This is an Australian broker that describes themselves as a new face in the industry but with rapid expansion. ETO Markets is established in 2013, based in one of the most prestigious commercial towers in Sydney. Chifley tower directory confirms that the broker is present and along with the ASIC valid license, ETO Markets belongs to the top choice for traders seeking reliability. Transparency about the company is good, with good content that backs up their developments, such as having New York Equinix NY4 data center, funds segregation in Westpac AA rating bank and several disclosed liquidity providers.

The broker could go a step further will responsible representatives presentation but this is more than what most brokers display. Even though the broker states they utilize the STP execution model, and from the legal documents, it is clear that ETO Markets has a market maker pricing model. The website has solid, organized content that is a mix between marketing, elementary explanations, and information only familiar trades can recognize right away.

Transparency on trading conditions is good enough, one could wish for more information on the spread or, even better, a live feed from the market. Traders will like the broker with a transparent approach that can be seen even in the extensive, easy to read legal documents, but could be worried about the fact ETO Markets does not have much public attention.

No user ratings are published on several reputable benchmarking internet media and thus creating a sensation of unknown. ETO Markets are operating since 2013, the broker should have some publicity rising and we are unsure if low marketing investments is the reason or the focus to Chinese and Russian market where the internet has separate trends. To make sure in the quality of service we will make this ETO Markets review in sections for each so readers will have a complete picture of the broker.

