Range Markets is a broker that is based out of Saint Vincent and the Grenadines. The firm’s mission revolves around addressing the flaws in the at-large brokerage industry by providing account holders with exceptional trading experience and unique offerings. Namely, they allow you to easily transfer funds, pick between a variety of transaction methods, and almost instantly deposit or withdraw money. Apart from that, Range Markets’s different account types are designed for different types of investors, including both retail and institutional traders.

What type of platform does this broker use? How can you deposit funds? Are there any commissions? What do the spreads look like? Does the firm offer promotions or educational material? We answer all of these questions and more in this article.

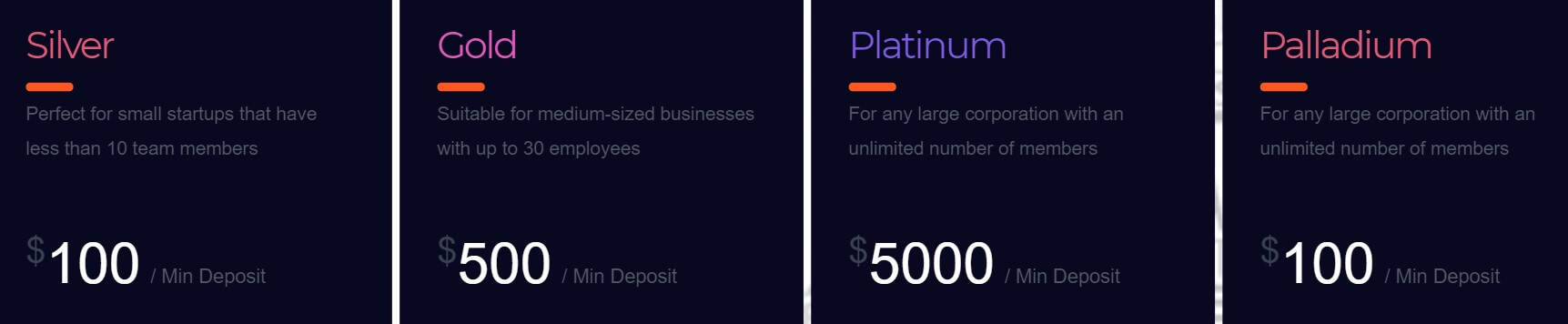

Account Types

This broker’s account selection suits traders with different preferences, market approaches, and risk tolerance levels. While the minimum deposits vary, their close proximity means that most users have the flexibility to choose an account type that fits what they need (as opposed to being restricted by minimum deposit requirements).

Silver:

Minimum Deposit: $100

Spreads: From 1.6 pips

Commission: $0

Gold:

Minimum Deposit: $500

Spreads: From 1.4 pips

Commission: $0

Platinum:

Minimum Deposit: $5,000

Spreads: From 0.5 pips

Commission: $0

Palladium:

Minimum Deposit: $100

Spreads: NA

Commission: $0

Islamic:

Minimum Deposit: $100

Spreads: From 1.6 pips

Commission: $0

The main differences between the 5 account types are the spreads, leverage (which decreases as capital goes up), margin call requirements, and lot sizes. It is important to note that the Islamic Account retains the same features and asset selections that the other account types have. However, Islamic doesn’t incur any swap fees on overnight trades, while each of the Silver, Gold, Platinum, and Palladium requires account holders to pay the interest on these positions. Yet, Islamic also has limited leverage because of this. In other words, through using a lot of buying power, traders who have this account type can accumulate a large interest fee when they hold on to a trade for 24 hours or more. The broker, when it comes to swap-free accounts, want to limit their losses.

Platforms

Range Markets utilizes the MetaTrader 4 (MT4) platform, a popular choice amongst technical analysts and fundamentals traders alike. Users have access to dozens of technical indicators, various charting timeframes, and a live newsfeed with the latest stories and reports. This technological efficiency is also prominent across MT4’s other characteristics. For example, they offer accurate prices and immediately execute orders, even when it comes to large positions and trade sizes. Above all else, MT4 is available on Windows, iPhones, and Android smartphones. MacBook users can also install the platform’s app, but they must first download a specific software (for free) to access their account.

