Prado is a newly released Expert Advisor for the MetaTrader 4 platform from a new developer that has already attracted some users. Prado EA is also developed for the Cent accounts under the name of Prado Micro, without the trade size dynamics function. It is just $5 cheaper so it is probably better to purchase the normal Prado EA. The developer of Prado is Tatyana Kulyapina from Russia with Prado EA as her main and only product published on the MQL5 market.

Prado’s first version is released on the 13th of March 2020, updating the EA with new functions and settings to the latest 2.2 version on the 4th of April. New iterations contain the fixed lot allocation option, spot Gold settings, some bugfixes, control options for the Stop Loss, Take Profit, and other pending orders, spread filter, and additional settings range.

Overview

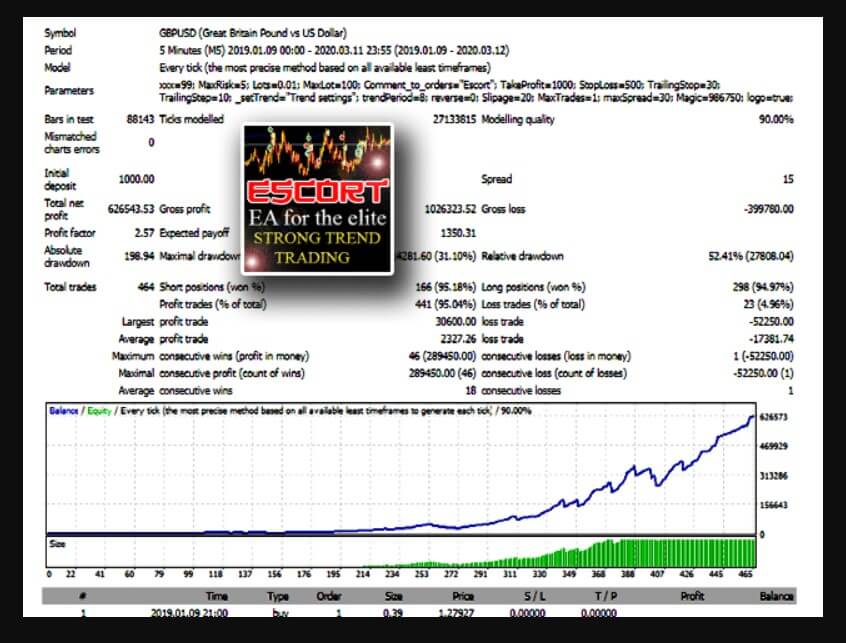

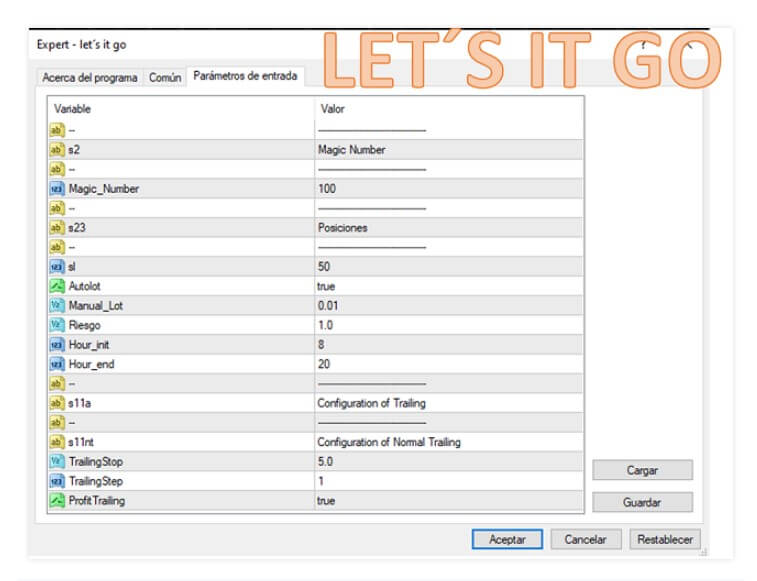

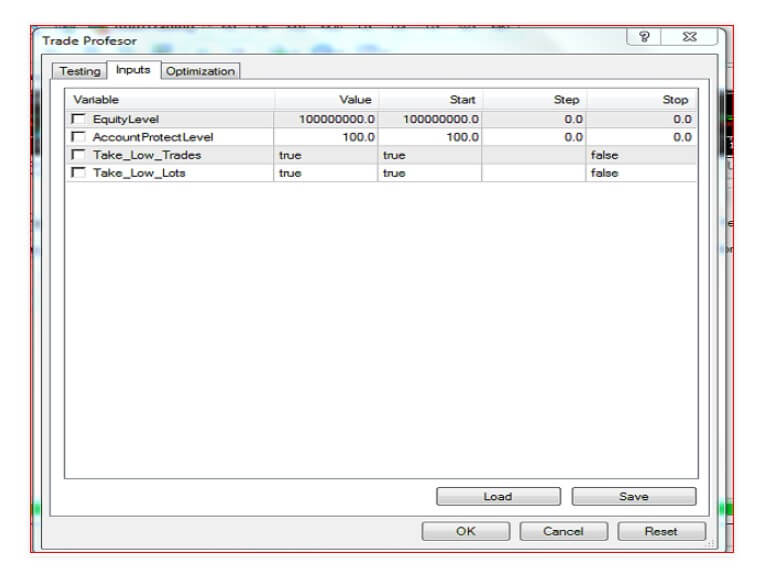

As we take a look at the settings of the EA, we could say Money Management well developed implying the developer has some experience with trading. There are 4 signals provided with various risk exposures and assets Prado is engaged, giving traders a much-needed insight into how this EA performs. On the other hand, the Overview page will not disclose much about the EA, most of the content is just filled with links to the signals and setting files. Still, we were able to extract some information based on the settings panel.

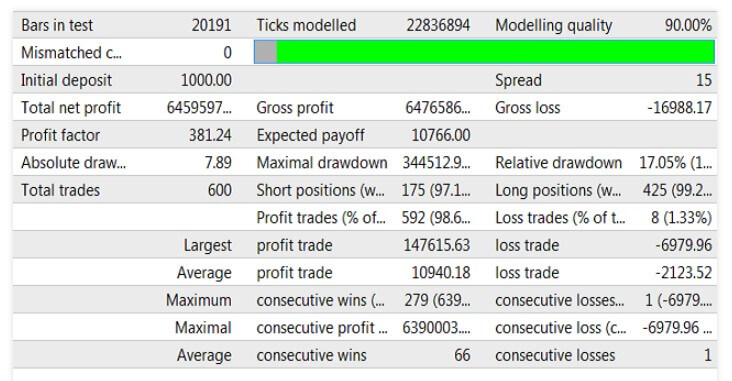

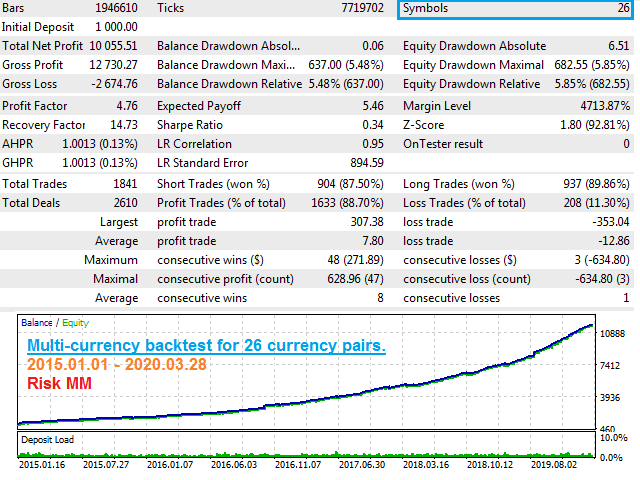

It is common to see the Russian language used in the Comments section and other pages when dealing with Russian speaking authors, making English a rare sight. Almost all content in the Comments section is like this so you might find it difficult to find some information. Prado’s main strategy is the daily breakouts followed by trailing stops and ATR managed risk exposure. Therefore, it is a slower trading EA with strict Risk Management, adaptive to volatility, with good exit signaling. All this combined draws a well-composed system with good figures in the backtesting charts.

