MyFX Markets prides itself on the way that the firm caters to beginners and professionals, alike. They do so efficiently by offering some of the best spreads, leverage rates, and platform tools on the market. Similarly, their selection of different financial instruments includes over 50 forex pairs, alongside the most popular cryptocurrencies. Perhaps most importantly, MyFX Markets strives to provide retail traders with the same accurate quotes and order processing times that institutional investors enjoy.

How many account types does this broker have? What is the buying power? How can I deposit and withdraw funds? Does MyFX Markets charge commissions? What do their spreads look like? Read this article for answers to these questions and much more.

Account Types

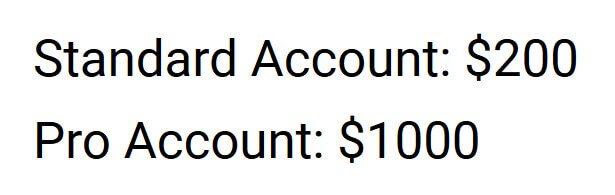

Both of this broker’s offered accounts have competitive spreads. Additionally, while the Pro has a minimum deposit of $1,000, it is considered relatively low in comparison to other firms in the industry, especially those that offer multiple account types. MyFX Markets also has a Multi-Account Manager (MAM) system. Traders who manage the funds of their clients or have several personal accounts can use the MAM functionality to oversee the different portfolios from one dashboard.

Standard Account:

Minimum Deposit: $200

Spreads: From 0.6 pips

Commission: $0

Pro Account:

Minimum Deposit: $1,000

Spreads: From 0 pips

Commission: $7 per trade

Opening an account is relatively easy. First, traders must fill out an online form and upload certain documents (namely a government-issued photo ID and proof of address, such as a bill or bank statement). Once these steps are done, MyFX Markets will approve the account (as long as all the needed information is provided). At this point, you can start trading immediately after making an initial deposit. This broker accepts transfers in the Australian Dollar (AUD), Japanese Yen (JPY), and US Dollar (USD).

Platforms

Arguably the globe’s most widely-used platform, MetaTrader 4 (MT4) is the software that MyFX Markets’ account holders use to trade. It enables them to exchange forex pairs, commodities, and futures, alongside other financial instruments. On MT4, you can initiate positions through one-click, access a variety of charting tools, utilize almost 50 technical indicators, and work with experienced financial advisors.

Perhaps most importantly, MT4 can be downloaded on Windows, MacBooks, Android, and iPhones. Through the MT4 app, you can view live prices, edit orders, execute new trades, program your own high-frequency algorithm, and more. These advantageous features are available on both of MT4’s desktop and smartphone apps.

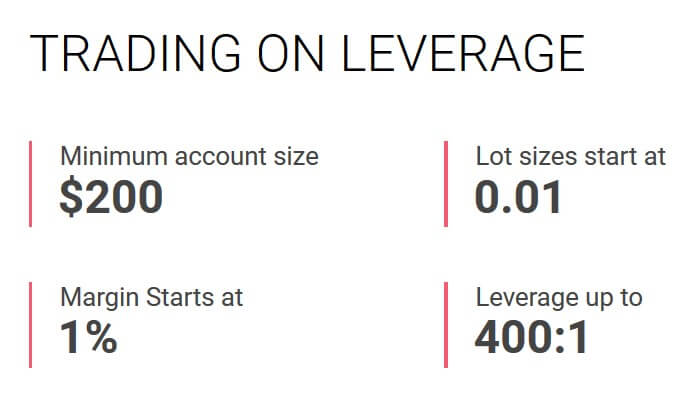

Leverage

The Standard and Pro Account each come with a 400:1 buying power. In this respect, MyFX Markets is different than other brokerage firms. Most of the time, brokers will either limit your leverage as you deposit more funds (to minimize risks) or, conversely, increase the buying power when an experienced trader has a sizable account balance (therefore, incentivizing them to transfer more capital). MyFX Markets takes a middle ground by giving different accounts the same leverage.

Equally as important, this broker’s buying power is even more advantageous because it is relatively high (the industry average will range between 200:1 and 400:1). Crypto traders should be aware that MyFX Markets’ 400:1 leverage only applies to forex pairs. Digital currencies, because of their risky and volatile nature, only give you up to 5:1 in buying power. Account-holders can modify or change their leverage through the user dashboard.

Trade Sizes

The smallest position size that this broker permits is 0.01 lots, which is a micro-lot. Crypto and fiat/paper currencies have the same minimum trade size. For all of MyFX Markets’ forex pairs, the largest permissible trade is 1,000 lots, with one lot equaling 100,000 in the base currency. Cryptos, meanwhile, has a maximum of 10 lots per position. Each digital currency has its own standard lot size.

