Introduction

Litecoin is an early Bitcoin spinoff as it was started in October 2011. It was created by Charlie Lee, who was a Google employee and a former director at Coinbase. Litecoin is a peer to peer cryptocurrency released via an open-source client through Github under the MIT/X11 license. It is one of the most commonly traded coins in the world of cryptocurrency and has a market value of billions. Forked initially from Bitcoin protocol, Litecoin takes the underlying source code from Bitcoin and making specific changes to increase the transaction speed of the network.

Objective

Litecoin is famously called silver to the bitcoin’s gold, i.e., in the world of cryptocurrency; if bitcoin is gold, then Litecoin is like silver. Mainly Litecoin was developed to overcome the shortcomings of Bitcoin. When it comes to the block time (the time taken to generate a block), Litecoin takes 2.5 mins to create a block while bitcoin takes 10 mins for the same. Hence, the Litecoin network is four times faster than the Bitcoin network.

Consensus Used

Litecoin uses a proof of work algorithm called Scrypt. Unlike Bitcoin’s Proof of work algorithm (SHA 256), Scrypt is more efficient as it prevents customization for hardware solutions and favors high-speed random-access memory. Hence miners find it easy to mine without much complexity as this algorithm allows them to use central processing units or graphics processing units.

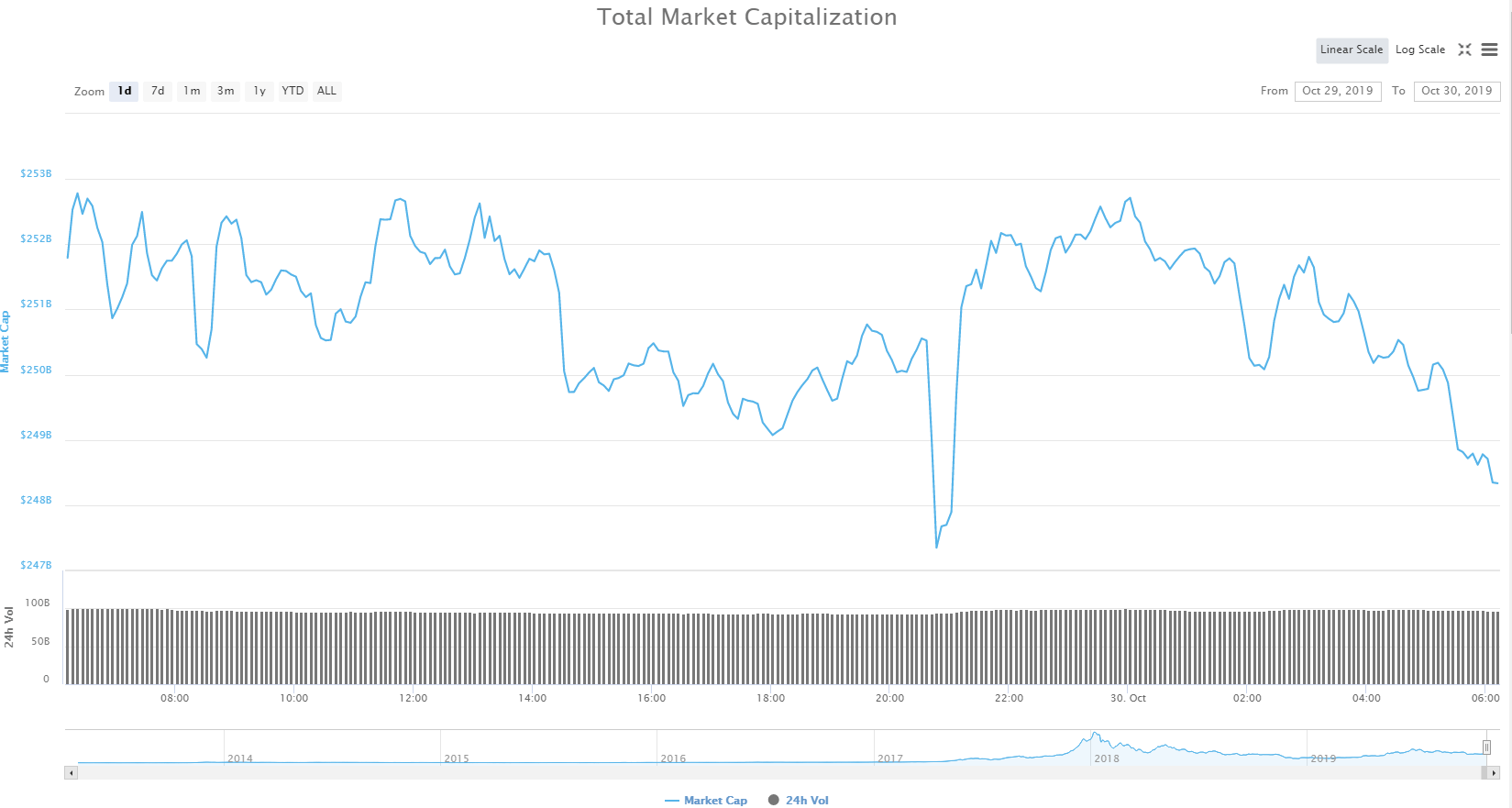

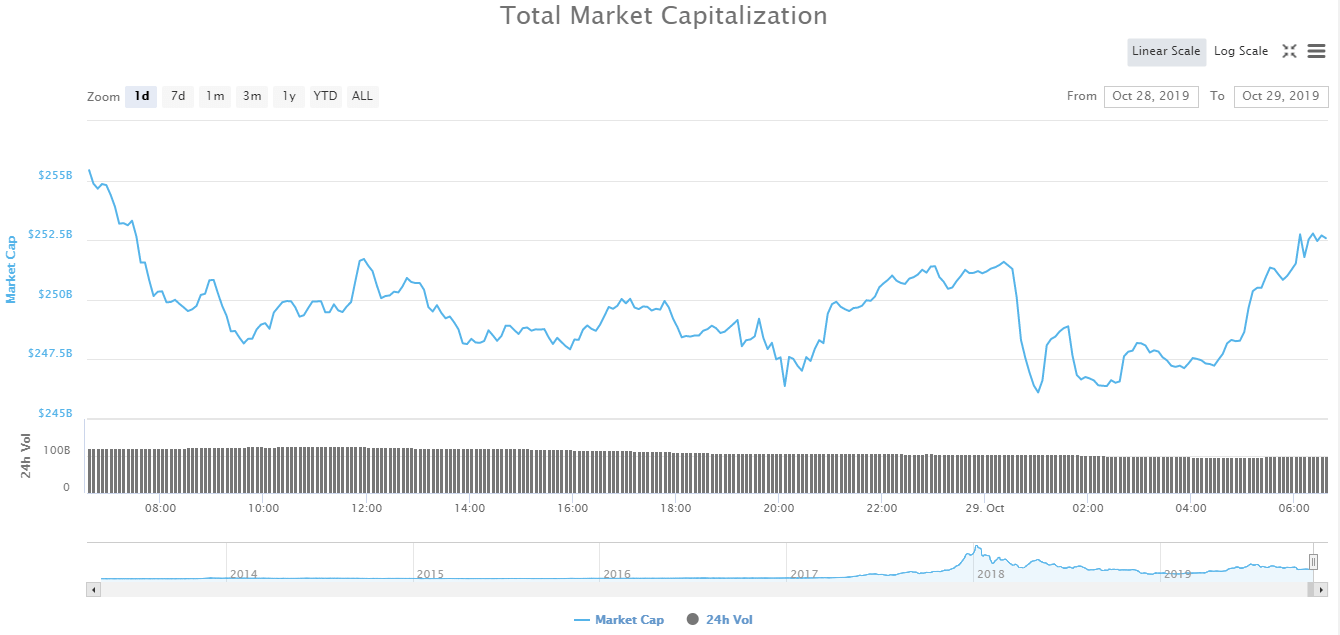

