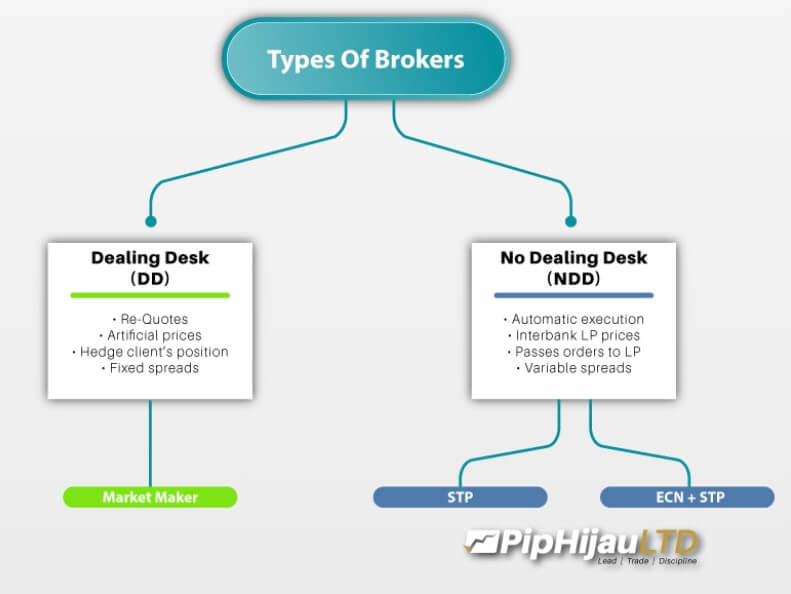

Starting their business in 2014 in Dubai, the group aims to have a good base and clientele where retail Forex trading is attractive and where the target market has enough financial capability. ParamaountFX aims to expand throughout the Middle East and the Persian Gulf countries. The broker utilized the market maker model as it can be recognized for the Legal documents. The company Mission statement states nothing specific as well as the About Us section. There is no information about any regulation, bank or another kind of entity related to the broker, the overall presence of FXParamount on the internet is almost non-existent. None of the reputable user review sites recognize FXParamount meaning the popularity is very low.

Starting their business in 2014 in Dubai, the group aims to have a good base and clientele where retail Forex trading is attractive and where the target market has enough financial capability. ParamaountFX aims to expand throughout the Middle East and the Persian Gulf countries. The broker utilized the market maker model as it can be recognized for the Legal documents. The company Mission statement states nothing specific as well as the About Us section. There is no information about any regulation, bank or another kind of entity related to the broker, the overall presence of FXParamount on the internet is almost non-existent. None of the reputable user review sites recognize FXParamount meaning the popularity is very low.

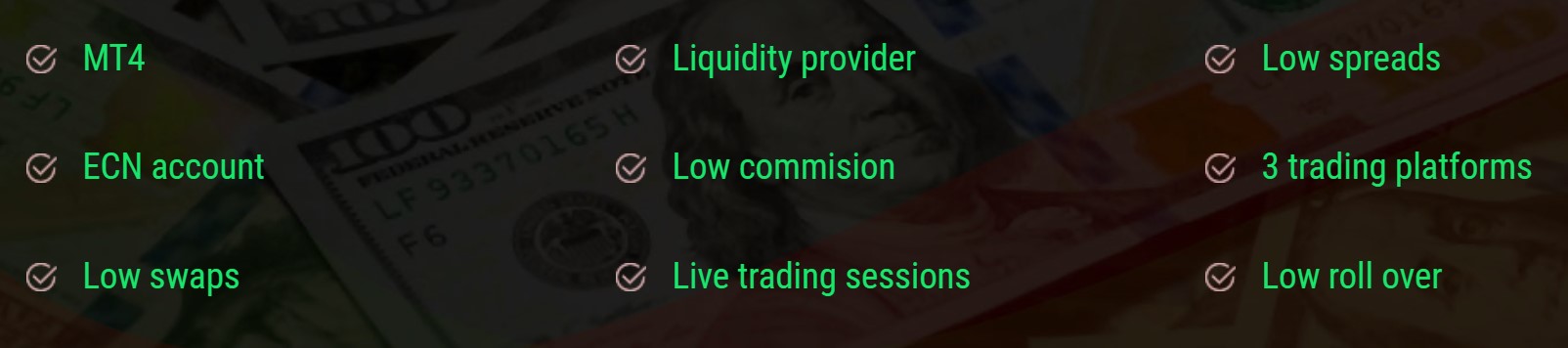

The website is available in Turkish, English and Arabian language, lacks transparency about the broker, utilizing empty marketing phrases, but has decent transparency on the trading conditions. It is stylish and well structured promoting “no commissions and no hidden spreads” on the homepage. What might be interesting to visitors is the Bulletin and Analysis section where FXParamount shows their added value to traders. FXParamaount is a relatively new broker without much to showcase on the website so everything is easy to find but puts them into the indistinguishable mass where they do not differentiate in any service category.

According to the Vision statement, the broker wants to become the largest and most organized international Forex trading organization. This FXParamaount review will reveal the steps undertaken towards that goal and if their current service is enough to be considered account opening.

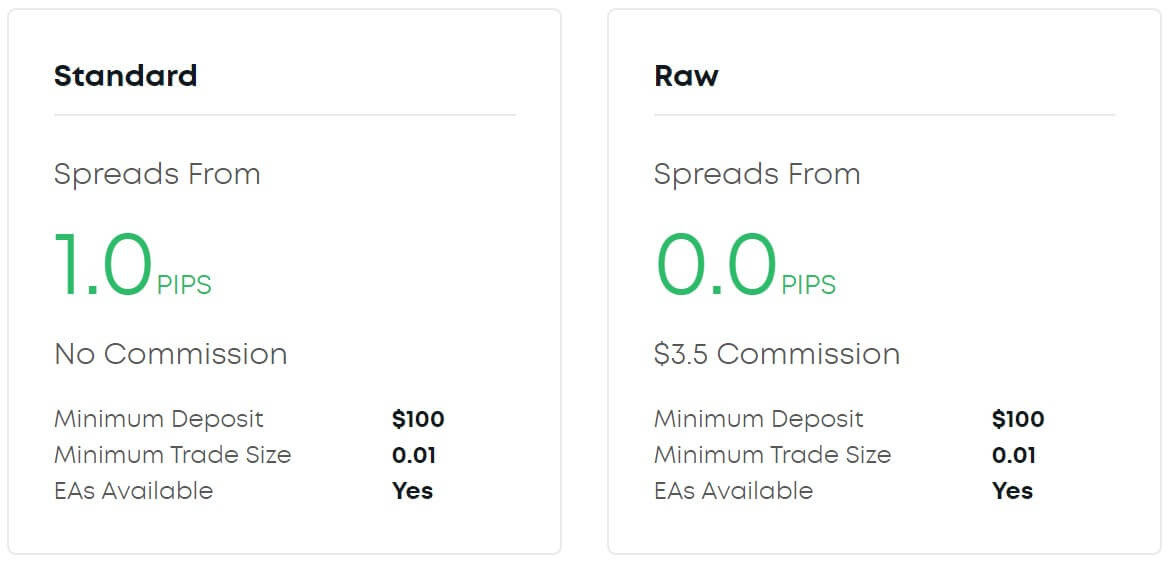

Account Types

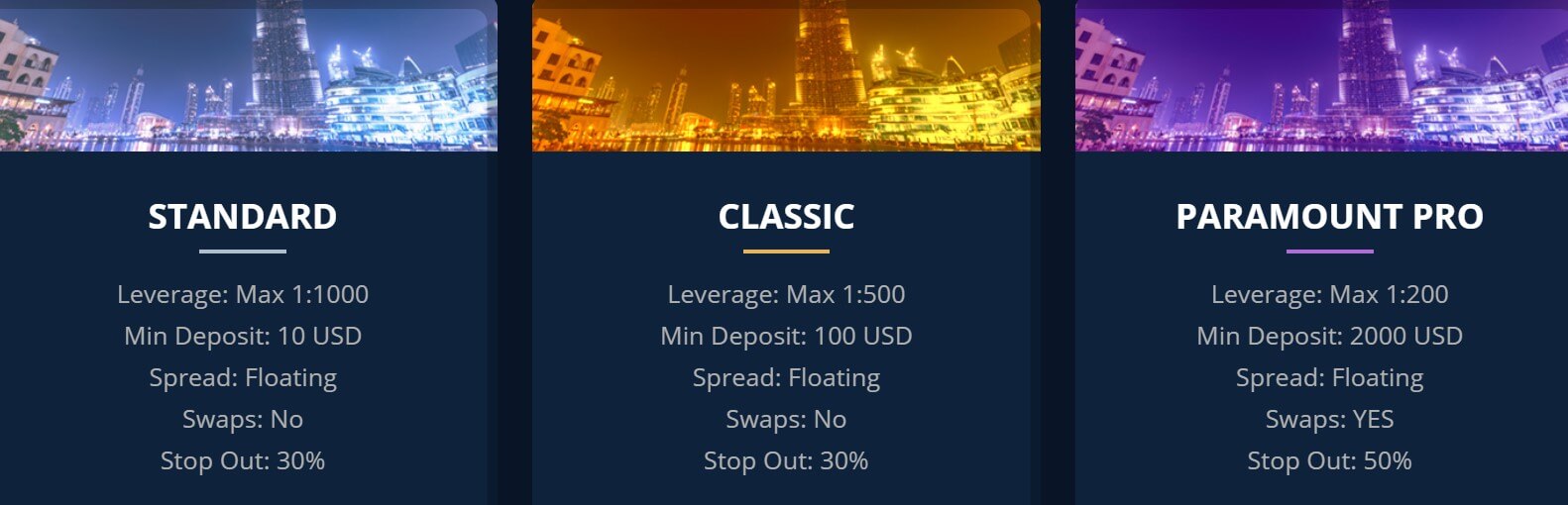

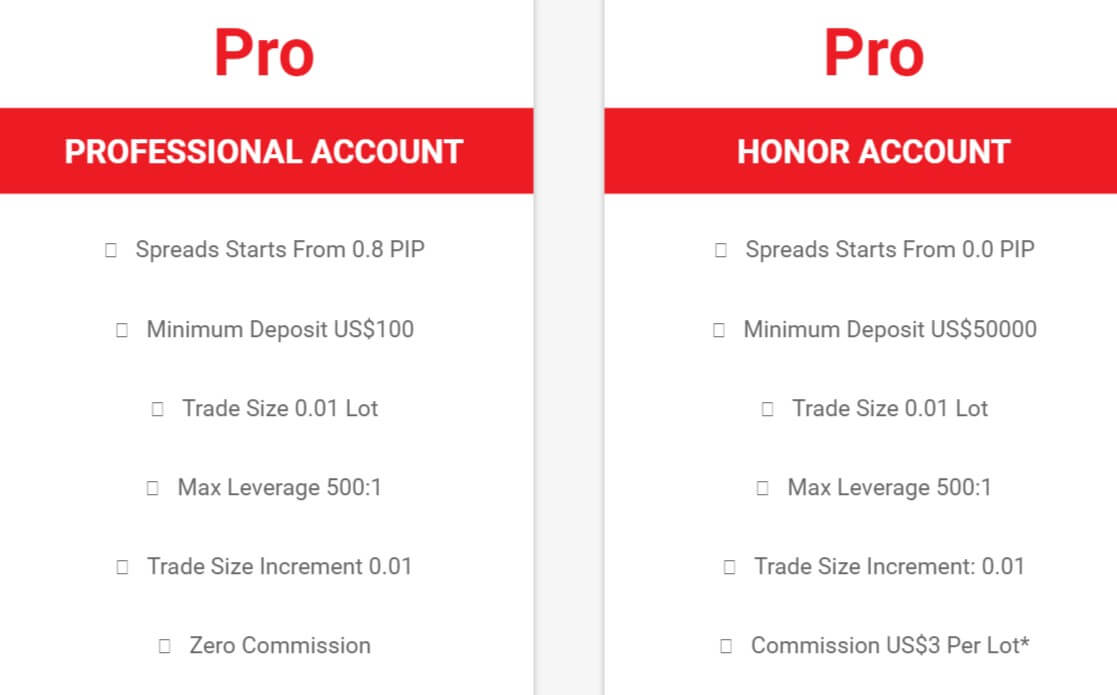

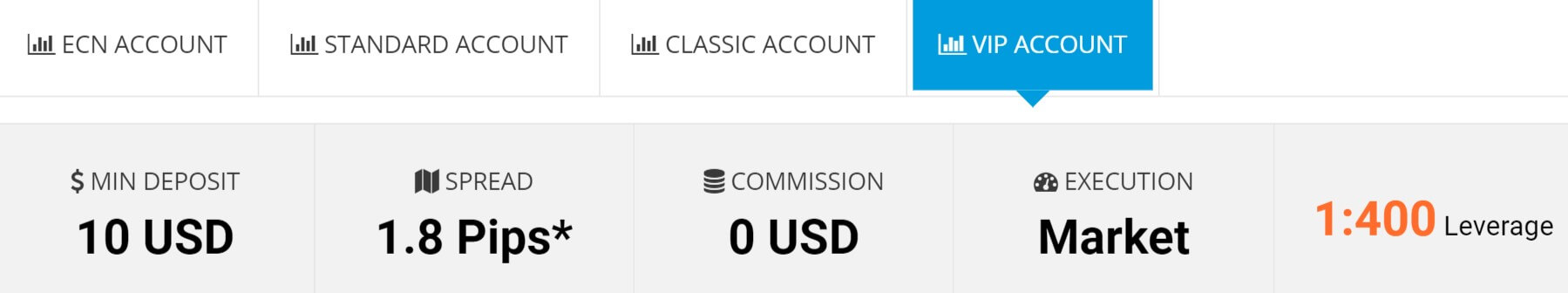

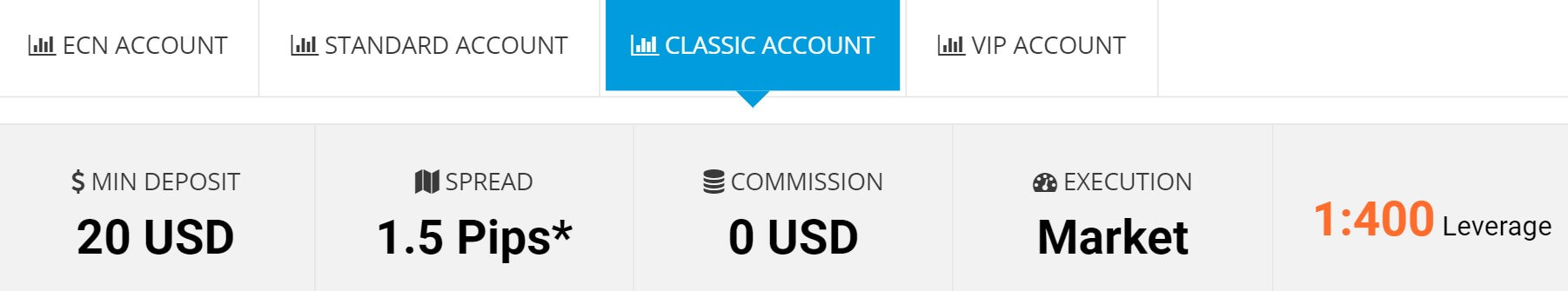

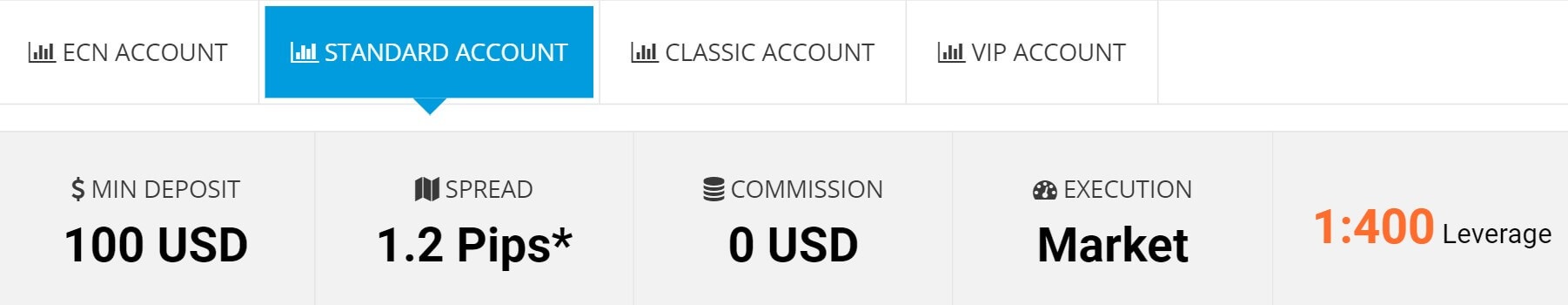

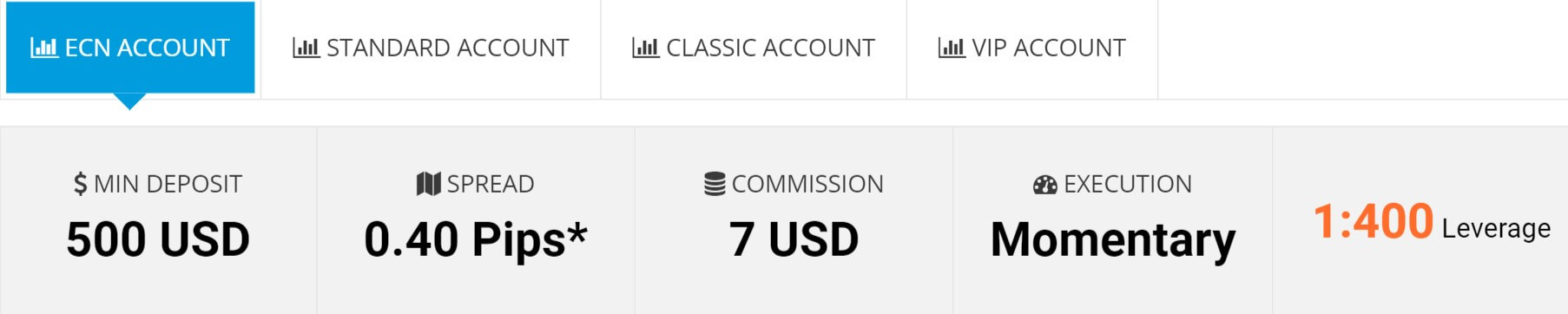

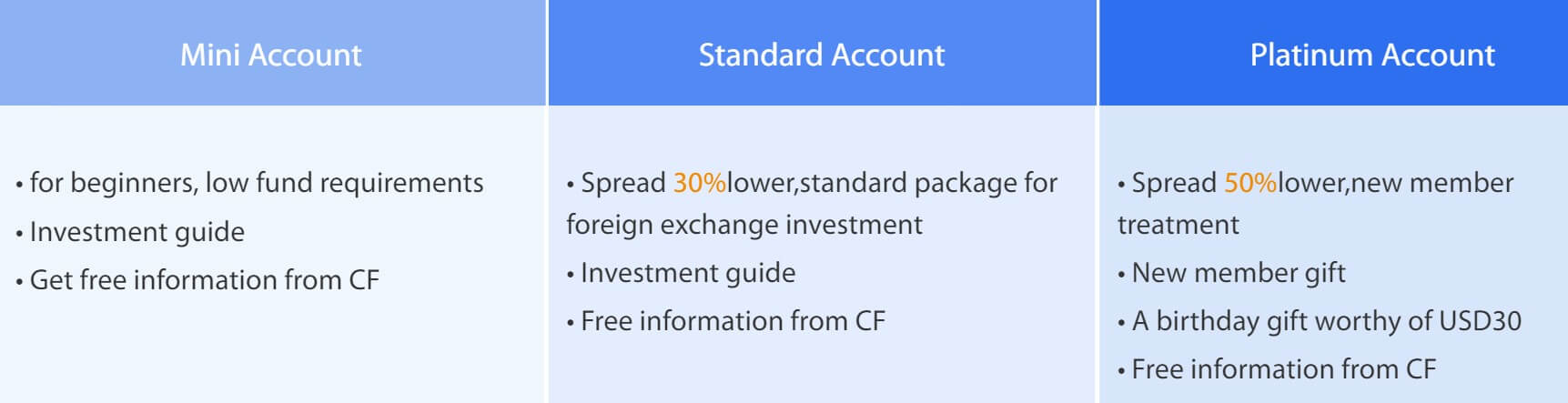

Visitors of the FXParamaount website will not have to spend a second to find pout key information about the account types offered, as it is presented right away on the homepage. There are three offers, Standard, Classic and Paramount Pro. The broker considers their target audience needs, the Standard and Classic Account feature no swaps to be in-line with the Shaira law.

Interestingly, the commission is not charged for the Standard Account but all others have a commission. Therefore, the account types are not just scaled to the minimum deposit but also have different features. Although, as usual, the most exclusive Paramount Pro Account has the biggest minimum deposit requirement and the tightest spreads. The leverage for this account is the lowest and the commissions the highest. Bonuses and Contests offered by the broker cannot be applied to the Paramount Pro account.

The Classic Account is positioned in the middle, with lower commissions, reduced spreads, no swaps, and reasonable leverage. The minimum deposit requirement for Classic is what the majority of traders can afford. Bonuses and contests participation is allowed and the leverage is half the Standard Account has.

The Standard Account is probably the one backing up the “no commission” promotion on the homepage as it is the only one without. On the other side, the spreads are the least favorable comparing to the other two account types. The minimum deposit requirement is negligible, the leverage is very high and bonuses or contests apply.

Traders should know that FXParamaount restricts scalping. Even though EAs and hedging are allowed, any trade closed under the 3 minutes will be considered scalping. More details can be read in the Agreement legal document under section 6.

Platforms

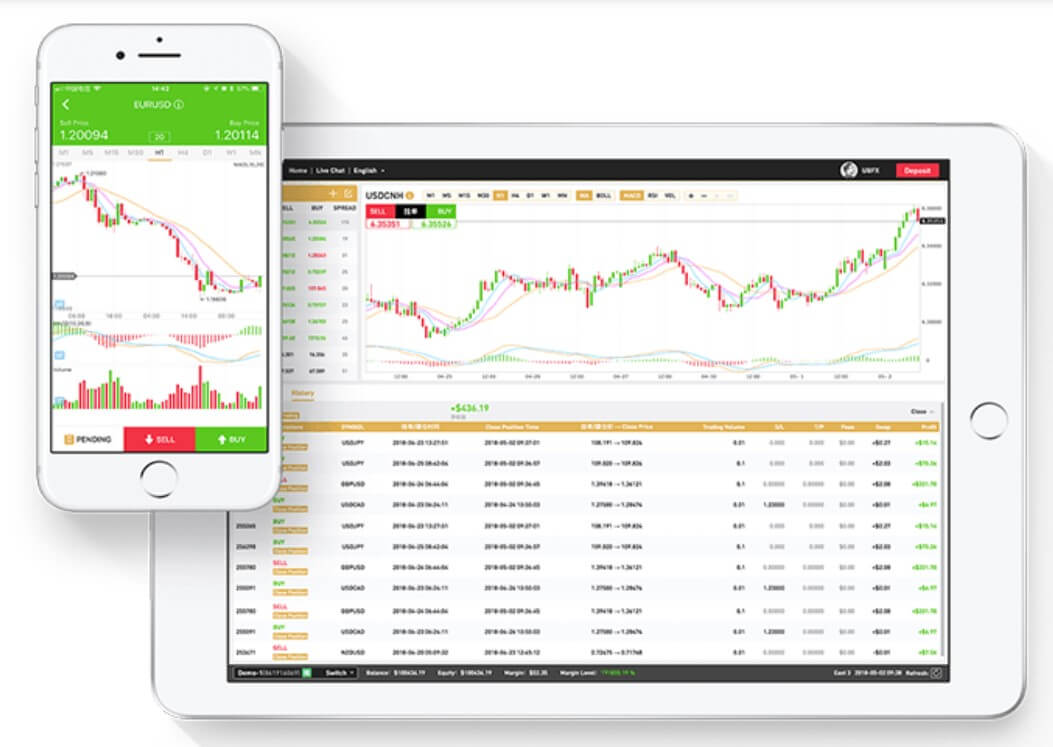

Only the MetaTrader 4 platform is offered. ParamountFX has links for Windows, Linux, Mac, Google Play and Apple App Store versions of the MT4 client. For those that want to access the web-based MT4, unfortunately, it is not available. The MT4 installation gave us a virus warning, a very rare occurrence.

There are two servers, Live and Demo, with an impressive ping rate of just 35ms on both servers. At the moment the account opening process is closed for both the Demo and Live and we were unable to test what Paramount has to offer.

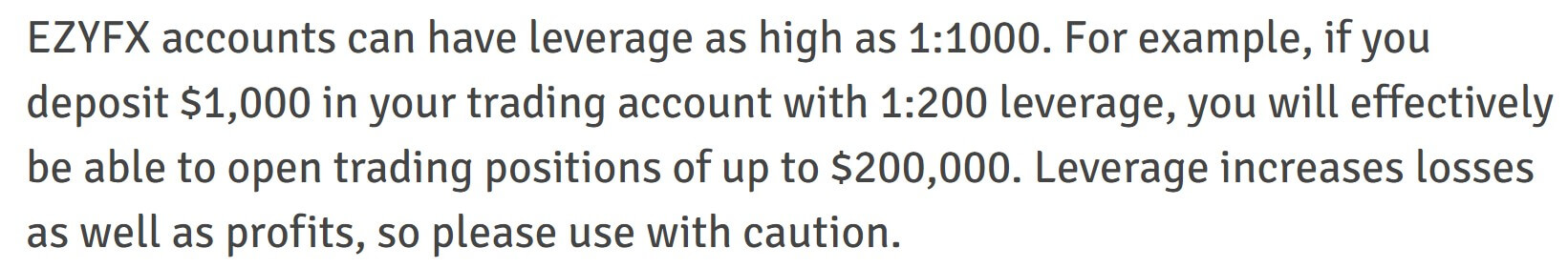

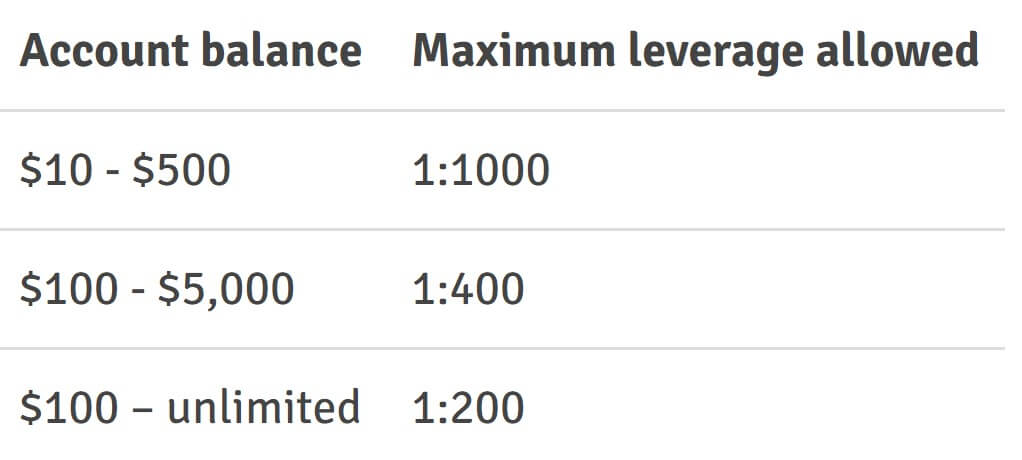

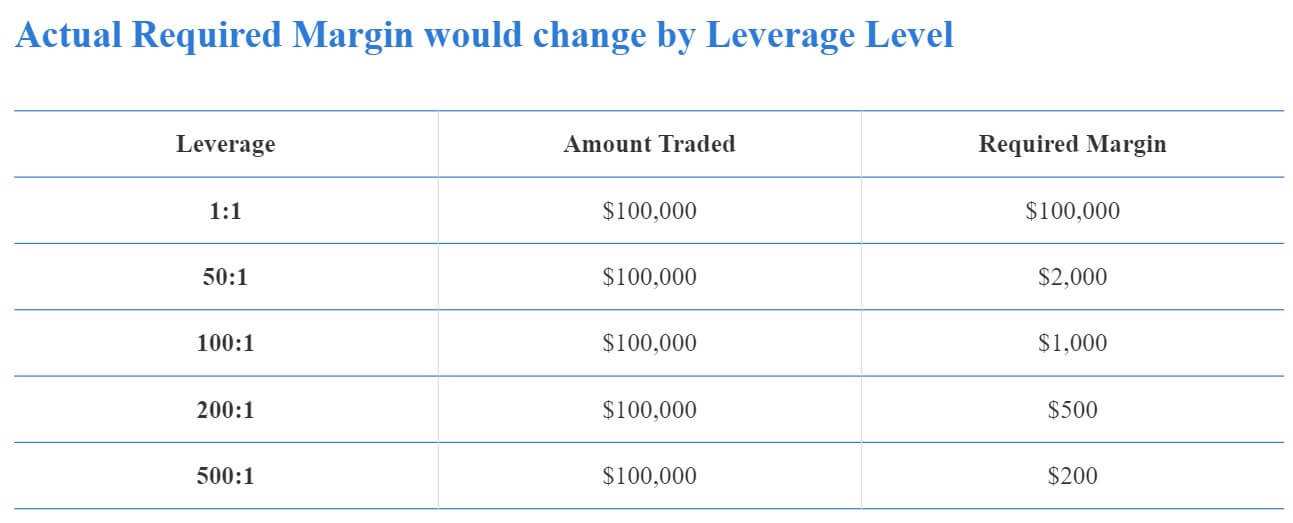

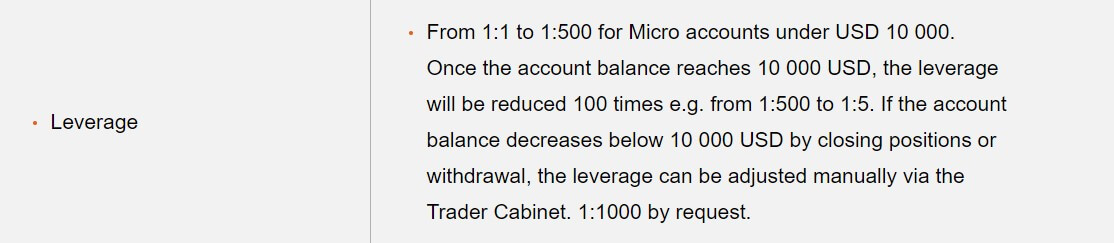

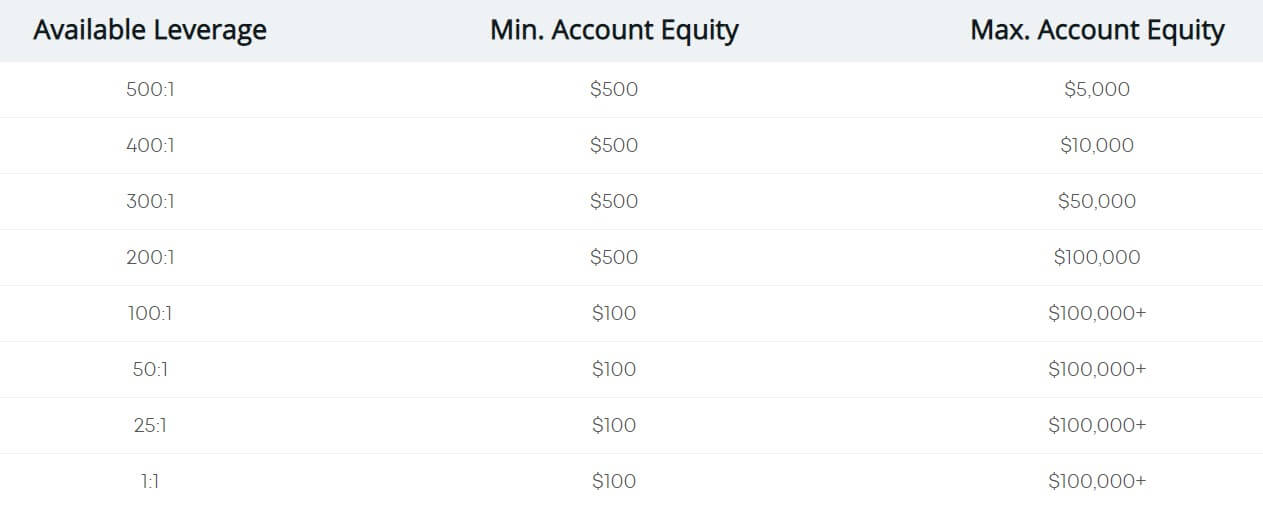

Leverage

Paramount FX offers 1:1000 leverage for the Standard, 1:500 for the Classic and 1:200 maximum for the Paramount Pro Account. Margin Call is not set, but expect a Stop Out at 30% for the Standard and Classic Accounts, and 50% for the Paramount Pro. Traders using the maximum leverage of 1:1000 for the Standard should apply proper risk management.

Paramount FX offers 1:1000 leverage for the Standard, 1:500 for the Classic and 1:200 maximum for the Paramount Pro Account. Margin Call is not set, but expect a Stop Out at 30% for the Standard and Classic Accounts, and 50% for the Paramount Pro. Traders using the maximum leverage of 1:1000 for the Standard should apply proper risk management.

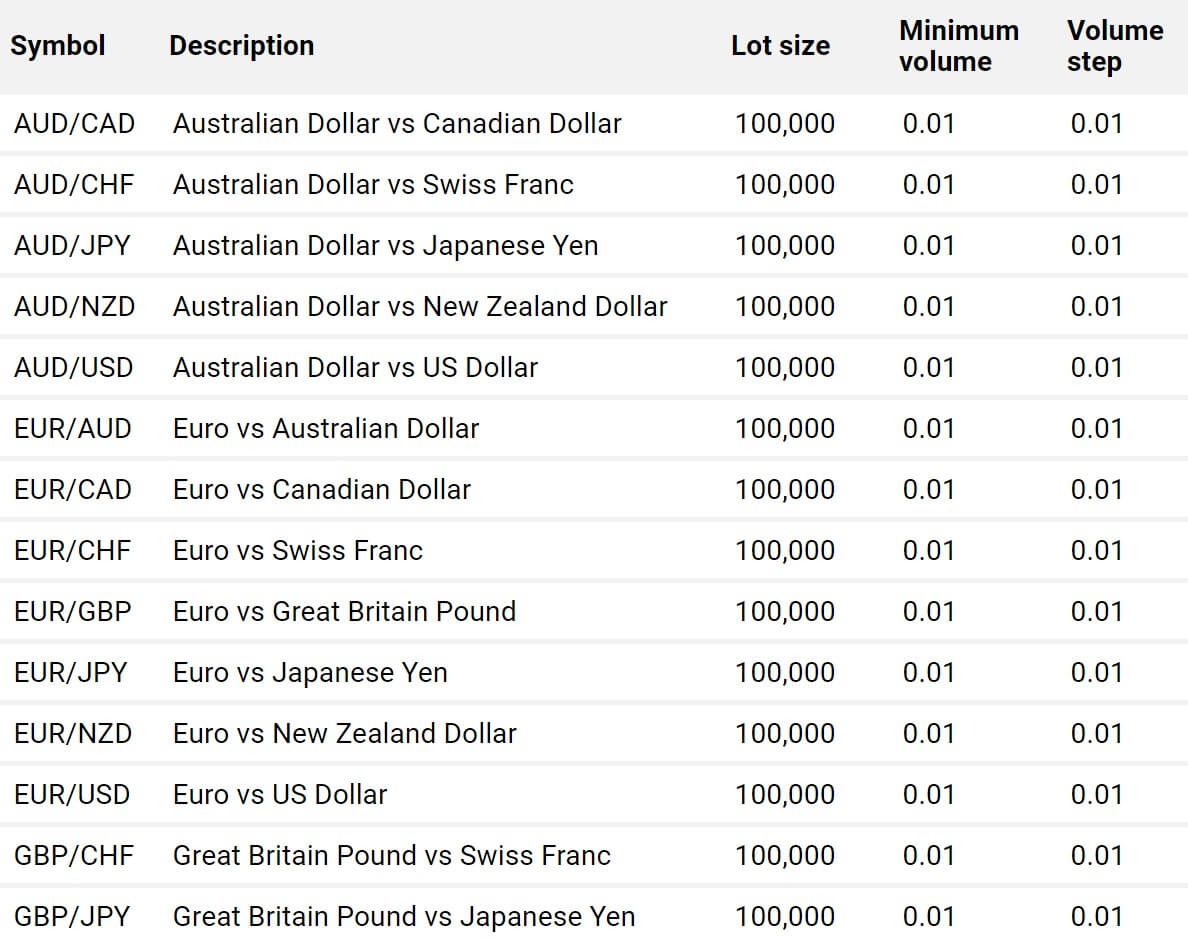

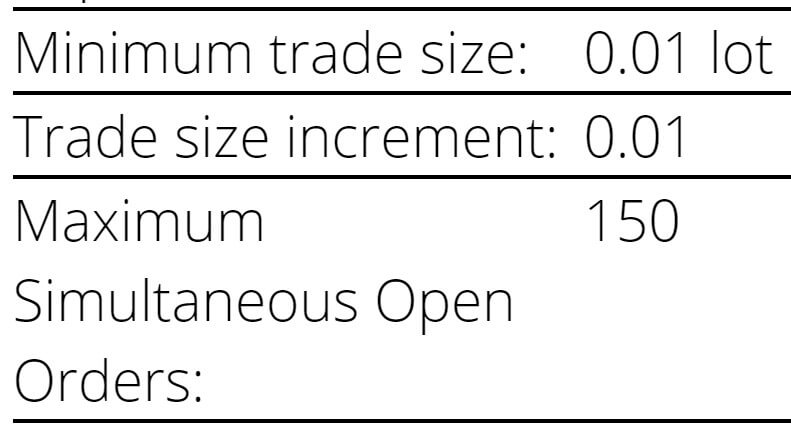

Trade Sizes

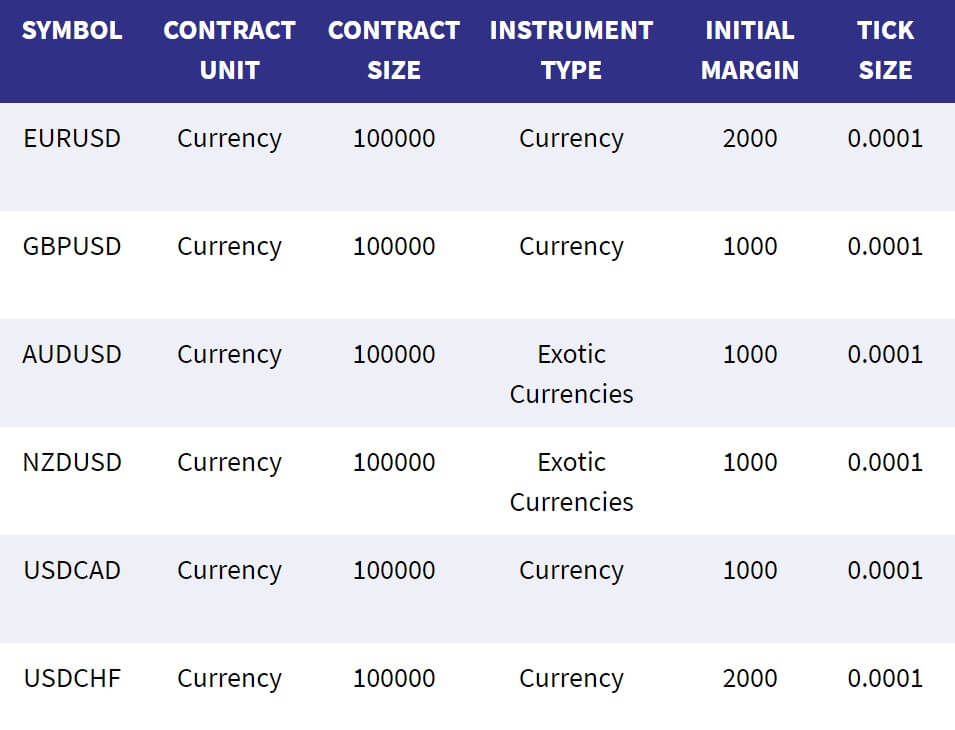

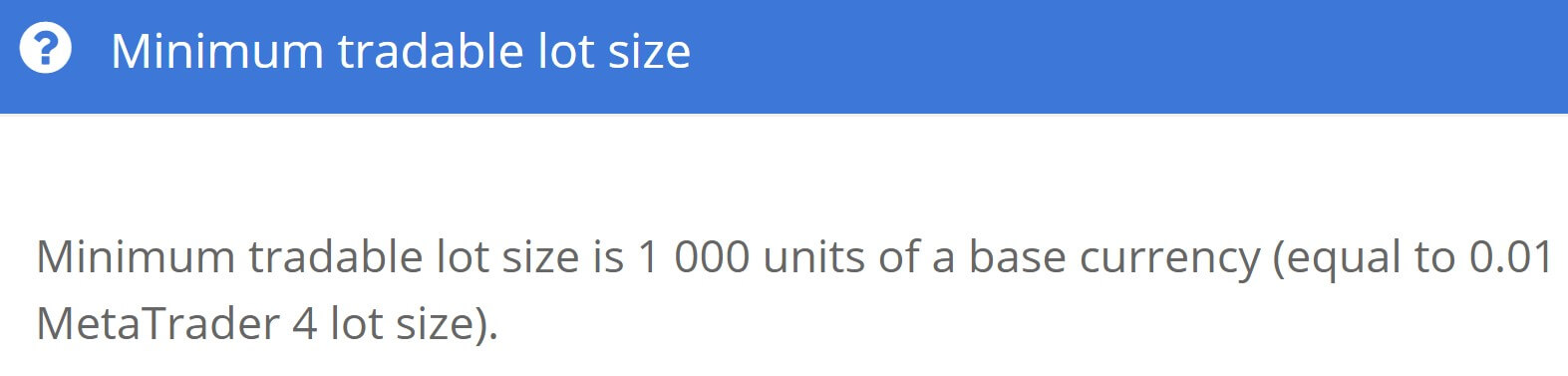

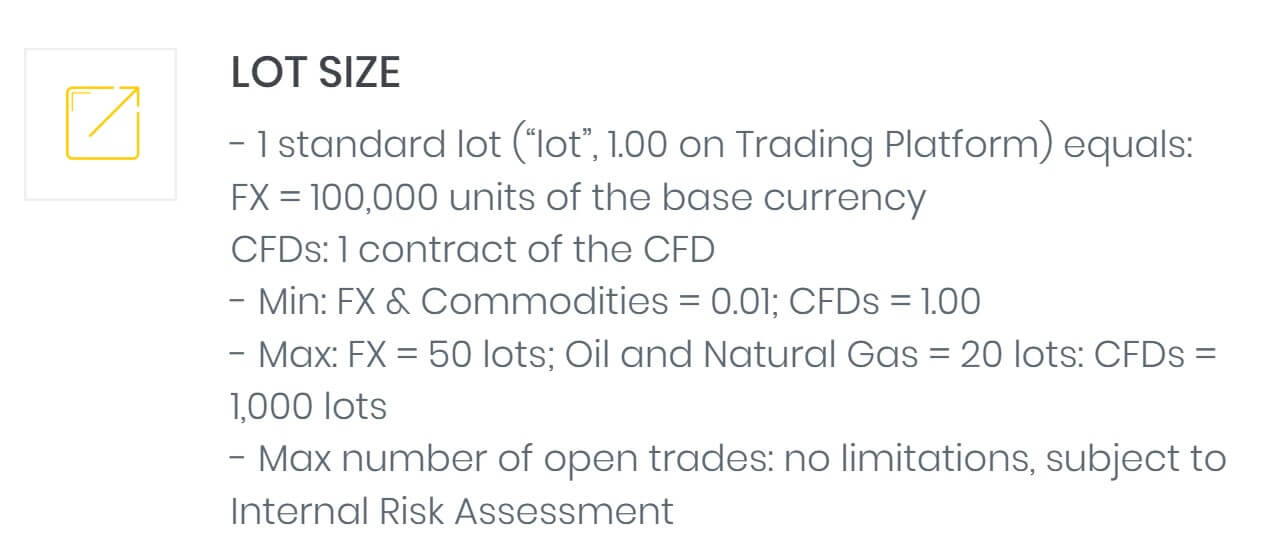

The information about the trade sizes is not published on the website. We were unable to check them in MT4. In the contract specification page, the contract size is 100,000 units but what is a minimum trade size cannot be confirmed.

