NPBFX is a forex broker specializing in trading products. They have been on the forex markets since 1996 and rebranded in 2016 to offer their services to the world. Offering their services to all client types NPBFX boast their main selling points as being on the markets since 1996, having a customer-focused service model, fast and high-quality transaction processing, having a compensation fund, a high-quality analytical portal, offering the best trading platforms and more. Throughout this review, we will be looking into the different services on offer to see how they rank next to the competition.

Account Types

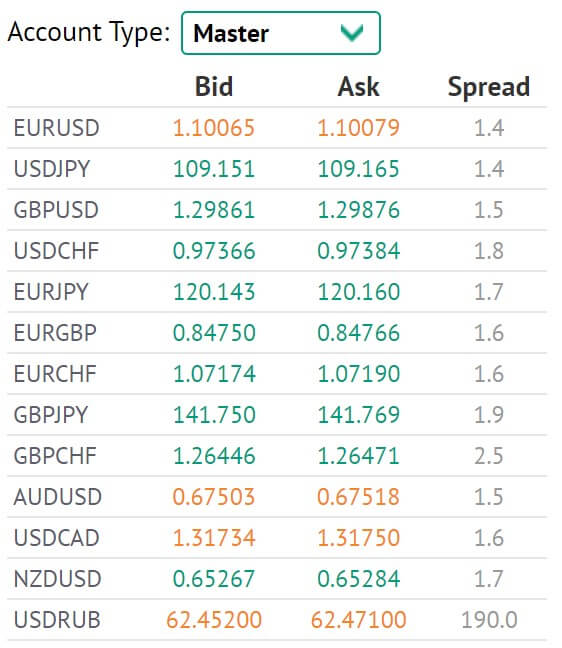

There are three different account son offer, they each have different requirements and features, however, they also share a lot of them, so we have outlined the similarities and differences below.

All Accounts: All three accounts have access to MetaTrader 4, 38 currency pairs, gold, silver oil and natural gas to trade. Thre is no added commission on any of the accounts and the base currency can be in USD, EUR or RUB. All accounts use STP execution and automated trading with expert advisors is allowed. All accounts shave swap fees, however, swap-free versions are also available, hedging is also allowed, and the stop out level for all accounts is set at 30%.

Master Account: The master account requires a minimum deposit of 10 USD, 10 EUr or 500 RUB. Its minimum trade size is 0.01 lots with increments of 0.01 lots. It has spread from 0.8 pips with an average of 1.2 pips and the leverage is up to 1:1000.

Expert Account: This account requires a minimum deposit of 5000 USD, 5000 EUR or 300,000 RUB./ It has a spread starting from 0.6 pips and an average spread of around 1 pip. Its trades start at 1 lot and go up in increments of 0.1 lots, the account has leverage up to 1:200.

VIP Account: This is the top tier account, it has a deposit requirement of 50,000 USD, 50,000 EUR or 3,000,000 RUB. It comes with a spread starting from 0.4 pips but with an average of 0.8 pips. Trade sizes start at 1 lot and go up in increments of 0.1 lots, the account also comes with a maximum leverage of 1:200.

Platforms

There are two different styles of the platform, a normal trading platform in the form of MetaTrader 4 and then social trading in the form of ZuluTrade and MyFXBook, so let’s see what each offers.

MetaTrader 4 (MT4): MetaTrader 4 is among the most widely used electronic trading and analytical platforms in the world. MetaTrader 4 provides end-users with advanced professional functionality, control over their trading account, price chart analysis, and Forex strategy development. MT4 also offers fully automated instant transactions, with transaction output taking place within the interbank foreign exchange market via STP/NDD technology. Users will further benefit from the ability to hedge, make use of Expert Advisors, and access financial news tape directly from Dow Jones Newswires in real-time.

Social Trading: There are two different social trading platforms available, ZuluTrade and MyFXBook. ZuluTrade is the world-leading online and mobile Social Trading platform. ZuluTrade enables users to locate successful traders that are ranked by ZuluRank, a proprietary performance evaluation algorithm, and follow their trades which are translated into real trades in their own broker accounts.

Users can fully manage their accounts via a customizable account management suite that is equipped with advanced risk management features such as ZuluGuard, a shield against volatile trading strategies. MyFXBook AutoTrade is one of the most advanced copy trading (mirror trading) platforms around with a sophisticated and intuitive web interface. Just as with Myfxbook’s service, AutoTrade is designed from the grounds up to be the most innovative, feature-rich and in the same time user-friendly platform for mirror trading.

