WIT Invest is an innovative company on technical maintenance of investment decisions and the provision of brokerage services worldwide. That is the opening statement on the website of this Saint Vincent and the Grenadines based foreign exchange broker. We will be using this review to see how innovative they actually are and to provide you with information about the available services that are being offered.

Account Types

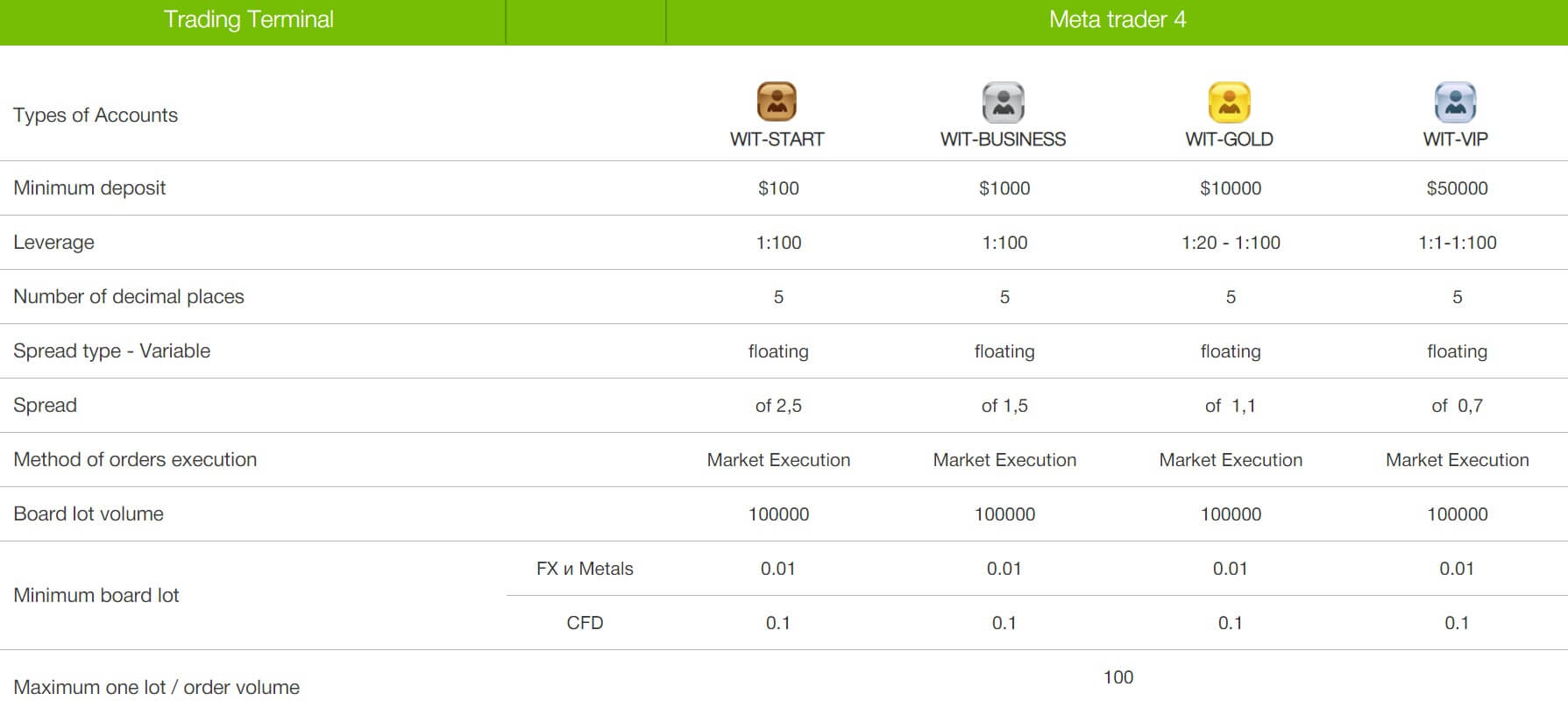

There are four different accounts available to sue, we have outlined their features and requirements below.

Starter Account: This account has a requirement of $100 to open, it comes with leverage up to 1:100 and aha s a floating spread starting at 2.5 pips. It uses market execution and trade sizes for forex start at 0.01 lots and CFDs from 0.1 lots. The maximum trade size is 100 lots, the margin call level is set at 20% and the stop out at 10%.

