LowCostForex is a foreign exchange broker aiming to become one of the best. They do not offer a lot of information about their background, just some of the targets they set out to meet, these include allowing clients to trade in the real markets, offering no slippage intervention, transparency, no conflict of interests and to offer a customer-centric model. We will be looking into the services on offer to see if they achieve this and so you can decide if they are the right broker for you.

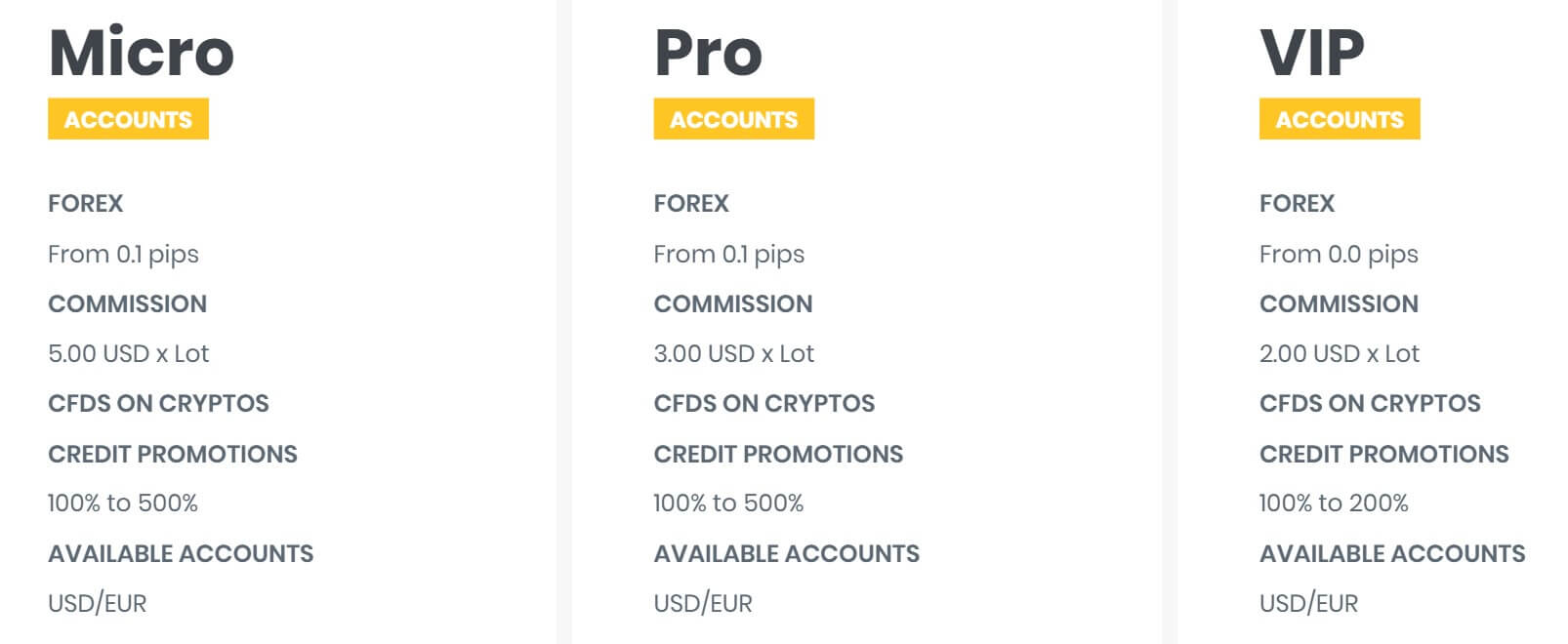

Account Types

There are three different main accounts when signing up with low-cost Forex. each one has its own trading conditions and entry requirements so let’s look at what they are.

