FXPlayer is a foreign exchange broker that was started in 2014 and is locate din the Marshall Islands.

According to the broker website, “We pledge to fair and transparent prices and execution that provides a level of confidence that is certainty invaluable in trading. The trading platforms provide consistently competitive spreads and margins to ensure that you get the most from your trading. Streaming tradeable prices through our online platforms allow you to act on the very latest price movements in real-time. Our prices track the underlying instruments accurately so you can be sure that your trade will result in the profit that you expect. Even in volatile markets, we will continue to offer fair prices, and to do everything we can to provide the market access you need to open and close positions when you want to.”

We will be using this Forex Player review to provide you with information regarding what the broker really offers so that you can decide if they are the right broker for you.

Account Types

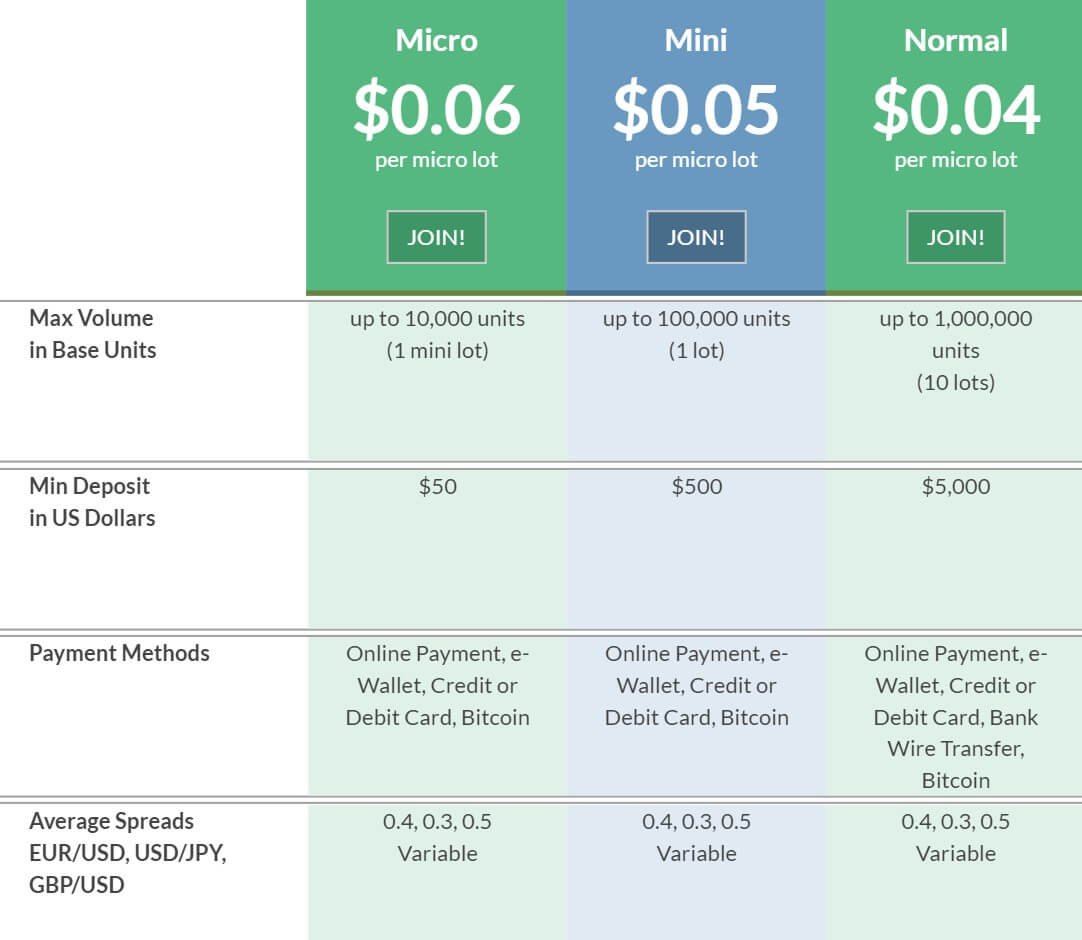

There are six different account types available to use. Below we outline their key features and differences so you can understand what is on offer.

