Templer FX is an online forex service provider. Located in Saint Vincent and the Grenadines, Templer FX aims to provide a superior level of service to retail and institutional customers to sustain long-term relationships that will enable us to respond more efficiently and proactively to their changing needs. Templer FX’s goal is to provide its customers with the very best trade execution and service in the FX industry. In order to meet its goals, Templer FX employs three strategies that are the backbone of their success: Customer Service, Research and Execution. That is according to them, this review will be looking into the services being offered to see if they manage to achieve their three main targets.

Account Types

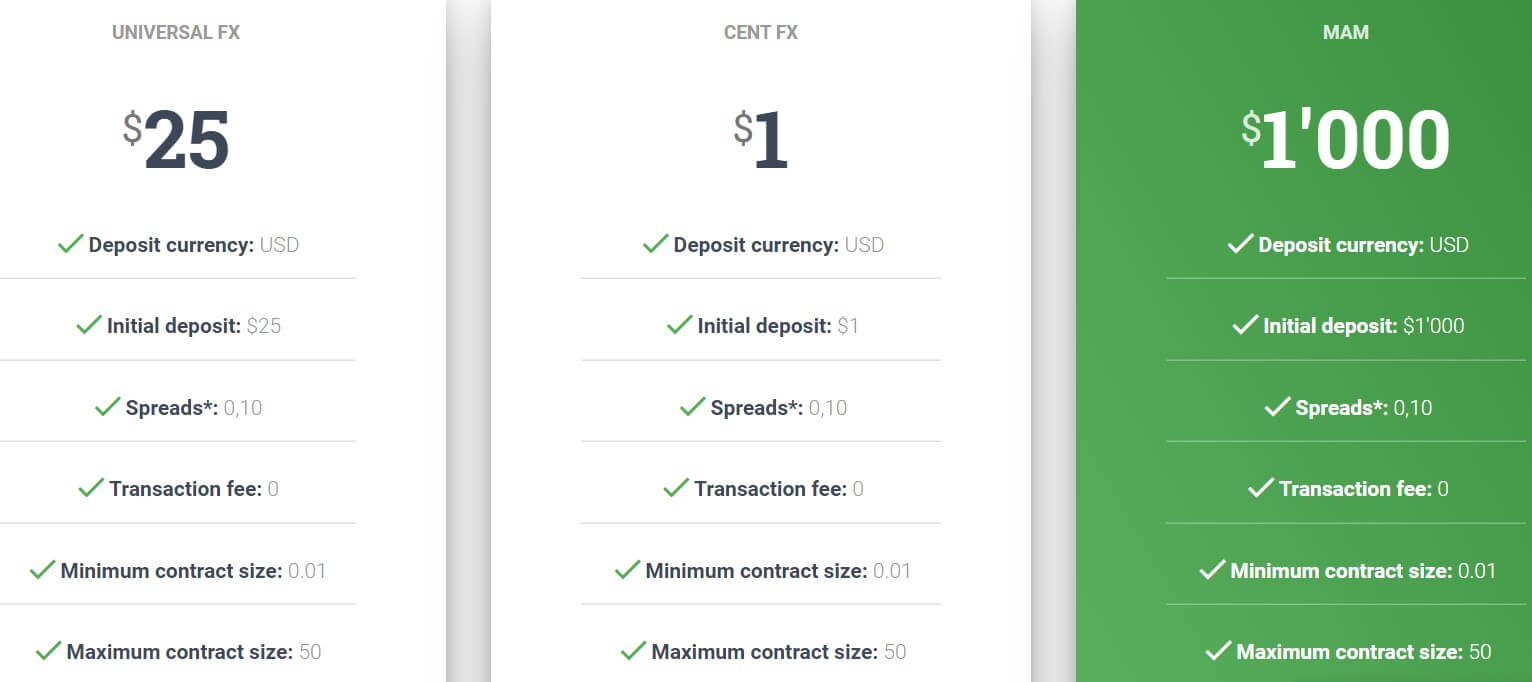

There are 5 different accounts available should you decide to sign up, each having their own requirements and features, so lets briefly look at what they are.

Universal FX: This account requires a minimum deposit of $25, the base currency must be in USD and it comes with spreads starting from 0.1 points and there are no added commissions. The minimum trade size is 0.01 lots with the maximum being 50 lots, there is also a maximum of 100 open trades at any one time. Leverage can be between 1:1 and 1:2000, a hedge margin is present at 50% and the margin call and stop out levels are 80% and 30% respectively, Expert Advisors are ok to use on this account.

