Miki Forex is a partner of Al Trade and they are bott Israeli capital brokers dealing with CFDs and Binary Options trading. Binary Options Trading is not allowed in Israel but Miki Forex is providing these services off-shore to the target market in Russia, Latin America, and others. It is established in 1998 where their origin may trace to Israel, but it is not known where the broker is based now, only the proxy company for deposits in Tel-Aviv.

There is no information on the company and also about any regulation. The website is not organized nor well designed, most of the content is unreliable with many inconsistencies. Some statements such as “Options trading it is profitable, affordable, quick and easy!” are red flags even for non-regulated off-shore brokers. This kind of promotion is possible only in a very mild legal environment. Miki Forex used to offer the MetaTrader 4 platform, but at the moment of this review a new platform is offered and the MT4 license is canceled.

The broker does not have enough attention on the brokerage stage and therefore almost no user reviews. This is especially the case if the marketing is done in countries where the English language is not introduced and therefore the internet is limited to the local network. Some information about the trading conditions is present but there are some inconsistencies in practice. One of the highlights of Miki Forex is the Bonus program, Contests, and the new trading platform. This Miki Forex review is made in sections so you have the right insight if this broker provides a service worth of your time and investment.

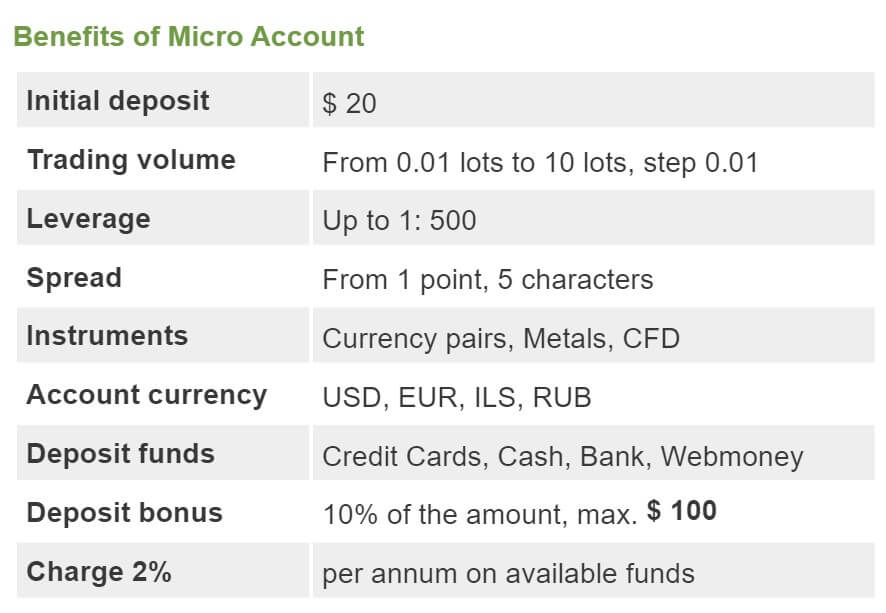

