The increased acceptance of Cryptocurrencies is a boon for the financial sector. It promises to improve the inefficiencies of the mainstream financial systems. Again, their adoption expands access to services. Furthermore, it creates a unique investment opportunity.

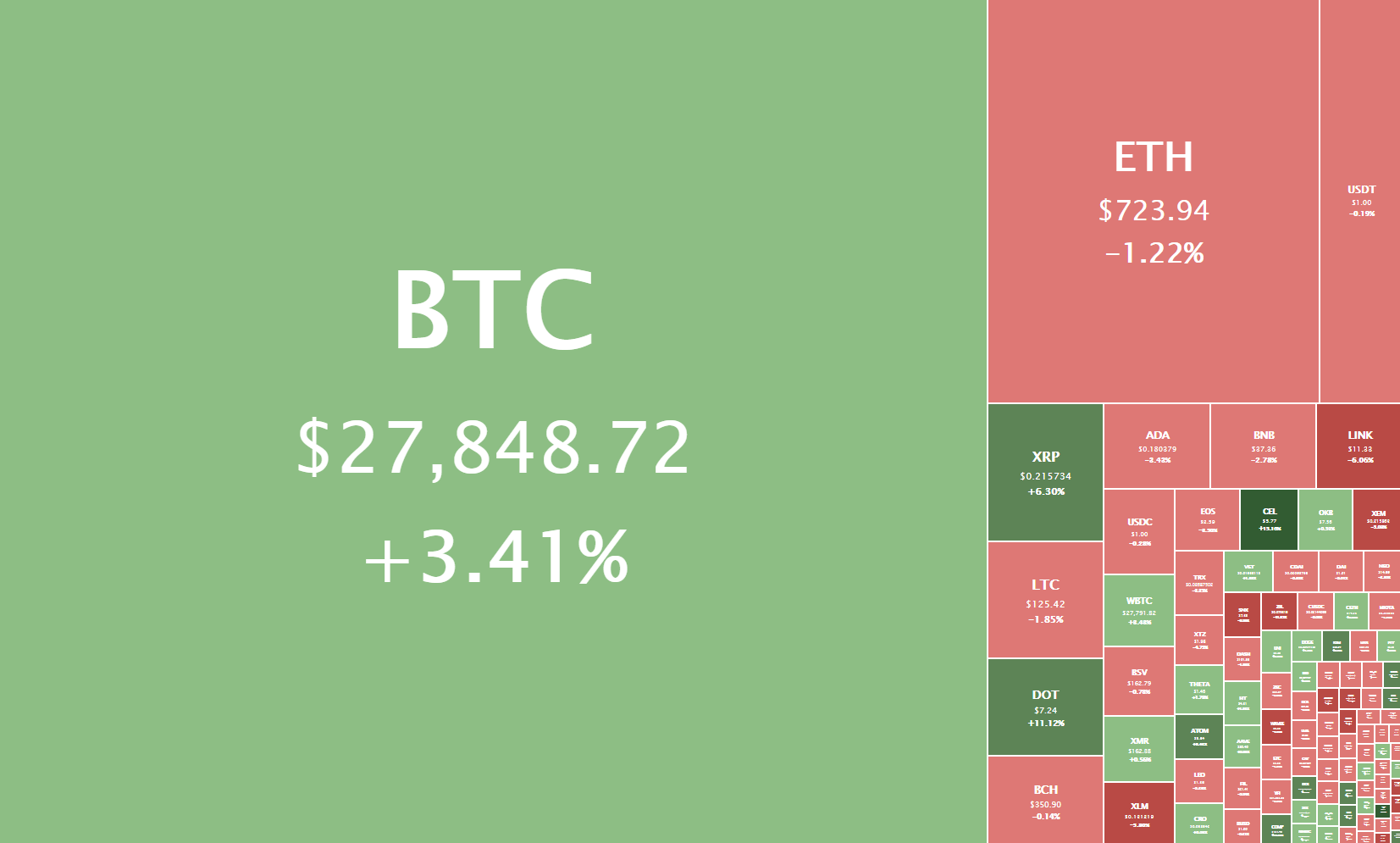

Their proliferation, however, is a nightmare to any would-be investor. According to CoinMarketCap, the total number of cryptos stood at 6,955 as of September 2020. Coupled with the fact that the crypto market never sleeps, this makes investments in the space daunting. We need solutions to deal with these challenges better. Here’s where trading bots come in.

Crypto trading bots are software apps that automate trade in cryptos. They scour the market for the optimal buy and sell values aiming to earn the user a profit. The volatility characterizing the cryptos market makes them all the more important. In this article, we look at them, factors to consider when selecting one, and finally, the outstanding bots going into 2021.