Account Types

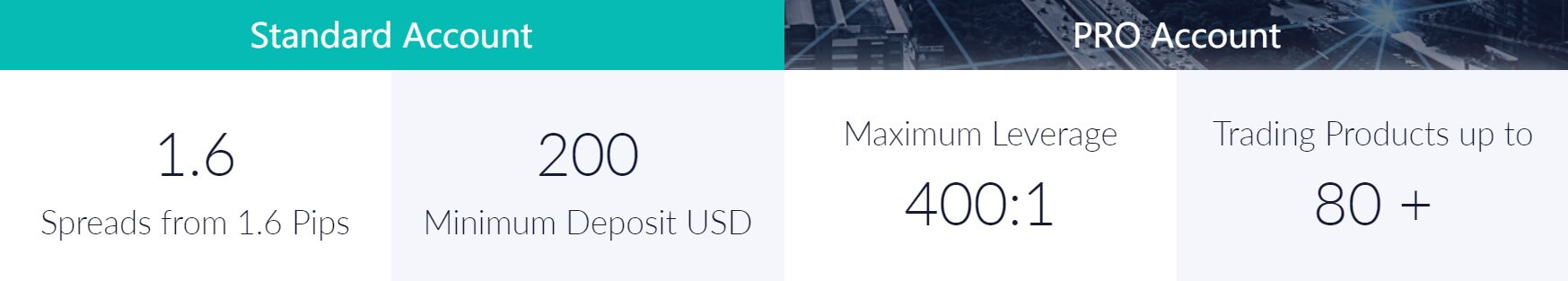

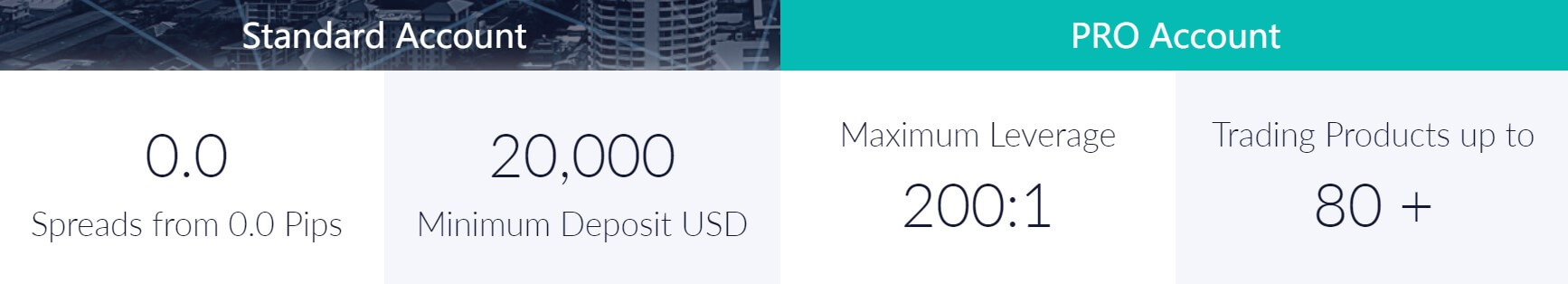

At the moment of writing this review, ETO Markets offers two account types, Standard and Pro. In the past, there were more accounts offered but it is common to see packages adaptation as a part of the ever-changing marketing. ETO Markets’s comparison table will state that the Pro Account is for Professional traders, but this has nothing to do with the ESMA classification. The minimum deposit requirements are affordable for the Standard Account but the Pro will require a sum only a few are willing to risk. All of the accounts are available in the USD, AUD or EUR currency.

Upon registration, you will be able to select 1:100 leverage only, but it can be adjusted after. All account types will use the Equinix NY4 servers and the accounts do not differ by the number of available trading assets. Also, there is no difference in the trading sizes nor the platform used. Standard Account has wider spreads, no commission and allows for higher leverage. Pro Account, on the other hand, has a commission but very attractive spreads that are promoted as from 0 pips.

The leverage for the Pro is reduced but still enough for most traders. The big gap between the two accounts in terms of the minimum deposit requirement is probably because of the more extreme demography financial capabilities difference in the Chinese and Russain markets. In the past, the broker offered a $2000 minimum deposit that was changed soon after.

Platforms

ETO Markets is a MetaTrader 4 platform only broker. MT4 is well described with links and installation tips for each operating system. It is offered for Windows, Android, Mac, and iOS. Web MT4 is not accessible so if you need to quickly see real-time trading conditions you will need to install the MT4 package. Upon installation, the MT4 presents us two ETO Markets servers to select, Live and Demo. They both have around 110 ms ping rate. The platform is updated to the latest version and shows the registration to the ETO Group Pty Ltd company.

Everything is set to defaults, there are 4 major forex pairs set on H4 timeframe with classic default indicators. One-click trading buttons are visible on all charts. There are no additional indicators or templates with the installation package, in fact, some from the Custom menu is missing. What is noticeable is the very fast price changes that reflect a very good connection and servers. The symbols are exemplary organized into relevant groups and subgroups where applicable and traders will easily find an instrument.

Pro Accounts will have a “.p” suffix to be distinctive from the Standard Account assets. The instrument specification window will show enough relevant information about the trading conditions. The commission is not filled in the specification window but it will be presented in the Terminal left to the Swap column. Execution times are very consistent, on average the order took about 163ms with almost no deviations, 3ms. The use of fast trading strategies and EAs have very good conditions with ETO Markets.

Leverage

For the Standard Account the leverage is 1:400 and for the Pro is reduced to 1:200 maximum. We went on to see what are the differences across assets in the MT4 platform. For Forex, most of the currency pairs hold true to the maximum leverage. The exceptions are some exotics, for the RUB related pairs the maximum leverage is 1:50 and for the TRY pairs, it is 1:20. For the XAU/USD or spot Gold and XAG/USD Silver, the leverage is limited to 1:100 on all account types. The same leverage is set for the Commodities and Indexes category.

Trade Sizes

ETO Markets does not complicate with trade sizing and thus offering micro lot or 0.01 lot minimum trade size for all trading instruments except for Indices where the minimum trade size is set to 1 lot. The maximum trade size is also considered practically unlimited to 200 lots on Forex assets and 100 lots for others. Contract sizes are up to standard, but Oil type assets have 100 units (barrels) instead of standard 1000, still, the minimum allowed trade size is not changed and remains at 0.01 lots.

In the Index category, only the Japan Nikkei 225 Index has a standard contract size of 10 units. Additional trade steps are also set to 0.01 lots except for the Indexes. Stop levels exist but only for Forex category instruments. It is set to set to 20 points for all, even for exotics. The Stop Out and Margin Call levels are not disclosed unless registered. These levels are subject to change and at the moment of this review Stop Out is set to 50% margin level.

