Starting their business in 2014 in Dubai, the group aims to have a good base and clientele where retail Forex trading is attractive and where the target market has enough financial capability. ParamaountFX aims to expand throughout the Middle East and the Persian Gulf countries. The broker utilized the market maker model as it can be recognized for the Legal documents. The company Mission statement states nothing specific as well as the About Us section. There is no information about any regulation, bank or another kind of entity related to the broker, the overall presence of FXParamount on the internet is almost non-existent. None of the reputable user review sites recognize FXParamount meaning the popularity is very low.

Starting their business in 2014 in Dubai, the group aims to have a good base and clientele where retail Forex trading is attractive and where the target market has enough financial capability. ParamaountFX aims to expand throughout the Middle East and the Persian Gulf countries. The broker utilized the market maker model as it can be recognized for the Legal documents. The company Mission statement states nothing specific as well as the About Us section. There is no information about any regulation, bank or another kind of entity related to the broker, the overall presence of FXParamount on the internet is almost non-existent. None of the reputable user review sites recognize FXParamount meaning the popularity is very low.

The website is available in Turkish, English and Arabian language, lacks transparency about the broker, utilizing empty marketing phrases, but has decent transparency on the trading conditions. It is stylish and well structured promoting “no commissions and no hidden spreads” on the homepage. What might be interesting to visitors is the Bulletin and Analysis section where FXParamount shows their added value to traders. FXParamaount is a relatively new broker without much to showcase on the website so everything is easy to find but puts them into the indistinguishable mass where they do not differentiate in any service category.

According to the Vision statement, the broker wants to become the largest and most organized international Forex trading organization. This FXParamaount review will reveal the steps undertaken towards that goal and if their current service is enough to be considered account opening.