Margin Call: 90%

Stop-Out: 50%

When your account balance reaches the 90% margin level, the broker will only send you notifications via email, without automatically closing any positions. However, if you don’t deposit additional funds or exit some trades (in order to bring your balance above the 90% margin call point) and the account size becomes 50% the margin requirement, a stop-out is triggered. In this instance, all of your open positions are automatically closed. Equally as important, some margin rules and levels may change based on the amount of leverage you have.

Trading Costs

The Standard Account incurs no commissions, but it has a spread that starts at 0.6 pips. The Pro Account, on the other hand, pays $7 per closed lot (6.2 JPY or 7 AUD). Otherwise, both Pro and Standard are charged an overnight swap fee, but it only applies to overnight positions that aren’t closed by the end of the day. It is important to keep in mind that the swap isn’t a fee that the broker determines, but it is based on the interest rate of the currencies held in the overnight position.

More specifically, the swap depends on the central banking policies and economic events in a currency’s home country. In fact, some of them have a positive swap that allows traders to earn interest, as opposed to paying it, when a trade is kept open by the end of the day. Whether you pay this amount or profit from it, the swap on MyFX Markets (as well as almost any other broker) is tripled on Wednesday.

Why? Because this fee isn’t incurred on the weekend (when the market is closed) and, instead, Wednesday’s interest also takes Saturday and Sunday into account. On your MT4 trader account, you can view the swap of each forex pair.

Assets

MyFX Markets’ 55 currency pairs entail both majors and exotics. This selection also makes the firm advantageous since many other brokers don’t offer as many forex instruments. Some, however, may allow you to trade over 60 currencies. Nonetheless, alongside major pairs, MyFX Markets account holders have access to exotics such as the Norwegian Krone (NOK), Singapore Dollar (SGD), and South African Rand (ZAR). This broker also offers the 5 most popular cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple. Apart from that, there are several indices that track global markets (such as the US’s Dow Jones, Hong Kong’s Hang Seng, and Britain’s FTSE 100). All of which are traded as CFDs. Lastly, MyFX Markets has commodities that include precious metals and energies.