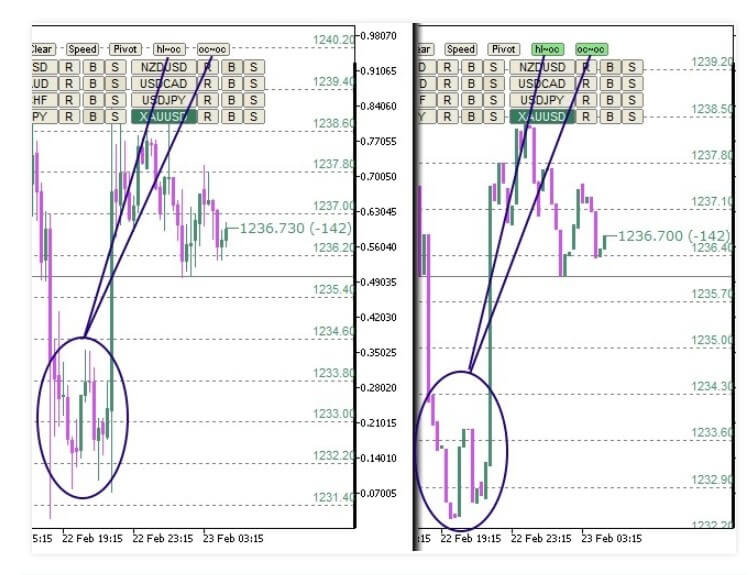

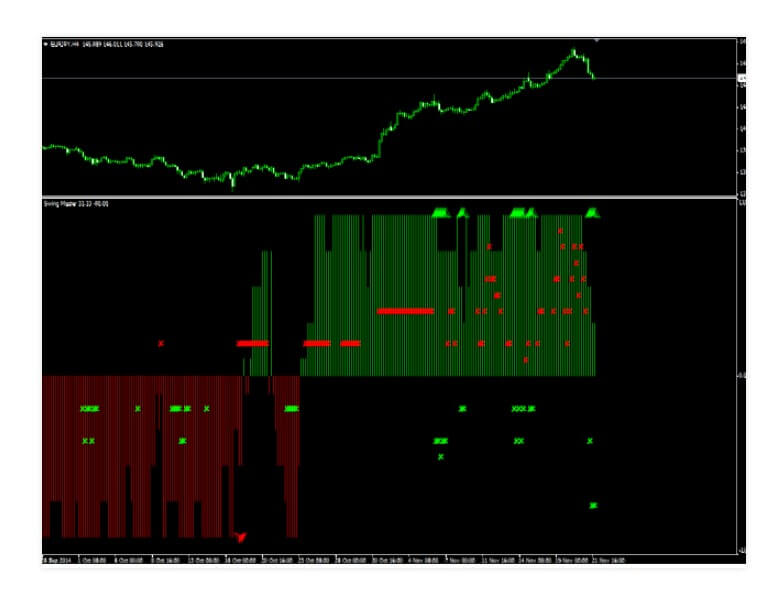

Once the EA is started, it will open Buy Stop and Sell Stop pending orders and the day extremes defined by the ATR or also called ADR (Average Daily Range) if set to the daily timeframe. Once the pending order gets triggered, Stop Loss and Take Profit are placed in with the composite Trailing Stop method trailing the price. Strategies like Martingale, Grid, or Averaging are not used here, Just breakouts on the ATR defined zone. Except for the obvious ATR indicator involvement, others remain undisclosed. One reason could be that the developer is not skilled with a presentation or English, but it could also be to refrain from the scary technical content.

Prado is described as a safe, FIFO compliant, volatility riding EA with a good loss control module. Interestingly, to understand the EA functioning, one could look at the EA thumbnail picture and see all the starting setup and the strategy to follow. After the Q1 2020 volatility jump caused by the COVID-19 in forex, commodity, and other markets, the developer posted a few screenshots of how the EA jumped into the action and resulted in a staggering gain. Still, now it is recommended to increase the minimum deposit to $500 from the initial $100.

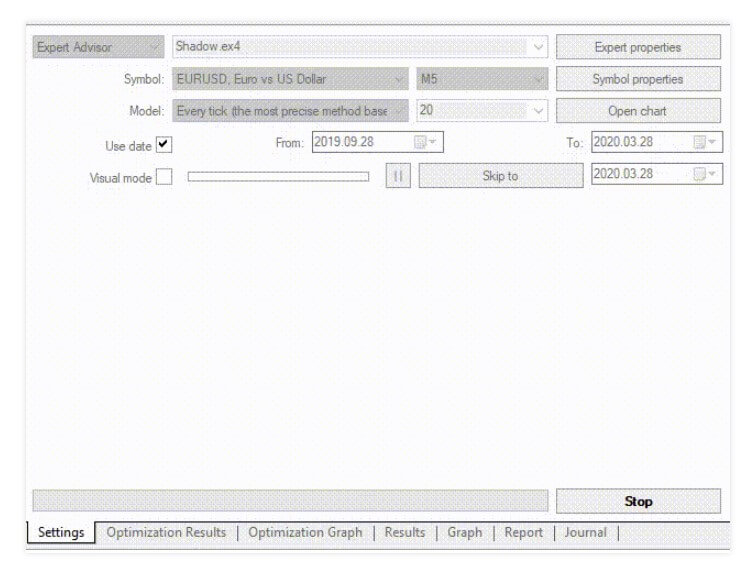

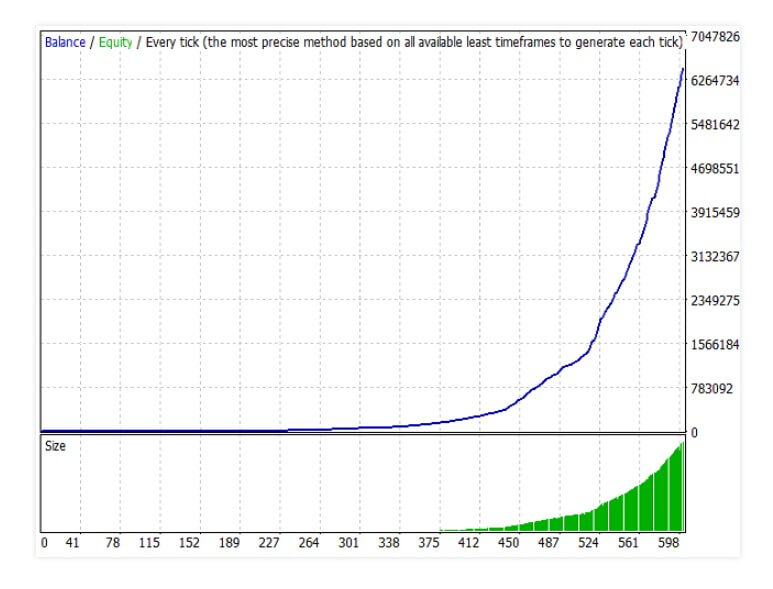

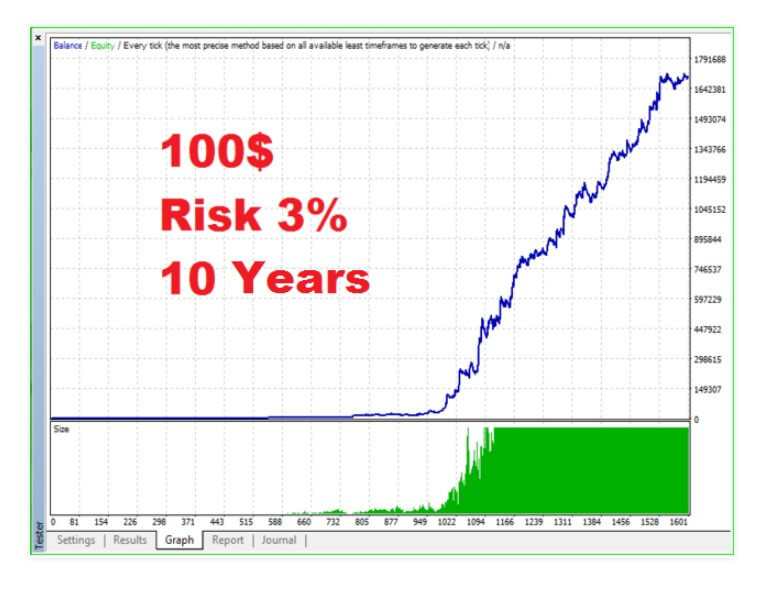

The default setting off the shelf is for the USD/JPY currency pair but there is no mention of the optimized timeframe. Settings for the spot Gold can be downloaded from the attached post in the Comments section, the link is provided. For testing purposes, it is recommended to count every tick and set it to the H1 timeframe. It is very likely the EA is most suited for this timeframe, as mentioned in the comments. Prado has a risk setting according to which you will have different backtesting gains. Of course, more risk percentages will result in bigger gains.

In the settings menu, you will have a lot of ambiguous parameters you will not get a feeling for backtesting purposes if you want to change it form the default levels. A few of the parameters are clear though. Risk is the exposure percentage of your balance for each trade, measure probably in Stop Loss distance in pips per dollar. LotFIxS is the classic lot allocation per amount from the account balance. The Stop Loss and Take Profit adjustments are made via the coefficient parameters which are not tangible.

The parameter values are not in pips obviously, so you will have to experiment with these as the formula is not disclosed. Other coefficient related parameters are OpenOrderCoef (2.0) for pending orders placement, the same description is given to the OrderCoefLevel, but this parameter is set to 0 by default. EveningCoef is another parameter affecting evening trading sessions but again, it is defined by the coefficient. TralCoef is the Trailing Stop factor, as well as the BoomCoef and the BoomMinDistCoef.

The coefficient is probably related to the same variable, most likely the ATR indicator, and this could be easily tested by comparing the values to the ATR current level on default settings. TralBoomStep is the classic step Trailing Stop jumping distance. There are other parameters related to the Trailing Stop such as BoomMaxPrc probably related to the price change percentage. This implies the EA is heavy with Risk Management measures as mentioned. Other settings are concerned with the slippage filter, EA working hours and evening tactics, comments plotting, and trade closing time point.

