If you are a bitcoin enthusiast or trader, you probably know that the markets are prone to price swings triggered by such things as government regulations, market news, and the good old supply and demand.

But are you aware of a lesser-known factor that could cause BTC prices to plummet, spike, or even affect their market value? Whenever you’ve seen a sudden boom or a decline in BTC prices, it’s very likely those movements were caused by a “whale.”

But what are Whales in Crypto Space?

Whales are known to have an enormous size and sheer strength. In cryptocurrency trading, whales are the biggest and most influential players in the “ocean.”

The reference to whales in crypto trading originates from traditional financial markets and gambling circles. The very term “crypto whales’ should give you a clue of the utter power of these players. It’s not hard to realize that a single transaction made by them is enough to cause waves that will reverberate throughout the cryptocurrency ecosystem.

Who are the Bitcoin Whales?

The forefront question at this point is; just who are these so-called whales? Are they individuals, investment companies, are they even known at all? The answer is yes, and no.

Whales can be people with enormous amounts of capital to invest in cryptocurrencies, or they can be finance institutions like trusts and hedge funds. And yes, some whales are well-known people, beginning with bitcoin’s very creator – Satoshi Nakamoto, who is estimated to own at least a million bitcoins. Whales that are companies include Pantera Bitcoin Fund and Fortress Investment Group.

Currently, 40% of bitcoin is owned by just a thousand people. This means there are many anonymous whales in the market – and their movement could change the entire bitcoin landscape if someone decided to sell large portions of their holding.

How Whales Affect Bitcoin Prices

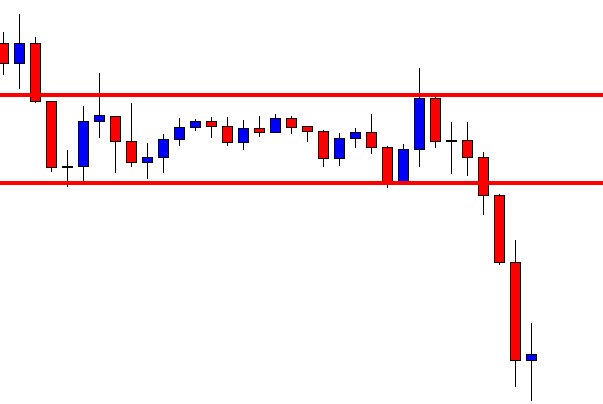

The activity of whales can impact crypto markets significantly. Prices can dramatically decline or shoot up, and the market value can increase or decrease. When whales buy or sell a cryptocurrency, they do so in tens or even hundreds of millions, sending prices plummeting or spiking.

When a whale buys out massive volumes of BTC, it will drive the value of BTC high because it sends the signal that it is in demand. The opposite is true for whale sell orders. BTC prices will drop because it will look like the currency is being disposed of, diminishing its value in the eyes of investors.

To grasp the impact that whales can trigger on the market, consider when two anonymous whales sold over 13,000 BTC in 2018 (total value of the sell was more than $100 million). This fact caused the price to decline by a whopping $200 in just under 20 minutes.

Whale-Watching: How to Detect Whale Movement

In the crypto trading sea, it’s wiser to swim along with whales than to move in the opposite direction. So if you’re looking to buy or sell bitcoin, why not wait for a whale to emerge first? Below are some clues that can help you spot whales on the horizon – before they make a big splash.

Detecting When a Whale Is Buying:

If you’re a “small fish” wishing to buy bitcoin, doing so at the same time as whales can guarantee you good profits with low risks. Here are some tips for detecting when whales are buying:

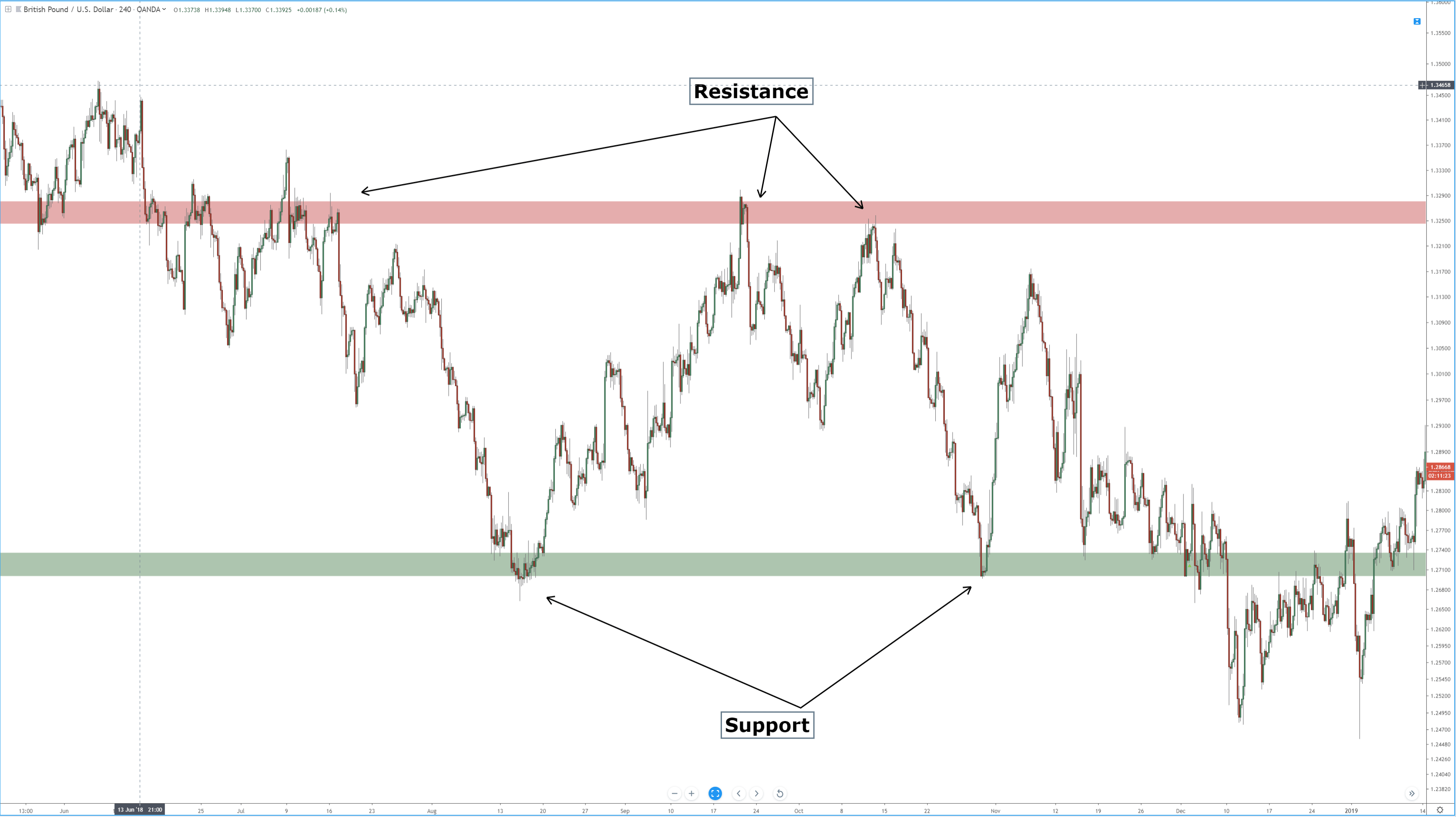

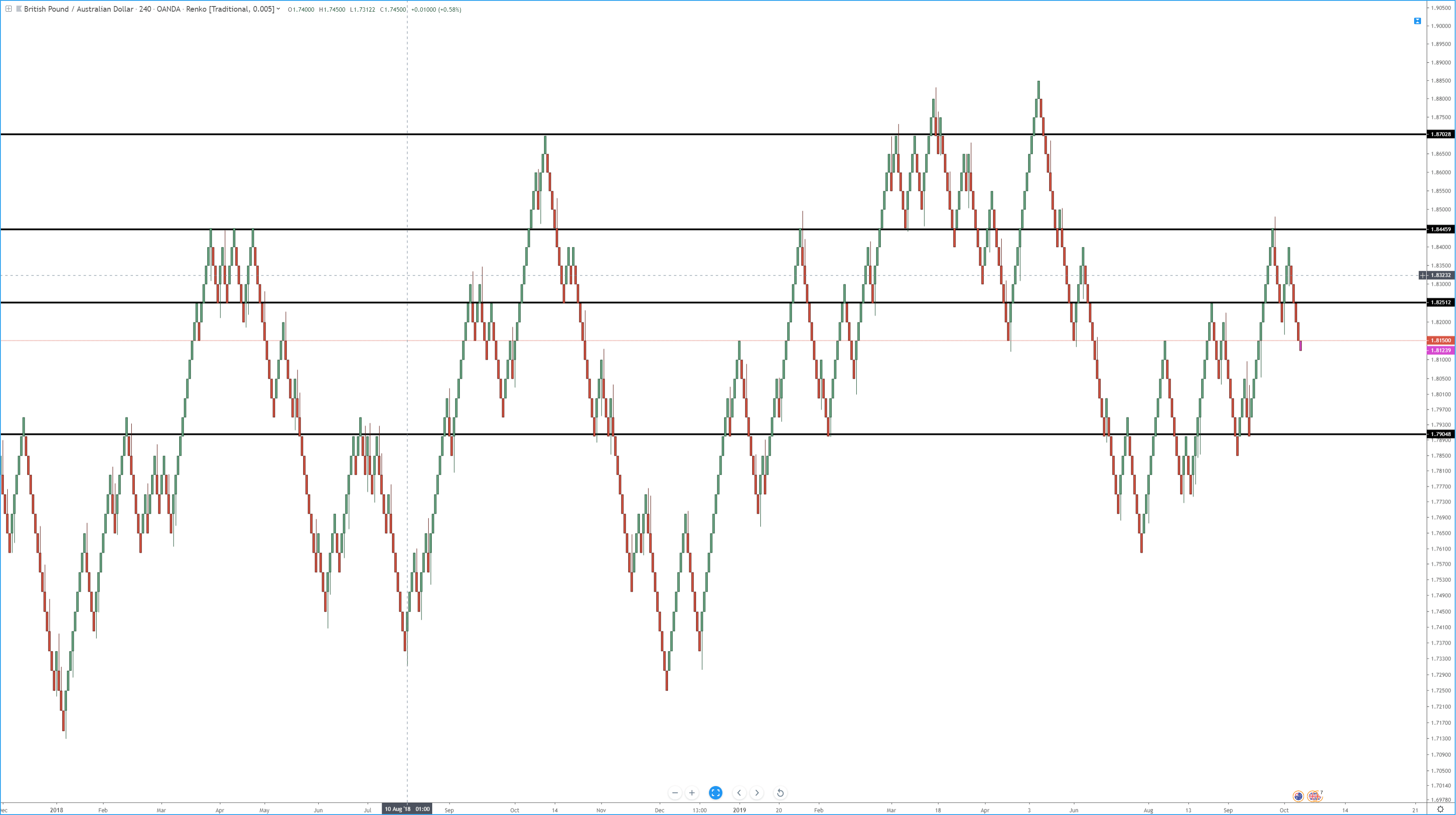

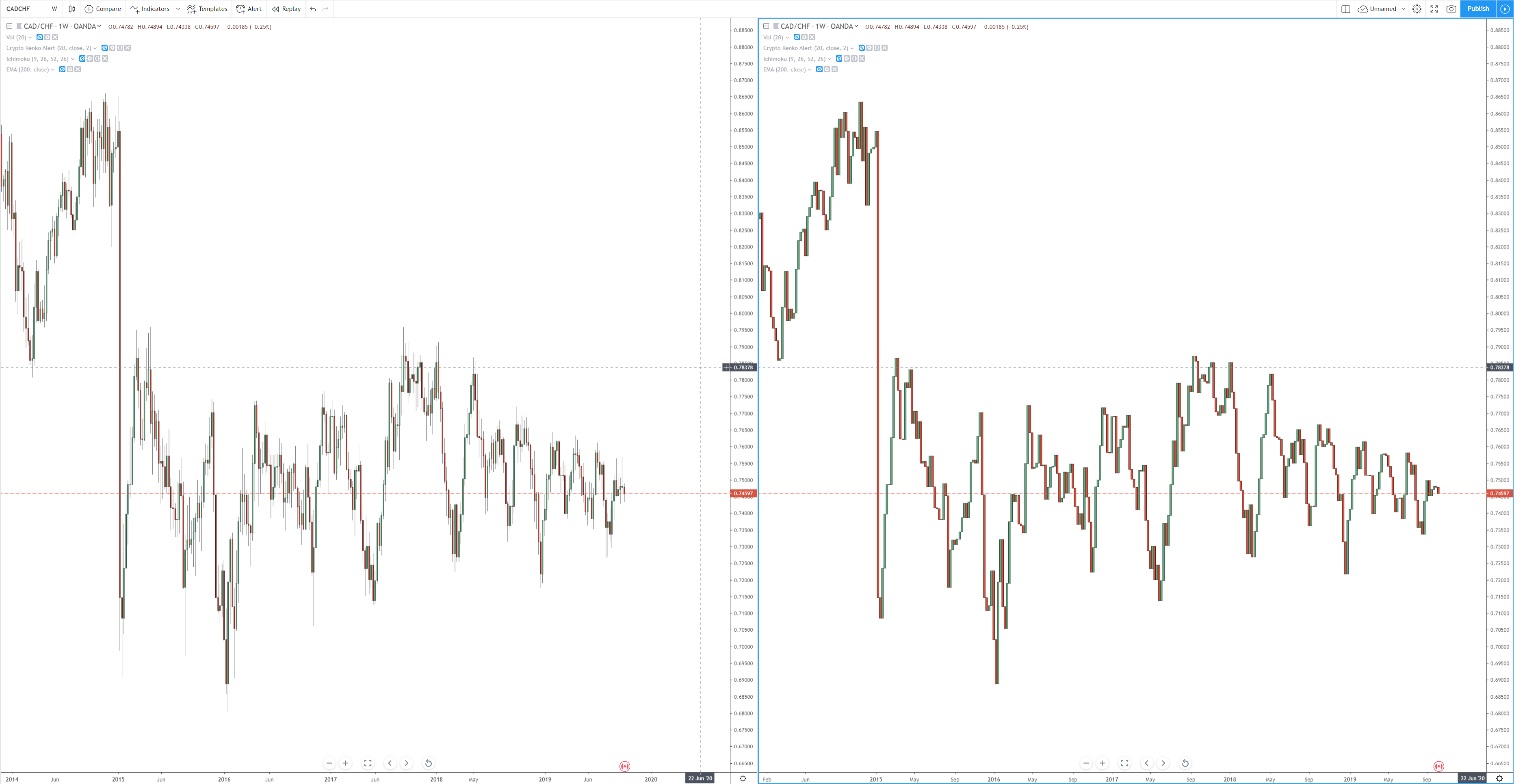

☑️ Look For an Increase in Volatility and Price When the Markets Are Quiet

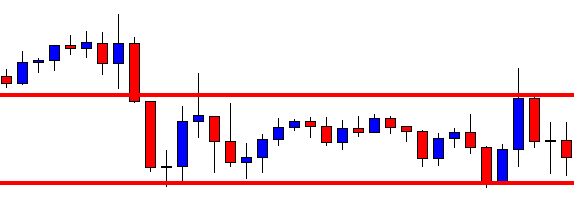

If bitcoin has been trading at roughly the same price and suddenly there’s larger-than-normal volatility and price, there could be a whale or several whales who have entered the market.

