Fusion is one of those cryptocurrencies that came not just as another currency but as a platform for innovation. Although it is an open technology that can be used in various applications, this crypto is best known for powering decentralized finance (DeFi). Like Ethereum and Ripple, which are both currencies and innovation platforms, Fusion also offers FSN, its native currency.

Fusion is currently among the least valued crypto in market capitalization and trading volume, but this is likely to change. If innovations on the platform pick up the pace, Fusion will soon be trading in the big league of major cryptocurrencies.

In this article, we review this underrated crypto and explain why, as an investor, you should keep an eye on Fusion.

Fusion is Driving the DeFi Revolution

As already mentioned, Fusion’s niche is in the financial technology innovation space. The crypto seeks to achieve this through:

#1: Enriching digital assets – Businesses can use Fusion to create bonds, futures, and other financial instruments with the end goal of separating asset ownership and rights. This is the kind of innovation that traditional finance needs.

#2: Creating digital exchanges – Fusion provides tools that businesses can use to create any kind of exchange – decentralized, centralized, private, and any other whose need might come up. Using Fusion’s digital exchange tools, low-cost transactions become an even closer reality.

#3: Managing licenses and royalties – Fusion provides businesses with a platform they can use to issue time-bound licenses and collect royalties for intellectual property while circumventing the traditional challenges associated with these processes.

These are only a few use cases that show Fusion is a crypto with real utility. And as you might know, utility is what gives crypto the potential for growth. With this knowledge, there is no denying that this cryptocurrency has a bright future.

While these proposed use cases only show that Fusion has the potential for exponential growth, there are more compelling reasons why you should think the crypto is set to rise. Let’s dig deeper.

Why Fusion Will Rise

We have already seen that Fusion is a crypto with real utility. Solely based on this information, speculators can bet their dollars on the crypto’s future success. But would its financial and technological outlook pass the scrutiny of analysts? Let’s analyze this together.

#1: Fusion is still undervalued – The crypto entered the scene in February 2018 at $3.60 and rallied within three months to reach $9 with a market capitalization of over USD 270 million. The market corrected months later, and the prices went below the $1 mark, where they have stagnated ever since.

At the time of writing, Fusion ranks at position 453 by market capitalization. Given that Fusion is a solid project, this position does not reflect the cryptocurrency’s true potential. It rose in the past; it will rise again.

#2: Fusion’s WeDeFi project is gaining momentum – WeDeFi is a DeFi project whose goal is to promote DeFi’s mass adoption. It sounds similar to some of Ethereum’s DeFi projects, but its bull’s-eye focus on mass adoption gives it an edge. Anyway, DeFi is already on the rise, and this makes Fusion even more promising.

#3: You can earn passively by staking – Fusion allows you to earn (at the time of writing) a 17% annual percentage yield (APY) by locking your funds on the network for at least 30 days. Unlike Bitcoin and other networks that rely on proof-of-work, Fusion uses proof-of-stake to verify transactions. According to the Staking Rewards website, Fusion ranks favorably, even higher than most of the top 30 cryptos. You don’t need expensive mining equipment or even the technical know-how – just delegating your savings to stake is enough to multiply your investment! Once investors learn this secret, Fusion’s stakes will increase.