Micro Account: This account requires a minimum deposit of $50, the account has average variable spreads of EURUSD 0.4 pips, USDJPY 0.3 pips and GBPUSD at 0.5 pips. With such low spread, there is also a commission of $0.06 per micro-lots (0.01) traded or $6 per lot traded. The account can be leveraged up to 1:100, has a margin call and stop out level set at 50% and has a maximum trade size of 10,000 units or 0.10 lots. Payment methods available on this account include Online Payment, e-Wallet, Credit or Debit Card, Bitcoin

Mini Account: This account requires a minimum deposit of $500, the account has average variable spreads of EURUSD 0.4 pips, USDJPY 0.3 pips and GBPUSD at 0.5 pips. With such low spread, there is also a commission of $0.05 per micro-lots (0.01) traded or $5 per lot traded. The account can be leveraged up to 1:100, has a margin call and stop out level set at 45% and has maximum trade size of 100,000 units or 1 lot. Payment methods available on this account include Online Payment, e-Wallet, Credit or Debit Card, Bitcoin

Normal Account: This account requires a minimum deposit of $5,000, the account has average variable spreads of EURUSD 0.4 pips, USDJPY 0.3 pips and GBPUSD at 0.5 pips. With such low spread, there is also a commission of $0.04 per micro-lots (0.01) traded or $4 per lot traded. The account can be leveraged up to 1:200, has a margin call and stop out level set at 40% and has a maximum trade size requirement of 1,000,000 units or 10 lot. Payment methods available on this account include Online Payment, e-Wallet, Credit or Debit Card, Bitcoin as well as Bank Wire Transfer.

Pro Account: This account requires a minimum deposit of $20,000, the account has average variable spreads of EURUSD 0.4 pips, USDJPY 0.3 pips and GBPUSD at 0.5 pips. With such low spread, there is also a commission of $0.03 per micro-lots (0.01) traded or $3 per lot traded. The account can be leveraged up to 1:200, has a margin call and stop out level set at 35% and has a maximum trade size requirement of 10,000,000 units or 100 lot. Payment methods available on this account include Online Payment, e-Wallet, Credit or Debit Card, Bitcoin as well as Bank Wire Transfer.

Institutional Account: This account requires a minimum deposit of $100,000, the account has average variable spreads of EURUSD 0.4 pips, USDJPY 0.3 pips and GBPUSD at 0.5 pips. With such low spread, there is also a commission of $0.02 per micro-lots (0.01) traded or $2 per lot traded. The account can be leveraged up to 1:200, has a margin call and stop out level set at 30% and has a maximum trade size requirement of 100,000,000 units or 1,000 lot. Payment methods available on this account include Online Payment, e-Wallet, Credit or Debit Card, Bitcoin as well as Bank Wire Transfer.

Flex Account: This account requires a minimum deposit of $10,000, the account has average variable spreads of EURUSD 0.4 pips, USDJPY 0.3 pips and GBPUSD at 0.5 pips. With such low spread, there is also a commission of $0.035 per micro-lots (0.01) traded or $3.5 per lot traded. The account can be leveraged up to 1:200, has a margin call and stop out level set at 30% and the account does not have a maximum trade size. Payment methods available on this account include Online Payment, e-Wallet, Credit or Debit Card, Bitcoin as well as Bank Wire Transfer.