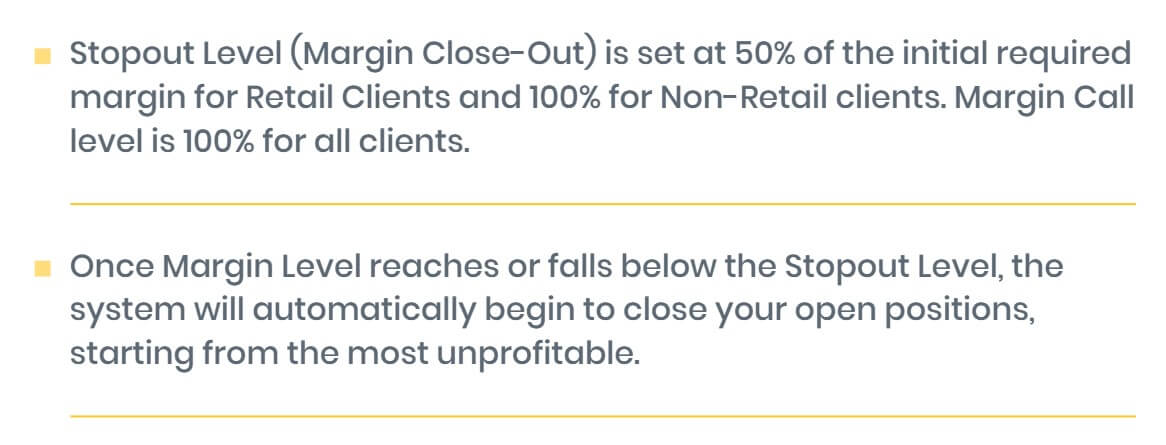

Micro ECN: This account has an entry requirement of 1000 USD, it comes with spreads from as little as 0.1 pips and as spreads are so low there is a commission of 5 USD per lot traded. Leverage can be between 111 and 1:1000. There are swap charges but the account can also be in a swap-free format. It has access to Forex, CFDs, Commodities, and Crypto with a minimum trade size of 0.01 lots, going up in 0.01 lots until it reaches a maximum of 1 lot. There is a margin call level of 1%0 and a stop out level of 5% and the account has access to the bonus program. If the balance is over $10,000 it has access to an account manager.

Pro ECN: This account comes with a minimum deposit requirement of 5000 USD. It has spread starting from 0.1 pips and there is an added commission of 3 USD per lot traded. Leverage can be between 111 and 1:1000. There are swap charges but the account can also be in a swap-free format. It has access to Forex, CFDs, Commodities, and Crypto with a minimum trade size of 0.01 lots, going up in 0.01 lots until it reaches a maximum of 100 lots. There is a margin call level of 1%0 and a stop out level of 5% and the account has access to the bonus program. If the account balance is over $10,000 then it has access to an account manager.

VIP ECN: This is the top-level account and it requires a minimum deposit of $50,000, this account can be leveraged between 1:1 and 1:200. It comes with spreads as low as 0 pips and there is an added commission of $2 per lot traded. There are swap charges but the account can also be in a swap-free format. It has access to Forex, CFDs, Commodities, and Crypto with a minimum trade size of 0.01 lots, going up in 0.01 lots until it reaches a maximum of 100 lots. There is a margin call level of 1%0 and a stop out level of 5% and the account does not have access to the bonus program. If the account balance is over $10,000 then it has access to an account manager.

Platforms

LowCost Forex uses MetaTrader 4 as its sole trading platform. MetaTrader 4 is an extremely popular trading platform from MetaQuotes. It is used by millions of traders and is packed full of features. Some of the features include 100+ trading instruments, 85+ preinstalled indicators with the ability to add thousands more, it offers a highly secure trading environment, it offers multiple languages and is accessible as a desktop download, mobile application and as a web trader in your browser. There is also API access, but this is very advanced and not something retail traders will look to do.