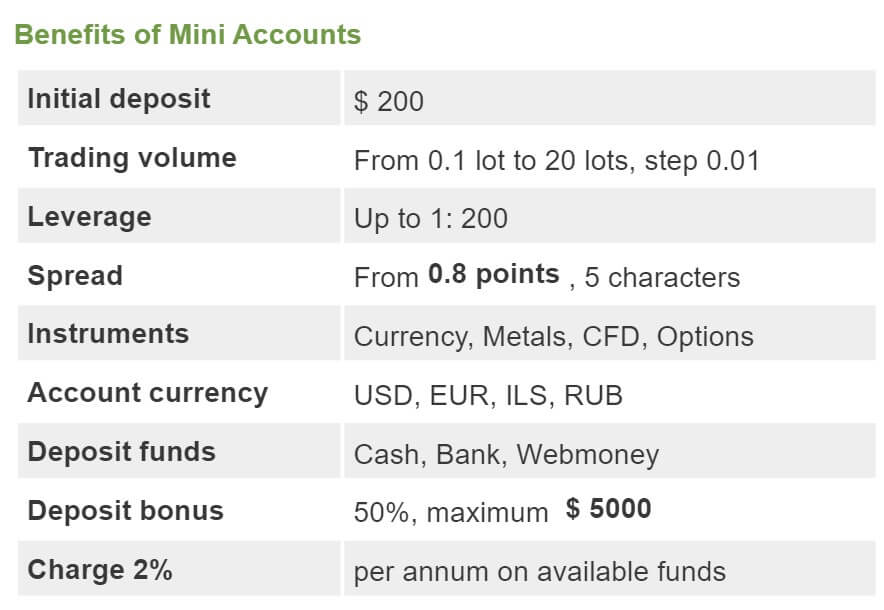

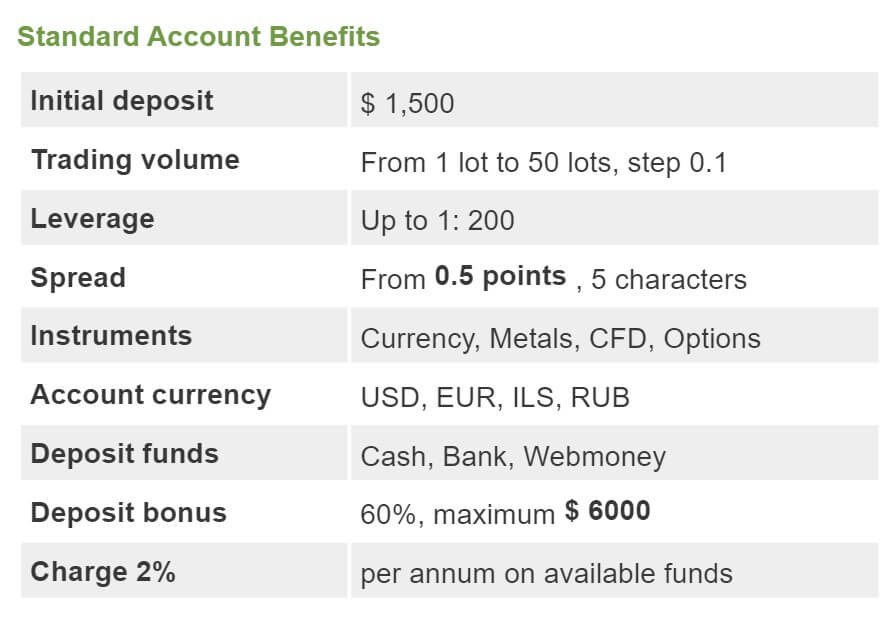

Account Types

Miki Forex offers 3 account types mainly differentiated by the spreads, minimum deposit requirement, and the bonus allowance. They are named Micro, Mini, and Standard. All accounts feature a 2% annual interest on free margin but there is no info on the terms. Deposit currency can be in USD, EUR, ILS, and RUB. What we have noticed is that once you register, you will have the option to have accounts in cryptocurrencies and even more fiat currencies published on the website. These are AUD, CAD, CHF, CNY, NZD, JPY, and even UAH (Ukraine). Cryptocurrency available is BTC, BCH, LTC, ETH, DASH, and Monero. Withdrawal will not be available in all and you will have to transfer funds to USD, EUR, ILS, or RUB.

Micro Account is the one with the lowest minimum deposit requirement which is low enough anyone can afford. The leverage offered is the highest for Micro but it does not feature tighter spreads as other account types. Also, a smaller bonus is allowed. On the other side, trading sizes are in micro-lots, giving you better precision for risk management. There are no restrictions on the trading instrument’s range for this account.

Mini Account has increased the minimum deposit requirement but is still affordable to most traders. Trading size minimums are increased and are not in line with the minimum deposit. Mini-lot size is too large for optimal risk management. The benefits are increased bonus allowance and tighter spreads than the Micro. The leverage is decreased but still high enough for most traders.