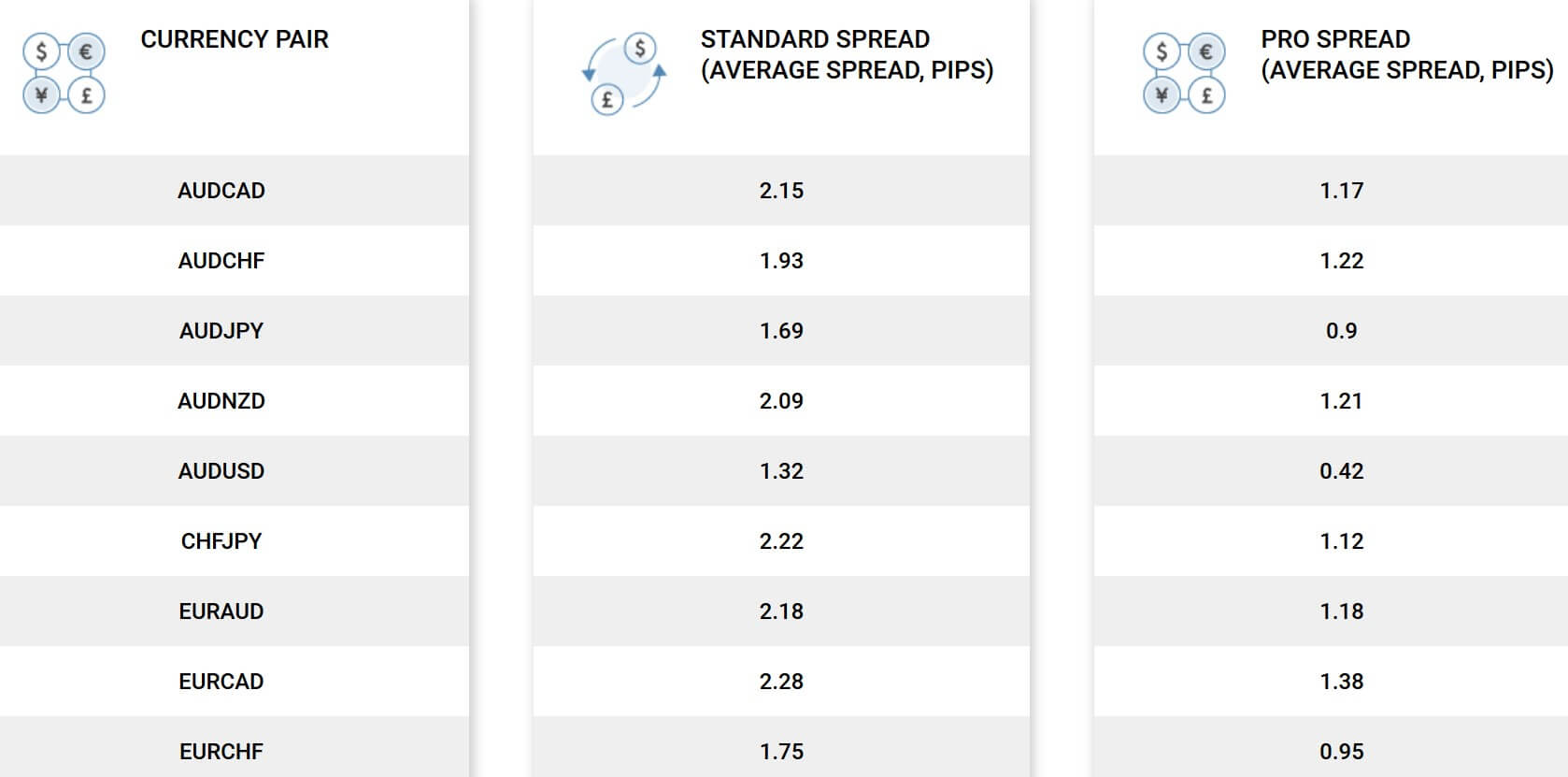

Spreads

The bid/ask price differences are floating for each of the Standard and Pro Accounts. In other words, during illiquid and volatile economic conditions, the spread may become undesirably large. Equally as important, different forex pairs have their own spreads. For the most part, though, we find that MyFX Markets bid/ask gap to be highly competitive and advantageous. Most brokers’ spreads will range between 1 and 3 pips, but MyFX Markets offers quotes that are down to a fraction of a pip (or a point). Furthermore, even though the spreads are variable, most of them are still below 1 pip. Traders should keep in mind, nonetheless, that the bid/ask variation for the same forex pair is different based on your account type. To clarify, Pro’s spreads are much lower than the Standard.

Minimum Deposit

As previously outlined, the minimum deposit requirements are $200 and $1,000 to open a Standard and Pro Account, respectively. No information about the minimum deposit per transaction is provided.

Deposit Methods & Costs

One of the main advantages that MyFX Markets account holders enjoy is that the broker offers a wide selection of deposit methods. You can fund your portfolio through a bank wire or Visa/MasterCard. The latter, though, is currently unavailable. Additionally, you may deposit money through electronic payment systems (Bitpay, Bitwallet, and STICPAY). It doesn’t cost any money/fees to make a deposit. MyFX Markets processes transfers within 10 minutes. At times, though, it may take up to 1 business day, depending on the payment method that you choose. Most deposits can be made 24 hours per day during weekdays and the broker will process them immediately.

Withdrawal Methods & Costs

In order to withdraw money out of your MyFX Markets, the external method (such as a bank account) must match your name. In other words, if you run a company account or manage funds on behalf of clients, money can’t be withdrawn to a personal account. Otherwise, you also have to incur a fee whenever you transfer funds out of your trading portfolio. Credit/debit card withdrawals are free, but bank wires, China Union Pay, and Allpay cost $25 for each transfer. Meanwhile, outbound transactions through Bitpay, Bitwaller, Fasapay, and STICPAY are also free.

Withdrawal Processing & Wait Time

Traders who wish to withdraw money must do so during regular business hours and on weekdays, despite the fact that deposits can be made 24 hours between Monday and Friday. When you withdraw money, your bank or electronic payment method defines how long it takes until the transfer is fully processed. Moreover, because MyFX Markets is a globally-present trader, some international withdrawals could require you to wait from 2 to 5 business days. Bank wires, specifically, might take up to 5 days to process.

Bonuses & Promotions

It seems that MyFX Markets doesn’t have any current promotions. Their most recent one, which expired at the end of November 2019, gave new and current account holders the opportunity to earn as much as $500. The ‘Celebration Bonus’ was launched after the broker switched to a new website. Traders with $500 to $999 in funds who close 5 lots get a $50 award. Account sizes that are between $1,000 to $1,499, $1,500 to $2,499, and $2,500 to $2,999 need to trade 10, 15, and 20 lots in order to receive $80, $120, and $200 in bonuses, respectively.

It seems that MyFX Markets doesn’t have any current promotions. Their most recent one, which expired at the end of November 2019, gave new and current account holders the opportunity to earn as much as $500. The ‘Celebration Bonus’ was launched after the broker switched to a new website. Traders with $500 to $999 in funds who close 5 lots get a $50 award. Account sizes that are between $1,000 to $1,499, $1,500 to $2,499, and $2,500 to $2,999 need to trade 10, 15, and 20 lots in order to receive $80, $120, and $200 in bonuses, respectively.

