Fidelis Capital Markets is a foreign exchange broker located in Saint Vincent and the Grenadines. Their main goals and aims focus on customer satisfaction, offering the best forex trading products as well as conditions within a flawless STP environment. Their core values are trust, reliability, and transparency. So in this review, we will be looking into the services being offered so you can decide if they live up to those goals and decide if they are the right broker for you.

Account Types

There are 6 different accounts on offer from Fidelis, each one requirement a different deposit amount and also offering different trading conditions, here is a brief overview.

Mini Account: The Mini account requires just $10 to open, it has leverage up to 1:400, and the trade sizes range from 0.01 lots up to 100 lots. The base currency must be in USD and it uses ECN/STP execution. There is no commission for forex or metals but there is a commission of $12.5 on CFDs (per side). The margin call is set at 100% and the stop out level set at 50%, this account can also be used as an Islamic account. It has access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as trading platforms. It also has access to 24/5 customer support, a personal account manager, free training, no requotes, credit card deposit/withdrawals, the client cabinet, free signals, news trading and is able to perform scalping and hedging.

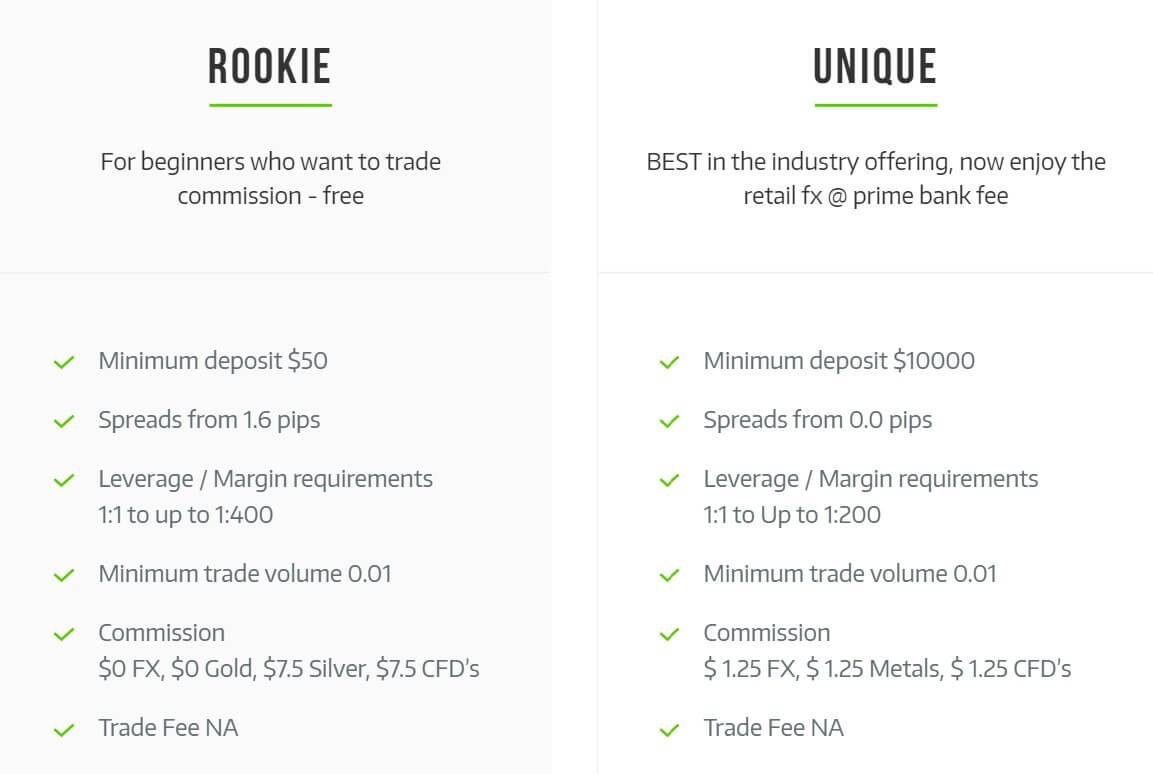

Rookie Account: The Rookie account increases the minimum deposit up to $50, the account can only be in USD. It comes with leverage up to 1:400 and also uses ECN / STP execution methods. The commission remains at 0 for forex and gold, however, silver has a commission of $7.5 and there is also a commission of $7.5 for CFDs. The margin call and stop out are set at 100% and 50% respectively and the account can also be used as an Islamic account. It can use both MT4 and MT5 as trading platforms. The account also has access to 24/5 customer support, a personal account manager, free training, no requotes, credit card deposit/withdrawals, the client cabinet, free signals, news trading and is able to perform scalping and hedging.

