DV Markets is a Forex broker and also trades CFDs in indexes and commodities. This broker is based in Australia. We consider that one of the most significant advantages of this broker is that it is authorized by one of the most popular and trusted financial regulators, the Australian Securities and Investment Commission (ASIC). DV Markets is a trademark, owned and licensed by Forex Financial Services Pty Ltd., and also operates Forex. Let us see in this review what DV Markets can bring us.

Account Types

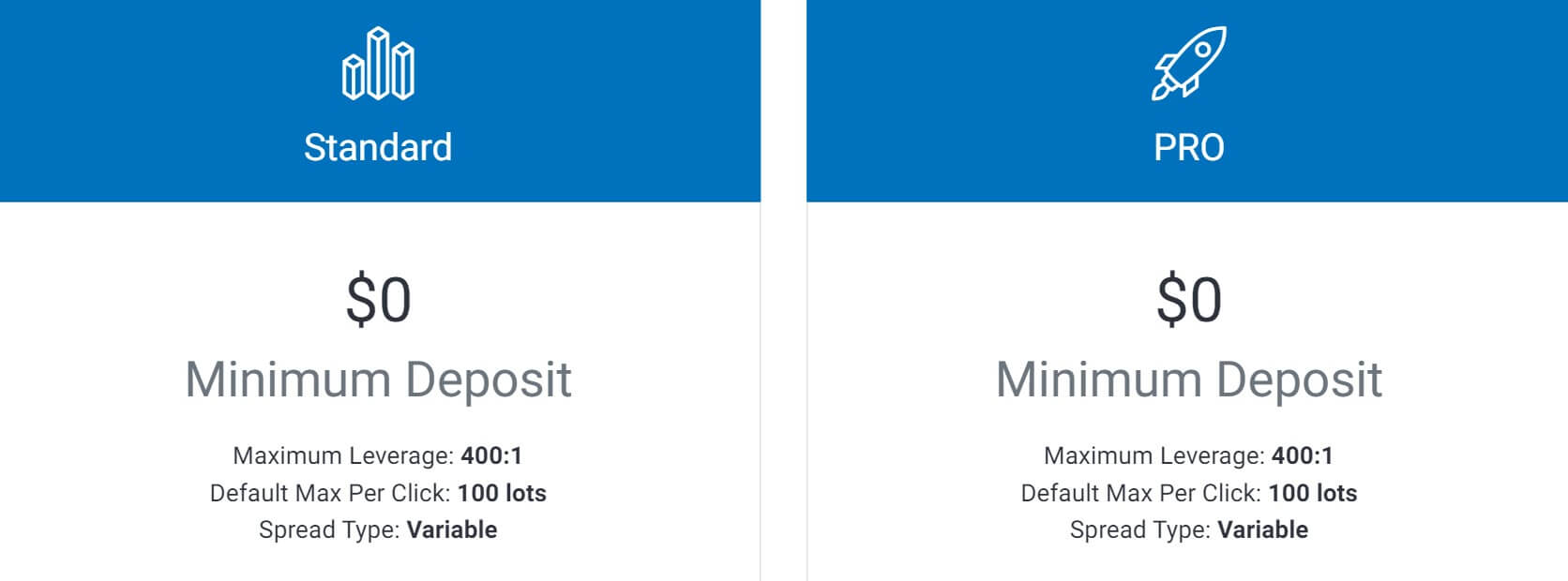

DV Markets offers its customers two different commercial accounts. They are called the STANDARD account and PRO account. The following are the essential features of each account:

Standard Account

- Minimum Deposit: 0 USD

- Maximum Leverage: 1:400

- Spread Type: Variable

- Default Max Per Click: 100 lots.

- Instruments: Forex, Indices, and Commodities.

- Platforms: Metatrader4, Web, Mobile

- Account Currencies: AUD, USD, GBP, and EUR.

- Minimum Trade Size: 0.01 (micro lot).