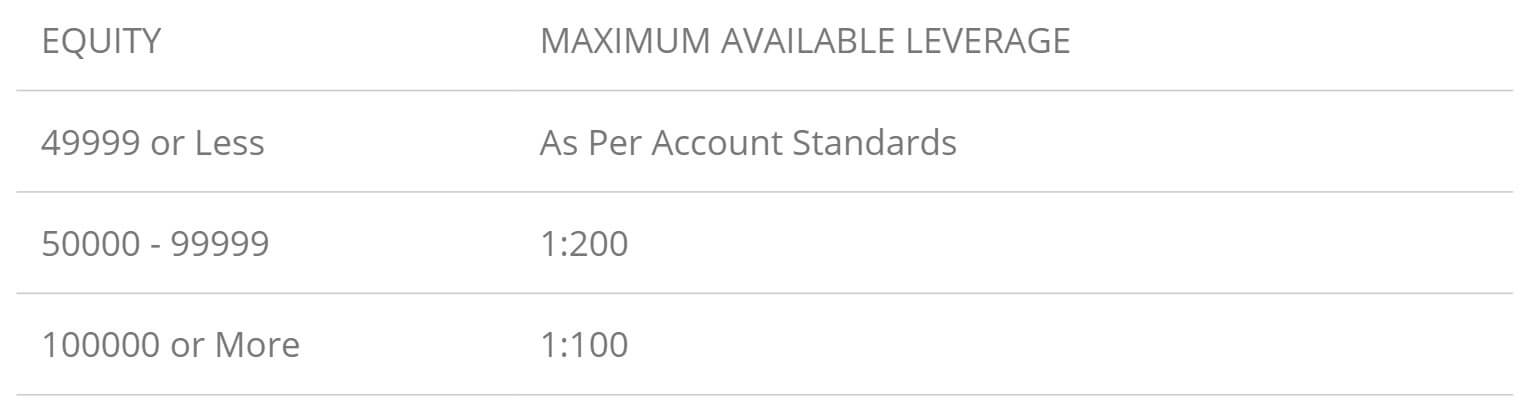

Leverage

In short, the more money that you deposit, the lower that your leverage gets. The Silver Account, which has the smallest minimum deposit requirement ($100), starts with 500:1 in buying power. After that, Gold’s $500 deposit requisite comes with a 400:1 leverage. Platinum (for traders with $5,000+ in capital) limits the buying power to 300:1. As mentioned earlier, the Islamic Account’s leverage is 300:1 because the broker wants to control overnight interest expenses, even though the minimum deposit for this type is only $100.

Similarly, Palladium has the lowest buying power on Range Markets (100:1). Yet, the account has a much larger maximum trade size and is intended for traders who have a large amount of capital. Giving them too much power is risky for a broker during volatile and unpredictable market conditions.

Having said all that, this broker may let you use up to 1000:1 in leverage, which puts them amongst the very few firms in the industry that offer more than 500:1. Traders can adjust this level by going to their user dashboard.

However, Range Markets will still limit your leverage as you deposit more money in order to control their risks and protect your account from incurring significant losses (especially when an unprepared trader makes errors or engages in risky strategies). If an account’s balance reaches $50,000 (regardless of the account type), leverage goes down to 200:1. It is further lowered to 100:1 at $100,000 in capital.

Trade Sizes

Silver, Gold, and Islamic can buy/sell a maximum of 65 lots (6,500,000 in the base currency) in a single trade. Platinum and Palladium, on the other hand, are permitted up to 100 lots in one position.

Margin Call: 50%

Stop-Out: 30%

When your account reaches the margin call level, Range Markets will inform you via email and/or on your MT4 account dashboard. However, the broker doesn’t close any of your trades or positions at this time. Similarly, unlike many other firms in the industry, Range Markets will not ask account holders to deposit additional funds and bring their balance above the margin call level. At the stop-out point, on the other hand, they will start closing your positions, beginning with the biggest loser and up until the account has enough funds to go above the 30% stop-out level. Many other brokers tend to liquidate all trades at this point, regardless of whether they are winners or losers. Range Markets, meanwhile, is less restrictive.

Trading Costs

We find that the absence of commissions on Range Markets to be a positive aspect. In fact, none of the account types even incur these fees, regardless of how much money a trader deposits. Their spreads are also competitive, but only for the Platinum Account. Silver, Gold, and Islamic have bid/ask gap of 1.4 pips or more. Swap charges apply when a trade is held overnight, which depends on the currency’s interest rate and whether you bought or sold the forex pair. Islamic might incur a fixed fee instead of the swap, which is typically the case in the brokerage industry (as far as interest-free accounts are concerned).

