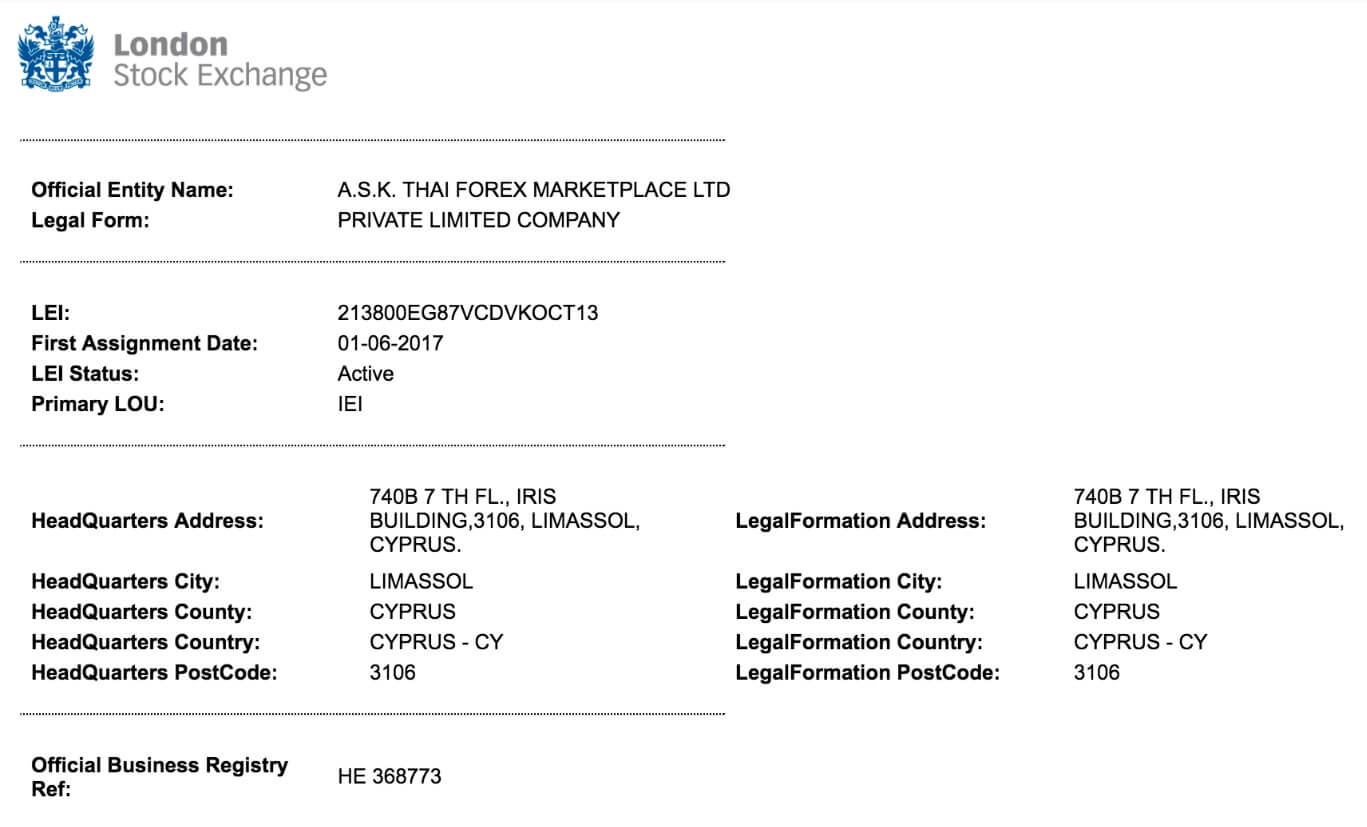

Ask Marketplace is a Cyprus based and regulated STP and ECN foreign exchange broker. They claim to have some of the best in class technology, which includes super-fast order execution, a huge depth of market, safety of clients funds 12/5 customer support, fast deposits and withdrawals, and an excellent partner program. We will be looking into the services on offer to see if they manage to live up to these goals.