- Commission: No

- Margin Call 100% – Stop Out Level, 50%

PRO Account

- Minimum Deposit: 0 USD

- Maximum Leverage: 1:400

- Spread Type: Variable

- Default Max Per Click: 100 lots

- Instruments: Forex, Indices, and Commodities

- Platforms: Metatrader4, Web, Mobile

- Account Currencies: AUD, USD, GBP, and EUR

- Minimum Trade Size: 0.01 (micro lot)

- Commission: Yes

- Margin Call 100% – Stop Out Level, 50%

We note that both accounts are very similar. They have almost the same characteristics. The main difference is that the Standard Account does not have commissions, and the PRO Account does. With the PRO Account, the broker will charge us 7 USD for each lot traded; instead, the spreads will be lower than those applied in the Standard Account.

Platforms

The platform that DV Markets has chosen for its customers is the popular Metatrader4 (MT4). This choice does not surprise us, as MT4 is the most widely used online trading platform in the world. MT4 has an excellent advanced graphics package, and also a massive variety of custom technical indicators. It also has automated trading strategies (expert advisors ), which is probably the most prominent option of this trading platform.

Also, their programming language is quite easy to learn, and those people who are skilled with computer programming can easily create their own Eas and technical analysis indicators.

Leverage

Customers can apply for leverage of up to 1:500 on Forex. Trading account leverage can be managed in the customer area of the broker’s website. We consider that the leverage of 1:500 is too high to be used by novice traders. Any sudden movement in the markets can cause a significant profit in money, but also a great loss. We, therefore, advise caution in leverage and use it depending on the risk we consider taking.

Customers can apply for leverage of up to 1:500 on Forex. Trading account leverage can be managed in the customer area of the broker’s website. We consider that the leverage of 1:500 is too high to be used by novice traders. Any sudden movement in the markets can cause a significant profit in money, but also a great loss. We, therefore, advise caution in leverage and use it depending on the risk we consider taking.

Inexperienced traders can lose all their account money in a concise time using very high leverage rates. That is why some jurisdictions have limited the leverage that brokers can provide to their clients at significantly lower levels. For example 1.30 in Forex with regulated brokers in Europe.

Trade Sizes

DV Markets use micro lots to trade with their assets. This is 1000 units of the base currency. The minimum batch size on the platform can be seen as 0.01.

Trading Costs

We detect two trading costs apart from the spread. One of them is the commission that applies to the PRO accounts of 7 USD for each lot operated. The Standard account has no commissions but higher spreads.

On the other hand, there is the cost of Swap. Swaps are any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

Assets

These are the different assets available to trade with DV Markets, including:

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CADSGD, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, SGDJPY, USDCAD, USDCHF, USDHKD, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, and USDTRY

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CADSGD, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, SGDJPY, USDCAD, USDCHF, USDHKD, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD, and USDTRY

Commodities: BRENT, WTI, XAGUSD, and XAUUSD

Indexes: AUS 200, CAC 40, CN, CNA 50, DAX 30, DOWJ 30, EUSTX 50, FTSE 100, HK 50, ITA 40, JP 225, NAS 100, SG 30, and SPX 500

The offer of CFDs in DV Markets is not very wide, in our opinion, lack of very popular commodities like copper, cotton, coffee, platinum, natural gas, and sugar among others.

Nor does it offer trading in cryptocurrencies, assets that have become very popular to trade within the trading community.

Spreads

The spreads offered by DV Markets for all your accounts are variable spreads. When we were able to test the MT4 platform of DV Markets in demo mode, we checked the spreads for EUR/USD, oscillating around 1.2 pips, which is a reasonable price. Most significant brokers offer spreads very similar to this, within the range of 0.6 to 1.5 pips.

Minimum Deposit

DV Markets does not require a minimum deposit for their trading accounts. You can start trading with this broker with little money. We recommend a minimum amount of 200 USD and low leverage to start trading and gain trading experience without taking too many risks.