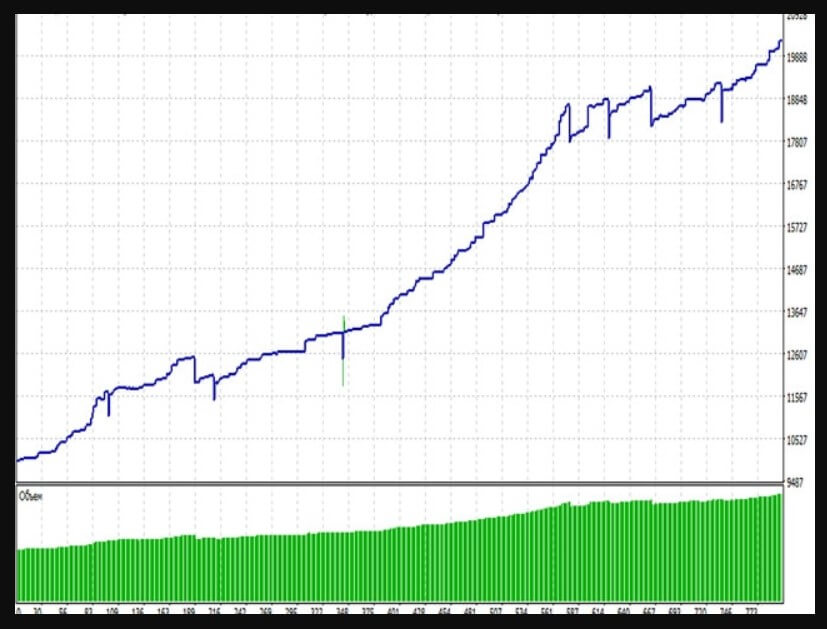

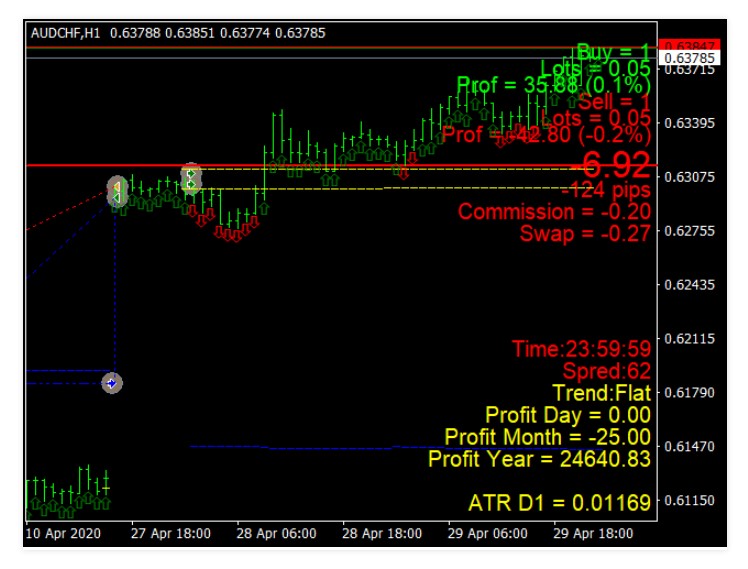

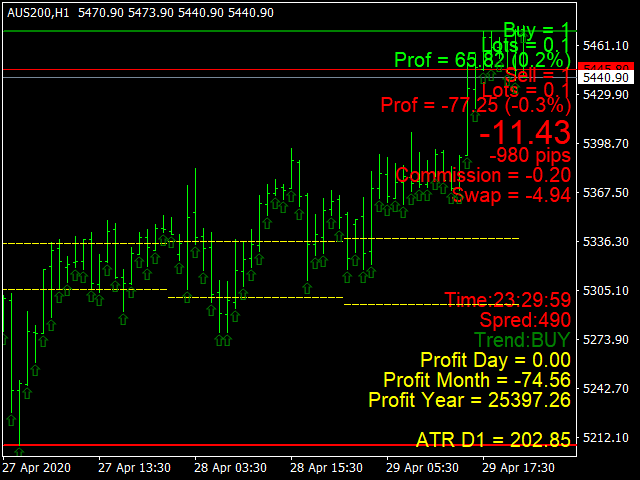

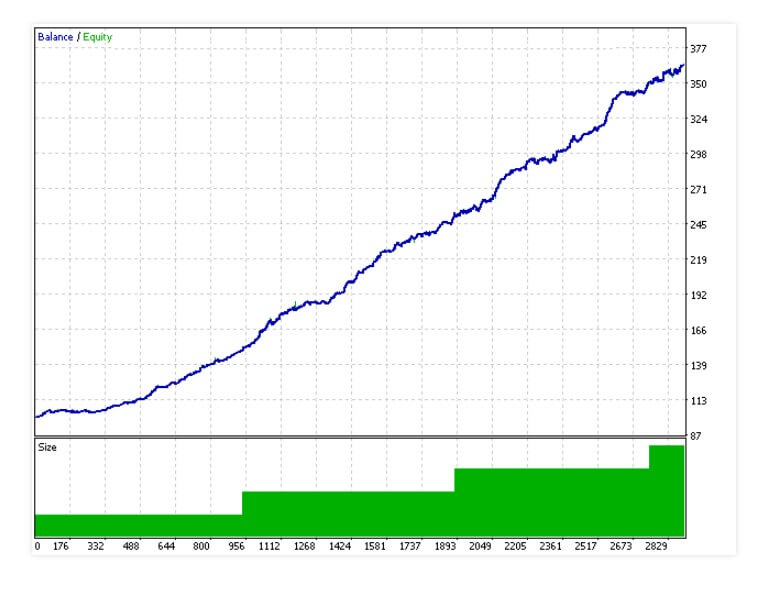

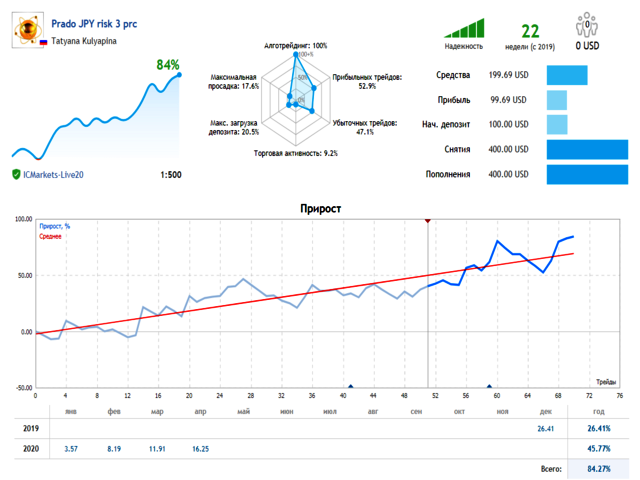

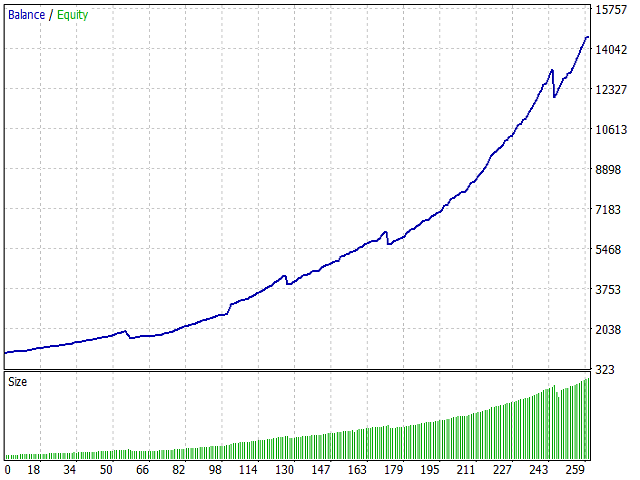

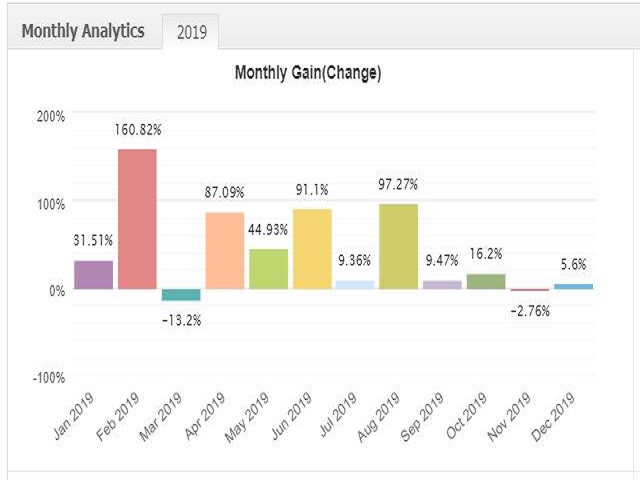

Prado performance is presented by 4 signals, and we will use these “forward” testing performance instead of the MT4 Strategy Tester results screenshots. On the IC Markets broker live account, Prado has gained 22% on the XAU/USD from the 4th of April 2020. This period is too short for any conclusions but the EA made 7 trades. Using the 3% risk scheme, 5 trades were in negative. This means Prado has a very sensitive trade exit, most likely the Trailing Stop. However, the 22% gain is generated by only 2 trades.

