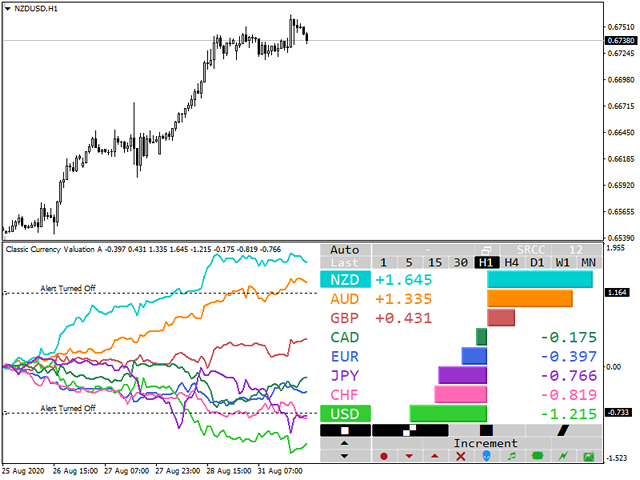

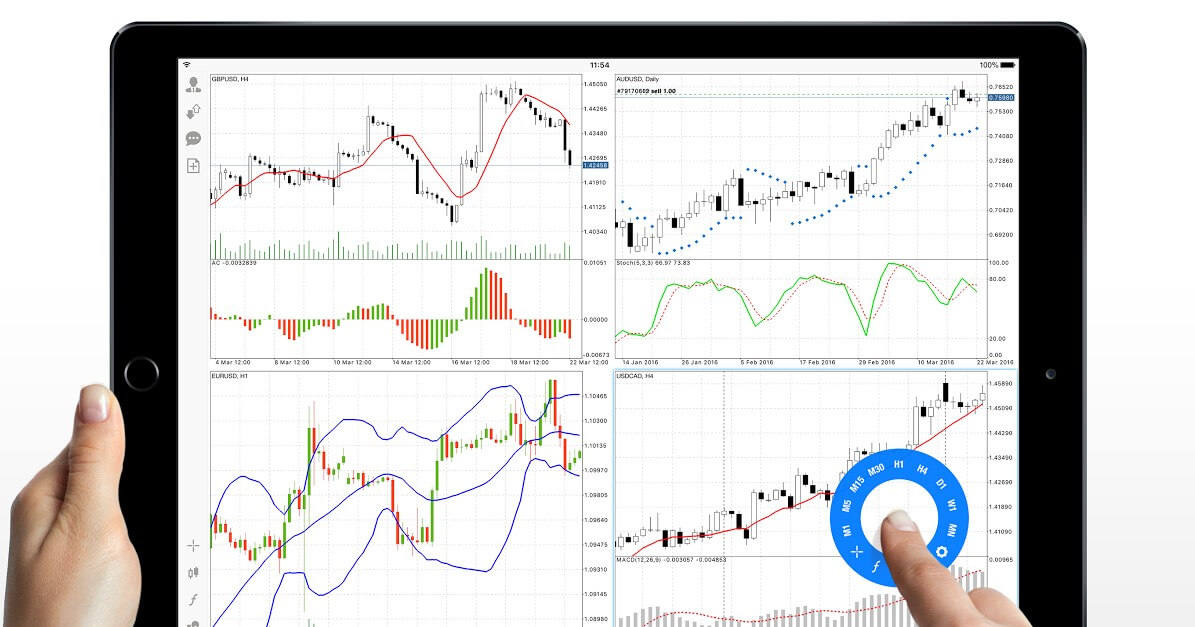

Igor Korepin is the creator of this indicator, created in June 2015, although with several later updates. The developer presents this indicator thought in monetary indices, and it can also analyze and control the market situation widely.

The indicator displays indices of eight major currencies and can also calculate indices of any other currency, metal, CFD, etc. You won’t need to study dozens of charts to determine strong and weak currencies, as well as their current dynamics. The picture of the entire currency market during any period can be seen in a single indicator window.

Main Features

It forms indices of eight major currencies, automatically determining the indices of the current instrument, as well as the best indices available at the moment. You can display only the required indexes in option and one of the indexes not included in the main group.

It allows you to quickly switch to any currency pair or open a chart of the desired instrument directly from the control panel. The indicator works both in standard mode with historical data and in real-time mode with tick data.

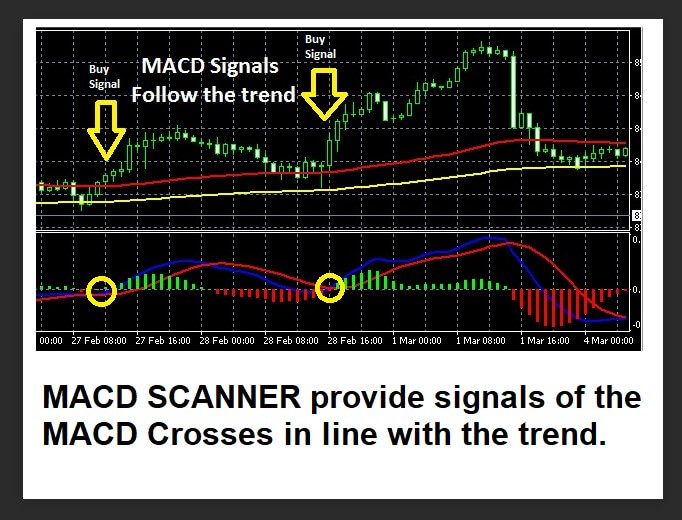

The reference point and the drawing depth are established using a vertical line available for movement. It has an integrated set of classic technical indicators – MA, MACD, CCI, RSI, Stochastic. The market situation is monitored through an integrated system of notifications.

The prefixes and postfixes of a symbol are determined automatically. It is possible to select a currency, whose index will be used as primary in the calculations. Graph of the correlation dependence between currencies in one click.

Advantages

-It is very easy to use – you do not need to prepare for the first use.

-Quick navigation – choosing the required currency pair or opening a new chart is easy.

-Exotic instruments – analyze the movements of metals, oil, and other raw materials.

-Real-Time Mode – The tick chart of all coins shows the best times to enter.

-The situation is under control – allow the notification system and never miss a strong movement in the market.

-Only seven currency pairs for calculations – the indicator is useful and easy to use.

In summary, we are looking at a handy indicator and suitable for every beginner trader. Please, ease of use and a very friendly interface. Users who have tried this indicator have been, for the most part, very satisfied with it, so we think it is an indicator to consider in our list of favorite indicators.

We have only found one thing against, it is not for sale, it is only available for rent at a price of 35 USD for a period of 3 months. You also have a demo version for your free trial.

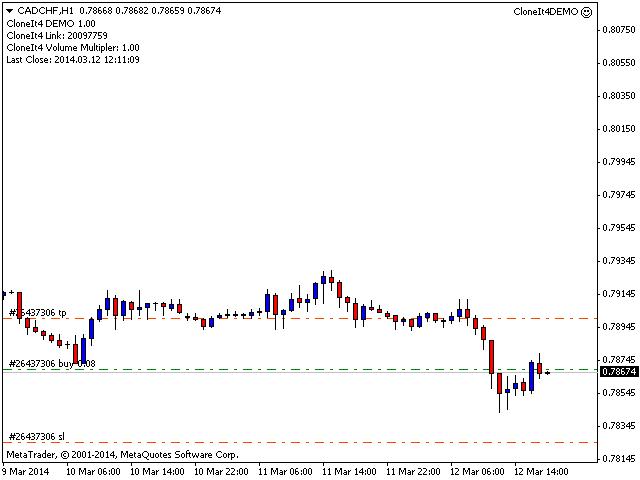

Xetera Multi TP Manager for FX is an Expert Advisor specially designed for Forex on the MetaTrader 4 platform to manage operations even while you are out or asleep. Many Forex signal services use multiple socket gain levels like TP1, TP2, and TP3.

