BlackBull Markets is an ECN foreign exchange broker specializing in Forex, CFDs, Commodities, Fibre Optic Communications, and Fintech solutions. Based in New Zealand and registered with the Financial Services Provider Registry (FSPR) and Financial Services Complaints Limited (FSCL), BlackBull Markets aim to be the best and to provide the best for their clients. We will be using this review to delve deep into the services being offered to see how they compare to the competition and so you can decide if they are the right broker for you.

Account Types

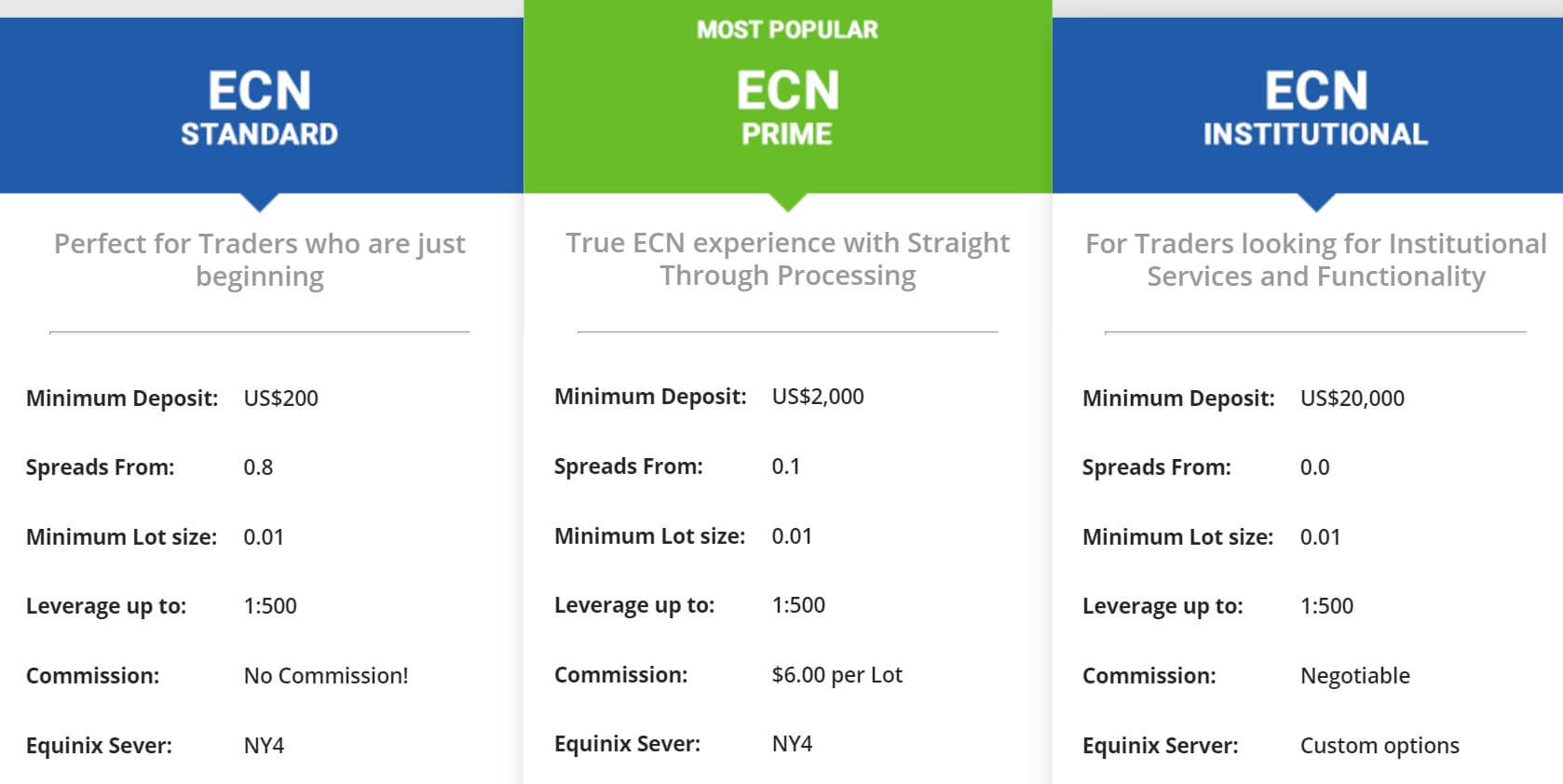

There are three different accounts available to use when signing up with BlackBull Markets, we have outlined some of their features below.