The average holding time is 4 hours making 3 trades per week. So entry timing is very careful, picking the right moments on the H1 timeframe. These two trades made a profit of $140.35 against -$73.41 5 losing trades. This caused a 16.7% drawdown which is acceptable for 22% monthly gain and a 3% risk scheme. Prado EA performance on the USD/JPY pair has almost the same gain on 3% and 5% risk. Both testings are on live accounts. The 3% signal shows 17.6% drawdown and 63% gain form the 15th of March 2020. When averaged, the EA made 15.33% per month, 5 trades per week, and 3 hours holding time. Profitable trades are almost on par with the losing ones, again demonstrating a great loss protection mechanism.

Service Cost

Prado price is $150 to buy with 5 activations and the Prado Micro is $145. Interestingly there are no options to rent the EA but the price is not an issue for most traders. The demo has been downloaded 379 times until now showing good attention in its early stage.

Conclusion

Prado has 7 reviews and all are positive, resulting in a perfect 5-star score. One of the more notable reviews reads as follows:

”That’s why I bought the EA: no risky tactics, no martingale, no grid, just pending and win or loss, well-calculated SL and well-calculated trailing stop. And now I’m looking forward to the results!”

Prado EA has a very sound strategy and great Risk management although it is not very friendly for optimization by users. Therefore, for now, it is best to use only the developer published settings files in the Comments section if you do not know how the settings affect the trading.

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/45995

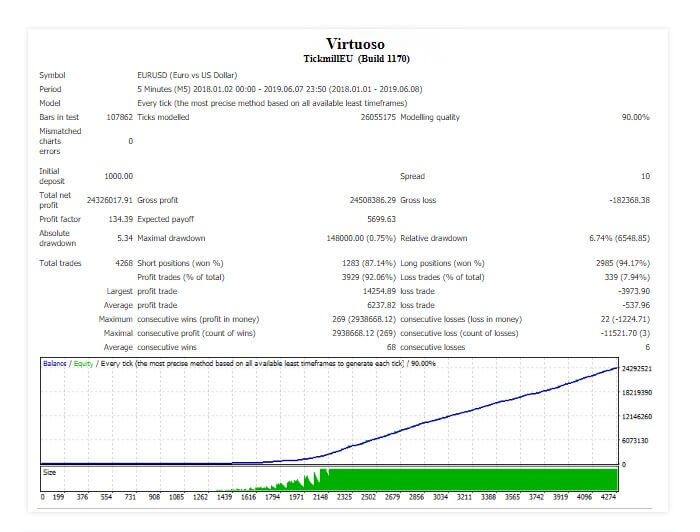

This EA is based on several trading algorithms and designed for major currency pairs. It is not known how it works or what is the strategy behind it. What is certain is the absurd price and the extremely low rating raising the question if this is a serious offer after all. The latest version is 2.4 updated in October 2019 with the additions of controlling module that adapts to trading conditions. Also, some new settings are added for better risk management. The initial version is published on 11th June 2019 by the developer Aleksandr Shurgin from Russia.

This EA is based on several trading algorithms and designed for major currency pairs. It is not known how it works or what is the strategy behind it. What is certain is the absurd price and the extremely low rating raising the question if this is a serious offer after all. The latest version is 2.4 updated in October 2019 with the additions of controlling module that adapts to trading conditions. Also, some new settings are added for better risk management. The initial version is published on 11th June 2019 by the developer Aleksandr Shurgin from Russia.

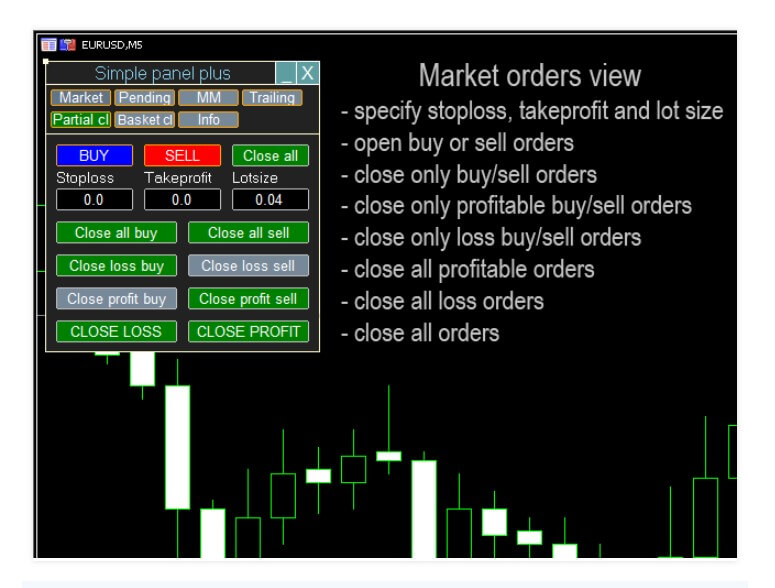

Most of the EAs follow a certain method or strategy, but it is uncommon to see an Expert Advisor made for traders to make their custom automated trading system. EA for Any Levels Indicators is such a product published on the MQL5 market. It is coded for the MetaTrader 4 platform and recently published, on the 14th of March 2020. The developer of this EA is Vyacheslav Nekipelov from Russia, selling 16 other products on the same market that do not have much popularity but they are useful and simple. There are no updates to this EA yet but it can certainly be upgraded with many ideas.

Most of the EAs follow a certain method or strategy, but it is uncommon to see an Expert Advisor made for traders to make their custom automated trading system. EA for Any Levels Indicators is such a product published on the MQL5 market. It is coded for the MetaTrader 4 platform and recently published, on the 14th of March 2020. The developer of this EA is Vyacheslav Nekipelov from Russia, selling 16 other products on the same market that do not have much popularity but they are useful and simple. There are no updates to this EA yet but it can certainly be upgraded with many ideas.

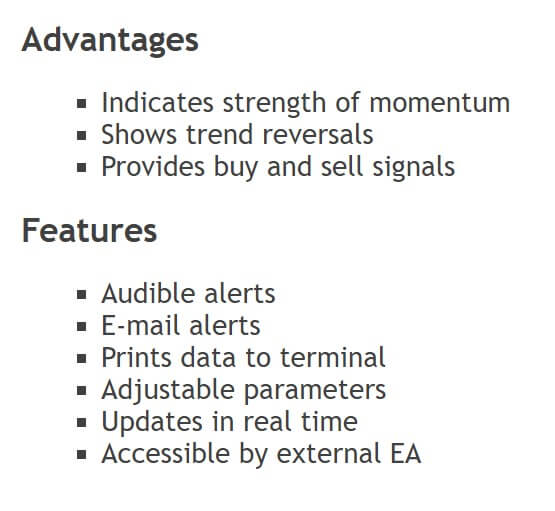

EMA or Exponential Moving Average is one of the most used and classic indicators for technical analysis. This indicator measures the difference between the closing candle prices and creates a momentum presented as an EMA in the MetaTrader 4 separate window chart. This idea is not new and is one of the classic ways of measuring momentum. The author made a simple indicator but it is very useful.

EMA or Exponential Moving Average is one of the most used and classic indicators for technical analysis. This indicator measures the difference between the closing candle prices and creates a momentum presented as an EMA in the MetaTrader 4 separate window chart. This idea is not new and is one of the classic ways of measuring momentum. The author made a simple indicator but it is very useful.

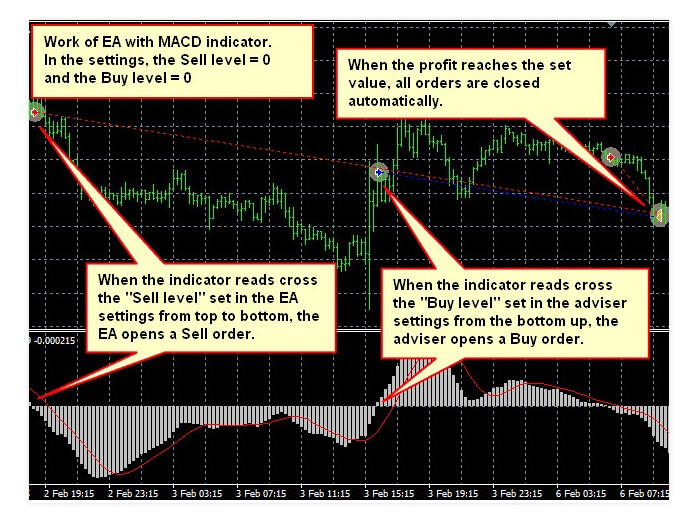

This product does not leave enough information for a trader to understand what kind of Expert Advisor Big Bang MT4 is. Nothing is disclosed about the indicator used or the system, even the settings range does not point to a specific strategy used. However, the EA is new, from April 2020 and probably the Overview page will be updated. The updated version is already out on the MQL5 market, reaching label 1.2. The update contains major improvement, specifically the entry signal is improved and added the filter to only apply strong signals. This way the signals are more reliable although less frequent.