Leverage

The leverage that you get depends on the account you are using, the Master account can be leveraged all the way up to 1:100o which is a little high, we would recommend not going over 1:500. The Expert and VIP accounts have a maximum leverages of 1:200. Leverage can be selected when opening up an account and can be changed on an already open account by contacting the customer service team with the request.

Trade Sizes

The trading sizes are also dependant on the account you are using. The Master account has trade sizes that start from 0.01 lots (micro lot) and they go up in increments of 0.01 lots. The Expert and VIP accounts have trade sizes starting from 1 lot and they go up in increments of 0.1 lots.

We do not know what the maximum trade size is but would recommend not trading over 50 lots in a single trade, we are also not sure what the maximum number of open trades allowed is.

Trading Costs

There are no added commissions on any of the accounts as they use a spread based system that we will look into later in this review. There are swap charges on all accounts which are charged for holding trades overnight and can be viewed within the MetaTrader 4 trading platform, Islamic swap-free accounts are available though.

Assets

The assets and instruments on NPBFX have been broken down into 4 different categories, we will briefly look through them to see what is on offer.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURRUB, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDDKK, USDHKD, USDJPY, USDMXN, USDNOK, USDRUB, USDSEK, SUDSGD, USDTRY and, USDZAR.

Metals: Gold and Silver, both tradable against USD.

CFD: Brent Crude Oil, WTI Crude Oil and, Natural Gas.

Crypto: Bitcoin Cash, Bitcoin, Dashcoin, Ethereum, Litecoin, and Ripple. All tradable against USD.

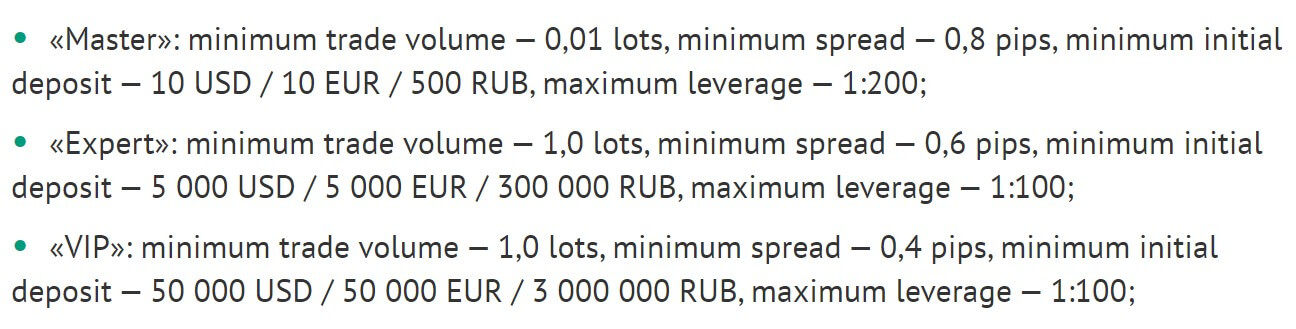

Spreads

The minimum spread depends on the account that you use, they are as follows.

- Master: From 0.8 pips (average 1.2 pips)

- Expert: From 0.6 pips (average 1 pip)

- VIP: From 0.4 pips (average 0.8 pips)

The spreads are variable which means they move with the markets so when there is added volatility the spreads will be seen higher. Different instruments will also have different spreads, for example, EURUSD will always be lower than USDZAR.

Minimum Deposit

The minimum deposit required to open an account is 10 SUD, 10 EUR or 500 RUB which will allow you to open the Master account.