Xetera Multi TP Manager for FX is an Expert Advisor specially designed for Forex on the MetaTrader 4 platform to manage operations even while you are out or asleep. Many Forex signal services use multiple socket gain levels like TP1, TP2, and TP3.

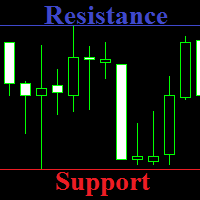

This indicator was designed to work either by itself or in combination with other indicators to provide better trading accuracy. The indicator works on the most popular trading platform MT4 and offers a special level of customization. Traders can choose support and resistance levels from Period 1 to Period infinity with any timeframe that is available. Traders can also manage the alert settings by turning the alarm on or off, or placing time limitations between alerts and setting a number of pips to be alerted at when the price is near the Support or Resistance line.

This indicator was designed to work either by itself or in combination with other indicators to provide better trading accuracy. The indicator works on the most popular trading platform MT4 and offers a special level of customization. Traders can choose support and resistance levels from Period 1 to Period infinity with any timeframe that is available. Traders can also manage the alert settings by turning the alarm on or off, or placing time limitations between alerts and setting a number of pips to be alerted at when the price is near the Support or Resistance line.

Mr Top Bottom is an indicator that was created in March 2019 by developer Mostafa Fouladi. Mr Top Bottom is a powerful no-paint indicator that draws arrows on Tops and Bottoms. It has too complicated calculations but is very simple to use. Each arrow has a specific impact value of 1 to 10. If the impact is greater it means that the signal is probably more reliable, because it is calculated on the basis of a larger oscillation.

Mr Top Bottom is an indicator that was created in March 2019 by developer Mostafa Fouladi. Mr Top Bottom is a powerful no-paint indicator that draws arrows on Tops and Bottoms. It has too complicated calculations but is very simple to use. Each arrow has a specific impact value of 1 to 10. If the impact is greater it means that the signal is probably more reliable, because it is calculated on the basis of a larger oscillation.

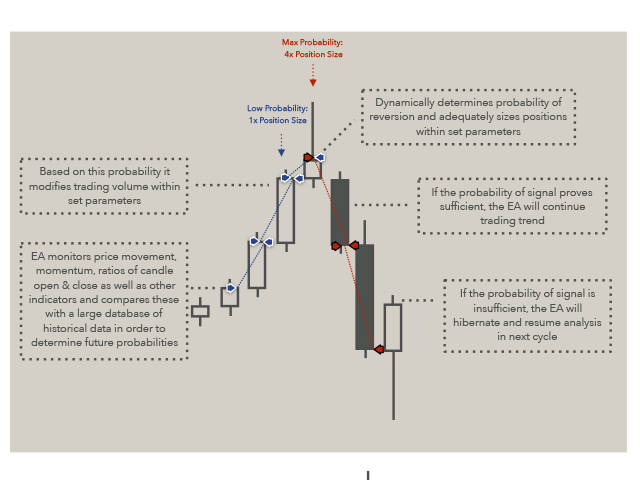

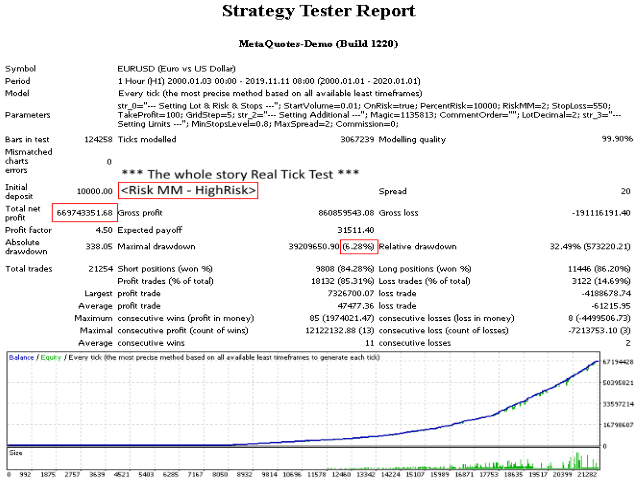

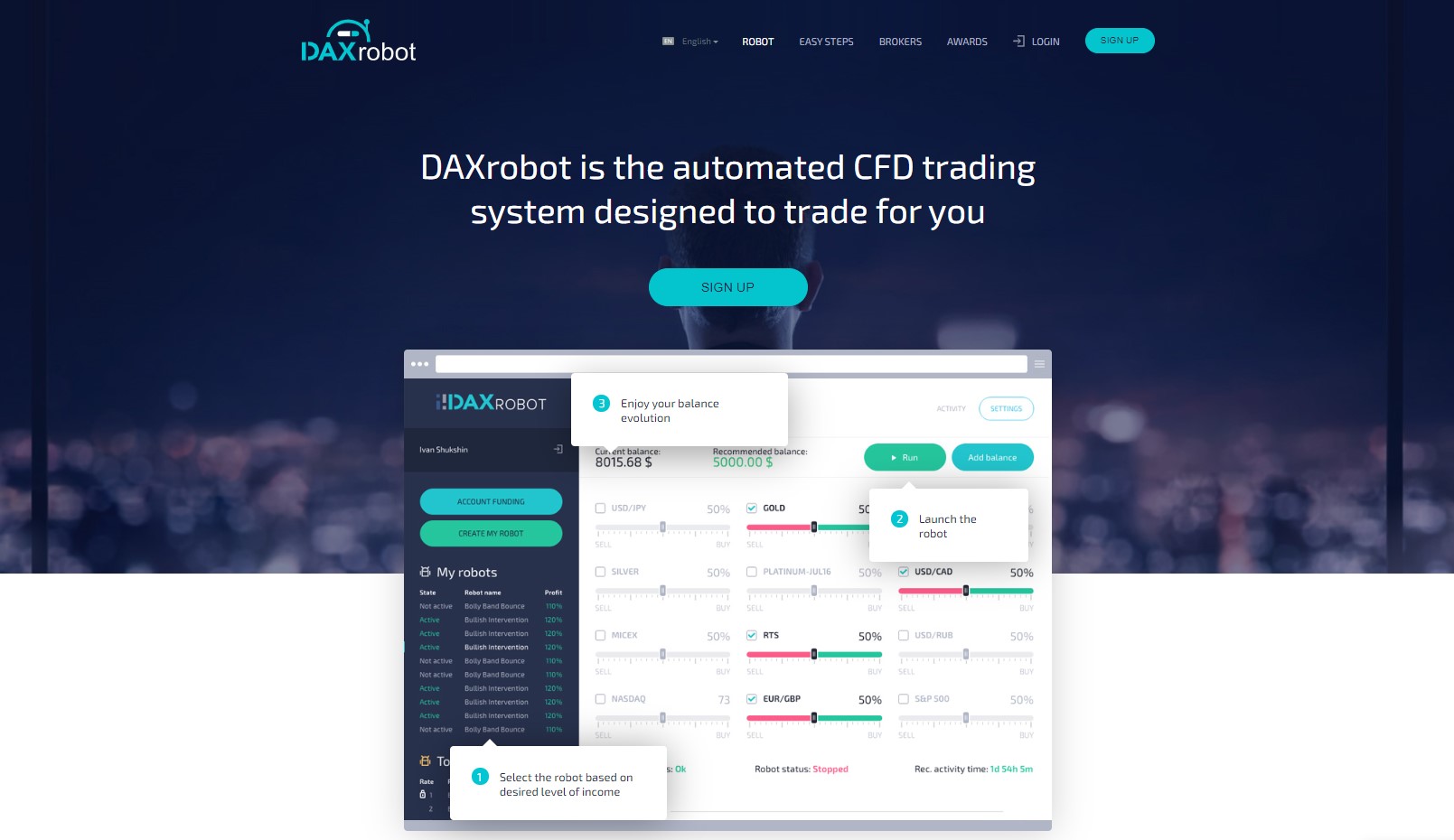

New Stable Profit is a robot that works in real accounts since August 2017. 100% of the trades in this system are based on algorithmic trading. The negotiation is based on trend correction movements, positions are opened depending on the strength of the trend and the volumes of negotiation according to a formula that the developer has not revealed.

