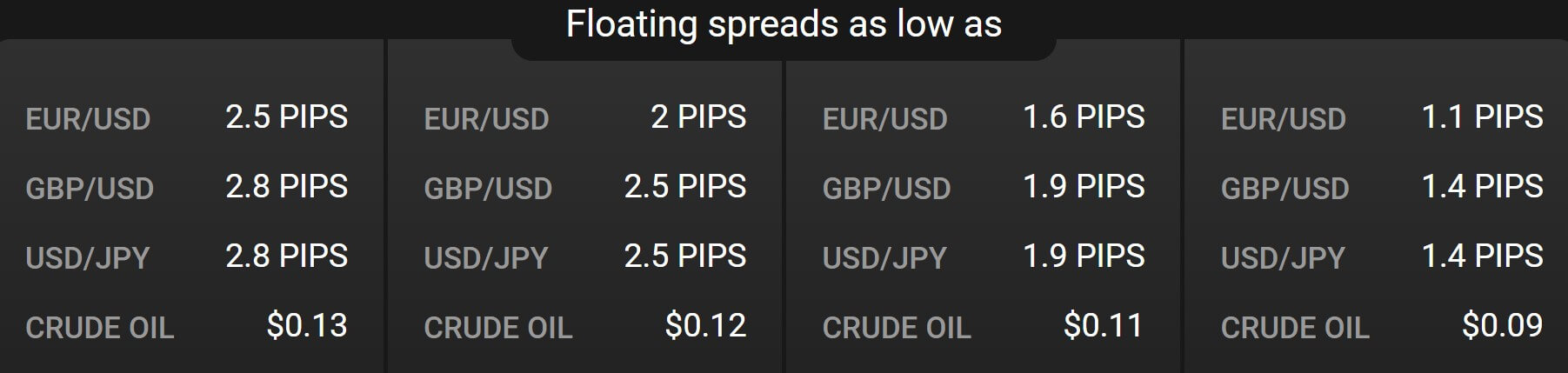

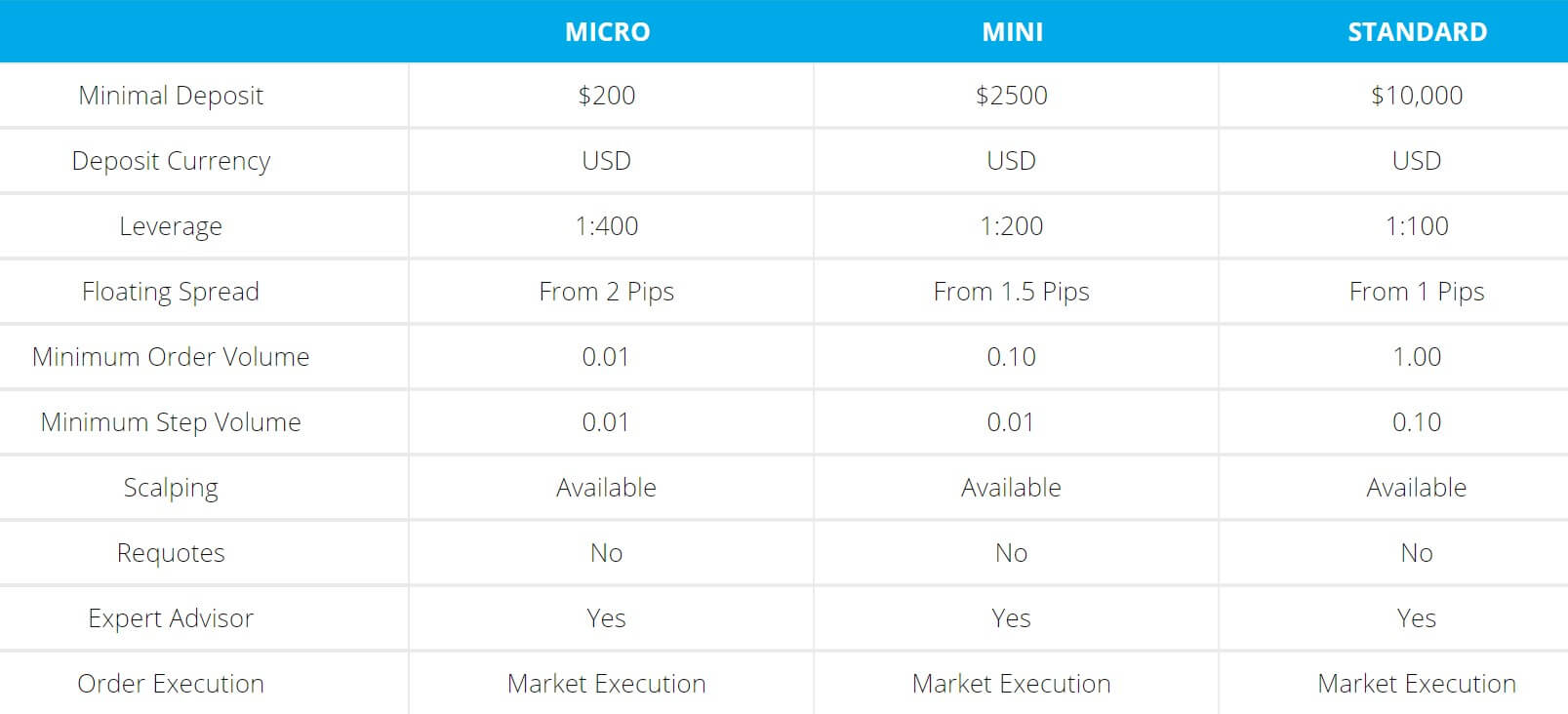

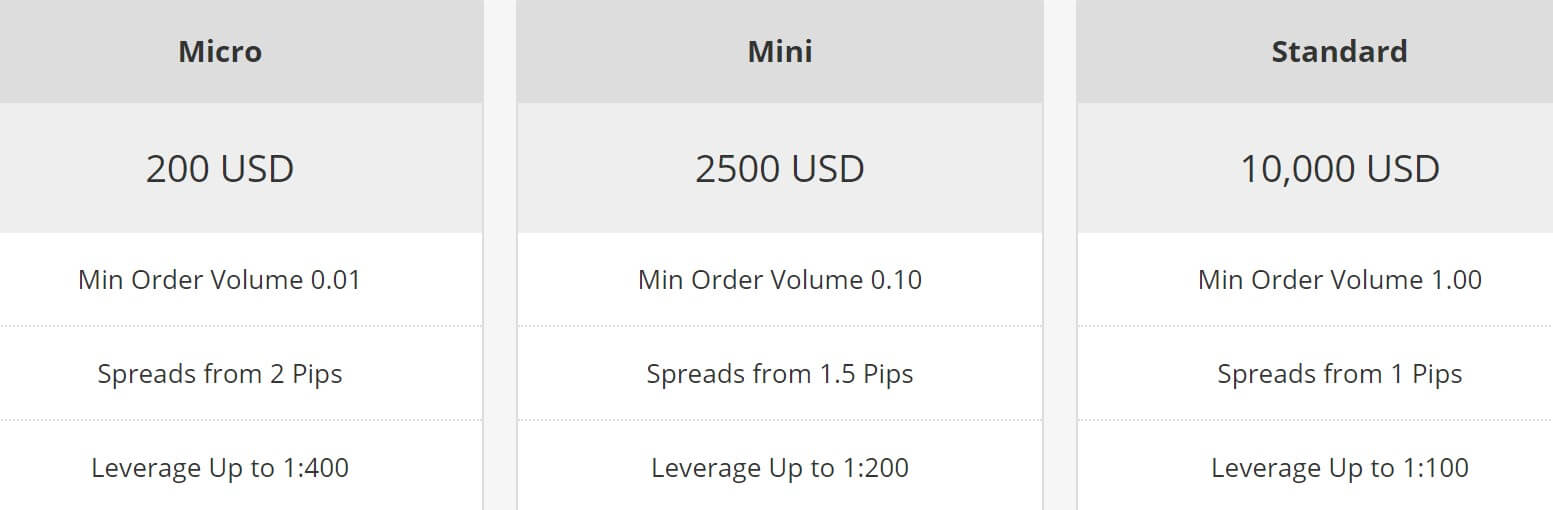

Spreads on the Micro, Mini, Standard, and Premium account types start from 3 pips on majors. It’s almost shocking to see that all of these accounts are offering spreads that are much higher than the industry’s average 1.5 pips, especially considering that it costs $25k to open a Premium account. On minors, we even see spreads as high as 6 pips or more. The only way to access average spreads through this broker would be to make the $100k deposit to open a VIP account and even then, spreads start from 1-2 pips.

Spreads on the Micro, Mini, Standard, and Premium account types start from 3 pips on majors. It’s almost shocking to see that all of these accounts are offering spreads that are much higher than the industry’s average 1.5 pips, especially considering that it costs $25k to open a Premium account. On minors, we even see spreads as high as 6 pips or more. The only way to access average spreads through this broker would be to make the $100k deposit to open a VIP account and even then, spreads start from 1-2 pips.

