RallyTrade is an international online broker providing highly competitive brokerage services to emerging financial economies. Based in multiple locations including Lagos, Port Harcourt, and Ibadan, RallyTrade looks to offer multiple trading platforms, low commissions, low fees, and top quality technology. Throughout this review, we will be looking to see how RallyTrade compares to the competition and so you can decide if they are the right broker for your trading needs.

Account Types

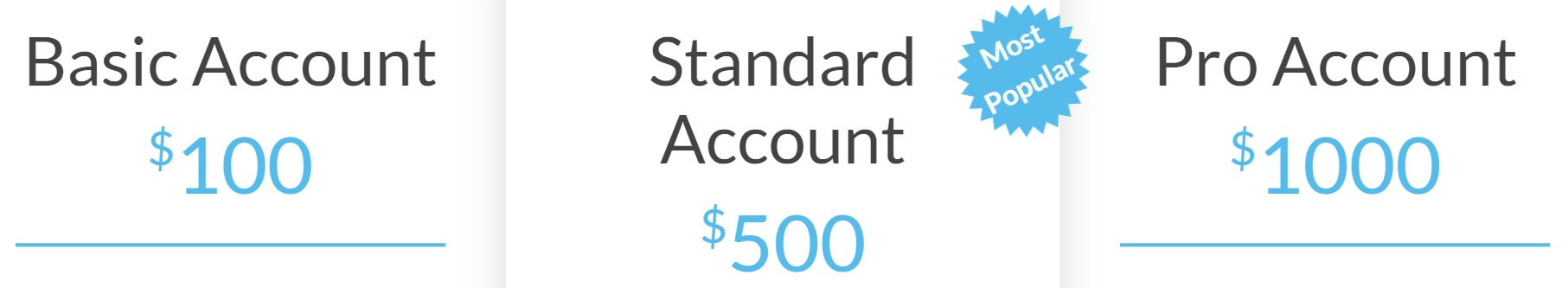

Should you decide to sign up with RallyTrade, you will have a choice of three different accounts. Each one has its own requirements to open and also trading conditions, so lets briefly look at what then options are.

Basic Account: This account has a minimum deposit requirement of $100 and comes with a fixed spread starting from 1.6 pips. It uses an instant execution-style and can be leveraged all the way up to 1:1000. It supports micro-lots (0.01 lots) and does not have any added commission. It has access to the educational program as well as the use of MetaTrader 4 and Rally xTrader as trading platforms.

Standard Account: This account has a minimum deposit requirement of $500 and comes with a floating spread starting from 1.2 pips. It uses an instant execution-style and can be leveraged all the way up to 1:1000. It supports micro-lots (0.01 lots) and does not have any added commission. It has access to the educational program as well as the use of MetaTrader 4 and Rally xTrader as trading platforms.

Pro Account: This account has a minimum deposit requirement of $1,000 and comes with market spreads starting from the standard market spread. It uses a market execution-style and can be leveraged all the way up to 1:1000. This account does not support micro-lots (0.01 lots) and has an added commission on each trade. It has access to the educational program as well as the use of MetaTrader 4 and Rally xTrader as trading platforms.

Platforms

There are two different trading platforms to chose from, we will briefly outline some of their features.

MetaTrader 4 (MT4): MetaTrader 4 has long been considered the mainstay of the Forex trading industry. As the world’s most popular platform, its strength is accredited to its overall simplicity. Traders who use this platform will benefit from a variety of analytical tools and ever-growing functionality which allows for the addition of indicators, oscillators and a huge number of automatic strategies.

xTrader 5: xTrader 5 is another trading platform, there are a number of features on offer including having all technical analysis tools are available on the charts. Traders who use multiple screens can also detach the charts from the platform. You can execute your orders directly from the charts and analyze correlations by layering two quotes onto each other. Upcoming economic events in the financial markets are ranked by importance and displayed in real-time directly on xTrader.

Market Sentiment allows you to see the orientation of trades in real-time. This tool can be used as supplementary information for your decision-making. Assets are updated every minute and, you can execute an order instantly or define the settings of a pending order. It displays the usual information to open a trade and the characteristics of the product (volume, contract value, margin, stop-loss, take profit, spread, commission, pip value, daily swap.

Leverage

Leverage

The maximum leverage is 1:1000 if using xTrader 5, if using MetaTrader 4 then you have a maximum leverage of 1:500. Leverage can be selected when opening up an account and should you need to change it you will need to contact the customer service team with your request.

Trade Sizes

Trade sizes on the Basic and Standard accounts start from 0.01 lots (known as a micro-lot) and go up in increments of 0.01 lots. The Pro account minimum trade size starts a little higher but we are not fully clear on what it starts at. The maximum trade size is set at 50 lots which is a good limit to have. It is not known how many trades you can have open at any one time.