New Stable Profit is a robot that works in real accounts since August 2017. 100% of the trades in this system are based on algorithmic trading. The negotiation is based on trend correction movements, positions are opened depending on the strength of the trend and the volumes of negotiation according to a formula that the developer has not revealed.

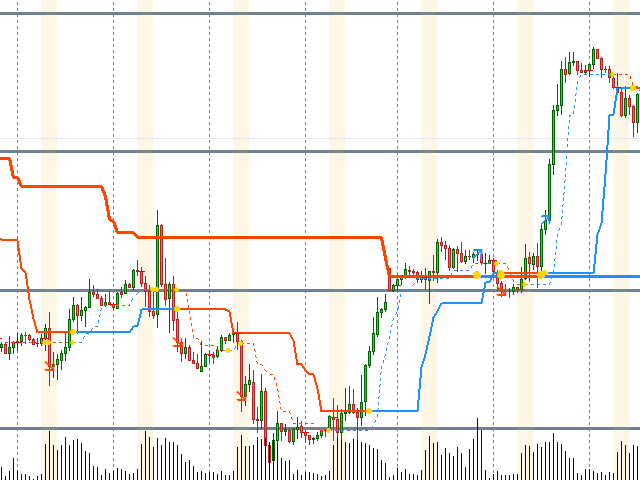

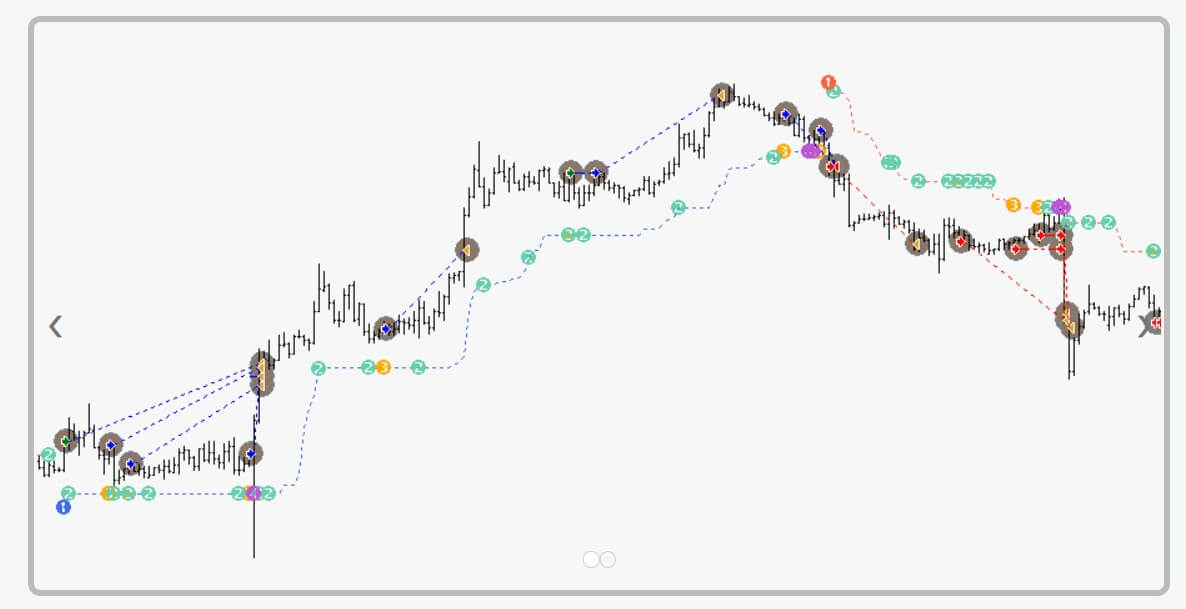

Multytrend PA is an indicator that was created in April 2019 by developer Mikhail Nazarenko. This indicator combines the principles of Price Action and a unique filtering algorithm with feedback for three moving averages. This allows you to know what are the pivot points and current trends in any time frame with a high probability of success in the trades you are pointing out. Multytrend PA is an update of the classic Trend PA indicator and can be used with the principle of the three Elder screens, but everything that is needed is shown in the same chart, which is easier for the user.

Multytrend PA is an indicator that was created in April 2019 by developer Mikhail Nazarenko. This indicator combines the principles of Price Action and a unique filtering algorithm with feedback for three moving averages. This allows you to know what are the pivot points and current trends in any time frame with a high probability of success in the trades you are pointing out. Multytrend PA is an update of the classic Trend PA indicator and can be used with the principle of the three Elder screens, but everything that is needed is shown in the same chart, which is easier for the user.

PZ Wedges is an indicator created in September 2017 by Arturo López Pérez. Arturo López Pérez is a private investor and speculator, software engineer, and founder of Point Zero Trading Solutions.

PZ Wedges is an indicator created in September 2017 by Arturo López Pérez. Arturo López Pérez is a private investor and speculator, software engineer, and founder of Point Zero Trading Solutions.

Stable Ex EA is a Forex trading robot that was created in March 2020 by German developer Vitalii Zakharuk. Vitalii Zakharuk is a prolific creator of automated trading tools and has many of them available on the MQL market.

Stable Ex EA is a Forex trading robot that was created in March 2020 by German developer Vitalii Zakharuk. Vitalii Zakharuk is a prolific creator of automated trading tools and has many of them available on the MQL market.