The case for Crypto Trading Bots

Crypto bots are essential in organizing one’s trades. Currently, the market is experiencing increased usage. Several factors explain this shift, and here we present the key ones.

i) Bots Eliminate the Human Element in Transactions

Left unchecked, emotions cloud the trader’s judgment. High-risk investments like cryptos require objectivity. Bots make transaction decisions based on rational analysis and interpretation of the market. This way, they eliminate impulsive and speculative trading that could imperil one’s investments

ii) Theirs is A Round The Clock Operation

The cryptocurrency space never sleeps. Again it is volatile. A momentary lapse and one could miss out on opportunities. Alternatively, they could incur losses. Here’s where trading bots come in handy. Their actions are automated. As such, they capture every shift in the market as it happens. This way, they save the trader the need to stay awake to track the market physically. Once configured, they automate transactions even when the trade is unavailable.

iii) They are Better at Multitasking

The crypto market is a maze. There are millions of transactions taking place in any instance. Physically tracking these is demanding even to the seasoned trader. Not so for the bots. They simultaneously track changes across multiple cryptos and exchanges. Thus they’re better at picking the best trades than us humans.

iv) Bots Streamline Transactions

For one to trade profitably, speed is essential. The market could quickly gain as it could fall. Unlike us, Bots execute transactions in a flash. Thus they enable timely settlements. Their use could make the difference between profit and loss.

Which Factors do You Consider When Selecting a Trading Bot?

Bots flood the crypto market. Each of these claims to be the real deal. Separating the quality product from the rest could be challenging. The following pointers will help you ease that decision:

- Reliability- quality bots guarantee round the clock function.

- Security- a good bot is robust and able to withstand attacks.

- User experience- it should be easy to understand and use.

- Affordability- a good bot offers efficiency at a fair rate.

- Profitability- Quality bots enable users to achieve consistent profits.

Which are The Best Crypto Trading Bots Going into 2021?

Each crypto trading bot is unique. Moreover, no single bot is perfect. Selecting one boils down to individual preferences and how they fit into one’s trading strategy. Here are our best five picks moving forward. It is a random list, not an indicator of some particular ranking.

1. CryptoHopper

It is easy to use a semi-automated bot seeking to simplify crypto trading. It fashions itself as a tool that makes crypto traders maximize profits while reducing losses. Its key features include:

Social Trading

Through telegram trading, experienced analysts ( signalers) share insight on rising coins with other traders. Users may subscribe directly to these signalers. Moreover, they may automatically respond with a buy or sell order when it comes in.

It’s Cloud-Based

The service is entirely cloud-based. Therefore one can trade 24/7. One can log in anytime from any device.

Enables Exchange and Market Arbitrage

The arbitrage tool enables the user to benefit from the price differences between exchanges or crypto pairs. On enabling the bot, it searches for arbitrage opportunities. Besides, you don’t need to withdraw your funds from one exchange for another.

Market-Making

Through the market making bot, one can easily make markets and trade on the spread.

Strategy Designer

The strategy designer helps a user to develop a strategy enabling them to get the best trading signals. One can harness many indicators and candle patterns, including RSI, EMA, Parabolic Sar, CCI, Hammer, Hanged Man, and many more. Your Hopper will scan the markets 24/7 searching for opportunities for you.

- Backtesting/Paper Trading

- Mirror Trading

- Trailing Stop Tool

2. 3Commas

Incepted in 2017, 3commas is a popular crypto trading platform offering bot development functions. Its easy usage makes it ideal for users of all levels of technical ability. Its key features include:

SmartTrade

This feature allows trading across several exchanges from a single window. Smart trade allows you the following functionalities:

- Trailing order- enables you to adjust Take Profit and Stop Loss parameters automatically

- Smart Cover- allows one to sell and buy back their coins

- Short orders

Wide Exchange Integration

3commas supports up to 13 different exchanges. This makes it convenient to trade over multiple platforms.

Portfolio Management

Through this feature, one tracks their investment. The user may:

- Create their coin portfolio(s)