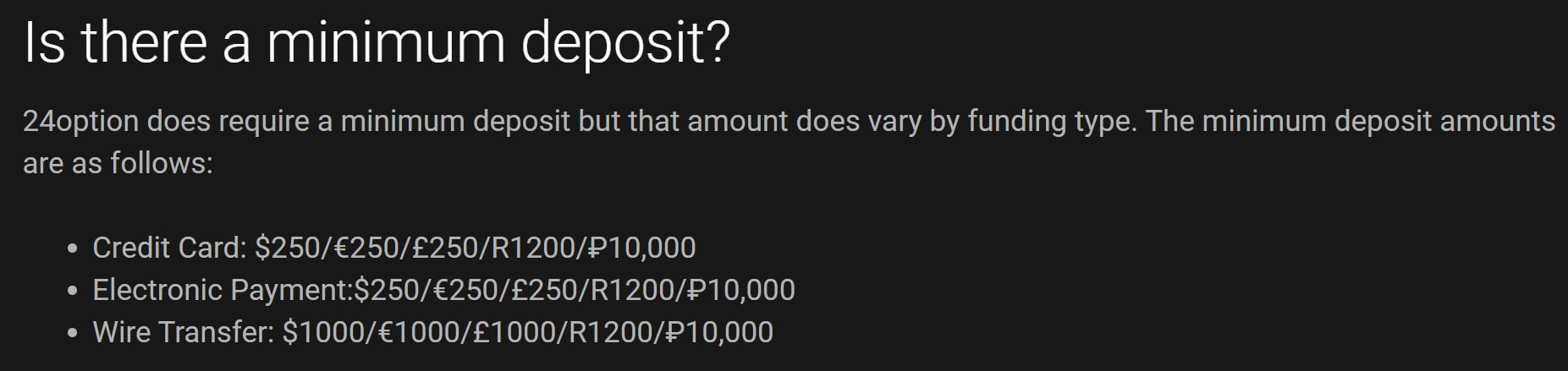

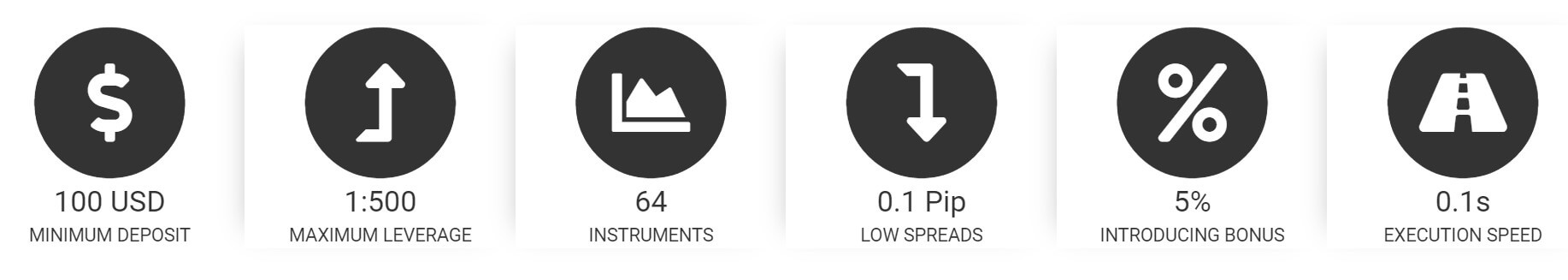

MINIMUM DEPOSIT

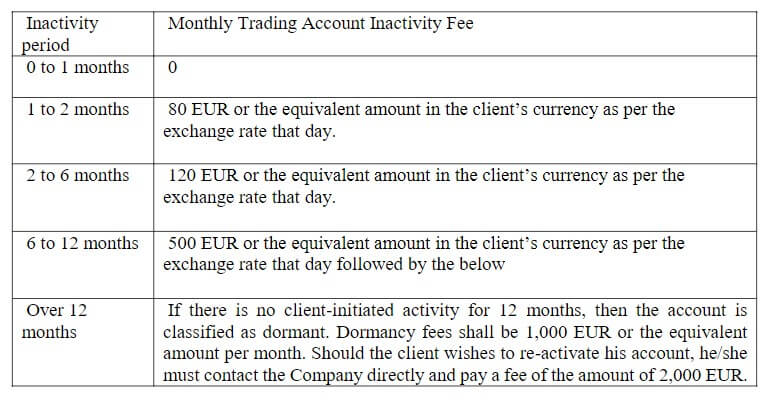

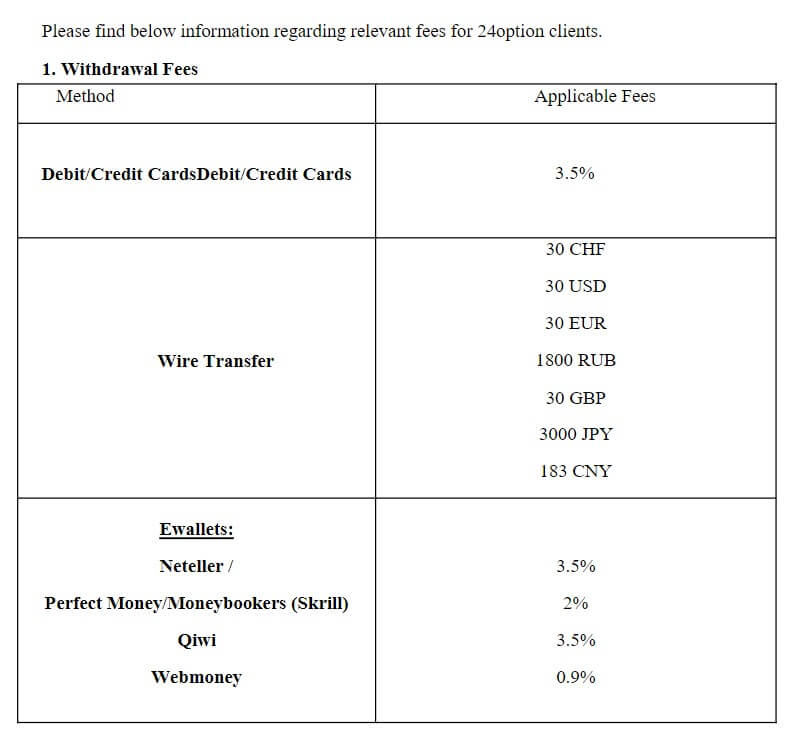

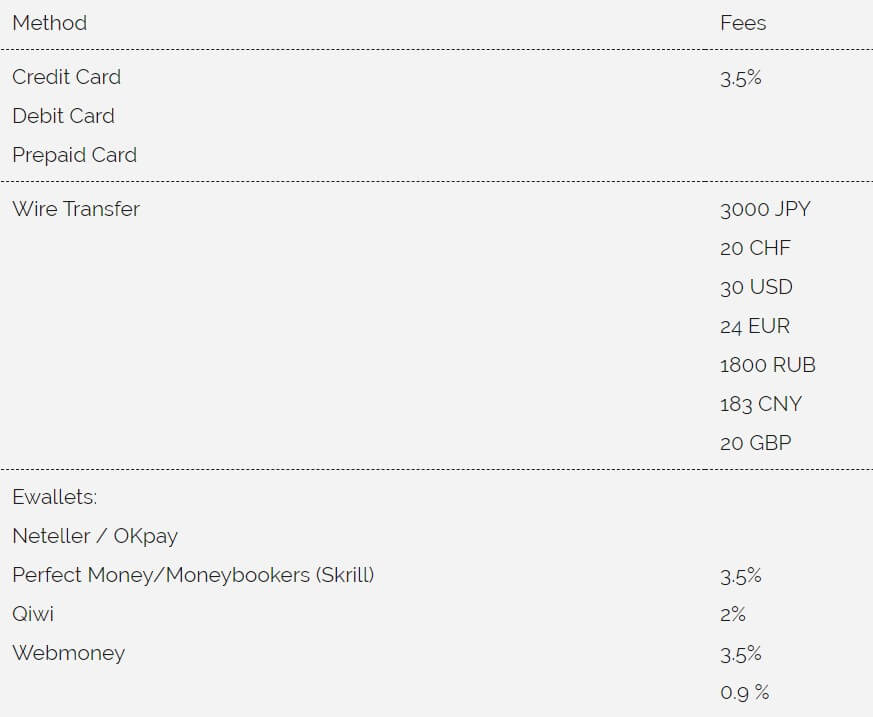

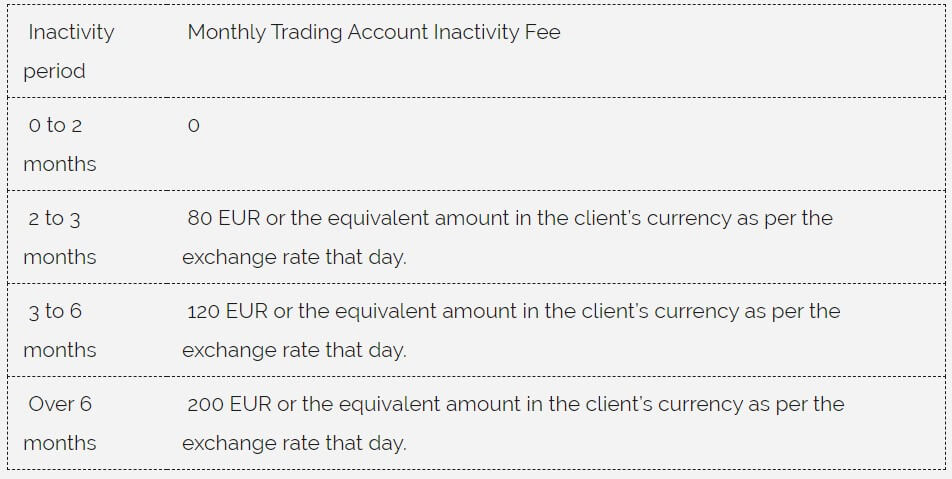

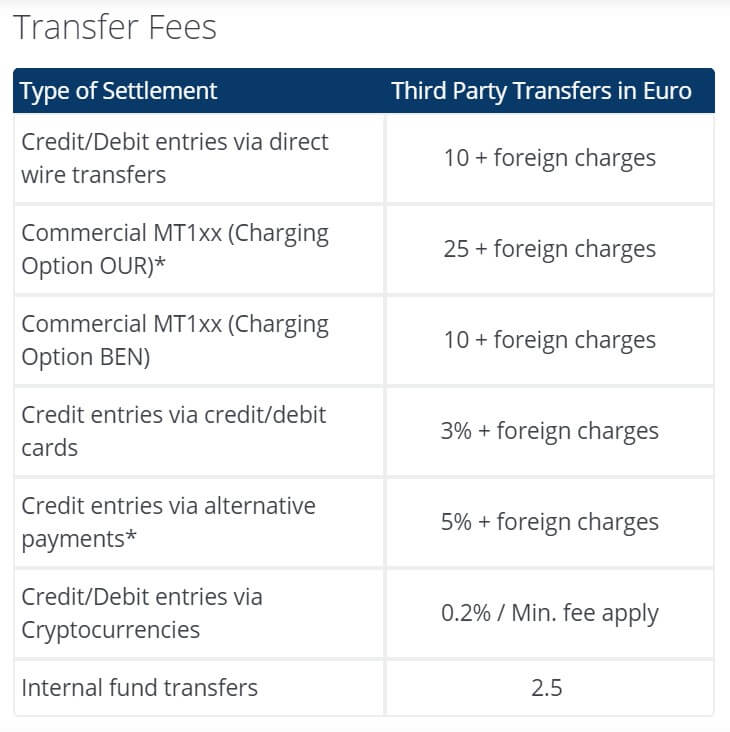

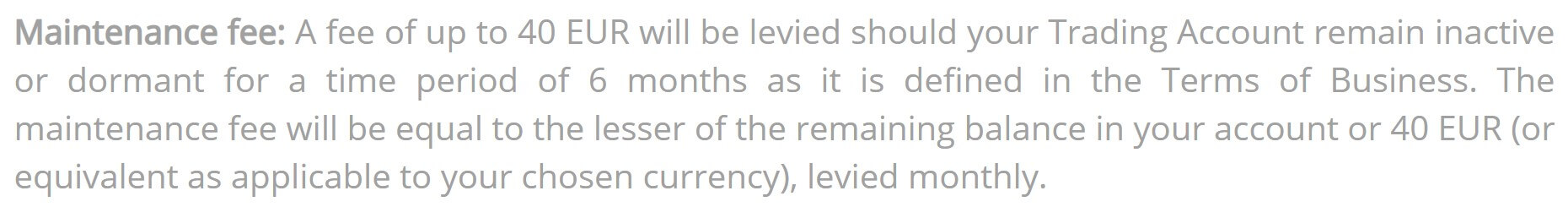

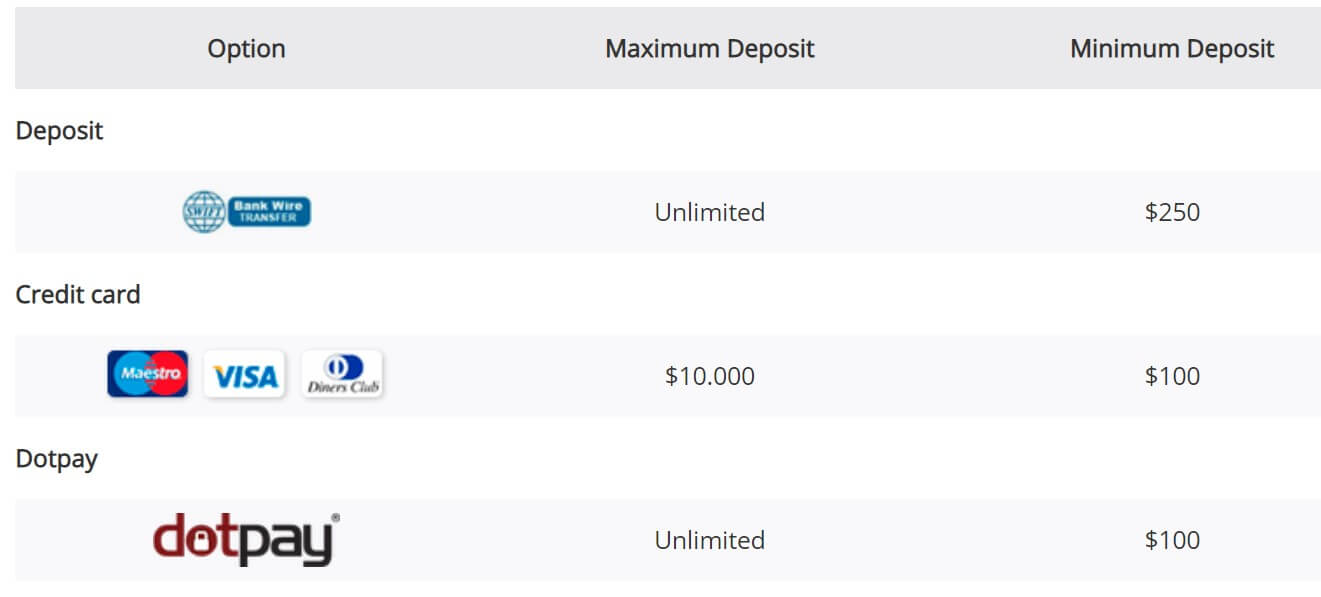

MINIMUM DEPOSIT Notwithstanding the above table, the Company reserves the right to charge a withdrawal fee equal to EUR 50. There is an inactivity fee. The monthly inactivity fee will increase as the total downtime increases:

Notwithstanding the above table, the Company reserves the right to charge a withdrawal fee equal to EUR 50. There is an inactivity fee. The monthly inactivity fee will increase as the total downtime increases:

Proper Trade has an area of educational tools and of interest to the trader. It has an economic news section, this is good for all traders who like to trade with fundamental. It also has a technical analysis area of several currency pairs. This is a positive aspect for all traders who want to have a different vision about these assets, and also to have investment ideas.

Proper Trade has an area of educational tools and of interest to the trader. It has an economic news section, this is good for all traders who like to trade with fundamental. It also has a technical analysis area of several currency pairs. This is a positive aspect for all traders who want to have a different vision about these assets, and also to have investment ideas.

