Introduction

EUR/NOK is the abbreviation for the Euro Area’s euro against the Norwegian Krone. This pair is classified as an exotic-cross currency. Here, EUR is the base currency, and NOK is the quote currency.

In this asset article, we shall understand what the value of this pair means, the volatility in different timeframes, the cost variations, and finally, the ideal way to trade this pair.

Understanding EUR/NOK

The value of this pair represents the value of NOK equivalent to one EUR. It is quoted as 1 EUR per X NOK. For example, if the value of this pair is 10.4373, approx. 10 Krones are required to purchase one euro.

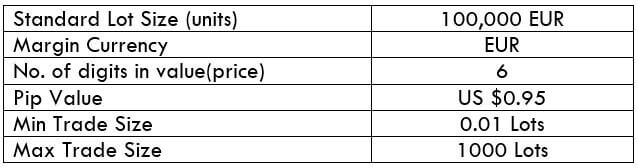

EUR/NOK Specification

Spread

The difference between bid and ask prices set by the brokers is referred to as the spread on the trade.

There are two types of trade execution models in forex, namely, ECN and STP. The spread on both vary.

- Spread on ECN: 55 pips

- Spread on STP: 57 pips

Fees

For every position you take on your account, you are required to pay some fee for it. This fee is typically between 5-10 pips. Moreover, there is no fee as such in STP accounts.

Slippage

When orders are executed by the market, the trader will not receive the exact price at which he triggered the button. The difference between the actual received price and the triggered price is called the slippage.

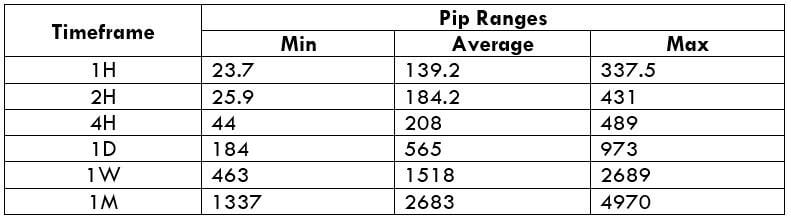

Trading Range in EUR/NOK

A Trading range is a tabular representation of the pip movement in a currency pair for different timeframes. Below is the same table for the EURNOK currency pair. From these values, we can assess our profit/loss on a trade beforehand. All you must do is, find the product of the volatility value and the pip value ($0.95).