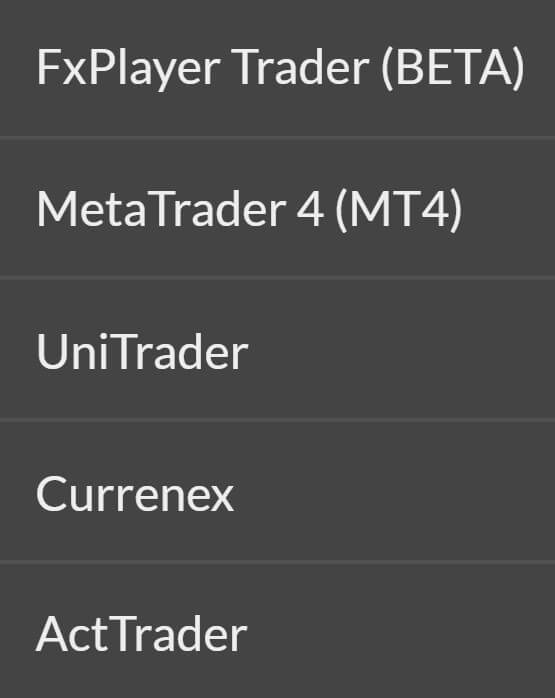

Platforms

There is a wide selection of platforms available to use which is refreshing to see, let’s look at what they are.

MetaTrader 4 (MT4): The MT4 platform provides a wide range of features for our traders, including various execution technologies, unlimited charting quantity, a large number of technical indicators and line studies, custom indicators and scripts and more. Some of its other features include the ability to use expert advisors, comprehensive charting packages, multilingual support, integration with web services and it offers a lot of flexibility.

UniTrader: UniTrader represents a new generation of trading platforms that were designed and built as an easy and logical instrument for active traders looking for an edge. It offers features like live streaming rates, easy order management, trading history, live trading, detailed account information, news streams and SquawkBow, real-time tradable charts, open position information and instrument subscriptions.

UniTrader: UniTrader represents a new generation of trading platforms that were designed and built as an easy and logical instrument for active traders looking for an edge. It offers features like live streaming rates, easy order management, trading history, live trading, detailed account information, news streams and SquawkBow, real-time tradable charts, open position information and instrument subscriptions.

Currenex: Currenex is the leading provider of fully integrated, high-performance FX trading solutions for clients who require advanced technology, diverse liquidity, and an environment that offers them greater choices in how to trade. Some of its other features include its liquidity, speed, execution, charts, and integration with the back office.

ActTrader: ActTrader combines power and efficiency with streaming two-way prices and fast trade execution. high-quality charting and up-to-the-minute news are both included in the platform. It contains a whole host of features including tabbed windows, a reports window, new options when creating conditional orders, a trading strategy report, accounts information bar, organized managed account windows, dealing rates windows and the ability to lock all accounts.

FxPlayer Trader (Beta): An unprecedented Innovative Social Mobile-Friendly platform is available for novice to advanced traders. It contains advanced charts, news and calendars, social and chat features and access to trading related radios and TV.

Leverage

The maximum leverage available depends on the account you are using. The Micro and Mini accounts have a maximum leverage of 1:100, while the Normal, Pro, Institutional and Flex accounts have a maximum leverage of 1:200. The leverage can be selected when opening up an account and can be changed by contacting the customer service team with the request.

