TegasFX describes themselves as a true ECN/STP broker with a low-latency infrastructure, low market spreads, and a wide variety of instruments with additional options added periodically. The company remains under the regulatory authority of the Vanuatu Financial Services Commission (VFSC license #14697) with headquarters located in Vanuatu. Through their three main account types, TegasFX manages to bring some competitive trading costs and advantages, although some features that we were looking for are missing from the website entirely. If you’re in the market for a broker, you’ll definitely want to read our detailed review to find out if this broker is worthy of your investment.

Account Types

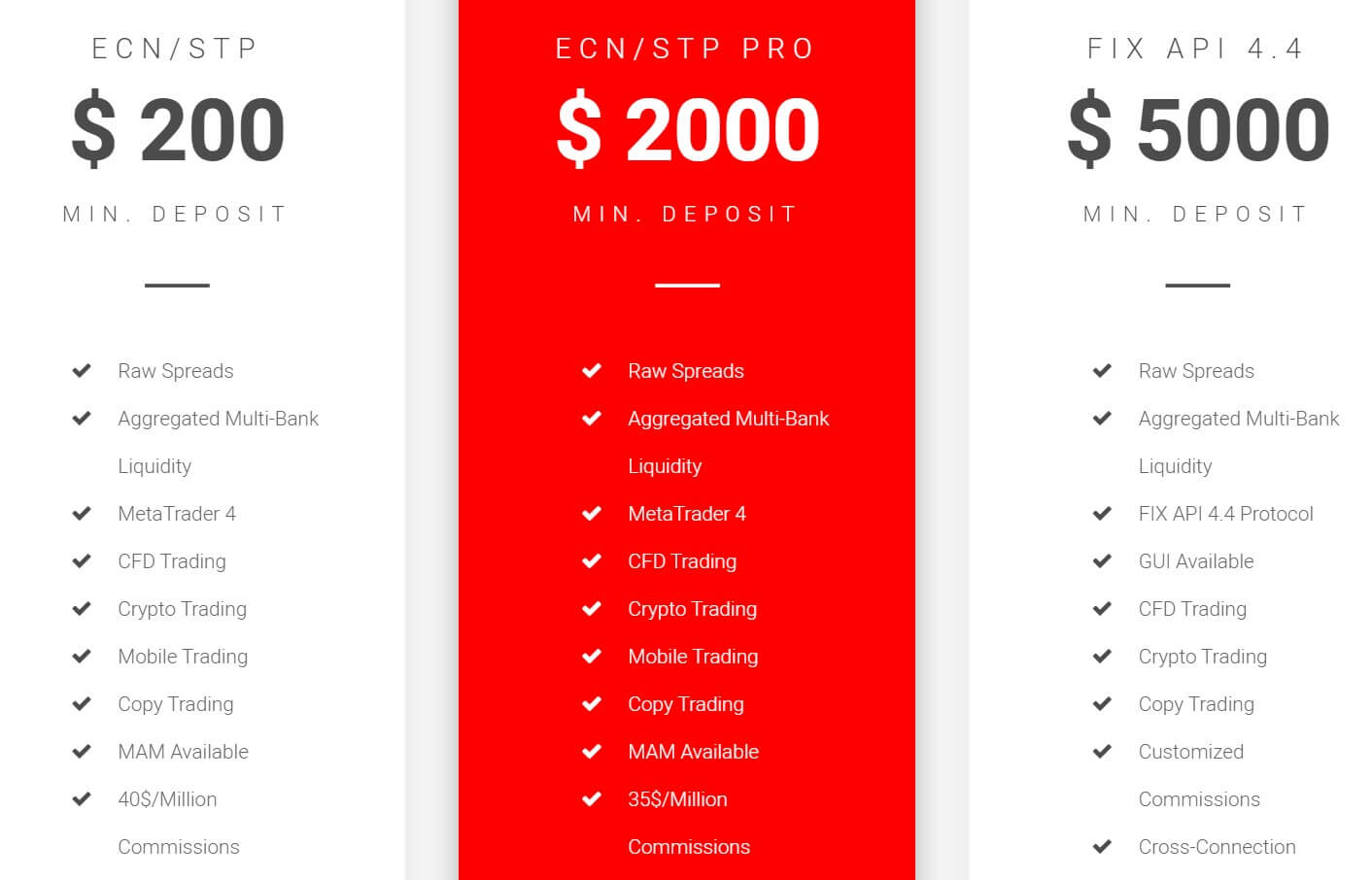

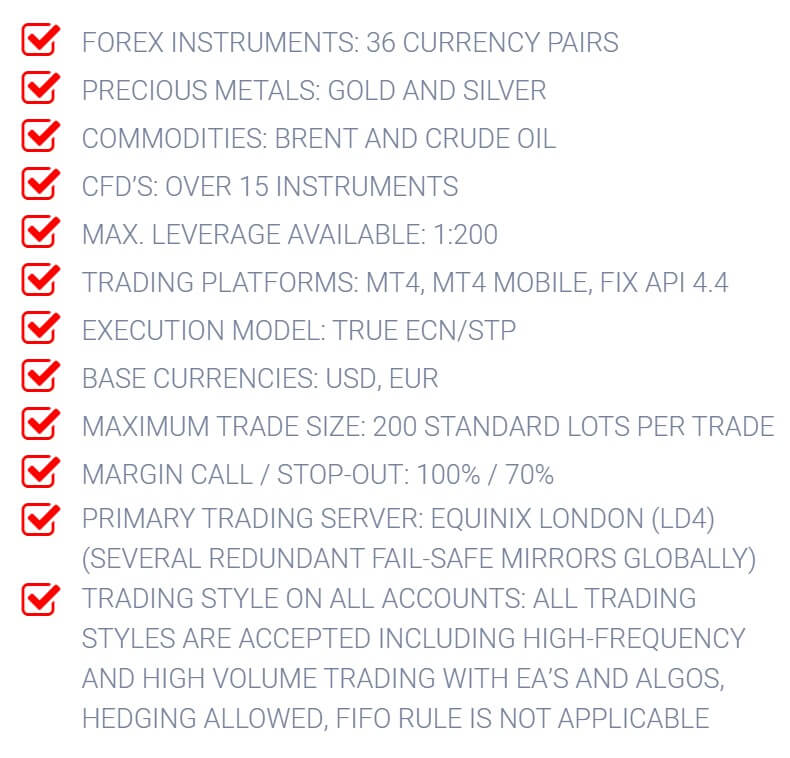

TegasFX offers three live account types; ECN/STP Standard, ECN/STP Pro, and Fix API. Islamic accounts and PAMM services are not available through the broker. The Standard and Pro accounts are for trading on the MetaTrader 4 platform, while the broker’s Fix API account operates on their own Fix API 4.4 trading platform. It costs $200-$2,000 to open an MT4-based account and the broker asks for a $5K deposit on their Fix API account. Leverage options are rather limited, at up to a 1:200 maximum cap.

All accounts offer the same spreads, which are much tighter than average. Having access to those options without the need to make a large deposit will be an advantage to many traders. The Fix API account offers slightly lower commission costs as another added advantage. This account type is aimed towards more professional traders or industrial traders, while the Standard and Pro accounts are suitable for all types of traders. The Fix API account also requires a larger trade size. We’ve provided an overview of each account type below.

Standard Account (MT4 platform)

Minimum Deposit: $200 USD

Leverage: Up to 1:200

Spread: From 0.2 pips on average

Commission: $4 USD

Minimum Trade Size: 0.01 lot

Pro Account (MT4 platform)

Minimum Deposit: $2,000 USD

Leverage: Up to 1:200

Spread: From 0.2 pips on average

Commission: $4 USD

Minimum Trade Size: 0.01 lot

Fix API Account (Fix API platform)

