This is an old brand that is mostly focused on Spanish speaking clients and having a specific approach to investing and trading. DIF Broker wants to be different on how the business is handled, offering and promoting alternative solutions than what we usually see for the brokerage houses. DIF Broker started in Portugal in 1999 and slowly going up the ladder to try to differentiate at all costs.

The company is transparent on its beginnings, location, business practice, and the product range. This is also something normal for broker under the MiFID II and EEA, but the content with DIF broker is different in both ways, good and bad. The website is designed with a good balance between style and professionalism, but the usual visitor might get lost in all the atypical information. They seek information on trading conditions, bonuses, leverage, spreads, assets, and similar basics.

DIF Broker has products that will not directly answer these questions but instead, you will need to research what the offer is. There is no content towards the trading conditions description nor any account types to compare. DIF Broker services seem to be centered on Managed Investment solutions. As such, the broker found the need to have their platform to integrate their services.

As for the regulation, the broker has many allowances to do business in the UK (FCA registration), Germany (BaFin), Italy (Consob), Netherlands (AFM), Poland (KNF), Portugal (CMVM), France (Bank France), Spain (CNMV), and is a member of Indemnity System for Investors (SII), a kind of protection fund similar to CySEC ICF and FCA FSCS. Based on the website, promotion, and content, we can see that DIF Broker is oriented on mid to long term investments alternative to banks and other, lower gain institutions. This idea is supported by content that induces trust and safety in visitors.

This DIF Broker review will reveal what is beneath the services for traders by putting aside anything redundant and show the pure trading value.

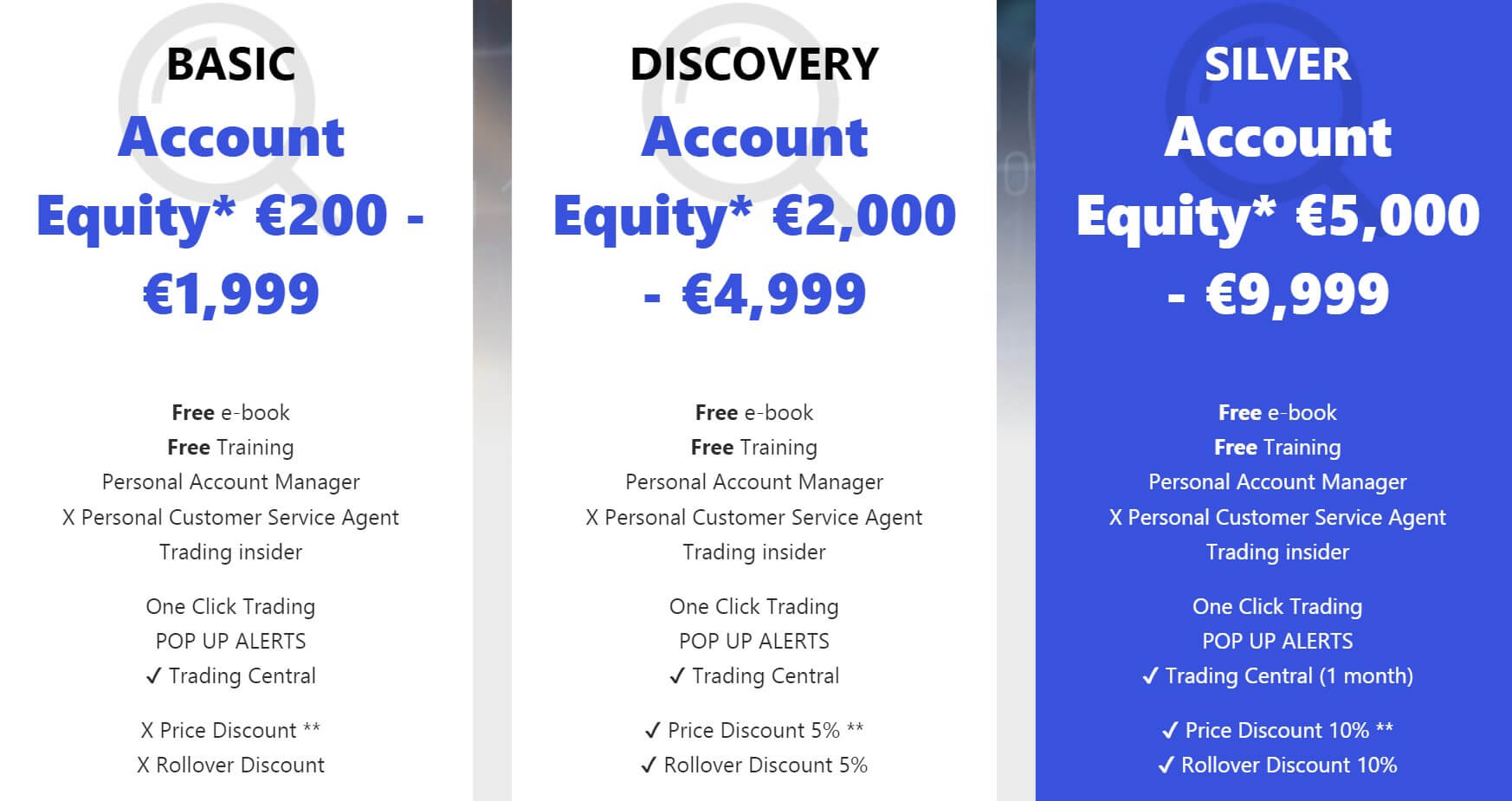

Account Types

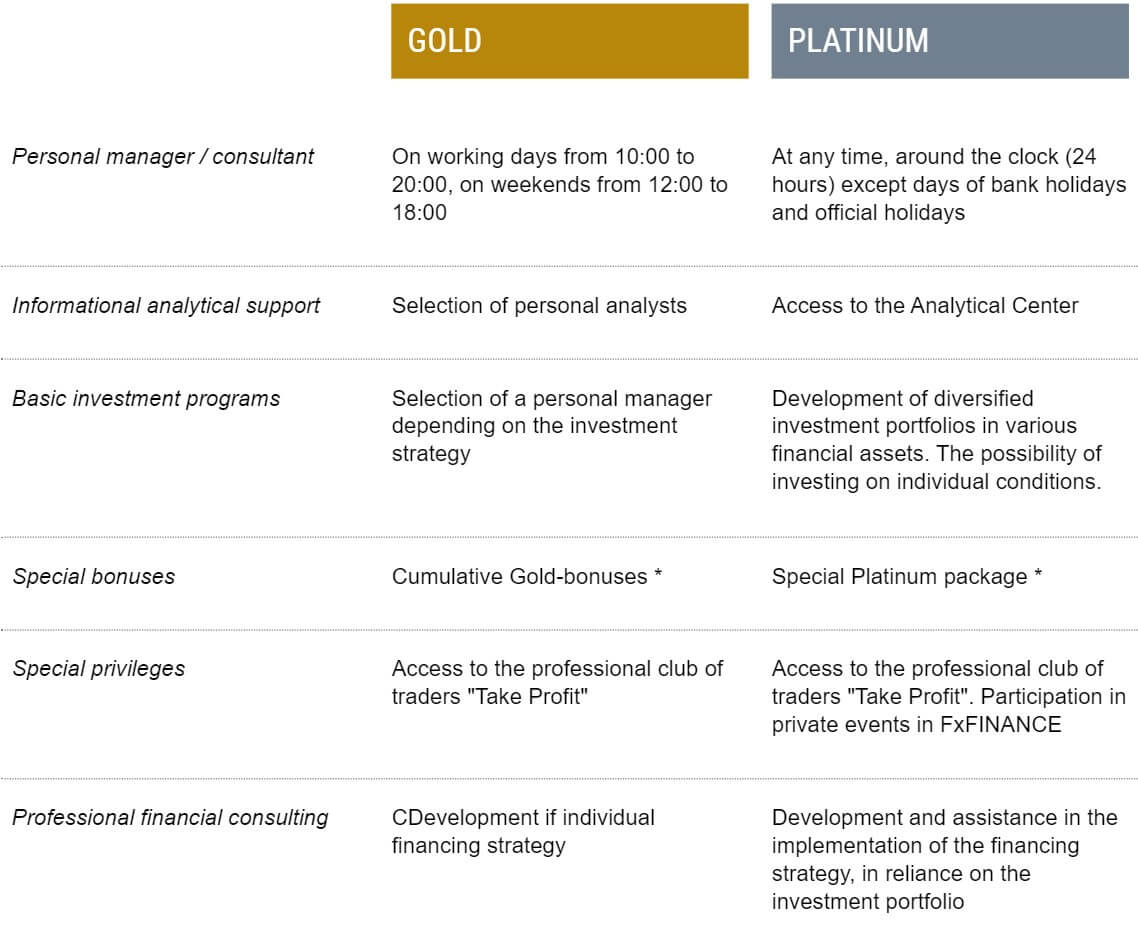

DIF broker does not have the usual accounts for trading. They are differentiated by the investment type, or whether you are going to trade (invest) by yourself, Invest with an Advisor, Invest with a Portfolio Manager or Invest with DIF Protect. If you want to know more about each, you will not find any trading conditions table or similar.

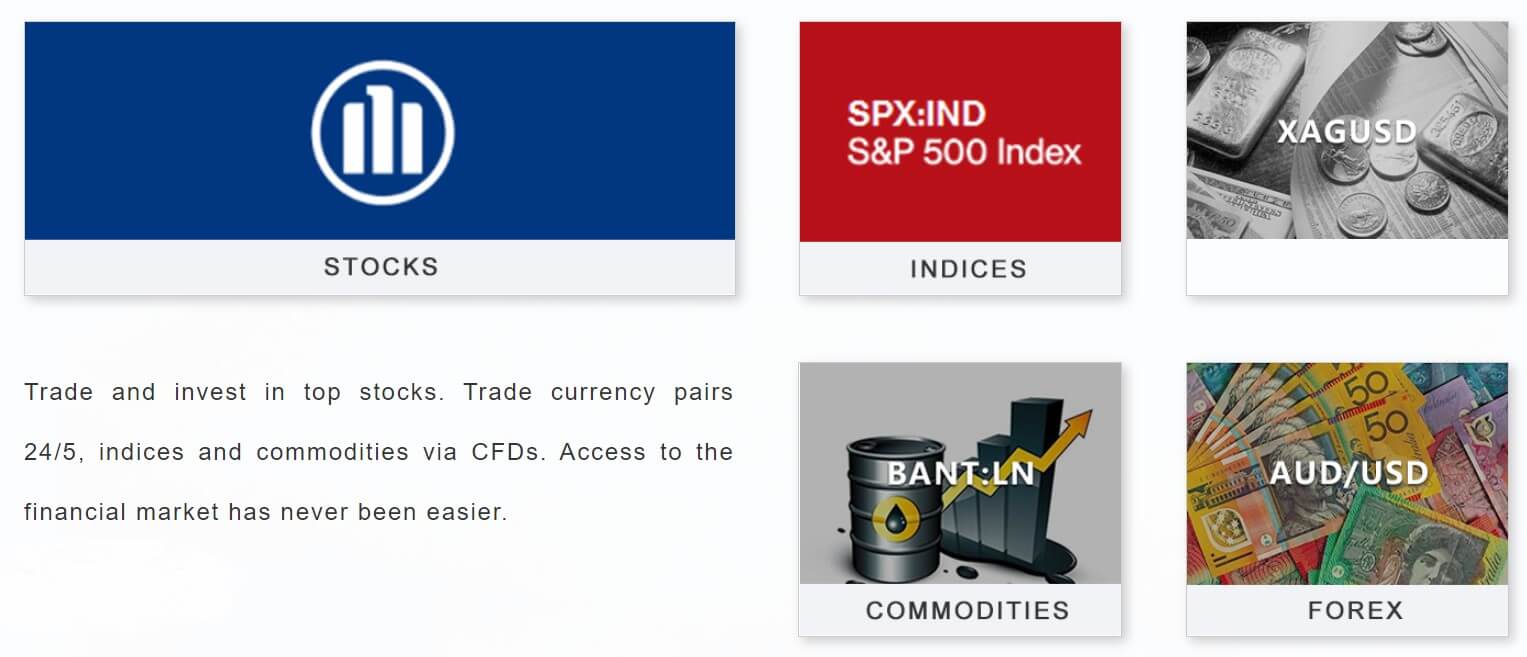

Investing in Yourself Account means you will trade on your own using their DIF platform. The page will present what assets categories you can trade and the range on each. furthermore, each category asset is explained with some promotional content, there is no more information and the action is directed in “Simulation Investment”, or in other words, a Demo account. You will also have a private broker, or more likely a salesperson, alerts service, and their platform with all the integrated services.

Invest with Advisor is a kind of managed investment service where the client receives a custom made portfolio by DIF Broker staff. The client is in full control of the investment using the DIF platform. This service is aimed at investors who do not want to develop their trading strategy or system and want to use broker made solutions but trade on his own decisions.

Invest with a Portfolio Manager is a customized portfolio creation based on the client’s specifics and needs. The strategy portfolio is mainly composed of Stocks and ETFs. This is for investors with higher risk tolerance and who are aiming at least 5 years of investment. From the broker statements, this service is similar to the “Invest with Advisor” but seems to be better customized and for longer-term. Also, the client does not have to monitor the investment all the time.

DIF Protect is a service that has the traits of an Option derivative. A trader can have a loss protection buffer if potential gains are capped at a certain level. This is a kind of automated Options structure creation where your losses can be negated if you set the upside limit, yet losses can exceed your buffer or loss protection area while your gains are capped. This service is unique but any details and the costs are not disclosed on the page.

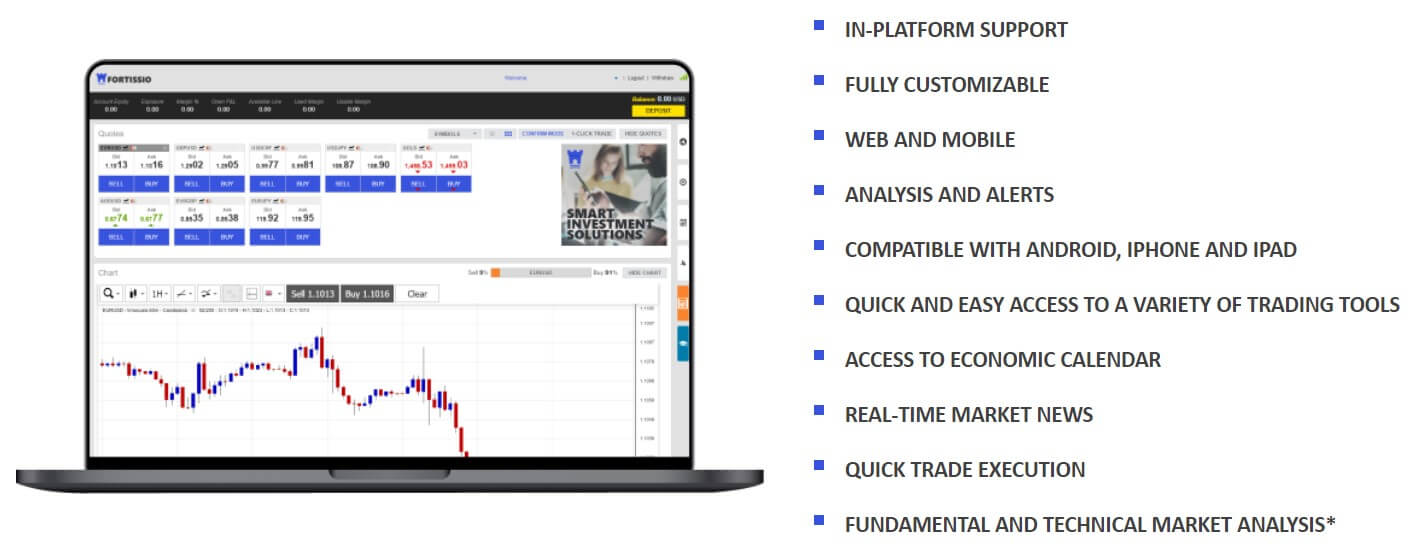

Platforms

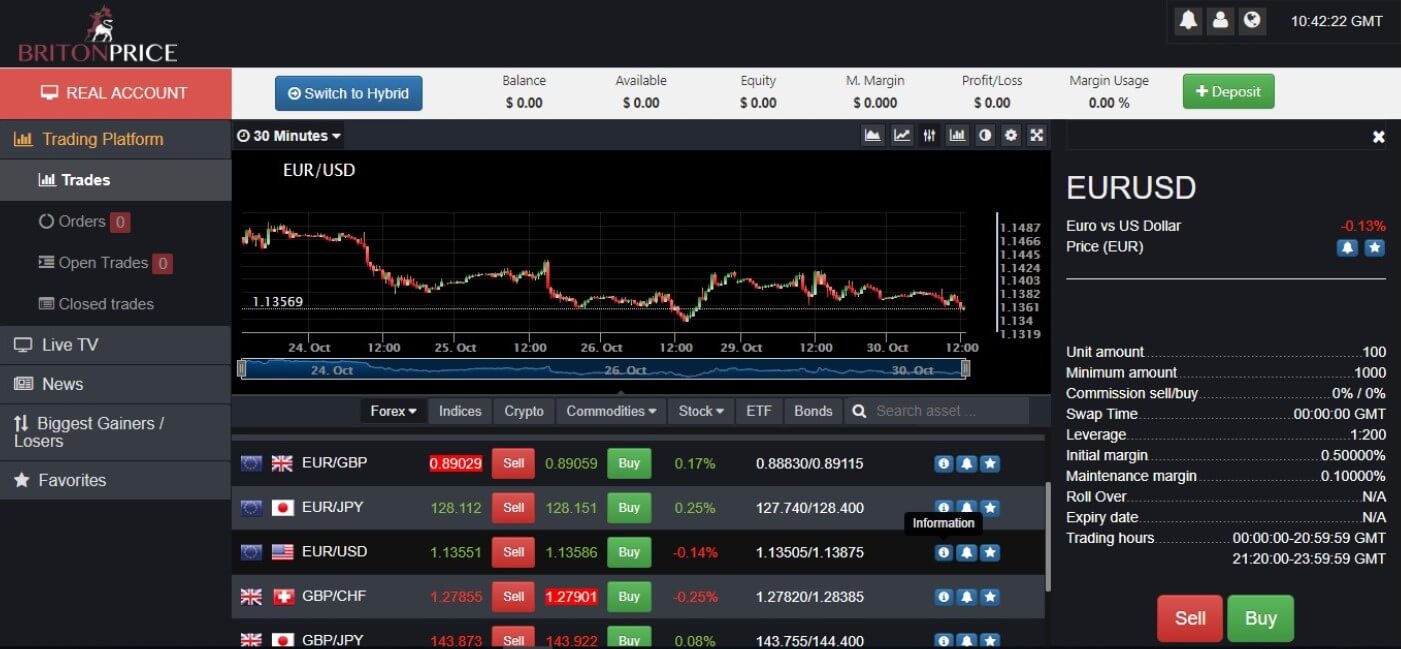

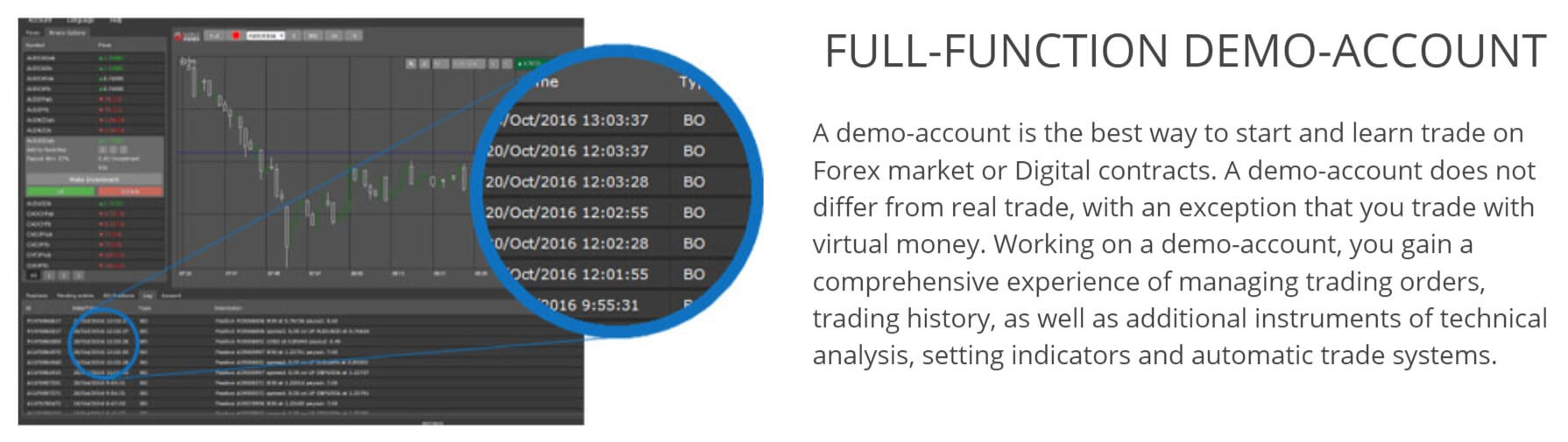

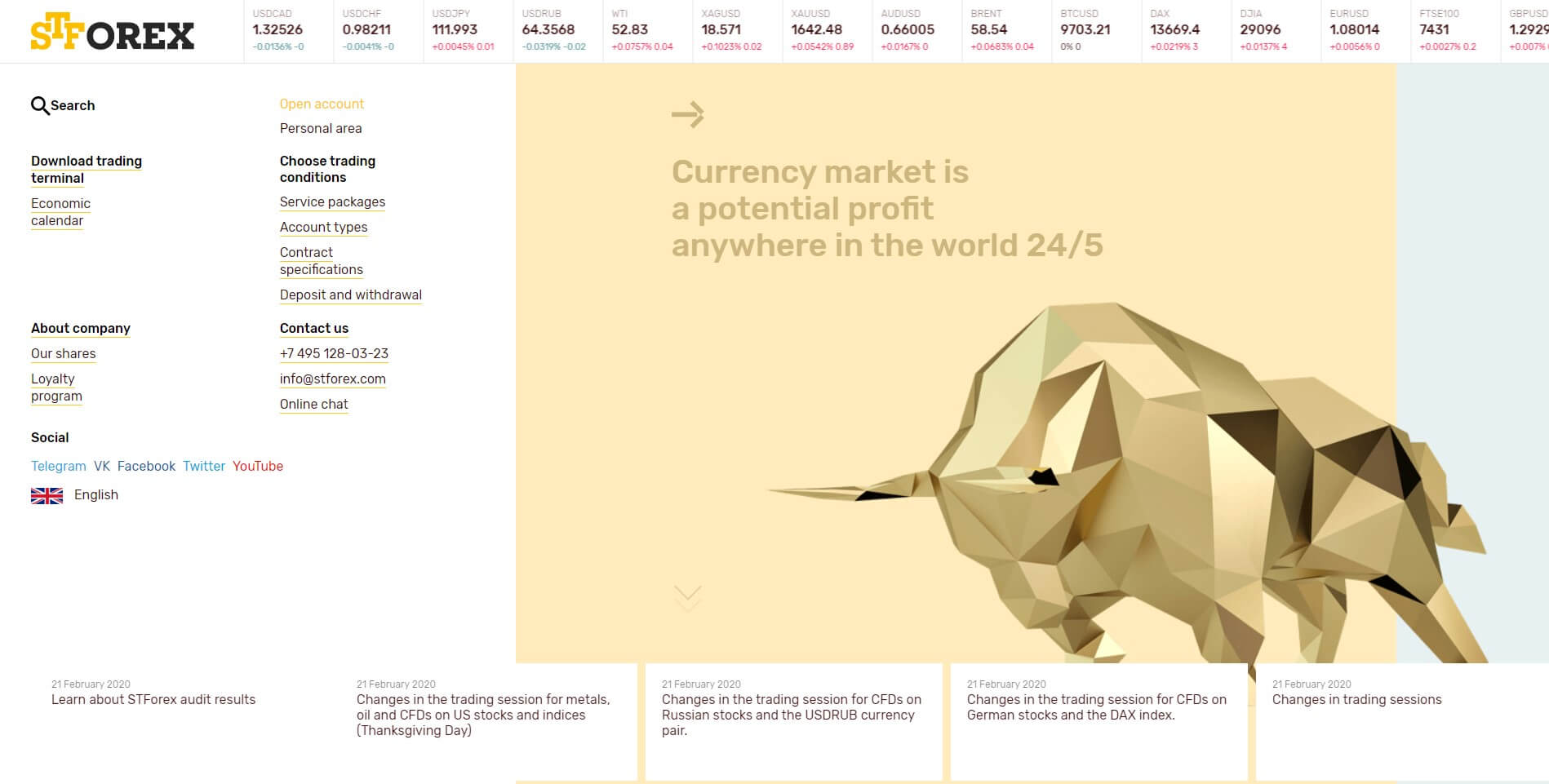

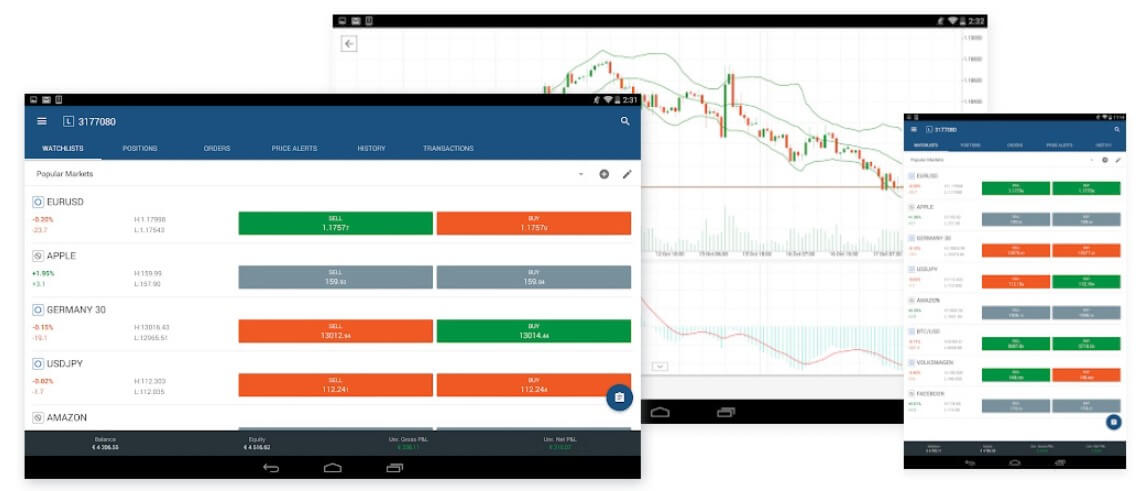

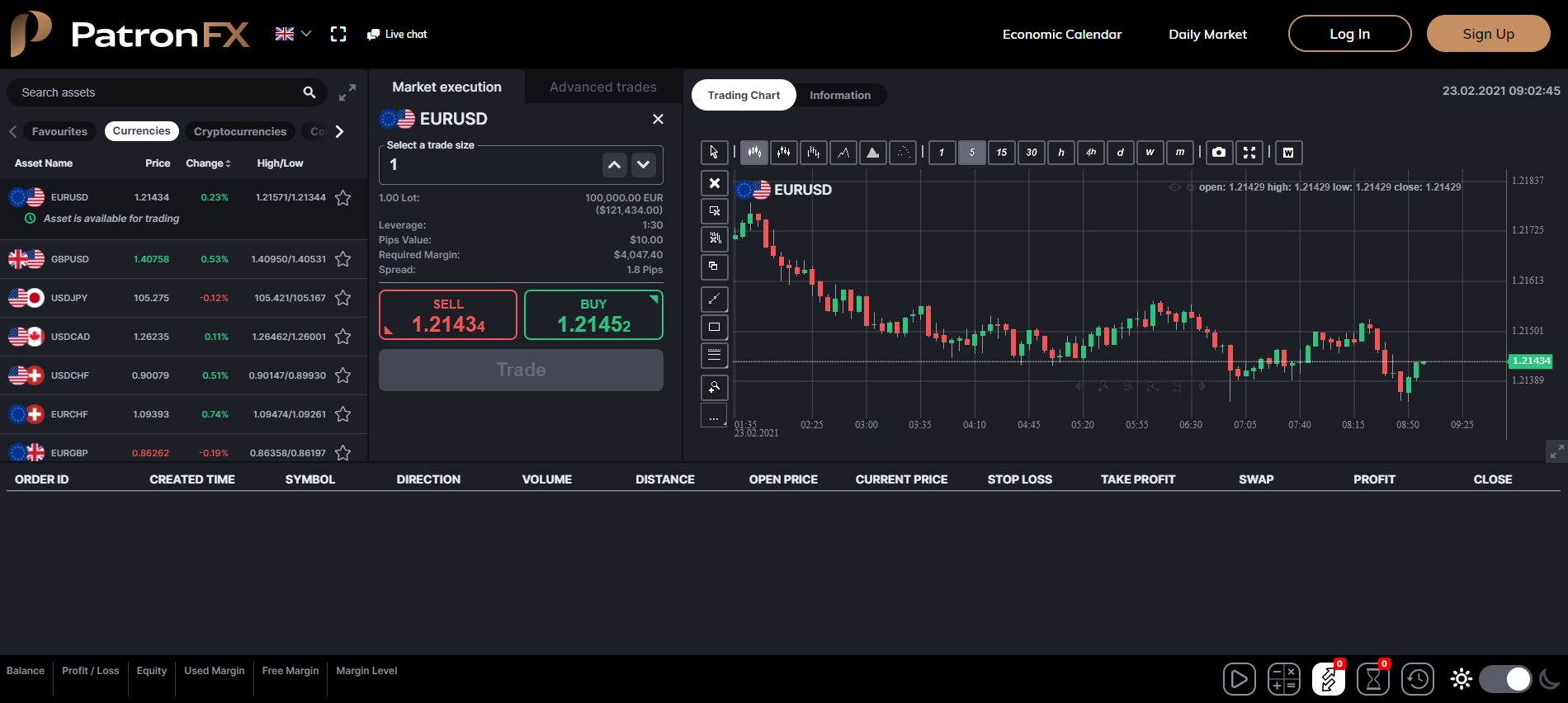

DIF Broker does not offer the classic MetaQuotes platforms and relies on its DIF platform available as a web-accessible and for desktop. We were unable to find a link for the downloadable desktop version since we were redirected directly to the Web version without giving the option to switch. Registering for the “simulation” is done via email where your Login details are sent. The platform will open once you set the language and some other parameters.

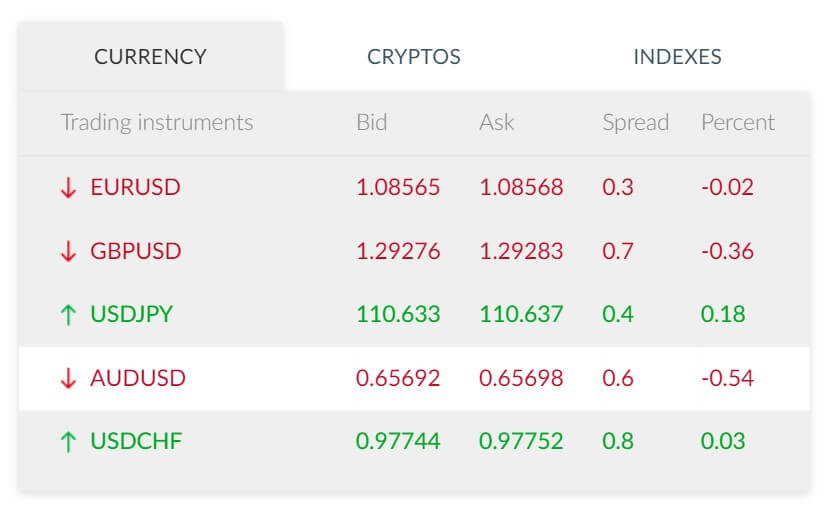

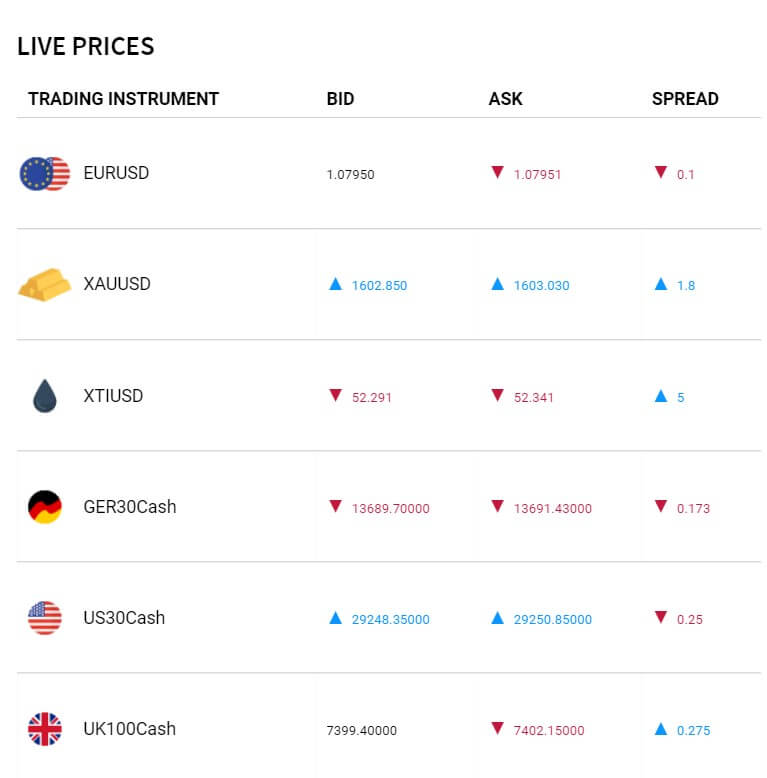

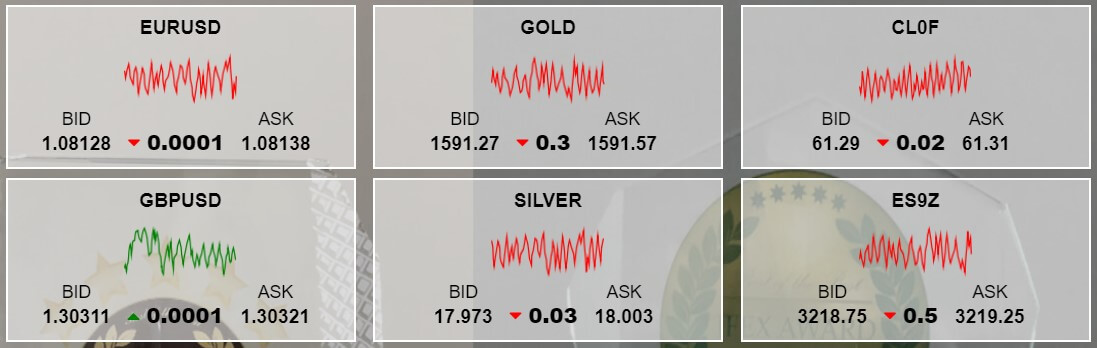

The platform is divided into 3 resizeable windows with a white theme by default, switchable to black on the top right button row. The right side window contains the chart with all the tools and modes. Product Overview mode has very good information on the asset movement. You will see the classic Bid, Ask prices, Spread, % change, Net change, Day range, and a price chart in the form of a histogram with switchable timeframes.

Charts mode presents the full feature chart which can be set to full screen or detached. Linking and instrument finder is available on the top left with advanced timeframes settings. The timeframe can be set to 1,2,3, 5, 10, 15, and 30 minutes, 1, 2, 4, 6, and 8 Hours, Daily, Weekly, and Monthly, with an additional setting for a range period to which the chart will be displayed. The top right side of the window has the indicators, chart type selection, drawing, snapshot, chart configuration, and other useful tools.

The chart can be configured in many ways, from colors to timezone and also has a context menu on right-mouse click with logical and useful features. Chart types available are Heikin Ashi, Candlestick, Bar, %Comparative, and a Line. There a total of 53 indicators you can insert with a good range of settings. Most of the indicators are popular and can also be found in the default installation of the MetaTrader platforms.

Options Chain mode is the selection of Options that can open a completely different way of trading and risk management. The left window contains the Watchlist with the Alerts tab. The watchlist has a lot of features and information feedback. The right-click context menu will give you options to open a new trade, add and remove the instrument to a watchlist, add price alert, and see Trading Conditions.

The alert tab features a filter box, sorting and alert add option. There are many conditions and settings you can set an alert, you can also set it to repeat, expire, on % price change and so on. At the bottom of the screen is the Positions and Orders window that holds all the information about open trades and how they affect your portfolio, balance, exposure, margin utilization and more. Even this window has a filter box and category column sorting. Ordering can be done in a few ways, the panel will open with more options than what you see in the MT4 or 5 platforms, see the cost of the trade, plus you can drag the pending orders on the chart.

DIF platform is probably one of the most advanced web-based platforms in the industry, so the technology promotion by DIF Broker holds. As for the integrated services, the DIF platform has the Research section next to the Trading, where the platform is linked with the Autochartist signal service. This function is very well blended into the platform, you can select the instrument category to your left and see the analysis on many assets on different intervals, probabilities, pattern names, type, age, and length.

On the Performance Disclaimer, traders can see the success rate of the Autochartist patterns and Key levels forecasts. At traders, disposal is also a great filtering selection so they can pin down only assets of interest with the best probabilities. The final tab is about the trader’s account. Statistics including exposure, gains, position values, P/L, and similar, Historical reports including dividends payments, CFD cahs adjustments, interest details, reports of various kinds and of course, trades executed.

Another tab contains all the setting for the Account such as Subscriptions, upcoming margin and Collateral changes, Demo account reset, etc. Chat is also integrated into the DIF platform but it is available only for Live accounts, thus limiting the ability to have contact with the broker in a non-phone way. As for the execution times, they do not have a time stamp so it cannot be measured precisely. Form our manual measures the execution times are under 200ms.

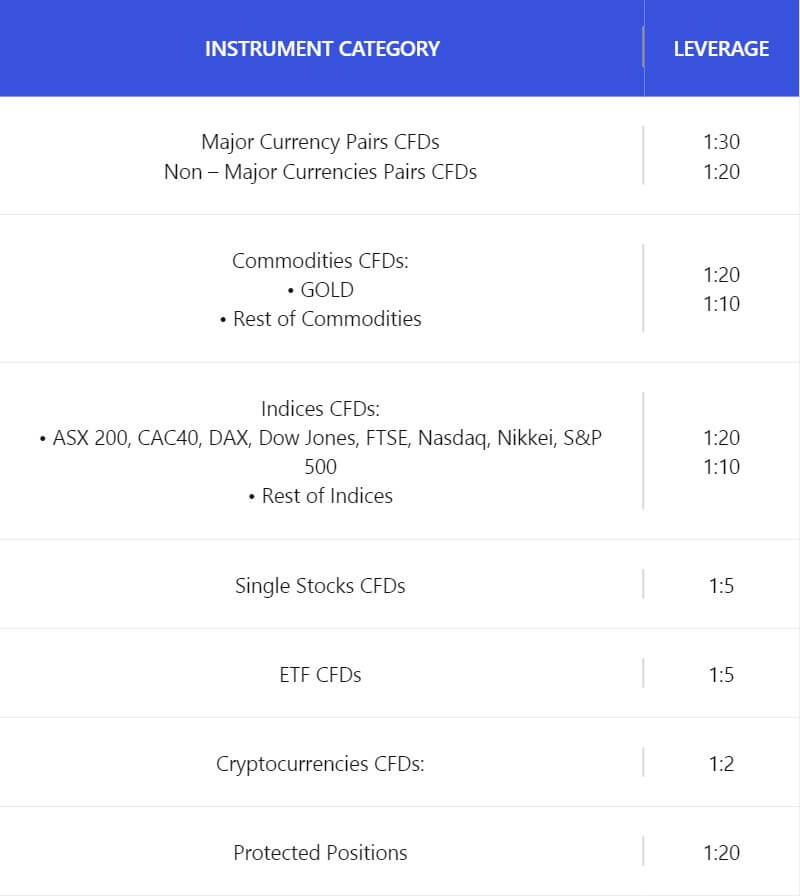

Leverage

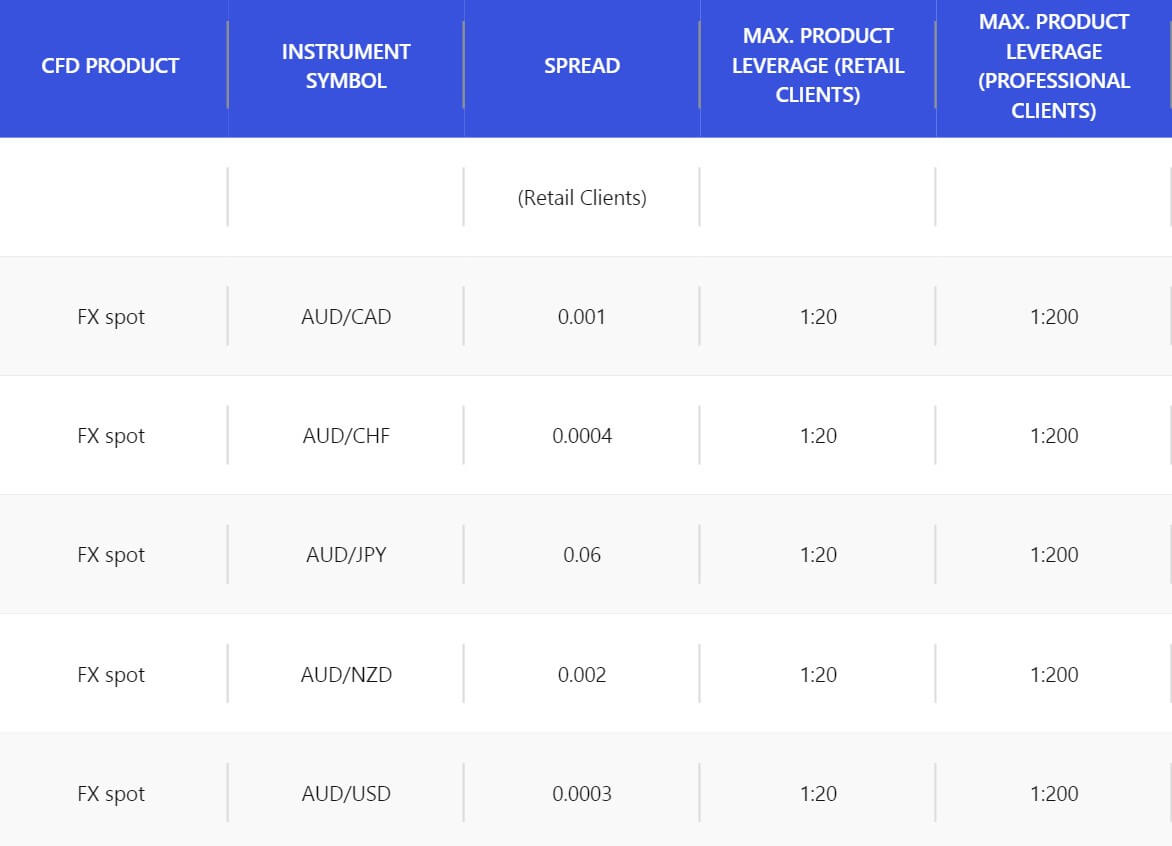

DIF Broker has Key Information documents but they are available only once you register and see the platform. Since DIF Broker is under the ESMA directive the maximum leverage for Retail traders is capped to 1:30 leverage. Forex currency pairs have 1:30 leverage for major currencies but for exotics like the TRY the leverage can be reduced to less than 1:7. For Spot Gold against the USD, the leverage is 1:20 for buying and 1:30 for selling. Indices have 1:20 and Commodities have margin levels based in currencies such as the USD. It is possible to increase the leverage if a trader can classify as a Professional. To qualify a trader must pass certain conditions.

