BCR is a forex broker based in the British Virgin Islands that aims to bring a new level of trading to the industry. Offering segregated bank accounts, 80+ tradable assets, 24/5 customer support, comprehensive educational tools, and an ideal trading environment, BCR is set to appeal to a large variety of FX traders. We will be looking into the services being offered to see if these are what they say they are, and also to help you decide if this is the right broker for you.

Account Types

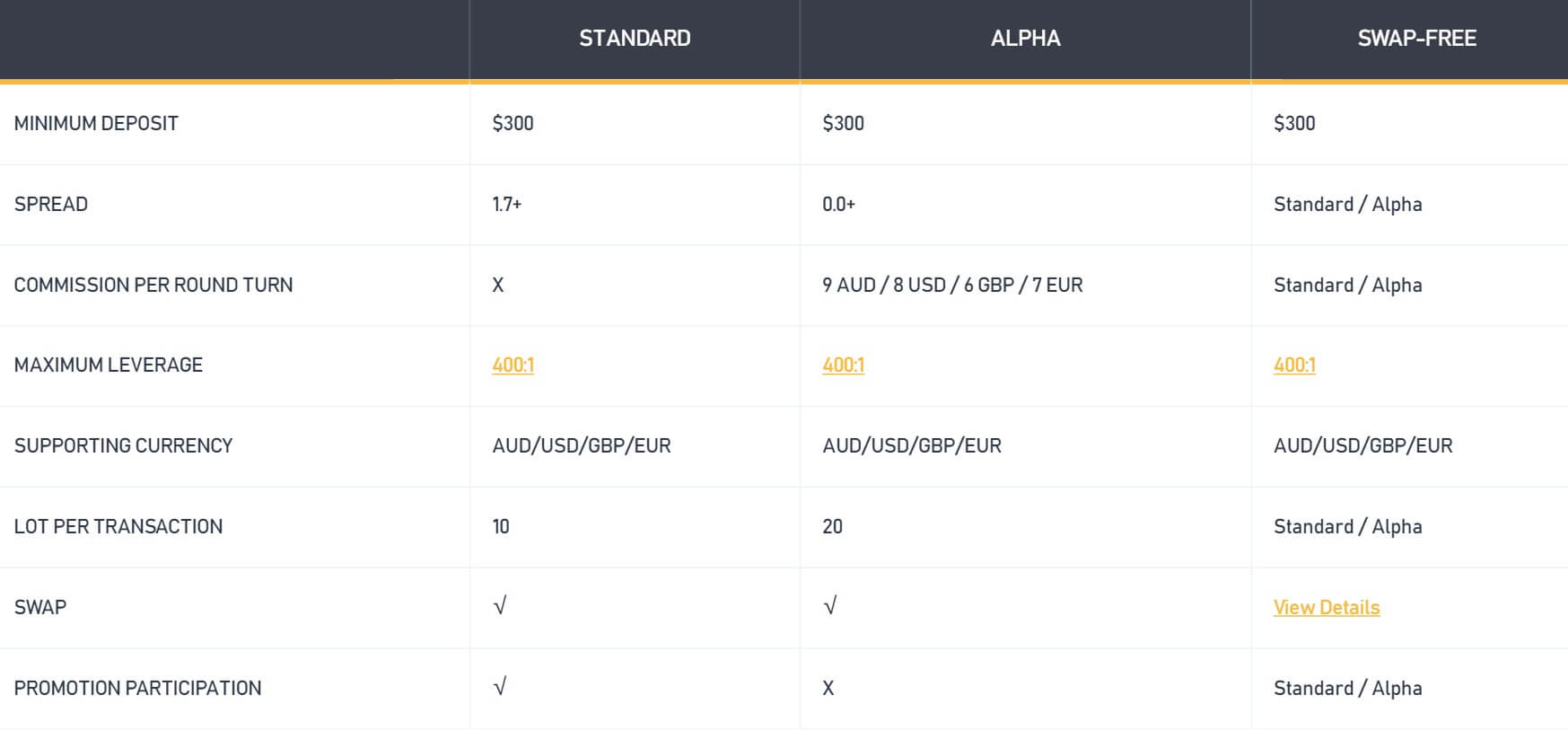

There are two main account types available and then an additional swap-free account, let’s have a look at what they offer.

