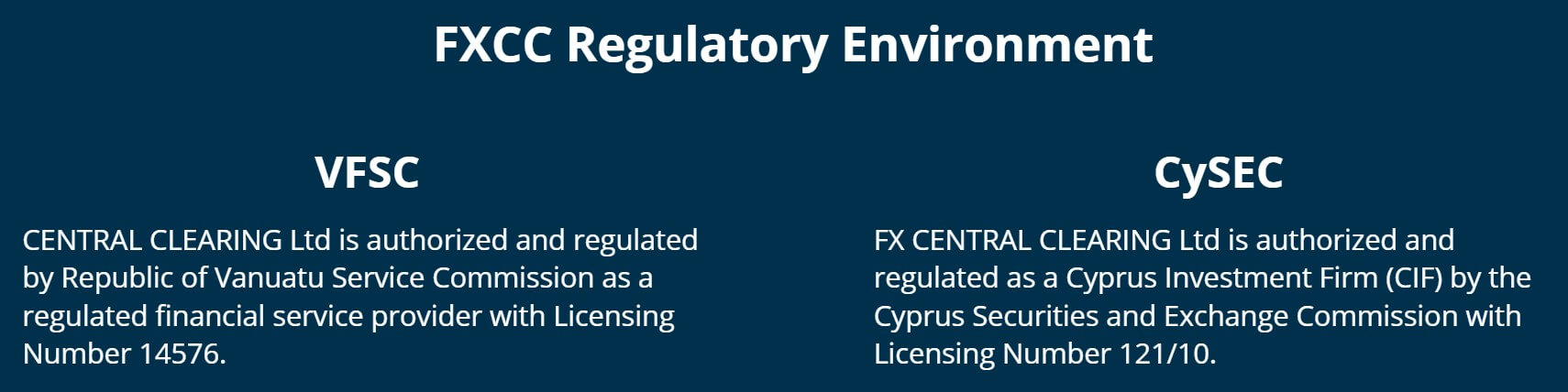

Founded in 2010, FXCC is a mainly Forex No-Dealing-Desk (NDD) broker, which has around 30 currency pairs, two precious metals, and a pair of indices across the most used and popular platform, Metatrader 4. FX Central Clearing Ltd., which is the company operating the trademark FXCC, is a Cyprus investment company (CIF), licensed and regulated by the Cyprus Securities and Exchange Commission (Cysec), under CIF Licence Number 121/10.

The Cypriot financial regulator applies specific rules and requirements to license holders and ensures that they are properly complied with. For example, client funds should be set up in segregated accounts, different from the broker’s operational accounts. Also, the Commission requires foreign exchange brokers to hold at least €1.000.000 of net tangible assets as proof of their sound financial position and solvency.

As an additional guarantee for customer funds, all companies regulated by Cysec are partners in the Investor Compensation Fund. This is a fund created for clients of regulated companies. If the company becomes insolvent or ceases trading, the Fund may assume to pay compensation to the customers concerned, and the maximum amount it would cover would be EUR 20000 per customer.

FXCC is also regulated by the Markets in Financial Instruments Directive (Mifid), like any company regulated by Cysec, in terms of offering cross-border services within the European Union under the Mifid Passport Scheme, allowing regulated companies in their “home state” to provide services to customers in other countries. In addition to being authorized by the European Economic Area, FX Central Clearing Ltd. is also registered in the UK FCA, which is perhaps the most respected regulator.