Trade Sizes

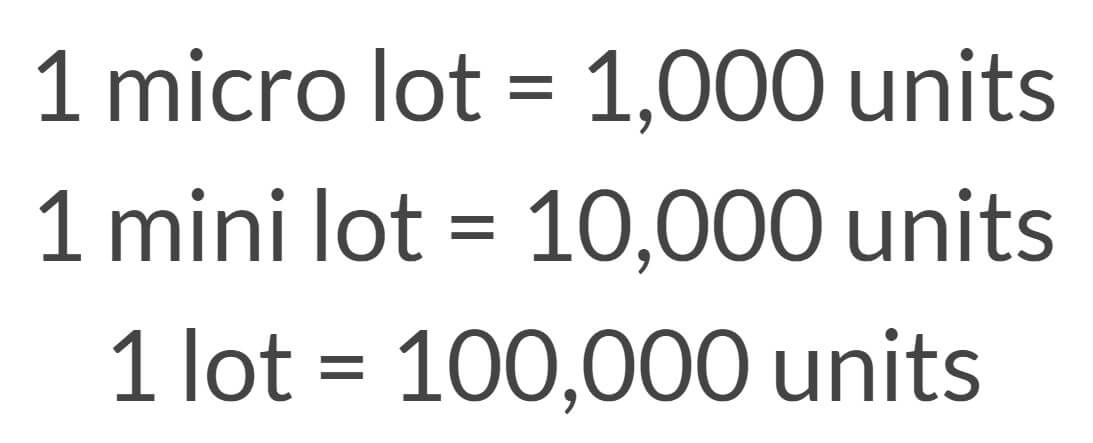

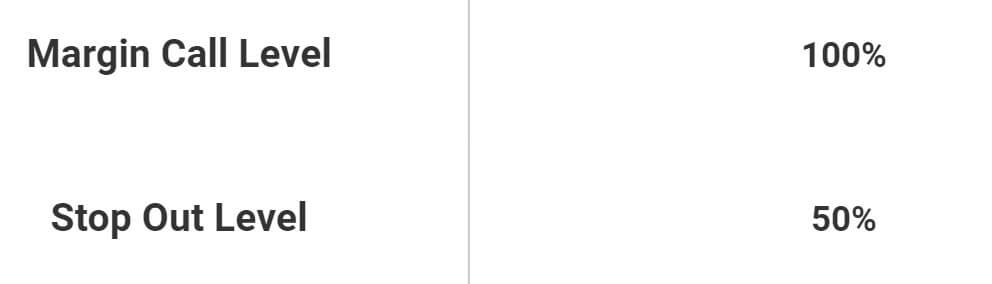

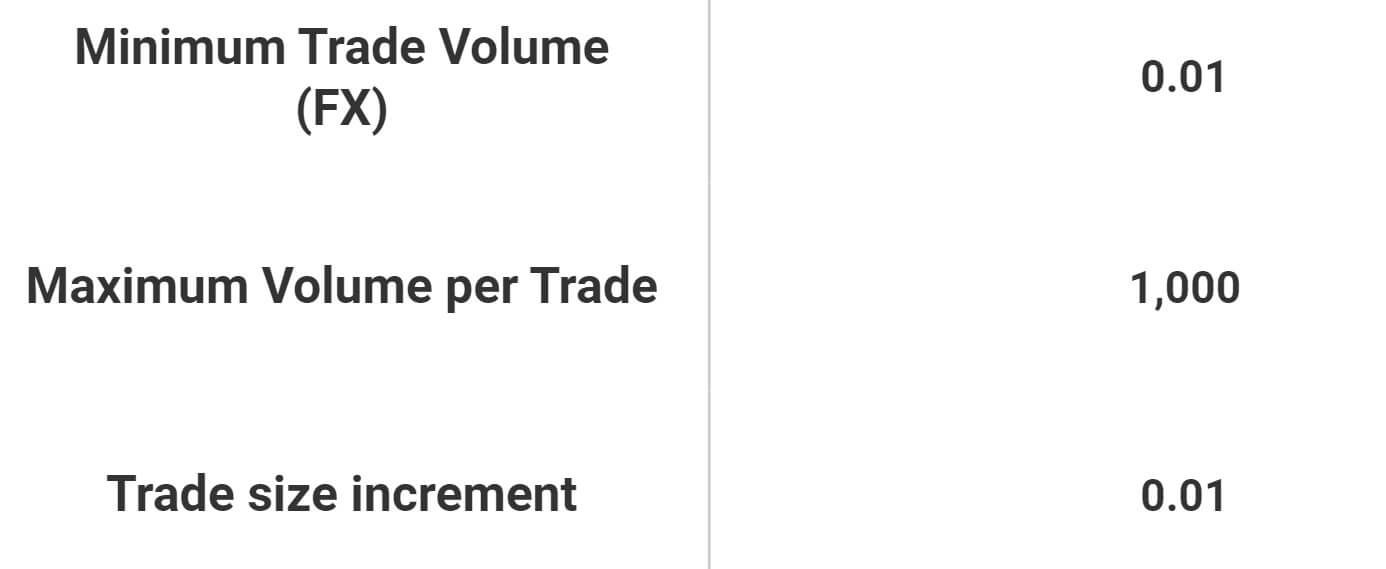

All the minimum volume trade sizes are in mini-lots or 10,000 units for Forex instruments. For Spot Gold, the minimum is 10 units or 10 Oz that is the equivalent of 0.1 lots. This minimum volume sizing is similar even for other assets and securities that have different margin calculations. The maximum trade volume is known in the ordering window but additional volume steps are also in mini-lots. The larger minimum trade sizes are not adequate for small values accounts and DIF Broker is aiming for bigger deposits this way. As for the Stops level, this parameter is not disclosed in the instrument specifications. Margin Call is set to 75% and Stop Out is at 50% margin level. In the DIF platform, the Margin Level is presented as a Margin Utilization meter, but the calculation is the same.

Trading Costs

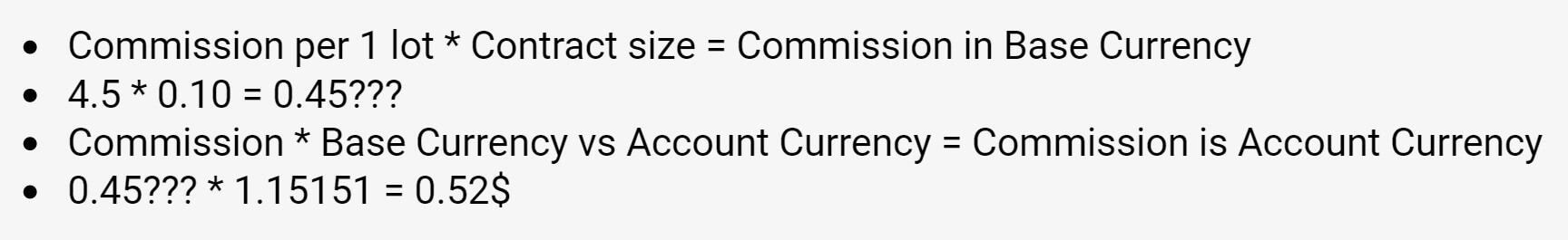

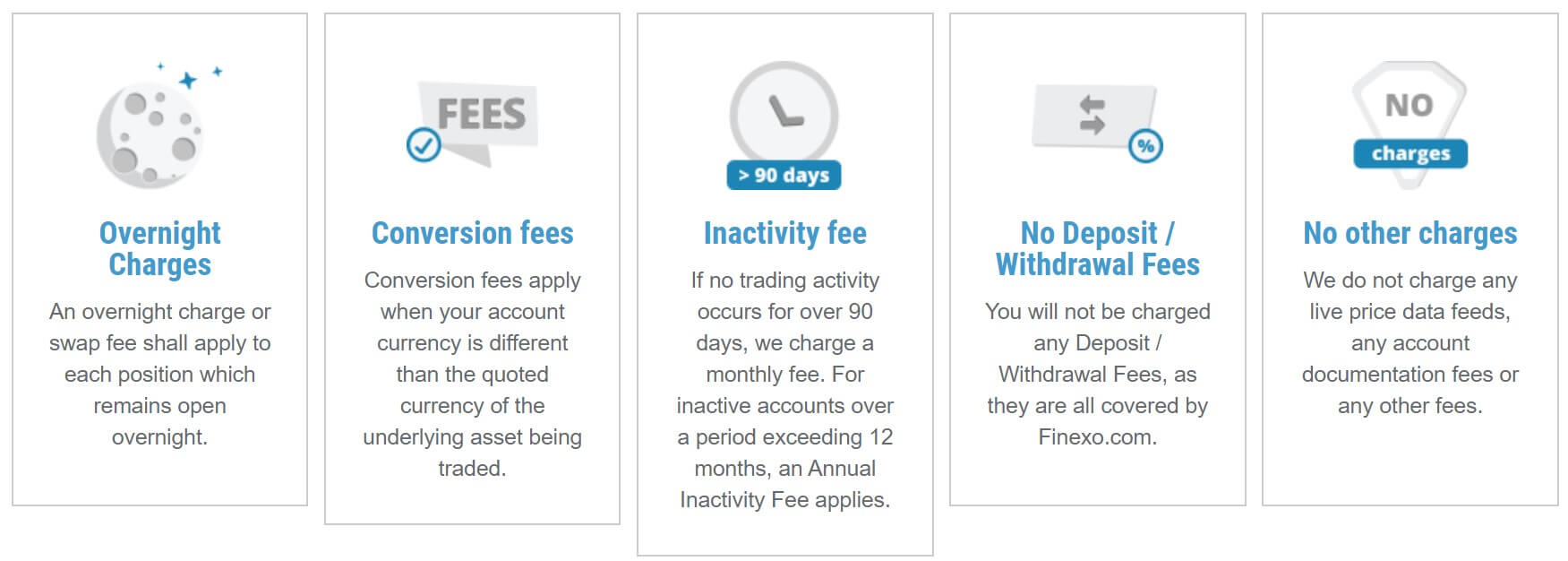

DIF Broker is different when it comes to calculation the trading costs. The platform will present the trading costs once you order a trade, the structure will be more clear to you. The point is that smaller trades carry the highest trading costs. So, for example, trade ticket cost (commission) will be $10 for 40 units of spot Gold (0.4 lots) against the USD, meanwhile, 0.5 lots or 50 units will not have any ticket costs. This dynamic policy is applied to all instruments and therefore it is not possible to determine the exact commission or trade ticket.

This setup certainly favors large accounts, and the costs are very high for the rest of the traders, comparing with the industry average. As for other costs, the official Pricing document, which is not easy to find, (we found it using Google search, not navigating the website) they are very complex. So complex we had problems to collect what is the final cost that a trader can have.

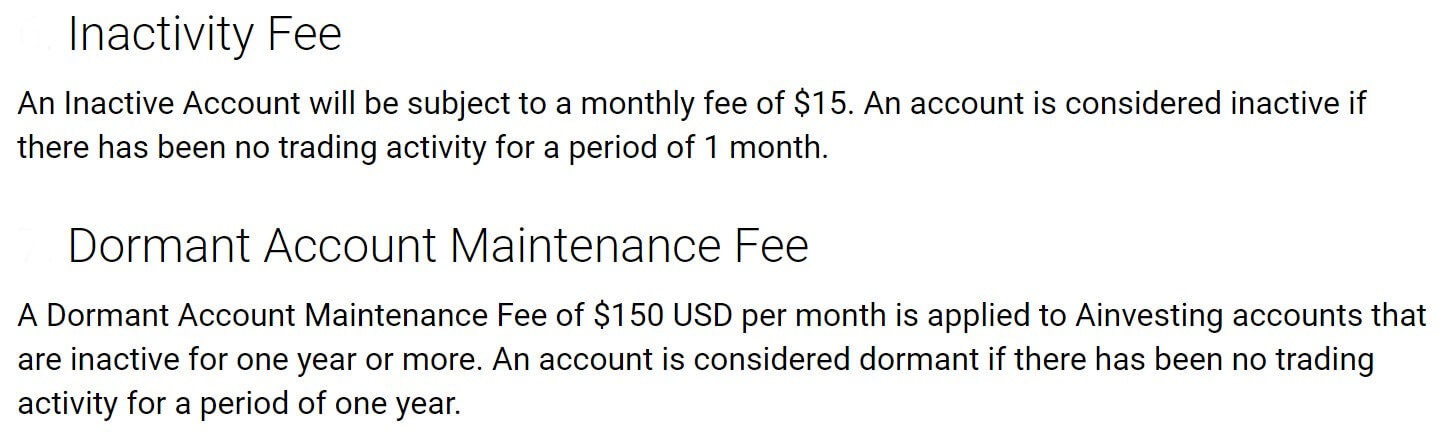

Let’s start with the Stock OTC trading commission of 4%. Other most important costs are regarding the portfolio management services, Success Fee is – 20 %, Annual Fixed Fee 3%. The inactivity fee is stated to be charged EUR 36, plus VAT. There is no information on when the account is considered inactive. All DIF Broker Fees charged are subject to VAT. Admin costs for the delay in sending the required legal documentation will be charged with a fee of 100 euros per quarter, plus VAT.

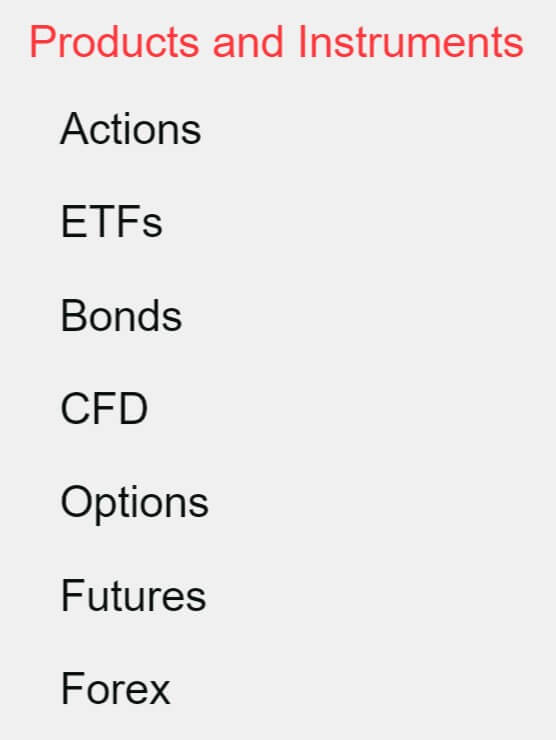

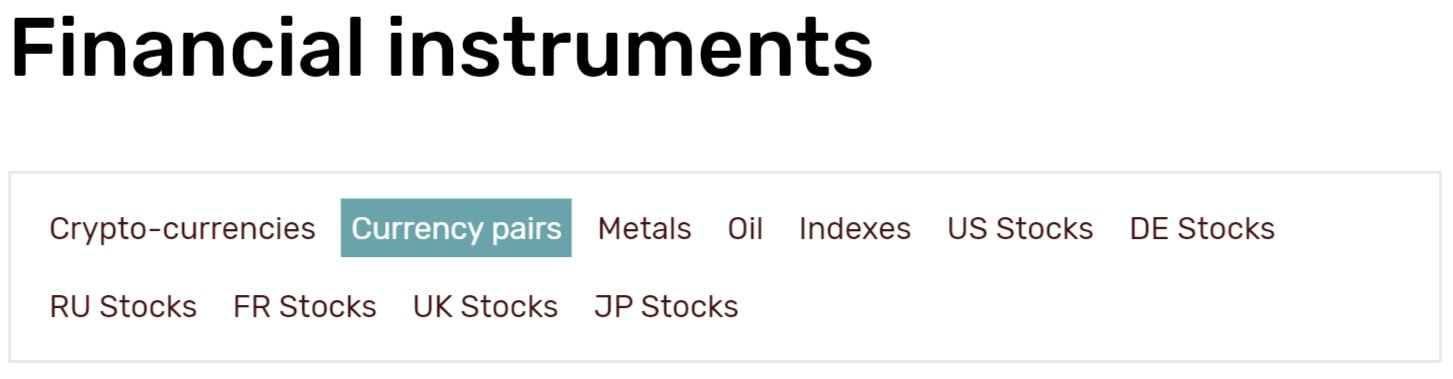

Assets

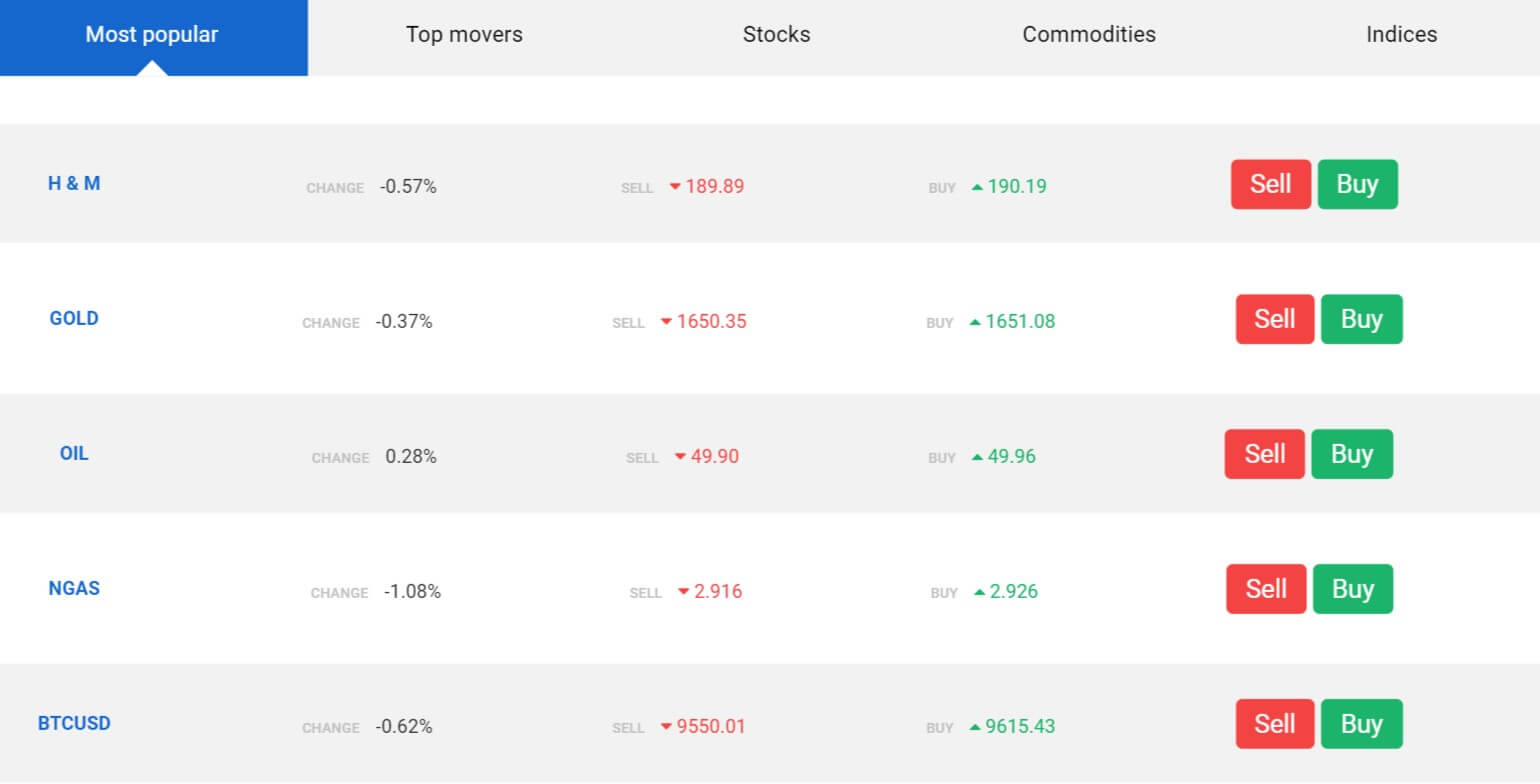

DIF Broker does not have only CFD instruments but also other securities and derivatives such as Forwards Futures and Options. Note that you will need to consult with all the instrument specifics so you can know your costs and benefits relevant to them. It can be said that the range in every category is phenomenal.

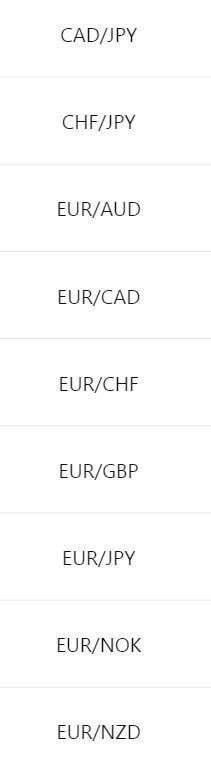

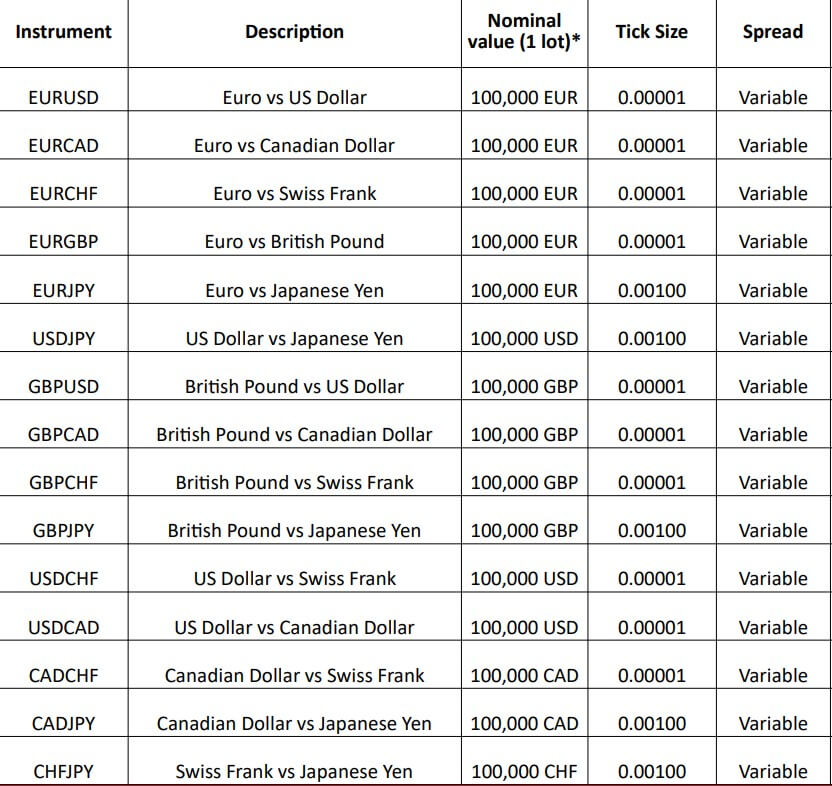

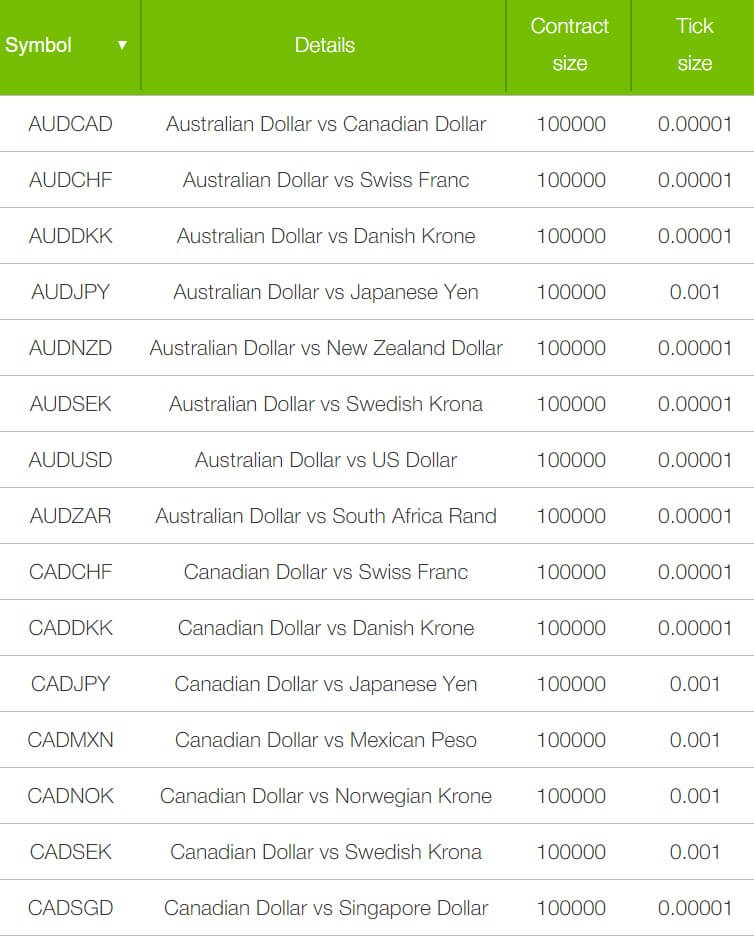

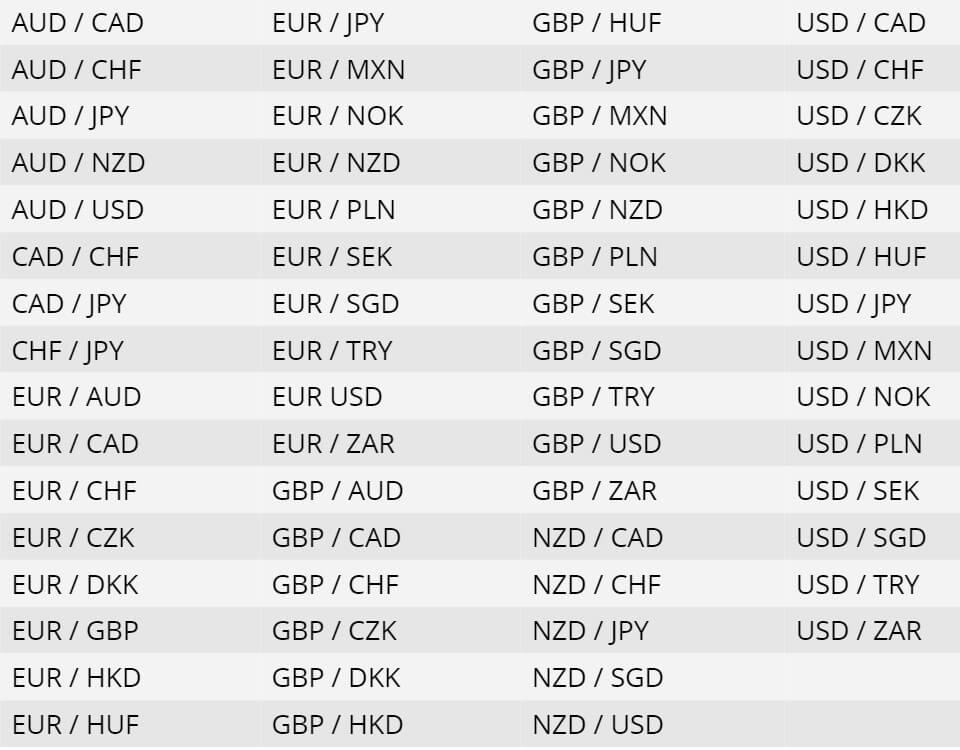

The drawback is there are no Cryptocurrencies. Starting with forex, there are 182 total assets, 140 of them are forwards contracts and 42 are on spot. This is almost the full Forex range one can find. Let’s just say you can find exotics pairs such as CHF/TRY, AUD/ZAR, SGD/CNH, USD/AED, GBP/ILS, JPY/HKG, PLN/DKK, and many more extremes.

The drawback is there are no Cryptocurrencies. Starting with forex, there are 182 total assets, 140 of them are forwards contracts and 42 are on spot. This is almost the full Forex range one can find. Let’s just say you can find exotics pairs such as CHF/TRY, AUD/ZAR, SGD/CNH, USD/AED, GBP/ILS, JPY/HKG, PLN/DKK, and many more extremes.

DIF Broker is on several Exchanges around the world. This enables this Saxo Group Broker to have over 19,000 stocks on 36 exchanges. These securities can be under the CFDs and Futures. There is enough range here employed traders could probably find their own public company.

Indexes are under CFDs and there is 21 total. The diversification is excellent and the choice of alternative Indexes is great. Notable, rare Indexes are Belgium 20, Denmark 20 and 25, Germany Tech 30, Germany Mid-cap 50, Germany 30, Norway 25, Portugal 20, Swiss 20, Spain 35, Sweden 30, and Wall Street 30. ETF range is one of the strongest categories of DIF Brokers, not only by the number of ETFs but their diversity and usability as alternatives and options on many holding or hedging strategies. There are over 1000 ETFs to choose from.

Bonds offer is also very extended with multiple countries around the world. The list is long enough to scroll a dozen times and still not reach the end. Classic Options are also offered, 1000 of them. Options on interest rates, stocks, energy, precious metals, and others open a new way of how you can trade and manage your risk.

Futures are contracts on many asset categories such as Currencies, Commodities, Indexes, and interest rates. There are more than 200 of them across 22 exchanges. Among these are commodity assets, many of them including Coffee, Corn, Cotton no2, Rice, metals and more.

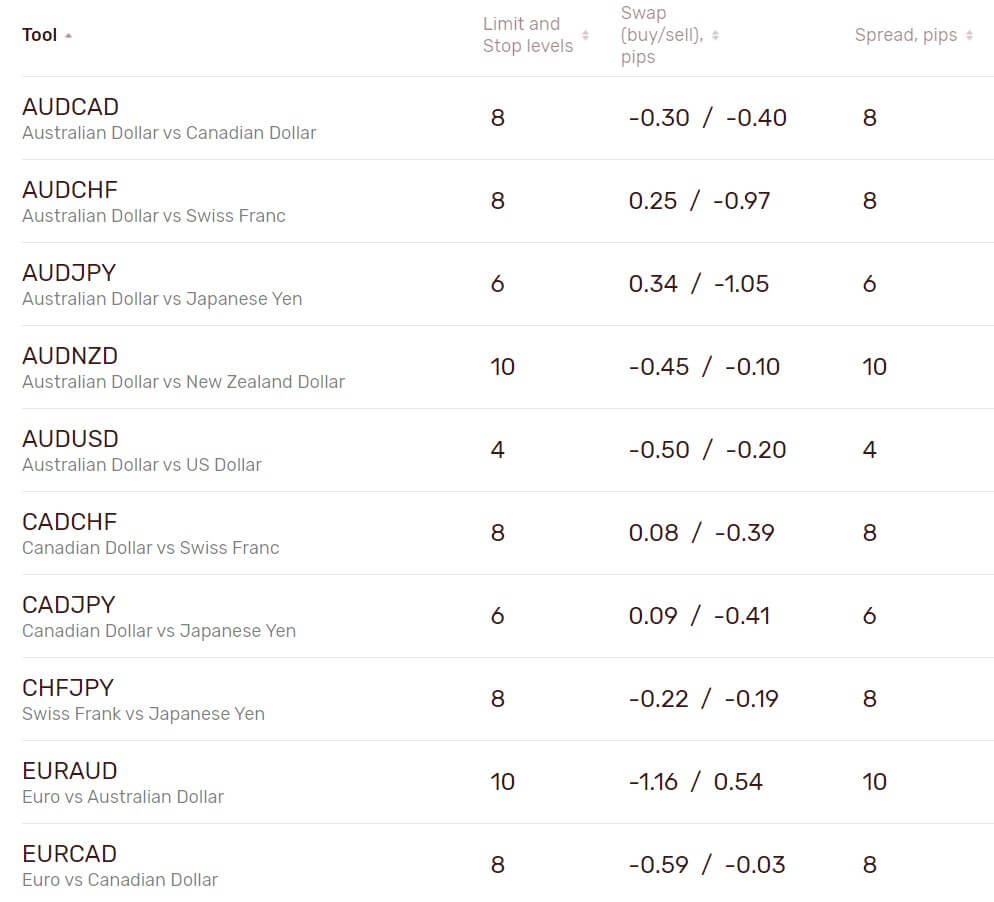

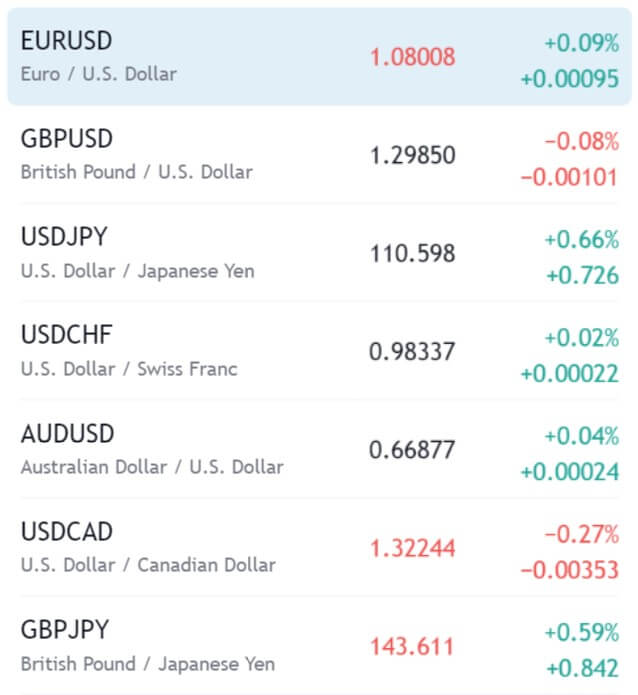

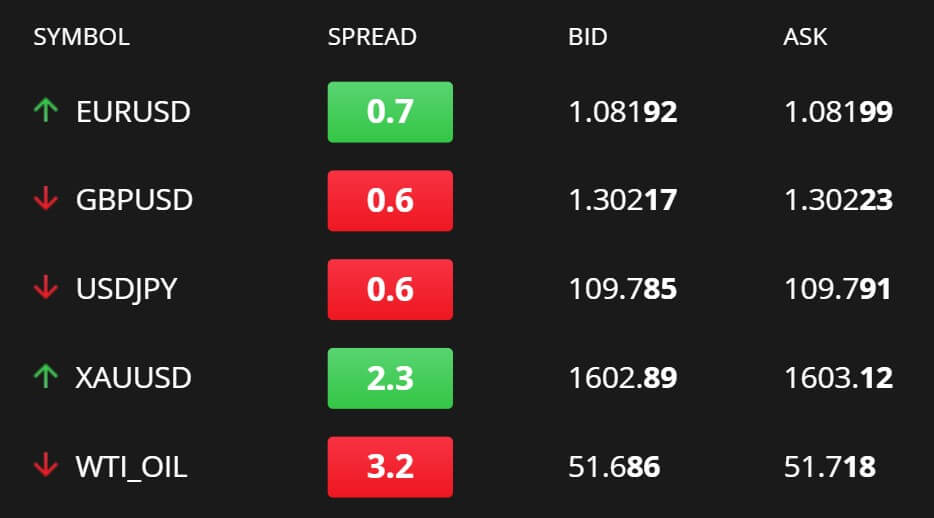

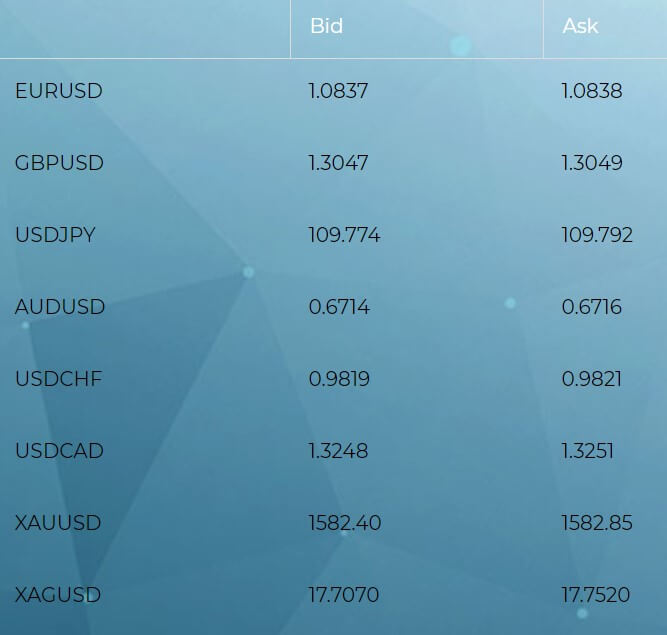

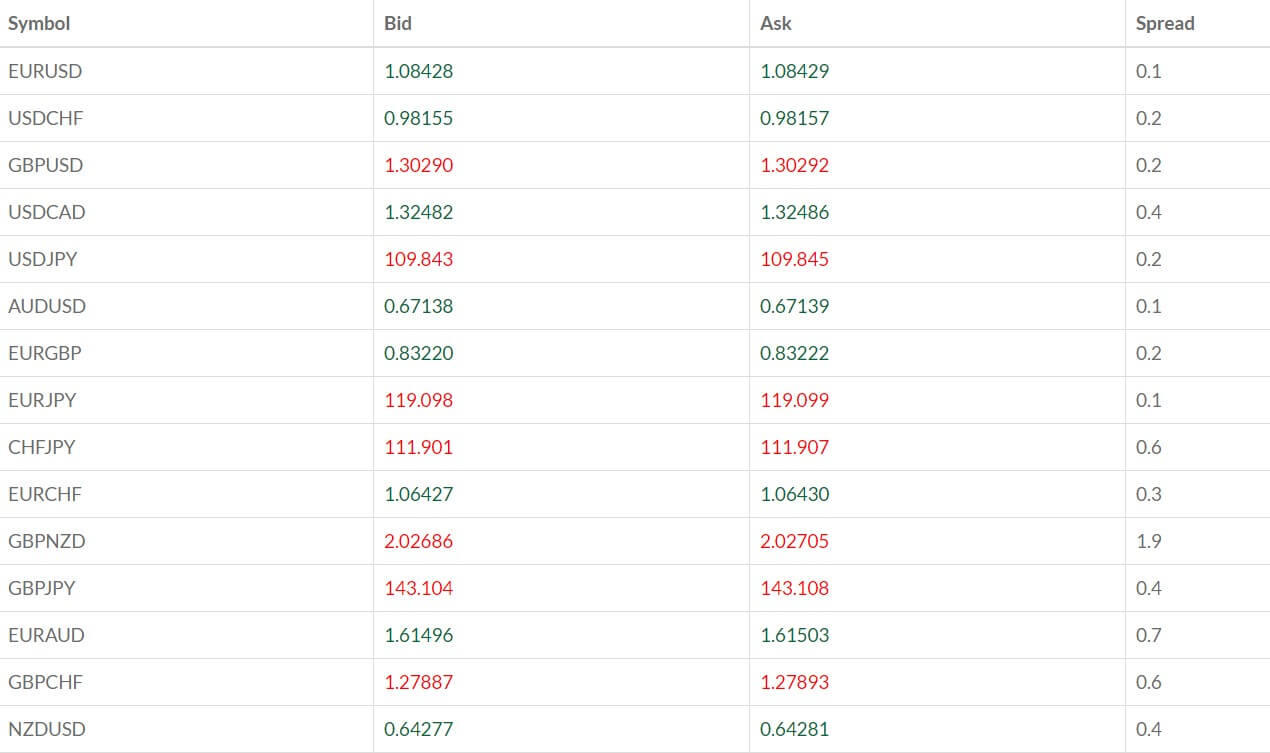

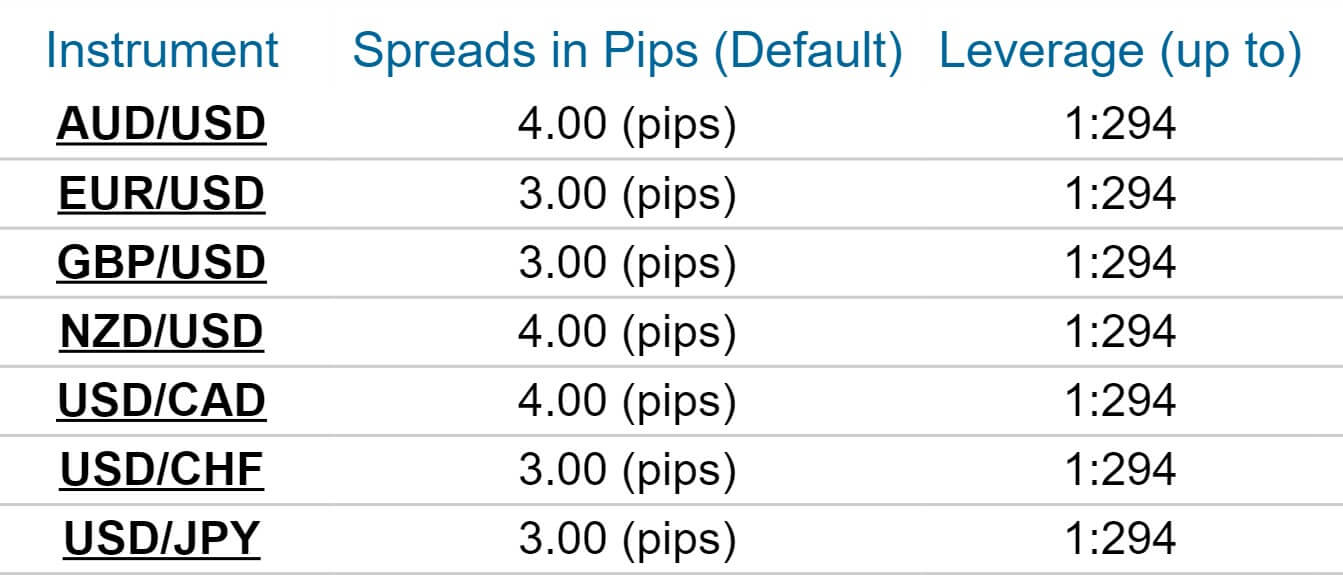

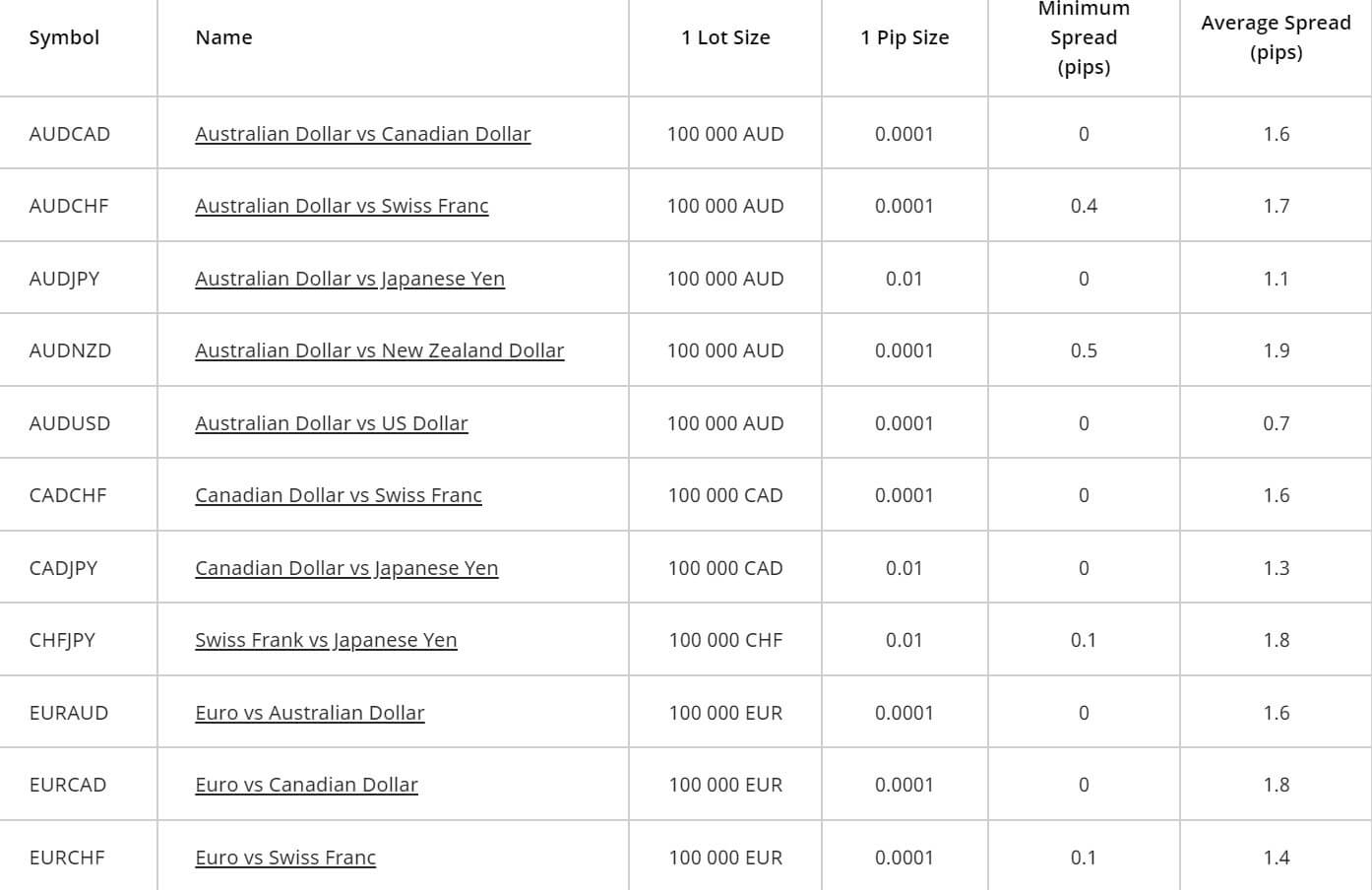

Spreads

Spreads are dynamic but can behave like fixed as they do not move that often, but can be dynamic on the trade volume. Interestingly, the bigger the trade volume is the wider the spread for certain assets. For Forex, we can say the levels are no competitive as most are higher than what we usually see with other brokers. Yet, DIF Broker is a market maker with many integrated services targeted to the high ticket investors.

To have some insights, EUR/SUD has 3 pip spread, USD/JPY 2.5 pips, AUD/USD 3 pips, NZD/USD 4 pips, and USD/CHF 4 pips. Wider spreads are for the GBP/NZD 11 pips, AUD/NZD 7 pips, and similar for other cross pairs. Exotics spreads are very good. There are many of them but the spreads remain competitive. USD/MZX spread is 40 pips, USD/ZAR 65 pips, USD/RUB 292 pips, GBP/HKD 33, etc. Spot Gold against the USD has 45 pips spread which is a bit higher than with other brokers, similar to other assets. You can expect higher than average spreads for all other categories.

Minimum Deposit

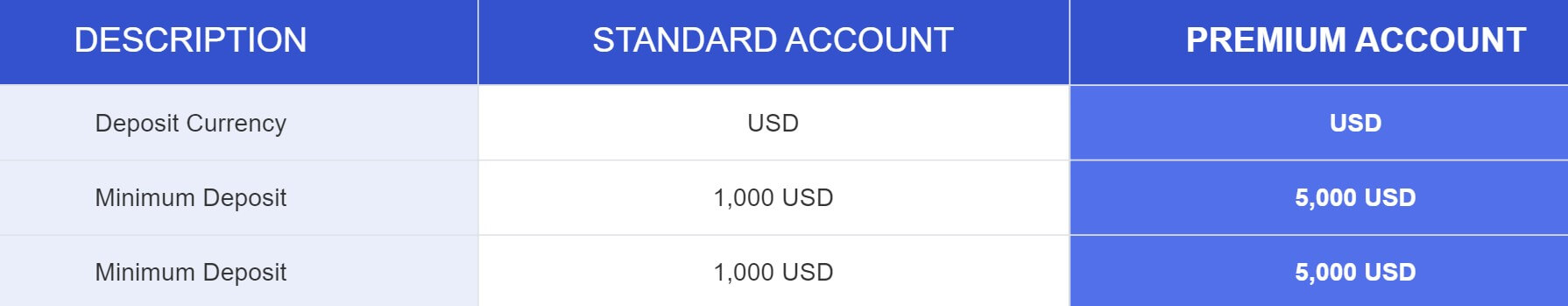

The minimum deposit in 2020 is $500 for individual self-managed accounts. For a managed portfolio, you will need a minimum of EUR 25,000. These figures are not present on the website.