Prime Account: The Prime account increases the minimum deposit up to $100, leverage is maxed at 1:400, trade sizes range from 0.01 lots to 100 lots. Account must be in USD and it uses ECN/STP execution. There is now a commission of $3 for forex, $4.5 for metals and $4.5 for CFDs. Margin call and stop out levels remain at 100% and 50% and the account can be used as an Islamic account. It can use both MT4 and MT5 as trading platforms. It also has access to 24/5 customer support, a personal account manager, free training, no requotes, credit card deposit/withdrawals, the client cabinet, free signals, news trading and is able to perform scalping and hedging.

Elite Account: The minimum deposit jumps up to $5,000 with this account, maximum leverage remains at 1:400, trade sizes range from 0.01 lots to 100 lots. Account must be in USD and it uses ECN/STP execution. There is now a commission of $2.5 for forex, $4 for metals and $4 for CFDs. Margin call and stop out levels remain at 100% and 50% and the account can be used as an Islamic account. It can use both MT4 and MT5 as trading platforms. It also has access to 24/5 customer support, a personal account manager, free training, no requotes, credit card deposit/withdrawals, the client cabinet, free signals, news trading and is able to perform scalping and hedging.

Unique Account: The Unique account increases the minimum deposit up to $10,000, the account can only be in USD. It comes with leverage up to 1:200 and also uses ECN/STP execution methods. There is a commission of $1.25 per side for forex, metals and, CFDs. This account can only use MetaTrader 4 as its trading platform. It also has access to 24/5 customer support, a personal account manager, free training, no requotes, credit card deposit/withdrawals, the client cabinet, free signals, news trading and is able to perform scalping and hedging.

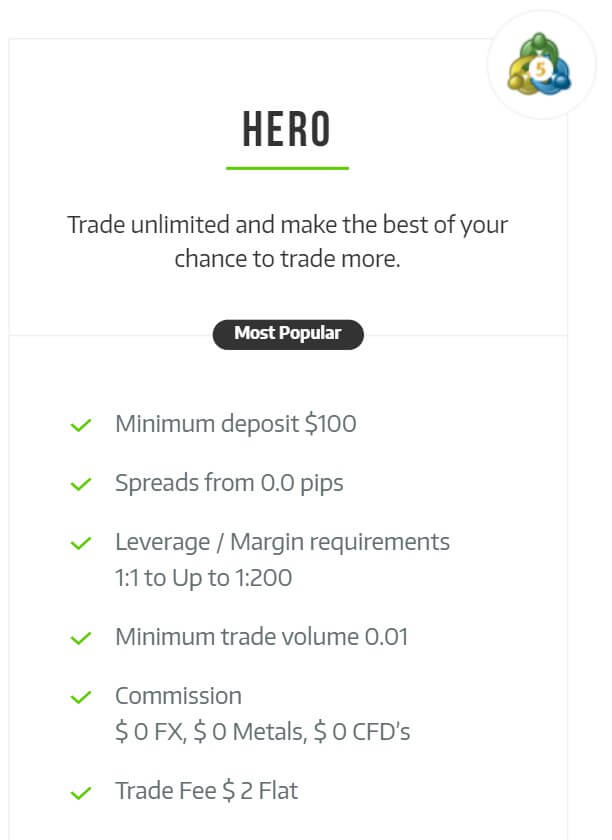

Hero Account: This account reduces the minimum deposit back down to $100. It has leverage up to 1:200 and trade sizes ranging from 0l01 lots up to 100 lots. It uses ECN/STP for execution and there is a fixed trading commission of $2 for each trade. The Margin call is set at 100% and stop out at 50%, Islamic accounts are also ok. This account can only use MetaTrader 5 as its trading platform. It also has access to 24/5 customer support, a personal account manager, free training, no requotes, credit card deposit/withdrawals, the client cabinet, free signals, news trading and is able to perform scalping and hedging.

