AAA Trade is an online broker that offers leveraged trading of up to 1:200 on 1,000+ instruments, including FX, Metals, Indices, Futures, Shares, Bonds, Options, ETFs, and Cryptocurrencies. The company was established back in 2014, with a central location in Cyprus and regulation through the Cyprus Securities and Exchange Commission (CySEC). The broker’s main goal is to help their clients harness the potential of the financial markets by providing all-inclusive investment services, including unrivaled customer support, according to their website. Keep reading to fund out if the broker manages to uphold their mission statement.

Account Types

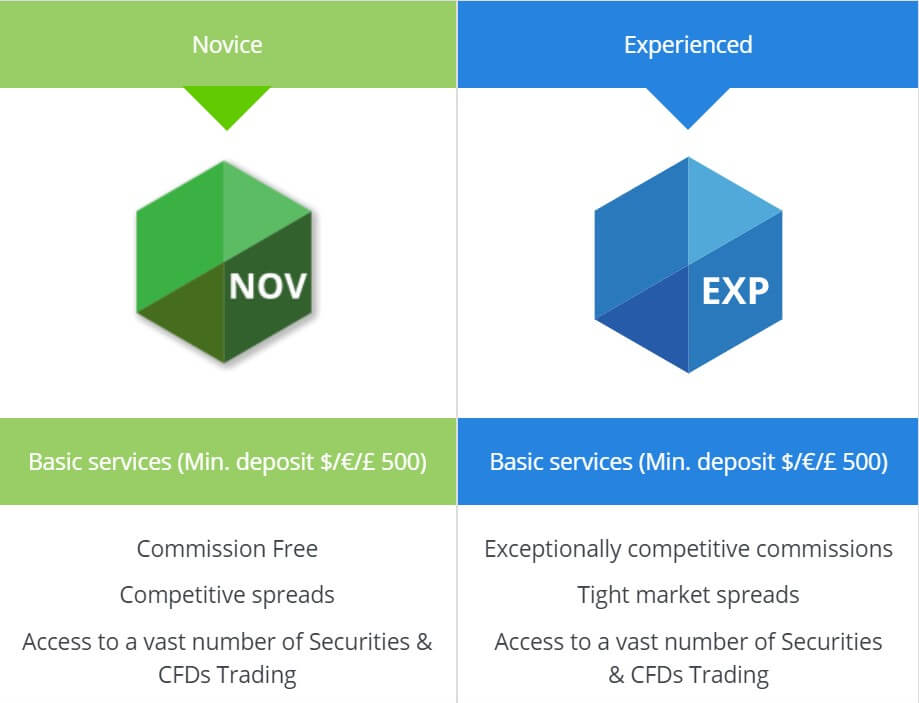

AAA Trade markets its CFD account types based on the trader’s skill level, with options being Novice or Experienced accounts. Alternatively, the CryptoExchange account is available for traders that would like the ability to trade Cryptocurrencies. Currently, the broker does not offer Islamic accounts, although demo accounts and corporate accounts are available in addition to the main individual account types. All accounts share the same deposit minimums and leverage options, although there are some small differences for trade sizes.

The main difference seems to revolve around the way that trading costs are paid, with a commission-free, higher spread option on the Novice account, or an option to pay low commission costs in exchange for lower spreads on the Experienced account type. The broker does not provide details about the costs on the CryptoExchange account type and it seems that one would need to reach out to support to open one of these account types since the option isn’t available on the main registration page. We’ve provided a quick overview of the account types below.