Trading Costs

Trading Costs

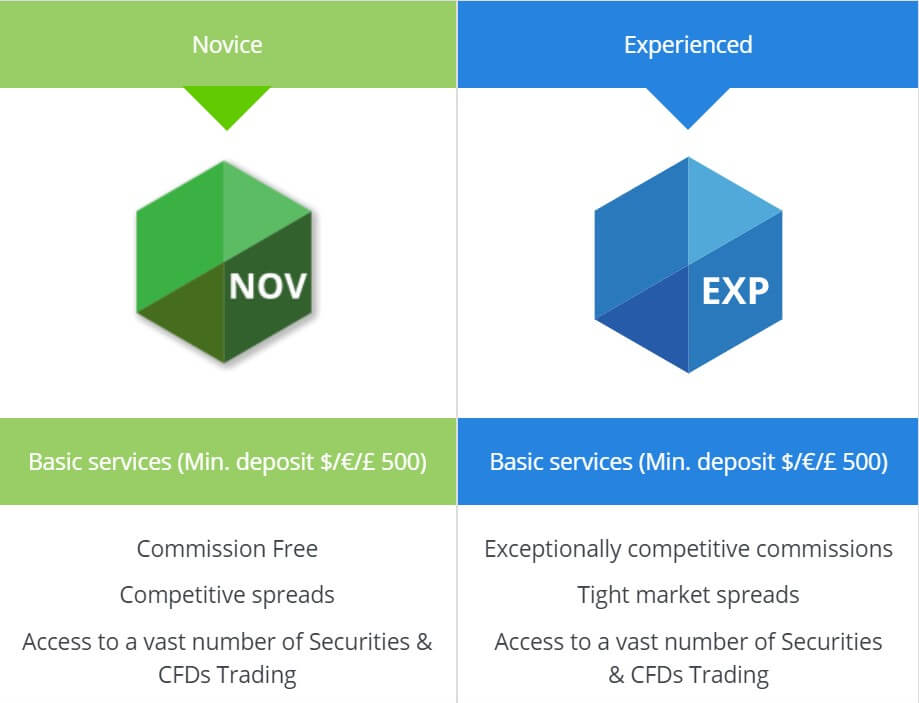

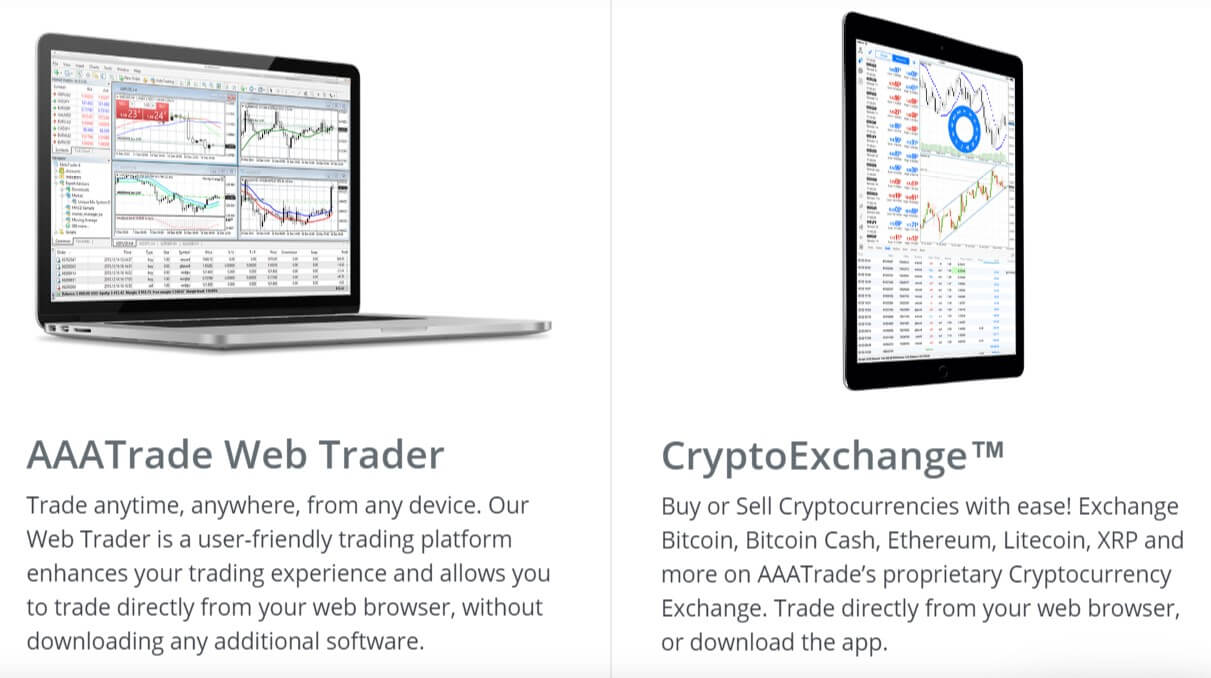

CryptoExchange Account

CryptoExchange Account

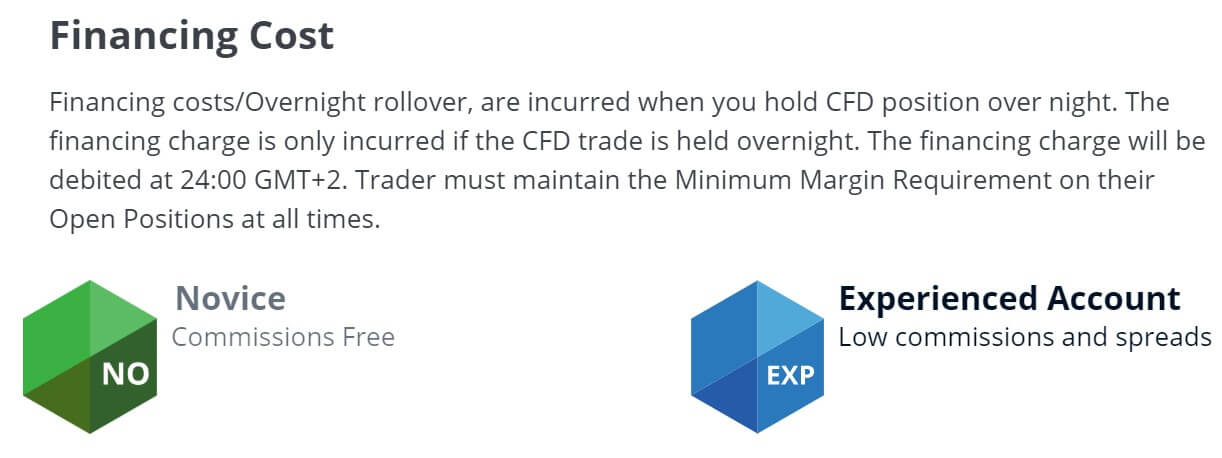

Trading Costs

Trading Costs

Bonuses & Promotions

Bonuses & Promotions

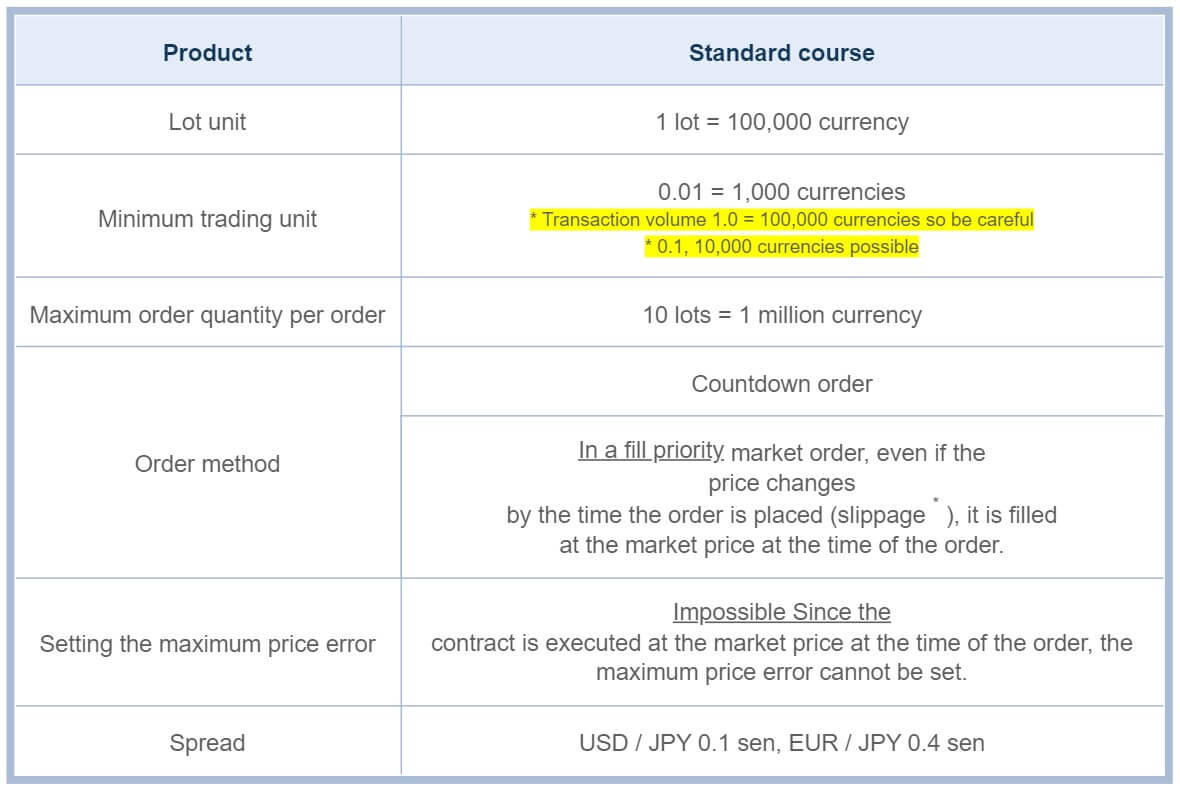

FXTF Live is another tool available only for live accounts and is purely made by the broker using the web service. FXTF Live is used for trade analysis, charting, position overview, ratio and other calculations, and position type filtering. It is complementary to the Mini Terminal tool. There is a long, dedicated page on how to use this tool along with practical applications.

FXTF Live is another tool available only for live accounts and is purely made by the broker using the web service. FXTF Live is used for trade analysis, charting, position overview, ratio and other calculations, and position type filtering. It is complementary to the Mini Terminal tool. There is a long, dedicated page on how to use this tool along with practical applications. Other highlighted indicators included in the package is the Span Mode and Super Bollinger developed by Toshihiko Masaki. The broker has published his biography, blog and his webinars on the trading system. The content has high quality and is deep into the subject, made for professionals but also appropriate for enthusiastic beginners.

Other highlighted indicators included in the package is the Span Mode and Super Bollinger developed by Toshihiko Masaki. The broker has published his biography, blog and his webinars on the trading system. The content has high quality and is deep into the subject, made for professionals but also appropriate for enthusiastic beginners.

Leverage

Leverage Forex Majors: AUDUSD, EURUSD, GBPUSD, NZDUSD, USDCAD, USDCH, FUSDJPY,

Forex Majors: AUDUSD, EURUSD, GBPUSD, NZDUSD, USDCAD, USDCH, FUSDJPY,

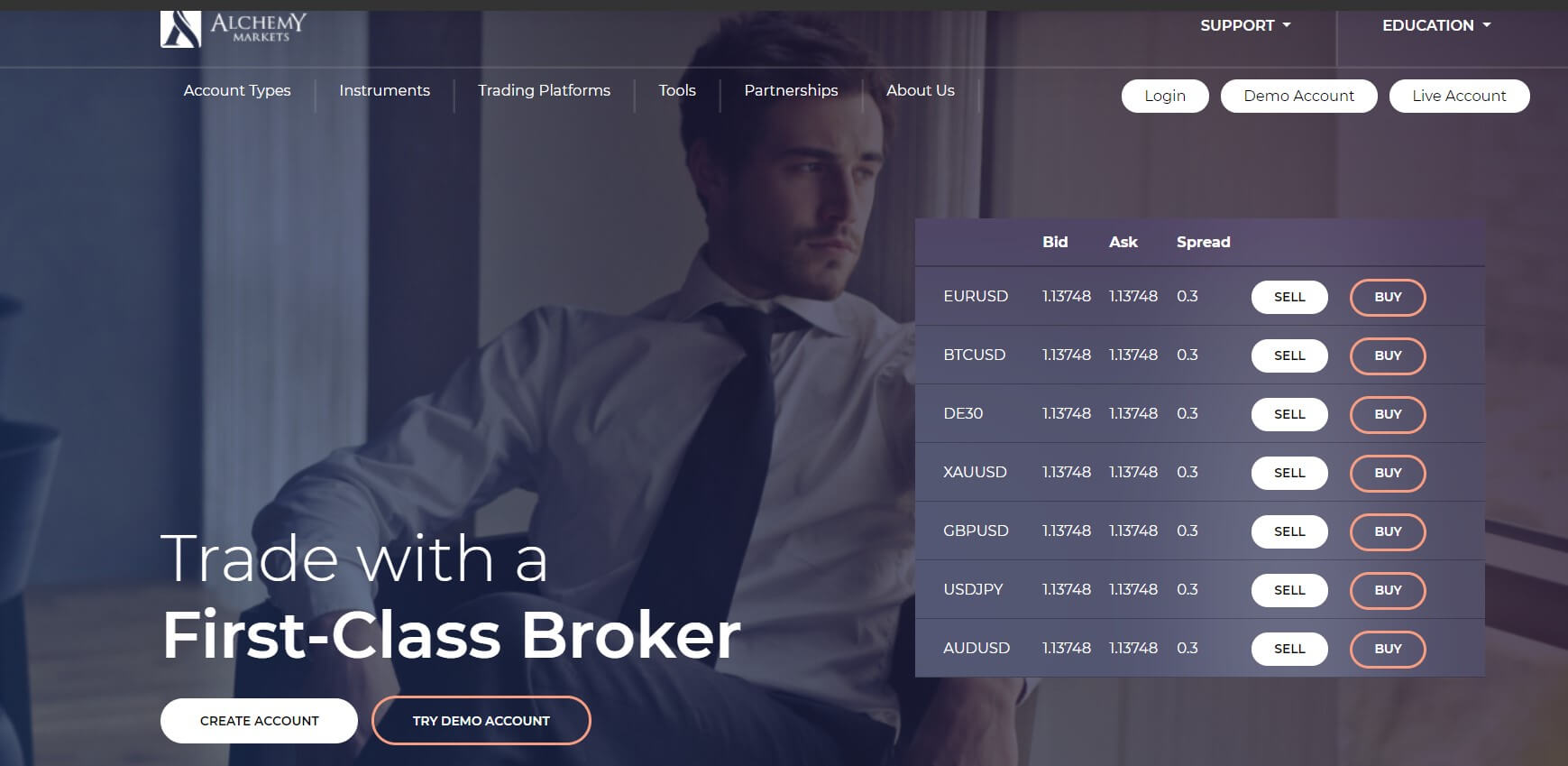

There are more than 80 forex pairs that are available to this broker’s account holders. Alchemy Markets’ selection includes major, minor, and