Minimum Deposit: $5,000 USD

Leverage: Up to 1:100

Spread: From 0.2 pips on average

Commission: $2-3.50 USD

Minimum Trade Size: 1 lot

Platform

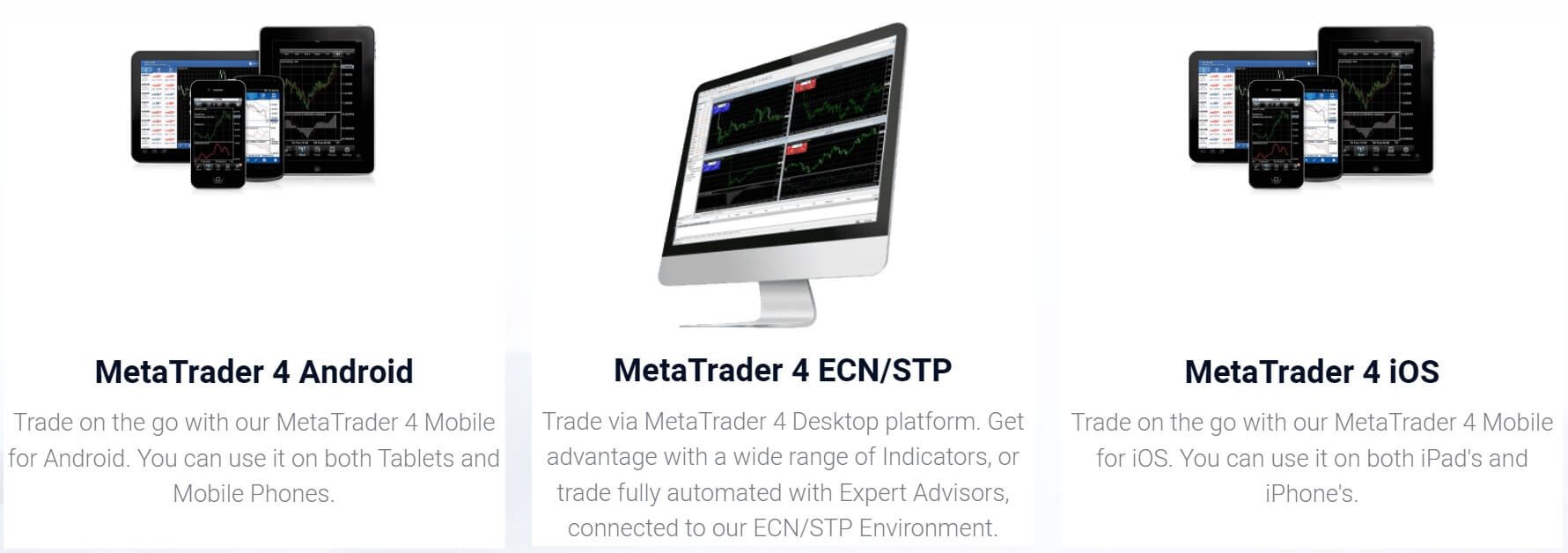

One would either be trading from the popular MetaTrader 4 platform on mobile, PC, or browser, or the broker’s own platform, named Fix API 4.4 through TegasFX. Your platform choice will depend on which account type you’ve opened since the Standard and Pro accounts support the MT4 platform and the broker’s Fix API account supports their Fix API 4.4 platform. Many of our readers have likely heard of MT4 already. MetaTrader 4 is basically an all-in-one platform that was designed to be powerful while providing an accessible, user-friendly experience with all of the tools and features a trader could need.

Traders can also take advantage of social trading through MT4, where the trades of other’s strategies can be selected and copied on their own account. The Fix API platform seems to focus on fulfilling high-speed connectivity with no re-quotes or delays during the confirmation process. The platform supports all trading strategies and algorithms with low-latency and a negotiable commission structure. One incentive to open a Fix API-based account would be slightly lowered commission costs that are $.50 – $2 lower per side; however, traders would need to deposit at least $5K to be able to access this account.

Leverage

While this broker does offer several advantages, its leverage caps can only be considered average. On the MT4-based accounts, the maximum leverage cap goes up to 1:200 and that cap is lowered to 1:100 on the Fix API account. Some beginners and professionals may not notice the lower limitations if they are used to trading with a lower option. In fact, many traders are accustomed to using a level of 1:100 or lower because of the greater risks that are associated with using a higher option.

On the other hand, some professionals may feel that the cap is somewhat restrictive when compared to the 1:300+ options that are available through several other forex brokers. It will really come down to personal preference when deciding whether the broker’s more restrictive leverage caps will affect one’s trading strategy in a negative way.