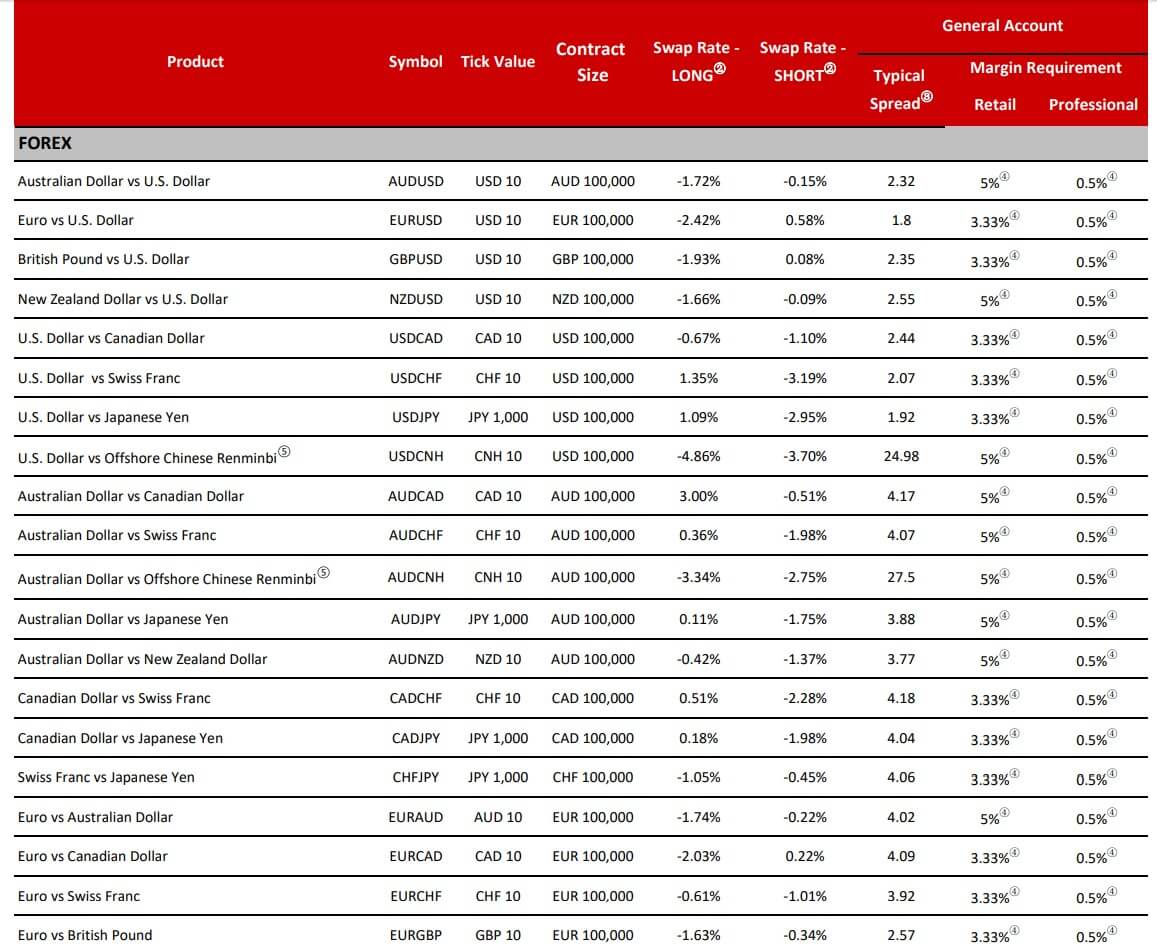

Trading Costs

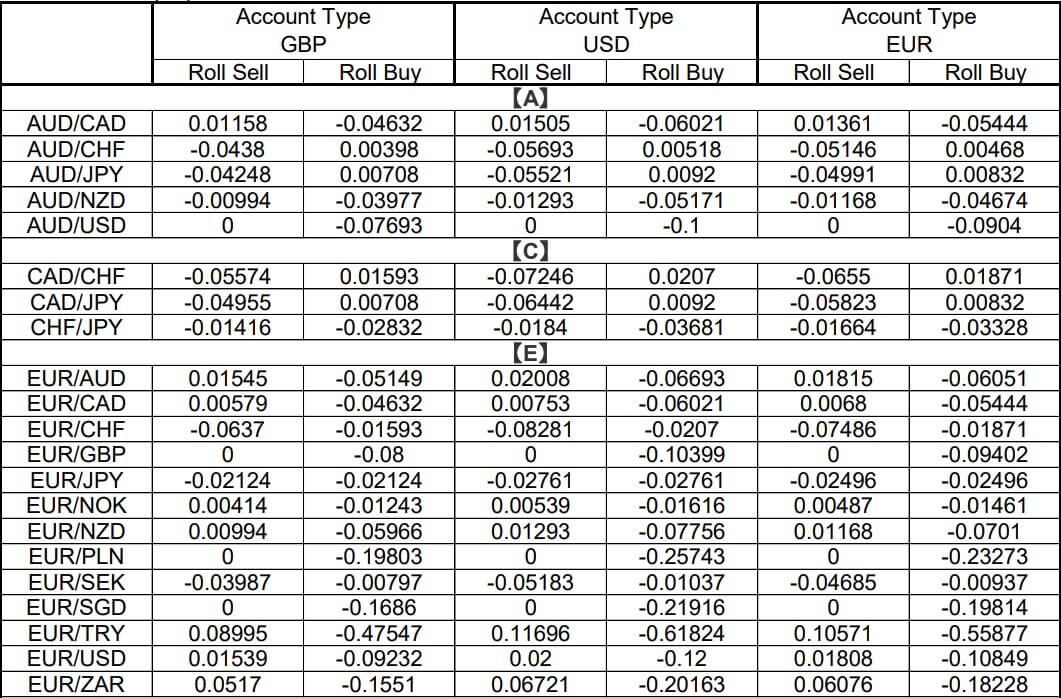

Paramount charges a commission on two of their account types, Classic and Paramount Pro. For the Classic the commission is $3.5 per lot and $4 for the Paramount Pro. Standard Account is free of commissions. Swaps are accounted only for the Paramount Pro Account. They are all almost negative swaps, regardless of the trading side. They are all under normal levels though, for example, the most traded currency pair, EUR/USD has a swap of -5.25 points for long and -3.17 for short, USD/JPY has -1.49 points for long and -2.76 points for short, GBP/USD -4.38 for long and -3.67 on the short side, and a positive for the NZD/USD with -1.66 points for long and 0.35 on the short side.

Paramount charges a commission on two of their account types, Classic and Paramount Pro. For the Classic the commission is $3.5 per lot and $4 for the Paramount Pro. Standard Account is free of commissions. Swaps are accounted only for the Paramount Pro Account. They are all almost negative swaps, regardless of the trading side. They are all under normal levels though, for example, the most traded currency pair, EUR/USD has a swap of -5.25 points for long and -3.17 for short, USD/JPY has -1.49 points for long and -2.76 points for short, GBP/USD -4.38 for long and -3.67 on the short side, and a positive for the NZD/USD with -1.66 points for long and 0.35 on the short side.

Minors pairs swaps are similar, none of them go over -5 points on either side except for the EUR/AUD with -5.55 points on the long and a positive 1.55 swap on the short side. For exotics currency pairs the swap is higher, for the USD/MXN it is -9.18 on the long and 0.54 on the short, USD/TRY has -55 long and 15 short, and EUR/TRY -69 long and 21 positive short side swap. Precious metals swaps are very low, XAU/USD has just -1.95 on the long and 0.1 on the short side. We could not confirm if these are calculated in percentage terms or points.

Paramount FX does not disclose their inactivity fee but we have managed to find a clause in the Terms and Conditions. Funded accounts that remain inactive for six (6) months will be charged a fee of $50.00. This fee may not be charged in every case.

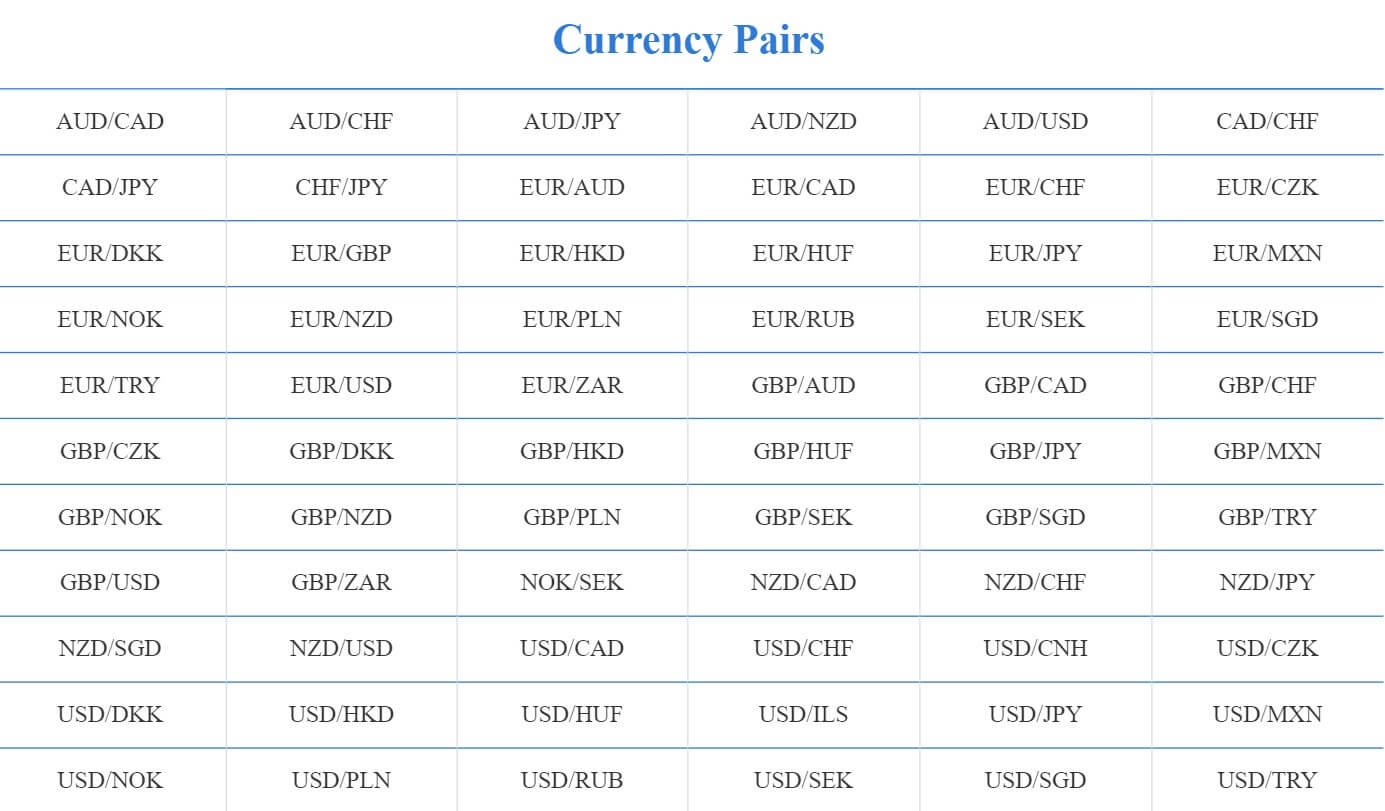

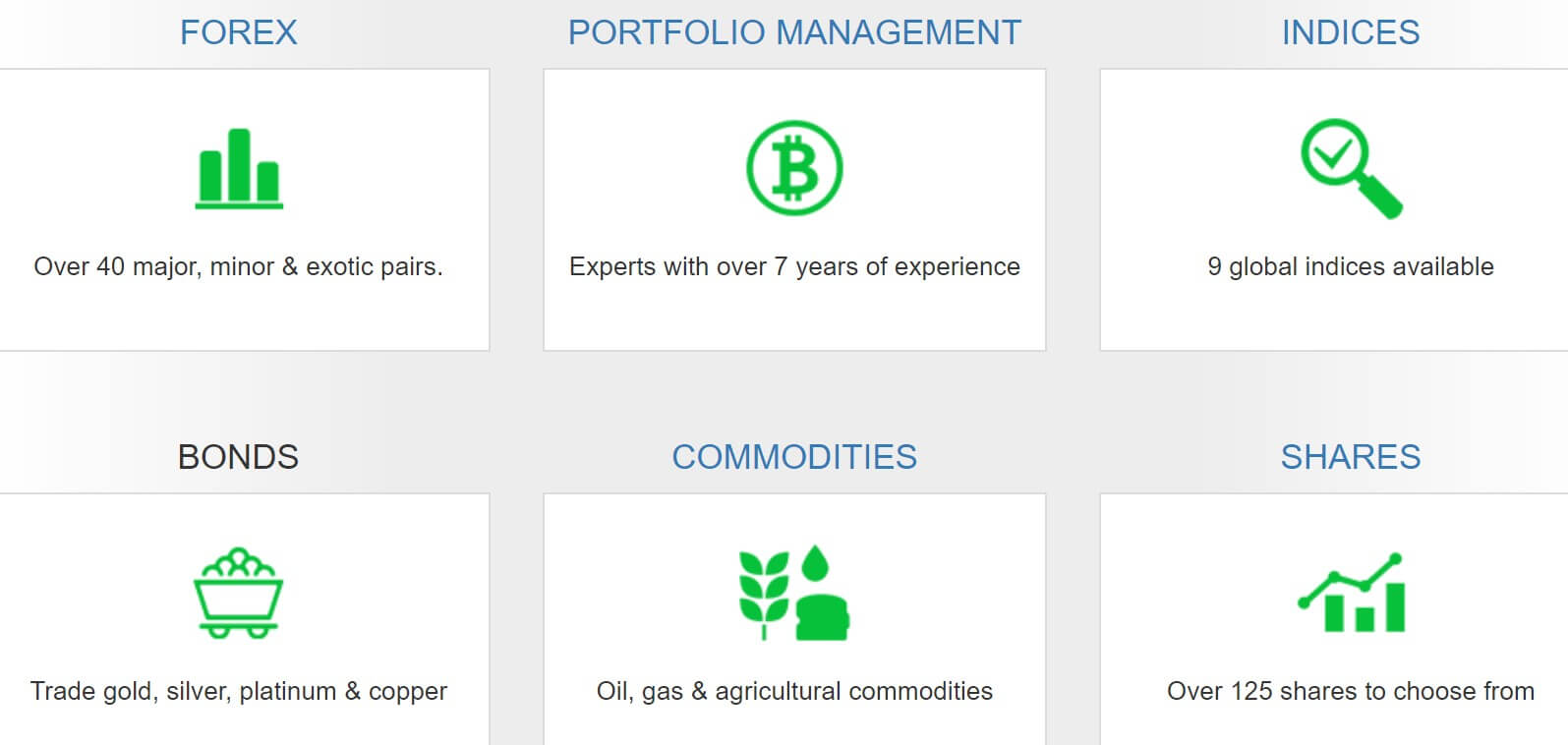

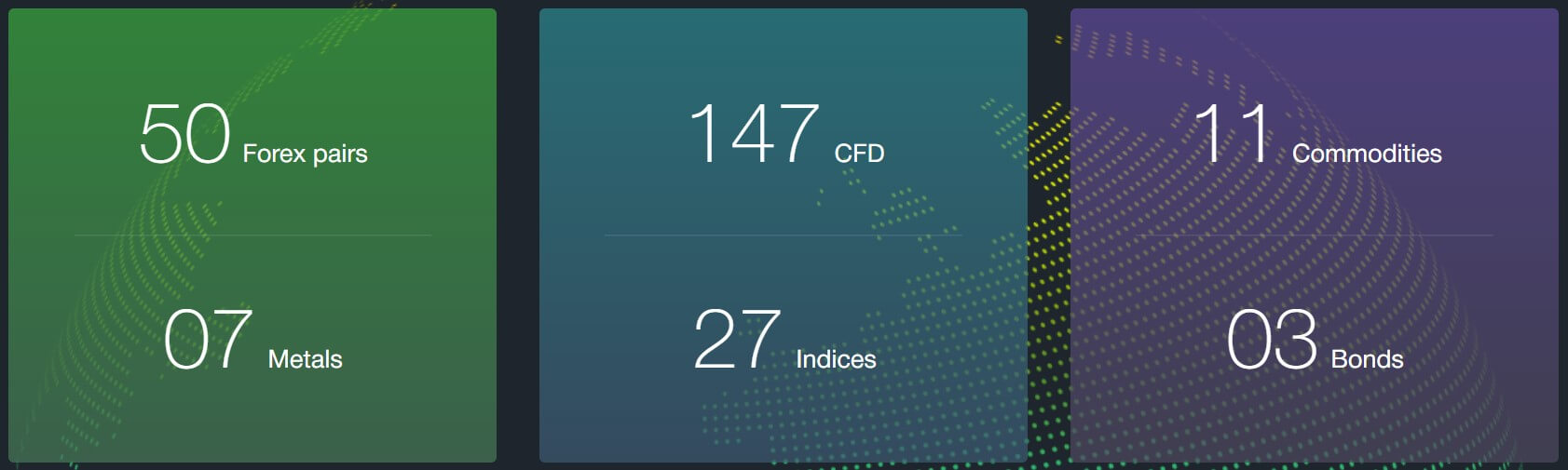

Assets

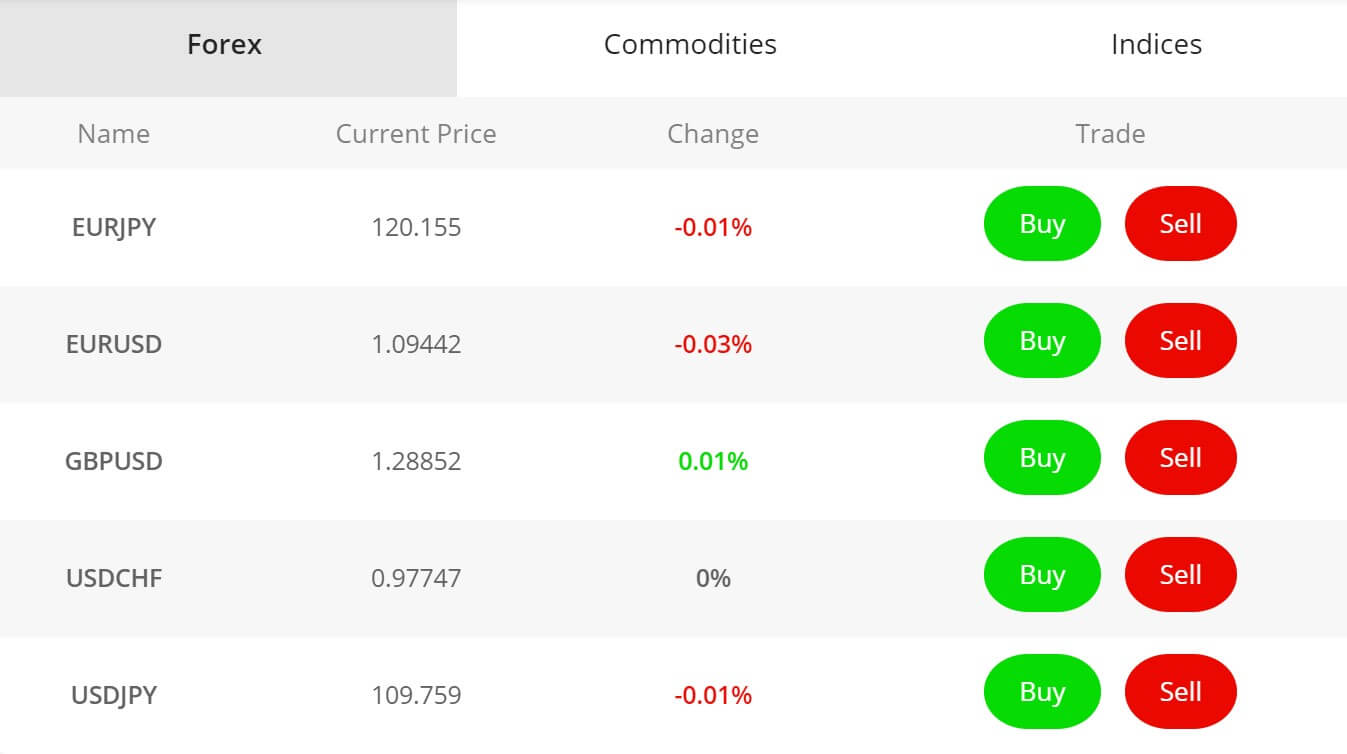

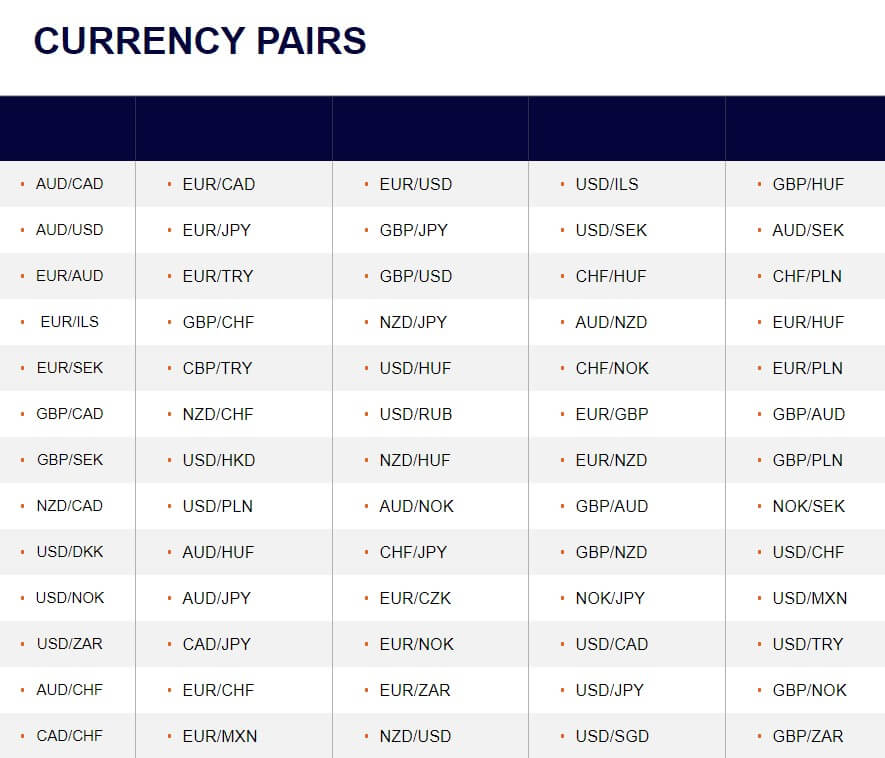

ParamountFX does not have a great instruments range in any category, but still offers more than typical small brokerages. There are 4 categories offered and they are the same for all account types. Starting with Forex, there are a total of 28 currency pairs. All the majors and minors are present, without any surprise rarities. The exotics are limited to just 3 pairs, USD/MXN, USD/TRY and EUR/TRY.

Precious metals are not limited to just spot Gold and Silver. Traders will enjoy Platinum against the USD as well. Precious metals have a 1-hour break for trading, between 5 pm and 6 pm. Commodities are limited to energy assets. These are both Oil types, spot Brent and WTI with the addition of Natural Gas and Crude Oil futures. We have noticed that the broker has set the Oil contracts to 100 units or barrels but the standard is 1000.

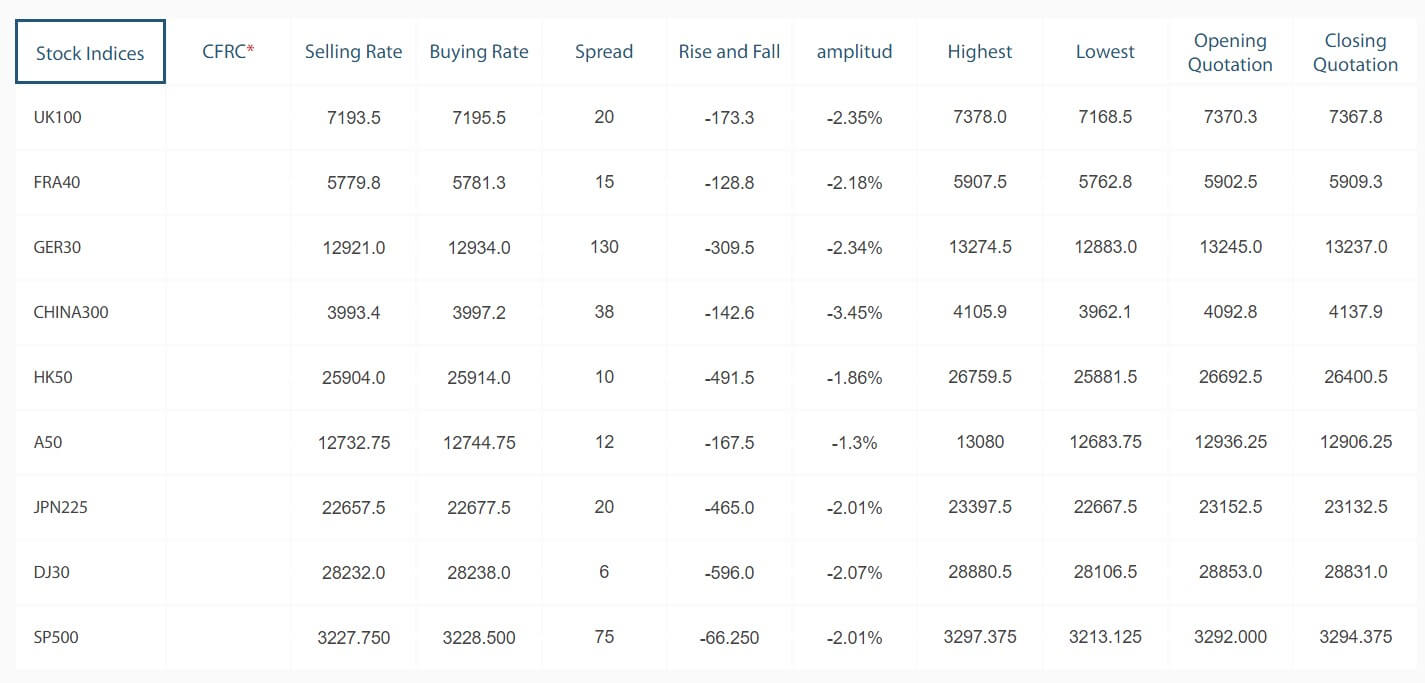

Indexes range is also limited to the 8 most popular ones. Among the S&P 500, NASDAQ 100, Dow Jones 30 and Nikkei 225, the ones from Europe are CAC 40, GER 30, UK 100, and EURO 50. Still, for the majority of traders, this is enough, although if a broker wants to attract specific region clients it is good to see indexes belonging to relevant countries.