There are more than 80 forex pairs that are available to this broker’s account holders. Alchemy Markets’ selection includes major, minor, and

Educational & Trading Tools

Educational & Trading Tools

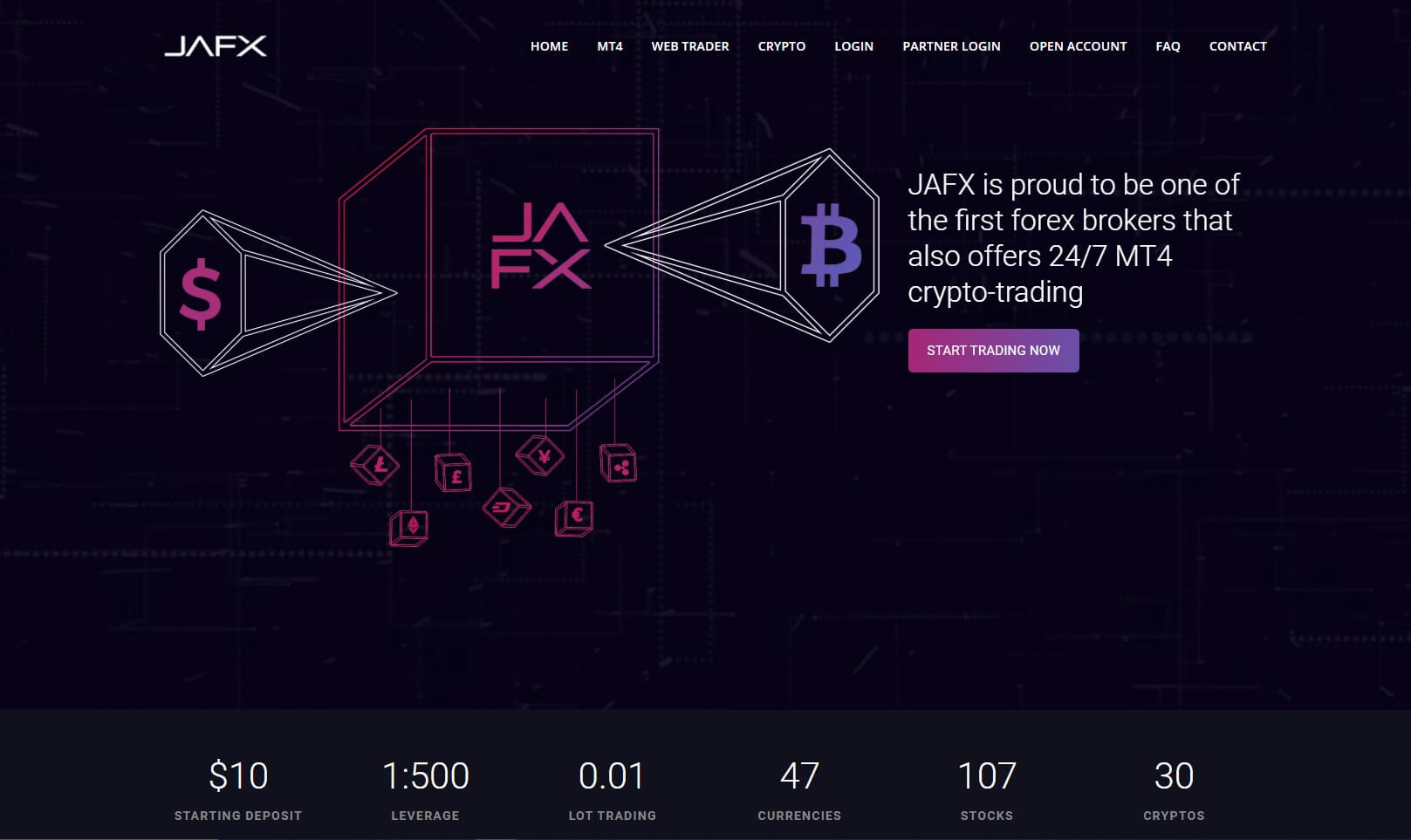

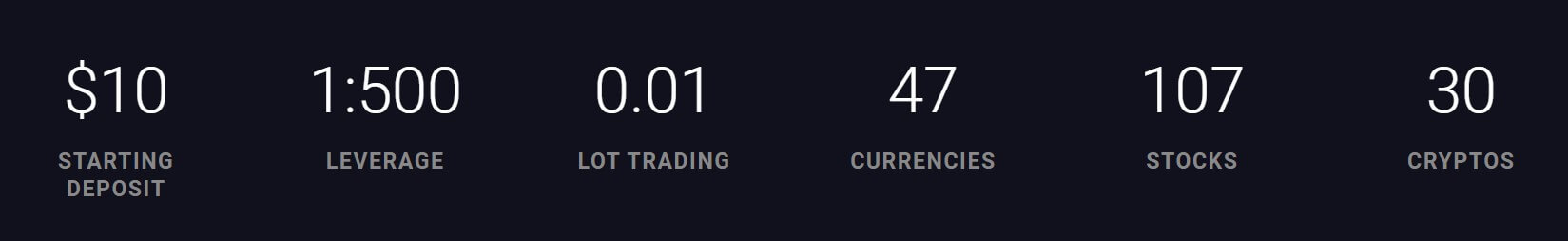

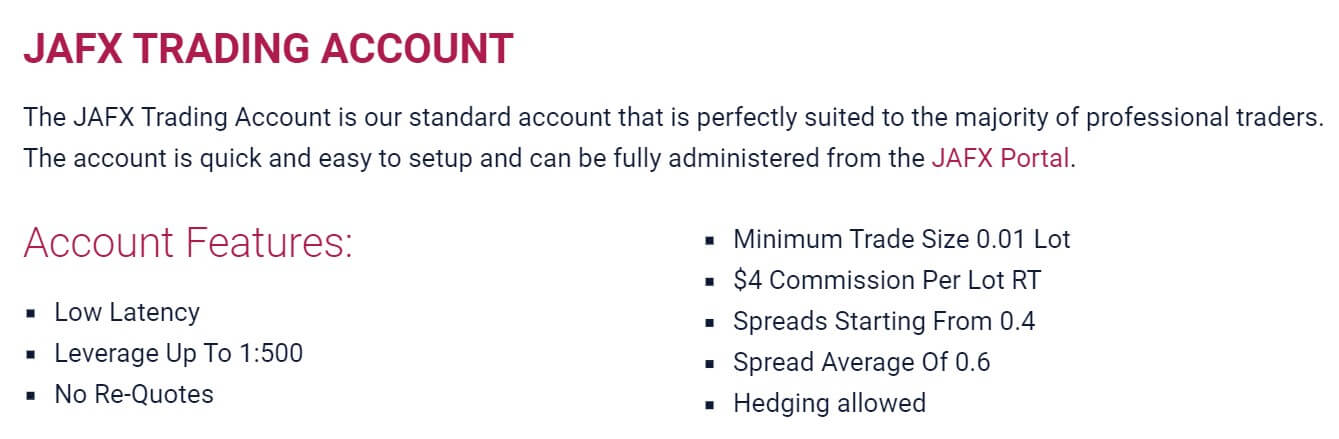

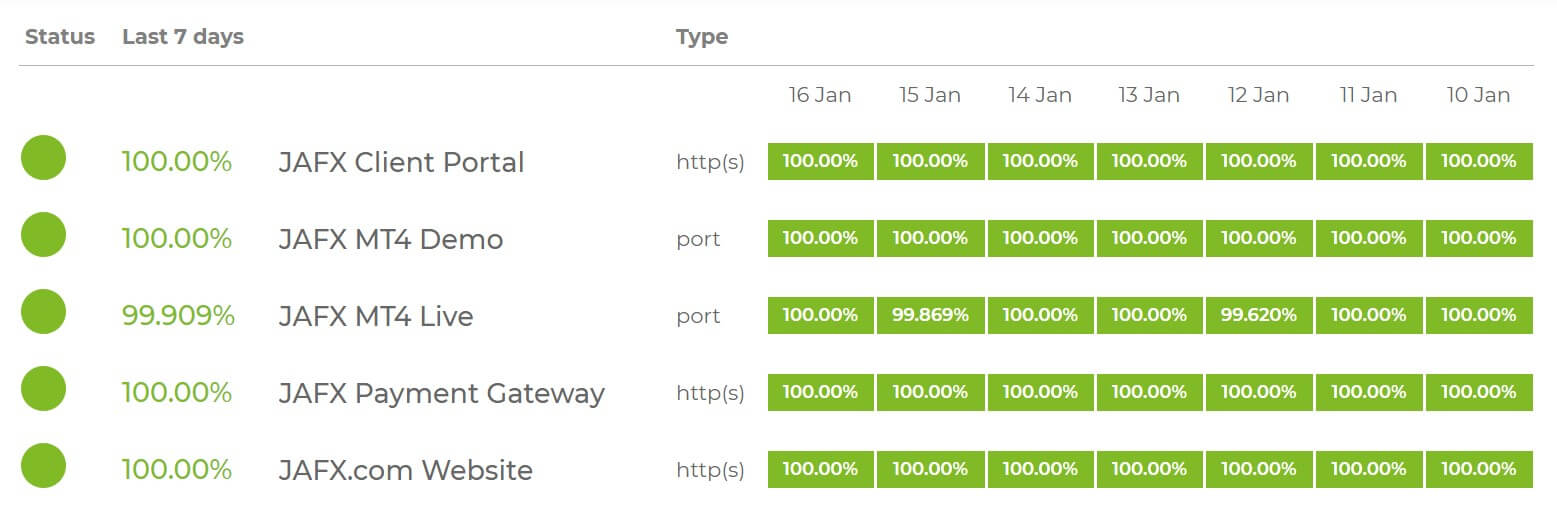

Same as with the deposits, the only method, for now, is the Bitcoin withdrawal. To withdraw your affiliate/IB commissions, it will first need to be transferred into your main trading account. JAFX cannot process withdrawals directly from affiliate/IB accounts. Of course, your account needs to be verified for withdrawals. Skrill or other e-wallets are not supported as stated by the JAFX staff.