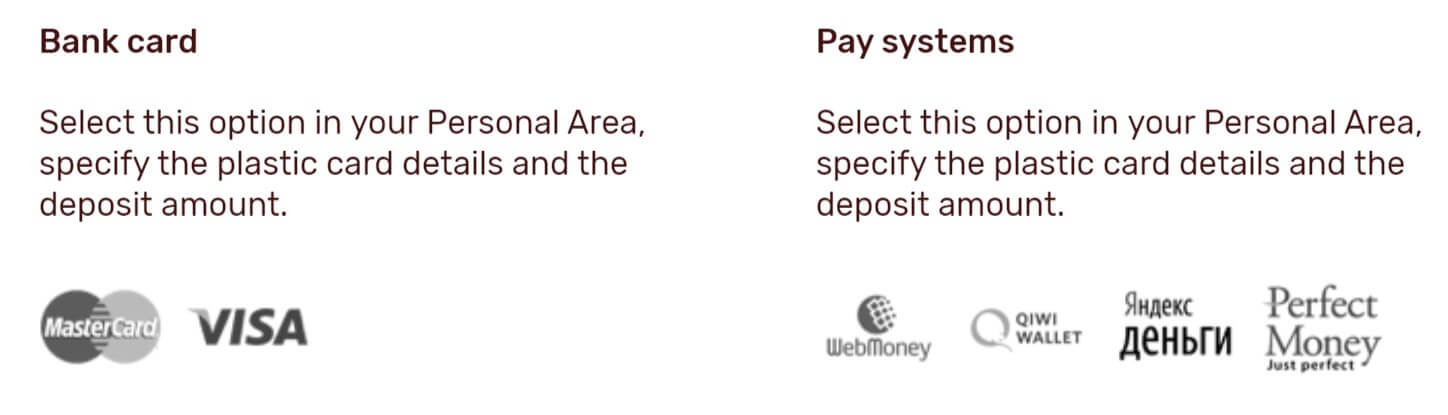

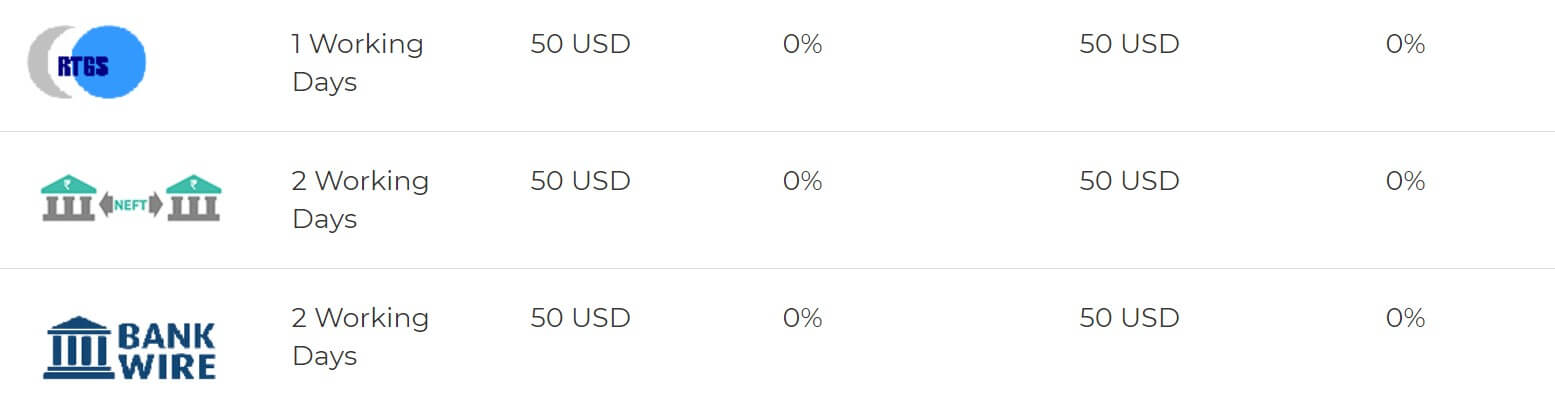

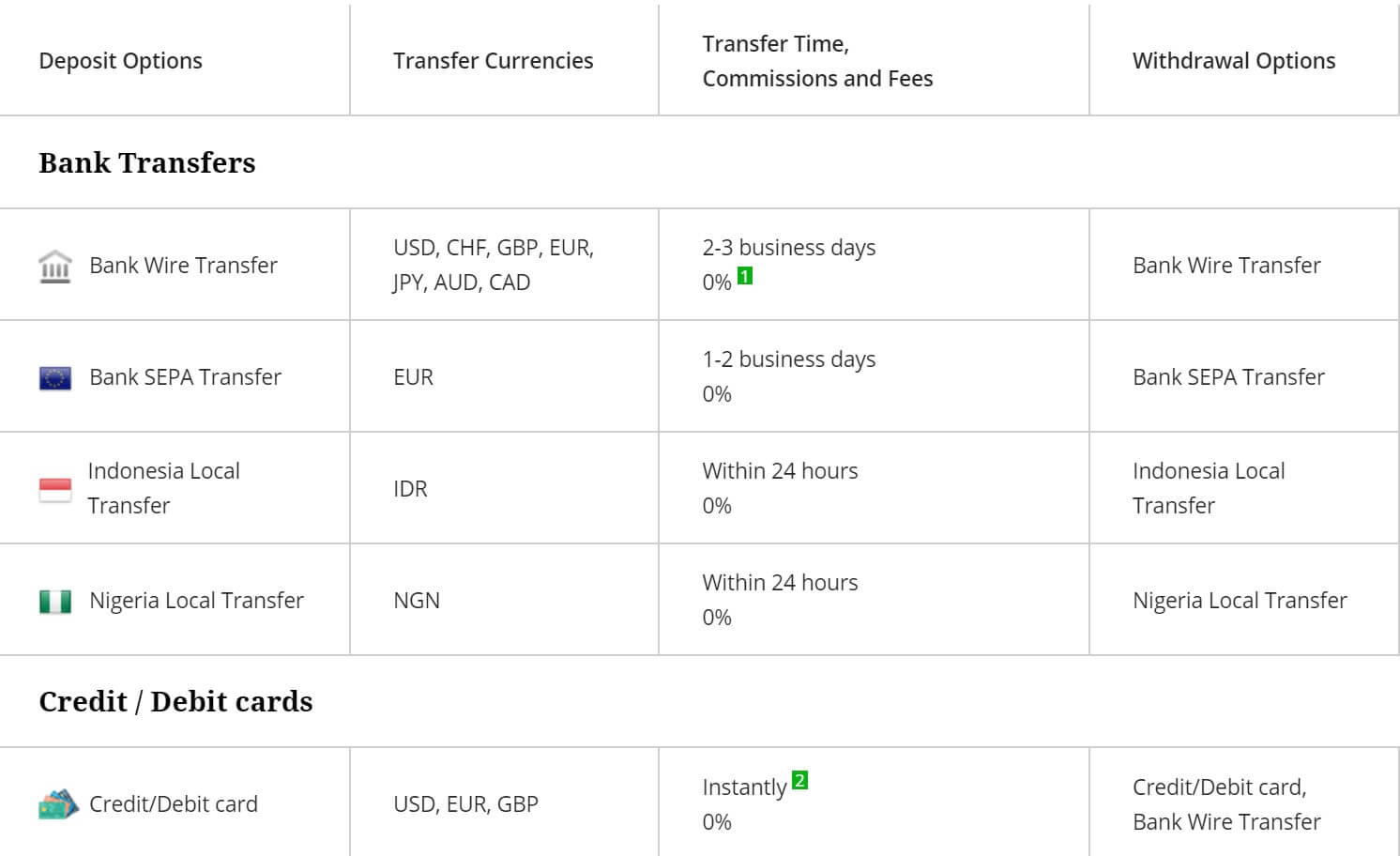

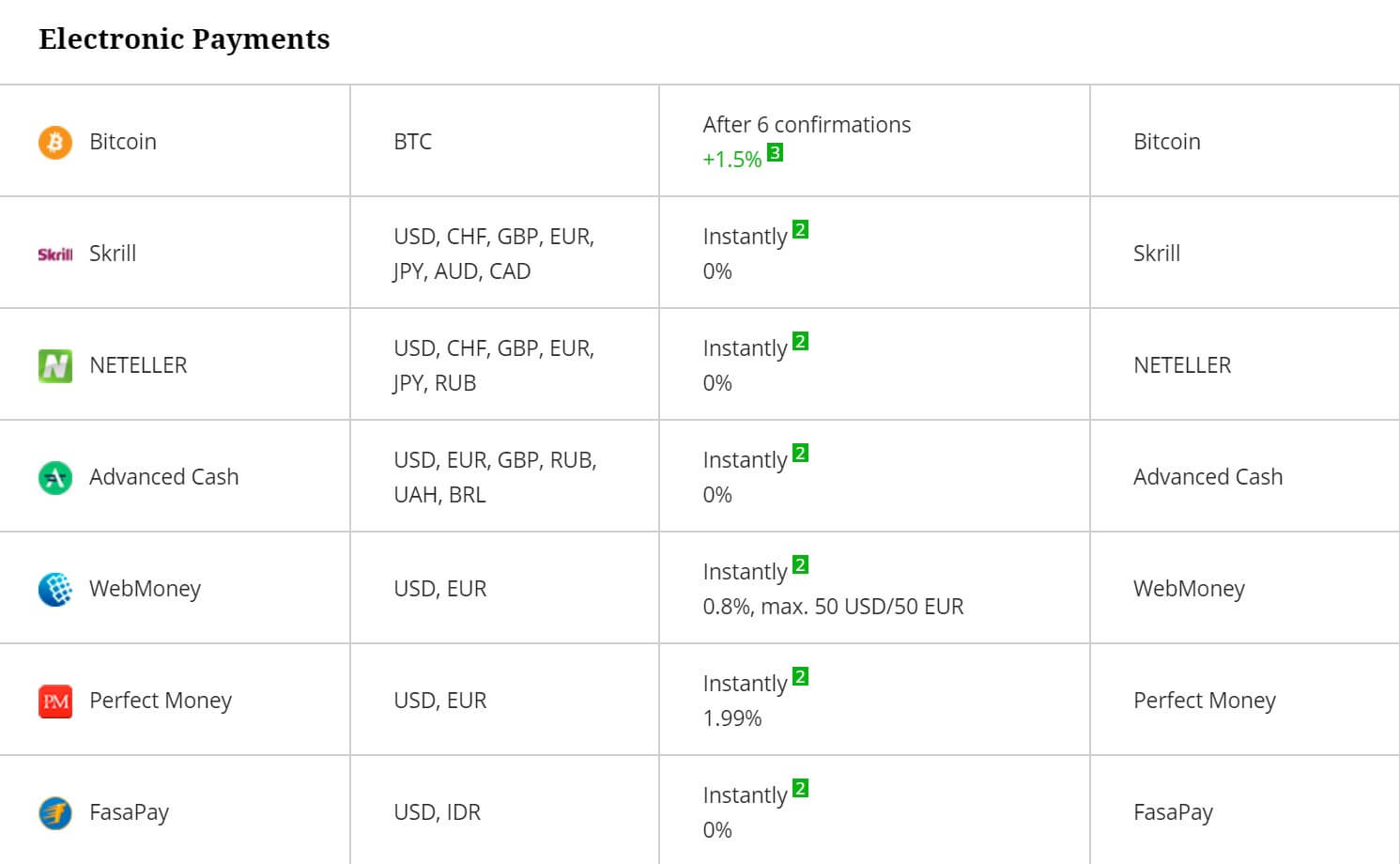

Deposit Methods & Costs

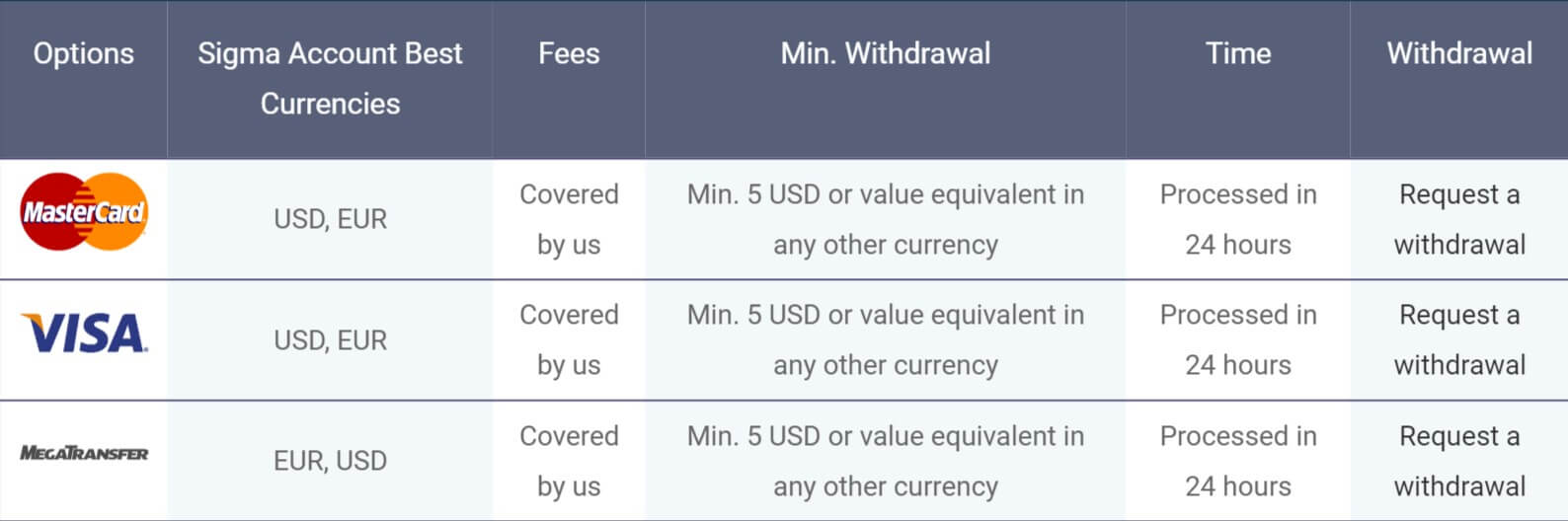

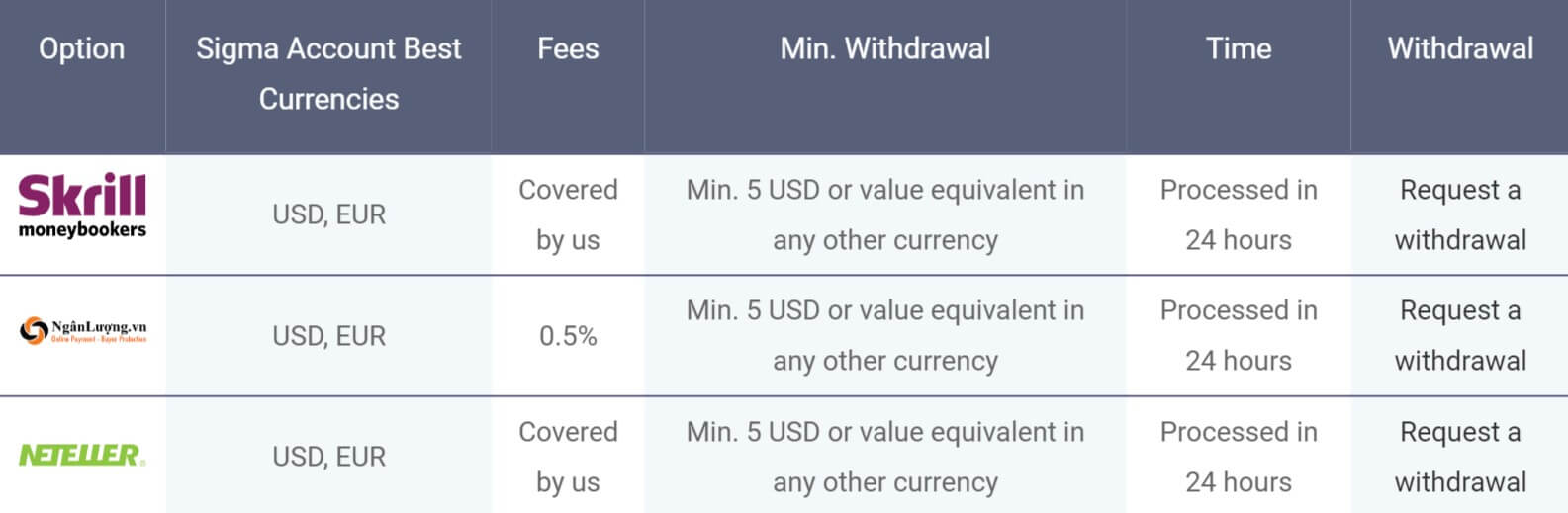

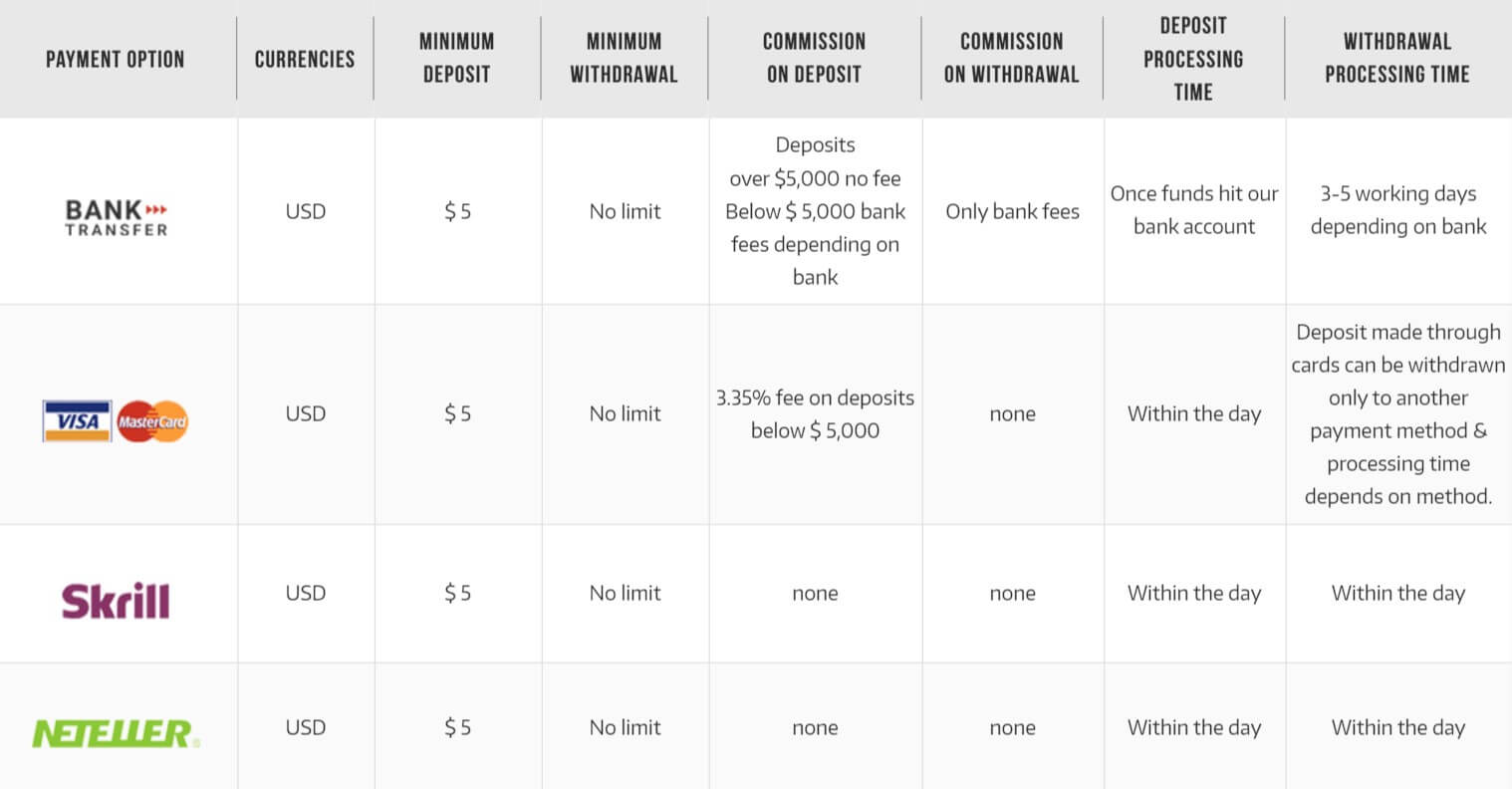

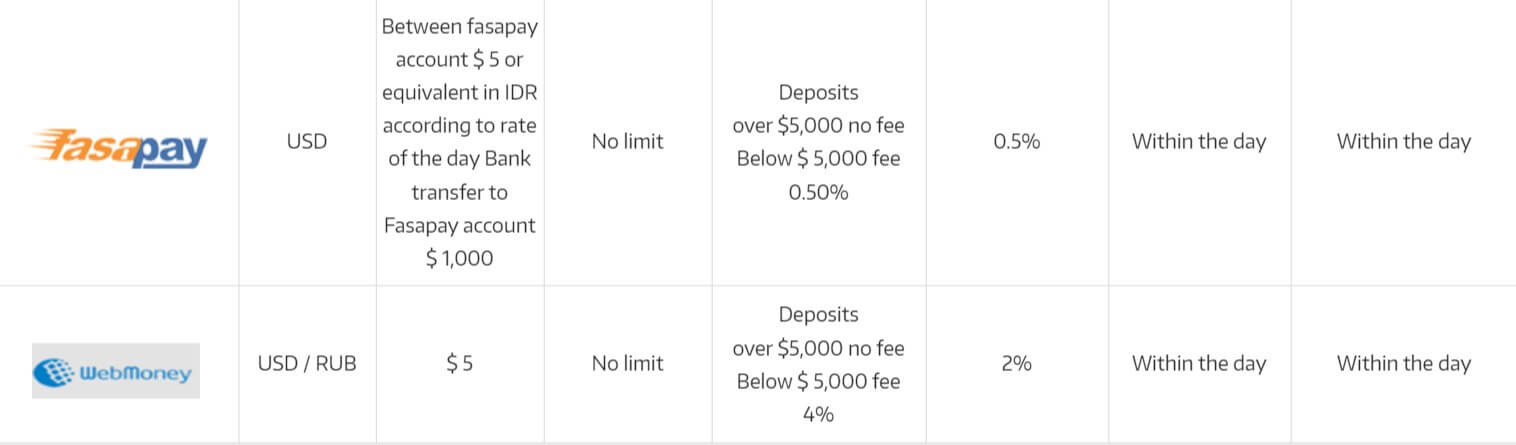

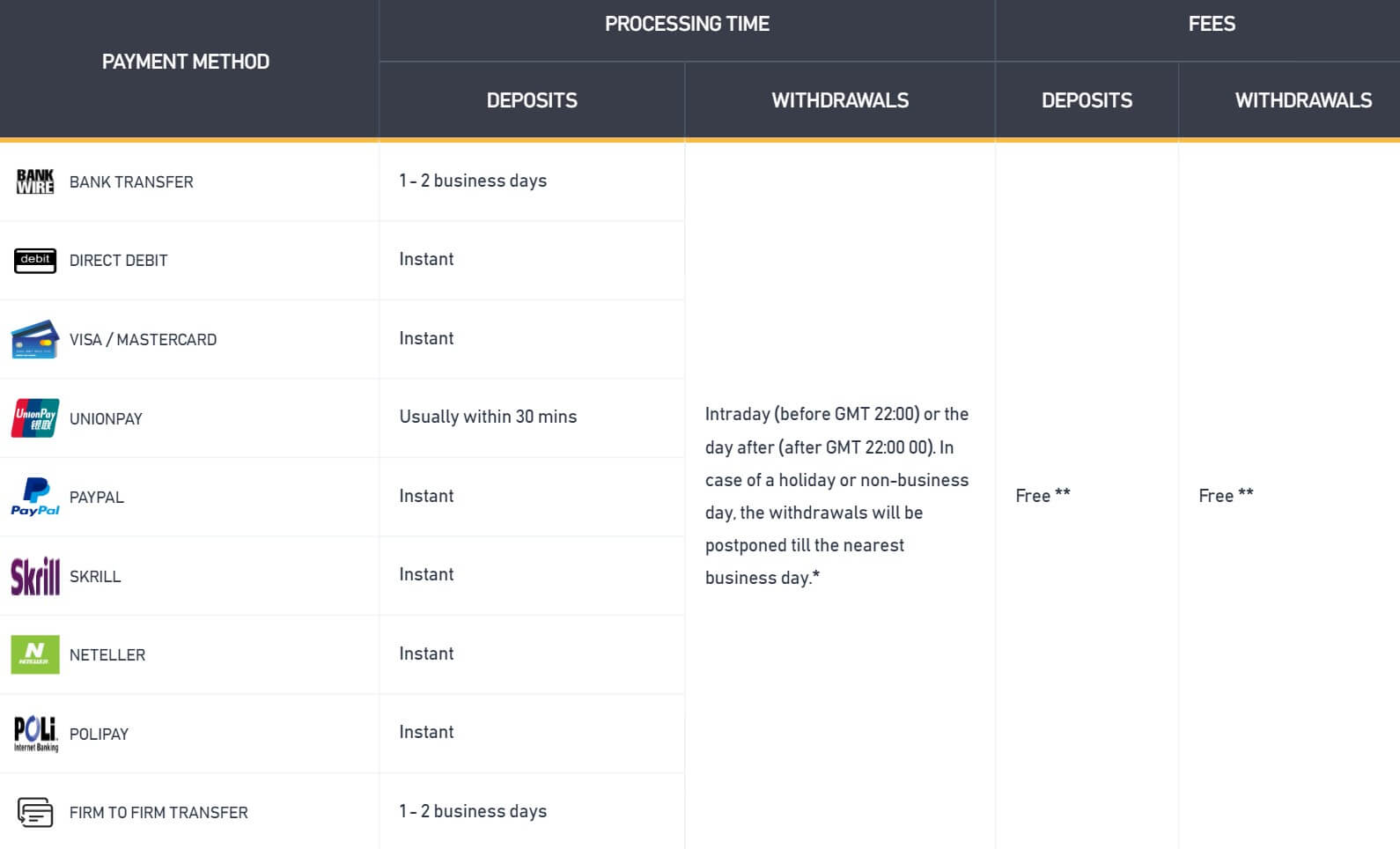

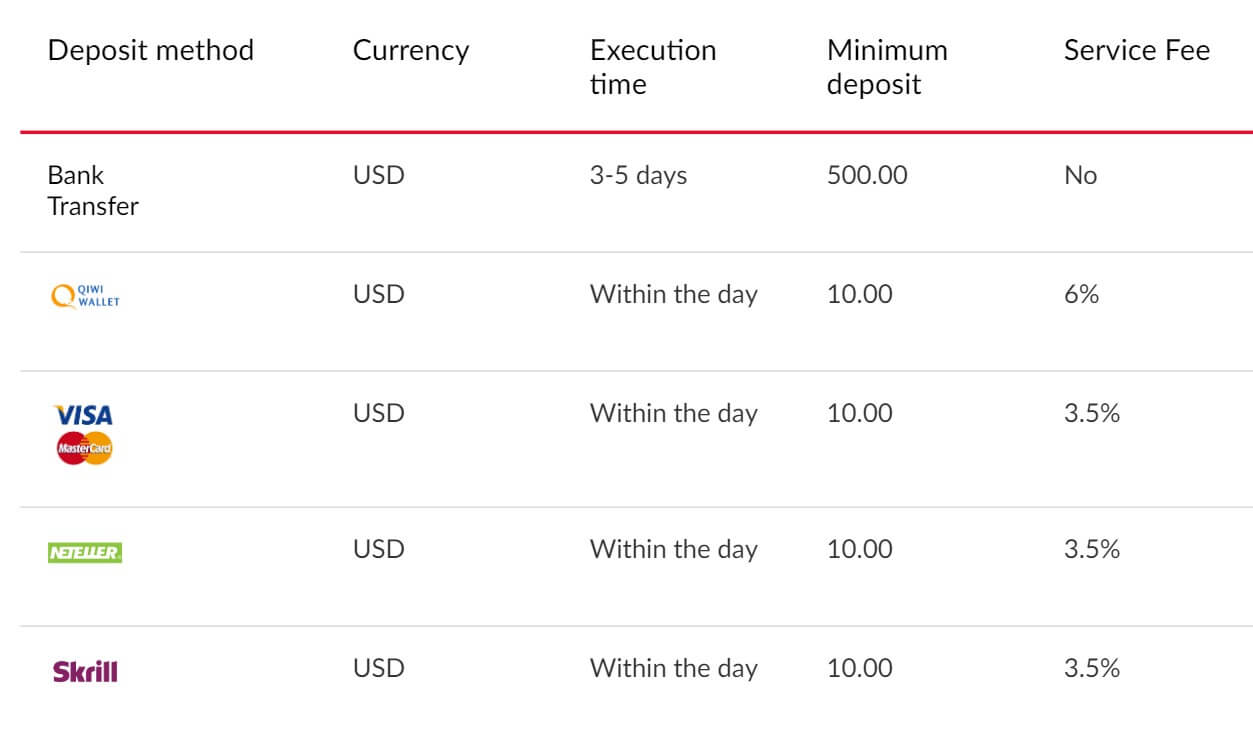

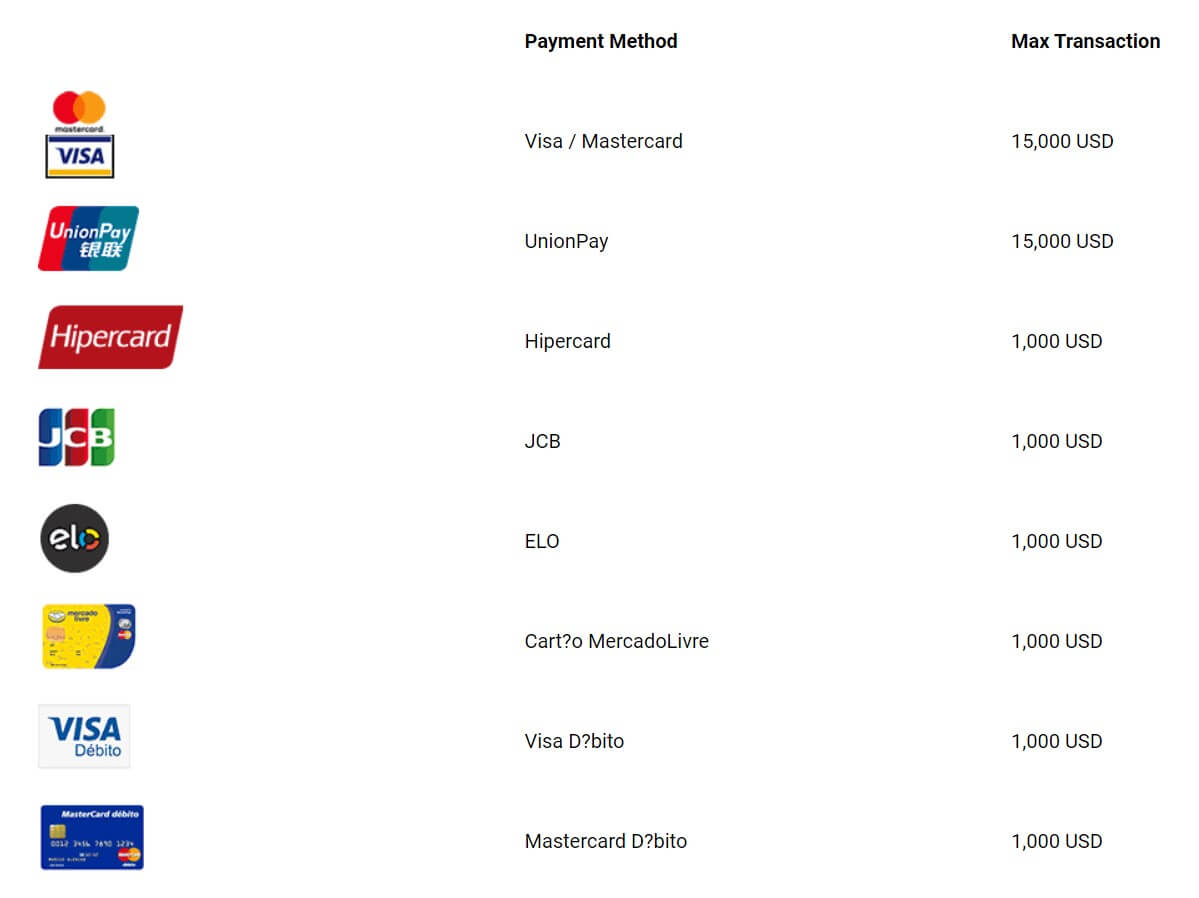

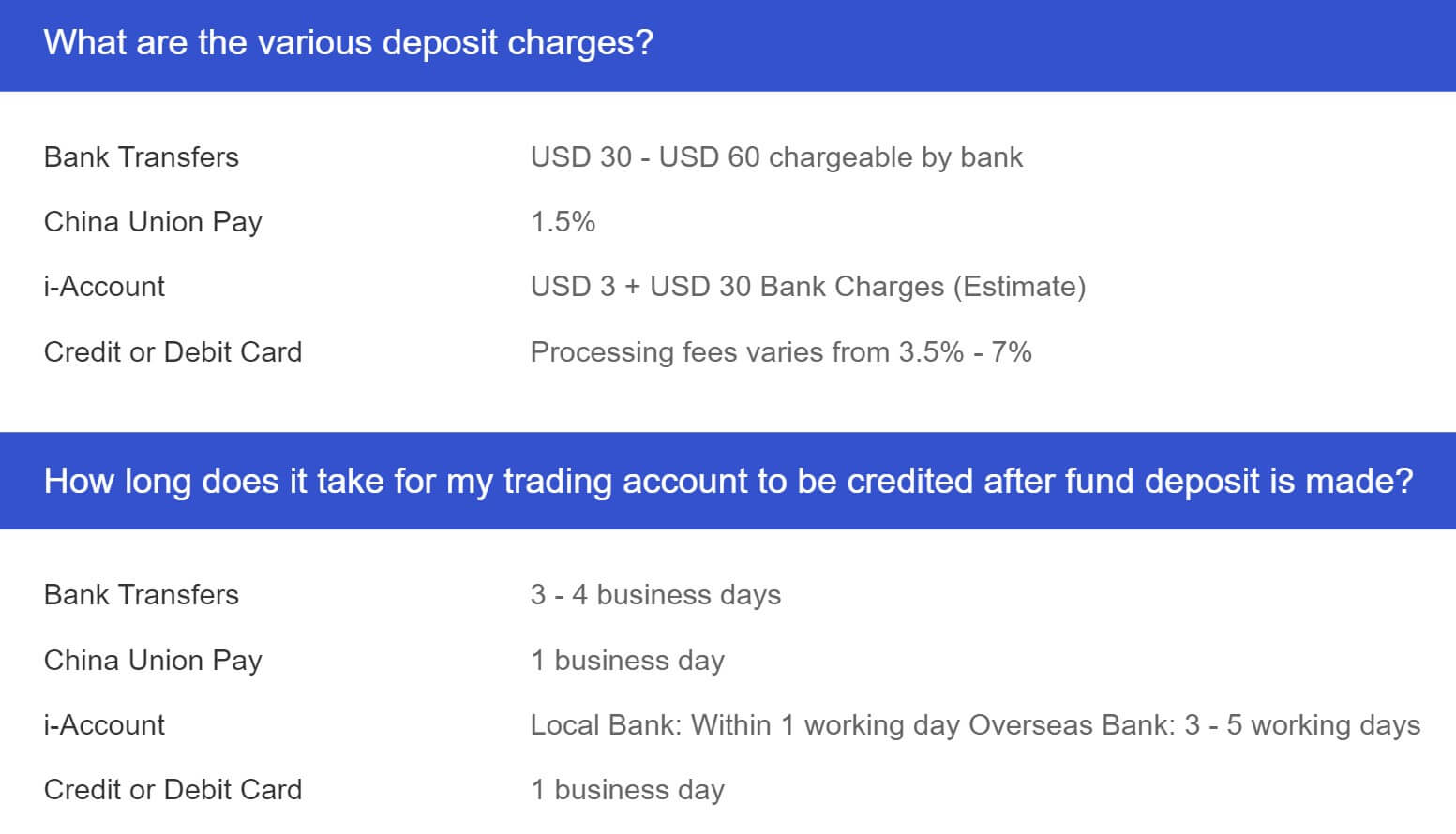

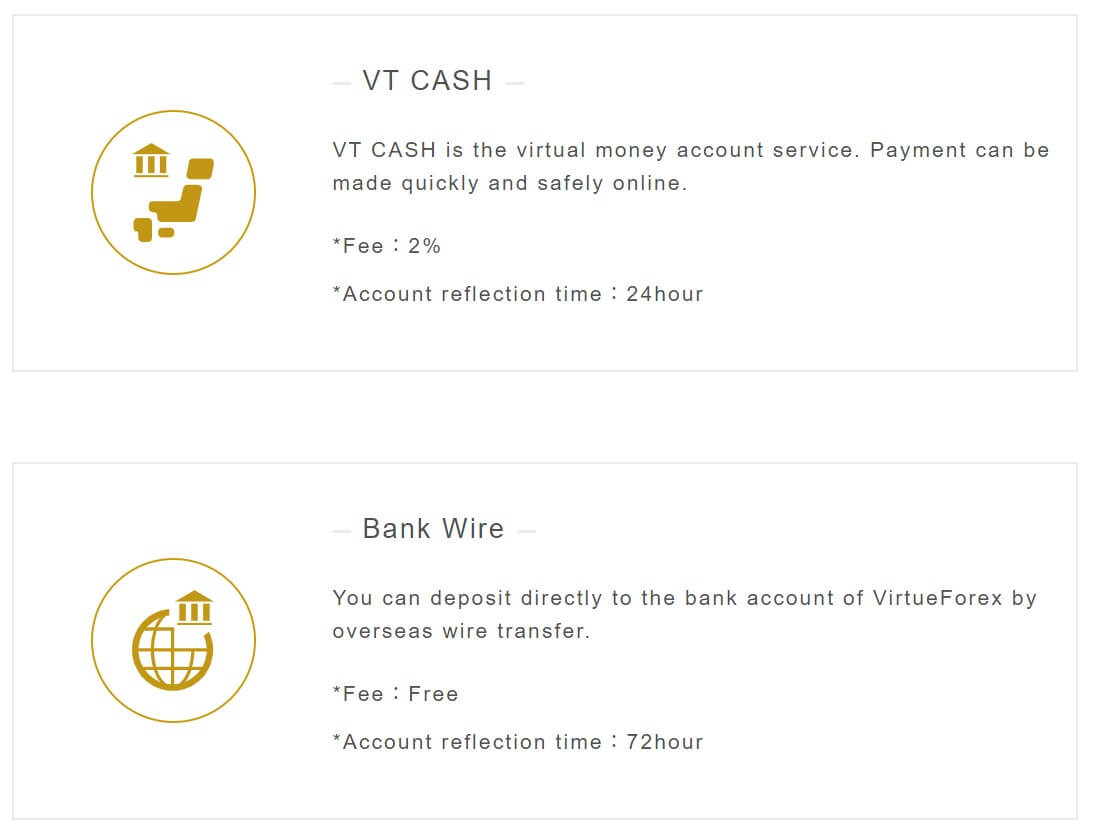

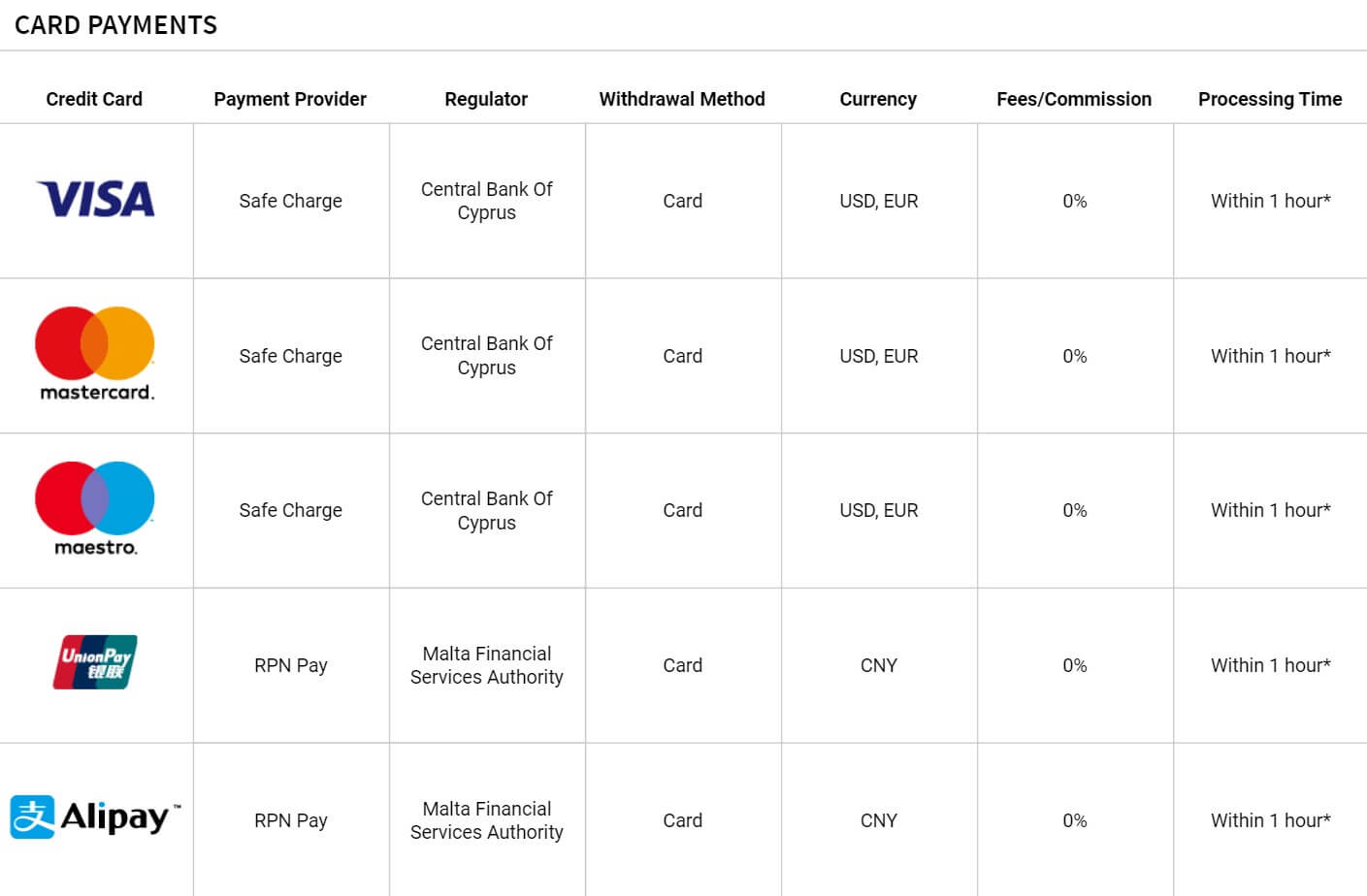

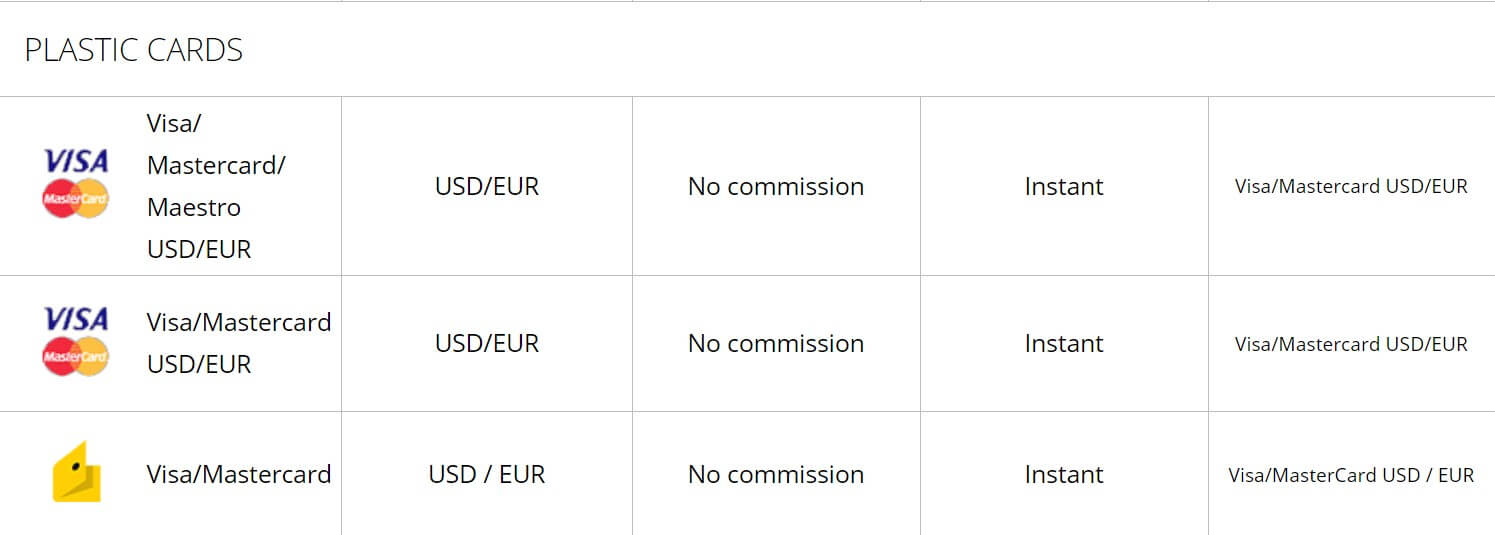

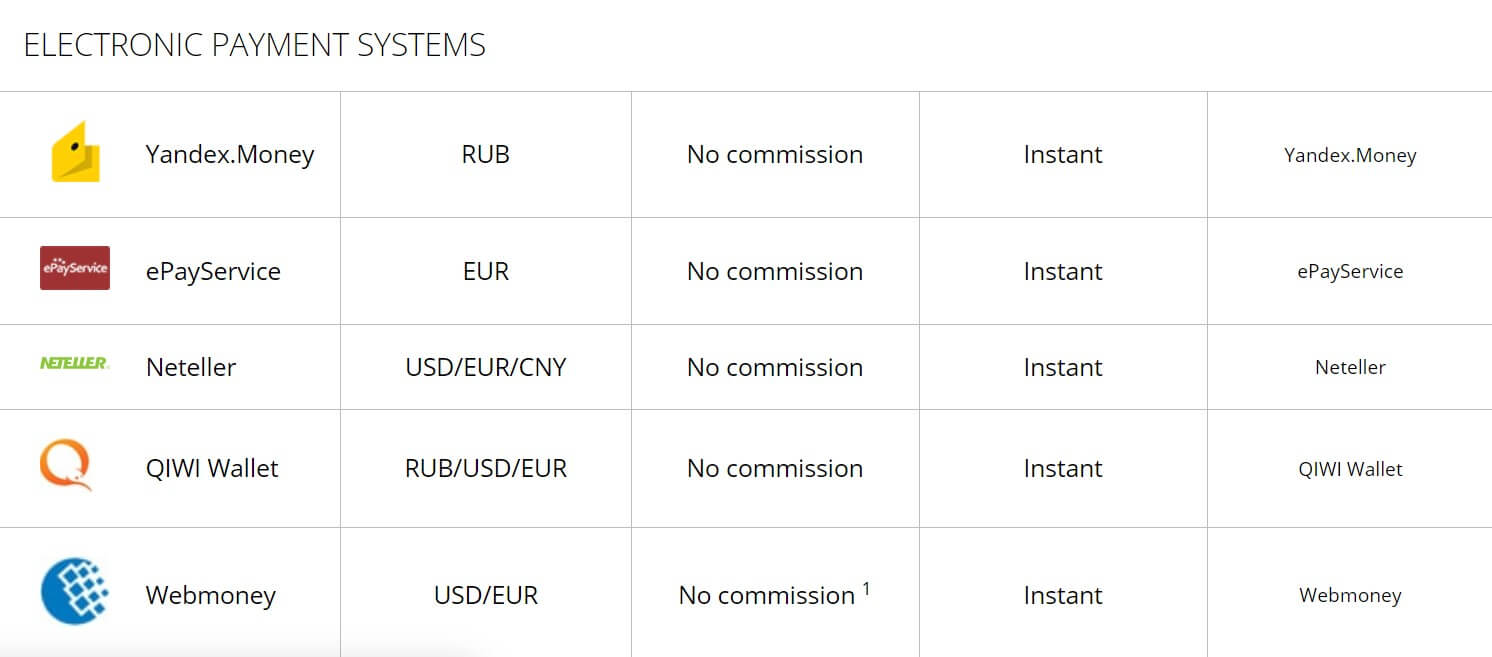

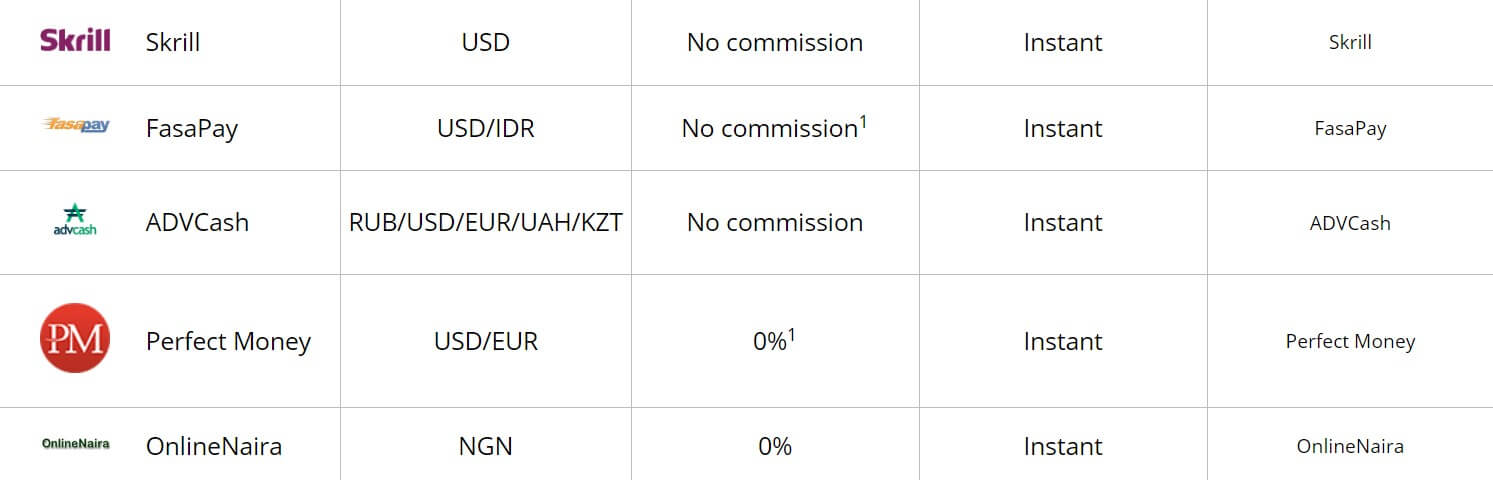

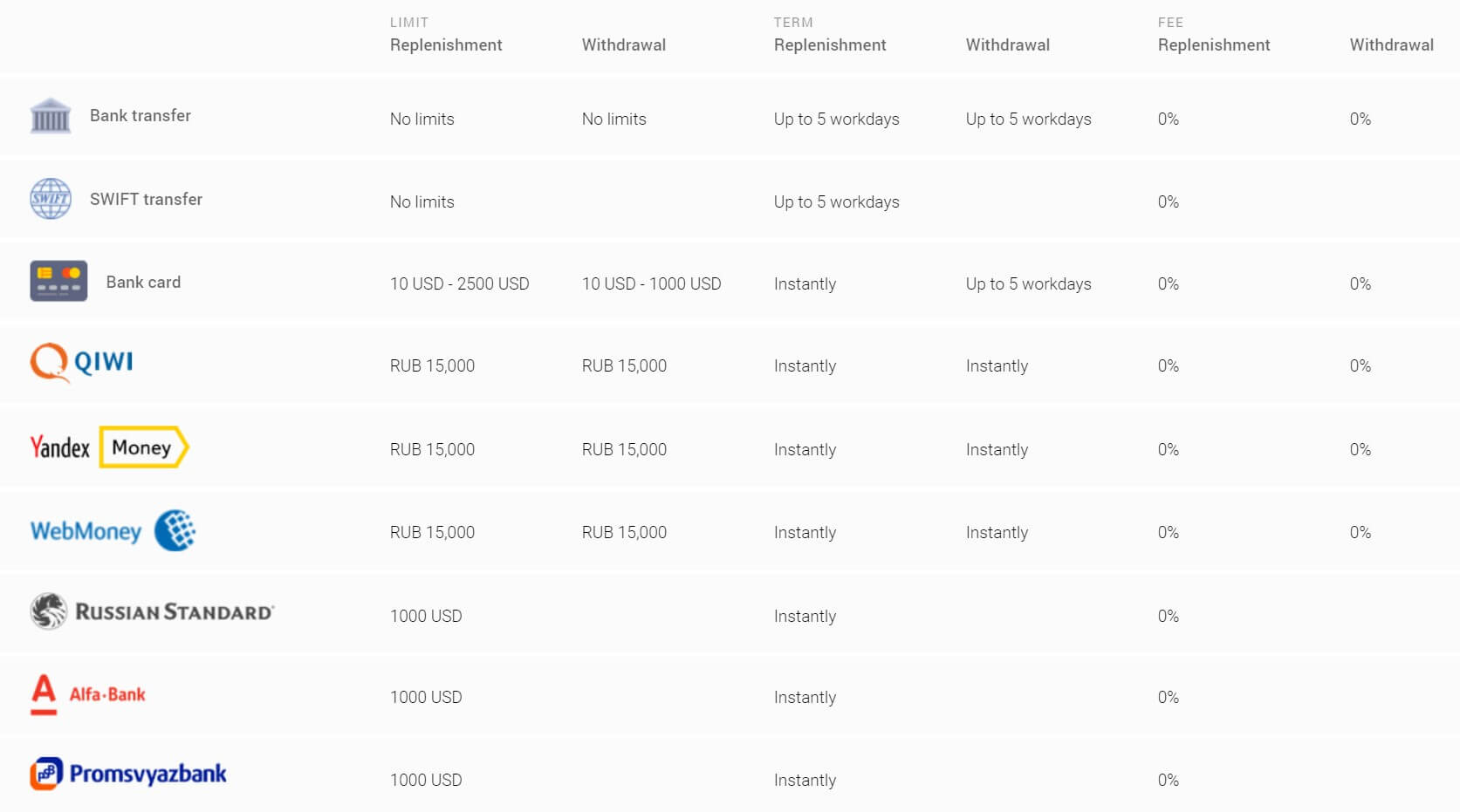

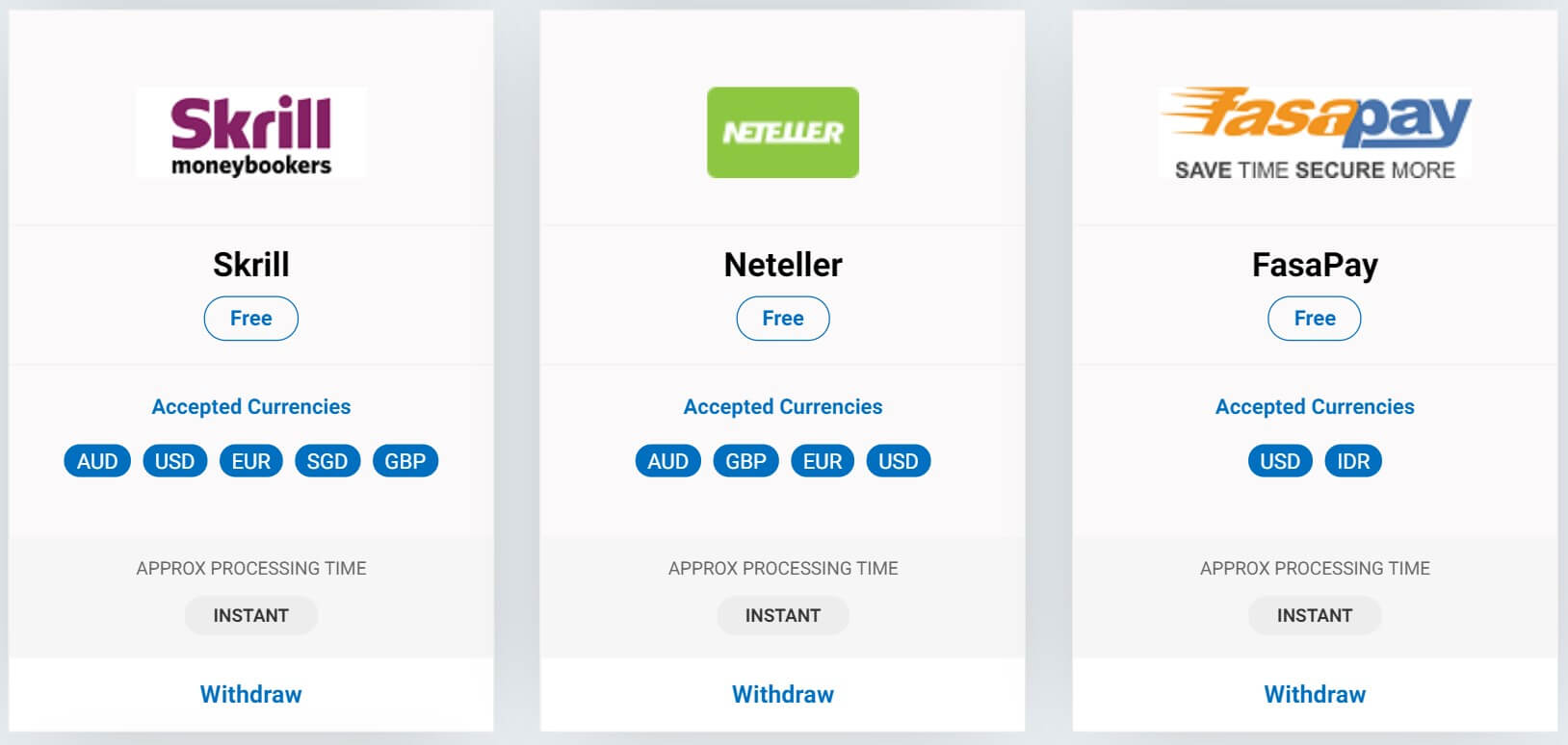

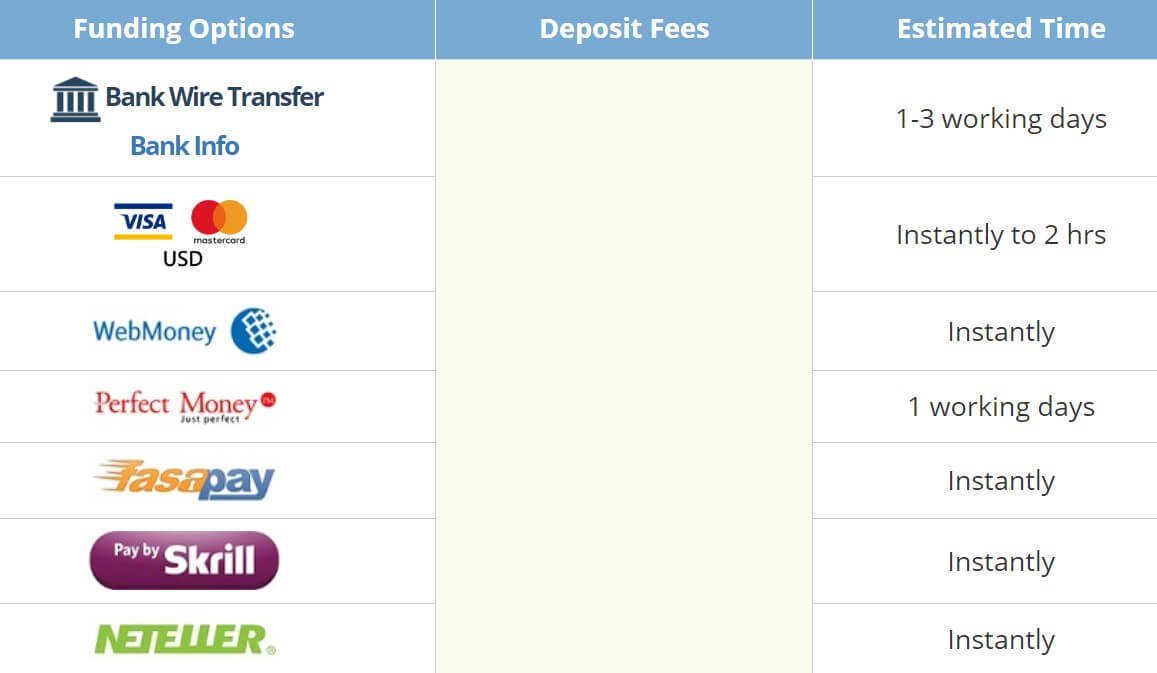

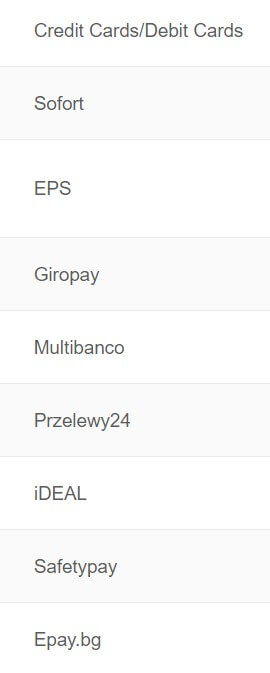

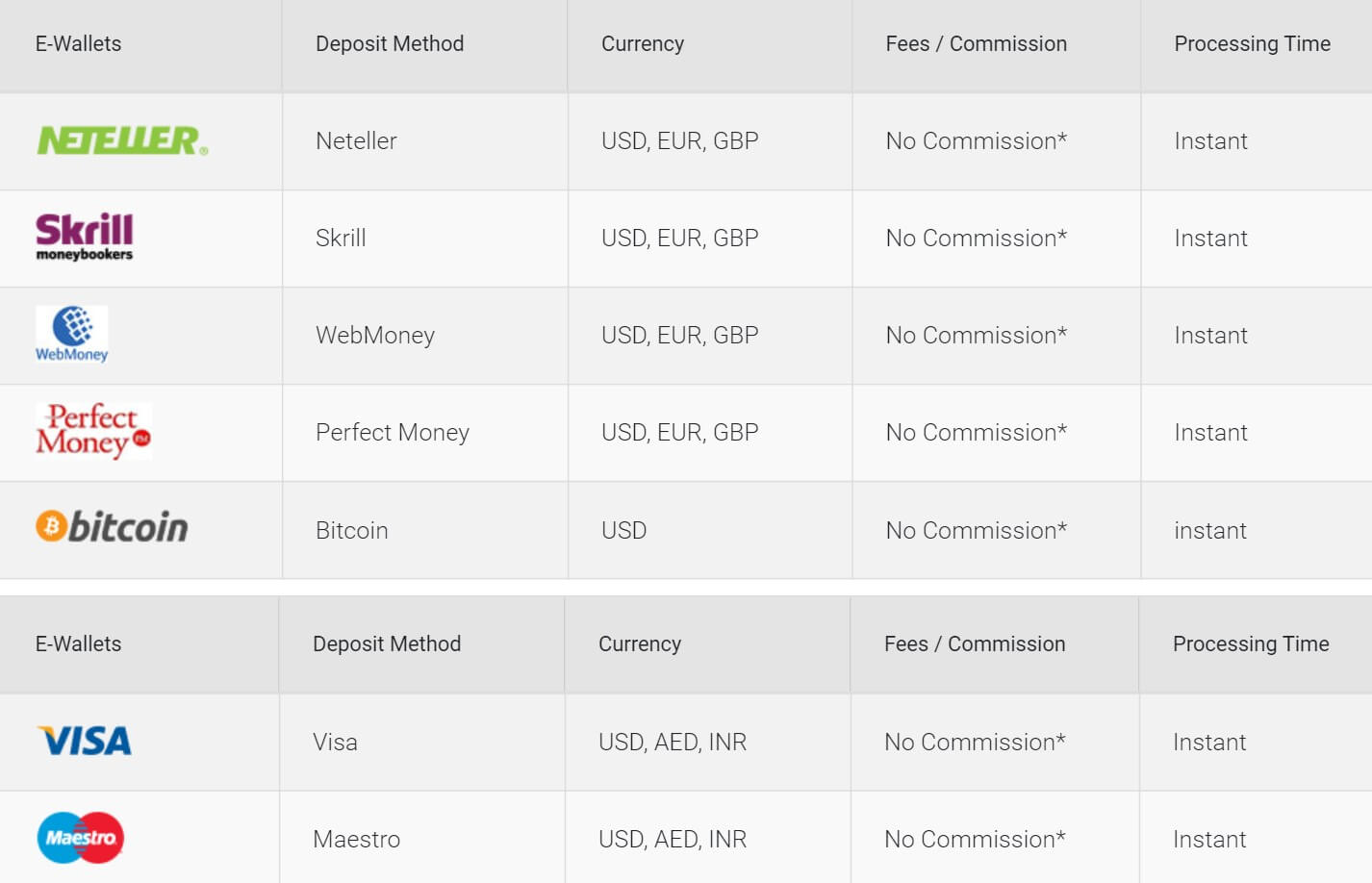

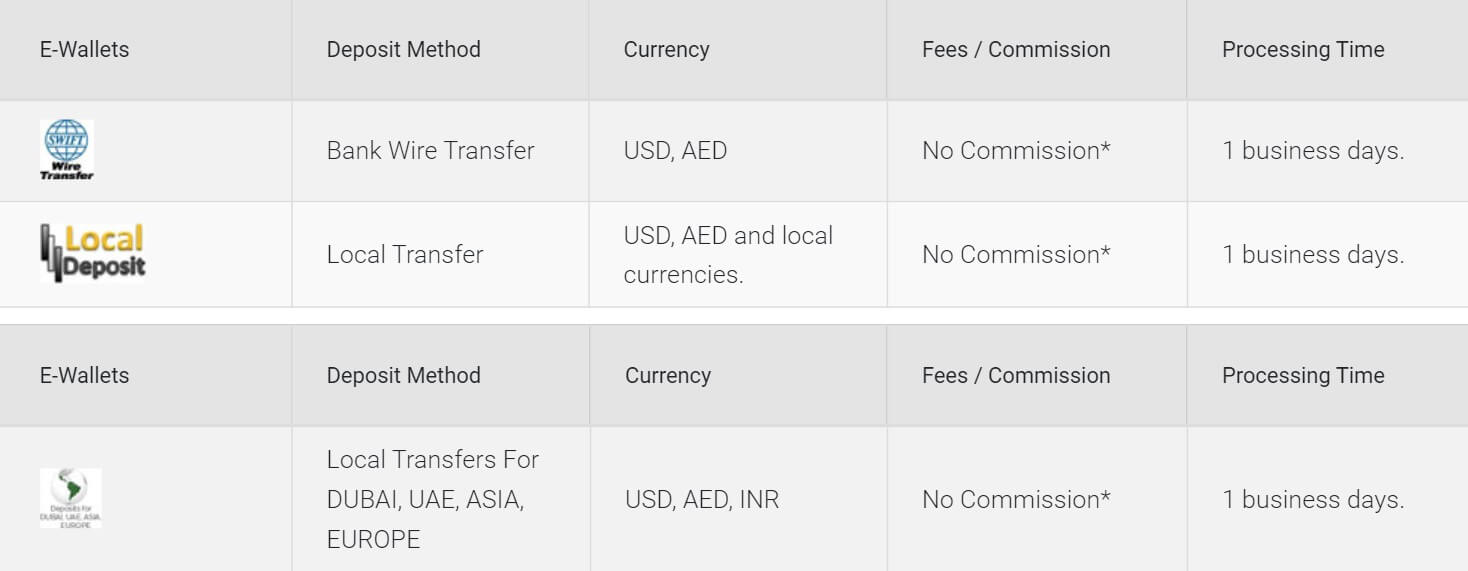

Deposit methods available are Wire transfer, Credit Cards, Neteller, and Skrill. Incoming transfer in Dollars for bank wires is 5 EUR plus stamp duty.

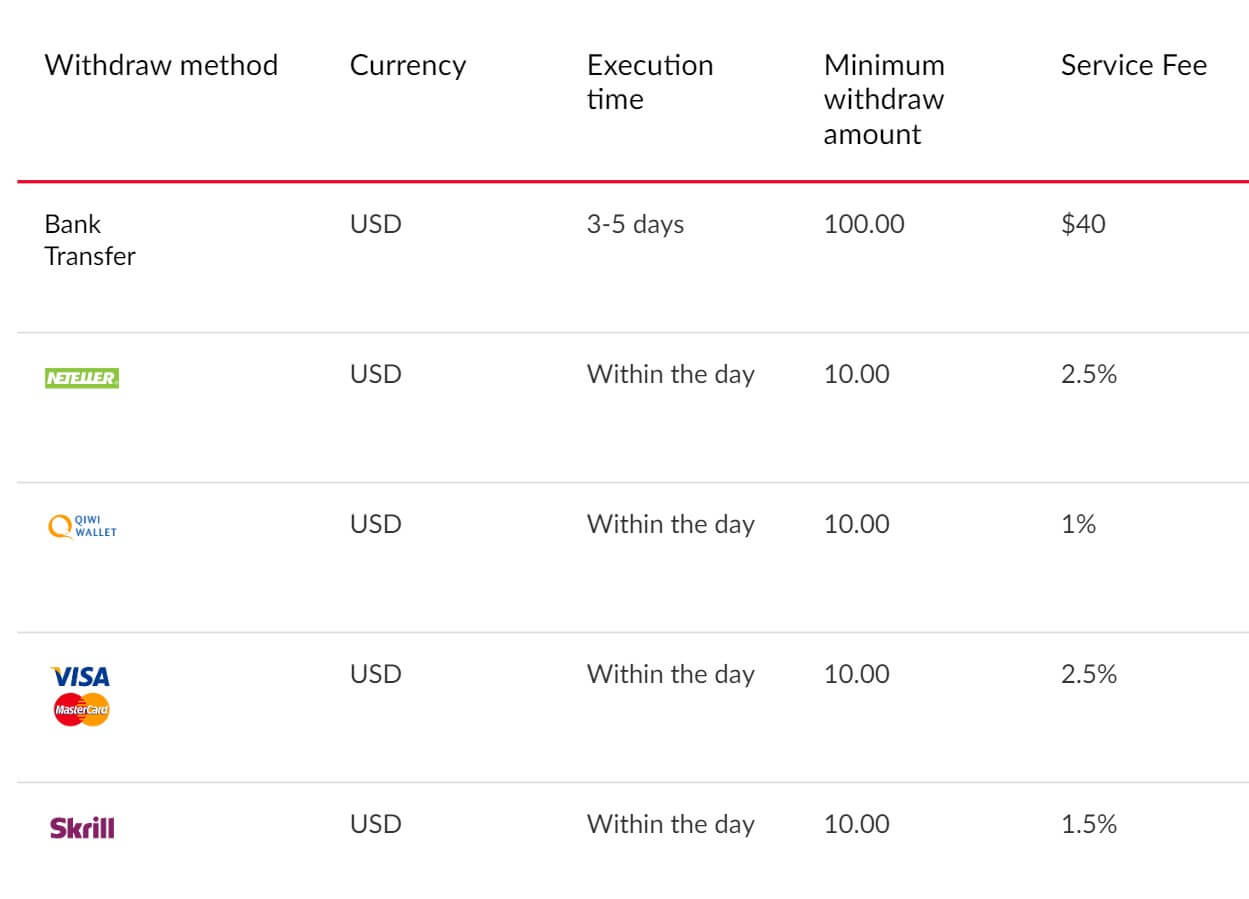

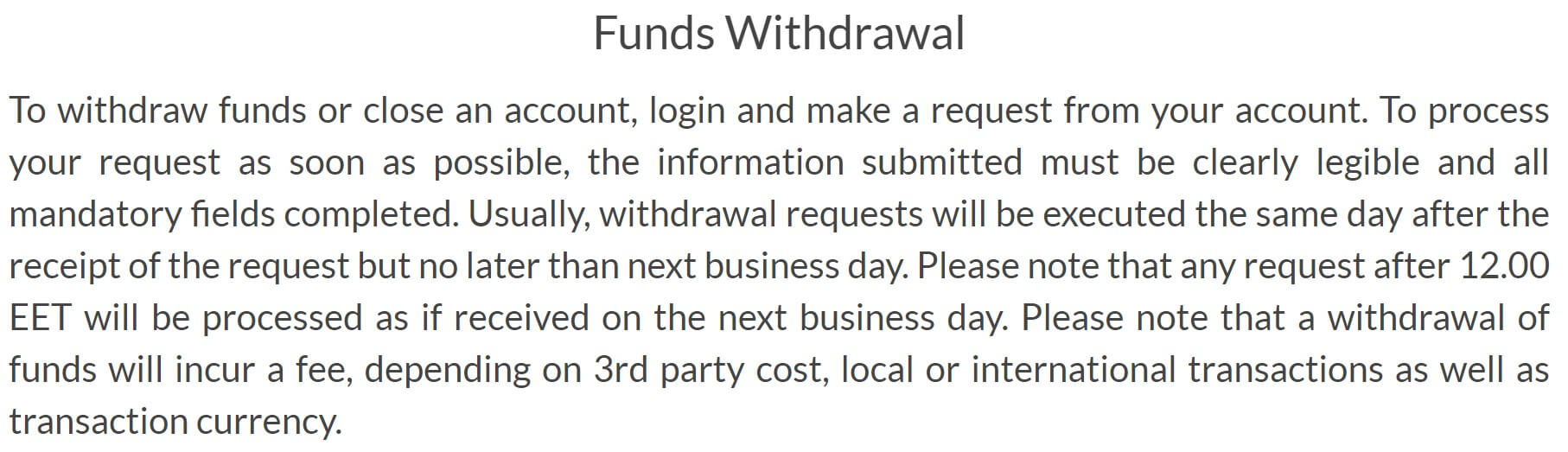

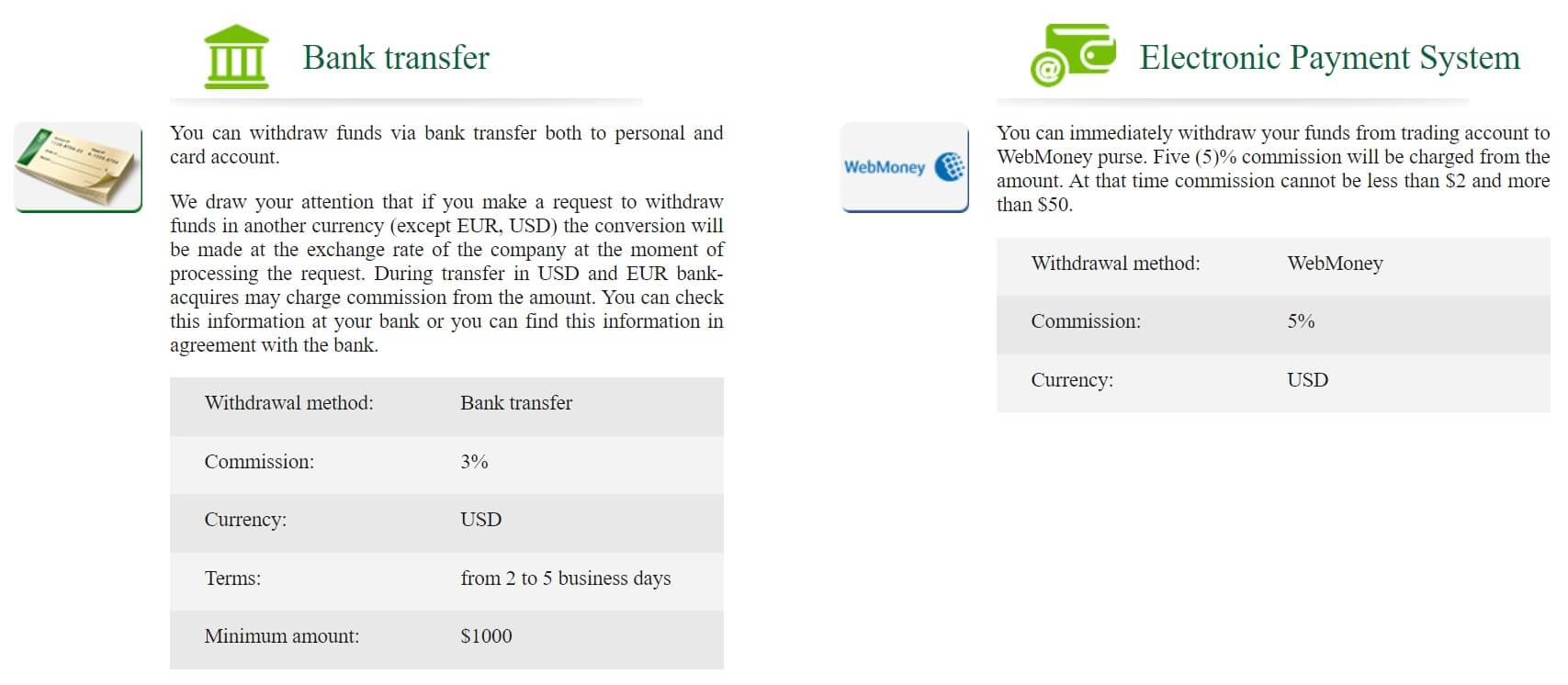

Withdrawal Methods & Costs

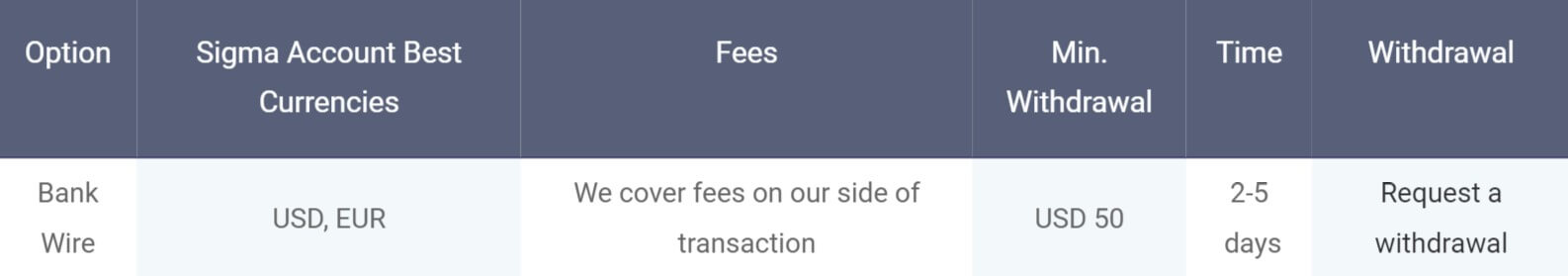

Same as with the deposits, the channels have to be the same per AML policies as deposits and under the investor name. For SEPA Transfers there are no withdrawal fees until EUR 100,000. SEPA Transfer above EUR 100.000 has a EUR 15 fee plus stamp duty. Also, US Tax Code Section 1441 points to Clients trading on the US markets, they are charged an annual fee of EUR 40 plus VAT according to the Pricing document from DIF Broker. Transfer outside SEPA area has a 0.20% fee, minimum of EUR 15 and a maximum of EUR 60 plus stamp duty. All transfers otherwise have a minimum of EUR 10 fee or 2% for transfers over the nominal portfolio with a maximum of EUR 200 per ISIN.