Those who have over $3,000 and execute 40 lots or more get the maximum $500 credit. Previously, MyFX Markets had a $25 bonus on each referral that opens an account. In 2017, they ran a ‘Welcome Bonus’ and credited new traders’ portfolios. Because of this, if promotions and bonuses are important to you, you should inquire about any upcoming ones. Since MyFX Markets ran similar programs in the past, they will likely do so again in the future.

They do, nonetheless, have current promotions for dedicated traders. Through the Introducing Brokers (IB) bonus, those who manage the funds of their clients can earn rebates and access valuable trading data for each account. IBs earn profits every day and on every trade that one of their clients executes. Serious and seasoned traders can also participate in the regional partnership program. If they qualify for this, MyFX Markets will give partners their branded materials, customized account types, and customer service reps that speak their local language. The regional partnership enables the broker to grow through recruiting and supporting dedicated and experienced forex traders.

Educational & Trading Tools

The only features that this broker offers are a financial/economic calendar (which can be customized based on your timezone and embedded onto third-party/external websites) and live quotes. Otherwise, MT4’s trading and educational tools will certainly benefit traders from all types of backgrounds. For example, beginners may work with consultants, read tutorials, and learn how to trade. Similarly, technical analysts can use a variety of indicators and charting tools. When it comes to the fundamentals, MT4 has customizable newsfeeds that can either be related to a specific forex pair or the at-large market. You may also set up phone notifications that alert you whenever something significant happens.

Customer Service

MyFX Markets is based out of Saint Vincent and Grenadines, an island country located in the Caribbean Sea. You can contact them via email or phone. They also offer live support if you prefer to chat with them online. Another option is to fill out the contact form on the website with information about your question/inquiry and the best way for customer service to reach you.

Phone: +64 9 889 4022

Email: [email protected]

Demo Account

Once you download the MT4 desktop software or smartphone app, you can immediately open a demo account. One of the best features of a MyFX Markets demo is that it doesn’t expire after a certain period of time. It only gets canceled when you don’t login for a period of 90 days. In general, demos are used by new traders who want to learn about the market before putting their real money on the line and those that never used MT4 before. Similarly, if you want to try a new trading strategy or technique, the demo is a perfect place to do so. Above all else, this paper/fake account gives you access to the same live quotes, spreads, and market conditions that you would have to navigate when you start trading real money.

Countries Accepted

This broker is not available in the United States, especially because cryptocurrencies are unregulated/unrecognized by American governmental bodies. However, if you are located in Belgium, Canada, France, Japan, or Germany, you may still open a MyFX Markets account. At times, these countries also have restrictions and rules on different types of financial products.

Conclusion

To summarize, MyFX Markets has the following pros and cons: The positive aspects are the incredibly reliable MT4 platform, a relatively high leverage, more flexible margin call policies, $0 commissions, very tight spreads, a wide selection of assets, different transfer methods, cashback bonuses, customizable tools, and a non-expiring demo account. The negative features, on the other hand, are the commissions that apply to the Pro Account, withdrawal fees, the broker’s lack of availability in the U.S, and the fact that almost all of the bonuses have expired. In short, while these cons are not ideal, we find that MyFX Markets’ positive aspects make this broker worthwhile.

Even though their services are not available in the U.S, they still work with traders in other countries that regulate or restrict cryptocurrencies and CFDs. Their demo account also doesn’t expire (unless you don’t use it for 90 days), which gives new traders and those who are unfamiliar with the MT4 platform plenty of time to go through the learning process. Additionally, MyFX Markets doesn’t provide you with a lot of educational content, but their economic calendar is customizable and the website includes live forex quotes. Otherwise, the MT4 platform has plenty of tutorials, one-on-one guidance sessions, sophisticated charting tools, and much more.

You can choose between several traditional (such as bank wires) and electronic transfer methods. Most deposits are processed instantly or on the same day. They also don’t require you to pay a fee. However, some withdrawal methods cost $25 per transaction. Outbound transfers may also take a few days until they are completed and you can only make a withdrawal request during regular business hours (deposits, on the hour hand, can be made 24 hours per day).

MyFX Markets’ spreads are very tight and advantageous. The Pro Account’s bid/ask gap starts at 0 pips, while Standard’s is 0.6 pips or more. Both of these figures are much more desirable than what competitors have to offer. Moreover, this broker doesn’t charge the Standard Account any trading commissions, although the Pro must pay $7 per round trip position. Lastly, but certainly not least, the firm’s leverage is 400:1, which is closer to the upper range in the brokerage industry.

All in all, the two account types’ distinct features offer traders the flexibility to choose the one that suits them best. Meanwhile, their common toolsets and trading conditions are very advantageous in comparison to most of the MyFX Markets competitors.