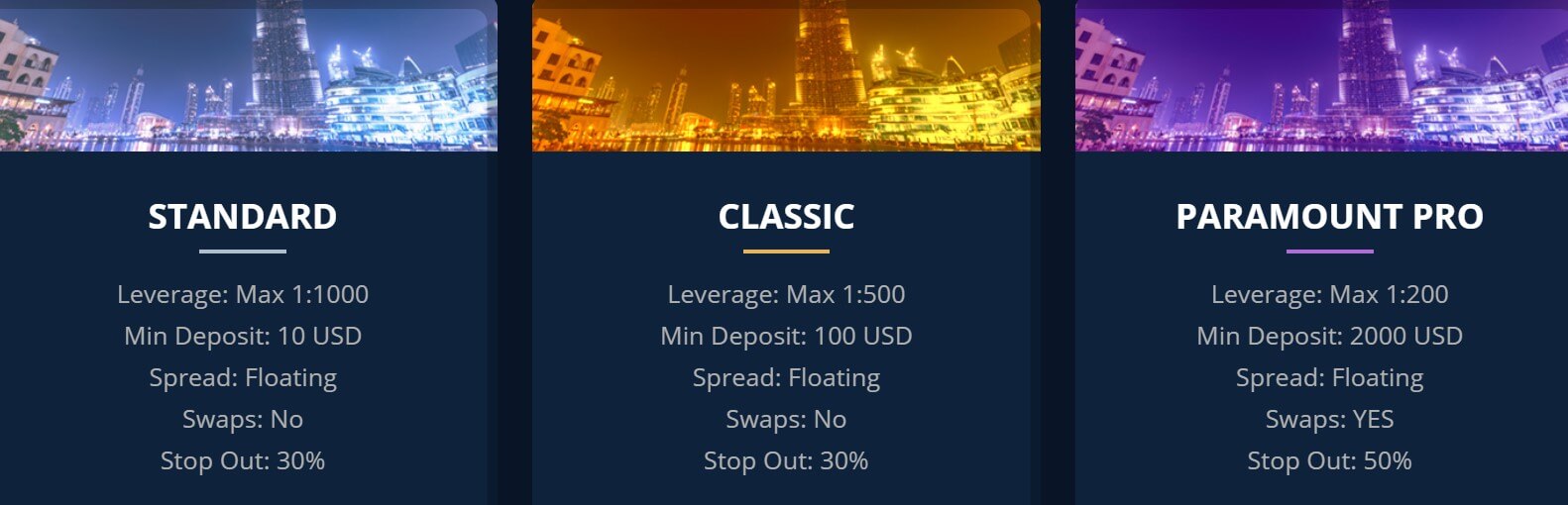

Account Types

Visitors of the FXParamaount website will not have to spend a second to find pout key information about the account types offered, as it is presented right away on the homepage. There are three offers, Standard, Classic and Paramount Pro. The broker considers their target audience needs, the Standard and Classic Account feature no swaps to be in-line with the Shaira law.

Interestingly, the commission is not charged for the Standard Account but all others have a commission. Therefore, the account types are not just scaled to the minimum deposit but also have different features. Although, as usual, the most exclusive Paramount Pro Account has the biggest minimum deposit requirement and the tightest spreads. The leverage for this account is the lowest and the commissions the highest. Bonuses and Contests offered by the broker cannot be applied to the Paramount Pro account.

The Classic Account is positioned in the middle, with lower commissions, reduced spreads, no swaps, and reasonable leverage. The minimum deposit requirement for Classic is what the majority of traders can afford. Bonuses and contests participation is allowed and the leverage is half the Standard Account has.

The Standard Account is probably the one backing up the “no commission” promotion on the homepage as it is the only one without. On the other side, the spreads are the least favorable comparing to the other two account types. The minimum deposit requirement is negligible, the leverage is very high and bonuses or contests apply.

Traders should know that FXParamaount restricts scalping. Even though EAs and hedging are allowed, any trade closed under the 3 minutes will be considered scalping. More details can be read in the Agreement legal document under section 6.

Platforms

Only the MetaTrader 4 platform is offered. ParamountFX has links for Windows, Linux, Mac, Google Play and Apple App Store versions of the MT4 client. For those that want to access the web-based MT4, unfortunately, it is not available. The MT4 installation gave us a virus warning, a very rare occurrence.

There are two servers, Live and Demo, with an impressive ping rate of just 35ms on both servers. At the moment the account opening process is closed for both the Demo and Live and we were unable to test what Paramount has to offer.

Leverage

Paramount FX offers 1:1000 leverage for the Standard, 1:500 for the Classic and 1:200 maximum for the Paramount Pro Account. Margin Call is not set, but expect a Stop Out at 30% for the Standard and Classic Accounts, and 50% for the Paramount Pro. Traders using the maximum leverage of 1:1000 for the Standard should apply proper risk management.

Paramount FX offers 1:1000 leverage for the Standard, 1:500 for the Classic and 1:200 maximum for the Paramount Pro Account. Margin Call is not set, but expect a Stop Out at 30% for the Standard and Classic Accounts, and 50% for the Paramount Pro. Traders using the maximum leverage of 1:1000 for the Standard should apply proper risk management.

Trade Sizes

The information about the trade sizes is not published on the website. We were unable to check them in MT4. In the contract specification page, the contract size is 100,000 units but what is a minimum trade size cannot be confirmed.

Trading Costs

Paramount charges a commission on two of their account types, Classic and Paramount Pro. For the Classic the commission is $3.5 per lot and $4 for the Paramount Pro. Standard Account is free of commissions. Swaps are accounted only for the Paramount Pro Account. They are all almost negative swaps, regardless of the trading side. They are all under normal levels though, for example, the most traded currency pair, EUR/USD has a swap of -5.25 points for long and -3.17 for short, USD/JPY has -1.49 points for long and -2.76 points for short, GBP/USD -4.38 for long and -3.67 on the short side, and a positive for the NZD/USD with -1.66 points for long and 0.35 on the short side.

Paramount charges a commission on two of their account types, Classic and Paramount Pro. For the Classic the commission is $3.5 per lot and $4 for the Paramount Pro. Standard Account is free of commissions. Swaps are accounted only for the Paramount Pro Account. They are all almost negative swaps, regardless of the trading side. They are all under normal levels though, for example, the most traded currency pair, EUR/USD has a swap of -5.25 points for long and -3.17 for short, USD/JPY has -1.49 points for long and -2.76 points for short, GBP/USD -4.38 for long and -3.67 on the short side, and a positive for the NZD/USD with -1.66 points for long and 0.35 on the short side.

