RW Markets is a forex broker based in the Marshall Islands claiming to offer a five-star web trader platform, benefits from a personal trading coach, a selection of the best accounts to chose from and keeping your money always secure. This review is intended to look at the services to see if they live up to the expectations and so you can decide if they are the best broker for you to use.

Account Types

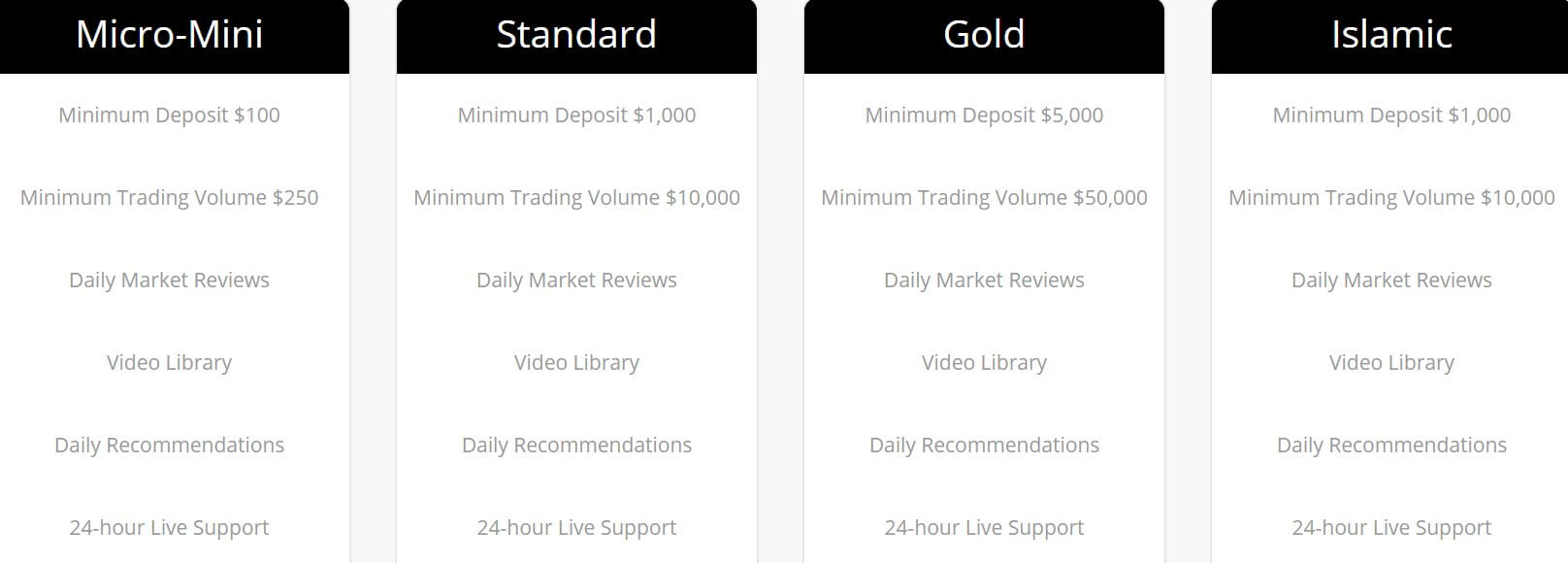

When signing up with RW Markets you are given a choice of 4 different account types, each one has its own requirements and trading conditions, let’s take a brief look at what they are.

Mini Account: A minimum deposit of $100 is required to open this account, it has a minimum trading volume of $250 and the account gets you to access to daily market reviews, a video library, daily recommendations, and 24-hour live support.

Standard Account: The standard account increases the minimum deposit up to $1,000, the account has a minimum trade volume of $10,000 which is 0.1 lots. The account comes with daily market reviews, access to a video library, daily recommendations, 24-hour live support, a personal trading coach, VIP trading support and exclusive updates.

Gold Account: The minimum deposit is further increased up to $5,000 and the account has a minimum trading volume of $50,000 which is 0.5 lots. The account comes with daily market reviews, access to a video library, daily recommendations, 24-hour live support, a personal trading coach, VIP trading support and exclusive updates and further access to SMS trading alerts and the MetaTrader 5 trading platform.

Islamic Account: The Islamic account is intended for those not able to accept or pay interest charges (swap charges) for holding trades overnight. The account has a minimum deposit of $1,000 and a trading volume of $10,000 (0.1 lots). The account gives you access to daily market reviews, a video library, daily recommendations, 24-hour support, and a personal trading coach.