ECN Standard: This account has a minimum deposit requirement of $200, it comes with spreads starting from 0.8 pips with a minimum trade size of 0.01 lots. There is no added commission on the account and it can be leveraged up to 1:500.

ECN Prime: The ECN Prime account increases the minimum deposit up to $2,000, it comes with spreads as low as 0.1 pips and there is an added commission of $6 per round lot traded. It can still be leveraged up to 1:500 and the trade sizes start at 0.01 lots.

ECN Institutional: This is the top tier account, it requires a minimum deposit of at least $20,000. The account has spreads starting from 0 pips and the commission is negotiable. The trade sizes start from 0.01 lots and the account can be leveraged up to 1:500 just like the other accounts.

Platforms

There are two different platforms both from MetaQuotes available to sue, let’s have a look at some of the features included in them.

MetaTrader 4 (MT4): MetaTrader 4 is one of the world’s most used trading platforms and for several good reasons. A few of its many features include multiple order types, Market watch window, a navigator window, lots of pre-installed indicators and analysis tools, multiple chart setups, and the ability for automated trading and order execution capabilities. The platform is also highly accessible, as you can use it as a web trader in your internet browser, a mobile application or as a desktop download.

MetaTrader 5 (MT5): MT5 is currently coming soon to BlackBull Markets, so it is not currently available to use but will be soon. Some of the features it includes are 20+ time frames, 30+ built-in indicators, an integrated economic calendar, optimized trade processing speeds, the ability to hedge your trade positions and, advanced pending order functionality. Just like with MT4, it is also available as a desktop download, mobile application, and web trader.

Leverage

The maximum leverage available on all three accounts is 1:500 and can be selected when opening up an account. Should you for any reason need to change the leverage on an account you are already using, you will need to contact the customer service team to request a change.

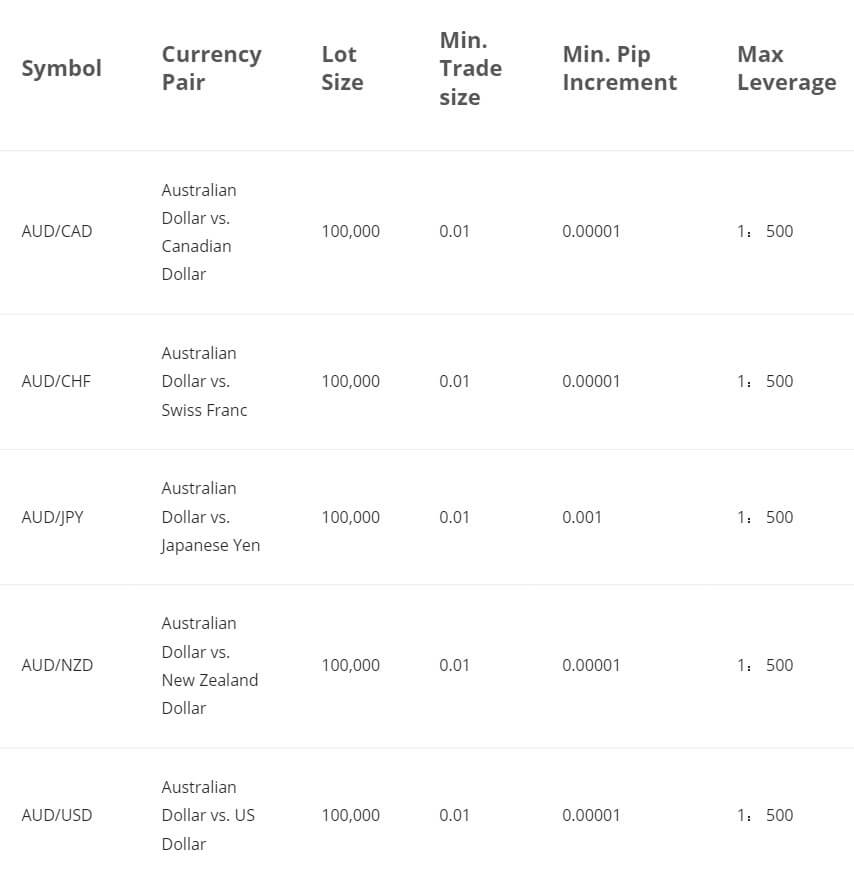

Trade Sizes

Trade sizes start from 0.01 lots which is known as a micro lot, they then go up in increments of 0.012 lots. The maximum trade size is unknown but we would recommend not trading over 50 lots in a single trade due to execution and slippage issues with larger trades. It is also not known to us what the maximum number of open trades at any one time is.