Standard Account has the highest minimum deposit requirement, ahs the most favorable spreads and bonus allowance. As expected, the minimum trading volume size is increased to 1 lot, thus a single trade will require a sizeable portion of the minimum deposit, even with the leverage offered. The leverage is not decreased and retains the same level as with the Mini Account.

Platforms

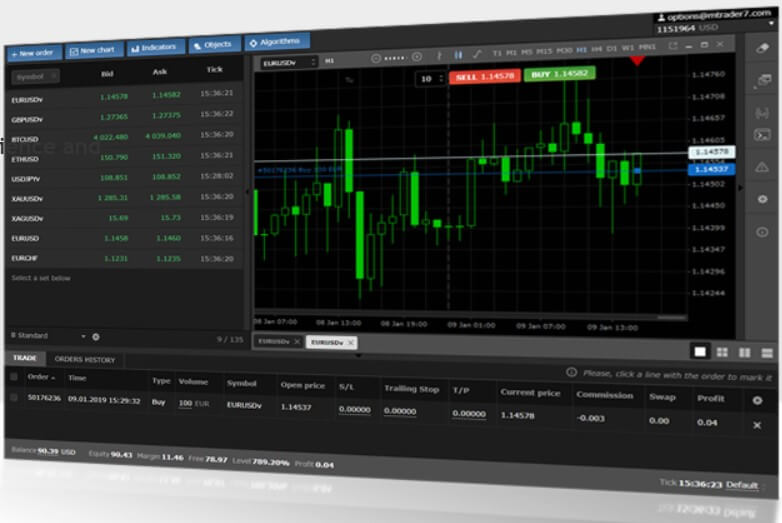

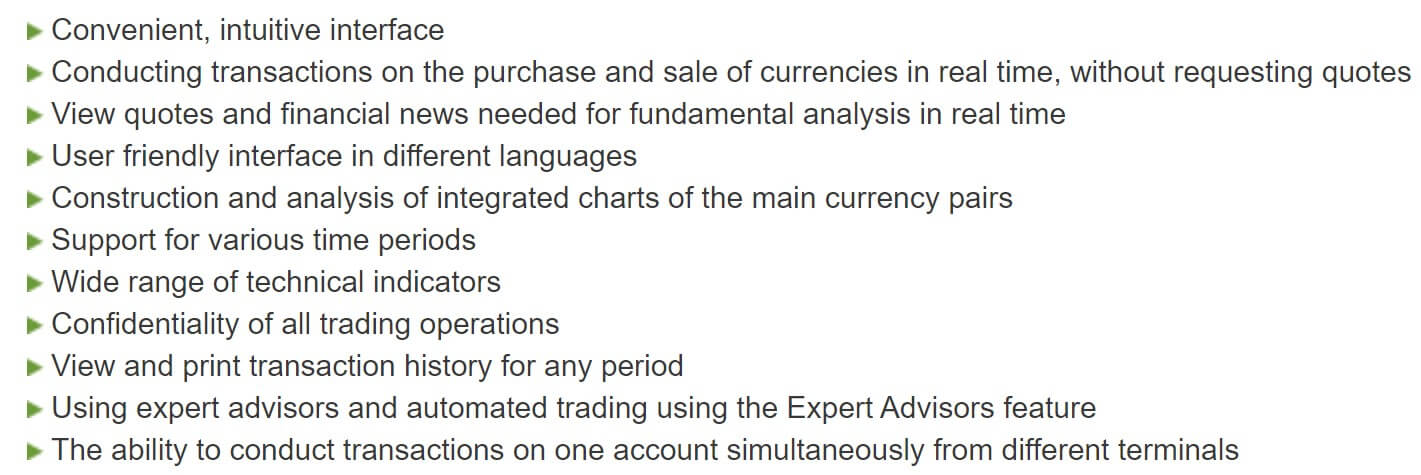

Miki Forex ceased with the MetaTrader 4 platform, even the logo is still on the website and introduced the Mobius Trader 7. This platform is developed by Mobius Soft company based in Russia. Upon further inspection, MetaQuotes terminated the server with the Miki Forex as the broker used Mobius Soft services. After this event, MetaQuotes started a campaign against the Mobius Trader 7 platform. The MT7 platform is all black by default, similar to the MT4 but simplified in certain areas and better in others. It is available for Windows, Mac, Linux, Android, and iOS. A web-accessible option is also offered and actually, you will be logged in to this platform automatically once you register.

We have installed the desktop version and upon opening, we could see 3 sections, chart window on the left with integrated tools and settings, watchlist to the left and the bottom holds the trading info panel. The module windows can be resized and chart windows can also be opened separately and detachedSimilarly, as with the MT4, the first step is opening a chart and it is easily done by clicking an icon next to the instrument’s name.

MT7 features a trading symbol search field but also a certain category asset listing. The Watchlist module does not display more info about the asset (or at least not with Miki Forex) except the Bid and Ask price and the full name of the asset. This is probably where more information could be filled in like in the MT4 specification window but nothing is found. The module windows can be resized and chart windows can also be opened separately and detached. Charts have similar features like in the MT4 but the tools bars are set to the side and on top.