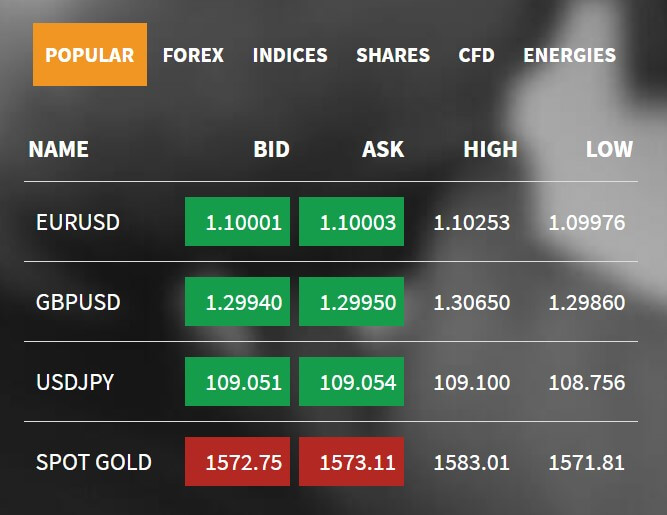

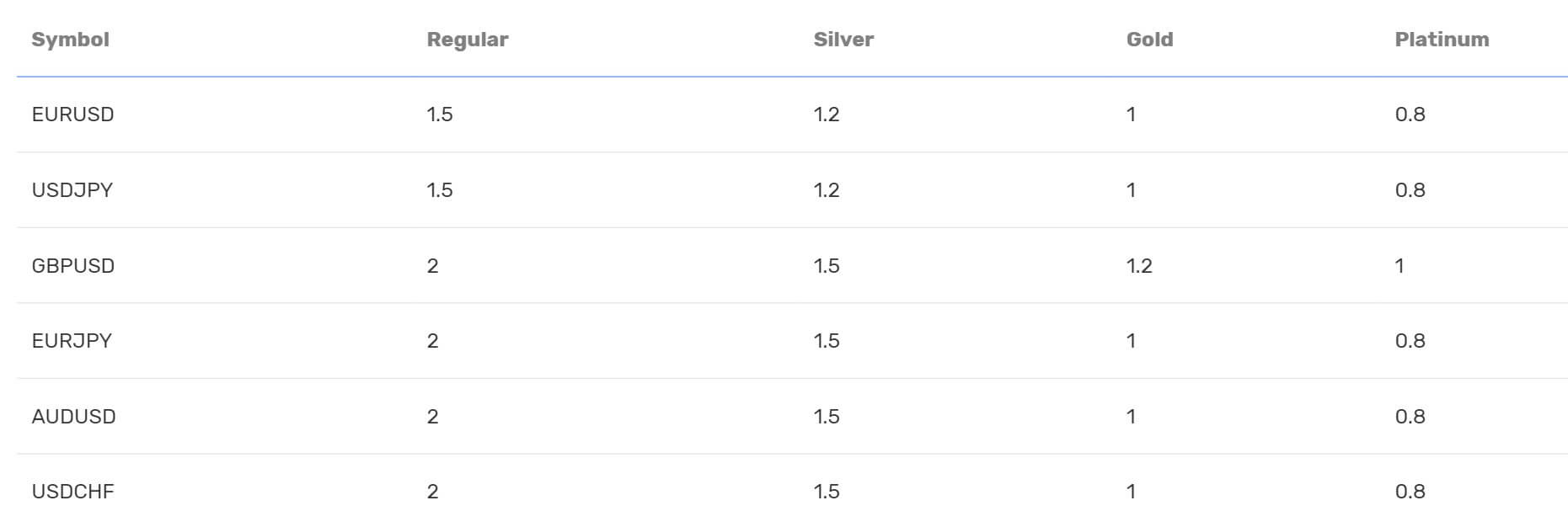

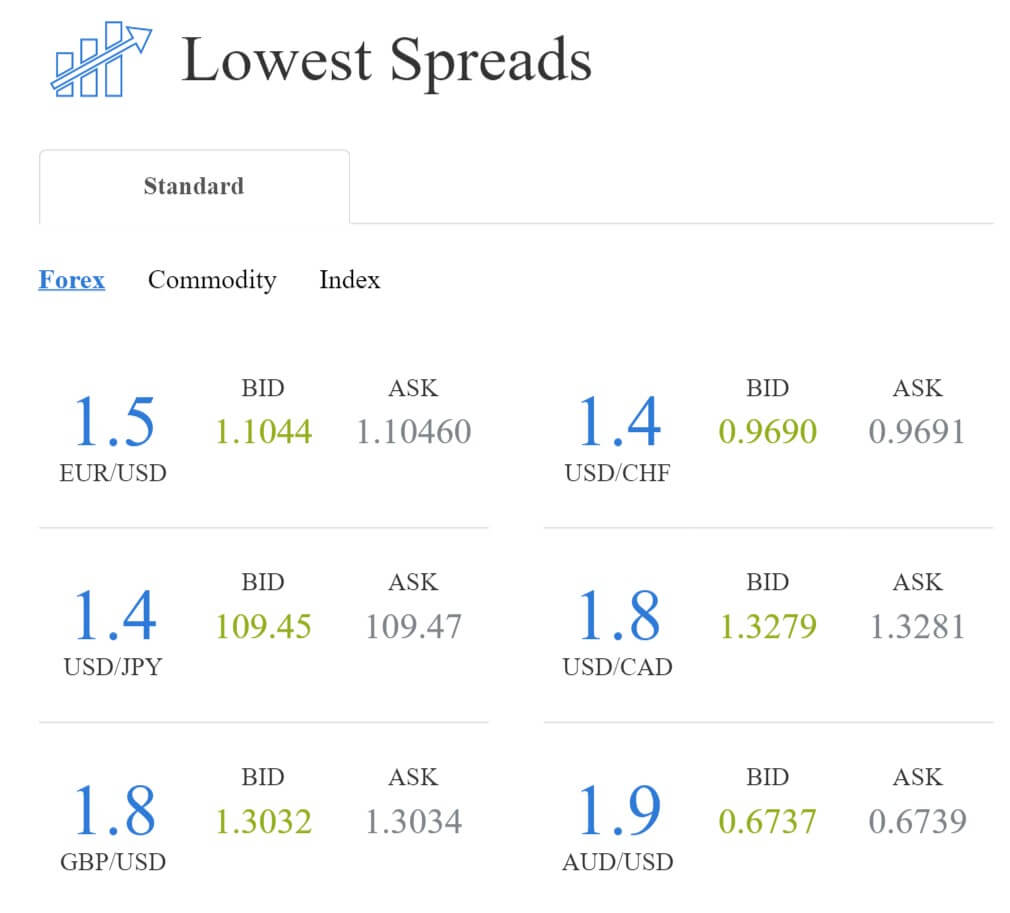

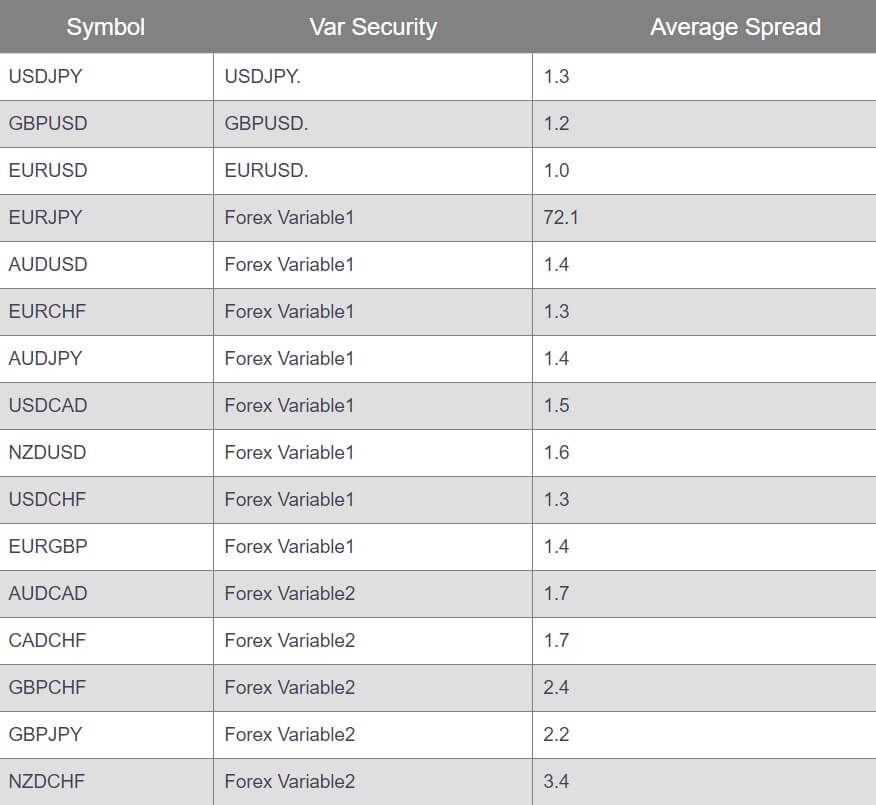

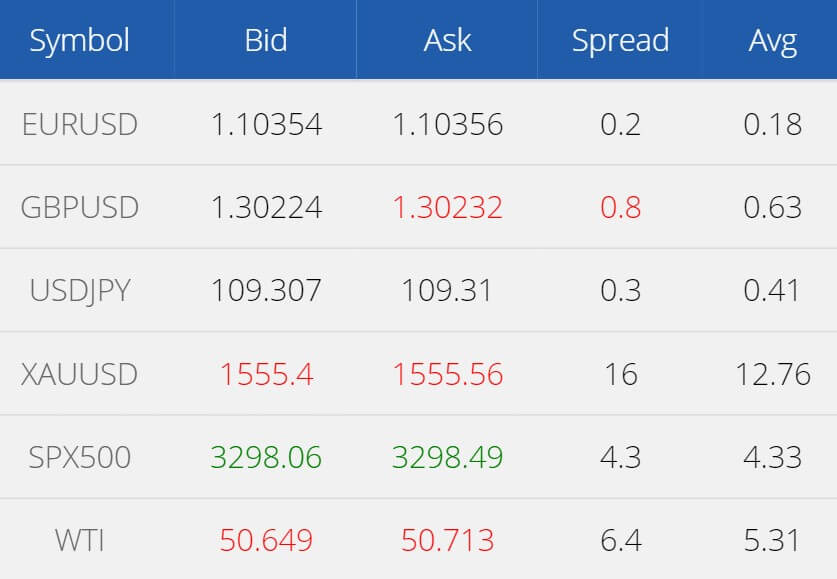

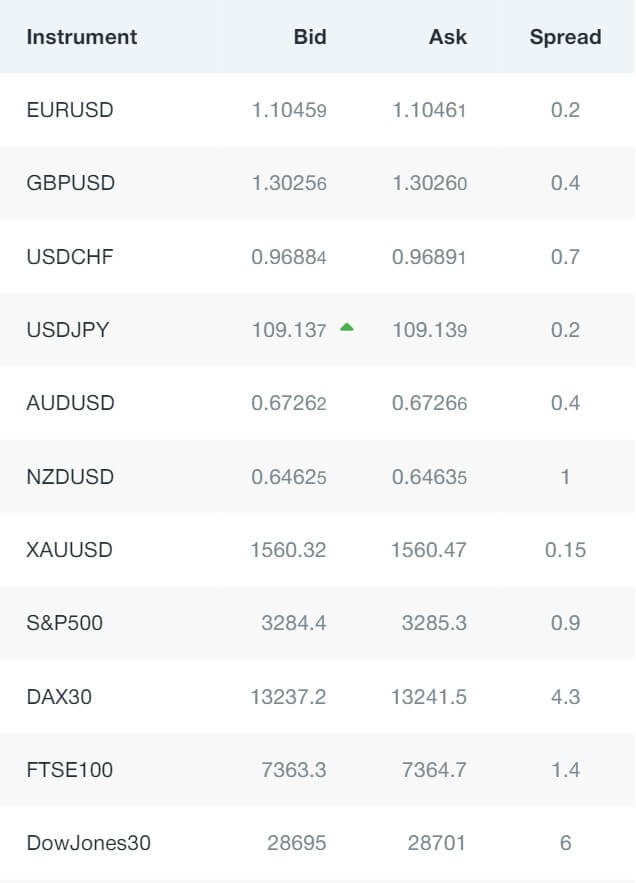

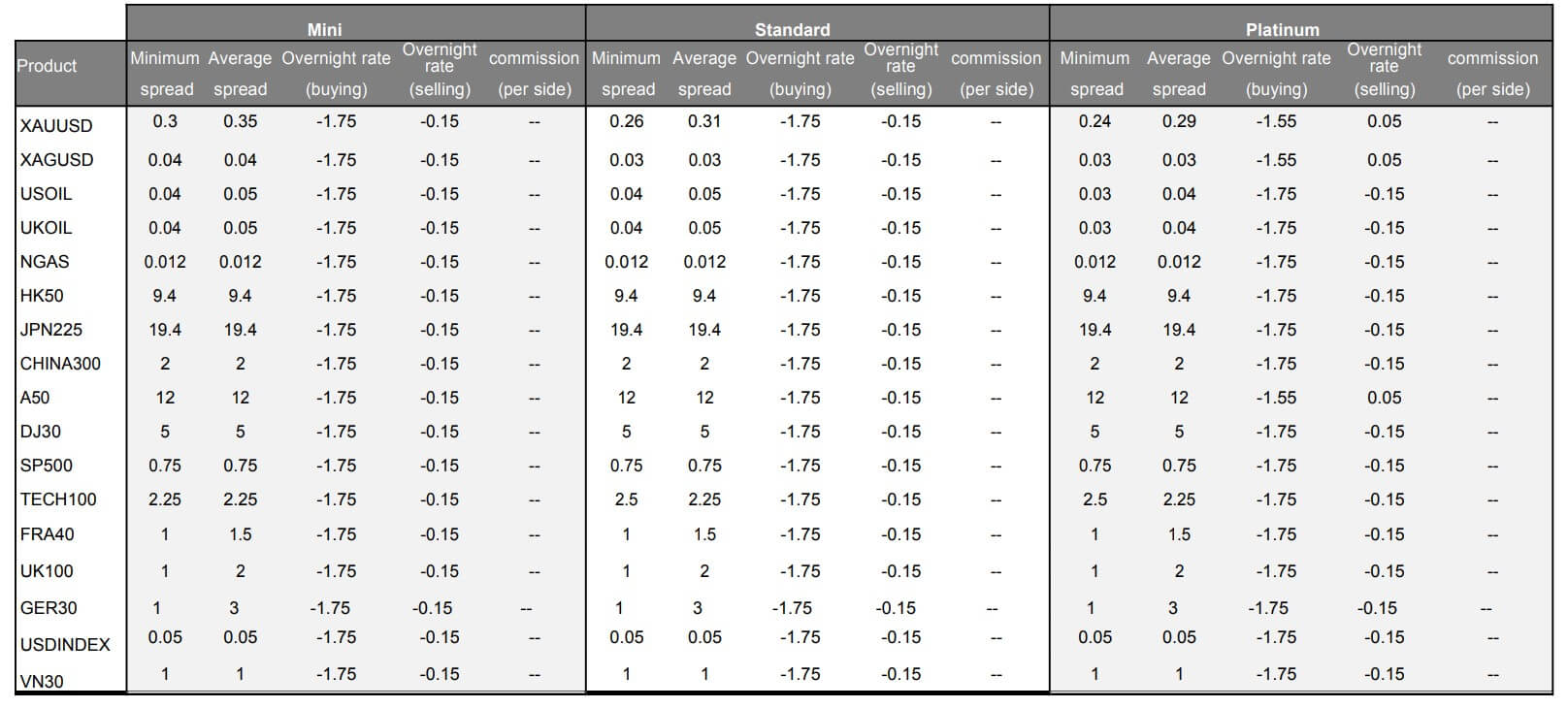

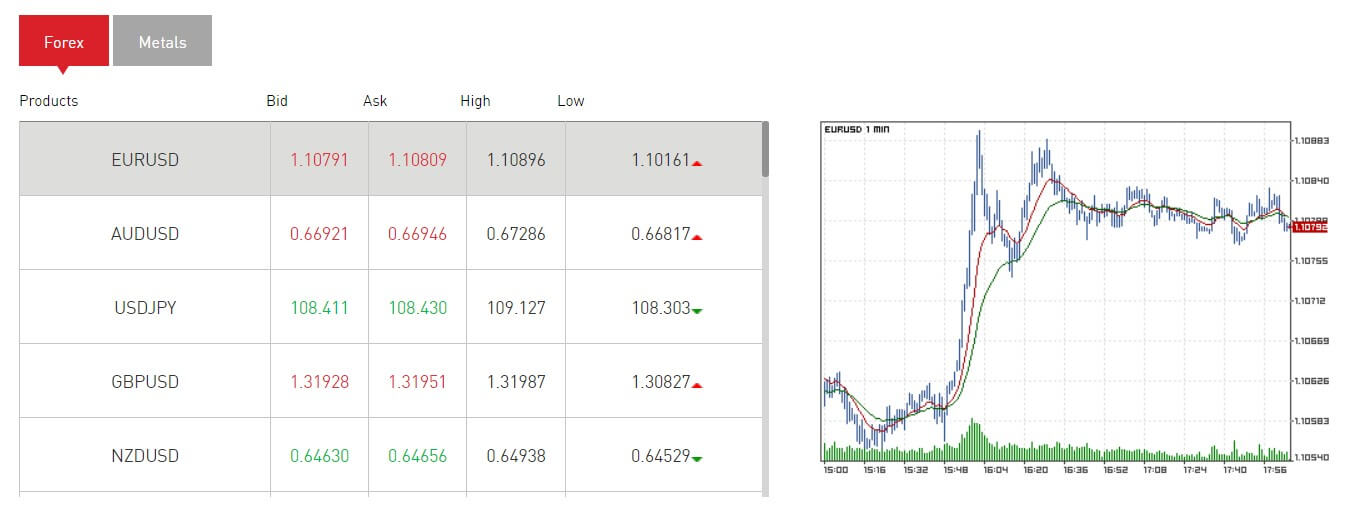

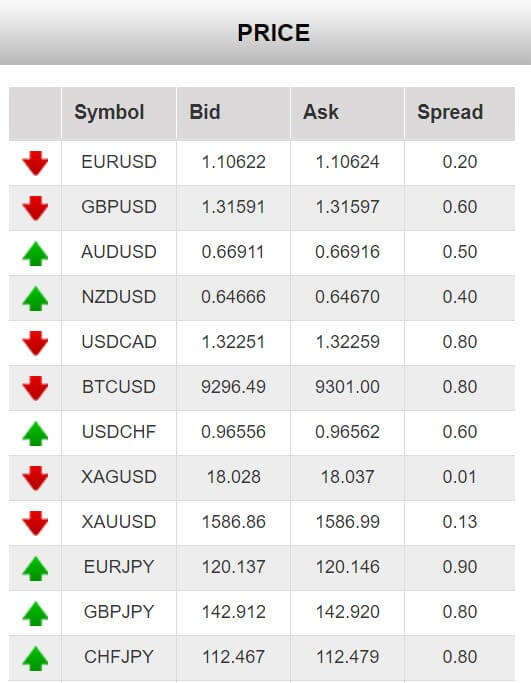

Spreads

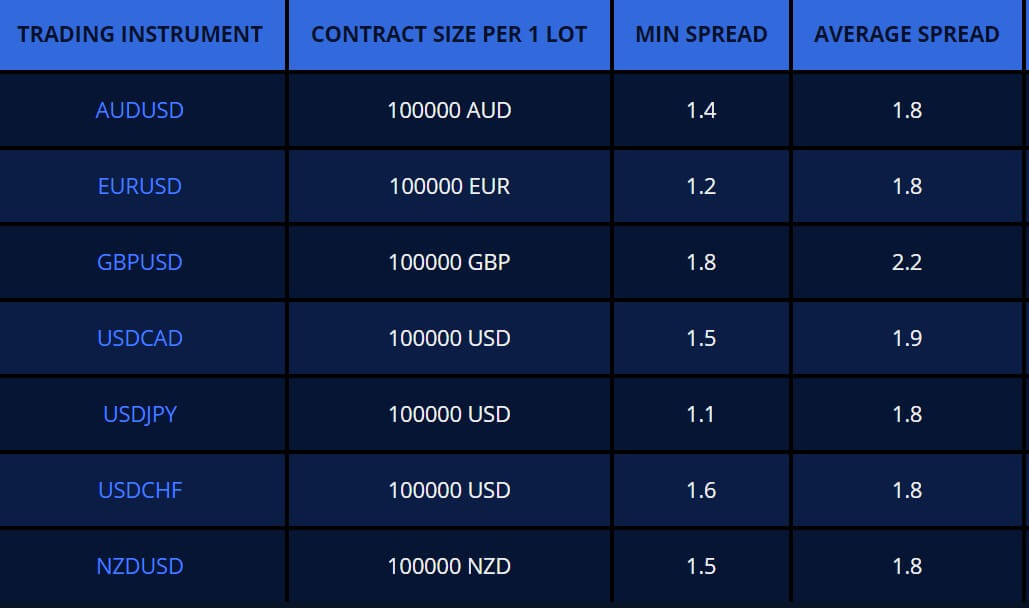

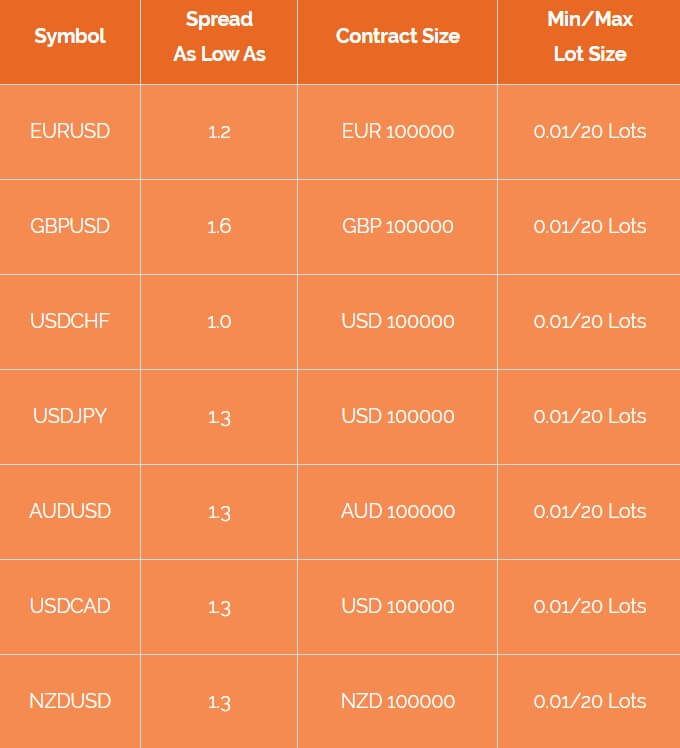

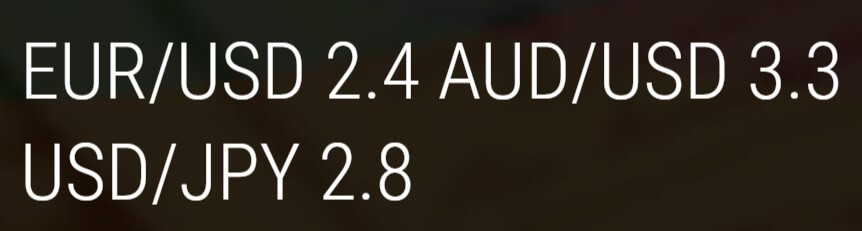

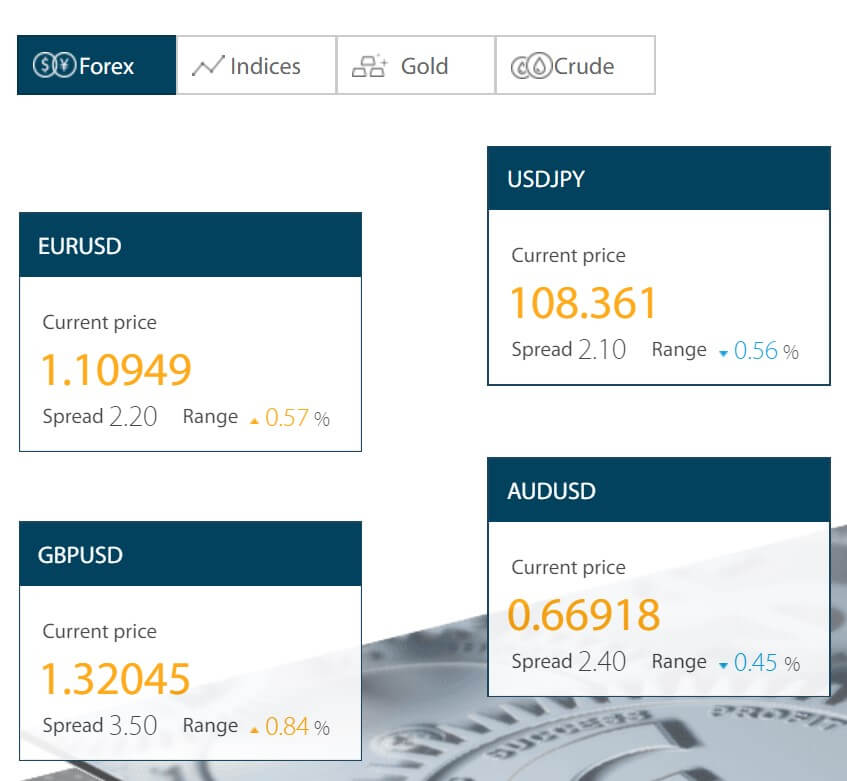

All accounts have a floating spread type. We are not able to check the real spreads from the MT4 platform. ParamountFX contains the spreads and their average values listed on the Contract Specification page. According to that list, for the Standard Account ahs about 20 to 30% wider spreads than the Classic Account. For reference, the Classic Account EUR/USD pair has a 1.2 pips minimum spread and 1.8 pips average. It is not disclosed what is the averaging period. For other majors the spread is similar, the highest minimum spread was for the GBP/USD, 1.8 pips and 2.2 pips on average.

All accounts have a floating spread type. We are not able to check the real spreads from the MT4 platform. ParamountFX contains the spreads and their average values listed on the Contract Specification page. According to that list, for the Standard Account ahs about 20 to 30% wider spreads than the Classic Account. For reference, the Classic Account EUR/USD pair has a 1.2 pips minimum spread and 1.8 pips average. It is not disclosed what is the averaging period. For other majors the spread is similar, the highest minimum spread was for the GBP/USD, 1.8 pips and 2.2 pips on average.

As expected, the widest spread among the minor currency pairs is for the GBP as it is one of the most moving currency. GBP/NZD has 4.5 pips minimum and 4 pips on average while GBP/AUD has 4.5 pips minimum and 3 pips on average. Exotics have low spreads for their volatility and liquidity, so USD/MXN has 70 pips minimum and 50 average, and USD/TRY has 25 pips minimum and 30 pips maximum.

For Precious metals, the spread is published in cents. XAU/USD has 4 cents spread but this is probably a typo, 40 cents per lot is more real. For silver, it is also 40 and for Platinum is $5. Commodities spreads are from 30 to 60 cents on average, and Indexes are all set to have a minimum of 4 pips and 5 pips on average according to the broker.

Paramount Pro Account has the best spreads. EUR/USD has from 0.6 pips to 1 pip, and other majors do not go above 1.5 pips on average (AUD/USD). Minors do not have average spread above 3 pips except for the GBP/CAD with 3.7 pips on average and 2 pips minimum. GBP/NZD and GBP/NZD are the ones with the higher minimum spread od 3 pips according to the list. Exotics start from 40 pips for the USD/MXN and with 60 pips on average.

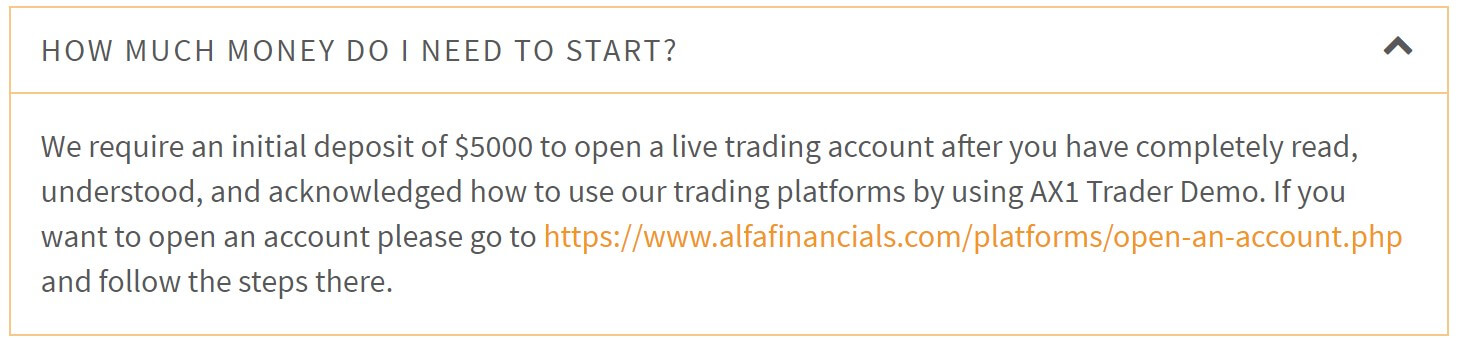

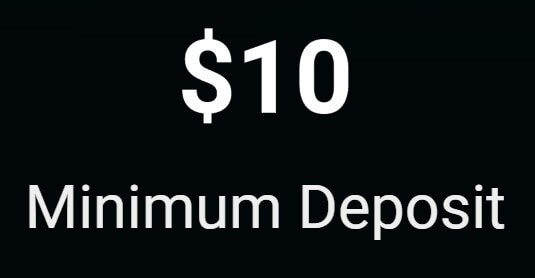

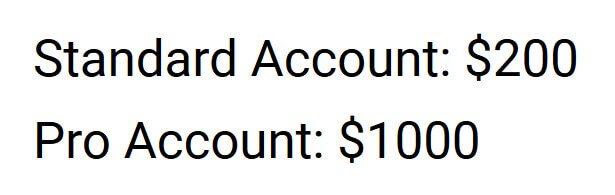

Minimum Deposit

The most affordable account type is the Standard with the minimum requirement of just $10. Classic Account is available form $100 and Paramount Pro from $2000. In the past, the broker set more drastic deposit requirements. It is not common for small off-shore brokers to frequently change the offers. Note that there are deposit methods minimums that may be greater than $10. More on this in the next section.

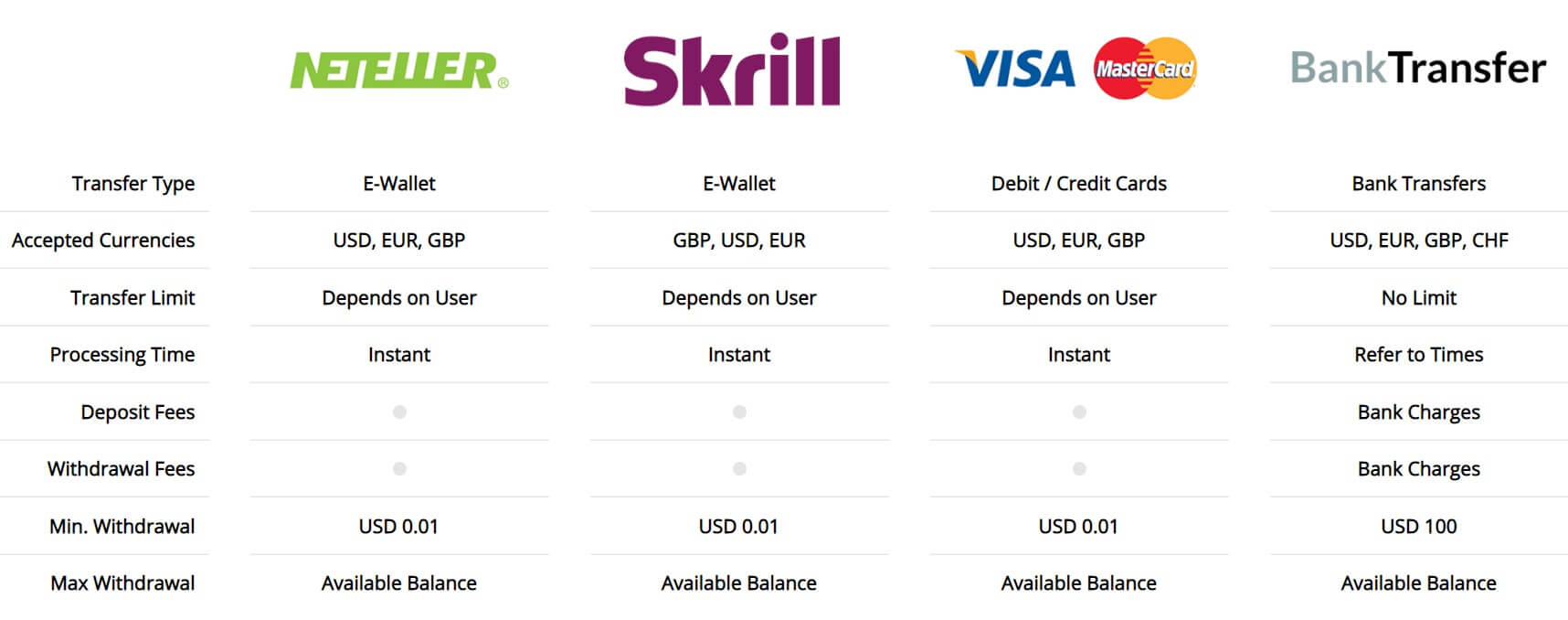

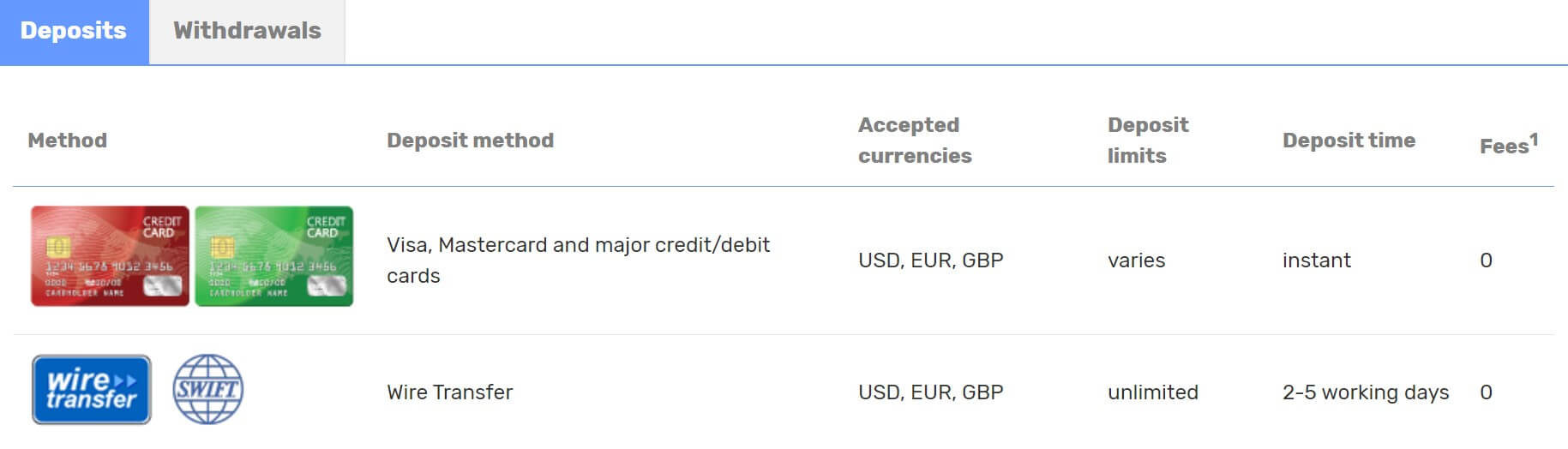

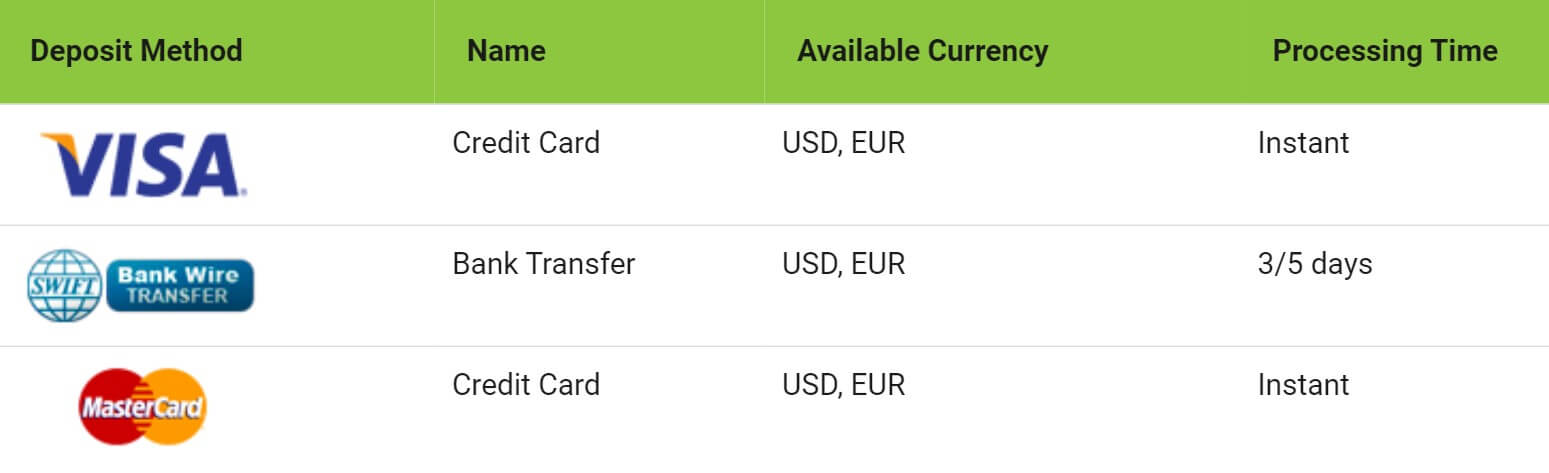

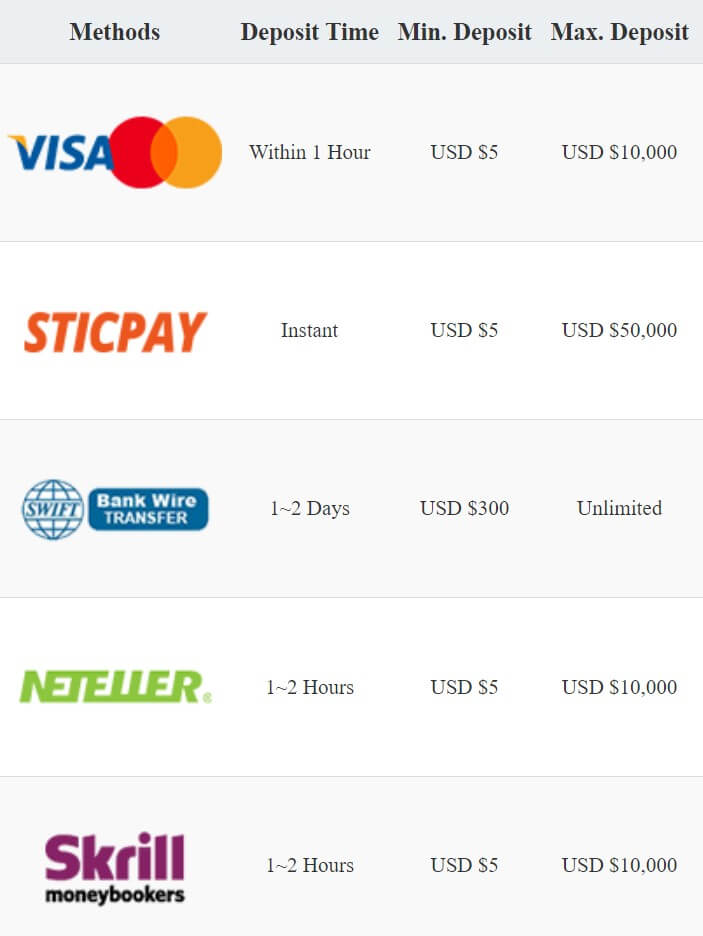

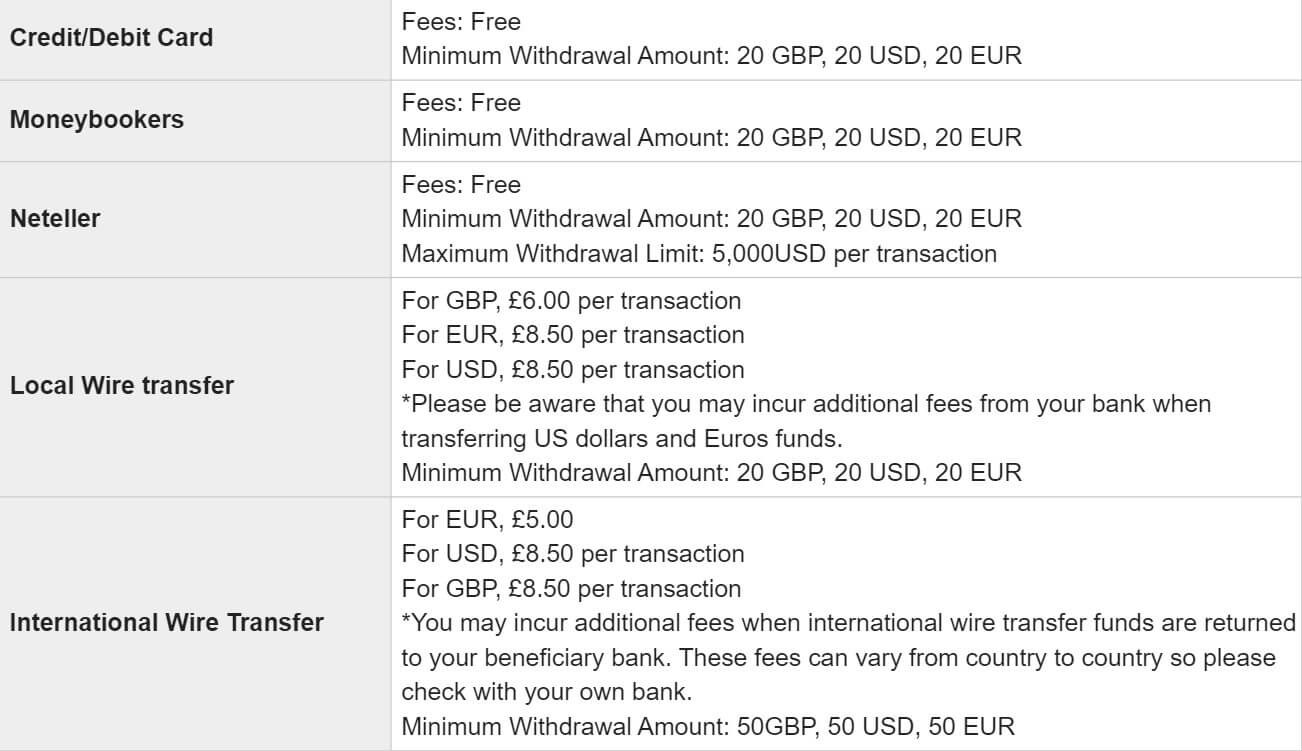

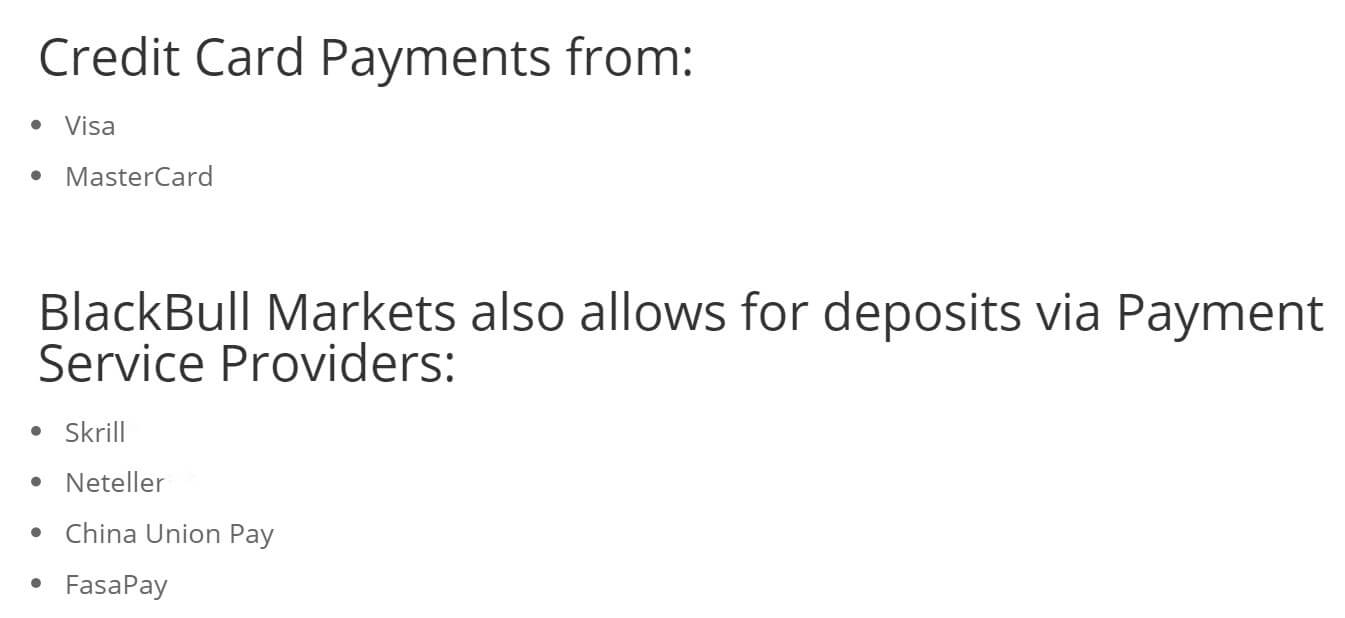

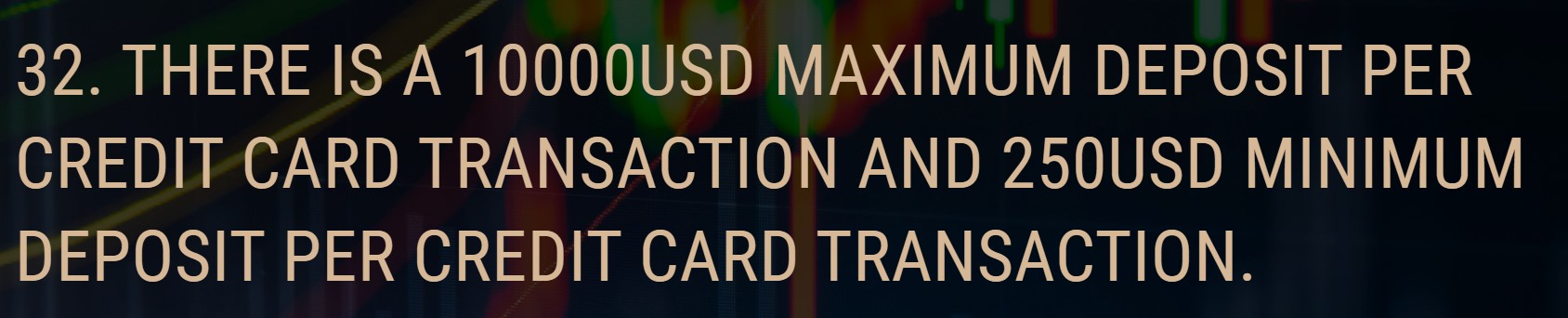

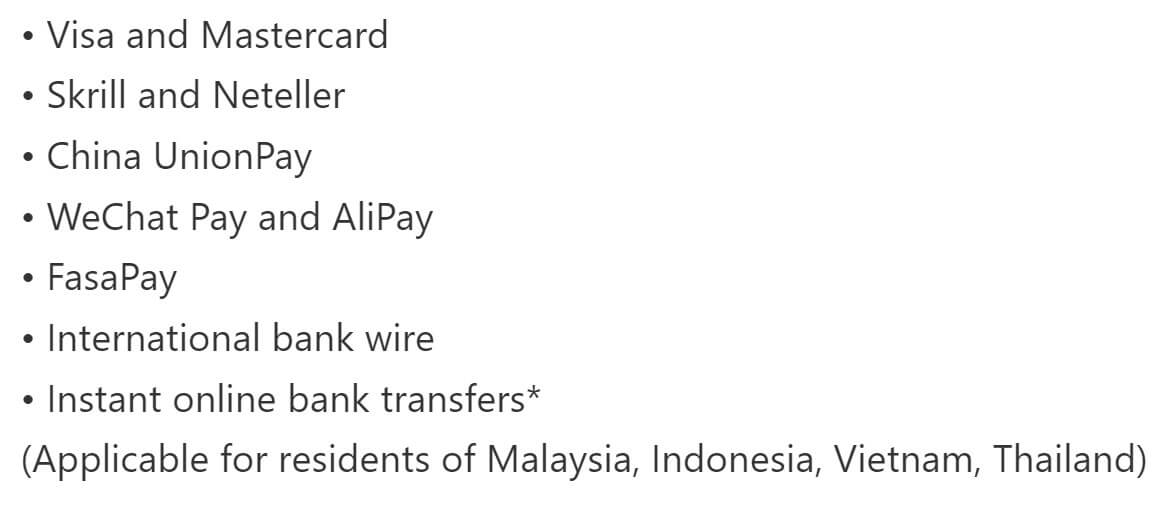

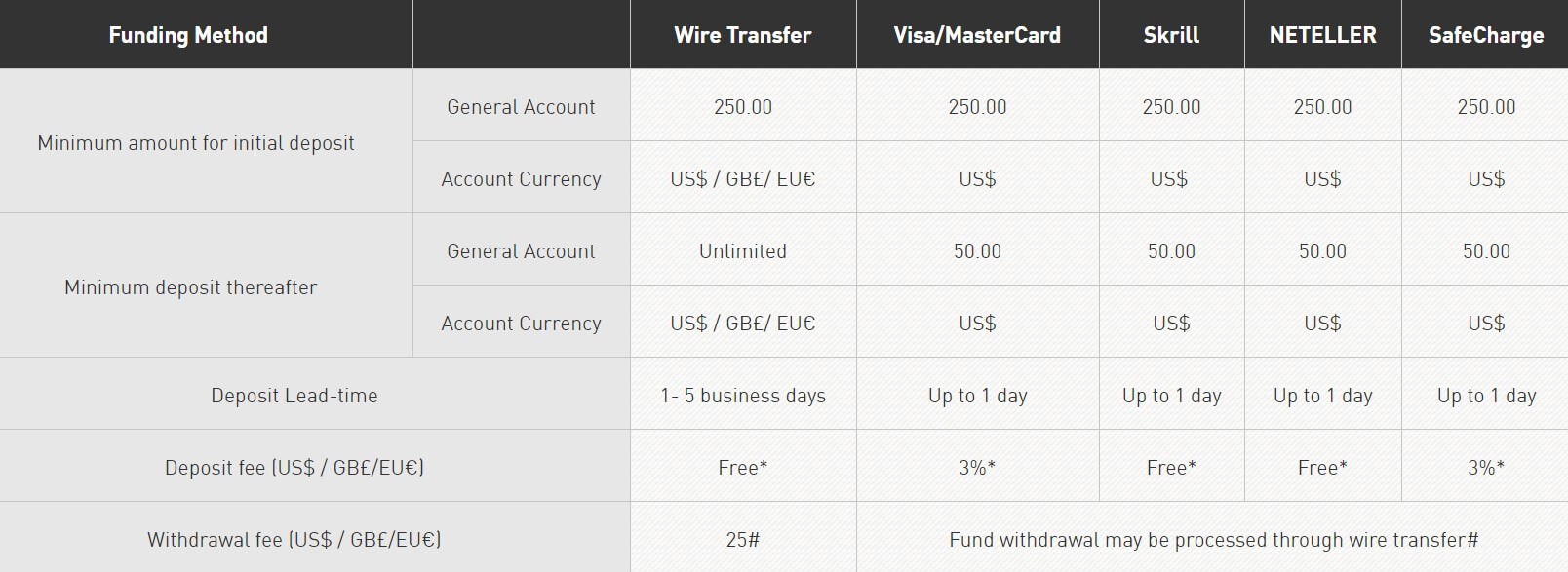

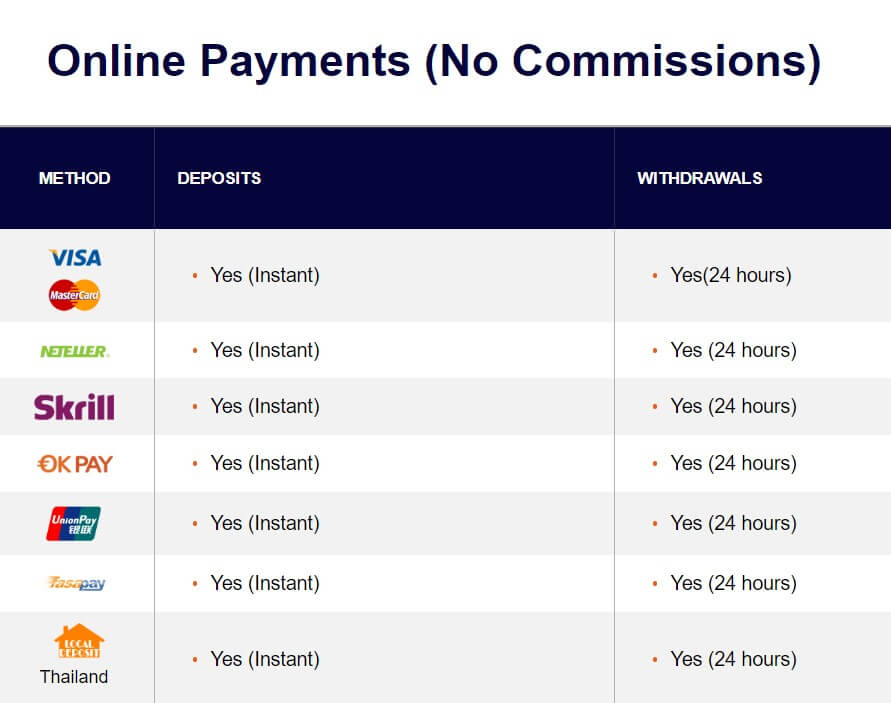

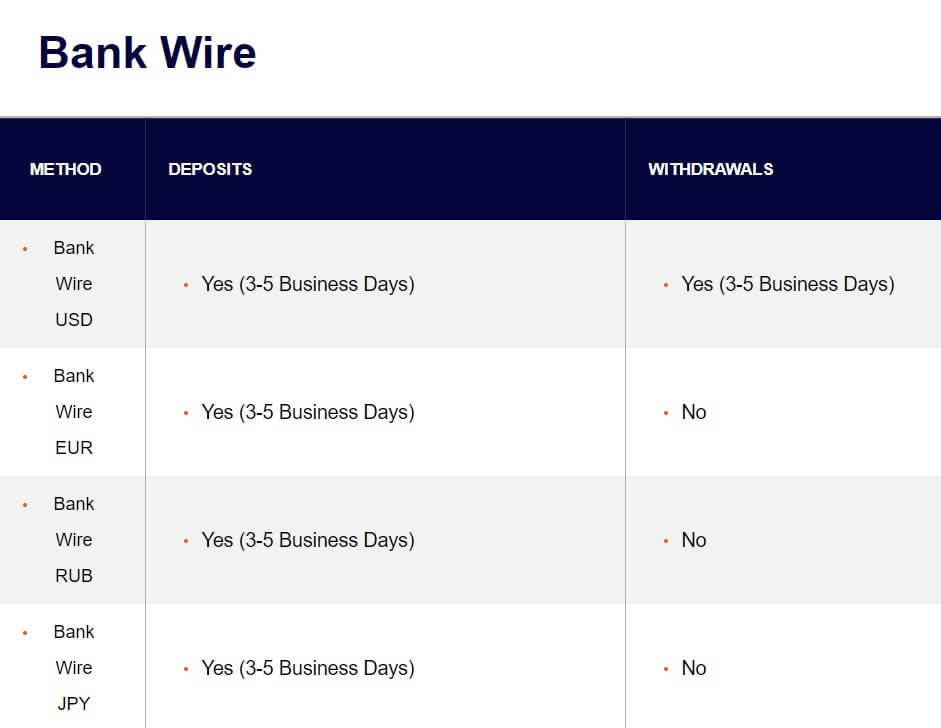

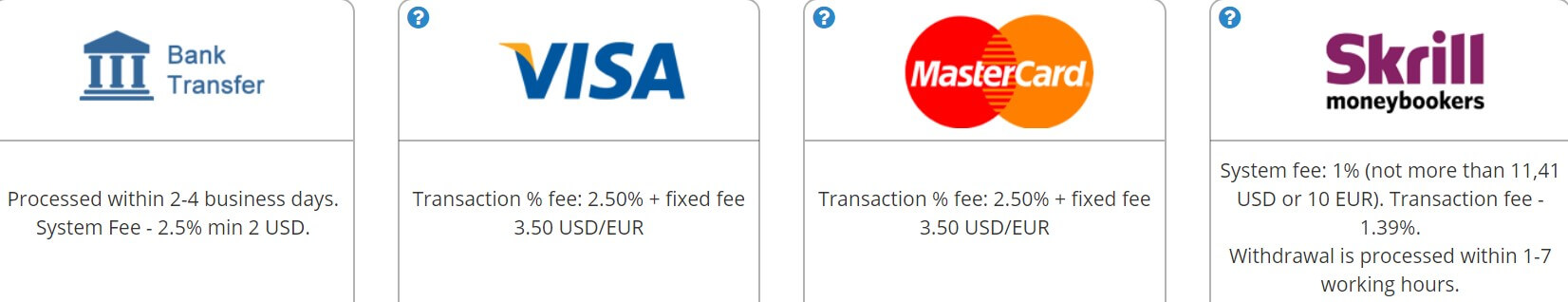

Deposit Methods & Costs

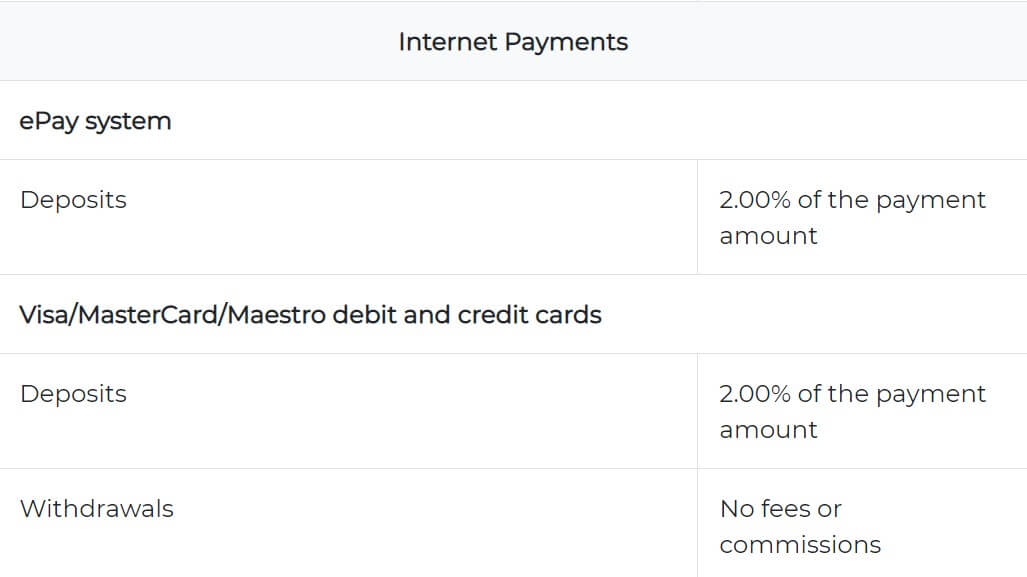

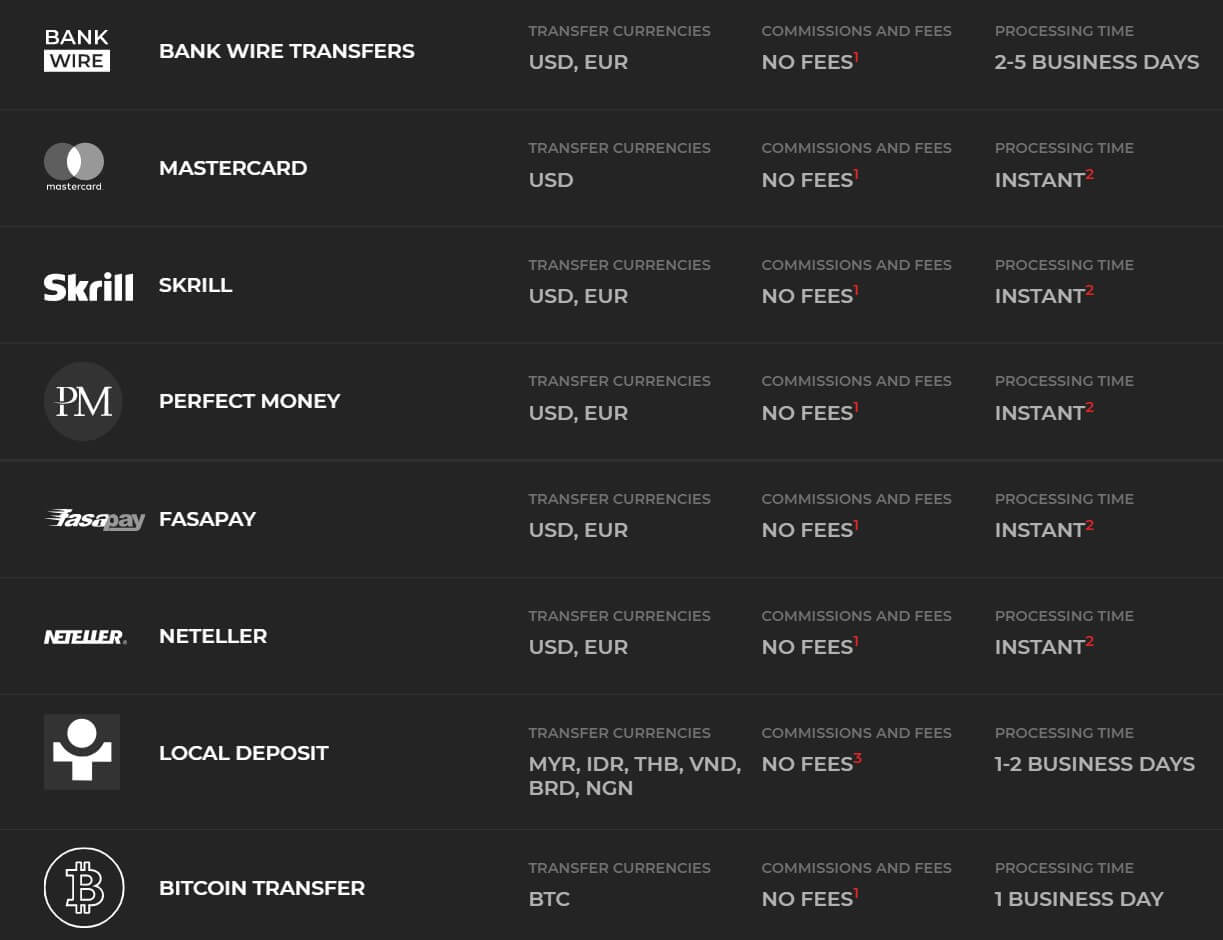

There are various channels traders can deposit and one of them is the Bitcoin. Traditional methods are included, Bank Wire transfers require $100 minimum for a transaction and no limits for the maximum. Credit/Debit Cards need at least $10 and have $5000 maximum, Web Money has a $10 minimum and $10,000 maximum, Paypal needs $10 to $10,000 maximum, Skrill from $10 to $25,000 maximum, and Bitcoin requirement is $100 minimum and $100,000 maximum deposit.