This product does not leave enough information for a trader to understand what kind of Expert Advisor Big Bang MT4 is. Nothing is disclosed about the indicator used or the system, even the settings range does not point to a specific strategy used. However, the EA is new, from April 2020 and probably the Overview page will be updated. The updated version is already out on the MQL5 market, reaching label 1.2. The update contains major improvement, specifically the entry signal is improved and added the filter to only apply strong signals. This way the signals are more reliable although less frequent.

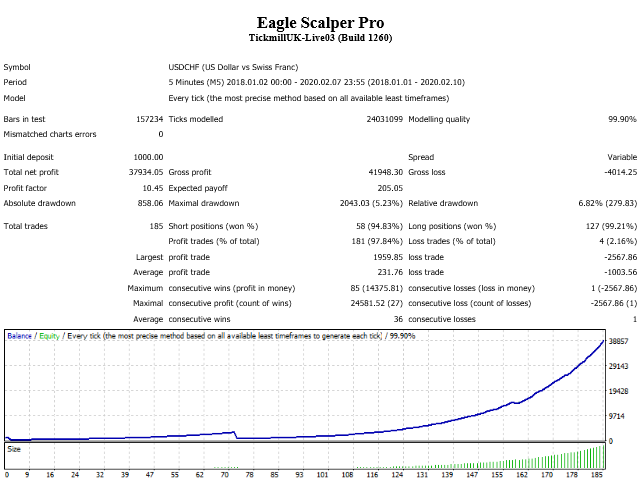

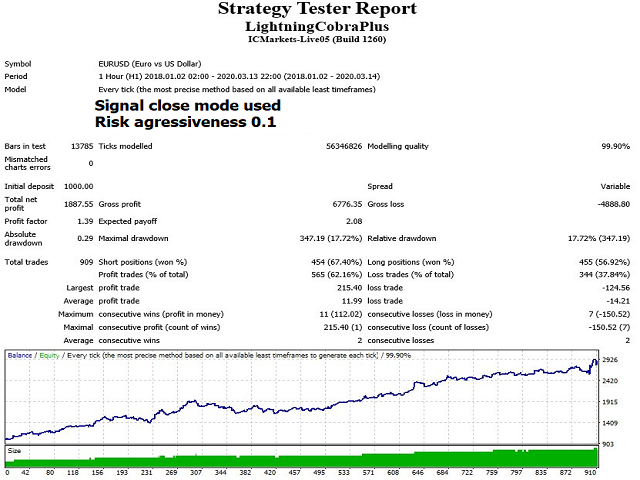

Eagle Scalper Pro is a new Expert Advisor published on the MQL5 market that reached significant popularity and user review rating already. The initial version was uploaded on the 10th of February 2020 and has been updated in March to the current 1.50 version. Updates are minor, just bug fixing and FIFO compatibility in case traders have this ordering method imposed by their broker. This EA belongs to the Trend Following strategy category and it is not frequently used the same as the scalper EAs. It does not use the Arbitrage method which is commonly frowned upon by brokers and traders alike.

Eagle Scalper Pro is a new Expert Advisor published on the MQL5 market that reached significant popularity and user review rating already. The initial version was uploaded on the 10th of February 2020 and has been updated in March to the current 1.50 version. Updates are minor, just bug fixing and FIFO compatibility in case traders have this ordering method imposed by their broker. This EA belongs to the Trend Following strategy category and it is not frequently used the same as the scalper EAs. It does not use the Arbitrage method which is commonly frowned upon by brokers and traders alike.

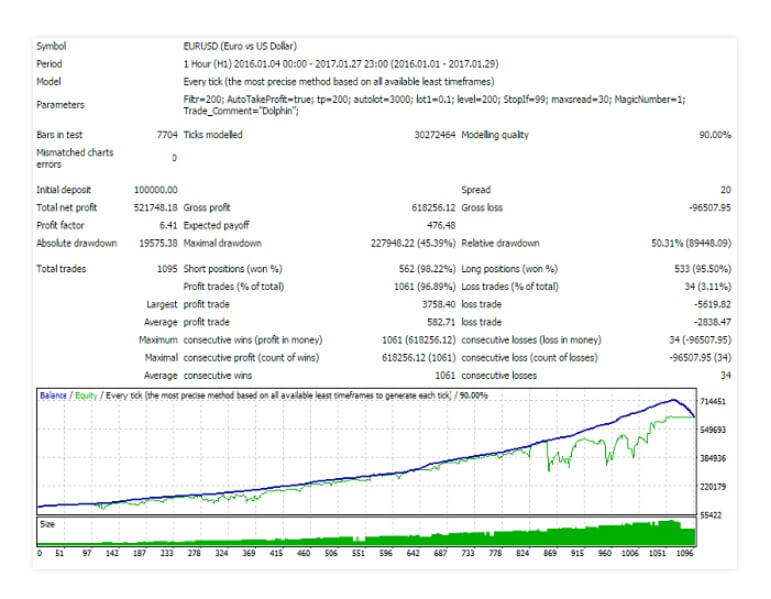

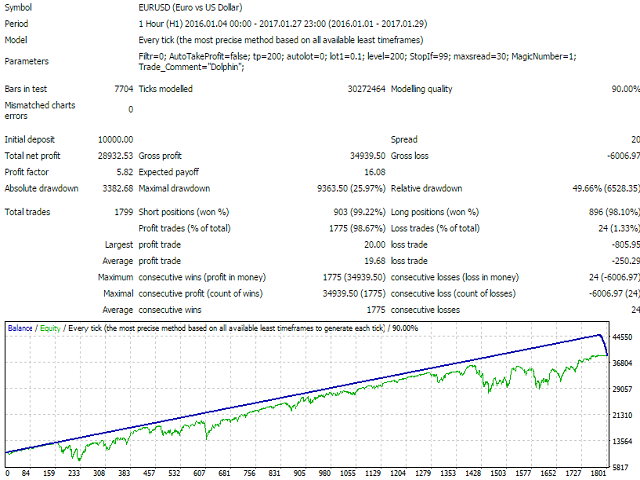

This EA belongs to the Grid strategies with integrated averaging. It is developed for the MetaTrader 4 platform by Sergey Kruglov from Russia. The initial version was published on 6th February 2017 on the MQL5 market set in the paid category. It is updated once in late 2017 adding a few functional averaging parameters such as Averaging Point, Averaging Take Profit points, and Auto Averaging. Sergey Kruglov has 26 other products on the market but none of them have any notable ratings or popularity. He seems to develop mostly Grid-based EAs.

This EA belongs to the Grid strategies with integrated averaging. It is developed for the MetaTrader 4 platform by Sergey Kruglov from Russia. The initial version was published on 6th February 2017 on the MQL5 market set in the paid category. It is updated once in late 2017 adding a few functional averaging parameters such as Averaging Point, Averaging Take Profit points, and Auto Averaging. Sergey Kruglov has 26 other products on the market but none of them have any notable ratings or popularity. He seems to develop mostly Grid-based EAs.

If you are familiar with the BBMA trading system, then this indicator or tool is the perfect addon. It is a specialized tool but can also be considered a complete trading system. It consists of multiple indicators designed for this algorithm trading. BBMA system is made by Mr. Oma Ally and the BBMA Dashboard tool is published by Alireza Yadegar from Iran. The system is relatively new, from mid-2016, and the tool soon followed a release on the

If you are familiar with the BBMA trading system, then this indicator or tool is the perfect addon. It is a specialized tool but can also be considered a complete trading system. It consists of multiple indicators designed for this algorithm trading. BBMA system is made by Mr. Oma Ally and the BBMA Dashboard tool is published by Alireza Yadegar from Iran. The system is relatively new, from mid-2016, and the tool soon followed a release on the

Traders familiar with Elliot Waves know there are a few elements that need to be determined before executing a trade. This indicator is developed with the idea to trade towards the 5th Elliot Wave in conjunction with other indicators, as a part of the “Trade The Fifth” swing strategy. This is a commercialized product also published in the MQL5 market for the MetaTrader 4 platform. Other platforms are supported but on the owner’s website. The developer is Paul Bratby from Spain who is the presenter of this swing strategy using Elliot Waves, publishing one more product related to this group strategy ideas. The first version is published on 13th December 2019 and has never been updated to date. Elliot Wave Indicator belongs to the paid category but it is not available to buy, this is a subscription-based service with several options.

Traders familiar with Elliot Waves know there are a few elements that need to be determined before executing a trade. This indicator is developed with the idea to trade towards the 5th Elliot Wave in conjunction with other indicators, as a part of the “Trade The Fifth” swing strategy. This is a commercialized product also published in the MQL5 market for the MetaTrader 4 platform. Other platforms are supported but on the owner’s website. The developer is Paul Bratby from Spain who is the presenter of this swing strategy using Elliot Waves, publishing one more product related to this group strategy ideas. The first version is published on 13th December 2019 and has never been updated to date. Elliot Wave Indicator belongs to the paid category but it is not available to buy, this is a subscription-based service with several options.

