STForex is a forex broker with an impeccable reputation, distinguished by a technological and innovative approach to working with Forex. That is what STForex is saying about themselves anyway. The broker was founded in 2014 and caters to more than 400,000 clients. We will be looking into the services that the Saint Vincent and the Grenadines based broker offers to see if they live up to their own expectations and so that you can decide if they are the right broker for our trading needs.

Account Types

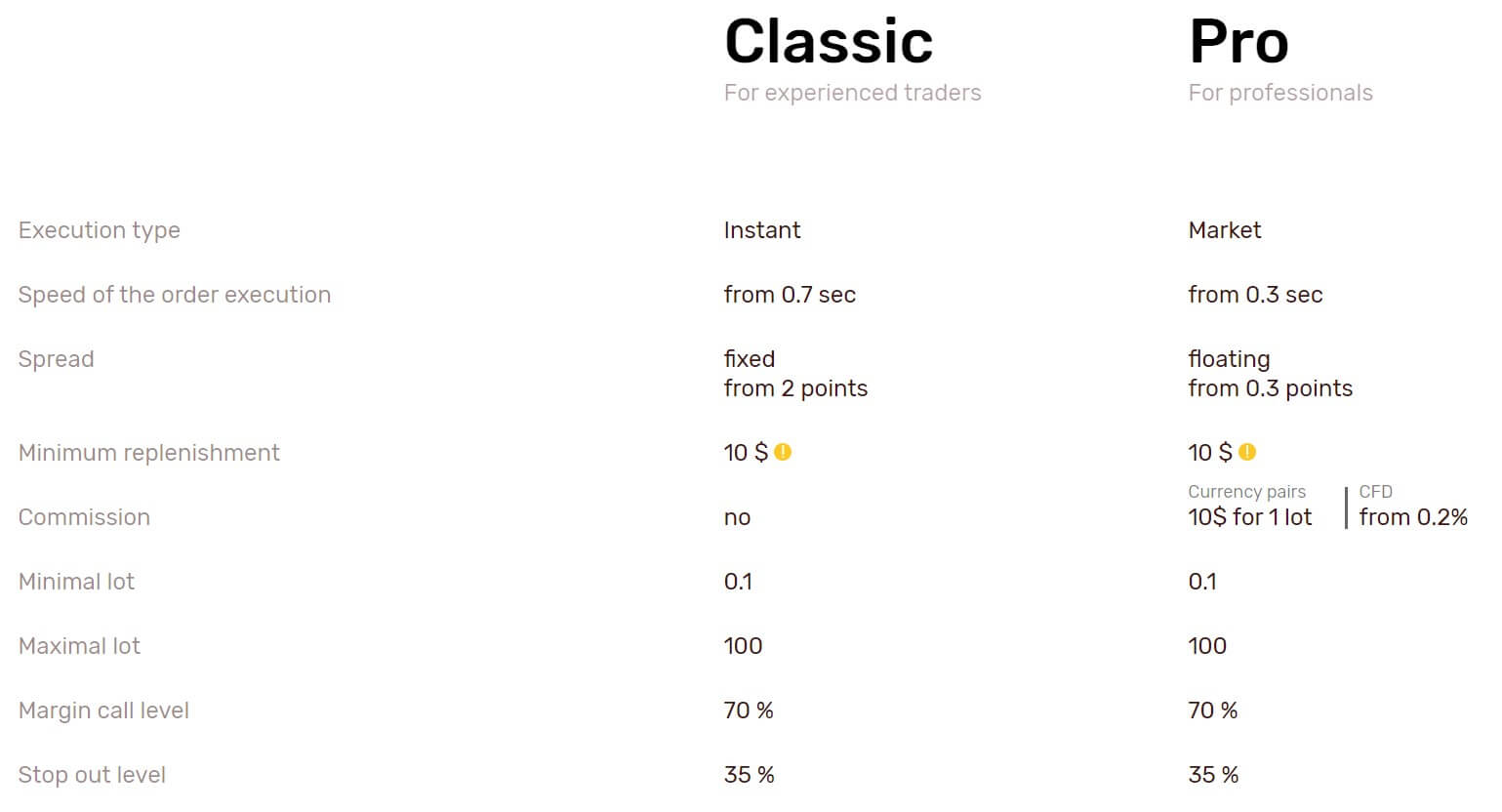

There are three different accounts available from ST Forex, the Classic account, the Pro account, and the Cent account. They both have different requirements and trading conditions so lets briefly look at what they are.