Standard Account:

This account has a minimum deposit requirement of $300, it comes with a spread starting from 1.7 pips and does not have any added commissions. The maximum leverage goes as high as 1:400 and the base currency can be in AUD, USD, GBP or EUR. It states lot per transaction which we assume means the maximum lot size which is 10 lots. There are swap charges on the account and the account is also eligible for promotions.

Alpha Account:

This account has a minimum deposit requirement of $300, it comes with a spread starting from 0 pips and so have an added commission of 9 AUD / 8 USD / 6 GBP / 7 EUR per lot traded. The maximum leverage goes as high as 1:400 and the base currency can be in AUD, USD, GBP or EUR. It states lot per transaction which we assume means the maximum lot size which is 20 lots. There are swap charges on the account and the account is not able to take part in promotions.

Swap-Free Account:

This account can use the same features as either of the other accounts with the main difference being that there are no swap charges, instead, there is an administration fee added to the account.

Platforms

Just the one platform which is MetaTrader 4. MT4 combines advanced features with an intuitive interface that allows you to set up your personal computer as a personalized trading station. MetaTrader 4 (MT4), which was developed by MetaQuotes, is one of the most popular and awarded trading platforms worldwide, and is utilized by over 300 brokerage companies and banks worldwide for their core trading services and operations. The platform also allows for the trading of CFDs across a range of popular instruments such as Forex, metals, commodities, indices, etc.

Leverage

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

Maximum Leverage Available:

- 100,000 or above 1:100

- 200,000 or above 1:50

- 300,000 or above 1:25

- 500,000 or above 1:20

- 1,000,000 or above 1:10

Trade Sizes

We are a little confused over the trade sizes, as the account page states that the lot per transaction is 10 or 20 depending on the account. We do not know what this actually means and assume it is the maximum with the minimum being 0.01 lots. The maximum number of open trades you can have open or pending is 200.

Trading Costs

The Alpha account has an added commission on its trading which is 9 AUD/8 USD/6 GBP/7 EUR. This is slightly over the industry average of $6 per lot traded but not by too much. The Standard account uses a spread based system and so there are no added commissions. The Standard and Alpha accounts both have swap charges for holding trades overnight, while the Swap-Free account doesn’t but does have an administration charge of $10 if trades are held over the weekend.

Assets

The asset have been broken down into a number of different categories below. We will outline them along with the instruments within them for you.

Forex: AUDCAD, AUDJPY, AUDUSD, AUDCHF, AUDNZD, CADJPY, CADSHF, CHFJPY, EURCAD, EURAUD, EURCHF, EURGBP, EURJPY, EURUSD, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPNZD, GBPJPY, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY, USDCNH, USDMXN, USDNOK, USDSEK, USDTRY, USDZAR, EURNOK, EURSEK, EURTRY.

Metals: XAUUSD, XAGUSD, CPDUSD, XPTUSD.

Commodities: XBRUSD, XTIUSD, XNGUSD.

Indices: US500, US100, US30, JPON225, AUD200, GER30, EUSTX50, FRA40, ESP35, UK100, CNH50, HKG50.

Cryptocurrencies: Bitcoin and Etherum.

Shares: Plenty of shares are available including Apple, Facebook, Netflix, Tesla, Microsoft and MacDonald’s.

