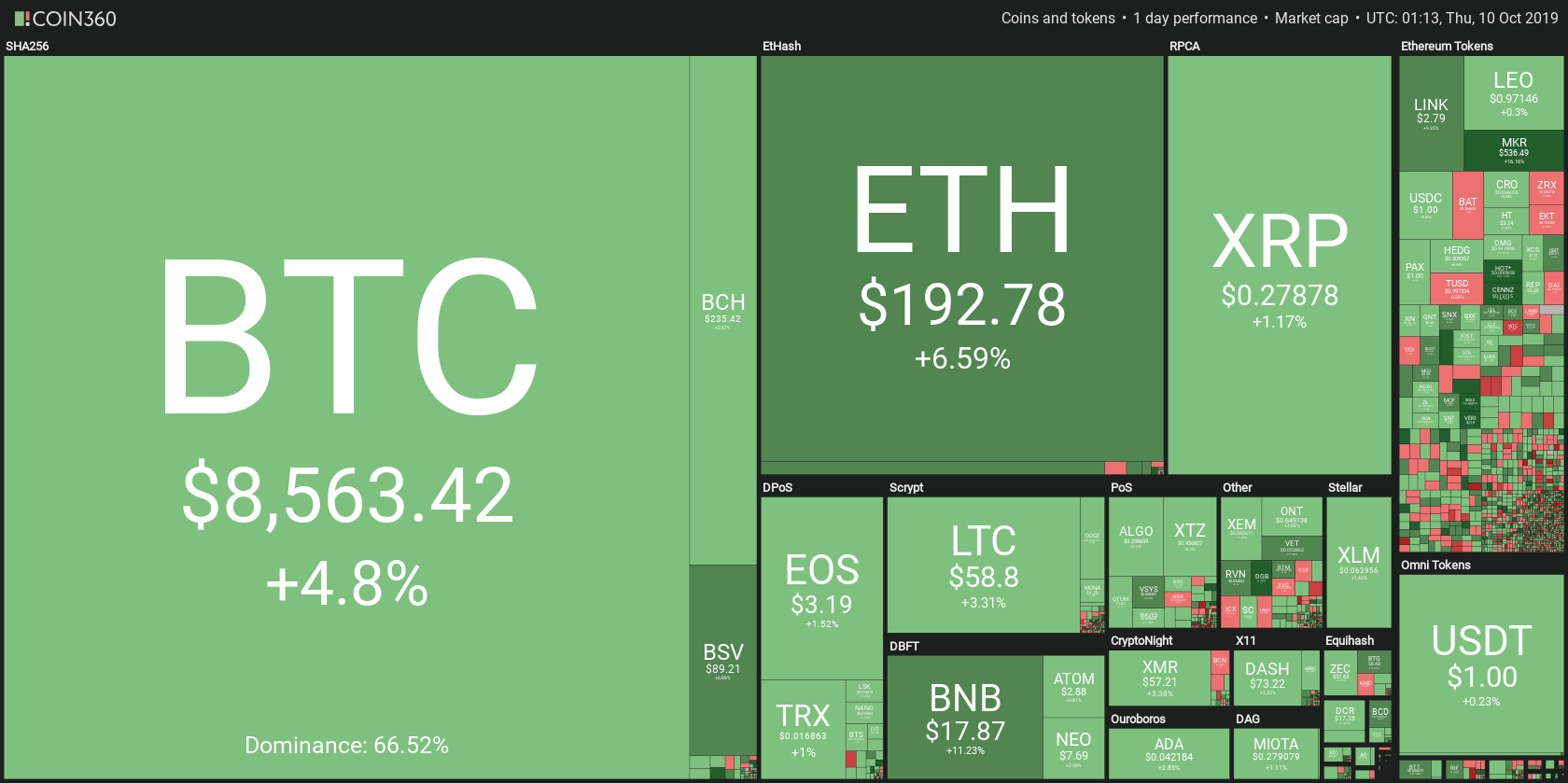

After yesterday’s day of consolidation, the markets decided to head up and test new prices. With increased volume and new money coming into the market, Bitcoin increased its price by 4.5%, while Ethereum managed to go up by 6.62% and XRP by 1.35%. After reaching RSI overbought territories, the prices started stabilizing at the same or slightly lower levels, while RSI managed to settle down.