Business Account: This account has a requirement of $1,000 to open, it comes with leverage up to 1:100 and aha s a floating spread starting at 1.5 pips. It uses market execution and trade sizes for forex start at 0.01 lots and CFDs from 0.1 lots. The maximum trade size is 100 lots, the margin call level is set at 20% and the stop out at 10%.

Gold Account: This account has a requirement of $10,000 to open, it comes with leverage between 1:20 and 1:100 and aha s a floating spread starting at 1.1 pips. It uses market execution and trade sizes for forex start at 0.01 lots and CFDs from 0.1 lots. The maximum trade size is 100 lots, the margin call level is set at 20% and the stop out at 10%. The account also has a charge of 12% but we arent 100% what this means yet.

VIP Account: This account has a requirement of $50,000 to open, it comes with leverage between 1:1 and 1:100 and aha s a floating spread starting at 0.7 pips. It uses market execution and trade sizes for forex start at 0.01 lots and CFDs from 0.1 lots. The maximum trade size is 100 lots, the margin call level is set at 20% and the stop out at 10%. The account also has a charge of 15% – 17% but again, we aren’t entirely sure what this means.

Platforms

WIT chooses to offer the always popular MT4 platform. They make this platform available for Windows, MAC, and Android systems. Even the most inexperienced traders will likely have heard of this platform, as it has long been the most popular in the industry due to its user-friendliness and plethora of tools and functionalities.

Leverage

We have outlined the leverages available on each account below.

- Starter: 1:100

- Business: 1:100

- Gold: 1:20 – 1:100

- VIP: 1:1 – 1:100

Depending on the account being used, the leverage can be selected when opening up an account and can be changed by contacting the customer service team with the request.

Trade Sizes

Trade sizes on all accounts for Forex start from 0.01 lots and go up in increments of 0.01 lots. For CFDs, they start at 0.1 lots but the increments are unknown. The maximum trade size is 100 lots and this is also the maximum number of open lots allowed, so 100 1 lot trades would also reach this limit.