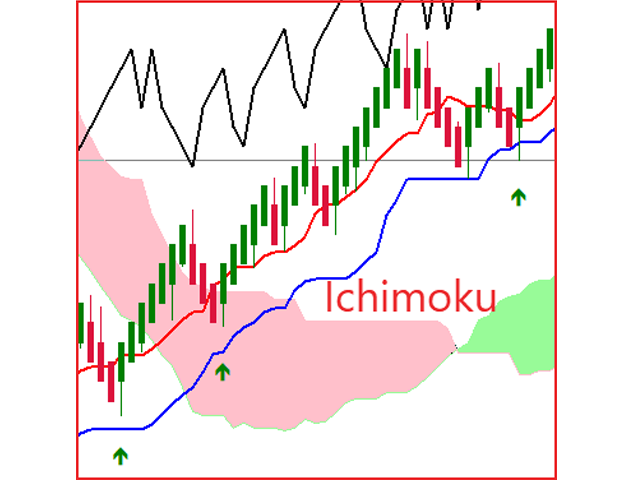

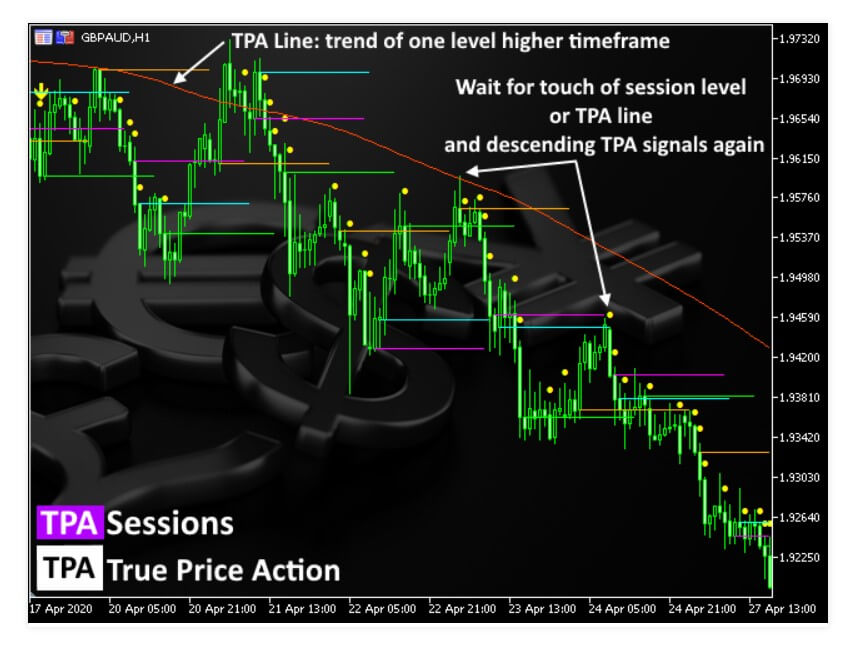

This indicator coded for the MetaTrader 4 and 5 platform belongs to the paid category and has a specific way of giving signals and trading use. The first version is published on the 3rd of July 2019, it is not a very old indicator but has received some attention. The developer is Janusz Trojca from Poland now under the team name of InvestSoft. This team has a total of 10 products with good ratings, some of them complement the TPA indicator for a complete trading system. As the name describes the indicator is based on the

This indicator coded for the MetaTrader 4 and 5 platform belongs to the paid category and has a specific way of giving signals and trading use. The first version is published on the 3rd of July 2019, it is not a very old indicator but has received some attention. The developer is Janusz Trojca from Poland now under the team name of InvestSoft. This team has a total of 10 products with good ratings, some of them complement the TPA indicator for a complete trading system. As the name describes the indicator is based on the

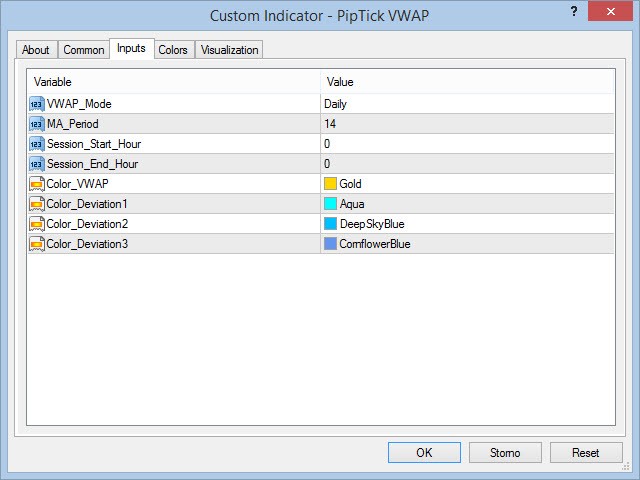

PipTick VWAP for the MT4 platform is a special form of the Volume-Weighted Average Price indicator. One of the most used Moving Averages apart from the EMA or Exponential Moving Average is VWAP for its adaptability to recent market changes. Michael Jurnik from the Czech Republic is the developer of this tool, partner at PipTick. They have published 59 products, many of them not having much popularity or ratings.

PipTick VWAP for the MT4 platform is a special form of the Volume-Weighted Average Price indicator. One of the most used Moving Averages apart from the EMA or Exponential Moving Average is VWAP for its adaptability to recent market changes. Michael Jurnik from the Czech Republic is the developer of this tool, partner at PipTick. They have published 59 products, many of them not having much popularity or ratings.

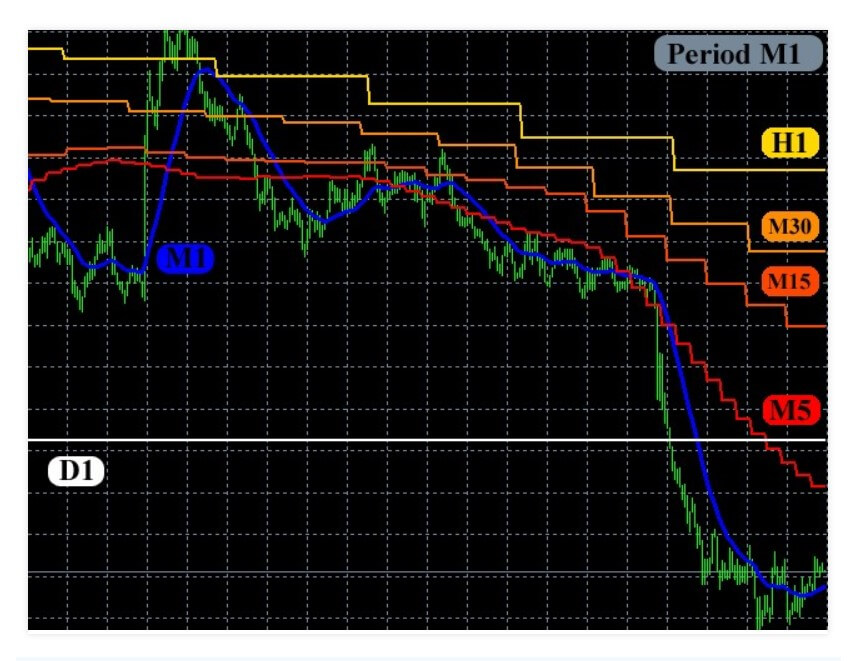

MA Multi stands for Moving Average Multi Timeframe indicator that is useful in many ways and for many strategies. The developer of this indicator is Dmitriy Susloparov from Russia having 16 products offered on the MQL5 marketplace. None of them have received much attention and only MA Multi and one more indicator have ratings. Most of the indicators published are similar, they are basic indicators made multi-timeframe on a single chart. MA Multi also exists for the MetaTrader 5 platform. The first appearance on the

MA Multi stands for Moving Average Multi Timeframe indicator that is useful in many ways and for many strategies. The developer of this indicator is Dmitriy Susloparov from Russia having 16 products offered on the MQL5 marketplace. None of them have received much attention and only MA Multi and one more indicator have ratings. Most of the indicators published are similar, they are basic indicators made multi-timeframe on a single chart. MA Multi also exists for the MetaTrader 5 platform. The first appearance on the