Classic Account: The Classic account has a minimum initial deposit of $200 and a minimum top-up deposit amount of $10. It uses an instant execution-style with fixed spreads starting from 2 pips. There are no added commissions on the account, trade sizes start from 0.1 lots and go up to 100 lots. The margin call level is set at 70% while the stop out level is set at 35%. Trades go up in increments of 0.01 lots and the account can be leveraged from between 1:10 all the way up to 1:1000. This account comes with the help of a personal manager.

Pro Account: The Pro account has a minimum initial deposit of $200 and a minimum top-up deposit amount of $10. It uses a market execution-style with floating (variable) spreads starting from 0.3 pips. There is ana added commission of $10 per lot for forex or from 0.2% on CFDs on the account, trade sizes start from 0.1 lots and go up to 100 lots. The margin call level is set at 70% while the stop out level is set at 35%. Trades go up in increments of 0.01 lots and the account can be leveraged from between 1:10 all the way up to 1:200. This account comes with the help of a personal manager.

Cent Account: The Classic account has a minimum initial deposit of $200 and a minimum top-up deposit amount of $10. It uses an instant execution-style with fixed spreads starting from 2 pips. There are no added commissions on the account, trade sizes start from 0.1 lots and go up to 100 lots. The margin call level is set at 20% while the stop out level is set at 10%. Trades go up in increments of 0.01 lots and the account can be leveraged from between 1:10 all the way up to 1:1000. There is no personal manager with this account.