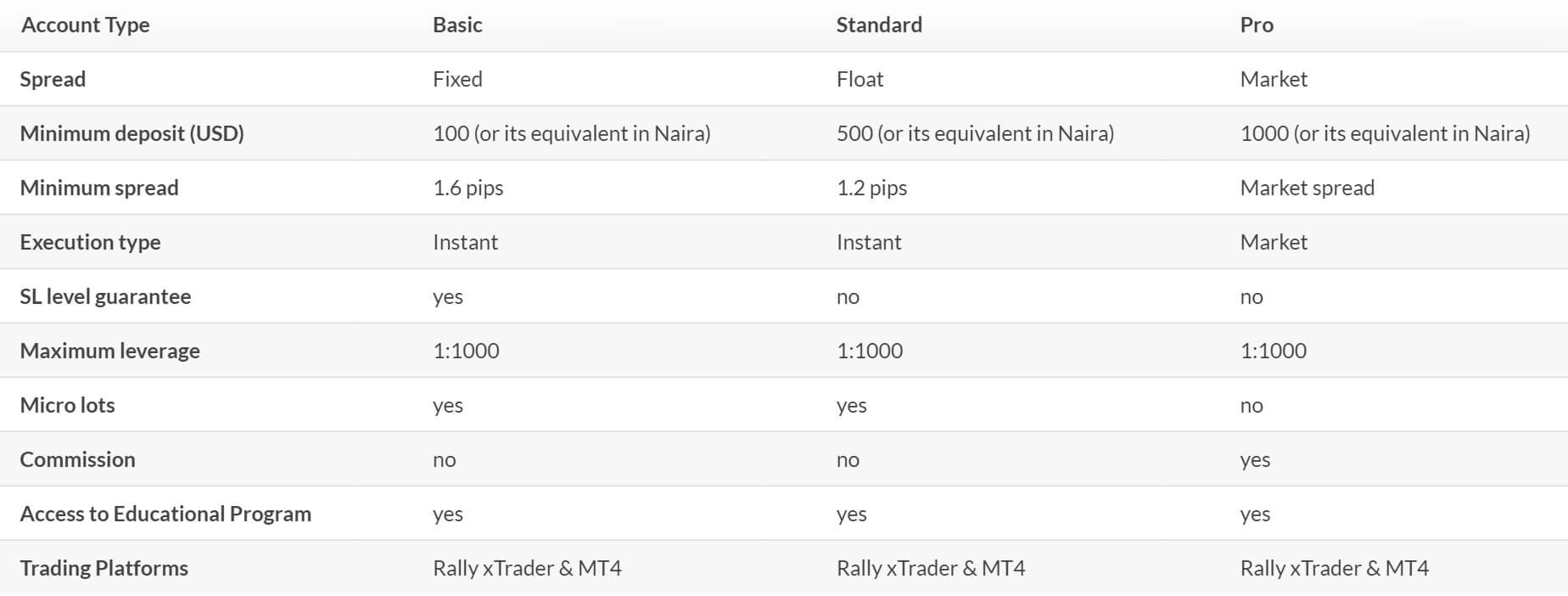

Trading Costs

There are quite a few different commissions to go through so we have outlined them into the different accounts.

Basic & Standard Account:

No commissions for forex or commodity trading.

For Equities, there is an added commission of 0.08% or 8 USD minimum.

Pro Account:

0.003% for opening a trade (Forex, Indices, and Commodities).

0.003% for closing a trade (Forex, Indices, and Commodities).

For Equities, there is an added commission of 0.08% or 8 USD minimum.

There are also swap charges which are fees charged for holding trades overnight, however, if you have a swap-free account the following commission is added to the account.

Swap-Free Account:

Opening trade = $/4 €/ for each 1 Lot 1

Holding trade = $/4 €/ for each 1 Lot every 7 days

Assets

There are plenty of assets available and they have been broken down into a few different categories, let see what they are.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFHUF, CHFJPY, CHFPLN, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURRON, EURSEK, EURTRY, EURUSD, GBPAUD, FBPCAD, GBPOCHF, GBPJPY, GBPNZD, GBPPLN, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDBRL, USDCAD, USDCHF, USDCLP, USDCZK, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDSEK, USDTRY, USDZAR.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFHUF, CHFJPY, CHFPLN, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURRON, EURSEK, EURTRY, EURUSD, GBPAUD, FBPCAD, GBPOCHF, GBPJPY, GBPNZD, GBPPLN, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDBRL, USDCAD, USDCHF, USDCLP, USDCZK, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDSEK, USDTRY, USDZAR.

Indices: AUS200, AUT20, BRAComp, CHNComp, CZKCash, DE30, ERU50, FRA40, HKComp, ITA40, JAP225, KOSP200, MEXComp, NED25, SPA35, SUI20, UK100, US100, US2000, US30, US500, USDIDX, VOLX, USFANG, W20, USCANNA, USLITH, USCHN, USBIOT, USGAME.

