LeoPrime is a forex and commodities broker offering a range of products to both retail and institutional clients. The main ethos is to be transparent, cost-effective, to have a strategy and to offer the best technology available. In this review, we will be looking at the services being offered to see if they have achieved these goals and so you can decide if they are the right broker for you.

Account Types

There are three main accounts on offer should you sign up with LeoPrime, these are the Cent, Classic and ECN accounts, each having their own requirements and features, so let’s see what they are.

Cent: The Cent account has a minimum deposit requirement of $10. It has spread starting from 1.6 pips and there is no additional commission on the account. Leverage can be as high as 1:1000 and it currently uses the MetaTrader 4 trading platform. Minimum trade sizes start from 0.01 lots and the margin call level is set at 50% with the stop out being 30%, there is no swap-free version of this account and there are 35 currency pairs, gold, silver, crude and indices available to trade.

Classic: The classic account also has a minimum deposit requirement of $10, tt has spreads starting from 1.6 pips and there is no additional commission on the account. Leverage can be as high as 1:1000 and it currently uses the MetaTrader 4 trading platform. Minimum trade sizes start from 0.01 lots and the margin call level is set at 50% with the stop out being 30%, there is a swap-free version of this account should you need it and there are 35 currency pairs, gold, silver, crude, 4 cryptos and indices available to trade.

ECN: The ECN account requires a minimum deposit of $1,000. It has spreads starting as low as 0.1 pips and due to this, there is a commission of $6 per lot traded. Leverage can go up to 1:200 and trade sizes start from 0.01 lots, the account uses the MetaTrader 4 trading platform and there is no maximum trade size. The margin call level is set at 50% with the stop out level set at 30%, there is a swap-free version of this account if it is needed and it can35 currency pairs, gold, silver, crude and indices available to trade.

Platforms

LeoPrime currently offers one platform, MetaTrader 4, however, they have a second platform from the MetaQuotes company coming soon. MT4 is provided for both Windows PC and Mac, while also being offered in app form for Android and iOS systems. MetaTrader is a powerful and convenient tool for both technical analysis and trading round-the-clock within the markets. Obtain access to live asset price data from the forex market from within the platform. The platform offers 3 chart types and 9 timeframes (periods), along with with real-time symbol quotes, and a connection to 2000+ broker servers.

Leverage

The maximum leverage available depends on the account that you use, the Cent and Classic account can be leveraged up to 1:1000, the ECN account can have leverage up to 1:200. The leverage available also depends on the account balance:

Trade Sizes

Trade sizes start from 0.01 lots which are known as micro-lots, they then go up in increments of 0.01 lots so the next trade will be 0.02 lots and then 0.03 lots. There is no maximum trade size, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

Trading Costs

The ECN account comes with an added commission of $6 per lot traded which is in line with the industry standard of $6, all other accounts do not have any added commission as they use a spread based system.

If you are using a normal account then there are also swap fees, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice. If an account is in swap free mode then there are no charges for holding the trade overnight.

Assets

LeoPrime has broken down their assets into 5 different categories, let’s go through and see what sort of instruments are available for trading.

Forex: There are 35+ currency pairs available, some of them include AUDUSD, CADJPY, EURSGD, EURUSD, GBPUSD, EURNOK, GBPJPY, NZDCHF, USDMXN and, EURPLN

Forex: There are 35+ currency pairs available, some of them include AUDUSD, CADJPY, EURSGD, EURUSD, GBPUSD, EURNOK, GBPJPY, NZDCHF, USDMXN and, EURPLN

Spot Metals: Gold and Silver

Cryptocurrencies: Bitcoin, Ethereum, Litecoin, Ripple

Energies: Crude Oil, Natural Gas

Indices: France 409, German 30, Dow Jones, S&P 500, Nasdaq 100, FTSE 100

Spreads

Spreads depend on son a number of different factors, the first being the account that you are using when using the Cent or Classic account spreads will start from around 1.6 pips, while on the ECN account they will start from around 0.1 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 1.6 pips, other assets like GBPJPY may start slightly higher, in this case, 2.9 pips.

Minimum Deposit

The minimum amount required to open an account is $10 which gets you the Cent or Classic account, if you want an ECN account then you will need to deposit at least $1,000.