Withdrawal Processing & Wait Time

Withdrawals are done in 2 to 5 business days regardless of the withdrawal channel. This on par with other FX brokers within the industry.

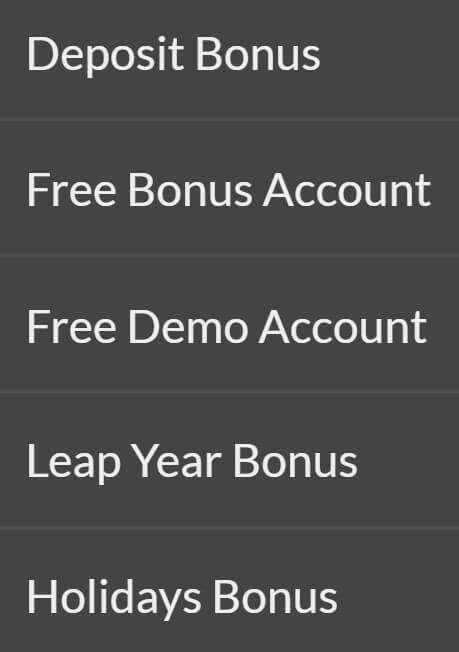

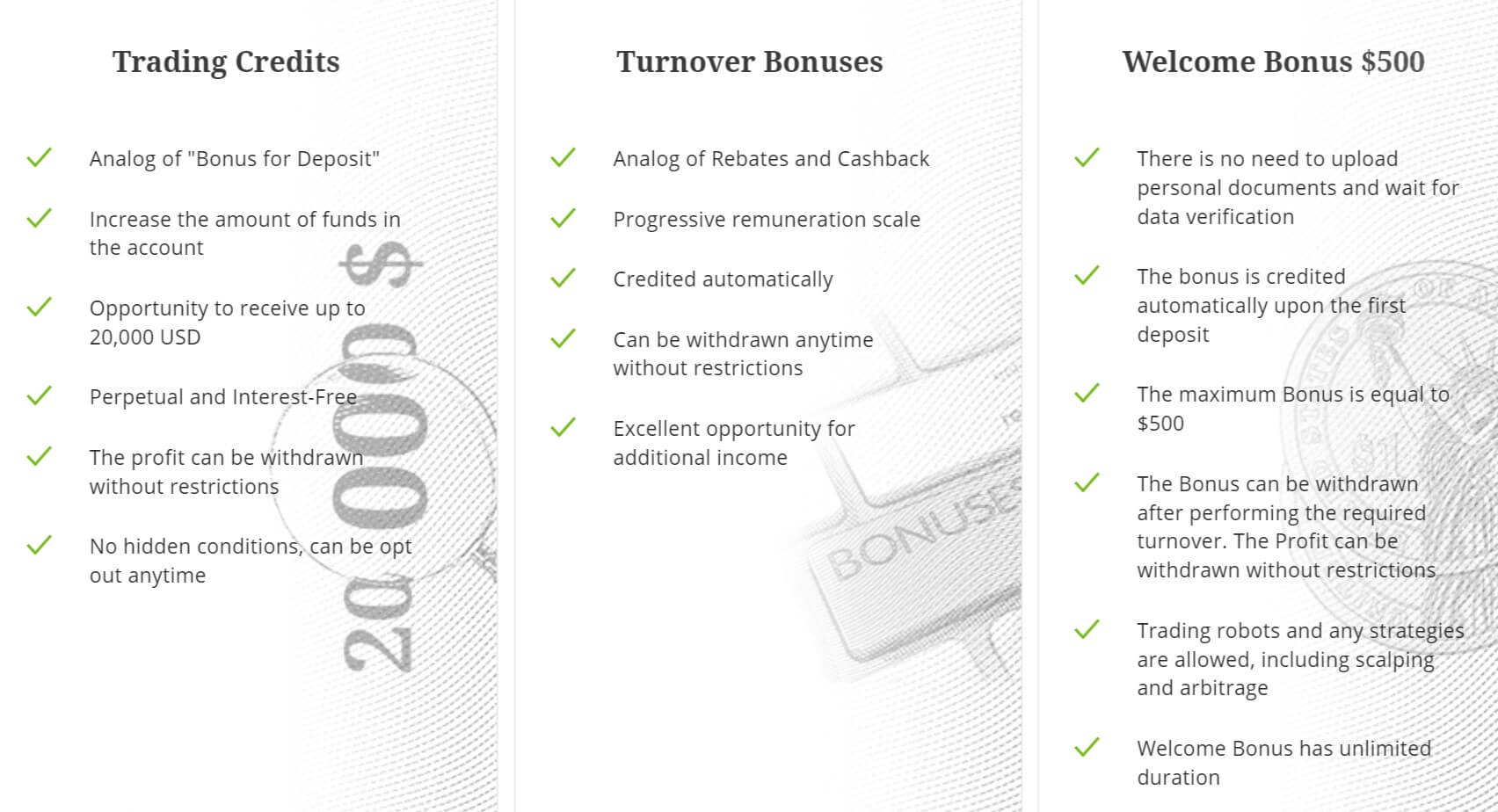

Bonuses & Promotions

DIF Broker is not allowed to have any promotions or bonuses per EU directives. We certainly cannot fault them for following the rules, can we?

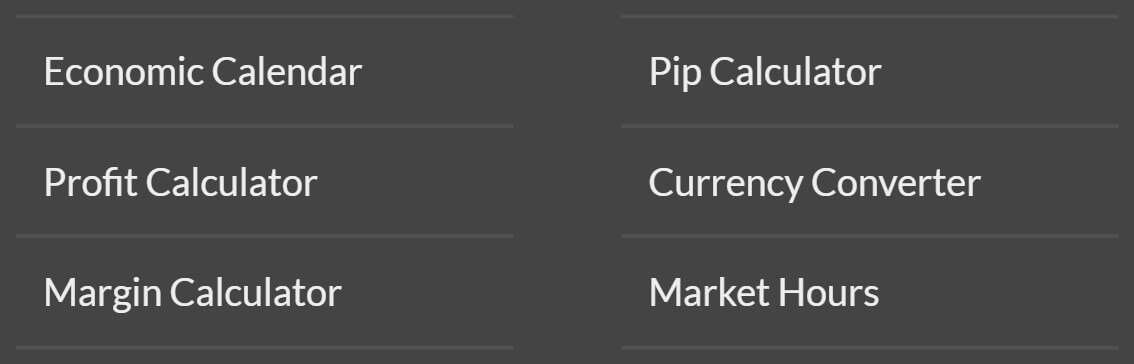

Educational & Trading Tools

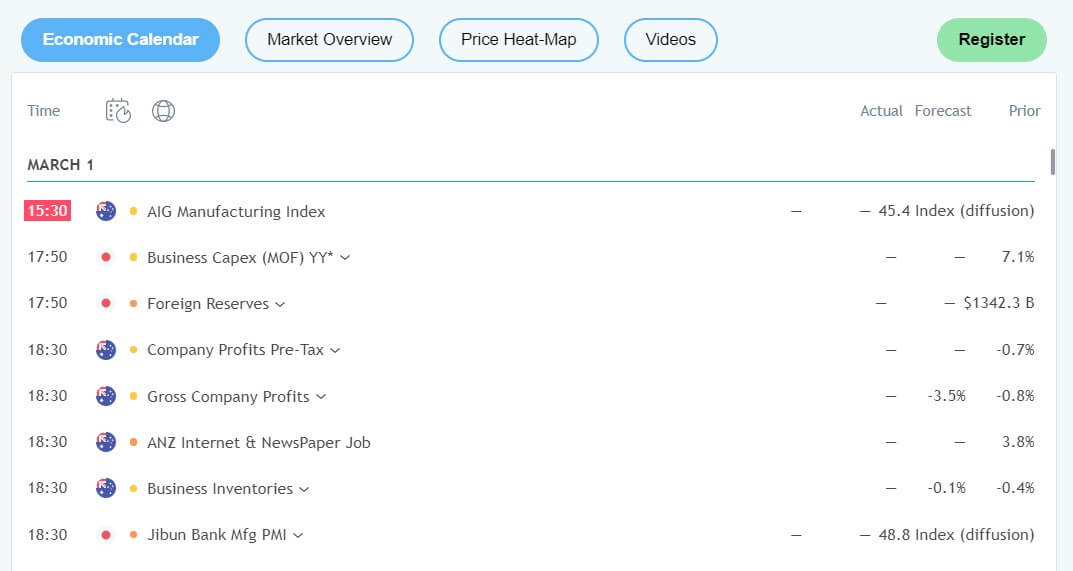

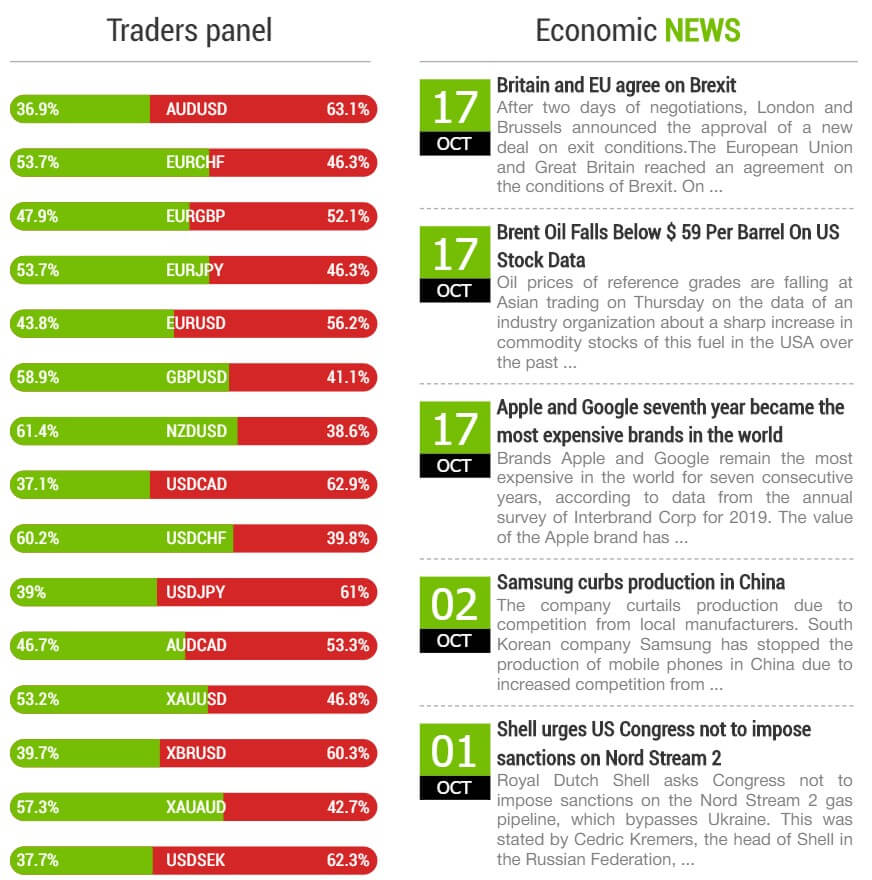

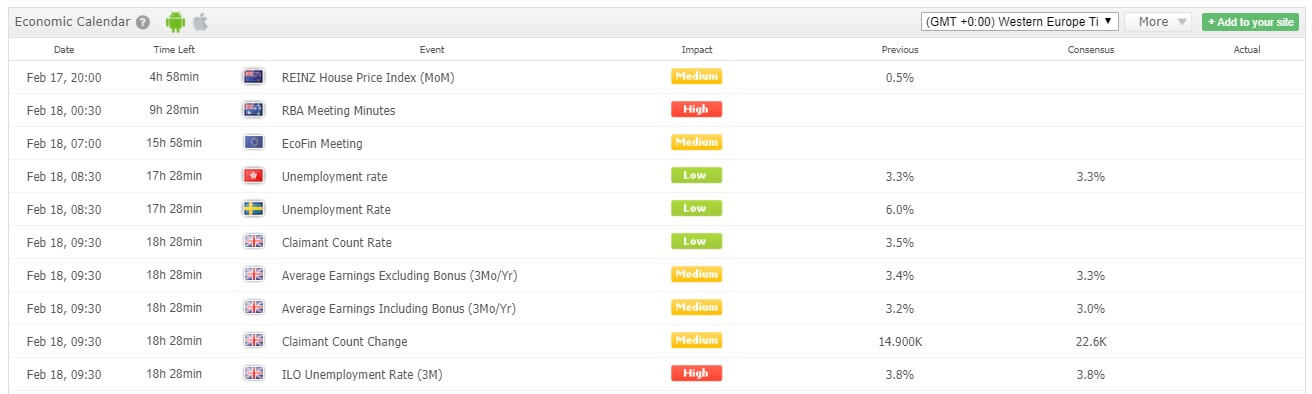

DIF Broker has tools integrated into the DIf platform. Under the Research tab, there are 3 modes traders can utilize, Signal service from the mentioned Autochartist, News and Economic Calendar. Autochartist is a well-known service that incorporates automated pattern recognition and plotting on the chart. Traders can use the signal information and trade on the spot without going to the Trading mode. This is very convenient for those that like AUtochartist and can easily find, sort and filter their signals on many categories.

The Newsfeed is updated regularly and currently only comes from NewsEdge Spanish LATAM. They are only available in Spanish without any way to translate. If non-Spanish speaking traders what to use this, they can utilize any translating service as the articles are not longer than one page.

The Newsfeed is updated regularly and currently only comes from NewsEdge Spanish LATAM. They are only available in Spanish without any way to translate. If non-Spanish speaking traders what to use this, they can utilize any translating service as the articles are not longer than one page.