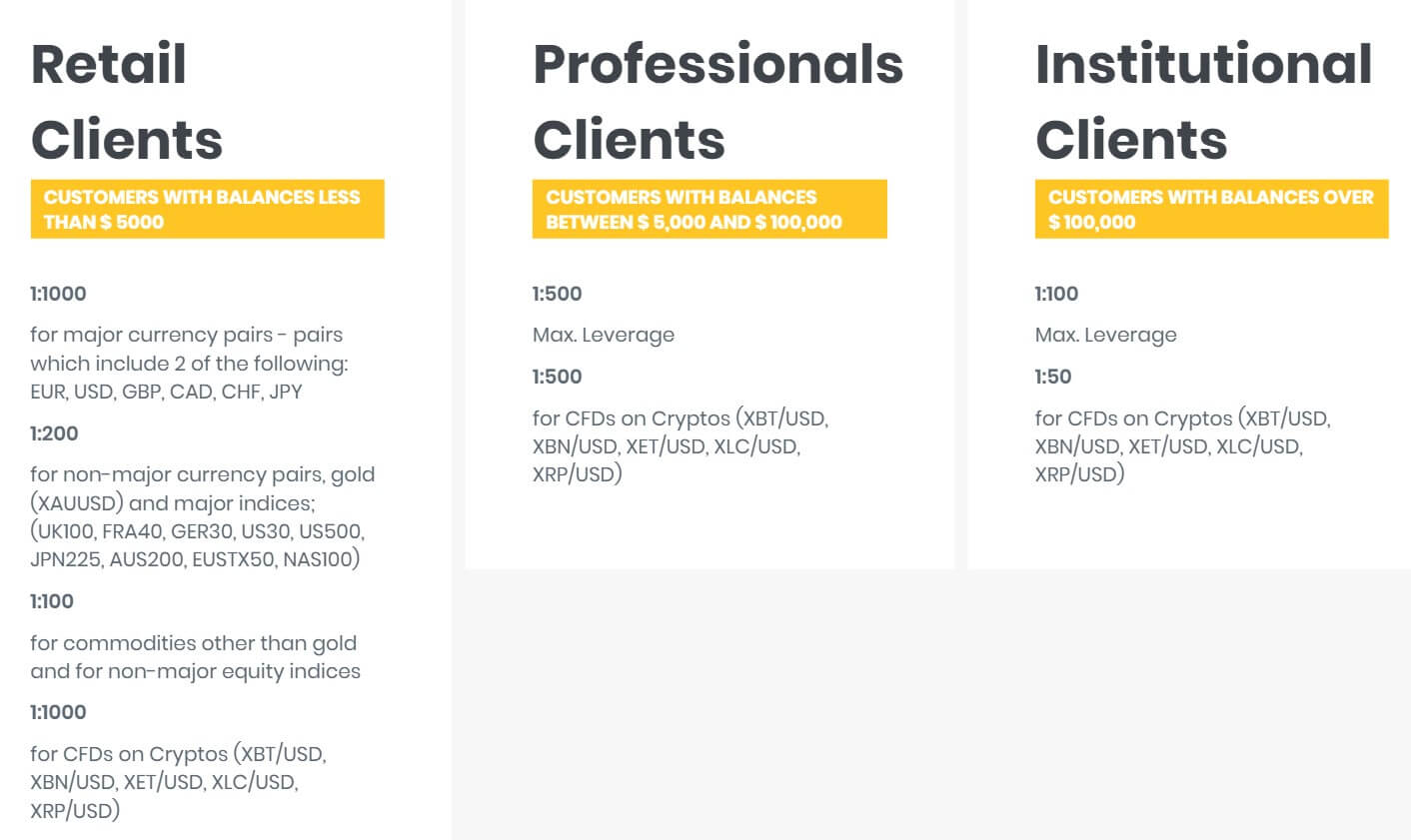

Leverage

The leverage that you receive is dependant on the account you are using, if you have the Micro or Pro ECN account then your leverage ranges between 1:1 and 1:1000, if you have the VIP ECN account then it ranges from 1:1 to 1:200. We would suggest not going over 1:500 where possible as the risks increase exponentially, stick to 1:500 where there is a good balance of risk and reward.

Leverage can be selected when first opening up an account, should you wish to change it on an account you have already opened then you should contact the customer service team with your request.