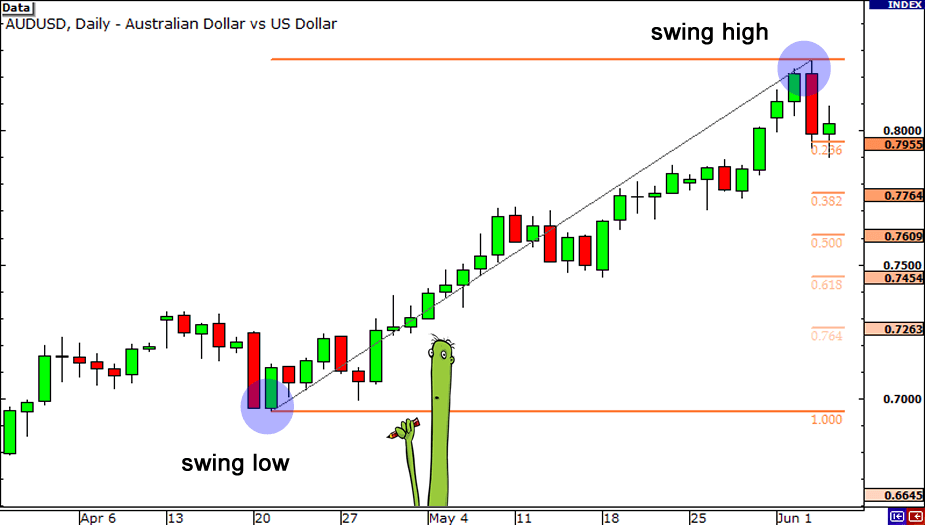

Eng GBP is a modest product by a Kuwait developer using a breakout strategy with Fibonacci levels. This Expert Advisor for the MetaTrader 4 is new, published on the 5th of April 2020 on the MQL5 market. It has no updates yet although it is evident Ahmad Alsaegh, the author of Eng GBP, is still testing new settings and uploads them in the Comments section. He has one other product also specialized for certain Indicies, using a similar breakout strategy. Eng GBP, as the name applies, is specialized for the GBP/USD currency pair although the author states it is suitable for all currency pairs. The Overview page does not have enough information about how the EA is working or anything about the set of indicators aside Fibonacci. According to the settings, it is clear additional Risk management tools are integrated.

Eng GBP is a modest product by a Kuwait developer using a breakout strategy with Fibonacci levels. This Expert Advisor for the MetaTrader 4 is new, published on the 5th of April 2020 on the MQL5 market. It has no updates yet although it is evident Ahmad Alsaegh, the author of Eng GBP, is still testing new settings and uploads them in the Comments section. He has one other product also specialized for certain Indicies, using a similar breakout strategy. Eng GBP, as the name applies, is specialized for the GBP/USD currency pair although the author states it is suitable for all currency pairs. The Overview page does not have enough information about how the EA is working or anything about the set of indicators aside Fibonacci. According to the settings, it is clear additional Risk management tools are integrated.

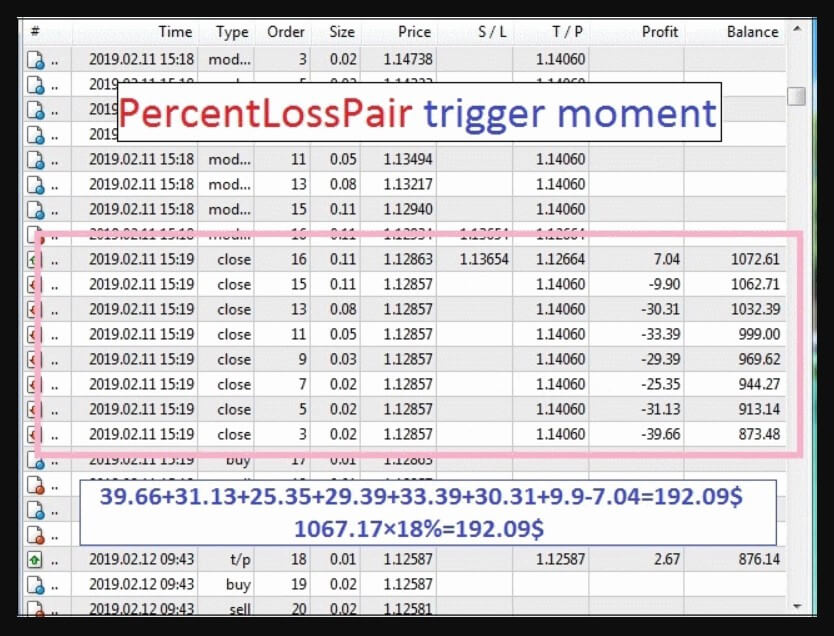

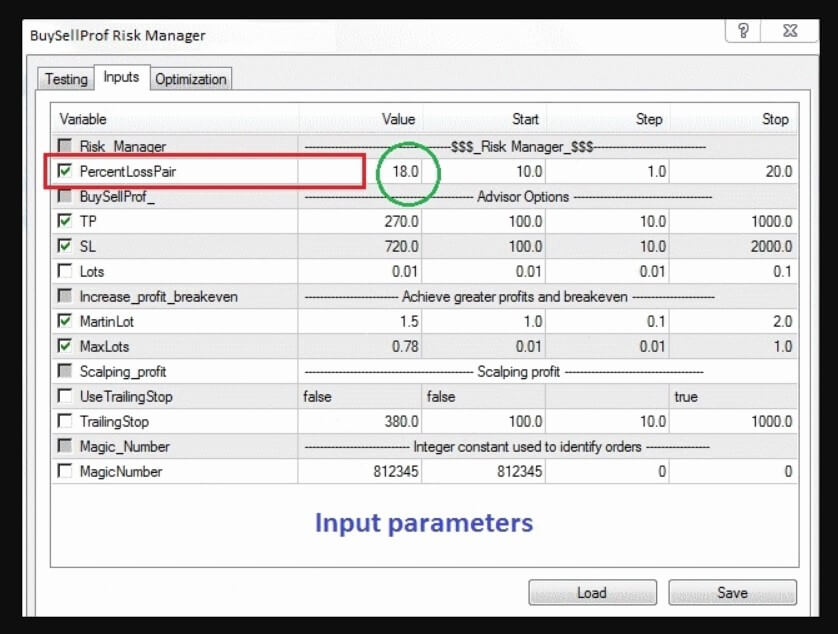

This is one of the most popular Expert Advisors that implement the Grid and the Martingale methods without using any indicators. Brazil System Premium is designed for the MetaTrader 4 platform and published on the MQL market in the paid category. This EA appeared on 11th October 2016 and has been updated many times, finalizing with version 13.0 from the 6th of April 2020. The updates contained bugfixes, additional functionalities, and optimizations.

This is one of the most popular Expert Advisors that implement the Grid and the Martingale methods without using any indicators. Brazil System Premium is designed for the MetaTrader 4 platform and published on the MQL market in the paid category. This EA appeared on 11th October 2016 and has been updated many times, finalizing with version 13.0 from the 6th of April 2020. The updates contained bugfixes, additional functionalities, and optimizations.

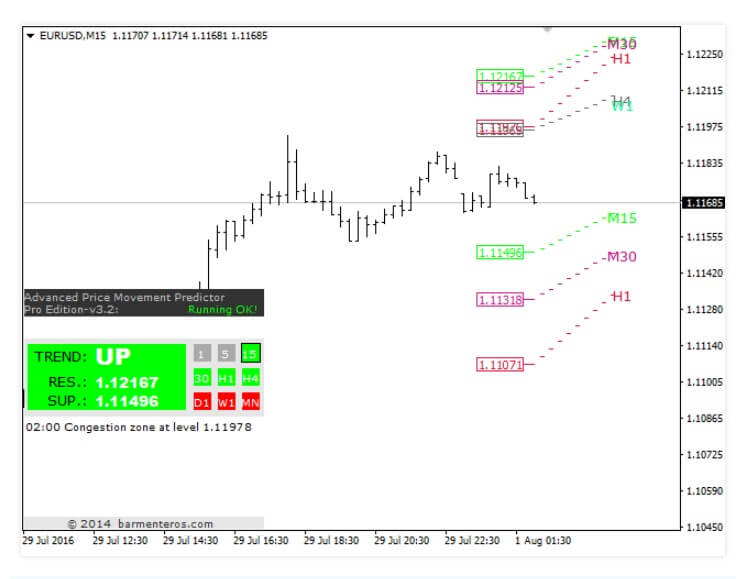

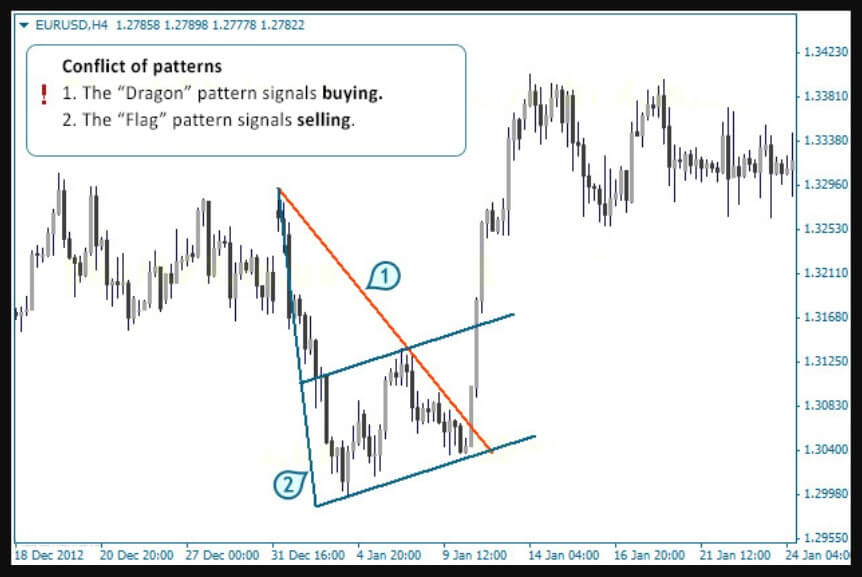

Given by the name one could think this indicator uses candle patterns or other non-lagging methods to predict trends. However, this is not true, this is a combo indicator for the trend following strategies using Price Action methodology. It is developed for the MetaTrader 4 client by Boris Armenteros from Spain, as the leader of the Barmenteros team. This team has some trading and coding experience having at least 15 products released on the MQL5 market. Advanced Price Movement Predictor is initially published in January 2014, however, it is not updated frequently.