Same as with the deposits, the only method, for now, is the Bitcoin withdrawal. To withdraw your affiliate/IB commissions, it will first need to be transferred into your main trading account. JAFX cannot process withdrawals directly from affiliate/IB accounts. Of course, your account needs to be verified for withdrawals. Skrill or other e-wallets are not supported as stated by the JAFX staff.

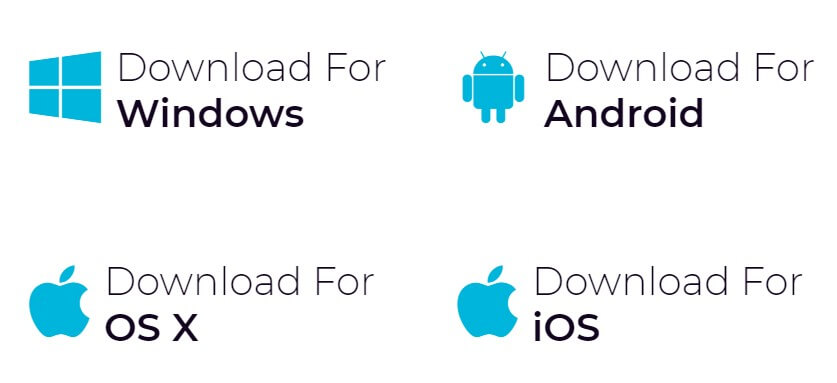

Equally as important, this platform’s software can be installed on Windows devices, iPhones, and Android smartphones. Regardless of which one you choose, the apps will allow you to manage your portfolio, place orders, and open/close positions. MT4’s software is also available to MacBook users. However, they have to first download an external app (for free) before installing MT4 on their Apple laptop or desktop device.

Equally as important, this platform’s software can be installed on Windows devices, iPhones, and Android smartphones. Regardless of which one you choose, the apps will allow you to manage your portfolio, place orders, and open/close positions. MT4’s software is also available to MacBook users. However, they have to first download an external app (for free) before installing MT4 on their Apple laptop or desktop device.

SG Global FX only highlights that their spreads are tight and incredibly competitive, without offering more details. They do, however, outline that their spreads are variable, which means that they change based on market conditions. Different forex pairs also have their own spreads. In general, the most liquid ones on the market, such as the EUR.USD, GBP.USD, and JPY.USD, tend to have the lower bid/ask price variations. Exotics, on the other hand, will have large spreads. However, this will almost always be the case when the markets are volatile and unstable, regardless of whether your traded currency is a major or exotic one.

SG Global FX only highlights that their spreads are tight and incredibly competitive, without offering more details. They do, however, outline that their spreads are variable, which means that they change based on market conditions. Different forex pairs also have their own spreads. In general, the most liquid ones on the market, such as the EUR.USD, GBP.USD, and JPY.USD, tend to have the lower bid/ask price variations. Exotics, on the other hand, will have large spreads. However, this will almost always be the case when the markets are volatile and unstable, regardless of whether your traded currency is a major or exotic one. Educational & Trading Tools

Educational & Trading Tools

Strangely enough, no information about the platform that VIP Way Zone utilizes is available on their website. In most cases, though, forex brokers will work with either MetaTrader 4 (MT4) or MetaTrader 5 (MT5). While the latter is a more modified version, both of the MetaTrader platforms come with valuable tools and resources, including technical indicators, several chart timeframes, live news feeds, and more.

Strangely enough, no information about the platform that VIP Way Zone utilizes is available on their website. In most cases, though, forex brokers will work with either MetaTrader 4 (MT4) or MetaTrader 5 (MT5). While the latter is a more modified version, both of the MetaTrader platforms come with valuable tools and resources, including technical indicators, several chart timeframes, live news feeds, and more.

Educational & Trading Tools

Educational & Trading Tools

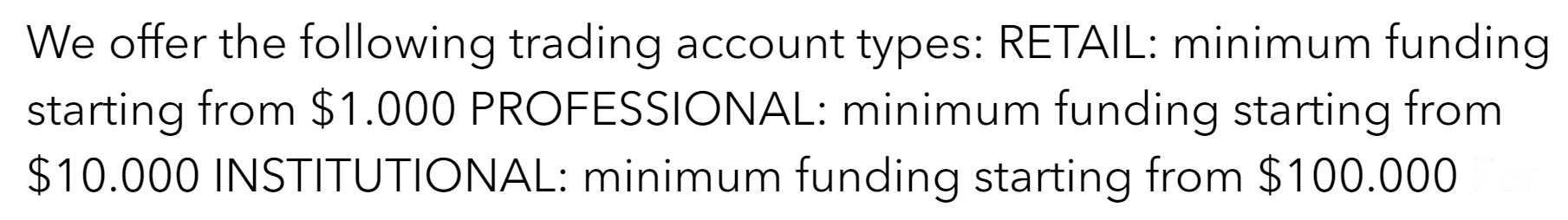

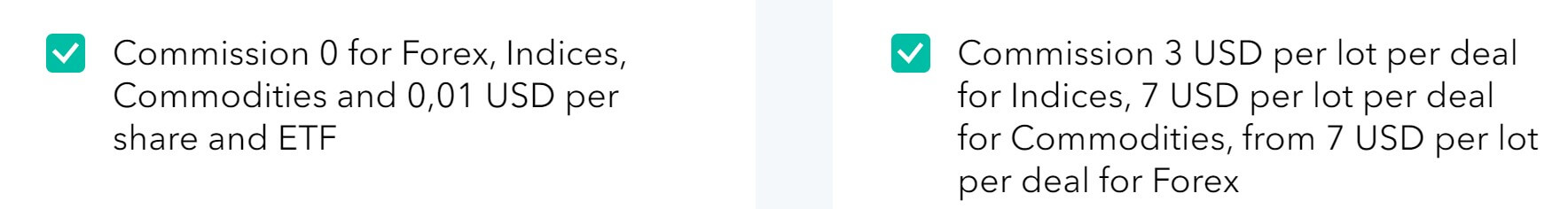

Moreover, even though AM Broker sets a maximum amount of lots per position, users of all three account types can buy/sell as many contracts as they like by breaking up each trade in smaller portions. For example, you want to trade 30 EUR.USD lots but the maximum is 10 per position. You can still open 3 different positions, with each of them being 10 lots in size, in order to exchange 30 lots.

Moreover, even though AM Broker sets a maximum amount of lots per position, users of all three account types can buy/sell as many contracts as they like by breaking up each trade in smaller portions. For example, you want to trade 30 EUR.USD lots but the maximum is 10 per position. You can still open 3 different positions, with each of them being 10 lots in size, in order to exchange 30 lots.

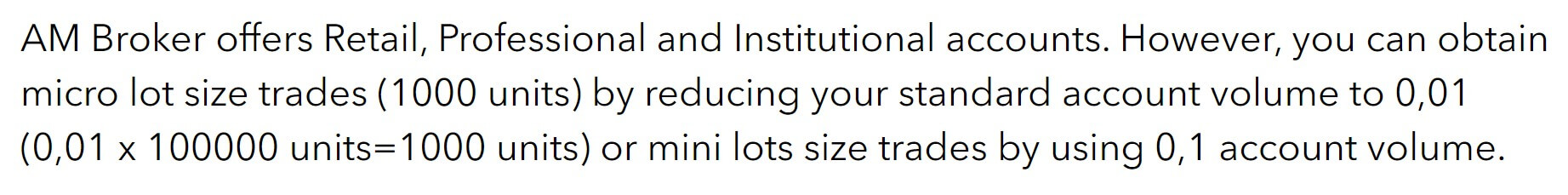

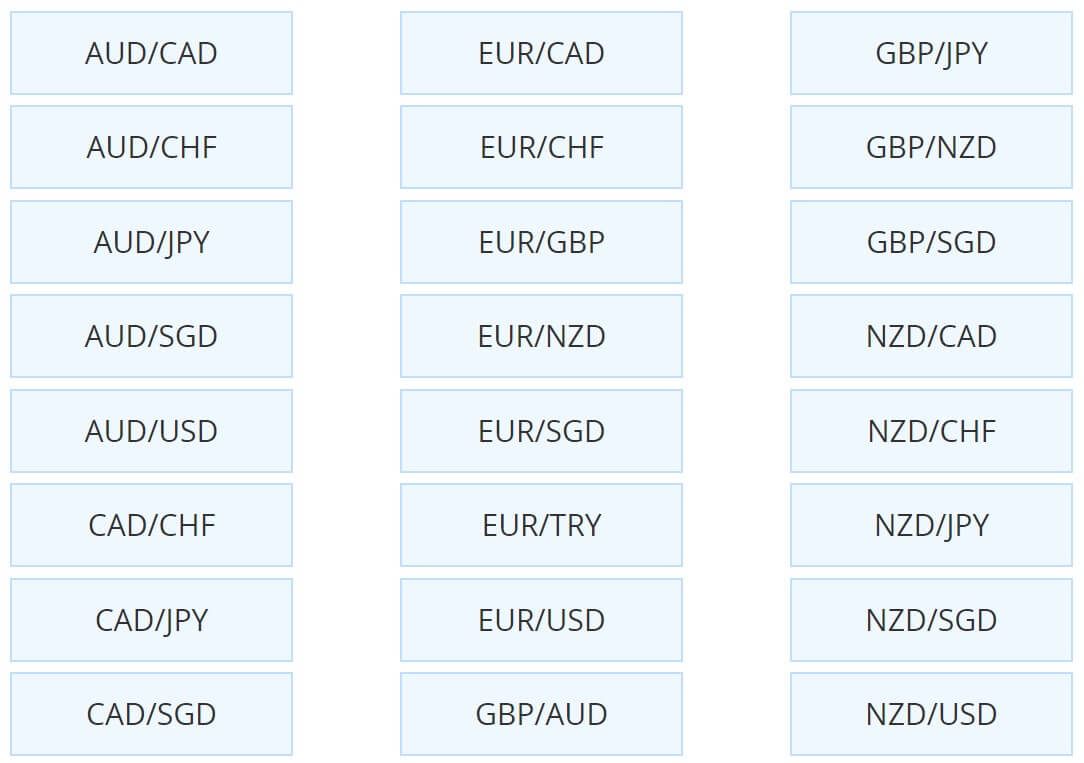

You can trade forex pairs, commodities, market indices, shares, and ETFs through AM Broker. For that matter, this firm provides you with almost 100 different currencies. In most cases, brokers will offer around 40 pairs or, if they’re more competitive, up to 80. To put it shortly, AM Broker’s 100-currency list is incredibly advantageous. Meanwhile, account holders can also buy/sell different types of commodities, including precious metals (gold and silver) and energies (Crude and Brent oil). The indices include each of the three major U.S indexes (the Dow, S&P 500, and Nasdaq), as well as those of European markets (like the UK’s FTSE 100 and Germany’s