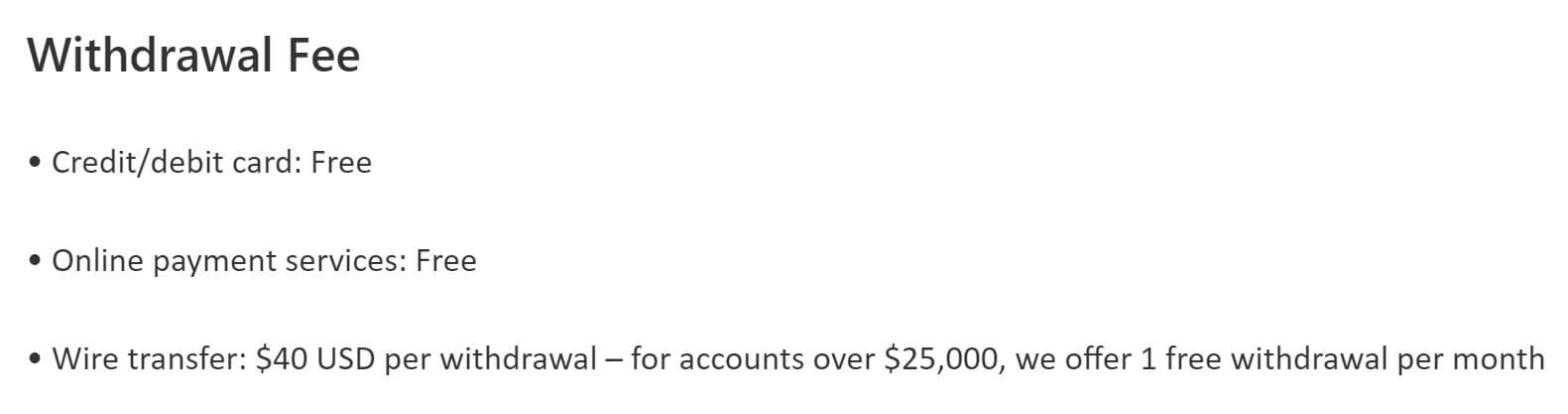

Costs related to deposits are not marginal. Bank transfers require $50 + 1% while Bank Cards do not have any costs. Web Money has a 1.5% fee, Paypal 3%, Skrill 4%, and Bitcoin has a 6% fee, unfortunately. The BTC fee is very discouraging for the crypto enthusiasts as they are designed to be free of transaction costs.

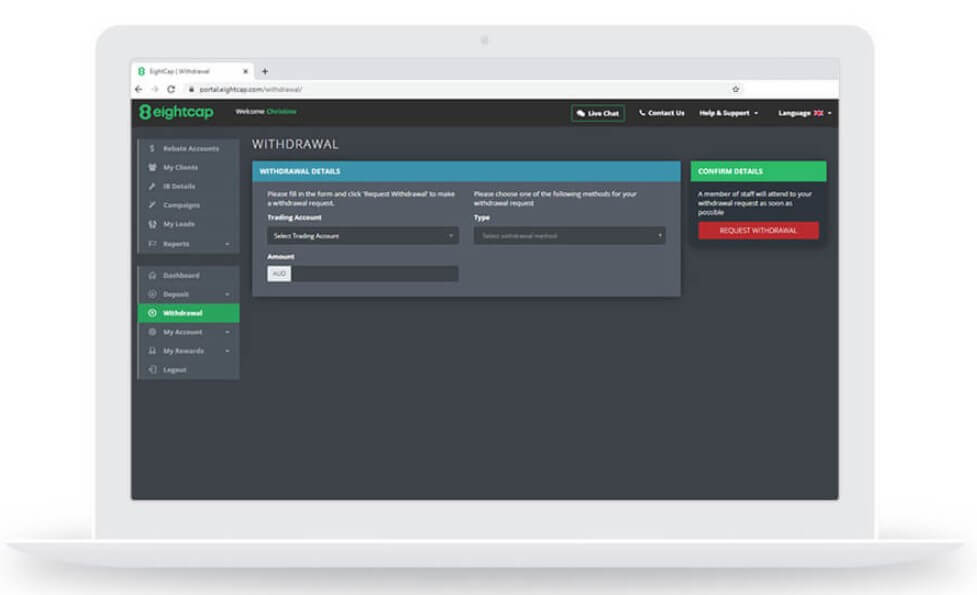

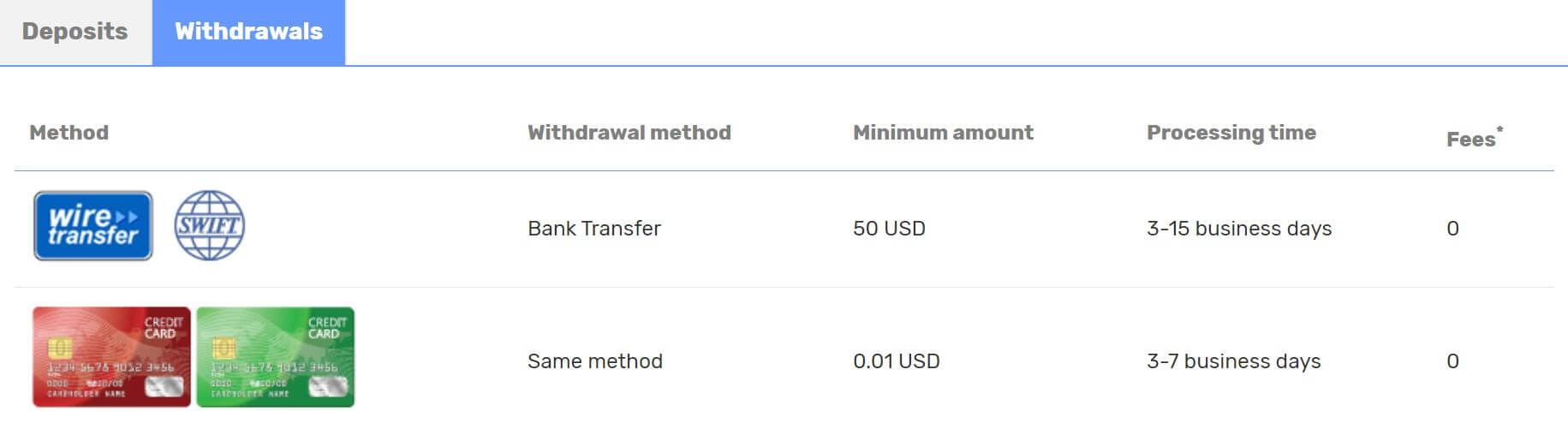

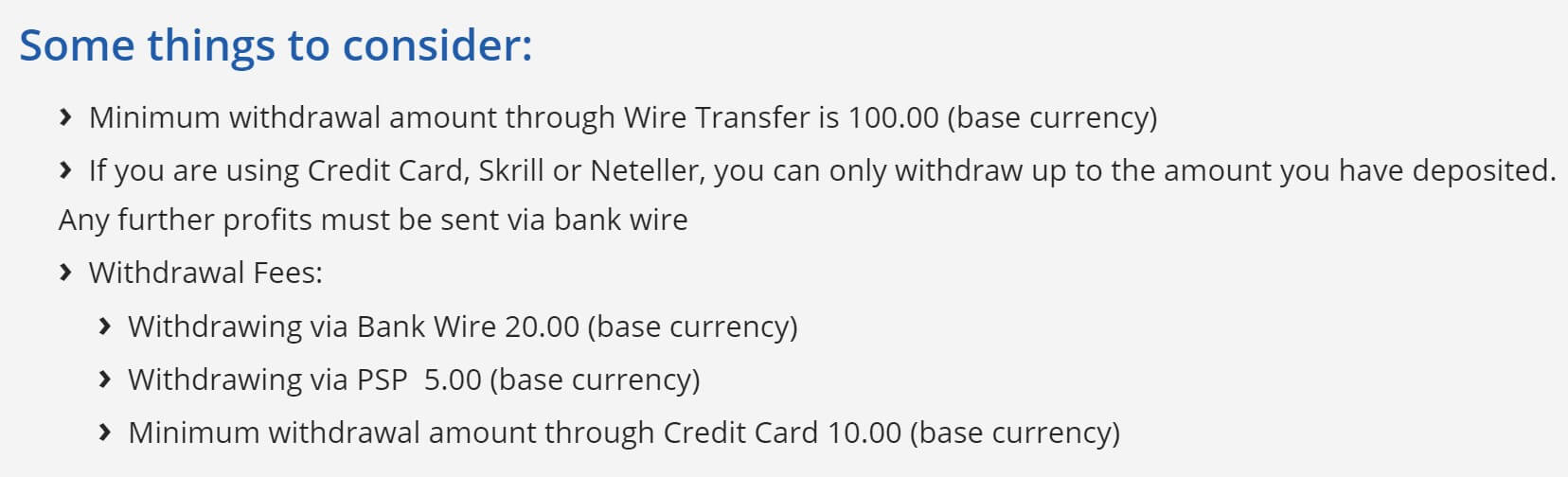

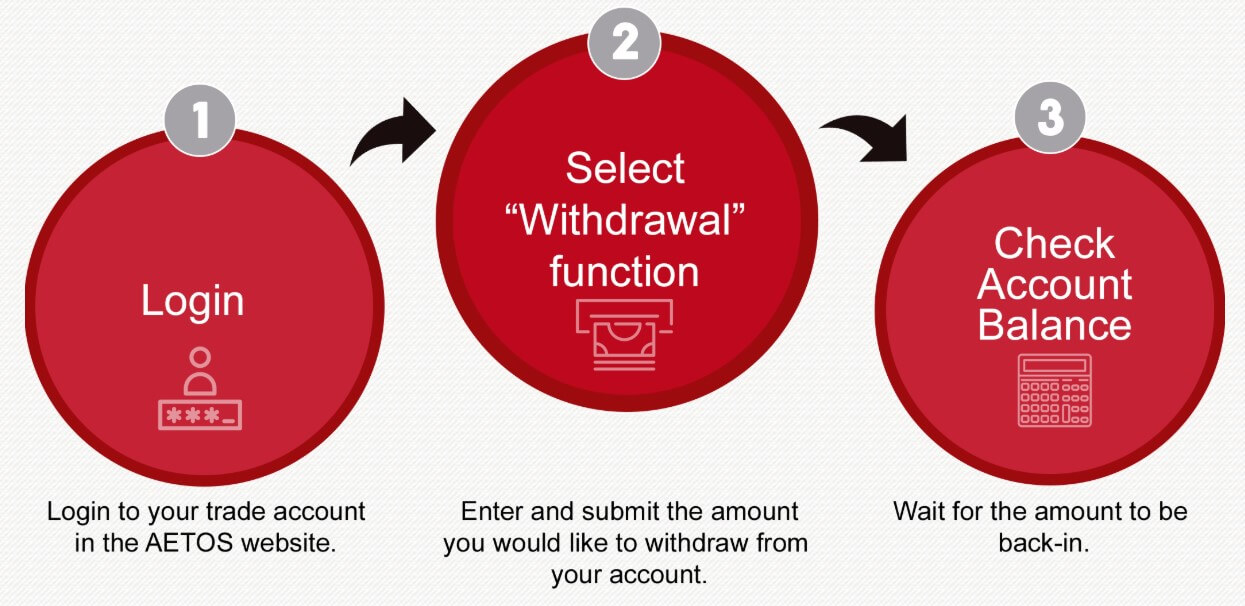

Withdrawal Methods & Costs

Withdrawal methods are the same as with deposits. There are also exactly the same costs for withdrawals, so for a complete turn of your investments, be ready for double charges. This is probably the spot where most of the visitors look away.

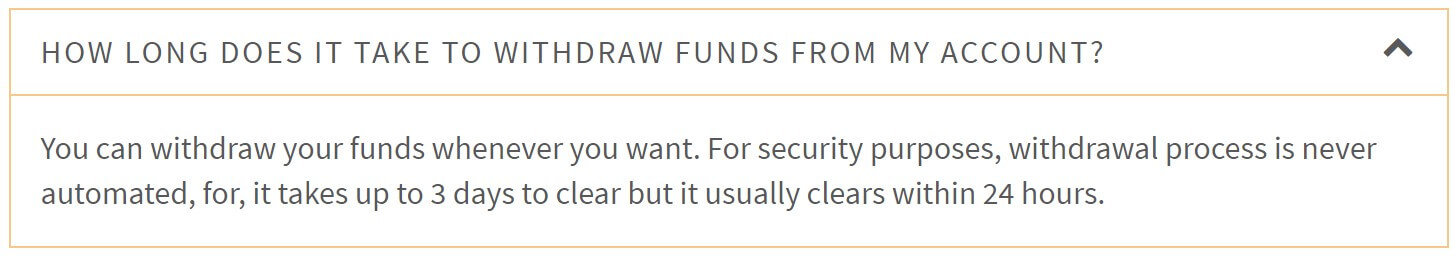

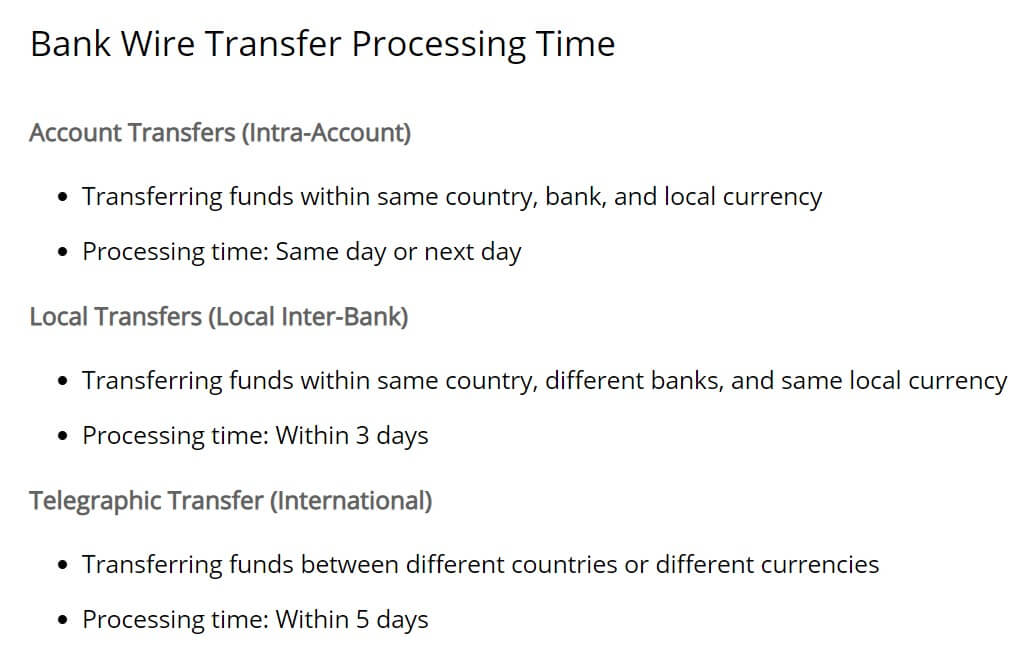

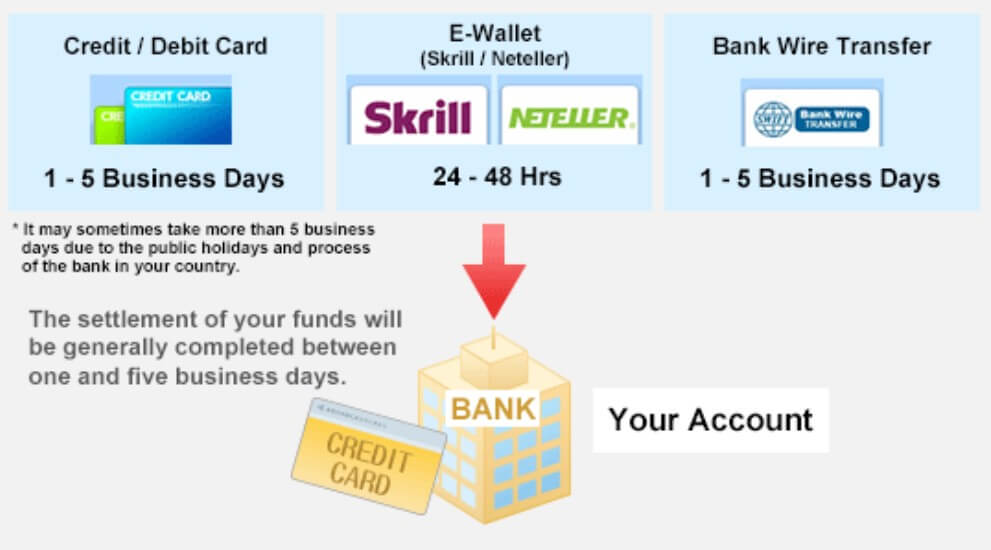

Withdrawal Processing & Wait Time

The broker has stated that every deposit is instant. This is probably after payment processors have finished theirs, therefore Bank Transfers require certainly at least 24 hours. Note that the ParamountFX applies AML procedures to which the same method will be used for withdrawals as with the deposit. Also, withdrawals from the Account may only be made in the same currency in which the respective deposit was made, unless the broker offers another method.

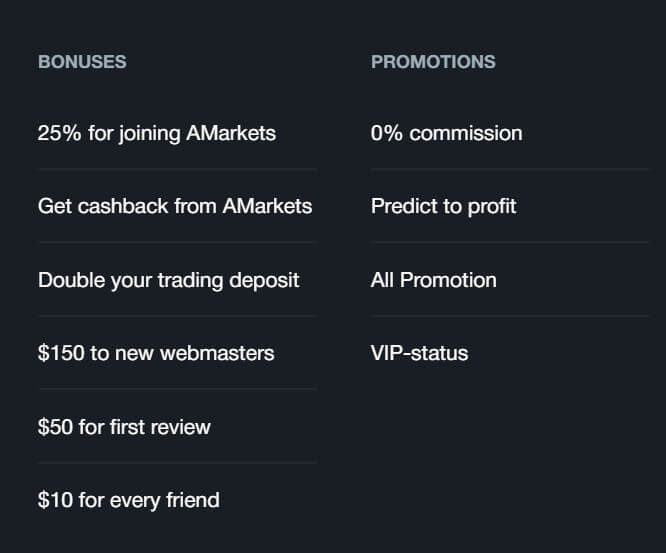

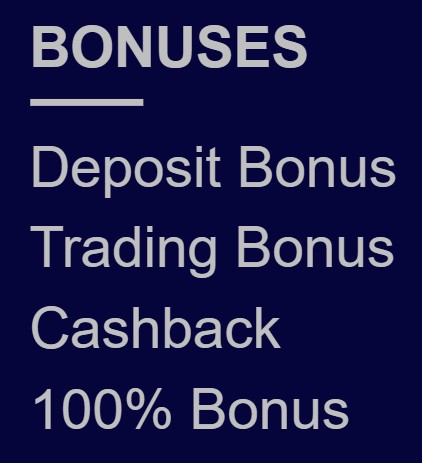

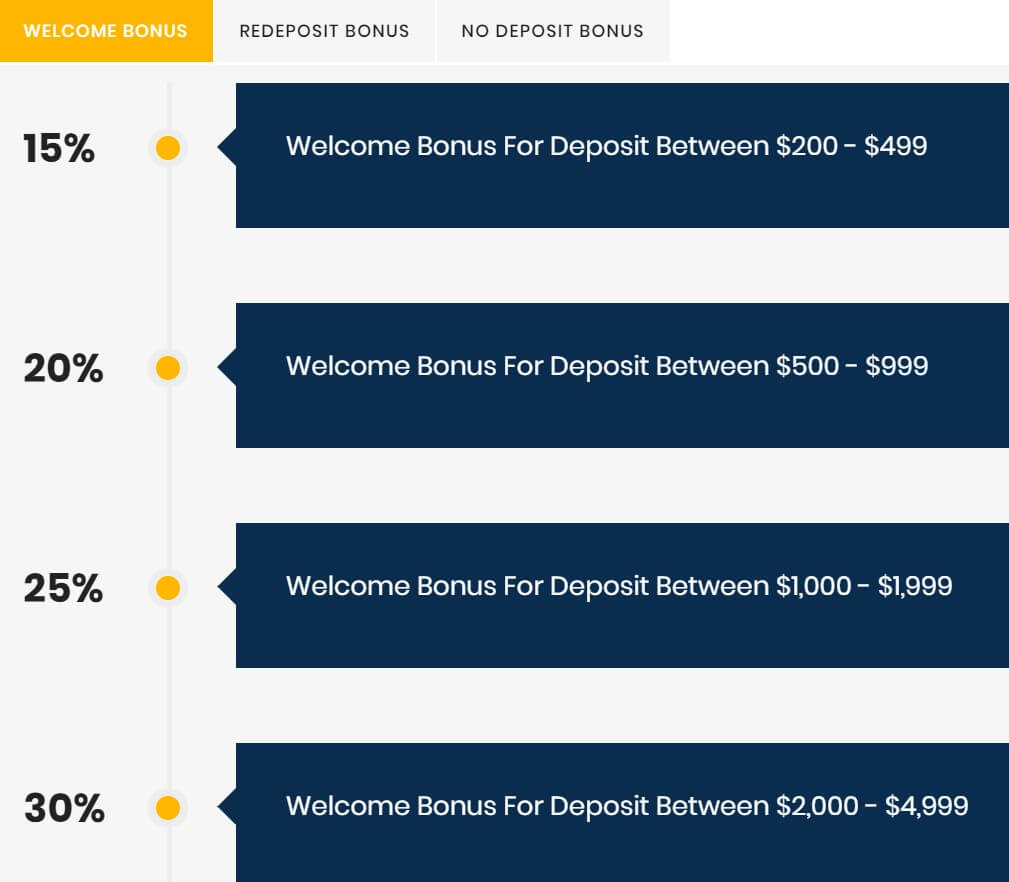

Bonuses & Promotions

Most of the small, unregulated, off-shore brokerages offer bonuses to attract clients, it is one of the most sought after features. ParamountFX offers two bonuses, Classic Bonus and MyParamount Bonus. Classic Bonus is a non-withdrawable bonus that acts as a margin extension. The bonus offered is 10% of the net deposit, Whereas it cannot exceed $5000 bonus total. This bonus is available only for the Classic Account type.

Most of the small, unregulated, off-shore brokerages offer bonuses to attract clients, it is one of the most sought after features. ParamountFX offers two bonuses, Classic Bonus and MyParamount Bonus. Classic Bonus is a non-withdrawable bonus that acts as a margin extension. The bonus offered is 10% of the net deposit, Whereas it cannot exceed $5000 bonus total. This bonus is available only for the Classic Account type.

MyParamount Bonus is a non-withdrawable bonus that has a formula based on trading volume and the net deposit. This means that the total bonus can go up to 60% depending on the trading volume. This bonus acts as margin support and is available only for the Standard Account. Contests are an unrealized idea of ParamountFX. At the moment of this review, it is still in development.

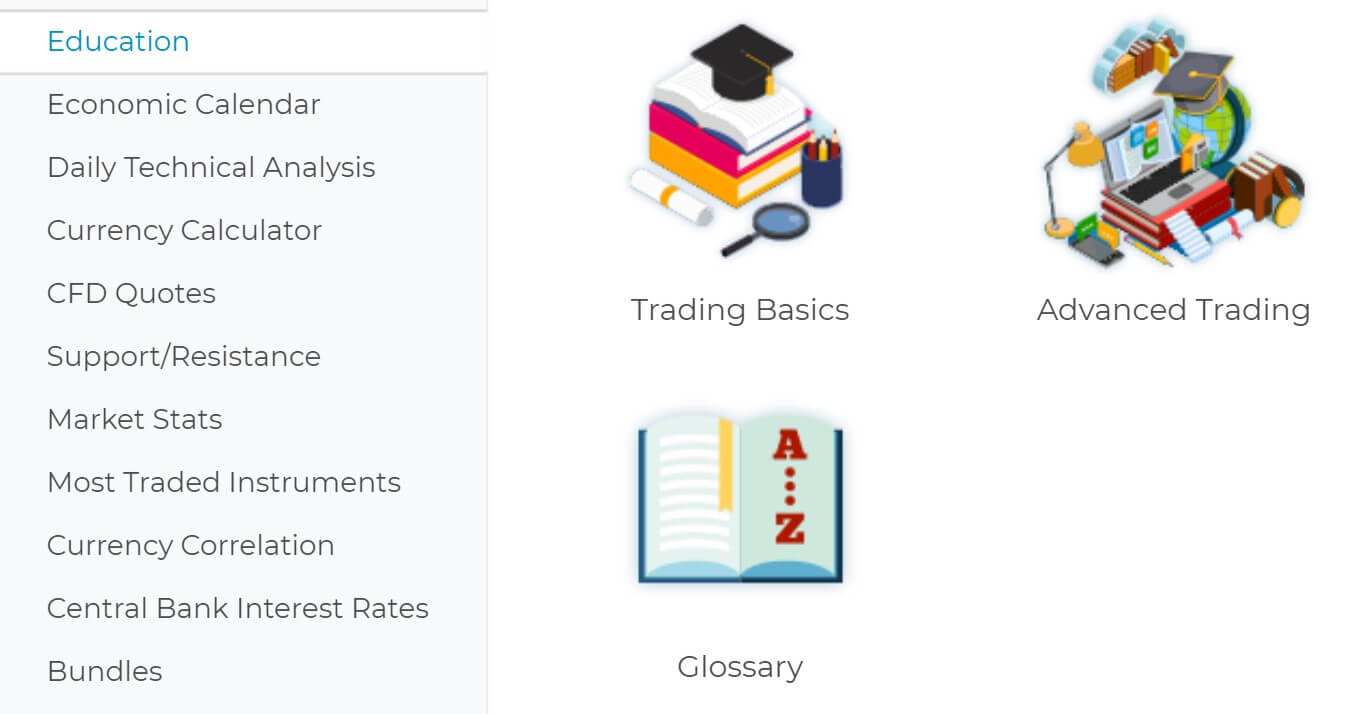

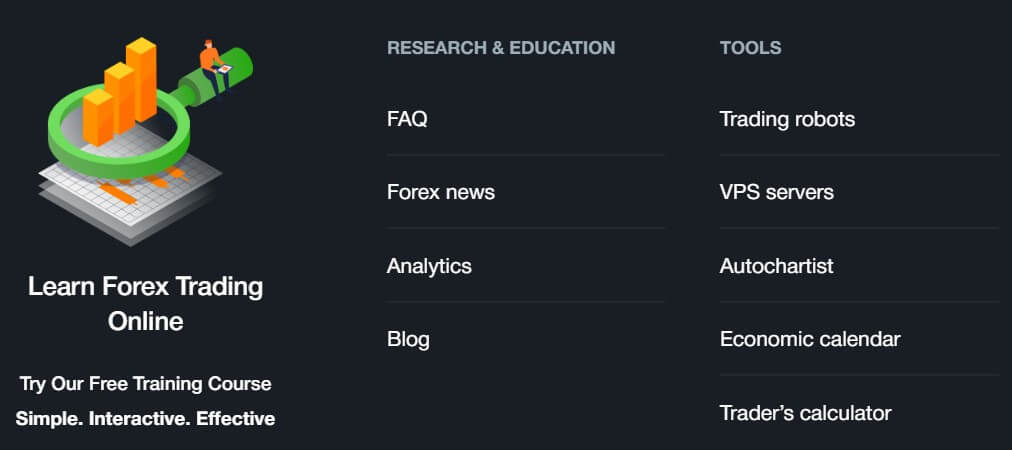

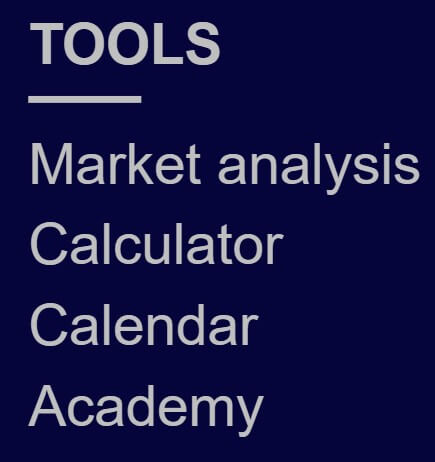

Educational & Trading Tools

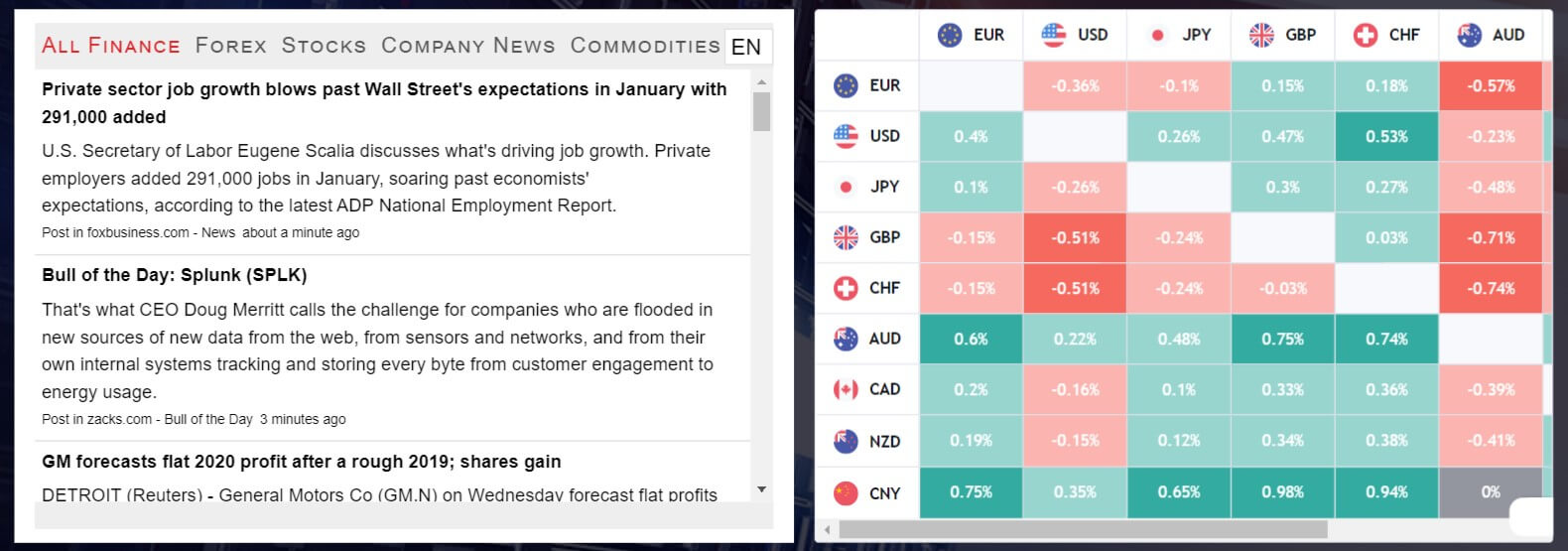

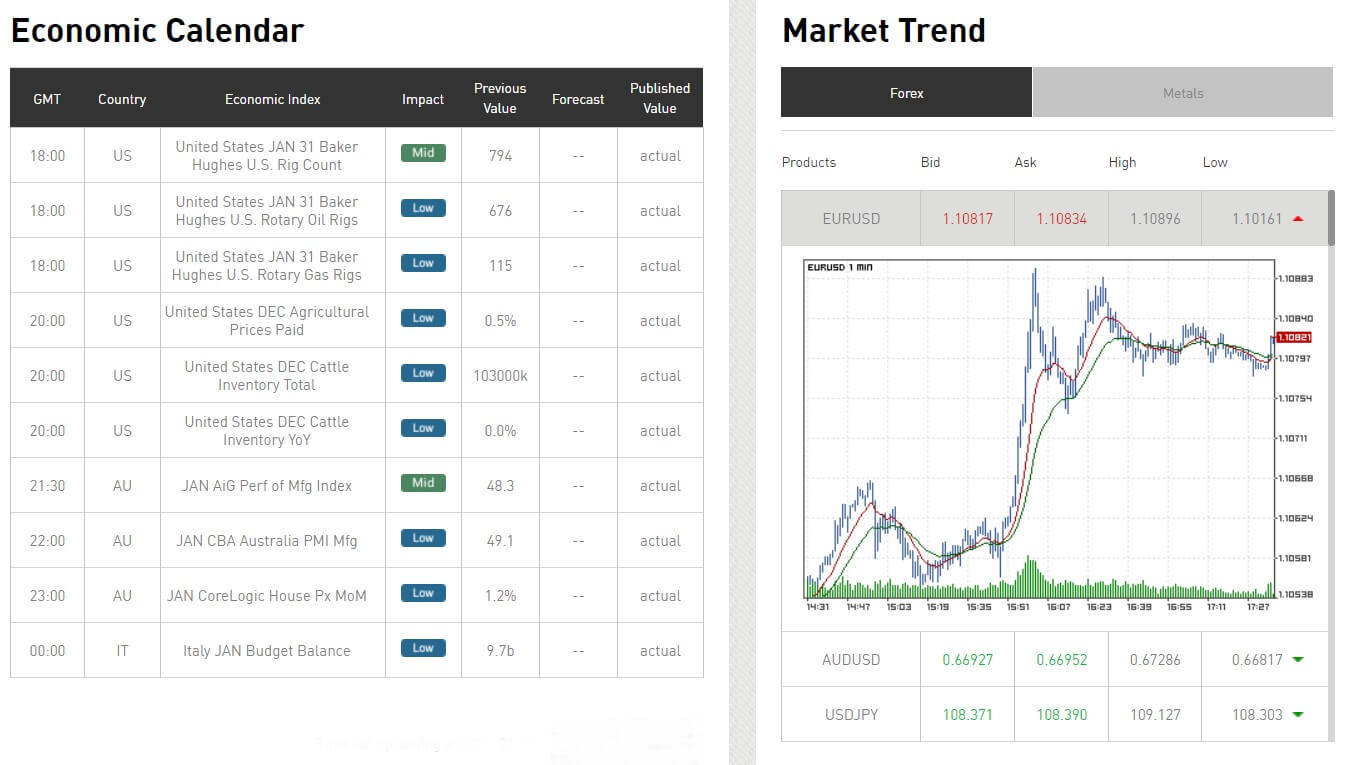

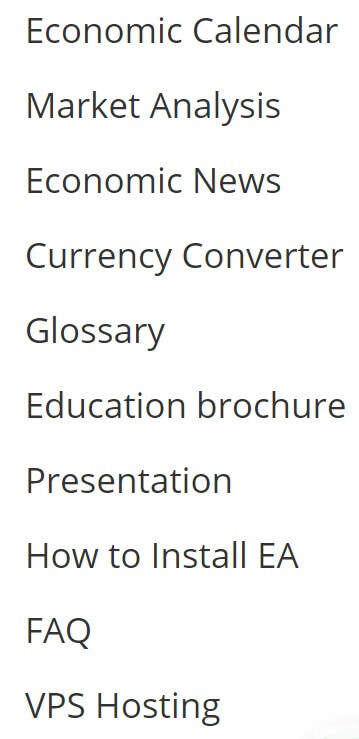

As for the trading tools, only Economic Calendar is available and it is placed on the homepage of the website. It is a good looking table with an option to set your timezone but this is all you can do to filter or sort the events. The Calendar will show the latest events, the impact rating and the figures related to past and forecast. On the screenshot, there is a trading system that contains a kind of Ichimoku indicator with the Support and Resistance lines. Additionally, there is an unknown histogram indicator with unknown function. Readers will be confused about what the system suggests as there is no explanation.

As for the trading tools, only Economic Calendar is available and it is placed on the homepage of the website. It is a good looking table with an option to set your timezone but this is all you can do to filter or sort the events. The Calendar will show the latest events, the impact rating and the figures related to past and forecast. On the screenshot, there is a trading system that contains a kind of Ichimoku indicator with the Support and Resistance lines. Additionally, there is an unknown histogram indicator with unknown function. Readers will be confused about what the system suggests as there is no explanation.

The more interesting part is the Bulletin and Analysis segment. Here, traders can see an in-house made analysis that is updated daily. Daily Bulleting articles start with the Economic Calendar events and move on to the trading instruments’ analysis screenshots without any related text. Not all instruments are included, just some major currency pairs, one index, and Gold.

The news section is updated and contains many articles. Unfortunately, this is not original news, they are copied from Investing.com. most of the selected articles are Investing.com’s “Top Things to Know in the Market.” ParamountFX also has the Education section that is not worthy enough. It contains one page with a few elementary Forex and trading terminology that is not even professionally explained.