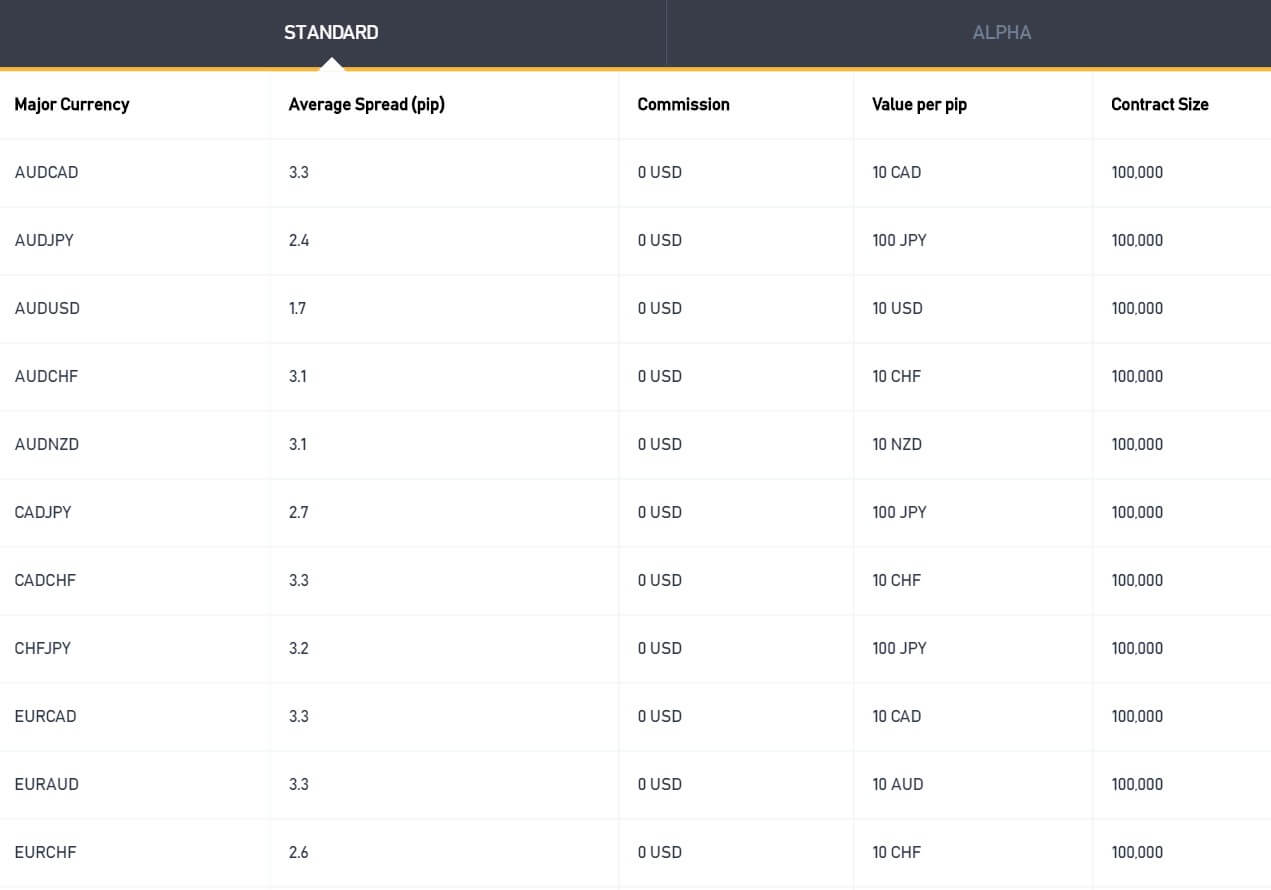

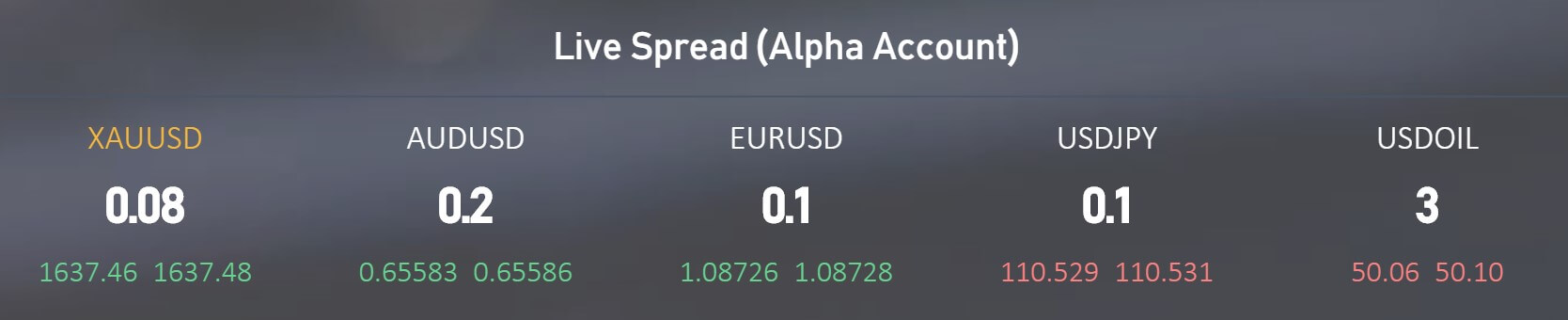

Spreads

The Standard account uses a spread based system and so the spreads are seen a little higher than the Alpha account. They seem to start around 1.6 pips while the Alpha account can have spreads starting as low as 0 pips. The spreads are variable on both accounts so they will constantly be moving and different instruments also have different starting spreads, so while EURUSD may start at 1.6 pips. Another asset such as AUDJPY is starting higher at 2.4 pips.

Minimum Deposit

Minimum Deposit

The minimum deposit required to pen up an account is $300. This will get you access to any of the three available accounts. We do not know if this amount is reduced for any further top-up deposits.

