Smart Forex is a forex and commodities broker based in the United Kingdom. Their main aims are to provide outstanding customer service, offer a multi-product bouquet, provide advanced trading platforms, to give tight spreads and to be run by an experienced founding team. In this review, we will be looking into the services being offered to see if they achieve their aims.

Account Types

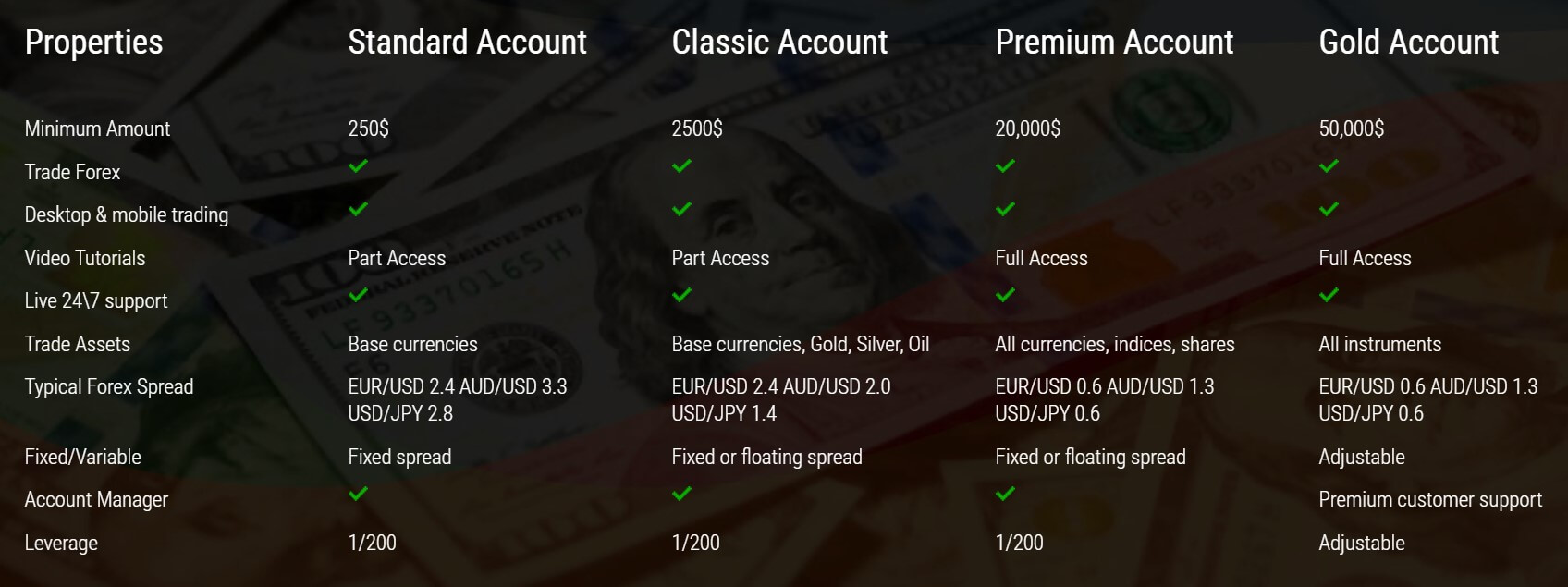

Should you decide to sign up with Smart Forex, you will have a choice of 4 different account types, each with their own requirements and features.

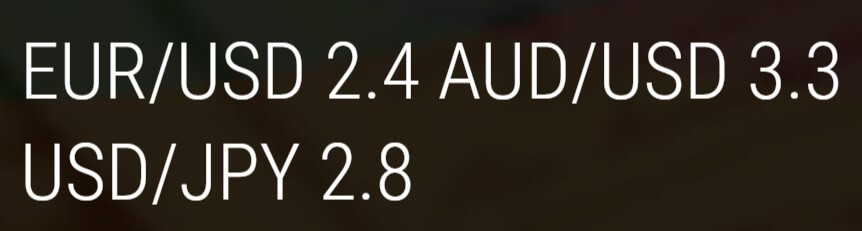

Standard Account: A minimum deposit amount of $250 is required to open this account, it allows you to trade forex on the MetaTrader 4 platform. It has part access to video tutorials and live 24/7 customer support. You are able to trade base currencies only and typical spreads are EUR/USD 2.4 pips, AUD/USD 3.3 pips and, USD/JPY 2.8 pips. The spreads are fixed and leverage on the account can go up to 1:200, there is also an account manager available.

Classic Account: The minimum requirement for this account increases up to $2,500, it allows you to trade forex on the MetaTrader 4 platform. It has part access to video tutorials and live 24/7 customer support. You are able to trade base currencies as well as Gold, Silver and Oil and typical spreads are EUR/USD 2.4 pips, AUD/USD 2 pips and, USD/JPY 1.4 pips. The spreads can be either fixed or variable (floating) and leverage on the account can go up to 1:200, there is also an account manager available.

Premium Account: A further increase of minimum deposit is required and is now set at $20,000, the account allows you to trade forex on the MetaTrader 4 platform. It has full access to video tutorials and live 24/7 customer support. You are able to trade base currencies as well as indices and shares and typical spreads are EUR/USD 0.6 pips, AUD/USD 1.3 pips and, USD/JPY 0.6 pips. The spreads can be either fixed or variable (floating) and leverage on the account can go up to 1:200, there is also an account manager available.