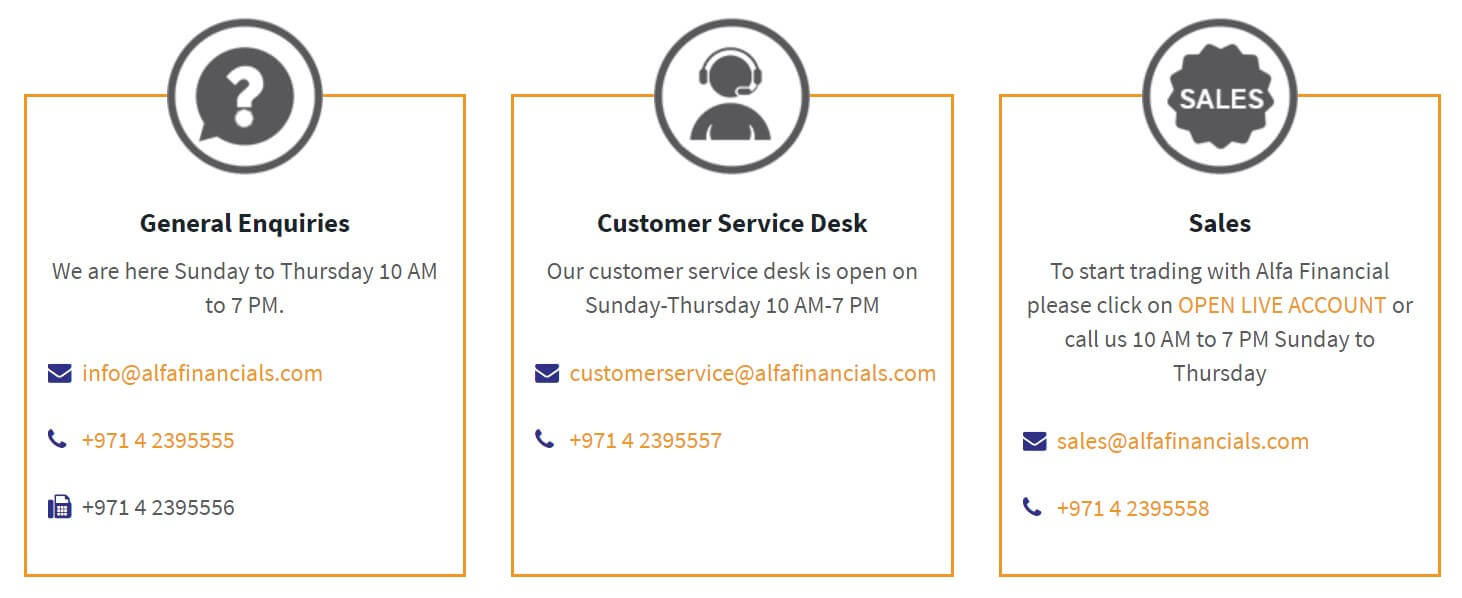

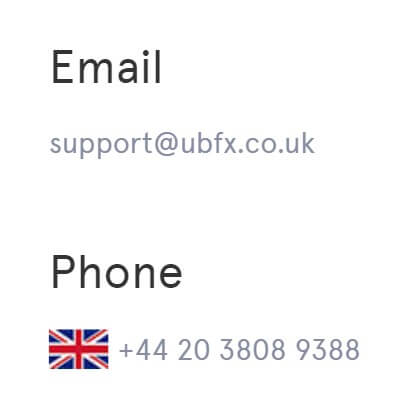

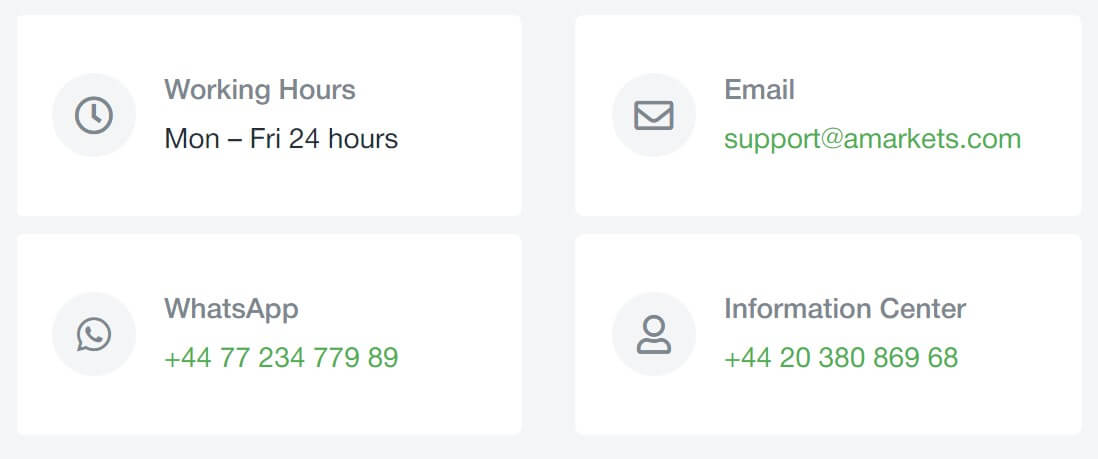

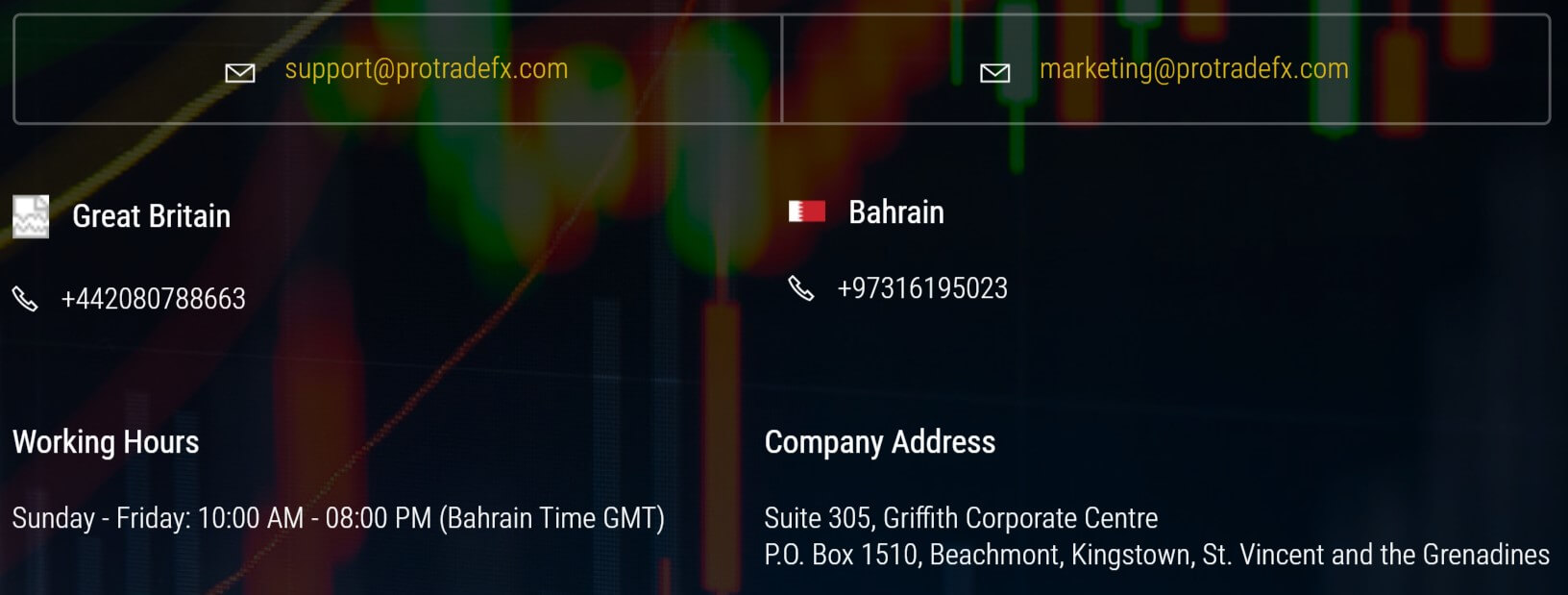

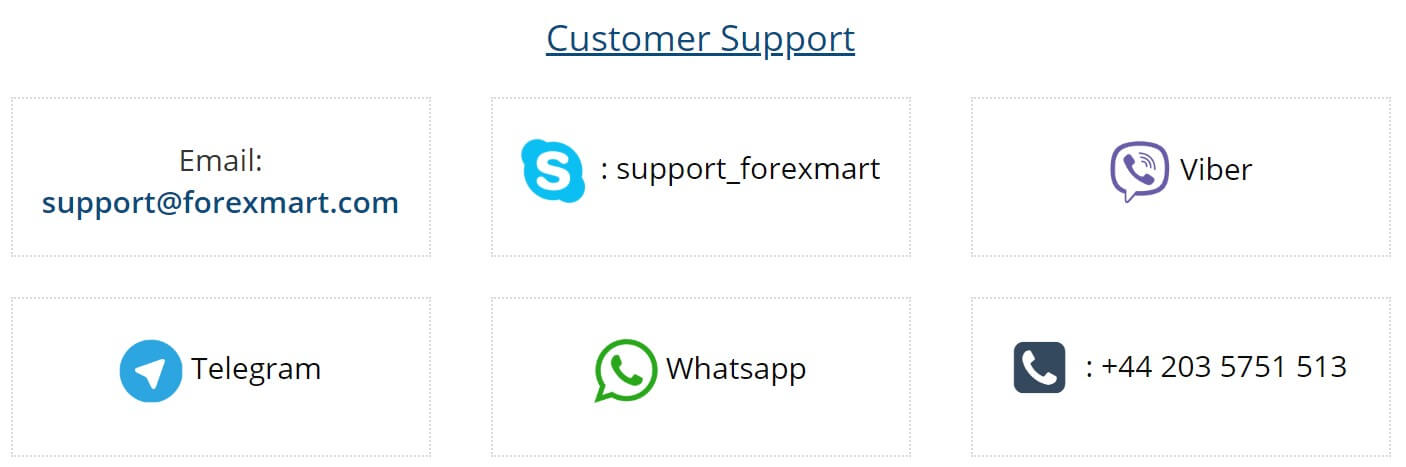

Customer Service

There is a phone line, email and chat service available to contact ParamountFX. The chat service app is well designed with a nice touch to upload files and insert emojis. Here we also found out that that last time support staff was active was 8 days ago. Upon our query, we did not wait longer than 5 minutes for someone to answer. The staff is knowledgeable and courteous but will not disclose some information that other transparent brokers would.

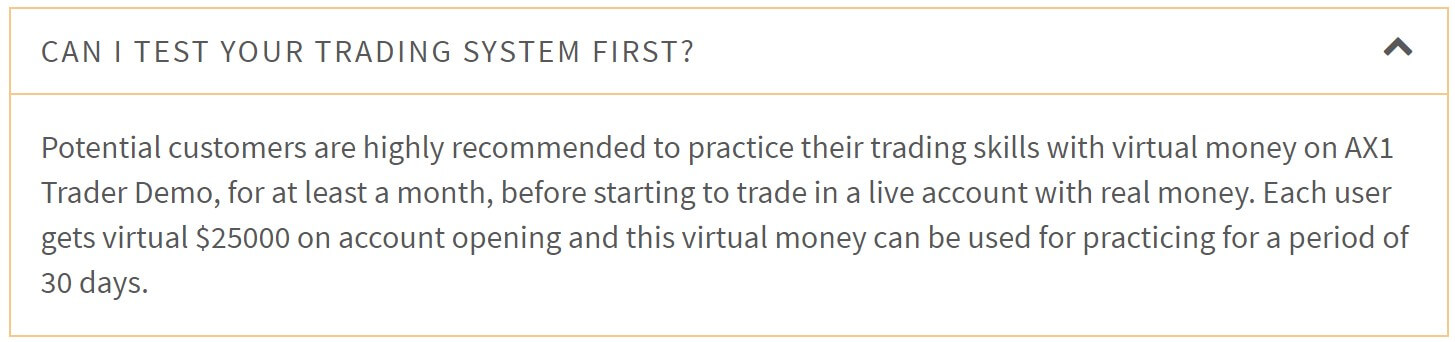

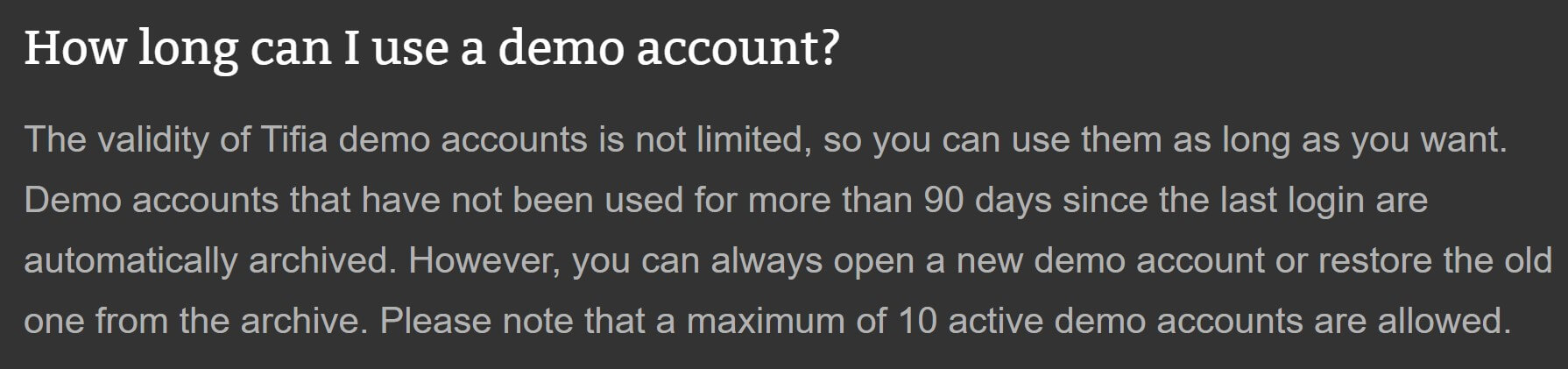

Demo Account

The demo is not promoted on ParamountFX’s website but we cannot confirm that the demo account is not available. Since the registration procedure was bugged we were unable to test it as well as some other services.

Countries Accepted

According to the legal documents, the broker mentions several times that the client must not be or reside in the United States or Canada.

Conclusion

In this section of the ParamountFX review, we will address some additional issues with the broker that are important to traders. As presented, ParamountFX belongs to the risky category of brokers as it is very obscured from the public, does not have any transparency regarding the company, no regulation and some clauses in the Agreements documents that are brow raising. For example, the broker states that willful default or fraud on the part of Paramount shall not be liable for losses arising from the default of any agent or any other party used by Paramount under this Agreement.

The broker’s winners percentage is also among the lowest in the industry. 90% of retail investor accounts lose money when trading CFDs with this ParamountFX. Even if we set aside the registration problems, just the fee structure on deposits and withdrawals alone are the reason enough most will turn away. It is rare to see commission on deposits, most of the brokers will seek to make the deposit process as easy as possible, psychologically and financially, but this is not the case with ParamountFX. The broker still needs to find its grounds, frequent changes to the minimum deposits and packages are not enough.

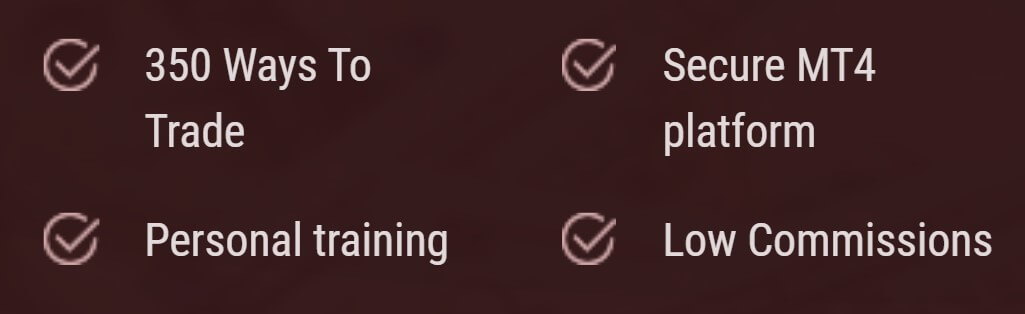

The Educational section of Binary.com contains 5 pages and 2 of them are educational. Why Us page is mostly self-promotion targeted to beginner and first-time visitors to this industry. Therefore, a limited amount of useful

The Educational section of Binary.com contains 5 pages and 2 of them are educational. Why Us page is mostly self-promotion targeted to beginner and first-time visitors to this industry. Therefore, a limited amount of useful

Customer Service

Customer Service

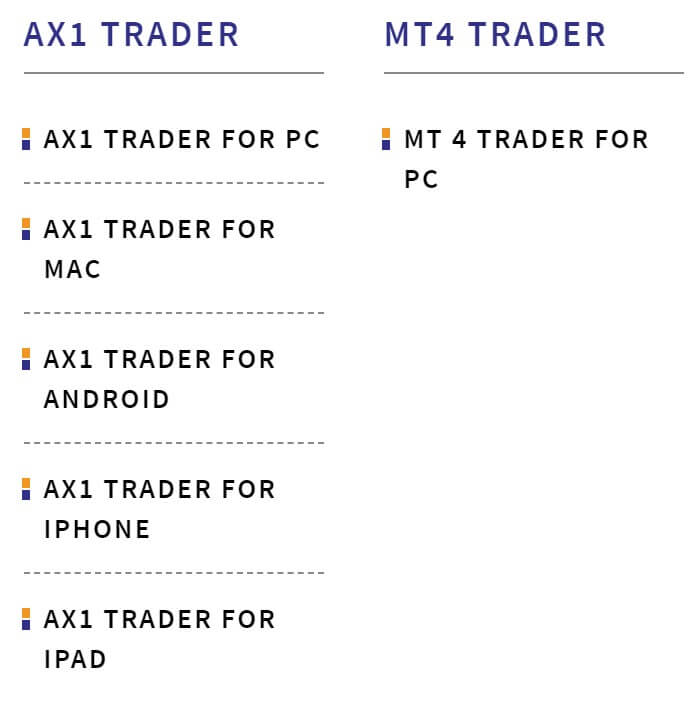

TradeFxP offers its clients one of the most popular and trusted platforms, the MT4. This multilingual platform features a large range of useful functions such as,

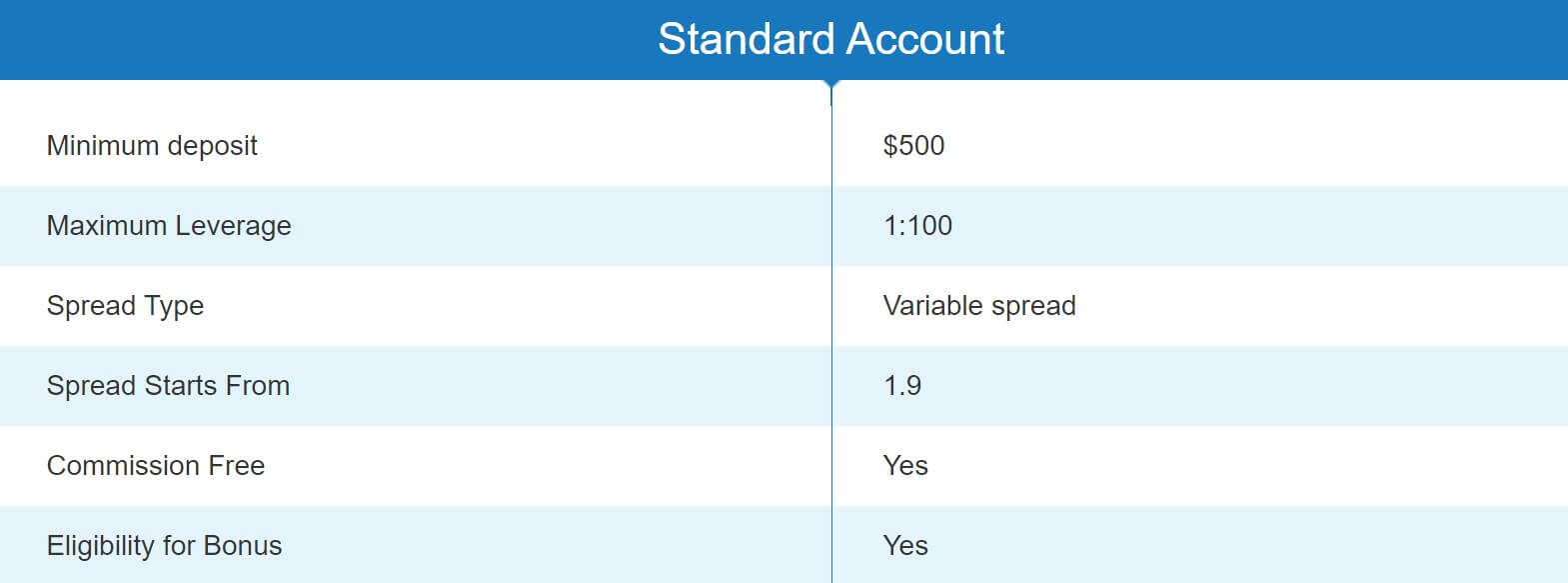

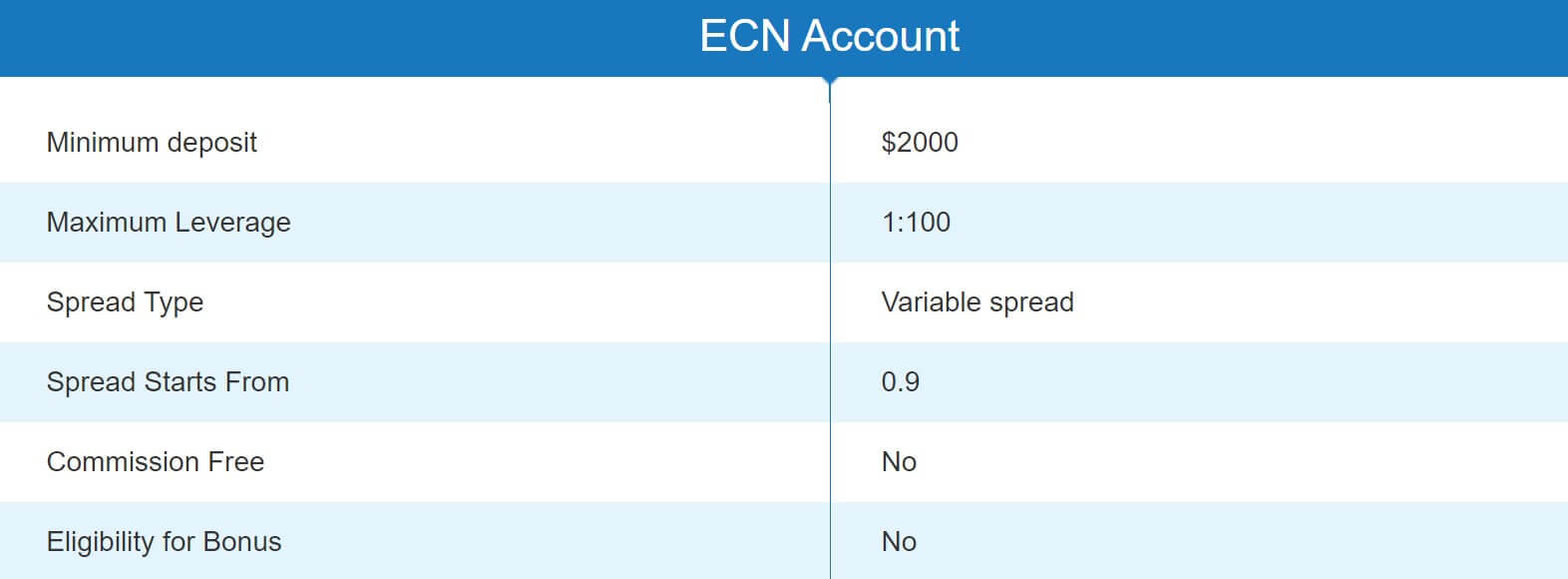

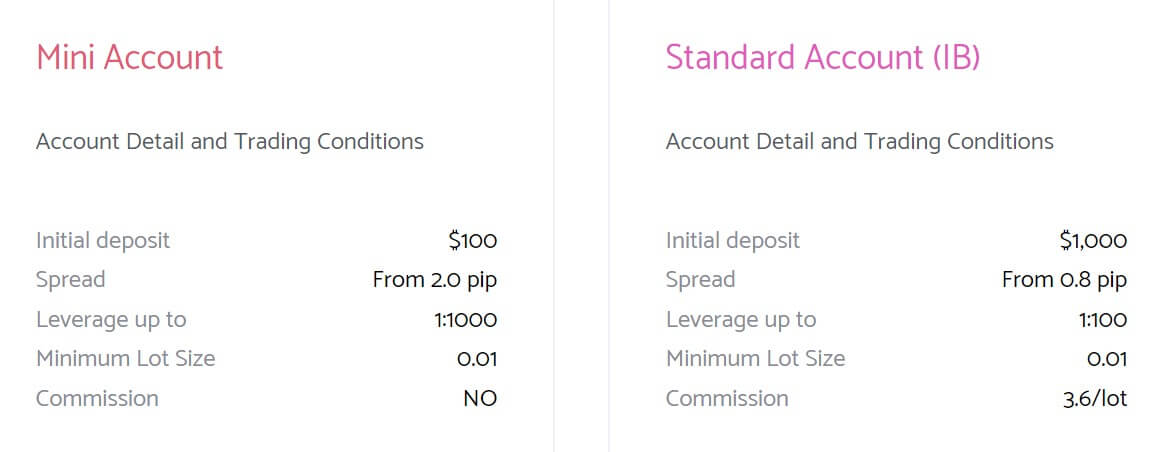

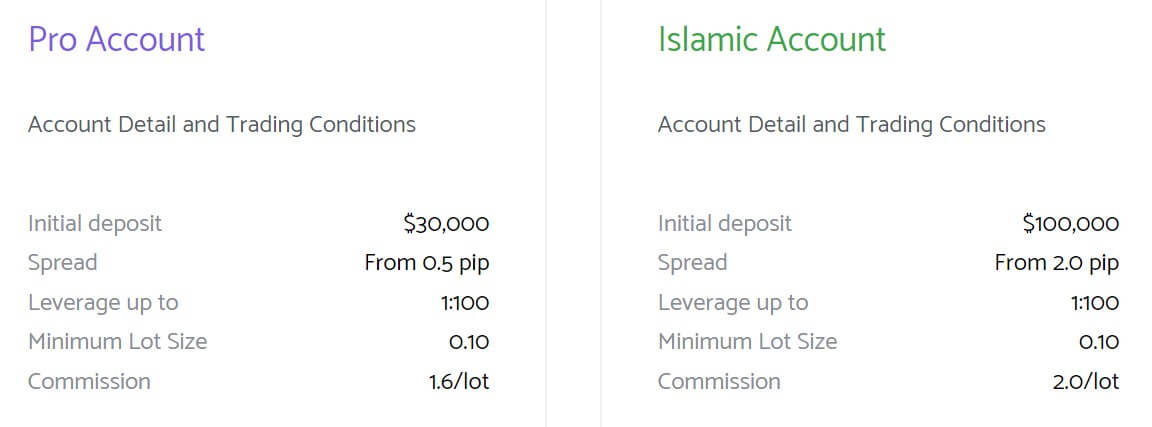

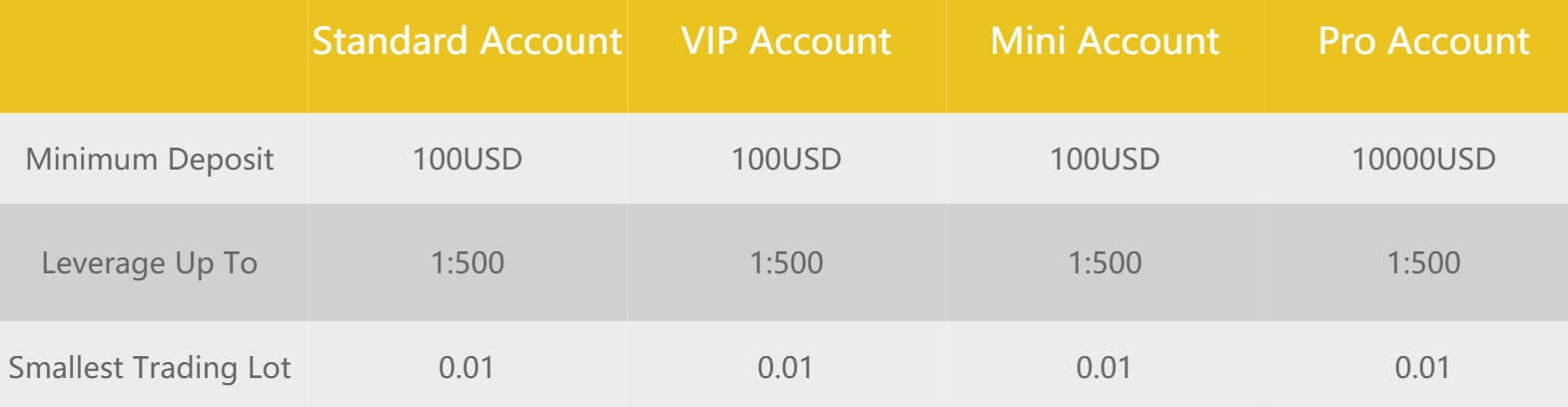

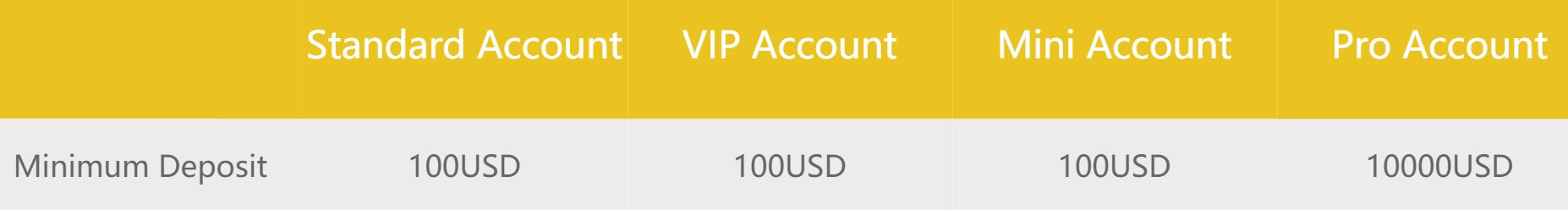

TradeFxP offers its clients one of the most popular and trusted platforms, the MT4. This multilingual platform features a large range of useful functions such as,  The highest leverage one can use with this broker is with the Mini Account, where leverage is set at 1:300. Recent regulations have forced brokers all over the globe to decrease their leverage to 1:100 or less, but seeing as this broker is unregulated they can still offer higher leverage. The two other accounts offered, the Standard and the ECN both have leverage of 1:100 which minimizes the risk that one encounters when trading with large leverages.

The highest leverage one can use with this broker is with the Mini Account, where leverage is set at 1:300. Recent regulations have forced brokers all over the globe to decrease their leverage to 1:100 or less, but seeing as this broker is unregulated they can still offer higher leverage. The two other accounts offered, the Standard and the ECN both have leverage of 1:100 which minimizes the risk that one encounters when trading with large leverages.

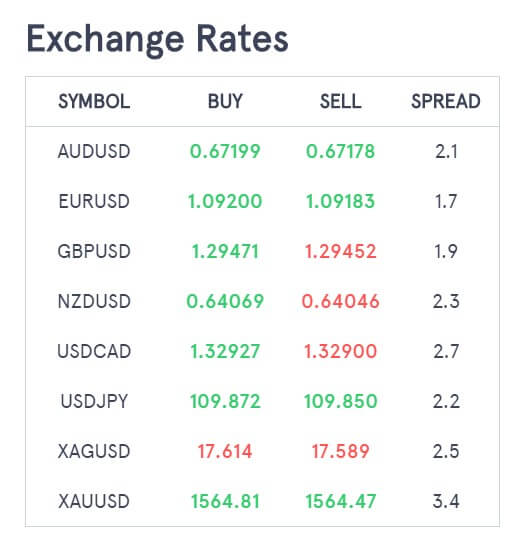

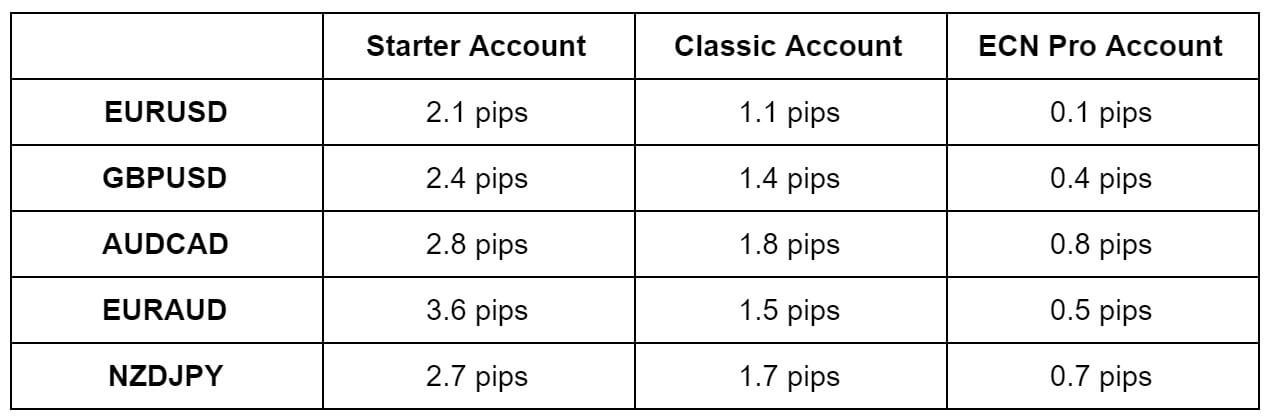

This broker offers variable spreads on all of their accounts. The Mini and the Standard accounts have spreads which seem to be quite high as they start from 2.1Pips, although we are not certain if this is a clear indication of the current spreads available through this broker. On the other hand, the ECN account has lower spreads that start from 0.9 Pips but clients should take into consideration the $5 commission fee per lot when trading with this account.

This broker offers variable spreads on all of their accounts. The Mini and the Standard accounts have spreads which seem to be quite high as they start from 2.1Pips, although we are not certain if this is a clear indication of the current spreads available through this broker. On the other hand, the ECN account has lower spreads that start from 0.9 Pips but clients should take into consideration the $5 commission fee per lot when trading with this account.

Educational & Trading Tools

Educational & Trading Tools

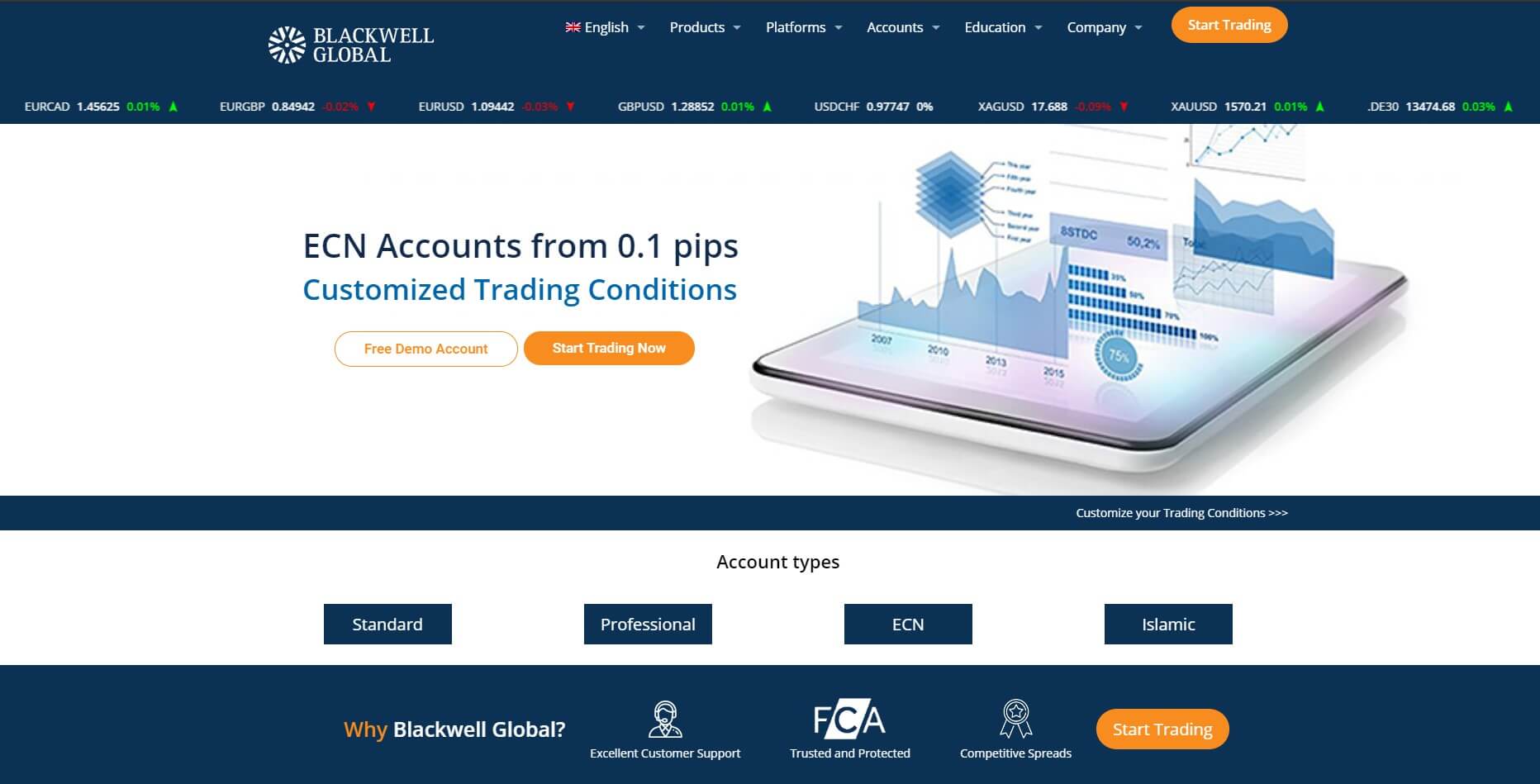

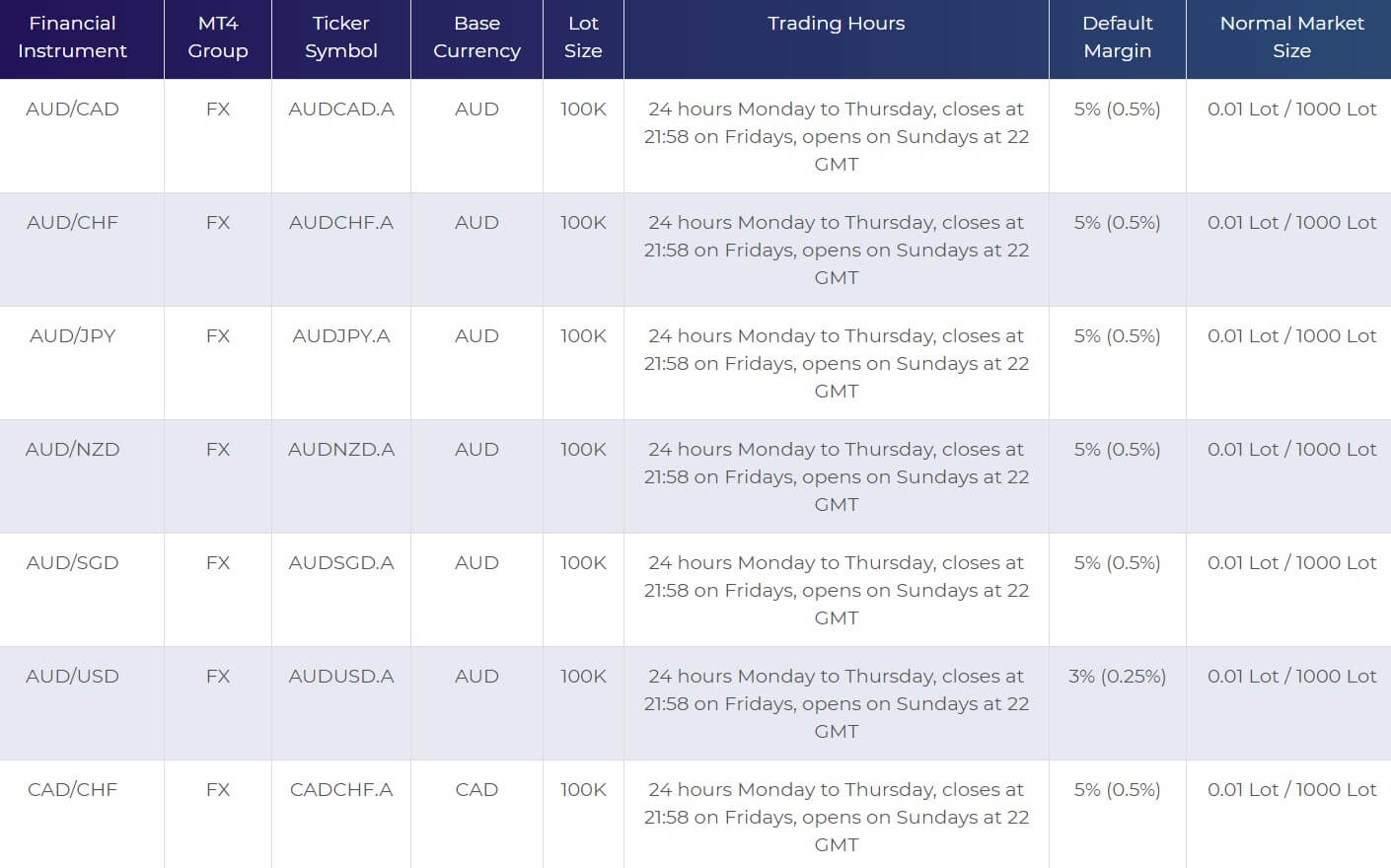

There is only one platform available with Blackwell Global and that is MetaTrader 4 so let’s see what it offers.

There is only one platform available with Blackwell Global and that is MetaTrader 4 so let’s see what it offers.