Trading Costs

The only commission costs are related to the Pro Account where they are charged $7 per lot round. Not so long ago commission was $5.5. This signals that the pricing model is still subject to frequent changes as the broker tries to find the balance. It is good to see that the commission cost is not halved (one half for opening a trade and one for closing) as many brokers do to present the cost lower than what it actually is. The commission is not charged for non-forex assets but the spread is the same as with the Standard Account.

Swap trading costs are under normal levels but also credits are present on most assets. Swaps are calculated in points and tripled on Wednesdays. For the EUR/USD the swap is positive on the short side with 6.89 points and -10.51 on the long side. USD/JPY has similar swaps with 5.37 points on the long and -10.25 on the short, AUD/USD has all negatives but low, -2.97 on the long and -1.69 on the short side. Other majors have similar swaps with one positive side. Minors have similar swaps, notable are the AUD/NZD with all negative -1 on the long and -2.6 points on the short, and EUR/AUD pair with over 10 points swap on the long side (-11.45) and a positive 7.35 on the short.

For the exotics, the swaps are increased but some are surprisingly low, for example for USD/CNH -30.9 on the long and a positive 16.2 for short, USD/HKD 11.2 long and -28.38 for short and TRY/JPY with just 8.97 for long and -9.91 for short side. Although, USD/RUB has one of the highest with -1254 points on the long and a positive 699 on the short side. As for the spot Gold, the swap is positive on the short side with 3.52 points and -6.77 on the long. There are no mentions about the fees related to the trading inactivity.

Assets

What we see listed in the MT4 platform we can confirm that ETO Markets offers Forex, Precious Metals, Indexes, and Commodities. The best is the Forex range with an amazing 73 currency pairs. The reason for this extended range is mainly major currencies combinations with many exotics and Scandinavian currencies. Forex traders will enjoy so many hard to find opportunities only big brokers offer.

Notable rarities are ZAR/JPY, USD/RUB, but also EUR/RUB, GBP/CZK, GBP/HUF, GBP/ZAR, CHF/ZAR, USD and EUR against the TRY, MXN, SGD, GBP/SGD, GBP/HKD, and many more. For serious traders, it is even good to open a demo just for testing these pairs.

Precious Metals range is not even close to Forex with just spot Gold and Silver. For most this is enough but most of the majority of forex traders combine their strategies with different metals.

Commodities are minimal. Traders will find only Brent and Crude Oil open for trading.

Indexes are better with a total of 11 listed in MT4. They are mostly major Indexes with some variety gained from France 40, Hong Kong 50, STOXX 50, IBEX 35 and German DAX 30.