Traders can change the timeframe to the same levels as in the MT4, starting from M1 to Monthly but with the addition of Tick chart presented as T1. Chart types available are Candle, OHLC and as a Line. The left side of the chart has several options to erase objects on the chart, save a workspace, open a console for errors made by indicators or algorithms, open mCode editor for coding new indicators, bug reporting, Chart, and General MT7 settings, and Traders Rating. Traders Rating is a feature to compare traders available for copy trading service but in the case of Miki Forex, this is not available. Ordering has the option to set the size in lots or units, all pending orders, aggregation, and more features MT4 lack.

The trade terminal module is very similar to the MT4 but enhanced with more features. Order History tab contains more information about your past trades such as Bid and Ask price. Active trade has the same columns as the MT4 and no noticeable differences. As for the execution times, it is not presented in the Journal, we have manually measured it to be around 200ms. Indicators selection is similar in range as with the default MT4 installation. There is a market developed for MT7 by the Mobius Soft but there are no additional made from users. Indicator settings will be displayed once inserted and the options are similar as with the MT4.

MT7 has several other modules integrated. These are Client account management panel, Economic Calendar, complete Profile and funds management and a switch to Binary Options trading. These facilitate and round up the usual web login portal management. Overall, the platform does not have great reviews by users on Google Play. Aside from this, the MT7 is not popular, few brokers are actually using it. Whatsmore, these brokers have a very bad reputation among traders.

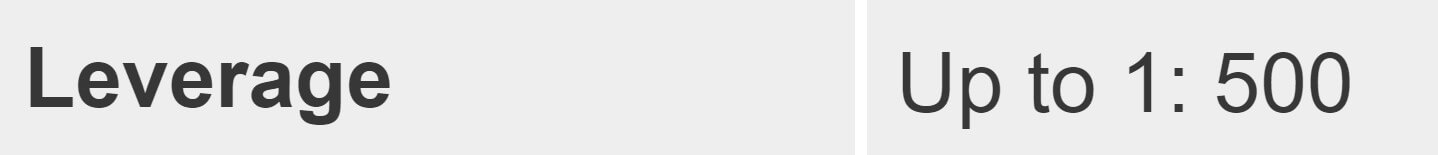

Leverage

The leverage offered for the Micro Account is 1:500 maximum while other accounts are set to 1:200. Still, from the MT7 Accounts tab you can select the leverage up to 1:500. We are not certain if the leverage level published on the website is updated. For Precious metals, the leverage is set to 1:20. Stop Out is set to 20% for all accounts. In the MT7 My accounts you can set the Margin Call level to your preference.