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

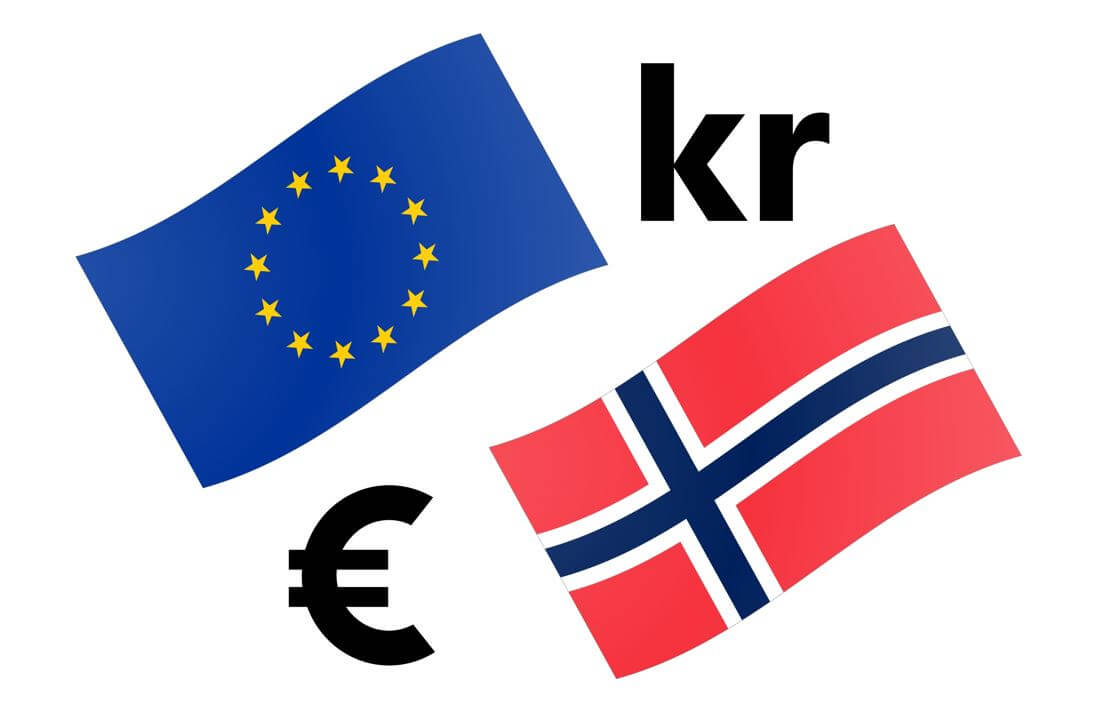

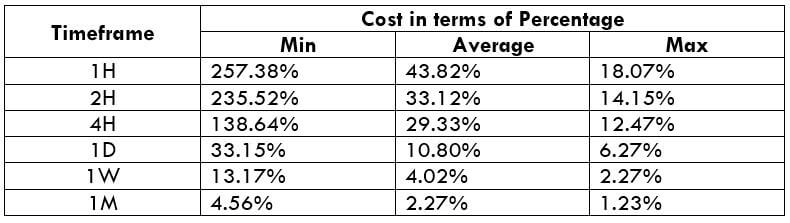

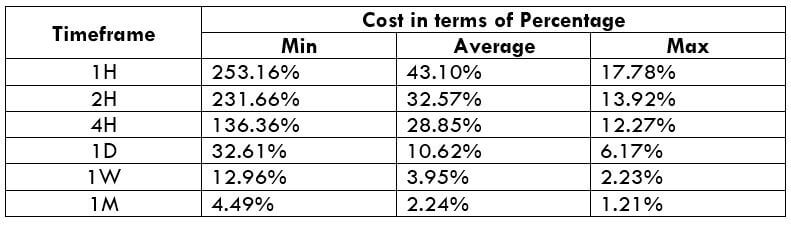

EUR/NOK Cost as a Percent of the Trading Range

This is an application to the above trading range table. By clubbing these values with the total cost of a trade, we can determine the cost variations for changing volatilities.

ECN Model Account

Spread = 55 | Slippage = 3 | Trading fee = 3

Total cost = Spread + Slippage + Trading Fee = 55 + 3 + 3 = 61

STP Model Account

Spread = 57 | Slippage = 3 | Trading fee = 0

Total cost = Spread + Slippage + Trading Fee = 57 + 3 + 0 = 60

The Ideal way to trade the EUR/NOK

Trading the EURSEK is similar to trading any other exotic-cross pair. This pair has pretty high volatility with liquidity lesser than major/minor pairs. This is the reason for its spreads to be at 55 pips. Yet, this pair can still be traded.

From the above cost percentage table, we can infer that the magnitudes are large in the min column and small in the max column. This means that the costs are more for low volatilities are less for high volatilities. It is neither preferable to trade during high volatilities nor when the costs are less, for obvious reasons. So, to maintain equilibrium between costs and volatility, it is ideal for entering this pair when the volatility is more or less near the average values in the trading range table.

Another simple way to bring down your costs is by placing orders by ‘limit’ and ‘stop.’ When trades are not executed as market orders, the slippage is cut off. Hence, the total cost is reduced by a decent percentage. An example of the same is given below.

Spread = 55 | Slippage = 0 | Trading fee = 3

Total cost = Spread + Slippage + Trading Fee = 55 + 0 + 3 = 58