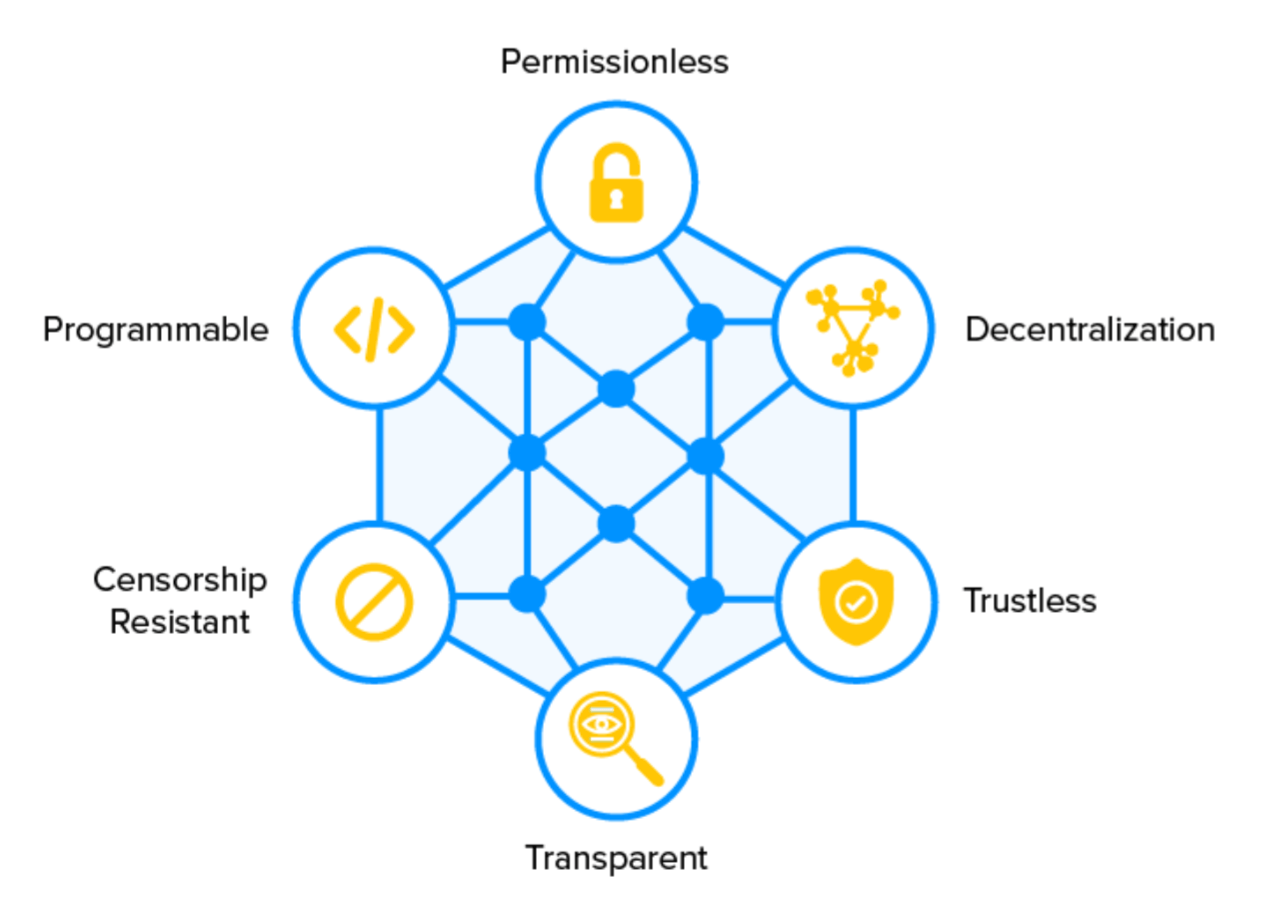

#4: Fusion supports smart contracts – There is an interesting feature called “Time Lock” that allows users to schedule transactions. It works like standing orders – a Fusion token holder can play around with their tokens on the network, but when the scheduled transaction is due, the tokens will be automatically transferred to their new owner. This feature will open up innovation on the network and spur its growth.