You can trade forex pairs, commodities, market indices, shares, and ETFs through AM Broker. For that matter, this firm provides you with almost 100 different currencies. In most cases, brokers will offer around 40 pairs or, if they’re more competitive, up to 80. To put it shortly, AM Broker’s 100-currency list is incredibly advantageous. Meanwhile, account holders can also buy/sell different types of commodities, including precious metals (gold and silver) and energies (Crude and Brent oil). The indices include each of the three major U.S indexes (the Dow, S&P 500, and Nasdaq), as well as those of European markets (like the UK’s FTSE 100 and Germany’s

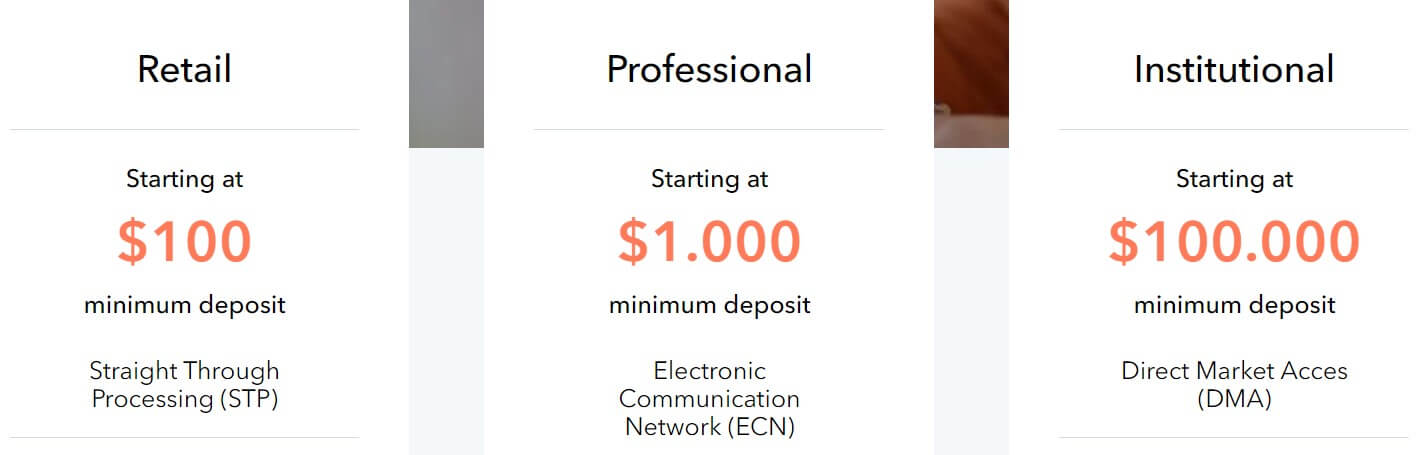

This broker will soon start offering online courses and video seminars. In the meantime, whether you have the Professional, Retail, or Institutional type, your portfolio comes with a Professional Account Manager that provides you with one-on-one training sessions. They also help traders understand how to use and take advantage of the different tools on the MT5 platform.

This broker will soon start offering online courses and video seminars. In the meantime, whether you have the Professional, Retail, or Institutional type, your portfolio comes with a Professional Account Manager that provides you with one-on-one training sessions. They also help traders understand how to use and take advantage of the different tools on the MT5 platform.

Assets

Assets

Leverage

Leverage

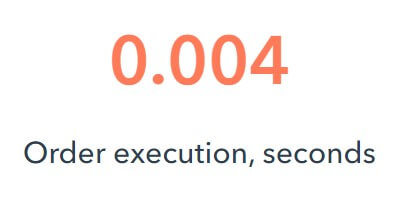

MetaTrader 5 (MT5) is a state-of-the-art and sophisticated platform that forex traders from all around the world utilize. There are several features that make MT5 especially desirable. First, the platform’s tools and displays are incredibly easy to use. Second, their prices and order executions are both accurate and instant. Third, you can integrate many technical indicators and analyze several chart timeframes on the platform. Lastly, but certainly not least, all types of financial instruments are available on MT5. Above all else, you can download the platform on any device (including smartphones) or directly trade through your browser.

MetaTrader 5 (MT5) is a state-of-the-art and sophisticated platform that forex traders from all around the world utilize. There are several features that make MT5 especially desirable. First, the platform’s tools and displays are incredibly easy to use. Second, their prices and order executions are both accurate and instant. Third, you can integrate many technical indicators and analyze several chart timeframes on the platform. Lastly, but certainly not least, all types of financial instruments are available on MT5. Above all else, you can download the platform on any device (including smartphones) or directly trade through your browser.

Meanwhile, the main downsides are as follows: A very small leverage, limited transfer options, the lack of trading tools, and country restrictions. Having said all that, this broker is continuing to expand and improve its offerings. For a start, they plan on introducing new payment methods, making their inclusive forex and asset selection even more accessible and lucrative. Support is also reliable and can be contacted through a variety of methods. Even if the firm’s educational content doesn’t suffice, you can still get plenty of advice and consultations from both JDC Markets’s team and MT5’s experienced specialists. Moreover, opening an account and meeting the minimum deposit requirement is certainly doable.

Meanwhile, the main downsides are as follows: A very small leverage, limited transfer options, the lack of trading tools, and country restrictions. Having said all that, this broker is continuing to expand and improve its offerings. For a start, they plan on introducing new payment methods, making their inclusive forex and asset selection even more accessible and lucrative. Support is also reliable and can be contacted through a variety of methods. Even if the firm’s educational content doesn’t suffice, you can still get plenty of advice and consultations from both JDC Markets’s team and MT5’s experienced specialists. Moreover, opening an account and meeting the minimum deposit requirement is certainly doable.

Just like depositing it seems that the only way to withdraw is through Nigerian local transfers, details on fees are not present but will most likely be the transfer fee of the bank.

Just like depositing it seems that the only way to withdraw is through Nigerian local transfers, details on fees are not present but will most likely be the transfer fee of the bank.

Minimum Deposit

Minimum Deposit Withdrawals can also only be done via Bank Wire Transfer, withdrawals can use the same currencies of GBP, USD, JPY, EUR, CHF, RUB, SEK, CAD, HDK, MXN, PLN, CNY, NOK, SGD or AUD. There is a fee of 30 EUR, GBP or USD added to each withdrawal, also be sure to check with your bank to understand if they add any fees of their own on top of the Exante fee.

Withdrawals can also only be done via Bank Wire Transfer, withdrawals can use the same currencies of GBP, USD, JPY, EUR, CHF, RUB, SEK, CAD, HDK, MXN, PLN, CNY, NOK, SGD or AUD. There is a fee of 30 EUR, GBP or USD added to each withdrawal, also be sure to check with your bank to understand if they add any fees of their own on top of the Exante fee.

Exante is a little different from your usual trading platform, they offer their services in a slightly different way moving away from the conventional lot system. Due to this, it can be a little confusing understanding of how things work but they actually function in much the same way. We could not work out if there was any leverage and the initial deposit is quite high potentially pricing out newer traders. Bank Wire Transfer is the only transfer method and there is, unfortunately, a hefty withdrawal fee. Exante seems to be aiming towards the more experienced traders, so if you are new, it may be better to look elsewhere.

Exante is a little different from your usual trading platform, they offer their services in a slightly different way moving away from the conventional lot system. Due to this, it can be a little confusing understanding of how things work but they actually function in much the same way. We could not work out if there was any leverage and the initial deposit is quite high potentially pricing out newer traders. Bank Wire Transfer is the only transfer method and there is, unfortunately, a hefty withdrawal fee. Exante seems to be aiming towards the more experienced traders, so if you are new, it may be better to look elsewhere.