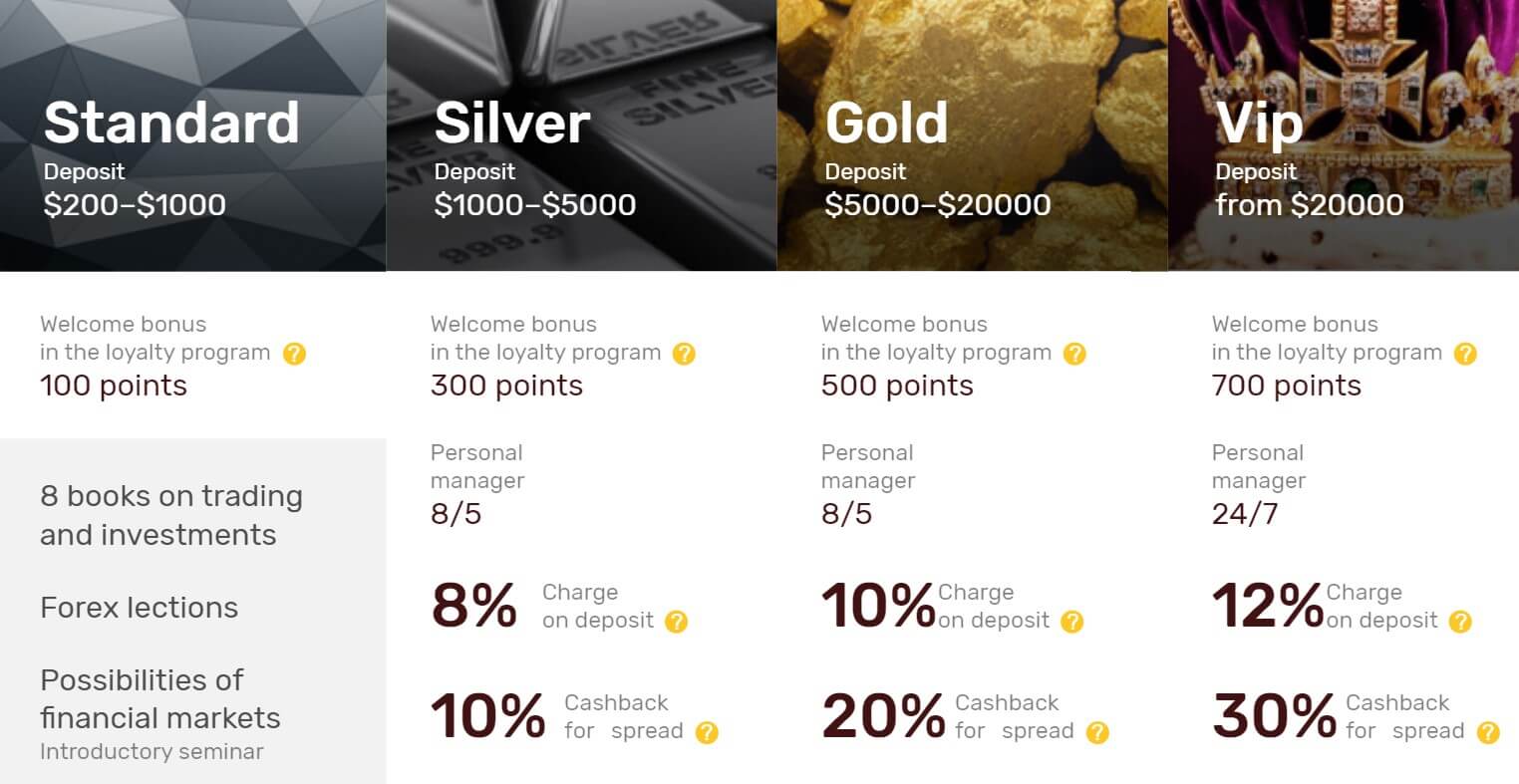

There is also a thing called a Service Package which gives you different benefits based on the size of the deposit you make, we will briefly outline these too.

Standard Package: Deposit between $200 to $1,000 in order to get this package. It orders you 100 loyalty points, access to 8 books on trading, and some seminars, it also gives you a course on currency trading.

Silver Package: Deposit between $1,000 to $5,000 in order to get this package. It orders you 300 loyalty points, access to a personal manager 8/5, 8% extra on deposits and 10% cashback from spreads. You get all the courses from Standard as well as courses on cryptocurrencies, shares, commodities, and stocks.

Gold Package: Deposit between $5,000 to $20,000 in order to get this package. It orders you 500 loyalty points, access to a personal manager 8/5, 10% extra on deposits and 20% cashback from spreads. You get all the courses from Standard and Silver Packages as well as courses advanced crypto and advanced shares, commodities, and stocks.

VIP Package: Deposit over $20,000 in order to get this package. It orders you 700 loyalty points, access to a personal manager 24/7, 12% extra on deposits and 30% cashback from spreads. You get all the courses from Standard, Silver, and Gold Packages as well the ability to get a $5,000 advance on deposits, money back on payment commissions and an advanced course for developing your trading skills.

Platforms

ST Forex uses MetaTrader 4 as its sole trading platform, which isn’t all bad as it is one of the world’s most popular trading platforms and for good reason too. Some of its features include flexible trading systems, trading signals, and transaction copying, analytics though indicators, Mobile and web trading, the ability to buy thousands of expert advisors or indicators and automated trading. You can also get notifications and alerts based on the news and events going on in the world.

Leverage

The maximum leverage available is based on the account you use. However, within each account, there may be some restrictions. These are based upon the account balance, with the leverage level rising and falling along with the amount of funds within the account. In general, leverage starts at 1:50 and climbs as high as 1:1000. Leverage can be selected when opening up an account but must be in line with the above criteria. You can change the leverages on an already open account by contacting the customer service team.

Trade Sizes

All accounts follow the same trade sizes, however, the Classic and Pro accounts have contract sizes of 100,000 units while the Cent account has a lower contract size at 1,000 units. Trade sizes start from 0.1 lots which are known as mini lots, they then go up in increments of 0.01 lots so the next trade would be 0.11 lots and then 0.12 lot. The maximum trade size on all accounts is 100 lots but we would suggest not trading over 50 lots in a single trade. We do not know how many open trades you can have at any one time.

Trading Costs

There is an added commission of $10 per lot traded on forex or starting from 0.2% on CFDs on the Pro account. The Classic and Cent accounts do not have any added fees and instead, use a spread based system. There are also swap charges which are fees charged when holding trades overnight, they can be viewed within the MetaTrader 4 trading platform.

Assets

The assets have been broken down into various categories, the Pro account has a lot more assets available that the other account which only has the Forex (not all pairs) and metals available to trade.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURRUB, EURSEK, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDACD, USDCHF, USDCNH, USDCZK, USDHUF, USDILS, USDJPY, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK, USDSGD, USDTRY, USDZAR.

Metals: XAGUSD (Silver) and XAUUSD (Gold).

Indices: DE 30, Wall Street 30, CAC 40, UK 100 (FTSE), Nasdaq, S&P 500, Euro Stoxx 50.

Commodities: Brent Crude Oil, Natural Gas, WTI Light Crude Oil, Palladium, Platinum.

Cryptocurrencies: BCHBTC, BCHUSD, BTCUSD, DSHUSD, SDHBTC, EDOUSD, EOSUSD, ETHBTC, ETHUSD, ETPUSD, IOATUSD, LTCBTC, LTCUSD, NEOBTC, NEUSD, OMGUSD, SANUSD, XMRBTC, XMRUSD, XRPUSD, ZECBTC, ZECUSD.

