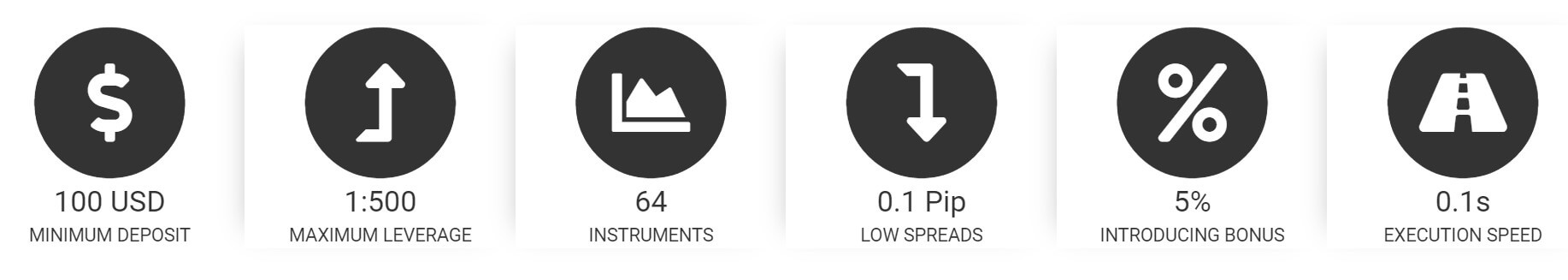

Atirox is a forex broker specializing in providing reliable and competitive services to its clients worldwide. They are a pure ECN / STP broker, allowing hem to bring the best pricing and liquidity to their clients. Established in 2015, Atirox brings sound brokerage experience and cutting-edge trading technology. Customers from all over the world successfully use the services of the Company. Atirox is well represented in Asia, CIS countries, in the Middle and the Far East as well as on the African continent.

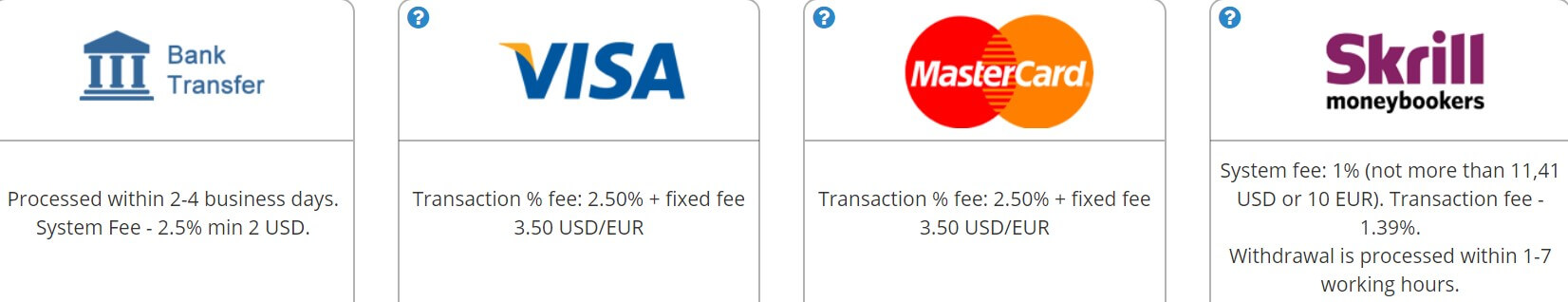

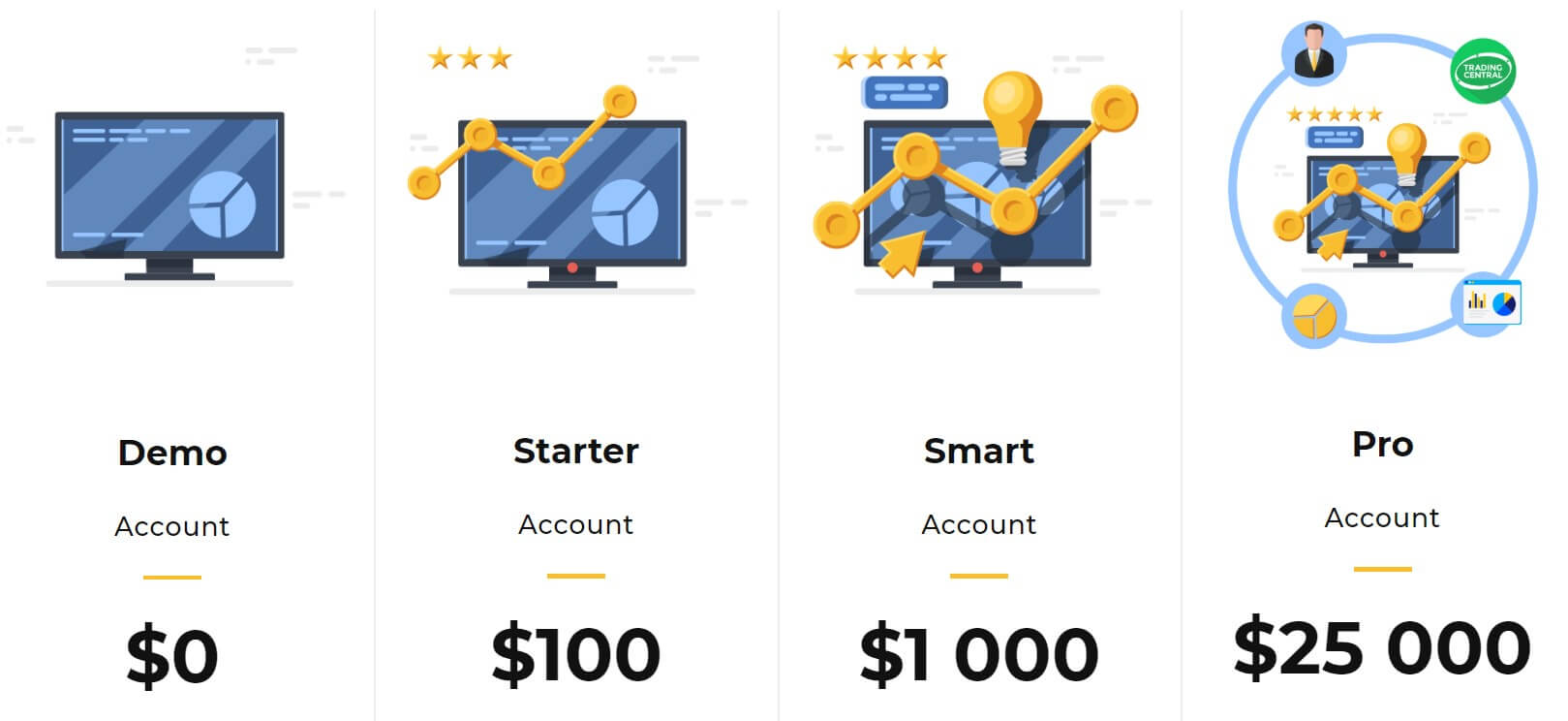

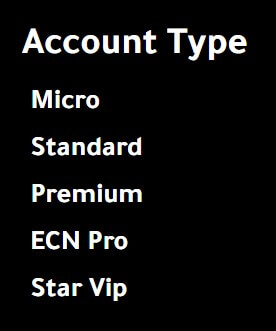

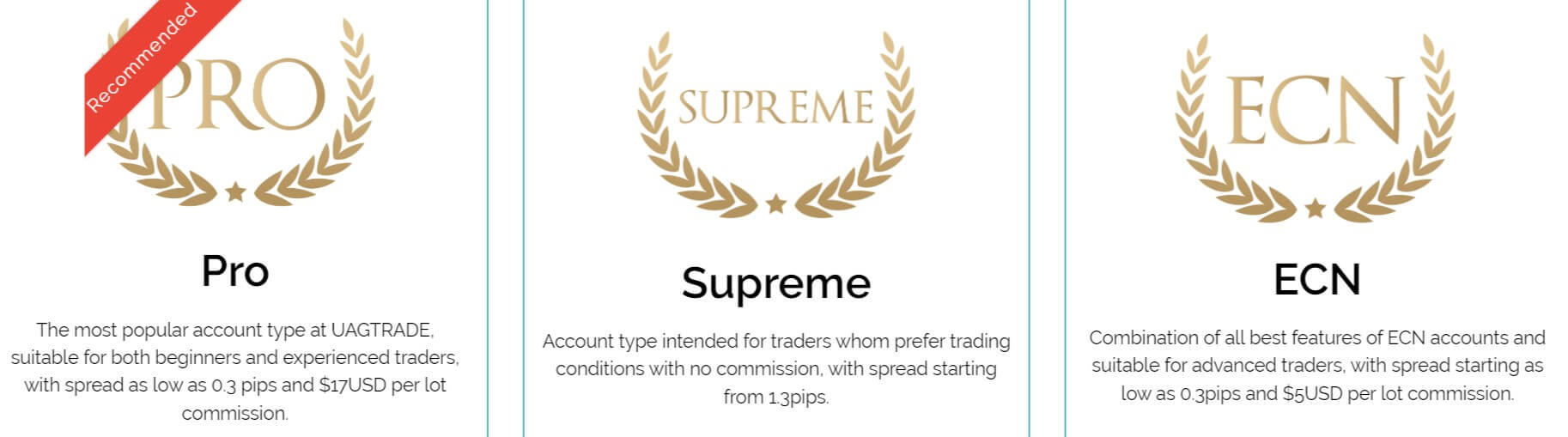

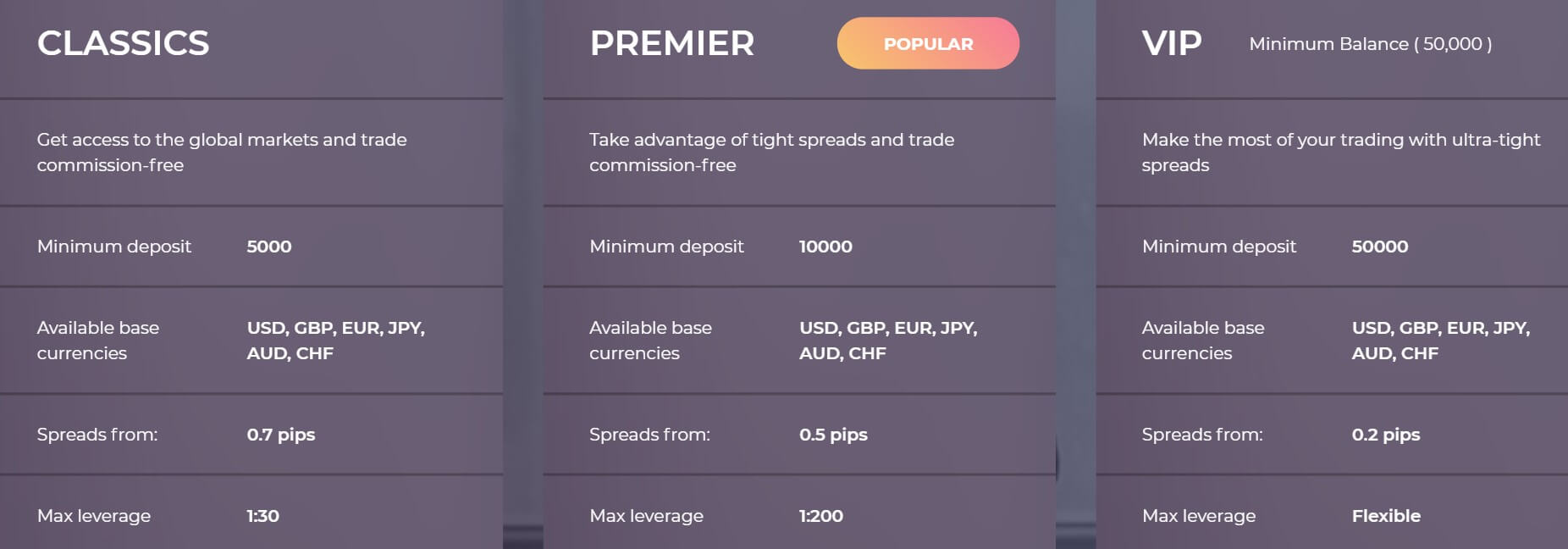

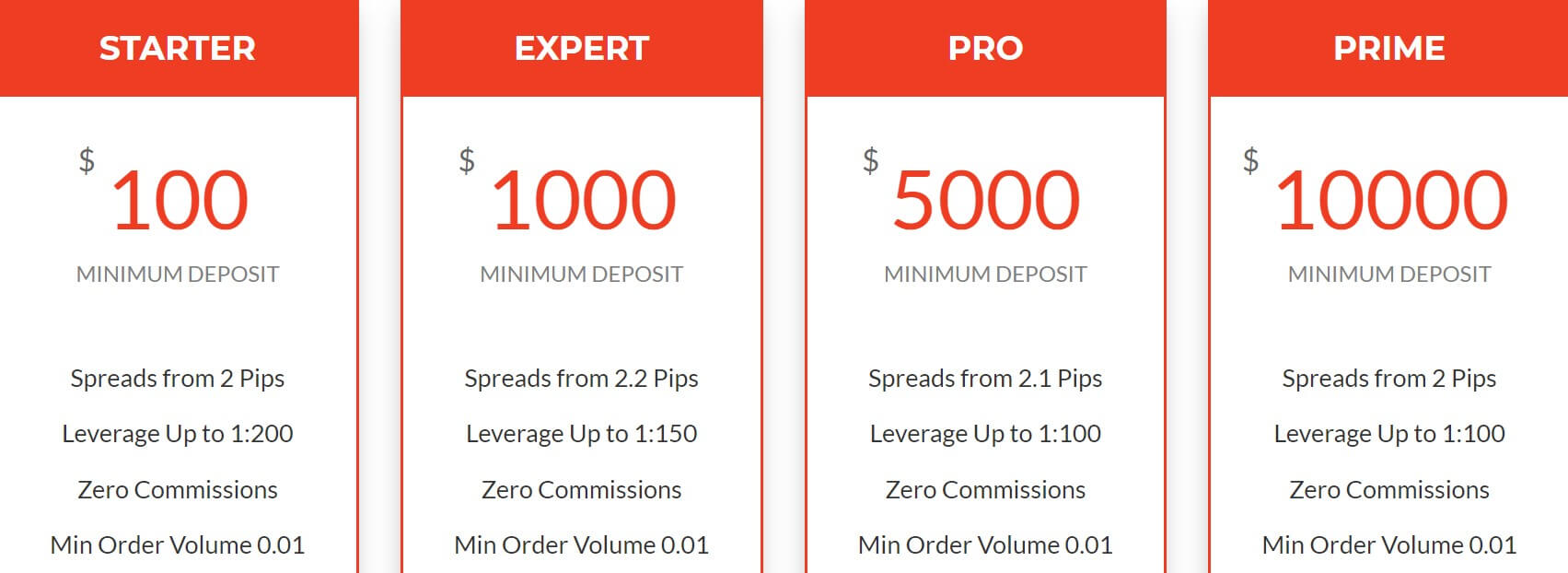

Account Types

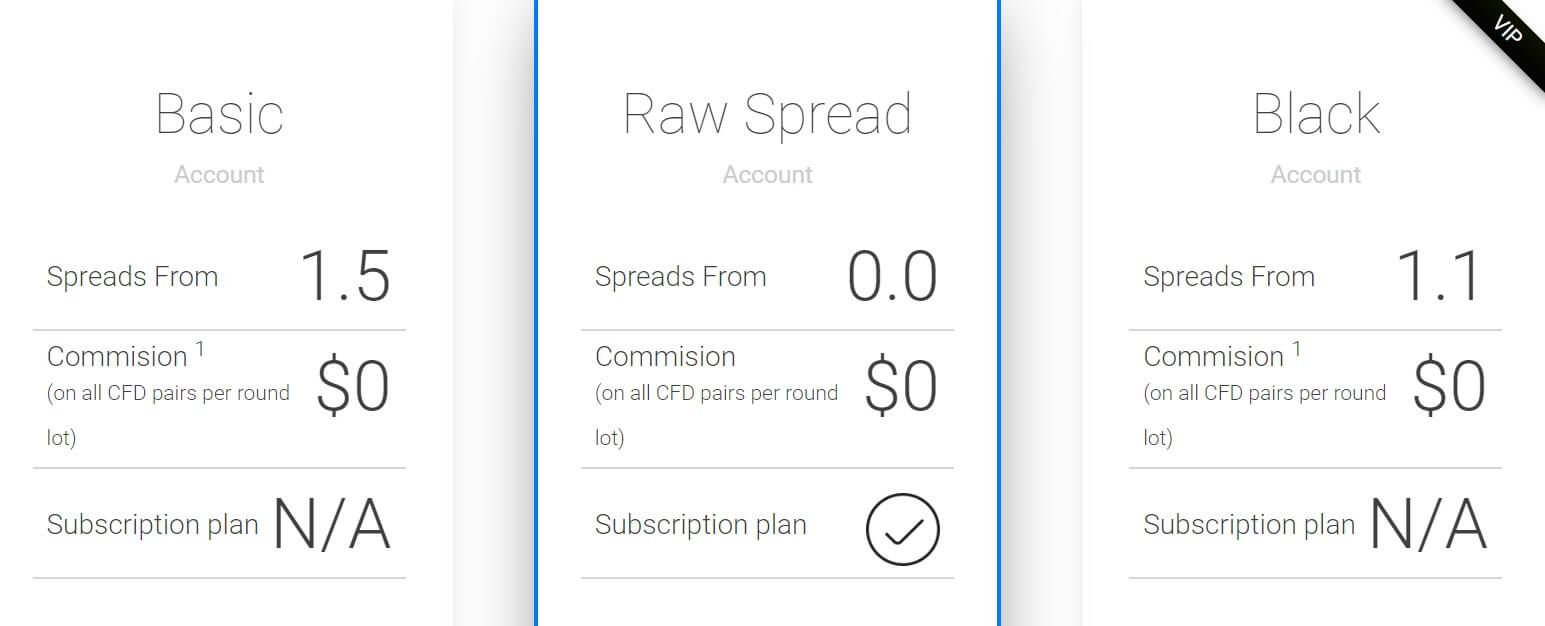

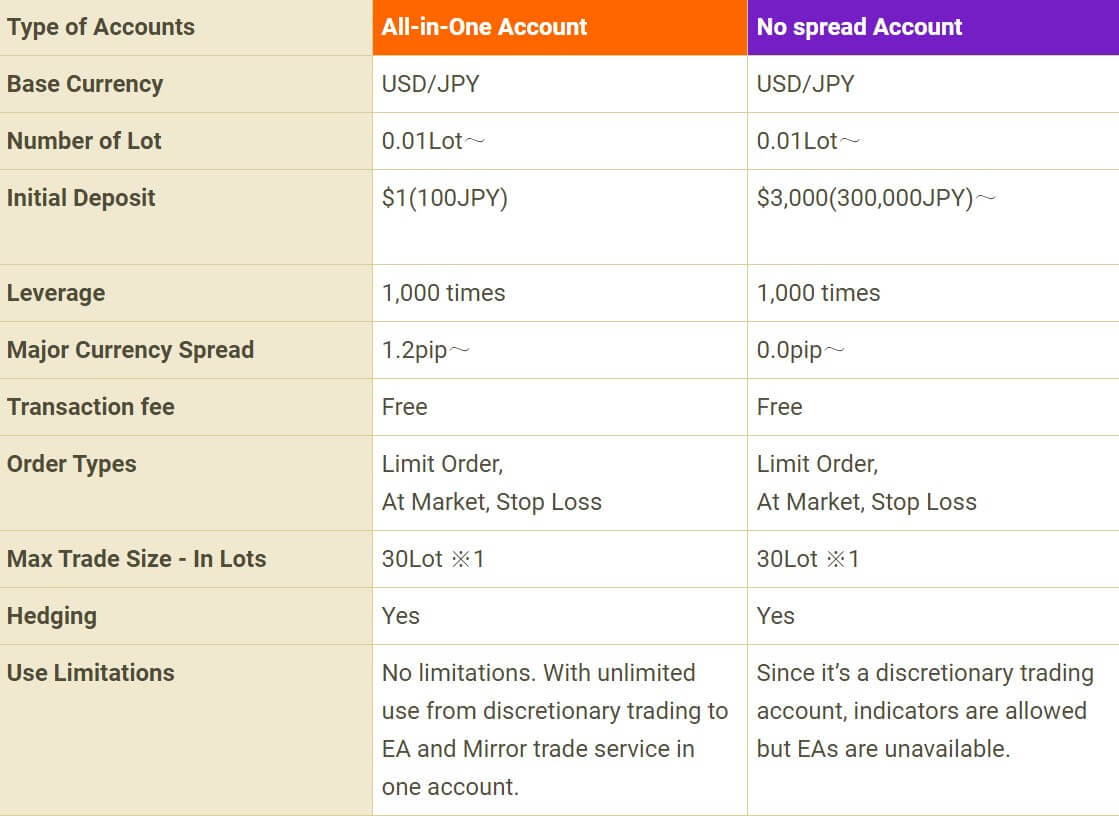

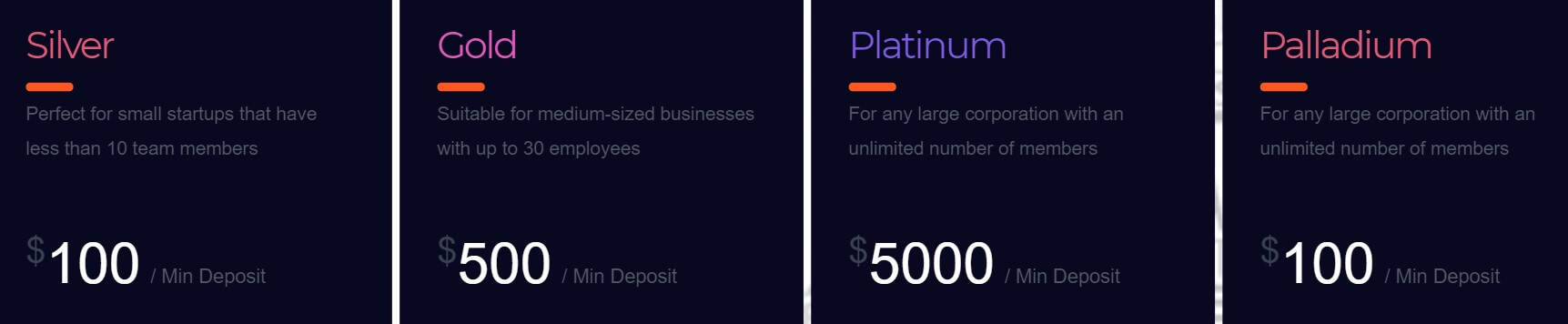

There are four different accounts on offer from Atirox, each one having its own deposit requirements and trading conditions, lets briefly look at what they are.

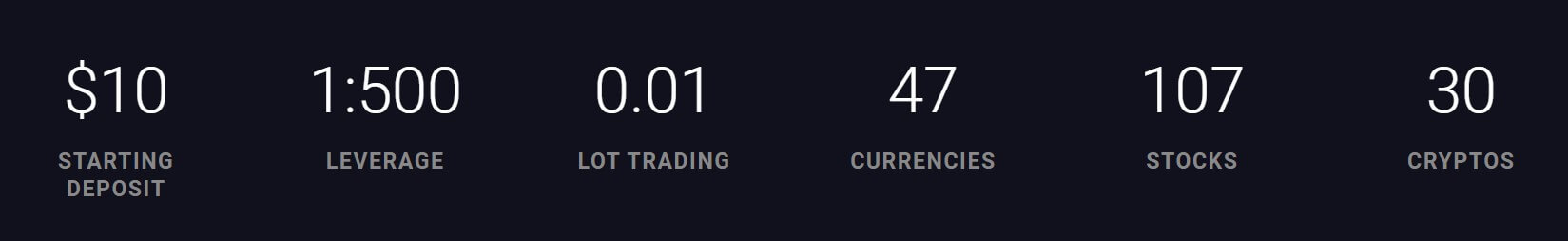

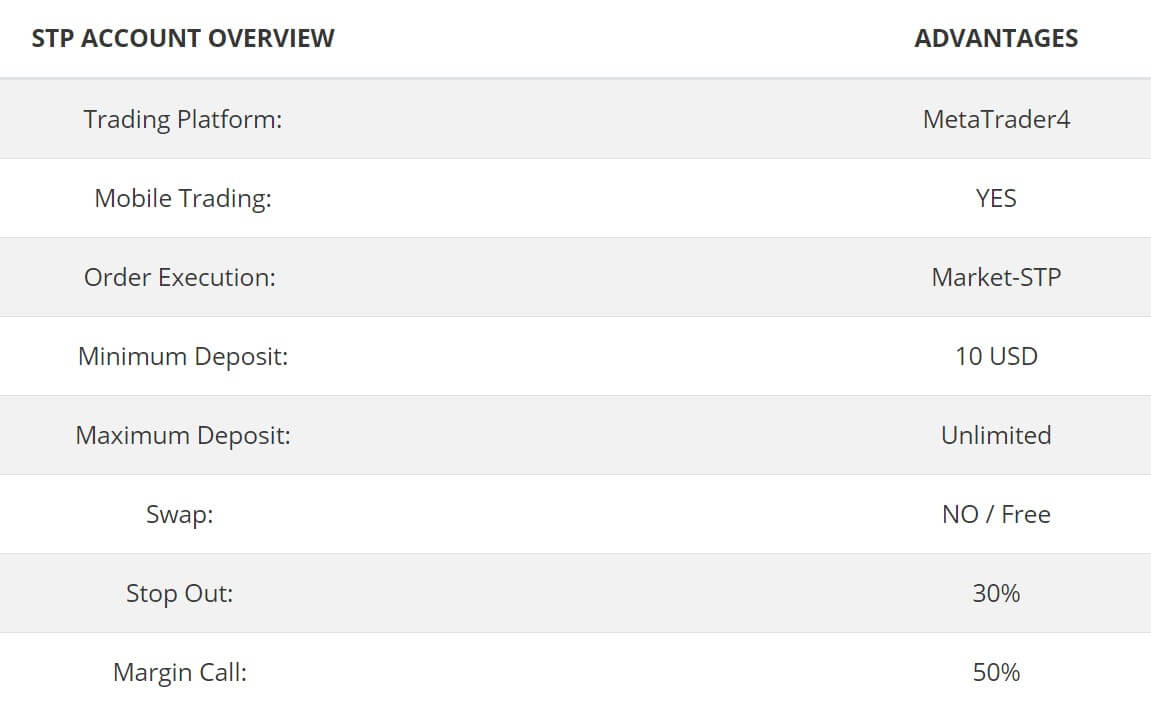

Micro Account: The entry requirement for this account is just $1, it can be leveraged up to 1:1000 and has spreads starting from 3.0 pips. There is no commission on this account and the minimum trade size is 0.01 lots. It uses STP execution and hedging, scalping, and expert advisors are all allowed to be used. It offers one-click trading and the margin call is set at 100% with the stop out being set at 50%.

Fix Account: This account requires a minimum deposit of $10, it can be leveraged up to 1:500 and has spreads starting from 2.4 pips. There is no commission on this account and the minimum trade size is 0.01 lots. It uses STP execution and hedging, scalping, and expert advisors are all allowed to be used. It offers one-click trading and the margin call is set at 75% with the stop out being set at 50%.

Classic Account: This account has a minimum requirement of $50, it can be leveraged up to 1:500 and has spreads starting from 1.1 pips. There is no commission on this account and the minimum trade size is 0.01 lots. It uses STP execution and hedging, scalping, and expert advisors are all allowed to be used. It offers one-click trading and the margin call is set at 70% with the stop out being set at 30%.

Pro Account: This is the top-level account, it requires a minimum deposit of $300, it can be leveraged up to 1:500 and has spreads starting from 0.05 pips. Due to the low spreads, there is an added commission of $4 per lot traded on this account and the minimum trade size is 0.1 lots. It uses STP execution and hedging, scalping, and expert advisors are all allowed to be used. It offers one-click trading and the margin call is set at 100% with the stop out being set at 50%.

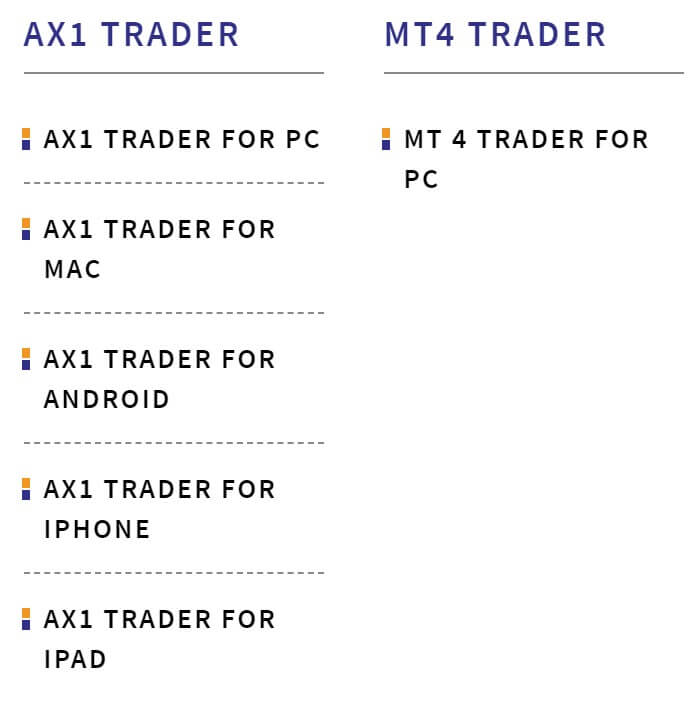

Platforms

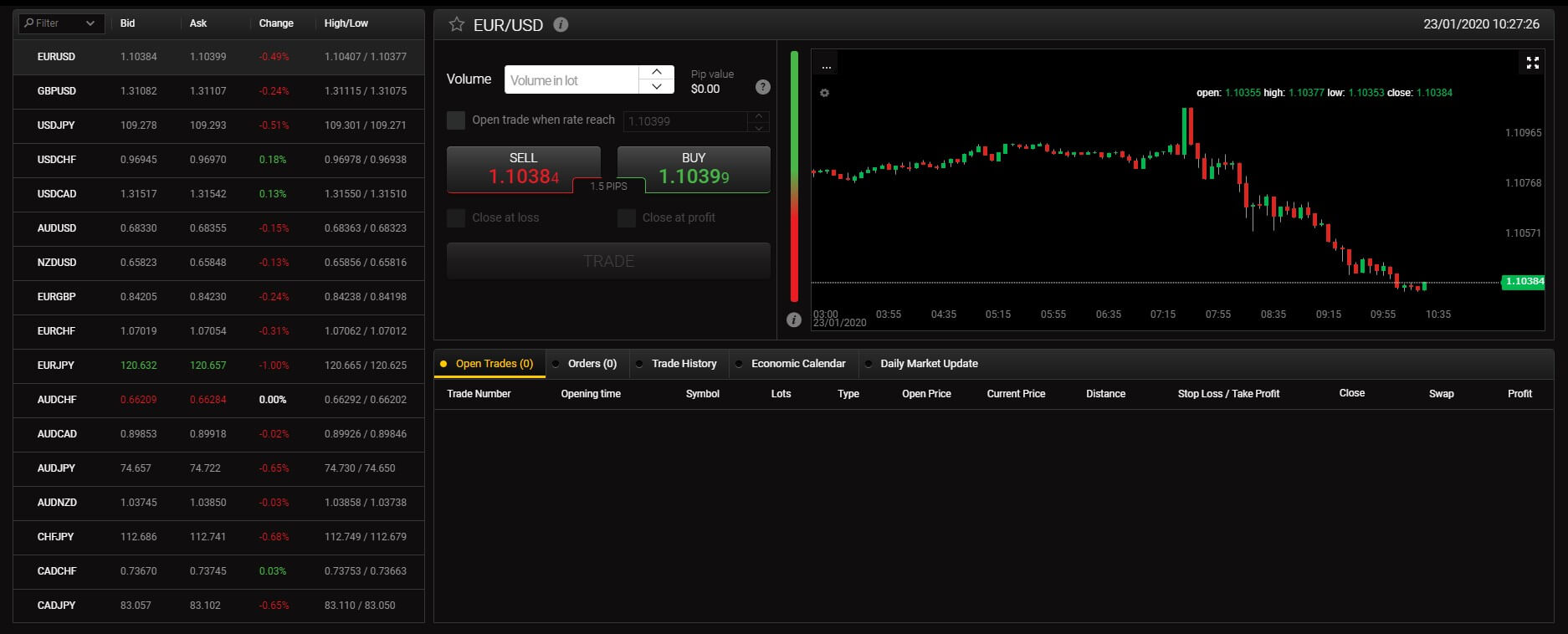

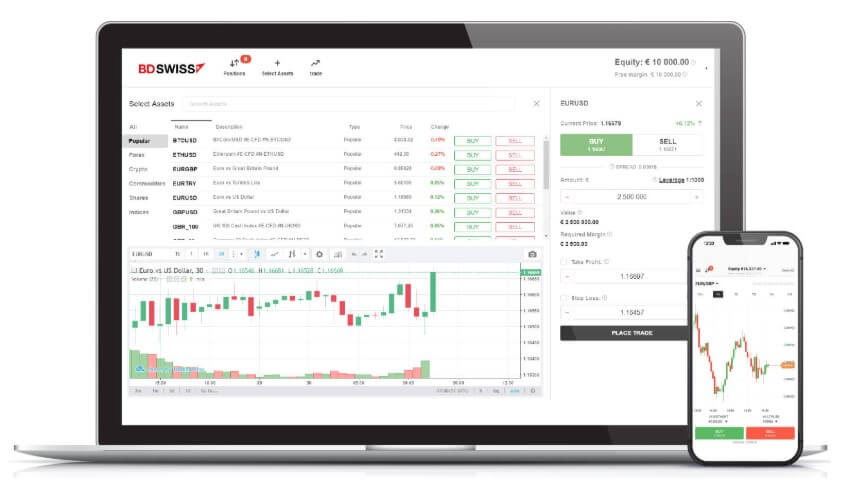

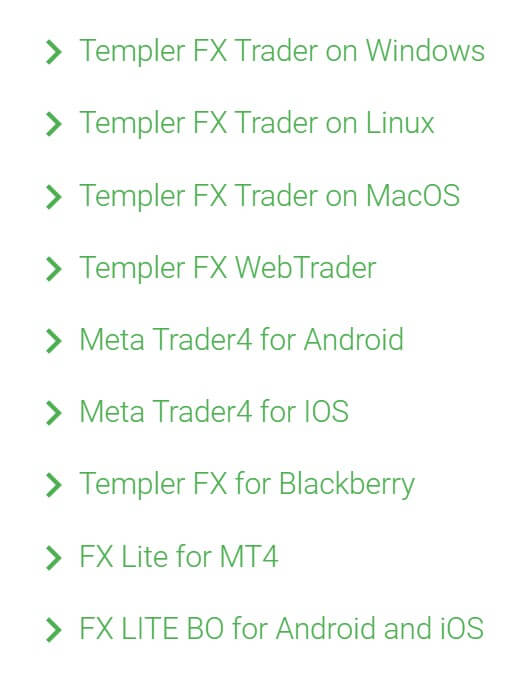

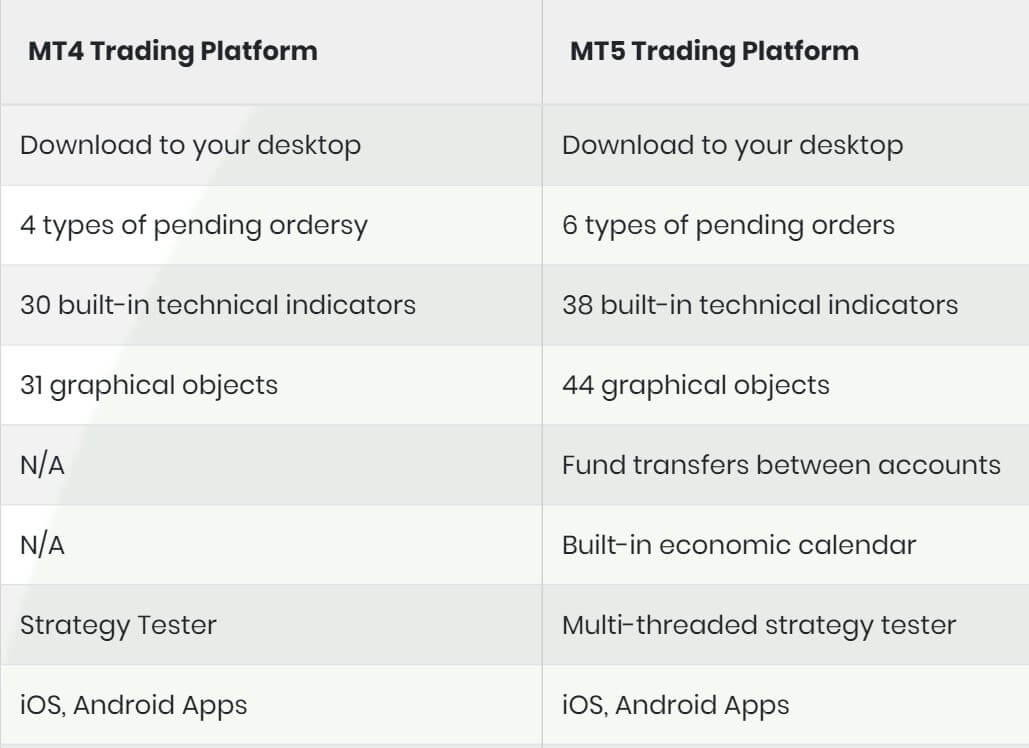

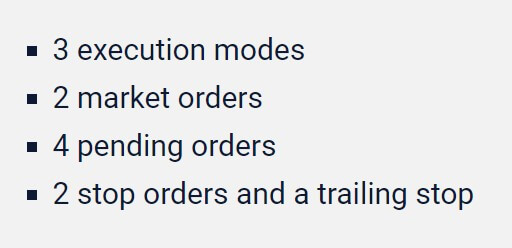

There are two main systems for trading, one being manual trading with MetaTrader 4 and the other being a copy trading system, so let’s see what they offer.

MetaTrader 4 (MT4): Atirox recommends that its clients install the MetaTrader 4 terminal for FX trading. Professional traders have long considered the MT4 trading platform to be one of the most intuitive and functional platforms of all-time. This is exactly why today MetaTrader has grown to become the industry standard in the world of online forex trading. Traders who prefer algorithmic FX trading can easily customize their Expert Advisors and use them while trading on the Atirox servers. Atirox offers MT4 for traditional desktop (Windows & Mac) computers, as well as the most popular mobile platforms (Android & iOS).

Copy System: Atirox Copy System is a service of copying deals, which allows followers to copy the transactions of the most successful traders and in turn, traders get the opportunity to have an additional income by sharing their experience with their followers. Registration in the system and configure the copy parameters takes only a few minutes. The main advantage of the system is its reliability. The follower fully controls the situation, as the funds remain on his account. He sets up the system for his own needs and can independently cancel the copied transactions if, in his opinion, the transactions bear unreasonable risks.