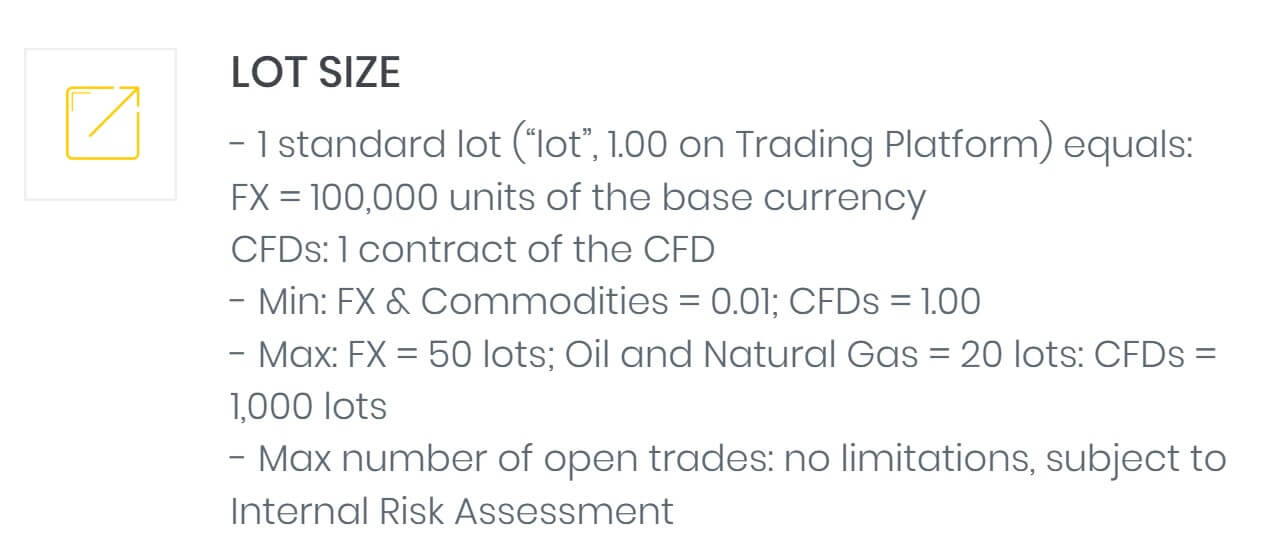

Trade Sizes

Trade sizes for all account start from 0.01 lots and go up in increments of 0.01 lots, the maximum trade size on the Micro ECN account is 1 lot, while the Pro ECN and VIP ECN are 100 lots, we would not recommend trading over 50 lots in a single trade though.

The Micro ECN is a cent account, this means that a trade size of 0.1 lots is actually the equivalent of 0.0001 lots. 1 lot is equal to 1,000 units while the Pro ECN and VIP ECN account 1 lot are equal to 100,000 units.

Trading Costs

All three accounts are ECN accounts so they have an added commission, we have outlined the fees below.

- Micro ECN: 5 USD per lot traded

- Pro ECN: 3 USD per plot traded

- VIP ECN: 2 USD per lot traded

Compared to the industry average of $6 per lot traded Low-Cost Forex really is low cost.

There are also swap charges, these are an added fee for holding trades overnight, they can be viewed within the trading platform of choice. There are also swap-free accounts should your beliefs require this.

Assets

Unfortunately, there doesn’t appear to be a full breakdown of available assets, so we cannot comment on what is available to trade. This information should be made available as it is important for potential clients to be able to see wat s on offer and to see if their favorite instruments are available to trade.

Spreads

LowCost Forex state that their spreads are all starting as low as 0.01 pips on the Micro and Pro account and 0 pips on the VIP account, unfortunately, there is not a breakdown of assets or a product specification so we cannot comment on the accuracy of this. What we can say is that the spreads are variable which means they move with the markets, added volatility in the markets will often make the spread s a little higher, the different instruments also have different starting spreads and some will naturally be higher than others.

Minimum Deposit

The minimum deposit required to open up an account is $1,000 which will get you the Micro account, if you want a full (non-mini) account you will need to deposit at least $5,000 for the Pro account. Once an account is already open, any subsequent top-up deposits do not have a minimum requirement.

Deposit Methods & Costs

On the site there isn’t a page dedicated to deposits and withdrawals, the only evidence we have of any available methods is via some images at the bottom of the site, these indicate that Bank Transfer, Visa / MasterCard, Skrill Neteller, and UnionPay are all available for use. LowCostForex dows not charge for deposits, however, be sure to check with your own bank to see if they add any fees of their own. LowCost Forex needs to get this information on the site for potential clients to know how they can fund the account.