Shares: There are shares from the United States, Russia, France, Japan, and the United Kingdom.

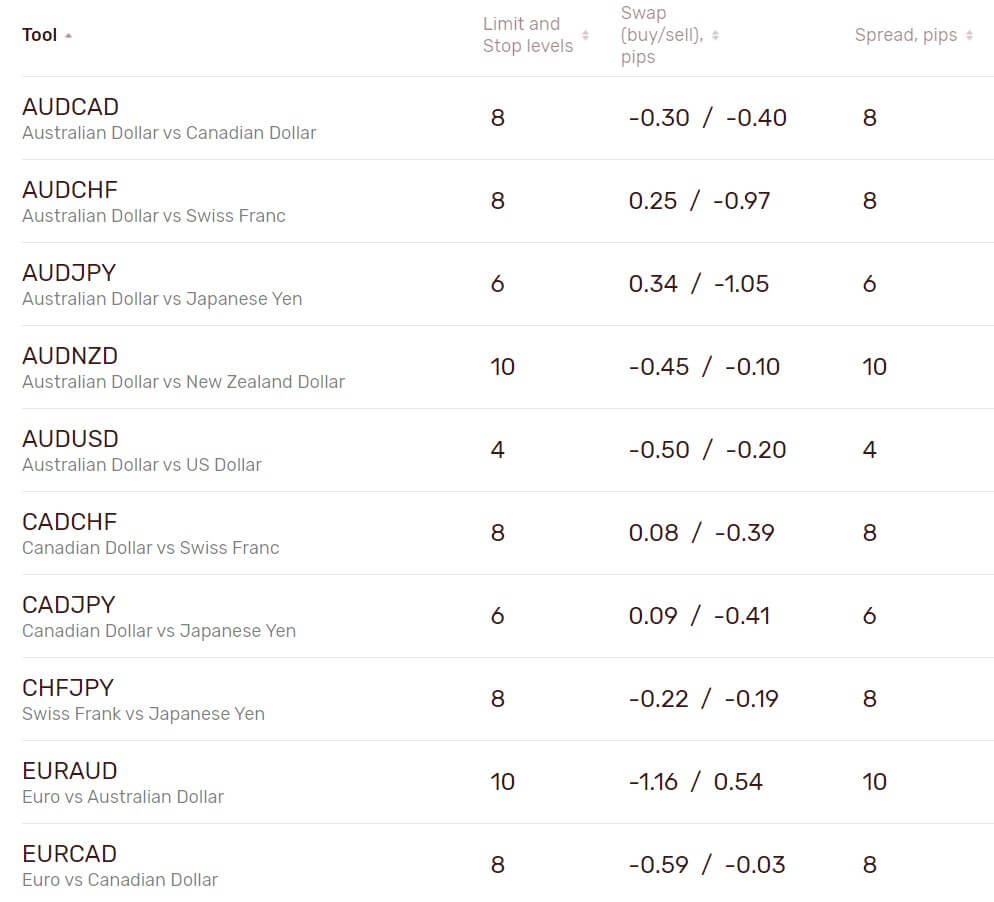

Spreads

The Classic and Cent account shave spreads starting from 2 pips however they are actually starting from 3 pips. The spreads are fixed which means they do not move, different instruments also have different starting spreads so while EURGBP is set at 3 pips, the AUDJPOY pair is set at 6 pips.

The Pro account has a variable spread starting from as low as 0 pips, the variable spread means it will move with the markets, hen there is added volatility they will be deen slightly higher than the stated 0 pips.

Minimum Deposit

The minimum amount required to pen up any of the accounts is $200. Once an account is open the required amount for further deposits is reduced down to $10.

Deposit Methods & Costs

There are a few different methods available to deposit with, sadly there are some added commissions with each method so we have outlined them below for you.

- Bank Cards – 2% commission

- WebMoney – 1% commission

- Qiwi Wallet – 0% commission

- Yandex Money – 0% commission

- Perfect Money – 0% commission

- Bank Transfer – Bank charges

Be sure to check with your own processor or bank for any further processing fees added by them.

Withdrawal Methods & Costs

The same methods are available to withdraw with, we have outlined them again with any applicable fees.

- Bank Cards – 3% commission

- WebMoney – 0% commission

- Qiwi Wallet – 3% commission

- Yandex Money – 5% commission

- Perfect Money – 0% commission

- Bank Transfer – $85 fee

The Bank Transfer fee is extremely high and one that we would suggest avoiding.

Withdrawal Processing & Wait Time

Each withdrawal method has its own withdrawal timeframe, we will outline them once again.