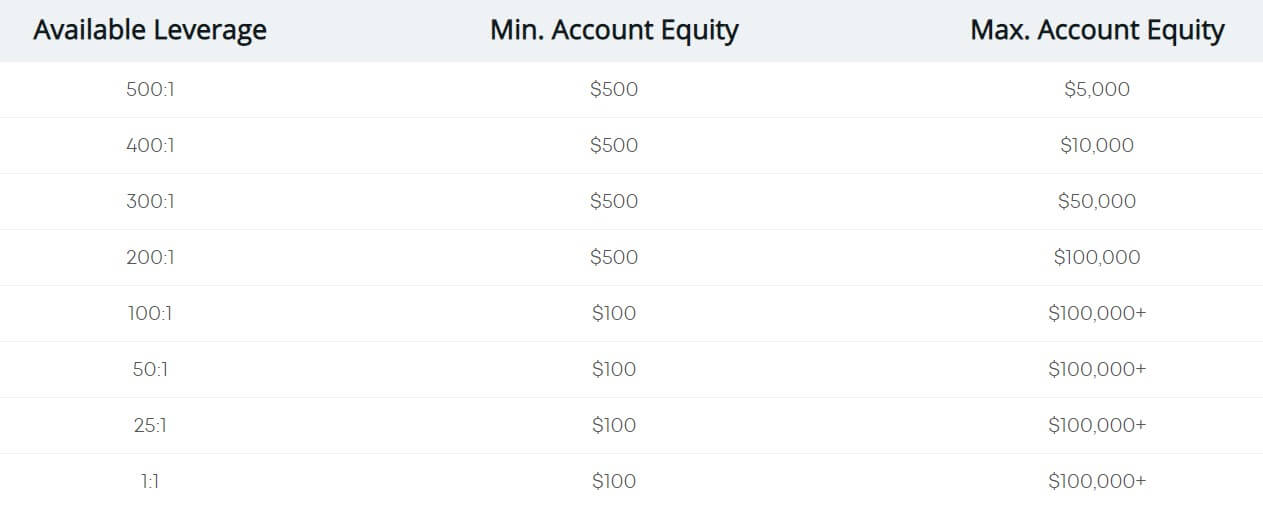

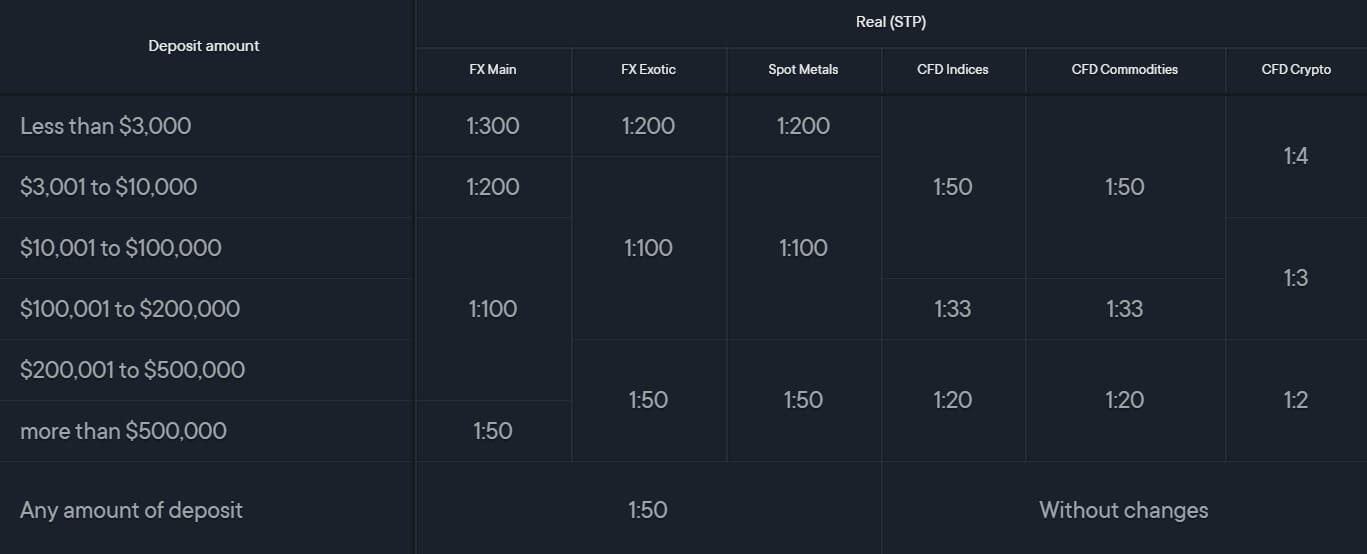

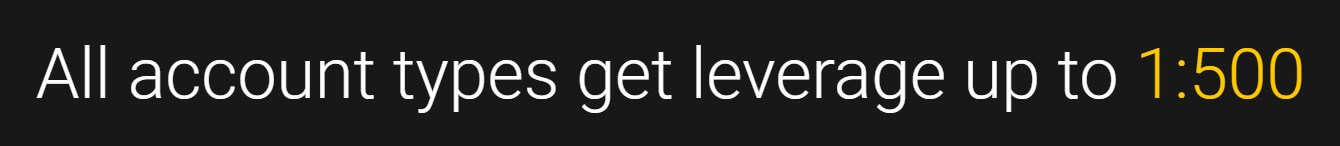

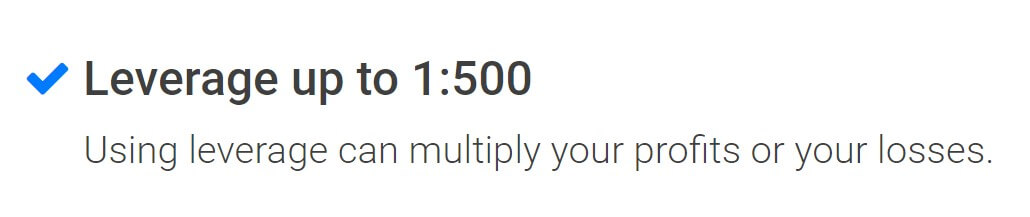

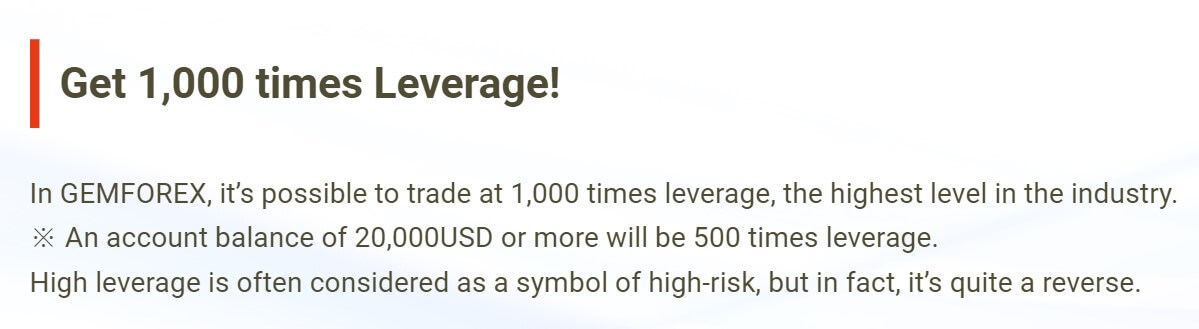

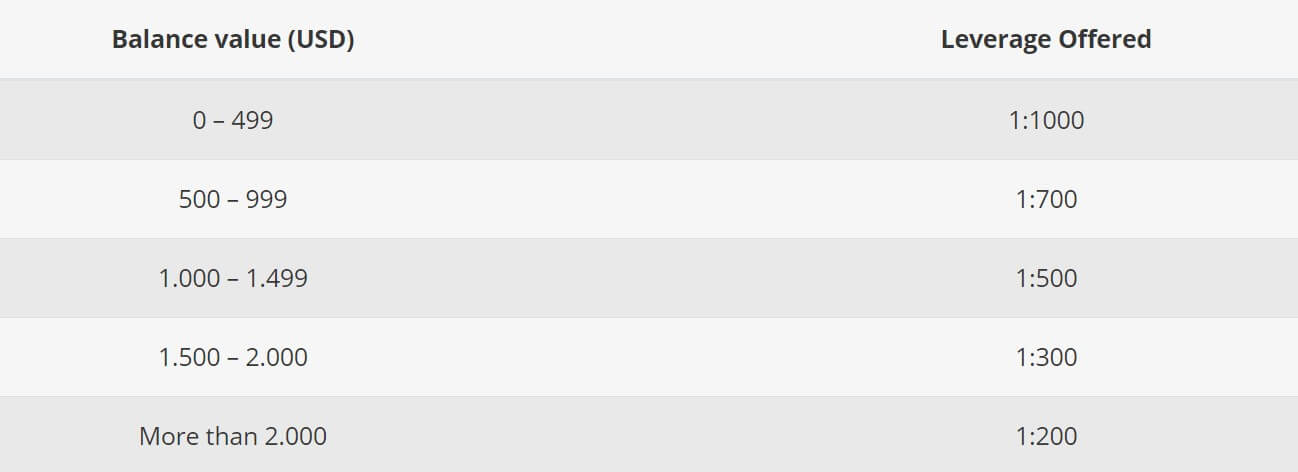

Leverage

Leverage

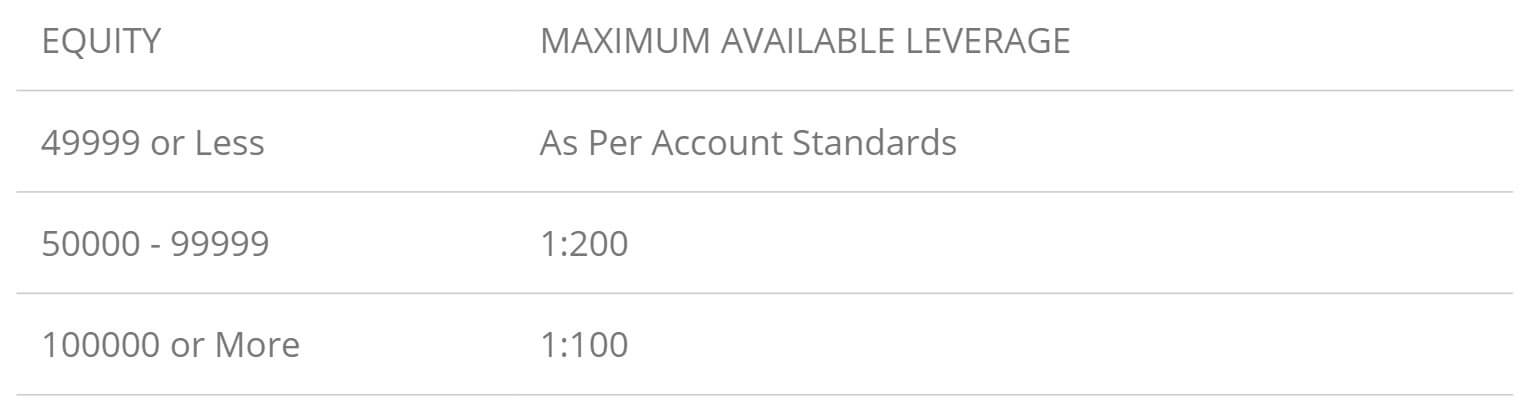

The leverage that you get can depend on the account you are using, different accounts have different limits.

- Micro: 1:1000

- Fix: 1:500

- Classic: 1:500

- Pro: 1:500

The leverage can be selected when opening up an account, should you wish to change it on an already open account you will need to get in contact with the customer service team.

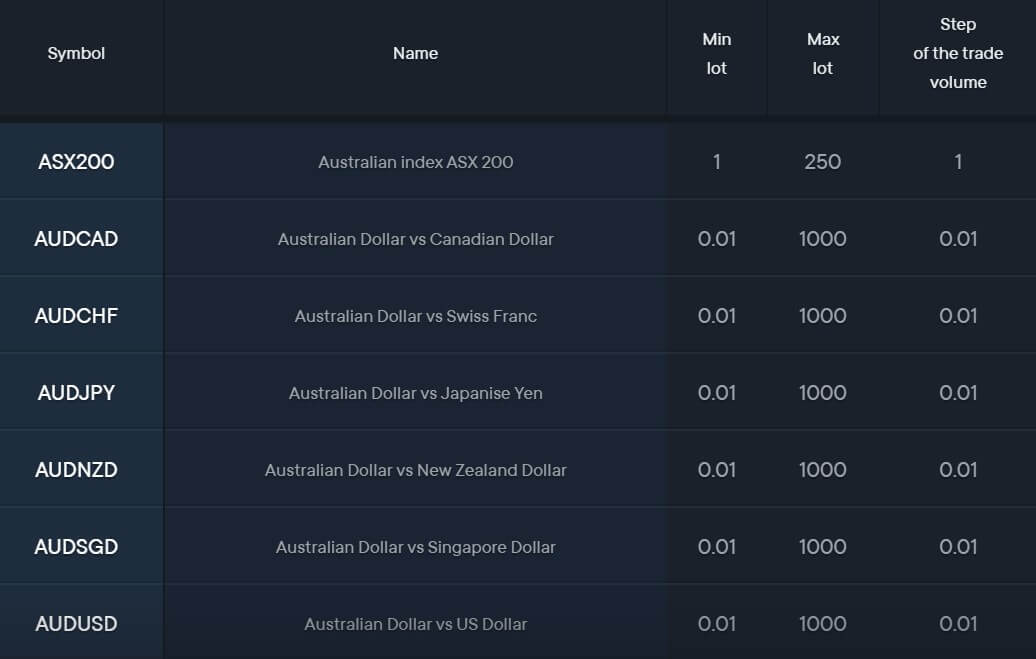

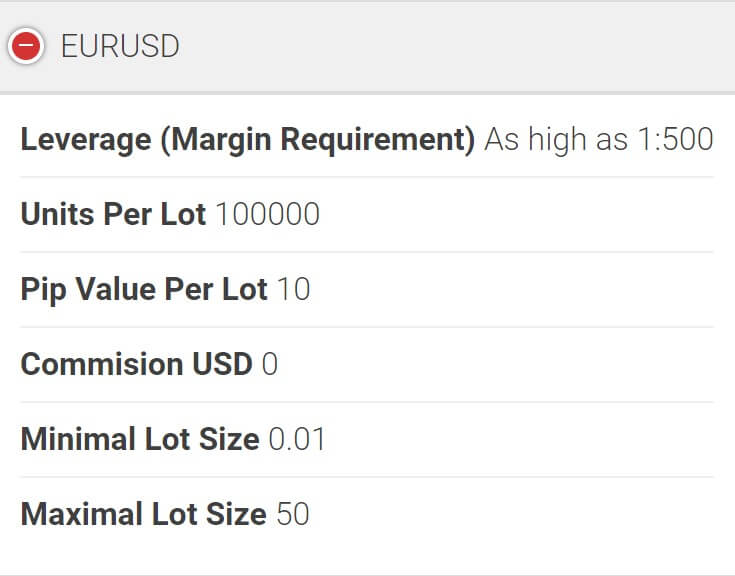

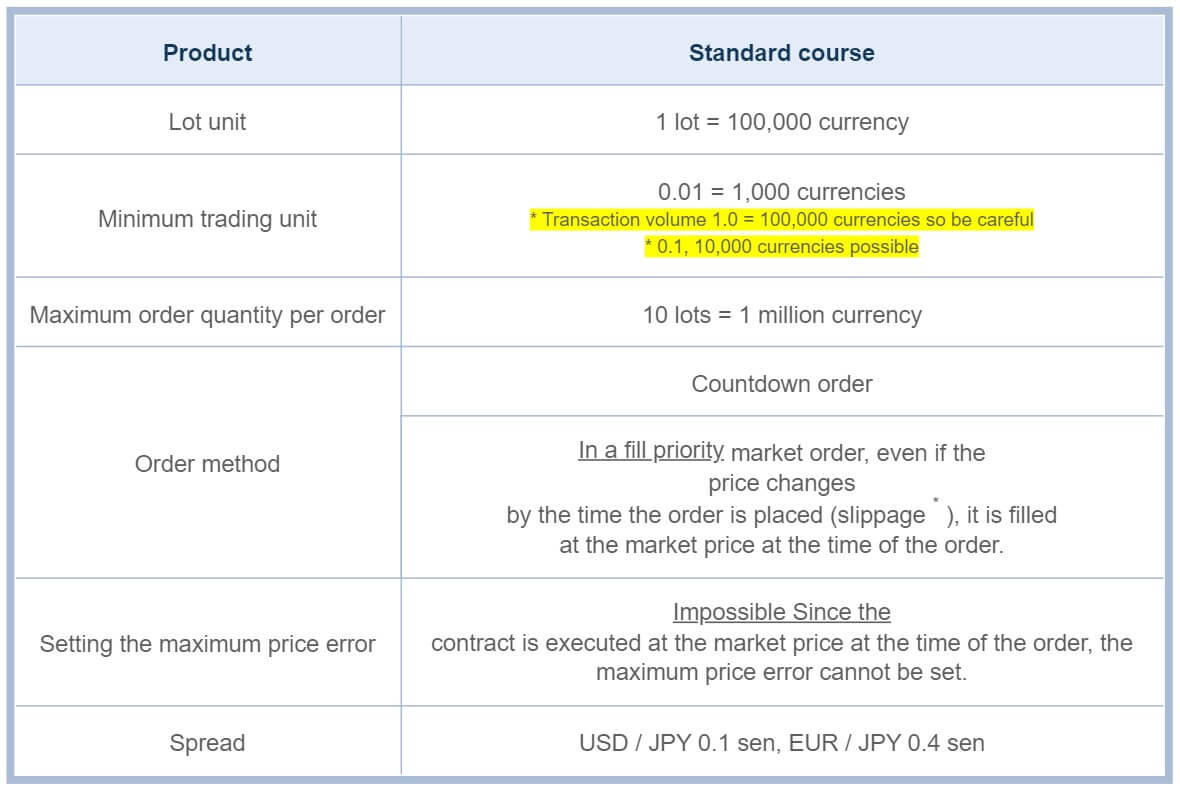

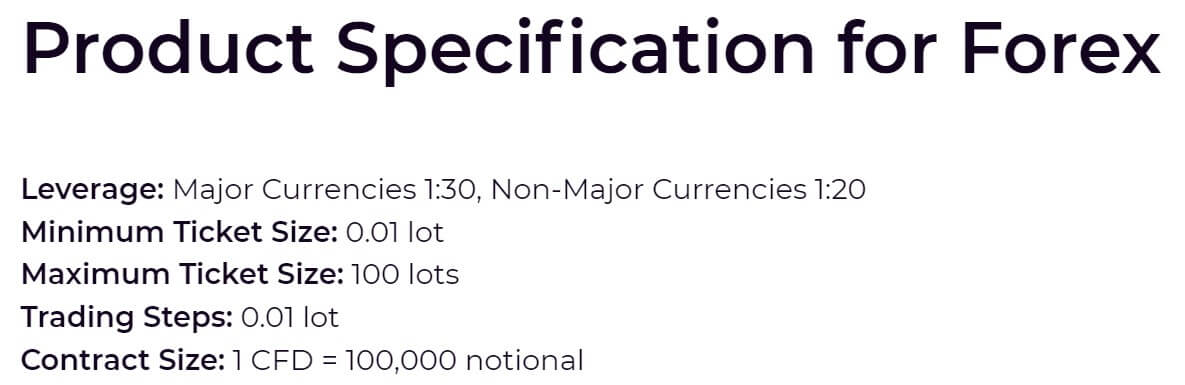

Trade Sizes

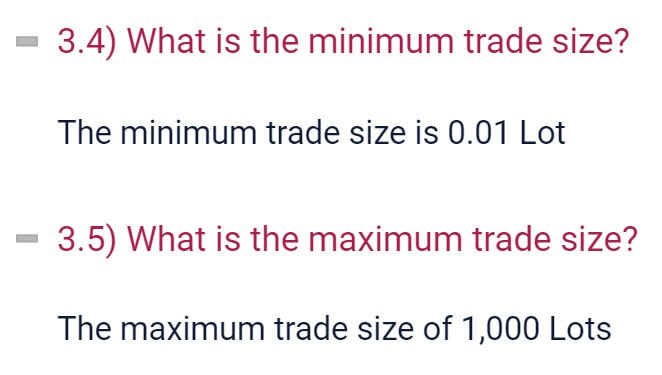

The minimum trade sizes on the Micro, Fix and Classic accounts is 0.01 lots (also known as a micro lot) they then go up in increments of 0.01 lots so the next trades are 0.02 lots and then 0.03 lots.

The starting trade size on the Pro account states that it is 0.1 lots, however on the product specification page it states 0.01 lots, but we will go with what is stated on the accounts plage. So the trades start at 0.1 lots and the incremental increase amount is not specified.

All account ahs a maximum trade size of 1,000 lots, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

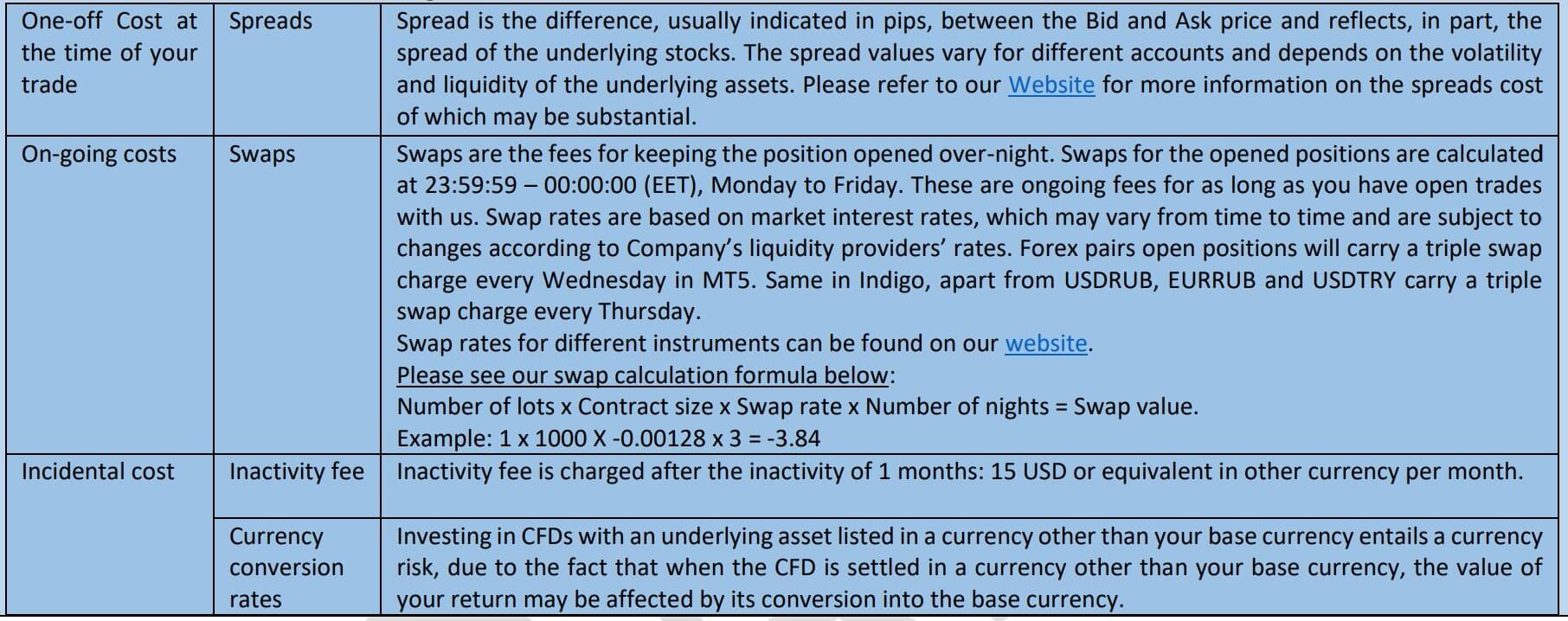

Trading Costs

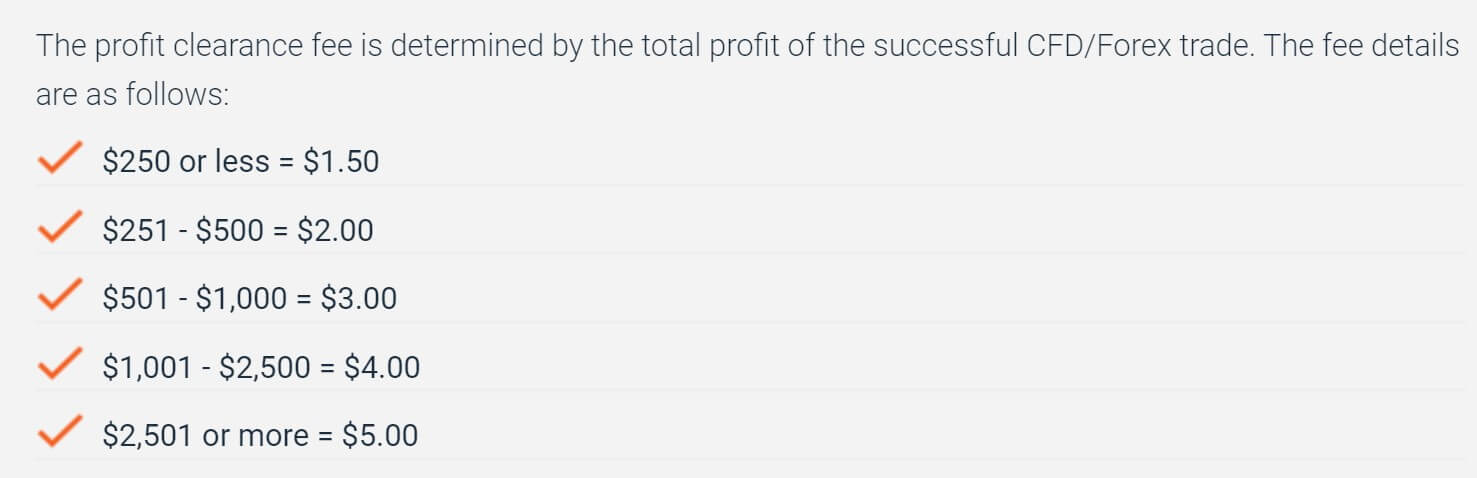

The Pro account is the only account with an added commission, it is $4 per lot traded which is lower than the industry standard of $6 per lot traded. All other accounts use a spread based system that we will look at later in this review.

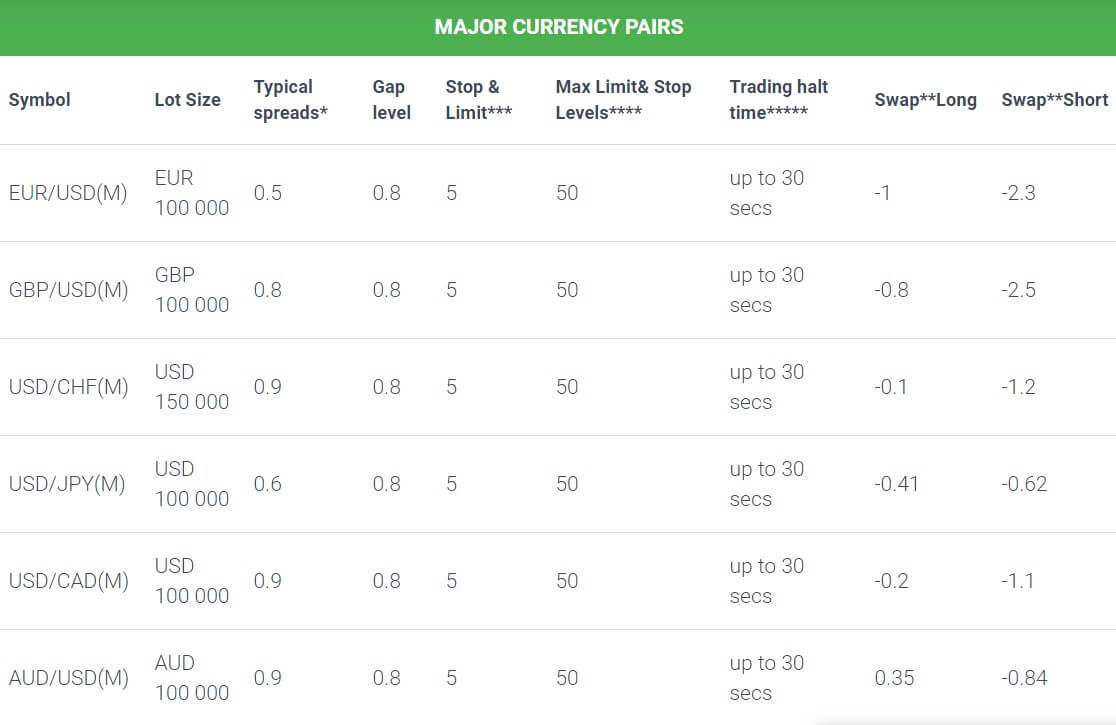

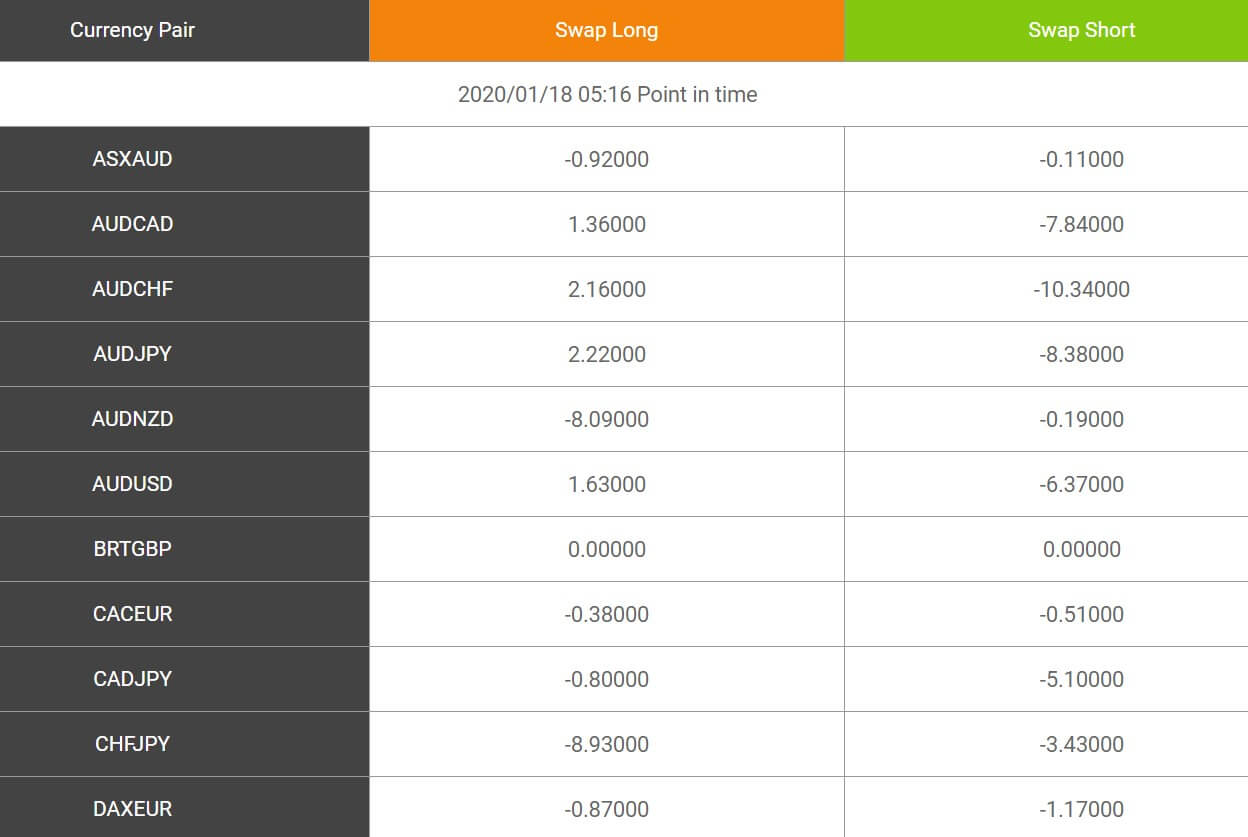

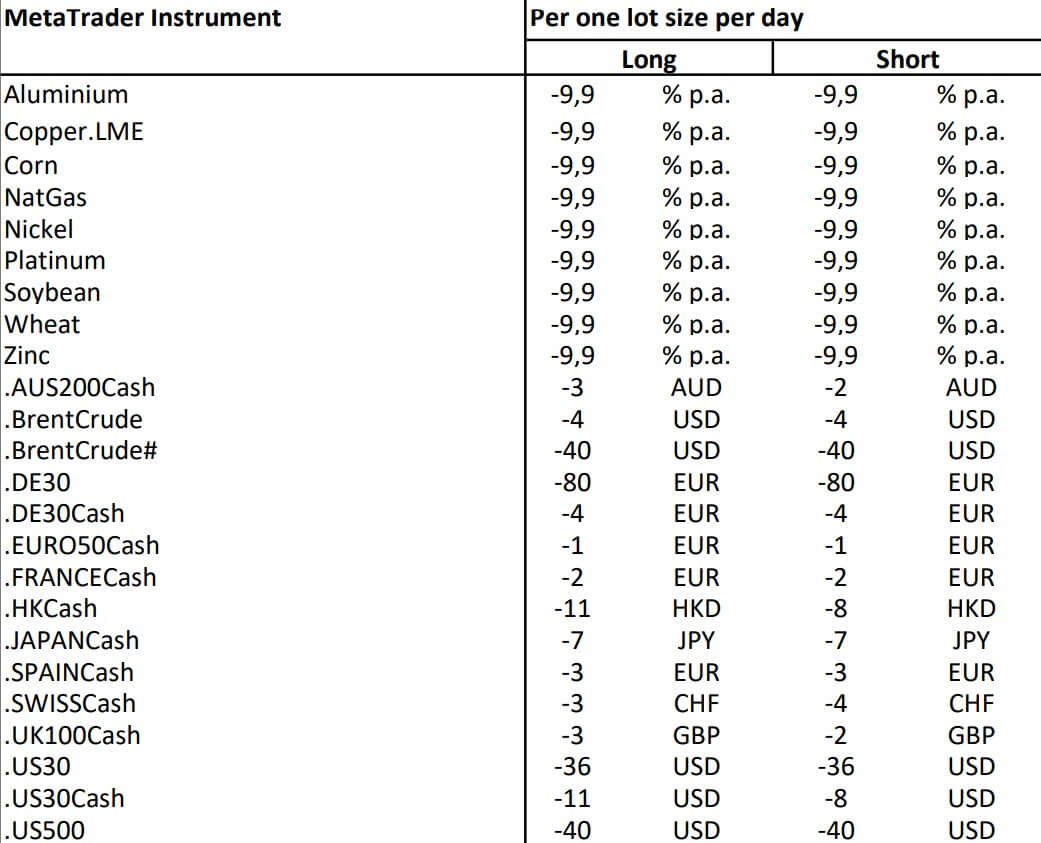

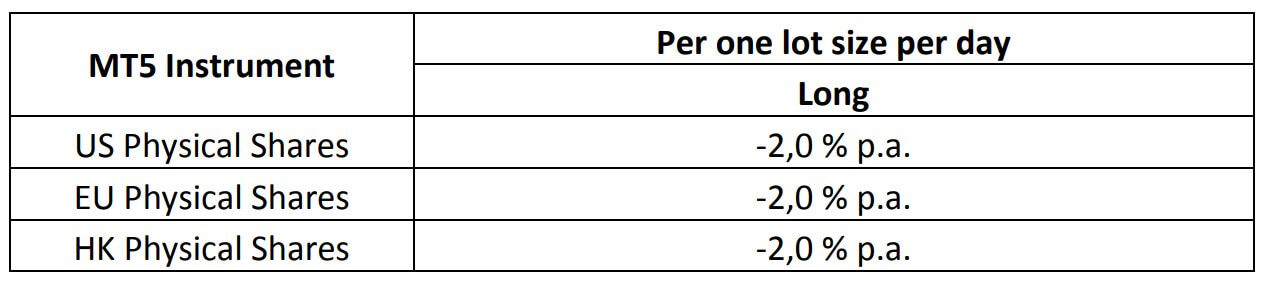

There are also swap charges to contend with, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice.

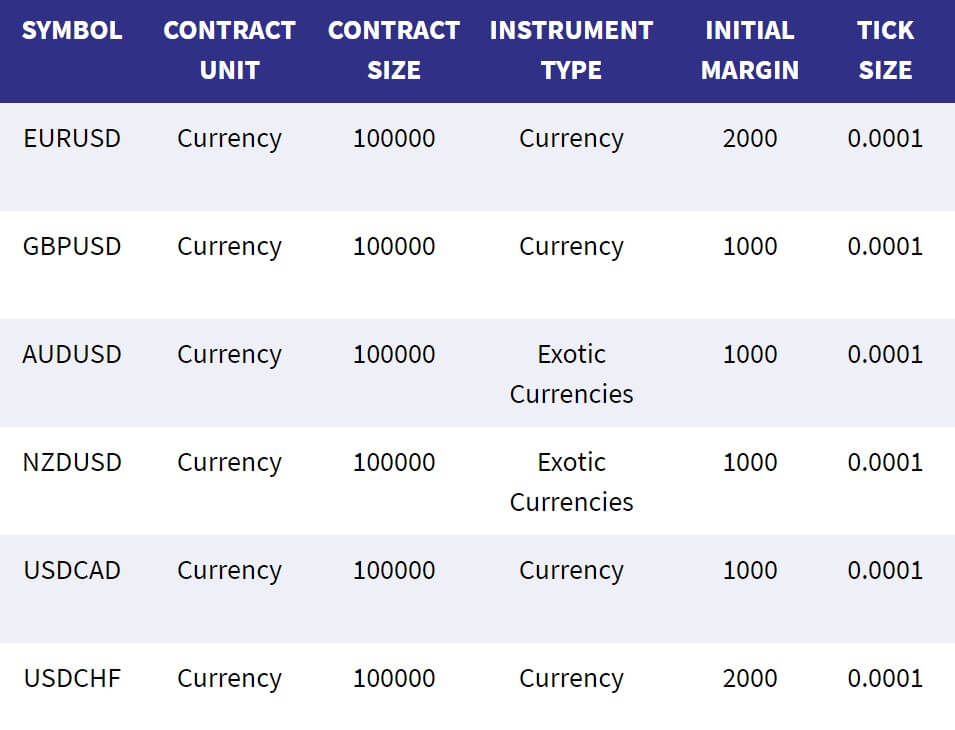

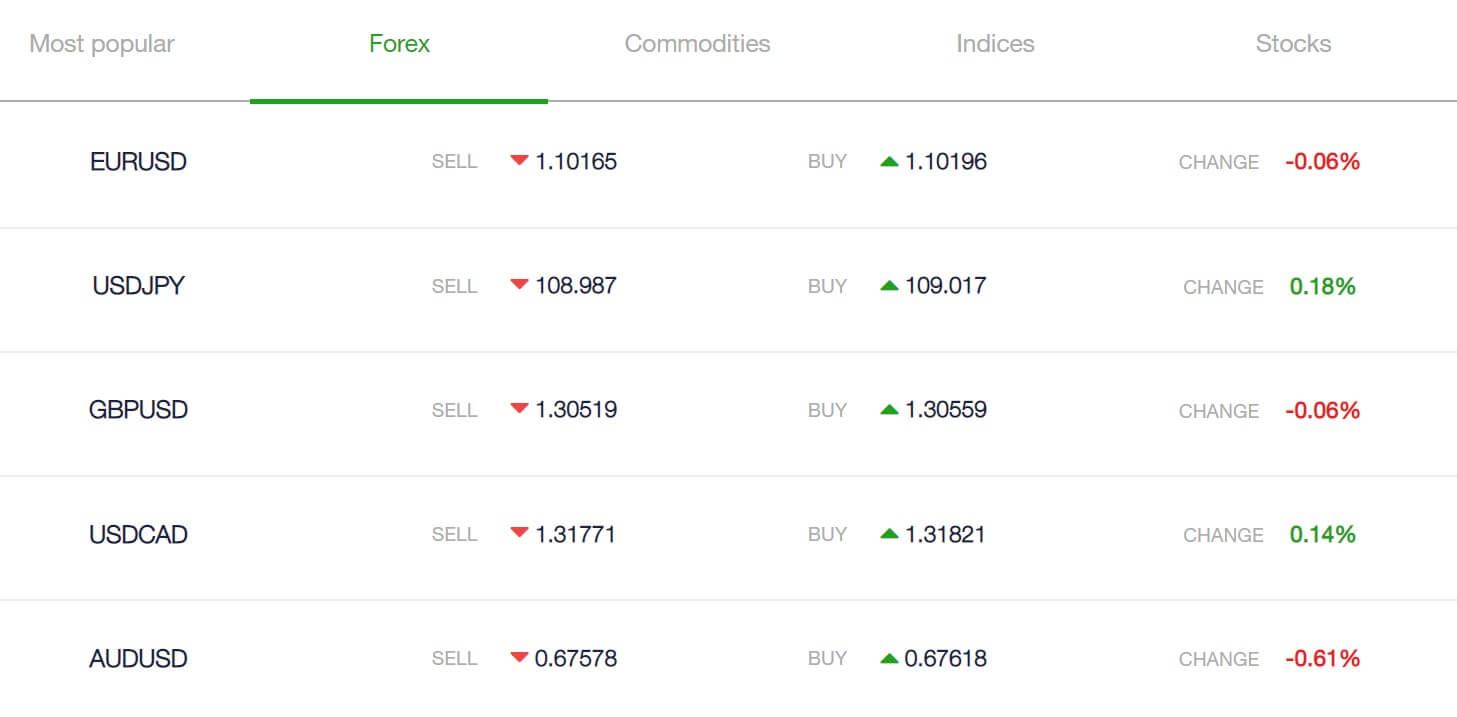

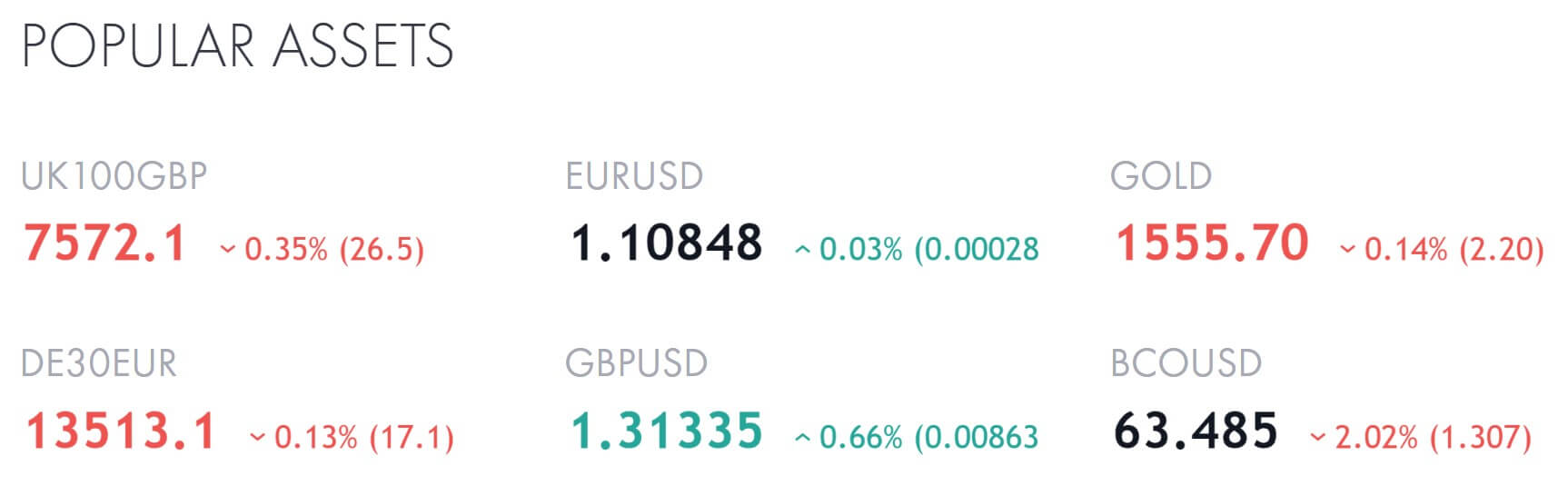

Assets

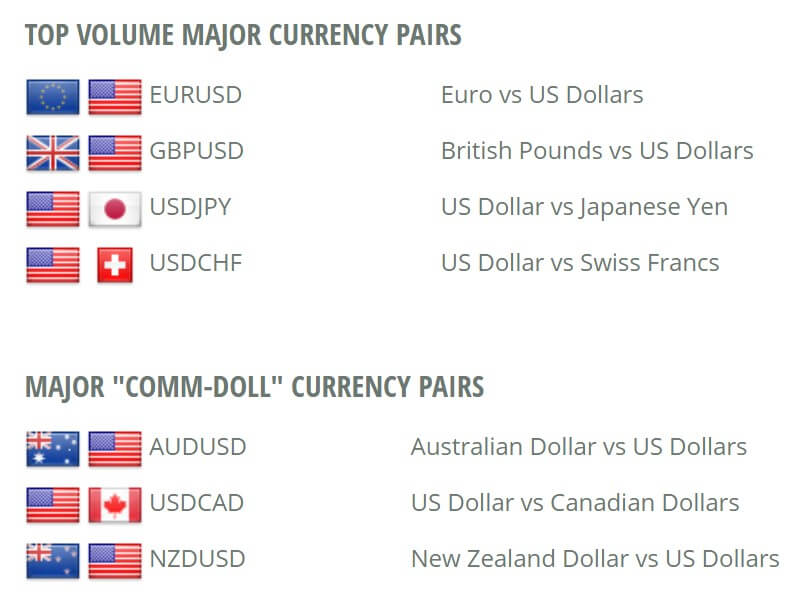

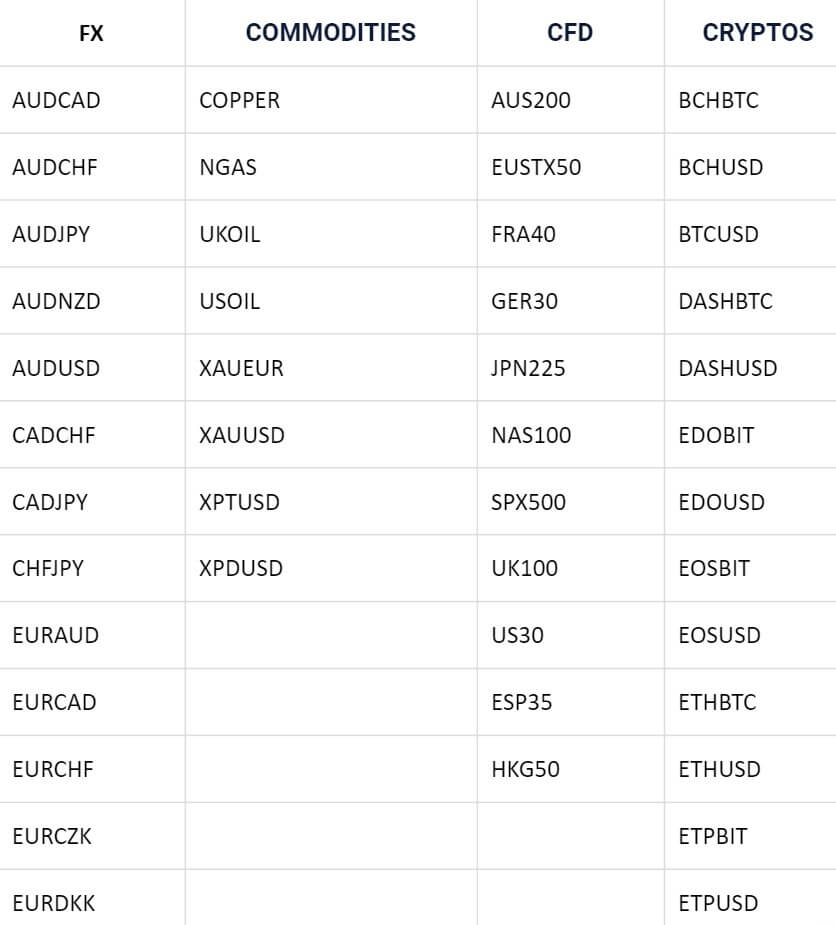

Atirox has broken their assets down into 6 different categories, we will outline some examples from each below.

