GBC FX is a forex broker based in Saint Vincent and the Grenadines. In their “Why Us2 section they claim to offer competitive spreads, advanced trading platforms, the fastest withdrawals, promotions, learning center, trading tools, and expert forex help. In this review, we will be looking into the services offered to see if they live up to these expectations and so you can decide if they are the right broker for you.

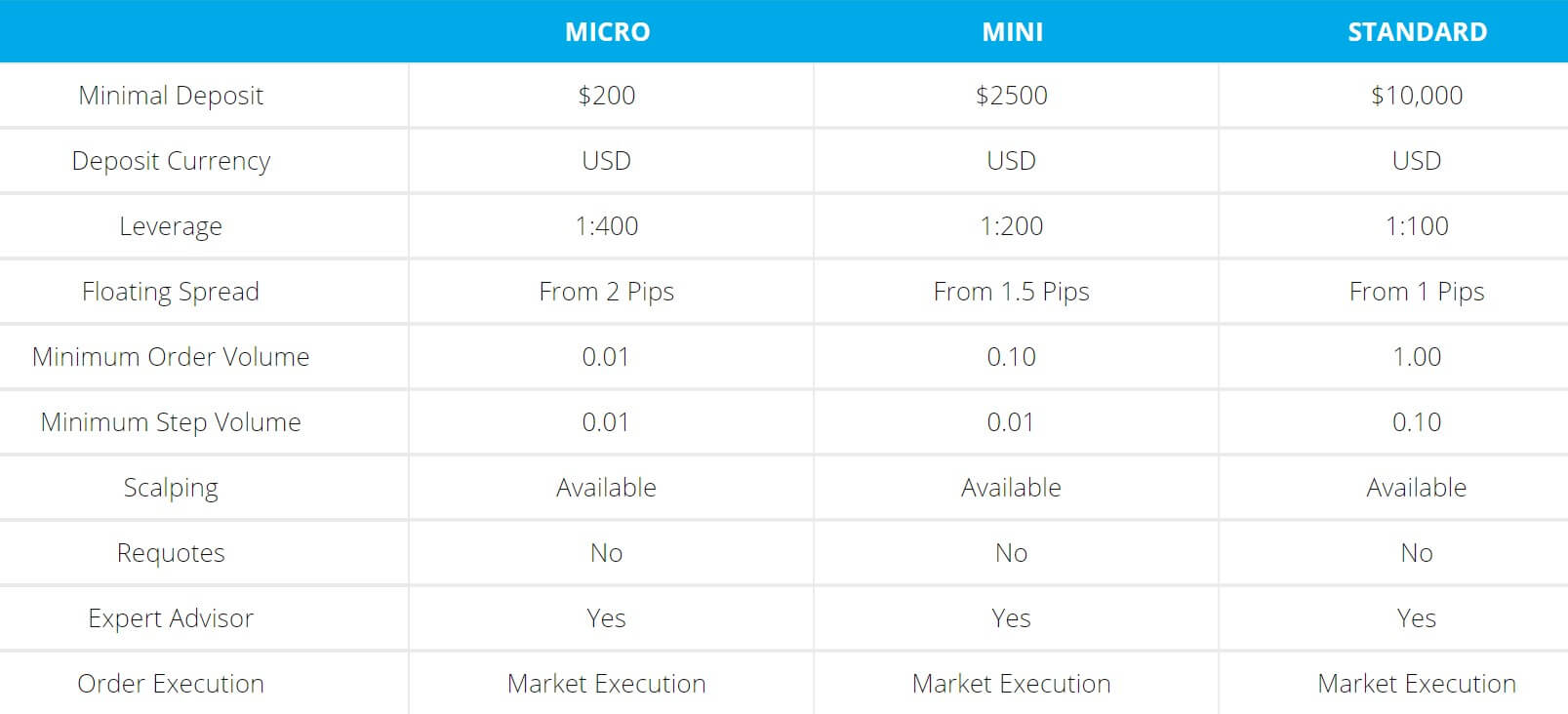

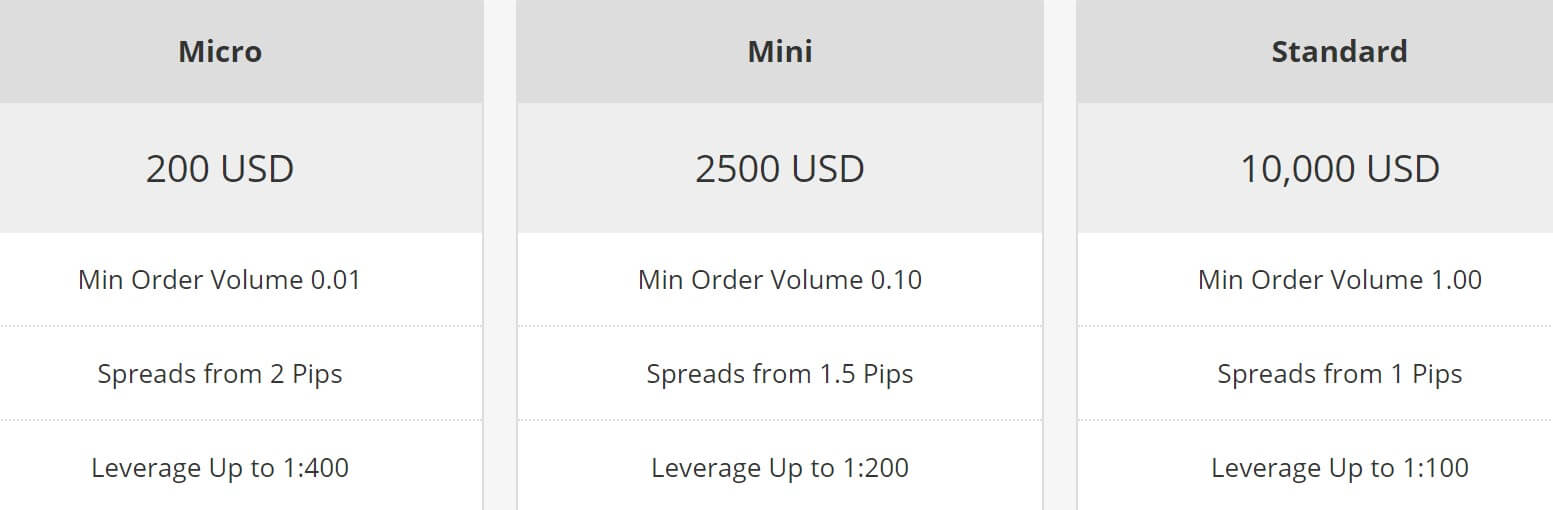

Account Types

There are three different accounts available should you sign up with GBC FX, here is a brief outline of their features and requirements.

Micro Account: This account requires a minimum deposit of $200, it must be in USD. It has leverage up to 1:400 and a floating spread starting from 2 pips. The minimum trade size is 0.01 lots with them going up in increments of 0.01 lots. Scalping is available as is the use of expert advisors. It uses market execution and tradable assets include Forex, CFDs, and Metals.

Mini Account: The Mini account increases the minimum deposit up to $2,500, as with the other accounts it much be in USD as a base currency. It has leverage up to 1:200 and a floating spread starting from 1.5 pips. The minimum trade size is 0.1 lots with them going up in increments of 0.01 lots. Scalping is available as is the use of expert advisors. It uses market execution and tradable assets include Forex, CFDs, and Metals.