Keep in and mind that the swap rate is tripled on Wednesday in order to account for the weekend, another common practice amongst brokers. The Islamic Account will likely pay triple the regular overnight cost. Lastly, Range Markets has a dormant fee that they charge inactive traders. More specifically, if someone doesn’t buy or sell any instruments for 90 days, they would pay $5. However, when the account has less than that, the broker will only charge you that amount to avoid a negative balance. For example, inactive traders who have $3 will only be charged that amount instead of $5 (so that they don’t have -$2 balance).

Assets

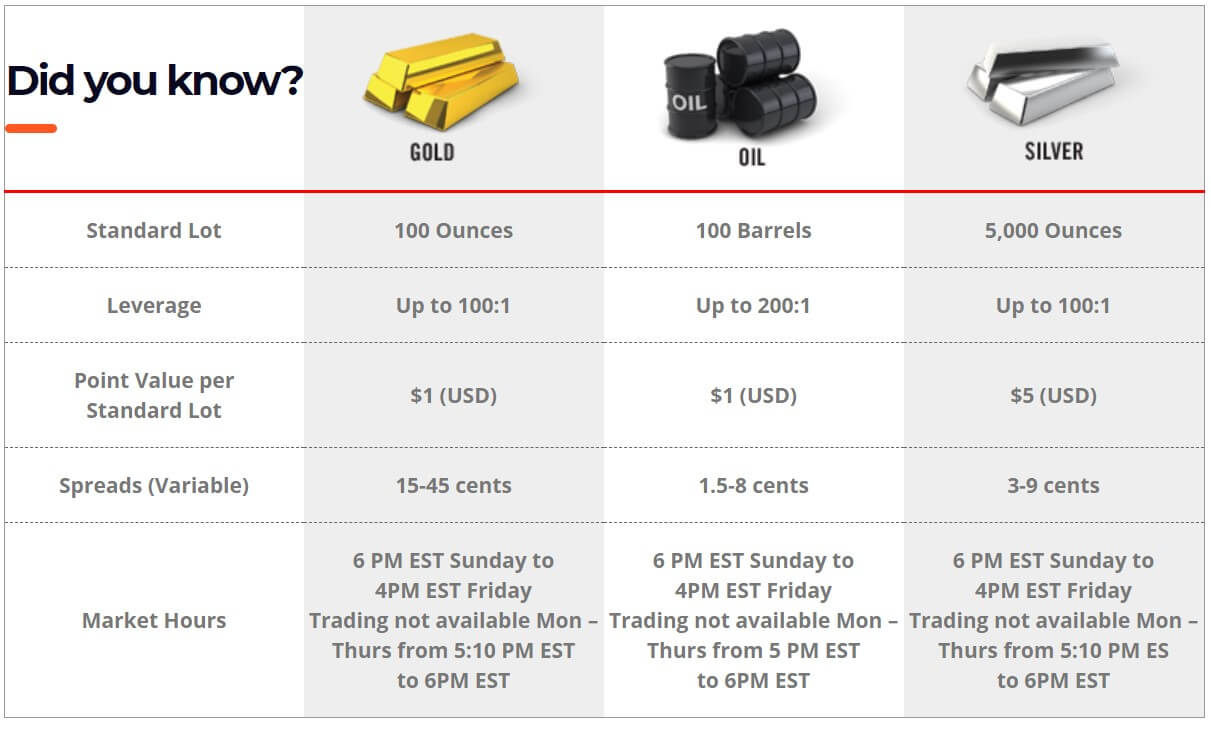

Range Markets’s financial instrument selection includes more than 60 forex pairs, alongside gold, silver, oil, and stock indexes. Commodities are traded against the USD. For example, gold’s ticker symbol is XAU.USD. You exchange indices, on the other hand, as CFD contracts. Keep in mind that each of those instruments has its own spread, leverage, and standard lot size. This is because they vary in terms of volatility, risk, and trade volume. To illustrate, gold and silver are both commodities, but 1 lot equals 100 ounces and 5,000 ounces, respectively. In addition, gold’s spread ranges between $0.15 and $0.45, while silver’s bid/ask gap is only $0.03 to $0.09. When compared to oil, which has a 200:1 leverage, the two precious metals’ buying power is constrained to 100:1.