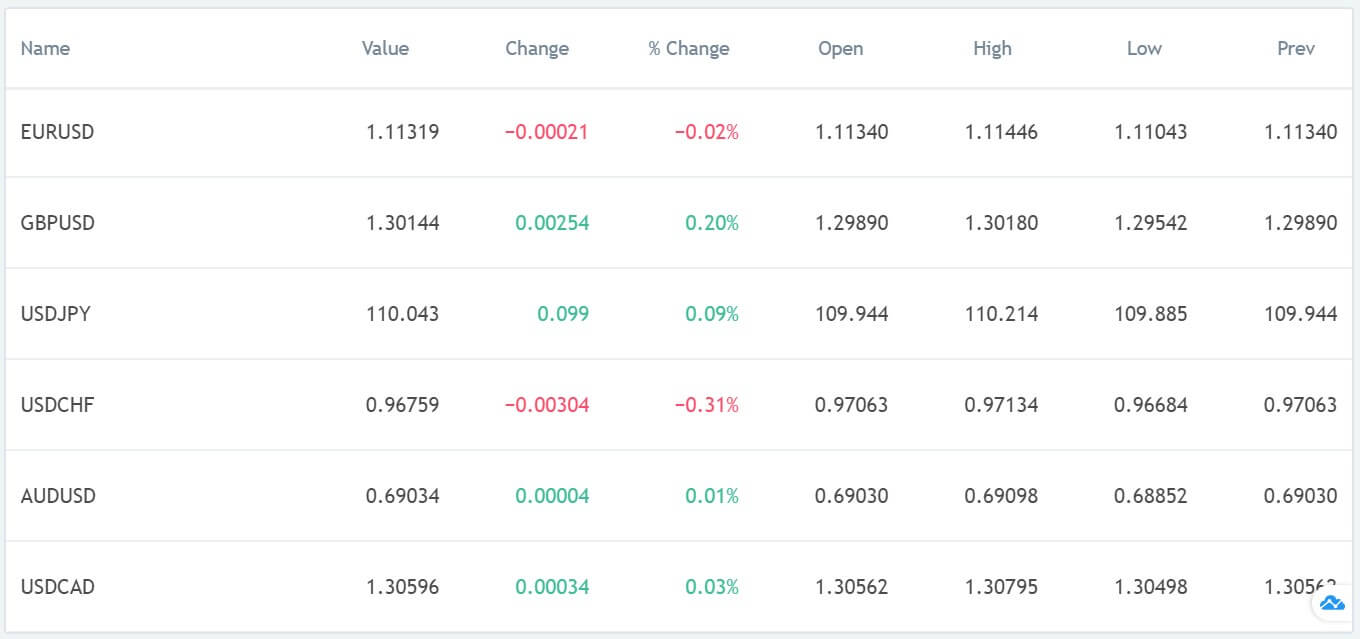

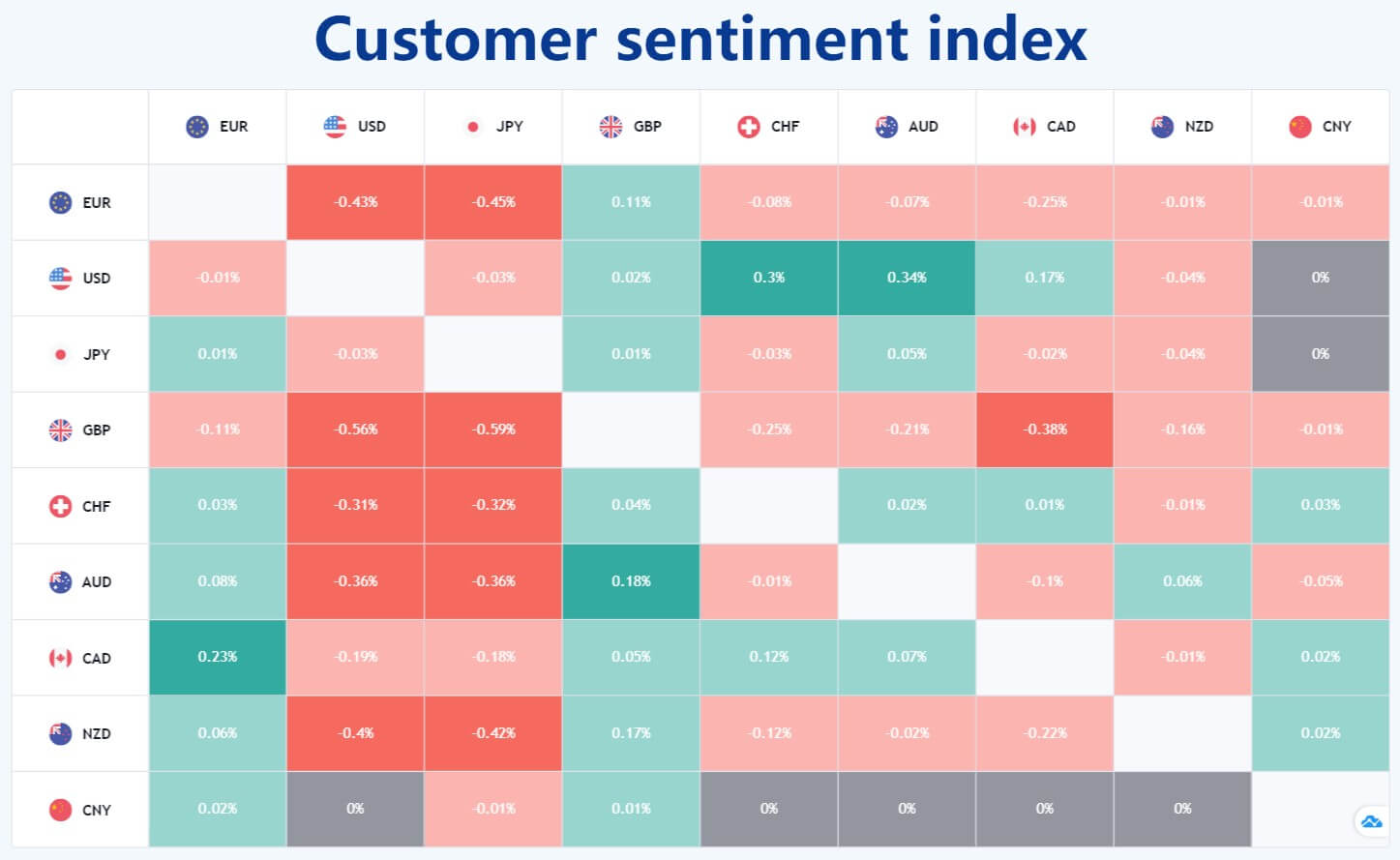

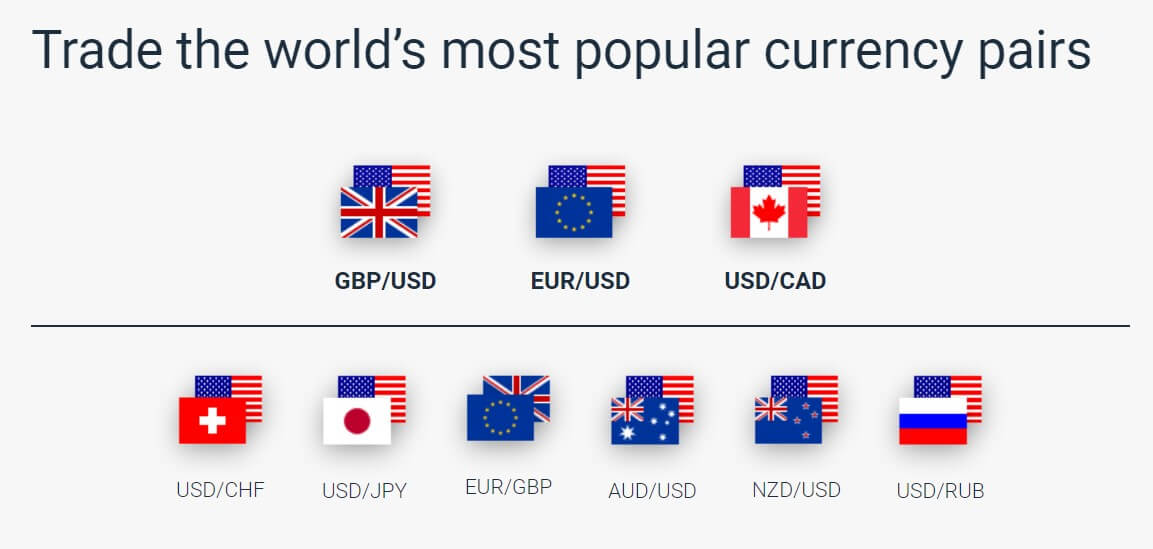

Forex Major: EURUSD, USDJPY, GBPUSD, EURGBP, EURJPY, EURCHF, AUSUSD, USDCAD, NZDUSD, EURCAD, EURAUD, EURNZD.

Forex Minor: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, CADCHF, CADJPY, CHFJPY, CHFSGD, EURCZK, EURDKK, EURHUF, WUENOK, WUEPLZ, EURSEK, SEUSGD, EURTRY, EURZAR, GBPAUD, GBPCAD, GBPCHF, GBPDKK, GBPJPY, GBPNOK, GBPNZD, GBPSEK, GBPSGD, GBPTRY, NOKJPY, NOKSEK, NZDCAD, NZDCHF, NZDJPY, SEKJPY, USDCNH, USDCZK, USDHUF, USDNOK, USDRUB, USDSEK, USDSGD, USDTRY, USDZAR, ZARJPY.

Commodities: XTIUSD (WTI Crude Oil), XBRUSD (Brent Crude Oil), XNGUSD (Natural Gas).

Spot Metals: XAUUSD, XAGUSD, XAUEUR, XAGEUR, XPTUSD, XPDUSD.

CFDs: AUS 200, EUSTX 50, FRA 40, GER 30, HK 50, JPN 225, NAS 100, SPA 35, SWI 20, UK 100, US 30, US 500, US 2000.

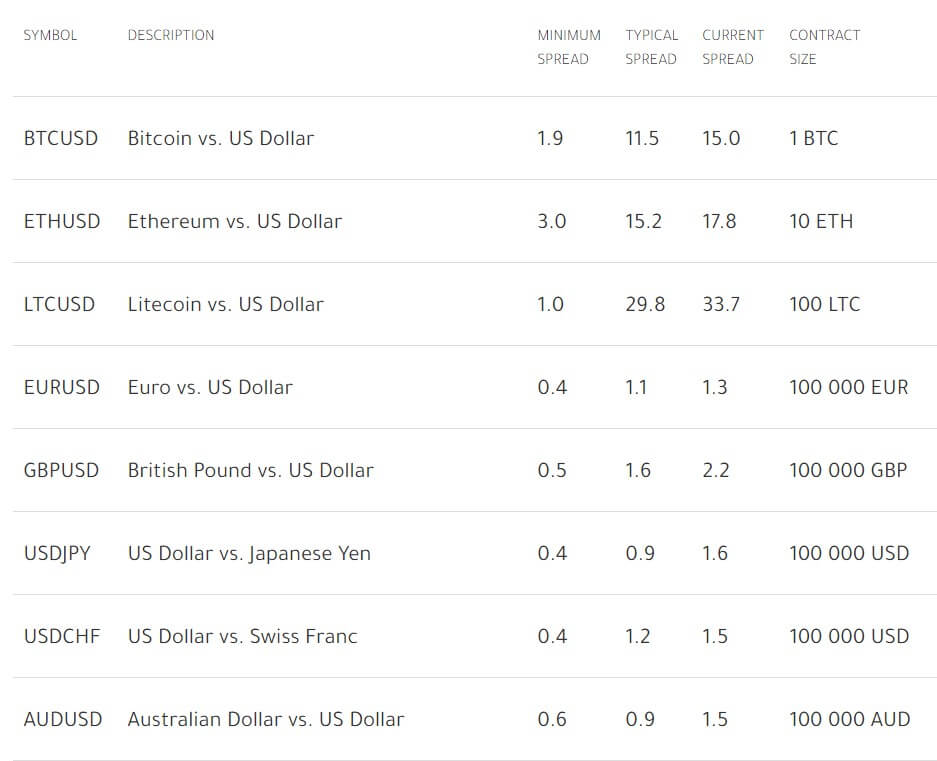

Crypto: BTCUSD, BCHUSD, DSHUSD, ETHUSD, LTCUSD, XAIUSD, XMRUSD, XRPUSD, ZECUSD.

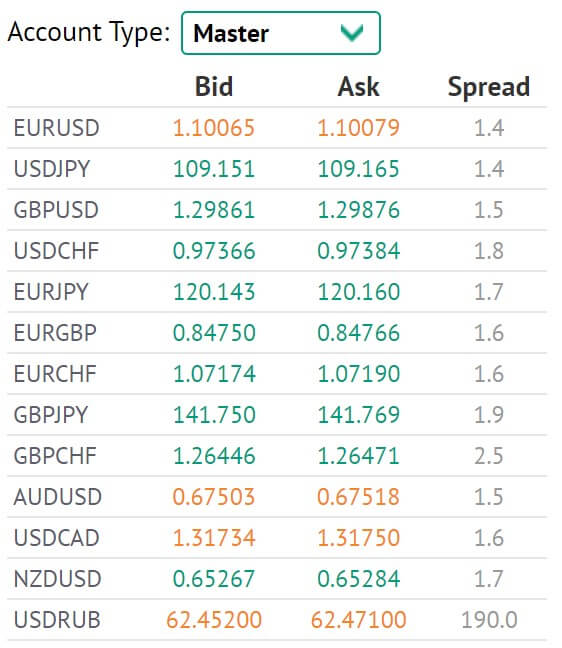

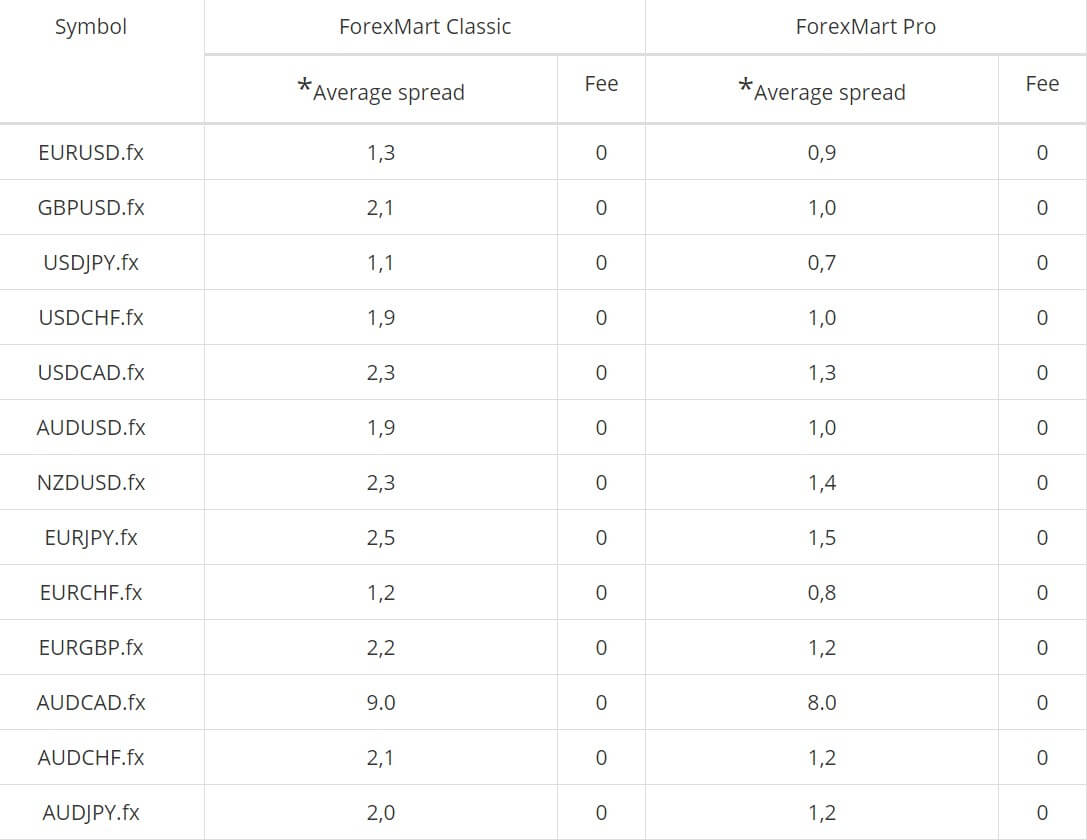

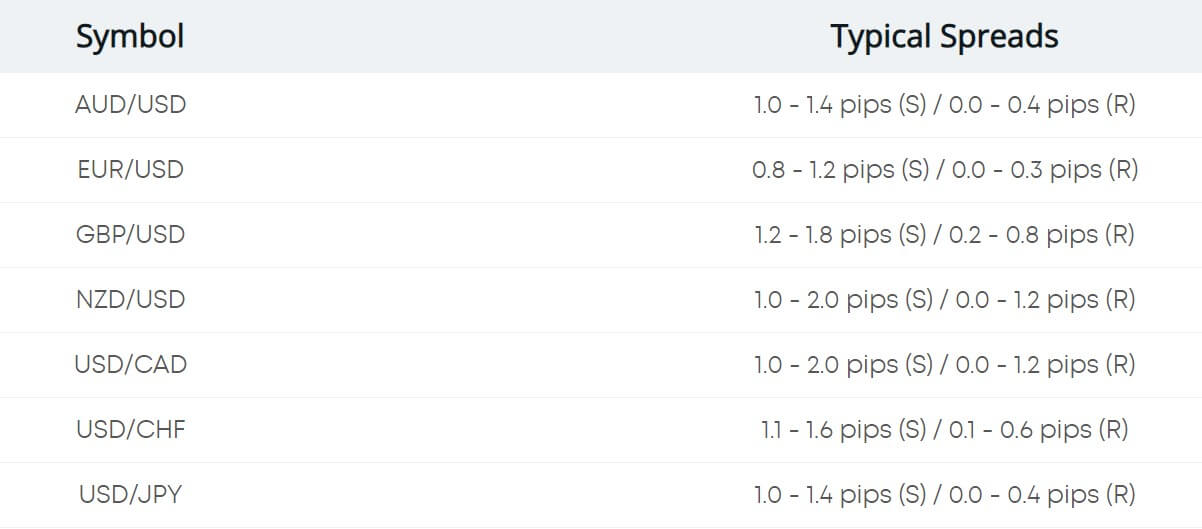

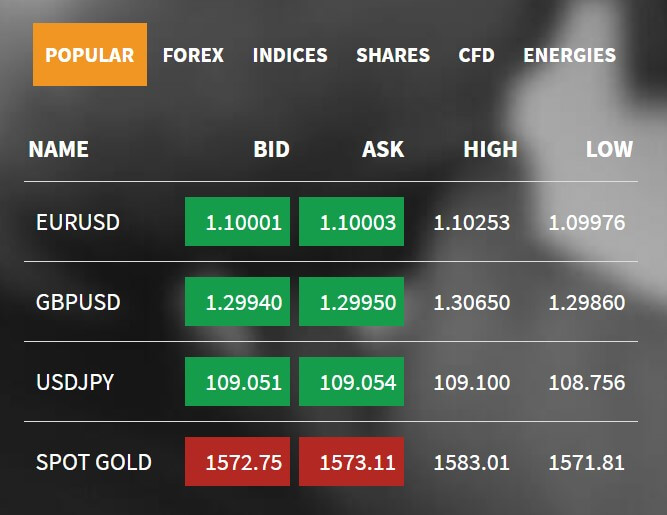

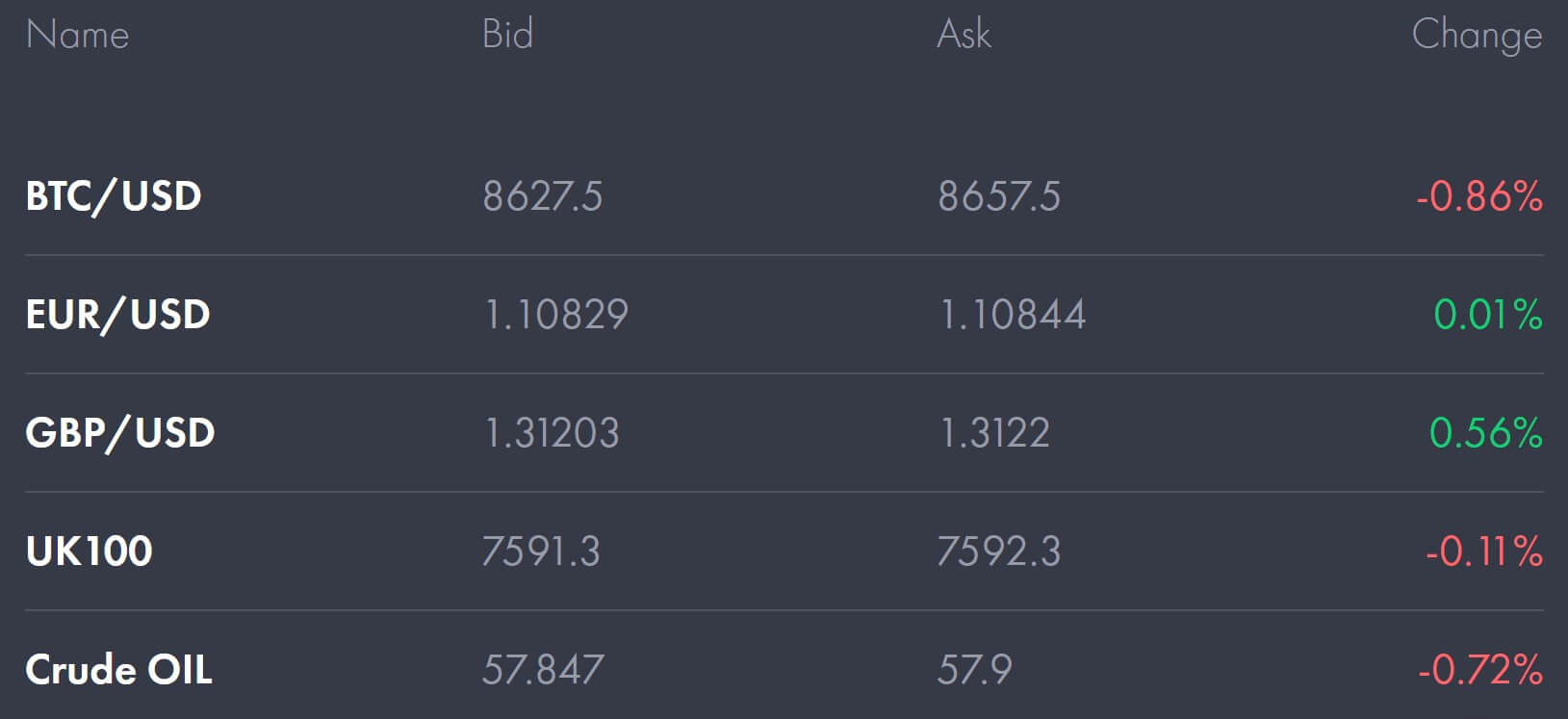

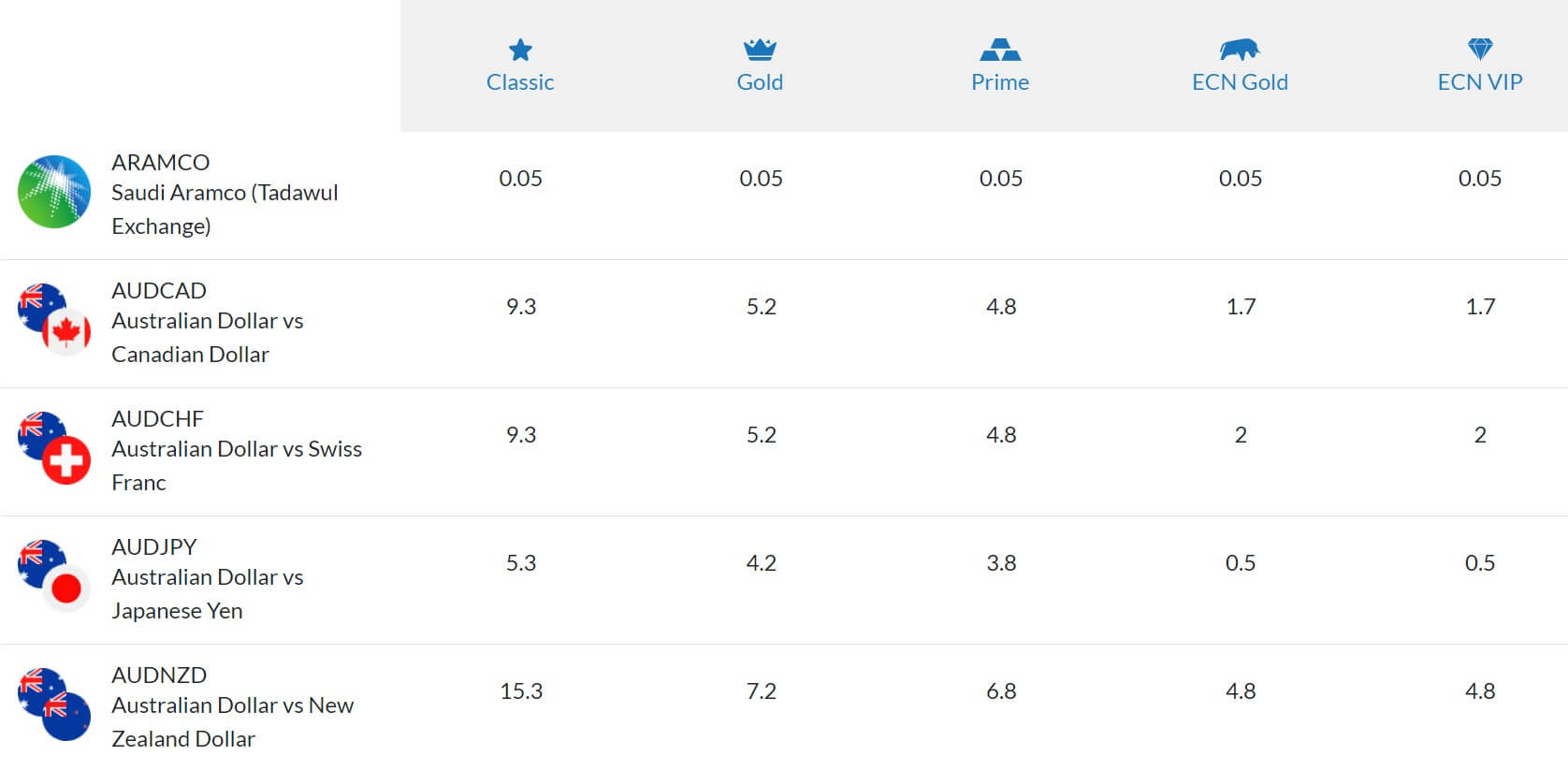

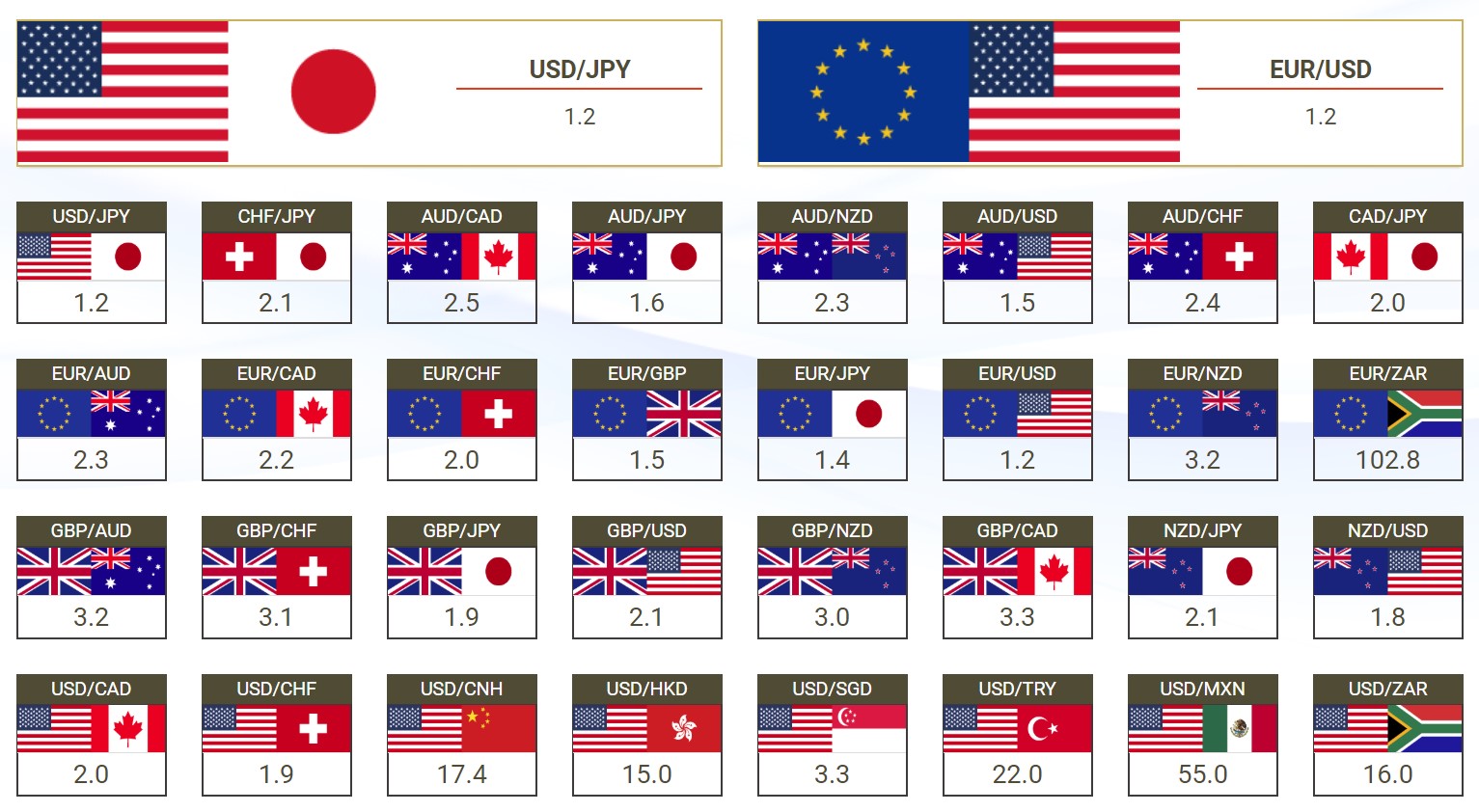

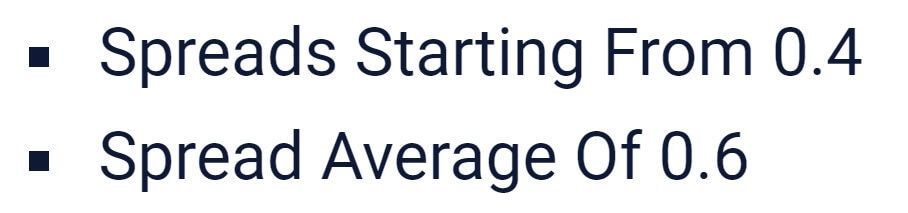

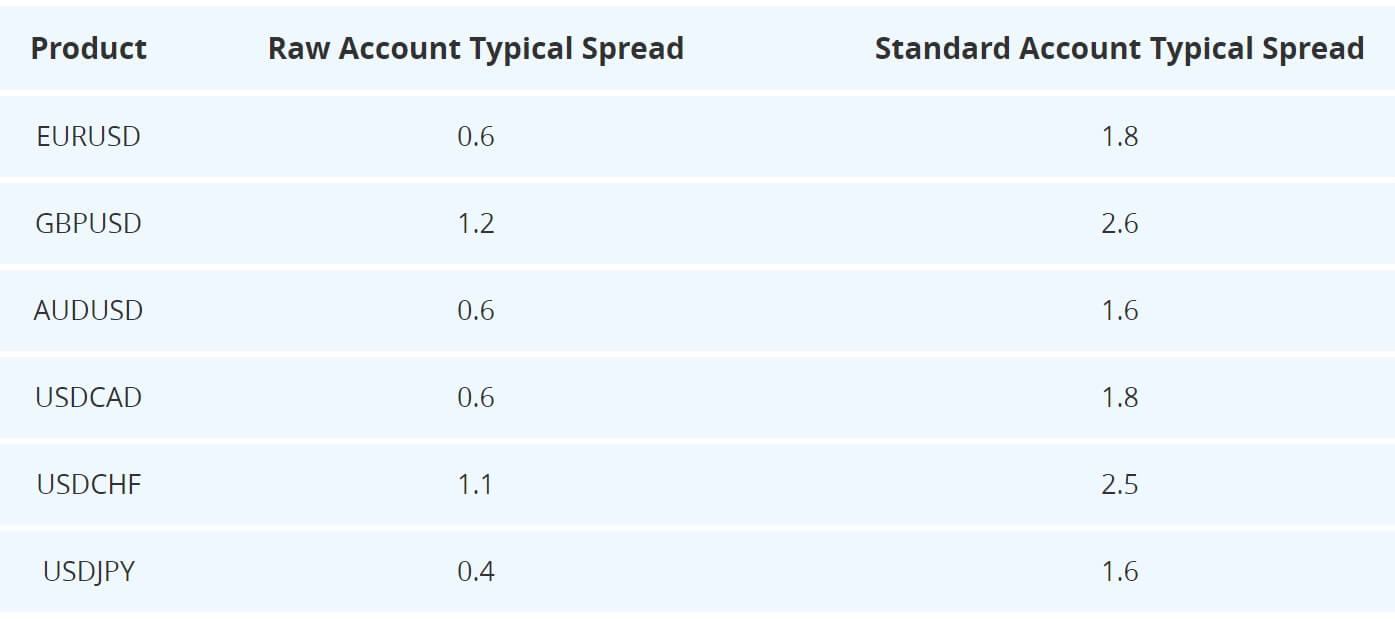

Spreads

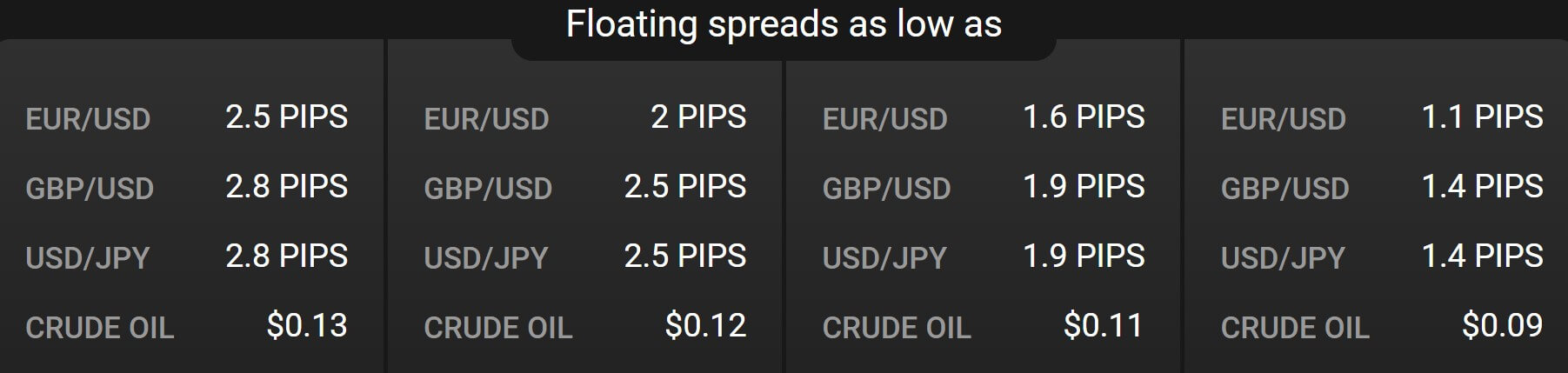

The spreads that you get depend on a few different factors first is the account you are using.

- Micro: From 3.0 pips fixed spread

- Fix: From 2.4 pips fixed spread

- Classic: From 1.1 pips variable spread

- Pro: From 0.05 pips variable spread

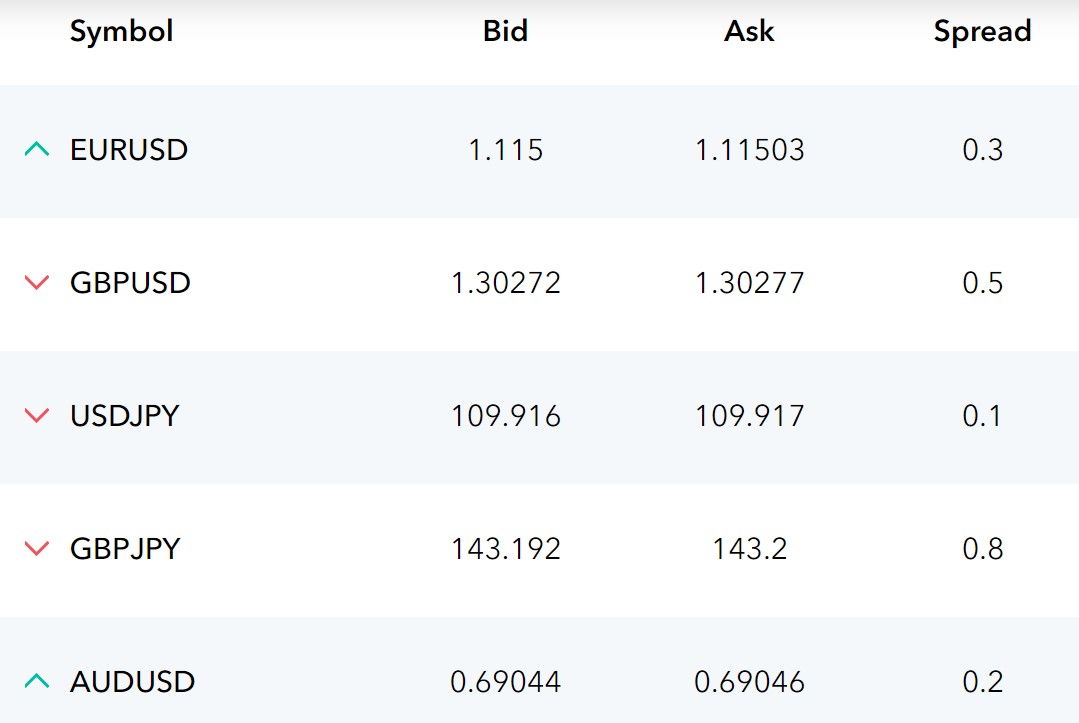

Fixed spreads mean that they do not change, they remain the same no matter what is happening in the markets. Variable (also known as floating) means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 1.1 pips, other assets like GBPJPY may start slightly higher, in this case, 1.4 pips.