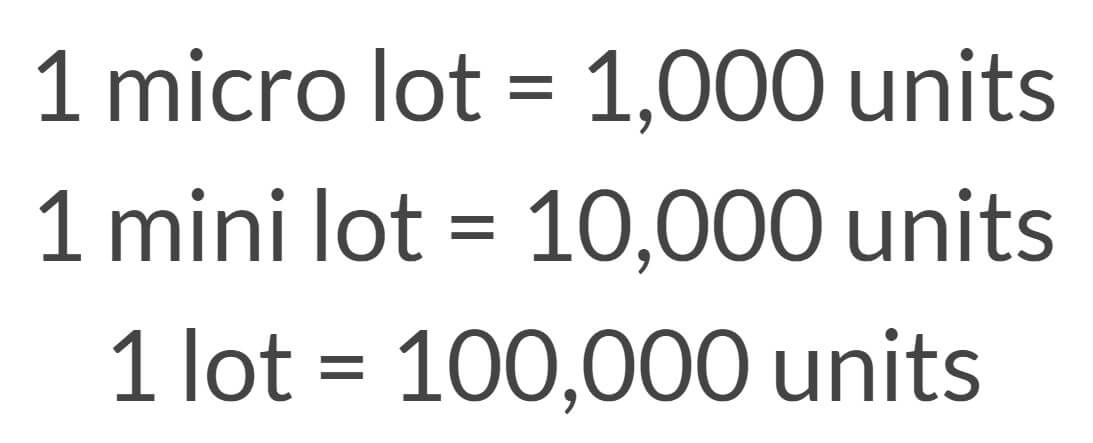

Trade Sizes

Trade sizes start from 0.01 lots and go up in increments of 0.01 lots. The different accounts have different maximum trade sizes, and we have outlined them below.

- Micro Account: 0.1 lot maximum

- Mini Account: 1 lot maximum

- Normal Account: 10 lot maximum

- Pro Account: 100 lot maximum

- Institutional Account: 1,000 lot maximum

- Flex Account: No maximum size

While some of the limits are very high, we would not recommend trading over 50 lots in a single trade due to execution and slippage issues.

Trading Costs

Each account has its own trading cost associated with it, and we have outlined them below for ease of understanding.

- Micro Account: $0.06 per micro lot, or $6 per lot traded

- Mini Account: $0.05 per micro lot, or $5 per lot traded

- Normal Account: $0.04 per micro lot, or $4 per lot traded

- Pro Account: $0.03 per micro lot, or $3 per lot traded

- Institutional Account: $0.02 per micro lot, or $2 per lot traded

- Flex Account: $0.035 per micro lot, or $3.5 per lot traded

All commissions are either in line with the industry standard of $6 per lot traded or below which is a positive sign to see.

Assets

The assets have been broken down into three different categories. Unfortunately, there isn’t a full breakdown of all available assets but we do know some of them. There doesn’t seem to be a large number of instruments which is a shame.

Forex: EURUSD, GBPUSD, USDJPY, AUDUSD, USDCAD, EURGBP, EURJPY, USDCHF, GBPCHF, EURCHF, NZDUSD, USDMXN, USDZAR, USDTRY, USDSEK, USDNOK, USDHKD, EURNOK, EURSEK, EURTRY, CHFJPY, EURAUD, EURCAD, AUDCAD, AUDJPY, CADJPY, NZDJPY, GBPCAD, GBPNZD, GBPAUD, AUDNZD, CADCHF, NZDCAD, AUDCHF, EURNZD, ZARJPY, NZDCF, TRYJPY.

Commodities: There isn’t a full breakdown of these assets but we do know that Gold, Silver, Crude Oil and futures are available to trade.

Indices: Again we do not have a full breakdown of available assets, the ones mentioned include Dow Jones, S&P 500 and Nasdaq.

Spreads

All accounts seem to have the same starting spreads which on average are 0.4 pips. For EURUSD, the average is 0.3 pips, while for USDJPY and GBPUSD the average is 0.5 pips. These spreads are acceptable for the account with a lower commission. However, with the Micro account, they are a little high for the $6 being paid. The spreads are variable which means they move with the markets. When there is added volatility they will be higher and when there is a lot of liquidity they can be lower.

Minimum Deposit

The minimum deposit to open up an account is $50 which gives you access to the Micro account. If you want a higher tier account then you will need to deposit at least $500.

Deposit Methods & Costs

There isn’t a definitive list or information on withdrawal requests. The funding information page simply shows some images of American Express, Bitcoin, MasterCard, PaySafeCard, PayPal and Visa. These methods are also mentioned on the account page as well as the addition of Bank Wire Transfer for the higher-tier accounts. We do not know if there are any added deposit fees, but you should check with your own bank or processor to see if they will add any transfer fees of their own.