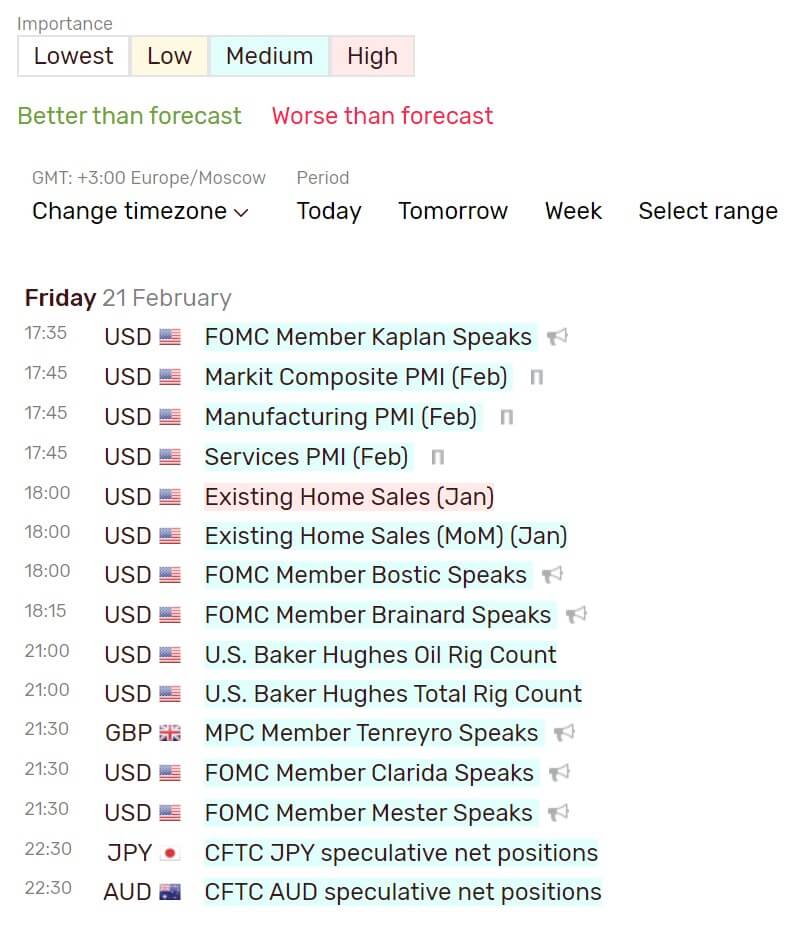

The integrated Economic Calendar is very basic not having any options for filtering, sorting or analyzing. It is designed as a stating non-interactive list without impact meters. What you will see are just the most recent event name, country relevant, and the figures for past, actual and estimated levels. Other educational content is mixed in on the website, intended for not-so-familiar investors.

Customer Service

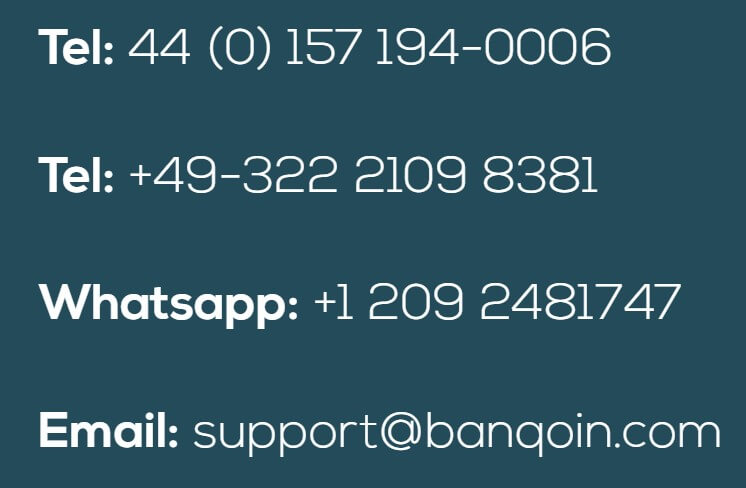

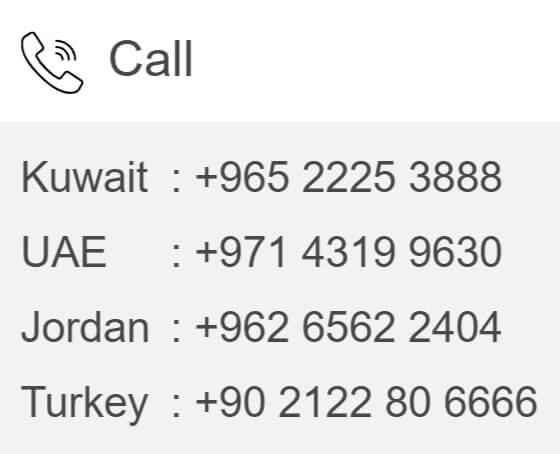

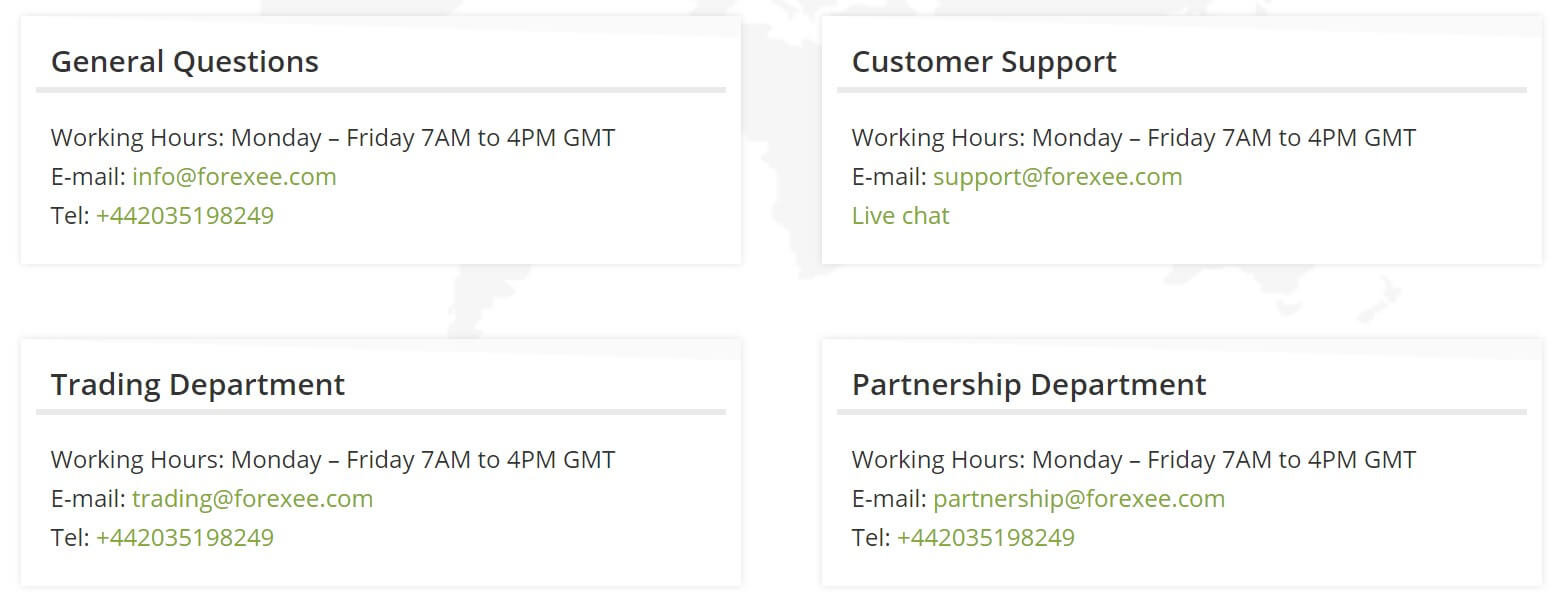

DIF Broker can be contacted only by phone or email. Once you have a Live account, you will have access to the chat integrated with the DIF platform. The quality of service is very good but have in mind that DIF broker has a very good selection of non-aggressive salespersons.

Demo Account

The Demo is promoted on most of the pages of the DIF Broker’s website. Yet the demo is time-limited to the next 15 days. This is not a good signal since this practice is common when brokers do not want you to spend too much time without any deposits.

Countries Accepted

Being registered with multiple EU regulators and having the license to do business in them, DIF Broker focuses on the Spanish speaking countries such as Spain, and Latin America in their respective branch. Other clients come from Germany, the UK, Armenia, and Poland. According to the regulations, the DIF Broker will not do business outside the scope of its licenses. The official licenses to provide services are held in Bulgaria, Germany, Italy, Netherlands, Poland, Portugal, Romania, France, Spain, the U.K., and Uruguay.

Conclusion

This section of the DIF Broker review will conclude our impressions and solidify your decision on investment. 77% of retail investor accounts lose money when trading CFDs with DIF Broker, an average percentage in the industry. But note this is only counted for CFD trading and this broker has many more other types of trading products.

One thing is certain, trading conditions are not good enough for the nowadays traders who like fast trading, cryptocurrencies, and automation. DIF Broker knows this and does not present this so openly. On the other side, the DIF Broker wants to differentiate by offering other managed portfolio services aimed towards long term clients with higher financial capabilities. Even though the great range of products on the specialized platform is great, only a small number of traders are willing to stay just for the ETFs, Stocks or Bonds.

At the current state, ordinary retail traders of today will seek other brokers, we are not sure how sustainable is this different direction DIF Broker embarked on.

There are over 470 total assets and we have been broken down into a number of different categories, including FX pairs, commodities, stocks, metals, and more. We did not see any cryptocurrencies, and this could certainly be an issue for a number of traders.

There are over 470 total assets and we have been broken down into a number of different categories, including FX pairs, commodities, stocks, metals, and more. We did not see any cryptocurrencies, and this could certainly be an issue for a number of traders.

Minimum Deposit

Minimum Deposit

Customer Service

Customer Service

The assets have been broken down into a number of different categories, we have outlined them below along with the available instruments.

The assets have been broken down into a number of different categories, we have outlined them below along with the available instruments.

Educational & Trading Tools

Educational & Trading Tools

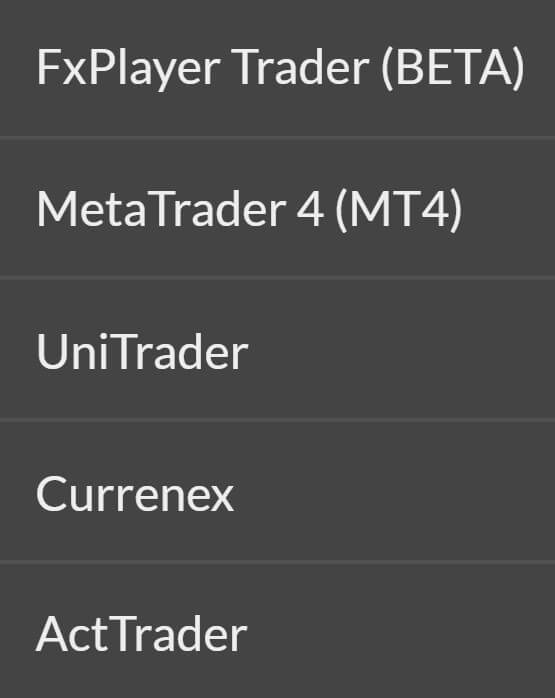

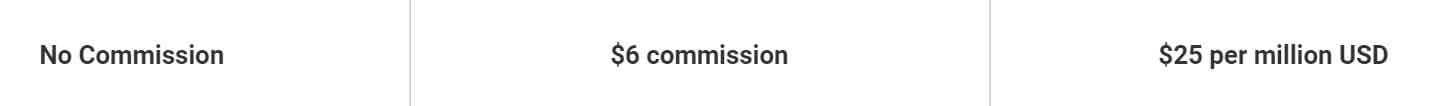

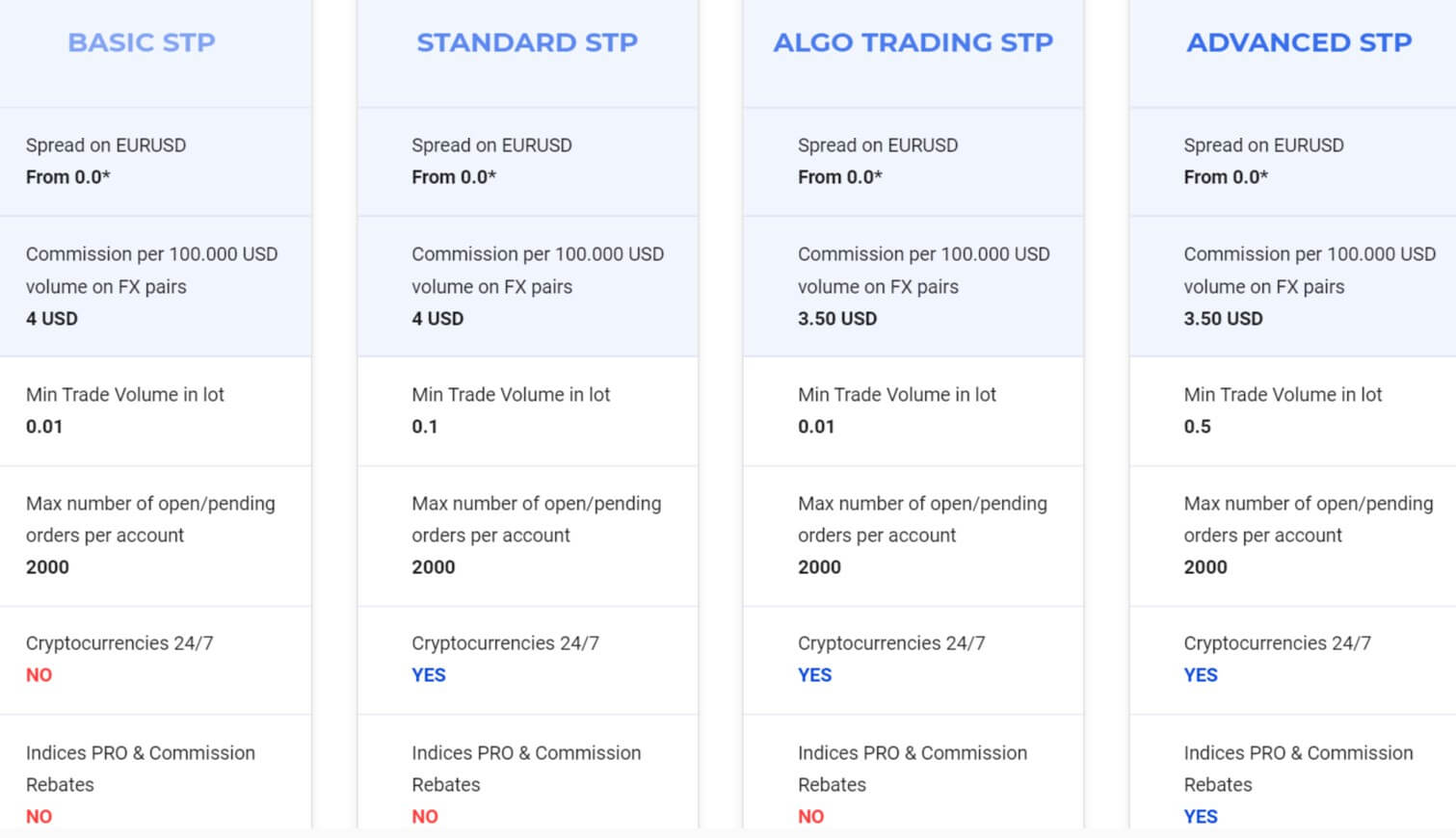

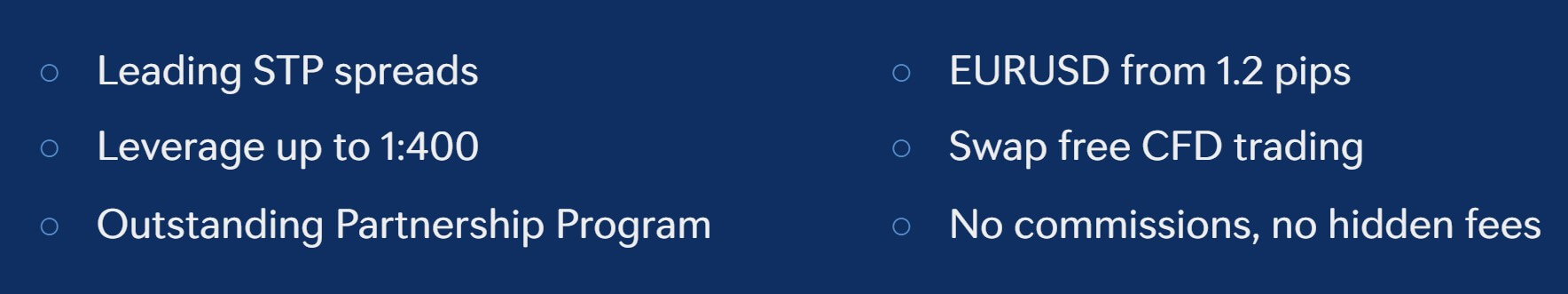

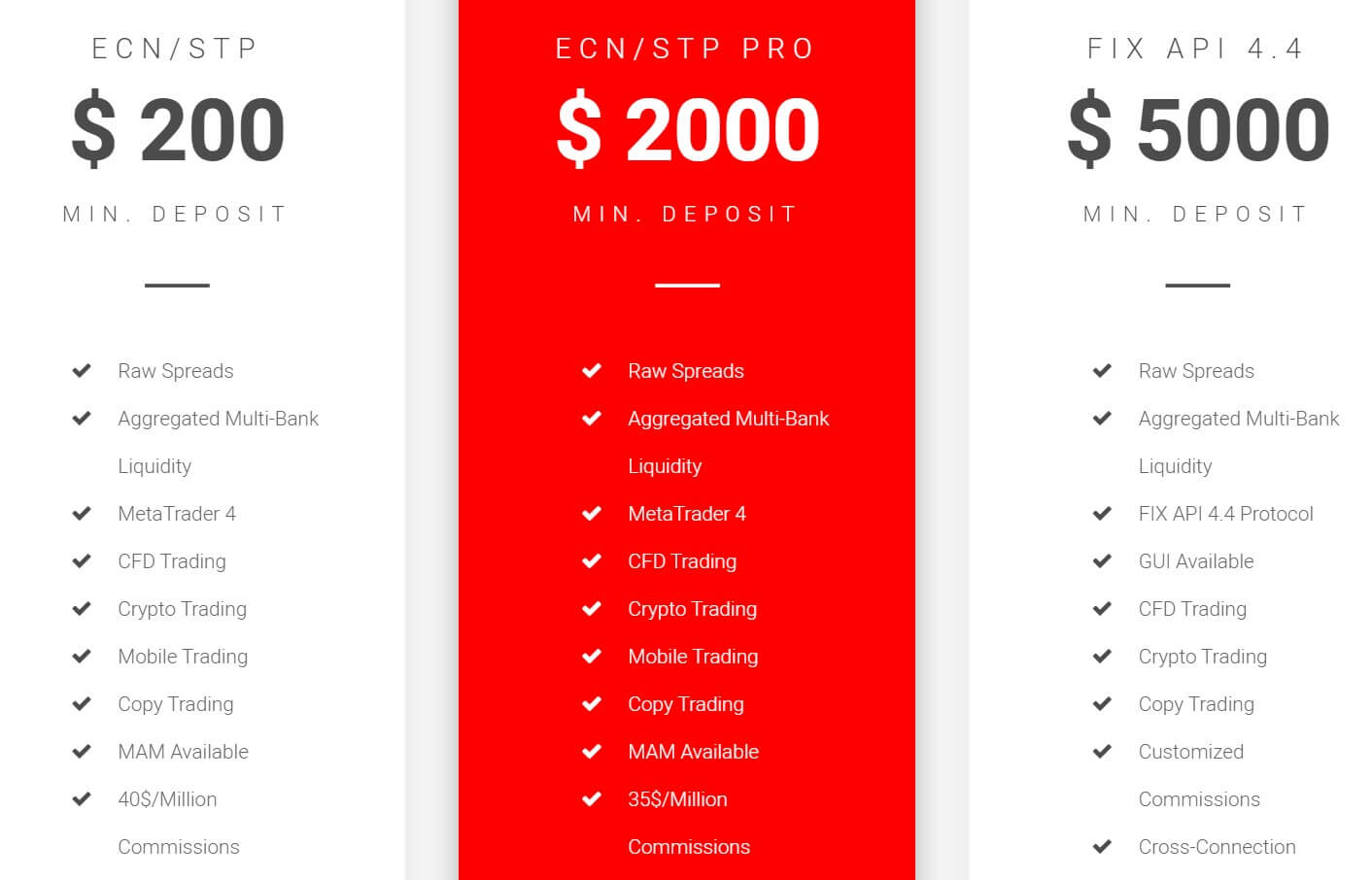

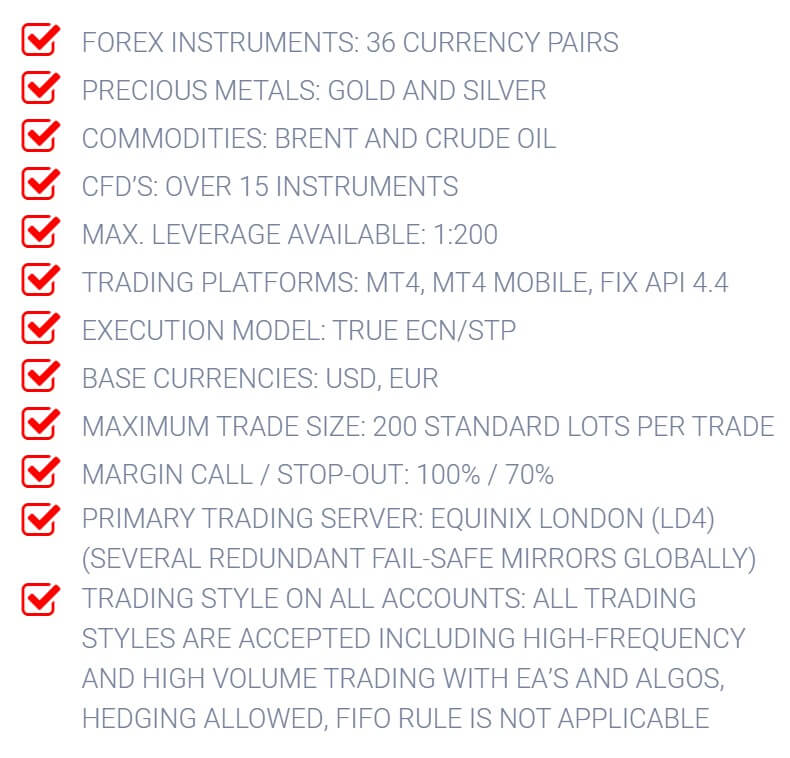

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

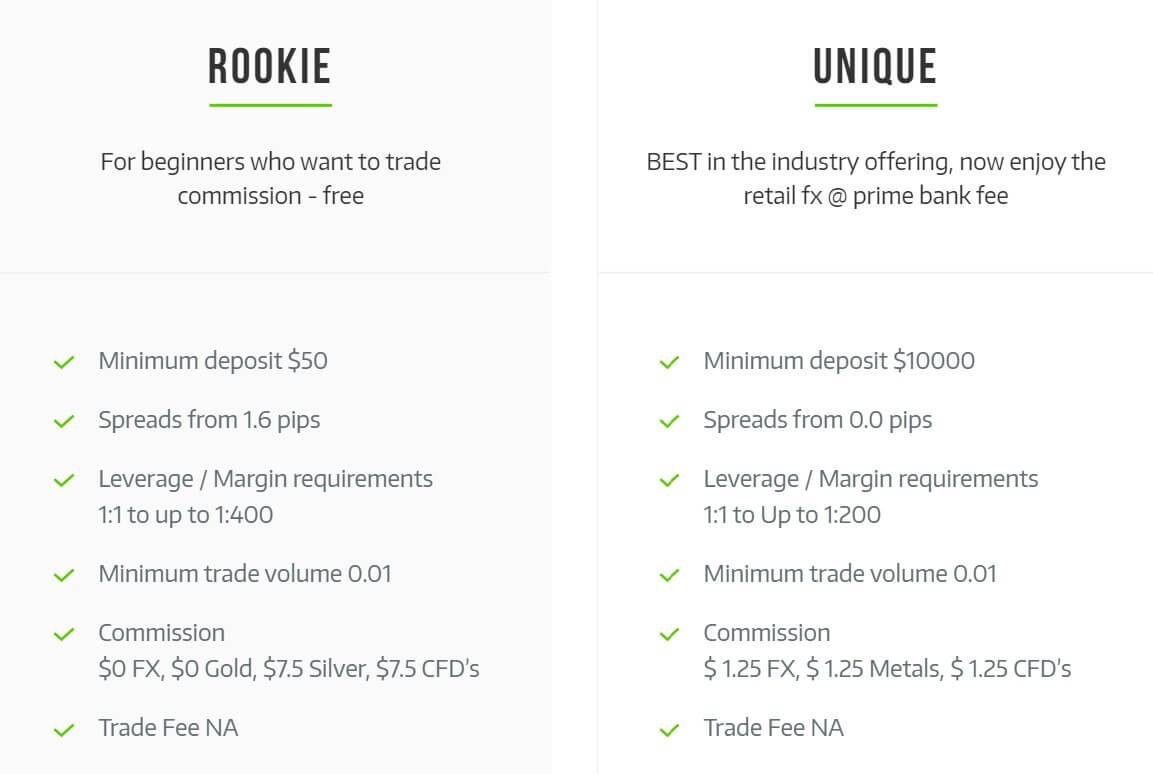

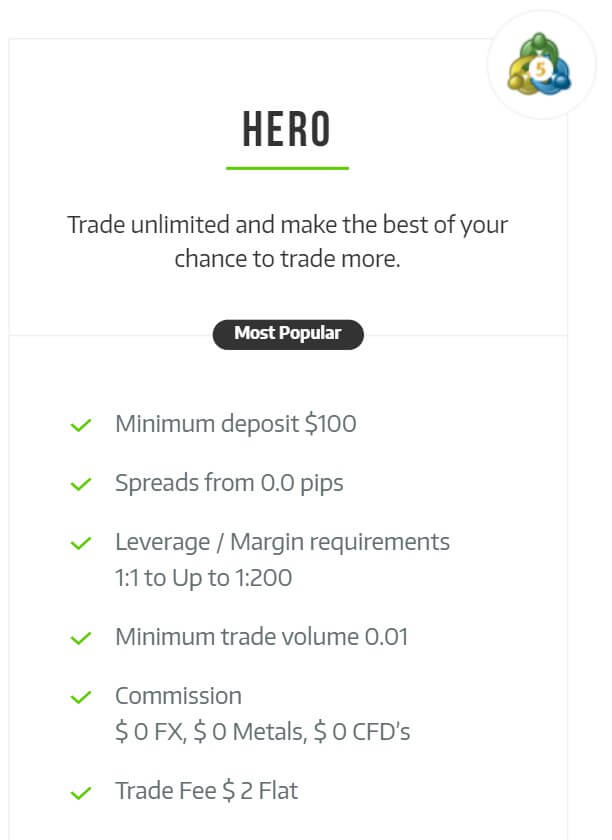

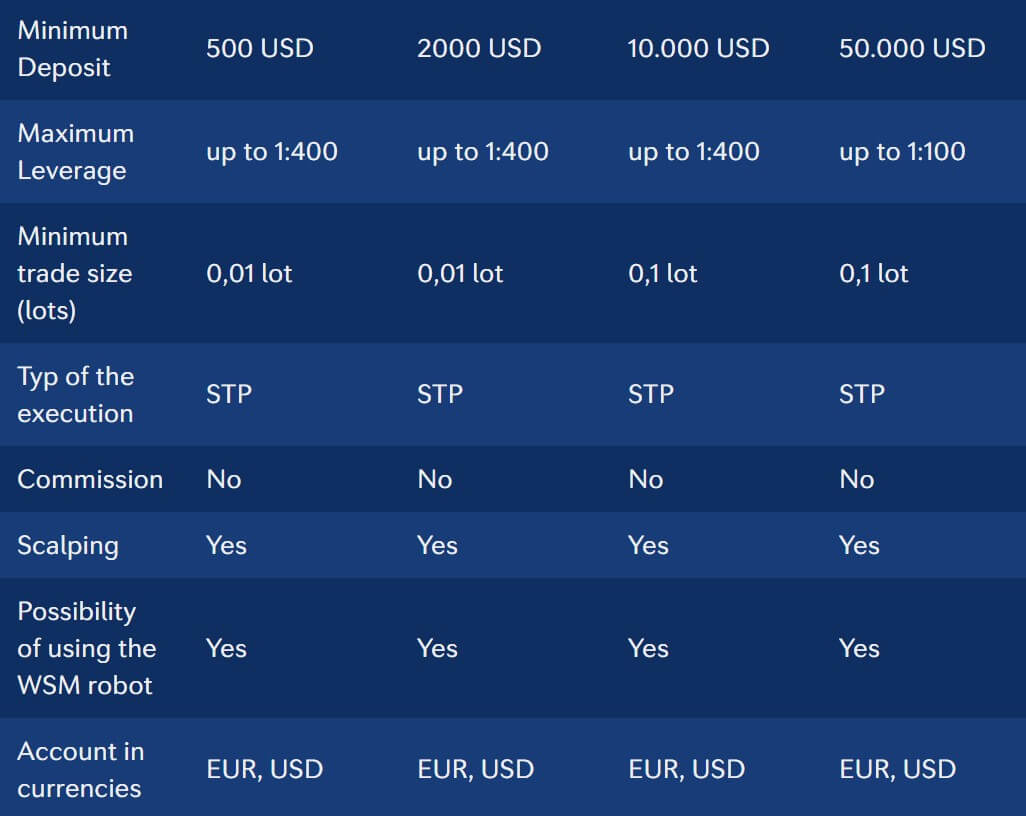

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

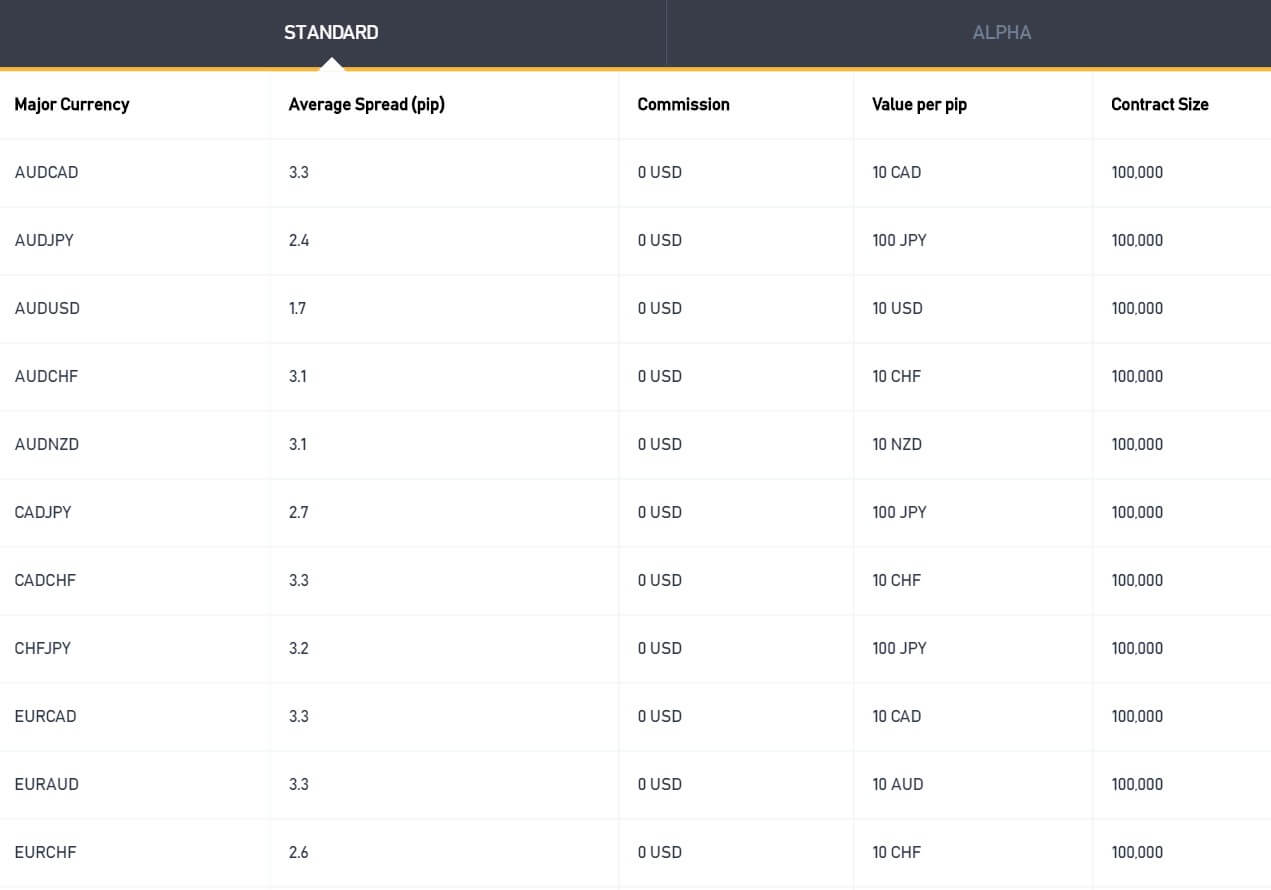

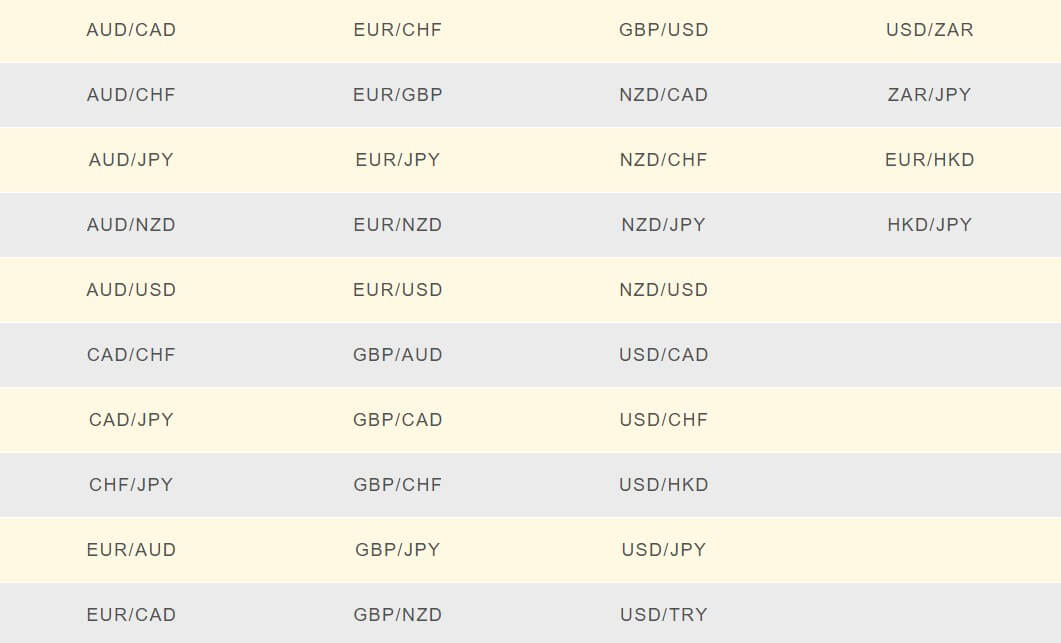

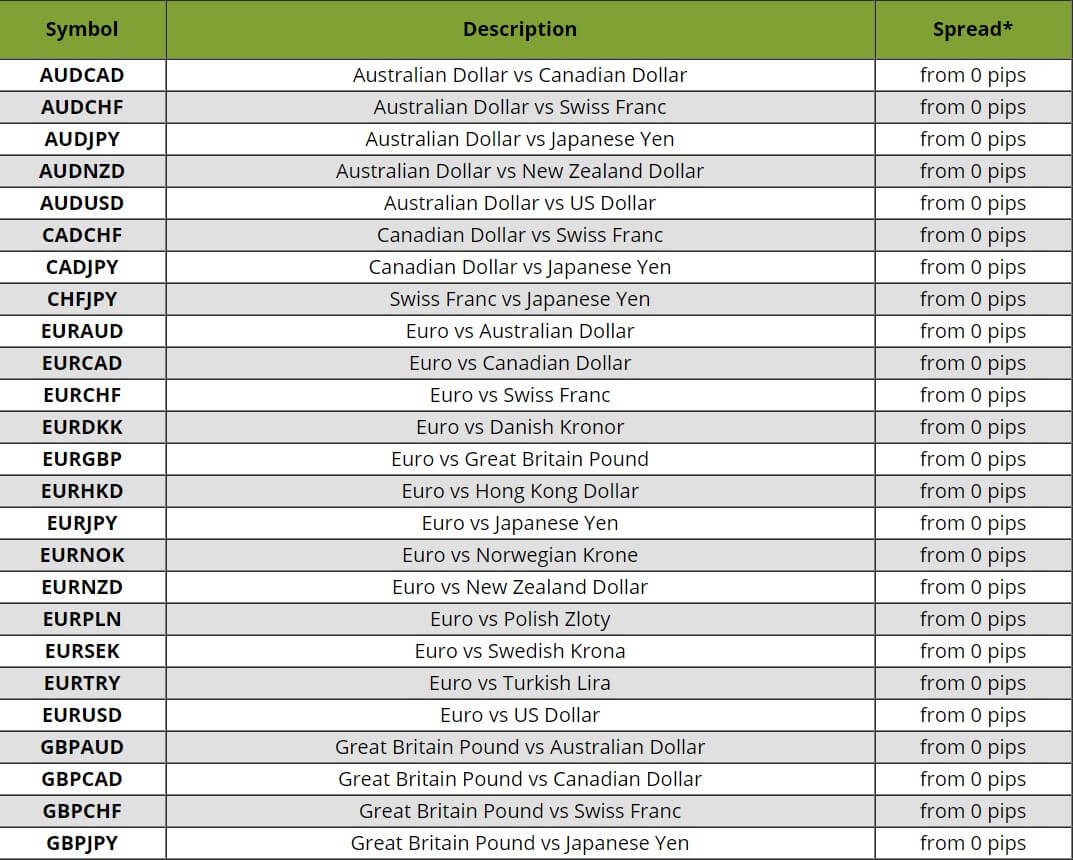

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Withdrawal Methods & Costs

Withdrawal Methods & Costs

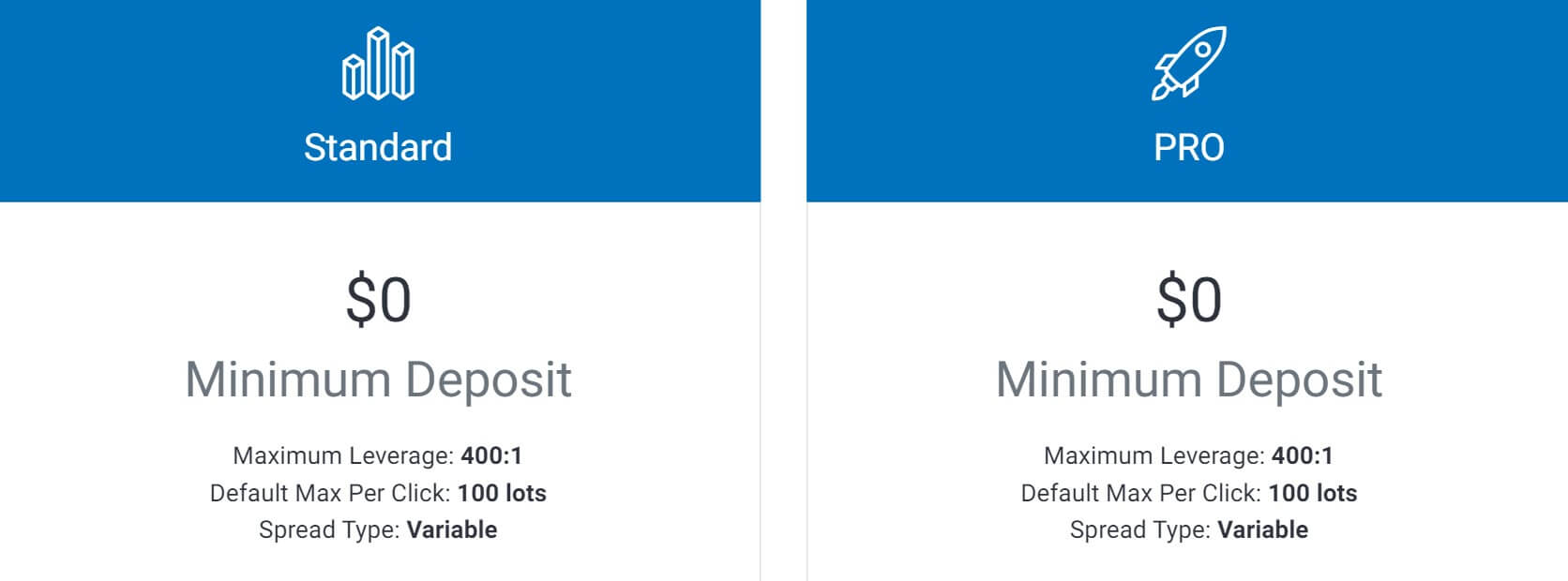

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

Minimum Deposit

Minimum Deposit

Platforms

Platforms

Aside from offering over 160 FX (and crosses) CFDs, HMS Markets offers a strong variety of assets to trade including Forex Spot, OTC Options and Forward Outrights. All symbols can be found directly on the website, and there is even a handy drop-down search feature to search for specific symbols. The addition of cryptocurrencies would be nice to see, but overall, the asset index is solid.

Aside from offering over 160 FX (and crosses) CFDs, HMS Markets offers a strong variety of assets to trade including Forex Spot, OTC Options and Forward Outrights. All symbols can be found directly on the website, and there is even a handy drop-down search feature to search for specific symbols. The addition of cryptocurrencies would be nice to see, but overall, the asset index is solid.

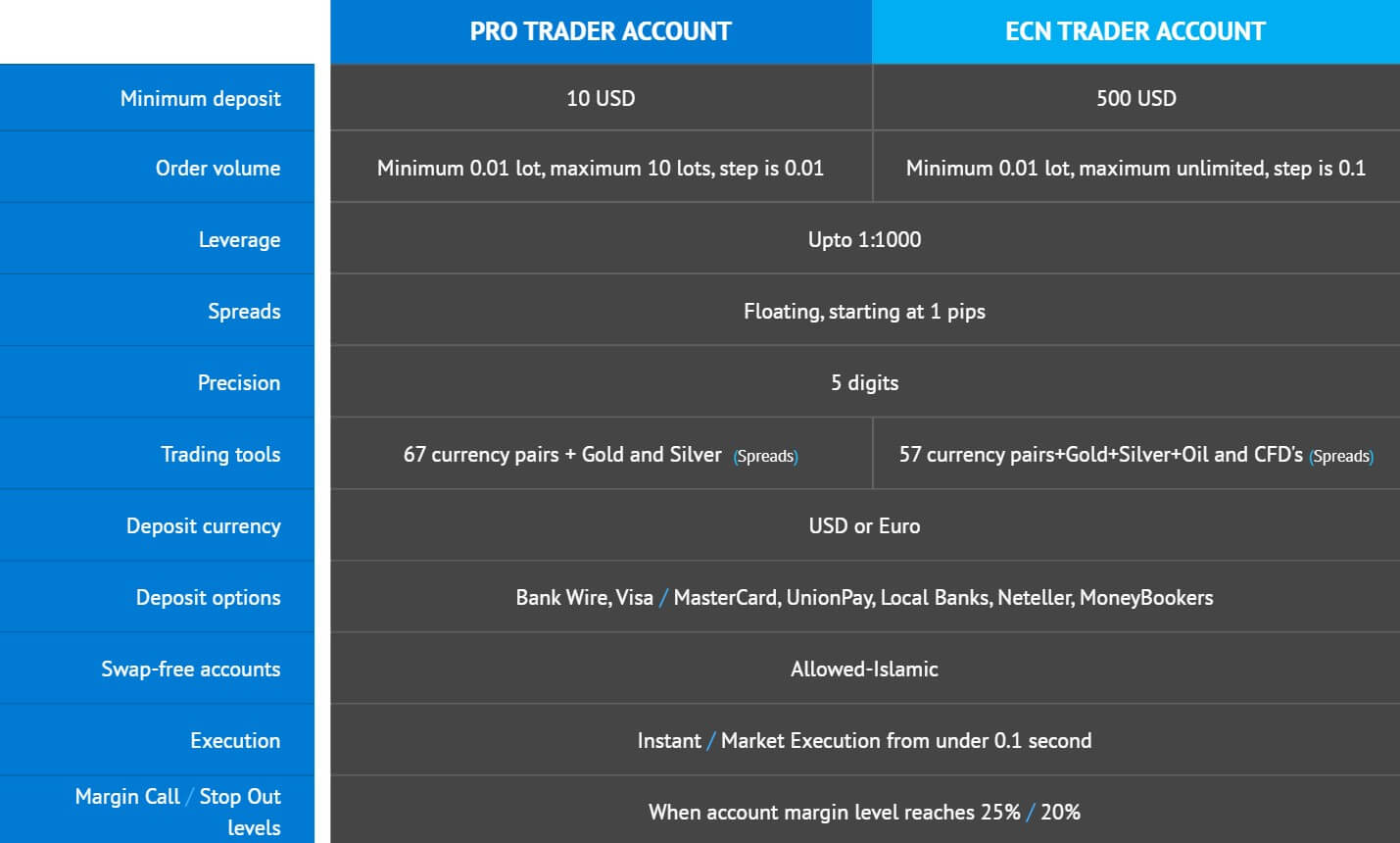

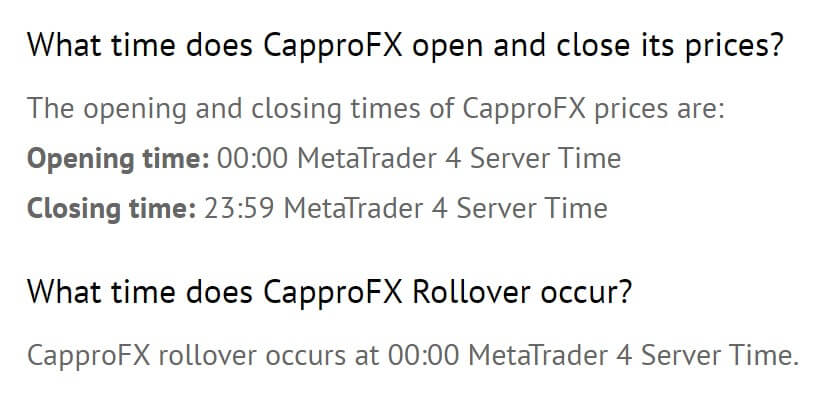

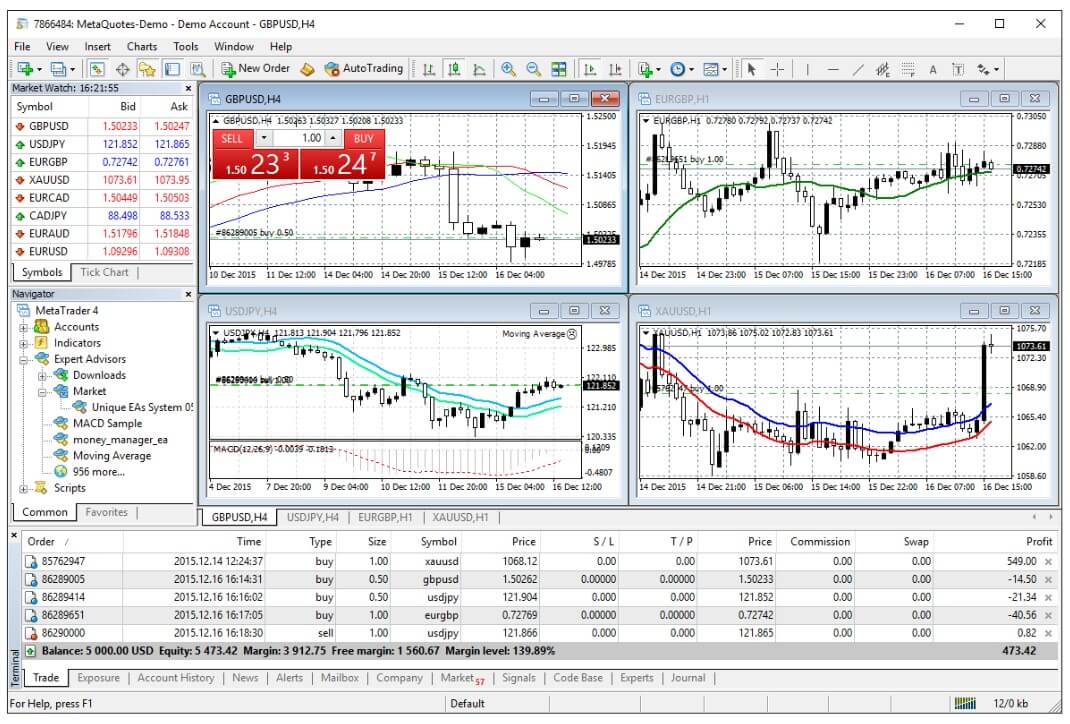

Cappro FX is a MetaTrader 4 platform broker only. It is offered as a downloadable installer for Windows, and for mobile devices running on iOS and Android. Web-accessible MT4 is not available and also the Mac operating system is not supported. Some users use emulators to run Windows designed programs in Mac. Upon installation of the platform, we have noticed some irregularities. The platform is not registered to Cappro FX but to Hermes Market, an alternative broker offering dubious services. The severs also bear the same name on the Live and Demo versions with a 31ms ping rate.