There are a few different educational pieces available on the website, these include a section called Forex Education which goes over a number of different topics, giving brief outlines on how things work and how different tasks can be performed. There is also a currency converter should you wish to change once currency into another, live forex quotes to see where the markets are at any point in time, daily

There are a few different educational pieces available on the website, these include a section called Forex Education which goes over a number of different topics, giving brief outlines on how things work and how different tasks can be performed. There is also a currency converter should you wish to change once currency into another, live forex quotes to see where the markets are at any point in time, daily

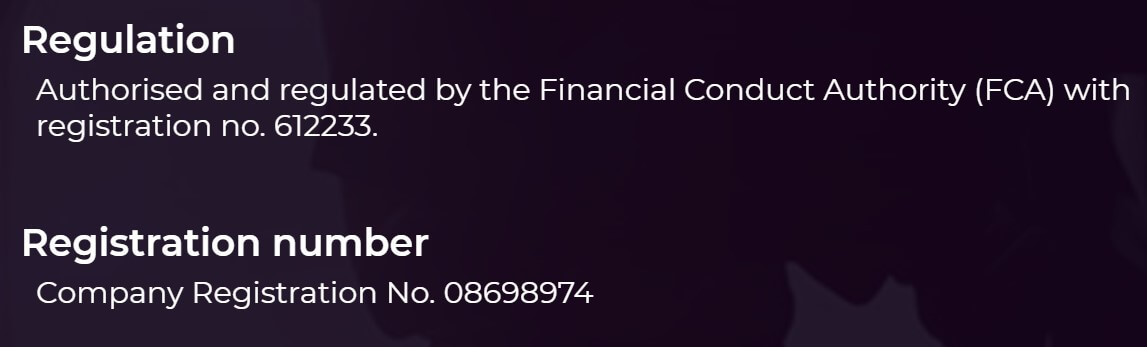

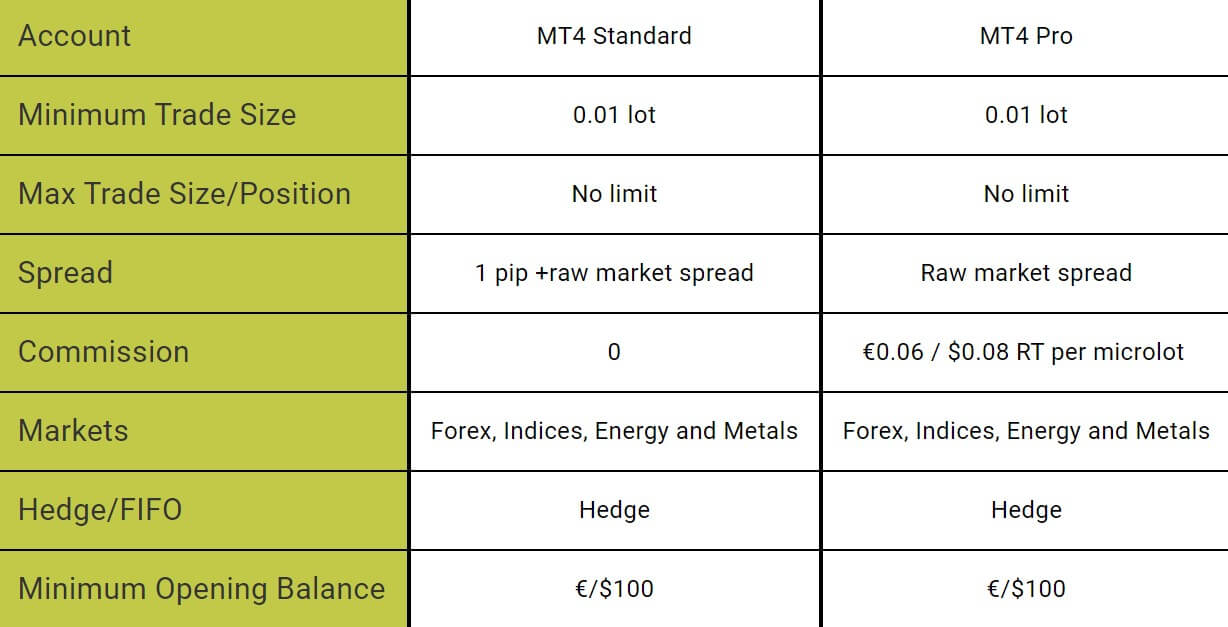

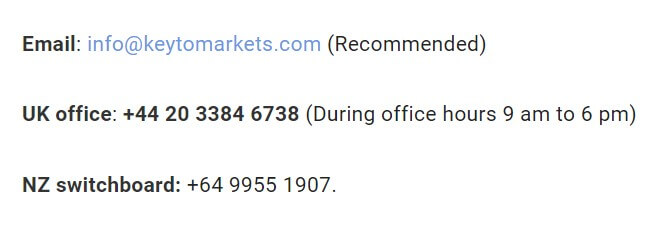

Key To Markets are not wholly transparent when it comes to the ins and outs of their services. It is very disappointing to see they do not offer even a demo account, which does not allow potential clients a fair judgement on whether this broker is suitable and in line with their expectations as well s their prefered trading style and strategies. In addition, it is incredibly poor conduct for a regulated company (FCA) to be totally unresponsive when it comes to customer support. This is a clear demonstration that not all brokers can stand tall with their regulation status being their one tool to attract clients when they have no time or thought for their clients.

Key To Markets are not wholly transparent when it comes to the ins and outs of their services. It is very disappointing to see they do not offer even a demo account, which does not allow potential clients a fair judgement on whether this broker is suitable and in line with their expectations as well s their prefered trading style and strategies. In addition, it is incredibly poor conduct for a regulated company (FCA) to be totally unresponsive when it comes to customer support. This is a clear demonstration that not all brokers can stand tall with their regulation status being their one tool to attract clients when they have no time or thought for their clients.

Java’s investment portfolio is primarily made up of currency pairs, in addition to futures, spot metals, and spot energies. In total, the broker is offering 24 currency pairs, with a few exotic options. We also seem some cryptocurrency pairs on the list, including BTCUSD, DSHUSD, ETHUSD, LTCUSD,

Java’s investment portfolio is primarily made up of currency pairs, in addition to futures, spot metals, and spot energies. In total, the broker is offering 24 currency pairs, with a few exotic options. We also seem some cryptocurrency pairs on the list, including BTCUSD, DSHUSD, ETHUSD, LTCUSD,

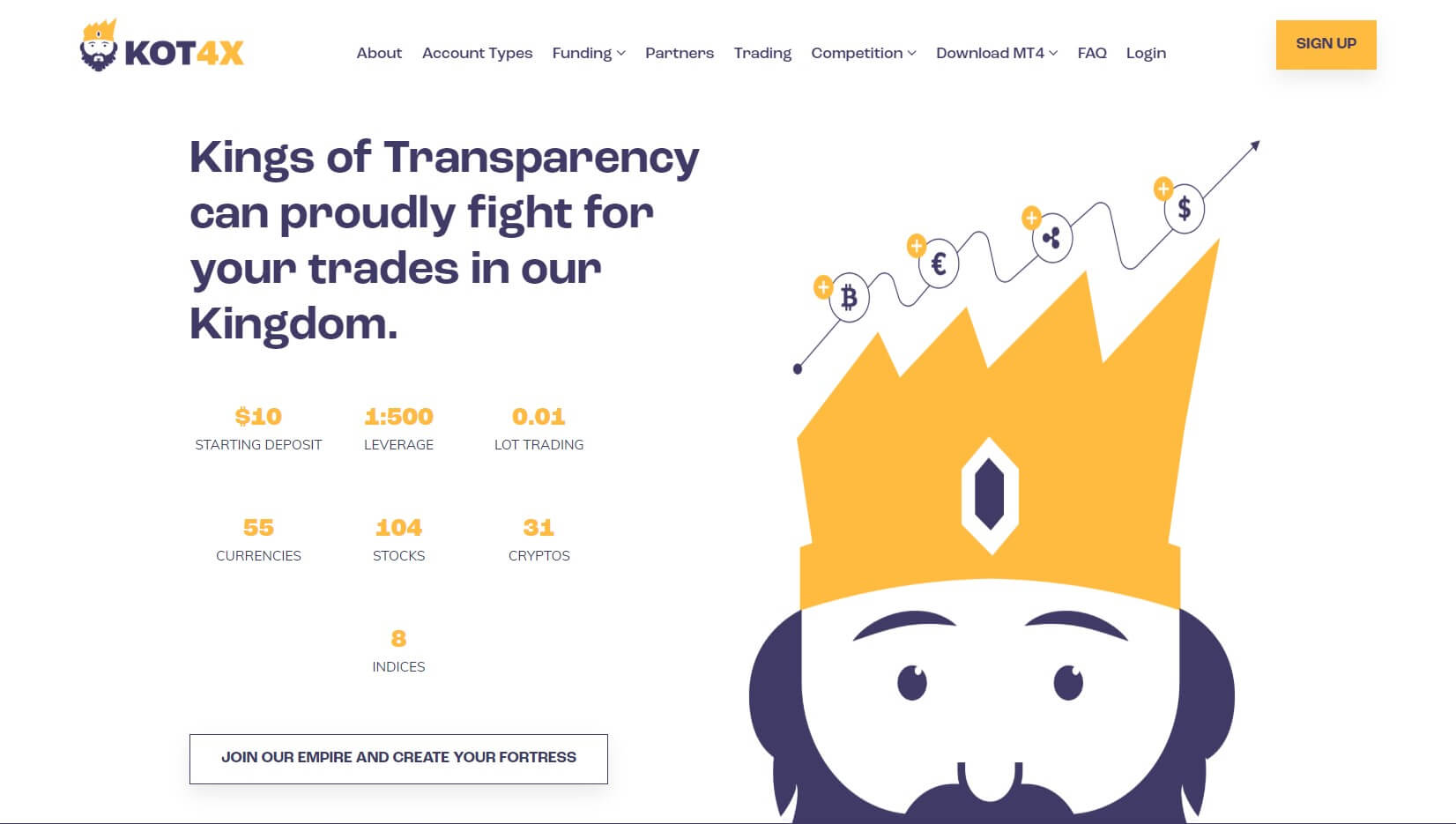

This broker offers one of the most recognized and prestigious platforms around, the MT4. This platform offers trading on a number of devices namely; Windows, Mac, Android and IOS and you can find a download link on the KOT4X website. The platform offers 30 built-in technical indicators with adjustable and interactive charts that enable clients to stay afloat current trading market activities. Some other advantages of this platform include full customizability, Expert Advisors and multilingual service among many others. Although we now have the MT5, the ‘bigger brother’ of the initial MT4 platform, many traders still prefer the latter.

This broker offers one of the most recognized and prestigious platforms around, the MT4. This platform offers trading on a number of devices namely; Windows, Mac, Android and IOS and you can find a download link on the KOT4X website. The platform offers 30 built-in technical indicators with adjustable and interactive charts that enable clients to stay afloat current trading market activities. Some other advantages of this platform include full customizability, Expert Advisors and multilingual service among many others. Although we now have the MT5, the ‘bigger brother’ of the initial MT4 platform, many traders still prefer the latter.

Minimum Deposit

Minimum Deposit

Educational & Trading Tools

Educational & Trading Tools