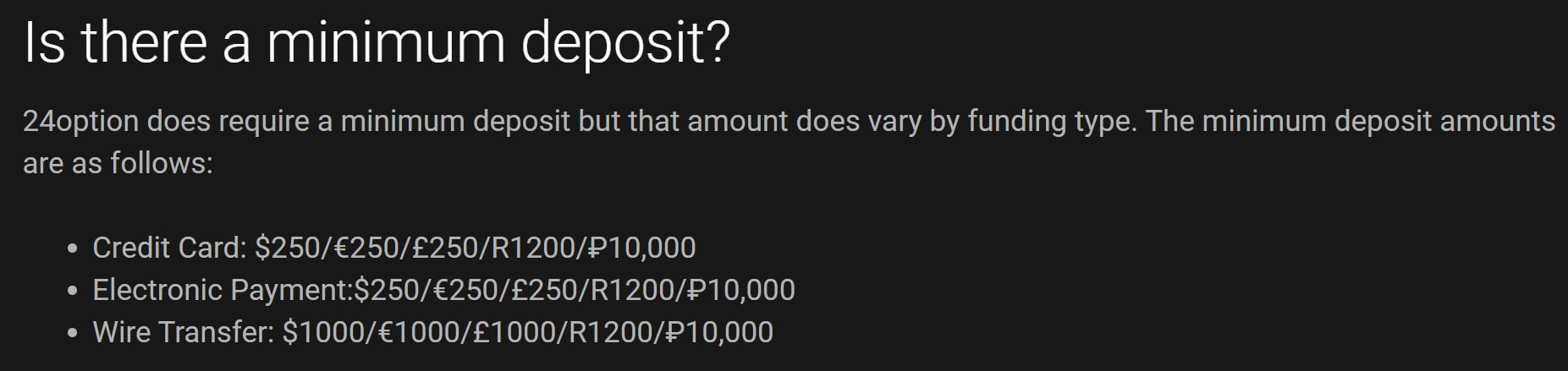

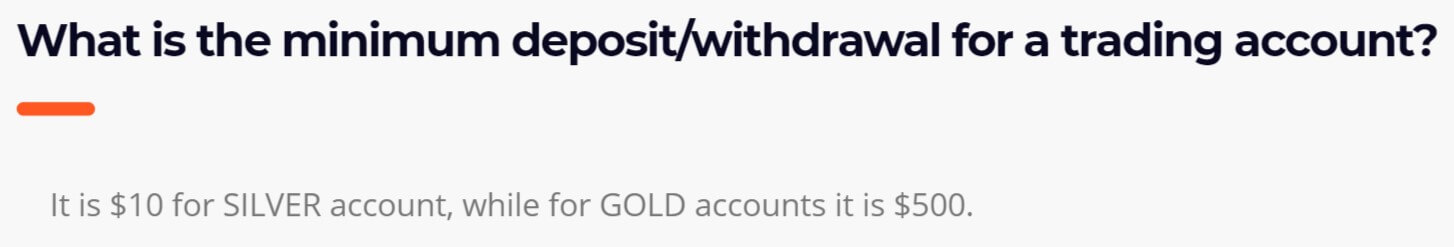

Minimum Deposit

The minimum deposit amount is $1 which is needed to open up the Micro account, all subsequent deposits also have the minimum requirement of $1.

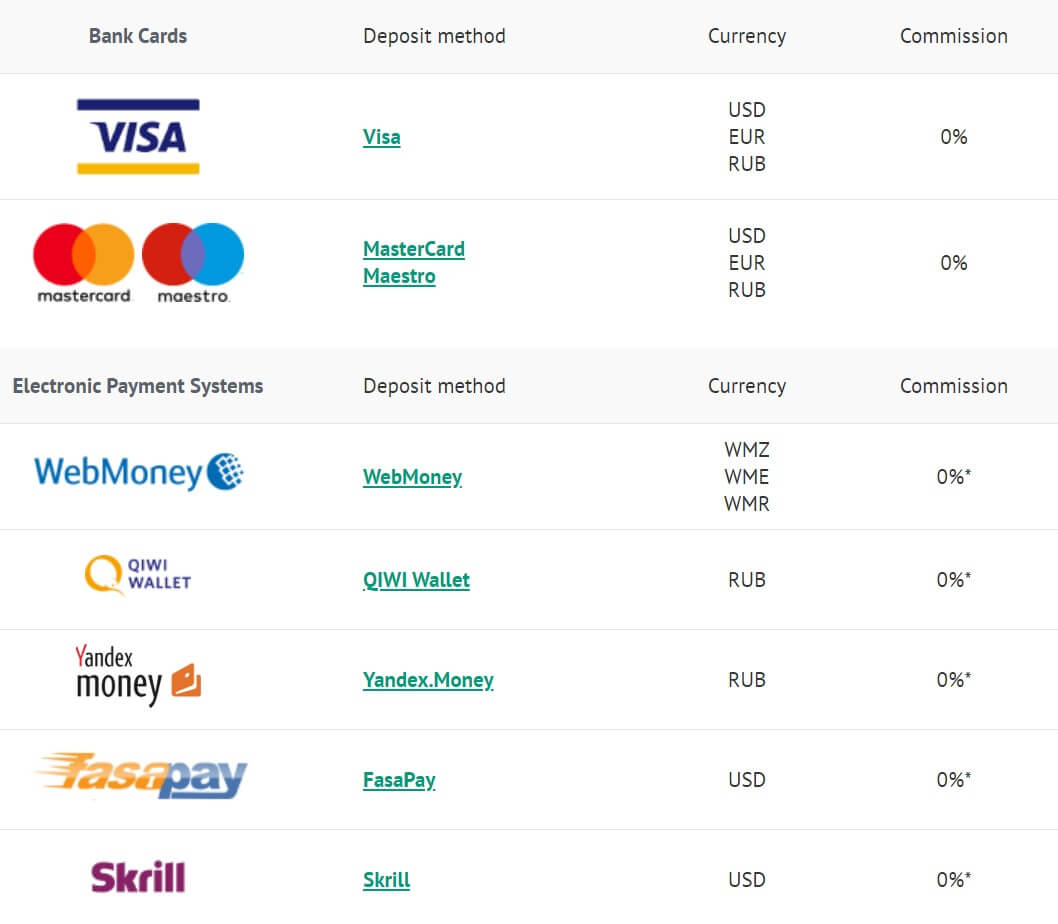

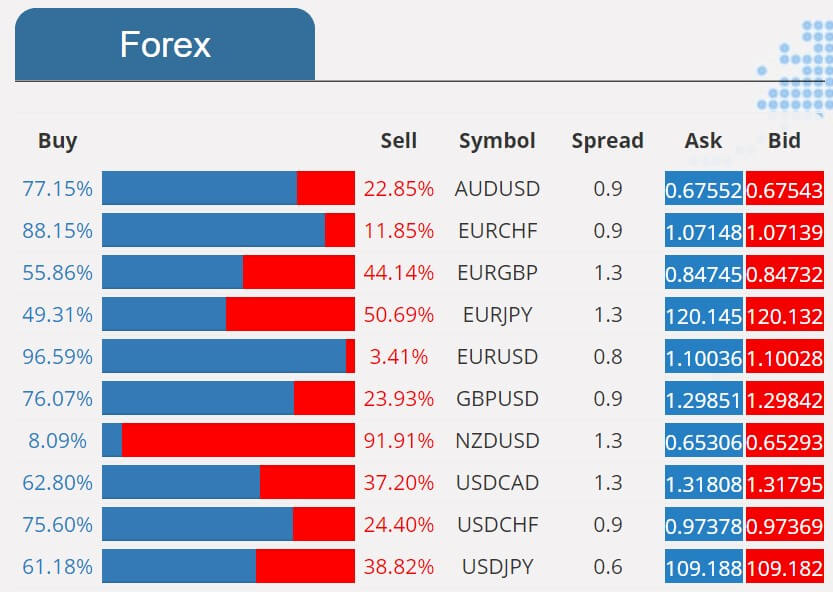

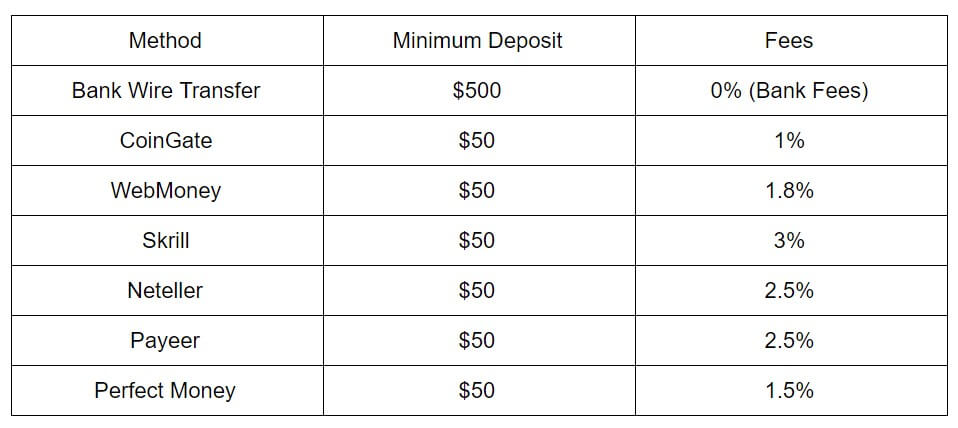

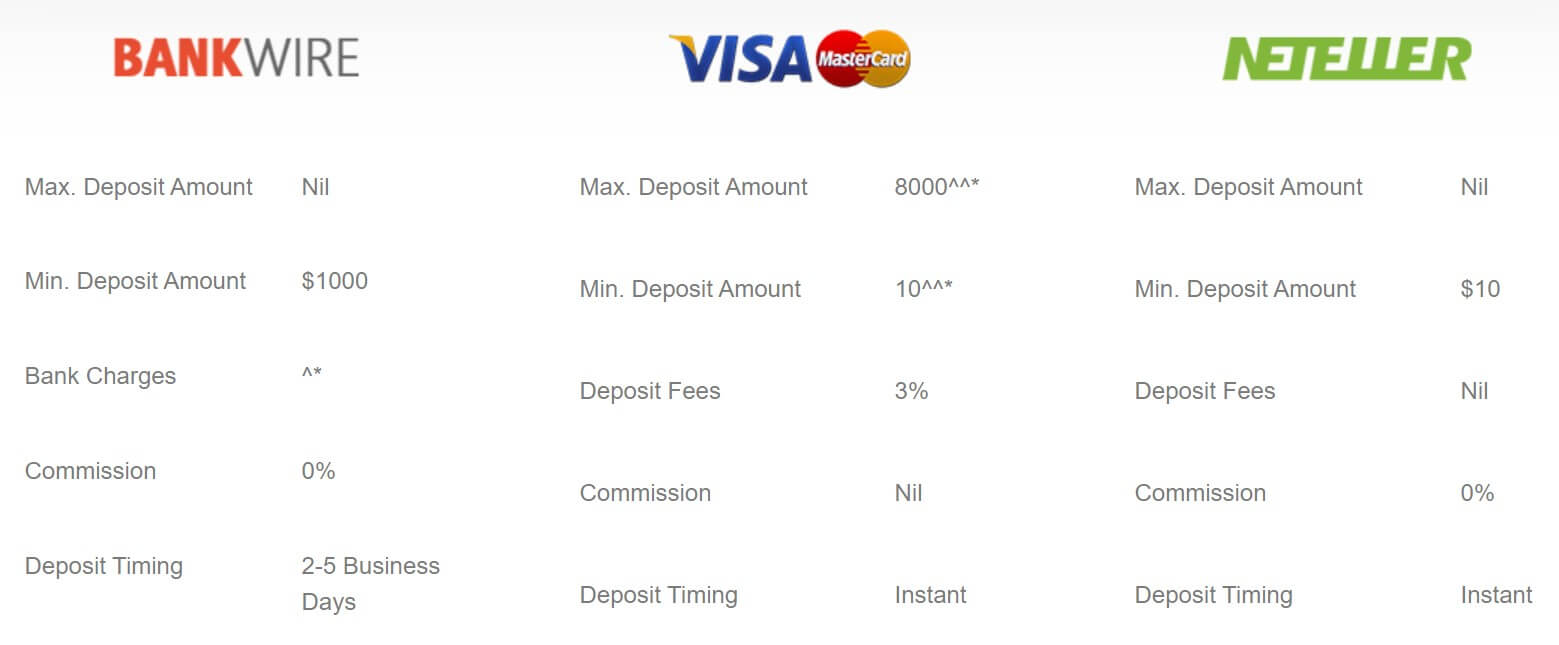

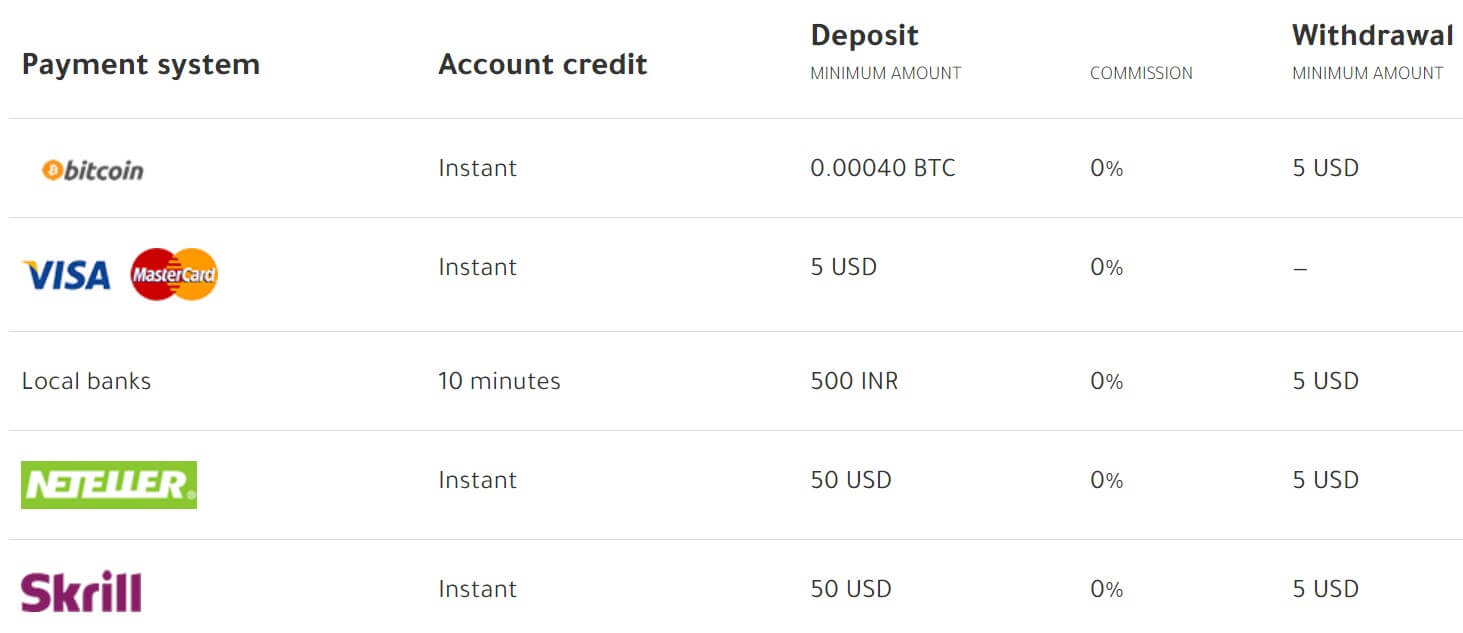

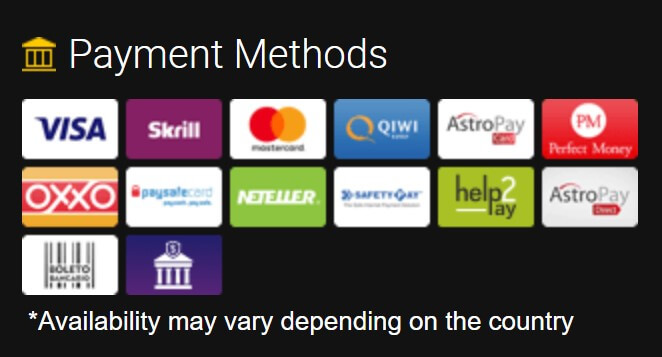

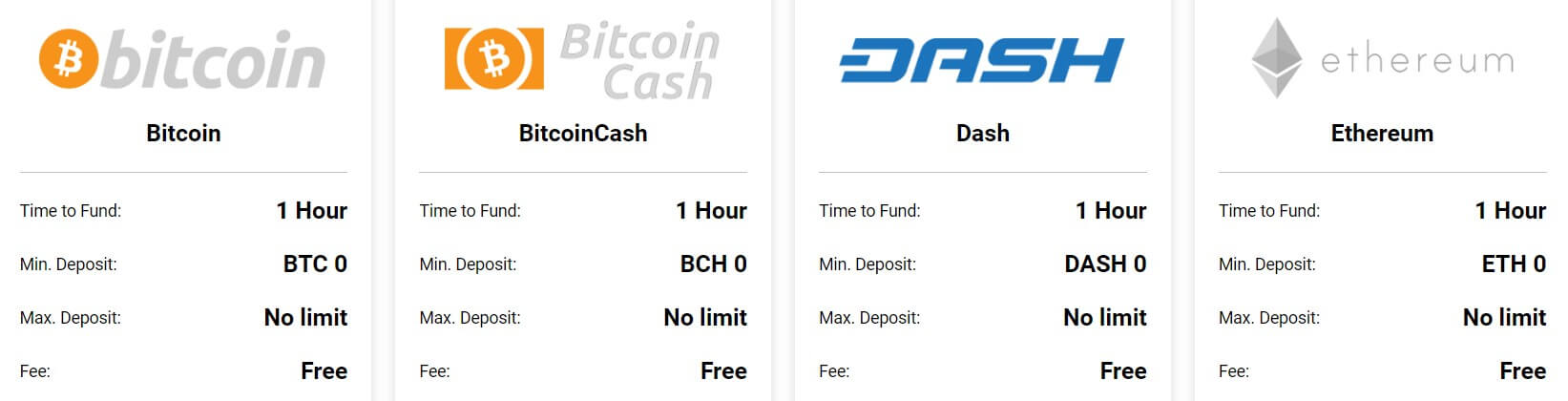

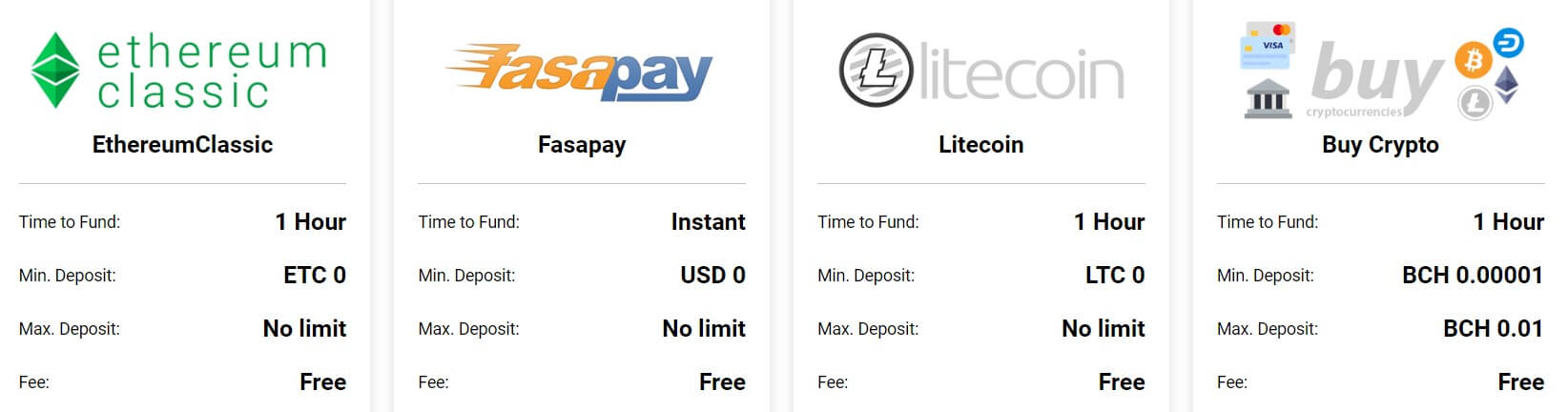

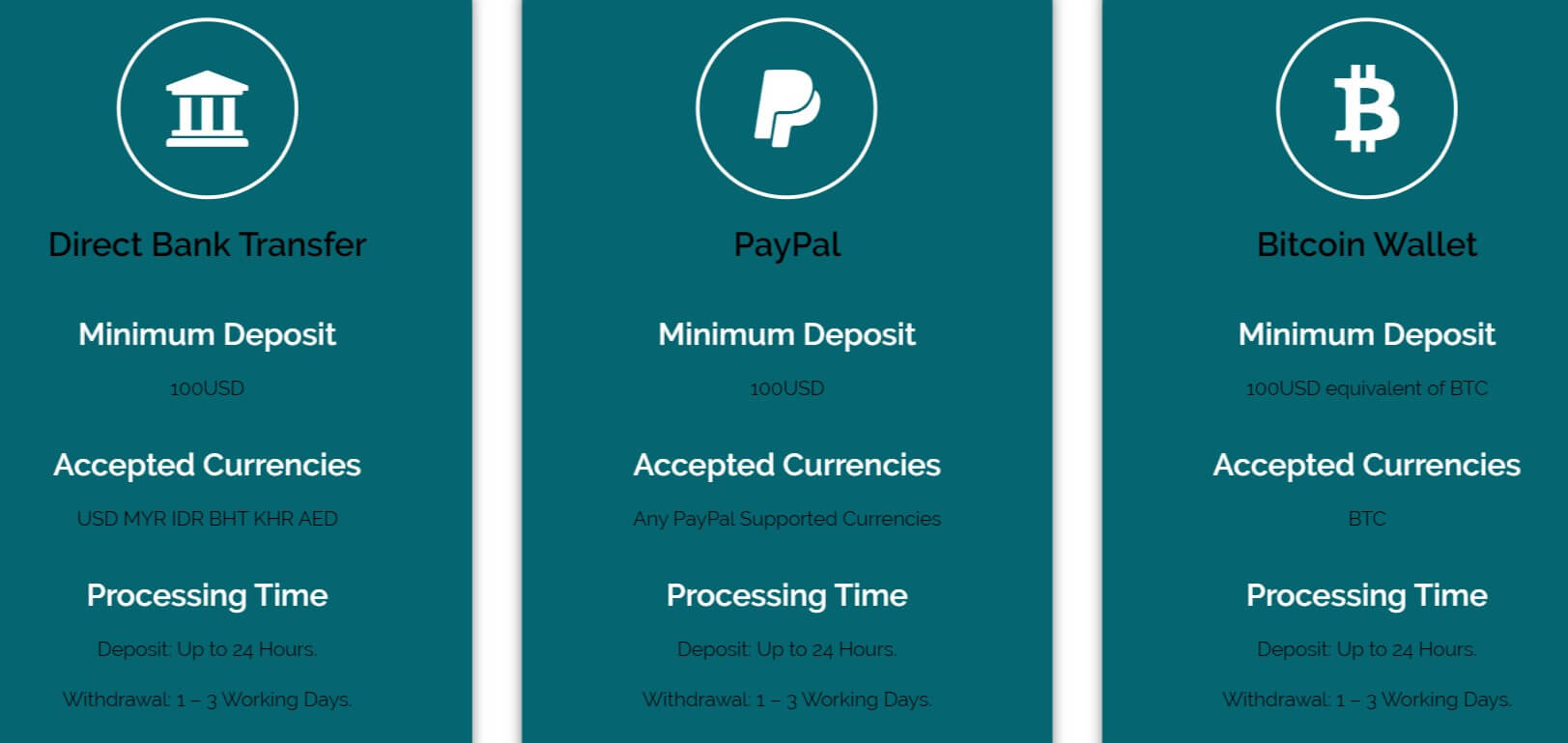

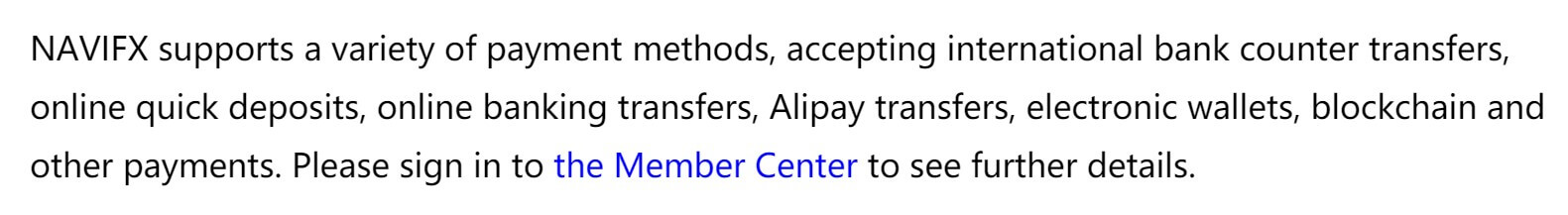

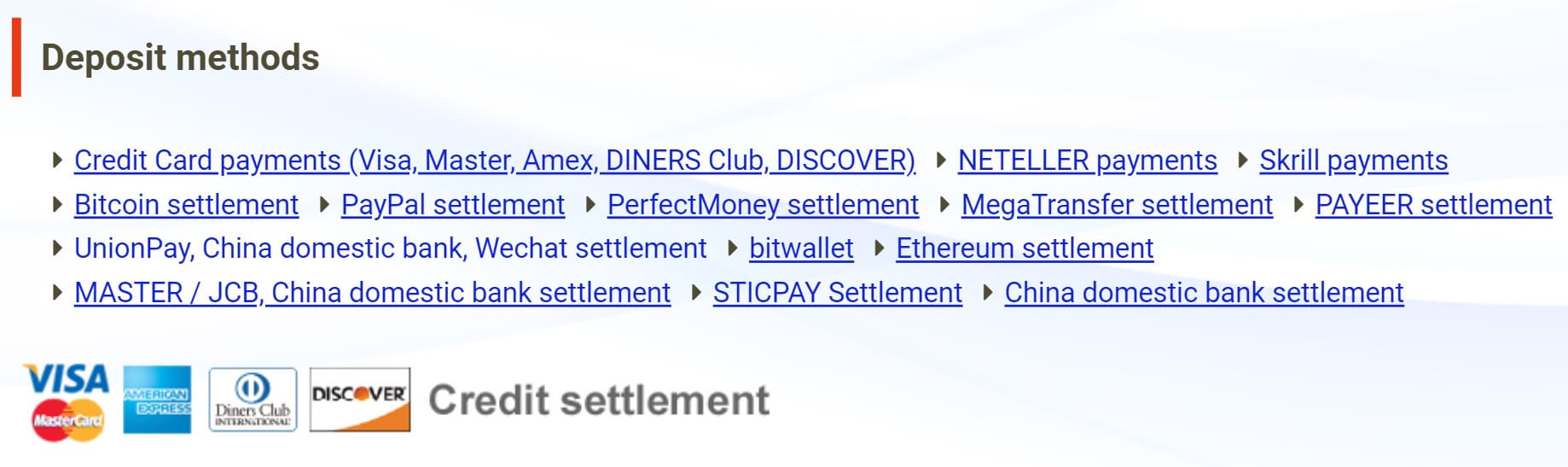

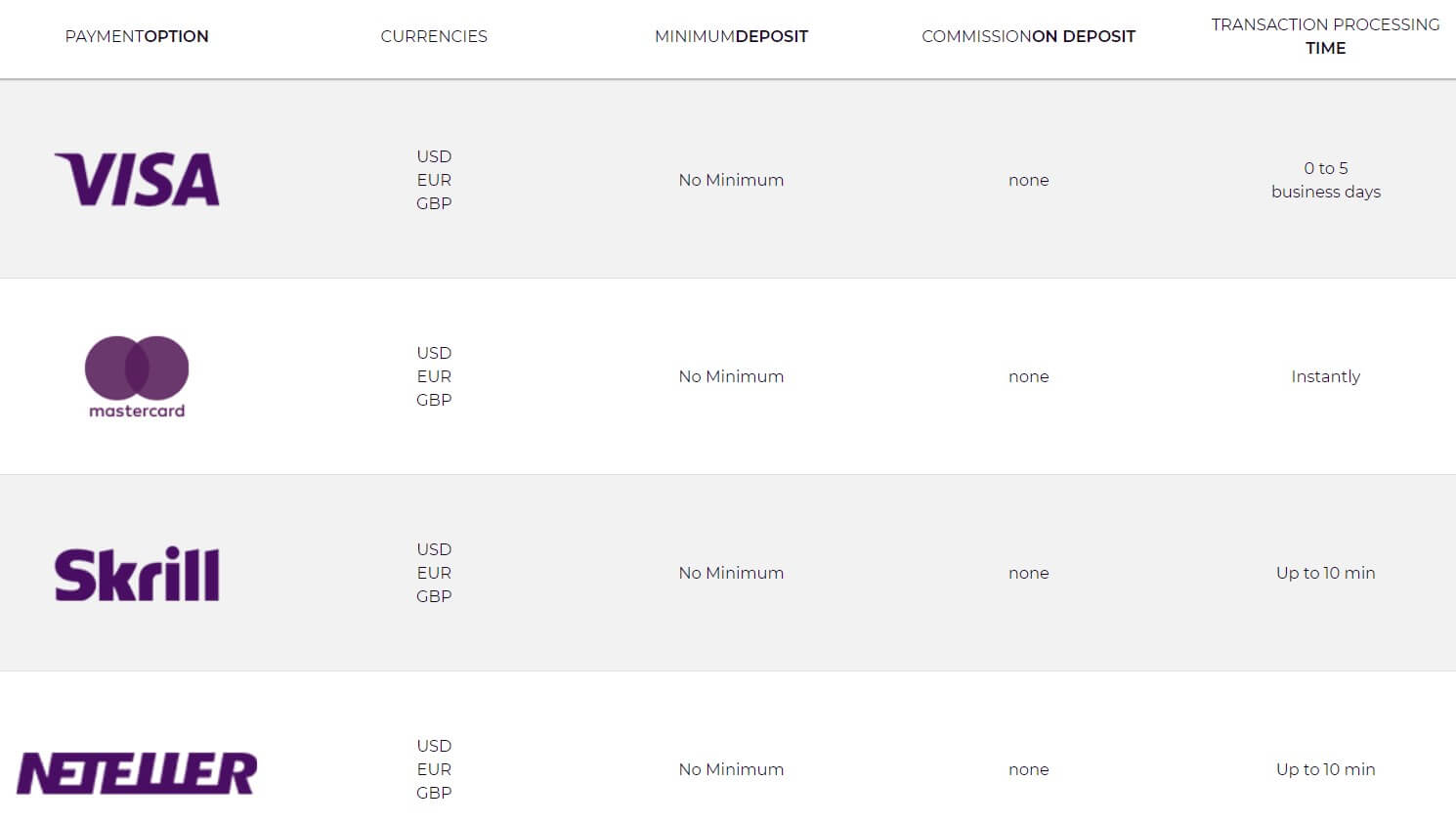

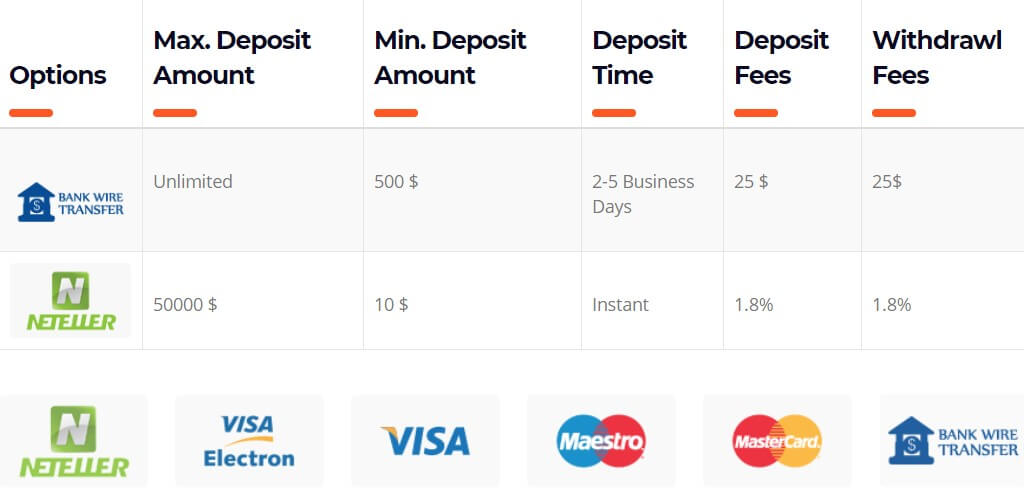

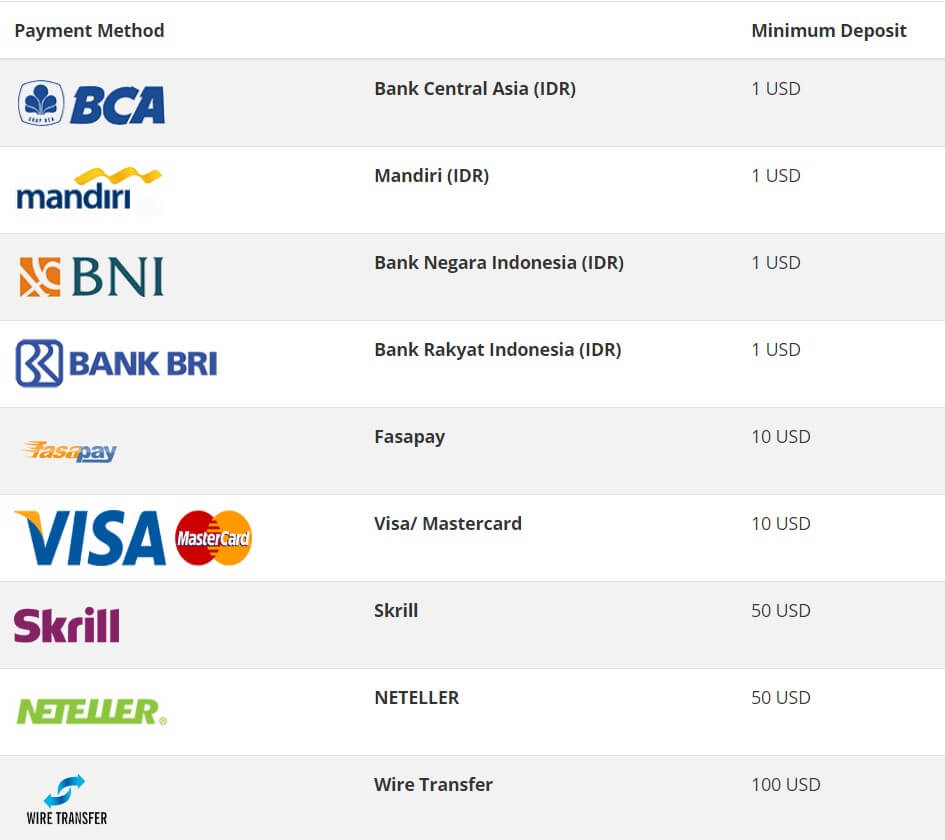

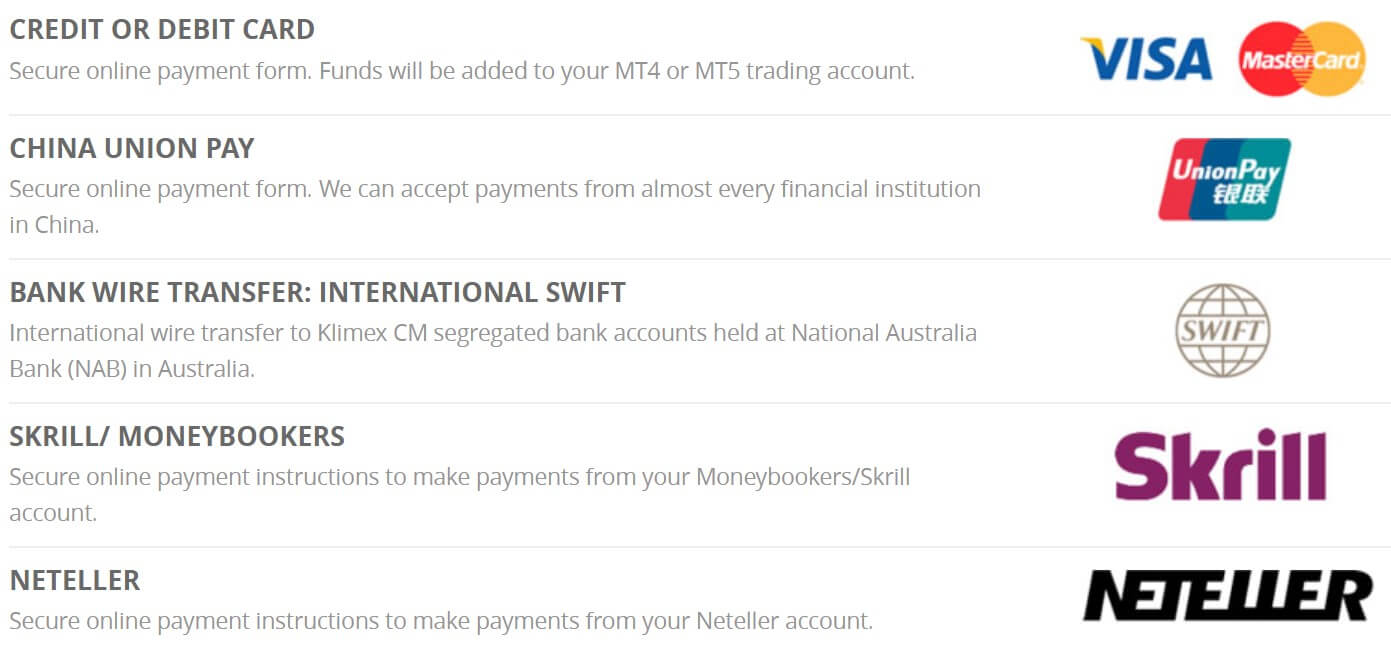

Deposit Methods & Costs

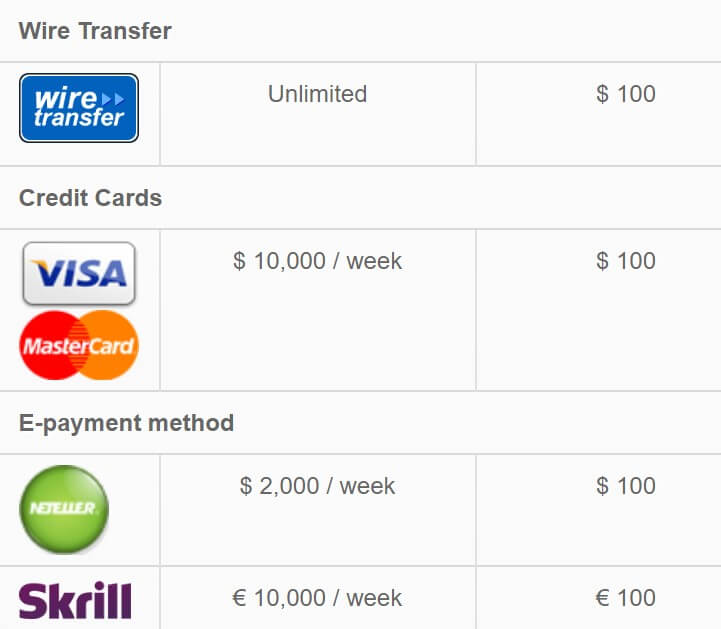

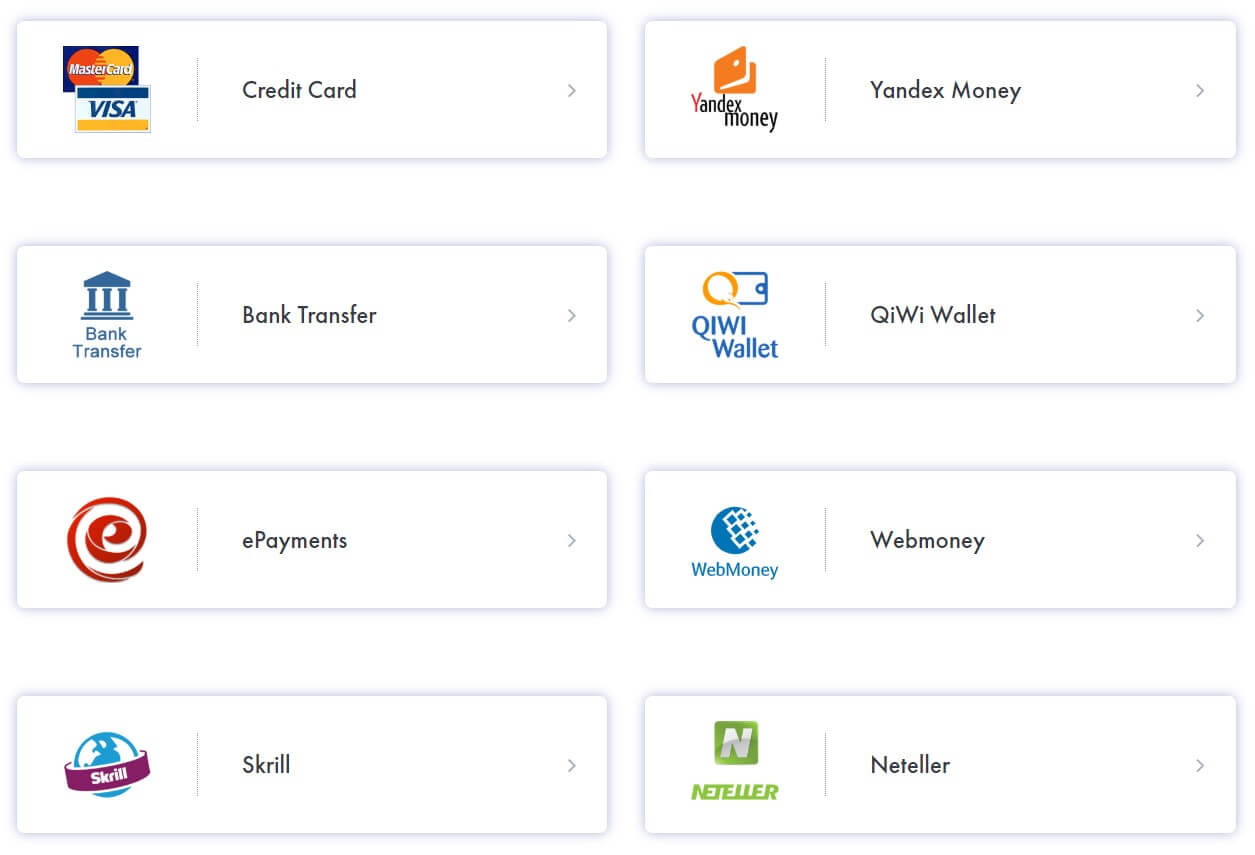

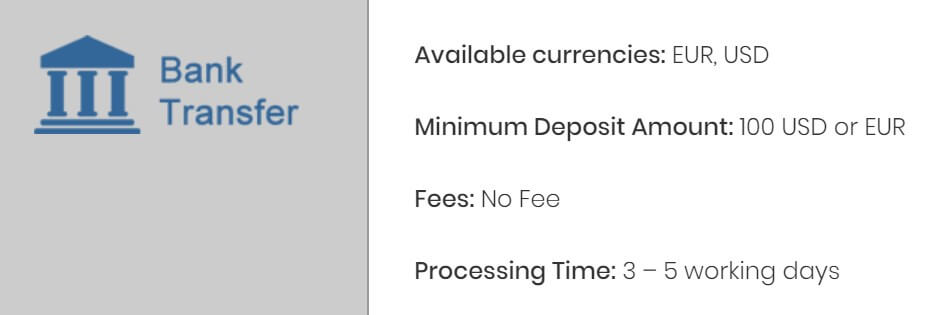

There are a lot of different ways to deposit with Atirox, we have outlined them for you below.