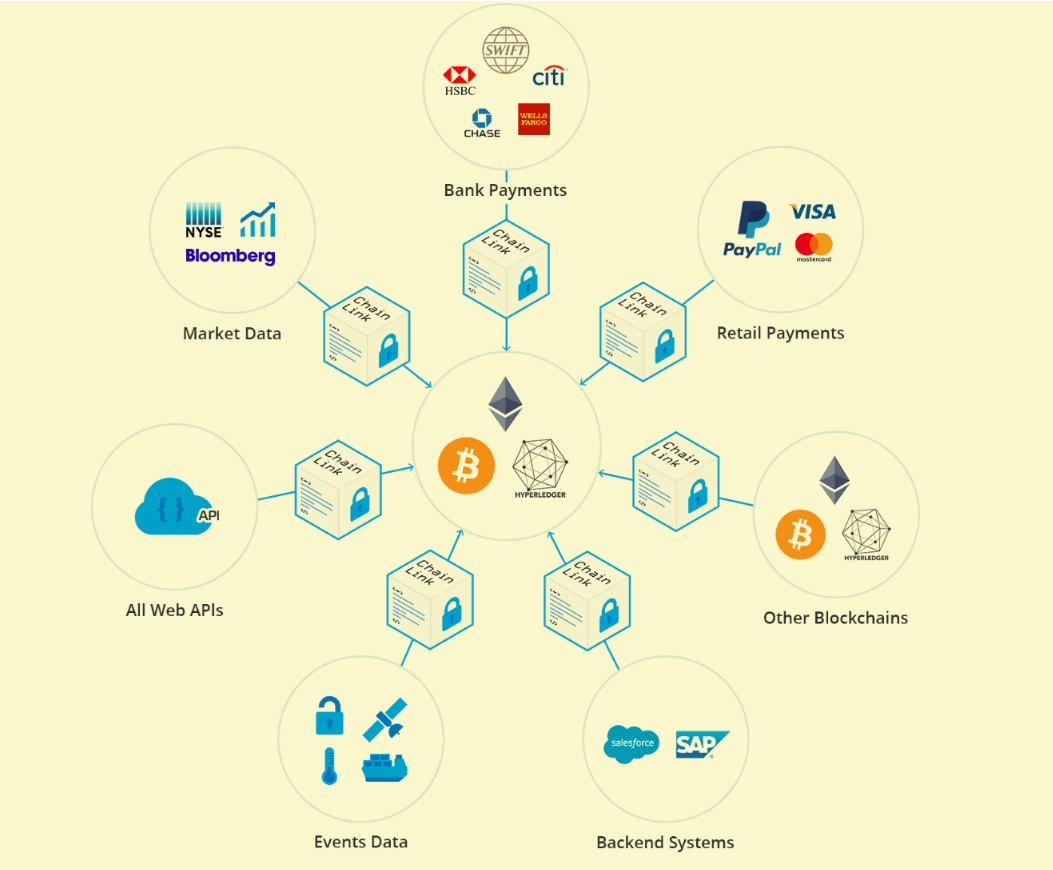

#5: Fusion will soon support cross-chain token swap – Fusion is the house of innovation, and this time, they want to make it even easier to exchange any crypto token with any other. Dubbed ‘Anyswap,’ this one-of-a-kind innovation will allow infinite crypto pair exchanges – fully secured with DCRM interoperability. Even Ethereum’s ERC-20 is not there yet. One can only imagine how attractive this innovation will be to investors.

