NICOFX is a Cypriot broker that primarily deals in Forex trading. The NICOFX website is available in several languages, including English, German, Spanish, Malay, Chinese, Indonesian, and French. Founded in 2013, NICOFX claims to be a pure STP broker. Straight Through Process brokers or STP brokers have similarities to ECN brokers, are in charge of connecting the transactions of their clients or investors with the broker’s liquidity providers, usually, they are financial institutions and banks.

NICOFX offers trading with up to 46 currency pairs, Spot Silver, Gold and Oil to retail customers and institutional customers. The company behind the trademark NICOFX is Mount Nico Corp Ltd. This company is based in Cyprus and is authorized and regulated by the Cyprus Securities and Exchange Commission Cysec (Licence No. 226/14). The company has also created another currency broker brand, called Greatsky.

CySec requires foreign exchange brokers to hold at least € 730,000 as a condition and proof of their financial stability and solvency. It also requires that client funds be kept in segregated accounts, different from the broker’s operating account. There is an additional guarantee for customer funds, and that is that all companies regulated by CySec are partners in the Investor Compensation Fund, which can pay compensation to its customers of up to EUR 20,000 if the broker becomes insolvent.

Also, all investment firms regulated by CySec also comply with Mifid and thus have the right to offer cross-border services in each EU Member State under the Mifid passport regime. Besides, NICOFX is also registered with the Financial Conduct Authority (FCA) of the United Kingdom under reference no. 672844 and Bafin of Germany under reference ID. 142143, so we’re talking about a very well regulated broker.