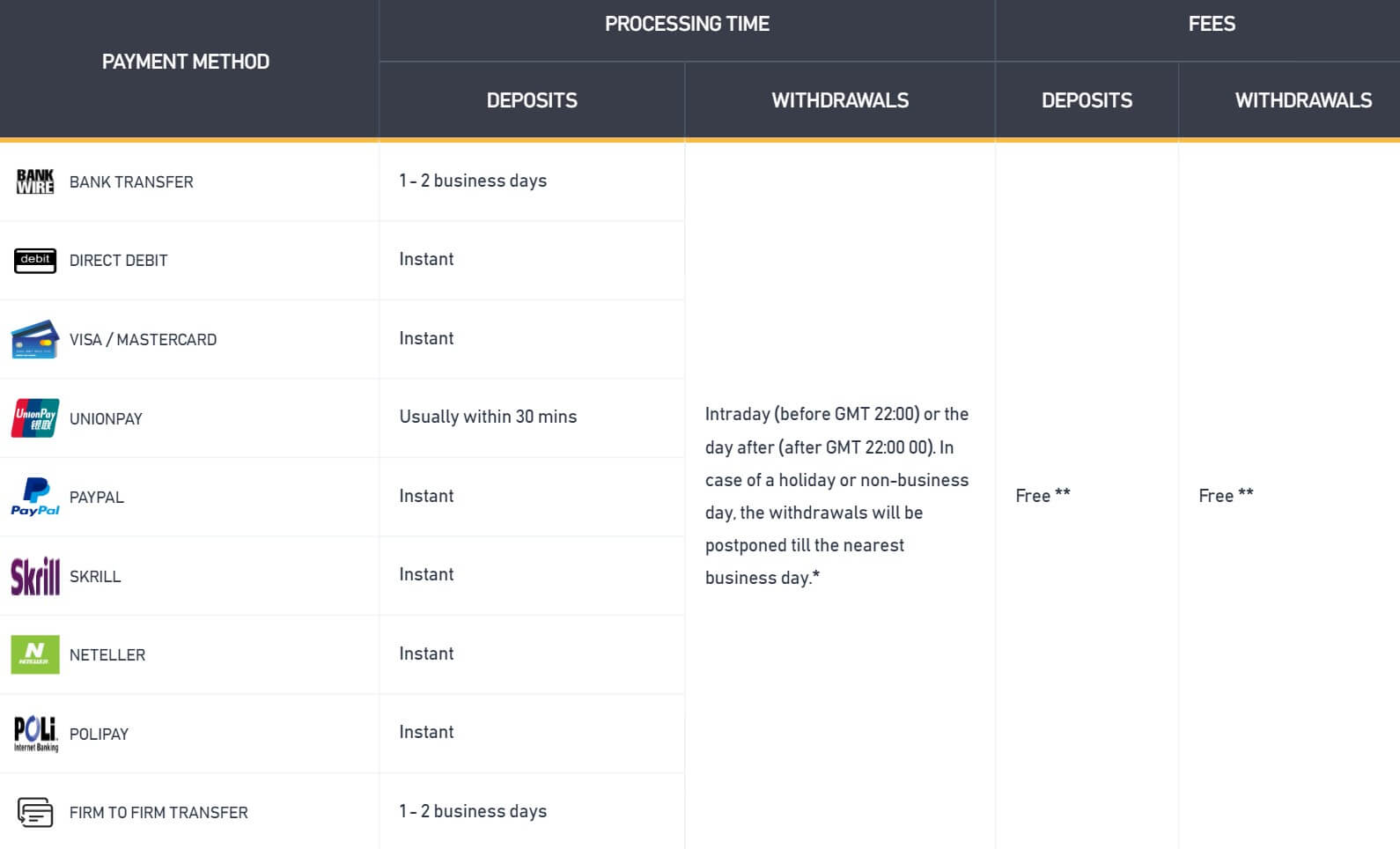

Deposit Methods & Costs

The currently available methods for depositing are Bank Transfer, Direct Debit, Visa/MasterCard, UnionPay, PayPal, Skrill, Neteller, POLi and Broker to Broker. There are no added fees for any deposits, however, you should check with your own bank or processor to see if they will add any fees of their own.

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification these are Bank Transfer, Direct Debit, Visa/MasterCard, UnionPay, PayPal, Skrill, Neteller, POLi and Broker to Broker. There are no added fees for any withdrawals, however, you should check with your own bank or processor to see if they will add any fees of their own.

Withdrawal Processing & Wait Time

The withdrawal times give are as follows “Intraday (before GMT 22:00) or the day after (after GMT 22:00 00). In case of a holiday or non-business day, the withdrawals will be postponed until the nearest business day.” It will then take between 1 to 5 days for the bank or processor to fully process your withdrawal based on the method used.

Bonuses & Promotions

At the time of writing this review, there was a 10% bonus taking place. The promotion is simple, simply deposit over $2,000 and you will receive a bonus of 10%. In order to withdraw the bonus, you must trade the number of lots which is equal to the bonus x 20%. So, on a bonus of $200, you will need to trade 40 lots in order to withdraw it.

Educational & Trading Tools

There are a few different tools available, with the first being called Market Live, which simply posts current news from the markets. There is also a market insight which is a little bit of analysis and opinions on where the markets could go. There is also a glossary of trading-related terms to check if you come across something you do not understand and an events notice board of different market holidays and events. The education section is simple, offering some pages about different topics of trading. This is good if you are a beginner, but if you have traded before then it won’t be anything new to you.