Platforms

RW Markets offer their own proprietary version of WebTrader, as well as access to MetaTrader 4 for certain account types, let’s see what these platforms offer. RWMarkets apps are also available for Android and iOS powered devices.

MetaTrader 4 (MT4): MetaTrader4, or MT4 for short, offers a variety of functionalities including advanced charting, automated trading, in-depth technical analysis and a wide variety of additional trading tools. MT4 is only made available to Premium account holders.

ParagonEx Web Trader: This award-winning, custom-designed trading platform is designed to render the FX trading experience as easy as possible. ParagonEx Web Trader works in conjunction with any internet browser, on any type of computer operating system.

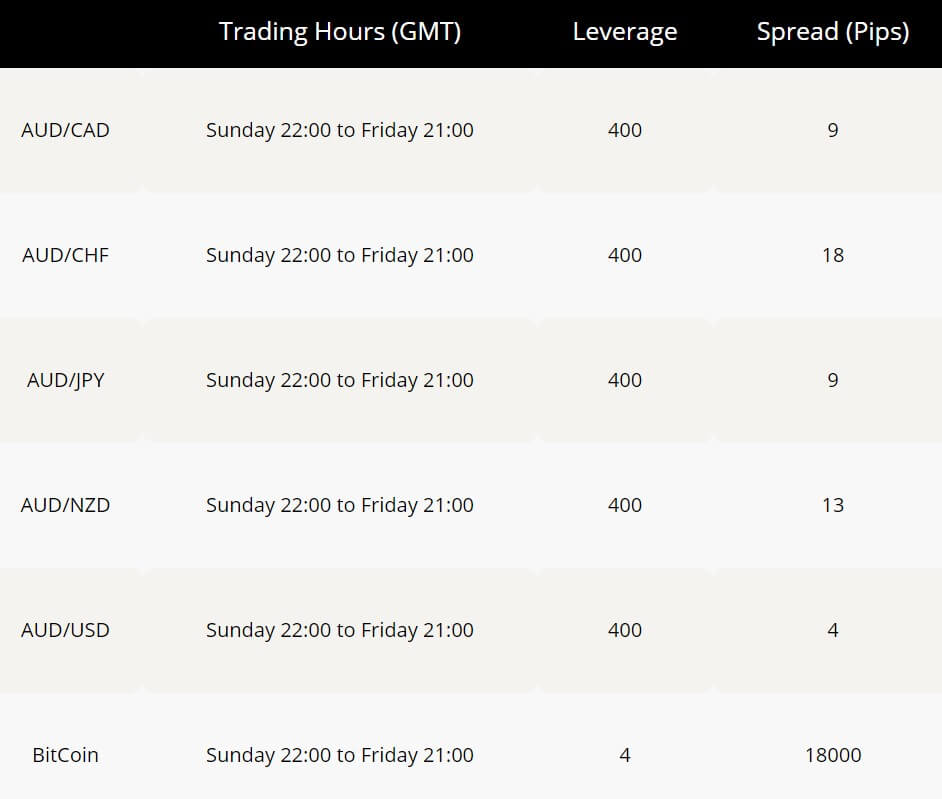

Leverage

Leverage can be up to a maximum of 1:400, this is a relatively good amount and around the industry standard. The leverage can be selected when opening up an account and should you wish to change it you will need to get in contact with the customer service team, however, WR Markets seem a little inflexible so they may not be willing to change it.

Trade Sizes

The minimum trade size depends on the account you are using, the Mini account has a minimum volume of $250, the Standard account has a minimum trade size of $1,000 which is 0.1 lots or a mini lot. The Gold account has a minimum volume of $50,000 (half lot) and the Islamic account has a minimum trade volume of $10,000 (0.1 lots). There is no mention of the maximum trade size, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

Trading Costs

There doesn’t appear to be any added commissions on the accounts as they all sue a spread based system that we will look at later in this review. Swap charges are present, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice.