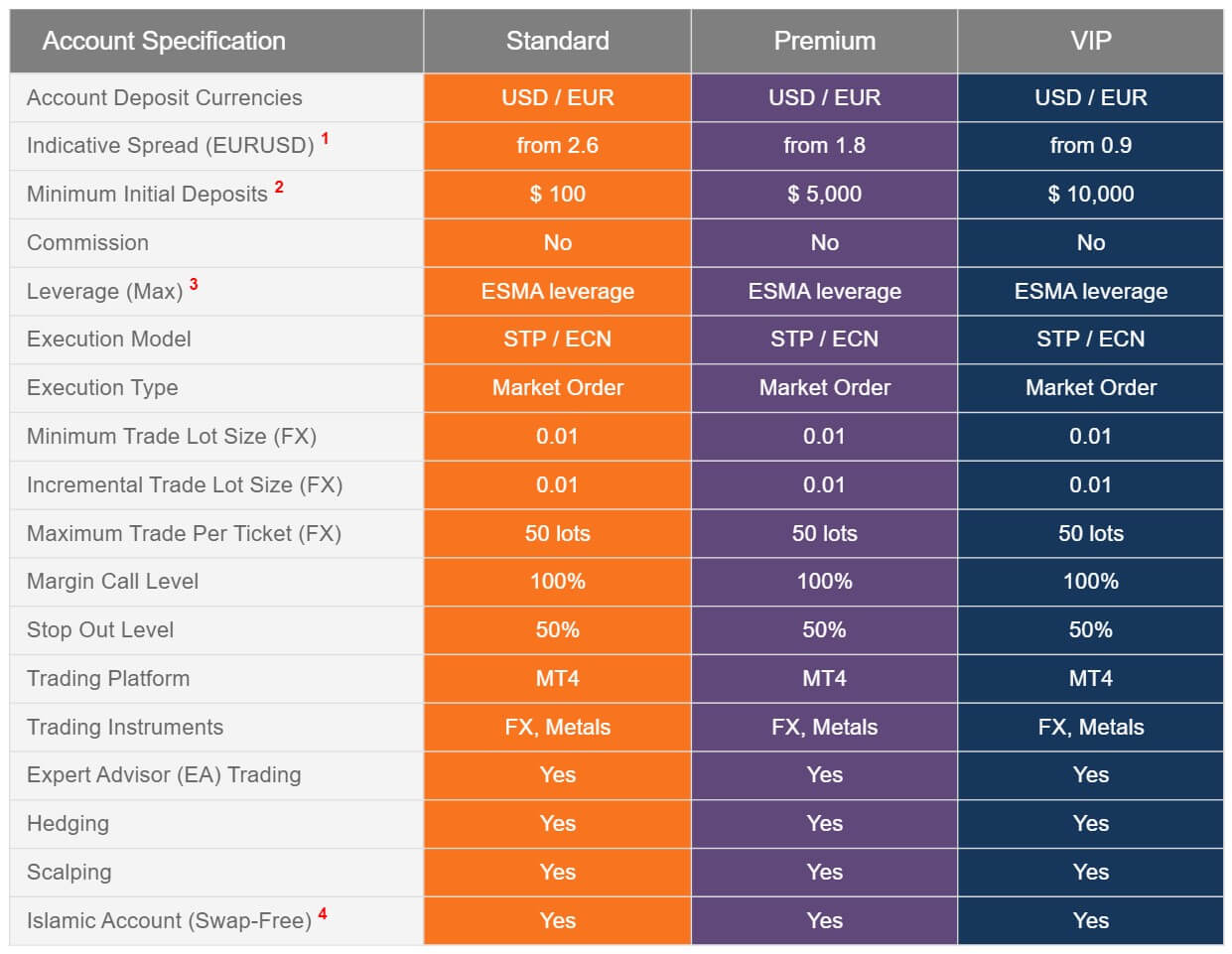

Account Types

This broker offers 3 types of accounts, called Standard, Premium, and VIP. Below we show you all the characteristics of each one of them:

We note that the main differences are found in the Spread and the required minimum deposit.

Platforms

This broker supports the most popular and famous currency trading platform: Metatrader 4 (MT4). This platform is available in the desktop version for use on desktop computers, and there is also a mobile version for use on tablets and smartphones. The platform combines an easy-to-use and accessible interface with a wide range of powerful features, making it suitable for both beginner and professional traders. MT4 provides a list of technical indicators, extensive back-up tests with historical data, a very advanced graphics package, and a wide range of Expert Advisors (EA), which can be used to automate our trading strategies. Commercial signals are also available on this platform.

Unlike some brokers, Nicofx does not provide VPS, a virtual server that can be used to host your MT4 Eas, providing additional protection when trading in Forex.

Leverage

The maximum leverage offered by Nicofx is 1:100 for professional traders. Retail customers should be satisfied with leverages between 1:10 and 1:30 because NICOFX faithfully respects the requirements of the ESMA in terms of leverages. The leverages required by the ESMA are intended to protect retail customers from the risk of trading in leverages above 1:100. Also, we advise traders to be cautious when dealing with high leverages, since greater leverage involves a greater risk of loss, but also profit, so you have to know how to control this variable.

Trade Sizes

The minimum trade size with which we can trade with this broker is 0.01 lots (micro lot). Beginner traders will appreciate being able to trade small lots to keep their risk contained while gaining experience in the markets. The maximum trade size with which you can trade with NICOFX is 50 lots, vast quantities, and only within reach of professional and experienced traders.

Trading Costs

The broker already reports on his website that he does not apply commissions for lots traded, so the main cost we have to bear is the Spread (price difference between the purchase price and sales price). The Spread with this broker is high on your most basic account (2.6 pips at par EUR/ USD), and to save costs, we should open a Premium or VIP account, but your minimum deposit requirements are quite high, (5,000 – 10,000 USD).

The other cost we have to take into account is the Swap or Overnight Financing, which is any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

Assets

This broker specializes mainly in Forex but also offers a small range of metals to trade. Here we show you an example of a few of the assets that you can trade with this broker:

Spreads

Unfortunately, the spreads offered by Nicofx are not among the tightest in the market. Variable broker spreads start from 2.6 pips in EUR/USD in your standard account when we know that most brokers offer spreads within the range of 1 – 1.5 pips for this pair. To get better spreads with this broker we have to be Premium or VIP account holders, but the initial capital requirements in those accounts are high. (5,000 – 10,000 USD).

Minimum Deposit

To open an account with NicoFX, traders must deposit a minimum of $100. Such a minimum initial amount is considered to be on average with what many other Cyprus-based brokers are requesting. The other two accounts offered by NICOFX are the Premium and the VIP, which require a minimum initial deposit of USD 5,000 and USD 10,000, respectively. Both of these minimums are on the higher side.