Trading Costs

The ECN Prime account comes with an added commission of $6 per lot traded which is in line with the industry average. The ECN Institutional account also comes with an added commission but the amount needs to be negotiated with an account manager. The ECN Standard account does not have any commission as it uses a spread based system that we will look at later. There are also swap charges, these are fees for holding trades overnight and can be viewed within the MetaTrader trading platforms.

Assets

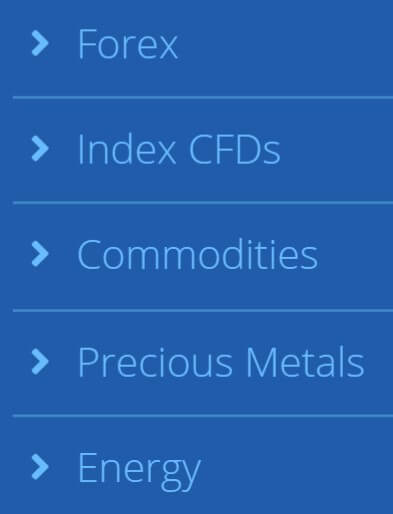

The assets on BlackBull Markets have been broken down into a few different categories, we have outlined the different instruments within them below.

The assets on BlackBull Markets have been broken down into a few different categories, we have outlined the different instruments within them below.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY, USDMXN, USDSGD

Metals: Silver and Gold

Energy: WTI Crude Oil, Brent Crude Oil

Indices: AUS 200, UK 100, US 500, ESTX 50, SUI 20, GER 30, JPN 225, NAS 100, US 30

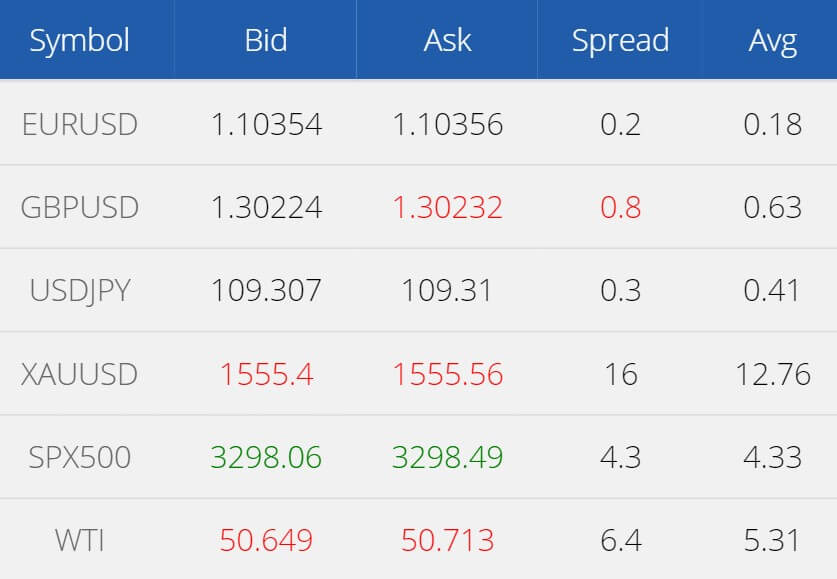

Spreads

The spreads that you get depend on the account you are using. The ECN Standard account has spread starting from 0.8 pips, the ECN Prime account has spread starting from 0.01 pips and the ECN Institutional account has spreads starting from 0 pips. The spreads are variable which means they move with the markets, the more volatility in the markets the higher the spreads will be, different instruments will also have different starting spreads.

Minimum Deposit

The minimum amount required to open up an account is $200 which will get you the ECN Standard account, if you want a commission-based account then you will need to deposit at least $2,000. Once an account has been opened the minimum deposit requirement is removed and there is no fixed limit for top-up deposits.