Spreads

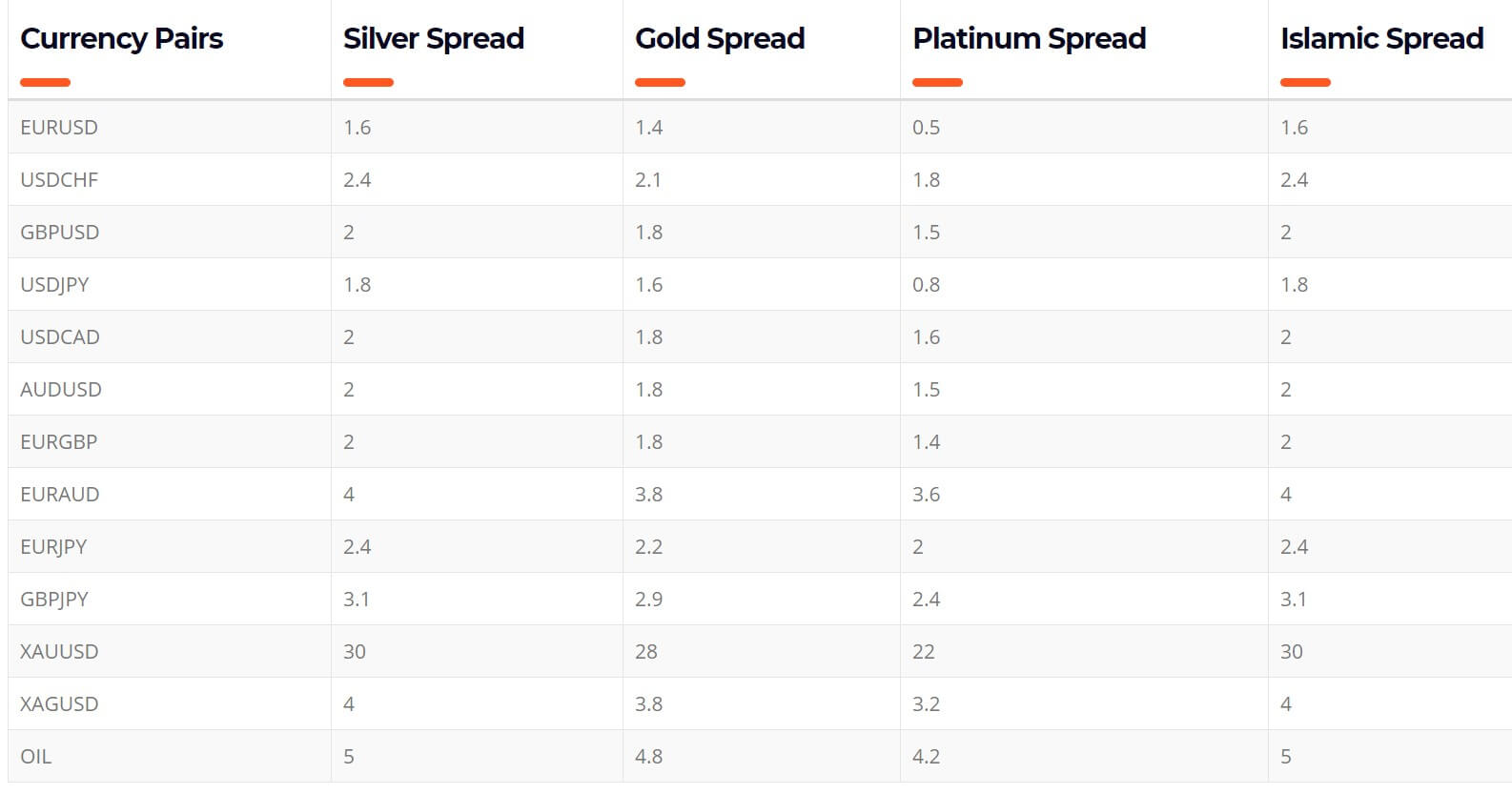

The price difference between the bid and ask quotes depends on your account type. This applies to currency pairs and other assets that Range Markets offers. Platinum enjoys the lowest spread, starting from 0.5 pips for the EUR.USD (Euro vs. US Dollar). The forex pair has a 1.6 and 1.4-pip spread when it comes to each of the Silver and Gold Account, respectively. Islamic also has a 1.6-pip bid/ask variation.

It is important to remember that Range Markets has a variable spread, which is subject to abrupt changes or larger than expected price differences when the markets behave in a volatile or erratic way. However, many traders prefer a variable spread because it is especially tight during regular conditions. Just as importantly, many market participants avoid trading after major news announcements or price-moving events.