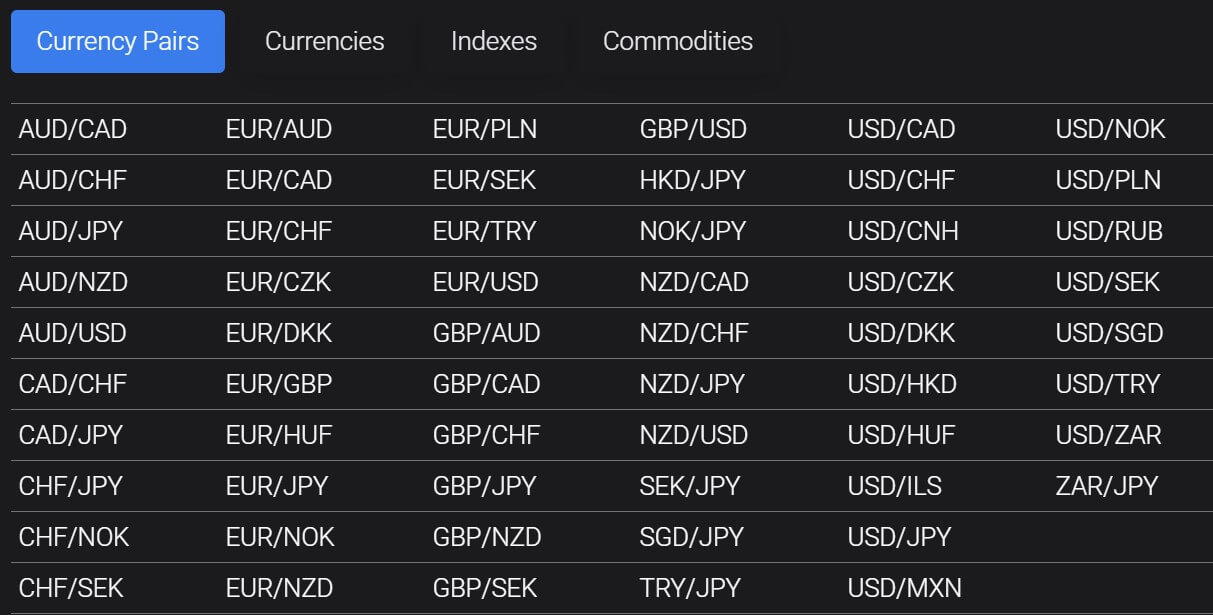

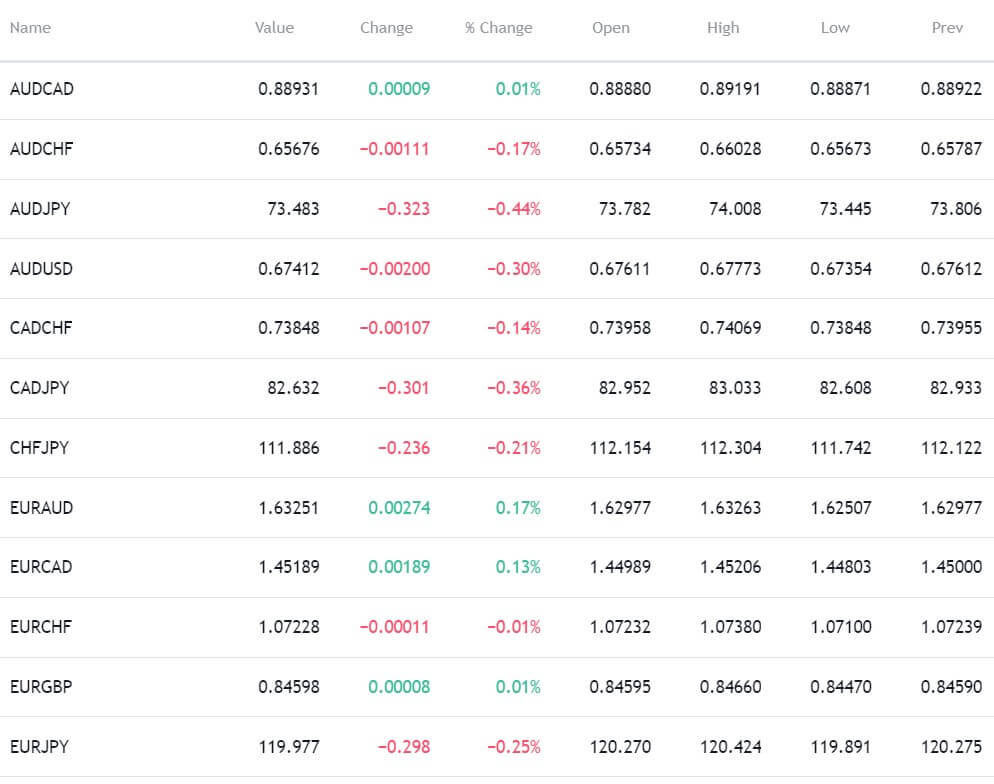

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NOKJPY, NOKSEK, NZDCAD, NZDCHF, NZDJPY, NZDUSD, SGDJPY, USDCAD, USDCHF, USDCNH, USDDKK, USDHKD, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDSEK, USDSGD, USDTRY, USDZAR

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NOKJPY, NOKSEK, NZDCAD, NZDCHF, NZDJPY, NZDUSD, SGDJPY, USDCAD, USDCHF, USDCNH, USDDKK, USDHKD, USDHUF, USDJPY, USDMXN, USDNOK, USDPLN, USDSEK, USDSGD, USDTRY, USDZAR

There are a lot of educational and trading tools mentioned on the site, we will briefly go through them to see if they are actually relevant or not. Firstly, there is an economic calendar that details upcoming news events and also which markets they may affect. There are also guides and ebooks on a number of different subjects such as Non-Farm Payrolls. There is something called a trading Bootcamp that is run by a professional trader and you need to attend this event in person. We cannot comment on the quality of this. The market news section is exactly that, it simply shows any news that has occurred.

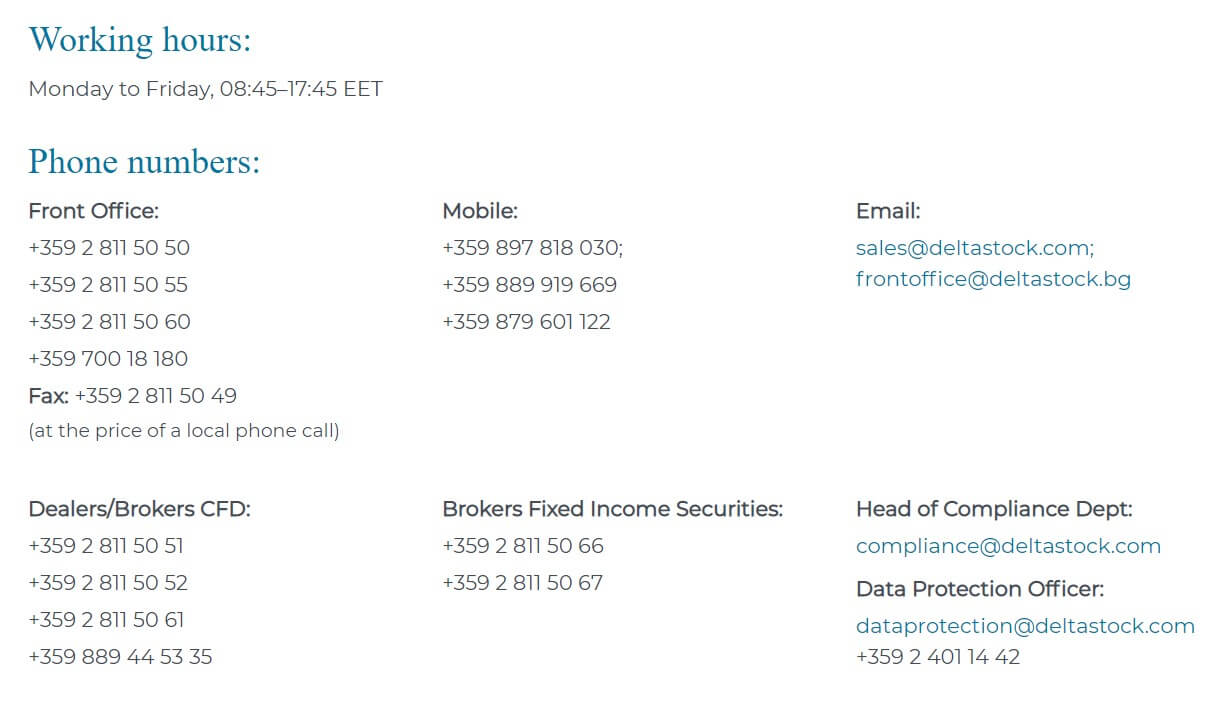

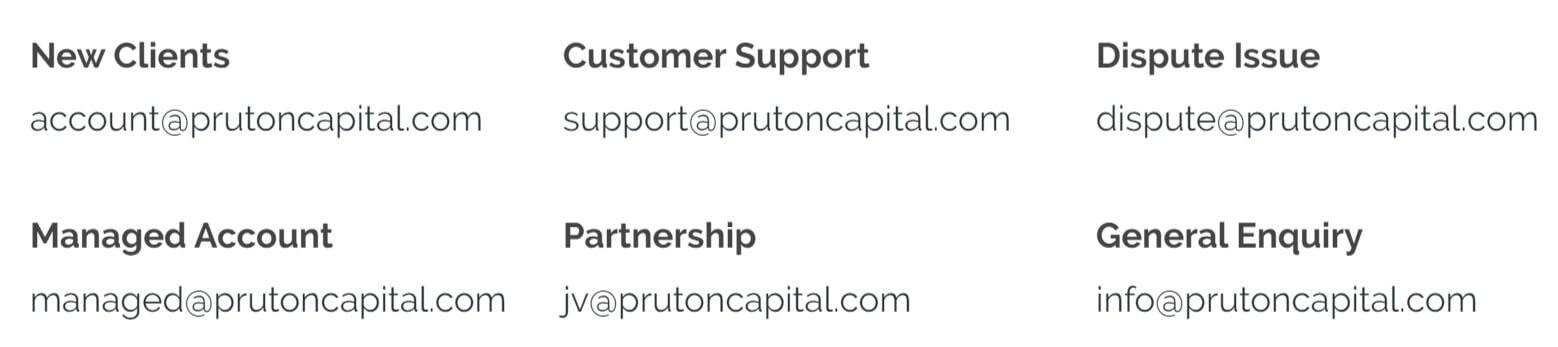

There are a lot of educational and trading tools mentioned on the site, we will briefly go through them to see if they are actually relevant or not. Firstly, there is an economic calendar that details upcoming news events and also which markets they may affect. There are also guides and ebooks on a number of different subjects such as Non-Farm Payrolls. There is something called a trading Bootcamp that is run by a professional trader and you need to attend this event in person. We cannot comment on the quality of this. The market news section is exactly that, it simply shows any news that has occurred. If you have a question or concern you can get in contact with Blackwell Global in a number of ways, you can use the online submission form to fill in your query and you should then get a reply via email. There are also three different email addresses available, one for Technical and Customer Support, one for Business and Partnership Enquiries and one for Marketing Enquiries. Finally, there is also a phone number should you wish to speak to someone directly along with a physical address.

If you have a question or concern you can get in contact with Blackwell Global in a number of ways, you can use the online submission form to fill in your query and you should then get a reply via email. There are also three different email addresses available, one for Technical and Customer Support, one for Business and Partnership Enquiries and one for Marketing Enquiries. Finally, there is also a phone number should you wish to speak to someone directly along with a physical address.

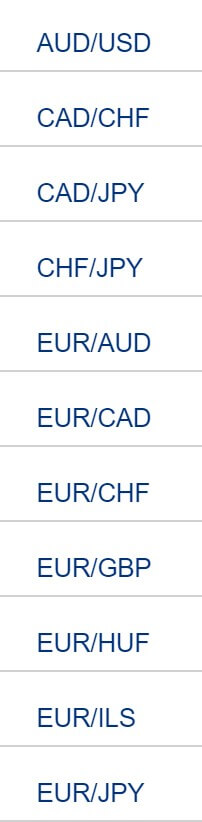

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURHUF, EURILS, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURUSD, GBPAUD, GBPCAD, GBPCHF, GNPJPY, GBPNZD, GBPUSD, NAZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDDKK, USDHUF, USDILS, USDJPY, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK USDSGD, USDZAR.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURHUF, EURILS, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURUSD, GBPAUD, GBPCAD, GBPCHF, GNPJPY, GBPNZD, GBPUSD, NAZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDDKK, USDHUF, USDILS, USDJPY, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK USDSGD, USDZAR.

Assets

Assets

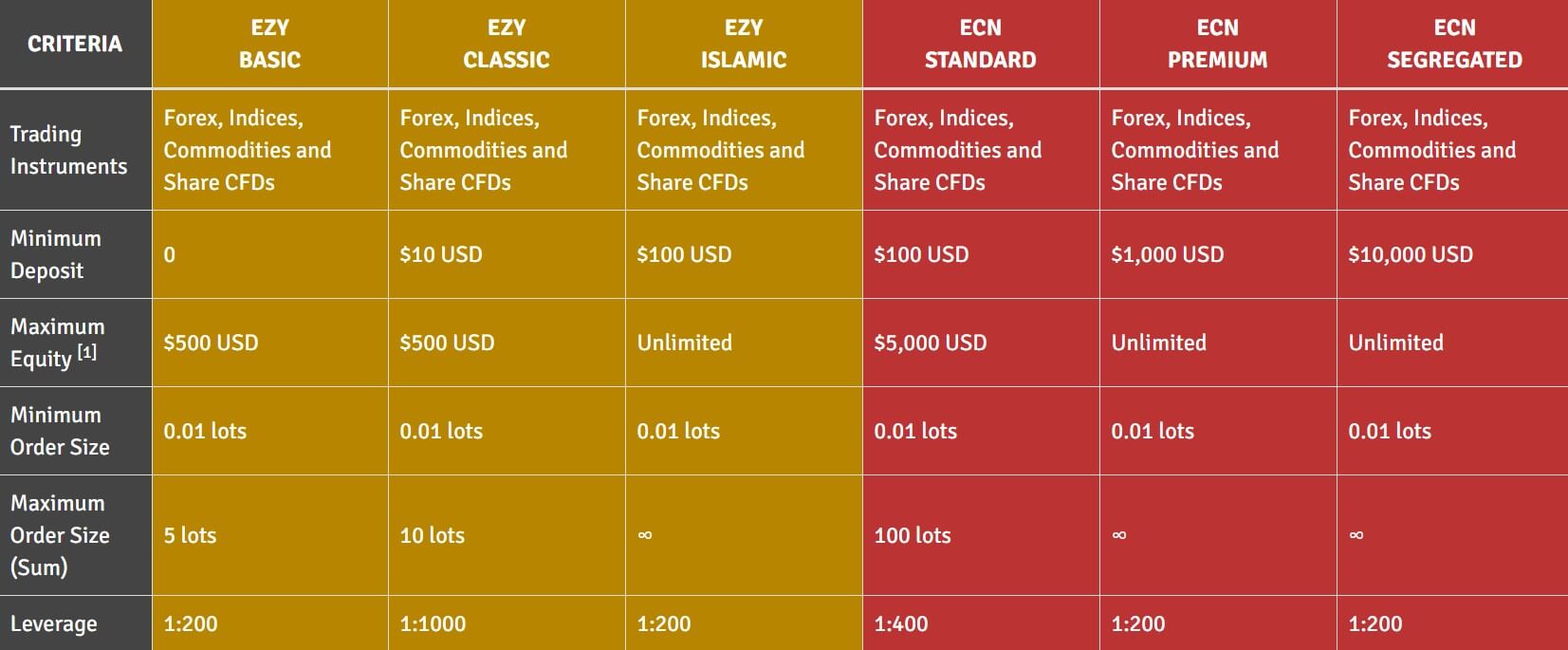

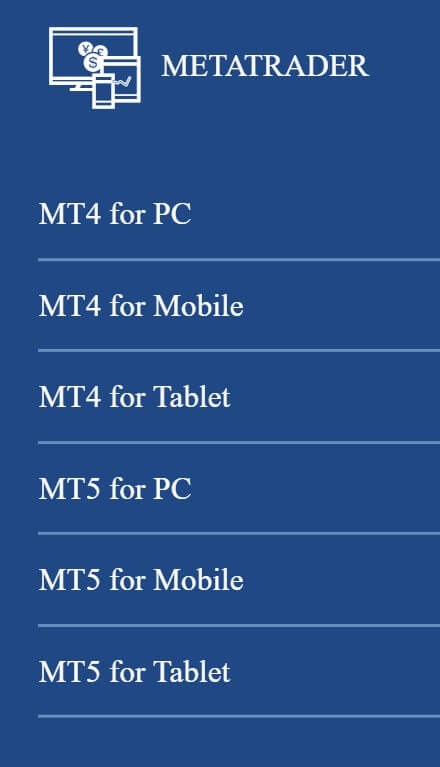

Traders can open a demo that retains the characteristics and conditions of each of the 6 different account types. Equally as important, the demo is managed through MT4, which gives you the time needed to learn about the platform’s tools and order execution processes (particularly if you never used it before). Moreover, even though you trade fake/paper money on the demo account, the return on investment (ROI) statement takes commission into consideration.

Traders can open a demo that retains the characteristics and conditions of each of the 6 different account types. Equally as important, the demo is managed through MT4, which gives you the time needed to learn about the platform’s tools and order execution processes (particularly if you never used it before). Moreover, even though you trade fake/paper money on the demo account, the return on investment (ROI) statement takes commission into consideration.

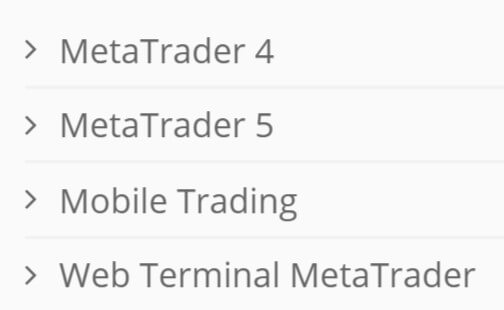

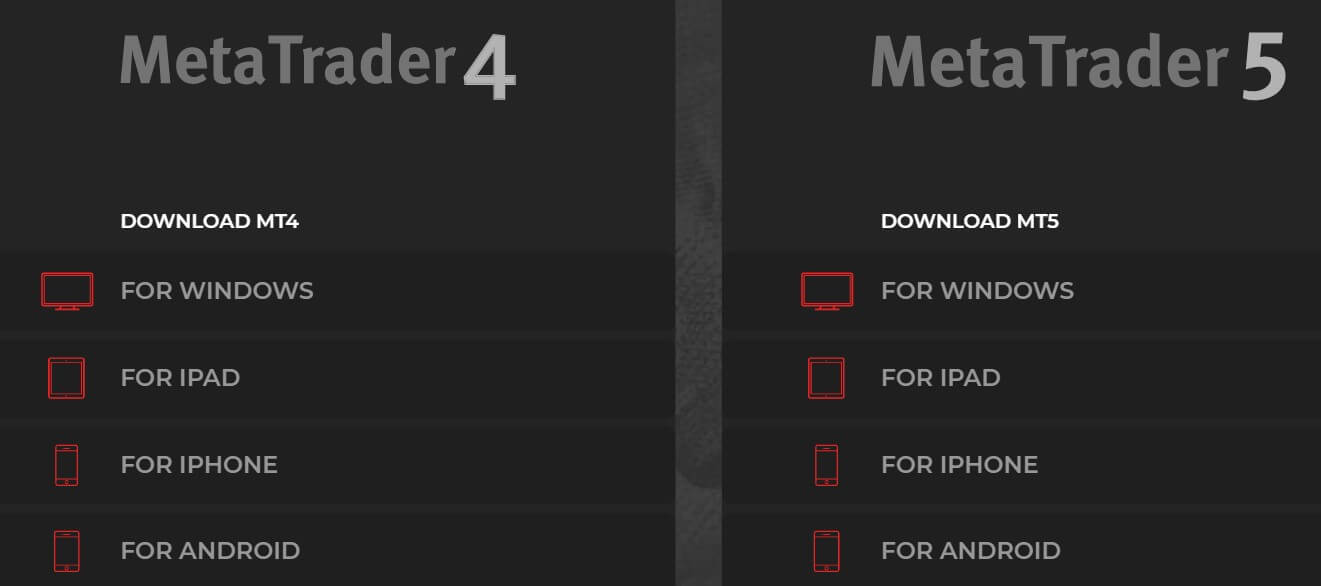

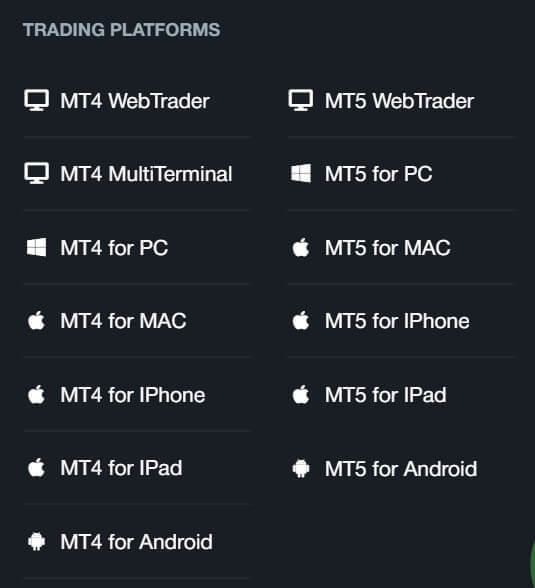

Traders whose strategy revolves around technical analysis might want to carefully do their research before choosing a platform. MT5 has more technical indicators (38), graphic tools (44), and timeframes (21). MT4, on the other hand, only offers 30, 31, and 9 of these tools, respectively. Yet, the Fibonacci charting and other analysis features work better on MT4. Technical analysts need to weigh in on how much they rely on Fibonacci and if it is more important to them than accessing a wider selection of indicators and timeframes.

Traders whose strategy revolves around technical analysis might want to carefully do their research before choosing a platform. MT5 has more technical indicators (38), graphic tools (44), and timeframes (21). MT4, on the other hand, only offers 30, 31, and 9 of these tools, respectively. Yet, the Fibonacci charting and other analysis features work better on MT4. Technical analysts need to weigh in on how much they rely on Fibonacci and if it is more important to them than accessing a wider selection of indicators and timeframes.

Assets

Assets

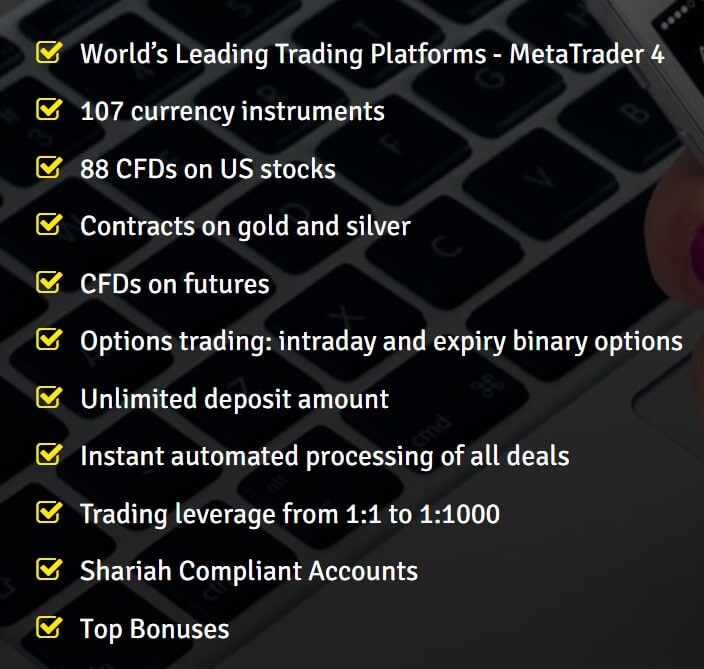

EBH Forex’s trading services are incredibly expanded and competitive. Equally as important, they suit traders who follow all types of strategies and have different levels of experience. Expert Advisors (EA) is a program that collects and analyzes data on forex pairs, such as volume and price patterns. When EBH Forex’s account holders subscribe to the EA service (and pay a fee), the broker will give them access to this data by giving buy/sell or ‘do nothing’ recommendations. Those who program their own high-frequency trading code can also integrate it into the algorithm, which means that the EA service will automatically open/close positions for them. This broker also provides you with

EBH Forex’s trading services are incredibly expanded and competitive. Equally as important, they suit traders who follow all types of strategies and have different levels of experience. Expert Advisors (EA) is a program that collects and analyzes data on forex pairs, such as volume and price patterns. When EBH Forex’s account holders subscribe to the EA service (and pay a fee), the broker will give them access to this data by giving buy/sell or ‘do nothing’ recommendations. Those who program their own high-frequency trading code can also integrate it into the algorithm, which means that the EA service will automatically open/close positions for them. This broker also provides you with

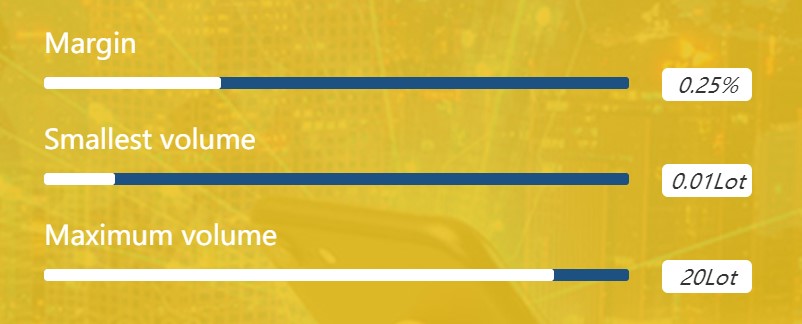

We could not locate information on the website in regards to leverage, we noticed out on the internet that certain places were listing 1:500 as a maximum leverage, but they also had different accounts, so we suspect things have changed and that info is now out of date, so we do not currently know what the maximum leverage is.

We could not locate information on the website in regards to leverage, we noticed out on the internet that certain places were listing 1:500 as a maximum leverage, but they also had different accounts, so we suspect things have changed and that info is now out of date, so we do not currently know what the maximum leverage is.

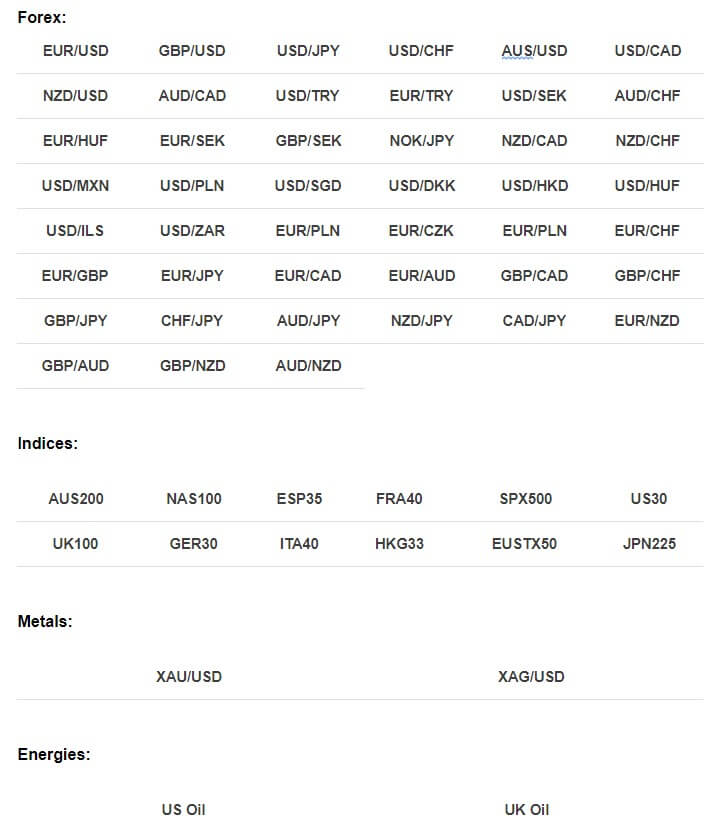

There is a breakdown of some of the assets, we are not clear if it is all of them but it is everything we could find.

There is a breakdown of some of the assets, we are not clear if it is all of them but it is everything we could find.

There is a trading tools section of the website which has 6 different sections to it, the first being Market News, this section details news that has happened, however, there is not a lot of it, just a single page with very brief information. The next section is an economic calendar detailing any upcoming news events and which markets they may affect. There is then an Education Centre which gives small lessons, these are short bite-sized chunks of information, unfortunately, it appeared that some of the links weren’t working but the majority were.

There is a trading tools section of the website which has 6 different sections to it, the first being Market News, this section details news that has happened, however, there is not a lot of it, just a single page with very brief information. The next section is an economic calendar detailing any upcoming news events and which markets they may affect. There is then an Education Centre which gives small lessons, these are short bite-sized chunks of information, unfortunately, it appeared that some of the links weren’t working but the majority were.

The only platform on offer from Pruton Capital is MetaTrader 4 from the MetaQuotes company. Some of the main features of MetaTrader 4 are that you can trade easily and professionally, trade from Mini or Standard Account, use one-click trading, have flexible leverage, mobile trading application available, access to rice alerts, signals and market news, you can trade FX, Metals, Energy, Indices, Stocks, and Binaries all in one platform, advanced charting package & technical analysis and, full use of Expert Advisors (EAs) and Indicators. It is also highly accessing as a mobile app, web trader or desktop download.

The only platform on offer from Pruton Capital is MetaTrader 4 from the MetaQuotes company. Some of the main features of MetaTrader 4 are that you can trade easily and professionally, trade from Mini or Standard Account, use one-click trading, have flexible leverage, mobile trading application available, access to rice alerts, signals and market news, you can trade FX, Metals, Energy, Indices, Stocks, and Binaries all in one platform, advanced charting package & technical analysis and, full use of Expert Advisors (EAs) and Indicators. It is also highly accessing as a mobile app, web trader or desktop download.

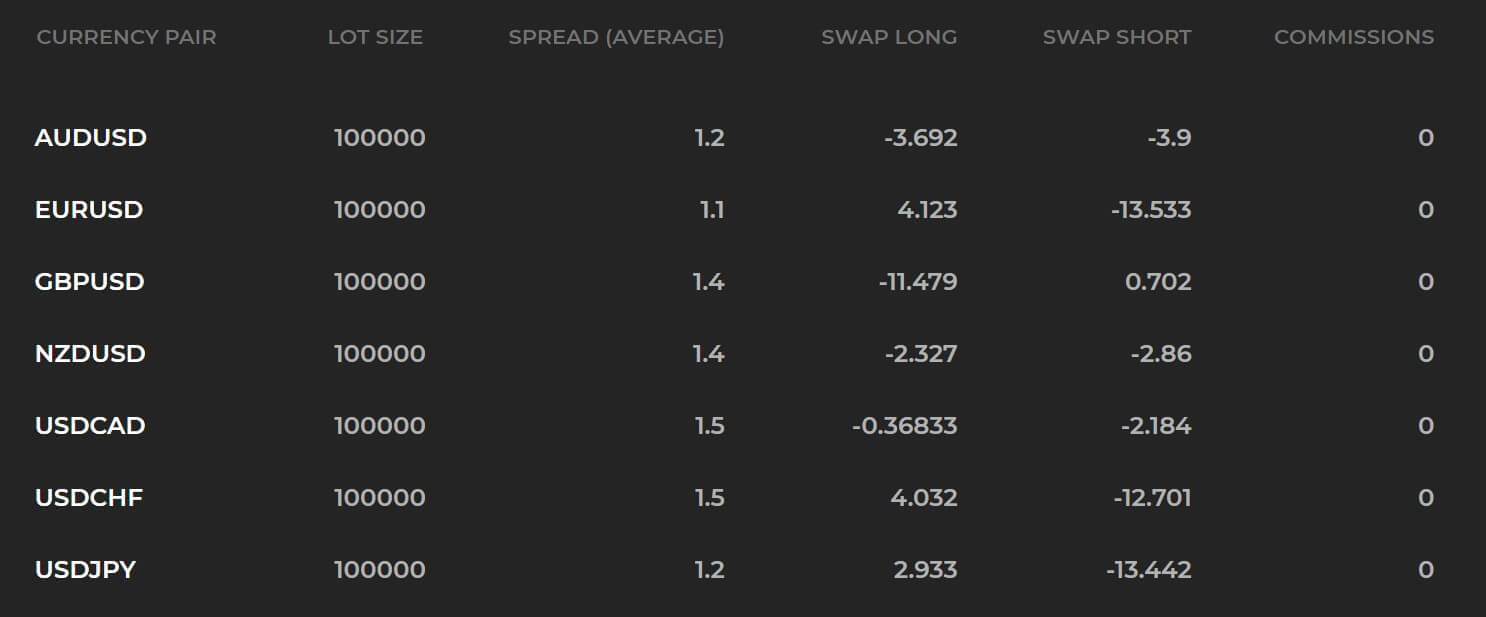

Major Currency Pairs: EURUSD, GBPUSD, USDCHF, USDJPY, AUDUSD, USDCAD, NZDUSD

Major Currency Pairs: EURUSD, GBPUSD, USDCHF, USDJPY, AUDUSD, USDCAD, NZDUSD

The maximum leverage available is 1:100 which is on the Mini account, this is far too high and we would recommend never going above 1:500. The Standard, Pro and Islamic account shave maximum leverage of 1:100 and the

The maximum leverage available is 1:100 which is on the Mini account, this is far too high and we would recommend never going above 1:500. The Standard, Pro and Islamic account shave maximum leverage of 1:100 and the

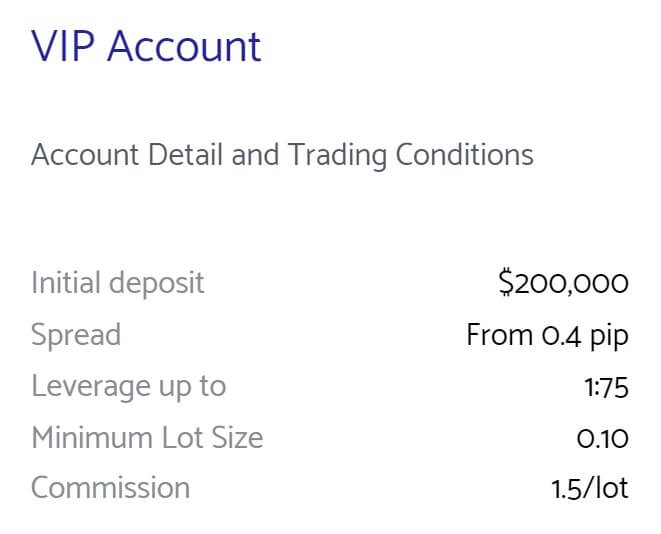

Trade sizes on the Mini and Standard account start from 0.01 lots and go up in increments of 0.01 lots. The Pro, Islamic and VIP account shave trade sizes starting from 0.10 lots. The maximum trade size is not currently known to us, neither is the maximum number of open trades allowed.

Trade sizes on the Mini and Standard account start from 0.01 lots and go up in increments of 0.01 lots. The Pro, Islamic and VIP account shave trade sizes starting from 0.10 lots. The maximum trade size is not currently known to us, neither is the maximum number of open trades allowed. Trading Costs

Trading Costs

Trade Sizes

Trade Sizes

Minimum Deposit

Minimum Deposit

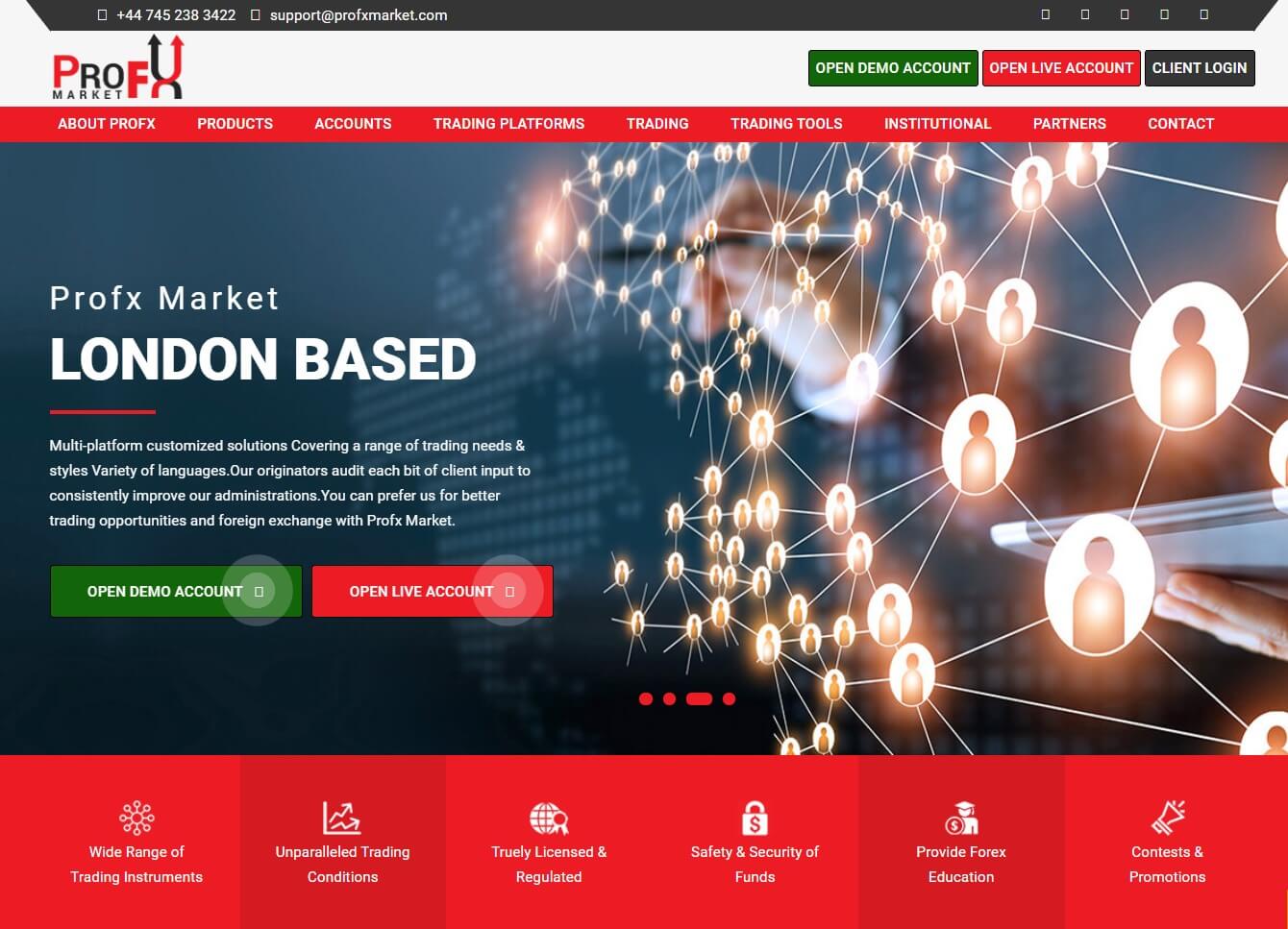

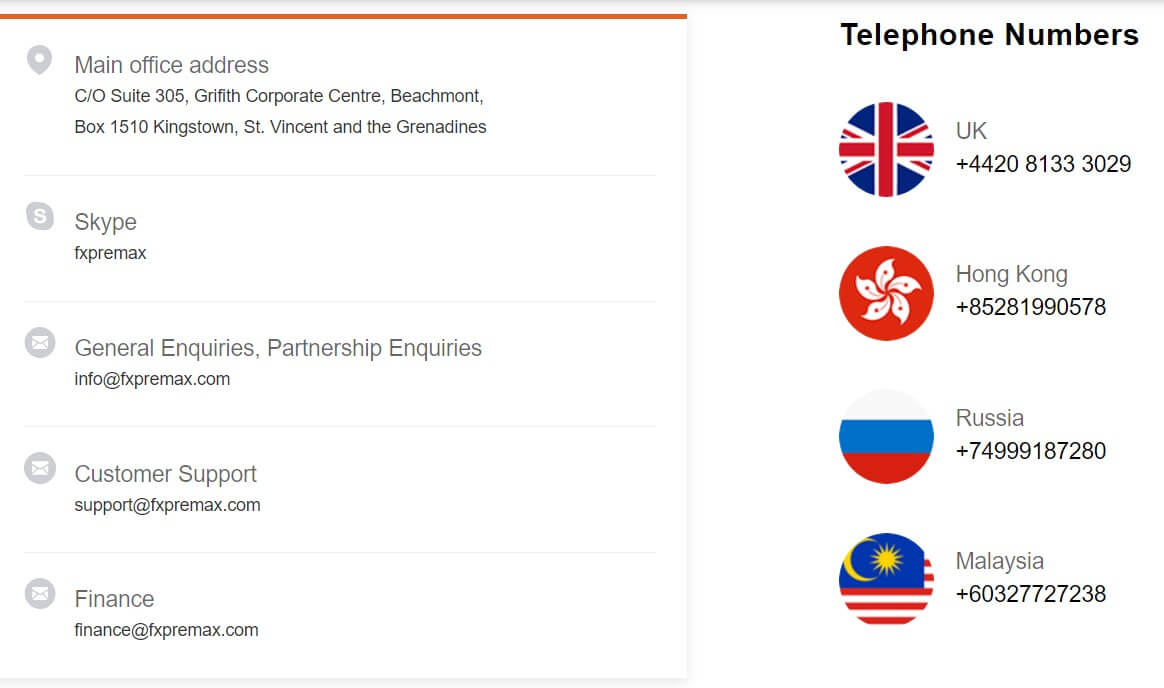

Should you need to contact ProFX Market, you can do so in a number of different ways. You can use the online submission form, fill in your query and you should get a reply via email. You can also use the postal address, phone number, email or skype username to contact them.