Standard Account: The top tier account has an entry requirement of $10,000 and the base currency must be in USD. It has leverage up to 1:100 and a floating spread starting from 1 pip. The minimum trade size is 1 lot with them going up in increments of 0.1 lots. Scalping is available as is the use of expert advisors. It uses market execution and tradable assets include Forex, CFDs, and Metals.

Platforms

GBC FX uses MetaTrader 5 as its sole trading platform. MT5 is designed for the active trader who desires access to comprehensive news and analytics, real-time price charts and live quotes. The platform also contains a loaded suite of management tools, expert advisors (EAs) and indicators. A few of the prime features of the platform are as follows:

- Full account management

- Market Watch Window

- Navigator Window

- Analysis & Charting Tools

- Automated trading (Expert Advisor)

- Newsfeed & alerts

- Account history report center

- Order execution capabilities

- One-Click Trading

Leverage

The leverage that you are offered is dependant on the account you are using, the maximum leverage levels are as follows.

- Micro Account: 1:400

- Mini Account: 1:200

- Standard Account: 1:100

Leverage can be selected when opening up an account, should you wish to change it on an already open account you can do so by getting in touch with the customer service team.

Trade Sizes

The trade sizes that you have depends on the account you are using, they each have different minimum and increments to their trading sizes. The Micro account has a starting trade size of 0.01 (also known as a micro lot) lots and goes up in increments of 0.01 lots, so the next trade would be 0.02 lots and then 0.03 lots.