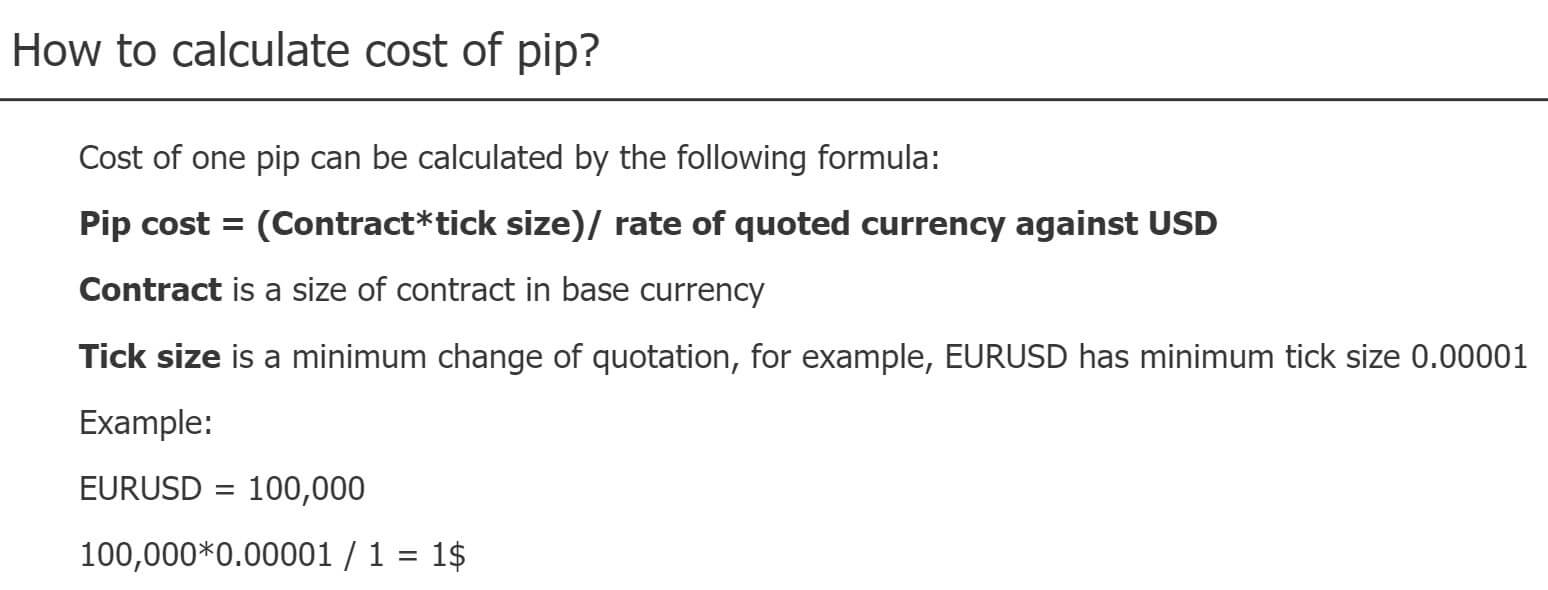

Trading Costs

There are no added commissions for trading on any of the accounts. They all use a spread based system that we will look at later in this review. There are also swap charges which are fees for holding trades overnight, they can be either positive or negative and can be viewed within the trading platforms being offered.

Assets

The assets have been broken down into a few different categories, we have outlined the instruments within each below.

Forex: AUDCAD, AUDCHF, AUDDKK, AUDJPY, AUDNZD, AUDSEK, AUDUSD, CADCHF, CADDKK, CADJPY, CADMXN, CADNOK, CADSEK, CADSGD, CHFDKK, CHFHUF, CHFJPY, CHFNOK, CHFPLN, CHFSEK, CHFSGD, DKKNOK, DKKSEK, EURAUD, EURCAD, EURCHF, EURCNH, EURCZK, EURDKK, EURBGP, EURHKD, EURHUF, EURILS, EURJPY, EURMXN, EURNOK, WUENZD, WUEPLN, WUERUB, EURSEK, ERUSGD, EURTRY, EURUSD, ERUZAR, GBPAUD, GBPCAD, GBPCHF, GBPCZK, GBPDKK, GBPHKD, GBPHUF, GBPJPY, GNPMXN, GBPNOK, GBPNZD, GBPPLN, GBPSEK, GBPSGD, GBPTRY, GBPUSD, GBPZAR, HKDJPY, NOKJPY, NOKSEK, NZDCAD, NZDCHF, NZDDKK, NZDJPY, NZDSEK, NZDSGD, NZDUSD, SEKJPY, SGDHKD, SGDJPY, TRYJPY, USDBRL, USDCAD, USDCHF, USDCNH, USDCZK, UDDKK, USDHKD, USDHUF, USDILS, USDINR, USDJPY, USDMXN, USDNOK, USDPLN, USDRON, USDRUB, USDSEK, USDSGD, USDTHB, USDTRY, USDZAR.

Spots: Aluminum, Copper, Natural Gas, Nickel, Platinum, Silver, Golde,m UK Brent Oil, Palladium, Platinum, US Crude Ol, Zink.

Indices: AUS200, CAC40, DAX30, EURO50, Japan225, NDX, NDZM, SMI, SPX, SPXM, UK100, WS30, WS30M.

Shares: Plenty of shares are available, some of them include Apple, Google, Netflix, Facebook, and Twitter.

Spreads

The spreads that you will be receiving depends on the account that you use.

- Starter Account: Floating spreads starting from 2.5 pips

- Business Account: Floating spreads starting from 1.5 pips

- Gold Account: Floating spreads starting from 1.1 pips

- VIP Account: Floating spreads starting from 0.7 pips

The spreads are floating (otherwise known as variable spreads) which means they will be constantly moving and when there is added volatility they will be seen hight. Different instruments will also have different starting spreads.

Minimum Deposit

The minimum amount required to open up an account is $100, this will get you the Starter account. We are not sure if this amount reduces for any further deposits into already open accounts.

Deposit Methods & Costs

The methods available are Credit/Debit Card, Bank Wire Transfer, and WebMoney. There is no mention of any fees but also no mention that there aren’t any, be sure to also check with your own bank to see if they add any fees of their own.