Minors pairs swaps are similar, none of them go over -5 points on either side except for the EUR/AUD with -5.55 points on the long and a positive 1.55 swap on the short side. For exotics currency pairs the swap is higher, for the USD/MXN it is -9.18 on the long and 0.54 on the short, USD/TRY has -55 long and 15 short, and EUR/TRY -69 long and 21 positive short side swap. Precious metals swaps are very low, XAU/USD has just -1.95 on the long and 0.1 on the short side. We could not confirm if these are calculated in percentage terms or points.

Paramount FX does not disclose their inactivity fee but we have managed to find a clause in the Terms and Conditions. Funded accounts that remain inactive for six (6) months will be charged a fee of $50.00. This fee may not be charged in every case.

Assets

ParamountFX does not have a great instruments range in any category, but still offers more than typical small brokerages. There are 4 categories offered and they are the same for all account types. Starting with Forex, there are a total of 28 currency pairs. All the majors and minors are present, without any surprise rarities. The exotics are limited to just 3 pairs, USD/MXN, USD/TRY and EUR/TRY.

Precious metals are not limited to just spot Gold and Silver. Traders will enjoy Platinum against the USD as well. Precious metals have a 1-hour break for trading, between 5 pm and 6 pm. Commodities are limited to energy assets. These are both Oil types, spot Brent and WTI with the addition of Natural Gas and Crude Oil futures. We have noticed that the broker has set the Oil contracts to 100 units or barrels but the standard is 1000.

Indexes range is also limited to the 8 most popular ones. Among the S&P 500, NASDAQ 100, Dow Jones 30 and Nikkei 225, the ones from Europe are CAC 40, GER 30, UK 100, and EURO 50. Still, for the majority of traders, this is enough, although if a broker wants to attract specific region clients it is good to see indexes belonging to relevant countries.

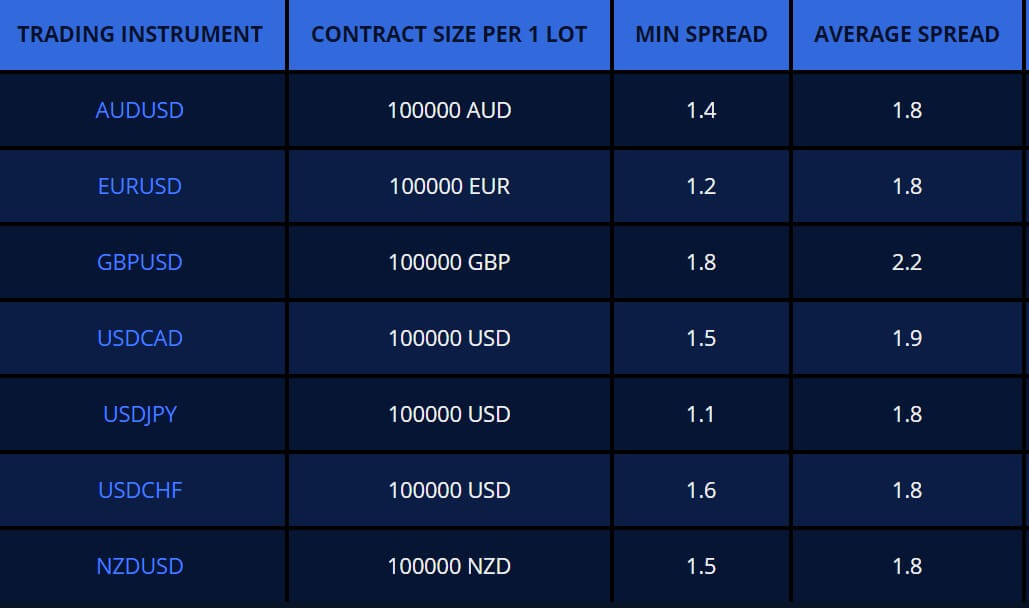

Spreads

All accounts have a floating spread type. We are not able to check the real spreads from the MT4 platform. ParamountFX contains the spreads and their average values listed on the Contract Specification page. According to that list, for the Standard Account ahs about 20 to 30% wider spreads than the Classic Account. For reference, the Classic Account EUR/USD pair has a 1.2 pips minimum spread and 1.8 pips average. It is not disclosed what is the averaging period. For other majors the spread is similar, the highest minimum spread was for the GBP/USD, 1.8 pips and 2.2 pips on average.