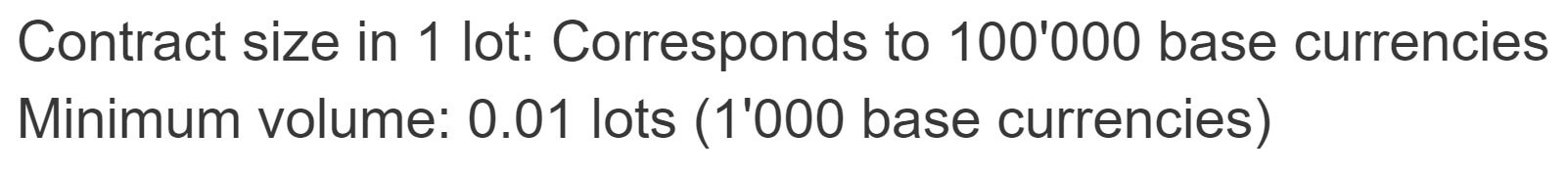

Trade Sizes

For Micro Account the minimum trade size is set to 0.01 lots or in micro-lots. Additional minimal volume steps are also set to 0.01 lots. Note that the Miki Forex’s MT7 platform supports orders in asset units. As there is no information on the contract sizes, pending orders limits, etc, we are not able to find out their values. Mini Account has set the minimum trade size to 0.1 lots but additional minimum volume steps in micro-lots. Standard Account has a very large minimum trade size of 1 lot. We are could not confirm what amount is applied in the MT7 platform. The minimum volume step is 0.1 lots.