Given by the name one could think this indicator uses candle patterns or other non-lagging methods to predict trends. However, this is not true, this is a combo indicator for the trend following strategies using Price Action methodology. It is developed for the MetaTrader 4 client by Boris Armenteros from Spain, as the leader of the Barmenteros team. This team has some trading and coding experience having at least 15 products released on the MQL5 market. Advanced Price Movement Predictor is initially published in January 2014, however, it is not updated frequently.

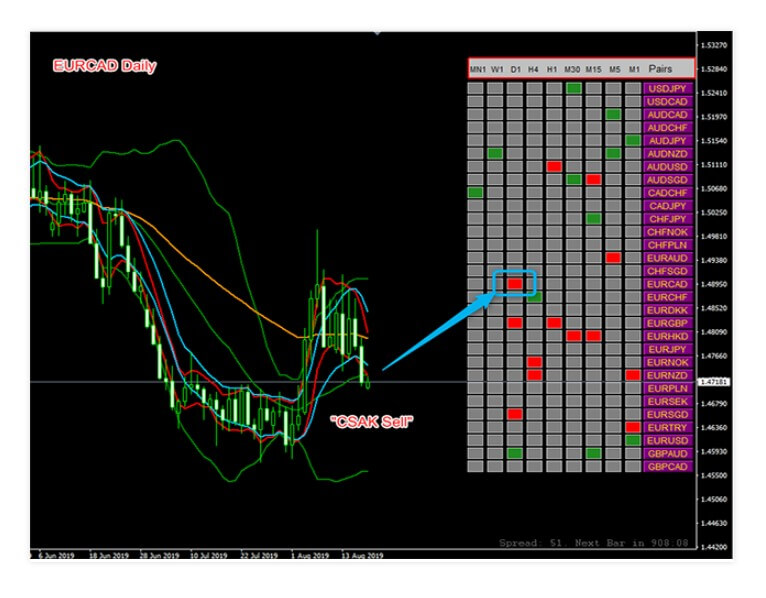

Currency Strength meter indicators are interesting to many traders and have many uses, not necessarily to enter new positions. CSM indicator is the work of Aliakbar Kavosi from Iran releasing the first version of CSM in March 2016 for the MetaTrader 4 platform and updated it twice in late 2019, giving the indicator a new code and better symbols integration with various brokers. This author is the owner of 18 published products on the MQL5 market without significant attention from the users. CSM is not free but seems to do other Currency Strength meters do, just with a small deviation.

Currency Strength meter indicators are interesting to many traders and have many uses, not necessarily to enter new positions. CSM indicator is the work of Aliakbar Kavosi from Iran releasing the first version of CSM in March 2016 for the MetaTrader 4 platform and updated it twice in late 2019, giving the indicator a new code and better symbols integration with various brokers. This author is the owner of 18 published products on the MQL5 market without significant attention from the users. CSM is not free but seems to do other Currency Strength meters do, just with a small deviation.

Price Action traders know Support and Resistance levels are the dominant element in their analysis, as well as other strategies. Support and Resistance is an elementary factor assessed for the prediction of points of trend reversals in both directions. This indicator is designed for the MetaTrader 4 for automatic recognition of concentrated prices based on which the zones are plotted on the chart. The indicator that can determine these levels instead of the trader makes the whole process faster, more precise, and non-subjective.

Price Action traders know Support and Resistance levels are the dominant element in their analysis, as well as other strategies. Support and Resistance is an elementary factor assessed for the prediction of points of trend reversals in both directions. This indicator is designed for the MetaTrader 4 for automatic recognition of concentrated prices based on which the zones are plotted on the chart. The indicator that can determine these levels instead of the trader makes the whole process faster, more precise, and non-subjective.

Judging by the provided video presentation on the Overview page of Greed GvGold for MT4 platform, this is a grid-like channel breakout strategy used with mixed performance results. Its first appearance was on the MQL5 marketplace in late March 2020, without much attention from the users. A couple of weeks later, it has been updated to version 2.1 introducing new features that dramatically change the final results from backtesting. It looks like the product was released in an incomplete stage or still in the testing.

Judging by the provided video presentation on the Overview page of Greed GvGold for MT4 platform, this is a grid-like channel breakout strategy used with mixed performance results. Its first appearance was on the MQL5 marketplace in late March 2020, without much attention from the users. A couple of weeks later, it has been updated to version 2.1 introducing new features that dramatically change the final results from backtesting. It looks like the product was released in an incomplete stage or still in the testing.

The Final Code is a relatively new EA without a clear description of how it works or any meaningful overview. It is made by Vitalii Zakharuk who has at least 46 products put into the MQL5 market. Final Code EA is published on 9th February 2020 without any updates so far. Based on what we have seen in the screenshots, The EA is a fast reversal strategy scalper working on lower timeframes. It belongs to the paid category and has no reviews or comments to date. The overview page presentation is very ambiguous, lacks even the elementary highlights, certainly inappropriate for the price set.

The Final Code is a relatively new EA without a clear description of how it works or any meaningful overview. It is made by Vitalii Zakharuk who has at least 46 products put into the MQL5 market. Final Code EA is published on 9th February 2020 without any updates so far. Based on what we have seen in the screenshots, The EA is a fast reversal strategy scalper working on lower timeframes. It belongs to the paid category and has no reviews or comments to date. The overview page presentation is very ambiguous, lacks even the elementary highlights, certainly inappropriate for the price set.

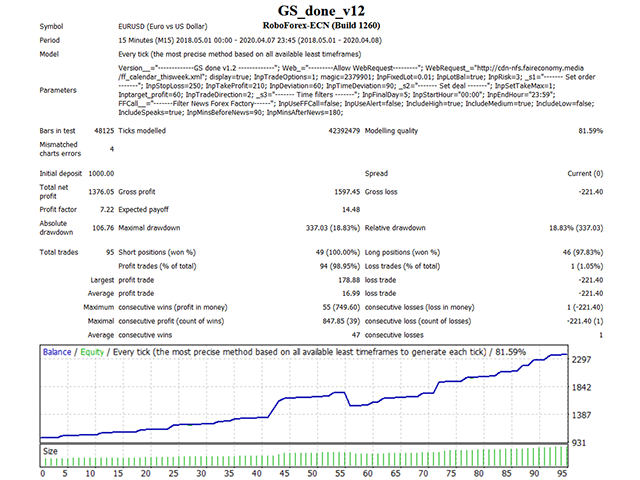

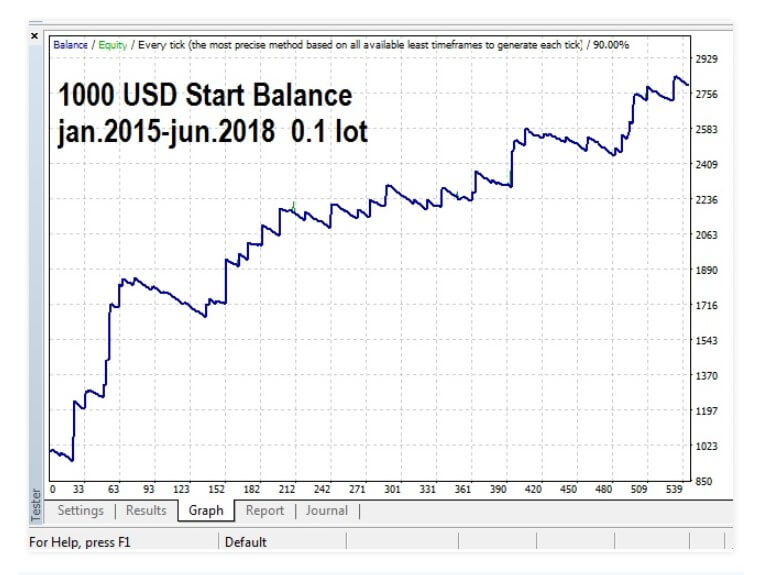

GS Done is an Expert Advisor made for the MetaTrader 4 platform that does not use Martingale or Grid methods in its strategy. The exact strategy and indicators used are not disclosed in the Overview page for this product published on the MQL5 market. The developer is Aleksander Gladkov from Russia, who has 11 product total on the market. This author is relatively new on the scene, only a handful of products have received attention form the community. Other products use Martingale methods in his EAs, but this one is different.