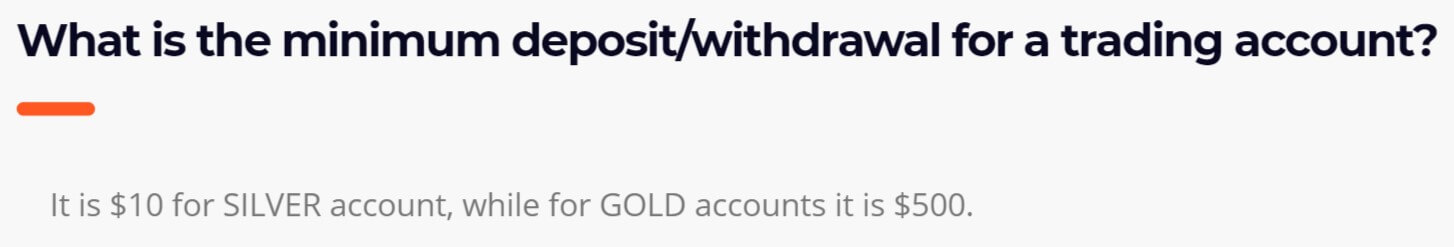

Minimum Deposit

While the 5 account types have their own funding requirements, the Islamic one enjoys more flexibility. The broker’s website shows a $100 minimum deposit, but in reality, any of the accounts can have Islamic features, which can be easily requested online. For example, a trader deposits $6,000 and gets the Platinum Account – which requires a minimum of $5,000. After their application is approved, they can contact the broker’s team and they will switch it to a swap/interest-free Islamic Account.

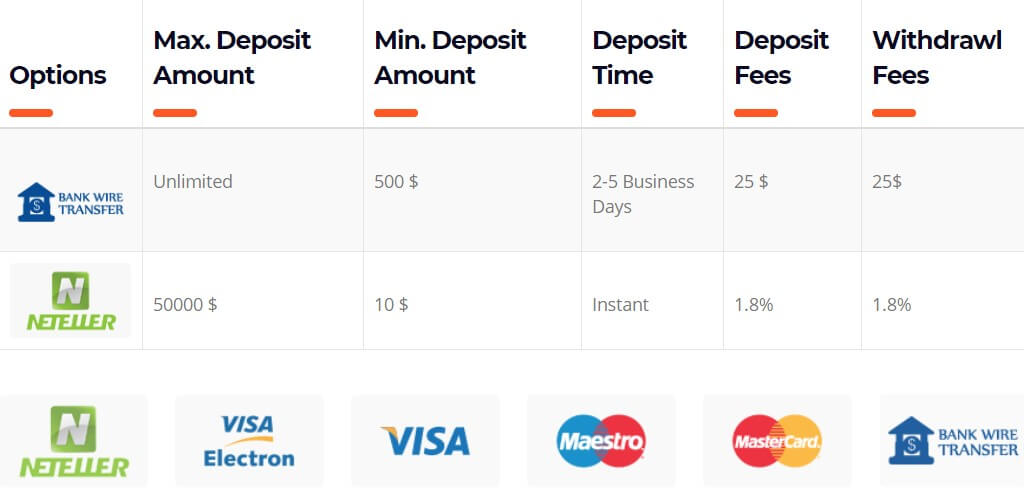

When it comes to transfers, the minimum deposit depends on the method that you choose to find your account through. Bank wires and Neteller’s are $500 and $10 per transaction, respectively. The former has an unlimited maximum deposit, while transfers through Neteller are constrained to $50,000 or less in one transaction.

Deposit Methods & Costs

Alongside the two methods mentioned above, you can fund your Range Markets account through Visa and MasterCard. Strangely, and perhaps undesirably so, this broker will charge you fees for depositing money, which is uncommon. Bank wires, which take between 2 and 5 days to process, cost $25 per transaction. Range Markets will also charge you 1.8% of the deposit size for Neteller transfers.

Funding your account with $1,000, as an example, costs you an $18 transaction fee. However, on the plus side, Range Markets refunds you all of these charges in the future after you deposit money. In the instance above, when you withdraw your original $1,000, the full amount (including the $18 deposit fee) is returned. The broker’s website doesn’t specify any fees related to debit and credit card transfers.