Account Types

Should you decide to sign up, there are 5 different account types available. We have outlined them below along with the different trading conditions they offer.

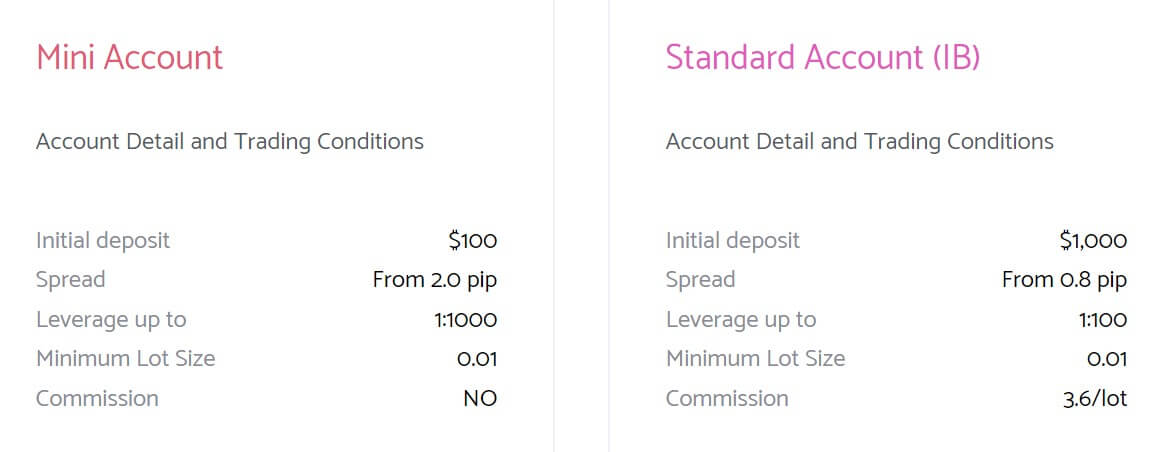

Mini Account: This account requires a minimum deposit of $100, it has spread starting from 2 pips and can be leveraged up to 1:1000, it has minimum trade sizes of 0.01 lots and no added commissions.

Standard Account: This account requires a minimum deposit of $1,000, it has spread starting from 0.8 pips and can be leveraged up to 1:100, it has minimum trade sizes of 0.01 lots and an added commission of 3.6 per lot traded.

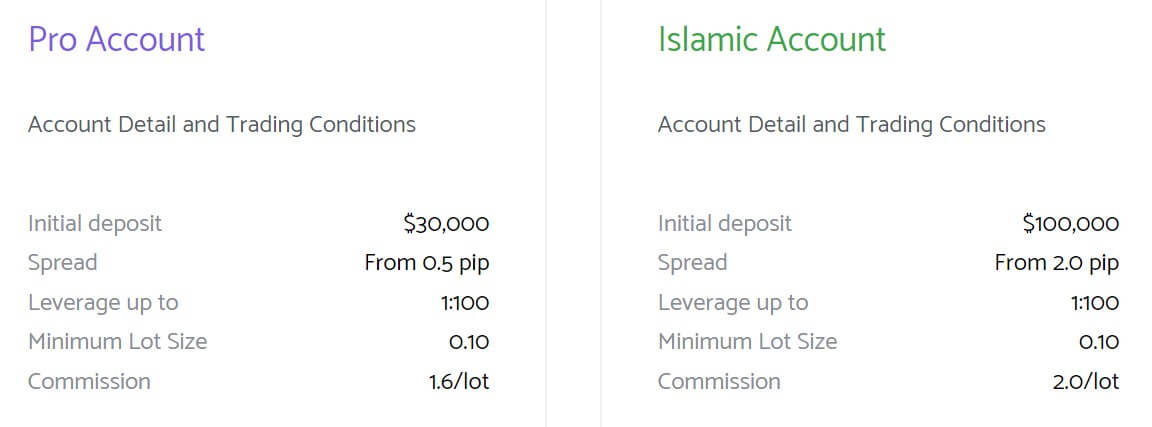

Pro Account: This account requires a minimum deposit of $30,000, it has spread starting from 0.5 pips and can be leveraged up to 1:100, it has minimum trade sizes of 0.1 lots and an added commission of 1.6 per lot traded.