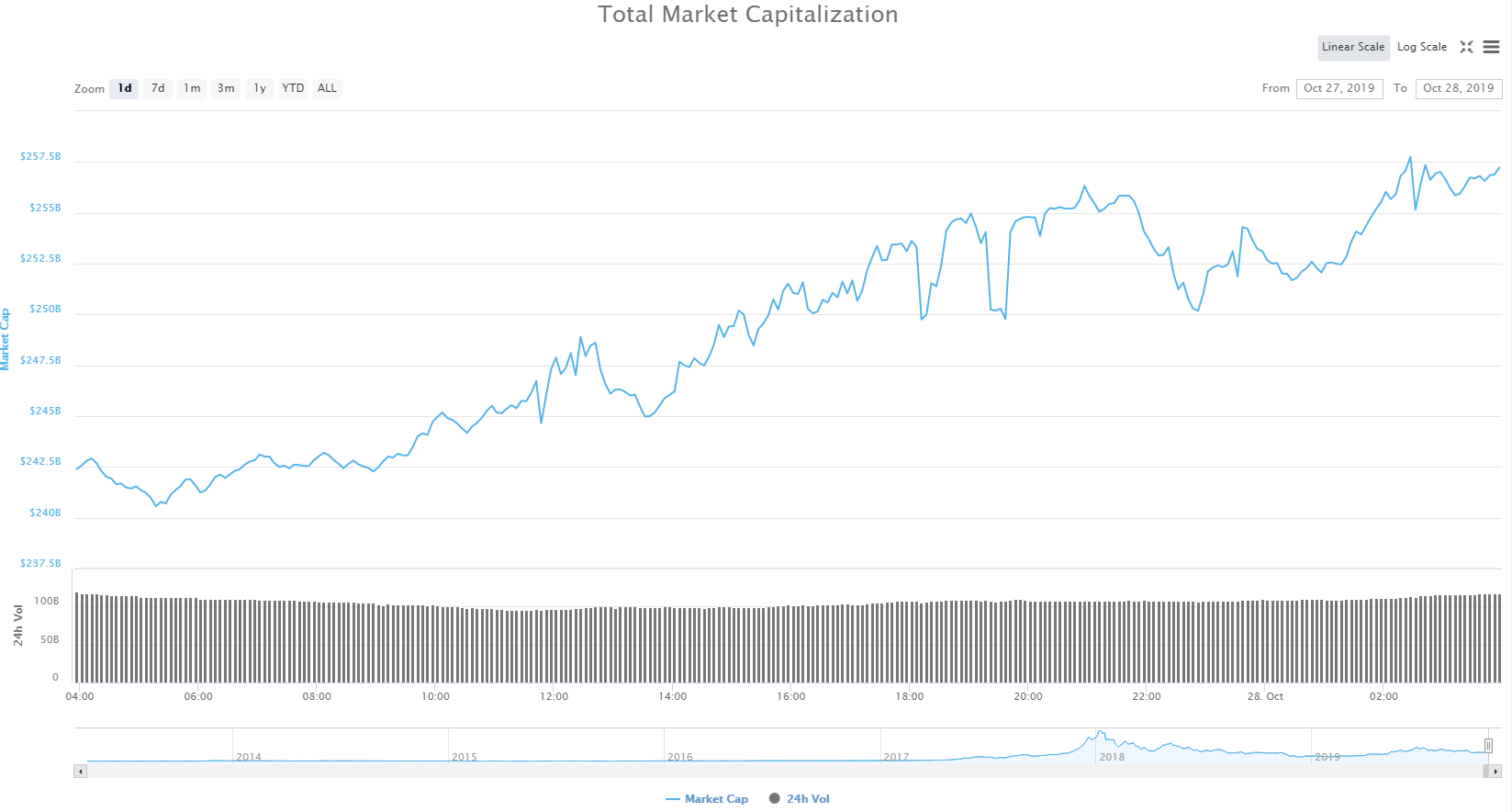

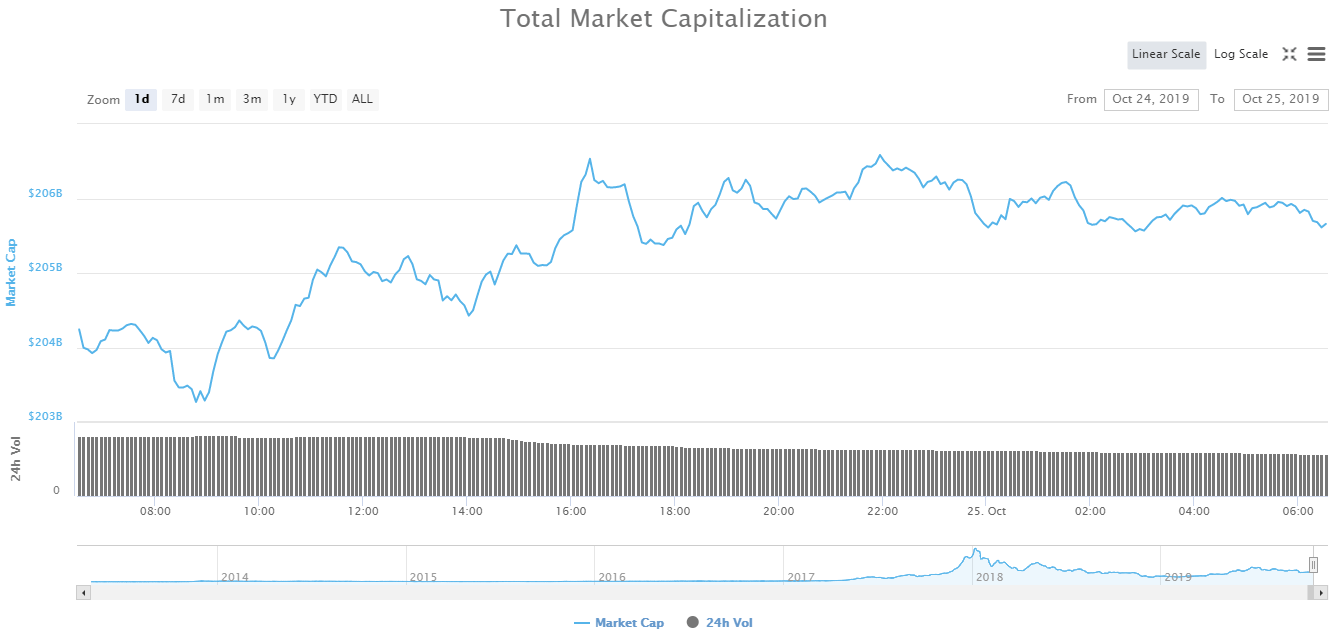

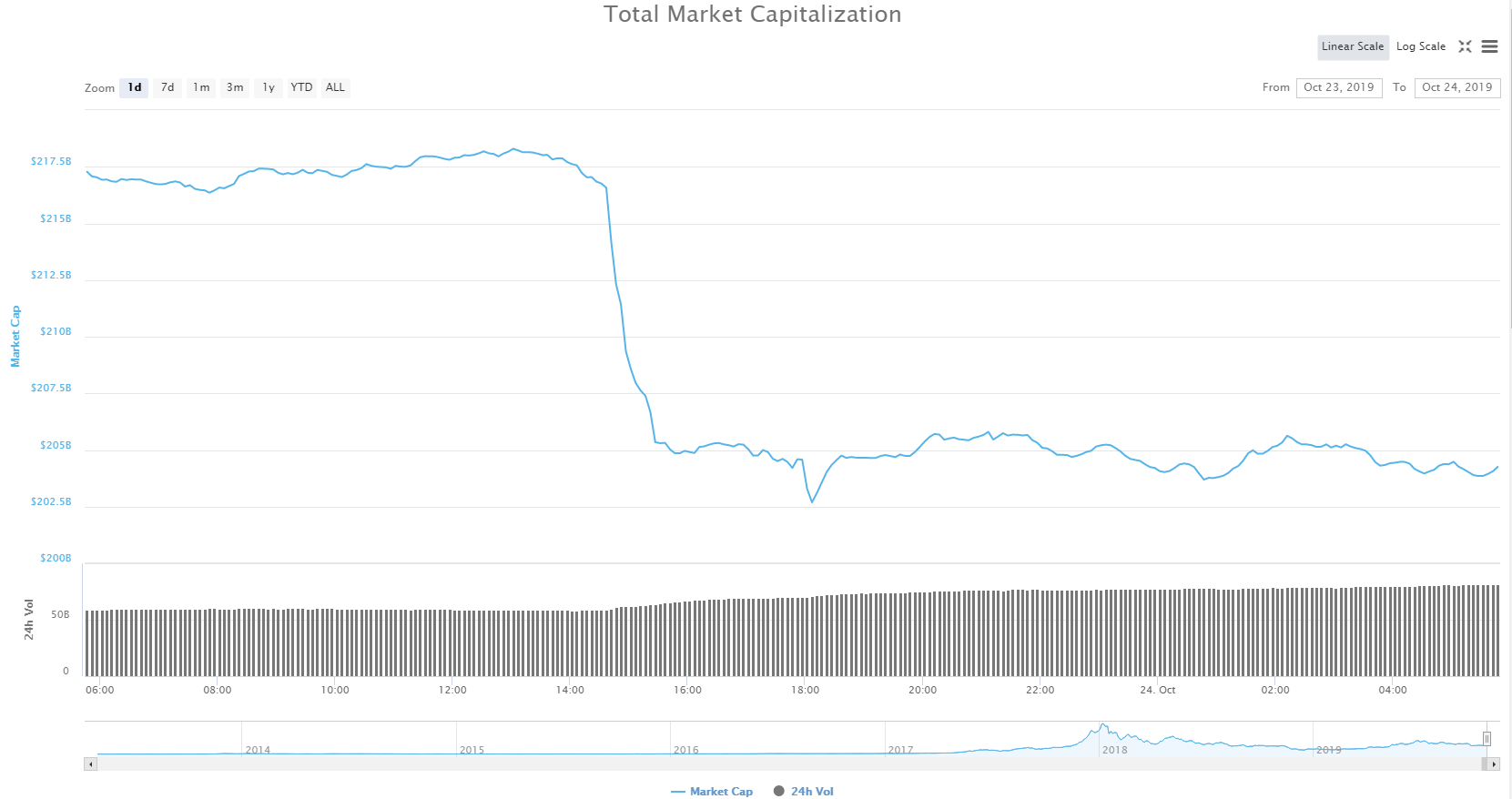

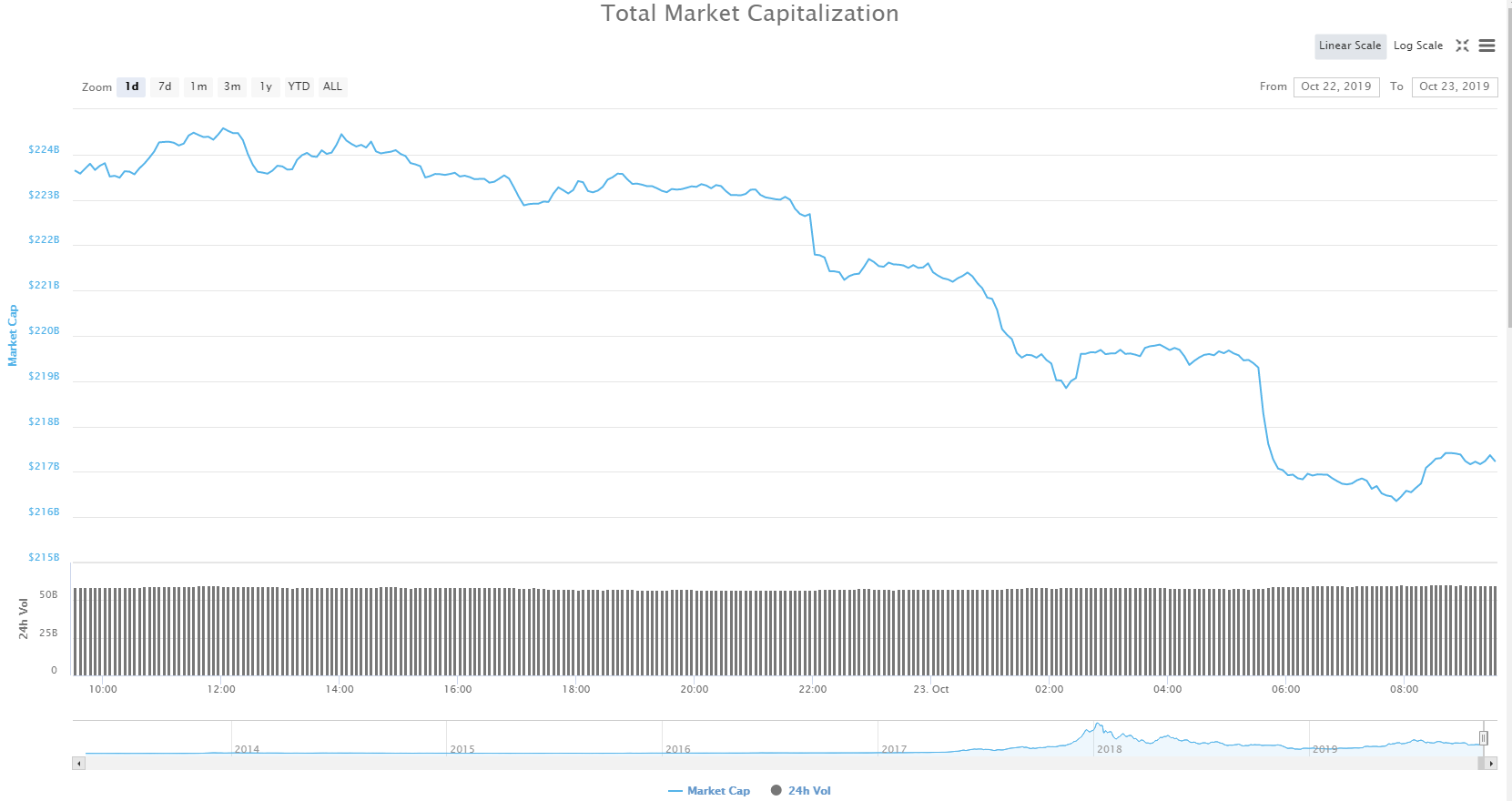

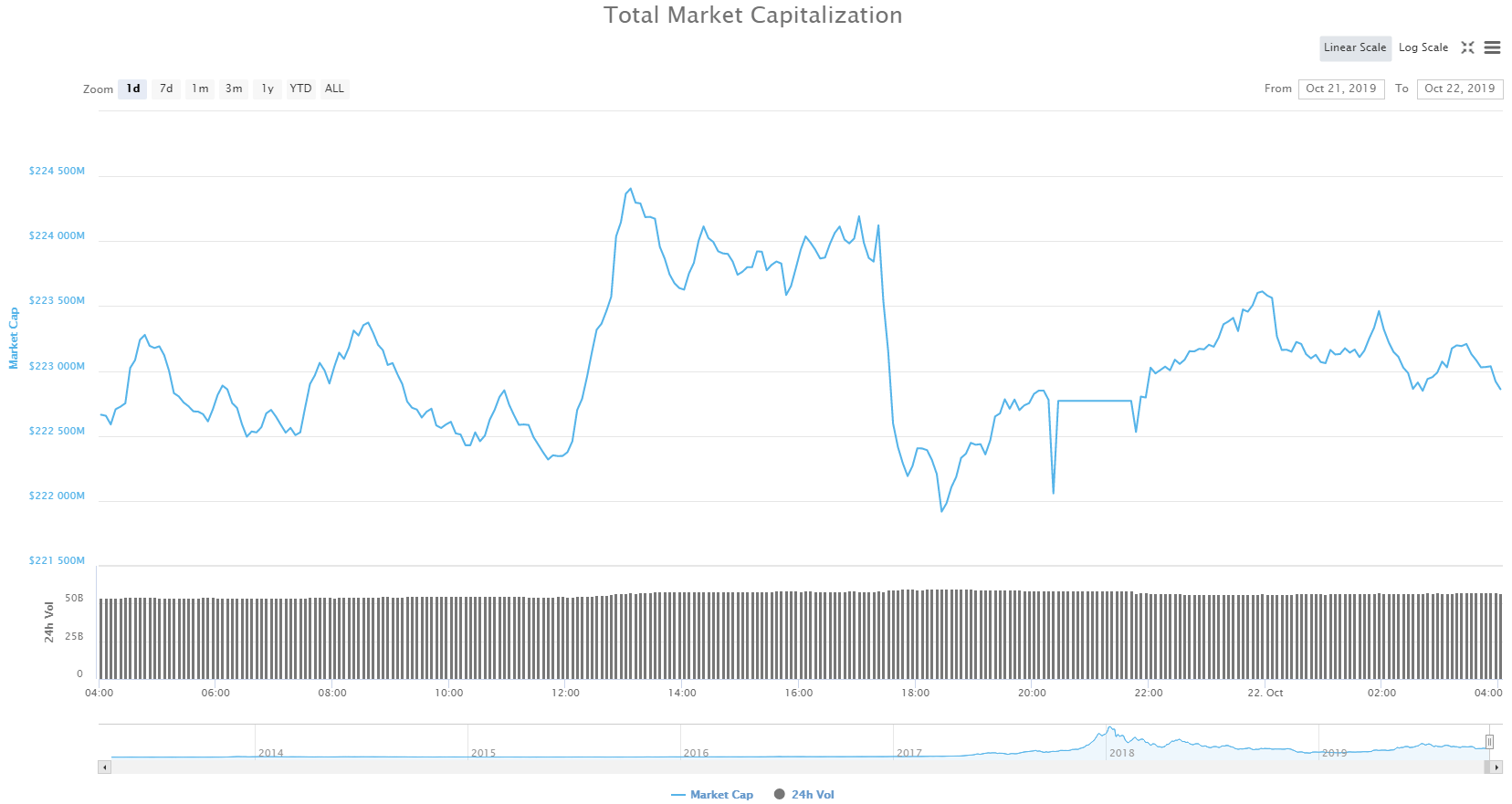

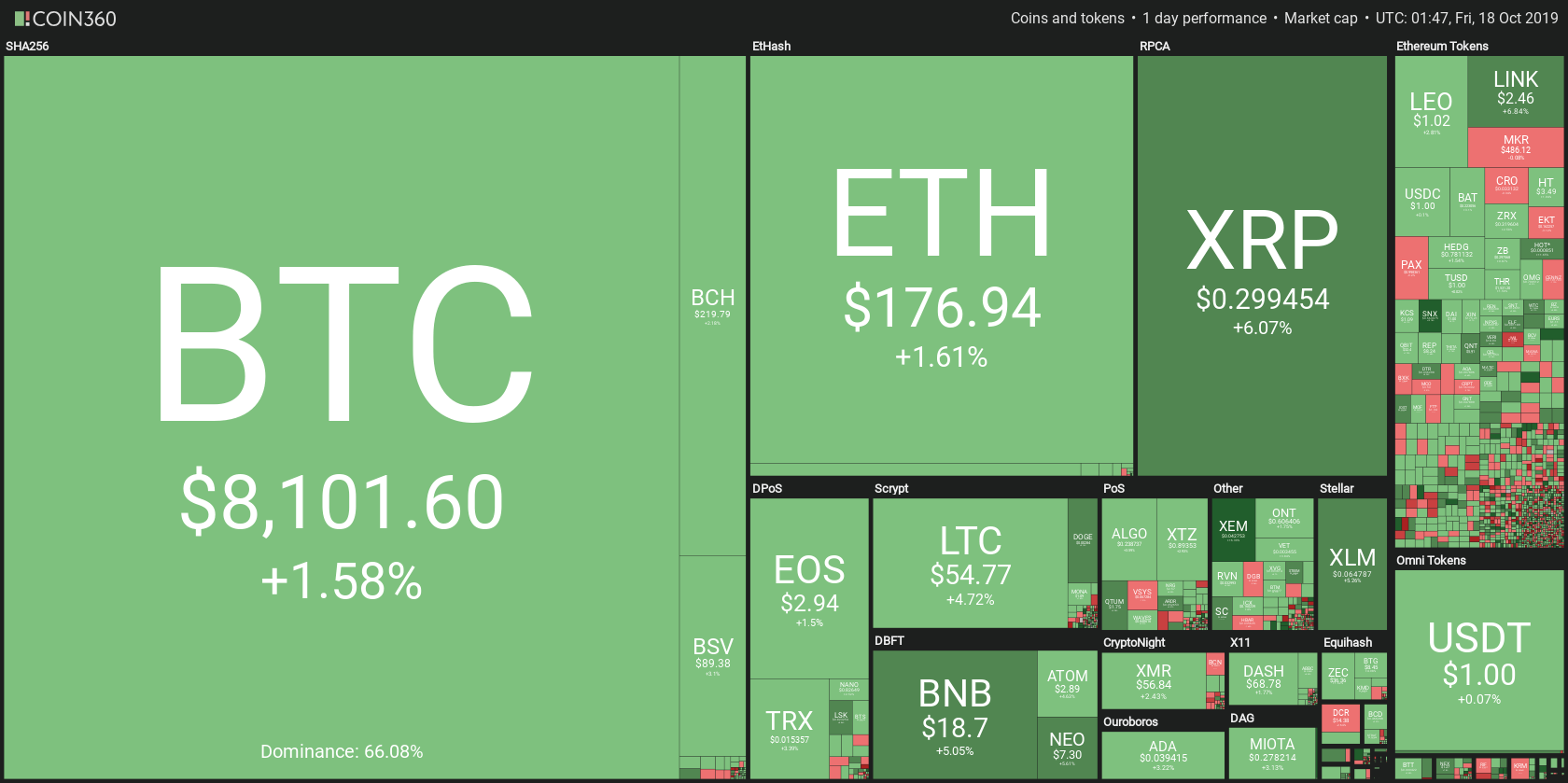

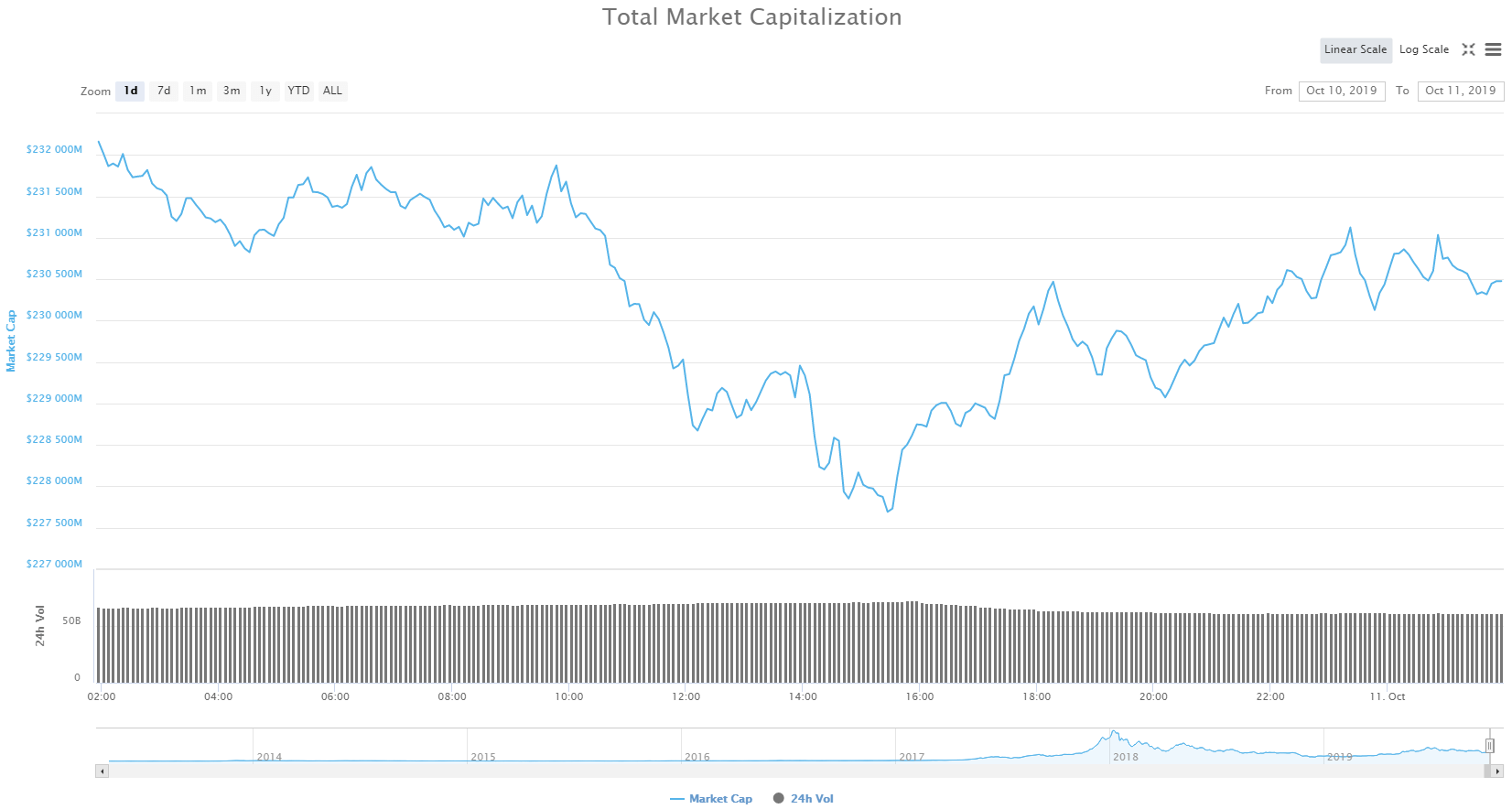

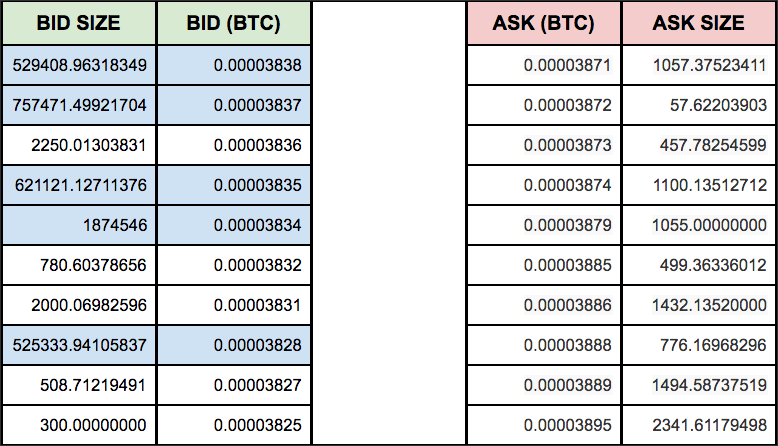

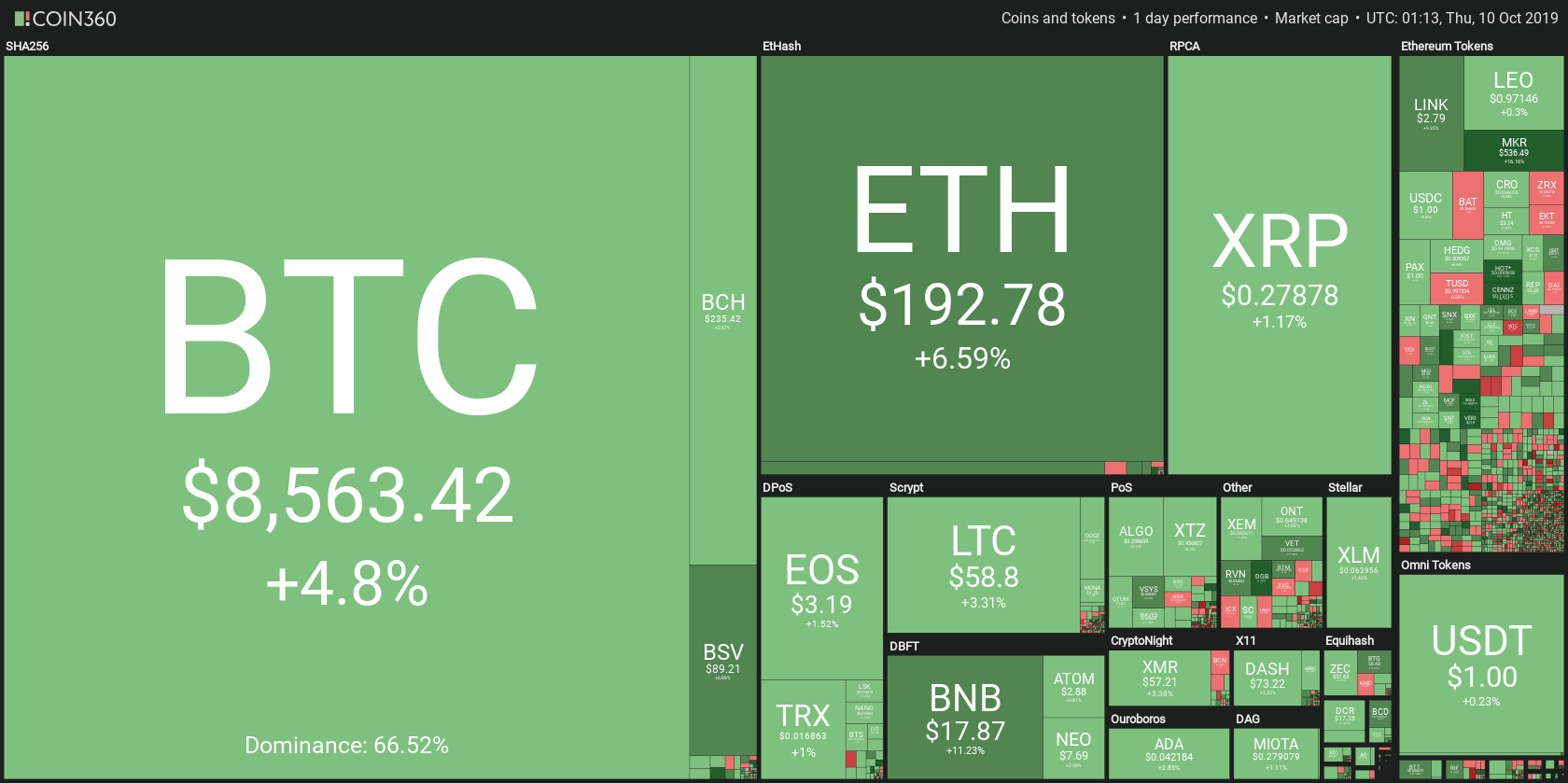