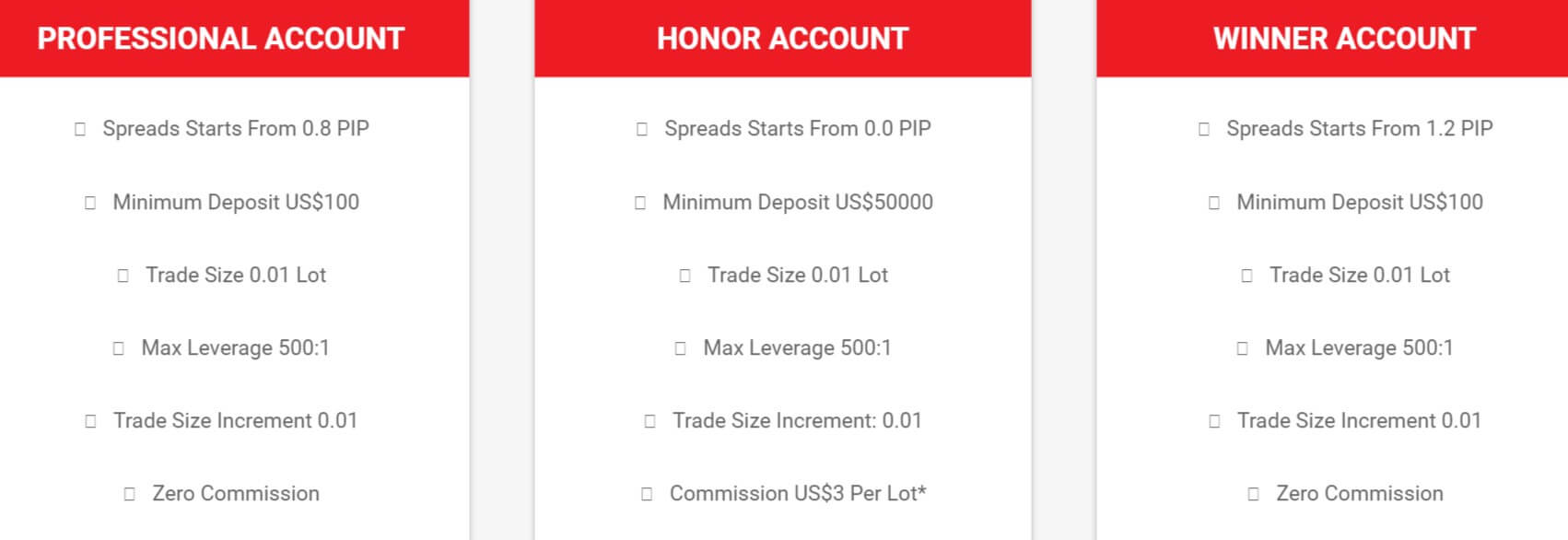

Should you need to contact ProFX Market, you can do so in a number of different ways. You can use the online submission form, fill in your query and you should get a reply via email. You can also use the postal address, phone number, email or skype username to contact them. The account pages provided by ProFX Market is a little confusing, there is a lot of info missing or muddles up to make it hard to understand what the real differences are. The trading conditions that we do know are passable. However, we do not know much about the

The account pages provided by ProFX Market is a little confusing, there is a lot of info missing or muddles up to make it hard to understand what the real differences are. The trading conditions that we do know are passable. However, we do not know much about the

Platforms

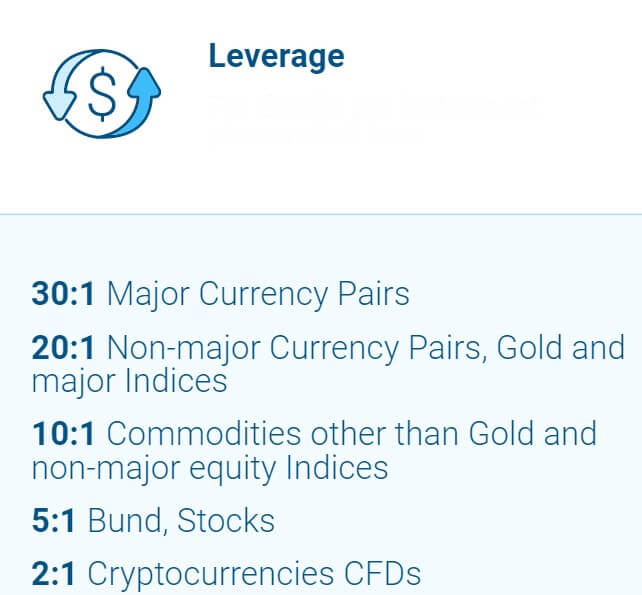

Platforms 30:1 for major currency pairs

30:1 for major currency pairs Trading Costs

Trading Costs

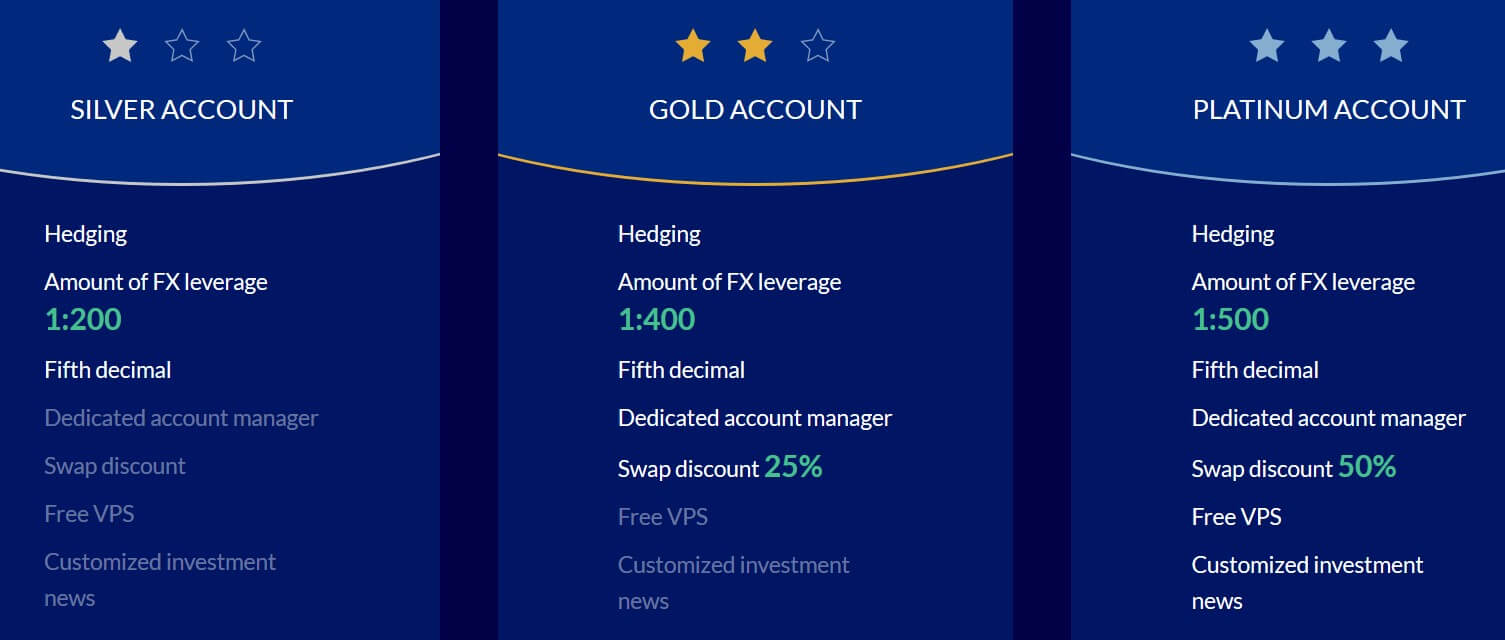

While we know that the account uses a spread based system, if we take EURUSD the following spreads have been stated as starting levels, the Silver account has spreads starting at 2.8 pips, the Gold account has spread starting at 2 pips and the Platinum account has spreads starting at 1.8 pips. These are just the starting numbers and as the spreads are variable they will move up and down, the more volatility in the markets the higher they will be. Different instruments also have different spreads as while EURUSD may be starting at 2.8 pips on the Silver account,

While we know that the account uses a spread based system, if we take EURUSD the following spreads have been stated as starting levels, the Silver account has spreads starting at 2.8 pips, the Gold account has spread starting at 2 pips and the Platinum account has spreads starting at 1.8 pips. These are just the starting numbers and as the spreads are variable they will move up and down, the more volatility in the markets the higher they will be. Different instruments also have different spreads as while EURUSD may be starting at 2.8 pips on the Silver account,

There are two main trading platforms as well as a social trading platform available, lets briefly look at what they are.

There are two main trading platforms as well as a social trading platform available, lets briefly look at what they are.

The following fees are present for the methods:

The following fees are present for the methods:

Educational & Trading Tools

Educational & Trading Tools

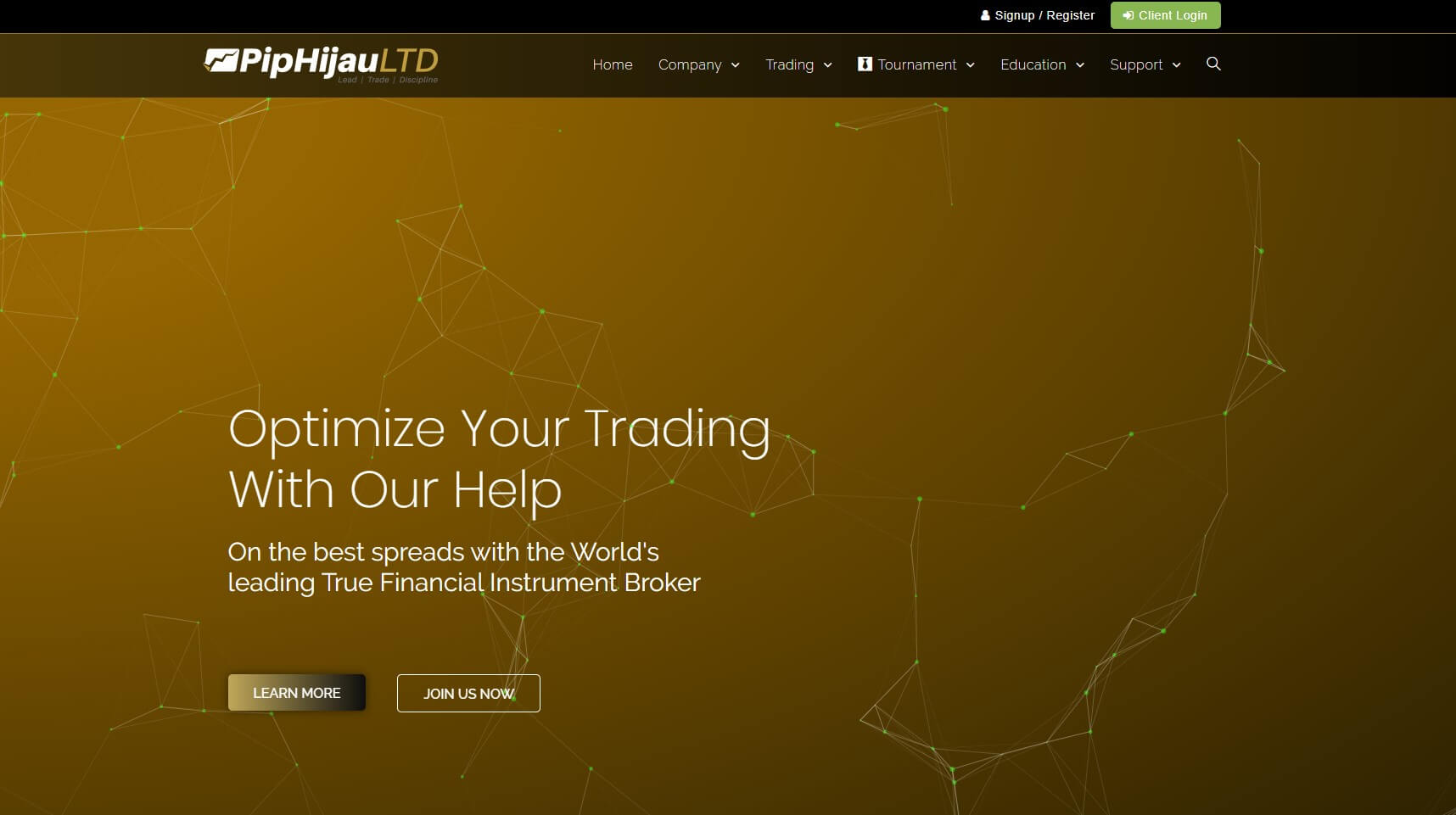

PipHijau offers MetaTrader 4 as a trading platform, normally just having one platform can limit choice e but the fact that it is MT4 is nothing to be disappointed about. A few of the many features it offers to include it being user-friendly, secure, offering multiple languages, automated trading, flexible, fast and responsive, offers advanced charting capabilities and is completely customizable. It is also highly accessing as it can be used as a desktop download, a mobile application or as a web trader on your internet browser.

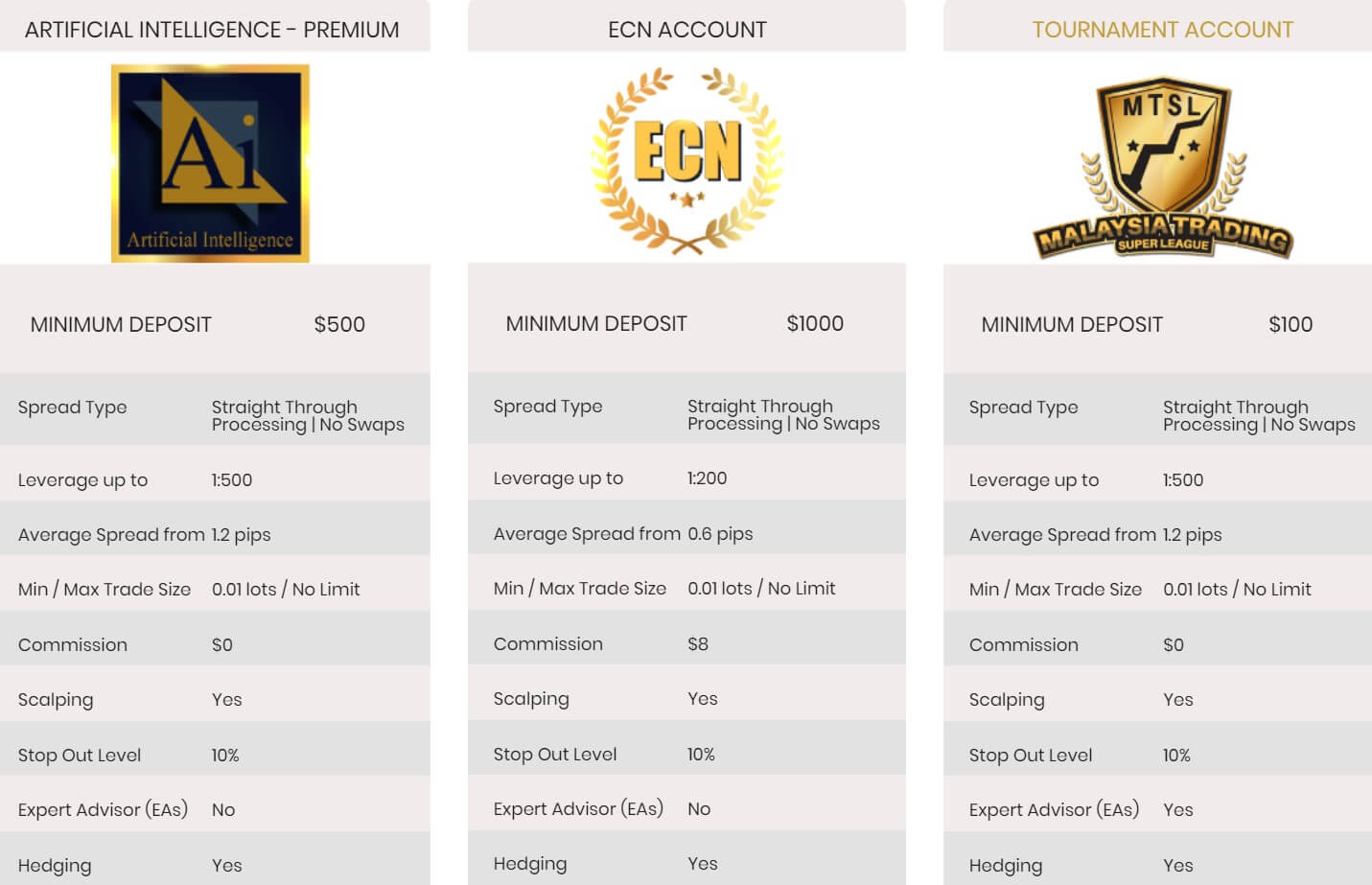

PipHijau offers MetaTrader 4 as a trading platform, normally just having one platform can limit choice e but the fact that it is MT4 is nothing to be disappointed about. A few of the many features it offers to include it being user-friendly, secure, offering multiple languages, automated trading, flexible, fast and responsive, offers advanced charting capabilities and is completely customizable. It is also highly accessing as it can be used as a desktop download, a mobile application or as a web trader on your internet browser. AI Premium Account: 1:500

AI Premium Account: 1:500

AI Premium Account: 1.2 pips

AI Premium Account: 1.2 pips

Bonuses & Promotions

Bonuses & Promotions

Platforms

Platforms

Trading Costs

Trading Costs Metals: Gold and Silver

Metals: Gold and Silver

Customer Service

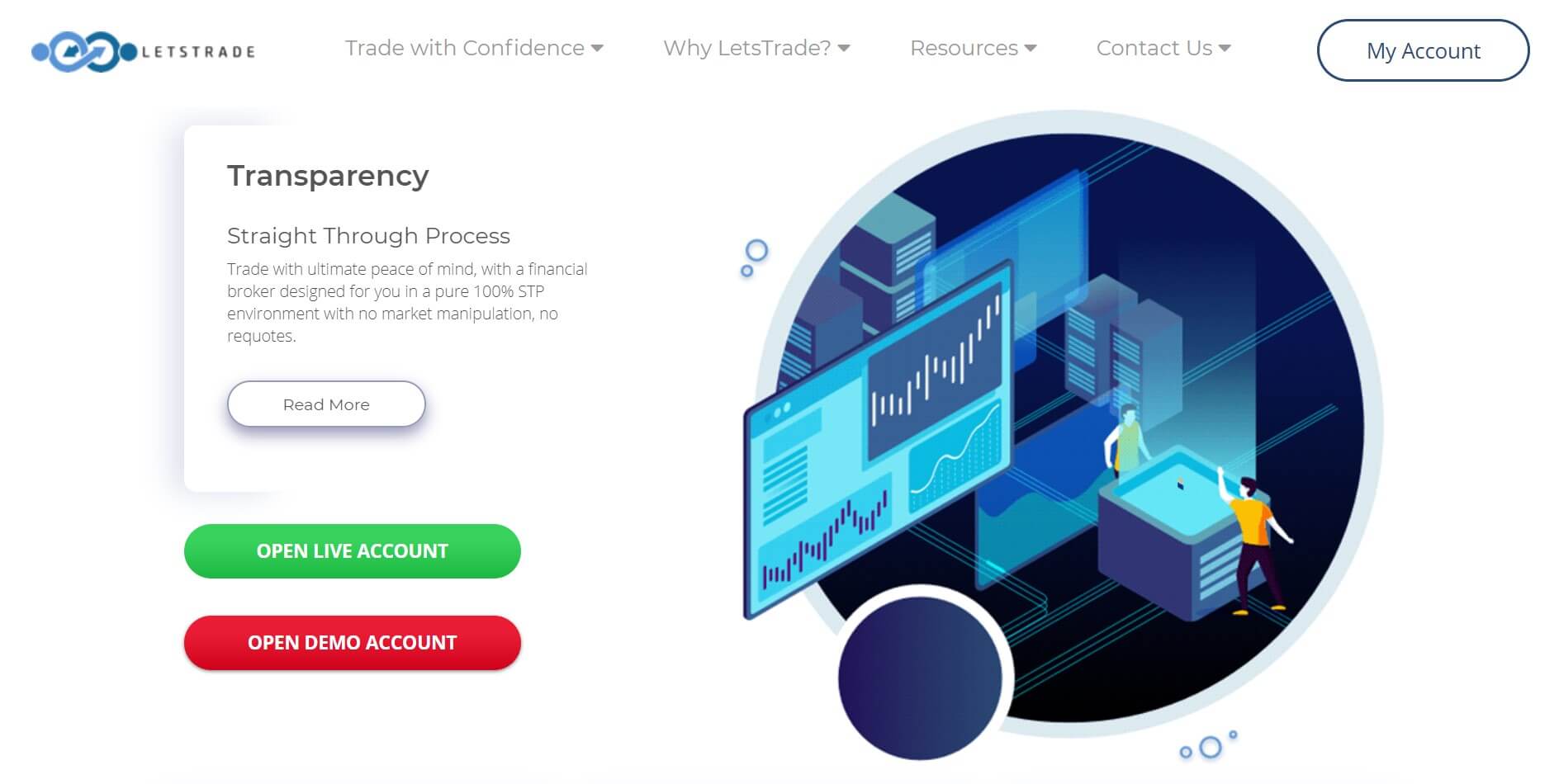

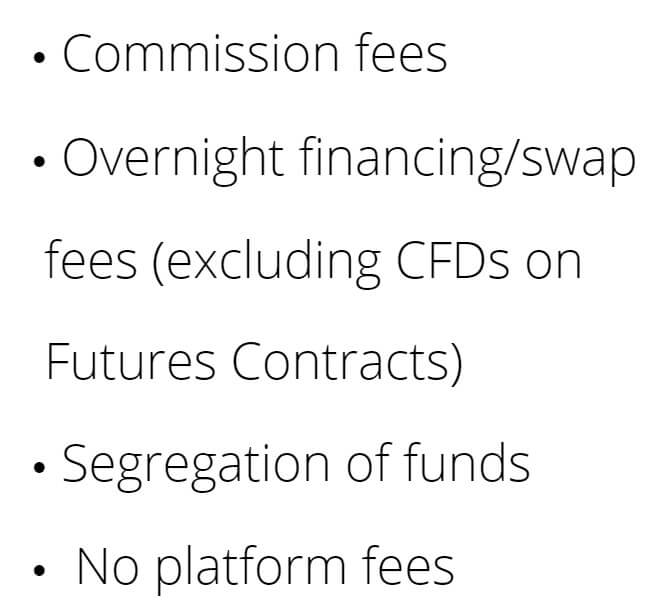

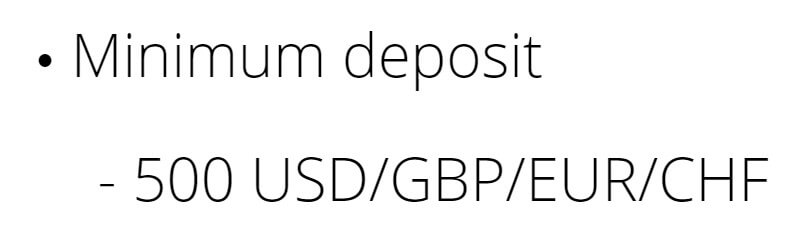

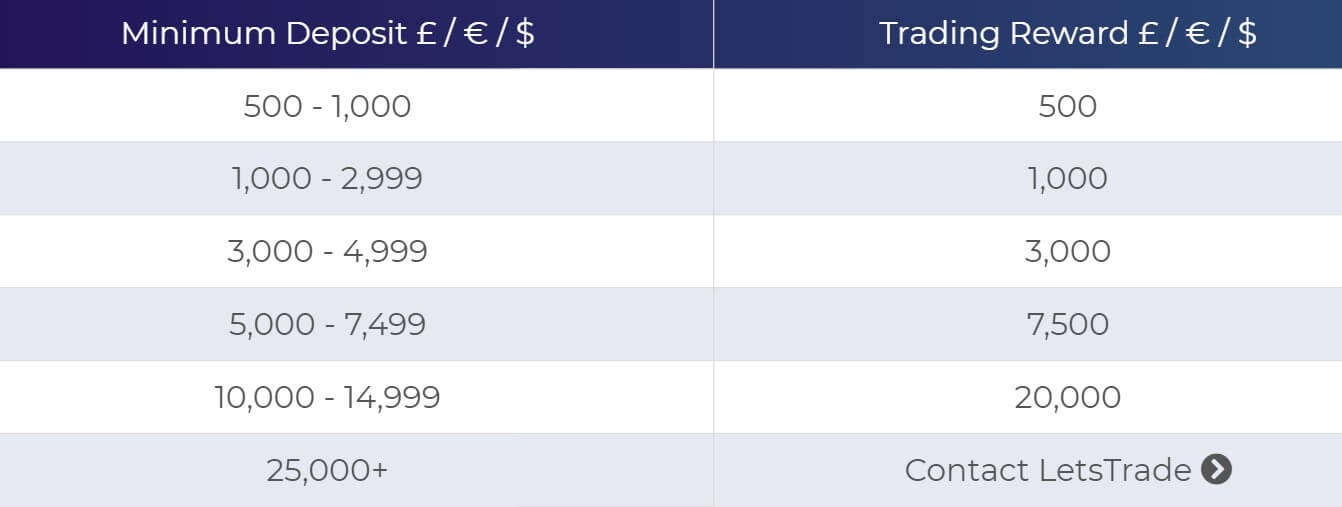

Customer Service LetsTrade seems to be offering quite a lot when it comes to their services, there is just one account to choose from which makes things simple, along with that just the one trading platform so you know exactly what you are getting yourself into. There is a slight issue of not knowing what the spreads are, and that to us is the all-important aspect as there is no added commission.

LetsTrade seems to be offering quite a lot when it comes to their services, there is just one account to choose from which makes things simple, along with that just the one trading platform so you know exactly what you are getting yourself into. There is a slight issue of not knowing what the spreads are, and that to us is the all-important aspect as there is no added commission.

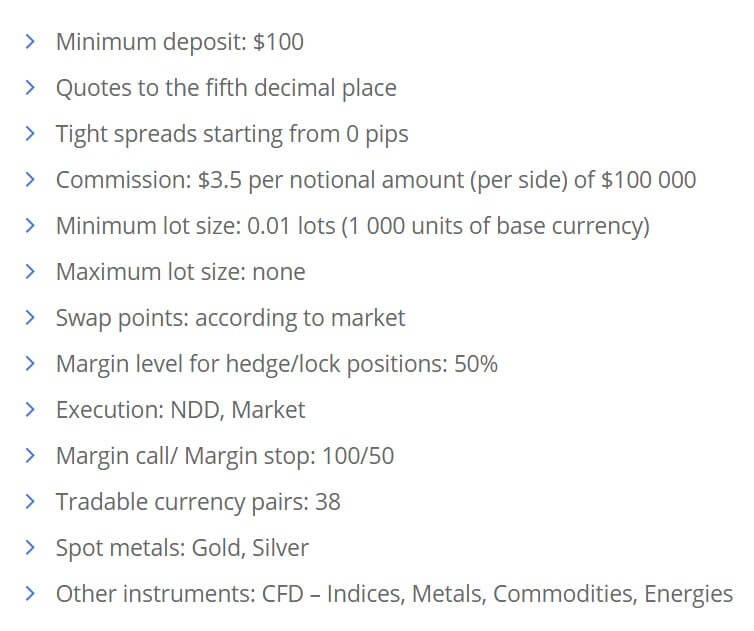

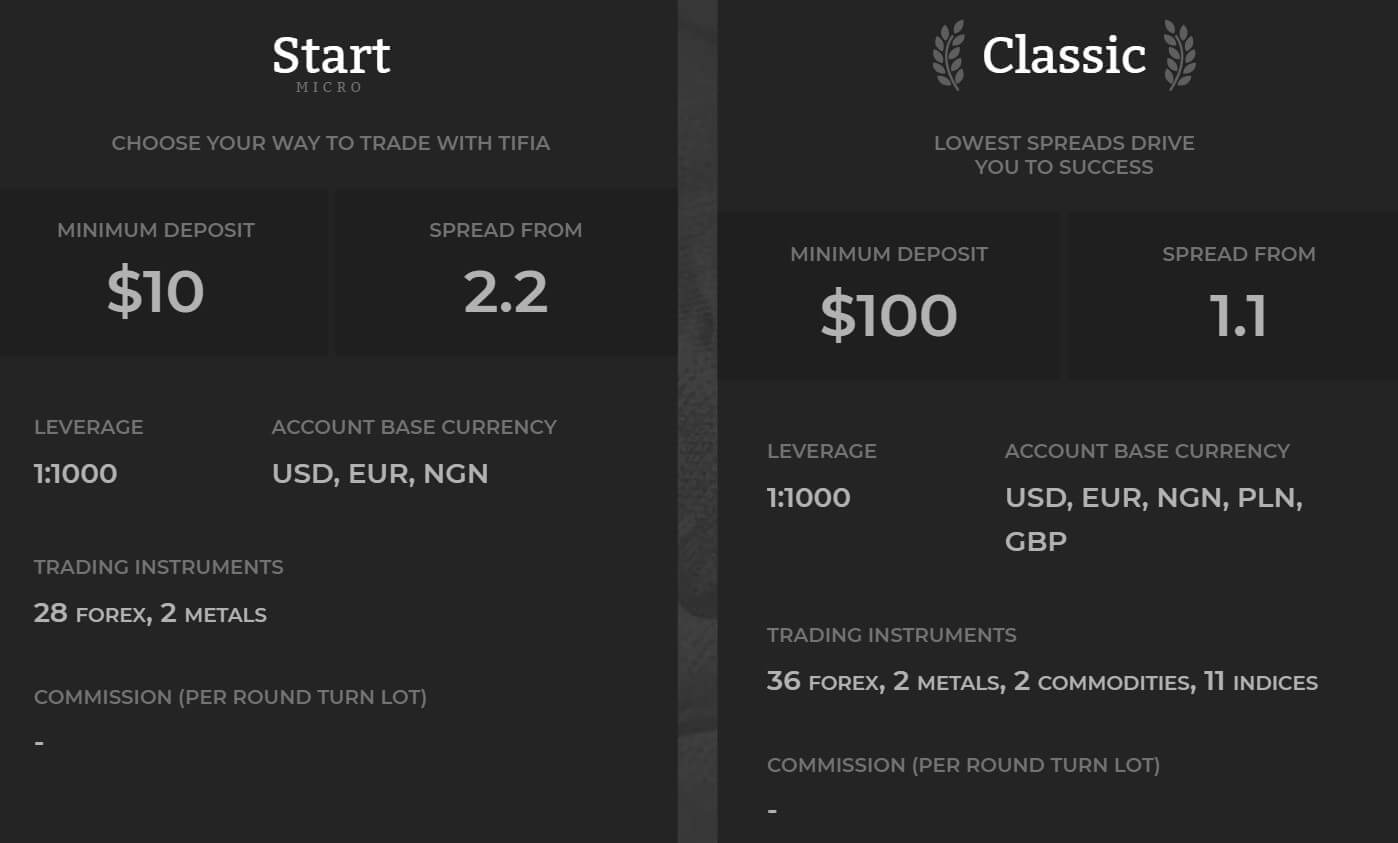

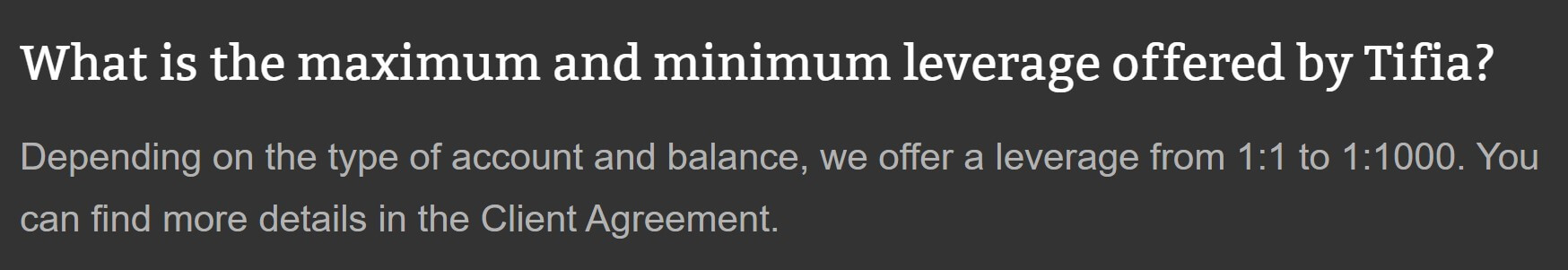

ECN Pro Account: This is the top-level account and the minimum deposit required is $500, it can use USD, EUR, PLN, GBP or NGN as a base currency and uses MetaTrader 4 and MetaTrader 5 trading platform. It has spread starting from 0 pips and so there is an added commission of $8 per round lot traded. Leverage can go as high as 1:100 and trading starts from 0.01 lots and goes up to 100 lots. A lot for this account is the usual 100,000 units. The margin call level is set at 100% and

ECN Pro Account: This is the top-level account and the minimum deposit required is $500, it can use USD, EUR, PLN, GBP or NGN as a base currency and uses MetaTrader 4 and MetaTrader 5 trading platform. It has spread starting from 0 pips and so there is an added commission of $8 per round lot traded. Leverage can go as high as 1:100 and trading starts from 0.01 lots and goes up to 100 lots. A lot for this account is the usual 100,000 units. The margin call level is set at 100% and

There are four different educational tools available, the first is a page for reviews and outlooks, it looks at different news and analysis on what the markets could do. There is an analysis app valuable, you need a fully verified account to access it so we do not know what it is like, but it seems that it will give you analysis and tips on your phone. There is then a calculator for working out margin,

There are four different educational tools available, the first is a page for reviews and outlooks, it looks at different news and analysis on what the markets could do. There is an analysis app valuable, you need a fully verified account to access it so we do not know what it is like, but it seems that it will give you analysis and tips on your phone. There is then a calculator for working out margin,

There seems to be quite a lot when it comes to education, the first aspect is a guide for beginners, this has various sections detailing the very basics of trading such as what leverage is, or how to place orders. There are also trading manuals which detail how each of the trading platforms works just in case you get stuck. There is then an FAQ about various aspects of trading and how to work things like pips out. The glossary is up next which simpy, details the meaning of lots of trading-related terms, handy if you come across something you do not understand.

There seems to be quite a lot when it comes to education, the first aspect is a guide for beginners, this has various sections detailing the very basics of trading such as what leverage is, or how to place orders. There are also trading manuals which detail how each of the trading platforms works just in case you get stuck. There is then an FAQ about various aspects of trading and how to work things like pips out. The glossary is up next which simpy, details the meaning of lots of trading-related terms, handy if you come across something you do not understand.

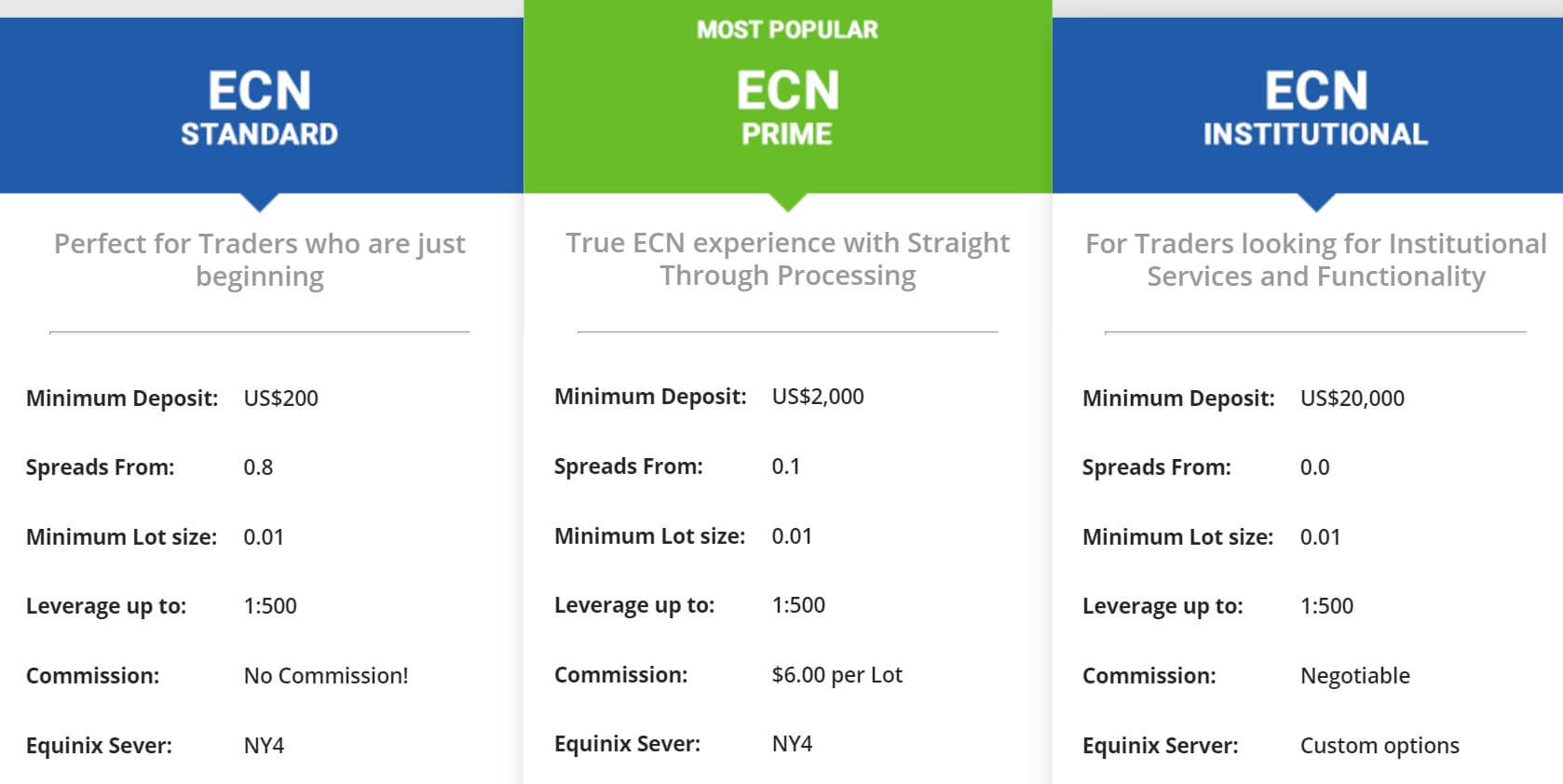

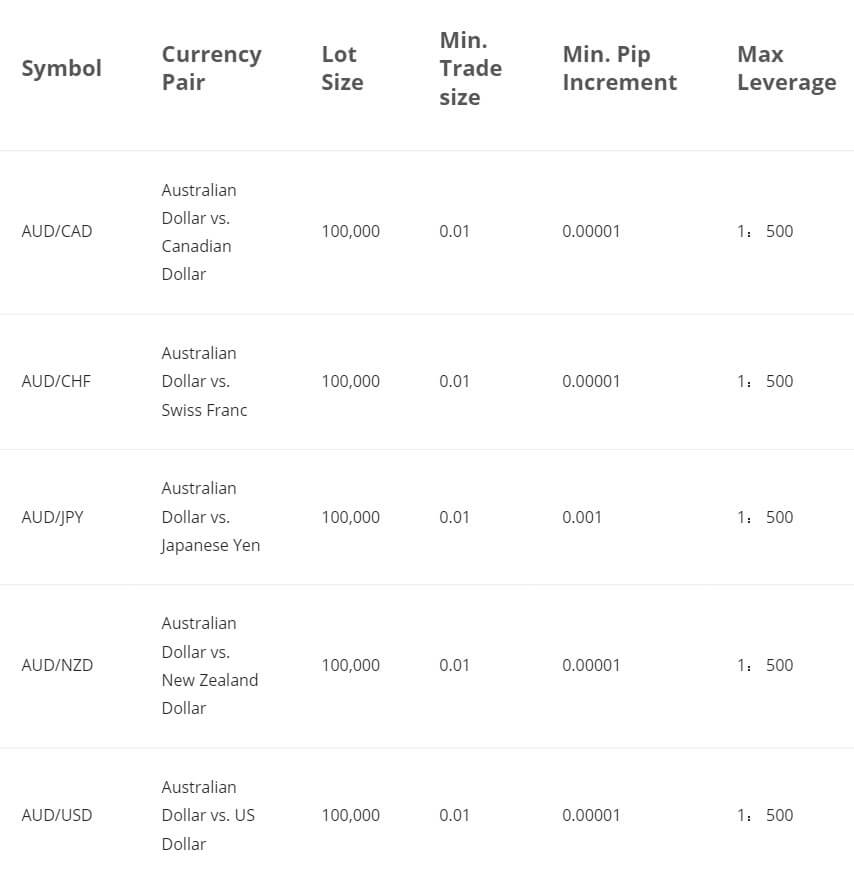

The assets on BlackBull Markets have been broken down into a few different categories, we have outlined the different instruments within them below.

The assets on BlackBull Markets have been broken down into a few different categories, we have outlined the different instruments within them below.

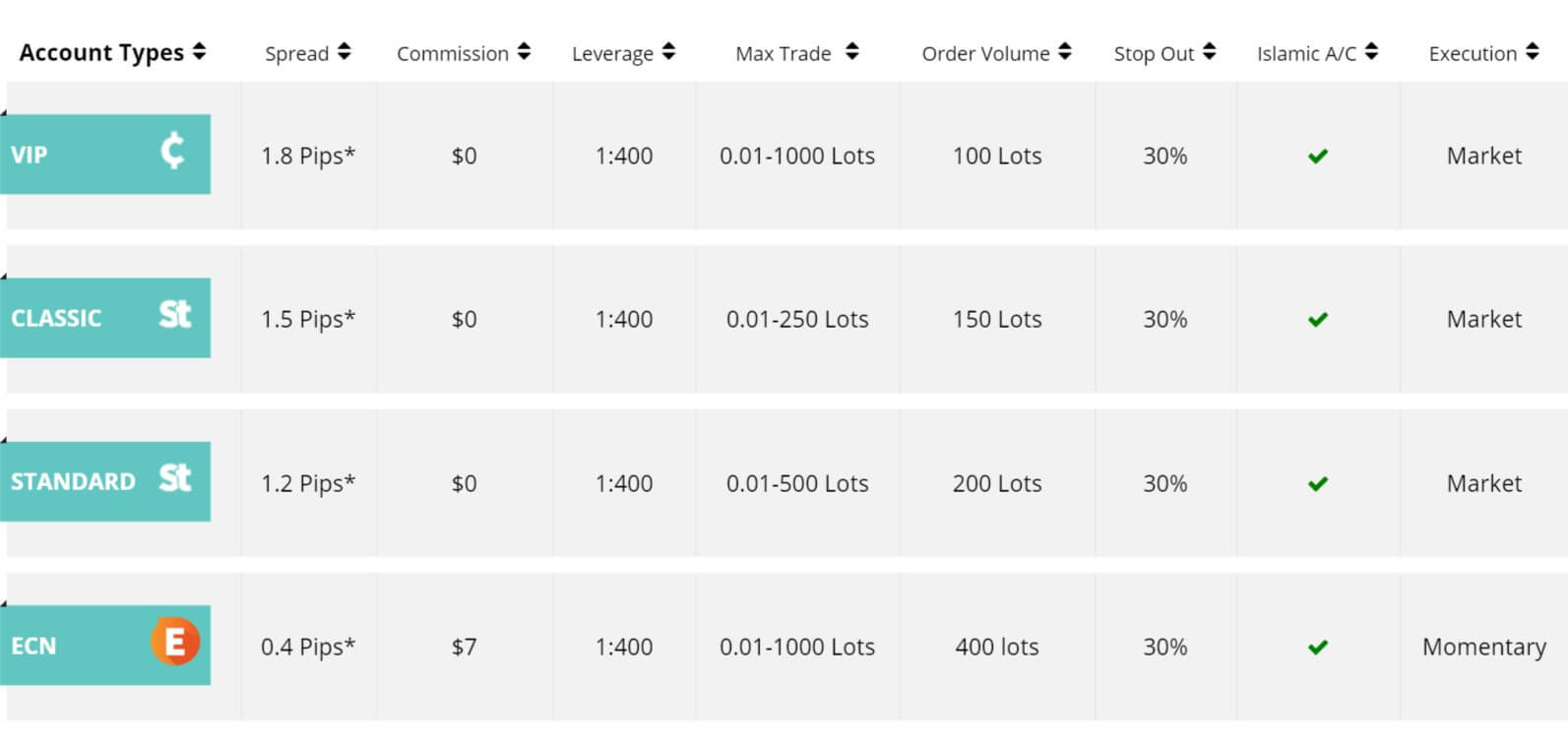

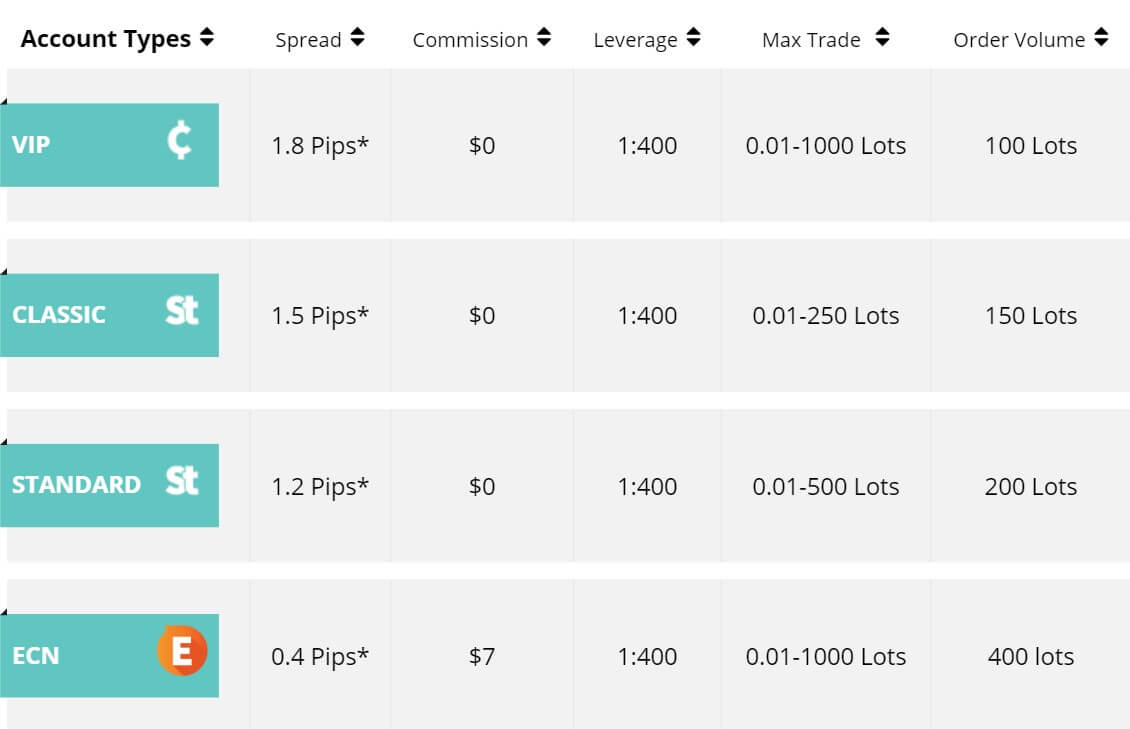

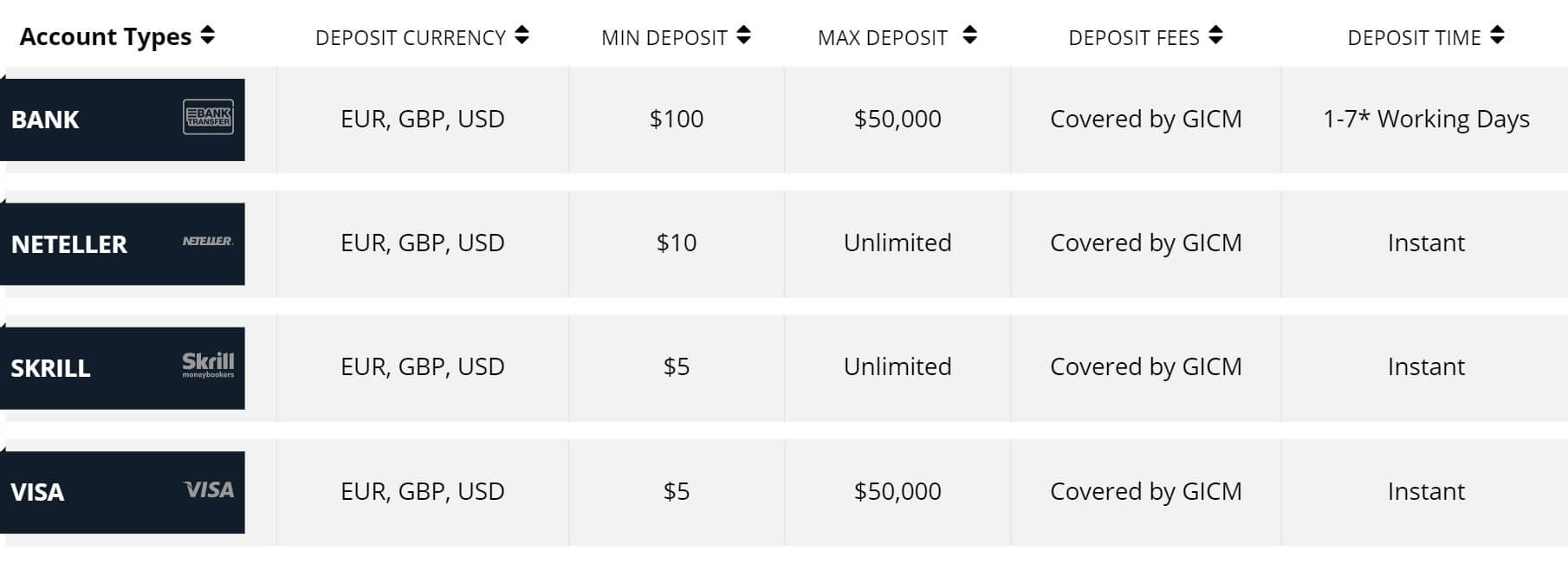

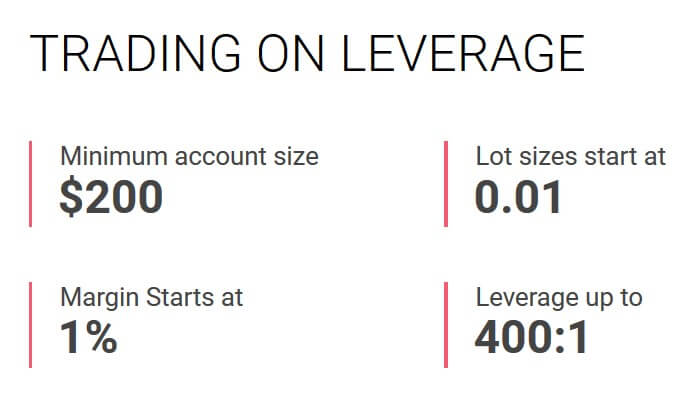

All traders will have access to a leverage cap of 1:400, regardless of the chosen account type or the amount of equity within the account. This amount is very flexible when compared to the 1:30 and 1:100 restrictions that are set by many regulators. The caps are so high, in fact, that some traders may want to stick with a lower amount since trading with higher leverages can be so risky. Either way, GIC Markets provides an impressive option that doesn’t feel so restrictive. Even if one isn’t prepared to use the highest option, many traders may become more comfortable with a larger leverage setting as time goes on. This broker leaves room for those clients to grow.