Withdrawal Methods & Costs

You can use the same deposit methods when making a withdrawal. However, keep in mind that the funds have to be transferred to the same account. If you deposit money through a bank account, as an instance, it must also be used when you decide to make a withdrawal. Since Range Markets refunds account holders the initial transfer fee, they return the amount alongside the rest of your withdrawn funds.

Withdrawal Processing & Wait Time

It takes this broker up to 24 hours to process an outbound transfer request. To initiate a withdrawal, traders would do so through their user dashboard. In many cases, however, withdrawals are processed instantly.

Bonuses & Promotions

There are over 5,000 participants in Range Markets’s Introducing Broker (IB) promotional program. First, an IB refers a friend, family member, or associate to the broker. After that, the IB receives a commission every time their referral makes a trade. Payments are made once a month (on the first). IB participants enjoy access to a 24-hour support team that is available on the weekends. They can also get help in more than one language.

Educational & Trading Tools

Educational & Trading Tools

Each of Range Markets and MT4 offers a strong selection of educational content and live trading resources. The broker’s website covers basic introductions into the forex markets, but it also delves into educating traders about utilizing order execution tools (such as ‘one-click’ buying/selling) and the types of fees that they might incur.

In addition, Range Markets has a list of beneficial aspects that forex market participants enjoy. If you are an experienced trader, then the broker’s economic calendar and market analysis are rich with resources and organized information. This is especially crucial at the beginning of the day or after the markets close. MT4 also offers these tools, alongside more educational content and a variety of competitive charting features.

Customer Service

Range Markets can be contacted via email or through an online form on their website. Most of their departments (customer support, IB program, finance, …etc.) are only available on weekdays, but Introducing Brokers can get help during the weekends. However, this firm is still reachable 24 hours a day to all of its account holders and other affiliates.

Phone: NA (not listed on the website)

Email: [email protected] (general support); [email protected] (current account holders); [email protected] (IB promotion)

Demo Account

You can open a paper/fake account and trade on MT4’s platform. Through a demo, Range Markets’s account holders will access live market prices and trading conditions. As a result, it helps beginners test their strategies and define a profitable trading method. Similarly, if you have plenty of market experience but are familiar with another platform (such as MetaTrader 5/MT5), the demo account gives you the time that you need to familiarize yourself with MT4. Above all else, whether you are a new or an experienced trader, demos allow you to learn what you need before putting your real money on the line.

Most noteworthy, Range Markets’s demos don’t come with an expiration date. Other brokers, meanwhile, may only give you up to 60 or 90 days. Some may even restrict the demo’s lifetime to a mere 30 days. Range Markets doesn’t just remove these deadlines, but they also allow traders to open up to 8 different paper accounts. Keep in mind, though, that the demo will be automatically closed when you don’t log in for a period of 90 days.

Countries Accepted

American traders and residents cannot open an account with this broker. This is mainly because of federal laws that limit or prohibit certain financial instruments and trading methods. Other than that, the broker is registered in Saint Vincent (an island country in the Caribbean) and serves traders from different parts of the world.

Conclusion

Range Markets’s account holders certainly appreciate the variety of account options that they have. In addition, this broker’s IB promotion can be utilized by marketers and those who have a strong referral network of traders. Just as importantly, there are many assets that Range Markets will give you access to, including about 60 forex pairs, alongside commodities and indices.

There are 5 different account types and we find that their affordable/reachable minimum deposit to be a huge plus. More specifically, traders have the freedom to choose an account that suits their personal strategy and preferences. You can also open an Islamic account either directly or by integrating swap-free features into one of the different portfolios that this broker offers. The demo account is also easy to use and doesn’t come with an expiration date, an aspect that differentiates Range Markets from the rest of the brokerage industry.

Traders may access educational content, economic calendars, and other practical resources on Range Markets’s website. If you don’t find what you need, MT4 also has its own tutorials, training programs, and valuable tools. While transfers are almost instant (with a few exceptions), this broker will charge you a fee for depositing money. The trading conditions may vary based on your account type. Some portfolios have a very low and competitive spread, but most of Range Markets’ accounts have a spread of 1 pip or more. This is about average in comparison to the rest of the industry.

Support is available 24 hours during weekdays. To summarize, this broker’s main positive aspects include the diverse account types, strong leverage, fewer restrictions at the margin call/stop out levels, the nonexistent commissions, and the almost instant transaction processing times. Meanwhile, the negatives are the deposit fees and, at times, an undesirably wide variable spread. However, at the end of the day, the cons are minimal when compared to Range Markets’s pros.