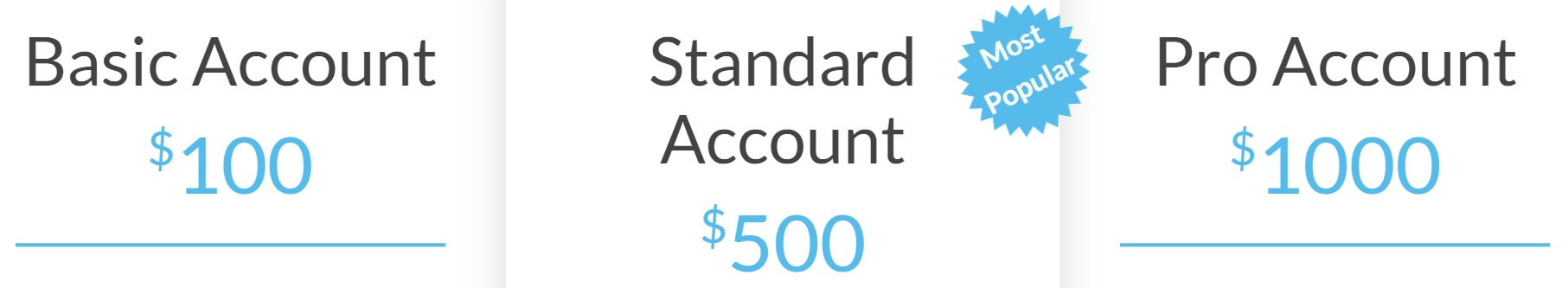

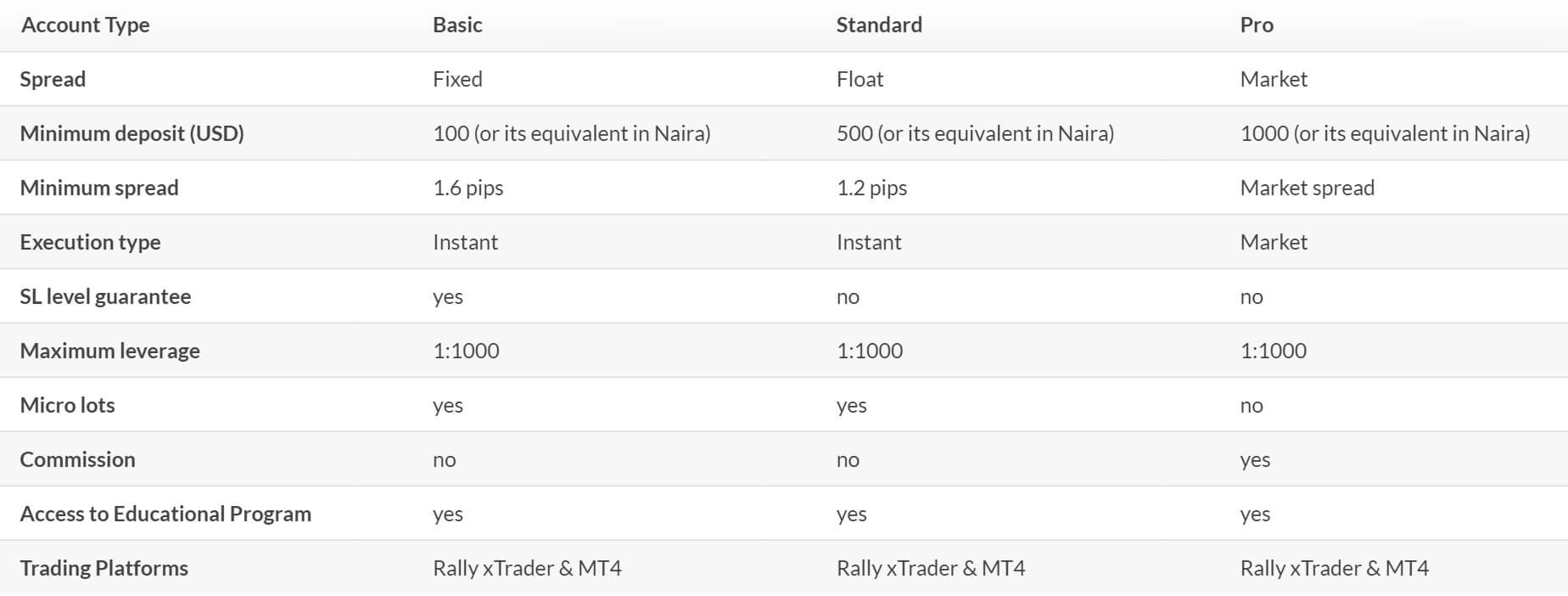

Cappro FX is a MetaTrader 4 platform broker only. It is offered as a downloadable installer for Windows, and for mobile devices running on iOS and Android. Web-accessible MT4 is not available and also the Mac operating system is not supported. Some users use emulators to run Windows designed programs in Mac. Upon installation of the platform, we have noticed some irregularities. The platform is not registered to Cappro FX but to Hermes Market, an alternative broker offering dubious services. The severs also bear the same name on the Live and Demo versions with a 31ms ping rate. According to the Cappro comparison table, all accounts feature 1:1000 leverage. We will check If this is true in the MT4 platform directly. The leverage we observed is not 1:1000 but 1:100 for

According to the Cappro comparison table, all accounts feature 1:1000 leverage. We will check If this is true in the MT4 platform directly. The leverage we observed is not 1:1000 but 1:100 for

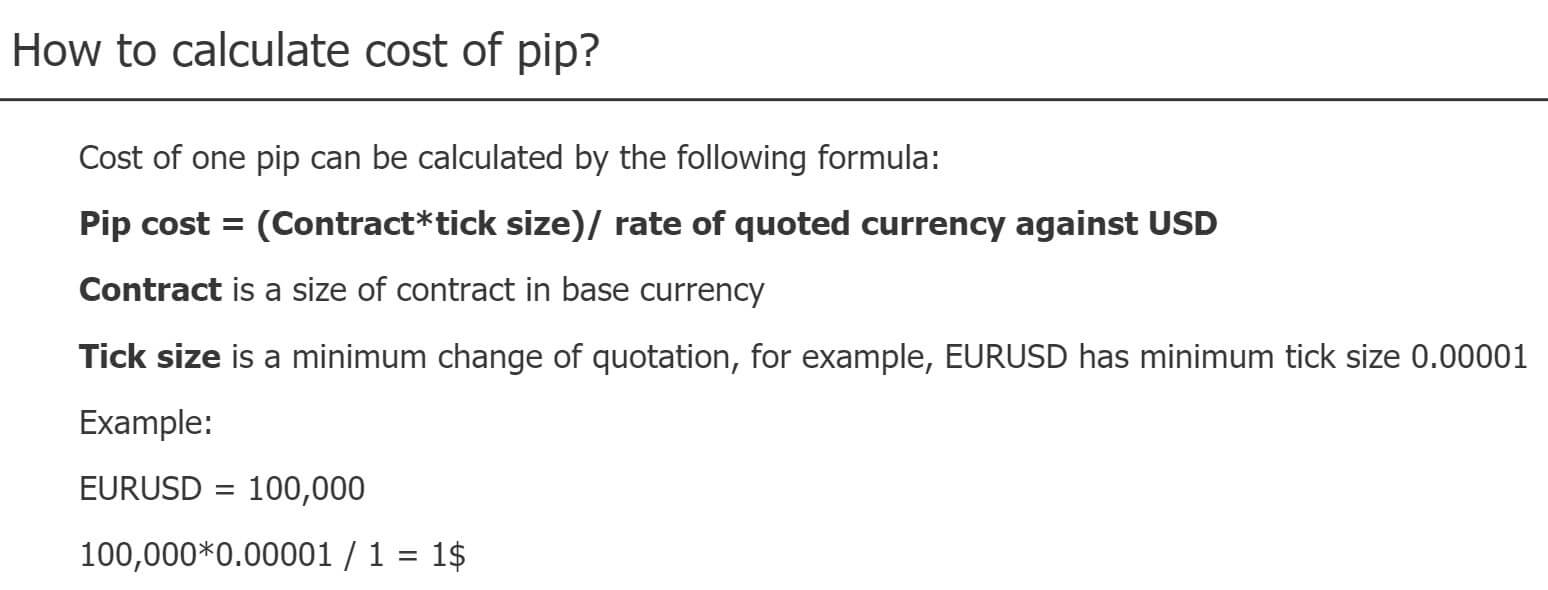

Educational and tools are mixed in the Tools section of the Cappro FX website. An Economic Calendar is available and it is from fxstreet.com. This calendar is basic, without any filtering or sorting options, search field or graphs. It shows the impact level, forecasts and previous levels and the link to the fxstreet.com website about the event. The calculator is also under the tools but it is not working as intended on our browser. It is intended for calculating the pip value, margin, Profit/Loss, and

Educational and tools are mixed in the Tools section of the Cappro FX website. An Economic Calendar is available and it is from fxstreet.com. This calendar is basic, without any filtering or sorting options, search field or graphs. It shows the impact level, forecasts and previous levels and the link to the fxstreet.com website about the event. The calculator is also under the tools but it is not working as intended on our browser. It is intended for calculating the pip value, margin, Profit/Loss, and

Based on what we see in the MT4 platform, there are 5 tradeable instrument categories. From the Forex range, the most interesting are USD/TRY, USD/RUB,

Based on what we see in the MT4 platform, there are 5 tradeable instrument categories. From the Forex range, the most interesting are USD/TRY, USD/RUB,

AIMS is a Singapore based forex broker who claims to be one of the world’s leading financial brokers. Their mission is to create the best trading environment for retail traders by offering superior spreads, execution, and service. AIMS is dedicated to maintaining open and transparent communication with our clients based on mutual respect, fairness, and integrity. We will be using this review to look into the services on offer to see if they achieve this or if they manage to fall short.

AIMS is a Singapore based forex broker who claims to be one of the world’s leading financial brokers. Their mission is to create the best trading environment for retail traders by offering superior spreads, execution, and service. AIMS is dedicated to maintaining open and transparent communication with our clients based on mutual respect, fairness, and integrity. We will be using this review to look into the services on offer to see if they achieve this or if they manage to fall short.

Trade Sizes

Trade Sizes

On the broker’s website says that the process times are 30 minutes, which we find speedy processing compared to most brokers if this is true. Even the withdrawals ordered on weekends will still be processed in 30 minutes. The waiting times are the usual, if the withdrawal is by bank transfer the time until your money appears in your account is 1 to 5 days. For withdrawals made using electronic and cryptocurrency media, you may have the withdrawal process completed on the same day.

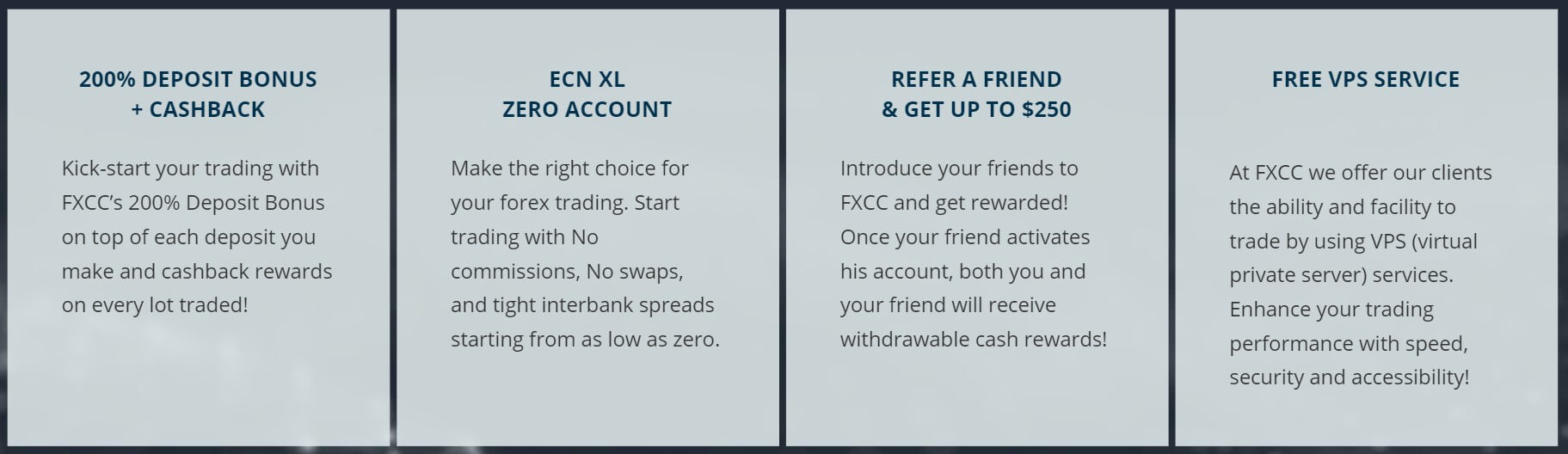

On the broker’s website says that the process times are 30 minutes, which we find speedy processing compared to most brokers if this is true. Even the withdrawals ordered on weekends will still be processed in 30 minutes. The waiting times are the usual, if the withdrawal is by bank transfer the time until your money appears in your account is 1 to 5 days. For withdrawals made using electronic and cryptocurrency media, you may have the withdrawal process completed on the same day. WorldForex has a promotion now consisting of a 100% deposit bonus. If the deposit amount is higher than 100 USD it also offers a free VPS server. Usually, this type of bonus is not removable; instead, what you do is increase your margin so you can trade with more volume. Profits made with bonus capital are usually refundable. As always, we recommend reading the terms and conditions surrounding bonuses prior to accepting one.

WorldForex has a promotion now consisting of a 100% deposit bonus. If the deposit amount is higher than 100 USD it also offers a free VPS server. Usually, this type of bonus is not removable; instead, what you do is increase your margin so you can trade with more volume. Profits made with bonus capital are usually refundable. As always, we recommend reading the terms and conditions surrounding bonuses prior to accepting one.

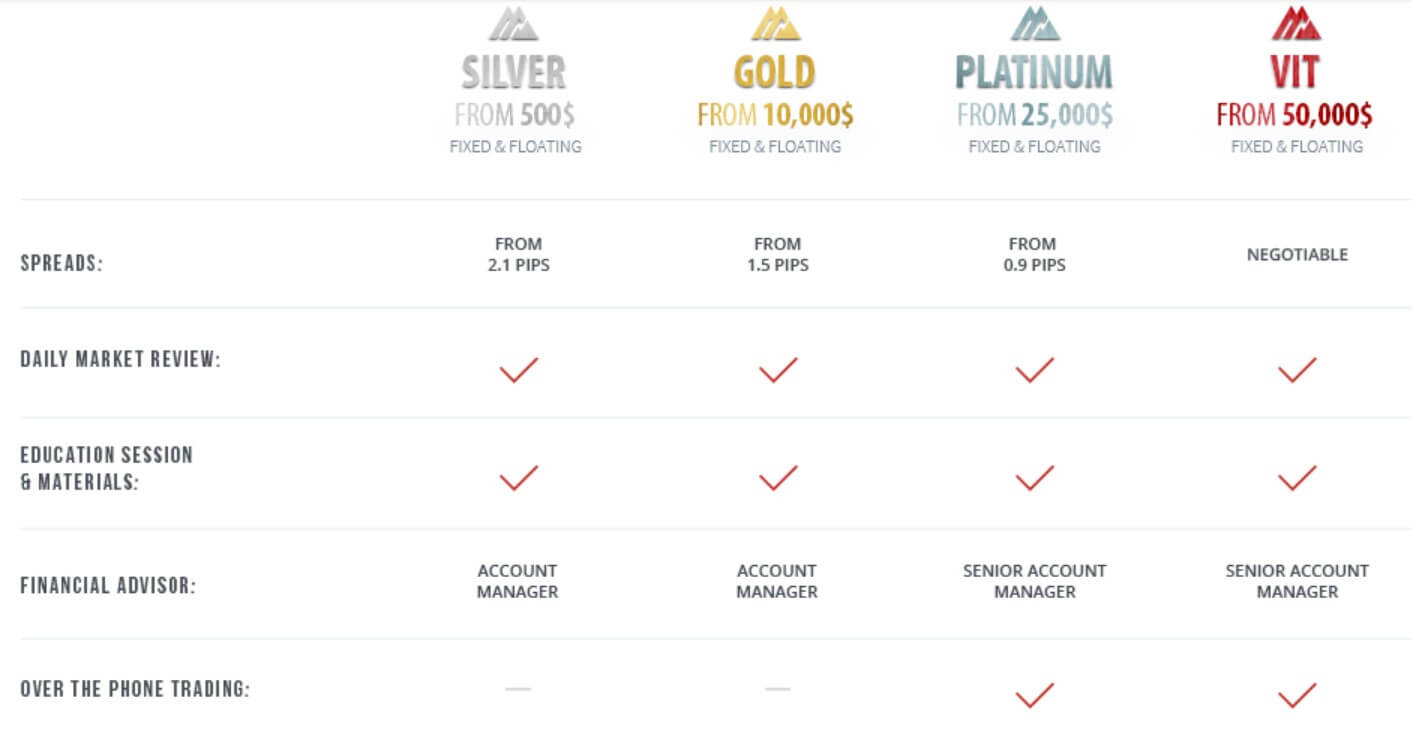

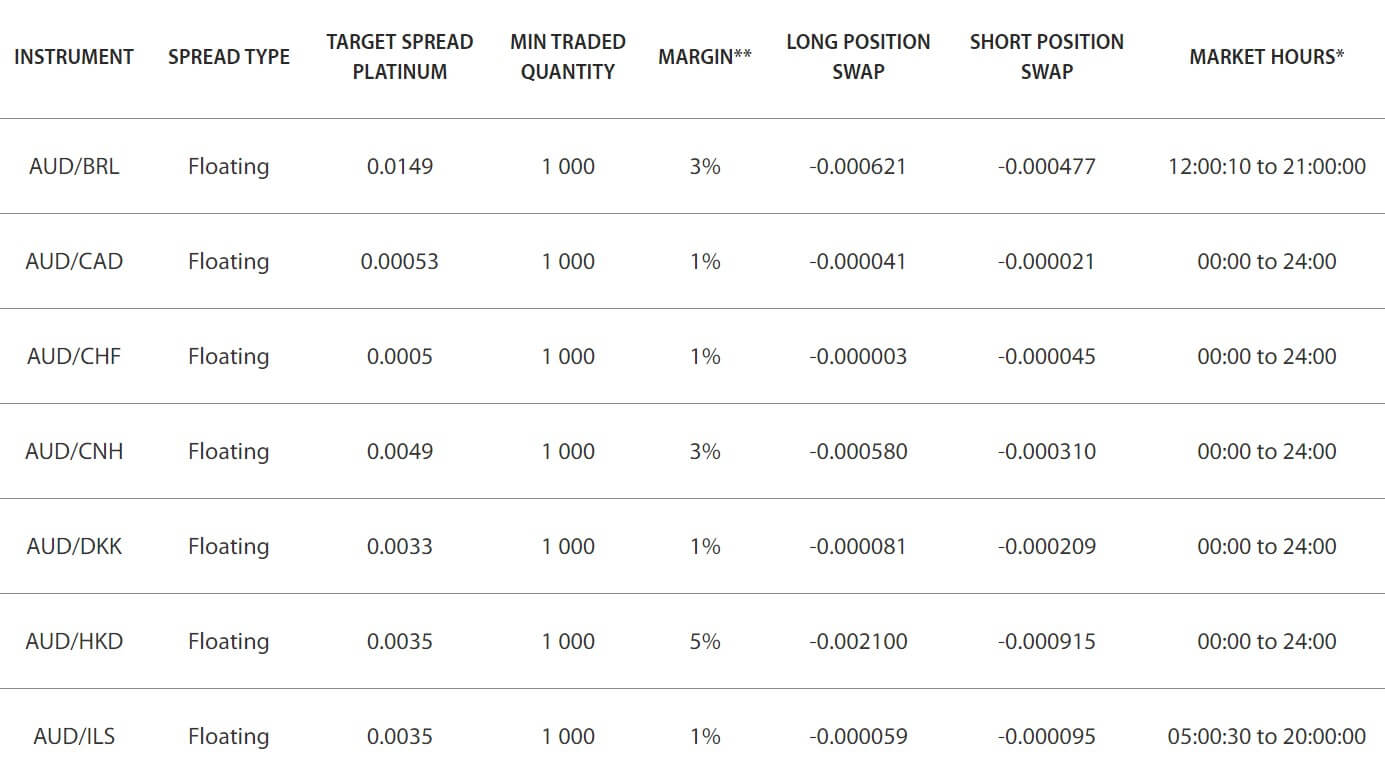

Swissmain is a broker with which you can access and trade more than 1,000 total assets in the financial market. They make available major currency pairs, commodities, indices, and stocks, and even

Swissmain is a broker with which you can access and trade more than 1,000 total assets in the financial market. They make available major currency pairs, commodities, indices, and stocks, and even

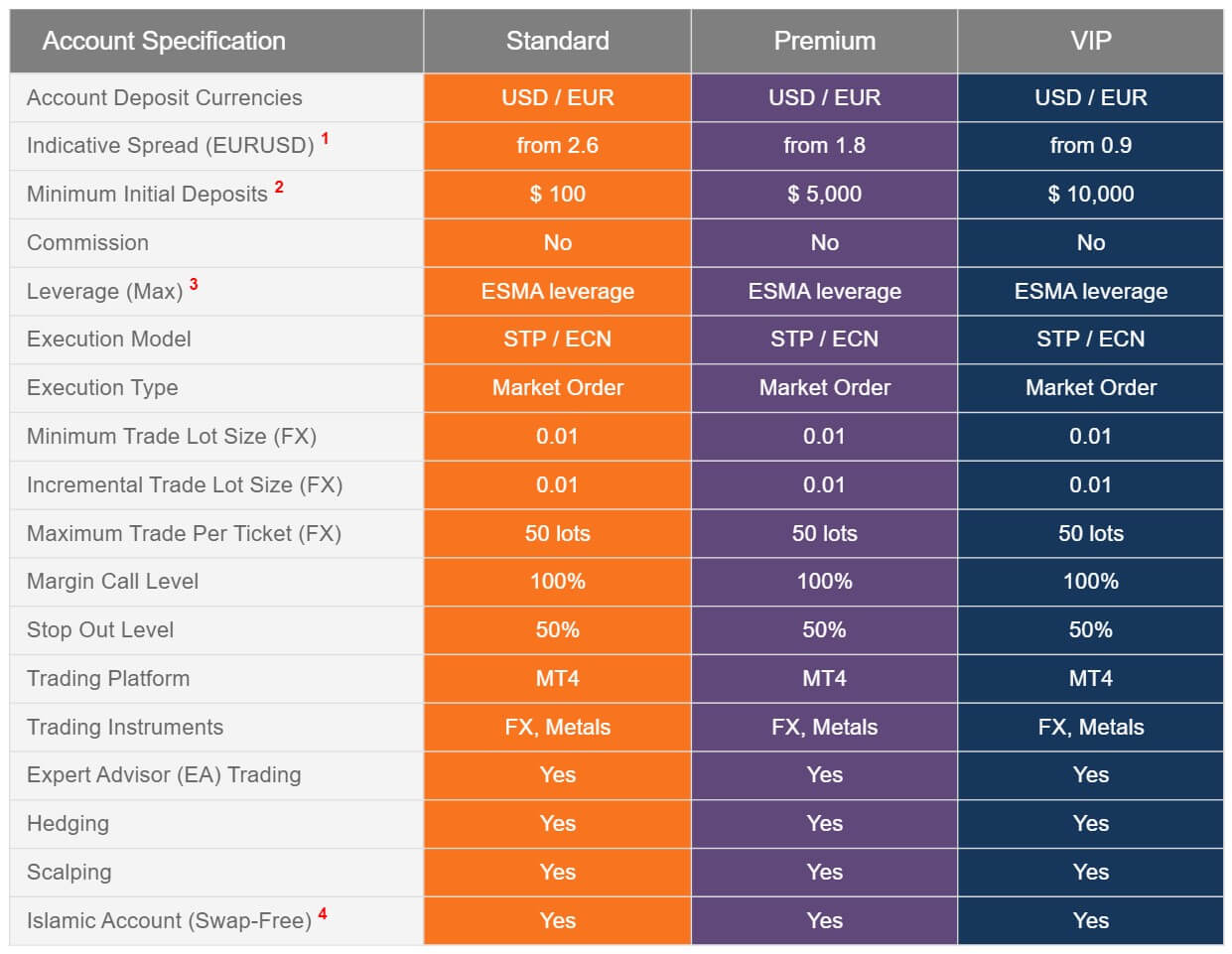

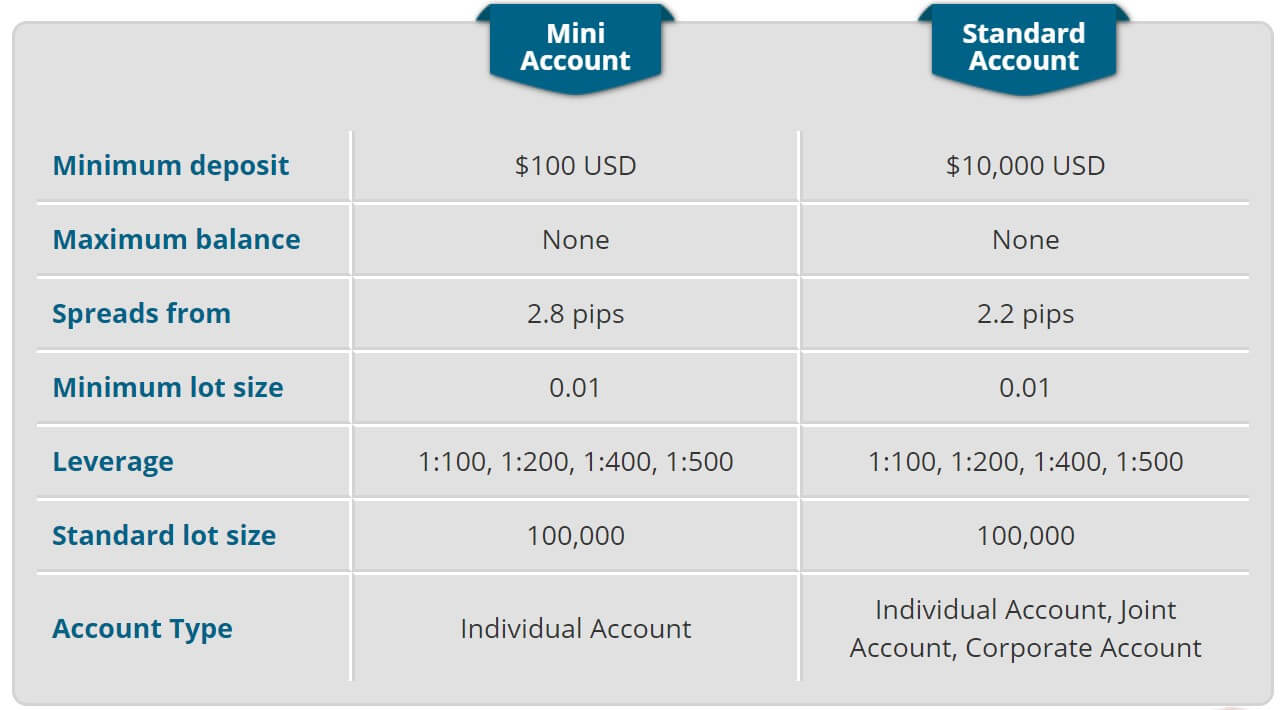

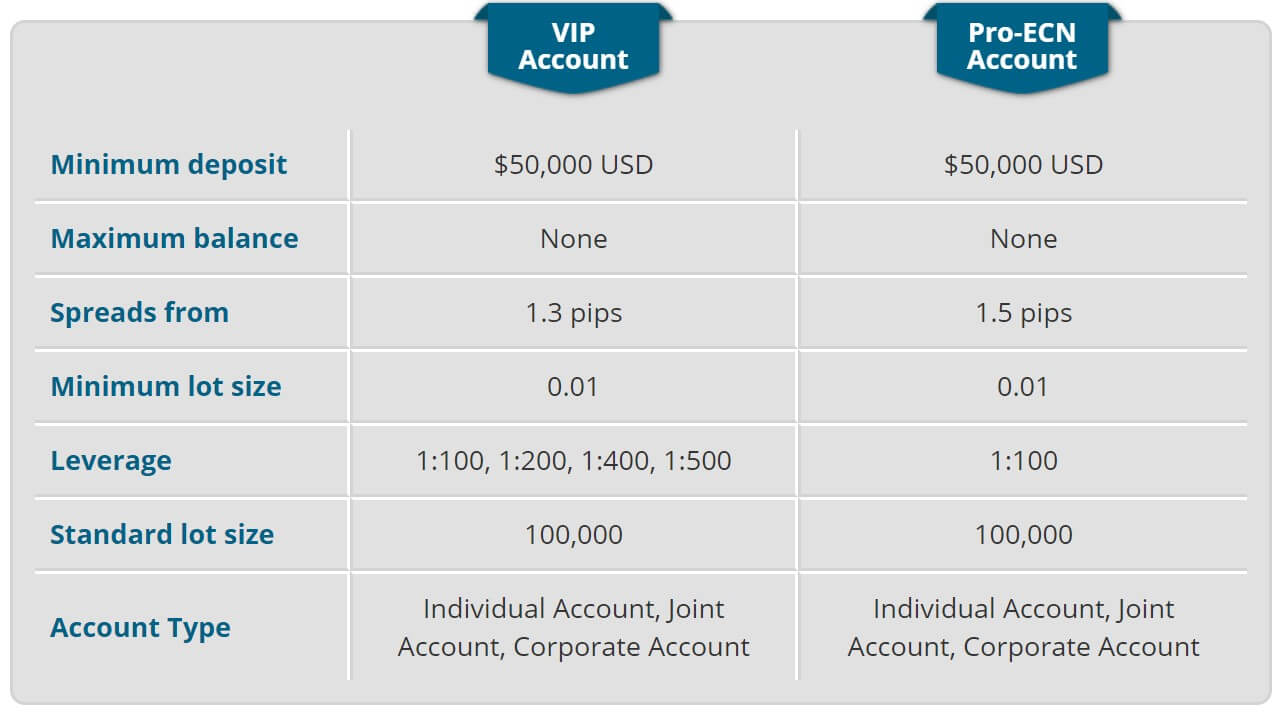

Nico FX is a reasonably well-regulated currency broker, with CySec, FCA and Bafin licenses. The firm is offering online trading on 46 currency pairs and precious metal CFDs. It uses the MT4 platform, which is a good thing. The spreads of this broker are quite contradictory, as there is a huge difference between the spreads offered in your basic account, 2.6 pips in EUR/USD, and 0.9 pips in your VIP account. The minimum deposits to open a trading account with this broker are also very disparate, from USD 100 in the base account to USD 10,000 in your VIP account, which is where the best trading conditions are offered.

Nico FX is a reasonably well-regulated currency broker, with CySec, FCA and Bafin licenses. The firm is offering online trading on 46 currency pairs and precious metal CFDs. It uses the MT4 platform, which is a good thing. The spreads of this broker are quite contradictory, as there is a huge difference between the spreads offered in your basic account, 2.6 pips in EUR/USD, and 0.9 pips in your VIP account. The minimum deposits to open a trading account with this broker are also very disparate, from USD 100 in the base account to USD 10,000 in your VIP account, which is where the best trading conditions are offered.

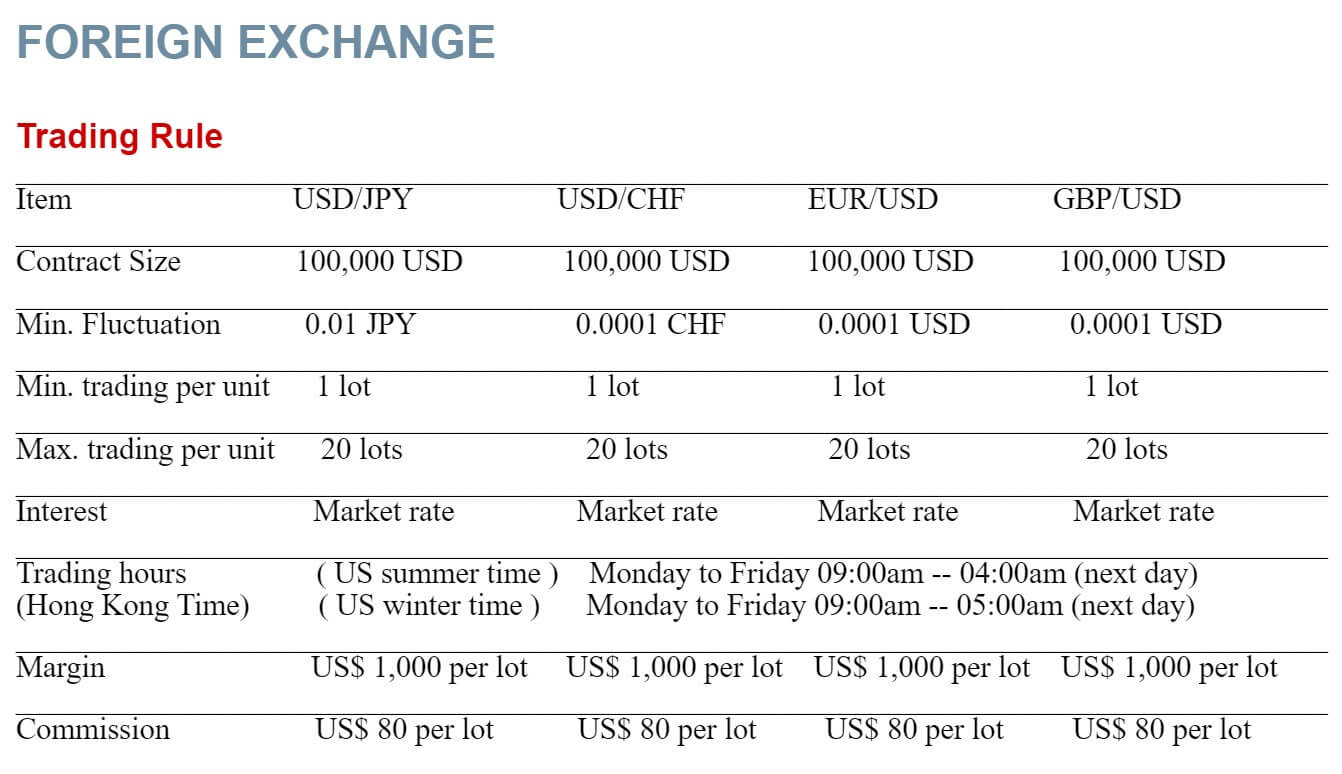

Forex: Just four different pairs are mentioned on the forex page, these are USDJPY, USDCHF, EURUSD, and GBPUSD. We would hope that there would be more to trade but unfortunately, we do not know for sure.

Forex: Just four different pairs are mentioned on the forex page, these are USDJPY, USDCHF, EURUSD, and GBPUSD. We would hope that there would be more to trade but unfortunately, we do not know for sure.