Islamic Account: This account requires a minimum deposit of $100,000, it has spread starting from 2 pips and can be leveraged up to 1:100, it has minimum trade sizes of 0.1 lots and an added commission of 2 per lot traded.

VIP Account: This account requires a minimum deposit of $200,000, it has spread starting from 0.4 pips and can be leveraged up to 1:75, it has minimum trade sizes of 0.01 lots and an added commission of 1.5 per lot traded.

Platforms

Ask Marketplace uses just one trading platform, this is Meta Trader 4, one of the world’s most useful and loved trading platforms. MT4 is accessible as a desktop download, mobile application and as a web trader, it also has compatibility with hundreds and thousands of indicators and expert advisors as well as have its own signal marketplace. Plenty to make your trading and analysis as easy as possible. The easy to use interface makes it welcoming and it is fully customizable to suit your own personal trading needs.

Leverage

The maximum leverage available is 1:100 which is on the Mini account, this is far too high and we would recommend never going above 1:500. The Standard, Pro and Islamic account shave maximum leverage of 1:100 and the VIP account has a maximum leverage of 1:75. Leverage is selected when opening an account and can be changed by getting in contact with the customer service team.

The maximum leverage available is 1:100 which is on the Mini account, this is far too high and we would recommend never going above 1:500. The Standard, Pro and Islamic account shave maximum leverage of 1:100 and the VIP account has a maximum leverage of 1:75. Leverage is selected when opening an account and can be changed by getting in contact with the customer service team.

Trade Sizes

Trade sizes on the Mini and Standard account start from 0.01 lots and go up in increments of 0.01 lots. The Pro, Islamic and VIP account shave trade sizes starting from 0.10 lots. The maximum trade size is not currently known to us, neither is the maximum number of open trades allowed.

Trade sizes on the Mini and Standard account start from 0.01 lots and go up in increments of 0.01 lots. The Pro, Islamic and VIP account shave trade sizes starting from 0.10 lots. The maximum trade size is not currently known to us, neither is the maximum number of open trades allowed.

Trading Costs

Trading Costs

Each account has its own amount of commission, we have outlined them below.

- Mini – 0 per lot

- Standard: 3.6 per lot

- Pro: 1.6 per lot

- Islamic 2 per lot

- VIP: 1.5 per lot

The commissions by themselves look quite low, but considering there is an additional spread as well, it means that the overall trading costs can be quite high.

Assets

Unfortunately, Ask Marketplace does not offer a product specification or breakdown of the available assets so we are not sure what they are or how many of them there are. This is a shame as t is important to know what is available to trade, especially if you are looking for a very specific instrument.

Spreads

As there is not a product specification we cannot give exact examples of spreads per instrument, what we can do is give the overview of each account.

- Mini: From 2 pips

- Standard: From 0.8 pips

- Pro: From 0.5 pips

- Islamic: From 2 pips

- VIP: From 0.4 pips

The spreads are variable which means they move with the markets and will often be seen higher than the figure stated above, especially if there is any added volatility in the markets.

Minimum Deposit

The minimum deposit required to pen up an account is $100 which gets you the mini account, any subsequent deposits are also restricted to a $100 minimum.

Deposit Methods & Costs

The only methods of depositing seem to be Bank Wire Transfer and Credit/Debit Card. In terms of fees, there is no mention of them but also no statement to say that there aren’t any, at any rate, when depositing be sure to check with your bank or card issuer to see if they add any fees of their own.