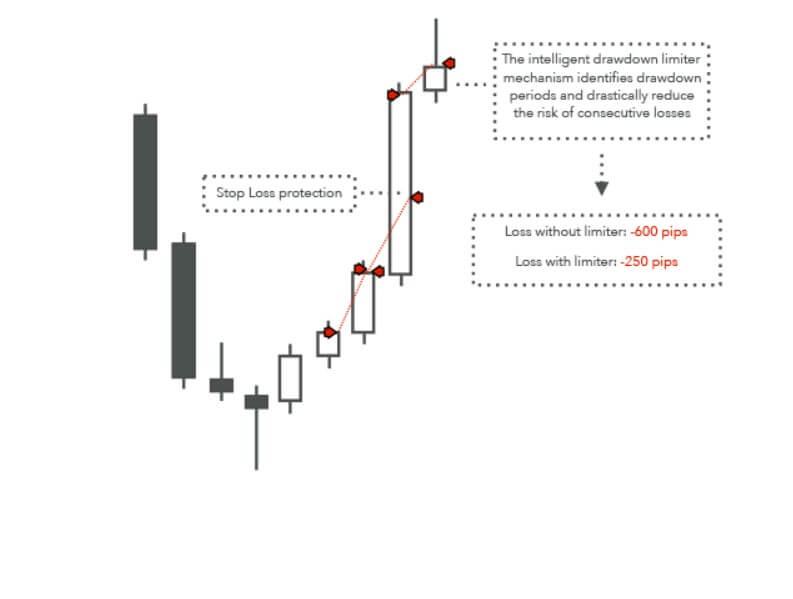

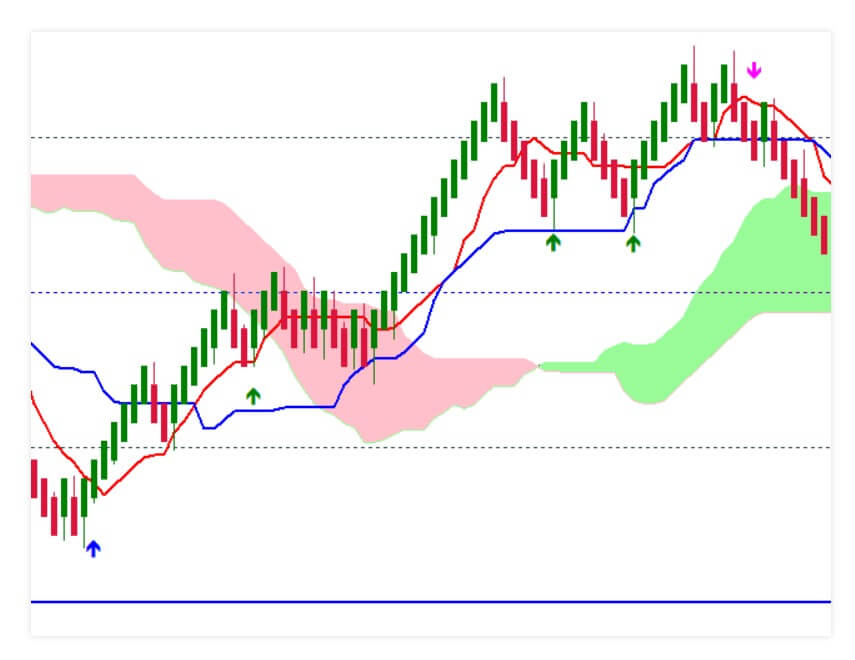

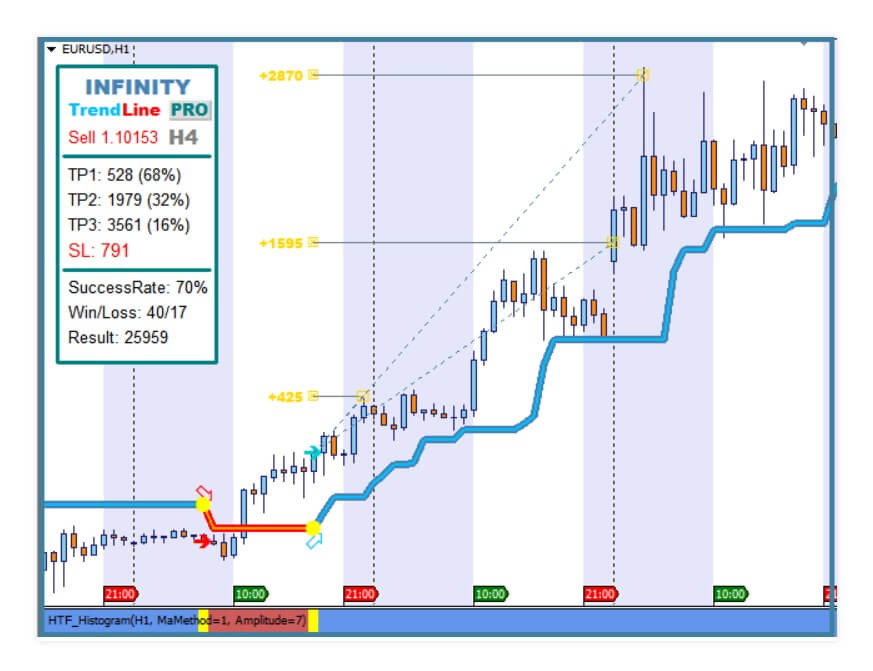

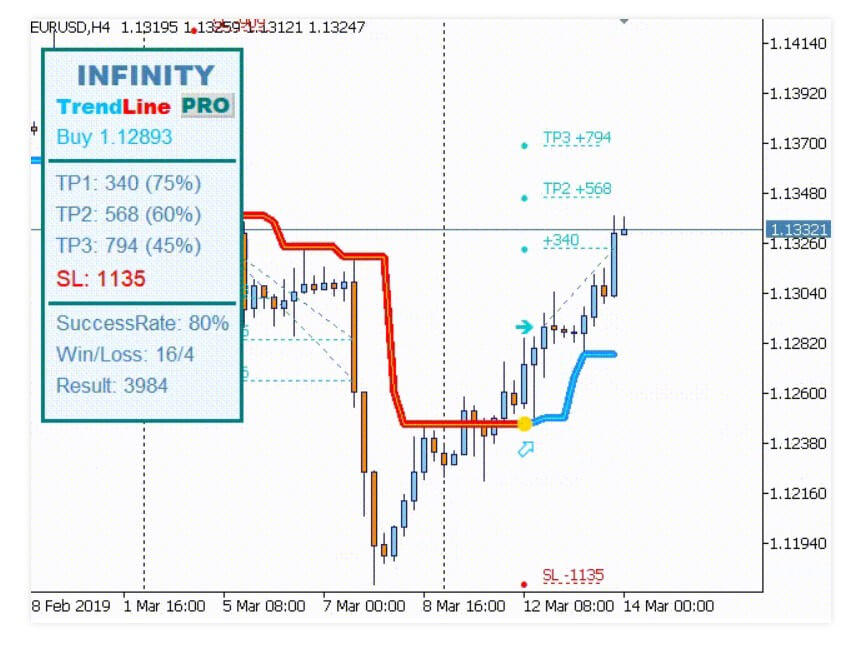

Infinity Trendline is a trend following indicator with integrated solutions for Taking Profit and Stop Loss management. It is developed for the MetaTrader 4 and 5. It was a top free indicator once it showed up in November 2018 on the MQL5 market and since it has received many updates. New things are mostly about adding features and updating the code, enriching the indicator with new goodies. The latest update sets the version to 52.0 and is updated recently, in March 2020. Evgenii Aksenov is the author of this popular indicator/ trading system consisting of few indicators. Main takeaways are the easy-to-use trading signal system, good support, and the fact this is a free indicator that is usable even though the PRO version has more features.

Infinity Trendline is a trend following indicator with integrated solutions for Taking Profit and Stop Loss management. It is developed for the MetaTrader 4 and 5. It was a top free indicator once it showed up in November 2018 on the MQL5 market and since it has received many updates. New things are mostly about adding features and updating the code, enriching the indicator with new goodies. The latest update sets the version to 52.0 and is updated recently, in March 2020. Evgenii Aksenov is the author of this popular indicator/ trading system consisting of few indicators. Main takeaways are the easy-to-use trading signal system, good support, and the fact this is a free indicator that is usable even though the PRO version has more features.