Withdrawal Methods & Costs

The same methods are presumably available to use for withdrawals. For clarification, these are American Express, Bitcoin, MasterCard, PaySafeCard, PayPal, Visa, and Bank Wire Transfer. The following statement was provided in relation to fees: “Please note that a withdrawal of funds will incur a fee, depending on 3rd party cost, local or international transactions as well as the transaction currency.”

Withdrawal Processing & Wait Time

Withdrawal requests will be processed on the same day of receipt. If it is not or if it is requested after 12:00 pm ET, then it will be processed the next working day. Once it has been processed the request will take a further 1 to 5 working days to fully process by your own bank or processor. The actual time will depend on their processing times.

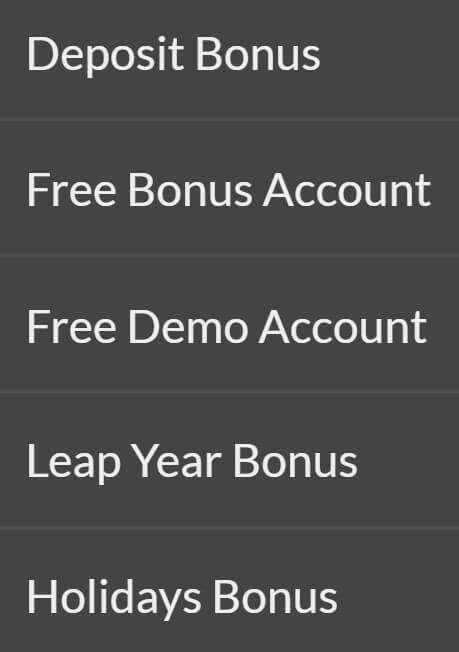

Bonuses & Promotions

There are a few different bonuses currently running, we have outlined two of them so you can get an idea of the sort of things that are on offer. Please visit the Forex Player website for information regarding additional promotions and bonuses.

There are a few different bonuses currently running, we have outlined two of them so you can get an idea of the sort of things that are on offer. Please visit the Forex Player website for information regarding additional promotions and bonuses.

Deposit Bonus Account: You can receive up to 300% up to $3,000 on your deposit. The bonus amount can be treaded for 2 months, after this time, in order to keep the account you must deposit the amount of equity that is in the account. This makes it a bonus to avoid as you may be forced to deposit in order to keep any profits.

Free Bonus Account: You can get a $100 no deposit bonus when opening the account, you need to trade 50 lots in order to withdraw any profit, you will also get a 100% deposit bonus on your first deposit up to $100, you must trade 50 lots per $100, this is a difficult target to reach.

Educational & Trading Tools

There are a few different tools available, with the first being an economic calendar detailing different news events that are coming up and what effect they may have on the markets. The Forex Player also offers a number of different calculators including profit, margin, pips, and a currency converter. There is also a section for live TV broadcasting different financial news channels.

Customer Service

The customer service team can be contacted using an online submission form. Fill it in and you will then get a reply via email. There is also a postal address available should you prefer to contact them that way.

Address: Trust Company Complex, Ajeltake Road, Majuro, Ajeltake Island, MH96960, Marshall Islands

Demo Account

Demo accounts offer a way to test out new strategies without any real risk, and they are available from FX Player. Demo accounts aim to replicate the live trading conditions with a demo capital of $10,000. We do not know if there are any expiration times on these accounts.

Countries Accepted

This information is not given on the site so if you are thinking of signing up with Forex Player, so we would recommend contacting the customer service team to see if you are eligible for an account based on your location.

Conclusion

There are plenty of different accounts to choose from. However, the only real differences are the commission charges and slight increases in leverage. In terms of trading costs, the lower accounts can be a little above average, while the higher tier accounts become cheaper than the average we see around the industry. There appears to not be a huge selection of tradable assets, although only limited information is provided. There also isn’t enough information on deposits and withdrawals. While FX Player may be a decent broker to use, with too much information missing it would be hard for us to recommend them as an FX broker to use at this point in time.