Novice Account

Minimum Deposit: $500 USD

Leverage: Up to 1:200 (See “Leverage”)

Spread: N/A

Commission: None

Experienced Account

Minimum Deposit: $500 USD

Leverage: Up to 1:200 (See “Leverage”)

Spread: From 1 pip

Commission: $4 per Standard Lot

CryptoExchange Account

CryptoExchange Account

Minimum Deposit: $500 USD

Leverage: Up to 1:200 (See “Leverage”)

Spread: N/A

Commission: N/A

During the registration process, traders will be required to fill in a short questionnaire that helps provide the broker with some insight into that trader’s experience level and knowledge of the financial markets. If one fails the questionnaire, the website will direct them to open a demo account and a 7 day wait period must be incurred before the test can be retaken. The broker will also require the client to take a selfie holding their passport/ID with a note stating the following; today’s date, telephone number, email, and signature. In addition, a copy of a recent utility bill, bank statement, local authority tax bill, bank reference letter, landline telephone or internet bill, etc. must be uploaded. As long as the submitted documents are acceptable, verification can be completed within minutes.

Platform

This broker provides three separate trading platforms; MetaTrader 5, AAA Trade, and CryptoExchange. For the Novice and Expert Account types, the broker’s own AaaTrade platform and MT5 are supported for download on Desktop or mobile. AAA Trade’s platform is also accessible through the browser-based WebTrader. The CryptoExchange account type supports the CryptoExchange platform, which is accessible through the browser, or for download through the App Store or Google Play.

While the website doesn’t offer a lot of details about their own supported platforms, the broker does mention that both platforms were designed to allow users to trade seamlessly across the global investment universe. One advantage of trading on MT5 with this broker would be the fact that this platform offers more available instruments than the others, although the broker doesn’t specify exactly how many more options would be available through MT5.

Leverage

Average leverage caps are limited based on the instrument that is being traded. The cap is set at 1:30 for major currencies, 1:20 for minor ones, and 1:10 for Commodities. Traders shouldn’t let the advertised 1:200 leverage cap be misleading and will need to know that this option is only available for clients that are considered professional. In order to increase the account’s leverage from the average options, traders must submit a request and complete the fitness test that was required at registration. In order for the broker to process the request, the trader will have to be considered a “professional” client and would likely need to earn a high score. Leverage can be lowered at any time from the settings within the client zone.

Trade Sizes

Minimum trade sizes for CFDs can vary based on the instrument that is being traded. The minimum is 0.01, or one micro lot, for FX options, and the broker suggests clients reach out to support for further information. For Cryptocurrencies, the minimum trade size varies based on the exact instrument. For example, Bitcoin, Bitcoin Cash, Litecoin, and Melon have a minimum trade size of 0.011 lot, while Dash, Ethereum Classic, Gnosis, and ZCash have minimum trade sizes of 0.035 lot. On CFDs, the margin call level is 50% and stop out occurs at 25%. On Securities, the margin call level is 70% and the stop out occurs at 25%.

