PipHijau LTD is a Malaysia based foreign exchange broker with a philosophy that ensures customer satisfaction and to help their traders and clients achieve their trading goals. Started in 2008, PipHijau has a few reasons why they think you should choose them, they include access to Islamic accounts, spreads as low as 1.2 pips, no requotes or rejections, leverage up to 1:500, minimum deposits of $50 and the ability to use expert advisors. These are all pretty standard things so we will use this review to dive deeper into the services on offer to see how they compare to the competition.

Account Types

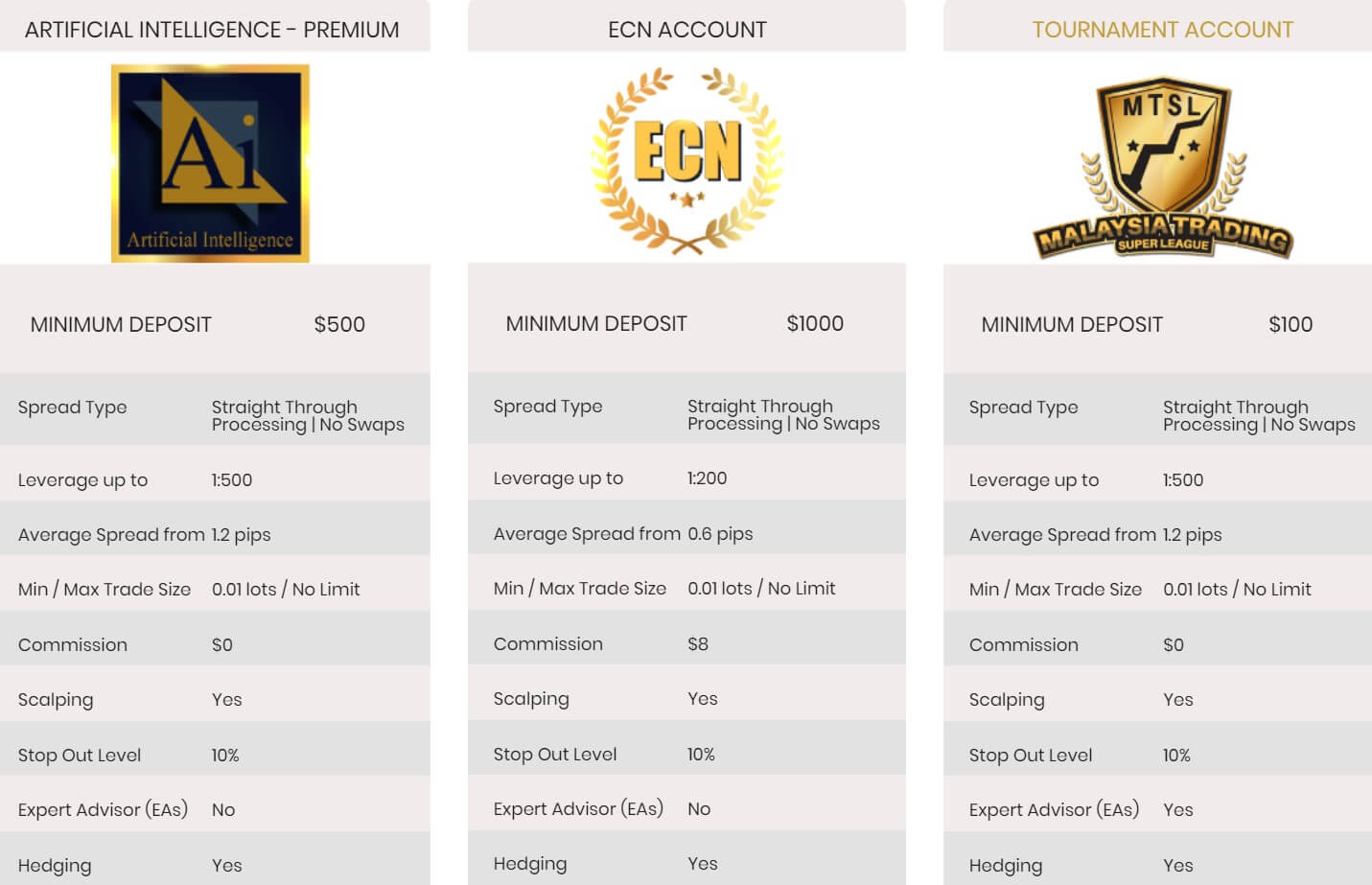

Should you decide to sign up, you will need to decide which of the five available accounts you will want to use, we have detailed them below for you.