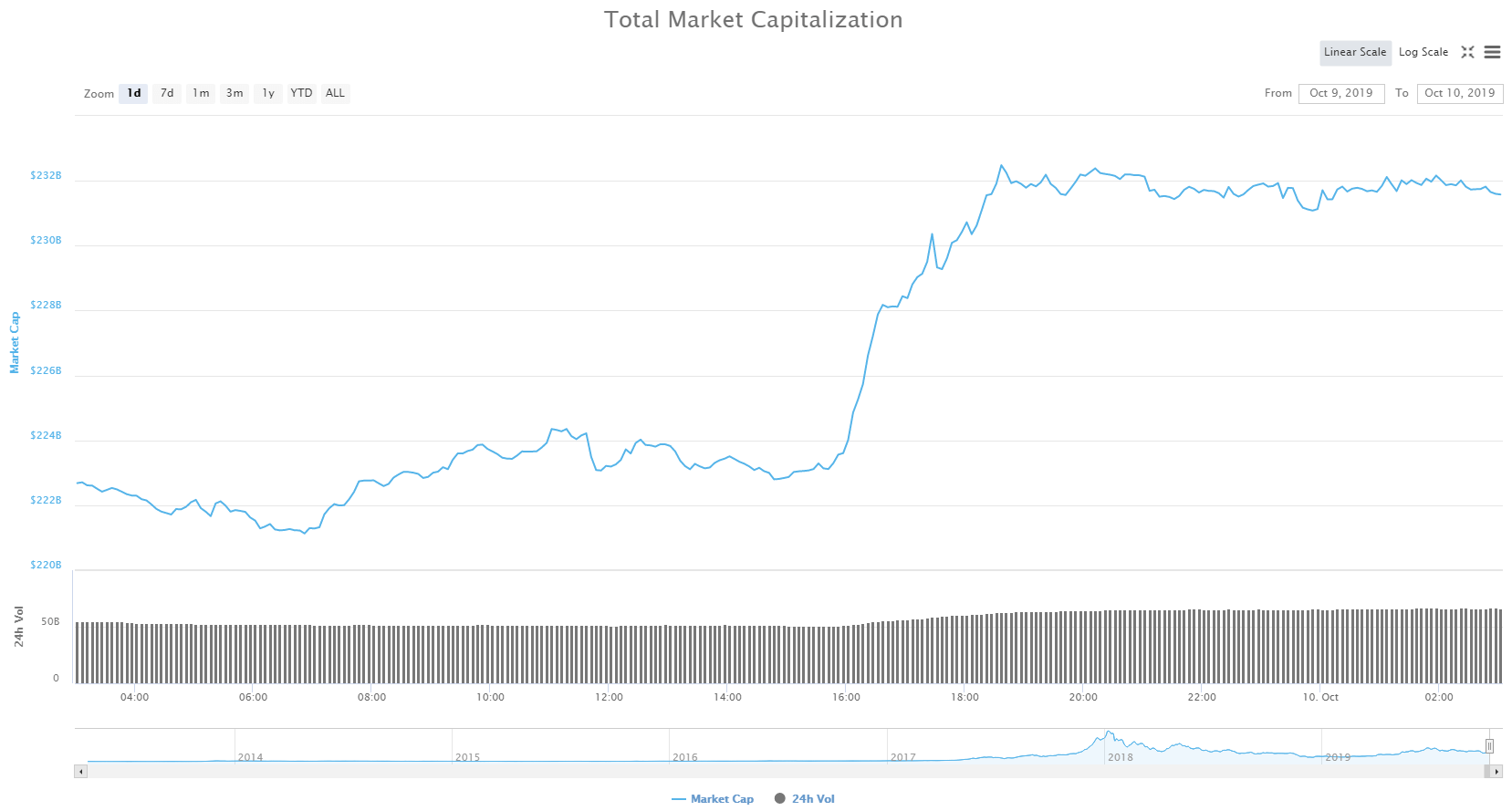

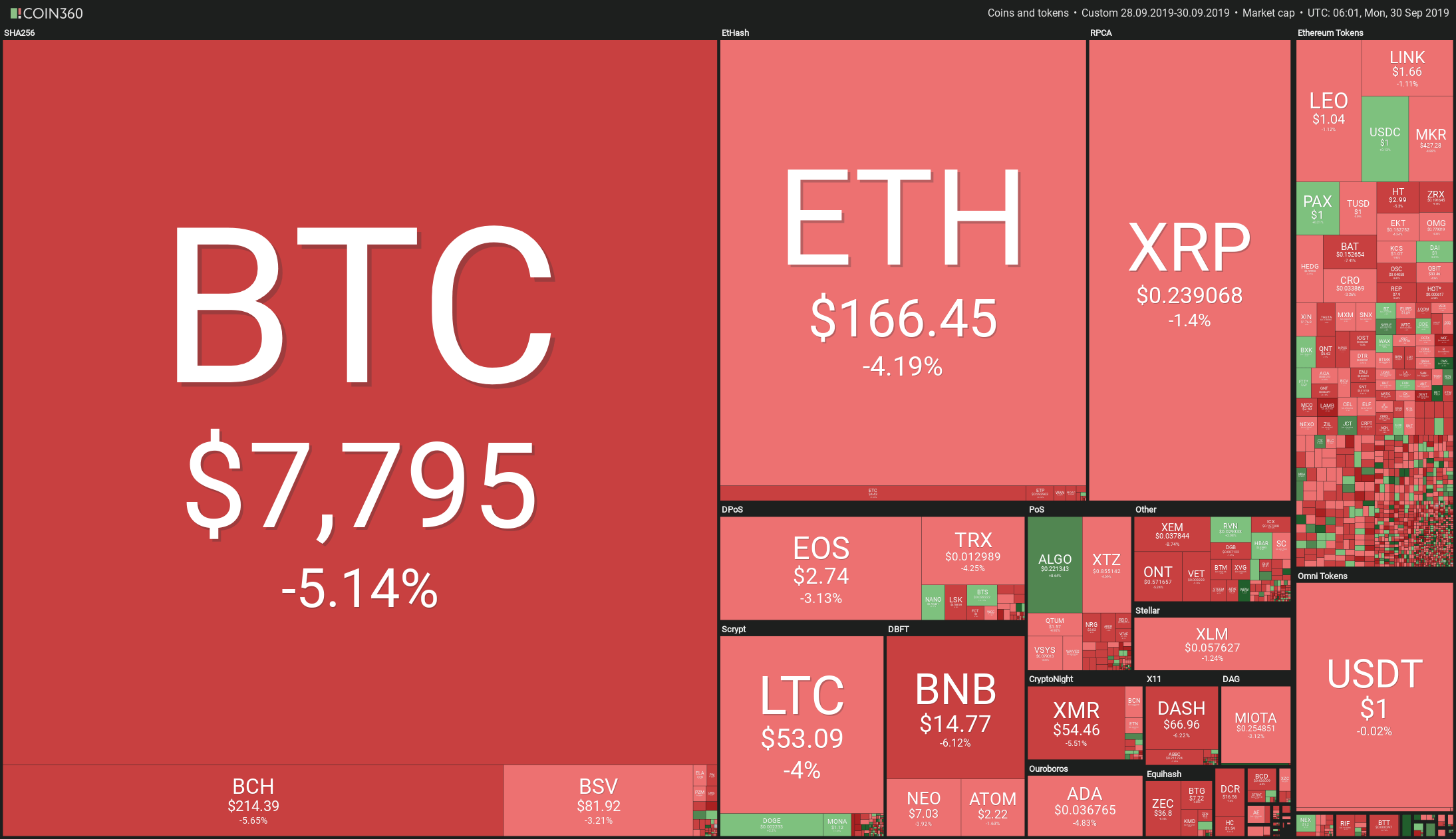

Market Capitalization

Litecoin is in sixth place in terms of market cap in the cryptocurrency world with $3.9 Billion value while the price of each coin is at $61.70 as of October 27th, 2019. 63.5 million number of coins are in circulation in the market with 24-hour trading volume as $4.3 Billion.