Cent FX: This account requires a minimum deposit of $1, the base currency must be in USD and it comes with spreads starting from 0.1 points and there are no added commissions. The minimum trade size is 0.01 lots with the maximum being 50 lots, there is also a maximum of 100 open trades at any one time. Leverage can be between 1:1 and 1:2000, a hedge margin is present at 50% and the margin call and stop out levels are 80% and 30% respectively, Expert Advisors are ok to use on this account.

MAM: This account requires a minimum deposit of $1,000, the base currency must be in USD and it comes with spreads starting from 0.1 points and there are no added commissions. The minimum trade size is 0.01 lots with the maximum being 50 lots, there is also a maximum of 100 open trades at any one time. Leverage can be between 1:1 and 1:2000, a hedge margin is present at 50% and the margin call and stop out levels are 80% and 30% respectively, Expert Advisors are ok to use on this account.

Muslim FX: This account requires a minimum deposit of $25, the base currency must be in USD and it comes with spreads starting from 0.1 points and there are no added commissions. The minimum trade size is 0.01 lots with the maximum being 50 lots, there is also a maximum of 100 open trades at any one time. Leverage can be between 1:1 and 1:2000, a hedge margin is present at 50% and the margin call and stop out levels are 80% and 30% respectively, Expert Advisors are ok to use on this account. There are no swap fees or charges with this account.

Segregated Account: This account requires a minimum deposit of 50,000 EUR, the base currency must be in EUR and it comes with spreads starting from 0.1 points and there are no added commissions. The minimum trade size is 0.01 lots with the maximum being 50 lots, there is also a maximum of 100 open trades at any one time. Leverage can be between 1:1 and 1:2000, a hedge margin is present at 50% and the margin call and stop out levels are 80% and 30% respectively, Expert Advisors are ok to use on this account.

Platforms

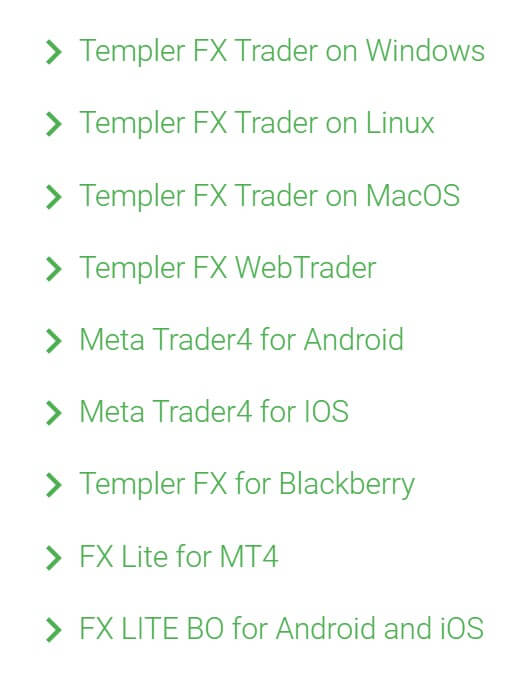

Templer FX is offering two platform versions to help meet the needs of their clients. These include MetaTrader 4 and Templer Trader Professional. Below, we take a look at each.

MetaTrader 4 (MT4): This FX broker offers MT4 in both Android and iOS app formats. There is no shorts of information surrounding the MetaTrader platforms online, but we’ll still point out some of the key features below.

- Trading from a real-time live tick chart

- Ability to use all symbols available

- Place Buy and Sell orders

- Place Pending orders

- Set Stop-Loss and Take-Profit

- Close and Modify Existing Orders

- View Real-Time Profit/Loss of Live Trades

- View Past history

- Real-time interactive currency charts

- Real-time market price overview

- Technical analysis tools

TemplerFX Trader Professional: The broker’s very own proprietary trading platform, this terminal successfully combines important functionalities that allow for effective FX trading with exceptional usability. Templer FX Trader Professional is among the fastest within the industry and boasts the following key features:

- Unlimited chart-analysis possibilities

- Support of different time series

- A high number of technical indicators and surveys

- Creation of automated trading systems (Expert Advisor)

- Real-time data export about DDE record

- Internal e-mail system

- Generation of confirmations and accounting in real-time

- Available for Windows, Linux, Mac, WebTrader, and Blackberry

Leverage

The leverage available ranges from 1:1 all the way up to 1:2000 which is a ridiculously high amount. We would recommend not trading on such a high amount and would limit yourself to 1:500 as a max. The leverage can be selected when opening up an account and should you wish to change it on an already open account you will need to get in contact with eh customer service team with your request.