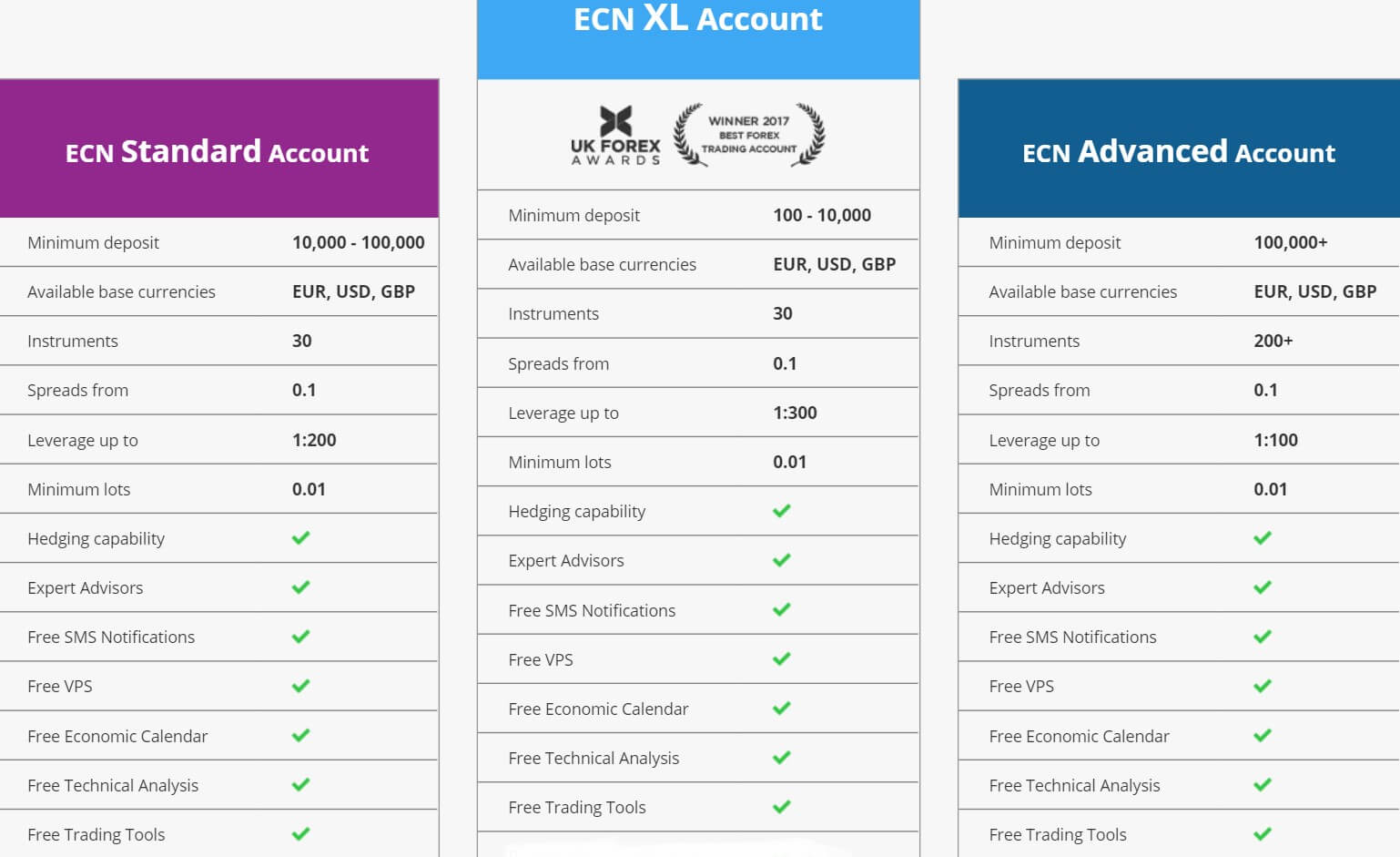

Account Types

FXCC offers 3 different accounts to its clients, below is a summary of each of them with their main characteristics.

ECN Standard Account:

- Minimum deposit 10,000–100,000 euros

- Available base currencies EUR, USD, GBP

- 30 Instruments

- Leverage up to 1:30

- Minimum lots 0.01

ECN XL Account:

- Minimum deposit of 100–10.000 euros

- Available base currencies EUR, USD, GBP

- 30 Instruments

- Leverage up to 1:30

- Minimum lots 0.01

ECN Advanced Account:

- Minimum deposit of 100,000+

- Available base currencies EUR, USD, GBP

- Instruments 200+

- Leverage up to 1:30

- Minimum lots 0.01

The 3 accounts have similar characteristics. The differences are found in the leverage that in the ECN Advance account can reach 1: 100, the commissions, and the spreads, as we will see in detail in the following sections.

Platforms

Like most brokers, FXCC is compatible with the award-winning and popular Metatrader 4 (MT4). This platform is the preferred choice of the most experienced traders, and also of beginners. The platform is equipped with a series of technical indicators, an advanced graphical package, and a wide range of Expert Advisors (EA), as well as several options for backtesting for EAS, which will allow you to evaluate your strategies. The platform is available in desktop and mobile versions for use on smartphones and tablets. FXCC customers are offered a multi-account management solution through MetaTrader 4 MultiTerminal, which is an integrated part of the MT4 package.