All accounts have a floating spread type. We are not able to check the real spreads from the MT4 platform. ParamountFX contains the spreads and their average values listed on the Contract Specification page. According to that list, for the Standard Account ahs about 20 to 30% wider spreads than the Classic Account. For reference, the Classic Account EUR/USD pair has a 1.2 pips minimum spread and 1.8 pips average. It is not disclosed what is the averaging period. For other majors the spread is similar, the highest minimum spread was for the GBP/USD, 1.8 pips and 2.2 pips on average.

As expected, the widest spread among the minor currency pairs is for the GBP as it is one of the most moving currency. GBP/NZD has 4.5 pips minimum and 4 pips on average while GBP/AUD has 4.5 pips minimum and 3 pips on average. Exotics have low spreads for their volatility and liquidity, so USD/MXN has 70 pips minimum and 50 average, and USD/TRY has 25 pips minimum and 30 pips maximum.

For Precious metals, the spread is published in cents. XAU/USD has 4 cents spread but this is probably a typo, 40 cents per lot is more real. For silver, it is also 40 and for Platinum is $5. Commodities spreads are from 30 to 60 cents on average, and Indexes are all set to have a minimum of 4 pips and 5 pips on average according to the broker.

Paramount Pro Account has the best spreads. EUR/USD has from 0.6 pips to 1 pip, and other majors do not go above 1.5 pips on average (AUD/USD). Minors do not have average spread above 3 pips except for the GBP/CAD with 3.7 pips on average and 2 pips minimum. GBP/NZD and GBP/NZD are the ones with the higher minimum spread od 3 pips according to the list. Exotics start from 40 pips for the USD/MXN and with 60 pips on average.

Minimum Deposit

The most affordable account type is the Standard with the minimum requirement of just $10. Classic Account is available form $100 and Paramount Pro from $2000. In the past, the broker set more drastic deposit requirements. It is not common for small off-shore brokers to frequently change the offers. Note that there are deposit methods minimums that may be greater than $10. More on this in the next section.

Deposit Methods & Costs

There are various channels traders can deposit and one of them is the Bitcoin. Traditional methods are included, Bank Wire transfers require $100 minimum for a transaction and no limits for the maximum. Credit/Debit Cards need at least $10 and have $5000 maximum, Web Money has a $10 minimum and $10,000 maximum, Paypal needs $10 to $10,000 maximum, Skrill from $10 to $25,000 maximum, and Bitcoin requirement is $100 minimum and $100,000 maximum deposit.

Costs related to deposits are not marginal. Bank transfers require $50 + 1% while Bank Cards do not have any costs. Web Money has a 1.5% fee, Paypal 3%, Skrill 4%, and Bitcoin has a 6% fee, unfortunately. The BTC fee is very discouraging for the crypto enthusiasts as they are designed to be free of transaction costs.

Withdrawal Methods & Costs

Withdrawal methods are the same as with deposits. There are also exactly the same costs for withdrawals, so for a complete turn of your investments, be ready for double charges. This is probably the spot where most of the visitors look away.

Withdrawal Processing & Wait Time

The broker has stated that every deposit is instant. This is probably after payment processors have finished theirs, therefore Bank Transfers require certainly at least 24 hours. Note that the ParamountFX applies AML procedures to which the same method will be used for withdrawals as with the deposit. Also, withdrawals from the Account may only be made in the same currency in which the respective deposit was made, unless the broker offers another method.