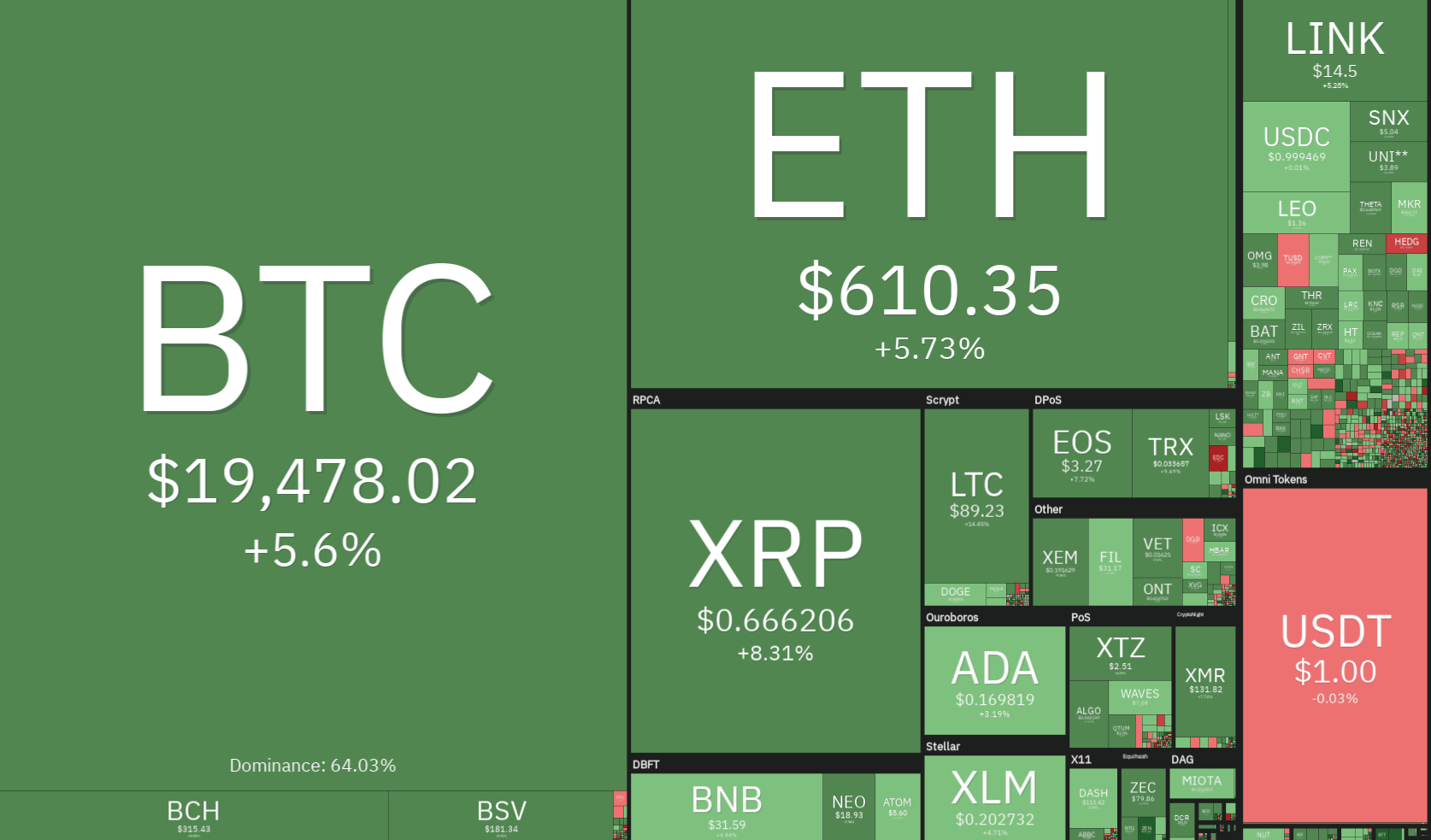

#6: Fusion has stable liquidity – Currently, many exchanges support FSN/BTC, FSN/ETH, and FSN/USDT pairs, quite impressive for a crypto that is not even on the top 400 list. Is this a sign of their faith in the imminent growth of the cryptocurrency?

We can go on and on unearthing the unique features that demonstrate that Fusion is poised for success. But, to clear all doubt, let’s take a look at the numbers – after all, numbers don’t lie.