Bank Wire Transfers

Credit / Debit Card: Visa, MasterCard

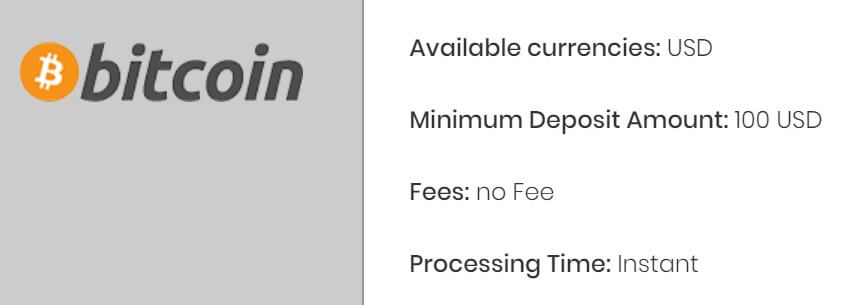

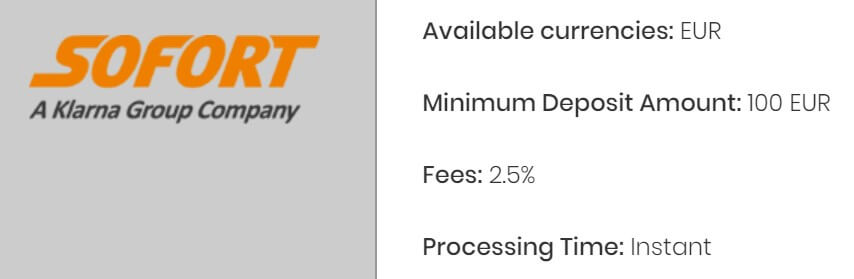

Electronic Payment Systems: FasaPay, Perfect Money, Neteller, Bitcoin, Skrill

Malaysian Bank Transfers: CIMB, MayBank, Hong Leong Bank, RHB, Public Bank

Indonesian Bank Transfers: BCA, Mandiri, Bank BRI, PermataBank, CLOMB NIAGA, Bank BTN

Thailand Bank Transfers: Bangkok Bank, KrungThai Bank, Siam Commercial Bank, KASIKORN Bank, UOB, Krungsri Bank

Vietnam Bank Transfers: VietinBank, Vietcombank, BIDV Banks, Eximbank, Techon Bank, ACB Bank, Sacom Banks, Dong A Bank

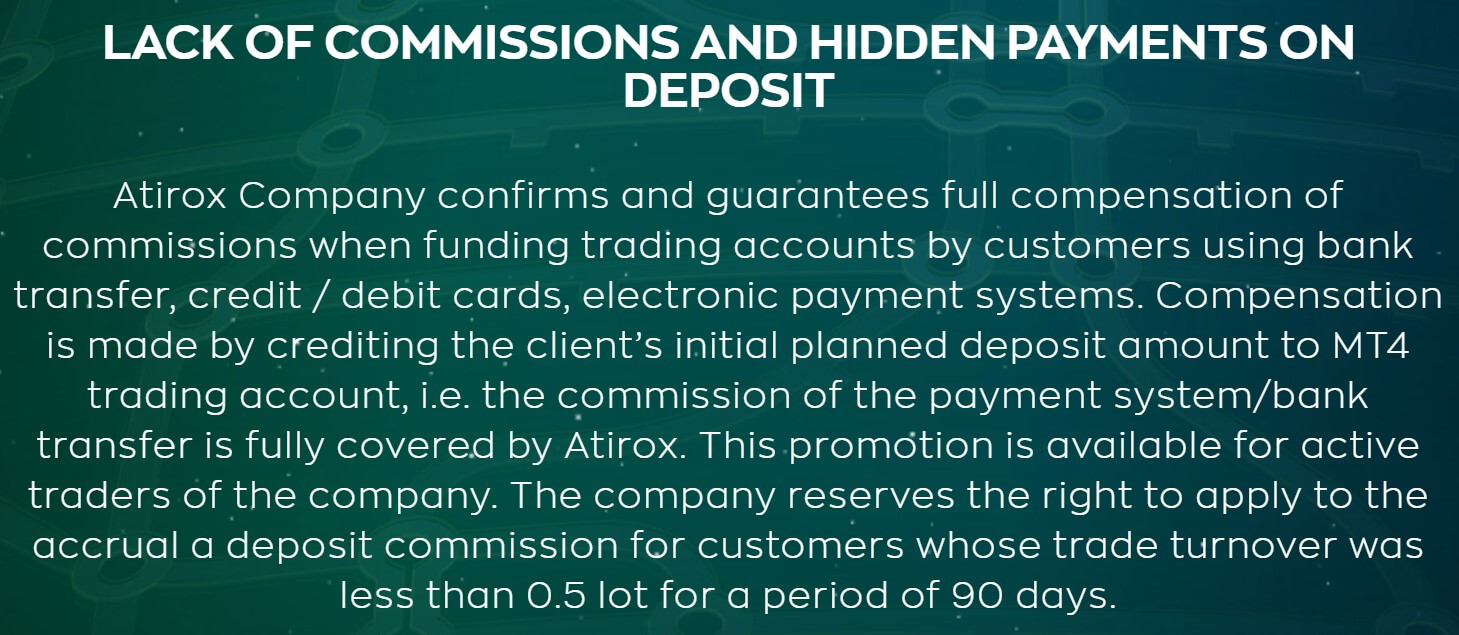

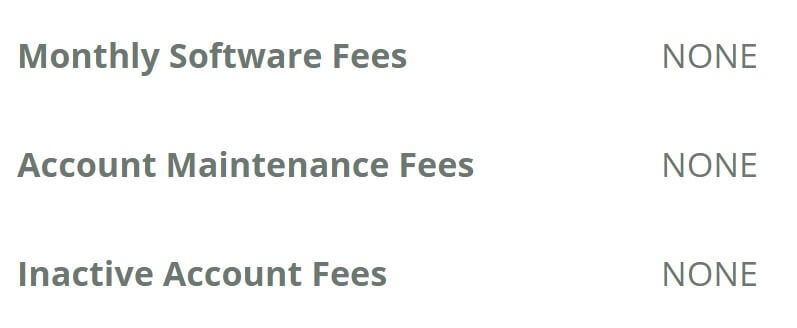

There are no added fees from Atirox for depositing, however, you should check with your bank or processor to see if they add any of their own fees.

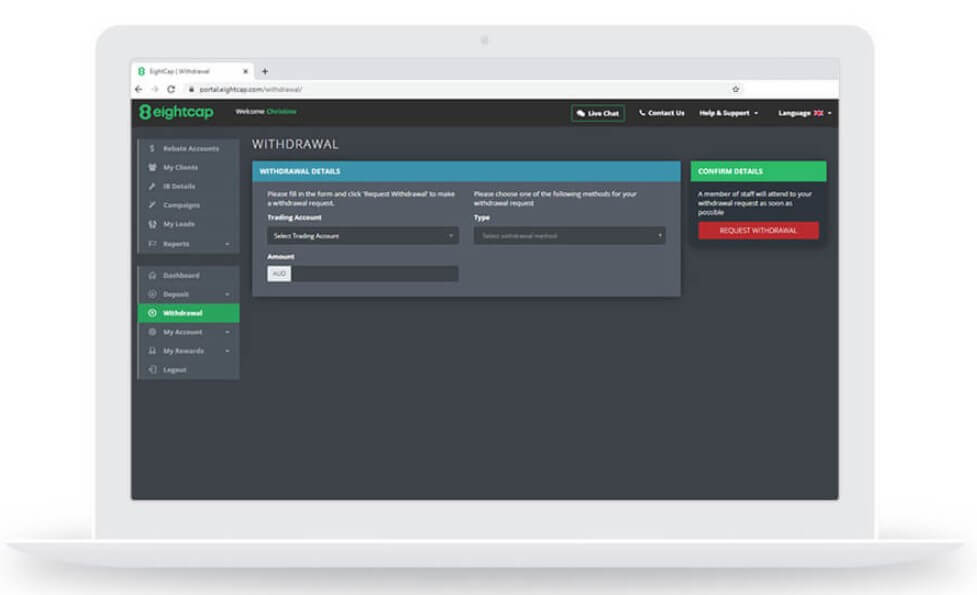

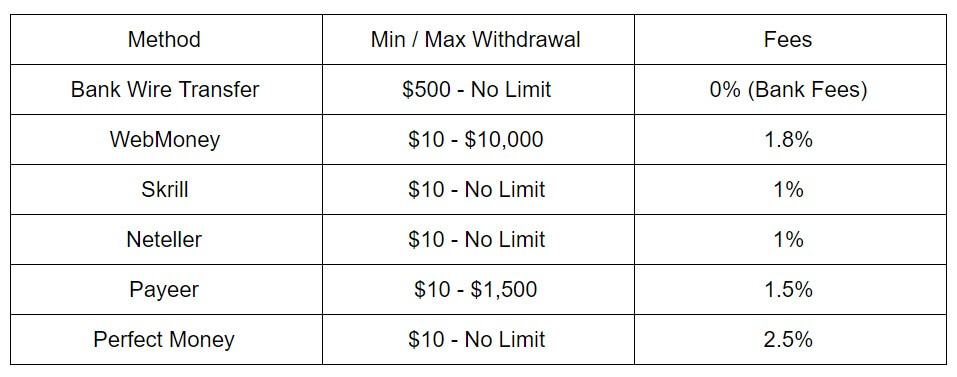

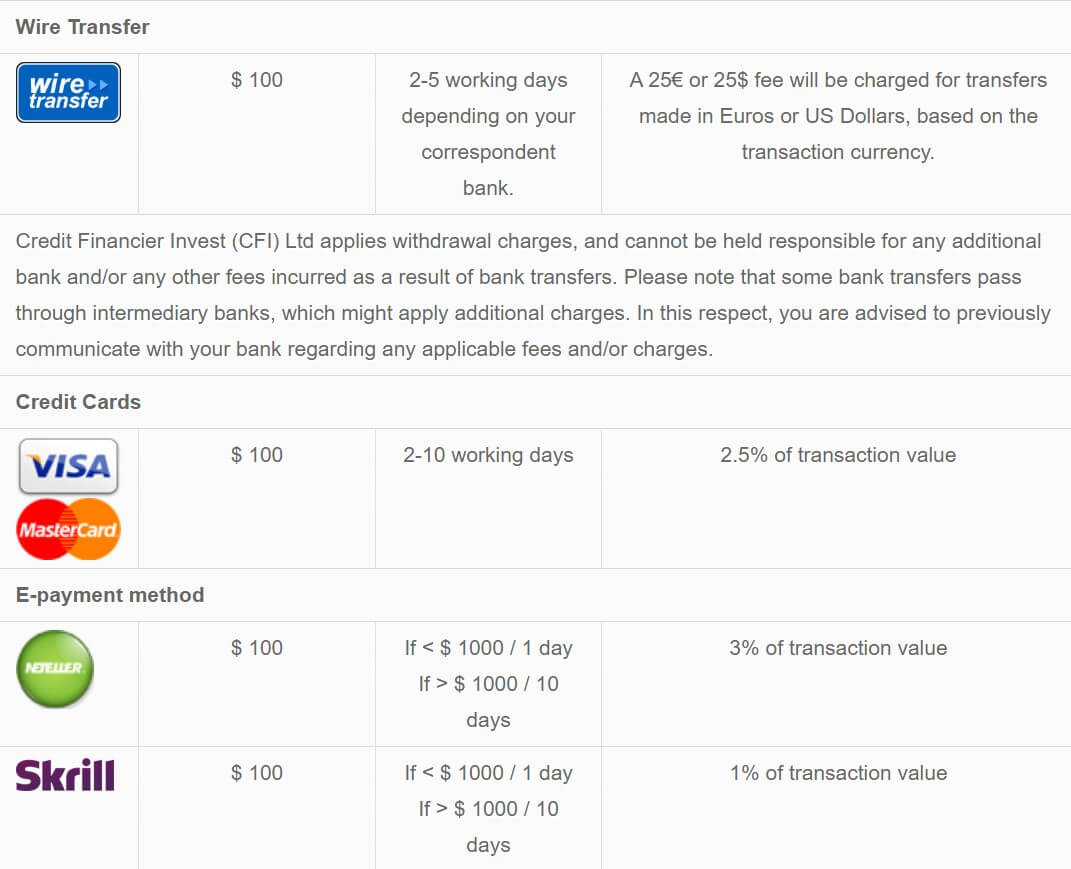

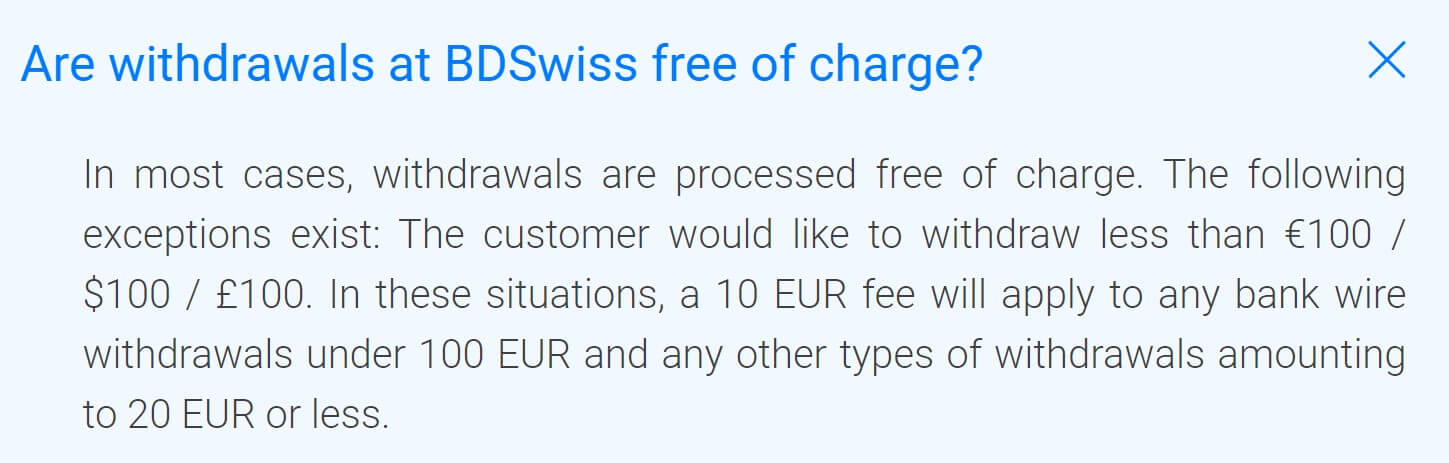

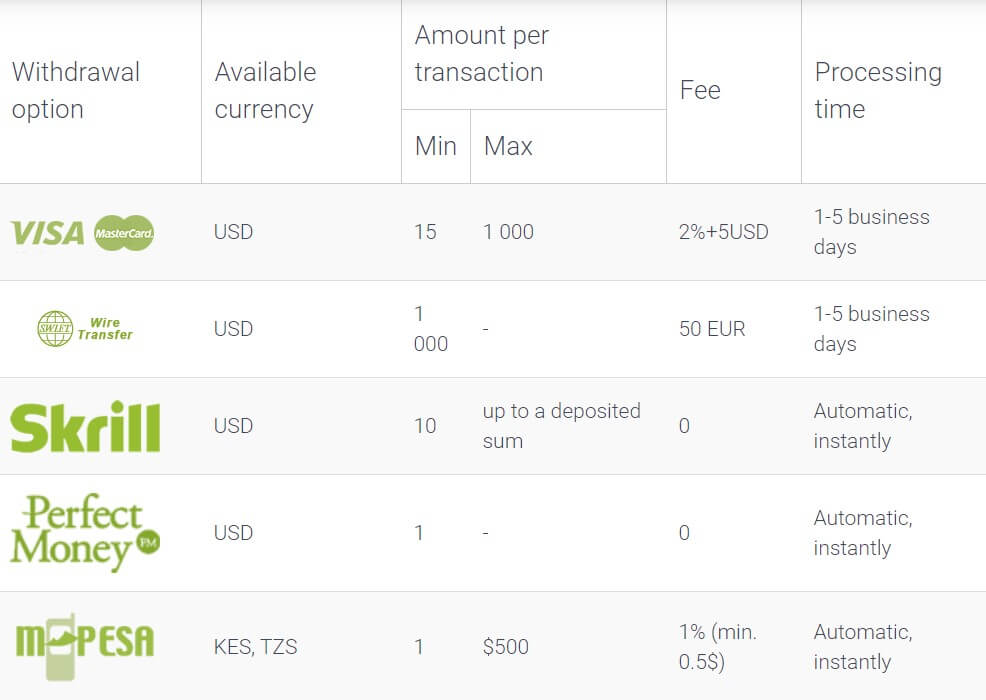

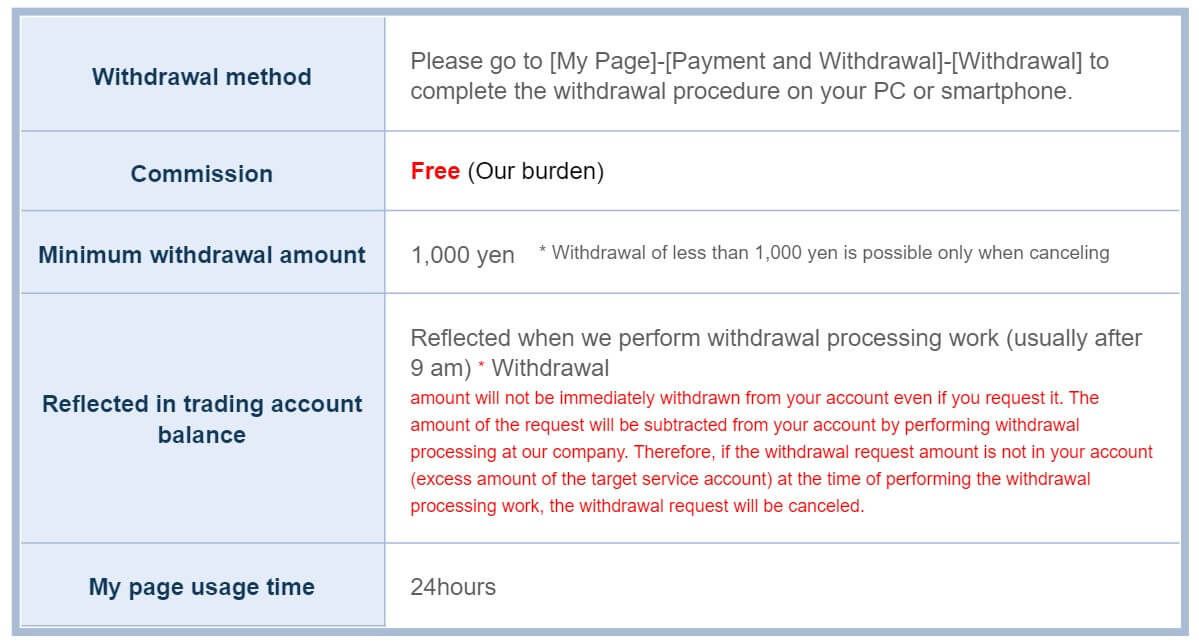

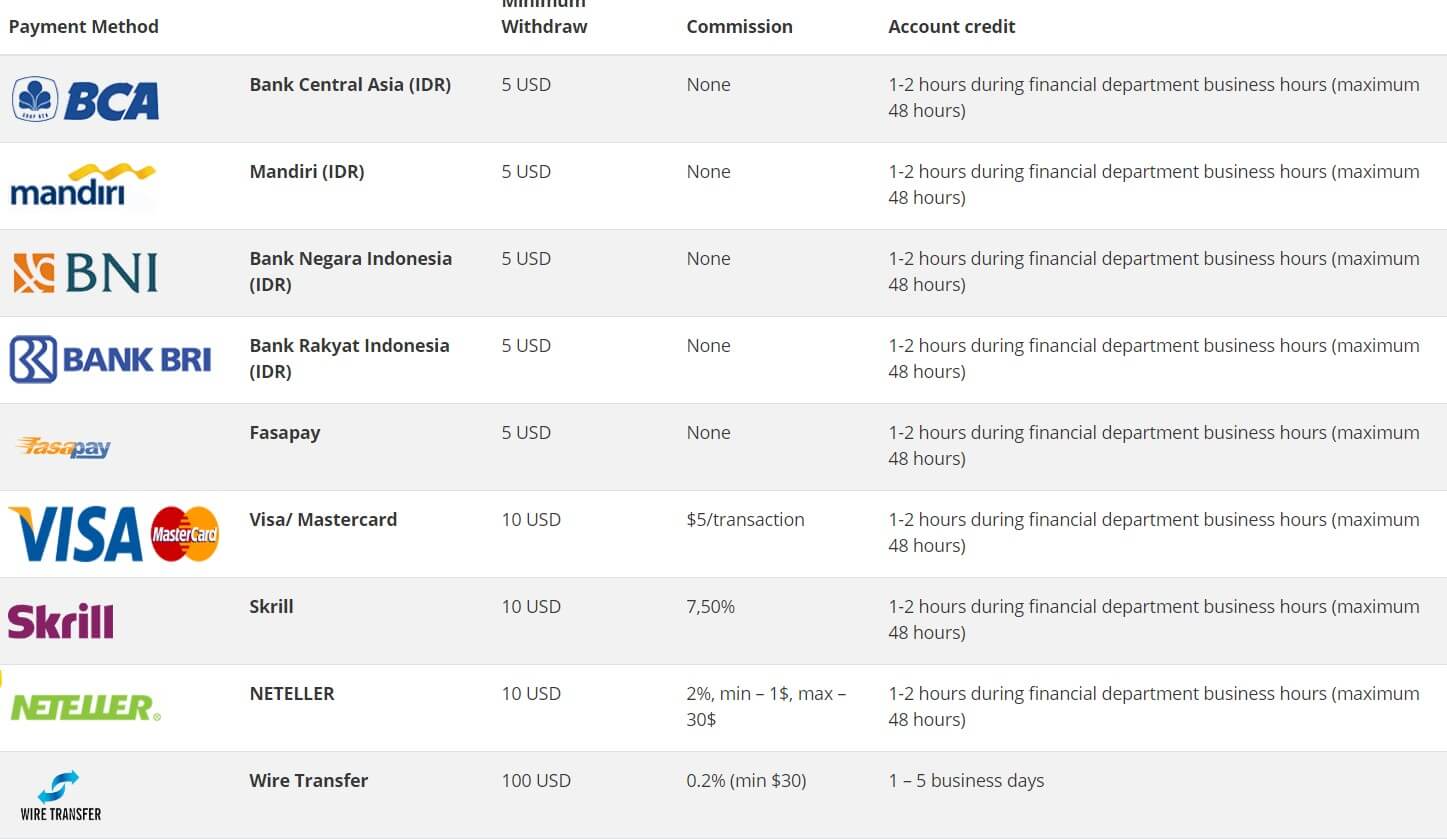

Withdrawal Methods & Costs

The same methods are available as withdrawals, Bank Wire Transfer, Visa Credit / Debit, MasterCard Credit / Debit, FasaPay, Perfect Money, Neteller, Bitcoin, Skrill, CIMB, MayBank, Hong Leong Bank, RHB, Public Bank, BCA, Mandiri, Bank BRI, PermataBank, CLOMB NIAGA, Bank BTN, Bangkok Bank, KrungThai Bank, Siam Commercial Bank, KASIKORN Bank, UOB, Krungsri Bank, VietinBank, Vietcombank, BIDV Banks, Eximbank, Techon Bank, ACB Bank, Sacom Banks and, Dong A Bank.

Just like deposits, there are no added fees, however, you should check with your bank or processor to see if there are any added fees from them.

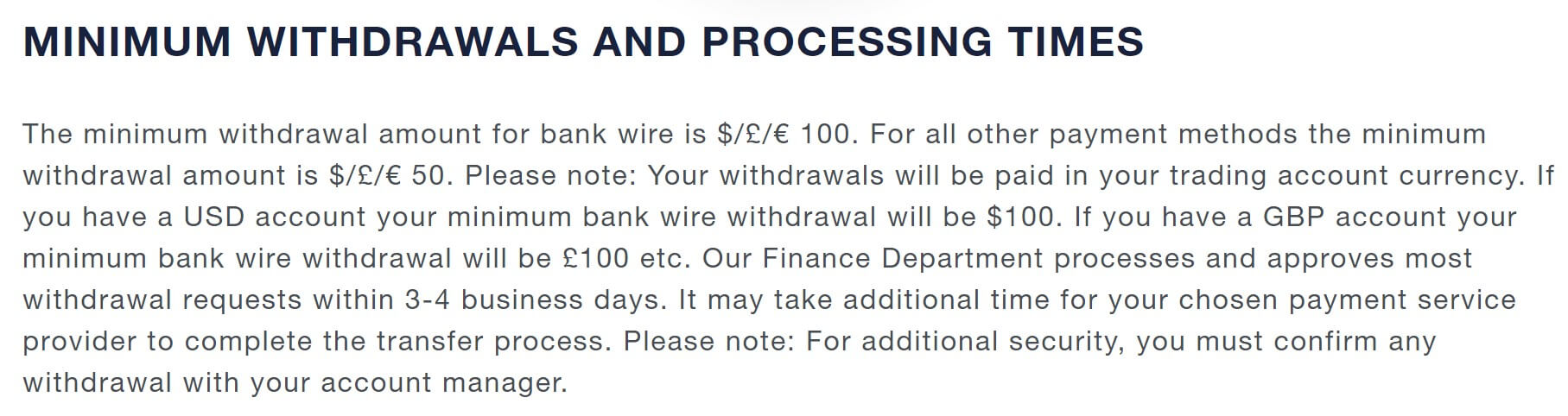

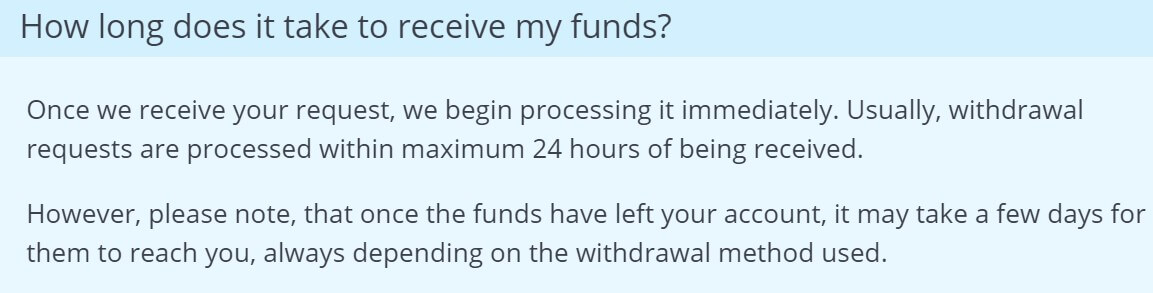

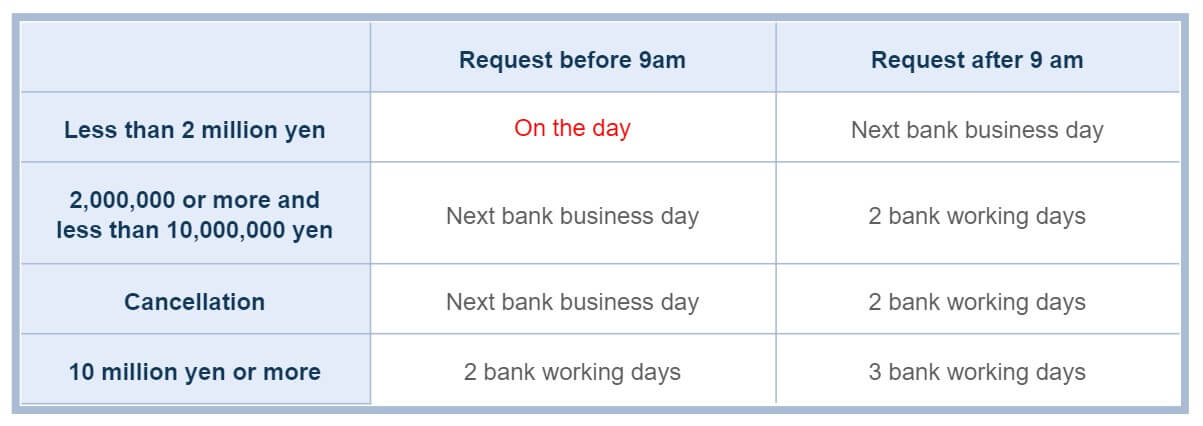

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

The withdrawal processing times seem to be the only bit of information missing from the website, we could not locate it anywhere. We would expect processing to be done within 48 hours, then it will depend on the method uses and could take anywhere between 1 – 5 working days for the funds to be available for use.

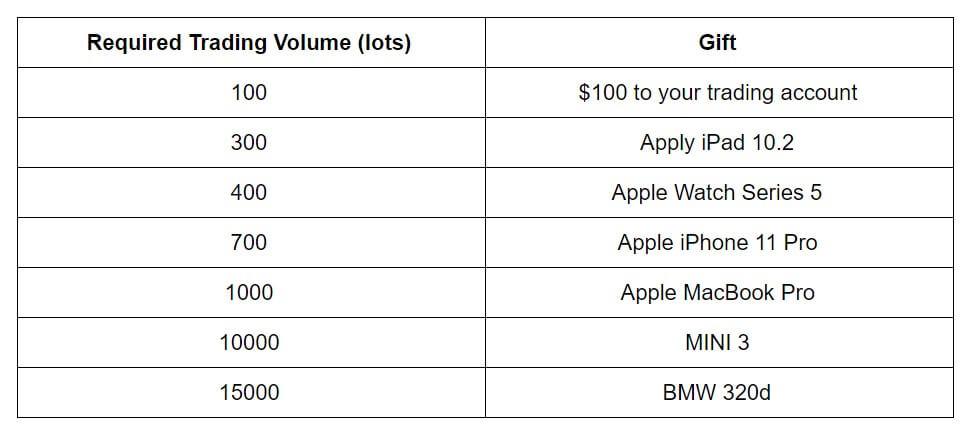

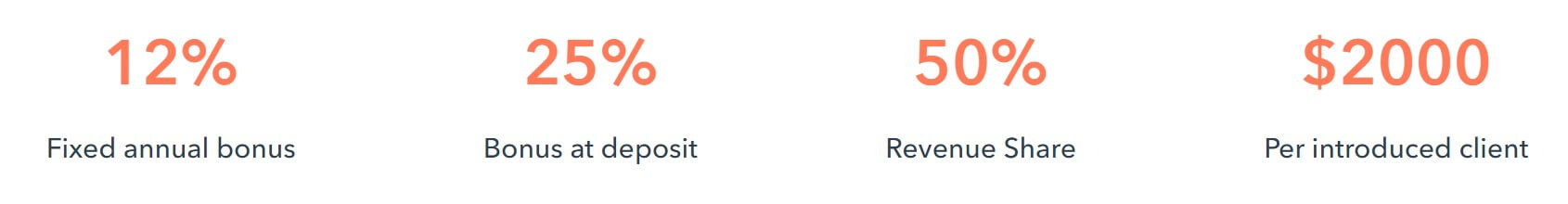

Bonuses & Promotions

There are two different bonuses available here is a brief overview of them both.

50% Deposit Bonus: You can receive a bonus of up to $12,000 on your account by simply depositing. Bonus 50% can be withdrawn under the fulfillment of the condition that the trading volume [amount of bonus / 7] lots in the account. For example: deposit $1000 – received $500 of bonus, then the bonus can be withdrawn only if the customer gain by trading: 500 / 7 = 71 lots. Withdrawable can be able only the whole amount of the received bonus (except for bonus funds which are registered in the account after the Stop Out); the possibility of a partial withdrawal of the bonus is not available.

Prime Bonus: The new bonus from Atirox is a great opportunity to start trading on Forex. Your way to the world of the largest and most liquid market in the world, which has become the main source of stable income for many traders around the world. With a Prime Bonus of $1800, you will be able to evaluate our unsurpassed quality of execution of orders in real trading conditions without risk. Upon receipt of the bonus, this amount will be instantly credited to your account and is available for trading.

There are also a number of different contests taking place, each one has a different prize such as a Toyota car or a Honda motorcycle. You simply need to deposit and then fill in the application form to enter. Each has slightly different rules so be sure to check them out if you are interested in taking part.

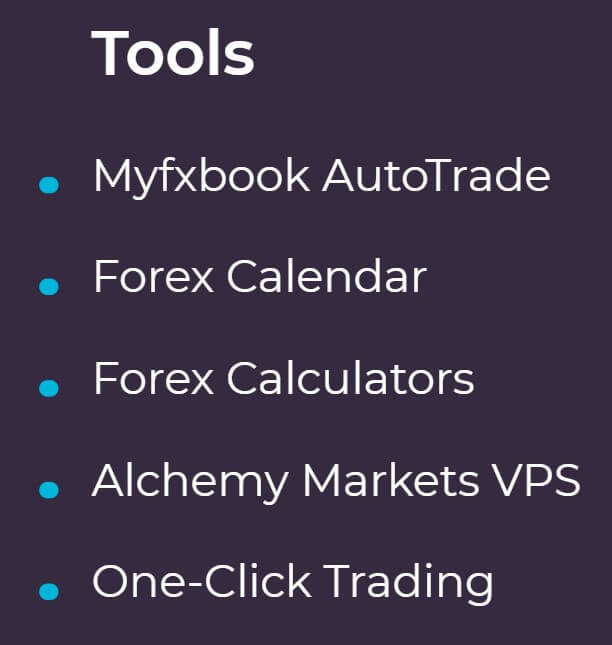

Educational & Trading Tools

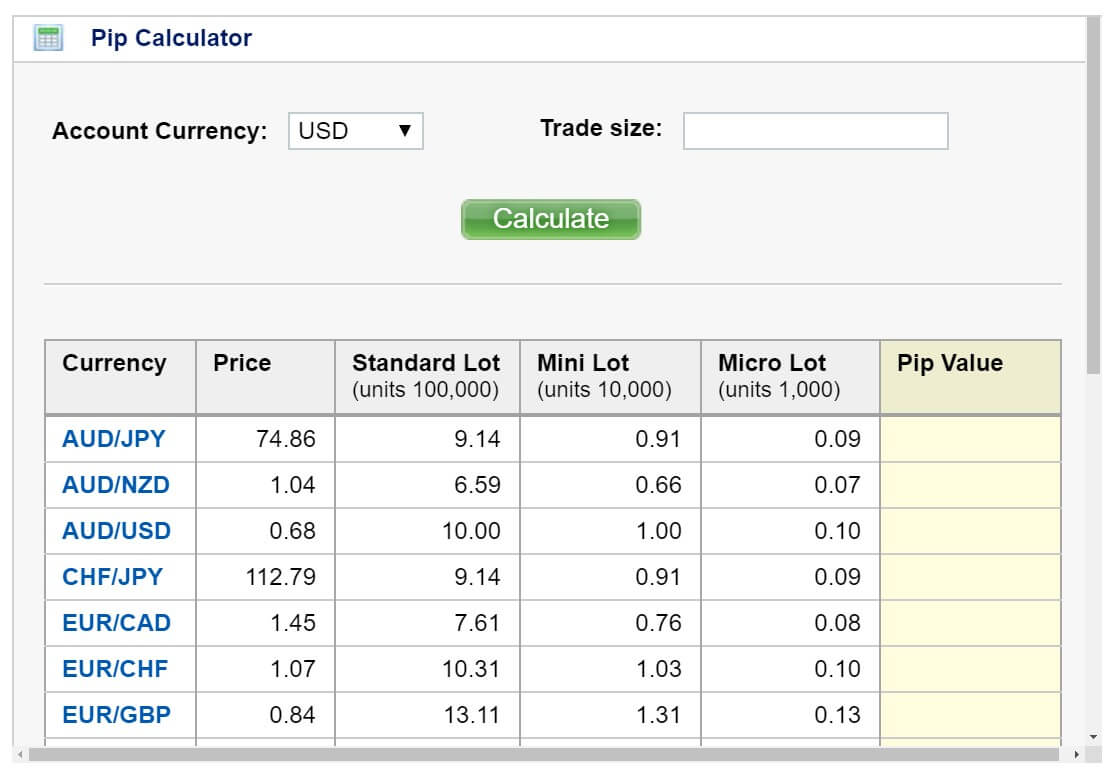

In terms of education and tools, there are some basic ones on offer, there are some calculators to that allow you to evaluate the potential profit or loss of their trade, compare the results of deals at various opening and closing prices, or receive information about the cost of pips in various trading instruments. The economic calendar contains information about when and for which country the reporting will be published, which allows you to build trading tactics based on the analytical forecast. Statistics are published at a fixed time (for example, on the second Friday of the month at 18.00). And it is at the time of the news release that the greatest volatility is observed in the financial markets.

Finally, there is some analytics, which looks at different aspects of the markets and analyzes them to see which ways the markets may move next, There is multiple analysis posted each day and it could be quite helpful to go along with the analysis you are doing yourself.