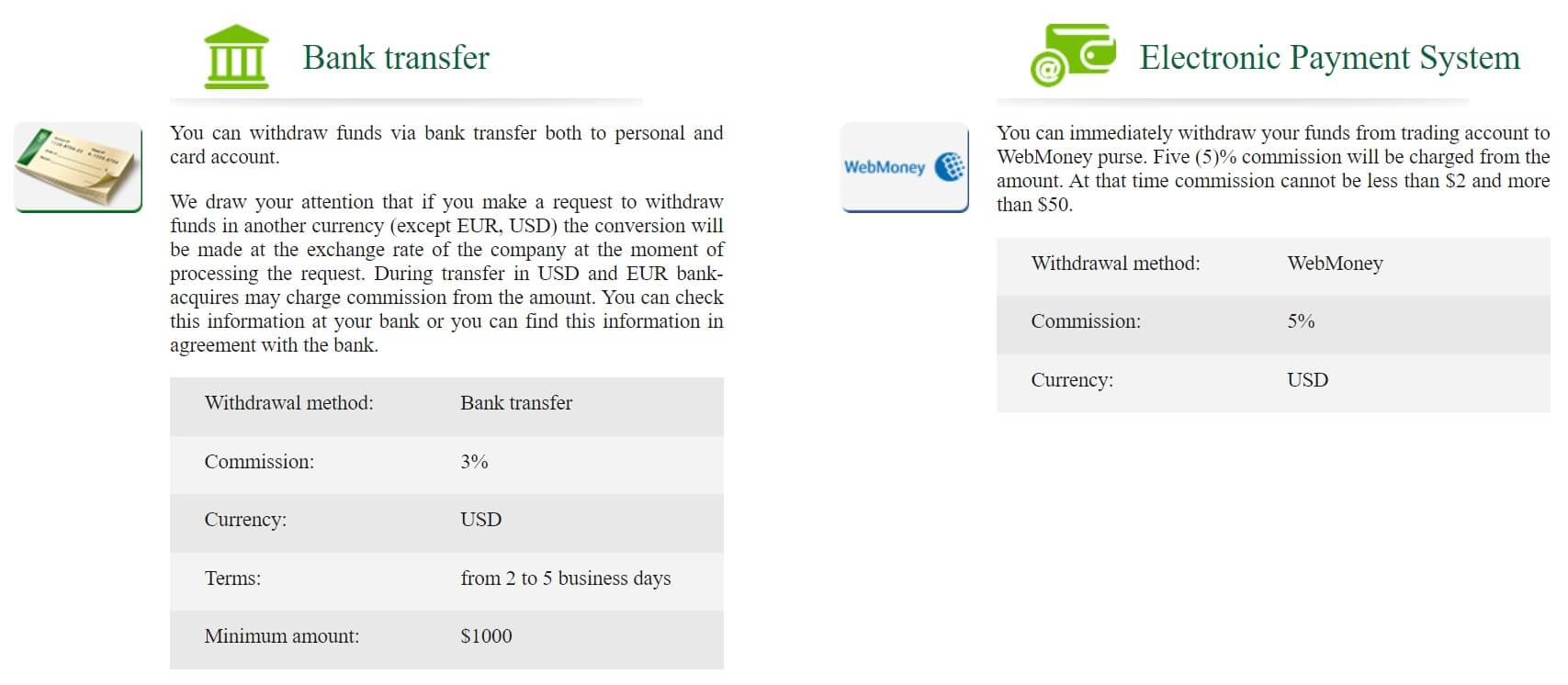

Withdrawal Methods & Costs

Only Bank Wire Transfer and WebMoney are available to withdraw with, we have outlined the features of the withdrawals below.

Bank Wire Transfer:

Added fees: 3%

Currency: USD

Minimum Withdrawal: $1,000

WebMoney:

Added fees: 5% (min $2, max $50)

Currency: USD

Withdrawal Processing & Wait Time

When using Bank Wire your request should be fully processed between 2 to 5 business days, there isn’t an estimate for WebMoney but we will suggest the same timeframe just to be safe.