Customer Service

You can contact BCR using the provided web form, simply fill it in and get a reply via email. You can also use the live chat feature, the postal address, a variety of phone numbers, and email addresses to reach the department you need.

Address: BCR Co Pty Ltd, Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands

Phone: +44 3300010590

Email: [email protected]

Demo Account

Demo accounts allow you to test out new strategies or training without any real risk, so it is good that BCR is offering them. You can use a demo account that mimics the Standard account or the Alpha account and so the trading conditions will match them. We do not know if there is an expiration on the demo account.

Countries Accepted

The following information is available on the site: “BCR BVI will not open accounts or provide CFD services in the below-listed jurisdictions: The Central African Republic, Democratic Republic of Congo, Guinea-Bissau, Iraq, Lebanon, Mali, Somalia, South Sudan, Sudan, Yemen, North Korea, Iran, Libya, The Former Federal Republic of Yugoslavia, Myanmar, Russia/Ukraine, Syria, and Zimbabwe. Products and Services offered on this website are not intended for residents of the United States.”

Conclusion

The two different accounts offer you two very different trading experiences. One commission-based and the other spread-based. The pricing on both seems reasonable and neither is massively overpriced. There are also loads of assets available to trade which is great tot see. In terms of deposit and withdrawals, there are enough methods to cater for most and there are no added fees which are other positives. The platform offered and service provided by BCR looks very promising on paper, but the decision to use them is ultimately up to you.