Like most brokers, FXCC is compatible with the award-winning and popular Metatrader 4 (MT4). This platform is the preferred choice of the most experienced traders, and also of beginners. The platform is equipped with a series of technical indicators, an advanced graphical package, and a wide range of Expert Advisors (EA), as well as several options for backtesting for EAS, which will allow you to evaluate your strategies. The platform is available in desktop and mobile versions for use on smartphones and tablets. FXCC customers are offered a multi-account management solution through MetaTrader 4 MultiTerminal, which is an integrated part of the MT4 package.

Leverage

FXCC offers its customers different types of leverage, depending on the account they have. All leverages are within the parameters that the ESMA recommends to regulated brokers in Europe, as is the case with this broker. Below is a table with information on the leverages offered:

- ECN Standard: Up to 1:200

- ECN XL: Up to 1:300

- ECN Advanced: Up to 1:100

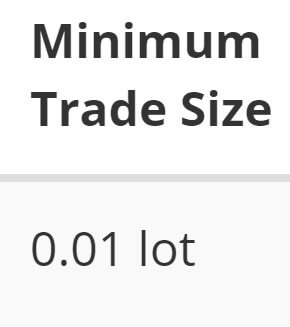

Trade Sizes

Trade Sizes

At FXCC, micro-lots (0.01 lots) are available for trading on all three account types. This is excellent for those who utilize tight money management plans, as well as for those who are risk-averse. Of course, the pricing associated with a micro-lot will vary by the asset, but having the ability to trade with smaller position sizes is still widely considered to be an advantage for FX traders.

Trading Costs

Regardless of the spreads, which will be commented in a later section, FXCC applies commissions for the lot traded. Here is a summary of these costs according to the type of account the customer has:

- ECN XL: Zero Commission

- ECN Standard: 0.75 per side (Metals 7.50 per side)

- ECN Advanced: 0.4 per side (Metals & Energies 4 per side)

Another expense to consider is the Swap fee, an expense that you will have with all the brokers unless you have an Islamic account that lacks them. The Swap is any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

Assets

The financial assets we will be able to trade with FXCC are not very extensive and are limited to 28 currency pairs and 2 metals. Below we detail the complete list of assets:

AUD CAD, AUD CHF, AUD JPY, AUD NZD, AUD USD, CAD CHF, CAD JPY, CHF JPY, EUR AUD, EUR CAD, EUR CHF, EUR GBP, EUR JPY, EUR NZD, EUR USD, GBP AUD, GBP CAD, GBP CHF, GBP JPY, GBP NZD, GBP USD, NZD CAD, NZD CHF, NZD JPY, NZD USD, USD CAD, USD CHF, USD JPY, GOLD, and SILVER.

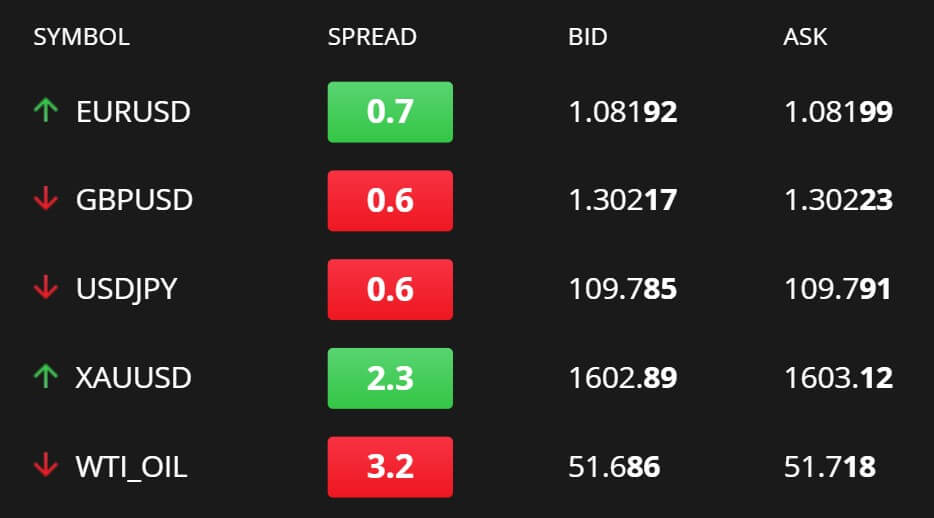

Spreads

Spreads vary depending on the type of account the client has. This broker offers fairly tight variable spreads, with an average of 0.4 pips in the EUR/USD pair. However, commission fees apply to almost all your accounts. Spreads in the Standard account type amount to 1.5 pips back, so the average trading costs would be 1.9 pips in EUR/USD, which is a reasonably high value for the foreign exchange market. We, therefore, recommend the ECN XL account type (with a minimum deposit requirement of USD 100), which is the only account that has no commissions.