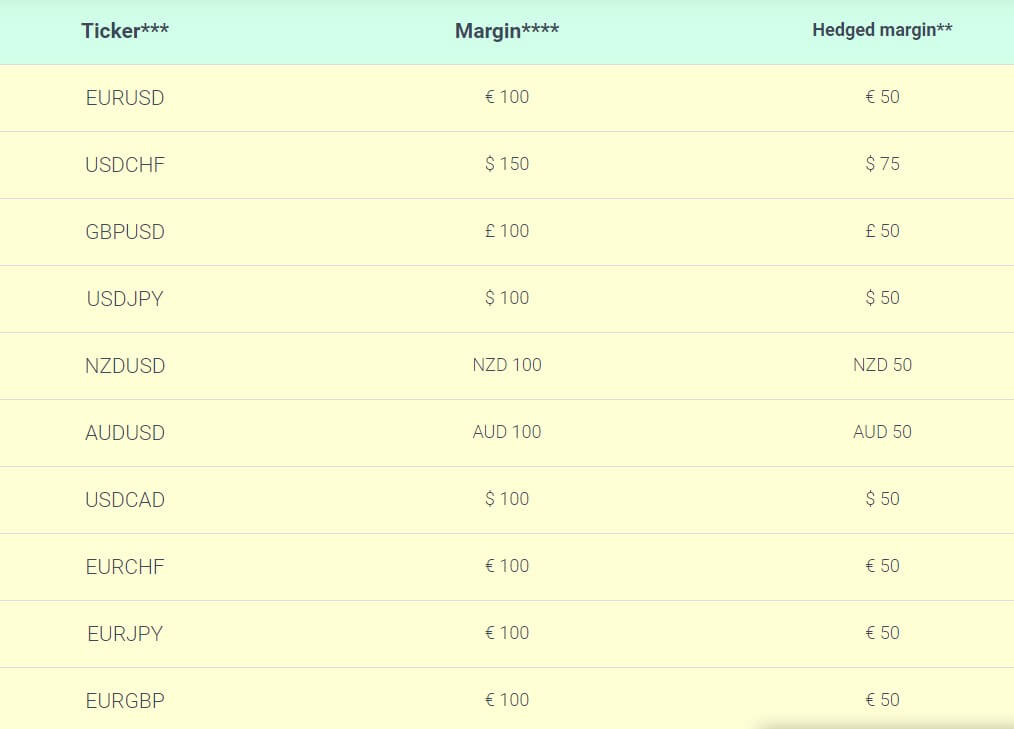

Trade Sizes

Trade sizes on all accounts start from 0.01 lots and go up in increments of 0,.01 lots so the next trade would be 0.02 lots and then 0.03 lots. The maximum trade size is 50 lots which are appropriate as we never recommend going over 50 lots in a single trade. There is also a limit of 100 open trades at any one time.

Trading Costs

There are no added commissions on any account as they all use a spread based system that we will look at later in this review. Apart from the Muslim FX account, swap charges are present on all other accounts, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice. The Muslim FX account does not have these charges.

Assets

The assets on Templer FX have been broken down into 5 different categories within each are a set of different instruments, we have outlined what they are below.

Forex: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, USDTRY, EURTRY, AUDUSD, NZDUSD, EURGBP, EURJPY, EURCHF, EURCAD, EURAUD, EURNZD, GBPJPY, GBPCHF, GBPCAD, GBPAUD, GBPNZD, CHFJPY, AUDJPY, AUDCHF, AUDCAD, AUDNZD, CADJPY, CADCHF, NZDJPY, NZDCHF, NZDCAD, USDZAR and, USDMXN.

Precious Metals: Just Gold (XAUUSD) and Silver (XAGUSD).

Energies: Brent Crude Oil seems to be the only energy available to trade.

Cash Indices: US 30, NAS 100, SPX 500 and German 30 are the only available indices.

Shares CFDs: There isn’t a breakdown of shares available, the website states that there are over 40 different shares available to trade.

As you can see, the asset index is sufficient, but many forex brokers do offer much larger asset indexes.