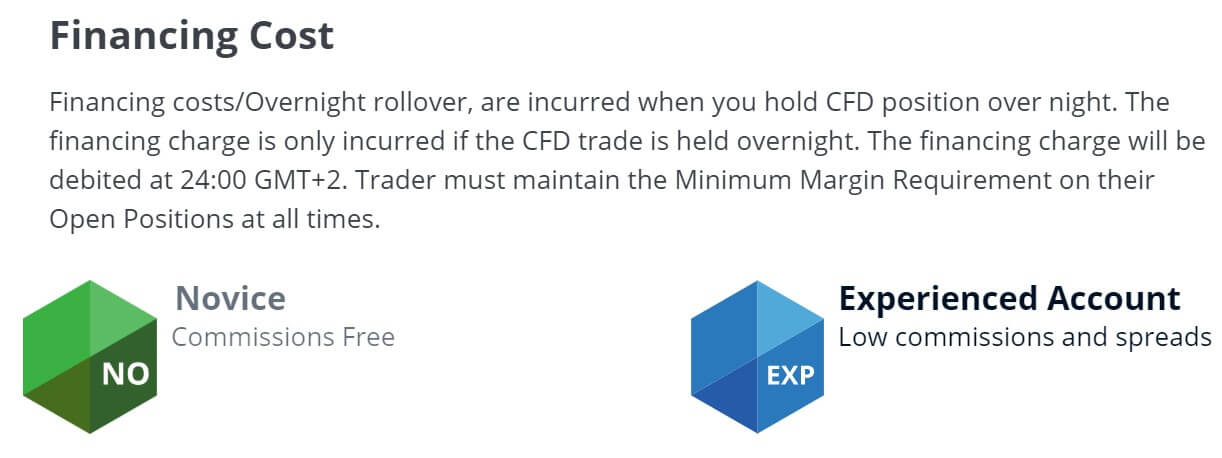

Trading Costs

Trading Costs

This broker profits through commissions (if applicable), spreads, and swaps. Commissions of $4 per Standard Lot are charged on the Experienced account type, while the Novice account is commission-free. Spreads seem to be competitive on the Experienced account, while the spreads are not listed for the Novice account type. All of the swap rates for each instrument can be viewed within the trading platform by clicking on the symbol in the market watch window, selecting symbols, clicking on the + beside an instrument, and then selecting “properties”. Traditionally, swaps are charged at a triple rate for positions that are held open on Wednesdays; however, this broker has responded to client feedback and only charges triple swaps on the weekend, starting from midnight on Friday.

Assets

This broker’s asset portfolio includes more than 1,000 FX, Precious Metals, Bonds, Futures, Indices, Shares, Options, ETFs, and Cryptocurrencies. FX options divided into 15 majors, 47 minors, and 11 exotics, for a grand total of 73 available currency pairs. Precious Metals include Gold, Silver, Platinum, Nickel, Pallidum, and Aluminum. In total, nine bonds are available from the US, Europe, and Asia.

The Futures category consists of 9 Agriculture majors and minors, in addition to 5 Energy majors and exotics. Indices are made up of 9 Asian, 2 Australian, 17 European, 2 Russian, and 7 USA options. 520+ Shares are also available from America, Australia, Japan, and many others. 80 total instruments are available from the Options category, including the sub-categories OPRA and the Eurex Exchange.

The ETF category is made up of 85 options and sub-categories include Bonds, County Index, Currency, Gold and Silver, US Sector & Industry, US Stock Indexes, and Volatility. The broker offers 50+ Cryptocurrencies, including popular options like Bitcoin, Litecoin, Ethereum, Ripple, and more.

Spreads

This broker offers floating spreads that vary based on market volatility and liquidity. The current spreads can be viewed from within the trading platform, or by checking the “Products” page of the website. We were alarmed initially to see that the broker didn’t provide a figure for spreads on their “Account Types” page, which could be a sign that spreads are higher than average. The broker does not provide exact options for the Novice account on their website, so this does leave some questions as to why 12where spreads can be checked directly. We saw examples of typical spreads like 0.00018 on AUDCAD, 0.002 pips on EURAUD, etc., although options can differ based on the exact instrument that is being traded.

Minimum Deposit

Instead of asking for a separate deposit amount for each account type, this broker separates each account into three tears; Basic Services, Advanced Services, and Premier Services. Traders must deposit at least $500 USD in order to open a Basic level of each account type, there is a $25,000 requirement for an Advanced level account, and a $100,000 deposit is required to open an account that is of Premier status.

Advanced level accounts are eligible for a 5% commission rebate on every trade, one-on-one training with a certified technical analyst, and a 0.25% positive interest rate. Premier account holders are eligible for a 10% rebate on every trade, a dedicated account manager, and concierge services. Aside from those perks, trading conditions will be the same, regardless of status level. Even if one wasn’t concerned about the account status, they would still be subject to the $500 deposit requirement, meaning that this broker is not as affordable as many of their competitors.