- View portfolios of other 3commas users

- Adopt other users’ portfolios to their needs

- Balance their coin ratios

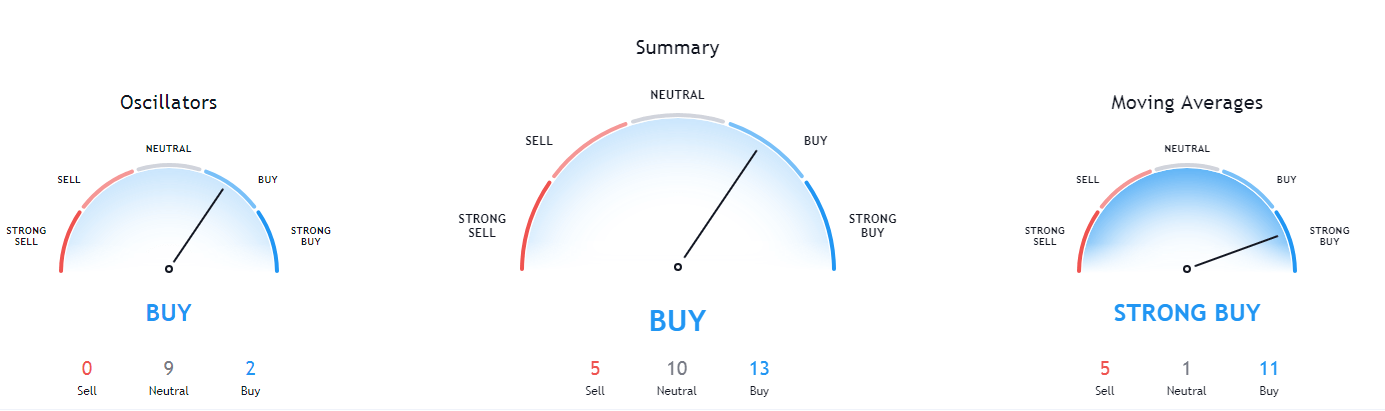

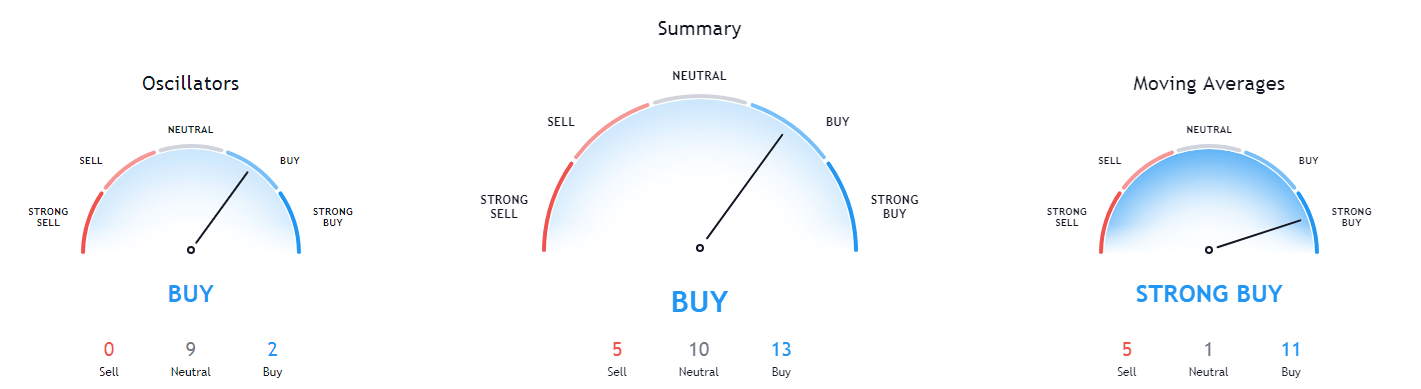

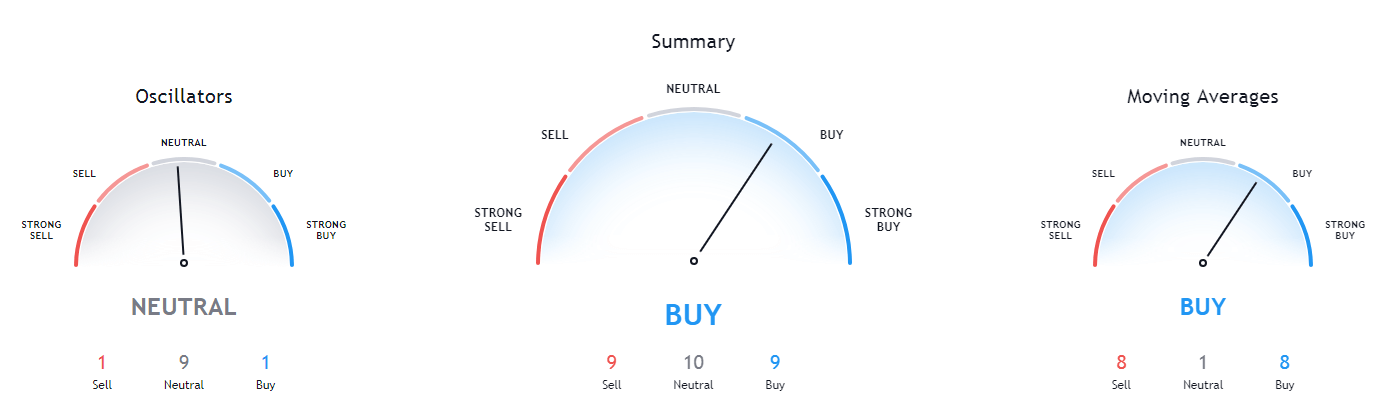

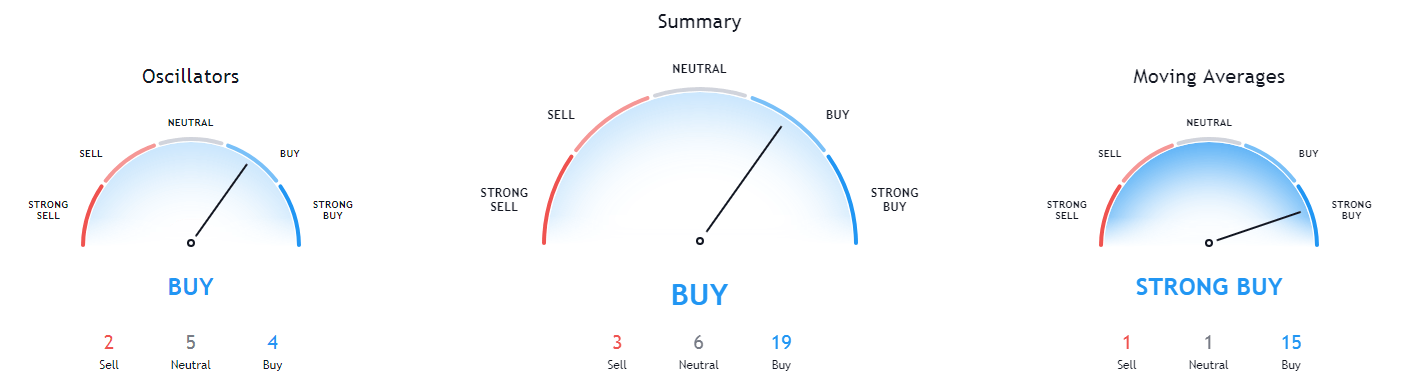

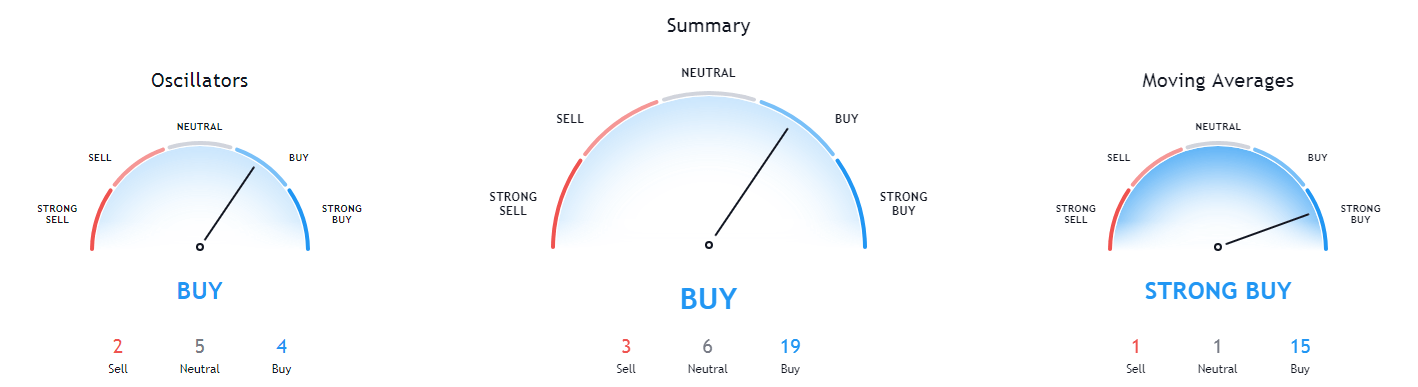

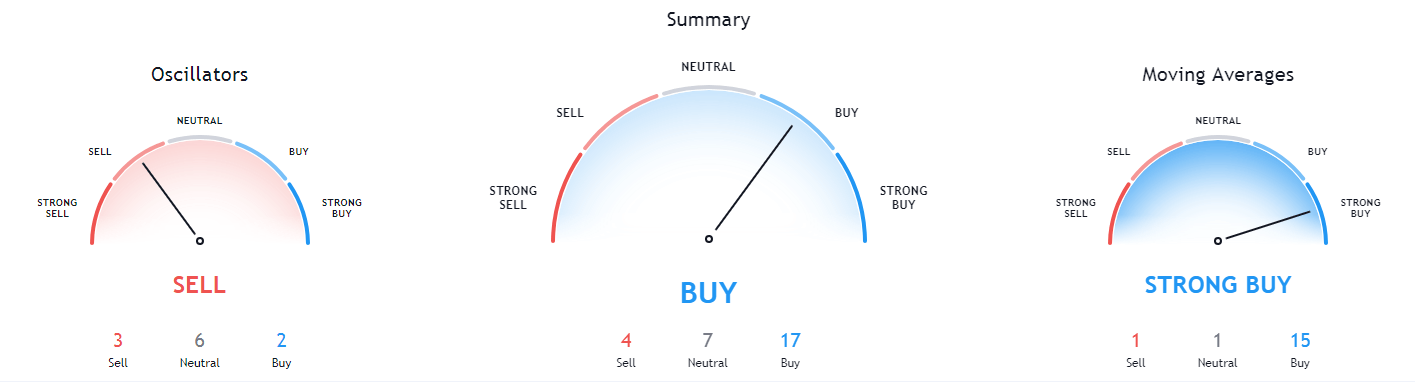

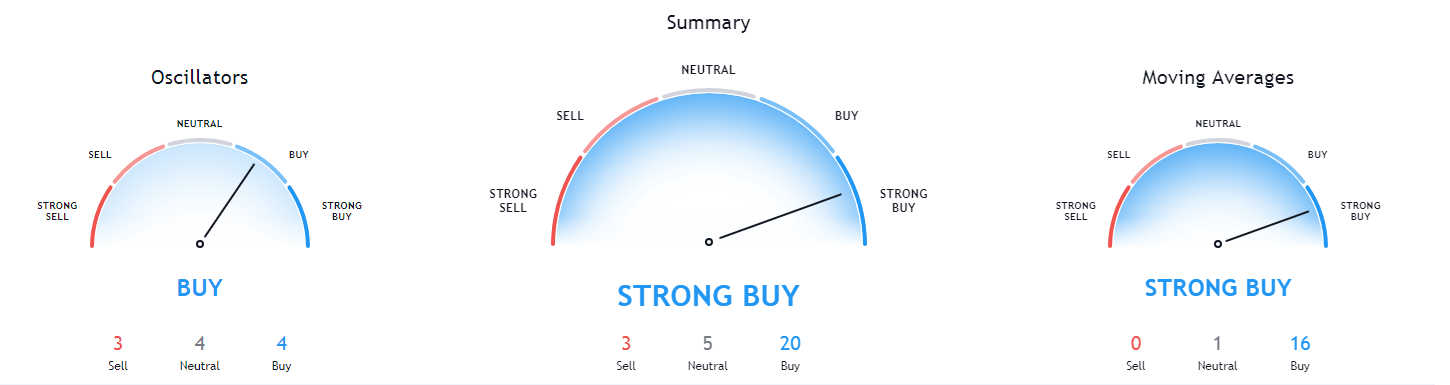

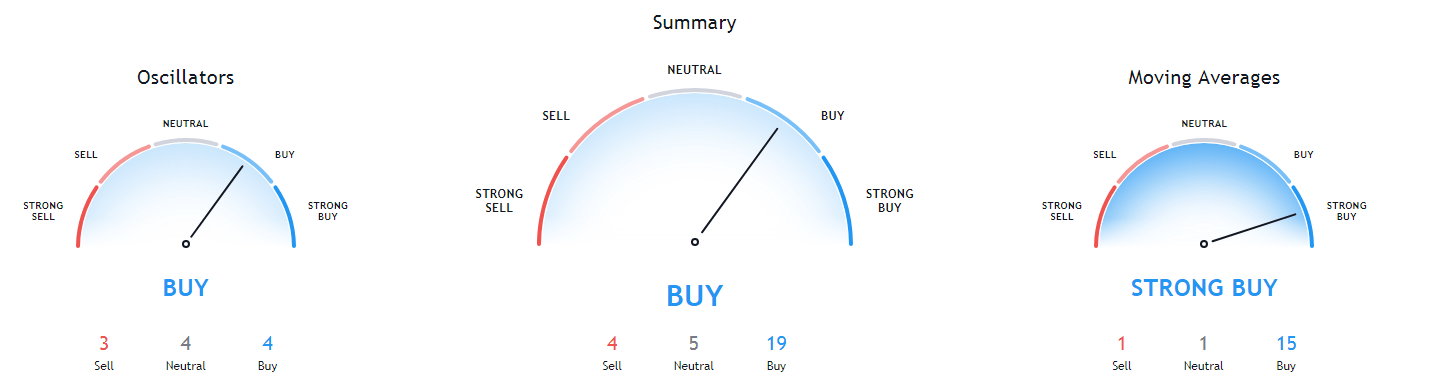

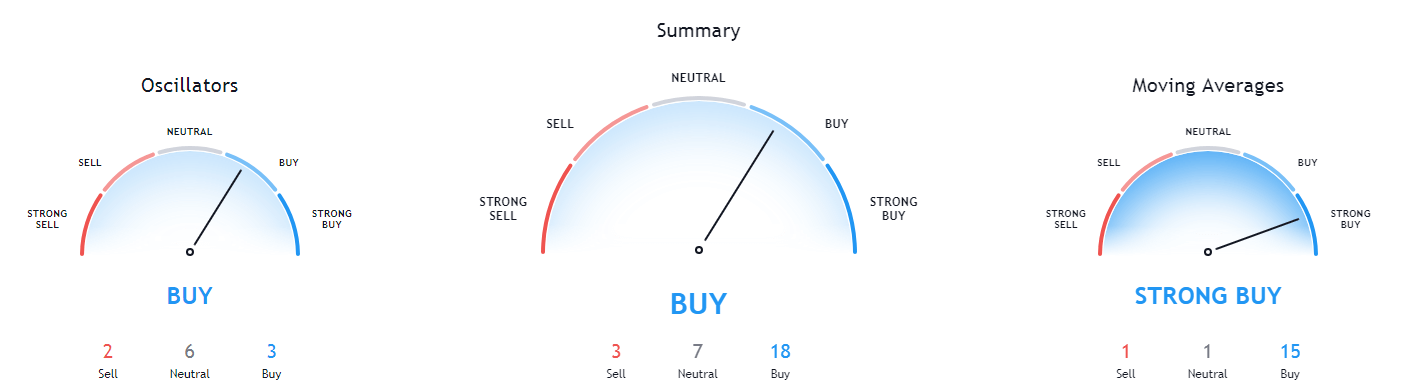

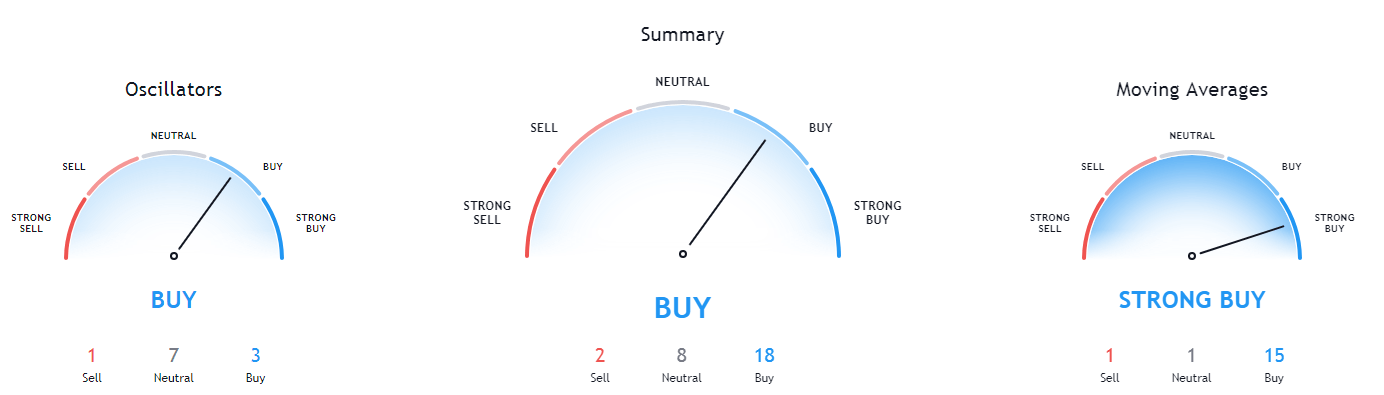

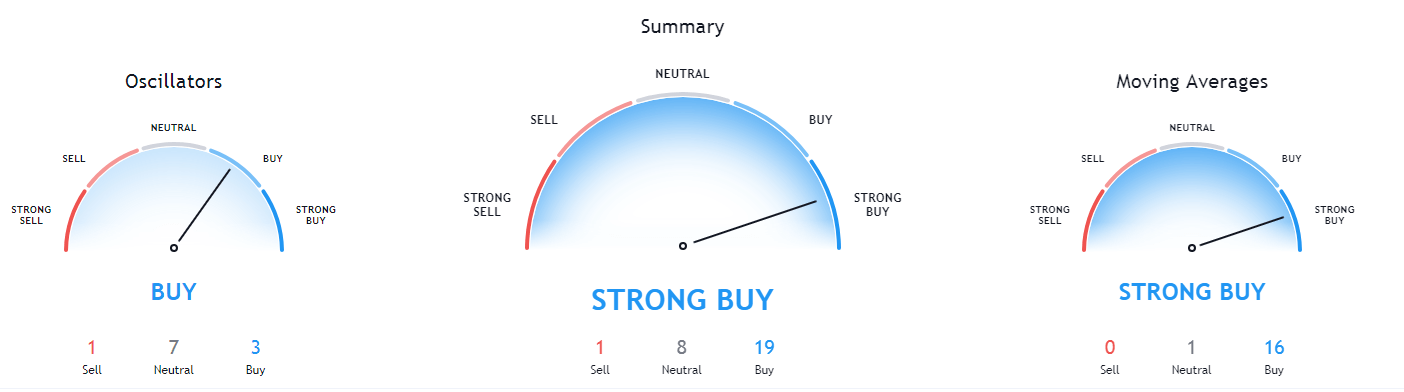

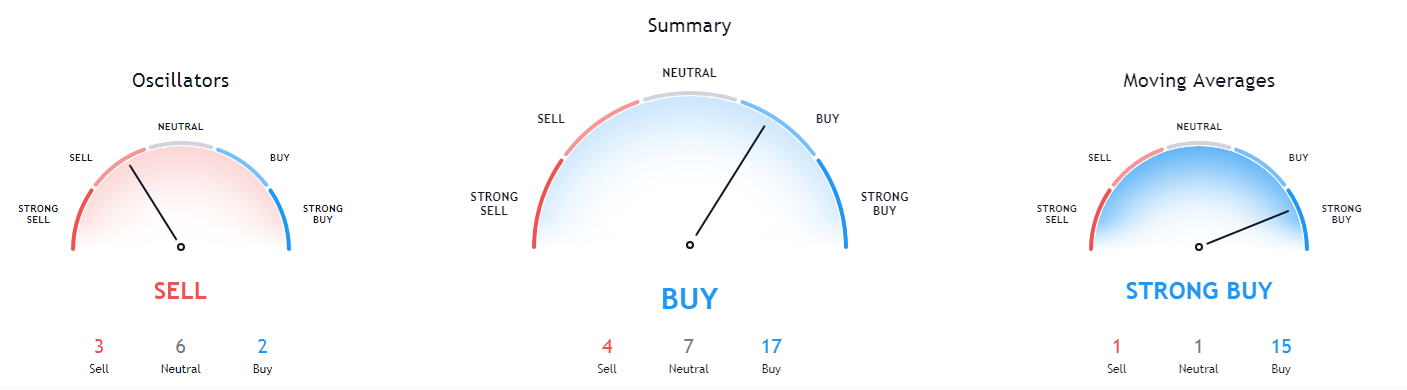

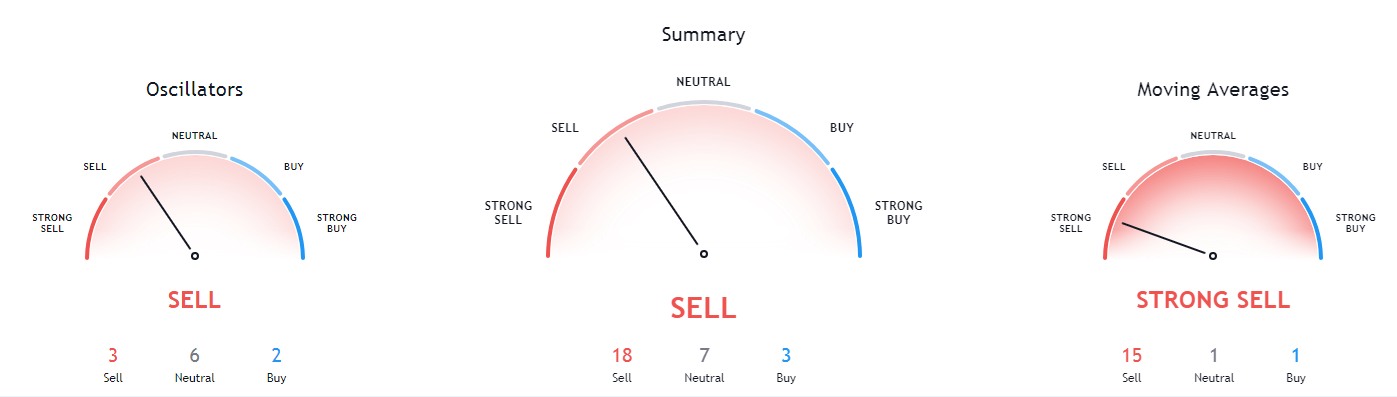

TradingView Signals

The TradingView signal finder allows instant tracking of the market. The signal finder issues four order types, namely:

- Buy

- Strong buy

- Sell

- Strong sell

Backtest