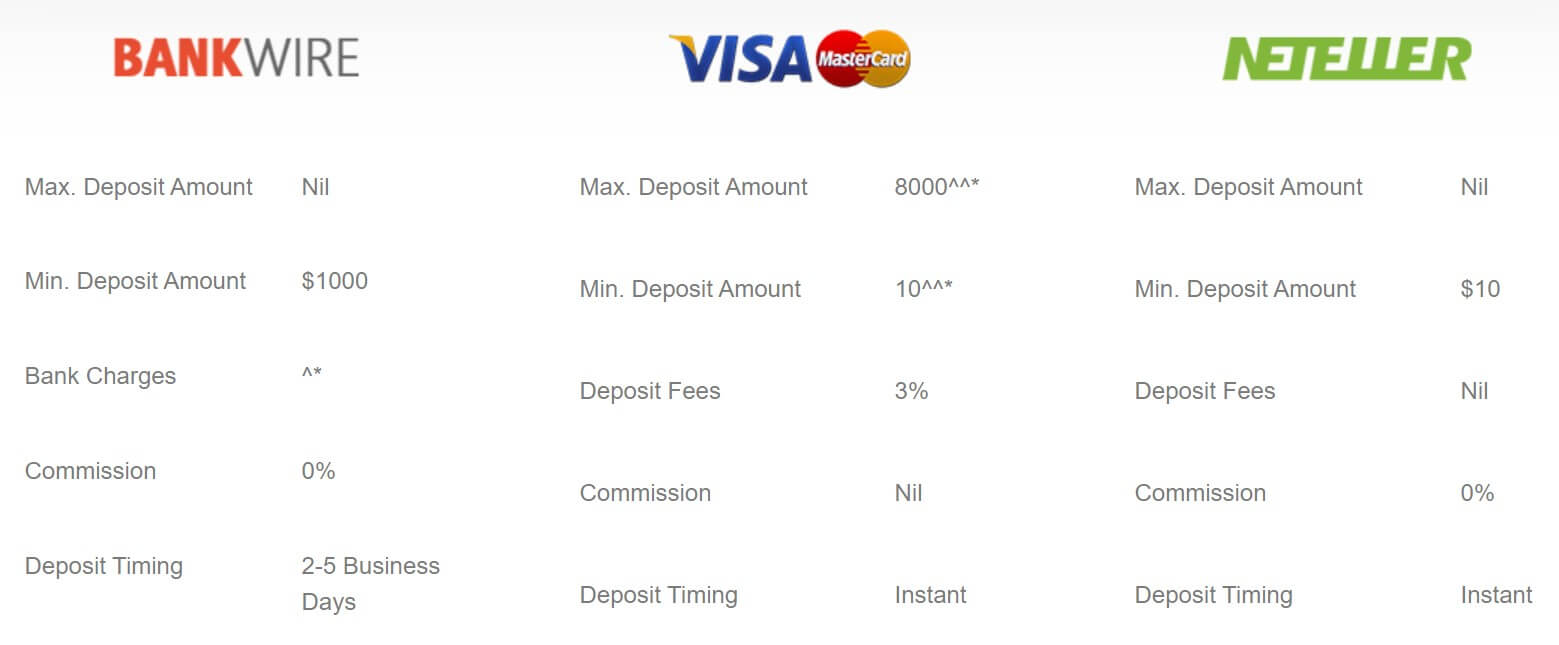

Deposit Methods & Costs

There are a number of different deposit methods available, we have listed them below along with the minimum amount possible to deposit and any fees that may be charged.

- Bank Wire – $1,000 – Bank Fees

- Visa / MasterCard – $150 – 3% Fee

- Neteller – $10 – No Fee

- Skrill – $10 – No Fee

- Perfect Money – $10 – No Fee

- Bitcoin – $10 – No Fee

- Fasapay – $10 – No Fee

- Malaysia Bank – $15 – No Fee

- Indonesia Bank – $15 – No Fee

- Thailand Bank – $20 – No Fee

- Vietnam Bank – $15 – No Fee

- WebMoney – $10 – No Fee

Withdrawal Methods & Costs

Not quite as many ways to withdraw, we have outlined them below along with the minimum withdrawal and any fees charged.

- Bank Wire – $1,000 – Bank Fees

- Neteller – $10 – No Fee

- Skrill – $10 – No Fee

- Perfect Money – $10 – No Fee

- Malaysia Bank – $15 – No Fee

- Indonesia Bank – $15 – No Fee

- Thailand Bank – $20 – No Fee

- Vietnam Bank – $15 – No Fee

- WebMoney – $10 – No Fee

Withdrawal Processing & Wait Time

Processing of withdrawal requests will take no longer than 24 hours, after this time the amount of time it takes will depend on the method used and could take between 1 to 5 business days to be accessible in your account.

Bonuses & Promotions

The main bonus available is a 25% extra welcome bonus, this bonus is only for the Classic account, however, there is not much information about the actual promotion, just that you can receive up to 25% extra when depositing. We do not know the terms of how to convert these funds into real funds if you even can.

Educational & Trading Tools

Educational & Trading Tools

The educational side of the site is a simple blog but it hasn’t been updated since April 2019 (at the time of writing this review). There are a few additional tools including an economic calendar that details any upcoming news events and which markets they may be affecting. There is also a calculator for helping work out trade sizes. There is some technical analysis that is being updated daily to help give ideas of potential trades and finally, there is a VPS on offer, you can get it free as long as you have an account with over $1,000.

Customer Service

If you need to get in contact with the customer service team you can 24/5. There is an online submissions form to fill in and you should get a reply via email, there are also phone numbers and email addresses for client support and for compliance support.

Demo Account

Demo accounts are available and come with the following features:

- Available for free on Metatrader 4

- An initial available balance of $1,000

- Safe, secure, and ultra-fast transactions

- Account valid for 90 days

- Create up to 8 separate demo accounts

Countries Accepted

The following statement is present on the website: “Leo Prime Services Limited does not offer its services to the residents of certain jurisdictions such as USA, Belgium, North Korea, France, Australia, Israel, and Japan.” If you are unsure of your eligibility, make sure to get in contact with the customer service team to check.

Conclusion

LeoPrime seems like a well thought out and competent broker. They offer a range of trading conditions which can be seen to be quite competitive. Plenty of assets available, however, more indices would have been nice. Deposit methods are plentiful and the majority have no added fees. We see no reasons as to why you should avoid LeoPrime but if they are the right broker for you, is your choice.