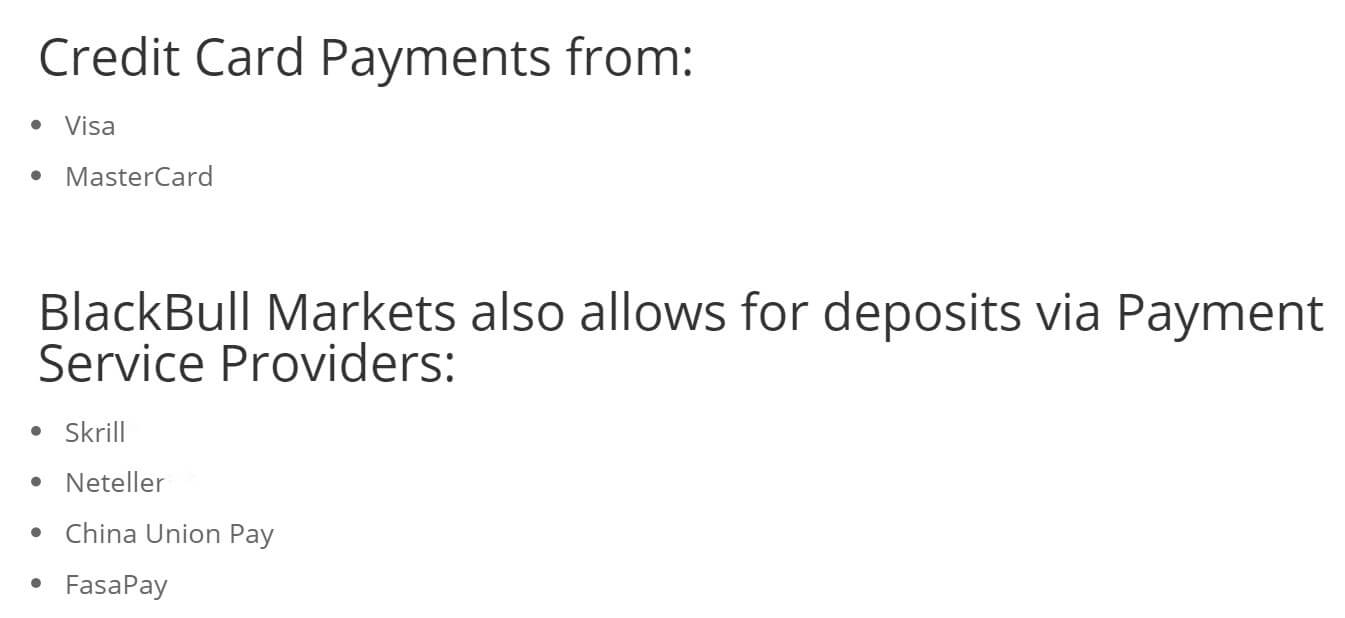

Deposit Methods & Costs

There are a number of different methods available to deposit with, these include Bank Wire Transfer, Visa, MasterCard, Skrill, Neteller, China Union Pay, and FasaPay. Fees are not mentioned on the site which leads us to believe that there aren’t any added fees for depositing, however, we cannot be 100% sure about this. At any rate, you should check with your own bank or processor to see if they add any fees of their own.