All traders will have access to a leverage cap of 1:400, regardless of the chosen account type or the amount of equity within the account. This amount is very flexible when compared to the 1:30 and 1:100 restrictions that are set by many regulators. The caps are so high, in fact, that some traders may want to stick with a lower amount since trading with higher leverages can be so risky. Either way, GIC Markets provides an impressive option that doesn’t feel so restrictive. Even if one isn’t prepared to use the highest option, many traders may become more comfortable with a larger leverage setting as time goes on. This broker leaves room for those clients to grow.

GIC Markets manages to keep spreads at or below the industry average 1.5 pips on three of their main account types. The ECN account features the

GIC Markets manages to keep spreads at or below the industry average 1.5 pips on three of their main account types. The ECN account features the

This broker provides a generous leverage cap of up to 1:500 for all account holders, with no restrictions based on the account’s equity. Many regulators limit that

This broker provides a generous leverage cap of up to 1:500 for all account holders, with no restrictions based on the account’s equity. Many regulators limit that

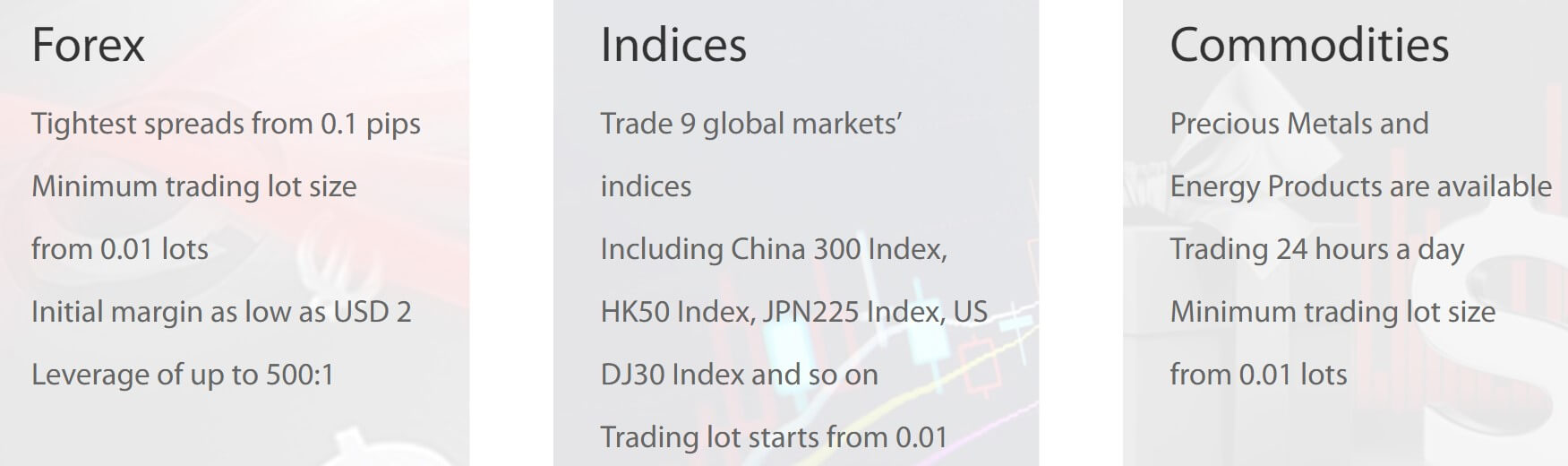

CF Group only profits from spreads and swap charges, with commission costs being eliminated altogether. We did find a category related to commission costs on the page that details minimum and average spreads and swap costs, but all of the inputs for that category remained blank, meaning that traders will not have to worry about commission costs when trading any instrument. Swaps would be charged or credited based on the current rate when holding positions past market closing time, and the applicable swap rates can be viewed on the website under “Charges and Fees on CF CFD Platform”. The broker reserves the right to charge statement fees, idle account fees, order cancellation fees, transfer fees, and other fees at any time without notice.

CF Group only profits from spreads and swap charges, with commission costs being eliminated altogether. We did find a category related to commission costs on the page that details minimum and average spreads and swap costs, but all of the inputs for that category remained blank, meaning that traders will not have to worry about commission costs when trading any instrument. Swaps would be charged or credited based on the current rate when holding positions past market closing time, and the applicable swap rates can be viewed on the website under “Charges and Fees on CF CFD Platform”. The broker reserves the right to charge statement fees, idle account fees, order cancellation fees, transfer fees, and other fees at any time without notice. Assets

Assets

Deposit Methods & Costs

Deposit Methods & Costs

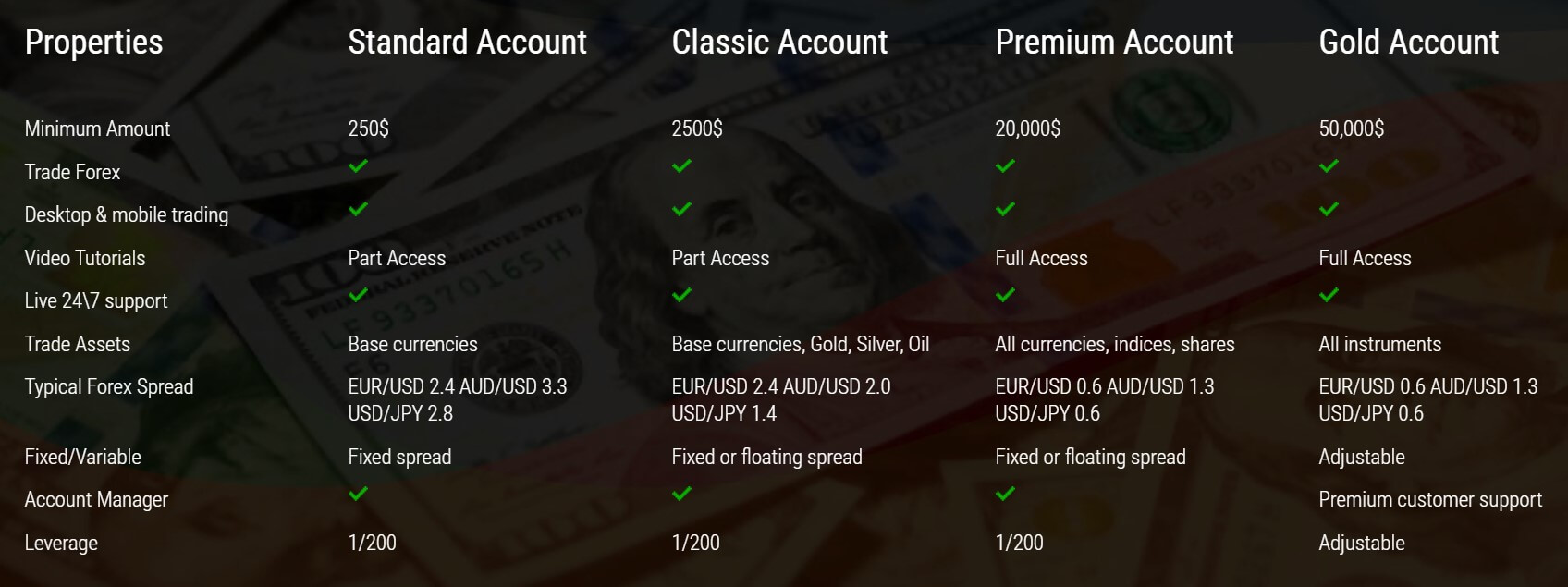

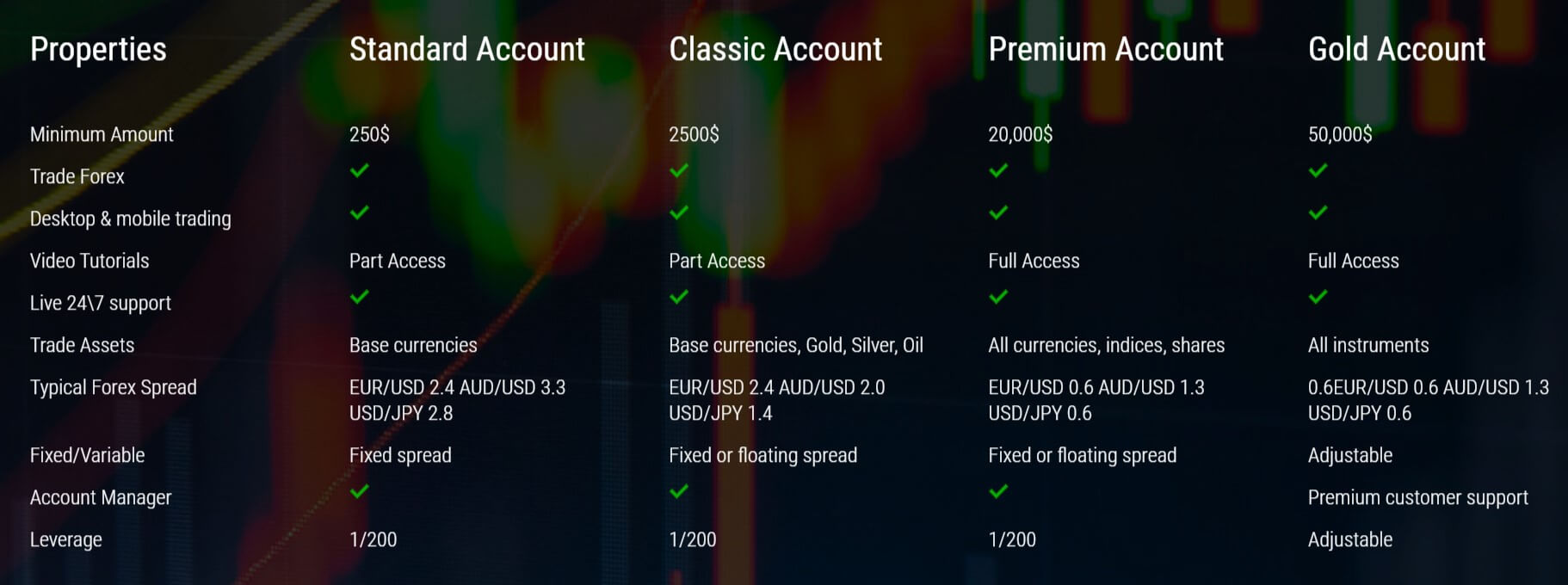

The leverage offered by ProTradeFX is set at 1:200 for the Standard, Classic and Premium account whereas the Gold account has adjustable leverage. The broker does not specify the

The leverage offered by ProTradeFX is set at 1:200 for the Standard, Classic and Premium account whereas the Gold account has adjustable leverage. The broker does not specify the

ZTP: Provides you with a fully-fledged web-based Trading Station for Forex and CFDs manual trading. Offers technical charts (Candlesticks, OHLC, lines) and indicators (Trend, Oscillators, volatility, volumes, Bill Williams, etc.) you can tailor according to your trading requirements. In addition, ZuluScripts™ allows

ZTP: Provides you with a fully-fledged web-based Trading Station for Forex and CFDs manual trading. Offers technical charts (Candlesticks, OHLC, lines) and indicators (Trend, Oscillators, volatility, volumes, Bill Williams, etc.) you can tailor according to your trading requirements. In addition, ZuluScripts™ allows

AAAFx is a well-known name in the social trading world thanks to their affiliation with ZuluTrade, they have adapted their accounts for that trading platform above all else. The spreads and leverage are what you would expect from a commission-based regulated broker, the big let down to the trading conditions are the huge commission, $20 (or currency equivalent) per

AAAFx is a well-known name in the social trading world thanks to their affiliation with ZuluTrade, they have adapted their accounts for that trading platform above all else. The spreads and leverage are what you would expect from a commission-based regulated broker, the big let down to the trading conditions are the huge commission, $20 (or currency equivalent) per

Three different categories of assets are available to trade at Juno Markets, these are forex currency pairs, the website only lists the major pairs however there is mention of minor pairs also being available, some examples given are EURUSD, GBPJPY, USDCAD and, NZDUSD. Next up is CFDs, this includes the likes of UK 100, NASDAQ 100, French 40 and German 30. Metals are the next available asset which includes the two regulars of Gold and Silver. There are a few commodities also thrown in although not given their own section, things like US Crude Oil are also available to trade.

Three different categories of assets are available to trade at Juno Markets, these are forex currency pairs, the website only lists the major pairs however there is mention of minor pairs also being available, some examples given are EURUSD, GBPJPY, USDCAD and, NZDUSD. Next up is CFDs, this includes the likes of UK 100, NASDAQ 100, French 40 and German 30. Metals are the next available asset which includes the two regulars of Gold and Silver. There are a few commodities also thrown in although not given their own section, things like US Crude Oil are also available to trade. Spreads are dependant on the account that you use along with a number of other factors. If you use the STP account then you will have spreads starting from 2 pips, the ECN account has spreads starting from 0.2 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like GBPJPY may start slightly higher, in this case, 2.5 pips.

Spreads are dependant on the account that you use along with a number of other factors. If you use the STP account then you will have spreads starting from 2 pips, the ECN account has spreads starting from 0.2 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like GBPJPY may start slightly higher, in this case, 2.5 pips.

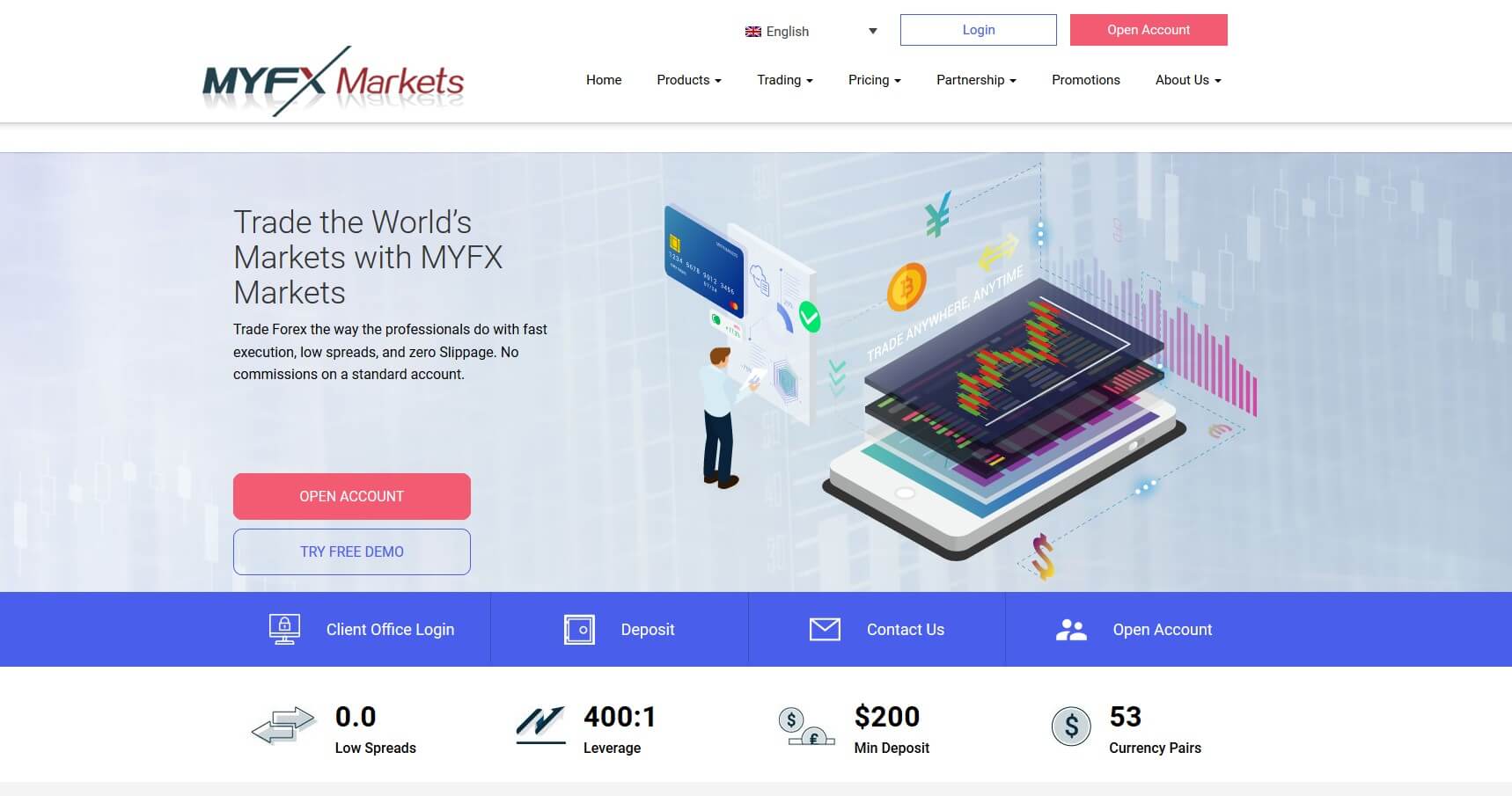

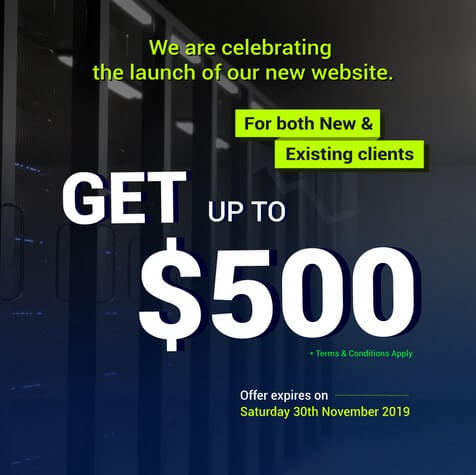

It seems that MyFX Markets doesn’t have any current promotions. Their most recent one, which expired at the end of November 2019, gave new and current account holders the opportunity to earn as much as $500. The ‘Celebration Bonus’ was launched after the broker switched to a new website. Traders with $500 to $999 in funds who close

It seems that MyFX Markets doesn’t have any current promotions. Their most recent one, which expired at the end of November 2019, gave new and current account holders the opportunity to earn as much as $500. The ‘Celebration Bonus’ was launched after the broker switched to a new website. Traders with $500 to $999 in funds who close

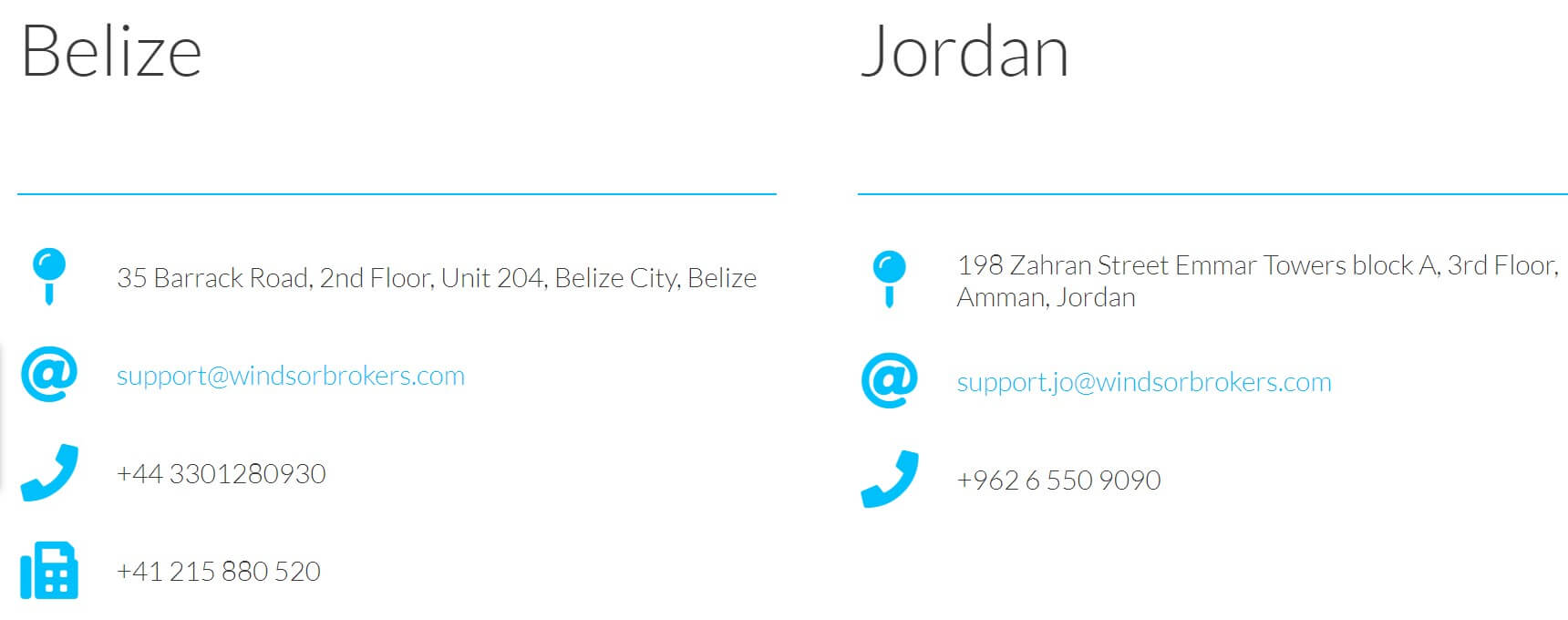

Meanwhile, the firm’s past bonuses can tell us a lot about what type of promotions they might run in the future. The Demo 500 competition was offered to traders who had a fake/paper account. Between March and June of 2018, each week’s top 3 demo account holders (in terms of profits) were awarded $250, $150, and $100 in cash, respectively. During the 2018 FIFA World Cup, Windsor Brokers picked a match every day and its existing account holders submitted their scoreline predictions. The firm gave away up to $30,000 in cash prices. While this is unrelated to the forex market, the bonus is certainly an engaging and stress-free way to make money.

Meanwhile, the firm’s past bonuses can tell us a lot about what type of promotions they might run in the future. The Demo 500 competition was offered to traders who had a fake/paper account. Between March and June of 2018, each week’s top 3 demo account holders (in terms of profits) were awarded $250, $150, and $100 in cash, respectively. During the 2018 FIFA World Cup, Windsor Brokers picked a match every day and its existing account holders submitted their scoreline predictions. The firm gave away up to $30,000 in cash prices. While this is unrelated to the forex market, the bonus is certainly an engaging and stress-free way to make money.

Whether you’re a beginner who is looking for tutorials or an expert that wants to utilize practical trading tools, you will certainly appreciate what Windsor Brokers has to offer. Every once in a while, the firm hosts live training webinars. They don’t have any courses scheduled in the near future, but you can access past videos on the website to learn about topics such as the different

Whether you’re a beginner who is looking for tutorials or an expert that wants to utilize practical trading tools, you will certainly appreciate what Windsor Brokers has to offer. Every once in a while, the firm hosts live training webinars. They don’t have any courses scheduled in the near future, but you can access past videos on the website to learn about topics such as the different  Windsor Brokers also has 3 ebooks and each of them covers the markets of a specific financial instrument, namely forex pairs, stocks, and CFDs. Lastly, but certainly not least, there is an in-depth trading glossary that defines different market terms and concepts.

Windsor Brokers also has 3 ebooks and each of them covers the markets of a specific financial instrument, namely forex pairs, stocks, and CFDs. Lastly, but certainly not least, there is an in-depth trading glossary that defines different market terms and concepts.

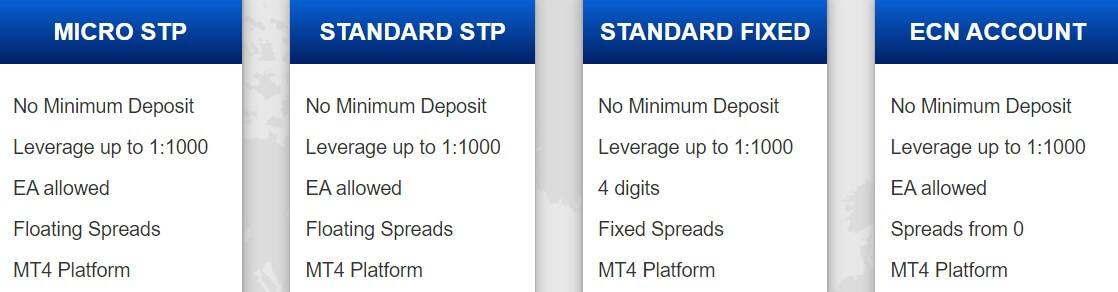

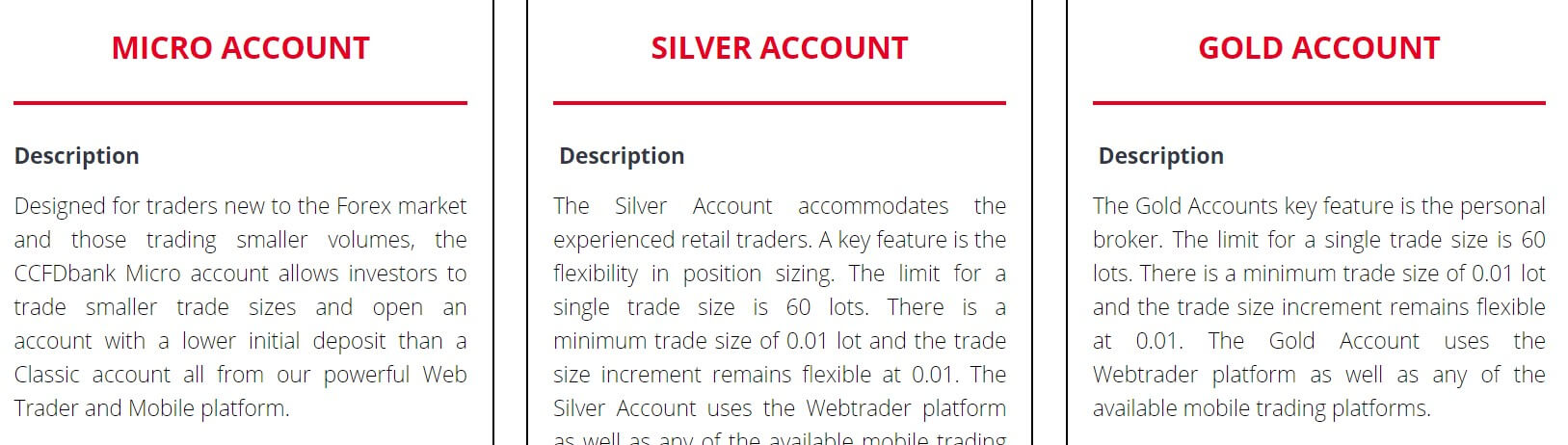

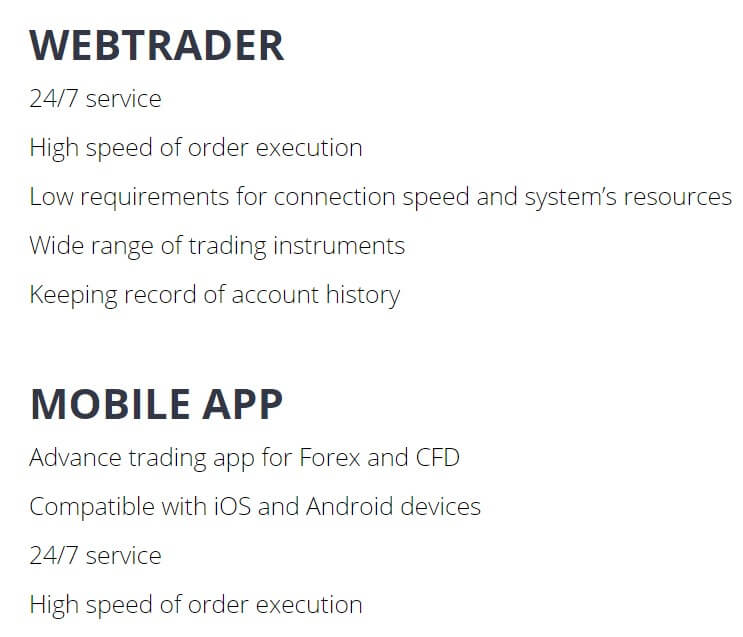

FXPremax offers five separate account types: Micro, Standard Fixed, Standard STP, ECN, and Crypto. Swap-free versions of each account type are available upon email request. Most of the accounts provide access to 74 currency pairs plus Gold and Silver, with no minimum deposit requirements. The Crypto account asks for a $1,000 deposit and features 36 crypto pairs.

FXPremax offers five separate account types: Micro, Standard Fixed, Standard STP, ECN, and Crypto. Swap-free versions of each account type are available upon email request. Most of the accounts provide access to 74 currency pairs plus Gold and Silver, with no minimum deposit requirements. The Crypto account asks for a $1,000 deposit and features 36 crypto pairs.

Deposit Bonus: $200 deposit bonus is credited per each $1,000 deposit that is made. The bonus can be received an unlimited number of times.

Deposit Bonus: $200 deposit bonus is credited per each $1,000 deposit that is made. The bonus can be received an unlimited number of times. Educational & Trading Tools

Educational & Trading Tools

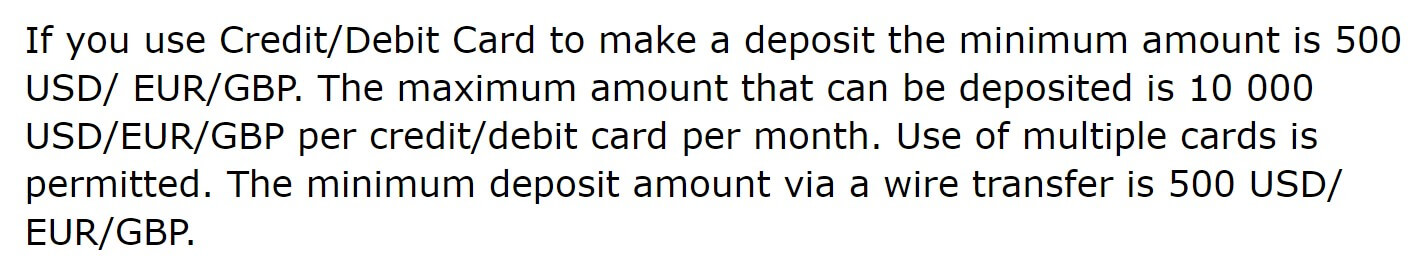

AK Global Markets offers Standard and Premium account types. The Standard account is designed for beginner and more experienced traders, while the Premium account is meant for professional clients that can afford the $500k deposit requirement, or who can meet the trade requirement of more than $500 million USD per month. The broker offers some extra benefits to Premium account holders, including one on one access with a senior trader, free access to training courses, briefings with the Chief Market Strategist, and discounted commissions.

AK Global Markets offers Standard and Premium account types. The Standard account is designed for beginner and more experienced traders, while the Premium account is meant for professional clients that can afford the $500k deposit requirement, or who can meet the trade requirement of more than $500 million USD per month. The broker offers some extra benefits to Premium account holders, including one on one access with a senior trader, free access to training courses, briefings with the Chief Market Strategist, and discounted commissions.

AK Global Markets profits through spreads, swaps, commissions, and dormant account fees. On their website, the broker mentions minimum account fees of 3%. We’re assuming that this is the commission amount on Premium accounts, and due to the fact that those accounts advertise discounted commissions, there’s a good chance that the account fees are higher than 3% on Standard accounts. Otherwise, commissions could be 3% on Standard accounts and cheaper once discounted on Premium accounts.

AK Global Markets profits through spreads, swaps, commissions, and dormant account fees. On their website, the broker mentions minimum account fees of 3%. We’re assuming that this is the commission amount on Premium accounts, and due to the fact that those accounts advertise discounted commissions, there’s a good chance that the account fees are higher than 3% on Standard accounts. Otherwise, commissions could be 3% on Standard accounts and cheaper once discounted on Premium accounts. Assets

Assets

Rather than focusing on providing educational material, AK Global Markets focuses more on market analysis, trends, and news. In addition, the website provides an economic calendar and free demo accounts. Overall, we do wish that the broker would offer some resources that are aimed more towards educating traders.

Rather than focusing on providing educational material, AK Global Markets focuses more on market analysis, trends, and news. In addition, the website provides an economic calendar and free demo accounts. Overall, we do wish that the broker would offer some resources that are aimed more towards educating traders.

Forex: There are 51 different currencies available to trade, these include AUDJPY, EURUSD, GBPUSD and, USDPLN.

Forex: There are 51 different currencies available to trade, these include AUDJPY, EURUSD, GBPUSD and, USDPLN.

Bonuses & Promotions

Bonuses & Promotions

Leverage

Leverage

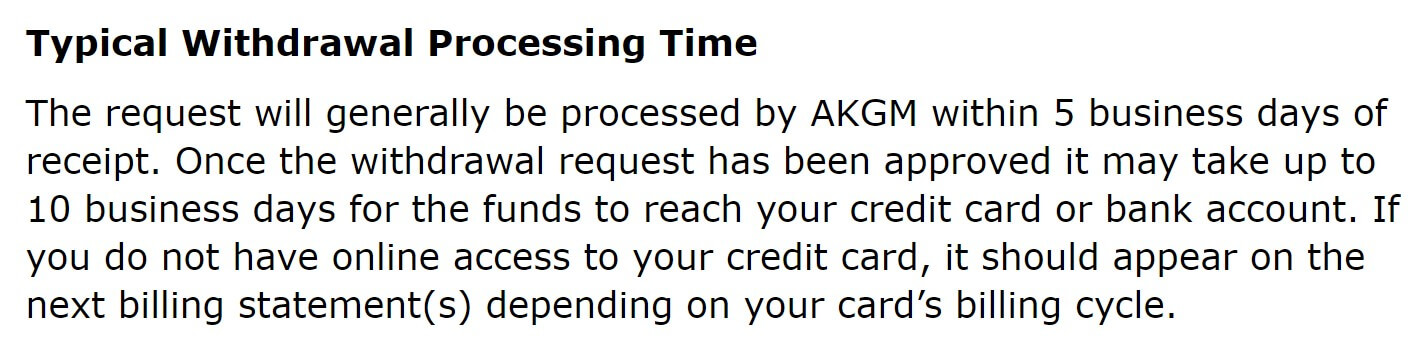

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

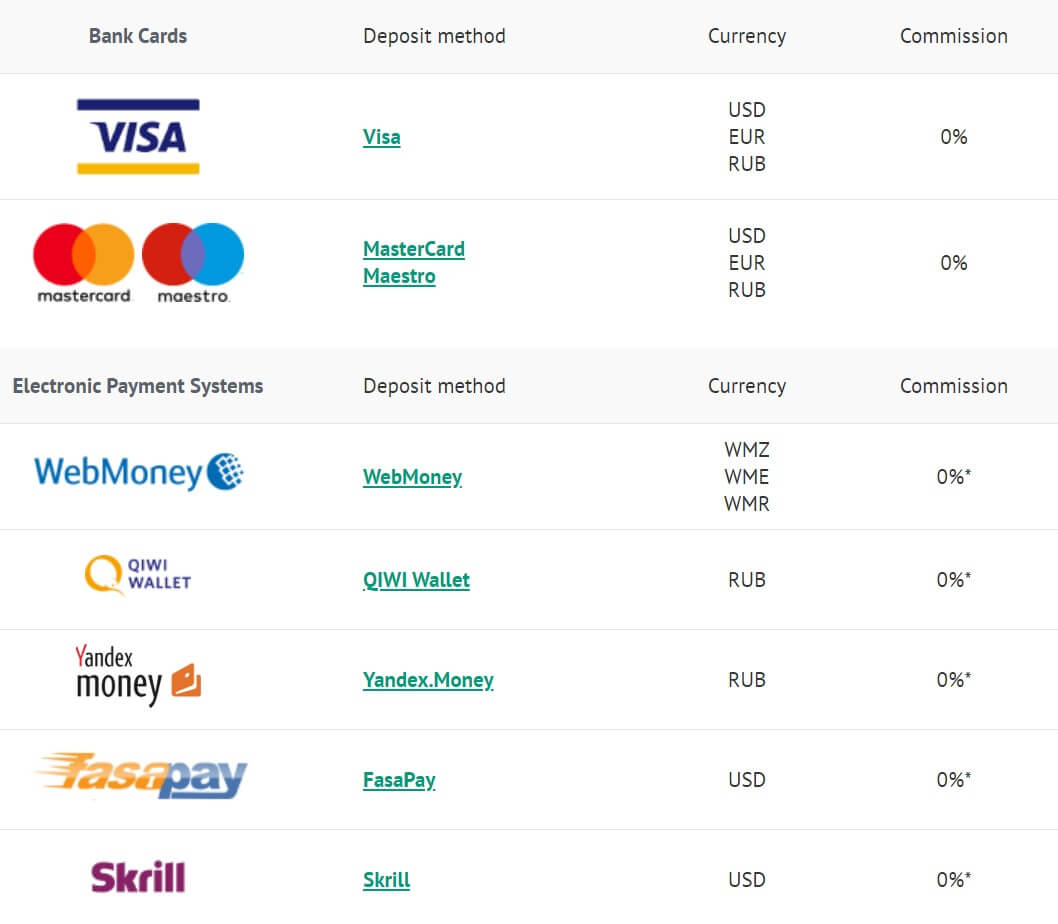

The same methods are available to withdraw to apart from some of the local bank transfers, for clarification, the methods available are Visa, MasterCard, Maestro, WebMoney, QIWI Wallet, Yandex Money, Fasapay, Skrill, Neteller, Ngan Luong, Bank Wire Transfer, and a few local bank transfers.

The same methods are available to withdraw to apart from some of the local bank transfers, for clarification, the methods available are Visa, MasterCard, Maestro, WebMoney, QIWI Wallet, Yandex Money, Fasapay, Skrill, Neteller, Ngan Luong, Bank Wire Transfer, and a few local bank transfers.

There is an Analytical Portal on the website, this offers clients the chance to revive things like trading signals, weekly review videos, training materials, calendars, and calculators, as well as the opportunity to talk with an analyst. There is a calculator available for all for working out costs and profits. We are unable to see the majority of the education as we do not have an account on the analytics portal to check.

There is an Analytical Portal on the website, this offers clients the chance to revive things like trading signals, weekly review videos, training materials, calendars, and calculators, as well as the opportunity to talk with an analyst. There is a calculator available for all for working out costs and profits. We are unable to see the majority of the education as we do not have an account on the analytics portal to check.

Educational & Trading Tools

Educational & Trading Tools

Platforms

Platforms

Assets

Assets