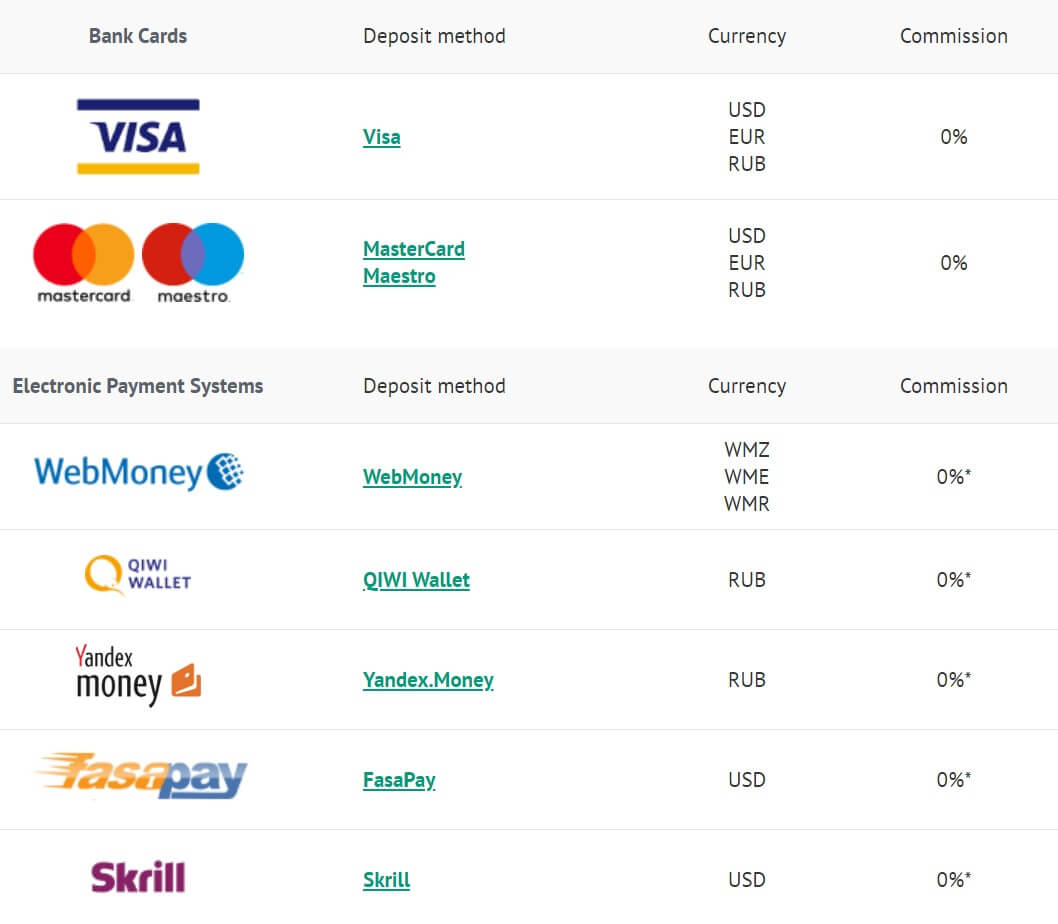

Deposit Methods & Costs

There are plenty of ways to deposit funds into NPBFX, including Visa, MasterCard, Maestro, WebMoney, QIWI Wallet, Yandex Money, Fasapay, Skrill, Neteller, Ngan Luong, Bank Wire Transfer and then there are a whole host of different local bank transfers. There are no added fees for depositing, however, you should check with your bank or card issuer to see if they add any transfer fees of their own.

Withdrawal Methods & Costs

The same methods are available to withdraw to apart from some of the local bank transfers, for clarification, the methods available are Visa, MasterCard, Maestro, WebMoney, QIWI Wallet, Yandex Money, Fasapay, Skrill, Neteller, Ngan Luong, Bank Wire Transfer, and a few local bank transfers.

The same methods are available to withdraw to apart from some of the local bank transfers, for clarification, the methods available are Visa, MasterCard, Maestro, WebMoney, QIWI Wallet, Yandex Money, Fasapay, Skrill, Neteller, Ngan Luong, Bank Wire Transfer, and a few local bank transfers.

Just as with deposits there are no added commissions apart from Bank Wire Transfer, there is a 100 EUR withdrawal fee which is very steep and so you should try to avoid this method if possible.

Withdrawal Processing & Wait Time

We do not know the processing times from NPBFX, however, depending on the method used you can expect processing to take between 1 to 5 working days.

Bonuses & Promotions

There are two main promotions currently on offer, lets briefly look at what they are.

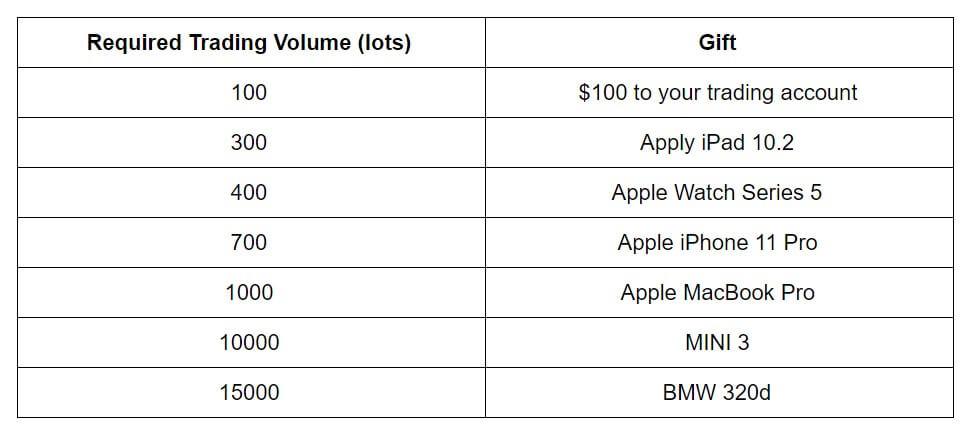

Loyalty Program: The following gifts are available when trading the required volume…