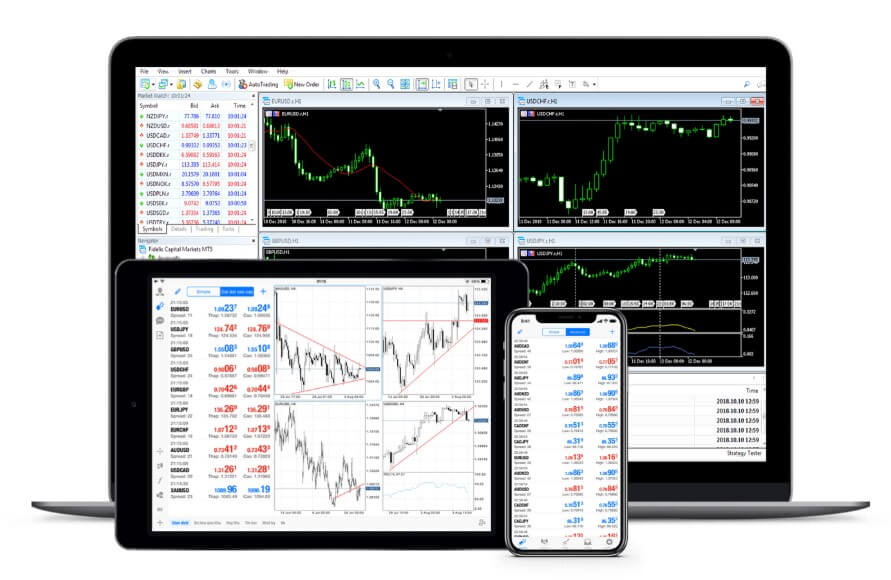

Platforms

There are two main platforms and then a social trading platform available. Let’s briefly look at the features.

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

MT5: MT5 is the newest MetaTrader platform version. It offers features such as allowing both hedging (by request) and Nettingm offering 38 technical indicators, 44 analytical objects, 21 timeframes, and an unlimited number of charts. It also provides Market depth and it also provides an economic calendar.

Social Trading: Social trading as about finding traders that suit your style and then copying their trades in the hope they are profitable. You are able to use both ZuluTrade and MyFXBook to do the copy trading. You will need to research different traders to find the right one for you, there is often a small commission on the trading or increased spreads as they platforms need to pay the trader commission on each trade.

Leverage

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

Trade Sizes

Trade sizes for all accounts start from 0.01 lots and go up in increments of 0.01 lots. The maximum trade size is 100 lots but we would not recommend trading over 50 lots in a single trade.

Trading Costs

The costs of trading can be a little confusing so we have outlined them below. Where we write “/ps” it means per side which means it is charged for opening and for closing, so a round lot will be double this amount.

Mini:

Forex – $0

Metals – $0

CFDs – $12.5 /ps

Rookie:

Forex – $0

Gold – $0

Silver – $7.5 /ps

CFDs – $7.5 /ps

Prime:

Forex – $3 /ps

Metals – $4.5 /ps

CFDs – $4.5 /ps

Elite:

Forex – $2.5 /ps

Metals – $4 /ps

CFDs – $4 /ps

Unique:

Forex – $1.25 /ps

Metals – $1.25 /ps

CFDs – $1.25 /ps

Hero:

$2 fixed fee

There are also swap charges which are charges for holding trades overnight, these can be viewed from within the trading platform of your choice.

Assets

Assets have been broken down into four different categories, we will outline the instruments within each.

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Precious Metals: The only available metals are Gold and Silver.

CFDs: The CFDs include indices, commodities, and shares, some examples are STSE 100, Nasdaq, US Oil, UK Oil, and Natural Gas.

Crypto: A few different coins, some tradable just against USD while some are also tradable against EUR. Bitcoin, Ethereum, Litecoin, Ethereum Classic, Monero, Ripple, ZCash and, Bitcoin Cash.

Spreads

This seems to be where the information stops. Unfortunately, there are no examples of spreads mentioned on the site. The only information is that they are variable which means they will move wit the markets and will be higher during periods of volatility.

Minimum Deposit

The minimum deposit required to open up an account is $10 which will get you the Mini account. Once an account is open the minimum deposit drops down to $5.