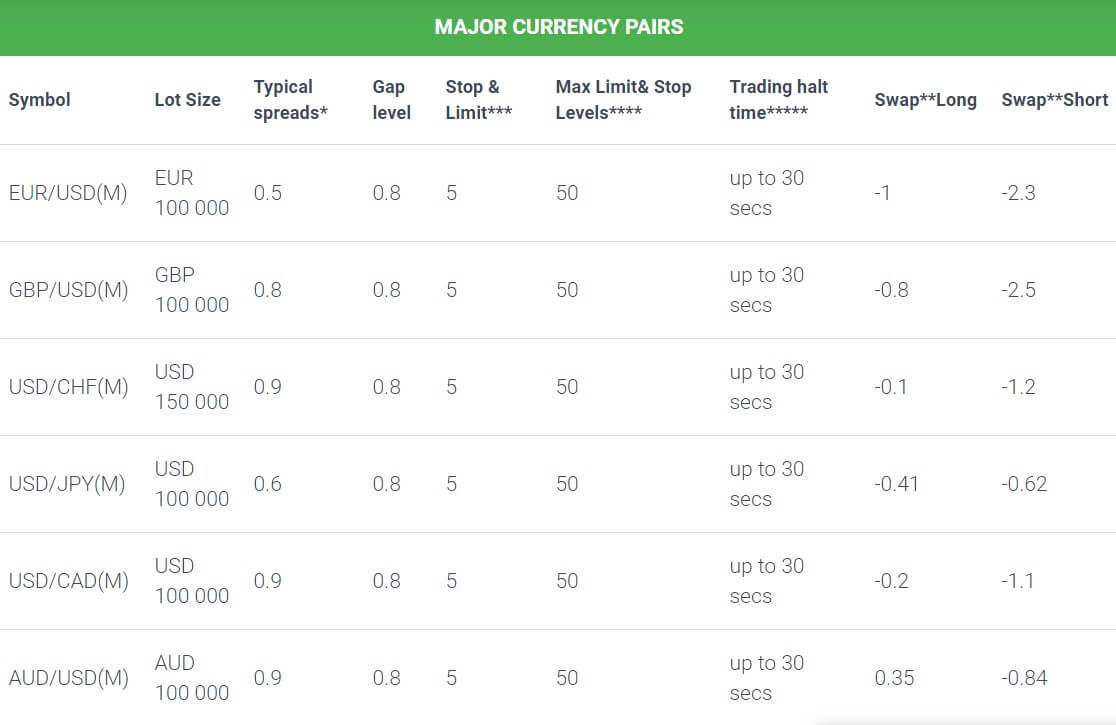

Spreads

The account comparison page states that spreads can start as low as 0.1 pips, however, looking at the contract specification it doesn’t look like any are under r0.8 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 0.8 pips, other assets like EURCAD may start slightly higher, in this case, 2.2 pips.

Minimum Deposit

The minimum deposit required to open an account is $1, this will get you the Cent FX account if you want a different account you will need to deposit at least $25. No matter which type of account you have, any subsequent deposits have a minimum of $1.

Deposit Methods & Costs

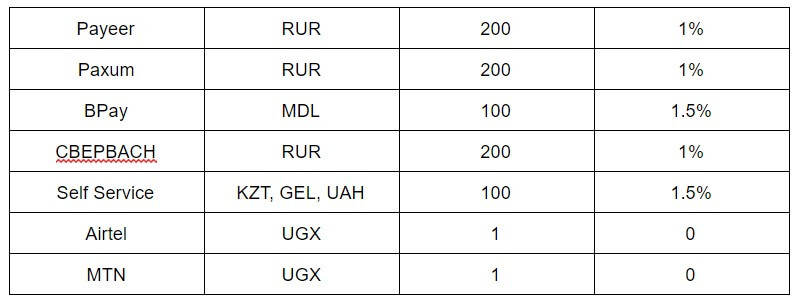

There are plenty of different methods available to deposit with, we have outlined them below in an easy to read table.