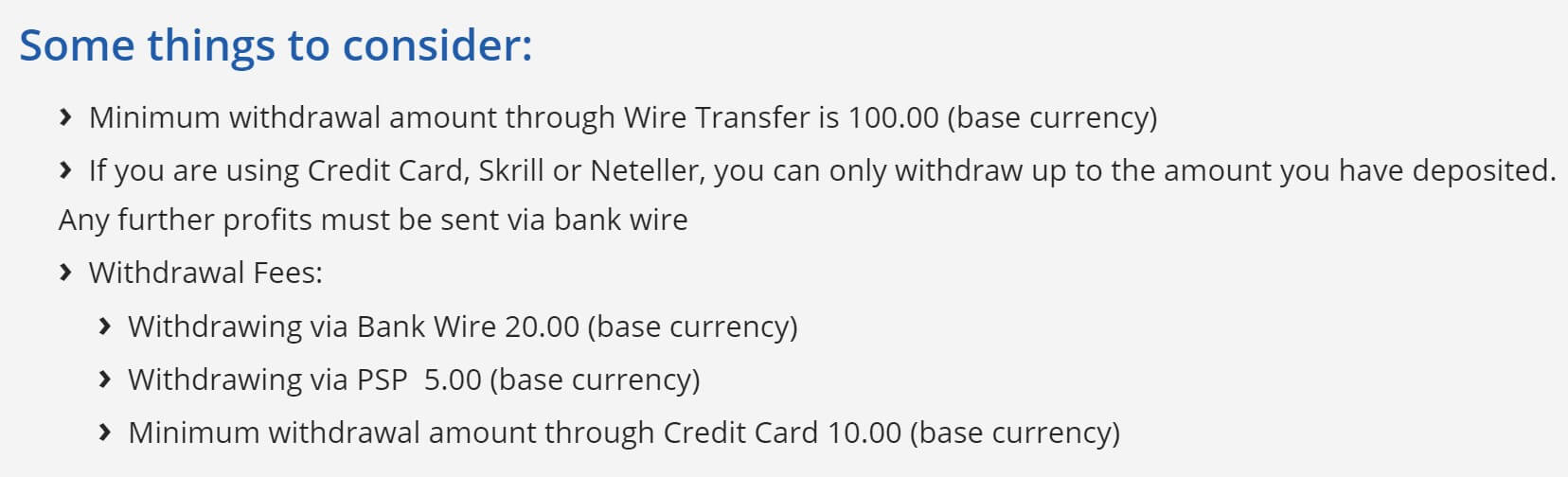

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification these are Bank Wire Transfer, Visa, MasterCard, Skrill, Neteller, China Union Pay, and FasaPay. When using Credit or Debit card, you are only able to withdraw the same amount that you have deposited, any extra will need to use another available method. There is an added fee of 20 base currency for withdrawing with Bank Wire Transfer and a fee of 5 base currency for withdrawals using any other method. You should also check with your own bank or processor for any potential fees added by them.

Withdrawal Processing & Wait Time

BlackBull Markets will aim to process any withdrawal requests within 24 hours of the request being made. The amount of time it takes after this will depend on the method used, however, all withdrawals should fully process between 1 to 5 business days from the request depending on the processing speed of the method used to withdraw.

Bonuses & Promotions

From looking around the site it does not appear that there are any promotions or bonuses currently running. If you are interested in bonuses you could always contact the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

In terms of education, there are only two things on offer, the first is an economic calendar that details any upcoming news events along with the markets and currencies that they may affect. Then there is are some market reviews, these are looking at what has happened in the past and the last few days to try and give a reason for any movement that took place. If you are looking to actually learn how to trade you will need to look elsewhere.

Customer Service

There are quite a few different ways to get in contact with BlackBull Markets, there are a whole bunch of email addresses to use to contact different departments including Customer Services, Chines Support, Compliance, Deposit and Withdrawal Queries, Institutional, Introducing Broker Queries, Partners/White Labels/Representative, Trade Relations and Queries and Media./Marketing/PR.

There are also postal addresses and phone numbers available for New Zealand and Malaysia.

New Zealand Offices:

Address: BlackBull Markets, Level 22, 120 Albert Street, Auckland, 1010

Phone: (+64) 9 558 5142

Email: [email protected]

Opening hours are Monday to Friday from 10:00 – 23:00 NZT.

Demo Account

Demo accounts were not mentioned o nth site so it gives the appearance that there aren’t any, we did not create an account so there may be a way to get them from within the back office, demo accounts are a great way for potential clients test the trading conditions and for existing clients to test new strategies without any risk, so if they are not available BlackBull MArkets should look at getting them implemented into their platform.

Countries Accepted

There is no information on the site about country eligibility, so we would suggest getting in touch with the customer service team prior to creating an account t just to be sure you are eligible to trade with them.

Conclusion

BlackBull Markets give a very good first impression with a very clean looking website. The accounts give enough variation for them to make sense. In terms of trading conditions, the spreads are starting low and the commission on the commission-based account is in line with the industry average ($6 per lot traded). There are enough ways to deposit to keep most people happy, there are some fees for withdrawing but they are kept relatively low. Plenty of ways to contact the customer service team gives a bit of confidence and so we are happy to recommend them as a broker to sue, but the final decision is up to you.