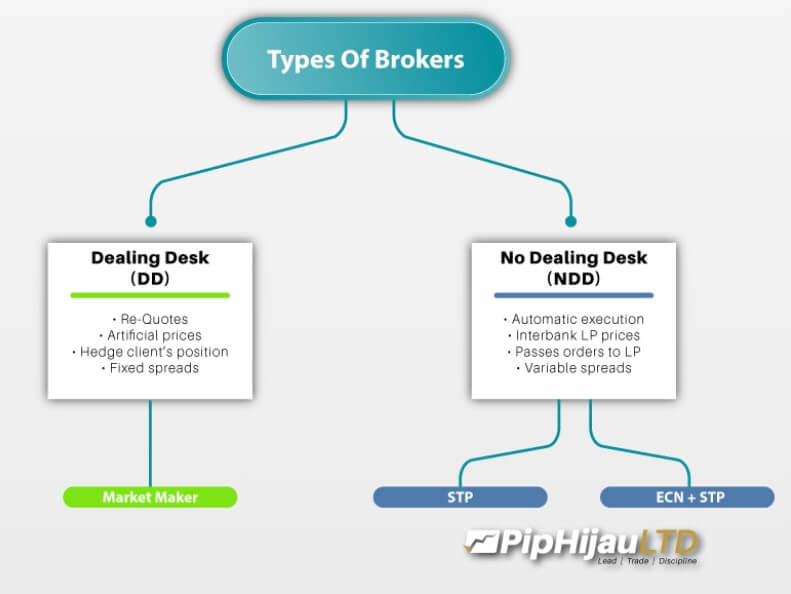

AI Premium Account: A minimum deposit of $500 is required to open this account, it uses straight-through processing (STP) and has leverage up to 1:500. There is a starting spread from 1.2 pips and a minimum trade size of 0.01 lots with no maximum. There is no added commission on this account and scalping and hedging are both allowed but the use of Expert Advisors is not. The stop out level for this account is set at 10%.

ECN Account: This account has a minimum deposit of $1,000 and it uses straight-through processing (STP) and has leverage up to 1:200. There is a starting spread from 0.6 pips and a minimum trade size of 0.01 lots with no maximum. There is an added commission on this account of $8 per lot traded and scalping and hedging are both allowed by the use of Expert Advisors is not. The stop out level for this account is set at 10%.

Tournament Account: A minimum deposit of $100 is required to open this account, it uses straight-through processing (STP) and has leverage up to 1:500. There is a starting spread from 1.2 pips and a minimum trade size of 0.01 lots with no maximum. There is no added commission on this account and scalping and hedging are both allowed and the use of Expert Advisors is also allowed. The stop out level for this account is set at 10%.

Standard Account: This account requires a deposit of $50 and it uses straight-through processing (STP) and has leverage up to 1:300. There is a starting spread from 1.2 pips and a minimum trade size of 0.01 lots with no maximum. There is no added commission on this account and scalping and hedging are both allowed and the use of Expert Advisors is also allowed. The stop out level for this account is set at 10%.

Micro Account: A minimum deposit of $10 is required to open this account, it uses a hybrid execution-style and can be leveraged up to 1:1000. There is a starting spread from 1.5 pips and a minimum trade size of 0.01 lots with a maximum of 100 lots. There is no added commission on this account and scalping and hedging are both allowed but the use of Expert Advisors is not. The stop out level for this account is set at 34%.

Platforms

PipHijau offers MetaTrader 4 as a trading platform, normally just having one platform can limit choice e but the fact that it is MT4 is nothing to be disappointed about. A few of the many features it offers to include it being user-friendly, secure, offering multiple languages, automated trading, flexible, fast and responsive, offers advanced charting capabilities and is completely customizable. It is also highly accessing as it can be used as a desktop download, a mobile application or as a web trader on your internet browser.

PipHijau offers MetaTrader 4 as a trading platform, normally just having one platform can limit choice e but the fact that it is MT4 is nothing to be disappointed about. A few of the many features it offers to include it being user-friendly, secure, offering multiple languages, automated trading, flexible, fast and responsive, offers advanced charting capabilities and is completely customizable. It is also highly accessing as it can be used as a desktop download, a mobile application or as a web trader on your internet browser.

Leverage

The maximum leverage available depends on the account you are using, we have outlined the differences below.