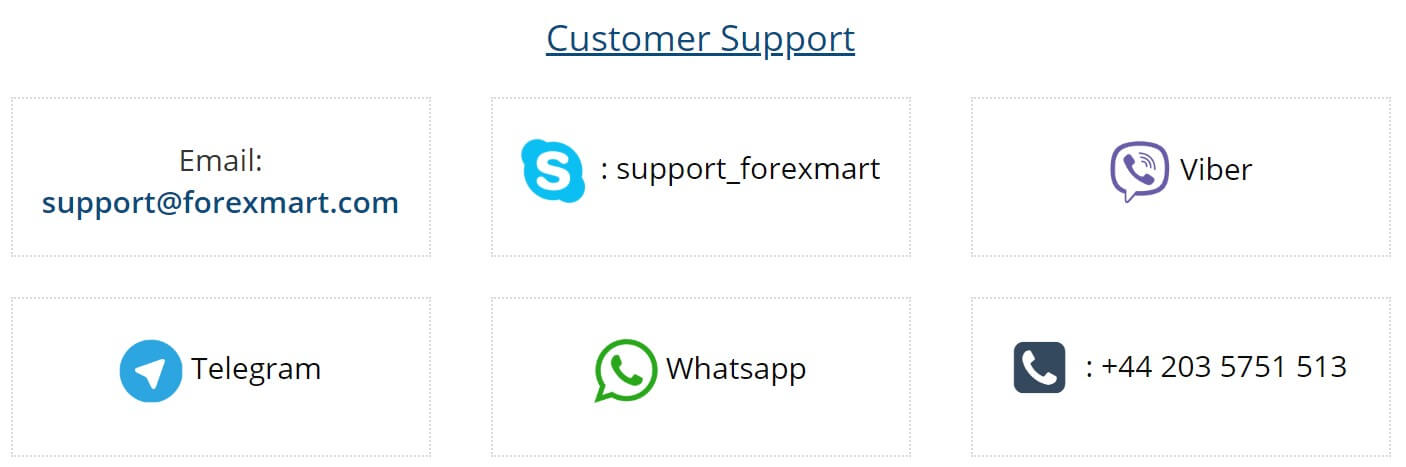

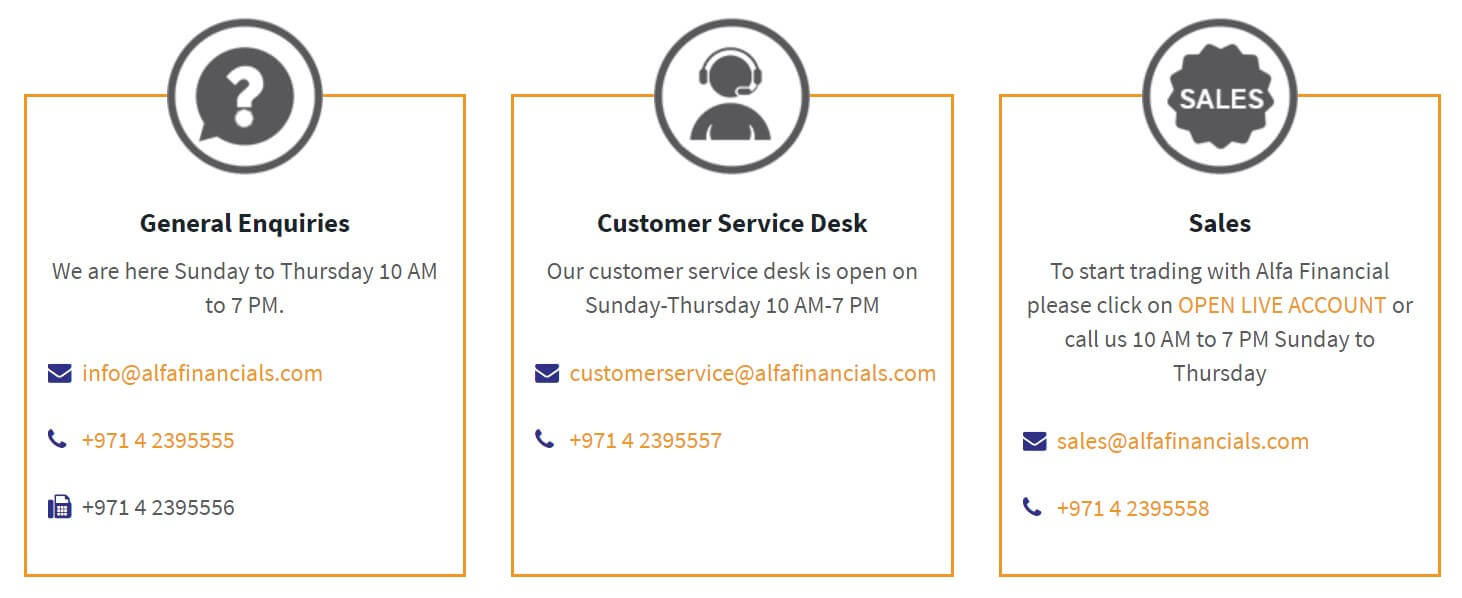

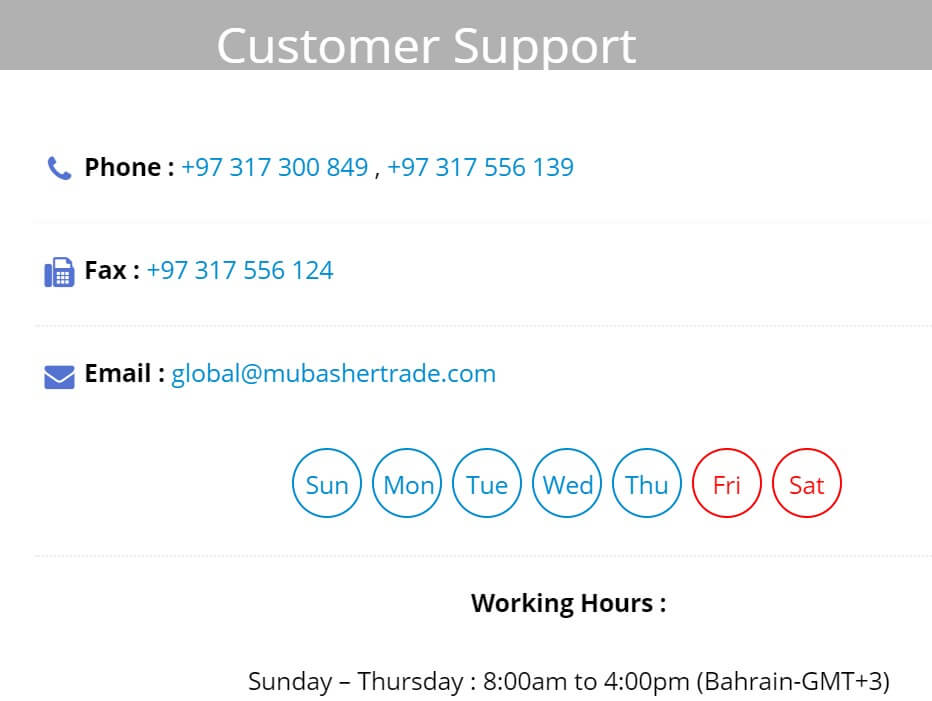

Customer Service

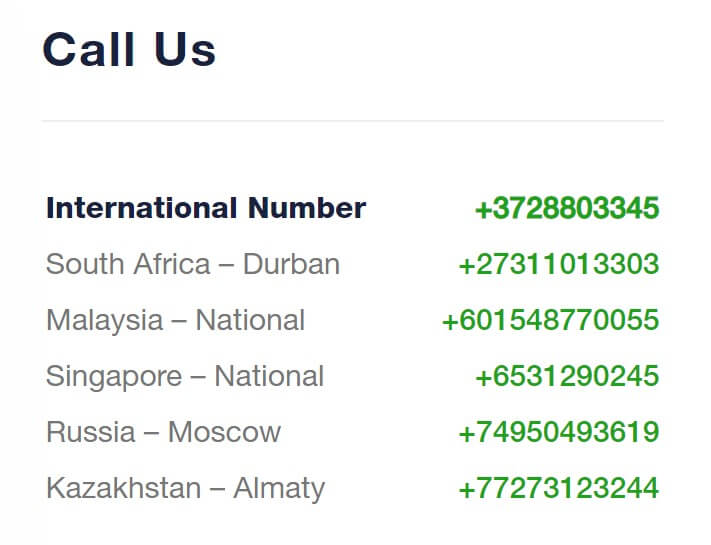

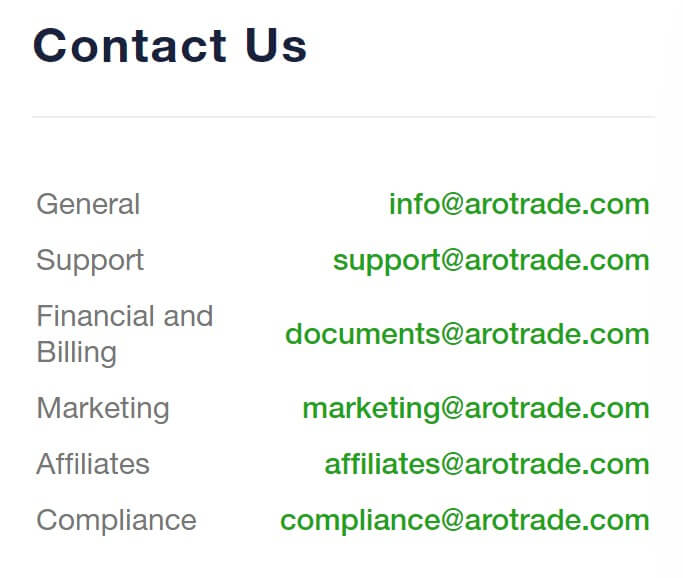

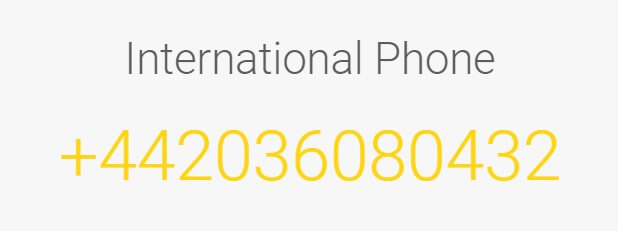

Atirox has made it simple and easy to get in contact with the people you need to, they have separated their contacts into various departments which are as follows.

Support Department:

Working Hours: 06:00 – 16:00 UTC

Tel: +60327112834

Email: [email protected]

Skype: atirox

Telegram: Atiroxbot

Partner Department:

Working Hours: 06:00 – 16:00 UTC

Email: [email protected]

Public Relations Department:

Working Hours: 06:00 – 16:00 UTC

Email: [email protected]

Finance Department:

Working Hours: 06:00 – 16:00 UTC

Email: [email protected]

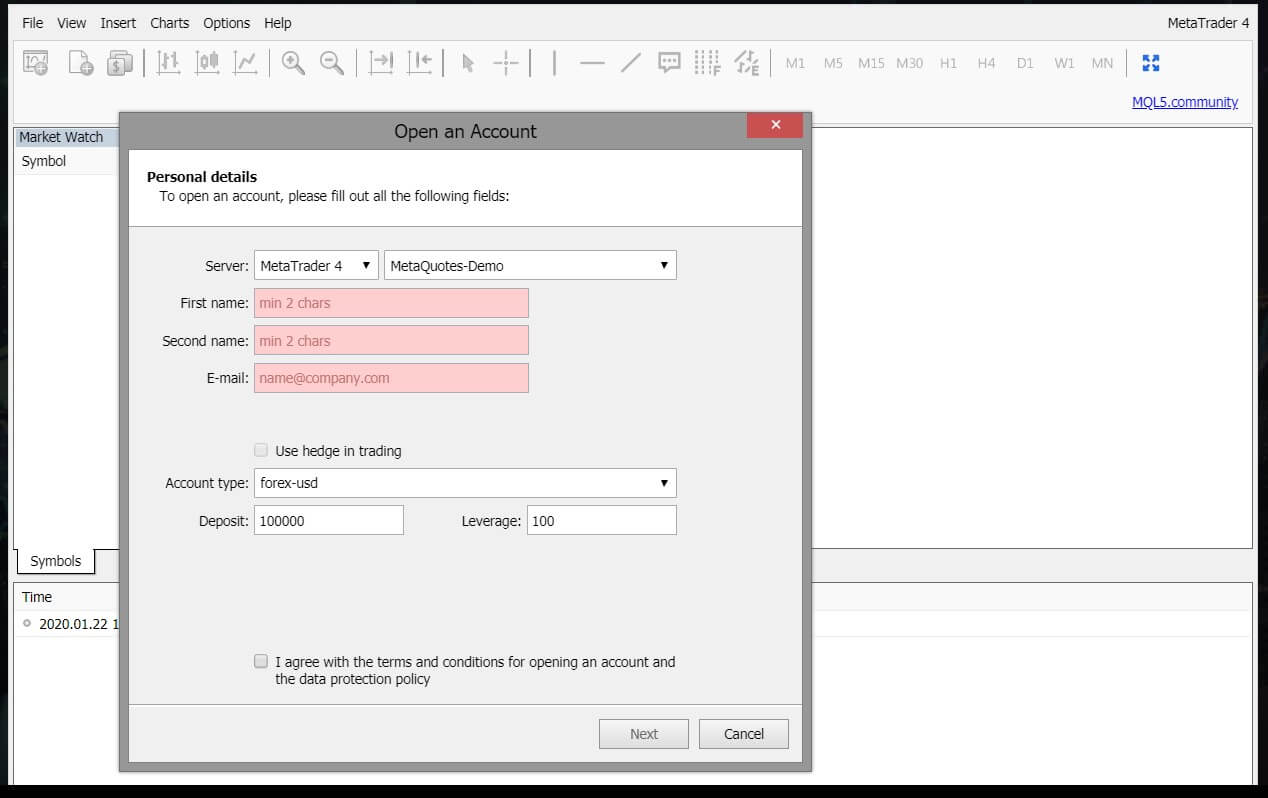

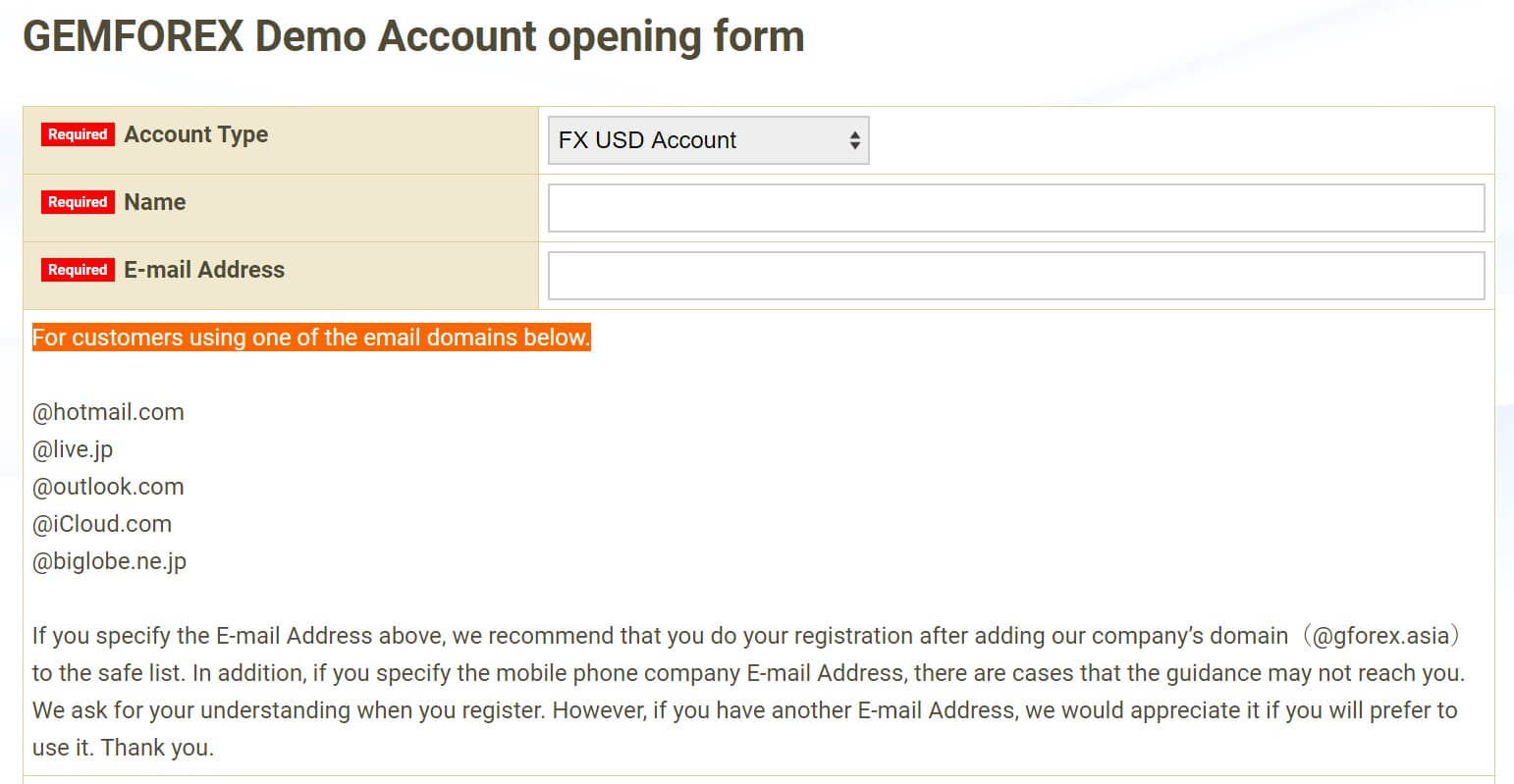

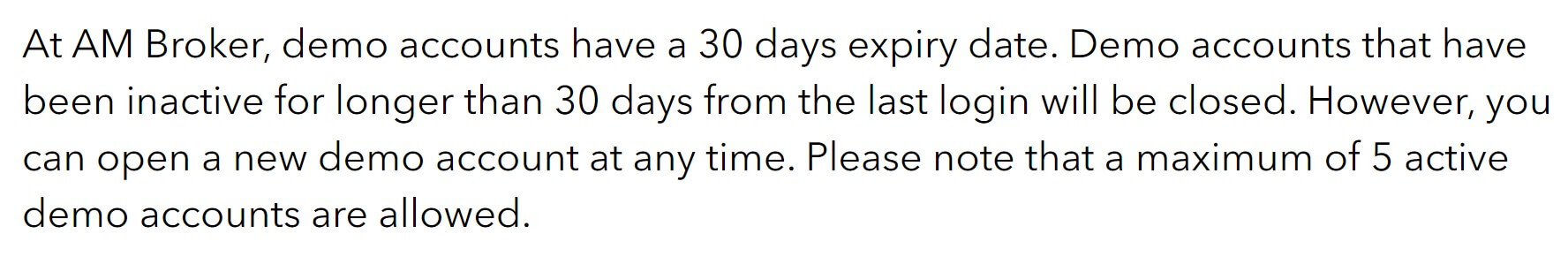

Demo Account

Demo accounts are available, you can sign up through a simple form, it is a free MetaTrader 4 account with real pricing, there is a balance of $10,000 in the account. It is not clear which of the accounts it mimics or if there is an expiration on the account. Demo accounts allow potential new clients to test out the servers and trading conditions while giving existing clients somewhere to test out their new strategies without risking any of their own capital.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

Atirox has made it easy to find the information that you need, it is refreshing to see a broker laying out all the information needed in such an easy to find manner. The only bit of information that seemed to be missing (we may have missed it ourselves) is the withdrawal times, everything else is available in detail which is great to see. The trading conditions (apart from the Micro account) are very competitive and certainly make for good reading. Plenty of assets to trade as well as many different ways to deposit and withdraw, all without any added fees. Atirox certainly seems like a competent broker and one we would be happy to trade with.

The same methods are available to withdraw to apart from some of the local bank transfers, for clarification, the methods available are Visa, MasterCard, Maestro, WebMoney, QIWI Wallet, Yandex Money, Fasapay, Skrill, Neteller, Ngan Luong, Bank Wire Transfer, and a few local bank transfers.

The same methods are available to withdraw to apart from some of the local bank transfers, for clarification, the methods available are Visa, MasterCard, Maestro, WebMoney, QIWI Wallet, Yandex Money, Fasapay, Skrill, Neteller, Ngan Luong, Bank Wire Transfer, and a few local bank transfers.

There is an Analytical Portal on the website, this offers clients the chance to revive things like trading signals, weekly review videos, training materials, calendars, and calculators, as well as the opportunity to talk with an analyst. There is a calculator available for all for working out costs and profits. We are unable to see the majority of the education as we do not have an account on the analytics portal to check.

There is an Analytical Portal on the website, this offers clients the chance to revive things like trading signals, weekly review videos, training materials, calendars, and calculators, as well as the opportunity to talk with an analyst. There is a calculator available for all for working out costs and profits. We are unable to see the majority of the education as we do not have an account on the analytics portal to check.

Educational & Trading Tools

Educational & Trading Tools

Platforms

Platforms

Assets

Assets

Forex: There are 35+ currency pairs available, some of them include AUDUSD, CADJPY, EURSGD, EURUSD, GBPUSD, EURNOK, GBPJPY, NZDCHF, USDMXN and, EURPLN

Forex: There are 35+ currency pairs available, some of them include AUDUSD, CADJPY, EURSGD, EURUSD, GBPUSD, EURNOK, GBPJPY, NZDCHF, USDMXN and, EURPLN

Educational & Trading Tools

Educational & Trading Tools

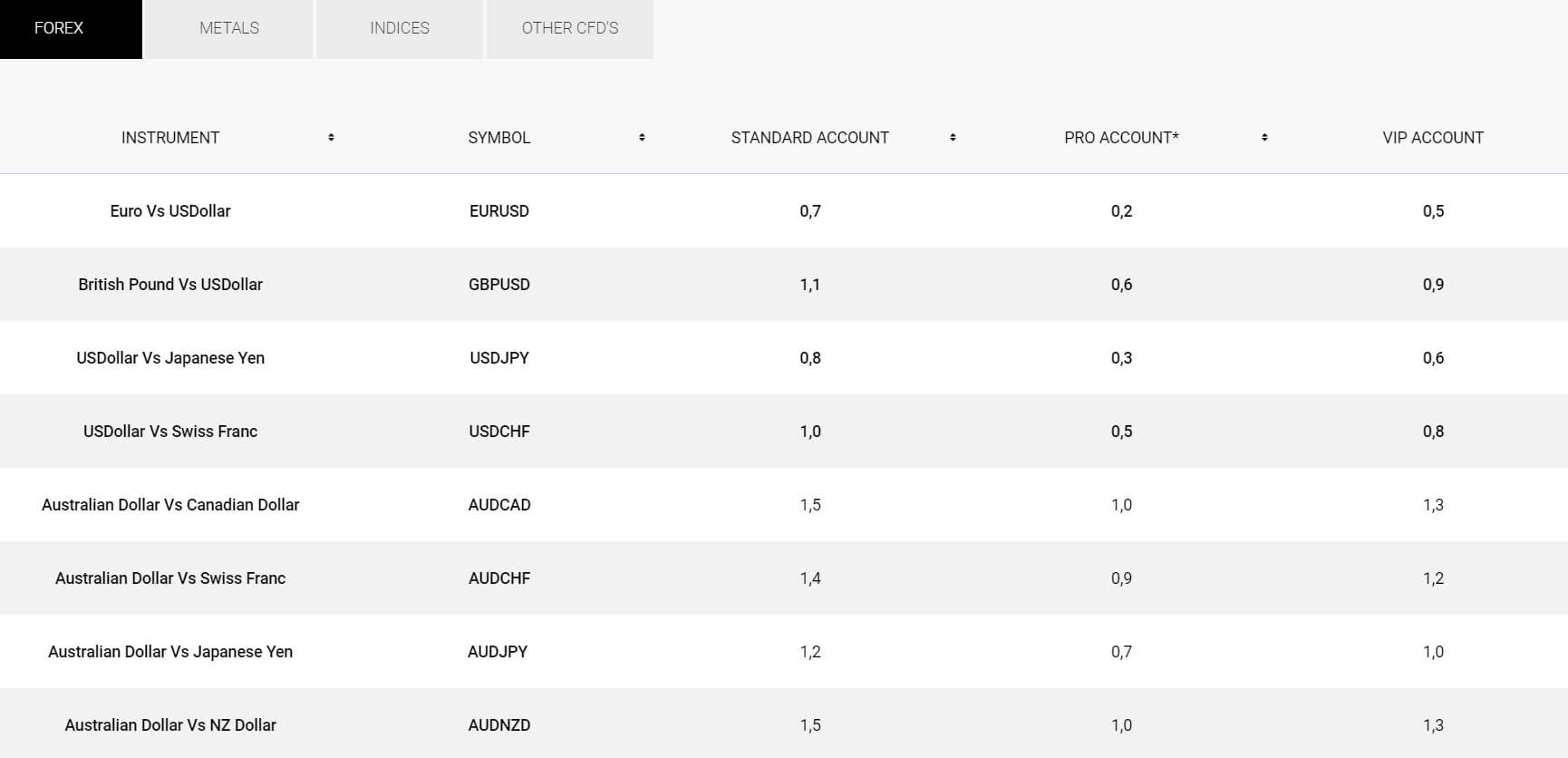

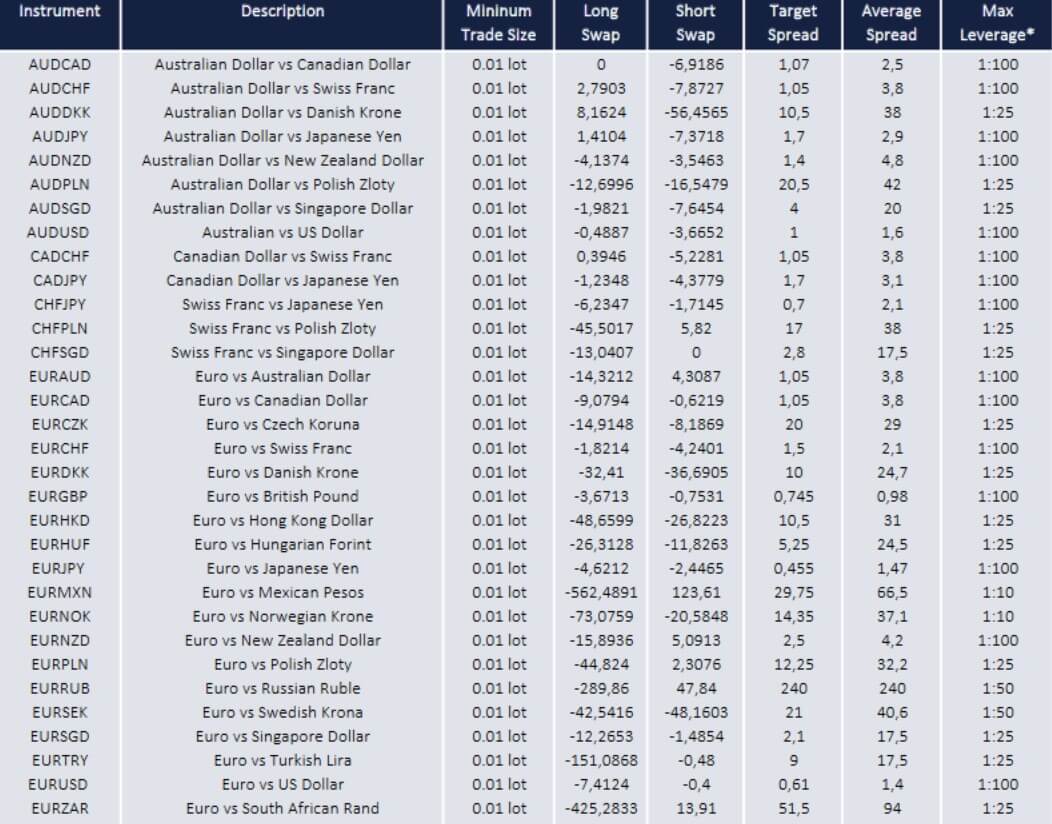

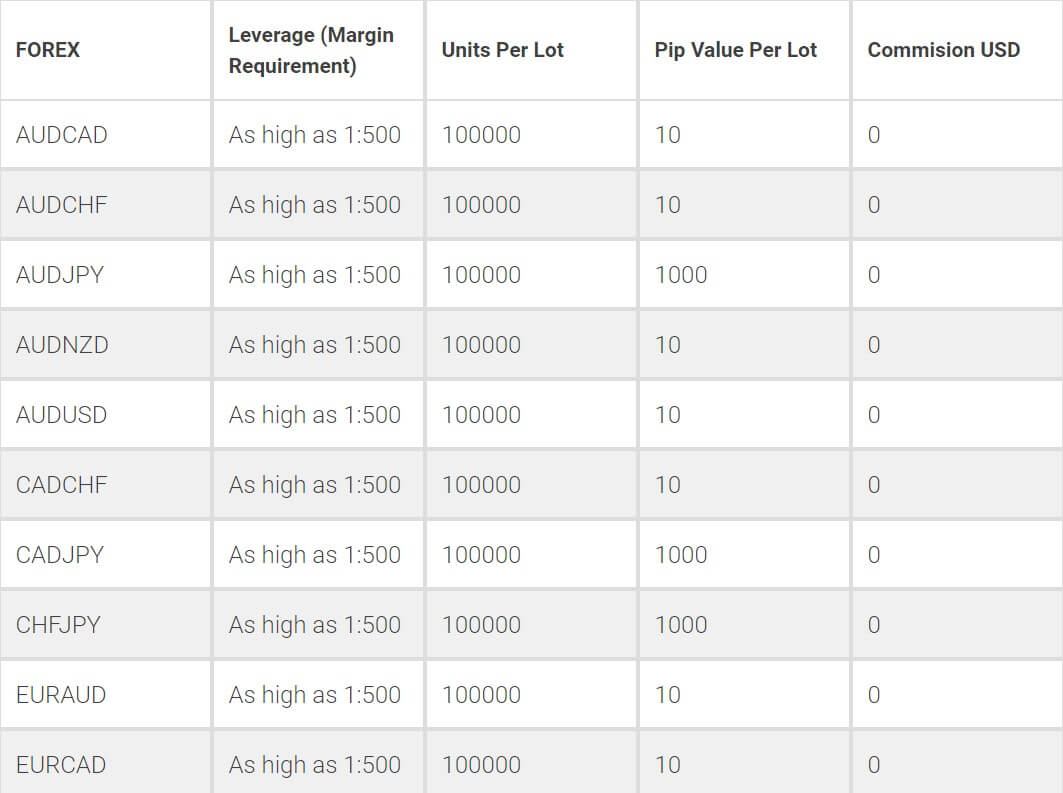

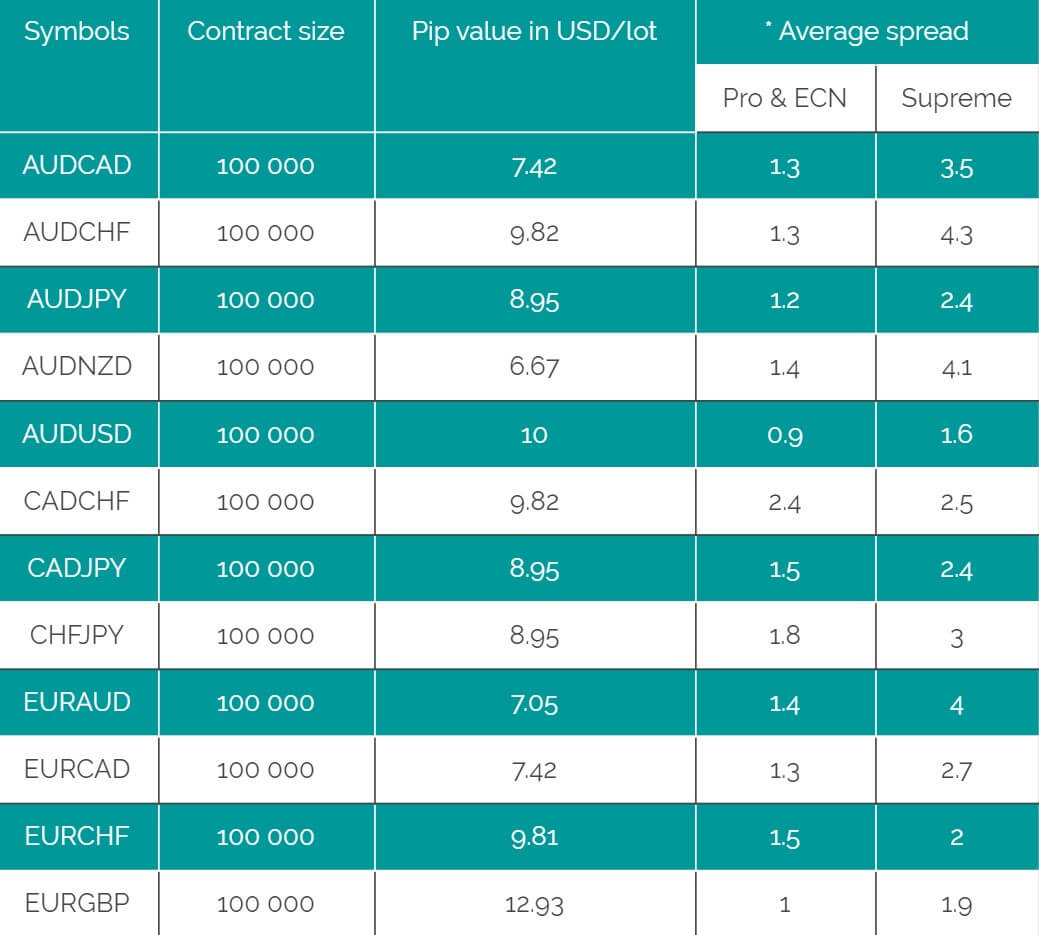

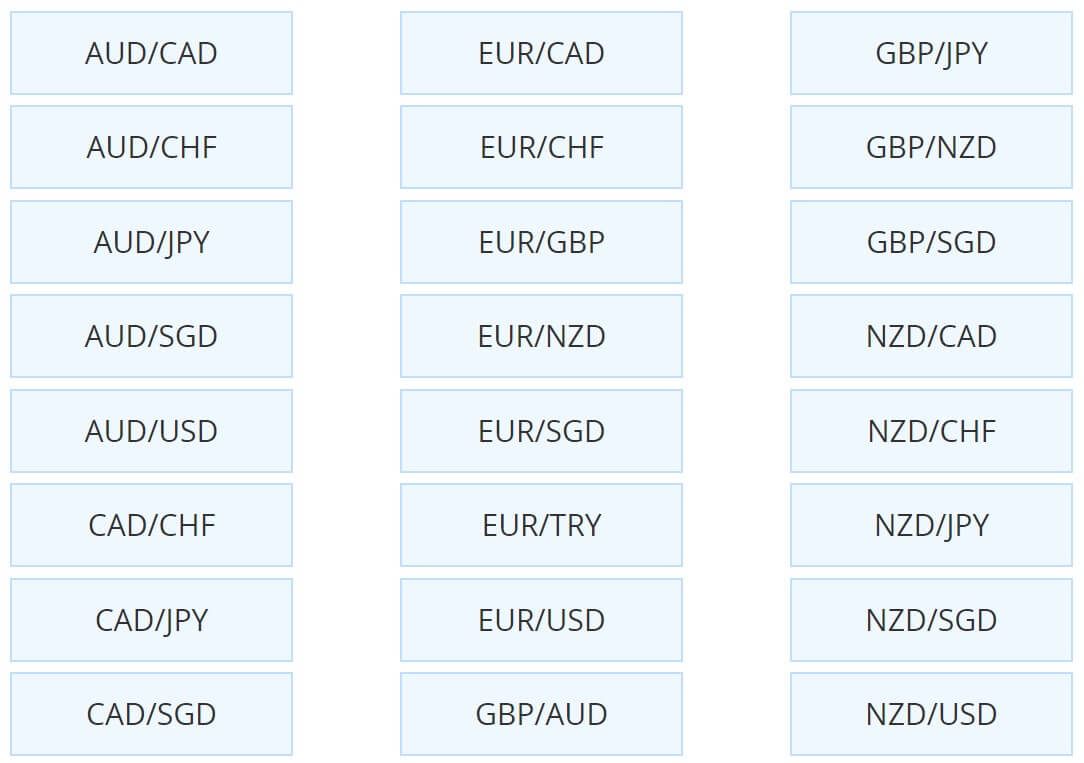

Forex: 53 different pairs available from Majors to Minors, some of the available pairs include AUDCAD, CHFJPY, NZDUSD, and EURUSD.

Forex: 53 different pairs available from Majors to Minors, some of the available pairs include AUDCAD, CHFJPY, NZDUSD, and EURUSD.

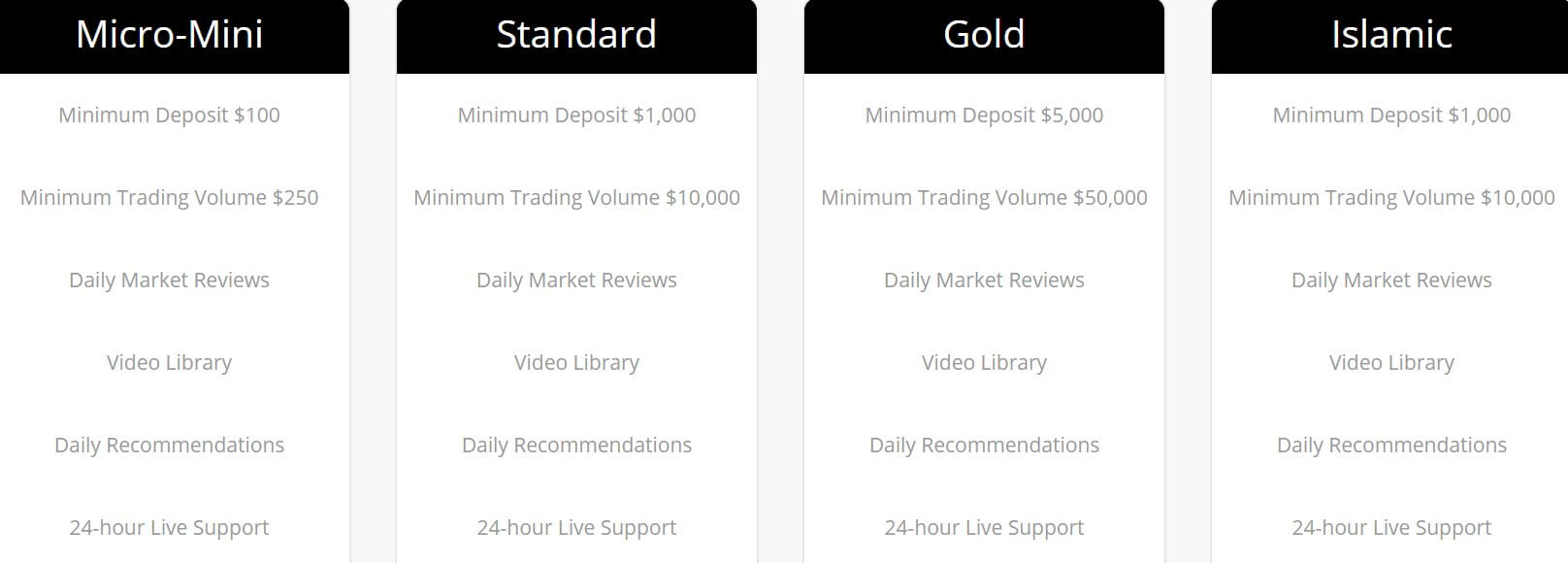

Arotrade has broken down its assets into 5 different categories. We have outlined the instruments in each below. Please note that any dated one will change based on the date.

Arotrade has broken down its assets into 5 different categories. We have outlined the instruments in each below. Please note that any dated one will change based on the date.

Leverage

Leverage

Minimum Deposit

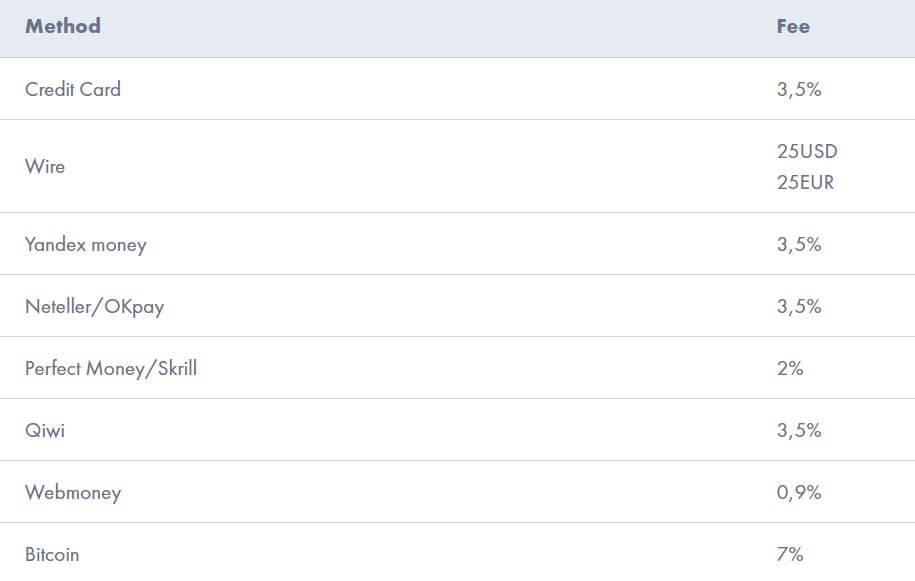

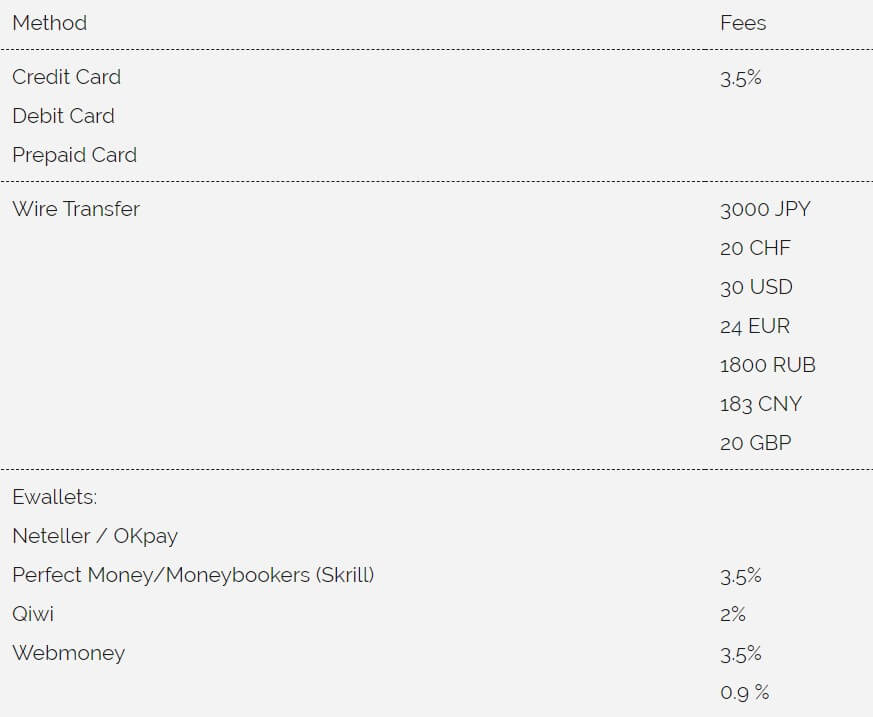

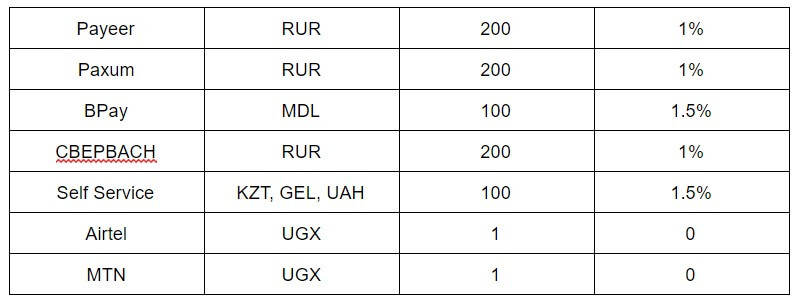

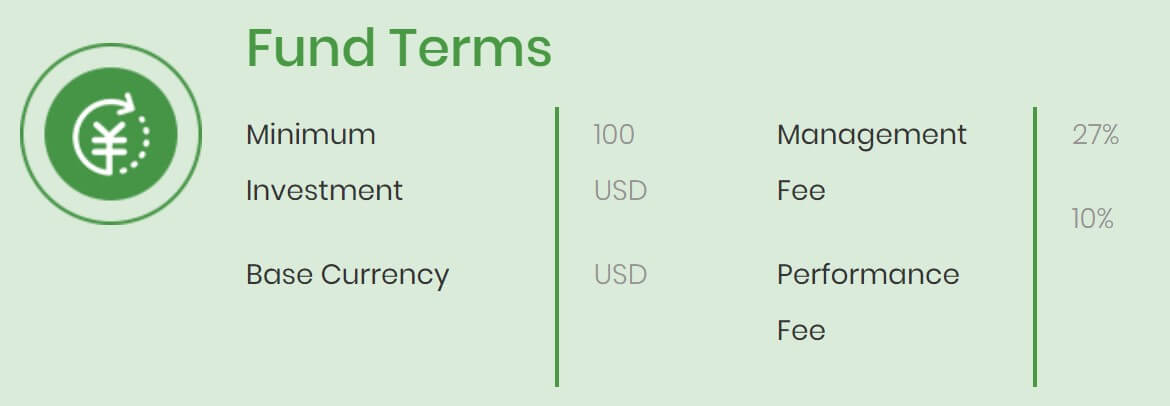

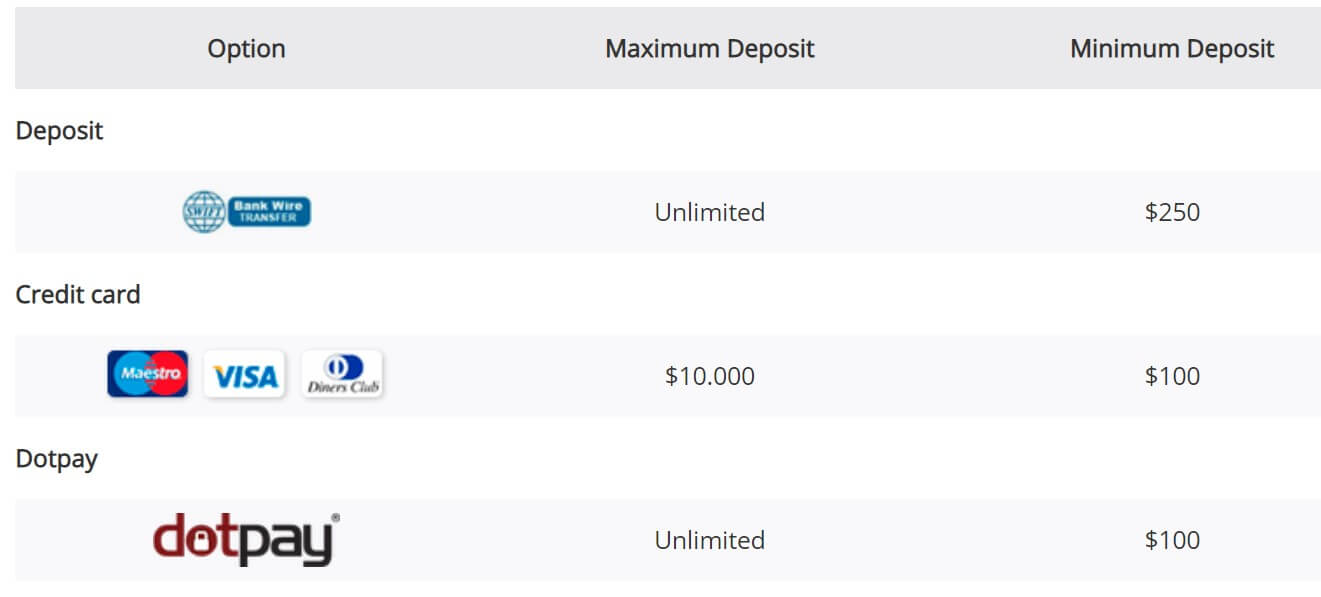

Minimum Deposit There are plenty of deposit methods and each one comes with different options and fees, we have outlined them below, it is important to note that the VIP account does not have any of the fees that are mentioned below.