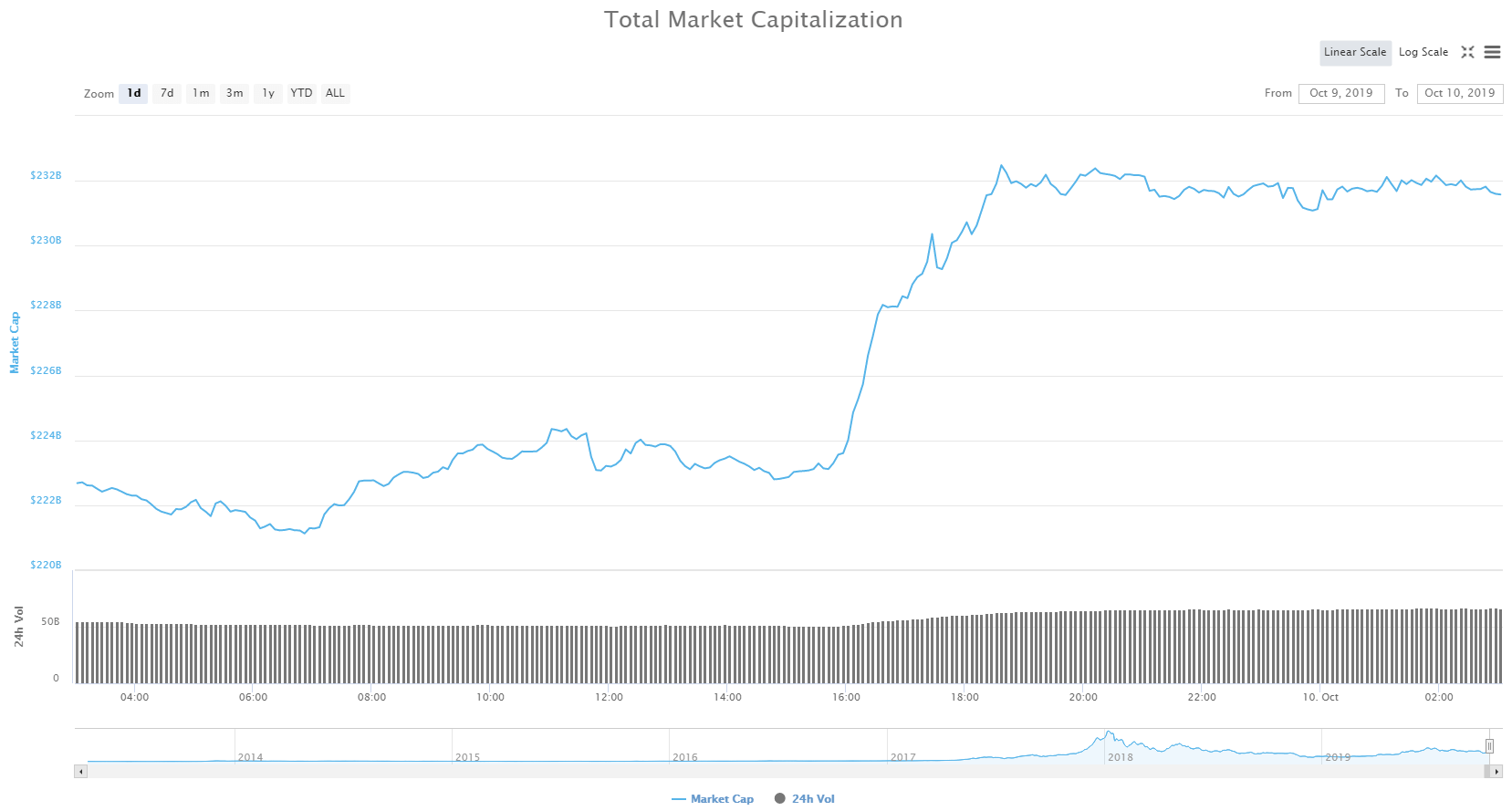

As both Bitcoin and most altcoins are in the green, the total cryptocurrency market cap has increased. It is now hovering at around $231,8 billion, just down from the daily high of $232,47 billion. Bitcoin is still keeping its dominance high, currently being around 66.6%.

What happened in the past 24 hours?

Cryptocurrency markets, judging by the increase of volume, have had an influx of new money coming. That has sparked some solid price growth, especially if we expand our views to not only Bitcoin but the rest of cryptocurrencies. Out of the top50 cryptocurrencies, only eight have been in the red. Out of the eight being in the red, half of them are stablecoins, which happen to lose out when the cryptocurrency markets go up. On top of this upward-facing move, the prices are not consolidating far below the levels they reached today. In fact, most of the cryptocurrencies kept their gains and are looking promising in the short-term.

Technical analysis

Bitcoin

Bitcoin has reached a new short-term high of just above $8700, before stabilizing its price at just below $8,600. The new influx of money coming into the markets helped Bitcoin surpass the immediate resistances and start making its way up. With volume skyrocketing, Bitcoin flew through the immediate resistance lines and stopped as the volume started reducing. However, it did not lose its gains and started consolidating at the top, which is rarely seen. This move has sparked some new thoughts in terms of whether the altcoins season has started or not. As the price reached the top of the movement, RSI indicated it was heavily overbought but managed to reach lower levels as the price consolidated.

Ethereum

Ethereum has surpassed Bitcoin in gains today, reaching the price of $196.3. It has retained its gains and started consolidating at close to its daily highs, which is a highly bullish sign. However, that may not be as promising as it sounds. Ethereum found new resistance at the $196.3 line. This price point acted as support and resistance as far as September and proved to be effective as both support and resistance. Only time will tell whether Ethereum can surpass this resistance, or if it will fall back to its previous levels.

On a brighter note, Ethereum’s RSI is almost identical to the one currently seen on the Bitcoin chart. After being heavily in the overbought territory, it started to fall while the price did not follow it. Even though the volume died down quite a bit, it still sits at a higher level than what it was before today’s spike.

XRP

Unlike Bitcoin and Etherum, XRP did not have a particularly good day. XRP moved, fueled by the price growth of Bitcoin and other cryptocurrencies, passed the 23.6% resistance line that the Fib retracement from the Oct 7th-Oct 8th move. However, it quickly found resistance at the top of the Fib retracement (0%), failed to break it, and retraced to the 23.6% line, which now acts as support.

Another thing separating XRP from the top2 cryptocurrencies at the moment is volume levels. Unlike the other two, XRP’s volume is currently lower than what it was before the upward-facing spike. Even with the RSI indicator reducing and the price staying relatively high, it might not be enough to keep XRP on a green path.