Deposit Methods & Costs

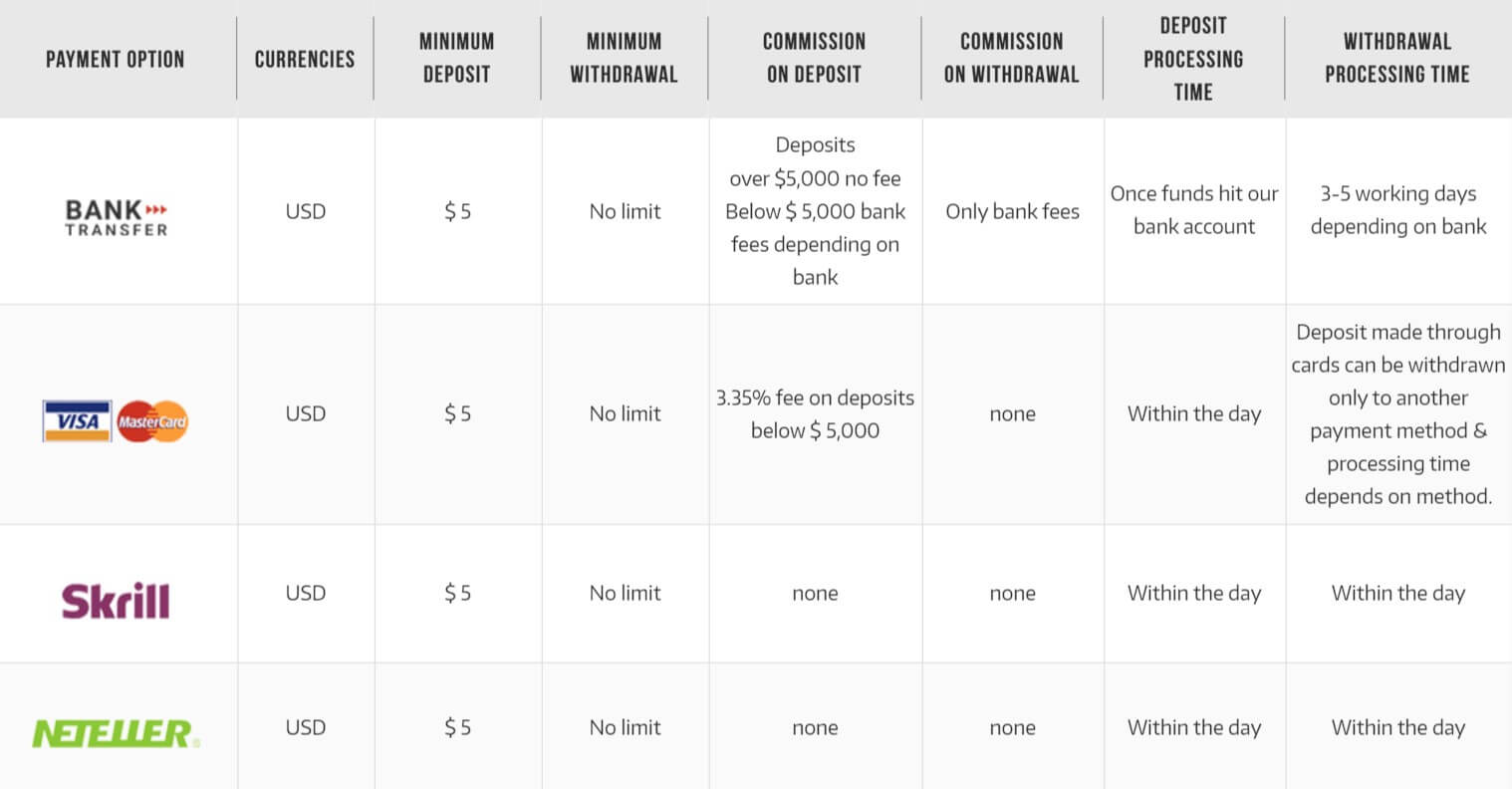

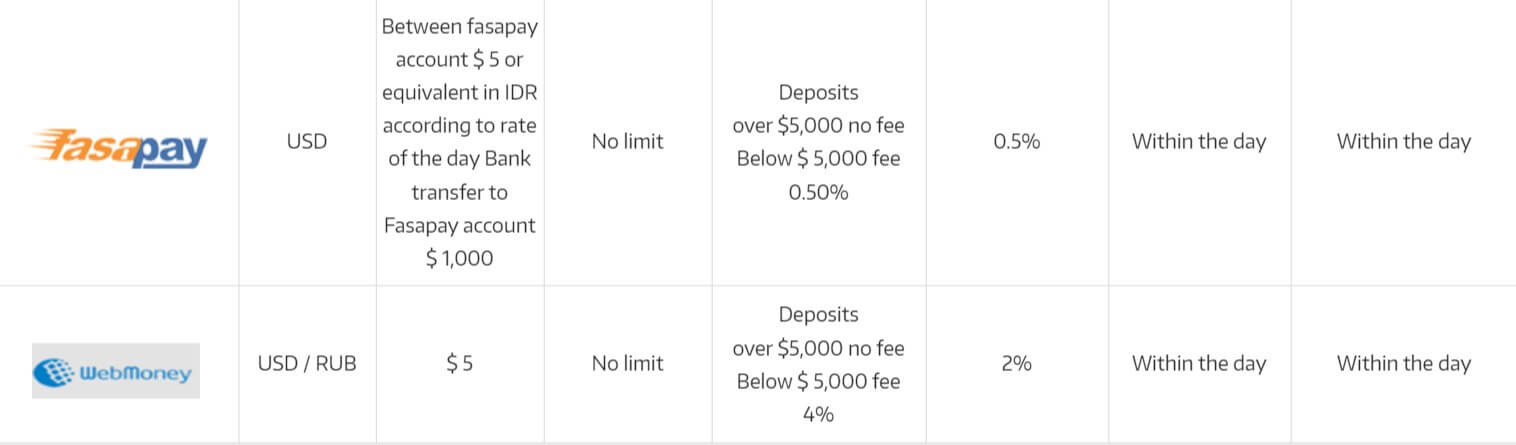

There are a few different ways to deposit, each having its own potential fees, so we have outlined them below.

- Bank Wire Transfer – Deposits over $5,000 no fee, below $ 5,000 bank fees

- Visa/MasterCard – 3.35% fee on deposits below $ 5,000

- Skrill – No fee

- Neteller – No fee

- Fasapay – Deposits over $5,000 no fee, below $ 5,000 fee 0.50%

- WebMoney – Deposits over $5,000 no fee, below $ 5,000 fee 4%

Withdrawal Methods & Costs

Withdrawal Methods & Costs

When withdrawing the same methods are available, they also have their own fees.

- Bank Wire Transfer – Only bank fees

- Visa/MasterCard – No fee

- Skrill – No fee

- Neteller – No fee

- Fasapay – 0.5% fee

- WebMoney – 2% fee

Withdrawal Processing & Wait Time

Withdrawal times depend on the method you are using. We have outlined them for you below.

- Bank Wire Transfer – 3-5 working days depending on bank

- Visa/MasterCard – Must be withdrawn to another method

- Skrill – Within the day

- Neteller – Within the day

- Fasapay – Within the day

- WebMoney – Within the day

Bonuses & Promotions

There are a few different aspects to the promotions but the only real promotion is around trade insurance. However, the terms of the promotion are not really known so it is hard for us to truly comment on it.

Educational & Trading Tools

There are a few small tools available the first is an economic calendar that will outline any upcoming news events along with which currencies the events may affect. The second tool is something called trading central analysis, this outlines some analysis of the markets. There is also an indicator for MetaTrader 4 that can be downloaded surrounding this analysis.

Customer Service