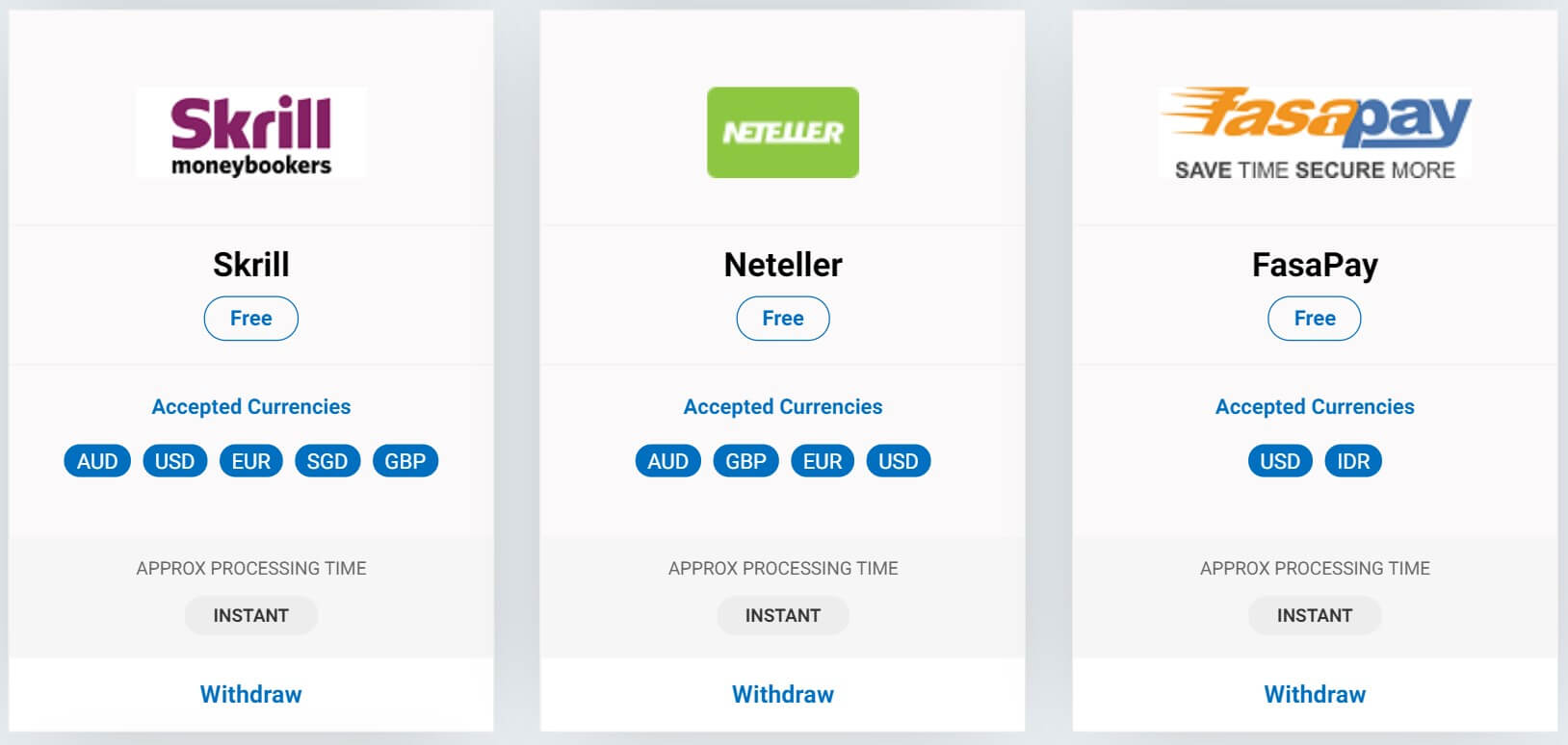

Deposit Methods & Costs

DV Markets have different methods for depositing into your trading account. All are processed through the customer area of the broker’s website. The different methods to make your deposit are Bank transfer, Credit or debit card (Visa or Mastercard), and electronic methods, Skrill, Neteller, China Union Pay, Poli, Fasapay, Alipay, and Dragonpay.

The costs associated with the deposits are different according to the method chosen are as follows:

- Bank transfer, no charge.

- Credit or debit card (Visa or Mastercard), 2% of the amount deposited.

- Skrill, 2% of the deposit.

- Neteller, 2% of the deposit.

- China Union Pay,

- Poli, at no cost.

- Fasapay, at no cost.

- Alipay, 2% of the deposit.

- Dragonpay, 2% of the deposit.

Withdrawal Methods & Costs

The different methods to perform your retreat are Bank transfer, Credit or debit card (Visa or Mastercard), and electronic methods, Skrill, Neteller, China Union Pay, Fasapay, and Dragonpay. The costs associated with withdrawals are different according to the method chosen are as follows:

- Bank transfer, no charge.

- Credit or debit card (Visa or Mastercard), free of charge.

- Skrill, at no cost.

- Neteller, at no cost.