There are plenty of deposit methods and each one comes with different options and fees, we have outlined them below, it is important to note that the VIP account does not have any of the fees that are mentioned below.

Platform

Platform

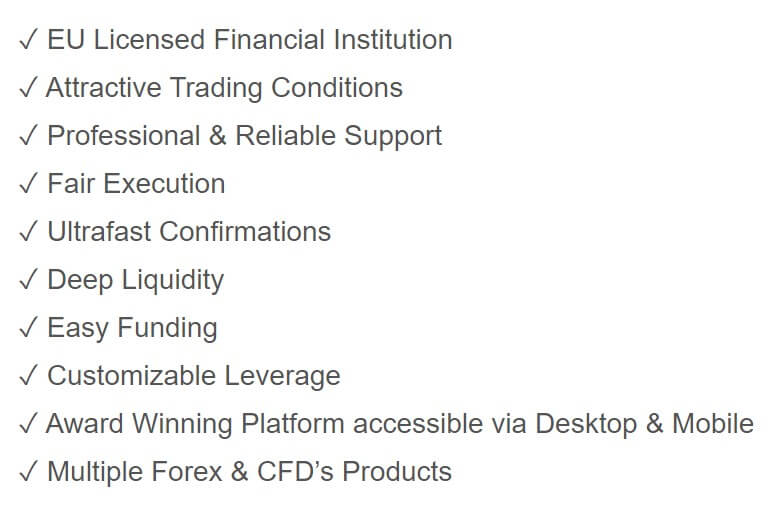

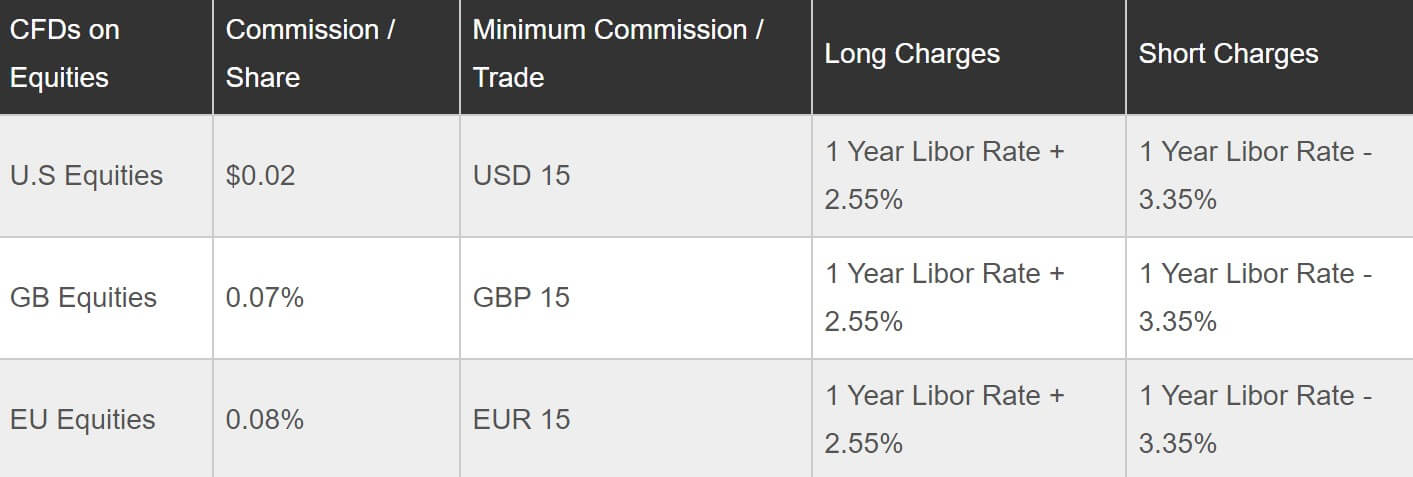

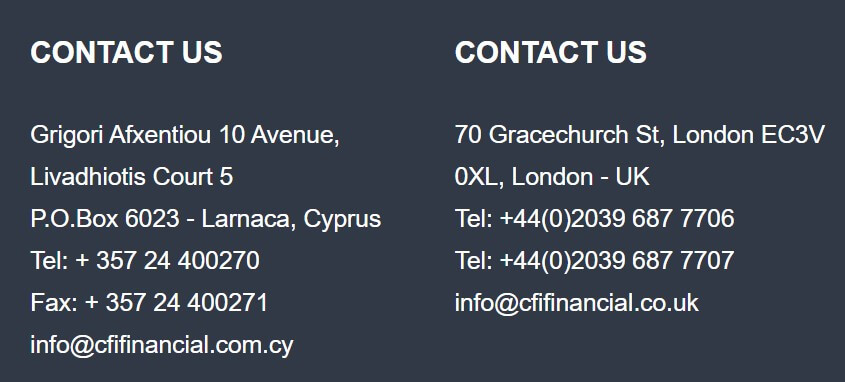

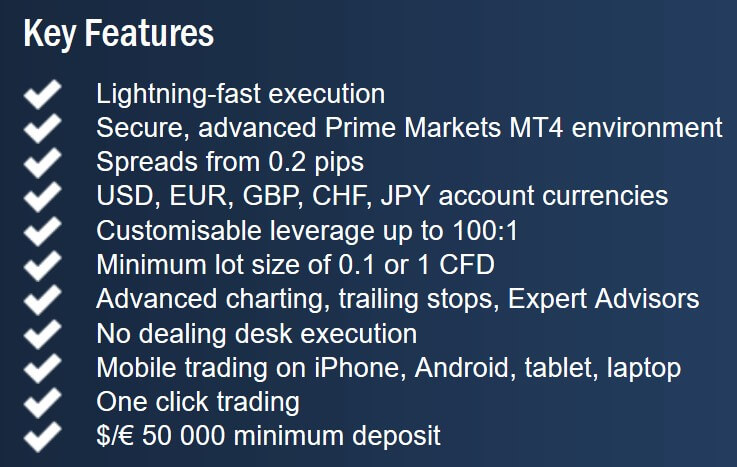

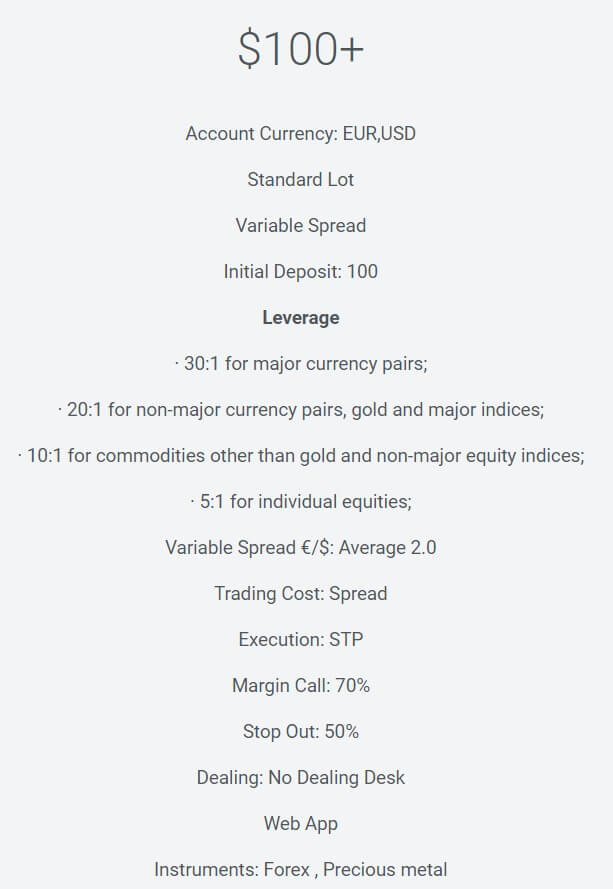

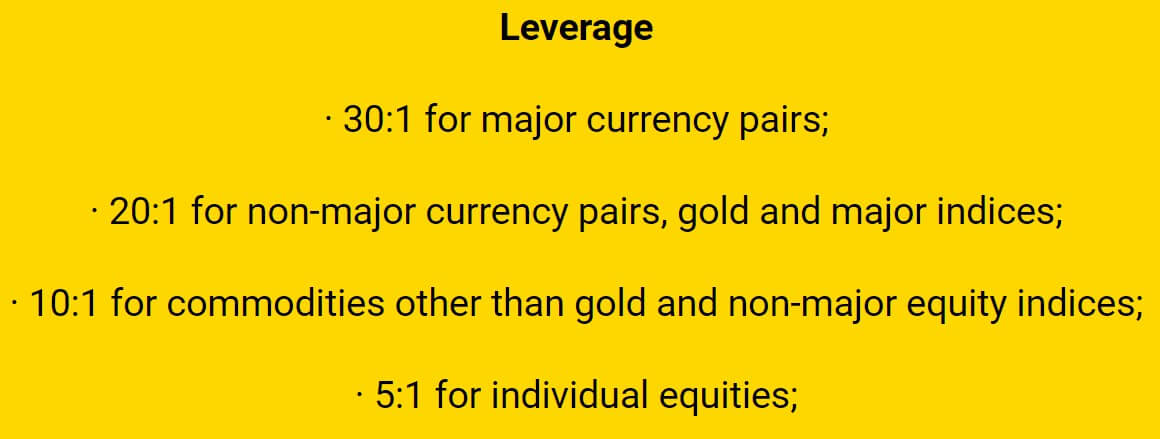

CFI is an online broker that offers leveraged trading of up to 1:400 for professional clients on FX and CFD instruments, including Cryptocurrencies, on the MetaTrader 5 platform. Those advertised leverage caps are set much lower for regular clients, with the highest cap offered to be a leverage of up to 1:30. One must deposit at least $100 to open a Standard account and traders can choose to maintain a certain trading volume or to maintain a certain account balance of a larger amount for the other account types. When it comes to trading costs, we see commission-free options on certain instruments, and commissions are negotiable in the case of the Prime account.

CFI is an online broker that offers leveraged trading of up to 1:400 for professional clients on FX and CFD instruments, including Cryptocurrencies, on the MetaTrader 5 platform. Those advertised leverage caps are set much lower for regular clients, with the highest cap offered to be a leverage of up to 1:30. One must deposit at least $100 to open a Standard account and traders can choose to maintain a certain trading volume or to maintain a certain account balance of a larger amount for the other account types. When it comes to trading costs, we see commission-free options on certain instruments, and commissions are negotiable in the case of the Prime account.

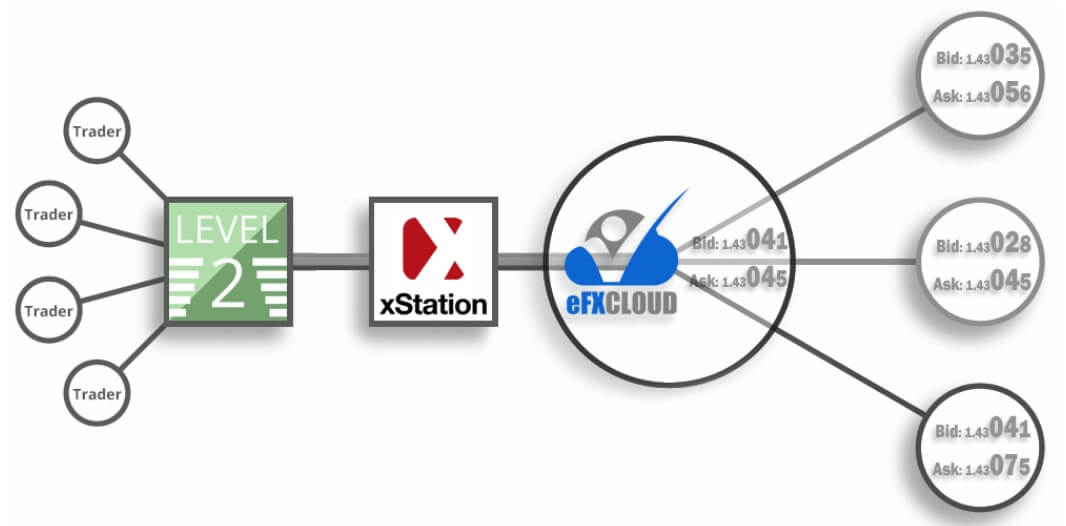

Those that choose to open an account through this broker will be trading from the eFX Cloud X Station Pro trading platform, which is available on the web, or downloadable on desktop and mobile devices. Within the platform, traders will have access to lightning-fast one-click trading, the ability to trade from charts by right-clicking on any

Those that choose to open an account through this broker will be trading from the eFX Cloud X Station Pro trading platform, which is available on the web, or downloadable on desktop and mobile devices. Within the platform, traders will have access to lightning-fast one-click trading, the ability to trade from charts by right-clicking on any

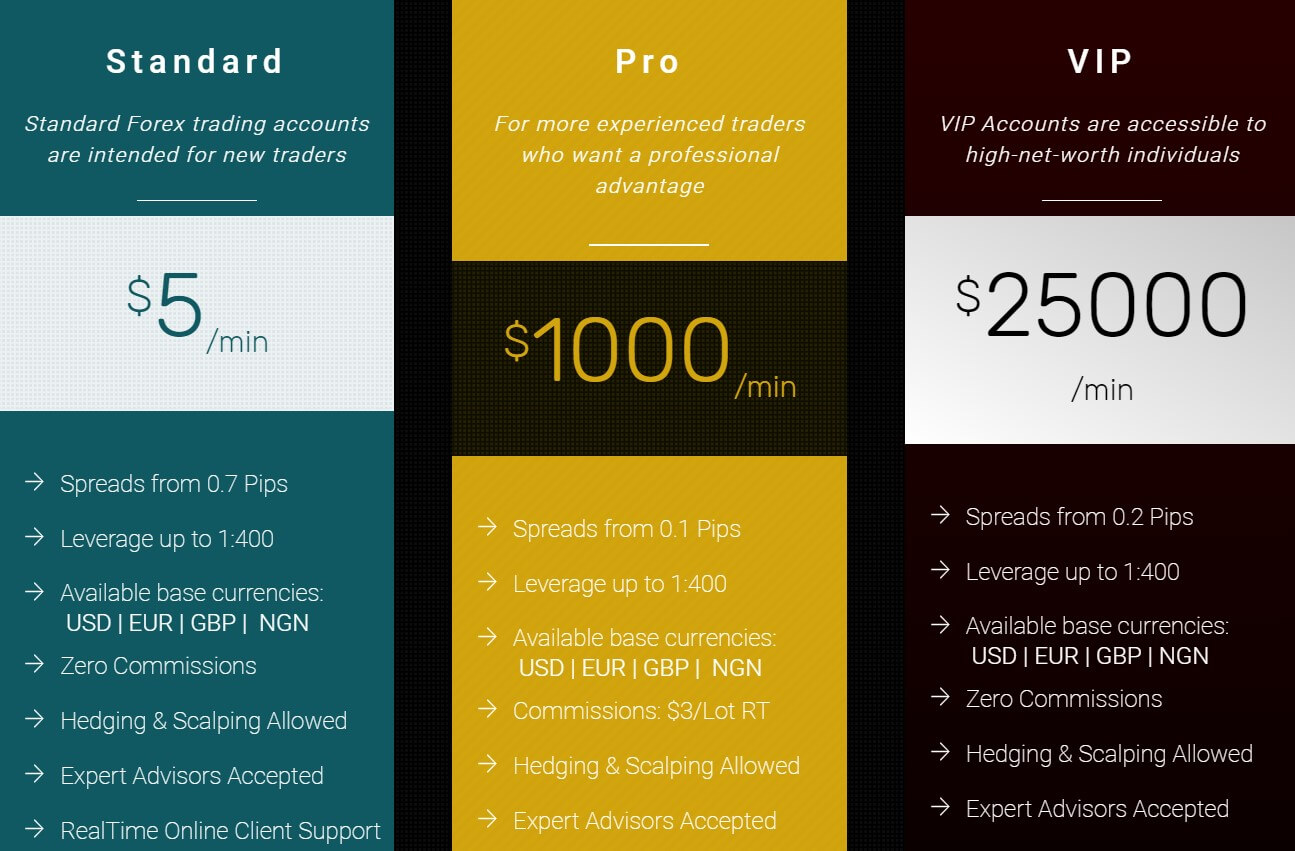

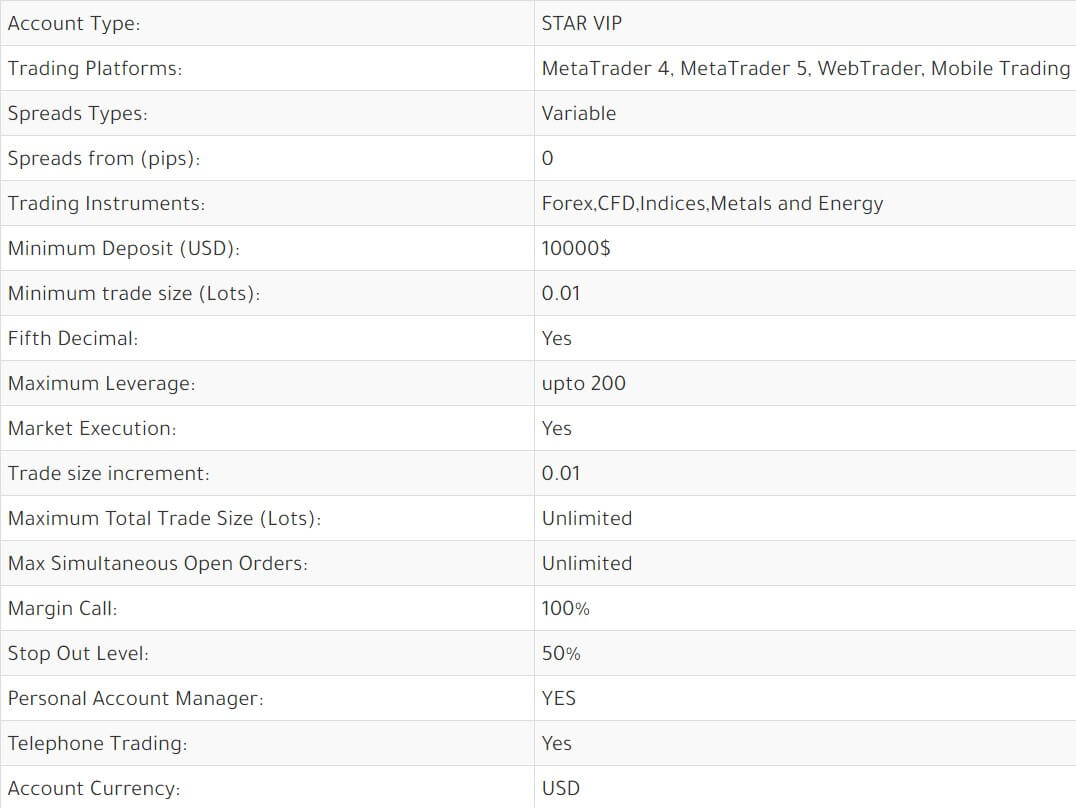

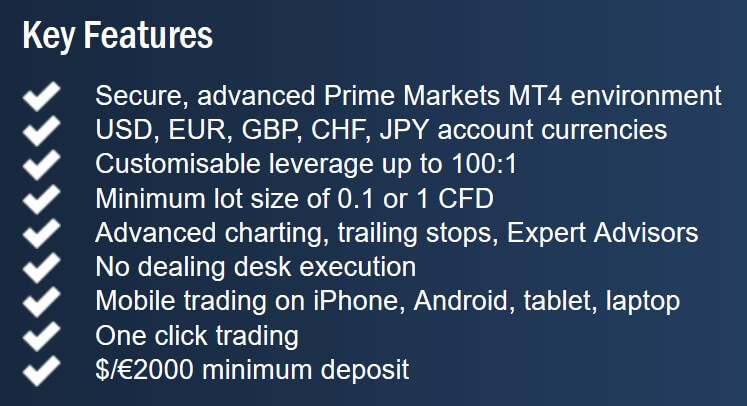

Standard Account: The standard account requires a minimum deposit of $50, it has variable spreads starting from around 2 pips, it can use MetaTrader 4 or MetaTrader 5 and trade sizes start at 0.01 lots with a maximum trade size of 80 lots. Leverage on the account can go up to 1:400, the account is able to trade forex, CFDs, indices, metals, and energies and it has a margin call level set at 150% and

Standard Account: The standard account requires a minimum deposit of $50, it has variable spreads starting from around 2 pips, it can use MetaTrader 4 or MetaTrader 5 and trade sizes start at 0.01 lots with a maximum trade size of 80 lots. Leverage on the account can go up to 1:400, the account is able to trade forex, CFDs, indices, metals, and energies and it has a margin call level set at 150% and

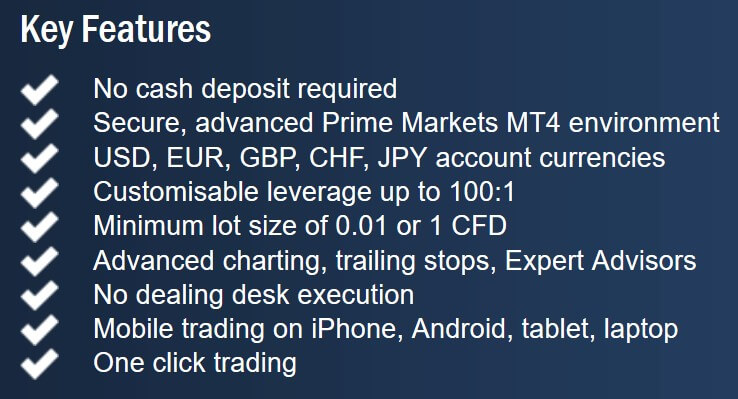

Key Features:

Key Features:

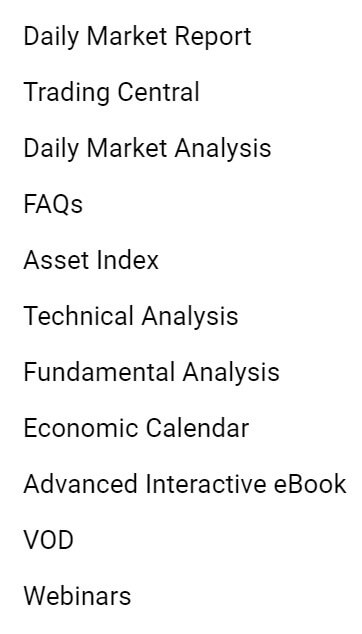

Aside from the mentioned tools integrated into the 24Optoin web platform, there is a dedicated Educational section and an Assets calculator. The Educational section contains the Daily Market report, Trading Central, Daily Market Analysis, FAQs, Asset Index, Technical Analysis, Fundamental Analysis, Economic Calendar, Advanced Interactive Ebook, VOD and Webinars. One of the most useful sections is the Daily Market Report which contains a nice overview of global markets across categories, with short descriptive content but without any backstories.

Aside from the mentioned tools integrated into the 24Optoin web platform, there is a dedicated Educational section and an Assets calculator. The Educational section contains the Daily Market report, Trading Central, Daily Market Analysis, FAQs, Asset Index, Technical Analysis, Fundamental Analysis, Economic Calendar, Advanced Interactive Ebook, VOD and Webinars. One of the most useful sections is the Daily Market Report which contains a nice overview of global markets across categories, with short descriptive content but without any backstories.

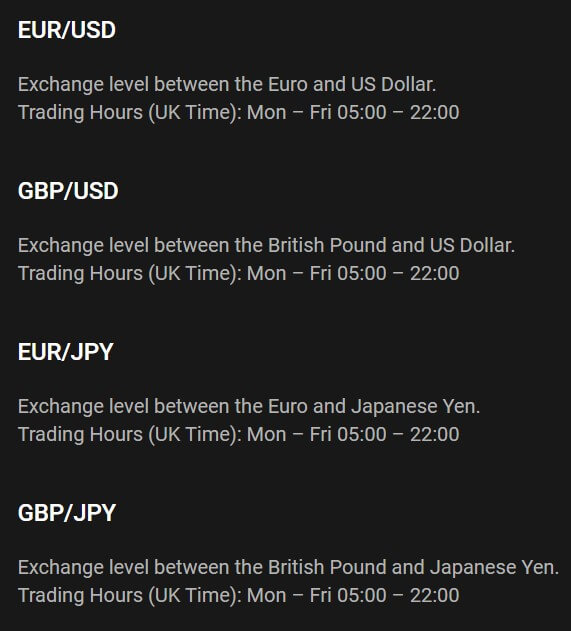

Forex Pairs: 50+ pairs in total which include major pairs, minor pairs and a selection of exotics, some examples are GBP/USD, EUR/JPY., EUR/USD and EUR/CHF.

Forex Pairs: 50+ pairs in total which include major pairs, minor pairs and a selection of exotics, some examples are GBP/USD, EUR/JPY., EUR/USD and EUR/CHF.

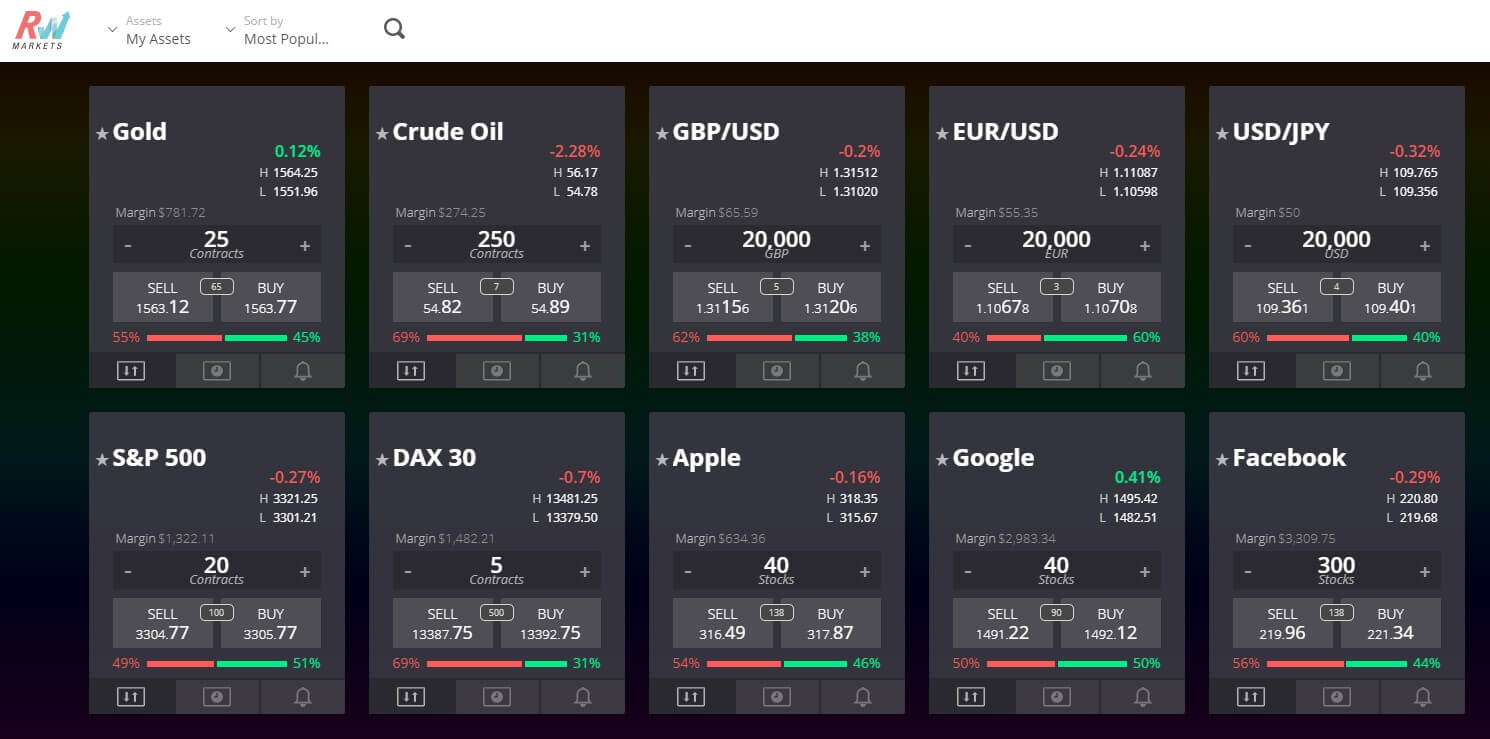

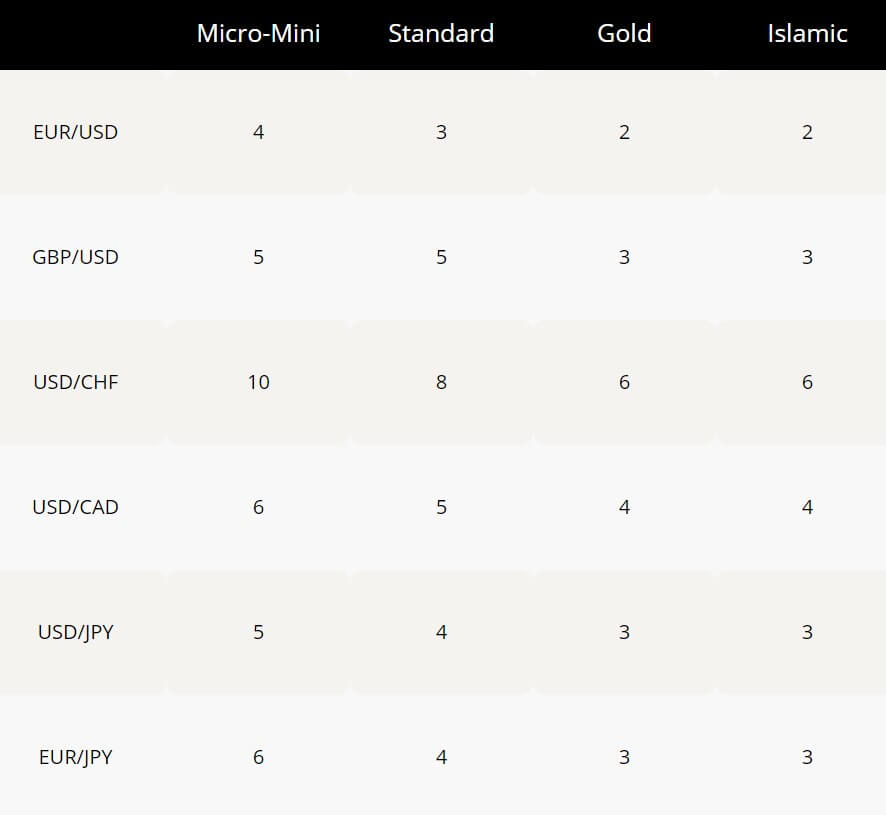

RW Markets have broken down their assets into a number of different categories.

RW Markets have broken down their assets into a number of different categories.

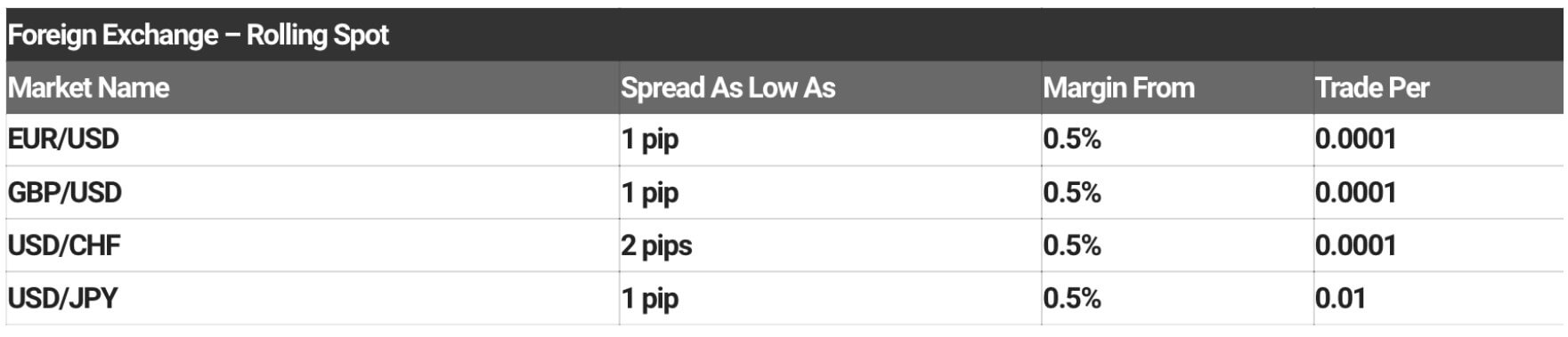

BlackStone Futures have quite a large number of assets available for trading, and you can find a full list on their Market Information Sheets. If you want to trade Indices, you can choose between the 19 available ones including; Euro Stocks 50, France 40, Germany 30 and US Tech 100 (Daily Rolling Cash) just to mention a few.

BlackStone Futures have quite a large number of assets available for trading, and you can find a full list on their Market Information Sheets. If you want to trade Indices, you can choose between the 19 available ones including; Euro Stocks 50, France 40, Germany 30 and US Tech 100 (Daily Rolling Cash) just to mention a few.

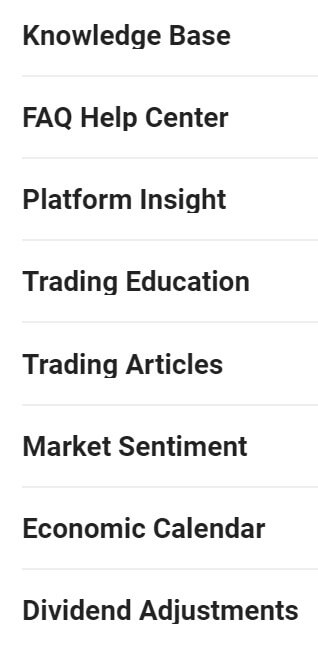

BlackStone Futures have an extensive education segment on their website. They have a Knowledge Base section which includes a number of articles and videos that should allow beginner traders to get a good basic understanding of the MT4 as well as their own Cloud Trade platform to make educated decisions when trading. Another number of articles and videos are dedicated to helping clients garner a broader understanding of how the market works and how they can implement indicators alongside

BlackStone Futures have an extensive education segment on their website. They have a Knowledge Base section which includes a number of articles and videos that should allow beginner traders to get a good basic understanding of the MT4 as well as their own Cloud Trade platform to make educated decisions when trading. Another number of articles and videos are dedicated to helping clients garner a broader understanding of how the market works and how they can implement indicators alongside

Leverage options range from 1:10 up to 1:200, regardless of which account has been chosen. The leverage cap is set at a different level on separate instruments. For example, most currency pairs allow the maximum cap, while some of the exotic options have a limit of 1:25 or 1:50. Leverage on cryptocurrencies goes up to 1:2 and options on stocks is set at 1:10. On commodities, the leverage cap is 1:100, except on Rice. Options vary more widely on indexes and metals. The leverage on all bonds goes as high as 1:100. Overall, we must say that the maximum cap offered by the broker is somewhat restrictive when compared to other options.

Leverage options range from 1:10 up to 1:200, regardless of which account has been chosen. The leverage cap is set at a different level on separate instruments. For example, most currency pairs allow the maximum cap, while some of the exotic options have a limit of 1:25 or 1:50. Leverage on cryptocurrencies goes up to 1:2 and options on stocks is set at 1:10. On commodities, the leverage cap is 1:100, except on Rice. Options vary more widely on indexes and metals. The leverage on all bonds goes as high as 1:100. Overall, we must say that the maximum cap offered by the broker is somewhat restrictive when compared to other options.

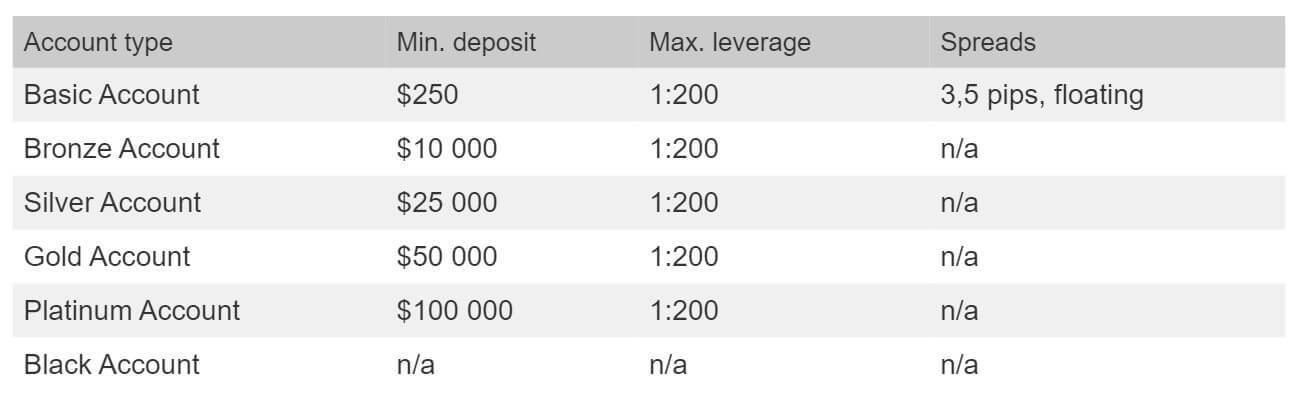

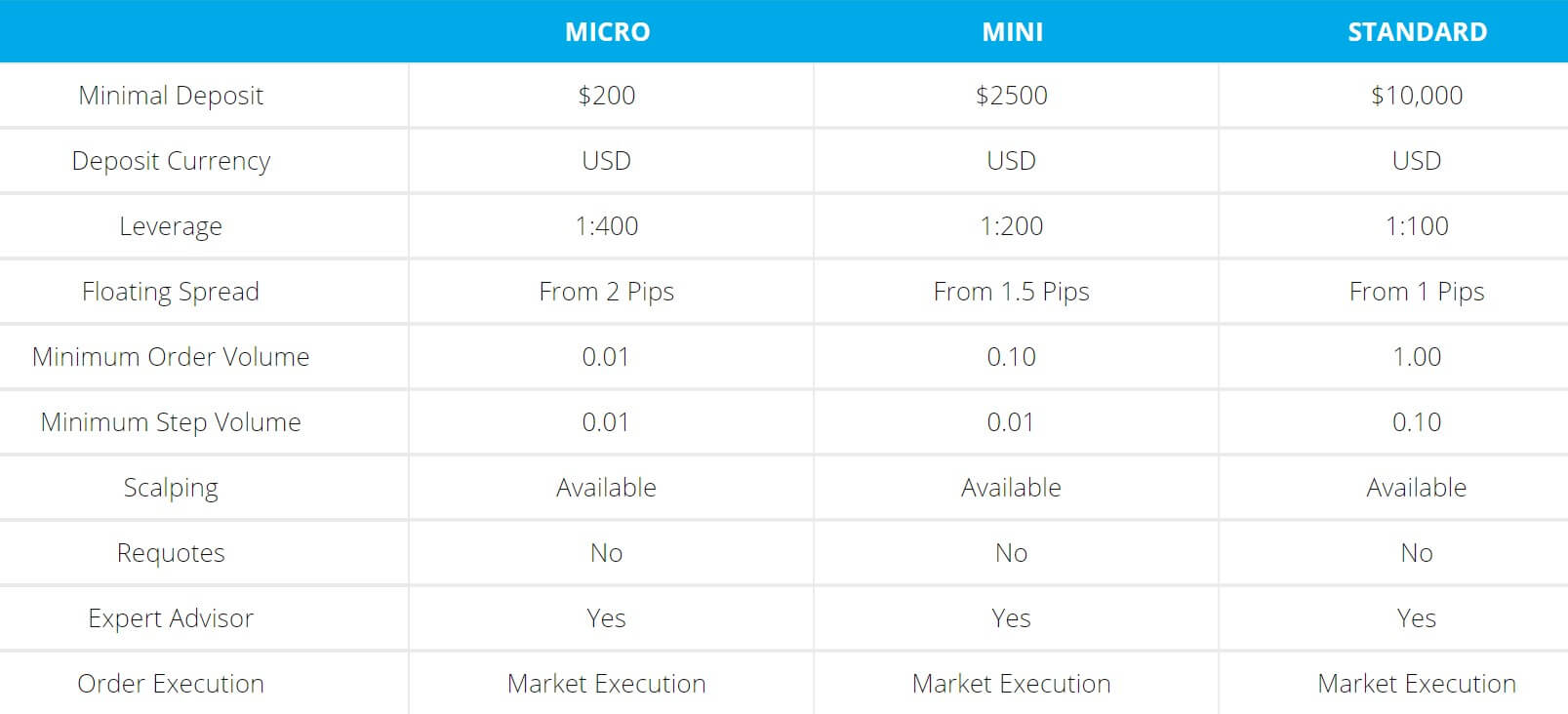

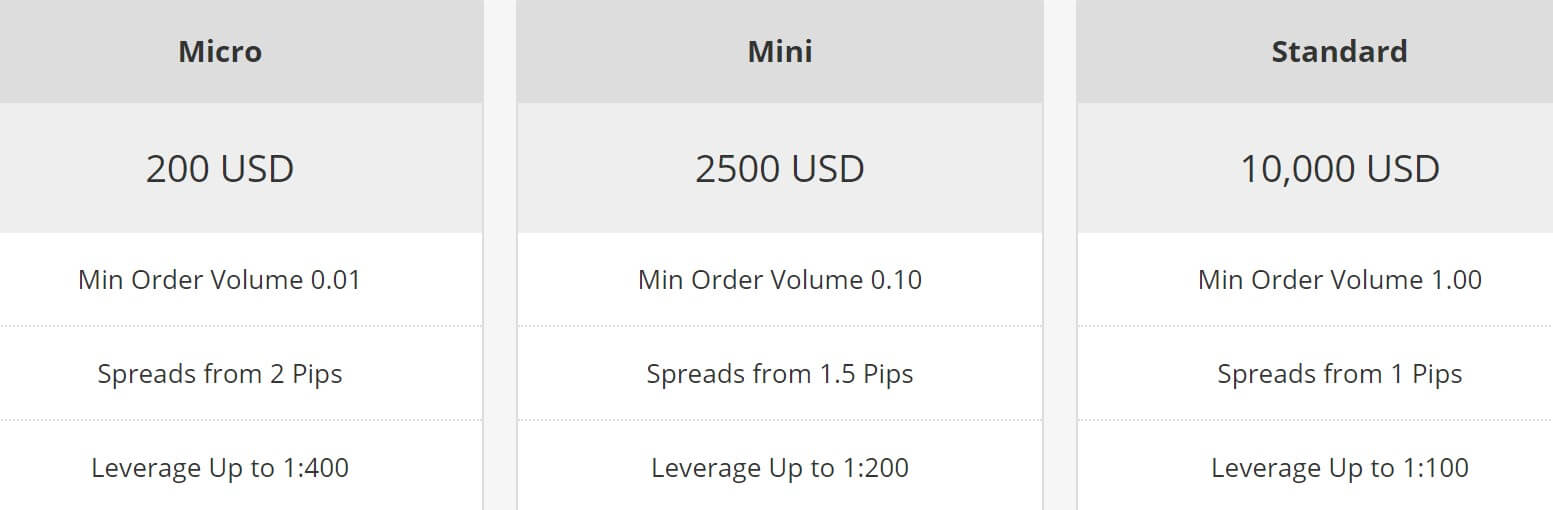

Spreads on the Micro, Mini, Standard, and Premium account types start from 3 pips on majors. It’s almost shocking to see that all of these accounts are offering spreads that are much higher than the industry’s average 1.5 pips, especially considering that it costs $25k to open a Premium account. On minors, we even see spreads as high as 6 pips or more. The only way to access average spreads through this broker would be to make the $100k deposit to open a VIP account and even then, spreads start from 1-2 pips.