Customer services can be contacted in a number of different ways and are open 24/5. There is an online form to fill out in order to request a callback, so fill it in and someone should give you a call.

There is also a physical address along with three different phone numbers and email addresses.

Address: Suite 305, Griffith Corporate Centre, Beachmont, P.O.Box 1510, Kingstown Saint Vincent and the Grenadines

Phone: +65 31635717

Malaysia: +60 392121910

Singapore: +65 31635717

Customer Service: [email protected]

Accounting: [email protected]

Documentation: [email protected]

Demo Account

Demo accounts are available but unfortunately, there is no information surrounding them such as trading conditions or possible expiration times. Demo accounts are good because they allow new traders to test out the servers and trading conditions while allowing experienced and existing clients a chance to test out new strategies without risking their own capital.

Countries Accepted

The following statement is on the website: “Fidelis Capital Markets does not offer its services to residents of certain jurisdictions such as the USA, and British Columbia.” If you are unsure of your eligibility, then be sure to get in touch with the customer service team to find out.

Conclusion

Fidelis claim to be offering competitive trading conditions. However, we find it hard to confirm this. The commissions being charged can be extortionate, especially on the lower tier accounts, and it doesn’t help that there aren’t any spreads displayed on the site to see how they compare to the competition. There are enough ways to deposit and withdraw, some with fees and some without. In terms of assets, there are lots of forex pairs, but a lack of anything else (apart from crypto coins). Leverage is good at 1:400 offering a good profit potential. While Fidelis may be competent, the missing information can make it hard to recommend this Forex broker at this point in time.