Beneforex is a foreign exchange broker based in Sydney, Australia with other branches in Hong Kong, Shanghai, Taiwan, Korea, and London. Founded by experienced traders Beneforex aims to bring their experience into the forex broker world to help create a broker for traders. Their vision is to seek to fulfill their client’s gratification and success rate by constantly upgrading their expertise to offer their clients world-class quality. Throughout this review, we will look into the services on offer to see if they can manage to achieve this.

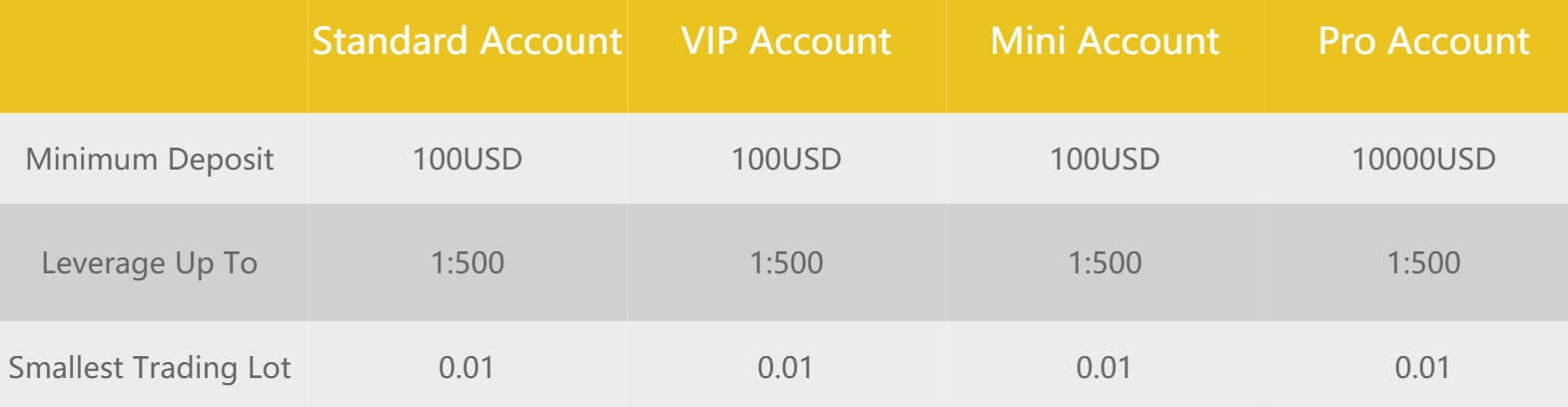

Account Types

There are four different accounts on offer, the account comparison page doesn’t offer too much information but we will tell you what they have.

Standard Account: This account requires a minimum deposit of $100, it comes with leverage up to 1:500 and trading starts from as low as 0.01 lots.

VIP Account: This account also has a minimum deposit of $100 and it comes with leverage up to 1:500 and trading starts from as low as 0.01 lots.

Mini Account: The Mini account is the same as the other accounts with a $100 minimum deposit, it can be leveraged up to 1:500 and trading starts at 0.01 lots.

(Note: There must be some differences to the above accounts that we will hopefully find as we go through this review.)

Pro Account: The initial deposit is now raised up to $10,000, the other elements such as leverage remain at 1:500 and minimum trade size also remains at 0.01 lots.

Platforms

In terms of trading platforms, there is only one available, that is MetaTrader 4 (MT4). MT4 is a hugely popular trading platform and offers a smooth and stable trading environment, lots of charting and analysis tools, automated trading through expert advisors and signals and flexible trading terms. MT4 is also highly accessible, it is available as a desktop download, a web trader or as an application for your mobile devices, you cannot go wrong when using MetaTrader 4. It would have been nice to have more choice, but MT4 is not a bad platform to be stuck with.

Leverage

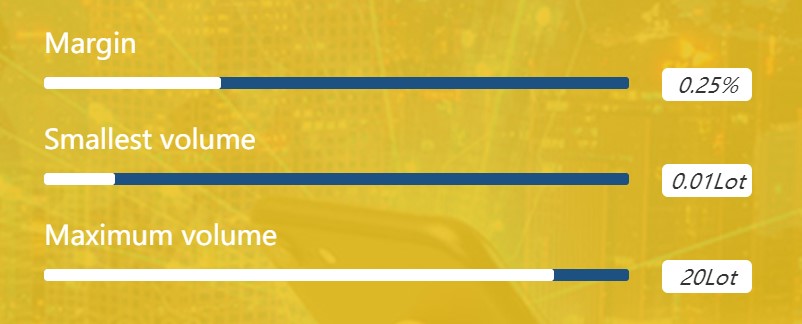

Leverage on all accounts goes up to 1:500, this can be selected when opening up an account and if you need to change it on ana already an open account you will need to contact the customer service team with your request. The leverage changes depending on a few different aspects that we have detailed below.