Spreads on the Micro, Mini, Standard, and Premium account types start from 3 pips on majors. It’s almost shocking to see that all of these accounts are offering spreads that are much higher than the industry’s average 1.5 pips, especially considering that it costs $25k to open a Premium account. On minors, we even see spreads as high as 6 pips or more. The only way to access average spreads through this broker would be to make the $100k deposit to open a VIP account and even then, spreads start from 1-2 pips.

MINIMUM DEPOSIT

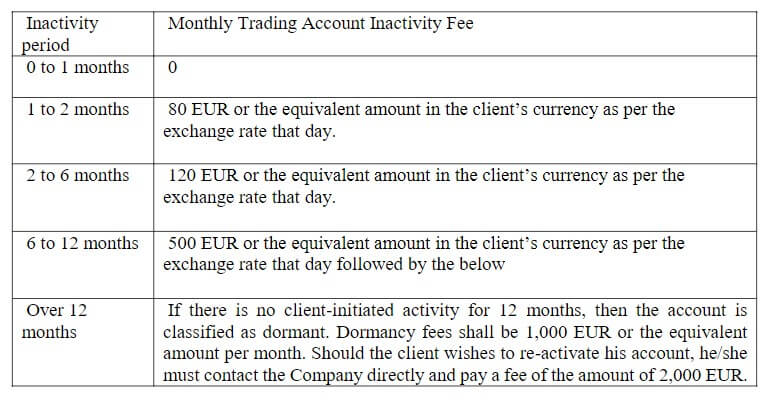

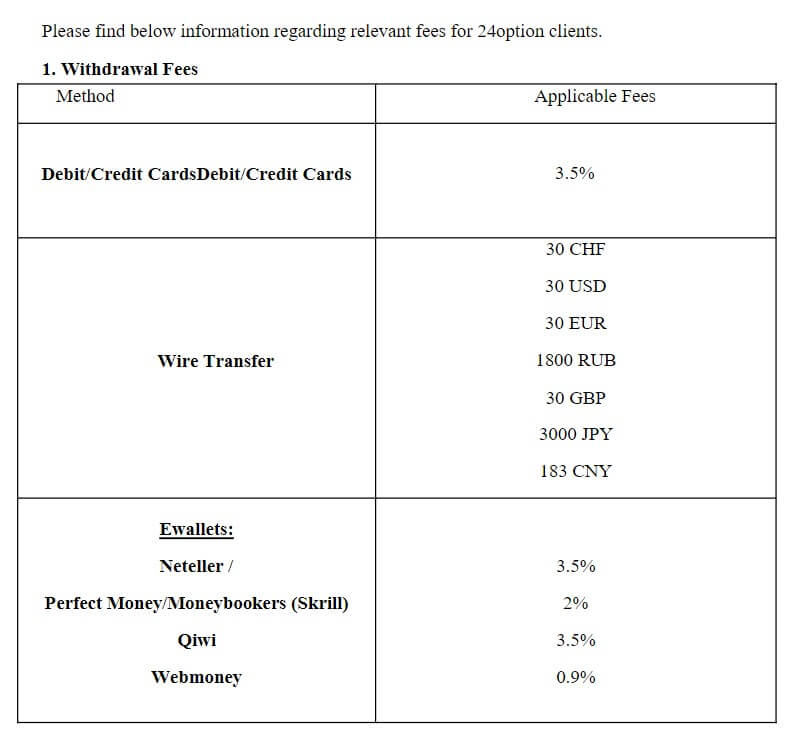

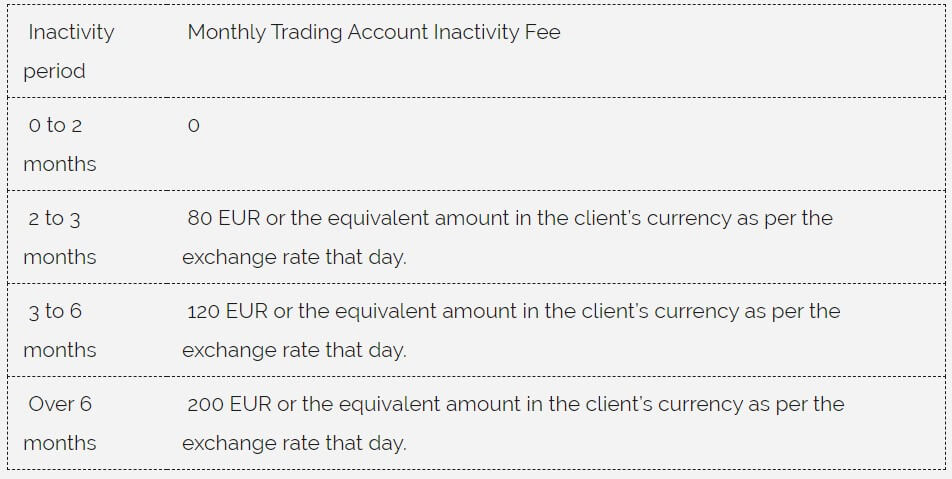

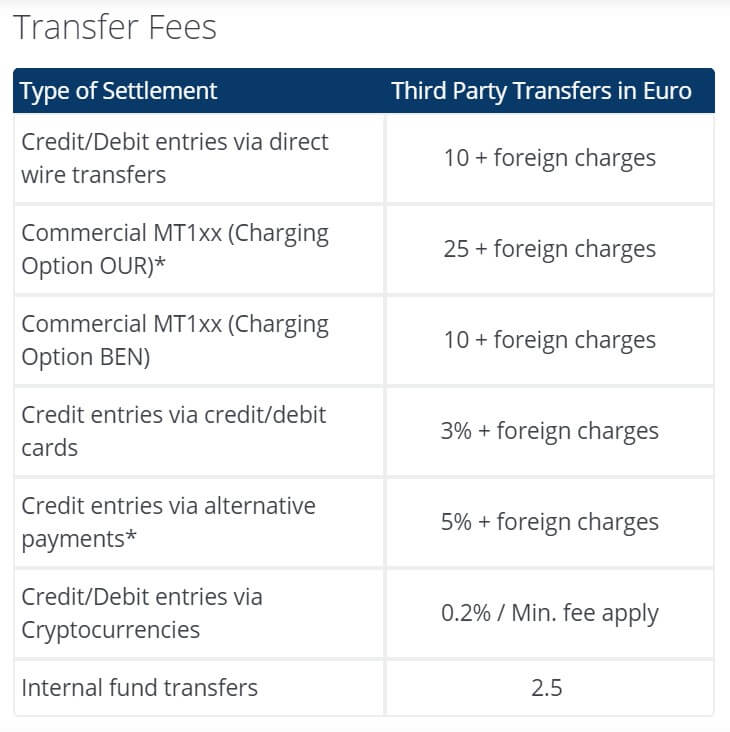

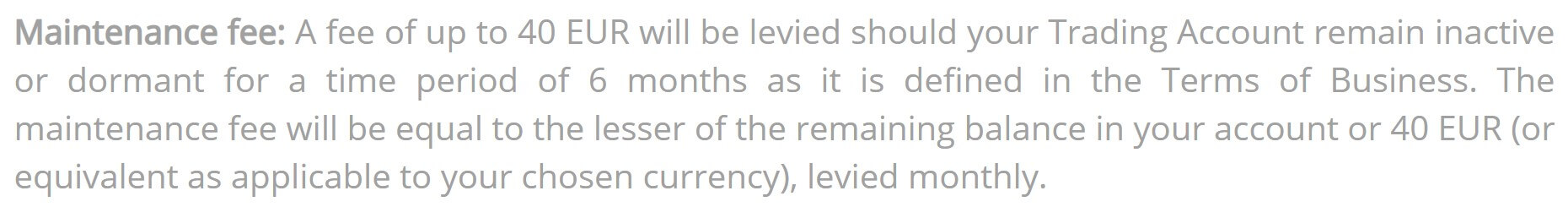

MINIMUM DEPOSIT Notwithstanding the above table, the Company reserves the right to charge a withdrawal fee equal to EUR 50. There is an inactivity fee. The monthly inactivity fee will increase as the total downtime increases:

Notwithstanding the above table, the Company reserves the right to charge a withdrawal fee equal to EUR 50. There is an inactivity fee. The monthly inactivity fee will increase as the total downtime increases:

Proper Trade has an area of educational tools and of interest to the trader. It has an economic news section, this is good for all traders who like to trade with fundamental. It also has a technical analysis area of several currency pairs. This is a positive aspect for all traders who want to have a different vision about these assets, and also to have investment ideas.

Proper Trade has an area of educational tools and of interest to the trader. It has an economic news section, this is good for all traders who like to trade with fundamental. It also has a technical analysis area of several currency pairs. This is a positive aspect for all traders who want to have a different vision about these assets, and also to have investment ideas.

Trading Costs

Trading Costs

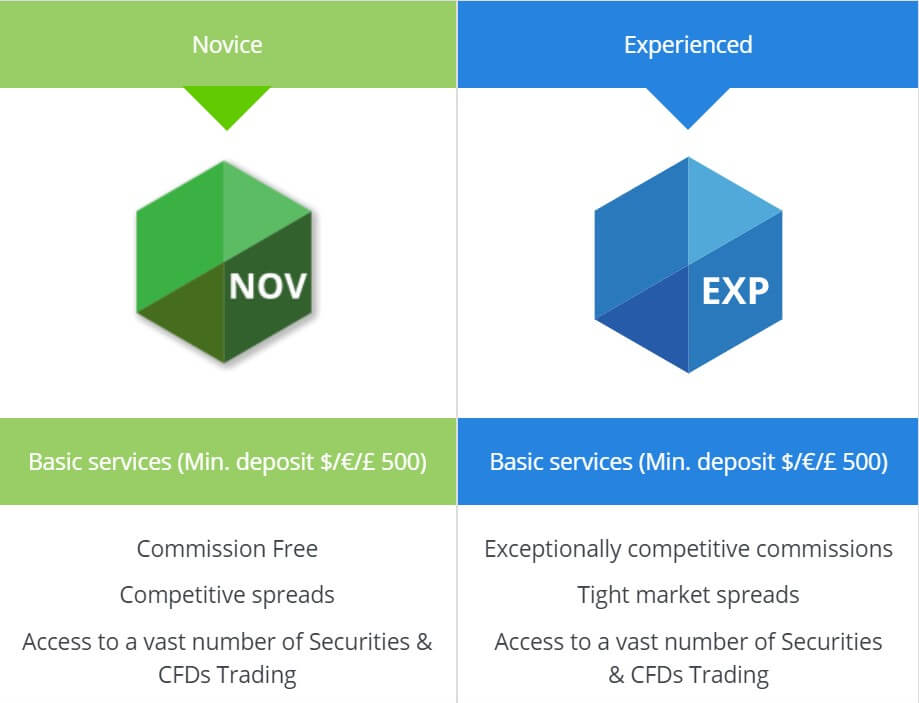

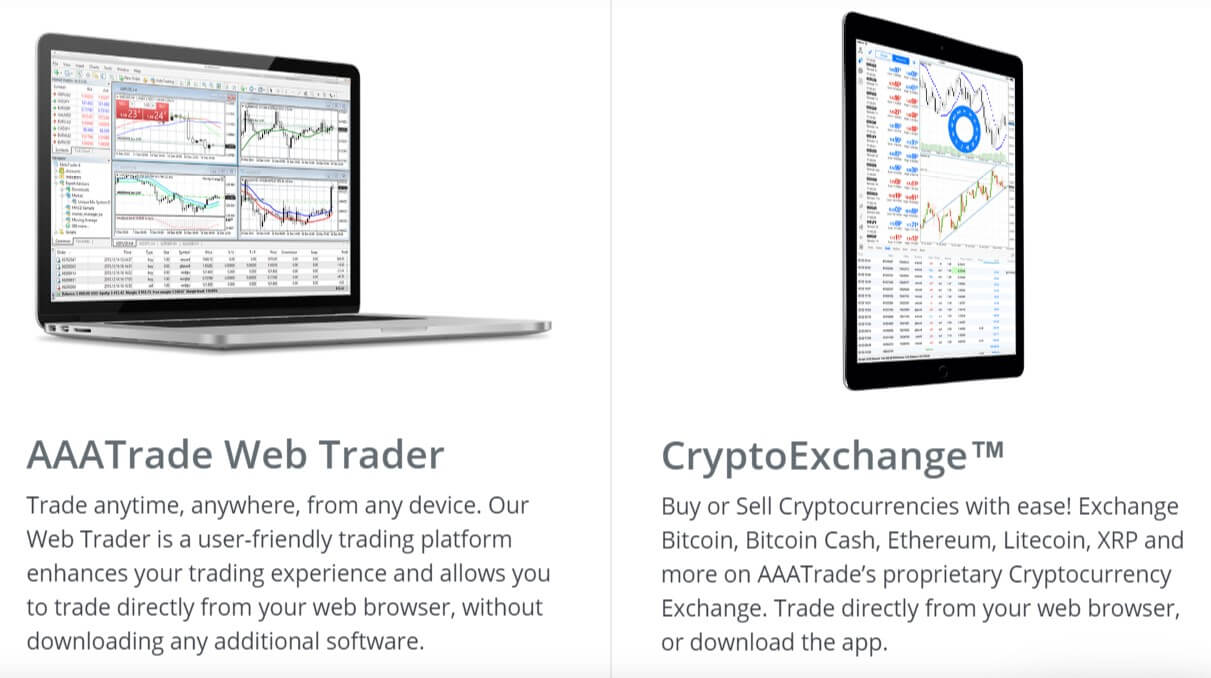

CryptoExchange Account

CryptoExchange Account

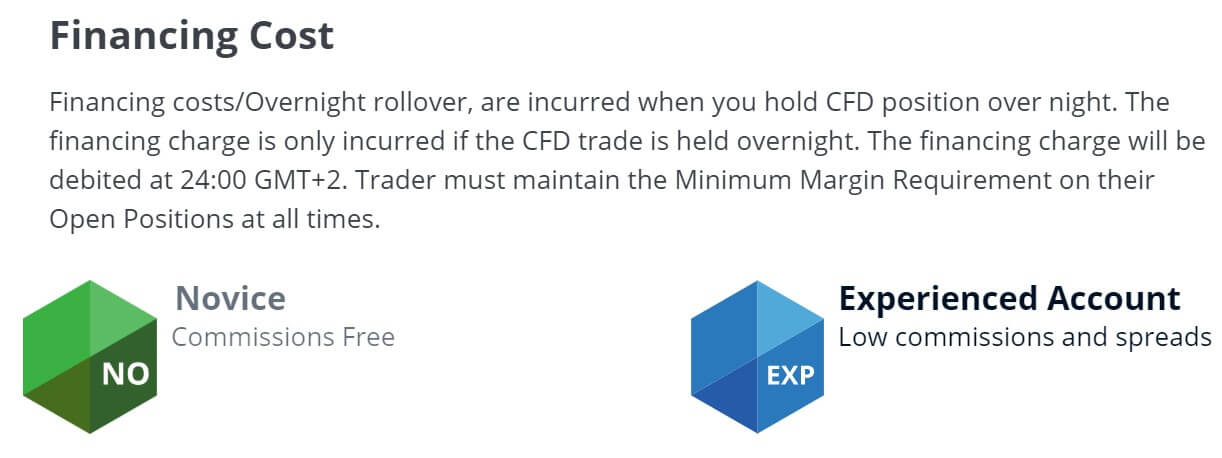

Trading Costs

Trading Costs

Bonuses & Promotions

Bonuses & Promotions

FXTF Live is another tool available only for live accounts and is purely made by the broker using the web service. FXTF Live is used for trade analysis, charting, position overview, ratio and other calculations, and position type filtering. It is complementary to the Mini Terminal tool. There is a long, dedicated page on how to use this tool along with practical applications.

FXTF Live is another tool available only for live accounts and is purely made by the broker using the web service. FXTF Live is used for trade analysis, charting, position overview, ratio and other calculations, and position type filtering. It is complementary to the Mini Terminal tool. There is a long, dedicated page on how to use this tool along with practical applications. Other highlighted indicators included in the package is the Span Mode and Super Bollinger developed by Toshihiko Masaki. The broker has published his biography, blog and his webinars on the trading system. The content has high quality and is deep into the subject, made for professionals but also appropriate for enthusiastic beginners.

Other highlighted indicators included in the package is the Span Mode and Super Bollinger developed by Toshihiko Masaki. The broker has published his biography, blog and his webinars on the trading system. The content has high quality and is deep into the subject, made for professionals but also appropriate for enthusiastic beginners.

Leverage

Leverage Forex Majors: AUDUSD, EURUSD, GBPUSD, NZDUSD, USDCAD, USDCH, FUSDJPY,

Forex Majors: AUDUSD, EURUSD, GBPUSD, NZDUSD, USDCAD, USDCH, FUSDJPY,

There are more than 80 forex pairs that are available to this broker’s account holders. Alchemy Markets’ selection includes major, minor, and

There are more than 80 forex pairs that are available to this broker’s account holders. Alchemy Markets’ selection includes major, minor, and

Educational & Trading Tools

Educational & Trading Tools

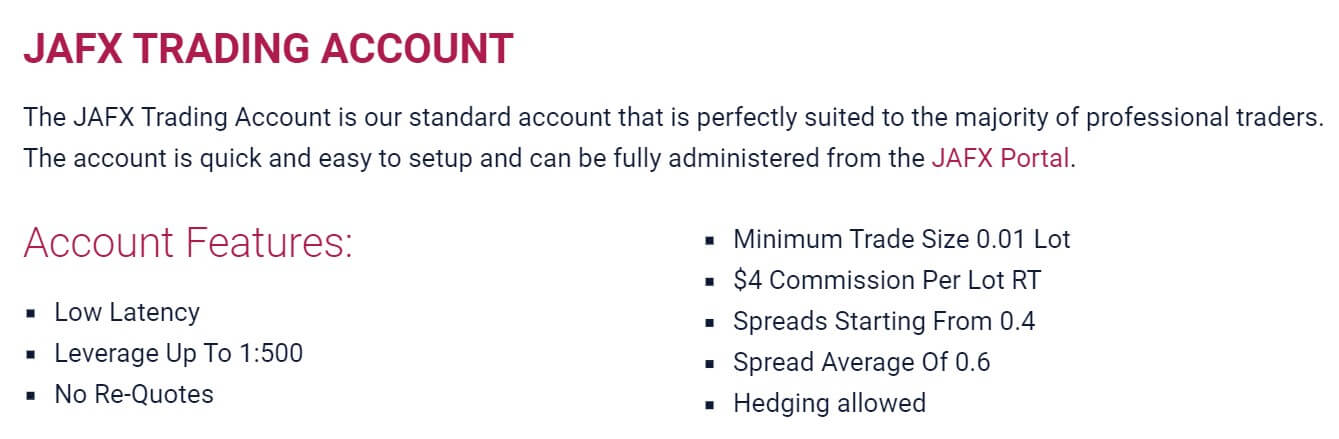

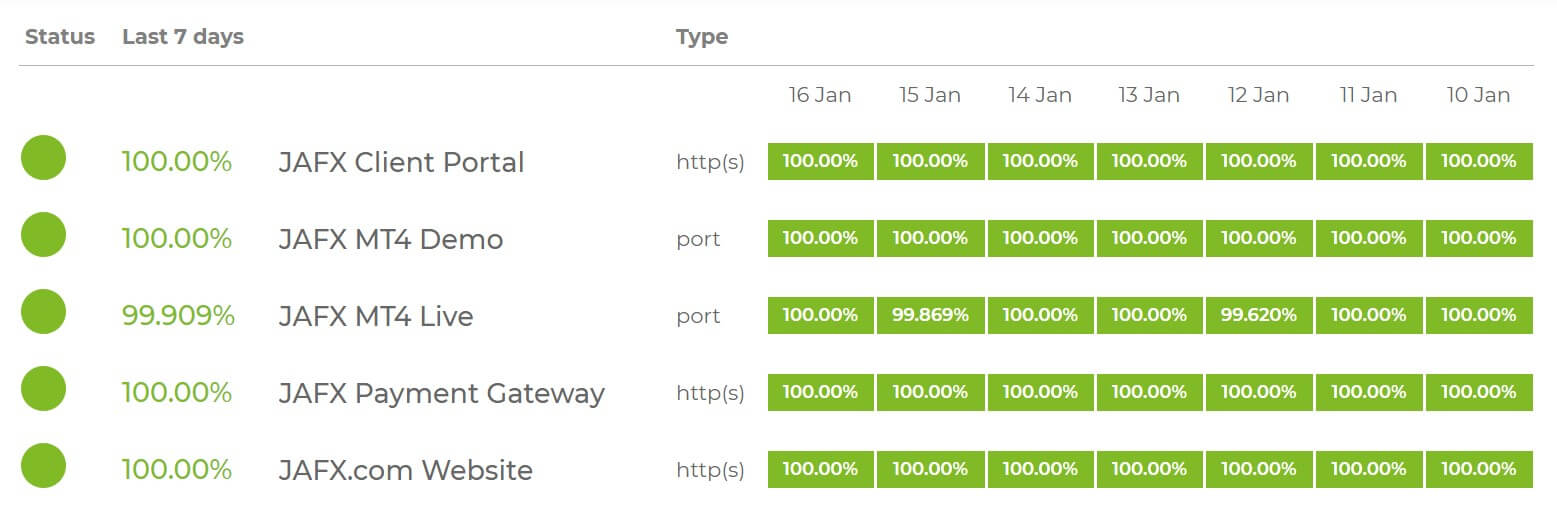

Same as with the deposits, the only method, for now, is the Bitcoin withdrawal. To withdraw your affiliate/IB commissions, it will first need to be transferred into your main trading account. JAFX cannot process withdrawals directly from affiliate/IB accounts. Of course, your account needs to be verified for withdrawals. Skrill or other e-wallets are not supported as stated by the JAFX staff.

Same as with the deposits, the only method, for now, is the Bitcoin withdrawal. To withdraw your affiliate/IB commissions, it will first need to be transferred into your main trading account. JAFX cannot process withdrawals directly from affiliate/IB accounts. Of course, your account needs to be verified for withdrawals. Skrill or other e-wallets are not supported as stated by the JAFX staff.

Equally as important, this platform’s software can be installed on Windows devices, iPhones, and Android smartphones. Regardless of which one you choose, the apps will allow you to manage your portfolio, place orders, and open/close positions. MT4’s software is also available to MacBook users. However, they have to first download an external app (for free) before installing MT4 on their Apple laptop or desktop device.

Equally as important, this platform’s software can be installed on Windows devices, iPhones, and Android smartphones. Regardless of which one you choose, the apps will allow you to manage your portfolio, place orders, and open/close positions. MT4’s software is also available to MacBook users. However, they have to first download an external app (for free) before installing MT4 on their Apple laptop or desktop device.

SG Global FX only highlights that their spreads are tight and incredibly competitive, without offering more details. They do, however, outline that their spreads are variable, which means that they change based on market conditions. Different forex pairs also have their own spreads. In general, the most liquid ones on the market, such as the EUR.USD, GBP.USD, and JPY.USD, tend to have the lower bid/ask price variations. Exotics, on the other hand, will have large spreads. However, this will almost always be the case when the markets are volatile and unstable, regardless of whether your traded currency is a major or exotic one.

SG Global FX only highlights that their spreads are tight and incredibly competitive, without offering more details. They do, however, outline that their spreads are variable, which means that they change based on market conditions. Different forex pairs also have their own spreads. In general, the most liquid ones on the market, such as the EUR.USD, GBP.USD, and JPY.USD, tend to have the lower bid/ask price variations. Exotics, on the other hand, will have large spreads. However, this will almost always be the case when the markets are volatile and unstable, regardless of whether your traded currency is a major or exotic one. Educational & Trading Tools

Educational & Trading Tools

Strangely enough, no information about the platform that VIP Way Zone utilizes is available on their website. In most cases, though, forex brokers will work with either MetaTrader 4 (MT4) or MetaTrader 5 (MT5). While the latter is a more modified version, both of the MetaTrader platforms come with valuable tools and resources, including technical indicators, several chart timeframes, live news feeds, and more.

Strangely enough, no information about the platform that VIP Way Zone utilizes is available on their website. In most cases, though, forex brokers will work with either MetaTrader 4 (MT4) or MetaTrader 5 (MT5). While the latter is a more modified version, both of the MetaTrader platforms come with valuable tools and resources, including technical indicators, several chart timeframes, live news feeds, and more.

Educational & Trading Tools

Educational & Trading Tools

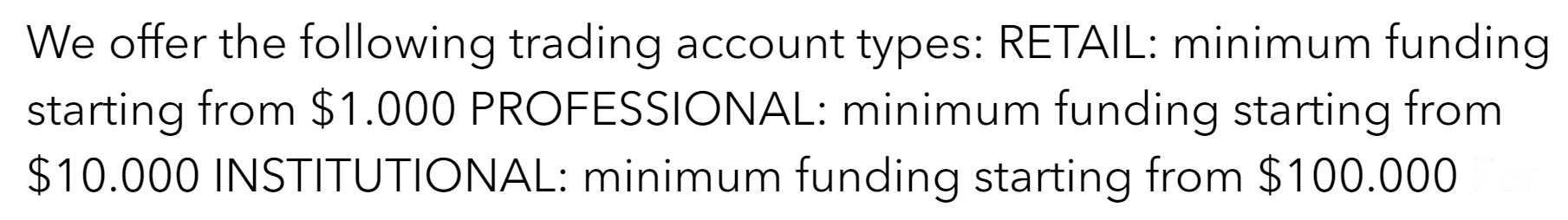

Moreover, even though AM Broker sets a maximum amount of lots per position, users of all three account types can buy/sell as many contracts as they like by breaking up each trade in smaller portions. For example, you want to trade 30 EUR.USD lots but the maximum is 10 per position. You can still open 3 different positions, with each of them being 10 lots in size, in order to exchange 30 lots.

Moreover, even though AM Broker sets a maximum amount of lots per position, users of all three account types can buy/sell as many contracts as they like by breaking up each trade in smaller portions. For example, you want to trade 30 EUR.USD lots but the maximum is 10 per position. You can still open 3 different positions, with each of them being 10 lots in size, in order to exchange 30 lots.

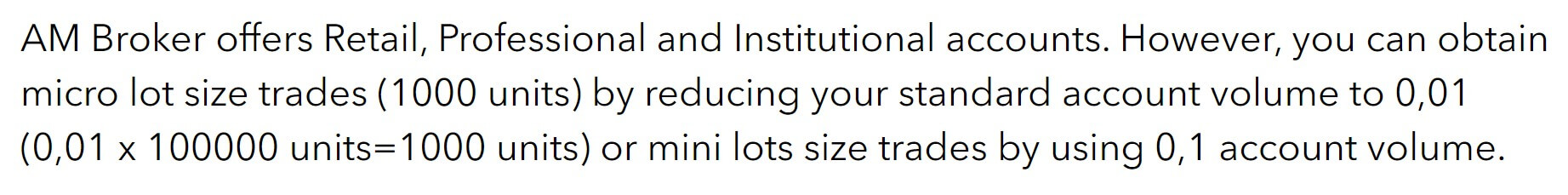

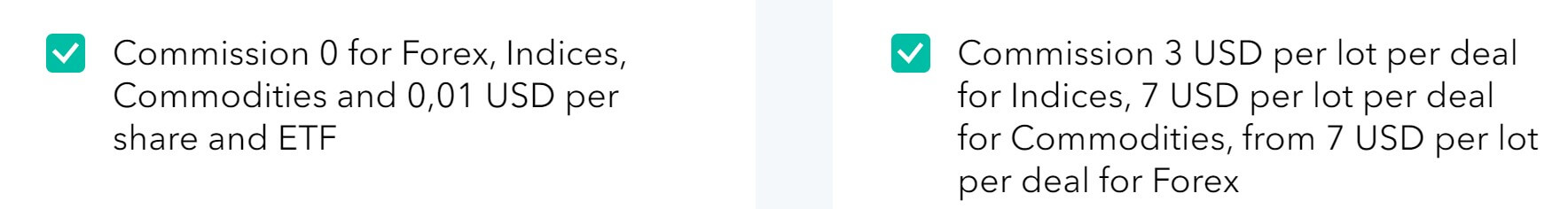

You can trade forex pairs, commodities, market indices, shares, and ETFs through AM Broker. For that matter, this firm provides you with almost 100 different currencies. In most cases, brokers will offer around 40 pairs or, if they’re more competitive, up to 80. To put it shortly, AM Broker’s 100-currency list is incredibly advantageous. Meanwhile, account holders can also buy/sell different types of commodities, including precious metals (gold and silver) and energies (Crude and Brent oil). The indices include each of the three major U.S indexes (the Dow, S&P 500, and Nasdaq), as well as those of European markets (like the UK’s FTSE 100 and Germany’s

You can trade forex pairs, commodities, market indices, shares, and ETFs through AM Broker. For that matter, this firm provides you with almost 100 different currencies. In most cases, brokers will offer around 40 pairs or, if they’re more competitive, up to 80. To put it shortly, AM Broker’s 100-currency list is incredibly advantageous. Meanwhile, account holders can also buy/sell different types of commodities, including precious metals (gold and silver) and energies (Crude and Brent oil). The indices include each of the three major U.S indexes (the Dow, S&P 500, and Nasdaq), as well as those of European markets (like the UK’s FTSE 100 and Germany’s

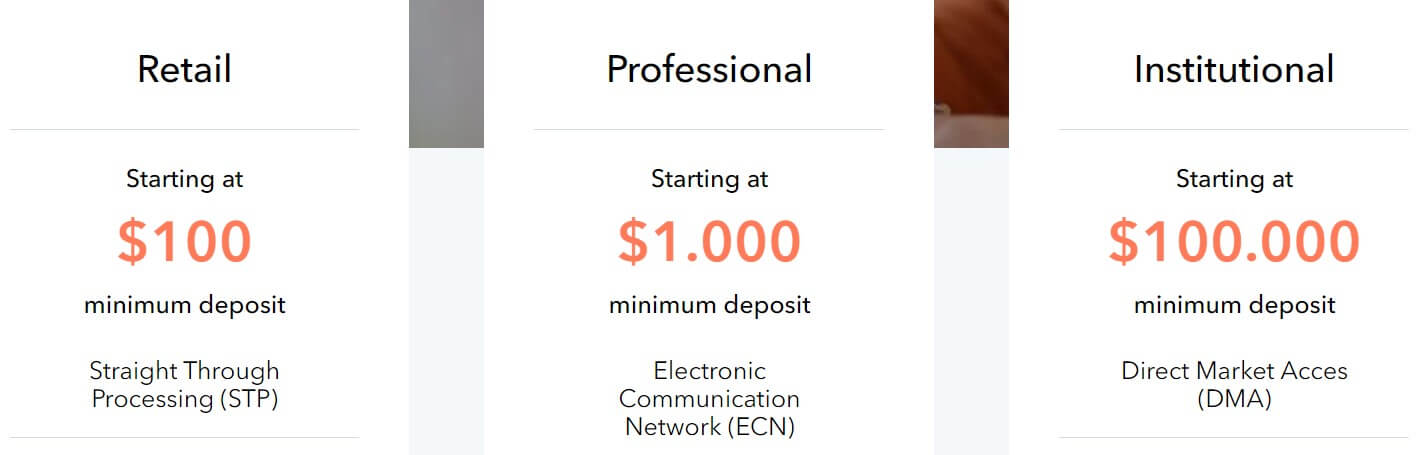

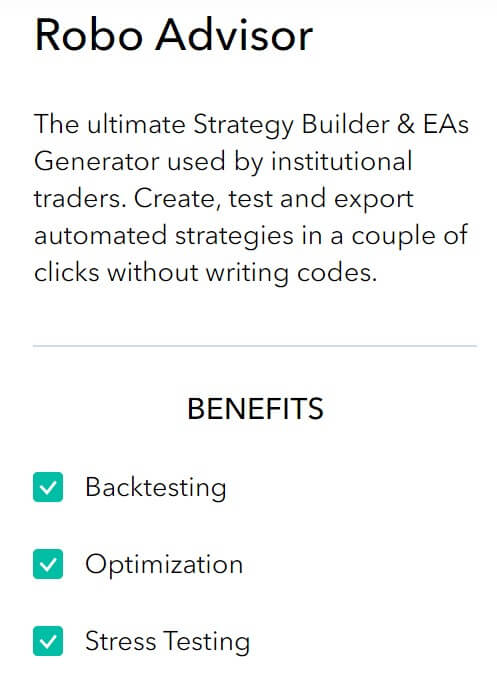

This broker will soon start offering online courses and video seminars. In the meantime, whether you have the Professional, Retail, or Institutional type, your portfolio comes with a Professional Account Manager that provides you with one-on-one training sessions. They also help traders understand how to use and take advantage of the different tools on the MT5 platform.

This broker will soon start offering online courses and video seminars. In the meantime, whether you have the Professional, Retail, or Institutional type, your portfolio comes with a Professional Account Manager that provides you with one-on-one training sessions. They also help traders understand how to use and take advantage of the different tools on the MT5 platform.

Assets

Assets

Leverage

Leverage

MetaTrader 5 (MT5) is a state-of-the-art and sophisticated platform that forex traders from all around the world utilize. There are several features that make MT5 especially desirable. First, the platform’s tools and displays are incredibly easy to use. Second, their prices and order executions are both accurate and instant. Third, you can integrate many technical indicators and analyze several chart timeframes on the platform. Lastly, but certainly not least, all types of financial instruments are available on MT5. Above all else, you can download the platform on any device (including smartphones) or directly trade through your browser.

MetaTrader 5 (MT5) is a state-of-the-art and sophisticated platform that forex traders from all around the world utilize. There are several features that make MT5 especially desirable. First, the platform’s tools and displays are incredibly easy to use. Second, their prices and order executions are both accurate and instant. Third, you can integrate many technical indicators and analyze several chart timeframes on the platform. Lastly, but certainly not least, all types of financial instruments are available on MT5. Above all else, you can download the platform on any device (including smartphones) or directly trade through your browser.

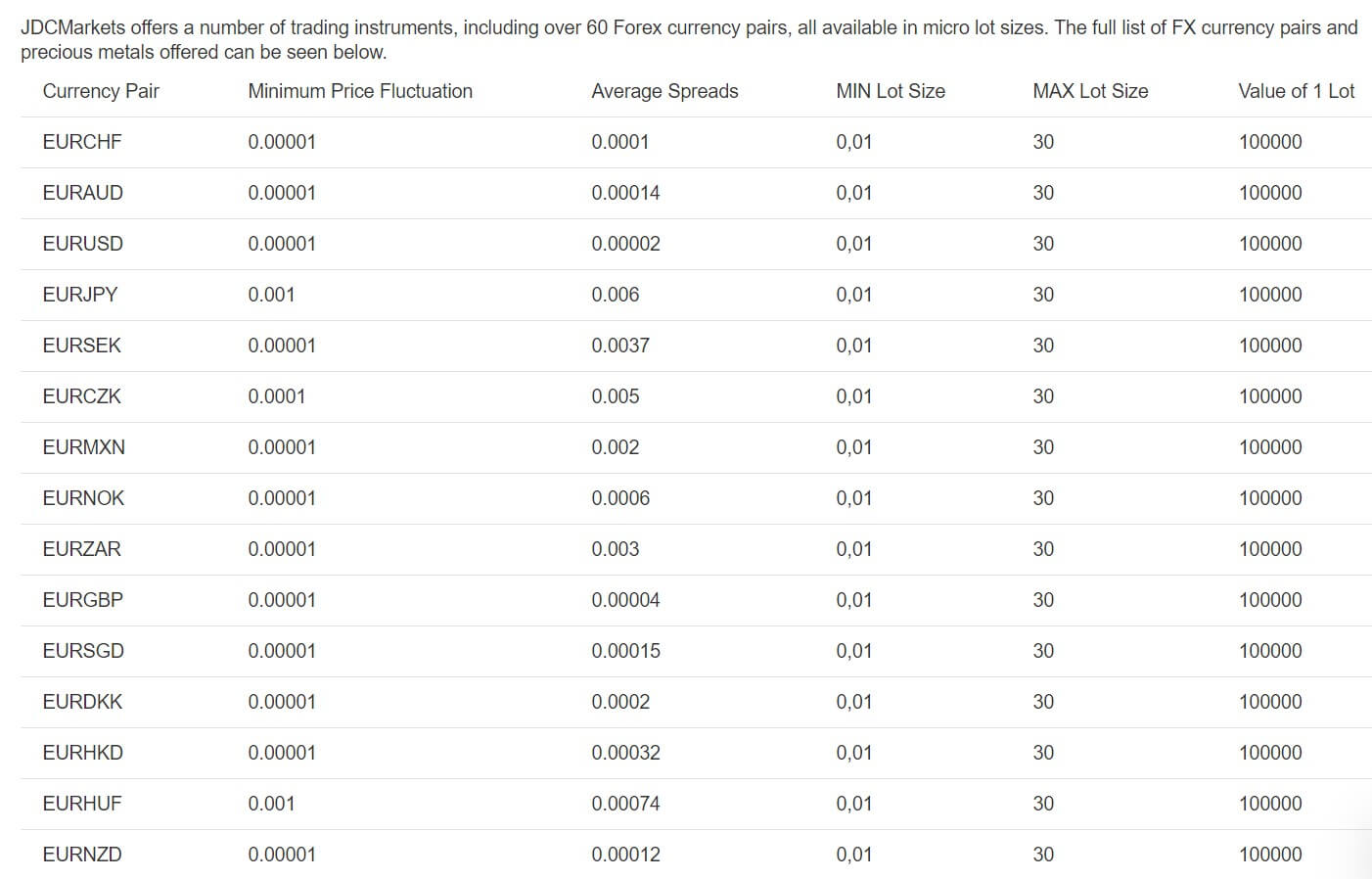

Meanwhile, the main downsides are as follows: A very small leverage, limited transfer options, the lack of trading tools, and country restrictions. Having said all that, this broker is continuing to expand and improve its offerings. For a start, they plan on introducing new payment methods, making their inclusive forex and asset selection even more accessible and lucrative. Support is also reliable and can be contacted through a variety of methods. Even if the firm’s educational content doesn’t suffice, you can still get plenty of advice and consultations from both JDC Markets’s team and MT5’s experienced specialists. Moreover, opening an account and meeting the minimum deposit requirement is certainly doable.

Meanwhile, the main downsides are as follows: A very small leverage, limited transfer options, the lack of trading tools, and country restrictions. Having said all that, this broker is continuing to expand and improve its offerings. For a start, they plan on introducing new payment methods, making their inclusive forex and asset selection even more accessible and lucrative. Support is also reliable and can be contacted through a variety of methods. Even if the firm’s educational content doesn’t suffice, you can still get plenty of advice and consultations from both JDC Markets’s team and MT5’s experienced specialists. Moreover, opening an account and meeting the minimum deposit requirement is certainly doable.