Commodities: Aluminum, Bund10Y, Cocoa, Coffee, Copper, Corn, Cotton, Emiss, Gold, Natural Gas, Nickel, Oil, WTI Oil, Platinum, Schatz2Y, Silver, Soybean, Sugar, TNote, Wheat, Zinc.

Equities: There is a whole bunch of equities available to trade including ones from the US, UK, Portugal, Spain, Germany, France and Italy.

Spreads

The spreads that you get depend on the account you are using. If we look at AUDCAD, the Basic account has spread starting from 13 pips, the Standard account starting from 4.5 pips and the Pro account has market spreads.

The Basic account ahs fixed spreads which means they always remain the same, no matter what is happening in the markets. The Standard and Pro accounts have variable spreads which means they move about when there is added volatility they are often seen higher. Different instruments also have different starting or average spreads, so while AUDCAD was sat at 4.5 on the Standard account, EURGPB is currently sitting at 2.1 pips.

Minimum Deposit

The minimum amount required to open up an account is $100 which will get you the Basic account, if you want a variable spread account you will need to deposit at least $500 for the Standard account.

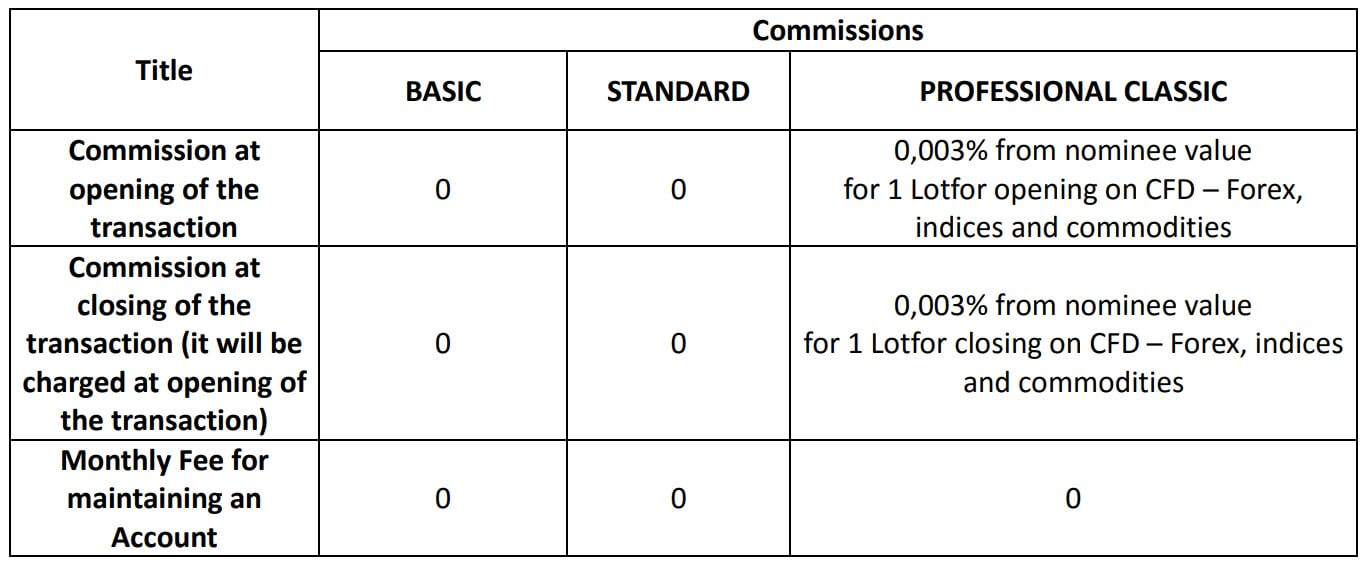

Deposit Methods & Costs

There are a number of different ways to deposit and each one has its own deposit fees, so we have outlined them below for you.

- Bank wire: the commission of the bank-sender, 0% from RallyTrade’s side

- Mastercard & Visa cards (Naira): 0.75% for local Nigeria cards

- Visa cards (USD): 2.25%

- Mastercard & Verve cards (USD): 0.75-1.25% (depends on the payment provider involved)

- Skrill: 1.95% + 0.37 USD

- Neteller: 1.95% + 0.15 USD (min. 1 USD)

- Perfect Money: 0%

- Webmoney: 0% (commission is paid by sender)

Withdrawal Methods & Costs

The following methods are available along with any additional fees.

- Bank wire: 50 USD

- Perfect Money: 0.25%

- Skrill: 0.5%

- Neteller: 1%

- Webmoney: 0.004% (max. 25 USD)

It is a shame to see fees on both deposits and withdrawals as a lot of brokers are looking to remove these, it would be nice to see RallyTrade do the same.