This is a MetaTrader 4 Expert Advisor that uses the popular “hamster” name commonly attributed to scapers working during night sessions or in very low volatility periods. The latest version is Version 9.0 updated on 9th June 2019, the first version was published in late 2017. Also, there is the MT5 version. Since then the EA received a few upgrades including the ATR filtering. The Author is a Russian named Ramil Minniakhmetov, he is the developer of 22 other products and 2 signals such as Rebate Robot, Brazil System, EA Black Star, or “TheFirst” signal service. Most of his work has above 4-star reviews on the

This is a MetaTrader 4 Expert Advisor that uses the popular “hamster” name commonly attributed to scapers working during night sessions or in very low volatility periods. The latest version is Version 9.0 updated on 9th June 2019, the first version was published in late 2017. Also, there is the MT5 version. Since then the EA received a few upgrades including the ATR filtering. The Author is a Russian named Ramil Minniakhmetov, he is the developer of 22 other products and 2 signals such as Rebate Robot, Brazil System, EA Black Star, or “TheFirst” signal service. Most of his work has above 4-star reviews on the

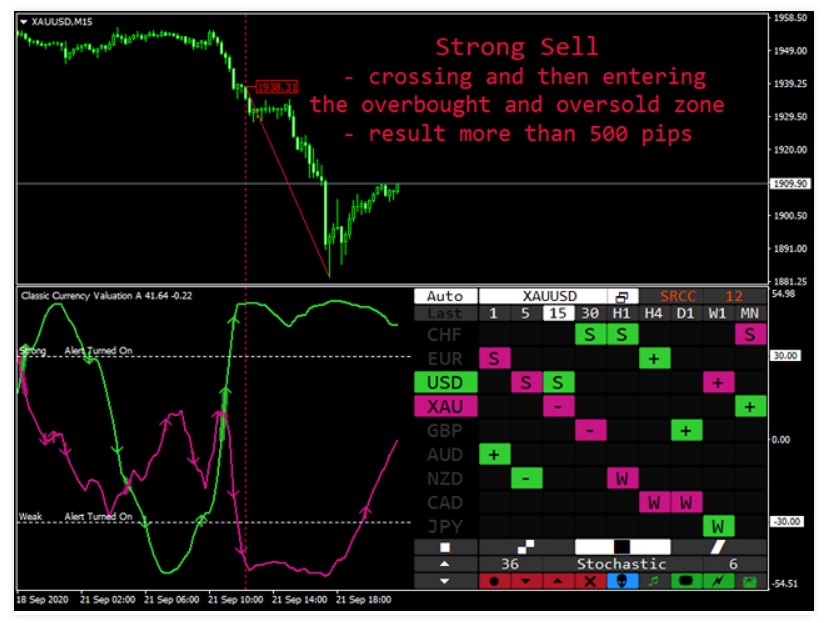

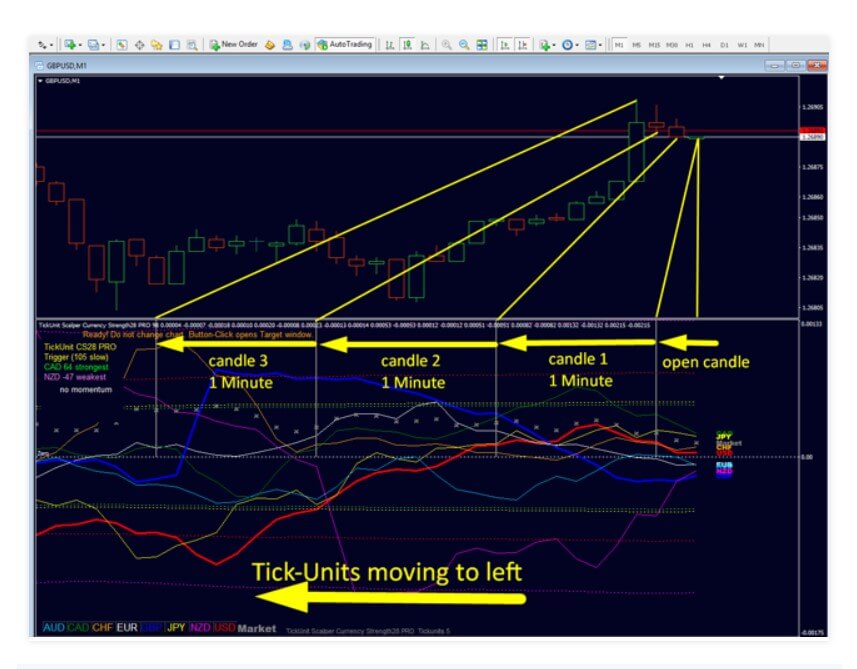

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

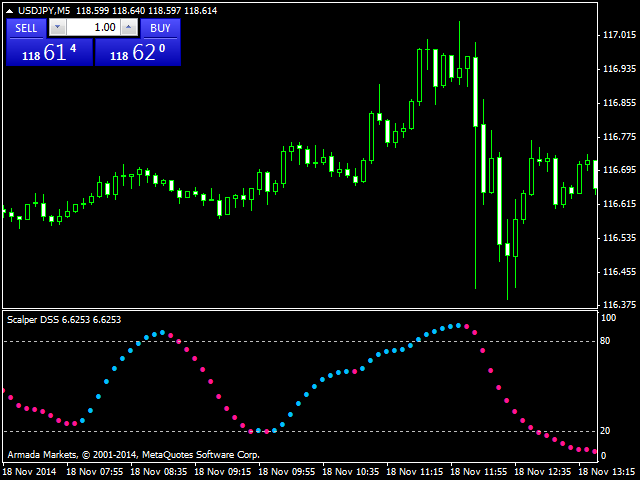

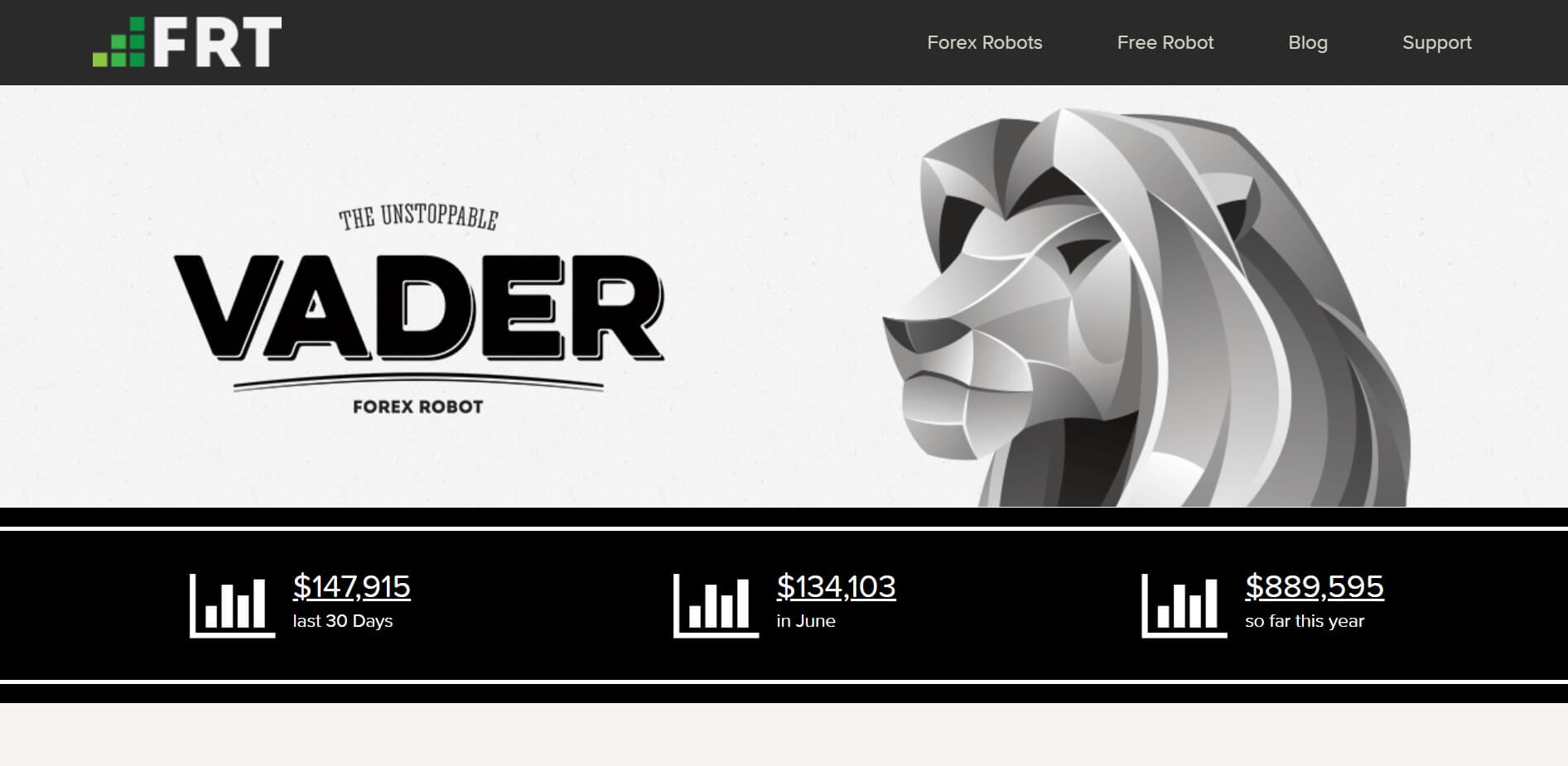

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

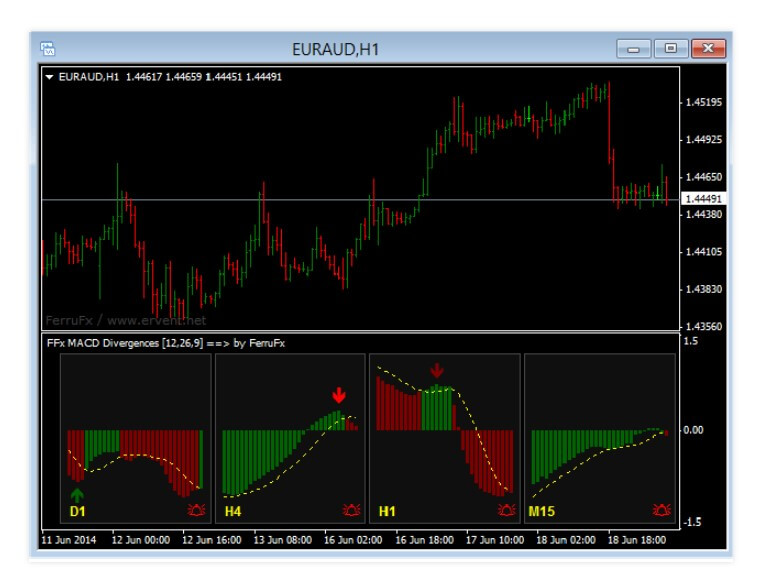

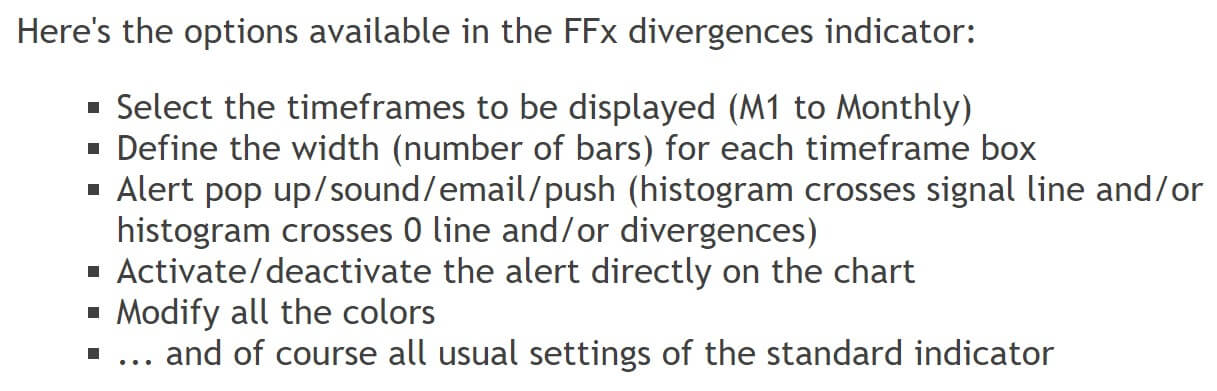

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.

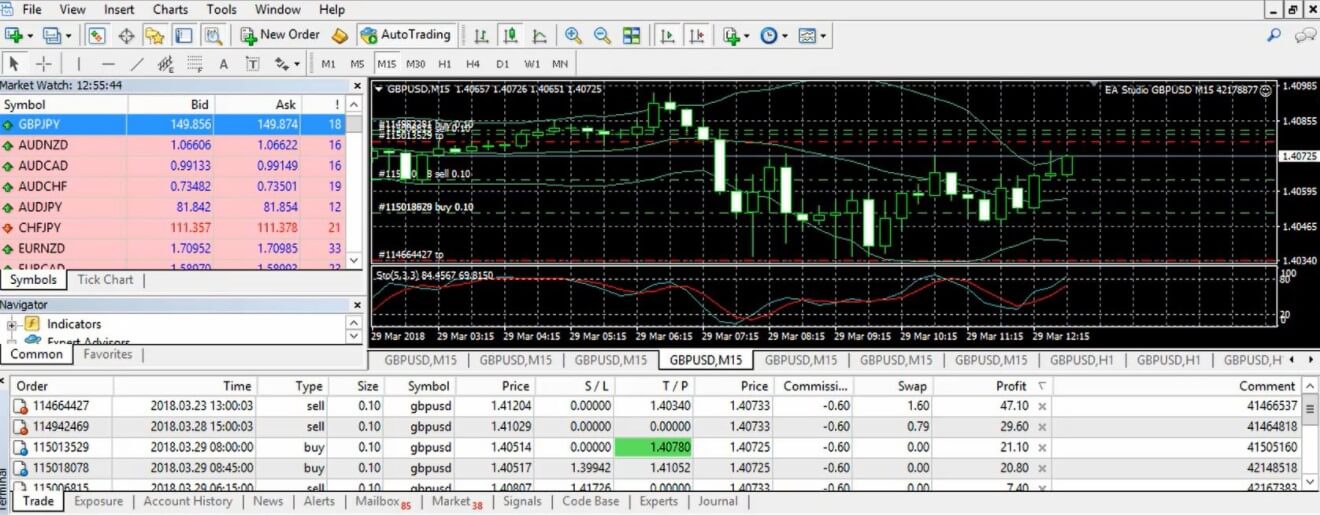

Do IT is an Expert Advisor developed for the MetaTrader 4 platform and is published on the MQL5.com by Ildar Kabirov from Russia. The EA is also available for the MT5. The latest version is 7.77 updated in March 2020. Ratings received are generally positive and there is a high activity in the comments section. Do IT is designed to be fully automated and specialized for Forex, and indices on the 1H timeframe.