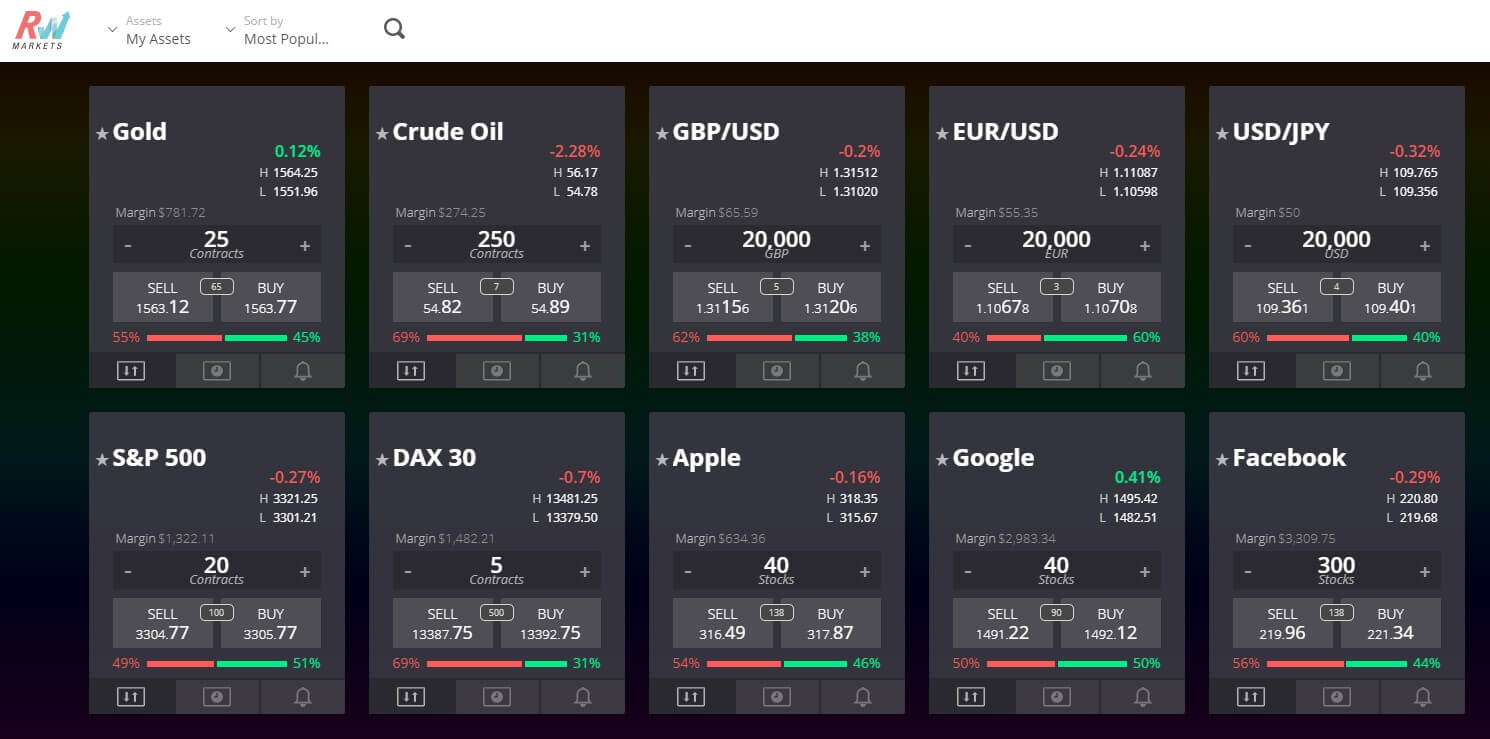

Assets

RW Markets have broken down their assets into a number of different categories.

RW Markets have broken down their assets into a number of different categories.

Currencies: There is a full breakdown of currencies on the website, it includes Majors and Minors and a few examples of them are AUD/CHF, EUR/CAD, GBP/AUD, and EUR/USD. When going through the list we also noticed that Bitcoin was noted in the currencies rather than in its own section.

Commodities: Gold, Natural Gas, Oil, Platinum, and Silver are all available to trade.

ETFs: EFTs are also present in the form of FEZ, GDX, QQQ, SMOG, SPY, UNG, USO, XLE, XLF, XLK and, XLV.

Indices: Indices are next up and the following are available for trading: DAX 30, Dow Jones, Nasdaq, Nikkei and, S&P 500

Stocks: Lastly are stocks and there are loads to chose from, a small selection includes Apply, Facebook, Tesla, and Amazon.