Trade Sizes

The MT4 ECN/STP accounts support the trading of micro-lots, while the Fix API account, meant for professional and institutional traders, supports a minimum trade size of one lot. The maximum trade size is limited to 200 standard lots per trade. All trading styles are accepted, including high-frequency and high-volume trading with EAs and hedging. The broker imposes a margin call level to warn traders when their account is getting close to stop out. Reaching this level would prevent one from opening any new trades until some of the losing trades were closed out or another deposit is made. If the stop out level is reached, the system would begin to close out positions automatically to safeguard the account from going into the negative. Those limits are Margin Call/Stop Out: 100%/70%.

Trading Costs

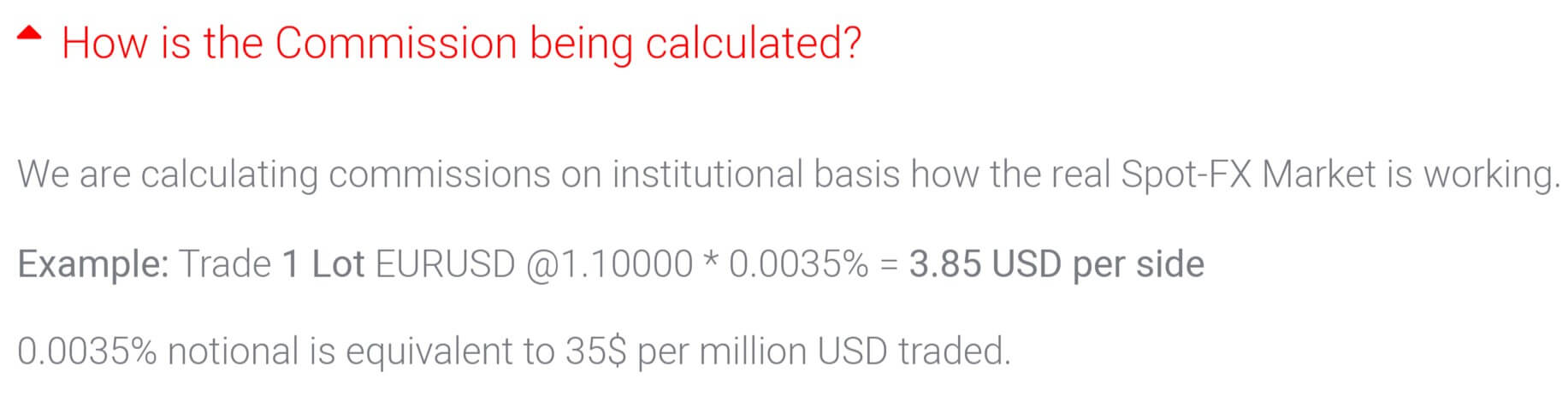

Commission costs are calculated based on an institutional basis. For example, trading 1 lot EURUSD @ 1.10000*0.0035% = a commission cost of $3.85 USD per side. The 0.0035% notational value is equivalent to $35 per million USD traded. All math aside, standard commissions come out to about $4 per lot on the MT4 accounts and $2-$3.50 per lot on the Fix API account. The broker does provide commission discounts for high-volume traders like scalpers, EA traders, HFT traders, and MAM clients and is even willing to consider special requests on a case by case basis. If you add the commission charges with the spreads, it seems that the average cost of trading per lot comes out to about 1 pip. This means that the overall costs associated with placing a trade through this broker remain competitive, even when considering all charges.

Traders will want to keep overnight interest charges in mind as well, and there are no Islamic accounts that make it possible to avoid those charges. The long and short swap rates can be viewed on the website under “ECN/STP Trading” > “Spreads & Conditions”. Keep in mind that charges are tripled on Wednesdays in order to account for the upcoming weekend. Our research did not reveal any additional fees associated with this broker where others sometimes implement unnecessary inactivity fees and other charges. Fortunately, the broker’s Fix API platform is also free, with no maintenance or access fees.