AI Premium Account: 1:500

AI Premium Account: 1:500- ECN Account: 1:200

- Tournament Account: 1:500

- Standard account: 1:300

- Micro Account: 1:1000

The leverage on the accounts can be selected when the first opening one and should you want to change it, you will need to log into your account and can change it from there.

Trade Sizes

Trade sizes on all accounts start from 0.01 lots which are known as a micro lot and the trades then go up in increments of 0.01 lots. All accounts shave no maximum trade size apart from the Mico account that has a maximum trade size requirement of 10 lots. It is not known what the maximum number of open trades you can have at any one time.

Trading Costs

There is only one account with any added commissions and that is the ECN account, there is an added commission of $8 per lot traded which is just a little higher than the industry average of $6 per lot traded. All the other accounts use a spread based system that we will look at later in this review.

Assets

It is unfortunate that there are no breakdowns or product specifications available, this means that we do not have any product specifics in relation to spreads or an exact list of available instruments, many potential clients look to see what assets are available as many have their favorite instruments they like to trade, not knowing if they are available could make them look elsewhere.

Spreads

The average spreads vary from account to account and we have outlined the stated figures below:

AI Premium Account: 1.2 pips

AI Premium Account: 1.2 pips- ECN Account: 0.6 pips

- Tournament Account: 1.2 pips

- Standard account: 1.2 pips

- Micro Account: 1.5 pips

The spreads are variable which means they move about when there is added volatility they are seen higher, different instruments will also have different average spreads.

Minimum Deposit

The minimum amount required to open up an account is $10 which gets you the Micro account, if you want a normal style account then you will need to deposit at least $50 for the Standard account.

Deposit Methods & Costs

We had to go into the FAQ of the site to find any information on deposits, the only methods mentioned are Credit Card (Visa and MasterCard) and electronic payment methods (FPX), they do not go into any more detail in the FAQ. There are no added fees from PipHijau but you should be sure to contact your own bank or processor to see if they add any transfer fees of their own.

Withdrawal Methods & Costs

There isn’t any specific information about withdrawal methods but we will expect the same ones to be used, for clarification these are Credit Card (Visa and MasterCard) and electronic payment methods (FPX). Just like with deposits there are no added fees and PipHijau will cover any transfer fees, however, if a withdrawal is under $200, PipHijau will not cover the transfer fees for you.

Withdrawal Processing & Wait Time

Withdrawal requests will be processed by PipHijau within 24 hours, it will then take between1 to 5 working days to fully process depending on the method used.

Bonuses & Promotions

Bonuses & Promotions

Rather than a bonus, there is a trading tournament, however, it ended n 2019 so it does not seem like there are any active tournaments at the time of writing this review. If you are interested in them, we would recommend contacting the customer service team to see if there are any new ones starting soon that you can take part in.

Educational & Trading Tools

The education section contains a few different aspects, the first is a training center which is a physical location that you would need to go to and is located in Malaysia, so unless you live there it won’t be of much use to you. They have included a photo gallery but that isn’t going to teach us much, there are seminars, but again these are located in Malaysia and finally, there is a blog that details different things about the company. If you want any proper online education you will need to look elsewhere.

Customer Service

The customer service team is available for support Monday to Friday between 9 am and 12 pm. There is a limited number of ways of contacting them, in fact, the main one is an online submission form, fill it in and you should get a reply via email, you can also use the postal address should you prefer that method.

Address: 113-1, Jalan Seria Gemilang, u13/BG, Setia Alam, 40170, Selangor D.E.

Demo Account

We didn’t notice demo account being mentioned so we are not sure if they are in fact available or not, demo accounts allow clients to test out strategies without risking their own capital and also allows a potential new client to test out the trading conditions.

Countries Accepted

Information on which countries are eligible and which are not is not stated on the site, so if you are interested in joining PipHijau, we would recommend contacting the customer service team prior to signing up to ensure you are eligible for an account.

Conclusion

There are lots of options from PipHijau when it comes to account but not a whole lot of difference between them. Just MetaTrader 4 as a trading platform which is not an entirely bad thing. There wasn’t a product specification or breakdown of tradable assets which means that some people may not be able to find the instruments they need and look elsewhere. PipHijau seems to be more aimed towards people who live in Malaysia as all of their education is physical-based and situated there, so if you are from Malaysia they may be a good broker to use, but if you are not, we would suggest looking elsewhere.