Deposit Methods & Costs

NicoFX makes available to its clients 4 deposit methods; below we show the details that have to comply with them, as well as the waiting time:

Withdrawal Methods & Costs

Below we also show you the withdrawal methods and the costs associated with them:

Withdrawal Processing & Wait Time

The processing time of the broker is of a maximum of 24-hours.

To this time, you have to add the waiting times that we inform you below:

- Bank Transfer: 2 – 5 days

- Union Pay: 1 – 4 days

- Visa/MasterCard: 1 day

- Skrill: 1 day

- Amex/Diners Club: 1 day

Bonuses & Promotions

NICOFX has no bonuses or promotions at present but does have a program for affiliates.

This program is made to reward individuals or companies who refer new clients, and they open trading accounts with DV Markets. Every time one of the clients you have indicated to perform a transaction, your account will be rewarded in real-time. There is no limit to the number of clients or transactions that may be paid.

Educational & Trading Tools

The broker does not offer educational content on its website. There is a Trading Tools section in the main menu, but the tab is currently disabled, so we can’t know what kind of tools they are, and how much interest they have for the trader.

Customer Service

To contact NICOFX customer service, they have 3 main ways of contact, phone, email, and a live chat that is available on the broker’s website. They also have offices in Cyprus in case you want to visit them.

Address: Andrea Zappa & Makedonon 4, Honey Court V, 1st floor, Office 11A, 4040 Limassol, Cyprus.

General Enquiries:

Phone: +357 24 020 299. Fax: +357 25 250 552. Email: [email protected]

Customer Support – Global Clients. Phone: +357 24 020 299. Email: [email protected]

Sales Department. Email: [email protected]

Customer Support – Chinese Speaking. Phone: +357 24 020 288. Email: [email protected]

Partners Department. Email: [email protected]

Back Office. Email: [email protected]

Demo Account

We regret to report that this broker does not provide a demo account, which we consider to be bad news and a negative point for NICOFX.

Countries Accepted

NICOFX does not offer its services to residents of jurisdictions of the U.S.A, Cuba, North Korea, Syria, Sudan, and Iran.

Conclusion

Nico FX is a reasonably well-regulated currency broker, with CySec, FCA and Bafin licenses. The firm is offering online trading on 46 currency pairs and precious metal CFDs. It uses the MT4 platform, which is a good thing. The spreads of this broker are quite contradictory, as there is a huge difference between the spreads offered in your basic account, 2.6 pips in EUR/USD, and 0.9 pips in your VIP account. The minimum deposits to open a trading account with this broker are also very disparate, from USD 100 in the base account to USD 10,000 in your VIP account, which is where the best trading conditions are offered.

Nico FX is a reasonably well-regulated currency broker, with CySec, FCA and Bafin licenses. The firm is offering online trading on 46 currency pairs and precious metal CFDs. It uses the MT4 platform, which is a good thing. The spreads of this broker are quite contradictory, as there is a huge difference between the spreads offered in your basic account, 2.6 pips in EUR/USD, and 0.9 pips in your VIP account. The minimum deposits to open a trading account with this broker are also very disparate, from USD 100 in the base account to USD 10,000 in your VIP account, which is where the best trading conditions are offered.

In terms of leverage, this broker conforms to the ESMA’s dictates, and a retail customer will have to settle for leverages ranging from 1:10 to 1:30, while professional traders will be able to opt for higher leverage of 1:100. We did not like the lack of educational content and, above all, the lack of demo account, something that we consider very important and that we think all brokers should offer to their clients. On the other hand, the deposit and withdrawal methods seem correct, although the associated costs are a little expensive.

To summarize the above, here are the advantages and disadvantages of this broker:

Advantages:

- Well regulated (CySec license), FCA, and Bafin

- No commissions for trading lots

- MT4 platform available

- STP Execution

Disadvantages:

- High spreads

- No CFDs on indices and shares

- No possibility of VPS

- High minimum deposit for accounts offering better trading conditions

- Lack of educational content and tools

- No possibility of demo account.

- High charges on deposits and withdrawals