Withdrawal Processing & Wait Time

There is so much documentation to go through that we have just missed this information, however, whatever the processing time from RallyTrade is, we would expect a withdrawal request to be fully processed between 1 to 5 working days from the request depending on the withdrawal method used.

Bonuses & Promotions

There is a 100% bonus available for your first deposit. The terms of this demo are not available but there are a lot of terms about past bonuses which is strange. It states that you will automatically receive your bonus funds after your first deposit so it could be a mandatory bonus, or there could be a way to opt-out.

Educational & Trading Tools

Educational & Trading Tools

There is an educational center available, this includes some basic, intermediate and advanced reading, however, it isn’t anything that you won’t already know, it is more for people who are just starting out with trading. Ther is also a glossary of forex related terms however, the list is rather small and only goes over the main terms. The final part is trading insights, however, these have not been updated since June 2019.

Customer Service

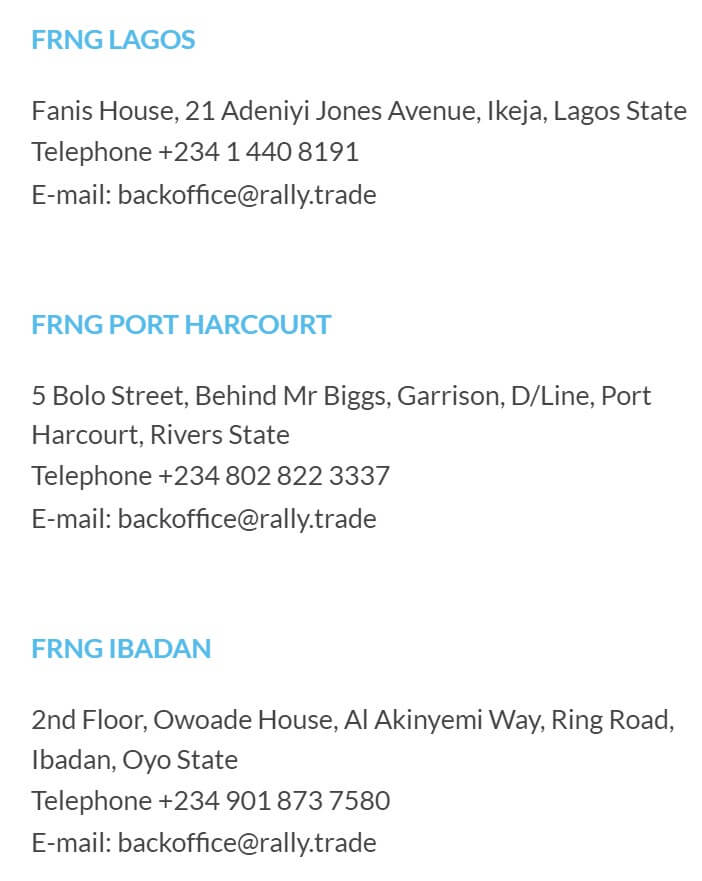

Should you wish to contact the customer service team, there are a few different ways to do it, you can use the online submission form to fill in your query and then get a reply via email. You can also use a number of different postal addresses, phone numbers and email addresses based on the location that you want to contact.

FRNG Lagos:

FRNG Lagos:

Address: Fanis House, 21 Adeniyi Jones Avenue, Ikeja, Lagos State

Telephone: +234 1 440 8191

E-mail: [email protected]

FRNG Port Harcourt:

Address: 5 Bolo Street, Behind Mr Biggs, Garrison, D/Line, Port Harcourt, Rivers State

Telephone: +234 802 822 3337

E-mail: [email protected]

FNRG Ibadan:

Address: 2nd Floor, Owoade House, Al Akinyemi Way, Ring Road, Ibadan, Oyo State

Telephone: +234 901 873 7580

E-mail: [email protected]

Demo Account

Demo accounts are available but there is no information surrounding the trading conditions or any potential expiration times. Demo accounts are great as they allow you to both test out trading conditions and test out new strategies without risking any capital.

Countries Accepted

There isn’t a statement regarding which countries are accepted or not so if you are thinking of signing up we would recommend contacting the customer service team to see if you are eligible for an account.

Conclusion

The account son offer from RaqllyTrade gives you a good choice of trading conditions, along with a choice of two popular trading platforms. The Basic account is one we would avoid, the trading costs are very high due to the high fixed spread, the spreads and costs reduce a lot wit the Standard account but could still be considered quite high compared to the competition. There are plenty of ways to deposit and withdraw, however, there are added fees for both transactions which could make getting your money in and then out quite expensive. We are not sure if we could justify the costs and so, for now, would recommend looking for a slightly less expensive option.