Gold Account: This top-tier account requires a minimum deposit of $50,000 which will price out a lot of potential clients, the account allows you to trade forex on the MetaTrader 4 platform. It has full access to video tutorials and live 24/7 customer support. You are able to trade all available assets and instruments and typical spreads are EUR/USD 0.6 pips, AUD/USD 1.3 pips and, USD/JPY 0.6 pips. The spreads can be either fixed or variable (floating) and leverage on the account is adjustable, this account also has access to premium customer support.

Platforms

Smart Forex offers MetaTrader 4 as their only trading platform, so what does this platform offer? MetaTrader 4 is an advanced Forex trading platform that provides traders with access to a wide range of tools and features to help with carrying out market analysis and thus customizing their trading experience. The tools within MT4 can also help you to utilize and construct trading algorithms that can automate FX trading.

Leverage

All accounts have access to leverage up to 1:200, the Gold account has adjustable leverage but we assume the maximum is still the same. Leverage can be selected when opening up an account, it appears that on the regular accounts you can not change t once it has been selected but on the Gold account you can as long as there are no open trades.

Trade Sizes

Trade sizes start from 0.01 lots which are known as a micro-lot and go up in increments of 0.1 lots so the next trade would be 0.0 lots and then 0.03 lots. We do not know what the maximum trade size is, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage. It is also unknown how many open trades you can have at any one time.

Trading Costs

It does not appear that there are any added commissions as all accounts seem to sue a spread based system, swap charges are charged though, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice.

Assets

There is not a full breakdown of available assets, in fact, there isn’t a breakdown at all, the only information about what is available to trade is on the account page where it simply states, base currencies, indices, shares, gold silver, and oil. There is no other mention of any assets or specifications. It would be good to have a full breakdown as a lot of the time potential new clients will look for specific instruments being available before they sign up, not having this information could make them look elsewhere.

Spreads

The starting level of spreads depends on the account you are using, we have listed down the expected spreads below.

- Standard account: EUR/USD 2.4 pips, AUD/USD 3.3 pips, USD/JPY 2.8 pips

- Classic Account: EUR/USD 2.4 pips, AUD/USD 2.0 pips, USD/JPY 1.4 pips

- Premium Account: EUR/USD 0.6 pips, AUD/USD 1.3 pips, USD/JPY 0.6 pips

- Gold Account: EUR/USD 0.6 pips, AUD/USD 1.3 pips, USD/JPY 0.6 pips

Spreads can be both fixed or variable, fixed spreads mean that they do not move, and are always at the same amount, variable (also known as floating) means that when the markets are being volatile, the spreads will often be seen higher.

Minimum Deposit

The minimum deposit needed to open an account is $250 which gets you the Standard account. It is unknown if the minimum deposit changes for any subsequent top-ups, but that is normally the case.

Deposit Methods & Costs

There isn’t any information regarding deposits, at the bottom of the website there is an image of Visa Maestro, and MasterCard which would indicate that they can be used as a deposit method, but there is no further information and nothing about any potential fees. Not having financial information available is a big concern, as clients need to know how they can fund their accounts and also what it will cost them.

Withdrawal Methods & Costs

Just like with the deposit there is very little information surrounding the withdrawals, but very little we mean none. This is vital information without it we do not know how we can get our money out or if Smart Forex will charge us for getting our money out, this information needs to be added as soon as possible.

Withdrawal Processing & Wait Time

As we do not know for sure which methods are available we can not answer this section of the review.

Bonuses & Promotions

We could not locate any information on the website in regards to bonuses or promotions so it does not appear that there are any active ones at the time of writing this review. If you are interested in bonuses then be sure to check back regularly or get in contact with the customer service team to see if there are any upcoming bonuses or promotions.

Educational & Trading Tools

There doesn’t appear to be anything in regards to education or trading tools. This is a shame as a lot of brokers these days are looking to help their clients improve and become more profitable with educational courses or tools to help them trade or analyze. It would be nice to see Smart Forex do something similar for their clients.

Customer Service

The contacts page offers a few different ways to get in touch, the support team according to the accounts page is available 24/7. However, on the support page, it states Sunday to Friday 10:aa am to 20:00 pm GMT. You can use the standard online submission form to send your query and then get a reply via email, the next option is to use email addresses, there are separate ones for Support and Marketing. There is also a phone number for Great Britain and Italy.

Demo Account

There doesn’t seem to be a demo account on offer, or at least we could not find any information about one. This is a shame as demo accounts allow potential new clients to test out the trading conditions and servers while it allows current clients to test out new strategies without risking any of their capital. This is an area that should be invested in and demo accounts should be made available.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

Smart Forex has a lot of information missing from their site that we would not consider smart. The account page offers a fair comparison on the accounts and trading conditions, however, that is about where the information stops. We were looking for the vital information on deposit and withdrawal methods along with their costs but it was nowhere to be seen. There was also a lack of information on available assets and other quite important information. Without all of this being present it is hard for us to recommend Smart Forex as a broker to use.