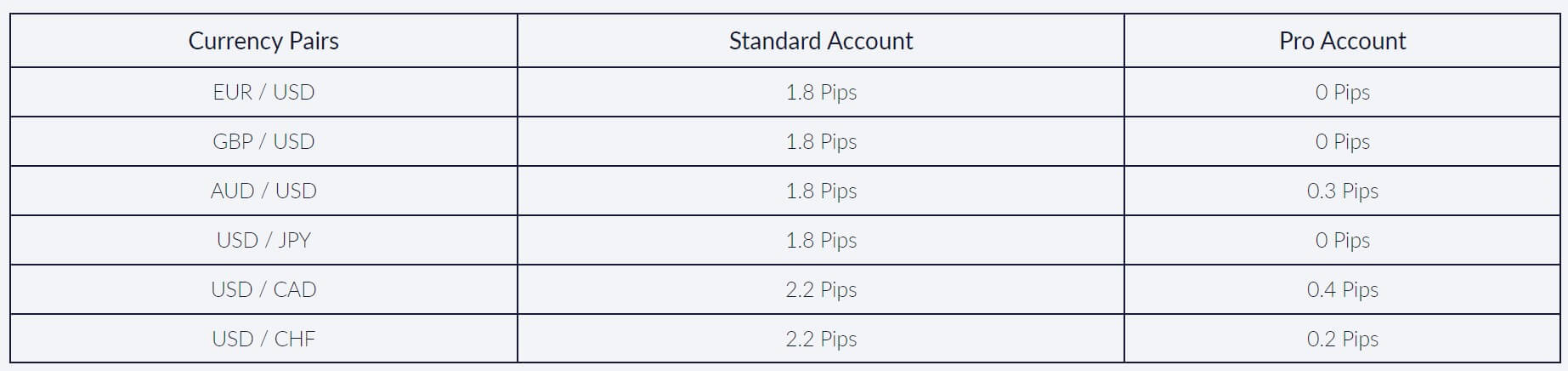

Spreads

ETO Markets has floating spreads for all assets. For the Standard Account, the spreads start from 16 points for the EUR/USD, exactly what the broker promotes. Other major pairs are almost the same, 1 or 2 points higher. The widest spread among the majors is for the NZD/USD with 19 points. Minor pairs have a bit higher spreads but very uniform. All of them are below 3 pips including the USD/SGD. Exotics have very attractive spreads starting from CHF/ZAR pair with just 21 points or 2.1 pips. This is a very rare combination.

SGD pairs also have spreads under 30 points and SGD is put under the Majors group as per the Symbols classification in the MT4. The highest spread was for the USD/RUB with 3625 points and EUR/RUB with 5441 points. They are followed by EUR/ZAR with 406 points and GBP/NOK with 349 points. Gold against the USD has 28 pips, which is competitive in the industry. Both Oil assets have 6 points spread.

Pro Accounts have one of the tightest spreads a broker can offer. It does not start from 0 pips as promoted but very close. EUR/USD has 1 point spread and the other majors follow with 2-3 points more. The widest spread among them is for the GBP/USD with 5 points. EUR/CHF is also among the lowest with 1 point spread. Minors are all below two digits spread in points, the one exception is the GBP/CAD with 11 points and GBP/NZD with 21.

Exotics also have low spreads, compared to the Standard Account more than double. For example, USD/RUB has just 710 points, USD/MXN 166 points, EUR/RUB – 2778 points. Some are almost the same, as the GBP/NOK with 316 points spread. Spot gold is the same with 28 pips, as well as commodities and Indexes. These categories do not have any better spreads than the Standard Account, but also do not have commissions.

Minimum Deposit

Traders will have to afford $200 or currency equivalent for the Standard Account. Pro Accounts require no less than $20,000. Whether the low spreads justify this deposit amount is up to the trader. Some other brokers have very competitive spreads similar to the ETO Markets but require far less for deposit.

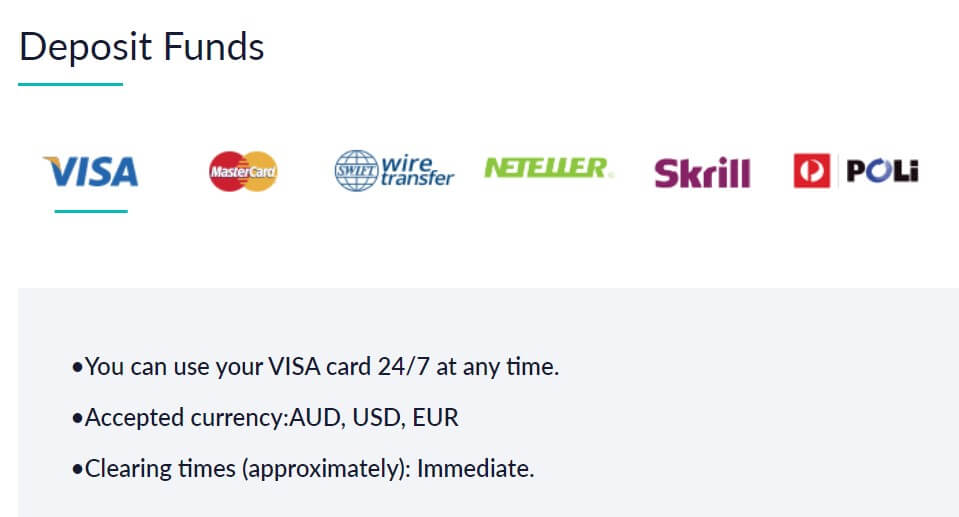

Deposit Methods & Costs

ETO Markets does not charge any fees for deposits. The costs associated with the payments processor is up to the investor to determine. The methods available are not numerous. The standard deposits with Bank Wire or Credit/Debit Cards are supported although the broker discourages any Credit Card usage for purchasing their products, as this is borrowed money. E-wallets are supported, Skrill, Neteller, and POLi – courtesy of Australia Post. ETO Markets target the Asian market so another option is available for China, Union Pay card in Yuan.