Users can simulate trading before executing actual trades. This way, they get to test their trading strategies and get a feel of the platform’s features.

3. Shrimpy

Shrimpy describes itself as the social trading platform for cryptocurrencies. It takes pride in simplifying portfolio management. Among its key features are:

Portfolio Management

Shrimpy enables you to connect all of your crypto exchanges and automate transactions. It helps you build a portfolio strategy. Also, through it, one can monitor the market. Its management tools automate portfolio allocations and rebalancing.

Social Trading

The platform has bet big on its community. Users have a forum for exchanging ideas and strategies. Again they get to educate each other on matters crypto. As a result, they increase their mastery of the sector.

Copy Trading

Shrimpy allows one to follow other investors on the platform. This way, they can model their investments on the leaders’. Copying the strategies of successful traders helps improve one’s profitability.

Robust Security

The platform boasts of robust security features. Each uses FIPS 140-2 security modules to encrypt all the API keys. Additionally, the platform only reads data for trading purposes. Therefore it’s unable to withdraw one’s funds. It also supports two-factor authentication.

Social Leader Reward

Through the social trading platform, Shrimpy creates leaderboards. Users earn $4 for every new follower they gain every month.

Shrimpy Universal Exchange API

Shrimpy offers its users an industry-leading API that facilitates crypto transactions, the instantaneous collection of data, and the management of exchanges.

4. Gunbot

Gunbot is an advanced bot allowing easy transaction of cryptos. After the user identifies a trading strategy, the bot automates it. Its popularity draws from the following features:

Multi-Platform Support

The software is compatible with different platforms. It runs on Windows, macOS, Linux, and ARM devices.

Multi Exchange Support

Gunbot supports the most popular exchanges. Additionally, the platform continues to support new exchanges. Further, it supports lesser-known spot exchanges through the CCXT library.

Strategy Presets for Beginners

For the uninitiated, trading can prove arduous. Gunbot eases things for the newbies. Its strategy presets allow them to trade easily as they learn the ropes.

Wide Variety Of Trading Options

Gunbot users can buy and sell in 14 different ways. You can use all these methods within a customized strategy. Also, one may employ a set of confirming indicators to specify the trading conditions they want to allow. Including a stop-limit reduces one’s risk exposure.

Dollar-Cost Averaging(DCA)

Gunbot uses the double up method to average down assets automatically. The morbid allows one to reach a lower average price per unit as prices decline. Thus it enables exit at the lowest profitable price. Through DCA, one can set up the following options:

- Trigger for DCA orders

- The minimum price difference between buy orders while in DCA

- Frequency of placing DCA orders

- The ratio of volume purchased via DCA orders to the amount of quote units already owned.

Reversal Trading

Gunbot can automatically accumulate quote currency when prices go down. It does so without investing more than the initial buy order. This way, it helps bring down the break-even point.

Telegram Integration

Through telegram, one gets to interact with their bot. This feature enables:

- Profit tracking- get profit/loss statistics for every trading pair.