☑️ Look Out for Strange Bid Sizes in the Order Book

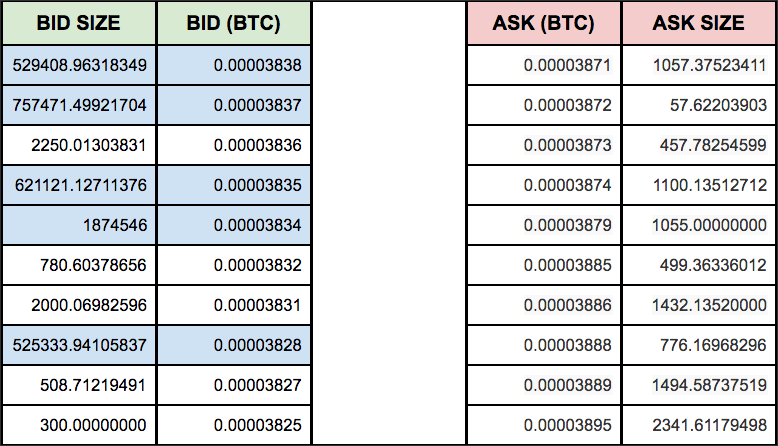

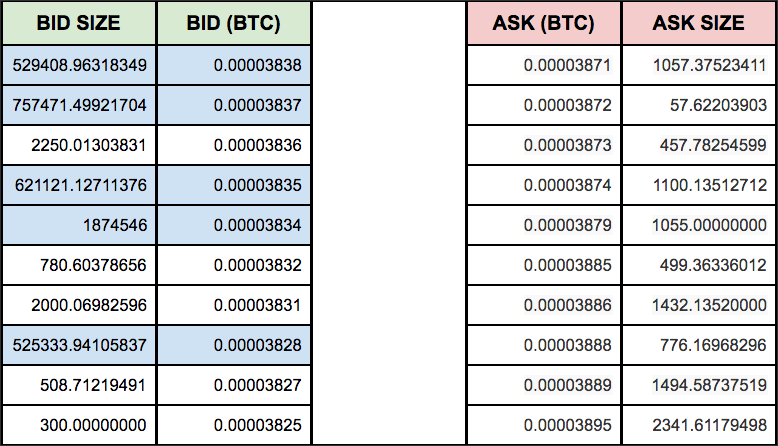

Keep an eye out for significant increases in order books. If you spot a sudden swell in bid sizes, a whale might be in play. For instance, suppose the usual bid size is 1000 and the ask size 2000. When a crypto whale is trading, the order book will register abnormally high bid sizes.

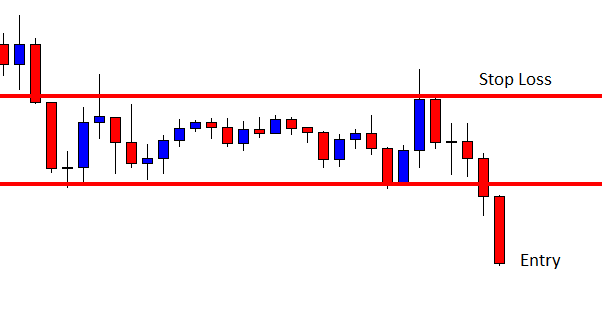

Detecting When a Whale Is Selling

The very act of whales placing sell orders is risky for traders holding smaller positions because this usually liquidates huge sums of the asset. In this scenario, you don’t want to hold on to your bitcoins very long. Here’s how to track a selling whale:

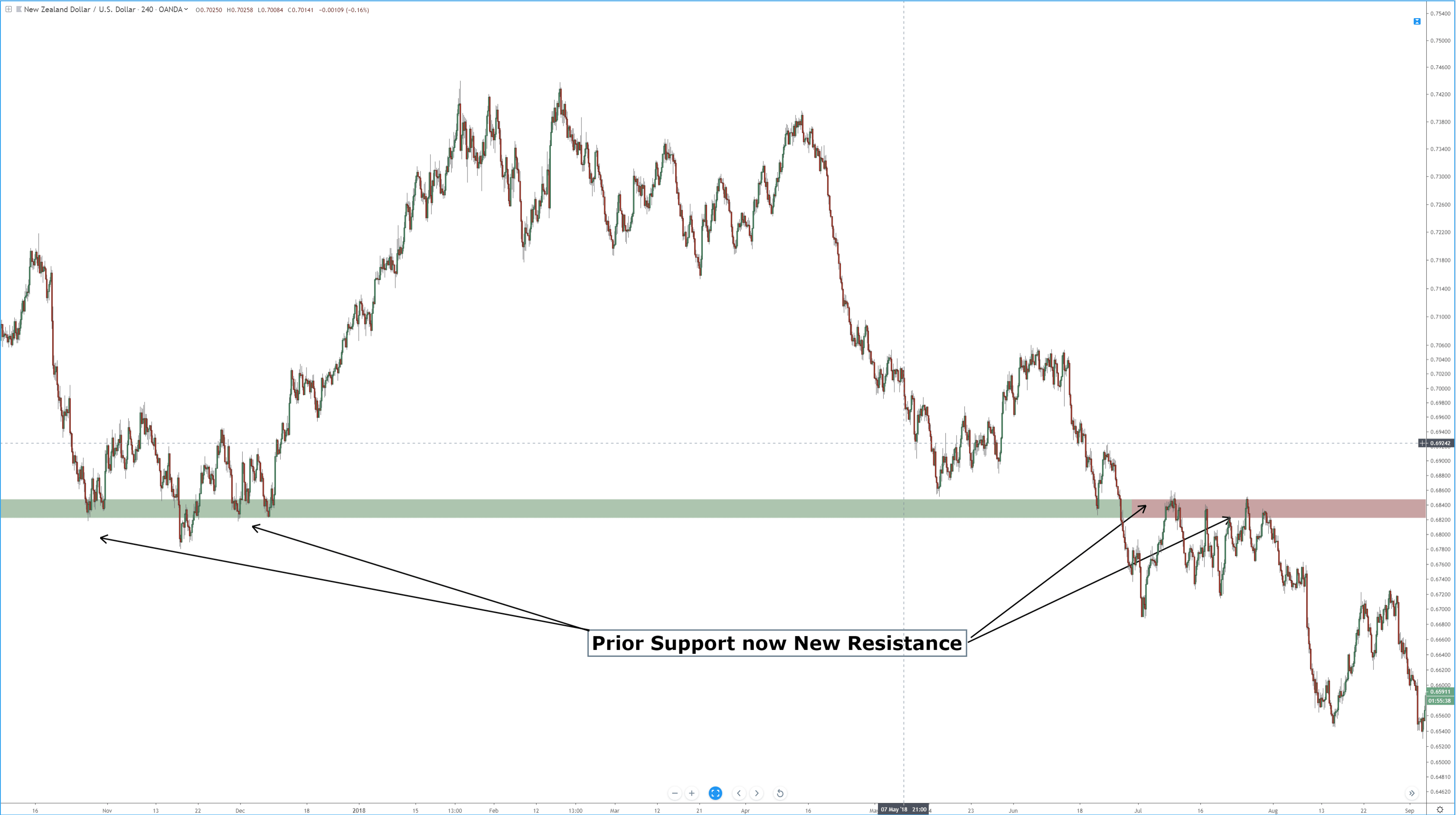

☑️ Check Abrupt Cancellation of Large Buy Orders

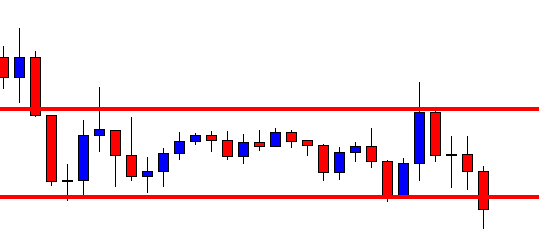

If you just noticed big buy orders quickly vanish from the order book, there is a possibility that a whale or a group of them is about to do a massive offload (selling in large quantities).

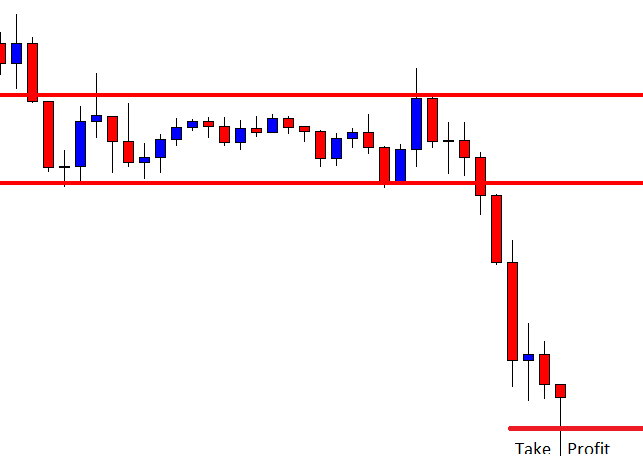

☑️ Look Out For a Sudden Uptrend that quickly disappears

Did you notice a sudden surge in price momentum, which quickly disappears as fast as it came? It’s highly unlikely this change was triggered by market news or a disruptive news story. It signals the presence of a whale.

☑️ Look out for A Strong volume Acceleration

A rapid increase in volume is another indication a whale is in play. But just how big of a jump should you watch out for? Usually, you want to be on the lookout for more than 3x larger than the routine volume.

Conclusion

The inherent nature of crypto prices is they will always drop and spike from time to time. This is what makes cryptocurrency trading possible (and fun) because investors are betting against future movement of prices. Crypto whales are one of the most powerful price movers. Understanding what they are and when they are going to move could help you make more accurate and profitable trades.