Assets

TegasFX offers FX pairs, the precious metals Gold and Silver, commodities, and CFDs for trading. FX options consist of 36 total currency pairs, alongside the popular cryptocurrency pairs BCHUSD, BTCUSD, ETHUSD, LTCUSD, and XRPUSD. When trading commodities, traders will have a choice between Brent and Crude Oil. There are 15 total CFD options, including a few cash indices. TegasFX is missing some extra options like stocks, bonds, etc. and the number of currency pairs is somewhat limited when compared to the 50+ instruments offered by many other brokers. However, the broker does feature cryptocurrencies, which aren’t nearly as accessible elsewhere.

Spreads

Average spreads are extremely tight on several FX options, although there are exceptions where some of the spreads can climb to higher levels on certain pairs and exotic options. The lowest average spread was at 0.2 pips on the benchmark EURUSD pair. On AUDJPY, AUDUSD, CADJPY, EURCHF, EURGBP, EURJPY, GBPCHF, GBPUSD, NZDUSD, USDCAD, and USDJPY the average spreads were well below 1 pip.

Meanwhile, some of those higher spreads were listed at 30.2 pips on USDNOK, 21.2 pips on USDSEK, 27 pips on USDRUB, and etc. These average spreads are offered to all account holders, meaning that traders can access tight spreads from 0.2 pips and up with a deposit as low as $200 USD. Elsewhere, it would be nearly impossible to find an offer this low for an account that asks for less than a $5,000 deposit. Even though the spreads climb on a few specific instruments, the majority are much lower than average and even metals and commodities come with tight spreads.

Minimum Deposit

If you’re interested in one of the broker’s MT4-based platforms, you’ll need to deposit at least $200 to gain access to a Standard MT4 account. It seems unnecessary to meet the Pro account’s $2,000 USD minimum, considering that the account is exactly the same as the cheaper option. The website doesn’t list a maximum balance that can be held on each account, but it is possible that the Pro account is specifically there to hold larger amounts of funds since other conditions are identical. If you’d like to open a Fix API account, which comes with access to the lowered commissions on the Fix API 4.4 platform, then you’ll need to meet a steep $5,000 deposit requirement. Obviously, the higher asking amount may force some traders to choose an MT4-based account, even if they would prefer to trade from the Fix API platform.

Deposit Methods & Costs

Accepted deposit methods include bank wire transfer, credit/debit card, Neteller, and Bitcoin. Note that deposits are only accepted if the name on the sending account matches the client’s name on the trading account. Charges that may apply to bank wire transfers include a transaction fee (from the bank that starts the transaction), an intermediary fee (if your bank does not have a direct connection with the recipient bank), and/or a receiving bank fee. TegasFX does not charge fees on Neteller from their side, but the payment provider does charge a 3.9% fee. It takes 1-3 business days to process wire transfers, 1 business day to process card and Neteller deposits, and Bitcoin deposits are processed instantly.

Accepted deposit methods include bank wire transfer, credit/debit card, Neteller, and Bitcoin. Note that deposits are only accepted if the name on the sending account matches the client’s name on the trading account. Charges that may apply to bank wire transfers include a transaction fee (from the bank that starts the transaction), an intermediary fee (if your bank does not have a direct connection with the recipient bank), and/or a receiving bank fee. TegasFX does not charge fees on Neteller from their side, but the payment provider does charge a 3.9% fee. It takes 1-3 business days to process wire transfers, 1 business day to process card and Neteller deposits, and Bitcoin deposits are processed instantly.

Withdrawal Methods & Costs

Withdrawals can be made through bank wire transfer, Neteller, or Bitcoin. Card withdrawals are not available and Neteller would act as the method of withdrawal for those that deposited by card. The same fees that apply to deposits would apply to withdrawals as well, meaning that traders would pay bank fees for wire transfer withdrawals and 3.9% of the total withdrawal amount on Neteller withdrawals. Bitcoin withdrawals may be subject to fees from the provider, depending on the current rate of the currency. While it would be nice to see completely free withdrawals, this isn’t something that the broker is willing to offer.