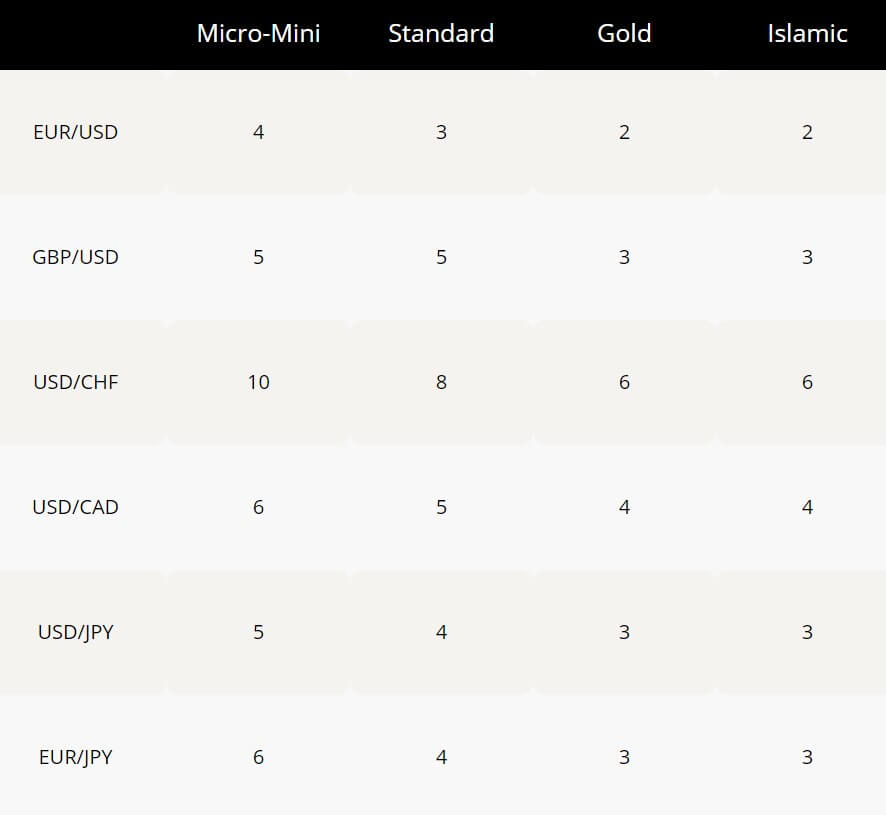

Spreads

Spreads seem to be starting quite high around 3 for EURUSD, The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 3 pips, other assets like GBPJPY may start slightly higher, in this case, 9 pips. It is unknown if different accounts have different spreads as this information is not stated on the website.

Minimum Deposit

The minimum amount required to open an account is set at $100 which is needed to open up the Mini account, it is unknown whether subsequent top-up deposits have a lower minimum requirement, as this information is not clear, we will stick with $100 as the minimum for all deposits. Some confusion lies in the FAQ which states that the minimum deposit is $500, so it is unclear what the minimum actually is.

Deposit Methods & Costs

You can use three different methods to deposit with, these are MasterCard Debit and Credit cards, Visa Debit and Credit cards and Bank Wire Transfers. The FAQ on the website states that there are no added fees on any of their transfers, however, you should be sure to check with your own bank or card processor to see if they add any fees of their won.

Withdrawal Methods & Costs

The same three methods are available to withdraw with, for clarification these are MasterCard Debit and Credit cards, Visa Debit and Credit cards and Bank Wire Transfers. Just like with deposits there are no added fees by RW Markets, however, you should be sure to check with your own bank or card processor to see if they add any fees of their won.

Withdrawal Processing & Wait Time

RW Markets try to process withdrawals within 24 to 48 hours. Once it has been processed it can take between 3 to 5 business days for the money to clear into your bank account.

Bonuses & Promotions

We could not locate any information on the website in regards to bonuses or promotions so it does not appear that there are any active ones at the time of writing this review. If you are interested in bonuses then be sure to check back regularly or get in contact with the customer service team to see if there are any upcoming bonuses or promotions.

Educational & Trading Tools

There isn’t any educational material on the website, but depending on the account that you use there is some coaching by a personal coach. “Your Personal Trading Coach will be there for you to consult for as long as you remain an RWMarkets trader. Come to us with any and all of your questions about trading and we’ll be there every step of the way to help you develop the best trading strategy to meet your needs and drive you to success.” That is the marketing of the coaches from RW Markets.

Customer Service

RW Markets have kept things simple when looking to get in touch with them, they have a department for General Inquiries and for Feedback and Complaints, each one has their own email address and phone number (although the phone number is the same for both). Both departments are open 24 hours a day from Monday to Friday and are closed over the weekend and on bank holidays when the markets are also closed.

Demo Account

Demo accounts are available by simply clicking the demo account button and filling in a short form. There is no information present about the demo account such as which account type it is mimicking and so trading conditions are unknown, it is also unknown how long they last as some brokers put a time limit such as 30 days on the demo account it would be nice to know if RW Markets do too.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

RW Markets offer a good selection of account types and assets to trade, there isn’t too much info on the differences of trading conditions between the different accounts but there is plenty of information about the conditions in general scattered around the website. Spreads are very high, even for accounts with no added commissions, they are double what you would expect and triple in some places making it very expensive to trade at RW Markets. Slight limitations to the ways you can deposit or withdraw but the no added fees are a big plus.