Introduction

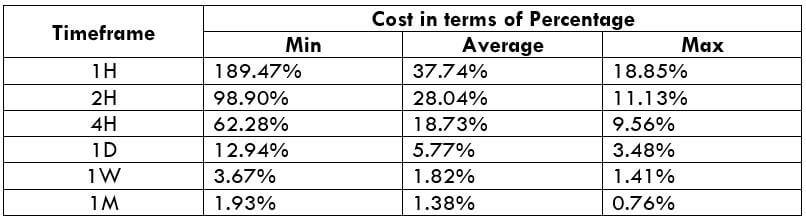

USD/DKK is the abbreviation for the US Dollar against the Danish Krone. This pair is considered as an exotic currency pair that typically presents high volatility and low trading volume. The US Dollar is the base currency, and the Danish Krone is the quote currency.

Understanding USD/DKK

The value of USD/DKK represents the value of DKK that is equivalent to one US Dollar. It is quoted as 1 USD per X DKK. So, if the current value of this pair is 6.9868, then these many Danish Krones are required to purchase one US Dollar.

Spread

Spread is the difference between the bid and the ask price of a currency pair. It is the primary way through which brokers generate revenue. It varies from broker to broker and also the model of execution.

ECN: 14 pips | STP: 15 pips

Fees

The fee is simply the commission that you pay on each trade you take.

Fee on ECN – 3-6

Fee on STP – 0

Slippage

Slippage is the difference between the price which was intended by the client and the price he got from the broker. This difference changes with the market’s volatility and the broker’s execution speed. Slippage on exotic pairs is typically high.

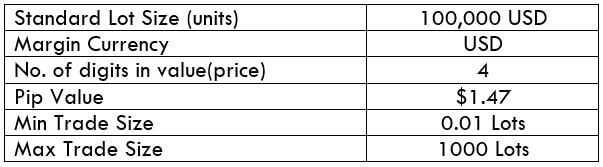

Trading Range in USD/DKK

As it is pretty evident from the table, the trading range is an illustration of the pip movement in a currency pair in different timeframes. These values help us determine the minimum, average, and maximum profit or loss that can be incurred in a trade during a specified time frame. Another application for this table is discussed in the next topic.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine an extensive period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

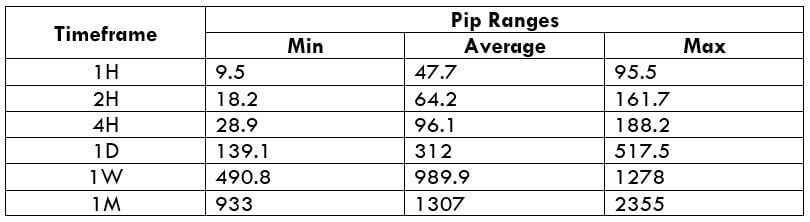

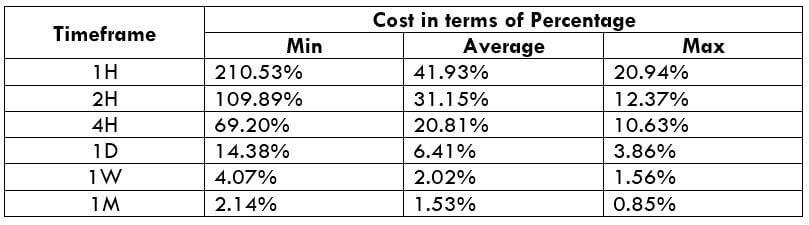

USD/DKK Cost as a Percent of the Trading Range

Cost as a percent of the trading range is an application to the above volatility table. The below two tables depict the total cost variation in different volatilities and timeframes for ECN and STP accounts.

Note: The percentages are obtained by finding the ratio between the total cost and the pip movement values in the above table.

ECN Model Account

Spread = 14 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 14 + 3 = 20

STP Model Account

Spread = 15 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 15 + 0 = 18

The Ideal way to trade the USD/DKK

What do the percentage values mean? Comprehending the above tables is simple. The higher the magnitude of the percentage, the higher are the costs for that particular volatility and timeframe. Similarly, lower percentage values mean that the costs are low.

Trading during high volatilities or when the cost is high is not ideal. So, to ensure an equilibrium between the two, it is best to enter the market during those times when the volatility is around the mid values illustrated in the volatility table.

Apart from this, one can reduce their total costs significantly by placing orders using limit/pending orders instead of market orders. This will altogether remove the slippage factor on the total cost and bring down its value by a high number.

As already mentioned, exotic currency pairs are highly volatile and have low trading volume. This results in higher costs on the trade. Hence, if you really want to trade this pair, it is recommended to follow the above-mentioned mentioned techniques to reduce costs by a considerable amount. Cheers!