Do IT is an Expert Advisor developed for the MetaTrader 4 platform and is published on the MQL5.com by Ildar Kabirov from Russia. The EA is also available for the MT5. The latest version is 7.77 updated in March 2020. Ratings received are generally positive and there is a high activity in the comments section. Do IT is designed to be fully automated and specialized for Forex, and indices on the 1H timeframe.

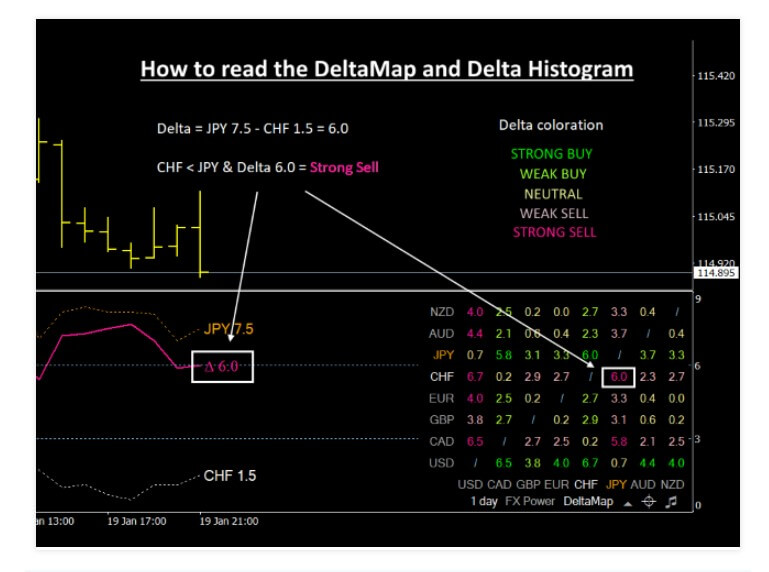

FX Power for the MetaTrader 5 (MT4 also available) is an indicator presented as “the first currency strength meter with a complete history across all timeframes”. Essentially it can be used standalone or as one of there indicators that compose the author’s Simple Trading System. The FX Power indicator developers are the Stein Investments team from Germany. The latest version is 3.76 updated in March 2020 and the first version is published in 2016.

FX Power for the MetaTrader 5 (MT4 also available) is an indicator presented as “the first currency strength meter with a complete history across all timeframes”. Essentially it can be used standalone or as one of there indicators that compose the author’s Simple Trading System. The FX Power indicator developers are the Stein Investments team from Germany. The latest version is 3.76 updated in March 2020 and the first version is published in 2016.

EMA Cross alert is a simple but paid category indicator created by Suriya Thammalungka from Thailand. The EMA means Exponential Moving Average, an indicator used very frequently in many combinations but mostly as a two-line crossing for trend following. The indicator is simple and is never updated since the initial version in June 2016 for MetaTrader 4. It is interesting to see this indicator in the paid category as it is too simple to belong here and the indicators used are basic.

EMA Cross alert is a simple but paid category indicator created by Suriya Thammalungka from Thailand. The EMA means Exponential Moving Average, an indicator used very frequently in many combinations but mostly as a two-line crossing for trend following. The indicator is simple and is never updated since the initial version in June 2016 for MetaTrader 4. It is interesting to see this indicator in the paid category as it is too simple to belong here and the indicators used are basic.

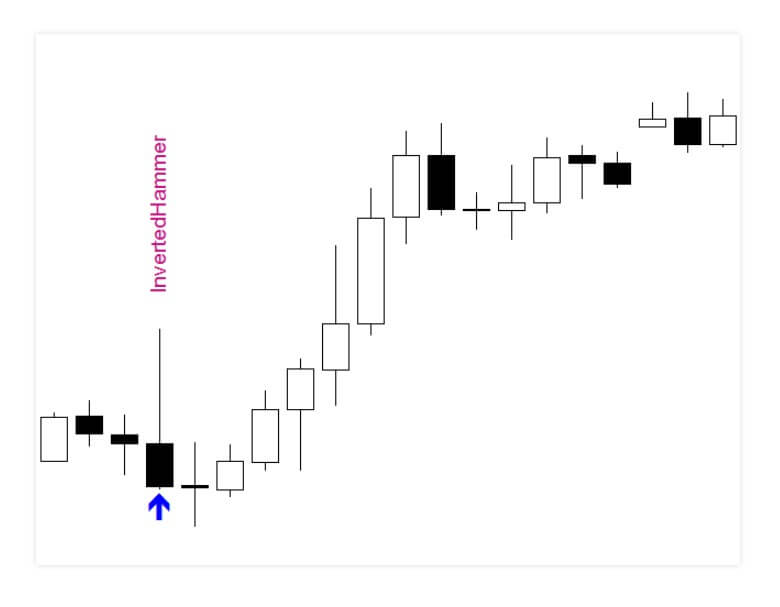

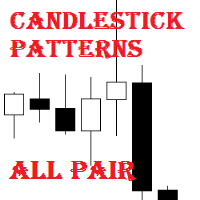

Candlestick Patterns All Pair is an indicator developed for automatic pattern recognition and plotting them on the MetaTrader 4 chart. The tool belongs to the paid category on the MQL5 market and is developed by Denis Luchinkin from Russia. He has over 20 published products but without notable popularity or ratings. This tool is published on the 23rd of March 2017 and has not been updated since. The candle patterns are used as predictive signals and could be reversal, trend, and sometimes scalp strategy elements.

Candlestick Patterns All Pair is an indicator developed for automatic pattern recognition and plotting them on the MetaTrader 4 chart. The tool belongs to the paid category on the MQL5 market and is developed by Denis Luchinkin from Russia. He has over 20 published products but without notable popularity or ratings. This tool is published on the 23rd of March 2017 and has not been updated since. The candle patterns are used as predictive signals and could be reversal, trend, and sometimes scalp strategy elements.

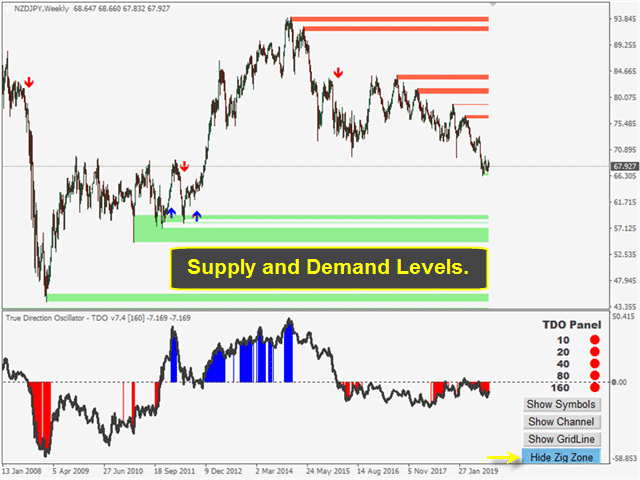

True Direction Oscillator or TDO is a trend gauging oscillator type indicator using a simple but effective formula. The developer is very open and transparent on how the indicator works and the Overview page has professionally made content. TDO has been initially published on the MQL5 market on 23rd November 2015 and since has received many updates. The latest version is v9.1, freshly updated in February this year. The author of this very interesting and popular indicator is Muhammad Al Bermaui from Egypt, showing great dedication to support his work.

True Direction Oscillator or TDO is a trend gauging oscillator type indicator using a simple but effective formula. The developer is very open and transparent on how the indicator works and the Overview page has professionally made content. TDO has been initially published on the MQL5 market on 23rd November 2015 and since has received many updates. The latest version is v9.1, freshly updated in February this year. The author of this very interesting and popular indicator is Muhammad Al Bermaui from Egypt, showing great dedication to support his work.