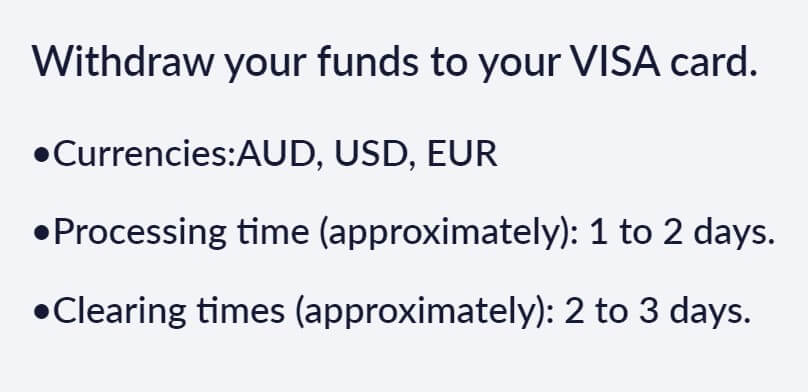

Withdrawal Methods & Costs

As with deposits, ETO Markets does not charge any fees for withdrawals. According to the AML, withdrawals are made using the same channel as a deposit. If this is not possible for any reason, the broker will pay you through electronic transfer. Withdrawal methods are the same, where possible.

Withdrawal Processing & Wait Time

Wire Transfers will require 2 to 3 working days to complete. We have noticed an error on the website about deposit/withdrawals channels where Union Pay is mixed with Wire Transfer. Processing time for Yuan based transfer is 1 to 2 working days and the transfer will take 2 to 3 working days. VISA and MasterCard processing also take 1 to 2 working days and 2 to 3 working days to complete. E-wallets require 1 to 2 working days to process and 2 to 3 for completion.

Bonuses & Promotions

ETO Markets does not offer any bonuses or promotions IB programs exist. A nice feature with the IB is that ETO Markets will instantly deposit your commission to the account.

Educational & Trading Tools

From the ETO Markets website, the Educational section will contain a glossary. It is very good but there are no other tools or materials. Most of the website pages will contain some kind of explanation or guide for the beginners. In a way, the educational content is all over the website. But this is not enough for anyone serious. Once you log in to the trader’s area traders will some of the demo videos about the basics on chart reading, and some are about strategies. Certainly, for more serious education, traders can attain better ways available on the internet. Some of the Daily digests seem present on the ETO Markets Instagram, but the latest post was from May 2019.

Customer Service

We were unable to find anyone online on their chat service form the clints portal for 24 hours. Also, ETO Markets is not responding on their Facebook page. Other contact channels are WeChat, phone line, and email.

Demo Account

ETO Markets is demo friendly. They promote 10,000 virtual balance in the demo account but we did it directly from the MT4 platform where you can select much more virtual funds than $10,000. There are options to select the account type, leverage, and the account currency. The demo is accurately reflecting real conditions, and this is even stated in the broker’s legal documents.

Countries Accepted

According to the ETO Markets Product Disclosure Statement, investors in the United States of America or Japan cannot be accepted as clients.

Conclusion

This section of ETO Markets review will provide additional information not contained above but are important on investment decisions with this broker. Under the ASIC registration license, we have noticed that the broker previous name was ETORO group. eToro is one of the most famous brokers but we cannot confirm that ETO Markets are their brand.

Certainly, the Forex range and the location is as it belongs to the major broker other services are not on par. The broker has very good transparency and a good approach to visitors’ interests. The homepage of the website will first promote a link for a demo account opening, not real, which is showing good intention. Whatsmore, the legal documents are one of the most comprehensive and useful we have read. We have not been able to see any rating bu users except on Facebook where they are not credible. This may be of concern to traders who seek at least some information that does not come from the internet or other media.

ETO Markets Forex range is a reason alone to open a demo account and test some rare currency pairs opportunities. As the broker develops, it will certainly improve offering more trading instruments, better customer support and gain more popularity.