Trade Sizes

Trade sizes start from 0.01 lots and go up in increments of 0.01 lots so the next trade would be 0.02 lots. The maximum trade size available is 20 lots which is a good amount as it is not too high, there is no indication of the maximum number of open trades you are able to have though. One lot is equal to 100,000 base units.

Trading Costs

There is no information available regarding any trading costs so the accounts may all be using a spread based system hat we will look at later in this review. Swap charges are present, these are interest fees that can be either positive or negative and are paid for holding trades overnight, these can be viewed within the MetaTrader 4 trading platform.

Assets

Beneforex has broken its assets down into a number of different categories which we will now go through.

Forex: EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCAD, USDCHF, EURGBPO, AUDCAD, AUDCHF, AUDJPY AUDNZD, AURSGD, CADCHF, CADJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURSGD, EURTRY, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPSGD, NOKSEK, NZDCAD, NZDCHF, NZDJPY, SEKHPY, USDCNH, USDHKD, USDNOK, USDPLN, USDSEK, USDSGD, USDTRY

Indices: Australia 200, German 30, Hong Kong 50, Japan 225, Nasdaq 100, UK 100, America 2000, US 30, SPX 500

Metals and Commodities: Gold, Silver, Platinum, Palladium, West Texas Oil, Brent Oil, Natural Gas

Spreads

Unfortunately, just lie commissions there is no information regarding spreads so the trading costs of the various accounts are completely unknown to us. This is disappointing as potential new clients need to know what trading will cost them to work out if it is worth signing up or not. The only information that we do know is that the spreads are variable which means they move about and when there is added volatility in the markets they are often seen higher.

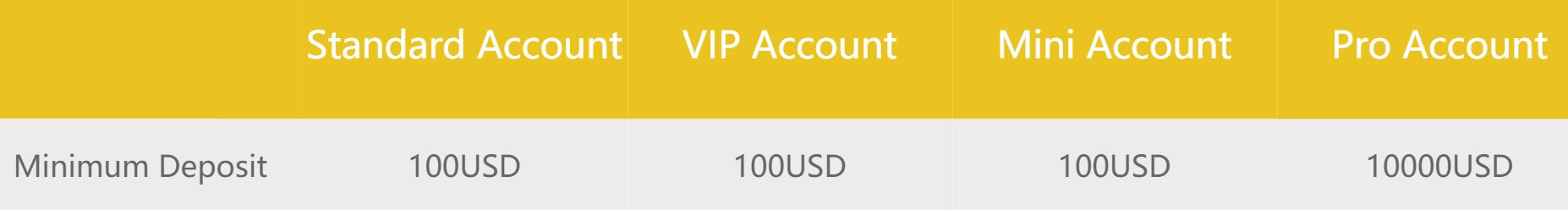

Minimum Deposit

The minimum amount required to pen up an account is $100 which will get you access to any of the accounts apart from the Pro account which will need a deposit of $10,000.

Deposit Methods & Costs

Unfortunately, there doesn’t appear to be any information on funding, there is a funding link at the bottom of the page but clicking it takes you to an account manager page which has nothing to do with any funding methods. This information should be available and clear, but it is not.

Withdrawal Methods & Costs

As there is no information on depositing there is also no information on withdrawing which once again is a real let down as clients need to know how they can get their money out and also how much it may cost them.

Withdrawal Processing & Wait Time

As you can expect this information is also not present, but we would hope that all withdrawal requests would be fully processed within 1 to 7 business days from the receipt of the request.

Bonuses & Promotions

It does not appear that there are any active promotions at the time of writing this review if you want a bonus you could contact the customer service team to see if there are any upcoming ones you could take part in.

Educational & Trading Tools

There is a basic and advanced section for education, however, when opening up these sections they are both blank. There is no information at all and so nothing we can comment on.

Customer Service

The contact page is simple and straight forward, there is an online submission form to fill in, once you send it off you should get a reply via email. There is also an address, email and phone number available. The customer support team aim to help all queries within 24 hours.

Address: Level 10, 20 Martin Place, Sydney NSW 2000

Phone: +61 2 9239 3210

Email: [email protected]

Demo Account

It does not appear that demo accounts are available, this is a shame as demo accounts allow new customers to test out the trading conditions and to get a feel for the servers which allowing experienced traders to test out new strategies without risking any of their own capital.

Countries Accepted

This information does not appear to be present, if you are interested in opening up an account we would suggest trying to contact the customer service team to see if you are eligible for an account or no.

Conclusion

The website was slow, very slow, sometimes taking over 1 minute to load a single page which made the user experience a horrible one. There is also a lot of information missing, for example, trading conditions, we do not know if there are any commissions or what the spreads are, so the costs of trading could be anything. There is also no information regarding funding methods so we do not know how to get money in or out and how much it would cost us. Without any of that information, it makes it incredibly hard for us to recommend this broker and so instead would suggest looking elsewhere.