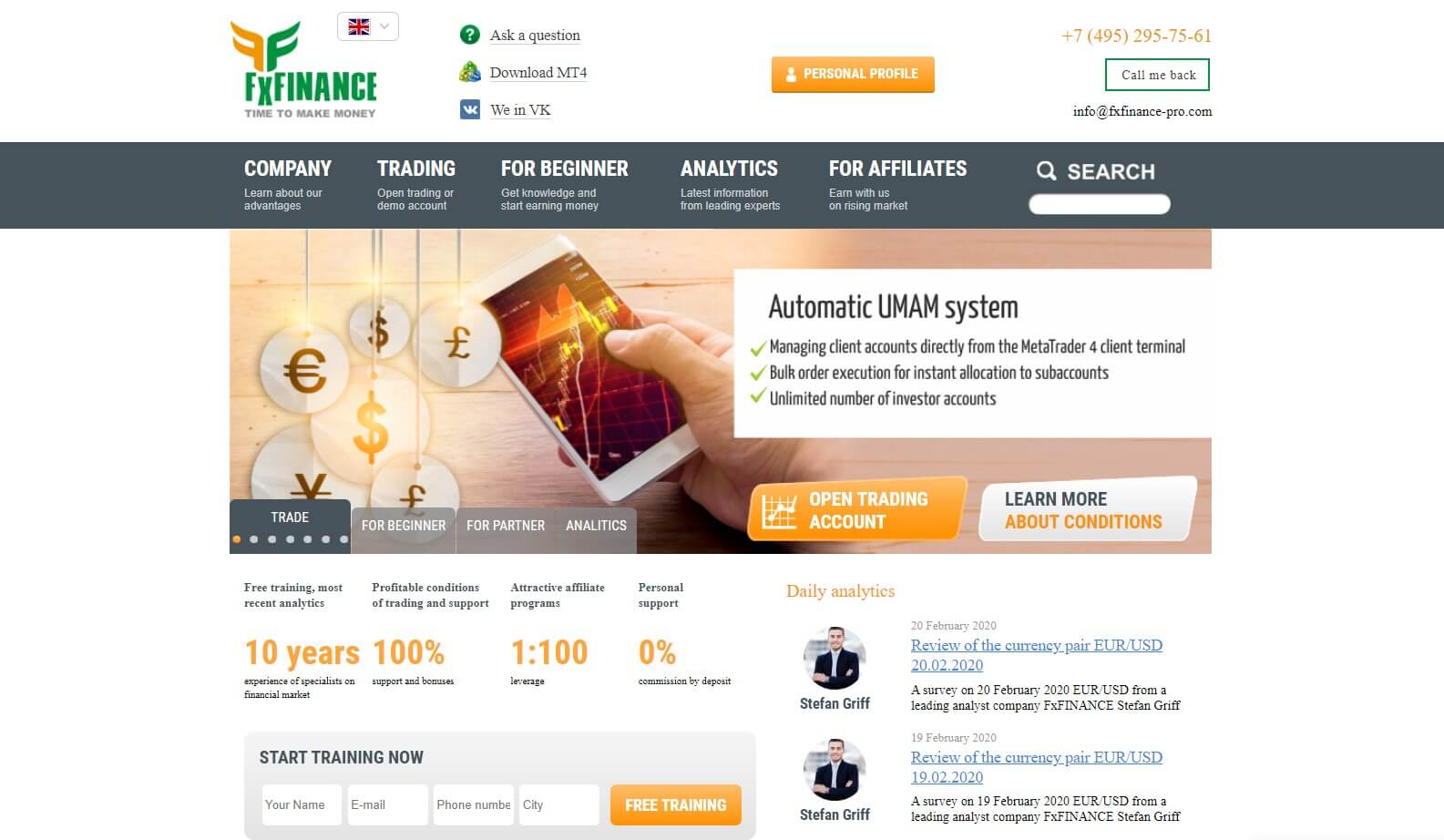

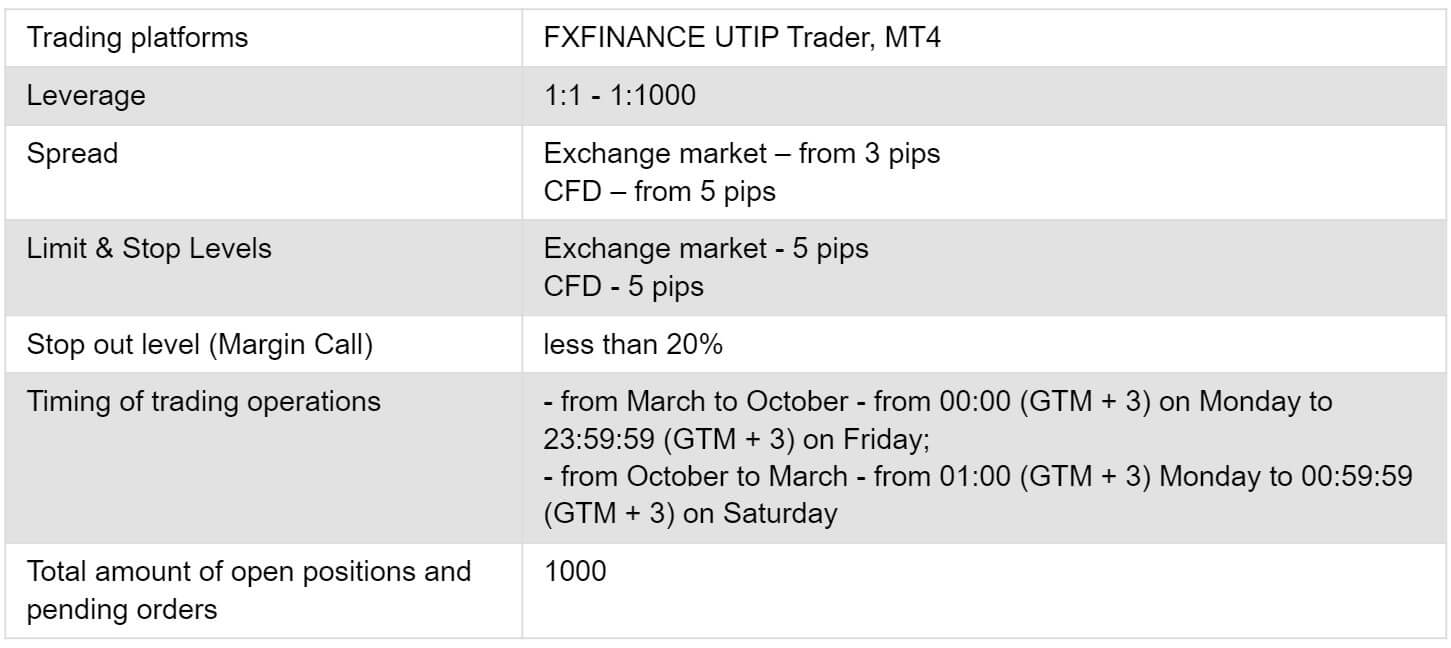

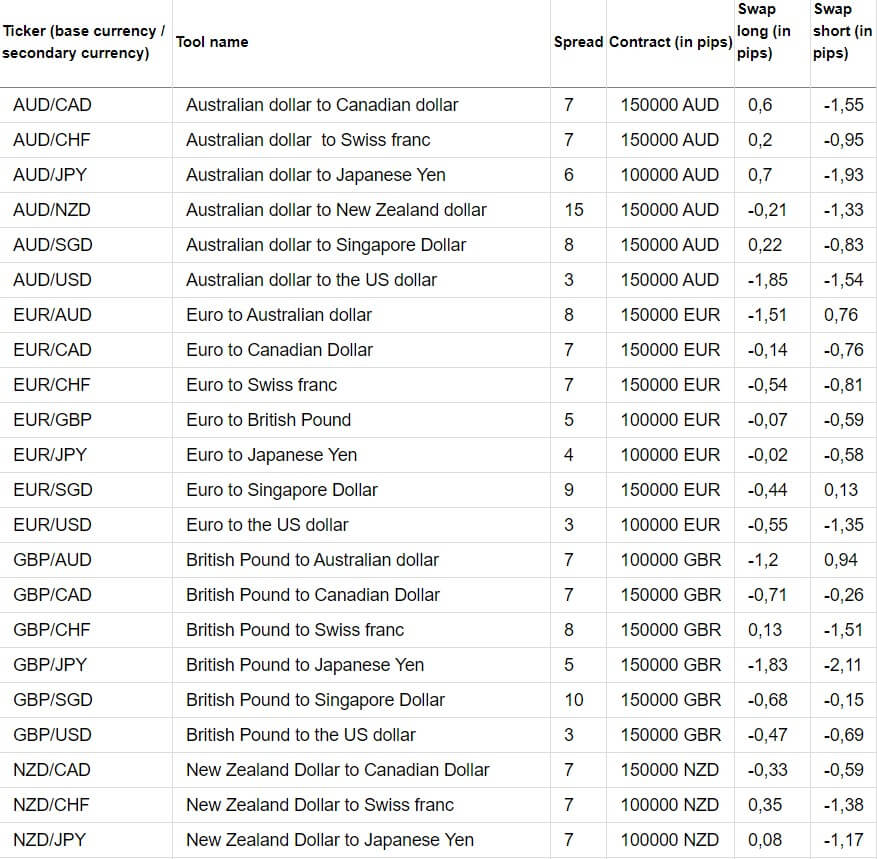

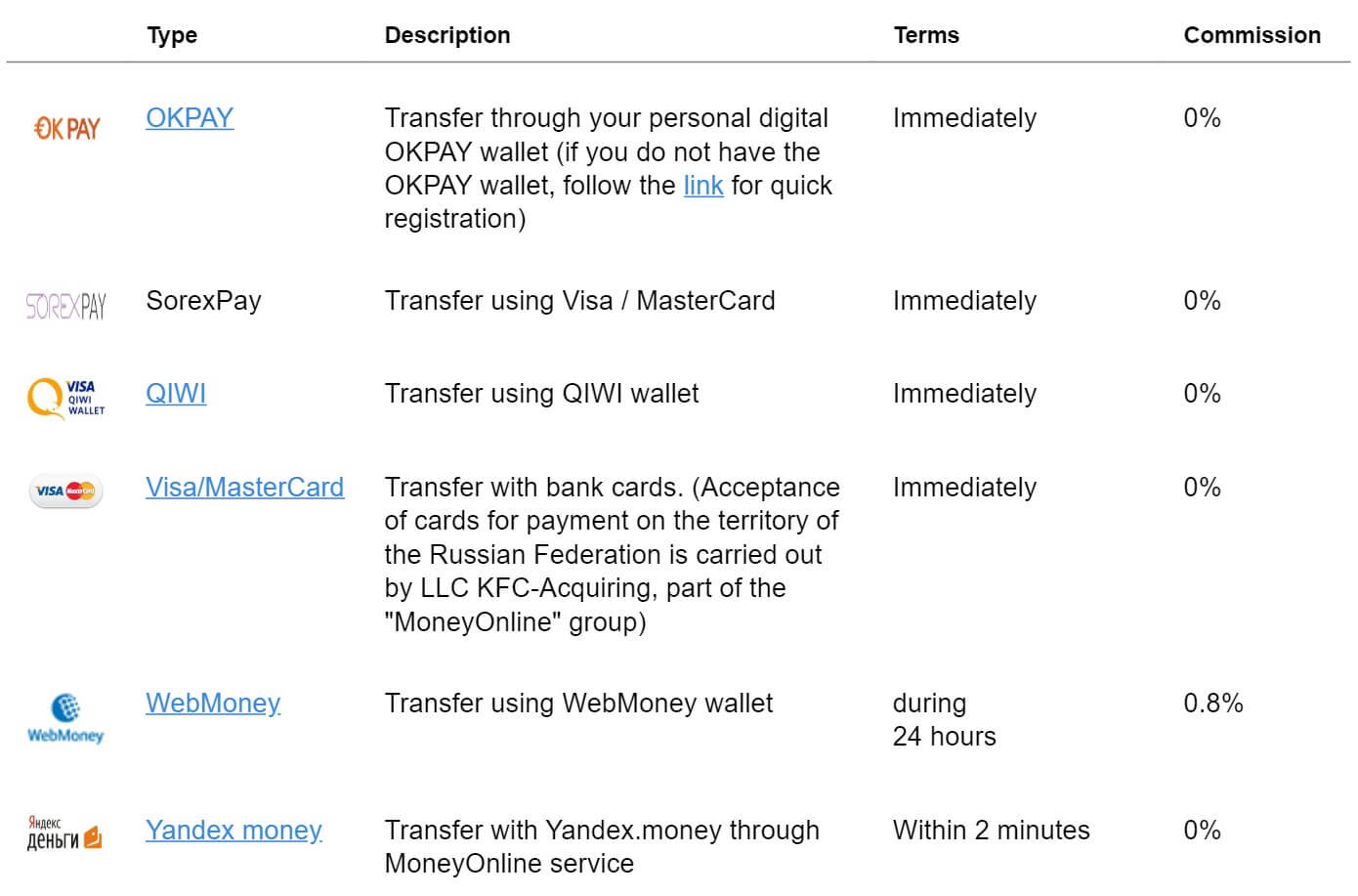

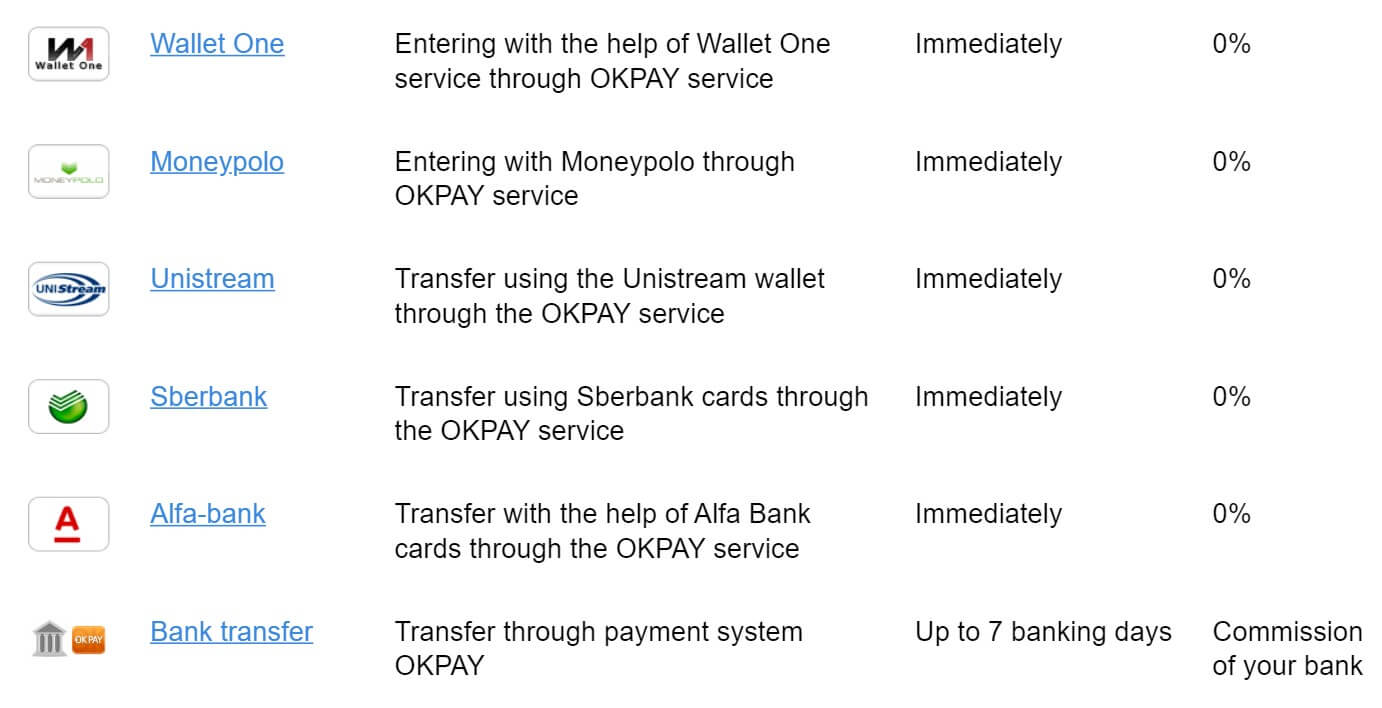

FXFinance is a foreign exchange broker based in Cyprus. They claim that by combining first-class specialists, the best training programs, trading services, and profitable tools under the brand of FxFINANCE Group of Companies, they have made work on financial markets truly fascinating, with brilliant prospects for everyone. We will be using this review to delve into the website and services on offer to see how they fare against other competition and to see if they are the right broker for you to use.

FXFinance is a foreign exchange broker based in Cyprus. They claim that by combining first-class specialists, the best training programs, trading services, and profitable tools under the brand of FxFINANCE Group of Companies, they have made work on financial markets truly fascinating, with brilliant prospects for everyone. We will be using this review to delve into the website and services on offer to see how they fare against other competition and to see if they are the right broker for you to use.

While the account section indicates more than one platform is available, the trading platform section of the site only mentioned MetaTrader 4 so we believe that this is the only platform currently available. MT4 is offered for both Windows and iOS-based systems, as well as for Android devices. The system requirements for each are provided on the broker’s website, as are download links for each of the versions. There are certainly no problems to report here, as MetaTrader 4 has been viewed by most to be the top platform in the world for over a decade now. Even with MT5 having been released several years ago, many FX traders still opt to use MT4 for their trading needs.

While the account section indicates more than one platform is available, the trading platform section of the site only mentioned MetaTrader 4 so we believe that this is the only platform currently available. MT4 is offered for both Windows and iOS-based systems, as well as for Android devices. The system requirements for each are provided on the broker’s website, as are download links for each of the versions. There are certainly no problems to report here, as MetaTrader 4 has been viewed by most to be the top platform in the world for over a decade now. Even with MT5 having been released several years ago, many FX traders still opt to use MT4 for their trading needs.

UniTrader: UniTrader represents a new generation of trading platforms that were designed and built as an easy and logical instrument for active traders looking for an edge. It offers features like live streaming rates, easy order management, trading history, live trading, detailed account information, news streams and SquawkBow, real-time tradable charts, open position information and instrument subscriptions.

UniTrader: UniTrader represents a new generation of trading platforms that were designed and built as an easy and logical instrument for active traders looking for an edge. It offers features like live streaming rates, easy order management, trading history, live trading, detailed account information, news streams and SquawkBow, real-time tradable charts, open position information and instrument subscriptions.

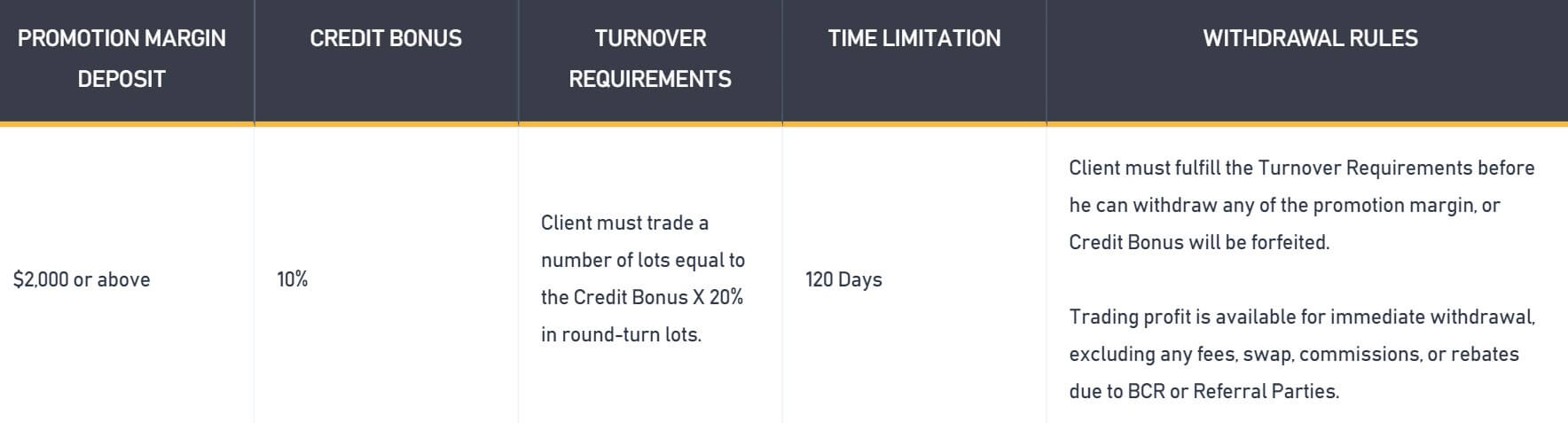

There are a few different bonuses currently running, we have outlined two of them so you can get an idea of the sort of things that are on offer. Please visit the Forex Player website for information regarding additional promotions and bonuses.

There are a few different bonuses currently running, we have outlined two of them so you can get an idea of the sort of things that are on offer. Please visit the Forex Player website for information regarding additional promotions and bonuses.

Leverage

Leverage

OneTrade allows traders to choose from a few different trading platforms, including our personal favorite MetaTrader 4 on a browser, PC, Android, and iOS devices, the OneTrade WebTrader, which also supports copy trading, and the Social Trading investment platform. MT4 is known for its powerful reliability, along with a vast array of built-in features that make the platform easy to use and navigate.

OneTrade allows traders to choose from a few different trading platforms, including our personal favorite MetaTrader 4 on a browser, PC, Android, and iOS devices, the OneTrade WebTrader, which also supports copy trading, and the Social Trading investment platform. MT4 is known for its powerful reliability, along with a vast array of built-in features that make the platform easy to use and navigate. Leverage

Leverage Trade Sizes

Trade Sizes

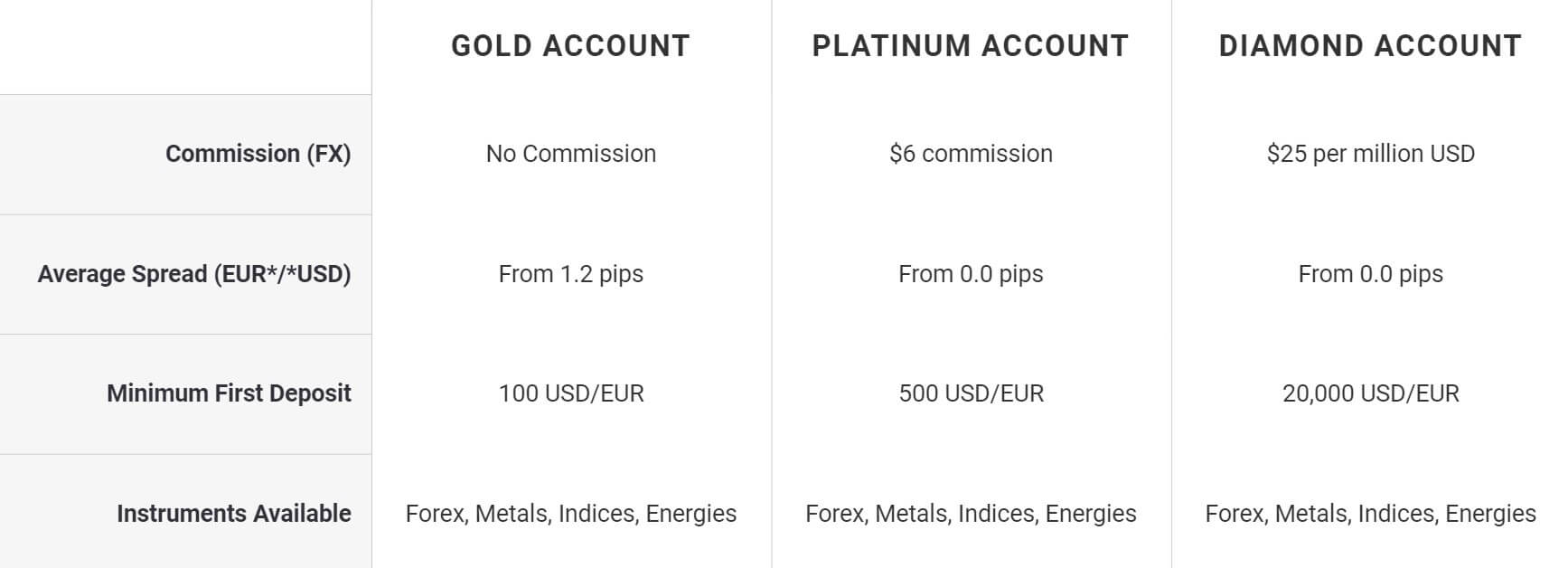

One advantage that Aplus Trader does provide would be the provision of access to the world-famous trading platform, MetaTrader 4. The platform is highly praised by beginner and professional traders alike and can be found among the available platforms supported by most

One advantage that Aplus Trader does provide would be the provision of access to the world-famous trading platform, MetaTrader 4. The platform is highly praised by beginner and professional traders alike and can be found among the available platforms supported by most  Aplus Trader is not consistent when describing their available leverage options. One section of the website states that caps go up to an impressive 1:1000, while the trading conditions actually list a 1:400 leverage cap. Either way, the leverage cap does appear to be extremely flexible, although we aren’t happy with the fact that Aplus is once again providing inconsistent information. There is a significant difference between the two options and traders that are looking for specific caps may not be able to make a decision without better supporting information.

Aplus Trader is not consistent when describing their available leverage options. One section of the website states that caps go up to an impressive 1:1000, while the trading conditions actually list a 1:400 leverage cap. Either way, the leverage cap does appear to be extremely flexible, although we aren’t happy with the fact that Aplus is once again providing inconsistent information. There is a significant difference between the two options and traders that are looking for specific caps may not be able to make a decision without better supporting information.

The broker’s website provides inconsistent information about spreads. On the homepage, spreads from 0.1 pip are advertised, yet the broker also lists starting spreads from 0.5 pips under their trading conditions. Once one actually opens an account, they will find that spreads are nearly five times higher than advertised options, at around 2.4 pips on EURUSD. That amount is also 1 pip higher than the industry average 1.5

The broker’s website provides inconsistent information about spreads. On the homepage, spreads from 0.1 pip are advertised, yet the broker also lists starting spreads from 0.5 pips under their trading conditions. Once one actually opens an account, they will find that spreads are nearly five times higher than advertised options, at around 2.4 pips on EURUSD. That amount is also 1 pip higher than the industry average 1.5  Oddly enough, Aplus does not mention its minimum deposit requirement anywhere on the website. It’s possible that the broker may base these amounts on the chosen deposit method, but there’s really no way of knowing until one prepares to make a deposit. If options fall into an average range, we would see minimum requirements from $1 to around $250, which is on the higher end of things. Based on what we know, Aplus is offering spreads that are high even for a Mini/Micro/Cent account type. Elsewhere, those types of accounts go for $100 or less. If Aplus is asking for more than that, then traders would be better off opening an account through another broker.

Oddly enough, Aplus does not mention its minimum deposit requirement anywhere on the website. It’s possible that the broker may base these amounts on the chosen deposit method, but there’s really no way of knowing until one prepares to make a deposit. If options fall into an average range, we would see minimum requirements from $1 to around $250, which is on the higher end of things. Based on what we know, Aplus is offering spreads that are high even for a Mini/Micro/Cent account type. Elsewhere, those types of accounts go for $100 or less. If Aplus is asking for more than that, then traders would be better off opening an account through another broker. As we mentioned, the broker doesn’t tell us much about their funding methods. Assuming that Aplus follows standard anti-money laundering practices, withdrawals would likely be processed back to the original bank account, card, or e-wallet that was used to fund the account. Typically, profits are returned to bank wire. The broker advertises an advantage in the form of fee-free withdrawals. Elsewhere, we’ve seen fees of 3%, 4%, and even higher, sometimes charged in addition to deposit fees, so this would definitely be one of the few advantages we’ve seen so far.

As we mentioned, the broker doesn’t tell us much about their funding methods. Assuming that Aplus follows standard anti-money laundering practices, withdrawals would likely be processed back to the original bank account, card, or e-wallet that was used to fund the account. Typically, profits are returned to bank wire. The broker advertises an advantage in the form of fee-free withdrawals. Elsewhere, we’ve seen fees of 3%, 4%, and even higher, sometimes charged in addition to deposit fees, so this would definitely be one of the few advantages we’ve seen so far.

Aplus Trader seems very dedicated to providing beginners with all of the tools that they would need to be successful, and the company has even won awards for having the best educational program in 2013, 2014, 2015, and 2016. The program teaches the pitfalls and roadblocks of trading, provides practical tips & tricks from pros, explains terminology, and basically explains everything from a beginner-friendly approach. Apps can be accessed from the “Trading Tools” section of the website and include an economic calendar and multiple calculators. Educational resources, on the other hand, cannot be accessed until one actually opens an account. Forcing one to make a deposit in order to access educational material is not ideal, since most brokers have those options available directly.

Aplus Trader seems very dedicated to providing beginners with all of the tools that they would need to be successful, and the company has even won awards for having the best educational program in 2013, 2014, 2015, and 2016. The program teaches the pitfalls and roadblocks of trading, provides practical tips & tricks from pros, explains terminology, and basically explains everything from a beginner-friendly approach. Apps can be accessed from the “Trading Tools” section of the website and include an economic calendar and multiple calculators. Educational resources, on the other hand, cannot be accessed until one actually opens an account. Forcing one to make a deposit in order to access educational material is not ideal, since most brokers have those options available directly. Support is available 24 hours a day, from 5 pm EST Sunday until 4 pm EST Friday. The quickest contact methods include phone, Skype, and Whatsapp. Traders can also fill out a contact form on the website, request a callback, or email support directly. Aplus seems to make contacting support fairly convenient, although the addition of weekend support and LiveChat would offer the ultimate convenience to clients. We’ve provided the available contact details below.

Support is available 24 hours a day, from 5 pm EST Sunday until 4 pm EST Friday. The quickest contact methods include phone, Skype, and Whatsapp. Traders can also fill out a contact form on the website, request a callback, or email support directly. Aplus seems to make contacting support fairly convenient, although the addition of weekend support and LiveChat would offer the ultimate convenience to clients. We’ve provided the available contact details below.

MetaTrader 4 is available to download for Windows, Mac, and Linux operating systems. Also offered for mobile devices running on iOS and Android. The web-accessible MT4 platform is not offered so visitors will have to download the installation packages and install the platforms to see the trading conditions.

MetaTrader 4 is available to download for Windows, Mac, and Linux operating systems. Also offered for mobile devices running on iOS and Android. The web-accessible MT4 platform is not offered so visitors will have to download the installation packages and install the platforms to see the trading conditions.

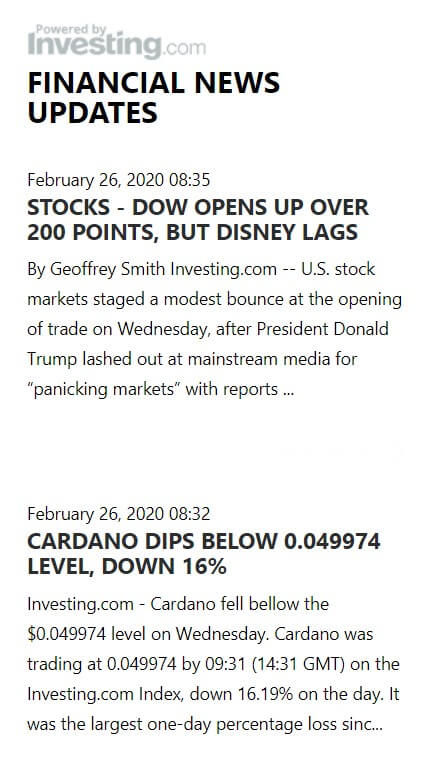

Live Market News contains a very good introduction for beginners on how to interpret the news. The feed is updated hourly and arranged as a grid. Most of the news comes from Reuters or Investing.com, it is not the work of the broker staff. Therefore, clients will have to digest the information on their own.

Live Market News contains a very good introduction for beginners on how to interpret the news. The feed is updated hourly and arranged as a grid. Most of the news comes from Reuters or Investing.com, it is not the work of the broker staff. Therefore, clients will have to digest the information on their own. Learn part of the main menu holds video tutorials, trading guides, glossary and trading FAQ. Video Tutorials are numerous with over 60 lessons on topics such as Indicators, Trading Psychology, Trading Strategies, MT4, Market Analysis and so on. They are not long and have good explanations but as such do not have any depth.

Learn part of the main menu holds video tutorials, trading guides, glossary and trading FAQ. Video Tutorials are numerous with over 60 lessons on topics such as Indicators, Trading Psychology, Trading Strategies, MT4, Market Analysis and so on. They are not long and have good explanations but as such do not have any depth.

The drawback is there are no Cryptocurrencies. Starting with forex, there are 182 total assets, 140 of them are forwards contracts and 42 are on spot. This is almost the full Forex range one can find. Let’s just say you can find exotics pairs such as CHF/TRY, AUD/ZAR, SGD/CNH, USD/AED, GBP/ILS, JPY/HKG, PLN/DKK, and many more extremes.

The drawback is there are no Cryptocurrencies. Starting with forex, there are 182 total assets, 140 of them are forwards contracts and 42 are on spot. This is almost the full Forex range one can find. Let’s just say you can find exotics pairs such as CHF/TRY, AUD/ZAR, SGD/CNH, USD/AED, GBP/ILS, JPY/HKG, PLN/DKK, and many more extremes.

The Newsfeed is updated regularly and currently only comes from NewsEdge Spanish LATAM. They are only available in Spanish without any way to translate. If non-Spanish speaking traders what to use this, they can utilize any translating service as the articles are not longer than one page.

The Newsfeed is updated regularly and currently only comes from NewsEdge Spanish LATAM. They are only available in Spanish without any way to translate. If non-Spanish speaking traders what to use this, they can utilize any translating service as the articles are not longer than one page.

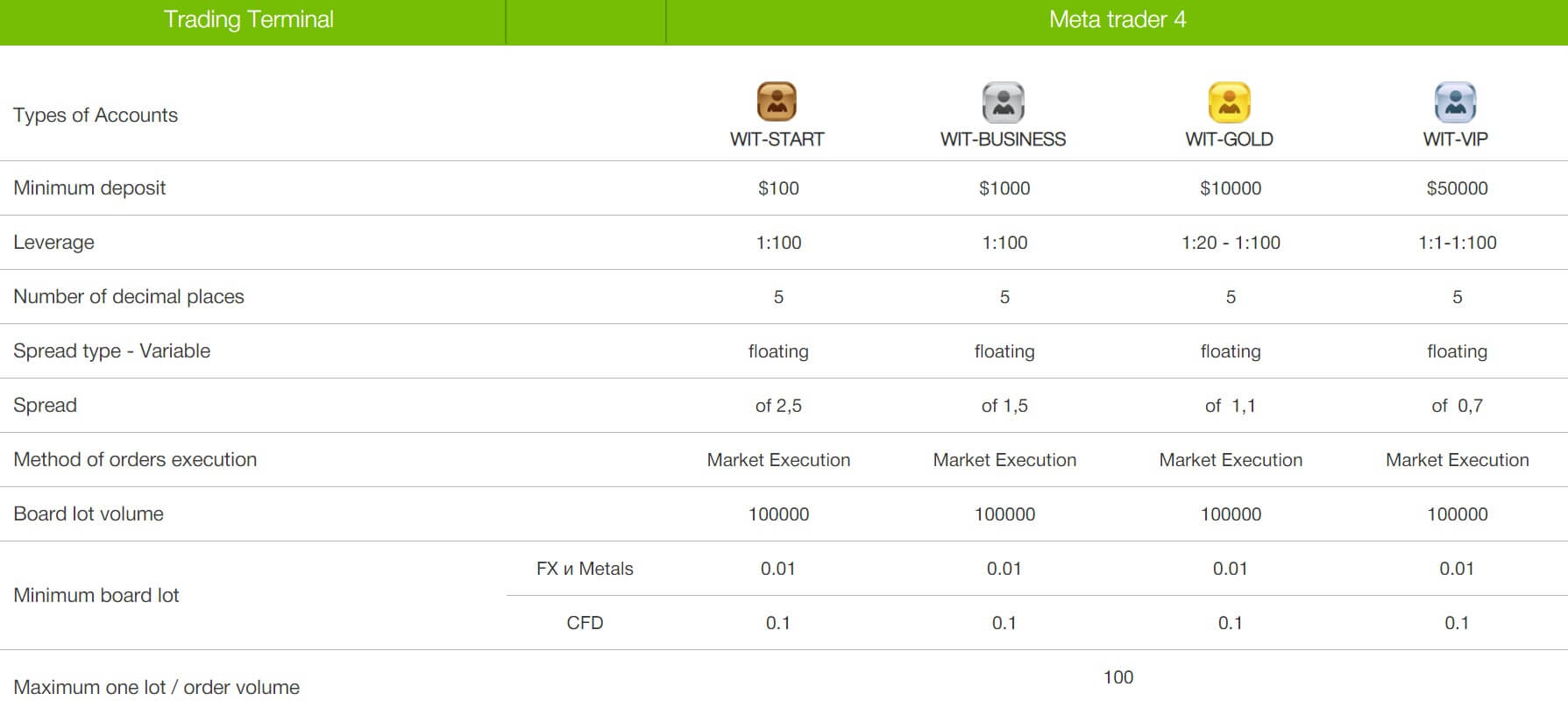

Gann Markets offers 4 account types. Actually, on the broker’s website, they give very little information on each of them. We did manage to gather that the account titles are as follows:

Gann Markets offers 4 account types. Actually, on the broker’s website, they give very little information on each of them. We did manage to gather that the account titles are as follows:

The leverage that Gann Markets applies to all its accounts is 1:400. Currently, such high leverage levels can only be seen in unregulated brokers such as Gann Markets or Australian licensed brokers, as Australia is the last major regulatory center where

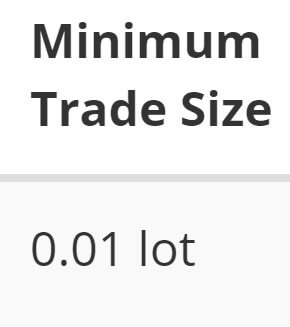

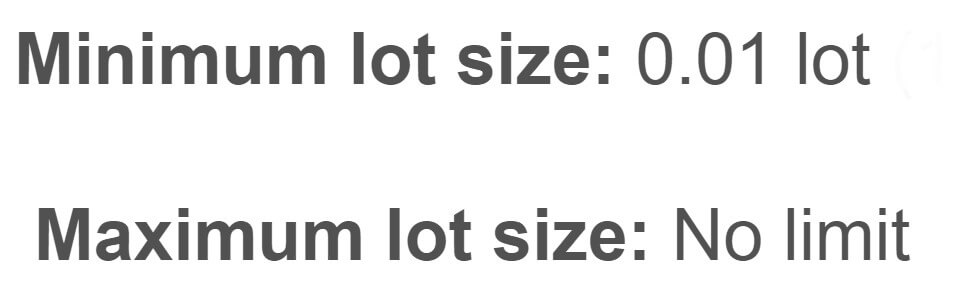

The leverage that Gann Markets applies to all its accounts is 1:400. Currently, such high leverage levels can only be seen in unregulated brokers such as Gann Markets or Australian licensed brokers, as Australia is the last major regulatory center where  We have not been able to inform ourselves about the trade sizes, but we assume that if we can open an account with 100 USD, it is normal that the minimum size of the trade is 0.01 lots (micro lot). Smaller trade sizes are the best way in which to control spending while learning

We have not been able to inform ourselves about the trade sizes, but we assume that if we can open an account with 100 USD, it is normal that the minimum size of the trade is 0.01 lots (micro lot). Smaller trade sizes are the best way in which to control spending while learning  Gann Markets offers its customers a good variety of trading assets, including more than 40 currency pairs, many of which are minor or exotic pairs such as USDZAR, USDSEK, USDPLN, USDNOK, USDMXN, USDDKK, USDSGD, USDTRY, as well as various CFDs, from precious metals such as gold, silver, platinum, and palladium to oil, natural gas, and 7 stock indices. Overall, the number of assets and variety should be more than enough to please any trader.

Gann Markets offers its customers a good variety of trading assets, including more than 40 currency pairs, many of which are minor or exotic pairs such as USDZAR, USDSEK, USDPLN, USDNOK, USDMXN, USDDKK, USDSGD, USDTRY, as well as various CFDs, from precious metals such as gold, silver, platinum, and palladium to oil, natural gas, and 7 stock indices. Overall, the number of assets and variety should be more than enough to please any trader. You can start trading with only $100 USD in the fixed account and floating account. While there are brokers who do accept less (some even as low as $1), one-hundred dollars is quite reasonable. The truth of the matter is, while you may be able to deposit only $1 elsewhere, it would be virtually impossible to enter into an FX trade with that amount of money.

You can start trading with only $100 USD in the fixed account and floating account. While there are brokers who do accept less (some even as low as $1), one-hundred dollars is quite reasonable. The truth of the matter is, while you may be able to deposit only $1 elsewhere, it would be virtually impossible to enter into an FX trade with that amount of money.

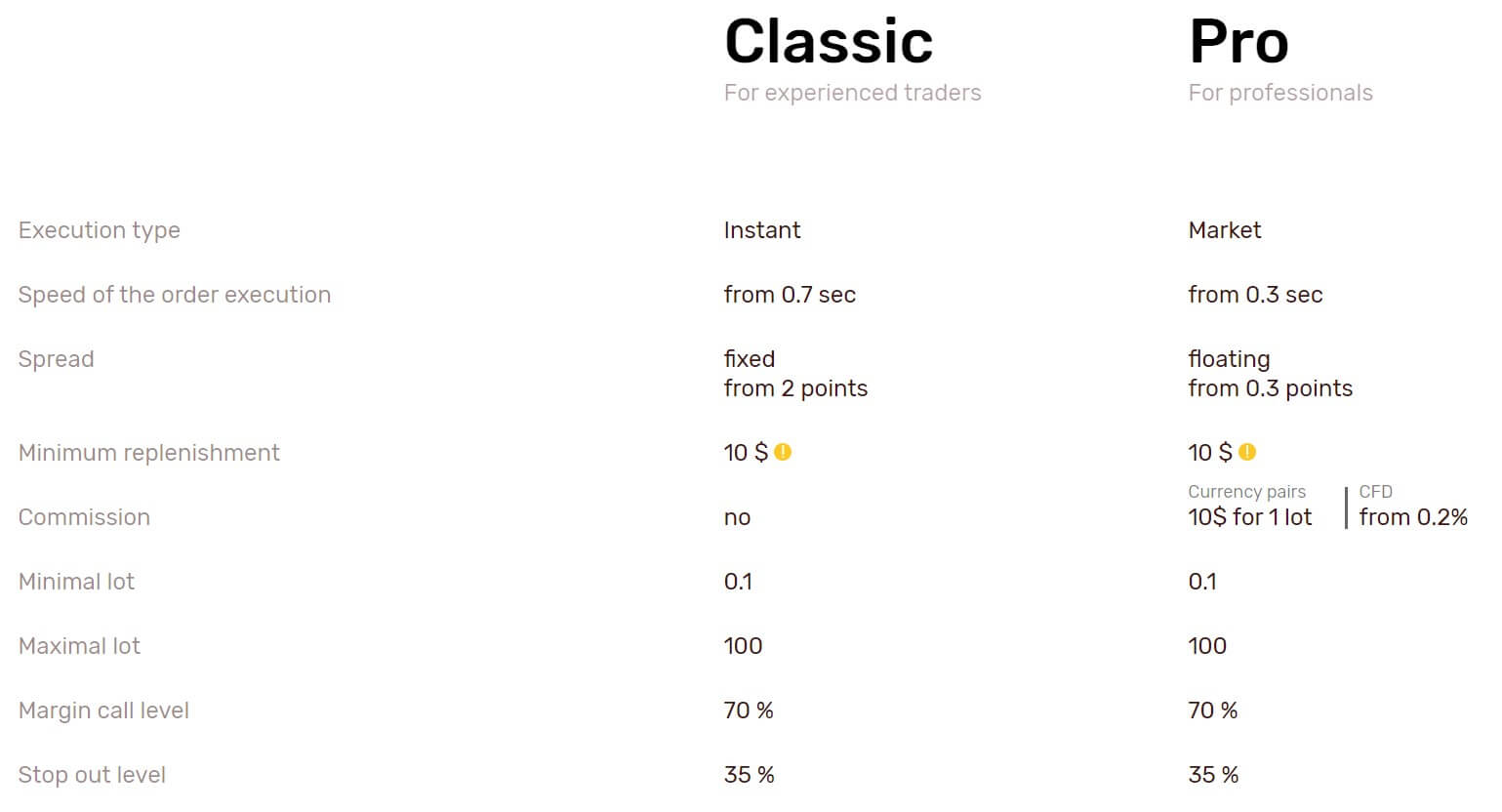

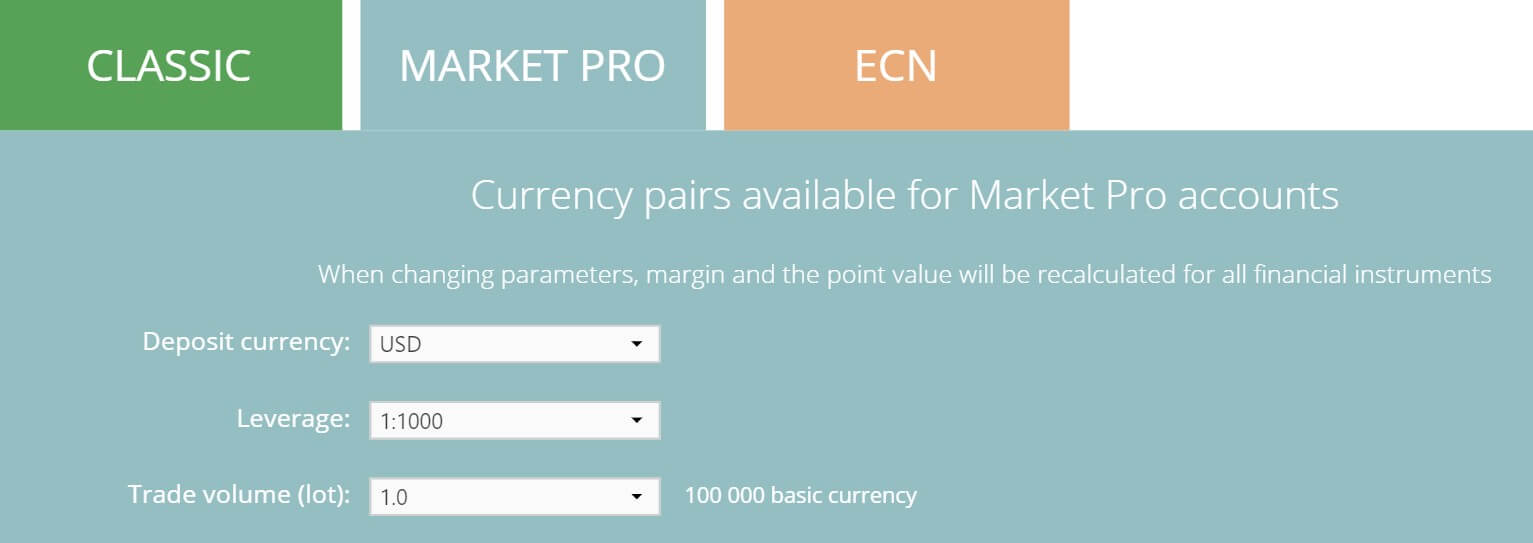

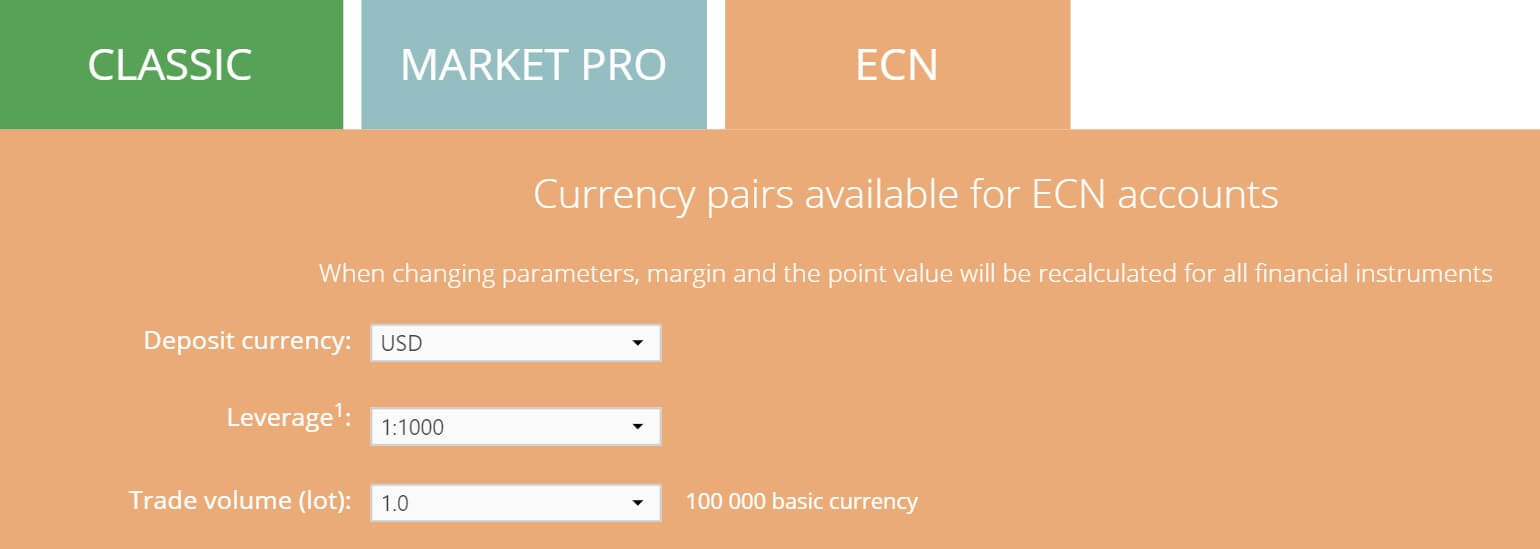

While not 100% sure, it looks like the Classic account can be leveraged up to 1:2000 while the Market Pro and ECN accounts can be leveraged up to 1:1000. Both of these figures are too high and you should avoid going over 1:500 as the risk factor increases drastically as you go up. Leverage can be selected when opening up ana account and you can get it changed by contacting the customer service team with the request to change it.

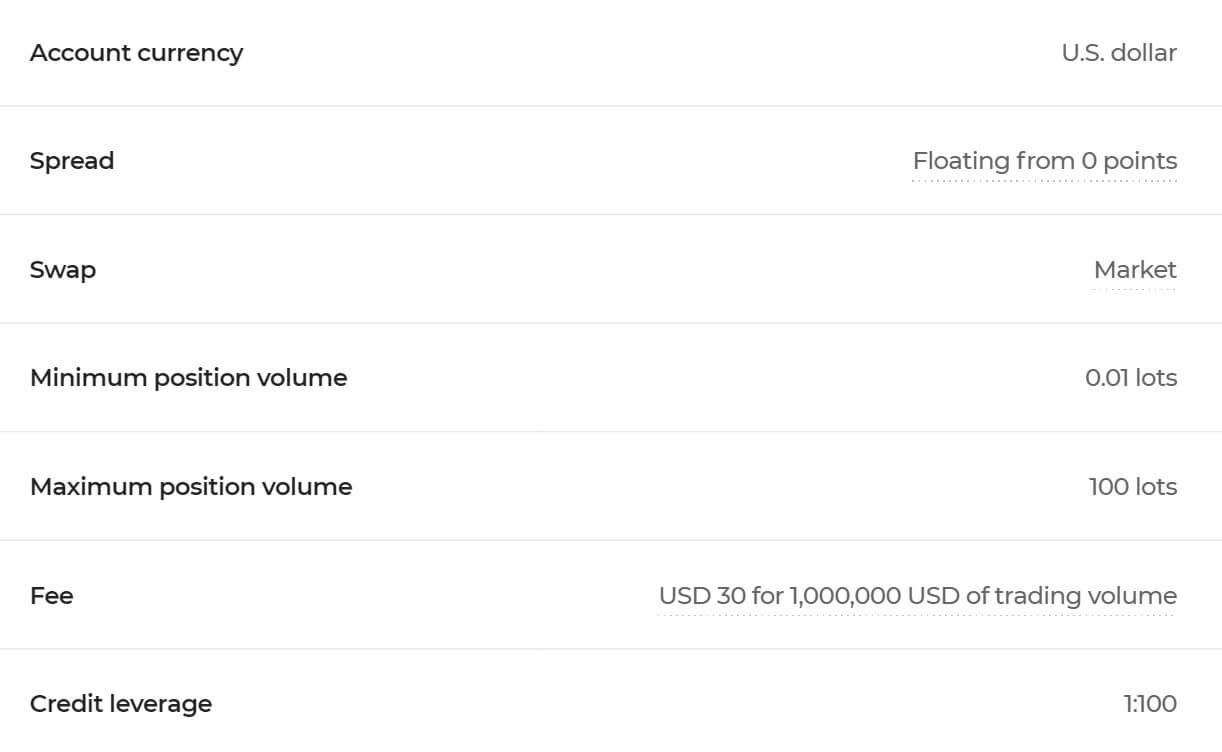

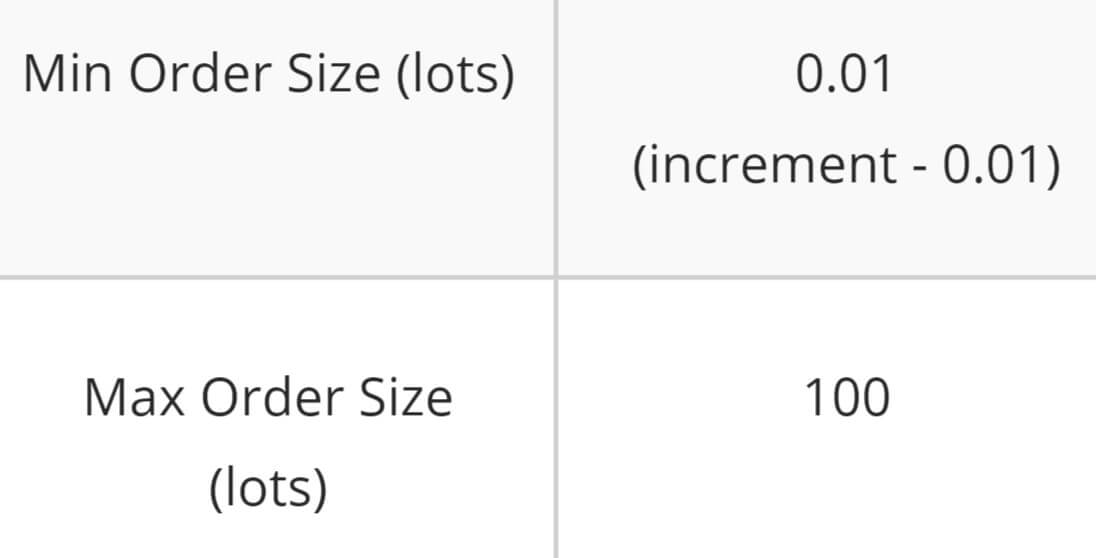

While not 100% sure, it looks like the Classic account can be leveraged up to 1:2000 while the Market Pro and ECN accounts can be leveraged up to 1:1000. Both of these figures are too high and you should avoid going over 1:500 as the risk factor increases drastically as you go up. Leverage can be selected when opening up ana account and you can get it changed by contacting the customer service team with the request to change it. As is often the case when a broker offers multiple types of accounts, Fresh Forex’s trade size requirements vary by account. Even so, trade sizes start from 0.01 lots on all three account types and then climb in increments of 0.01 lots. The Classic Account has a maximum trade size limit of 20 lots. The Market Pro Account maximum is 100 lots and the

As is often the case when a broker offers multiple types of accounts, Fresh Forex’s trade size requirements vary by account. Even so, trade sizes start from 0.01 lots on all three account types and then climb in increments of 0.01 lots. The Classic Account has a maximum trade size limit of 20 lots. The Market Pro Account maximum is 100 lots and the  The different account types shave different spreads, the Classic account ahs spread starting at 2 pips and they are fixed, while the Market Pro account has an average spread starting from 1.3 pips which are variable and the ECN account has a starting spread as low as 0 pips. Fixed spreads mean they do not change no matter what happens in the markets while variable spreads will get larger and smaller depending on the amount of volatility in the markets.