- Bank Cards – from 1 min to 5 days

- WebMoney – instantly

- Qiwi Wallet – instantly

- Yandex Money – instantly

- Perfect Money – instantly

- Bank Transfer – from 2 min to 5 days

Bonuses & Promotions

There is a loyalty program available, each time you deposit and for every lot, you trade you will receive loyalty points, and these can then be redeemed for various prizes. It looks like half the amazon stock has been imported for you to choose to spend your money on as there is everything from bookstore kettle and waffle makers available. You can also receive cashback and deposit bonuses based on the deposit amount you make. We outlined these in the Package section of the ‘Account Types’ section of this review.

Educational & Trading Tools

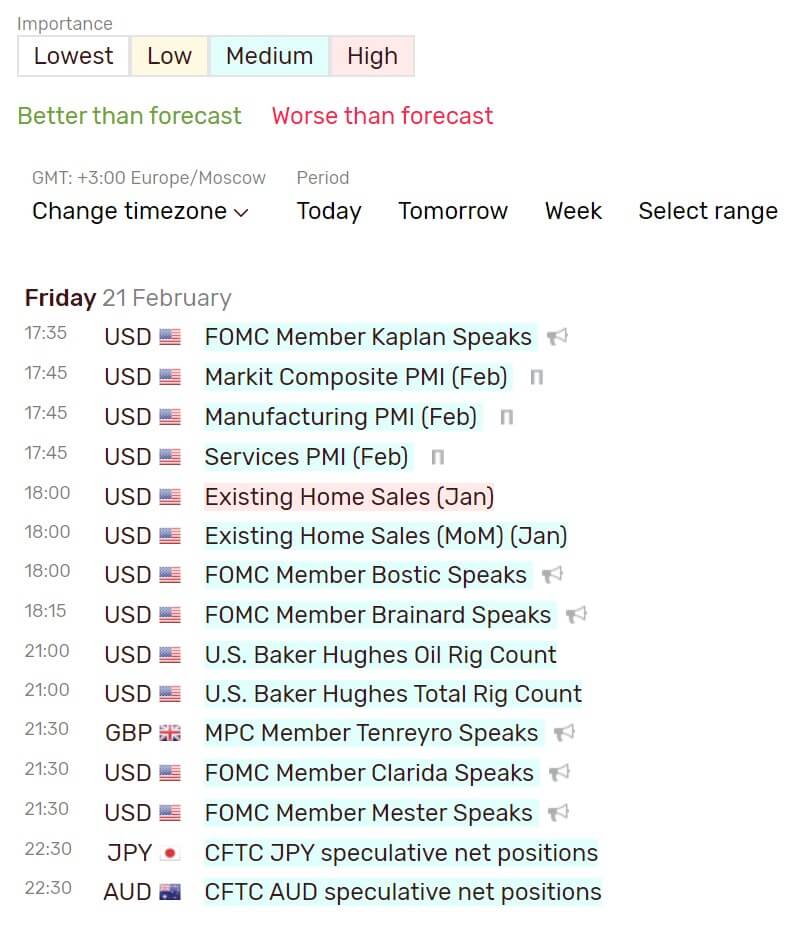

In terms of education, there only appears to be an economic calendar on offer. This details any upcoming news events along with any markets that the news could potentially have an effect on.

Customer Service

You can contact the support team in a number of ways. You can use everyone’s favorite online submission form, fill it in and you will get a reply via email. You can also use one of the available phone numbers or email addresses depending on the department you want to contact.

Support Phone: +7 495 128-03-23

Email: [email protected]

Partner Email: [email protected]

Demo Account

The demo account allows you to trade with virtual fake money in order to test out strategies or training without any risk, and so it is good that they are available from ST Forex. You can select trading conditions similar to the main accounts. We do not know if there is an expiration on the accounts though.

Countries Accepted

This information was not made obvious to us so we would suggest contacting the customer support team to find out if you are eligible for an account prior to signing up.

Conclusion

While there are just the three accounts available to you, things are made a little more complicated with the additions of the packages, but ultimately they are just different rewards for depositing more. The trading conditions on the Pro account seem average, however, the $10 per lot is nearly double what the average of $6 is. The spreads on the Standard and Cent accounts are also pretty high with 3 pips being the lowest. There are plenty of tradable assets though so you will always have something to trade. The other downside is the deposits and withdrawals. While there are enough methods the fees can be quite high, with the Bank Transfers having an added fee of $85. Due to all the fees and high trading costs, we would recommend looking elsewhere for a broker that is a little cheaper to use.