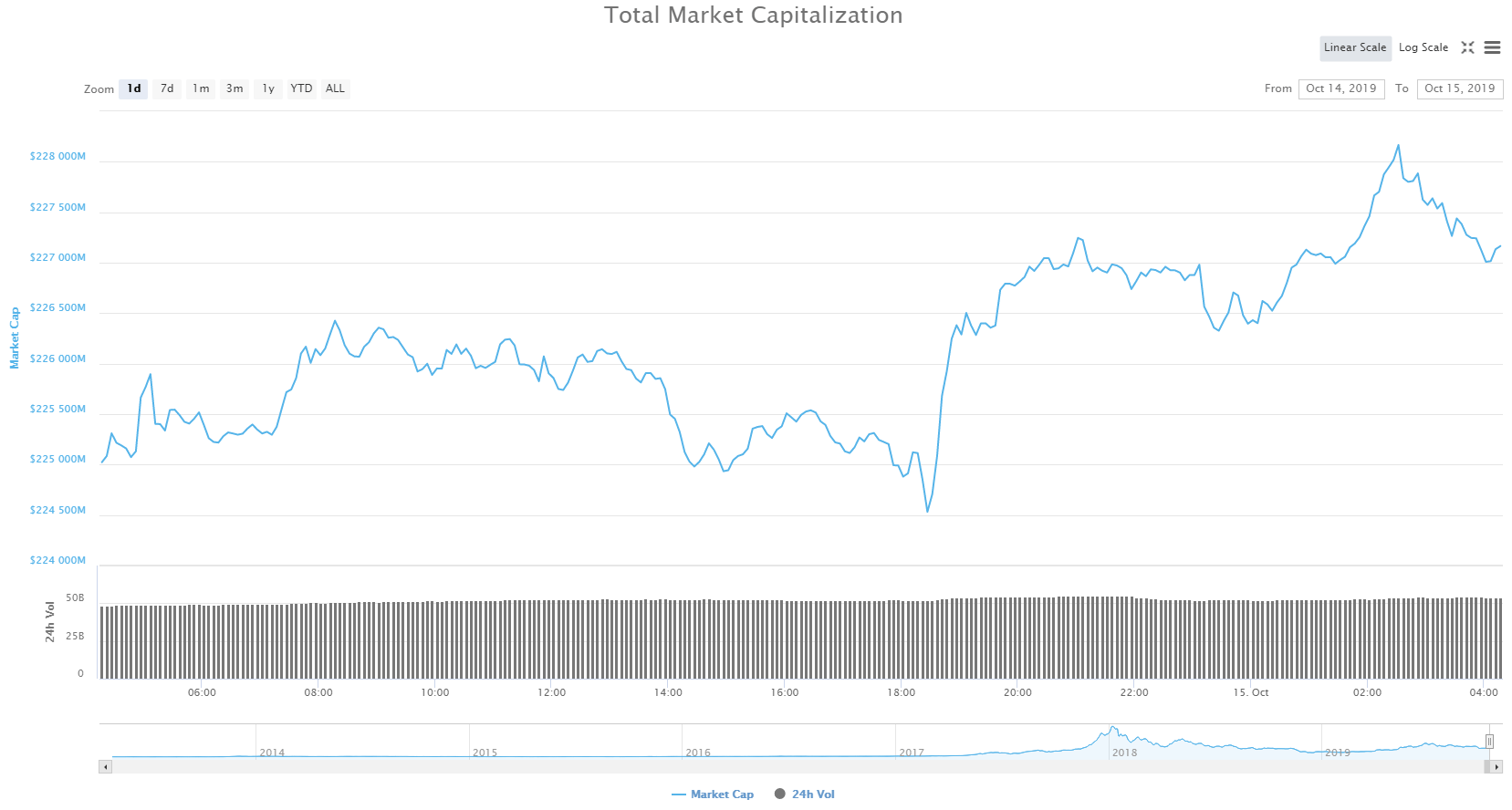

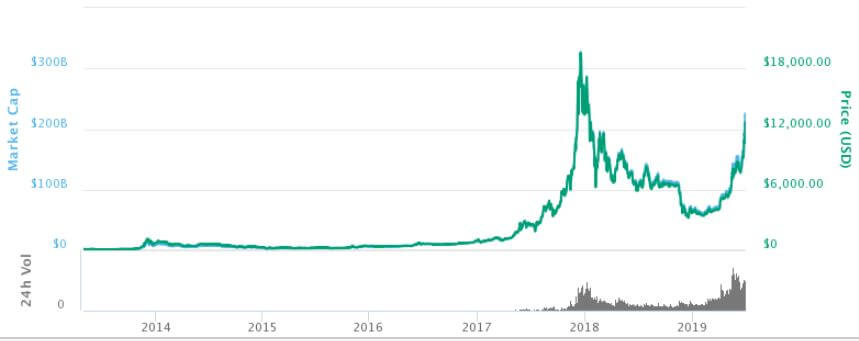

Price History

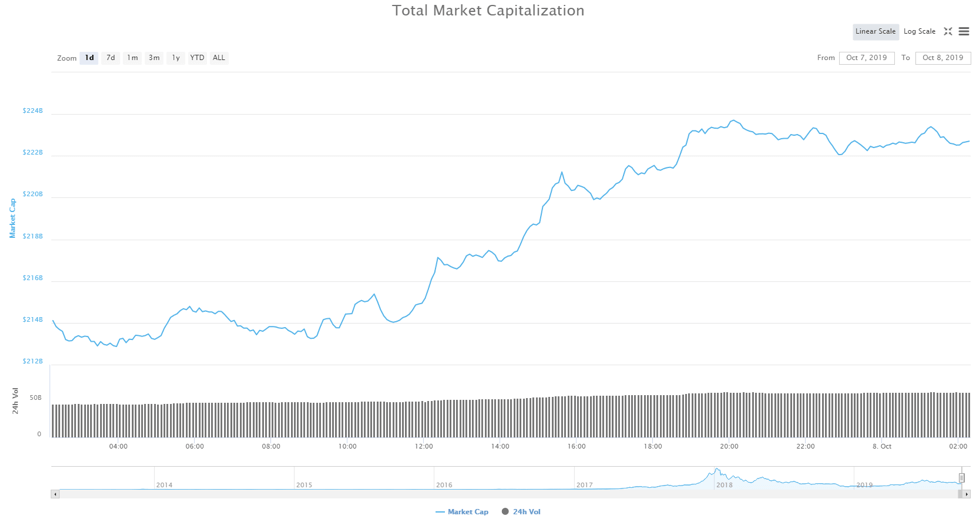

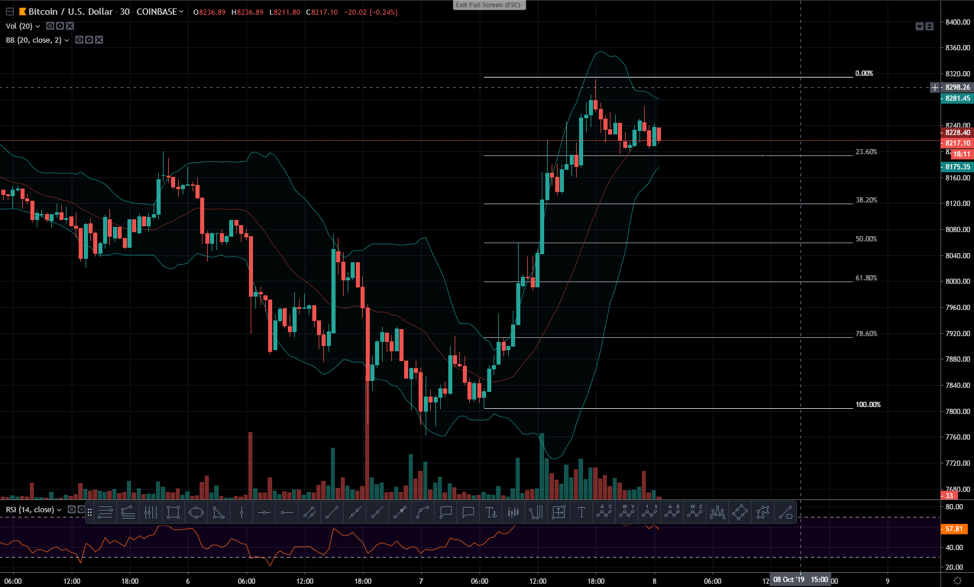

Litecoin was traded first with a price of $4.30 in April 2013. By November 2013, it was selling at a double-digit price of $35.78. The form then has seen a continuous downfall and maintained a moderate standard rate until April 2017. It had seen a slow and steady rise from April 2017 with $10.28 to $297.18 in Jan 2018. The coin has yet again seen a downfall in 2018, with a price of $30.99 by December 31st, 2018. This crypto has been performing well in 2019 when compared to the previous year, with its highest rate in the year with $145.45 in June 2019. Industry experts are bullish about the growth of the coin due to its transaction speed and other vital properties.

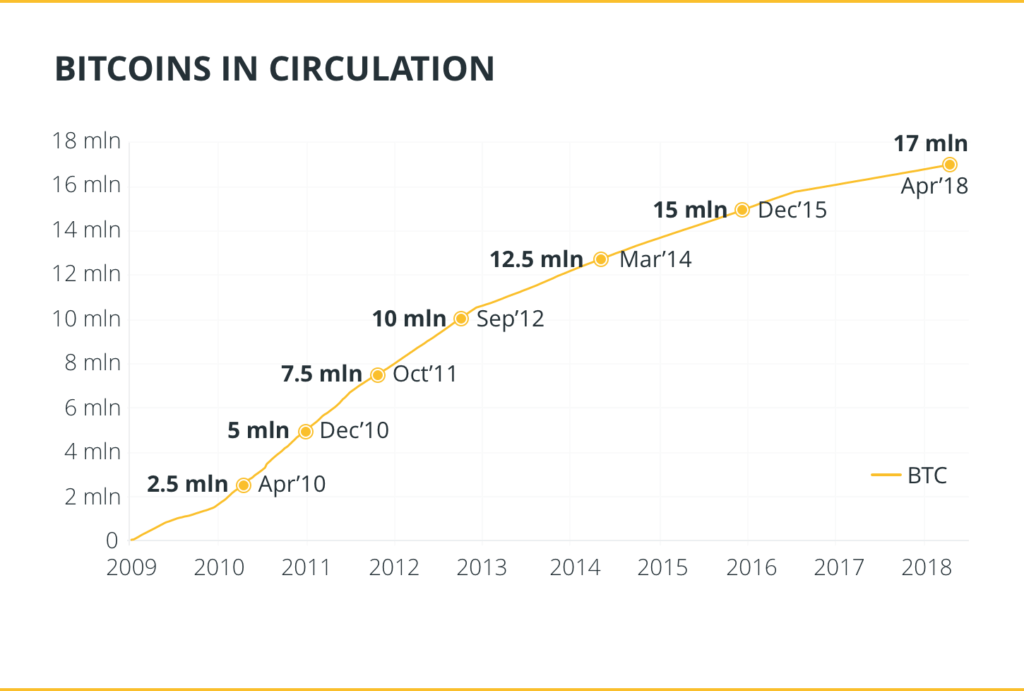

Total number of Coins

Cryptocurrencies have a cap when it comes to production. While Bitcoin has a cap of 21 million coins, Litecoin has a cap of 84 million coins, which means only 84 million Litecoins can be ever mined from the network.

Rewards

For running and maintaining the network, the miners are rewarded for each block generated. Litecoin network rewards the miners with 25 Litecoins for every block generated. However, the reward gets halved for every 8,40,000 blocks made. In August 2019, the network halved the rewards as the milestone was reached, and hence the reward as of now per block is only 12.5 LTC.

Bottom line

The main aim of any cryptocurrency is to stabilize itself as a medium of exchange. While Litecoin has approximately around 100,000 users, it is nowhere near to be the standard medium of exchange amongst the cryptocurrencies. Still, as the usage of cryptocurrencies increases, Litecoin holds an excellent position to attain the place due to its transaction speed.