Withdrawal Processing & Wait Time

The broker doesn’t specify as to whether the withdrawal timeframes are equal to the deposit timeframes. If this is the case, then traders would be able to expect to see instant processing times on Bitcoin withdrawals. It would take the broker one business day to process Neteller withdrawals and 1-3 business days to send wire transfers. Of course, wire transfers would likely incur an additional waiting period on the bank’s behalf.

Bonuses & Promotions

Aside from commission discounts for high-volume traders, there aren’t any ongoing promotions at this time and the website doesn’t suggest that this is something the broker is planning on adding in the near future. It’s always nice to see something in this category, especially welcome bonuses, deposit bonuses, no-deposit bonuses, or basically any opportunity that is helpful to those that are just getting started. Traders shouldn’t cross TegasFX off their list based on the lack of these options, due to the fact that the broker still manages to offer several other advantages.

Educational & Trading Tools

Sadly, TegasFX has nothing to offer when it comes to educational resources or trading tools. The internet can always serve a purpose to help beginners find information, but it does seem especially important for brokers to provide educational material for their clients. It’s also frustrating that there are no tools like calculators or calendars available on the website, although a quick Google search would provide websites that host these tools for free.

We aren’t impressed with the broker’s disregard of the importance of a good education, but we still wouldn’t recommend choosing another broker based on this alone. Hopefully, TegasFX will realize how helpful these resources can be and make the decision to feature some options on their website in the future. They do, however, redeem themselves somewhat by offering trading tools and services such as Copy Trading, a MAM Platform, and Fixed API trading.

Demo Account

We were surprised to find that this broker doesn’t even offer basic demo accounts on their website. Even when brokers fail to provide any additional educational resources, the majority of them still manage to provide free demo accounts as the bare minimum in education. Traders will definitely miss out on several opportunities without access to these risk-free accounts. Once again, TegasFX has failed to deliver when it comes to extra opportunities that could help to enhance their client’s experiences.

Customer Service

The broker’s customer service team is readily available to answer questions and assist clients 24 hours a day on weekdays. TegasFX provides multiple ways to reach a member of their support team, including the instant contact option LiveChat, phone, email, and a contact form on the website. As usual, we felt it was crucial to test out the website’s LiveChat option since this is typically the fastest and most preferred contact method. Our experience proved the customer support team to be efficient, and we received a response from a real person almost immediately. Traders are even given the choice between English, German, or Thai speaking agents at the start of the chat. The broker can be reached at +65 316 367 71 or via email at [email protected].

Countries Accepted

According to the broker’s website, those located in Bangladesh, Belarus, Bolivia, Cuba, Cote d’Ivoire (Ivory Coast), Democratic Republic of Congo, Ecuador, Former Liberian Regime of Charles Taylor, Iran, Kyrgyzstan, Liberia, Libya, North Korea, the Republic of Vanuatu, Singapore, Sudan, Syria, the United States of America, and Zimbabwe are prohibited from opening an account. We often find that brokers don’t actually uphold claims about restricted countries, so we weren’t surprised to find all of these options listed on the sign-up list. The website allowed us to register an account from our US-based office with no issues, which made us draw the conclusion that none of the aforementioned restrictions are upheld. This is a great advantage for those that are located in a country that is commonly blacklisted due to regulatory issues.

Conclusion

TegasFX offers leveraged trading of up to 1:200 on FX options and CFD’s, including a handful of cryptocurrency pairs. Traders would be able to choose from two MT4-based account types from $200, or an account that operates on the broker’s Fix API platform for a $5,000 USD minimum deposit.

One of the broker’s primary advantages would be the low trading costs that are offered to all traders, regardless of account type. The average cost per lot comes out to about 1 pip, while the industry average is at 1.5 pips or above. Accounts can be funded through bank wire, card, Neteller, and Bitcoin, but the broker doesn’t allow card withdrawals and it is impossible to withdraw funds through this broker without being charged a fee by the payment providers.

We found the broker’s customer support team to be readily available to answer any questions and traders are able to reach out to an agent instantly using the website’s LiveChat feature. Our final conclusion is that this broker keeps its promise to provide traders with the best possible trading environment, minus some of the extra options we were looking for, like promotional offers, demo accounts, and other educational resources.