Bonuses & Promotions

There are a lot of promotions taking place, we will very briefly look at them now. Register and you can get $20 credit added to your account. The Gold and VIP accounts receive interest on account balances, 12% for Gold account sand 17% for VIP accounts. The final bonus that will mention is a deposit bonus, you can receive a 20% bonus on your first deposit.

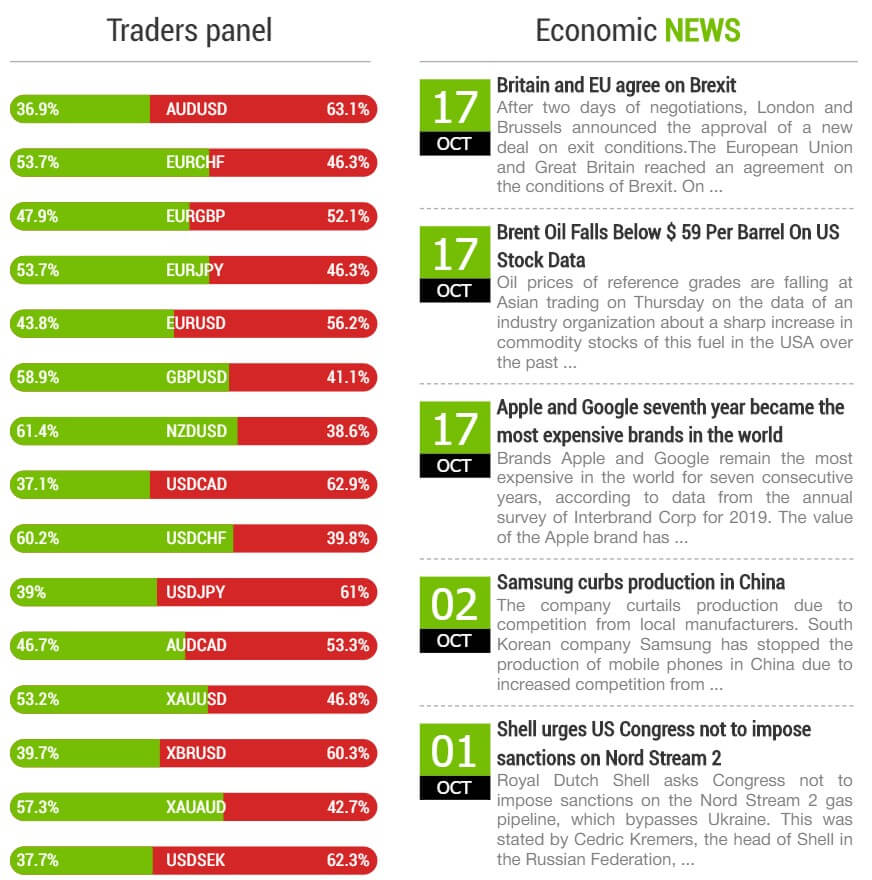

Educational & Trading Tools

There are a few little tools available. The first is an economic calendar detailing news events that are coming up and giving an indication of what markets they may affect. There is also a news section which is past news events and what happened. There is an analysis section but it has been updated since December 2019. There is also a section for beginner, going over the basics of trading and finally a literature section that has some ebooks on trading.

Customer Service

The customer service team can be contacted in a number of ways, you can use the callback feature, put in your name and number and they will give you a call. You can also use the available email addresses for departments such as technical support, finance, and marketing. There are also phone numbers for various locations such as Europe, Germany, Asia, Russia, Kazakstan, Ukraine, and China.

Support Email: [email protected]

Europe Phone: +44 20 35 19 29 69

Demo Account

Demo accounts allow you to test out the market and strategies without any added risk. You can sing up for a demo account by filling in a form, we, unfortunately, do not know what the trading conditions are or if there is an expiration time on the accounts.

Countries Accepted

This information is not present on the site, so if you are thinking of signing up, just contact the customer service team to check that you are eligible for an account prior to doing so.

Conclusion

The trading conditions offered by WIT Invest are average. The spreads on the Starter account are a little high but as the account goes up in tiers, the costs become a lot more manageable. There are plenty of assets available to trade so you should always be able to find something to trade. There is a limited way to get your money out of the broker and with each withdrawal is an added fee which when coupled with the cost of trading can make it quite an expensive broker. Whether it is too much for you is ultimately your decision.