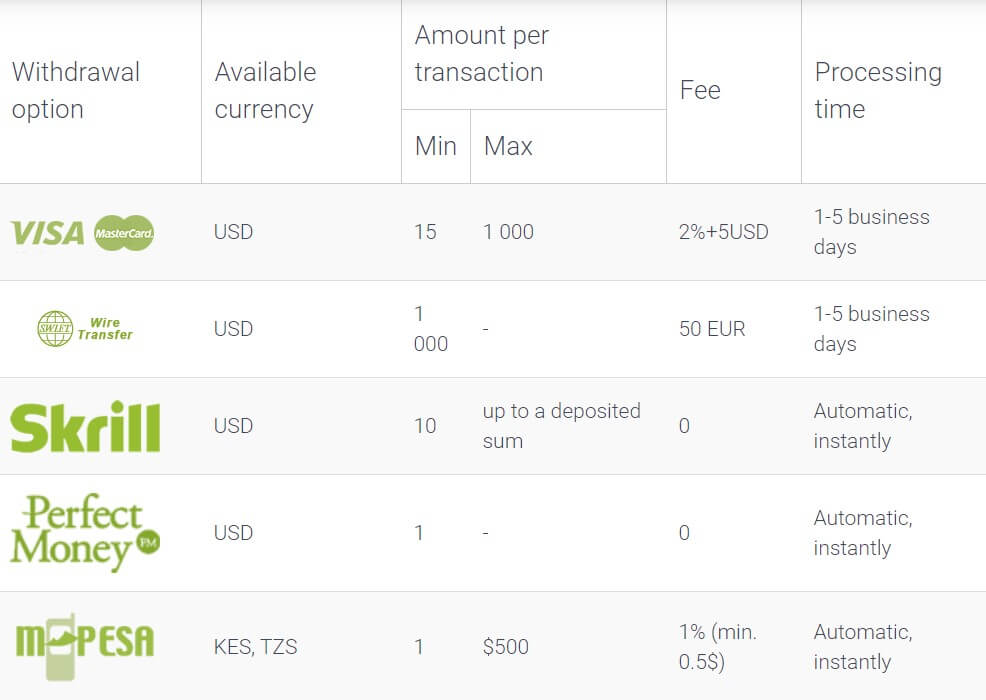

Withdrawal Methods & Costs

There isn’t any differentiation between the deposits and withdrawals, so we believe that the information provided above for deposits is also relevant for withdrawals. When using Ban Transfer be sure to check with your bank for any possible fees added by them.

Withdrawal Processing & Wait Time

There wasn’t any set information in regards to processing time, we would hile that Templer FX would process withdrawals within 48 hours. The total amount of time it will take will depend on the method used but you could expect some withdrawals to take between 1 to 5 business days to clear.

Bonuses & Promotions

We could not locate any information on the website in regards to bonuses or promotions so it does not appear that there are any active ones at the time of writing this review. If you are interested in bonuses then be sure to check back regularly or get in contact with the customer service team to see if there are any upcoming bonuses or promotions.

Educational & Trading Tools

The educational section contains three very basic sections, the first is three steps to becoming a trader, the page consists of just three sentences so nothing groundbreaking. The expert tips section contains three paragraphs on trading, again nothing amazing. Finally, there is a glossary of trading-related terms just uncase you come across something you don’t know the meaning of. Nothing here ill make you an expert or be too helpful if you are new to trading too so you will need to go elsewhere to satisfy your educational needs.

Customer Service

There are three different ways to get in contact with Templer FX, the first is to request a callback, simply put in your name, number and message and you should get someone giving you a call regarding your message. You can also email, using the online submission form, fill it in and you should get a reply via email. There is also a live chat available should you wish to communicate that way.

At the bottom of the page there is some additional contact information:

Address: Suite 305, Griffith Corporate Centre Beachmont P.O.Box 1510, Kingstown, SVG

Tel: +44 20 33557076

Fax: +44 02 071128046

Email: [email protected]

There is no information about opening times of the customer support team but we would expect them to be closed at the same time as the markets over the weekends and on bank holidays.

Demo Account

Demo accounts are available, but there isn’t any specific information about them such as trading conditions or if there is an expiration time. Demo accounts allow potential new clients to test the servers and trading conditions while allowing existing traders to test out new strategies without risking any of their own capital.

Countries Accepted

The following statement is present on the Templer FX website: “We do not provide services for US, UK, EU, Canada, Turkey, Israel, and Japan residents and entities of any kind.” If you are unsure of your eligibility we would recommend getting in touch with the customer service team to check.

Conclusion

You get a good selection of options when choosing an account, however, a lot of the trading conditions for the accounts are all the same, so the only difference seems to be the cost of entry. Leverage can be up to 1:2000 which is far higher than most brokers, but also far higher than anyone would recommend, it is nice to have the option though. Plenty of ways to get in contact with the customer service team and the spreads along with no commission can make the trading experience a non-costly one. There is a slight lack of tradable assets, the instrument list is not too big, which could mean that there are times of no trading due to there being no suitable assets. The trading conditions seem good, so the decision is now up to you.