Deposit Methods & Costs

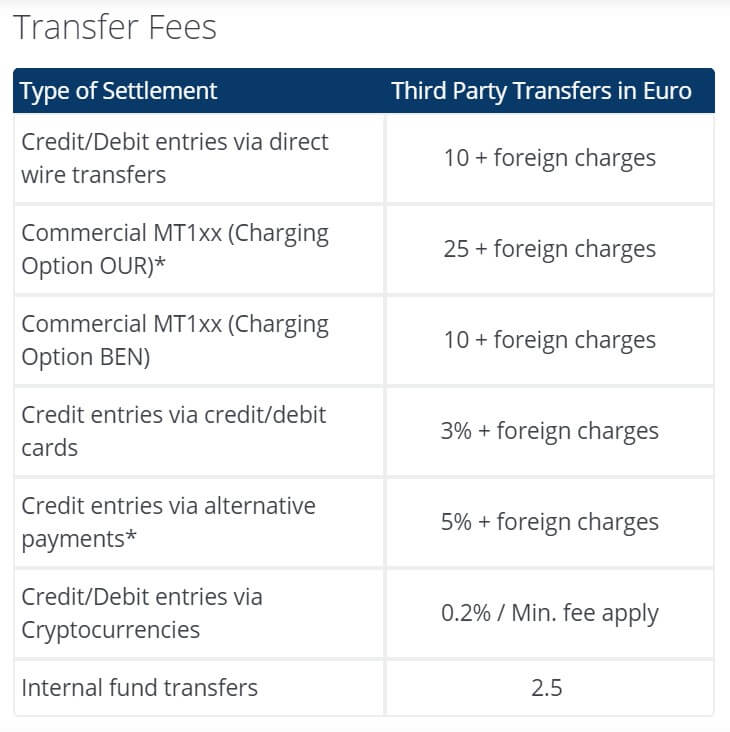

Accounts can be funded through Bank Wire, Visa, MasterCard, Maestro, Crypto Wallets, QIWI, Neteller, Skrill, FasaPay, and Union Pay. Prior to sending any funds from a Crypto Wallet, one would need to provide a screenshot that shows the user logged in with their full name and the wallet address. There is a maximum funding limit of 20,000 EUR for deposits via Neteller, Ideal, GiroPay, Yandex, and QIWI. A 50,000 EUR limit is placed on Visa/MasterCard/Maestro deposits. Deposits via card are processed instantly, while it can take a few days for the broker to process Bank Wire Transfers. Transfer fees are applicable to all deposit methods and those fees have been listed below.

- Wire Transfer: 10+ Euros

- CommercialMT1xx (Charging Option OUR): 25+ Euros

- CommercialMT1xx (Charging Option BEN): 10+ Euros

- Credit/Debit Cards: 3% + foreign charges

- Alternative Methods (Excluding Cryptocurrencies): 5% + foreign charges

- Cryptocurrencies: 0.2% (Minimum Fee Applies)

- Internal Fund Transfers: 2.5

Withdrawal Methods & Costs

All available funding methods are also available for withdrawals. Typically, funds will be withdrawn back to the method that was used to fund the account. In the case that this isn’t possible, clients can contact support to explore alternatives. Profits will be withdrawn back to Bank Wire. The broker does not charge fees on Visa/MasterCard/Maestro withdrawals, while a 10 Euro charge will be applied to any bank transfers on the bank’s behalf.

Withdrawal Processing & Wait Time

Withdrawals are typically processed within a maximum of 24 hours once the request is received, although it can take a few days for the funds to reach the account. In the case of Bank Wire, it would be wise to expect a longer wait time, which is typical. Withdrawals through cards or Cryptocurrencies would likely be received much more quickly.

Bonuses & Promotions

Promotional opportunities are limited to positive interest rates and commission rebates, with no bonus options available. As we mentioned earlier, one would need to meet the deposit amount for the Advanced or Premier status in order to qualify for either of these. For the Advanced status, a $25,000 USD is required and traders would be rewarded with 0.25% positive interest rates and a 5% commission rebate back on every trade. To achieve Premier status, one would need to deposit at least $100,000 USD in order to access a 10% commission rebate and a 0.25% positive interest rate. Clients must keep accounts active, with at least one trade being open or closed every 30 days, otherwise accrued interest may be lost.