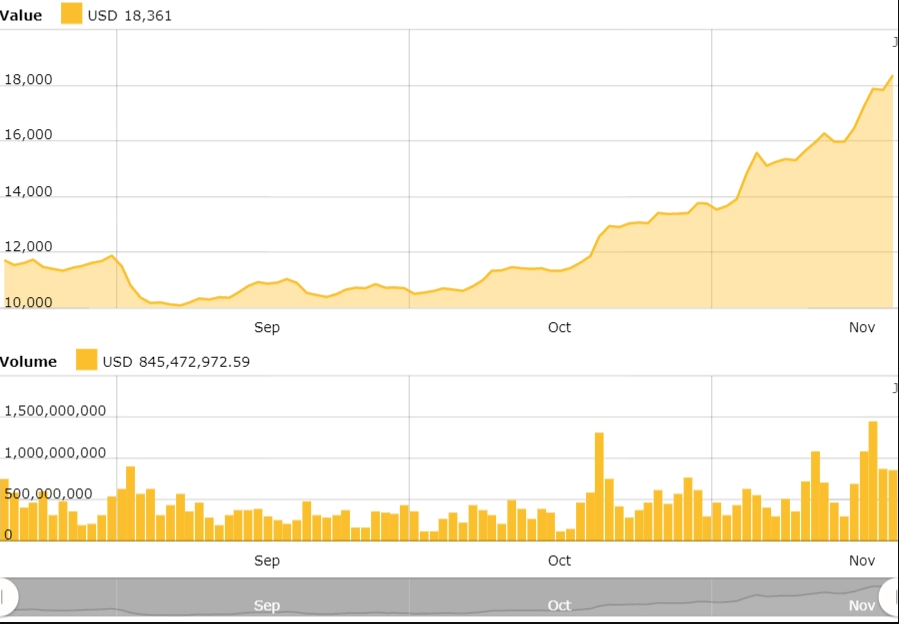

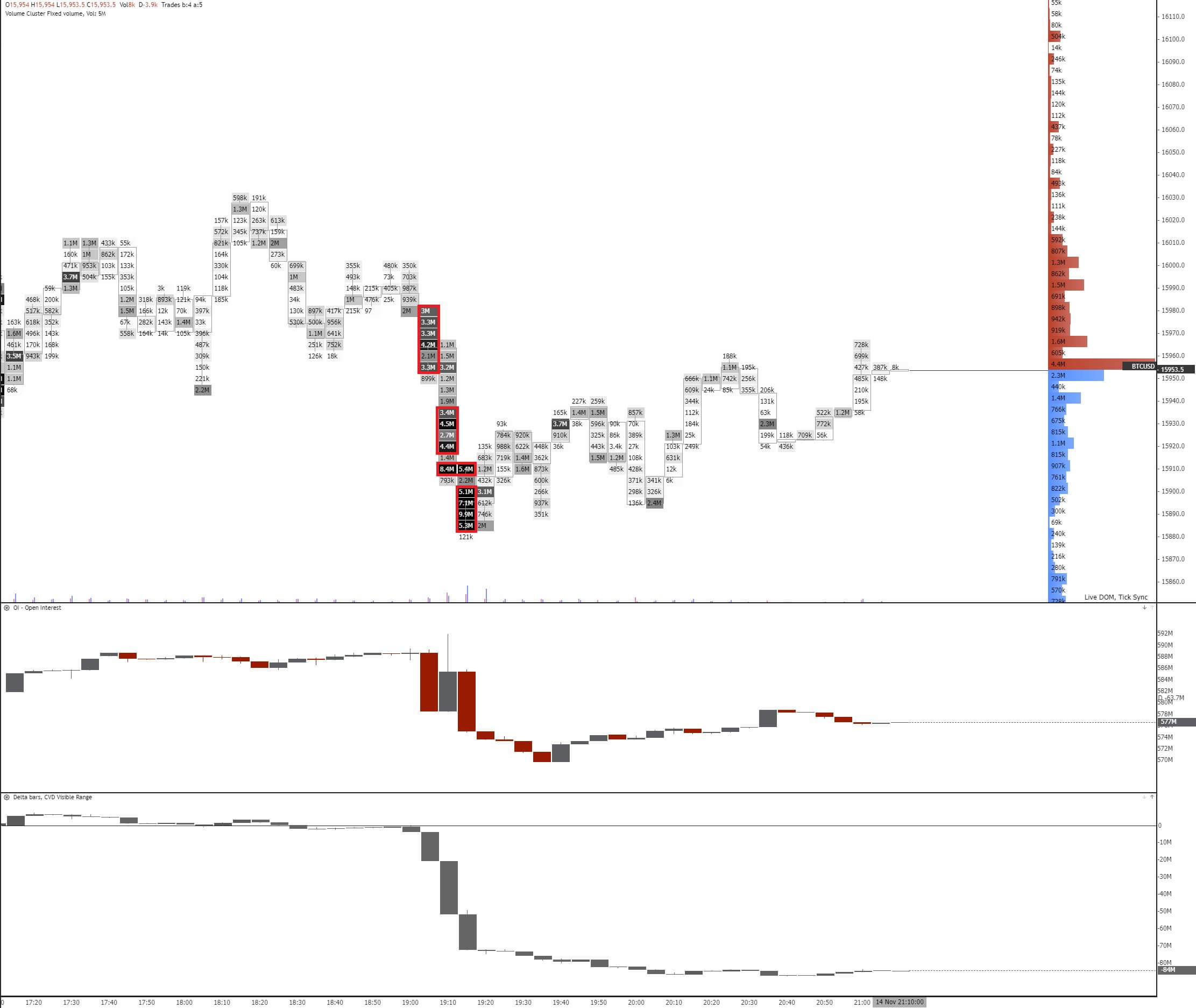

Fusion’s Financial Outlook

In the whole of 2020, Fusion has mostly traded below $0.50 and maintained its market cap roughly between 5 and 35 million dollars – a marginal variation by crypto market cap trends. One would say that the crypto is uneventful and perhaps lacks the volatility desired by investors. While there’s some truth in this school of thought, investors with a low-risk appetite and a long-term vision might find this relative stability desirable. In the long run, all indicators point to Fusion’s growth, and the coin’s historical stability means that investors can hope for more rallies than corrections.

Fusion’s 24-hour volume (at the time of writing) was roughly $2 million. This is the volume at a time when the coin was exchanging at $0.26. In contrast, its 24-hour volume was only $7 million when it was exchanging at more than $9. What we’re saying here is that the crypto’s trading volumes have yet to reach their potential explosive heights. When that happens (indicators say it shall come to pass), Fusion’s value will skyrocket, and investors will reap big.

Final Thoughts

Fusion is one of the most underrated cryptos, yet, it is among the most innovative with lots of potential. With solid utility, a good track record, and numerous innovations in the pipeline, this cryptocurrency is poised for success. Currently, it is marked by relatively low trading volumes, market cap, and exchange rates. However, on the brighter side, it can be exchanged for several common currencies – both crypto and fiat, which guarantees investors liquidity. As we have seen, there are many reasons to believe that the future of Fusion is promising.