Bonuses & Promotions

Most of the small, unregulated, off-shore brokerages offer bonuses to attract clients, it is one of the most sought after features. ParamountFX offers two bonuses, Classic Bonus and MyParamount Bonus. Classic Bonus is a non-withdrawable bonus that acts as a margin extension. The bonus offered is 10% of the net deposit, Whereas it cannot exceed $5000 bonus total. This bonus is available only for the Classic Account type.

Most of the small, unregulated, off-shore brokerages offer bonuses to attract clients, it is one of the most sought after features. ParamountFX offers two bonuses, Classic Bonus and MyParamount Bonus. Classic Bonus is a non-withdrawable bonus that acts as a margin extension. The bonus offered is 10% of the net deposit, Whereas it cannot exceed $5000 bonus total. This bonus is available only for the Classic Account type.

MyParamount Bonus is a non-withdrawable bonus that has a formula based on trading volume and the net deposit. This means that the total bonus can go up to 60% depending on the trading volume. This bonus acts as margin support and is available only for the Standard Account. Contests are an unrealized idea of ParamountFX. At the moment of this review, it is still in development.

Educational & Trading Tools

As for the trading tools, only Economic Calendar is available and it is placed on the homepage of the website. It is a good looking table with an option to set your timezone but this is all you can do to filter or sort the events. The Calendar will show the latest events, the impact rating and the figures related to past and forecast. On the screenshot, there is a trading system that contains a kind of Ichimoku indicator with the Support and Resistance lines. Additionally, there is an unknown histogram indicator with unknown function. Readers will be confused about what the system suggests as there is no explanation.

As for the trading tools, only Economic Calendar is available and it is placed on the homepage of the website. It is a good looking table with an option to set your timezone but this is all you can do to filter or sort the events. The Calendar will show the latest events, the impact rating and the figures related to past and forecast. On the screenshot, there is a trading system that contains a kind of Ichimoku indicator with the Support and Resistance lines. Additionally, there is an unknown histogram indicator with unknown function. Readers will be confused about what the system suggests as there is no explanation.

The more interesting part is the Bulletin and Analysis segment. Here, traders can see an in-house made analysis that is updated daily. Daily Bulleting articles start with the Economic Calendar events and move on to the trading instruments’ analysis screenshots without any related text. Not all instruments are included, just some major currency pairs, one index, and Gold.

The news section is updated and contains many articles. Unfortunately, this is not original news, they are copied from Investing.com. most of the selected articles are Investing.com’s “Top Things to Know in the Market.” ParamountFX also has the Education section that is not worthy enough. It contains one page with a few elementary Forex and trading terminology that is not even professionally explained.

Customer Service

There is a phone line, email and chat service available to contact ParamountFX. The chat service app is well designed with a nice touch to upload files and insert emojis. Here we also found out that that last time support staff was active was 8 days ago. Upon our query, we did not wait longer than 5 minutes for someone to answer. The staff is knowledgeable and courteous but will not disclose some information that other transparent brokers would.

Demo Account

The demo is not promoted on ParamountFX’s website but we cannot confirm that the demo account is not available. Since the registration procedure was bugged we were unable to test it as well as some other services.

Countries Accepted

According to the legal documents, the broker mentions several times that the client must not be or reside in the United States or Canada.

Conclusion

In this section of the ParamountFX review, we will address some additional issues with the broker that are important to traders. As presented, ParamountFX belongs to the risky category of brokers as it is very obscured from the public, does not have any transparency regarding the company, no regulation and some clauses in the Agreements documents that are brow raising. For example, the broker states that willful default or fraud on the part of Paramount shall not be liable for losses arising from the default of any agent or any other party used by Paramount under this Agreement.

The broker’s winners percentage is also among the lowest in the industry. 90% of retail investor accounts lose money when trading CFDs with this ParamountFX. Even if we set aside the registration problems, just the fee structure on deposits and withdrawals alone are the reason enough most will turn away. It is rare to see commission on deposits, most of the brokers will seek to make the deposit process as easy as possible, psychologically and financially, but this is not the case with ParamountFX. The broker still needs to find its grounds, frequent changes to the minimum deposits and packages are not enough.