The Mini account has trade sizes stating from 0.1 lots (known as mini lots) and goes up in increments of 0.01 lots, so the next trade available will be 0.11 lots and then 0.12 lots. The Standard account starts with trade sizes of 1 lot (known as a standard lot), it then goes up in increments of 0.1 lots so the next trade is 1.1 lots and the 1.2 lots.

We do not know the maximum trade size, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

Trading Costs

There does not seem to be any added commissions as the accounts use a spread based system which we will look at later in this review. There are swap charges though, and these are interest charges that are incurred for holding trades overnight. They can be both negative or positive and can usually be viewed from within the trading platform of choice.

Assets

We could not locate a breakdown of assets or any real information of assets apart from the fact that the account page states that there are Forex, CFDs, and Metals available to trade. It would be good for a breakdown to be added as a lot of potential clients will look at what assets are available to trade to ensure the ones they like are available, without it, they may look elsewhere.

Spreads

As there is no breakdown of the assets, we can only go by what the account page states which is as follows:

- Micro Account: Starting from 2 pips

- Mini Account; Starting from 1.5 pips

- Standard Account: Starting from 1 pip

This is reasonable for non-commission based accounts, we also know that the spreads are variable (also known as floating) which means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like GBPJPY may start slightly higher.

Minimum Deposit

The minimum deposit required o open an account is $200 which gets you the Micro account, if you want a different account you will need to deposit at least $2,500. It is unknown whether the minimum deposit decreases once an account is already open.

Deposit Methods & Costs

There isn’t a whole lot of information on deposit methods, the methods available are Bank Wire Transfer, Visa, Skrill, and Neteller. We would expect MasterCard to also be accepted seeing as Visa is. There is no mention of any fees, but also no mention that there aren’t any so we cannot say for sure. We can say to check with your own bank or processor to see if they add any fees of their own.

Withdrawal Methods & Costs

Just like with deposits, there isn’t much information on withdrawals, all that we do know is that Bank Wire Transfer, Visa, Skrill, and Neteller are available for withdrawals. As with the deposits, there is no mention of any fees so we cannot say if there are any or not, but again, be sure to check with your own bank or processor to see if they add any transfer fees of their own.

Withdrawal Processing & Wait Time

We also have no information on this aspect of the withdrawals, we would hope that they would be processed by GBC FX within 48 hours. However long they take,m once it has been processed it will normally take between 1 to 5 business days for your funds to become available based on the processing time of your bank, card issuer or e-wallet provider.

Bonuses & Promotions

Bonuses & Promotions

We could not locate any information on the website in regards to bonuses or promotions so it does not appear that there are any active ones at the time of writing this review. With that being said, GBCFX does state that it does offer promotions from time to time. If you are interested in bonuses then be sure to check back regularly or get in contact with the customer service team to see if there are any upcoming bonuses or promotions.

Educational & Trading Tools

There is a small introduction section to trading which outlines what different aspects are such as what CFDs are or what a pip is. There is also a page on both technical analysis and fundamental analysis, this isn’t providing you with any, instead, it is just page detailing what it is and what is involved, not anything that will make you an expert at it. There is also a section on trading mechanisms and trading systems, again this is just basic information and not something that will improve your knowledge unless you are completely new.

Customer Service

If you want to get in contact with GBC FX there are a limited number of ways to do this, you can use the online submission form to fill in your query and you should the get a reply via email, there is also a direct email address available, then there are a number of different physical addresses provided. There is no phone number to use which is a little bit of a shame. There is a chat window in the bottom right of the screen but we have only ever seen it say offline so we are not sure if it is even functional.

The opening times of the support are also not mentioned but we would assume that they are closed over the weekend and on bank holidays just like the markets are.

Demo Account

Demo accounts are available, if you click the open demo account button it will instantly start downloading MetaTrader 5, you need to install this and then open a demo account from within there rather than within the GBC FX website. The trading conditions are unknown and which account it mimics is unknown and there is also no information on potential expiration of the demo accounts.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

The trading conditions offered by GBC FX actually seem quite reasonable, the spreads are in line with many other brokers that also do not offer commission-based accounts. Leverage is acceptable at 1:400 for the Mini account. The main downsides are the lack of information regarding deposit and withdrawals, this info is vital as people need to know how they can get their money in and out of the broker and also how much it is going to cost them, without this, it can be hard to build a certain level of trust.

There are also limited ways to get in touch with the customer service team which is a little concerning but nothing that will prevent someone from signing up. The main decision is on the deposit and withdrawal info, we would not recommend them based on this information missing, but if you are able to ascertain this then they could be a potential broker to use.