Minimum Deposit

The minimum deposit depends on the account chosen by customers and varies as much as the USD 100 required to open an ECN XL account at the USD 100,000 required by the broker for ECN Advanced accounts. We leave a summary with the minimum deposits required in each account:

- ECN XL: $100

- ECN Standard: $10,000

- ECN Advanced: $100,000

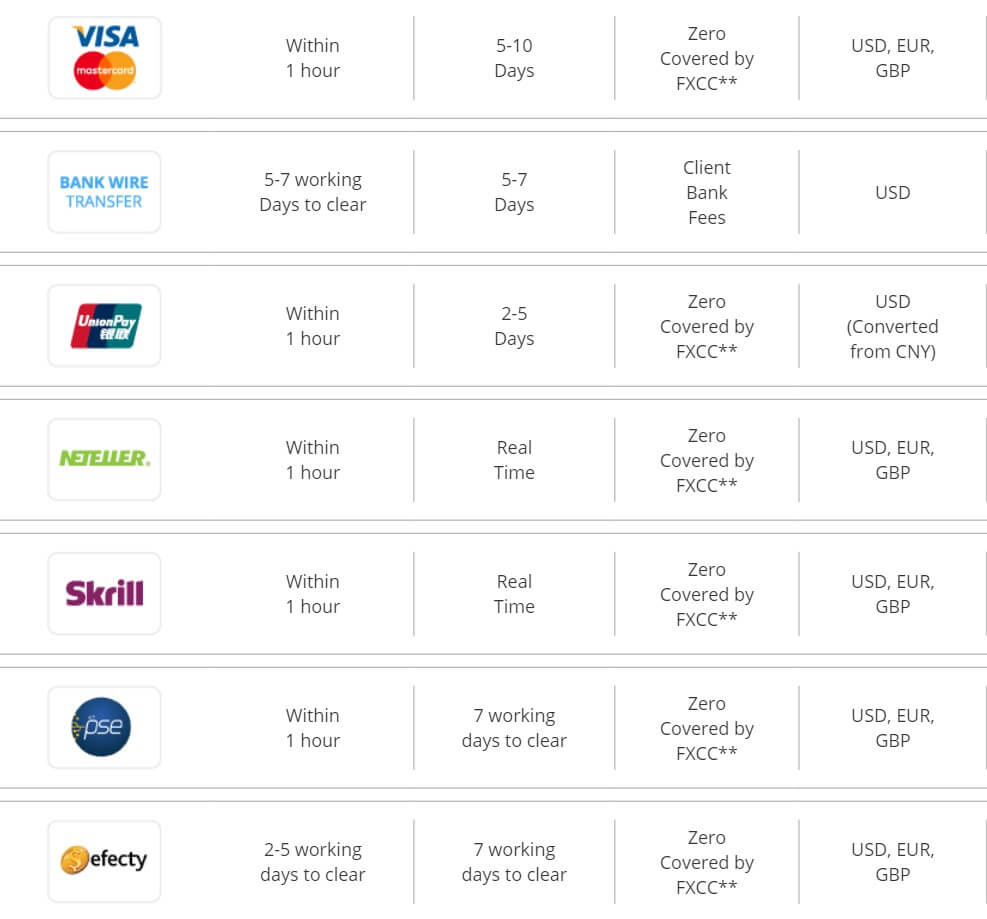

Deposit Methods & Costs

For making deposits, the broker offers us a wide range of methods. The following are the deposit methods, the estimated time of entry into the trading account and its commissions:

The broker applies zero fees to deposits less than or equal to 10,000 USD.

Withdrawal Methods & Costs

Below we detail some of the methods of withdrawal that the broker makes available to its customers. FXCC requires that the minimum withdrawal amount be at least 50 USD.