60% Cashback: You can receive up to 60% of the spreads as cashback (up to $7 per lot traded). The cashback is fully withdrawable and there is a maximum cashback of 10,000 per month. EAs and scalping are allowed.

Educational & Trading Tools

There is an Analytical Portal on the website, this offers clients the chance to revive things like trading signals, weekly review videos, training materials, calendars, and calculators, as well as the opportunity to talk with an analyst. There is a calculator available for all for working out costs and profits. We are unable to see the majority of the education as we do not have an account on the analytics portal to check.

There is an Analytical Portal on the website, this offers clients the chance to revive things like trading signals, weekly review videos, training materials, calendars, and calculators, as well as the opportunity to talk with an analyst. There is a calculator available for all for working out costs and profits. We are unable to see the majority of the education as we do not have an account on the analytics portal to check.

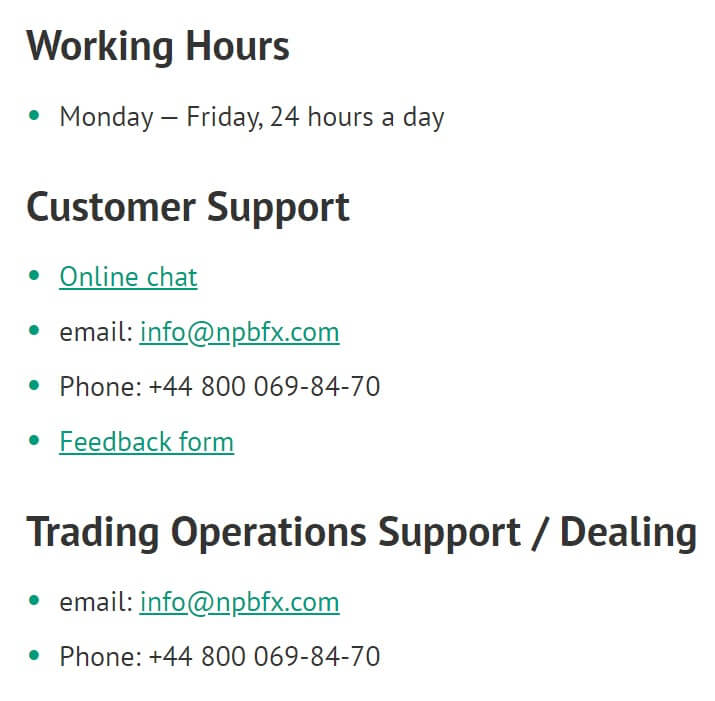

Customer Service

There are plenty of ways to get in touch, the customer service team works 24 hours a day from Monday to Friday. There is an online chat system as well as email and phone numbers of various different departments.

Customer Support:

Email: info:npbfx.com

Phone: +44 800 069-84-70

The same email and phone are also used for trading operation support and non-trading operations support.

Address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, Saint Vincent and the Grenadines

Demo Account

Demo accounts are available, and you can open one by filling in a short form. The accounts allow you to trade on the Forex without risk of losing real money, learn the trading platform and gain experience of making deals, test trading strategies using real market prices, read the terms of service, check prices and spreads. It is not clear which account type the demo mimics or if there is an expiration time on the accounts.

Countries Accepted

The following statement is present at the bottom of the NPBFX website: “NPBFX does not provide services for Canada and United States residents.” If you are not sure of your eligibility for an account, you should get in contact with the customer service team to find out prior to signing up.

Conclusion

The trading conditions on offer from NPBFX seem to be quite competitive and in line with the competition. The spreads are appropriate for an account that does not have any added commission and there are enough assets to keep you busy, however, it would be nice to see some more indices and commodities. There are also plenty of ways to deposit and withdraw, with no added fees, however, if using bank wire transfer you may want to look elsewhere as the 100 EUR withdrawal fee is a little too high for us.