Educational & Trading Tools

This broker offers several resources under the “Tools & Academy” section of their website. Academy options include webinars, video tutorials, e-books, online academy, and sessions with the market research department. This should certainly be enough to help beginners get on their feet and traders should be able to learn enough through this section to pass the broker’s registration test. Looking at tools, we see an economic calendar, Market Analysis, live market events, AAA Trade Analysis, and trading calculators.

Demo Account

Risk-free demo accounts can be opened from the same window used for live account registration and the same initial details are required upon sign-up, including name, email, phone number, country, currency type, and account type, with the choice between the Novice or Experienced accounts. Alternatively, traders can sign-up using their Facebook or Google accounts. Demo accounts will remain active indefinitely, or for a period of up to 1 year with no trading activity. If you could use some experience, we would highly recommend taking advantage of this free option, since conditions mimic those experienced in a live trading environment so closely. If you don’t think you’ll pass the broker’s registration questionnaire, it may be a good idea to practice ahead of time on a demo account.

Customer Service

This broker advertises 24/5 support, available via LiveChat, phone, email, or by filling out a contact form on the website. While the hours do seem flexible, we didn’t get the advertised experience when we tested out the broker’s LiveChat. Initially, we were informed that support wasn’t available, even though it was during business hours. Five hours later, the chat was displaying the same message, even though an agent should have been available at that time.

It would certainly be more effective if the broker would at least take email addresses in order to get back to clients at a later time, especially if this is a common problem. If you also find that support is offline, the next fastest contact option would be a phone call, followed by email. Although the company is located in Cyprus, several contact numbers are provided for clients from different locations. We’ve listed the primary numbers below, although numbers for different countries can be found on the contact page.

Email: [email protected]

Phone:

Cyprus: +357 250 300 60

Australia: +61 283 173 544

Brazil: +55 1131 8174 09

Japan: +81 345 704 320

Russia: +7 499 609 4203

United Kingdom: +44 203 769 2245

Countries Accepted

While the broker tries their best to offer services to everyone, certain restrictions prevent residents from the following countries from opening accounts: Zimbabwe, Iceland, Mongolia, Ethiopia, Syria, Yemen, Sri Lanka, Pakistan, Panama, Tunisia, Trinidad, and Tobago, The Bahamas, Botswana, Ghana, Iran, North Korea, American Samoa, Guam, Samoa, US Virgin Islands, Sudan, US, Afghanistan, Bosnia and Herzegovina, Guyana, Algeria, Bolivia, Morocco, Nepal, Iraq, Lao PDR, Uganda, Cambodia, and Vanuatu. We did double-check the registration page to see if any of these options could be selected; however, the broker does seem to reinforce these restrictions.

Conclusion

Right off the bat, we noticed that one of the primary advantages offered by this broker would be the 1,000+ tradable instruments that are available from several different categories, including Bonds, Shares, Cryptocurrencies, and more. It costs $500 to open the most basic level of any account type, with larger requirements for Advanced or Premier status levels. This broker does set some restrictive limitations and requires traders to pass a test in order to open an account or to access leverage that would typically be available through another broker. Unless you’re a professional client, you’ll be limited to a stricter leverage cap, of up to 1:30 on major currencies.

Some details are also missing from the website, including exact spreads on the Novice account type. Accounts can be funded through a wide variety of methods and the broker has quick processing times for withdrawals. Promotions in the form of rebates and positive interest are limited to Advanced or Premier level status accounts, which requires a deposit of at least $25,000. The broker offers multiple educational resources and trading tools, making for a seamless learning environment. Support is available 24 hours a day on weekdays, although there were no agents online when we reached out via LiveChat during business hours. Overall, the broker does seem to be offering some advantages, although one would need to weigh those against potential disadvantages.