Withdrawal Methods & Costs

Just as with deposits there is no real information about withdrawals, there is a refund policy but this doesn’t really give any insight into what is available, just that they will be following money-laundering rules such as returning funds to the same method used to deposit and other things like that. This information is vital, so it not being present is a real shame, people need to know how they can get their money out and how much it will cost them to do it.

Withdrawal Processing & Wait Time

LowCostForex aims to process withdrawals within 1 business day and we would expect and hope that any withdrawal requests would (depending on the method used) be fully processed between 1 to 7 working days after the request is made.

Bonuses & Promotions

The accounts page and accounts comparison page both indicate that the Micro and Pro accounts have access to a bonus program, however, there is no indication as to what this is, no information anywhere on the website. This may mean that there were promotions in the past but it doesn’t look like there are any at the moment. There does seem to be a 500% credit bonus which is only displayed as a banner, but the terms are unknown.

Educational & Trading Tools

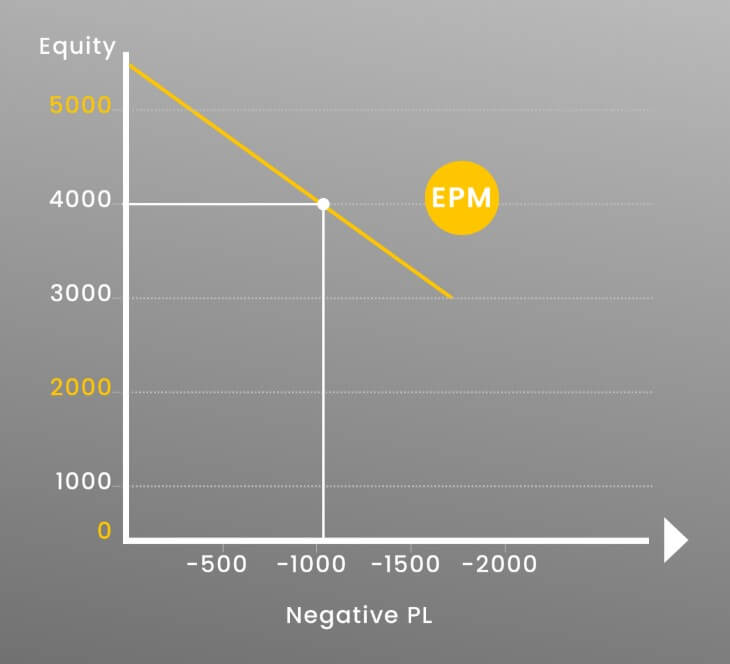

It does not look like there is any education available on the site. This is a shame as a lot of brokers are now trying to help their clients improve, so it would be good to see LowCost Forex follow the same route. They do, however, offer an equity protection program for those who have managed accounts. Details regarding this program are available on the LowCostForex website.

Customer Service

You can get in contact with the customer service team in a couple of ways, you can use the online submission form to fill in your query and you should then get a reply vial email. There is also an email address, unfortunately, that seems like the only way to make contact which limits contact to an extent. It would be nice to have more options such as a way to speak to someone directly via the telephone.

Demo Account

Demo accounts are available but we couldn’t actually work out how to access them or how to sign up, there also wasn’t any information surrounding their trading conditions or any potential expiration times.

Countries Accepted

The information on the site states “Any information and software provided by LowCostForex.com is not intended to solicit citizens or residents of the US for the purpose of financial trading.”, so if you are interested in signing up, we would recommend contacting the customer service team prior to doing so to find out if you are eligible for an account or not.

Conclusion

The accounts from Low-Cost Forex offer very low spreads and they live up to their name as the commission is low, all under the $6 average we see around the forex industry. The part where they fall short is on their target of being transparent, it is hard to achieve this when you do not display what assets are available to trade, and even worse, do not describe what funding methods are available. Potential new traders need to know what they can trade and how they can get their money in or out and if it will cost them Just having those aspects of the site missing make it enough for us to recommend looking elsewhere.