- Modify settings- change settings on the go, such as enabling or disabling pairs.

- Get notifications on trades.

- Monitor trades.

Final Thoughts

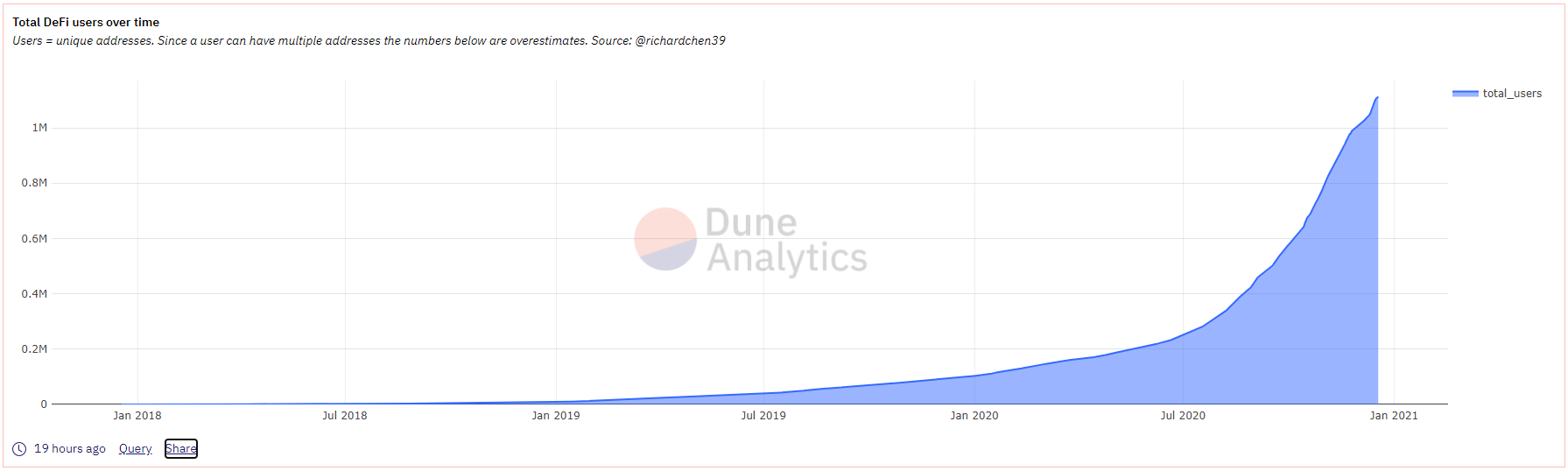

The crypto space is disruptive. Our continuing acceptance of cryptos is reshaping the financial landscape. Thanks to them, there’s the possibility of increasing financial access. Additionally, we can look forward to enhanced efficiencies and the opening up of investment opportunities.

As crypto markets are volatile and complex to navigate, we require better analyzing and strategizing tools. Crypto trading bots make this possible. They take the chore out of transactions while seeking profit for the investor.

In a market bursting with them, one should exercise caution in their choice. This article outlines the key factors to consider when picking one over the other(s). It goes on to identify the best bots going into 2021. Though not exhaustive, this guide is a good starting point in your crypto bot choosing journey.

Appearing on episode 439 of the Anthony Pompliano’s Pomp

Appearing on episode 439 of the Anthony Pompliano’s Pomp

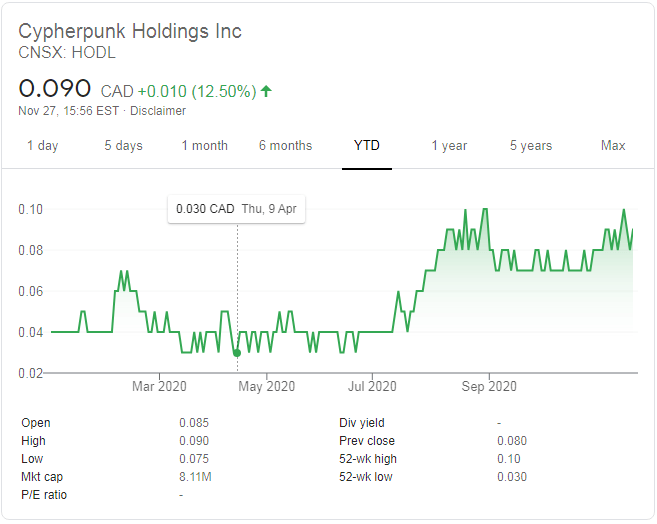

Cypherpunk Holdings is run by Antanas Guoga, also known as Tony G, a Lithuanian businessman, politician, and former professional-level poker player. He currently serves as an elected member of the Seimas, a legislative branch of the Lithuanian government. Prior to this, he served as a member of the European Parliament for Lithuania.

Cypherpunk Holdings is run by Antanas Guoga, also known as Tony G, a Lithuanian businessman, politician, and former professional-level poker player. He currently serves as an elected member of the Seimas, a legislative branch of the Lithuanian government. Prior to this, he served as a member of the European Parliament for Lithuania.