Trading Costs

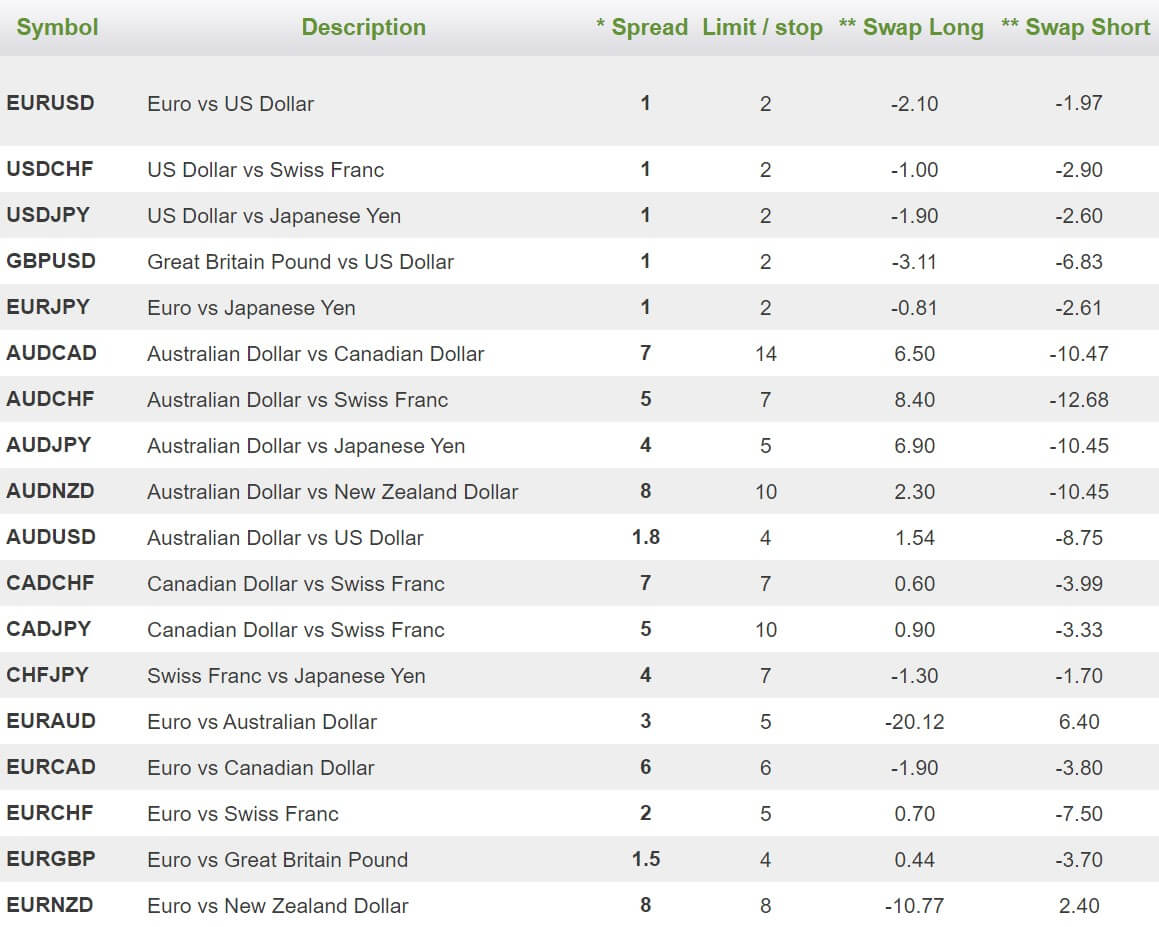

Miki Forex does not state any commissions but to our surprise, they exist. The MT7 platform showed us a $5 commission per round lot traded. Other trading costs are related to negative swaps, which are under normal levels. It is not known how they are calculated but based on the values on the table published we assume it is in points. EUR/USD swap is low, -1.97 for long position and a positive 0.019 for short, USD/JPY has -1.90 points on the long and -2.60 on short, GBP/USD has -1.11 on long and -3.33 on short, USD/CHF -1.00 on long and -2.90 on the short side. GBP/AUD has the highest level with -20.47 on the long and 7.78 positive swap on the short side. There are just two extremes for the exotics, for the EUR/TRY with -40.69 on the long and 10.59 on the short side, and for the GBP/TRY with -50.43 on the long and 18.83 on the short.

Upon further inspection, we have found that GBP/TRY is not offered in the MT7 platform, therefore we can confirm that the swap table is not updated. As for other trading costs such as inactivity and conversion fees, no info is available. In the MT7, funds transfer between accounts has a calculator for the estimation of using unknown rates. Miki Forex may have its rates or conversion fees. The MT7 also features a “no swaps” button, although we are not sure is swaps are disabled by this.

Assets

There are more assets presented on the Miki Forex website than what we noticed in the MT7. We will mention what we see on the platform and actually available for trading. The overall asset range is very limited in each category. Starting with Forex, we have counted 31 currency pairs. Having all the majors, the range does not even feature all the crosses. As for the exotics, they are just indicative and not open for trading. These are USD/TRY, EUR/ILS, USD/ILS, and USD/RUB. Precious metals range is limited to the standard spot Silver and Gold, without any other currency quotes except the USD. Indexes are also limited. There are a total of 4, their symbols are USA 30, USA 100, USA 500 and GER 30. Commodities are just the two Oil Types, UK OIL and US OIL.

Spreads

The spreads are lower than what is published on the website. They are a floating type for all assets. What we see in the MT7 platform is very competitive. We are not sure there are differences between accounts and if the actual webpage presentation is relevant. EUR/USD spread is just 4 points, USD/JPY has also 5 points, GBP/USD 9 points, USD/NAD 10 points, AUD/USD 11 points and USD/CAD 13 points. XAU/USD spread is 25 pips. These spreads are competitive compared to the industry average.

The spreads are lower than what is published on the website. They are a floating type for all assets. What we see in the MT7 platform is very competitive. We are not sure there are differences between accounts and if the actual webpage presentation is relevant. EUR/USD spread is just 4 points, USD/JPY has also 5 points, GBP/USD 9 points, USD/NAD 10 points, AUD/USD 11 points and USD/CAD 13 points. XAU/USD spread is 25 pips. These spreads are competitive compared to the industry average.