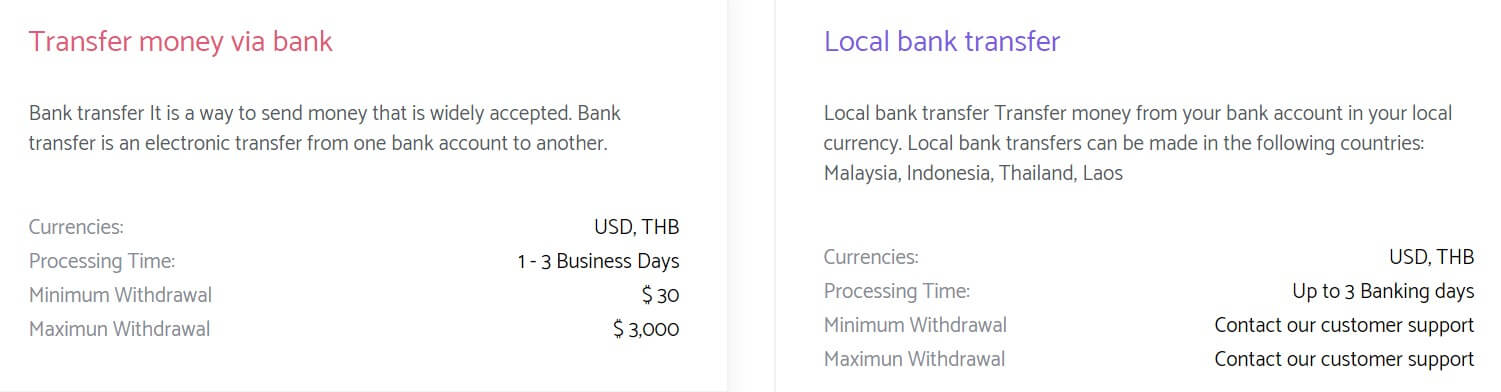

Withdrawal Methods & Costs

For withdrawing the same 2 methods are available, for clarification these are Bank Wire Transfer and Credit / Debit cards. Just like with the deposits, it is unknown if there are any additional fees added by Ask Markets, but be sure to check with your own bank.

Withdrawal Processing & Wait Time

Processing for Bank Wire Transfer will take between 1 to 3 banking days, for credit card withdrawals it should take 1-day fort he refunds to be issued.

Bonuses & Promotions

You can get a bonus of between $100 to $10,000 as a 100% deposit bonus. The bonus requires you to trade the balance at a 1:1 ration in order to withdraw it. You need to complete the entire rollover in 90 days which depends on the amount received can be quite a difficult challenge.

Educational & Trading Tools

There is a small news section detailing different thing but this has not been updated since 2018, apart from that there is nothing in regards to education.

Customer Service

Getting in contact with Ask Marketplace is easy and there are a few ways of doing it. You can fill in the online submission form and then get a reply via email, you can also use the email address provided as well as a postal address, Facebook and Line account.

Address: 740B 7th Fl., Iris Building,3106, Limassol, Cyprus.

Email: [email protected]

Line: @askmarketplace

Facebook: askmarketthailand

Demo Account

We could not find any demo accounts while browsing the site which is a shame as demo accounts allow people to test the markets and trading conditions or to test new strategies without risking any actual capital.

Countries Accepted

This information is not present on the site, so if you are looking to join, we would recommend checking with the customer service team to see if you are eligible or not.

Conclusion

There are a few different options when it comes to accounts, the main difference between them is the spreads and commission, however, the total combined costs of both commission and spreads mean that each account actually has quite a high cost. There isn’t a product specification or breakdown of assets which is a shame and there are also very limited ways of depositing and withdrawing. There needs to be a little more information available for us to truly recommend them, but the conditions are acceptable and the decision to use them is yours.