Withdrawal Processing & Wait Time

The broker will process the withdrawals in less than 24 hours. Below is the timeout for each withdrawal method:

- Visa or Mastercard: 5-10 Days

- Wire Transfer: 5-7 Days

- Neteller: Real-Time

- Skrill: Real-Time

- Neosurf: 5-10 Days

- Sofort: 3-5 Days

- Rapid: 3-5 Days

- Paysafecard: N/A Withdrawal by Bank Wire

Bonuses & Promotions

FXCC has no bonuses or promotions at present. The broker does have an Introducing Broker program. This program is made to reward individuals or companies who refer new clients, and they open trading accounts with DV Markets. Every time one of the clients you have indicated to perform a transaction, your account will be rewarded in real-time. There is no limit to the number of clients or transactions that may be paid.

Educational & Trading Tools

FXCC has an “education center” where the following topics are discussed:

- What is ECN Forex Trading?

- Forex ECN Trading Model vs Fixed Spread Forex Broker Trading

- Basic Characteristics of EUR / USD Trading

- Understanding Forex Rollover (Swaps)

- Forex Slippage vs. Price Improvement

- Concept of Leverage Explained

- Importance of Economic Indicators

It also has a glossary of terms related to Forex and an e-book where it addresses the following topics:

- The Right Trading Strategy to Match your Lifestyle

- Traders Mindset

- Money Management

- Straight Through Processing

- How to Build a Winning Trading Plan

- Technical and Fundamental Analysis

- The use of Stop Orders

- Your Trading Plan

- An introduction to the Basics of Price Action Trading

- Scalping as a Trading Strategy

- Day Trading as a Trading Style

FXCC also has an economic calendar, a tool that we always consider very useful for traders because in it we find the most important events of the day, and that can affect different assets, with which we may be trading. The broker also has a Daily Technical Analysis, where daily technical analyses of different currency pairs are performed. It offers an excellent economic news section, very complete, and a blog where it also provides a market watch. In summary, we were very satisfied with how FXCC cares about having a functional area of educational resources for its customers and several tools of interest for the trader.

Customer Service

To get in touch with FXCC’s customer service, we have several options. We can get in touch, by phone, by email, through a contact form on the web, a live chat available 24 hours and call service. When entering your personal data and your phone, the broker contacts you.

To get in touch with FXCC’s customer service, we have several options. We can get in touch, by phone, by email, through a contact form on the web, a live chat available 24 hours and call service. When entering your personal data and your phone, the broker contacts you.

ADDRESS: Amorosa Centre, 2nd floor, 2 Samou Street, 4043 Yermasoyia, Limassol, Cyprus

TEL: +357 25 870750 , +357 25 025001

FAX: +357 25 030523

Working Hours: Monday – Friday. 24 hours

EMAIL: [email protected]

Demo Account

FXCC provides a Demo account to its customers.

A Demo account can benefit the trader in 2 ways:

– Practicing commercial techniques

– Learning the different tools of the platform

It is widespread for traders to open a Demo account before depositing money into a real account. It is also essential to know that the Demo account retains the same live prices and market conditions, simulating the exposure in a real account. To get the demo account offered by FXCC, just fill out a form with your personal data, and they will respond with the instructions for installation.

Countries Accepted

FXCC says that it does not provide services for United States residents. Likely, some other country will not be available to be an FXCC customer. Contact customer service to find out if your nationality is suitable for opening an account with this broker.

Conclusion

FXCC is a Cypriot ECN / STP broker offering standard trading terms. It has the MT4 platform, which is always good news. Their customer service looks pretty good, and they have plenty of means to contact them. FXCC has a tasty variety of deposit methods, and currently has a promotion, in which deposits and withdrawals made by any means are free as the broker assumes any expense generated.

The variety of assets offered seems scarce to us, but if you are a trader you will only trade with Forex may be sufficient. We have been surprised by the educational area and resources to the trader, a positive point for this broker who has been concerned to create a good service in this regard. Finally comment that you can open an account from only 100 USD, although to access accounts with better commercial conditions, the disbursement to be made seems to us excessive, 10.000 USD, and 100.000 USD for the accounts ECN standard and ECN Advance.

To summarize the above, here are the advantages and disadvantages we find with respect to FXCC:

Advantages:

- Broker properly regulated (CySEC and FCA)

- Multiple forms of contact with customer service

- Good variety of deposit methods

- Excellent educational area and tools for the trader

- Open an account with only 100 USD

- MT4 platform

- Model STP/ECN

- You have a DEMO account

- Good customer service with many ways to contact them

- No commissions for deposits and withdrawals

Disadvantages:

- Spreads somewhat elevated in your basic account

- Leverages somewhat low (according to the indications of the ESMA)

- The variety of assets available is somewhat minimal