- China Union Pay, no charge.

- Fasapay, at no cost.

- Dragonpay, at no cost.

Always remember that withdrawals should be made by the same method with which the previous deposit was made. For example, it is not possible to deposit by bank transfer and subsequently request a withdrawal from Neteller. Withdrawals may not be made in the name of third parties. All this is due to international anti-money laundering laws, and all brokers must act in the same way.

Withdrawal Processing & Wait Time

The DV Markets website reports that all withdrawals are processed instantly. Therefore, all withdrawals requested by Credit or debit card (Visa or Mastercard), Skrill, Neteller, China Union Pay, Fasapay, and Dragonpay, will be received in your bank account instantly. Only withdrawals requested by bank transfer will be delayed between 2 and 5 business days.

Bonuses & Promotions

DV Markets has no bonuses or promotions at present. The broker has an Introducing Broker program. What is it? This program is made to reward individuals or companies who refer new clients, and they open trading accounts with DV Markets. Every time one of the clients you have referred to performs a transaction, your account will be rewarded in real-time. There is no limit to the number of clients or transactions that may be paid.

Education & Trading Tools

DV Markets has an area of resources of interest to traders. What this broker offers us on its website is:

An economic news box, which we’ve seen updates.

An economic news box, which we’ve seen updates.

An economic calendar with the most important events of the day, and that every trader should consult daily to know what events may affect their trades.

A platform with various tutorials. Some of them are: How to open a market order, how to open a pending order, how to modify an order, what is trailing stop and so on, up to a total of 20 tutorials.

There is also a toolbox, where you can find, for example, Forex calculators.

Customer Service

To contact DV Market’s customer service team, we have two main channels, telephone, and email. This broker does not have a live chat on his website, nor does he have a contact form. They have offices in Australia and St Vincent and the Grenadines.

The contact details are:

Australia:

Address: International Tower 1, Barangaroo Avenue Sydney NSW 2000, Australia.

Phone Number: +612 8330 0850

Email Address: [email protected]

Office Hour: 08:00AM – 08:00PM

St. Vincent & Gradines:

Address: Suite 305, Griffith Corporate Centre, Kingstown, St Vincent and the Grenadines.

Phone Number: +612 8330 0850

Email Address: [email protected]

Office Hour: 08:00AM – 08:00PM

Demo Account

A Demo account can benefit the trader in 2 ways:

– Practicing commercial techniques

– Learning the different tools of the platform

It is very common for traders to open a Demo account before depositing money into a real account. It is also important to know that the Demo account retains the same live prices and market conditions, simulating the exposure in a real account. DV Markets offers a demo account without time restrictions, as long as you log in once every 30 days. The broker will automatically delete demo accounts that have not been used for more than one month.

Countries Accepted

DV Markets does not report on any part of its website about citizens or jurisdictions that cannot trade their accounts. In case of doubt, it is best to contact customer service to find out whether or not you can open an account with this broker. US citizens usually have restrictions on opening trading accounts outside their country.

Conclusion

DV Markets is an Australian foreign exchange broker with an exciting offer. It provides competitive spreads and very high leverage levels. This broker uses the MT4 platform, which is the industry-leading and also the most popular trading platform for Forex and CFDs. However, in our opinion, one of the aspects that we liked the most is that DV Markets has an ASIC (Australian Securities and Investments Commission) license.

ASIC requires companies that provide licensed financial services to meet specific capital requirements (at least US$1 million) to demonstrate their financial solvency. They also have to comply with several internal processes for risk management, accounting, and auditing. Also, Australian regulated Forex brokers have to keep clients money in segregated accounts and send regular reports to ASIC of their transactions. Moreover, the regulation of Australian foreign exchange brokers does not have a clearing procedure in case a licensed broker becomes insolvent.

To summarize our review on DV Markets, we will list the advantages and disadvantages that in our opinion this broker has:

Advantages: Reliable regulation (ASIC). It has an excellent educational area and tools for the trader. It offers its customers the most popular trading platform (MT4). Spreads consulted in the Demo account are competitive. No minimum deposit required. The leverage level is very high (up to 1:500), although the customer can set lower leverage on his account.

Disadvantages: No CFDs of shares and cryptocurrencies. Spreads not announced on the website; you have to download the platform with the Demo account to know them.