The different account types shave different spreads, the Classic account ahs spread starting at 2 pips and they are fixed, while the Market Pro account has an average spread starting from 1.3 pips which are variable and the ECN account has a starting spread as low as 0 pips. Fixed spreads mean they do not change no matter what happens in the markets while variable spreads will get larger and smaller depending on the amount of volatility in the markets.

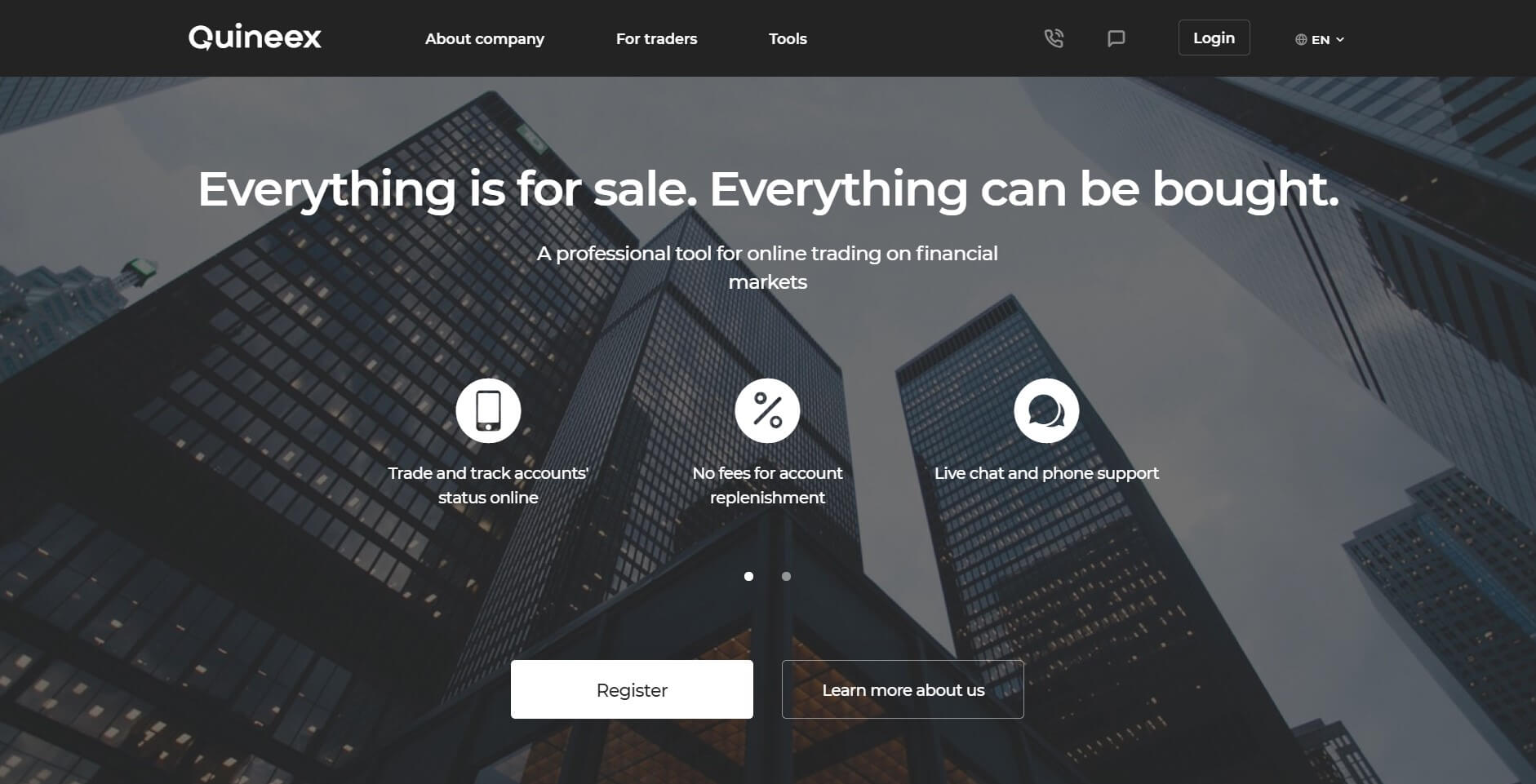

Quineex’s leverage is one of its downsides. Account-holders only get 100:1 in buying power, without the option of increasing it in the future. To put that into perspective, many brokers may give you up to 500:1, although 200:1 or 300:1 is a more common leverage rate in the industry. Nonetheless, fixed, non-changing leverage still has some advantages. First, it makes your trading experience more predictable.

Quineex’s leverage is one of its downsides. Account-holders only get 100:1 in buying power, without the option of increasing it in the future. To put that into perspective, many brokers may give you up to 500:1, although 200:1 or 300:1 is a more common leverage rate in the industry. Nonetheless, fixed, non-changing leverage still has some advantages. First, it makes your trading experience more predictable. Since there is no minimum deposit, funding your account with enough money to buy 0.01 lots or 1,000 in the base currency (the smallest trade size that Quineex permits) would suffice. This includes leverage. For example, if you deposit $10, your 100:1 buying power enables you to buy or short-sell $1,000 worth of forex pairs, which meets Quineex’s minimum

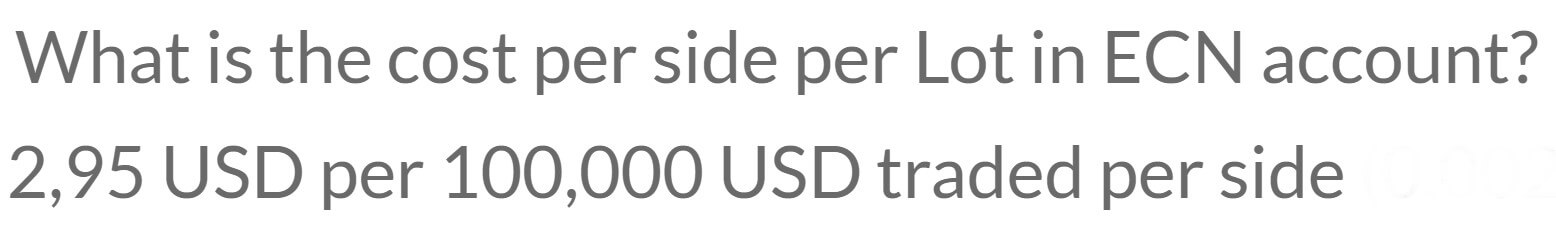

Since there is no minimum deposit, funding your account with enough money to buy 0.01 lots or 1,000 in the base currency (the smallest trade size that Quineex permits) would suffice. This includes leverage. For example, if you deposit $10, your 100:1 buying power enables you to buy or short-sell $1,000 worth of forex pairs, which meets Quineex’s minimum  Commissions are $3 on each lot that you trade. You incur this fee when you open a position. It is also charged upon closing it. In other words, a fully closed round-trip trade would cost $6 per lot. When taking a step back, we can notice that Quineex’s commissions are about average, particularly in comparison to other brokerage firms.

Commissions are $3 on each lot that you trade. You incur this fee when you open a position. It is also charged upon closing it. In other words, a fully closed round-trip trade would cost $6 per lot. When taking a step back, we can notice that Quineex’s commissions are about average, particularly in comparison to other brokerage firms.

If a trader chooses to open an account with Quineex, the average spread on the EUR.USD (which is the most liquid

If a trader chooses to open an account with Quineex, the average spread on the EUR.USD (which is the most liquid

To clarify, ‘High’ priority announcements tend to be followed by strong market reactions; ‘Low’ priority ones are less relevant and don’t have a very noticeable impact on prices; and ‘Medium’ events are in between the former two. Quineex also has a currency conversion calculator, which allows you to view the live/current price based on your selected lot size and the exchanged forex pair.

To clarify, ‘High’ priority announcements tend to be followed by strong market reactions; ‘Low’ priority ones are less relevant and don’t have a very noticeable impact on prices; and ‘Medium’ events are in between the former two. Quineex also has a currency conversion calculator, which allows you to view the live/current price based on your selected lot size and the exchanged forex pair.

Moreover, this broker will not charge you any fees when you transfer money (both in and out of your account) through one of their various transaction methods. Not only that, but both deposits and withdrawals are instantly processed. Quineex also offers two demo accounts that cater to different traders’ needs. The temporary one serves those who want to learn about the MT4 platform, while the permanent demo (the Trial Account) is especially suitable for beginners.

Moreover, this broker will not charge you any fees when you transfer money (both in and out of your account) through one of their various transaction methods. Not only that, but both deposits and withdrawals are instantly processed. Quineex also offers two demo accounts that cater to different traders’ needs. The temporary one serves those who want to learn about the MT4 platform, while the permanent demo (the Trial Account) is especially suitable for beginners.

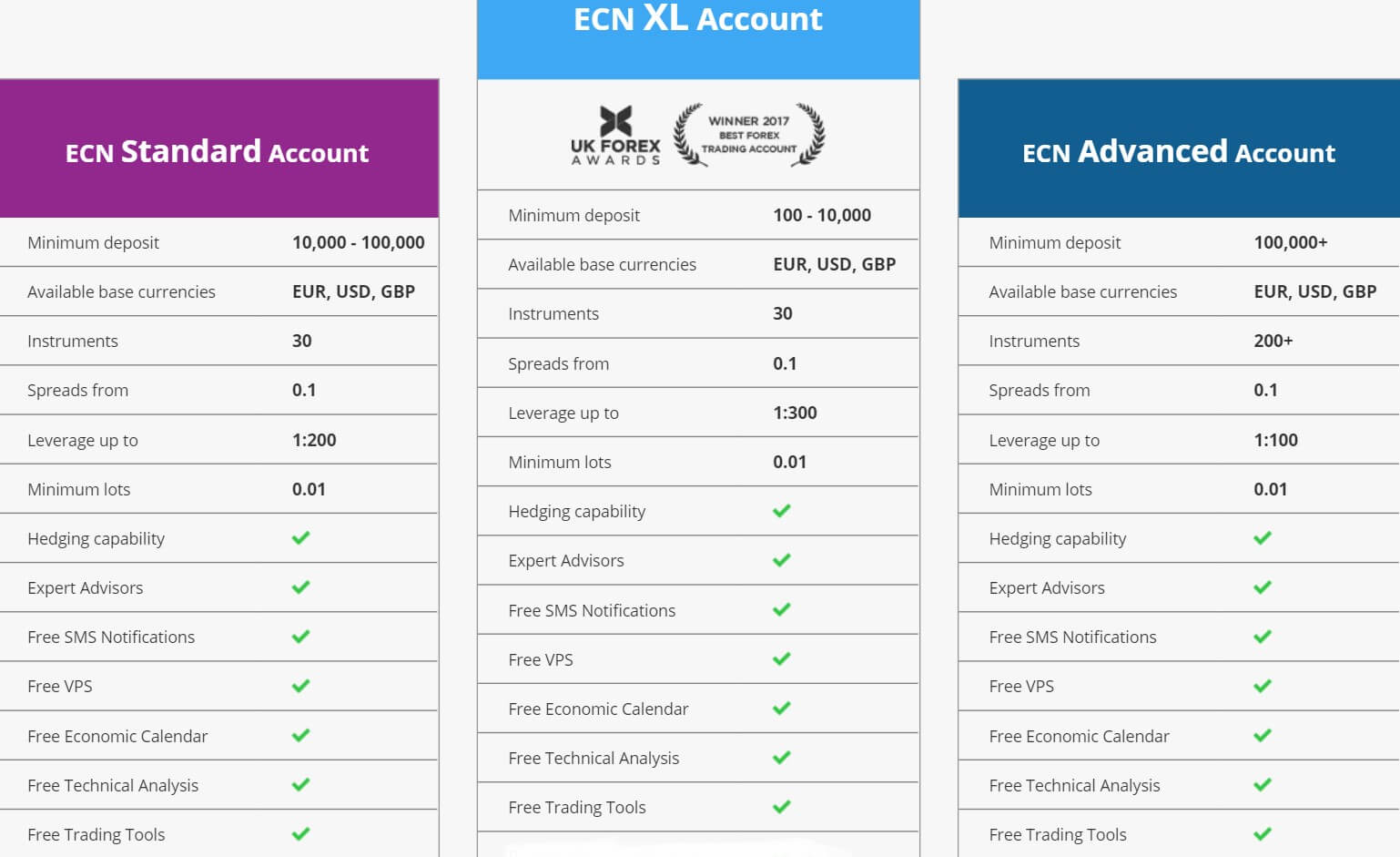

Like most brokers, FXCC is compatible with the award-winning and popular Metatrader 4 (MT4). This platform is the preferred choice of the most experienced traders, and also of beginners. The platform is equipped with a series of technical indicators, an advanced graphical package, and a wide range of Expert Advisors (EA), as well as several options for backtesting for EAS, which will allow you to evaluate your strategies. The platform is available in desktop and mobile versions for use on smartphones and tablets. FXCC customers are offered a multi-account management solution through MetaTrader 4 MultiTerminal, which is an integrated part of the MT4 package.

Like most brokers, FXCC is compatible with the award-winning and popular Metatrader 4 (MT4). This platform is the preferred choice of the most experienced traders, and also of beginners. The platform is equipped with a series of technical indicators, an advanced graphical package, and a wide range of Expert Advisors (EA), as well as several options for backtesting for EAS, which will allow you to evaluate your strategies. The platform is available in desktop and mobile versions for use on smartphones and tablets. FXCC customers are offered a multi-account management solution through MetaTrader 4 MultiTerminal, which is an integrated part of the MT4 package. Trade Sizes

Trade Sizes

To get in touch with FXCC’s customer service, we have several options. We can get in touch, by phone, by email, through a contact form on the web, a live chat available 24 hours and call service. When entering your personal data and your phone, the broker contacts you.

To get in touch with FXCC’s customer service, we have several options. We can get in touch, by phone, by email, through a contact form on the web, a live chat available 24 hours and call service. When entering your personal data and your phone, the broker contacts you.

Kuwait Headquarters:

Kuwait Headquarters: NCM Investment (HQ) is regulated by Capital Markets Authority, Kuwait under license No: AP / 2019 / 0003 & AP / 2017 / 0009 | LEI No. 2 1 3 8 0 0 1 6 3 E L E M N K Q Z I 7 7

NCM Investment (HQ) is regulated by Capital Markets Authority, Kuwait under license No: AP / 2019 / 0003 & AP / 2017 / 0009 | LEI No. 2 1 3 8 0 0 1 6 3 E L E M N K Q Z I 7 7

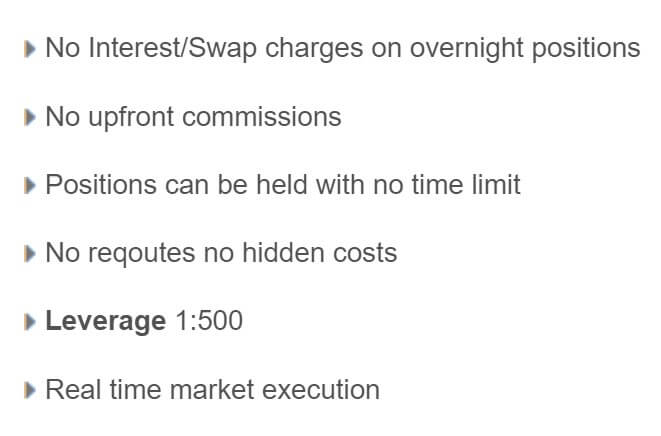

Customers can apply for leverage of up to 1:500 on Forex. Trading

Customers can apply for leverage of up to 1:500 on Forex. Trading

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CADSGD, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, SGDJPY, USDCAD, USDCHF, USDHKD, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, and USDTRY

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CADSGD, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, SGDJPY, USDCAD, USDCHF, USDHKD, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, and USDTRY

An economic news box, which we’ve seen updates.

An economic news box, which we’ve seen updates.

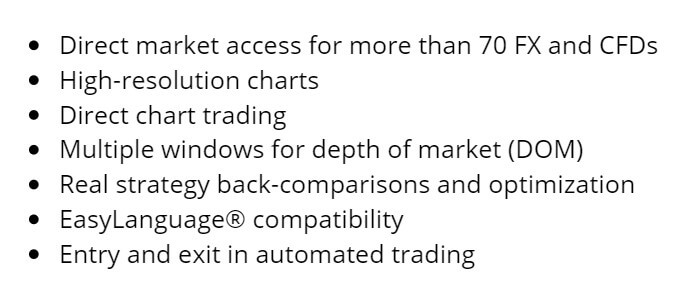

Multicharts: With Multicharts, Swissdirekt traders can access the LMAX Exchange directly from the graphics. Multicharts is a professional graphics technology specially designed for

Multicharts: With Multicharts, Swissdirekt traders can access the LMAX Exchange directly from the graphics. Multicharts is a professional graphics technology specially designed for

Again the broker does not give information about what the deposit methods are to deposit money into your accounts. It is prevalent for brokers to accept bank transfers and credit or debit card payments, including some electronic payment systems. If any trader wishes to trade with this broker, he will need to contact customer service for deposit methods.

Again the broker does not give information about what the deposit methods are to deposit money into your accounts. It is prevalent for brokers to accept bank transfers and credit or debit card payments, including some electronic payment systems. If any trader wishes to trade with this broker, he will need to contact customer service for deposit methods.

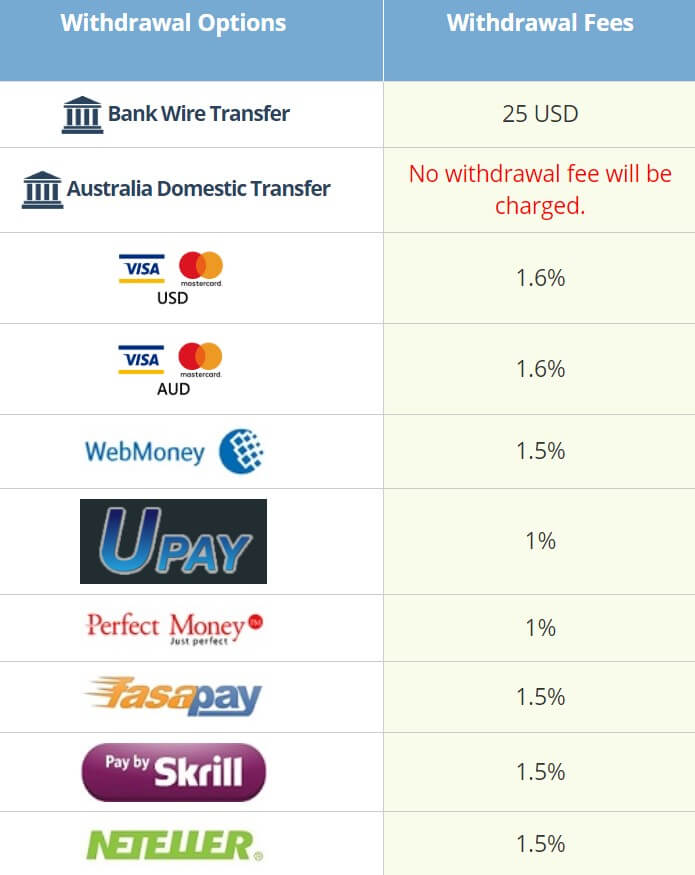

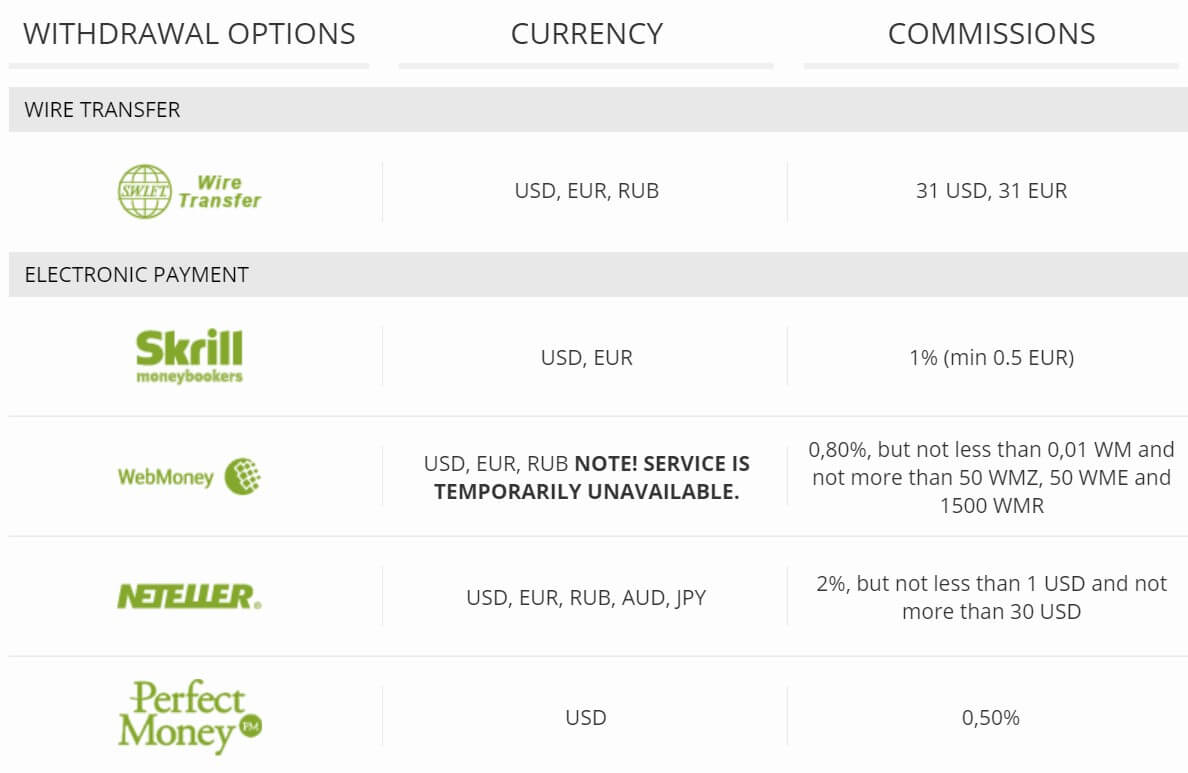

In accordance with their regulation, the broker has a few boundaries set in place when it comes to withdrawing funds. Clients who have made a deposit via card must withdraw the amount of their deposit back to that same card within 180 days of the initial deposit. Withdrawal of additional funds that exceed the initial deposit amount can be made via separate payment methods. Also, an extra 3% charge will be applied to any withdrawals of more than $3,000 USD made through e-wallets (WebMoney, PerfectMoney, Skrill, Neteller, Vogue Pay, Vietnam Online Banking). The only fee-free method would be Australian Domestic Bank Wire; however, regular Bank Wires will be charged fees. All applicable fees have been listed below.

In accordance with their regulation, the broker has a few boundaries set in place when it comes to withdrawing funds. Clients who have made a deposit via card must withdraw the amount of their deposit back to that same card within 180 days of the initial deposit. Withdrawal of additional funds that exceed the initial deposit amount can be made via separate payment methods. Also, an extra 3% charge will be applied to any withdrawals of more than $3,000 USD made through e-wallets (WebMoney, PerfectMoney, Skrill, Neteller, Vogue Pay, Vietnam Online Banking). The only fee-free method would be Australian Domestic Bank Wire; however, regular Bank Wires will be charged fees. All applicable fees have been listed below. All withdrawals are processed by the finance team within 24-48 hours. The broker doesn’t go into further detail as to whether it would take a longer amount of time to actually receive the withdrawal. In the case of Bank Wire Transfers, it would be best to expect it to possibly take 3-5 business days, especially for international transfers. This is based on the fact that banks tend to have a longer waiting period before funds are credited. Hopefully, all funds would be available within a day or two.

All withdrawals are processed by the finance team within 24-48 hours. The broker doesn’t go into further detail as to whether it would take a longer amount of time to actually receive the withdrawal. In the case of Bank Wire Transfers, it would be best to expect it to possibly take 3-5 business days, especially for international transfers. This is based on the fact that banks tend to have a longer waiting period before funds are credited. Hopefully, all funds would be available within a day or two.

This broker seems to understand the importance of educating their clients, based on the fact that the website has devoted an entire section to an “Education Centre”. The category is made up of an FX Blog, Trading Guide (Book), USGFX TradersClub, Webinars & Seminars, Forex Exhibition, Forex Contest, Forex Seminar, Everything About

This broker seems to understand the importance of educating their clients, based on the fact that the website has devoted an entire section to an “Education Centre”. The category is made up of an FX Blog, Trading Guide (Book), USGFX TradersClub, Webinars & Seminars, Forex Exhibition, Forex Contest, Forex Seminar, Everything About

WTI profits through spreads and overnight interest charges, or swap fees. One advantage of choosing

WTI profits through spreads and overnight interest charges, or swap fees. One advantage of choosing

Leverage

Leverage

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFHUF, CHFJPY, CHFPLN, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURRON, EURSEK, EURTRY, EURUSD, GBPAUD, FBPCAD, GBPOCHF, GBPJPY, GBPNZD, GBPPLN, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDBRL, USDCAD, USDCHF, USDCLP, USDCZK, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDSEK, USDTRY, USDZAR.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFHUF, CHFJPY, CHFPLN, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURRON, EURSEK, EURTRY, EURUSD, GBPAUD, FBPCAD, GBPOCHF, GBPJPY, GBPNZD, GBPPLN, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDBRL, USDCAD, USDCHF, USDCLP, USDCZK, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDSEK, USDTRY, USDZAR.

Educational & Trading Tools

Educational & Trading Tools FRNG Lagos:

FRNG Lagos:

Deposit Methods & Costs

Deposit Methods & Costs

The broker’s customer service team can be contacted through LiveChat, email, or phone. Agents are in the office from 22:00 GMT on Sunday evening through Friday afternoon at 22:00 GMT. Although we were initially happy to see the instant contact option LiveChat available on the website, there weren’t any agents online when we attempted to start a chat. This was during business hours, so it seems as though support agents can’t be counted on to always be online when they’re supposed to be. In the broker’s defense, the chat does ask for an email address and allow one to type in their problem to receive a response once an agent does come online, but this doesn’t really provide more convenience than simply emailing support in the first place. We’ve provided contact details below and LiveChat can be accessed from the bottom right corner of the website.

The broker’s customer service team can be contacted through LiveChat, email, or phone. Agents are in the office from 22:00 GMT on Sunday evening through Friday afternoon at 22:00 GMT. Although we were initially happy to see the instant contact option LiveChat available on the website, there weren’t any agents online when we attempted to start a chat. This was during business hours, so it seems as though support agents can’t be counted on to always be online when they’re supposed to be. In the broker’s defense, the chat does ask for an email address and allow one to type in their problem to receive a response once an agent does come online, but this doesn’t really provide more convenience than simply emailing support in the first place. We’ve provided contact details below and LiveChat can be accessed from the bottom right corner of the website.

This broker exclusively supports the successor of the world’s most popular trading platform MT4, MetaTrader 5. The newer version basically aims to provide more features, while keeping the older platform’s convenient and navigable interface. MT5 also comes with more languages, timeframes, and a built-in economic calendar. The platform is available for download on PC, iOS, Android devices, or accessible through the online WebTrader.

This broker exclusively supports the successor of the world’s most popular trading platform MT4, MetaTrader 5. The newer version basically aims to provide more features, while keeping the older platform’s convenient and navigable interface. MT5 also comes with more languages, timeframes, and a built-in economic calendar. The platform is available for download on PC, iOS, Android devices, or accessible through the online WebTrader.

CDFX is an online broker with an asset portfolio that includes currency pairs and metals. The broker requires a $5,000 deposit and only offers two main account types, Standard and Islamic. Considering that the deposit requirement is so high, we would expect to see spreads that start lower than the broker’s 1.5 pip offer, even with a lack of commission fees. You’ll find an average leverage cap of up to 1:300 on the broker’s Standard account, while Islamic account holders are allowed a leverage option of up to 1:500.

CDFX is an online broker with an asset portfolio that includes currency pairs and metals. The broker requires a $5,000 deposit and only offers two main account types, Standard and Islamic. Considering that the deposit requirement is so high, we would expect to see spreads that start lower than the broker’s 1.5 pip offer, even with a lack of commission fees. You’ll find an average leverage cap of up to 1:300 on the broker’s Standard account, while Islamic account holders are allowed a leverage option of up to 1:500.

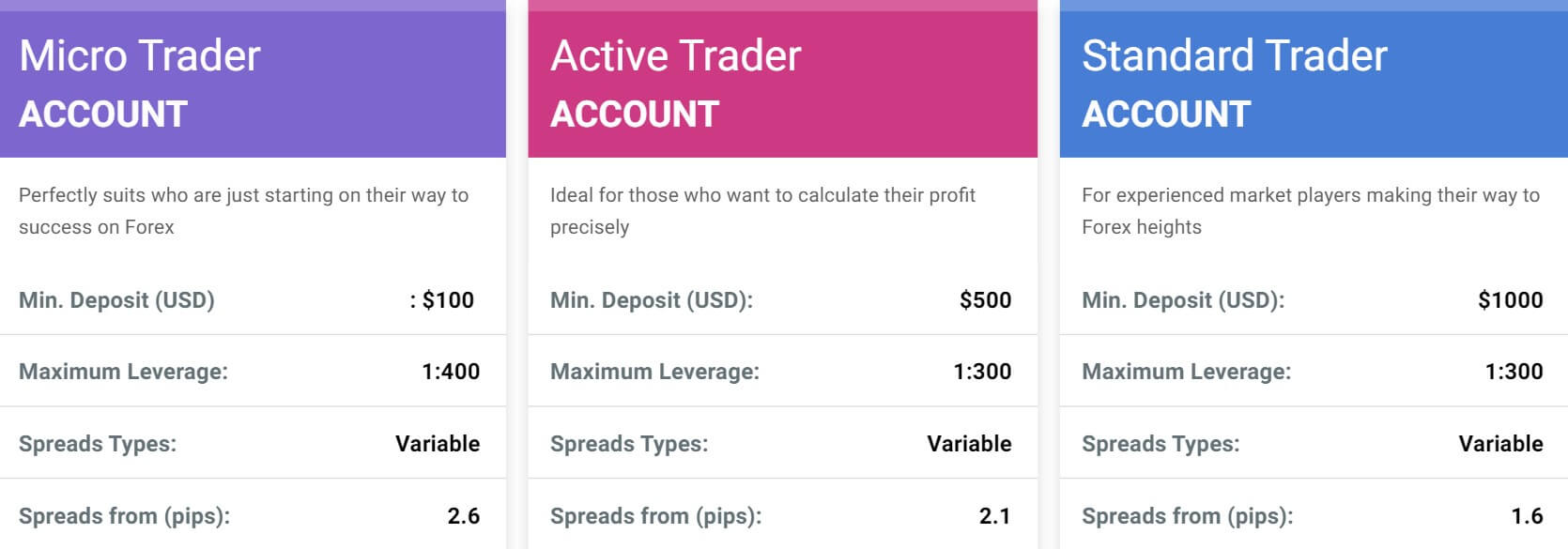

The Micro account allows a more flexible leverage choice of up to 1:400, while the Active Trader and Standard accounts both lower the cap slightly to 1:300. These options hold up to many other broker’s offers and allow for a good amount of flexibility. On the accounts that hold larger balances, the leverage options are decreased to a lower 1:200 cap on the Premium, Elite, and

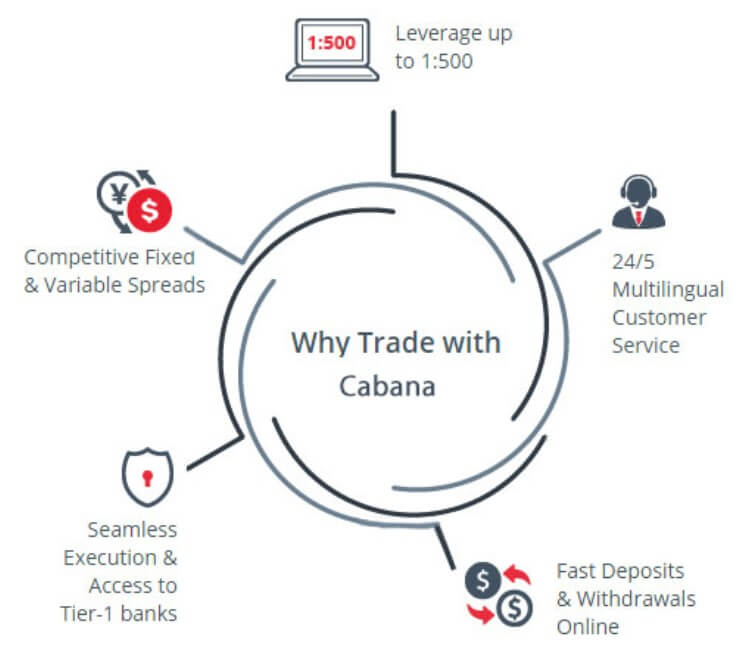

The Micro account allows a more flexible leverage choice of up to 1:400, while the Active Trader and Standard accounts both lower the cap slightly to 1:300. These options hold up to many other broker’s offers and allow for a good amount of flexibility. On the accounts that hold larger balances, the leverage options are decreased to a lower 1:200 cap on the Premium, Elite, and  Cabana Capitals advertises the minimum spreads for each account type, but we don’t get to see a more detailed product page that would allow us to compare how high options could actually go. If at all possible, we would definitely recommend making the $1K deposit to open a Standard account, due to the fact that spreads on the more affordable account types are well above average. To be exact spreads start from 2.6 pips on the Micro account and 2.1 pips on the Active Trader account. The higher than average spreads will certainly put traders that can’t afford a better account type at a disadvantage.

Cabana Capitals advertises the minimum spreads for each account type, but we don’t get to see a more detailed product page that would allow us to compare how high options could actually go. If at all possible, we would definitely recommend making the $1K deposit to open a Standard account, due to the fact that spreads on the more affordable account types are well above average. To be exact spreads start from 2.6 pips on the Micro account and 2.1 pips on the Active Trader account. The higher than average spreads will certainly put traders that can’t afford a better account type at a disadvantage.

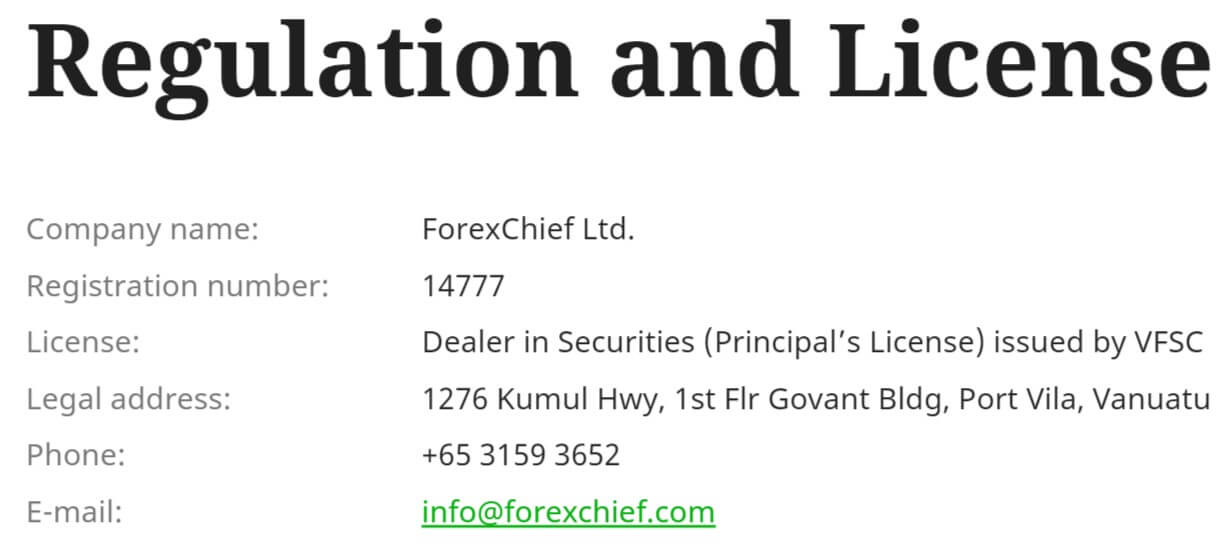

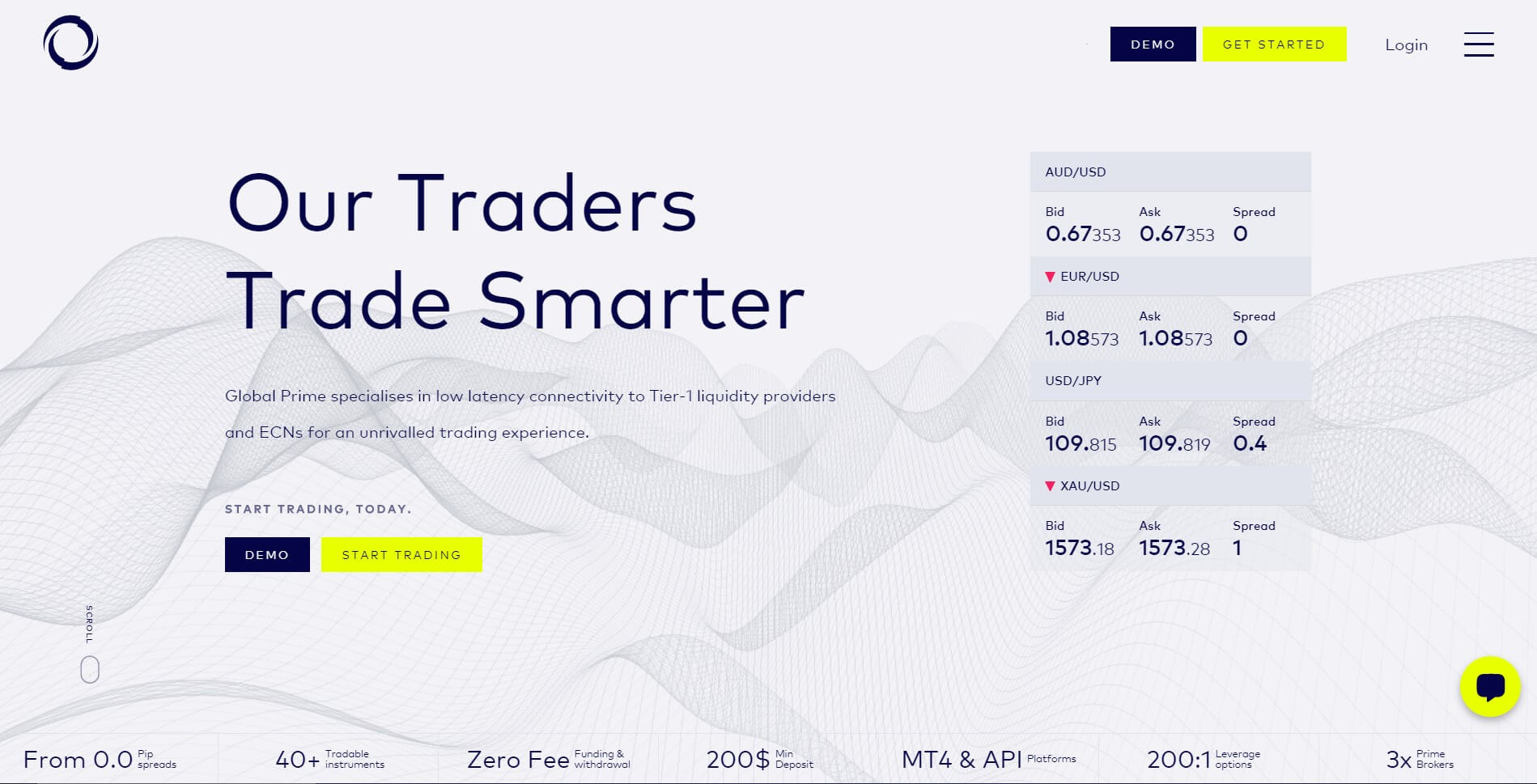

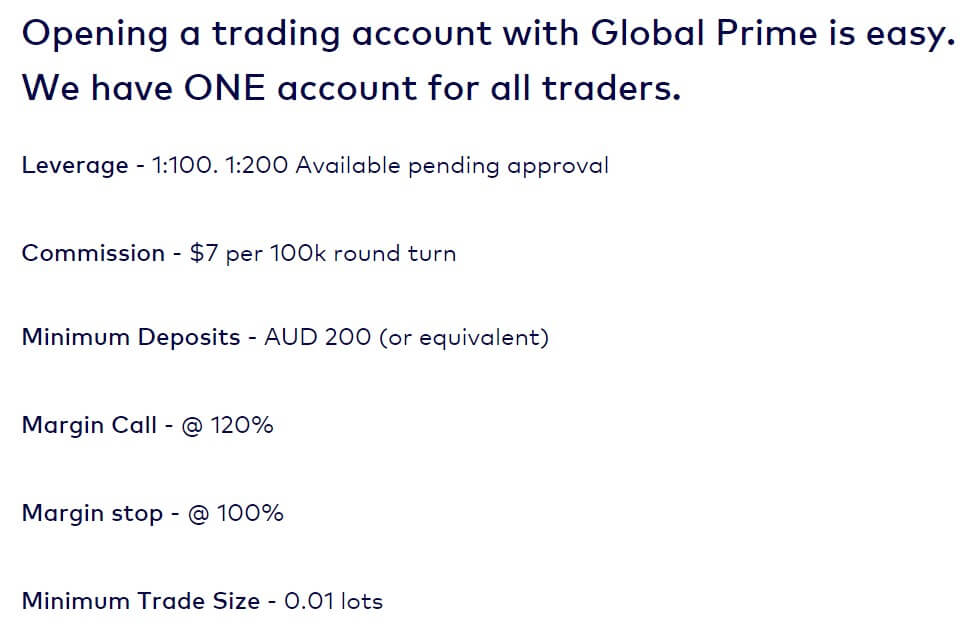

Forex Chief supports the world’s favorite trading platform MetaTrader 4, alongside its popular successor MetaTrader 5. Each account is available in an MT4 or MT5 version, so traders would simply need to select the account based on the platform version they would prefer. Comparing both options is difficult since MT4 and MT5 are both powerful trading platforms that come with multiple built-in features. We suppose that it could be argued that MT5 provides more options since it comes equipped with 21 timeframes, vs MT4’s 9 timeframes, plus 8 more technical indicators, and 13 more drawing tools, including the Fibonacci studies and Elliot Wave drawing tools.

Forex Chief supports the world’s favorite trading platform MetaTrader 4, alongside its popular successor MetaTrader 5. Each account is available in an MT4 or MT5 version, so traders would simply need to select the account based on the platform version they would prefer. Comparing both options is difficult since MT4 and MT5 are both powerful trading platforms that come with multiple built-in features. We suppose that it could be argued that MT5 provides more options since it comes equipped with 21 timeframes, vs MT4’s 9 timeframes, plus 8 more technical indicators, and 13 more drawing tools, including the Fibonacci studies and Elliot Wave drawing tools.

Under the “Market Insights” section of the website, traders will find the following options;

Under the “Market Insights” section of the website, traders will find the following options;

Accepted deposit methods include bank wire transfer, credit/debit card, Neteller, and Bitcoin. Note that deposits are only accepted if the name on the sending account matches the client’s name on the trading account. Charges that may apply to bank wire transfers include a transaction fee (from the bank that starts the transaction), an intermediary fee (if your bank does not have a direct connection with the recipient bank), and/or a receiving bank fee. TegasFX does not charge fees on Neteller from their side, but the payment provider does charge a 3.9% fee. It takes 1-3 business days to process wire transfers, 1 business day to process card and Neteller deposits, and Bitcoin deposits are processed instantly.

Accepted deposit methods include bank wire transfer, credit/debit card, Neteller, and Bitcoin. Note that deposits are only accepted if the name on the sending account matches the client’s name on the trading account. Charges that may apply to bank wire transfers include a transaction fee (from the bank that starts the transaction), an intermediary fee (if your bank does not have a direct connection with the recipient bank), and/or a receiving bank fee. TegasFX does not charge fees on Neteller from their side, but the payment provider does charge a 3.9% fee. It takes 1-3 business days to process wire transfers, 1 business day to process card and Neteller deposits, and Bitcoin deposits are processed instantly.