Minimum Deposit

The minimum deposit requirement for the Micro Account is $20. Mini Account requires $200 and the Standard account minimum deposit is set to $1500. What we have encountered when depositing is the minimum amount of $0.01 by the WebMoney method so we are not sure if the requirements are valid.

Deposit Methods & Costs

Deposit methods presented on the website are not in line with what we have in the MT7 platform or Profile management. On the Miki Forex’s website, the methods presented are Wire Transfer, Skrill, WebMoney, in cash, Yandex.Money, and OKPAY. For us, there was only a Bank Transfer option and WebMoney. WebMoney deposit has a commission of 0.8% while Bank Transfer is free.

Withdrawal Methods & Costs

Withdrawals are possible only vie WebMoney at the moment. The commission is 0.8% and the minimum amount is $1.00.

Withdrawal Processing & Wait Time

This information is not disclosed anywhere on the Miki Forex’s website or legal documents.

Bonuses & Promotions

Miki Forex has a bonus and a trading contest program. The bonus presented on the website seems outdated and what is actually offered in the MT7 platform is the 500% bonus. This is a deposit bonus that requires a certain number of trading volumes to be released, but it is doe after every trade. The amount depends on the number of lots and the type of currency pair. No more info is available.

The trading Contest page is just promoting the existence of them. The information is mainly promotional but nothing specific is written. To participate in the contest, a trader needs to register for a live account and then “demonstrate talent” and wait to be picked by the Miki Forex. Future and Past contests links are in the menu but do now show any other page.

Educational & Trading Tools

Economic Calendar is out of order on the website. The one integrated into the MT7 platform is in a form of on chart vertical lines that signal the time of the event and its name. Also, there are values for the past event. This indicator-type Economic Calendar can be enabled by the context menu. There are no other options or filters. A Forex glossary page available on the website contains very limited but well-explained terms from the Forex world.

A beginner’s section contains 7 pages with elementary subjects about trading and the Forex markets. For example, the topics are “What is Forex”, “How to Start”, “What is CFD”, and so on. Additionally, there is a form where beginners can sign up for an education program that is personal and can also sign up for a free webinar. The individual program covers: Stock terms and concepts, Forex market, Chart types, Moving averages, The direction of the market, The latest technical indicators, Trading signals, Point of entry, Profit technique, MetaTrader 4, and real-time mode on the Forex market.

A beginner’s section contains 7 pages with elementary subjects about trading and the Forex markets. For example, the topics are “What is Forex”, “How to Start”, “What is CFD”, and so on. Additionally, there is a form where beginners can sign up for an education program that is personal and can also sign up for a free webinar. The individual program covers: Stock terms and concepts, Forex market, Chart types, Moving averages, The direction of the market, The latest technical indicators, Trading signals, Point of entry, Profit technique, MetaTrader 4, and real-time mode on the Forex market.

The analytics page does not contain anything related to the actual analysis of the market but just some additional educational content about the analysis types, Elliot Wave and Interest Rates, that are not updated since 2014.

Customer Service

Customer Service

Miki Forex can be contacted by email, within the MT7 platform, and by chat service. The chat service was not available during our testing.

Demo Account

Demo Account is available and easy to open form the MT7 platform. You will receive $5000 virtual funds and no restrictions. You can also set your leverage level and Margin Call.

Countries Accepted

The only information confirmed is that clients from the United States are not accepted.

Conclusion

This section of the Miki Forex review will disclose additional information not mentioned above. It is noticeable in the Wire Transfer details that the beneficiary company is called Net Plus Web Ltd based in Tel Aviv. The broker is not developed and poses a serious risk for investment for many reasons. The most serious one is the complete lack of valid information, commission obscurity, questionable business ethics and low quality of service. As for the MT7 platform, there are some bad reviews about a few brokers that actually use it. In the current condition, Miki Trade does not have anything to offer, despite the bonus and competitive spreads.