GS Done is an Expert Advisor made for the MetaTrader 4 platform that does not use Martingale or Grid methods in its strategy. The exact strategy and indicators used are not disclosed in the Overview page for this product published on the MQL5 market. The developer is Aleksander Gladkov from Russia, who has 11 product total on the market. This author is relatively new on the scene, only a handful of products have received attention form the community. Other products use Martingale methods in his EAs, but this one is different.

Based on the information and the settings for this EA we have determined it is using a channel breakout strategy for trade entries with several modifications and indicator combos for Risk Management and exits. HitAndRun is developed by Catalin Zachiu from Romania who has at least 26 other products, a couple of them having notable popularity and high ratings. The initial version of HitAndRun was published on the MQL5 market for the MetaTrader 4 platform on 10th February 2019. Updates are frequent with many new functionalities, the latest version 3.6 is from 31st of March 2020. The author’s dedication is notable as it is also evident in the comments page with the users. This EA is in the paid category but also has a free version linked.

Based on the information and the settings for this EA we have determined it is using a channel breakout strategy for trade entries with several modifications and indicator combos for Risk Management and exits. HitAndRun is developed by Catalin Zachiu from Romania who has at least 26 other products, a couple of them having notable popularity and high ratings. The initial version of HitAndRun was published on the MQL5 market for the MetaTrader 4 platform on 10th February 2019. Updates are frequent with many new functionalities, the latest version 3.6 is from 31st of March 2020. The author’s dedication is notable as it is also evident in the comments page with the users. This EA is in the paid category but also has a free version linked.

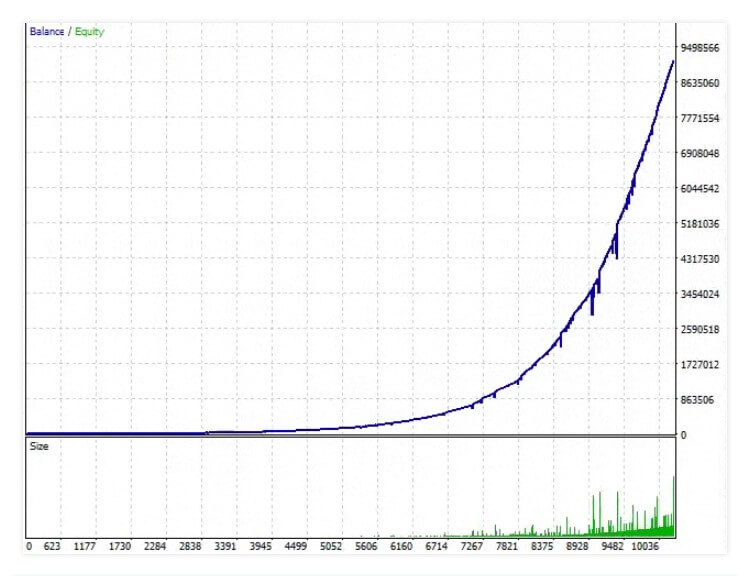

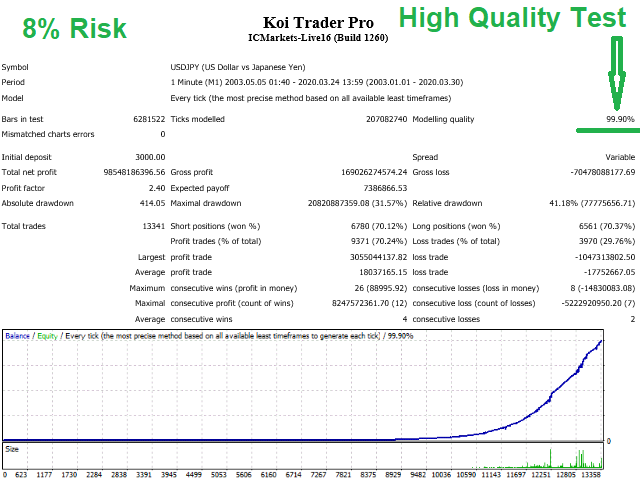

The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the

The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the

This version of the Let’s Do it EA is designed for the MetaTrader 4 platform and published on the MQL5 market as a simple averaging method EA for beginners. There are no specific traits about this EA and probably it is meant to avoid the promotion of any content that they could not consume. Let’s Do it is developed by Marta Gonzalez from Spain who has at least 53 products published on the MQL5 market and mostly works as a freelance programmer receiving good ratings. The first version of this EA is published on the 8th of February 2020, it is a new product with one update bringing the current version to 1.1. The update contains just the adaptation to Asian traders.

This version of the Let’s Do it EA is designed for the MetaTrader 4 platform and published on the MQL5 market as a simple averaging method EA for beginners. There are no specific traits about this EA and probably it is meant to avoid the promotion of any content that they could not consume. Let’s Do it is developed by Marta Gonzalez from Spain who has at least 53 products published on the MQL5 market and mostly works as a freelance programmer receiving good ratings. The first version of this EA is published on the 8th of February 2020, it is a new product with one update bringing the current version to 1.1. The update contains just the adaptation to Asian traders.

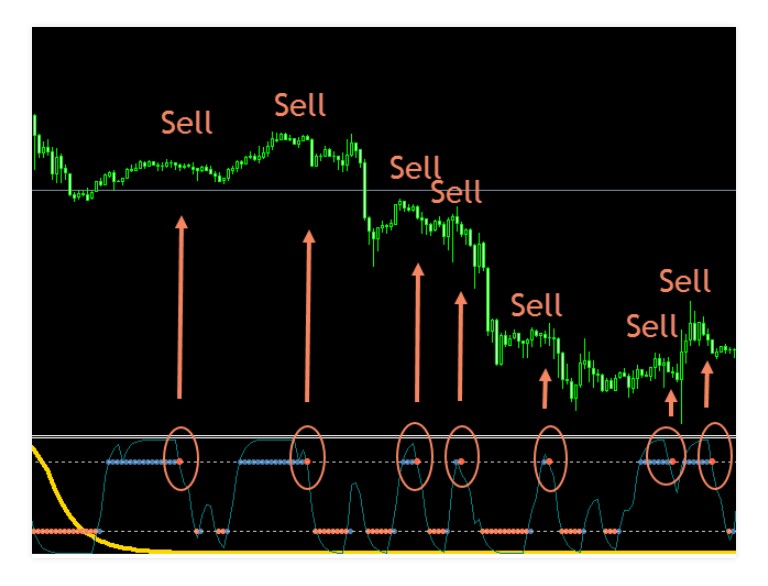

This is a classic composite trend confirmation indicator designed for trend following on the MetaTrader 4 platform. The author is Andrey Kozak who also has no less than 85 other products published on the MQL5 market. None of these products received any notable attention for the community. This is also the case with the Market Trend, even though the indicator may produce good results. The initial version was published on 16th January 2018 and has never been updated. It may be reasonable not to put effort into a product that is not needed. Still, trend confirmation indicators like this may be hidden gold to someone.

This is a classic composite trend confirmation indicator designed for trend following on the MetaTrader 4 platform. The author is Andrey Kozak who also has no less than 85 other products published on the MQL5 market. None of these products received any notable attention for the community. This is also the case with the Market Trend, even though the indicator may produce good results. The initial version was published on 16th January 2018 and has never been updated. It may be reasonable not to put effort into a product that is not needed. Still, trend confirmation indicators like this may be hidden gold to someone.

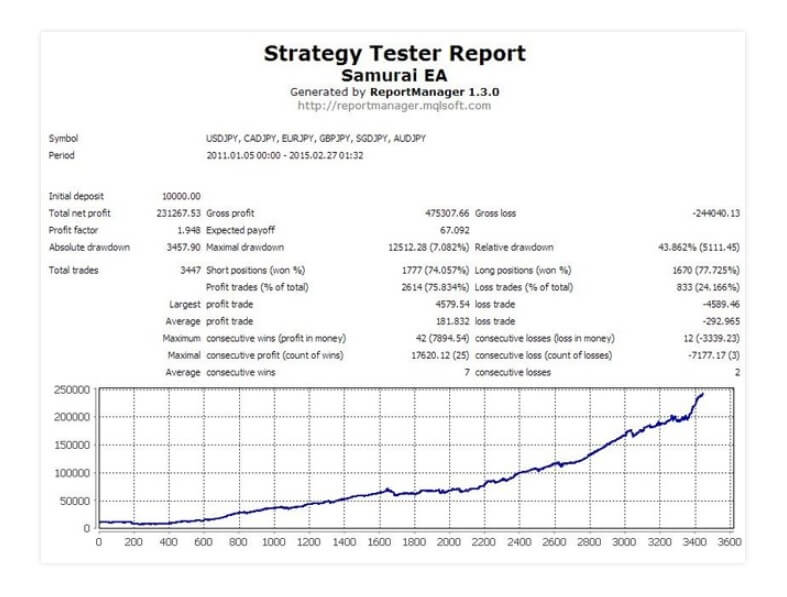

Scalper EAs are popular nowadays, especially among the younger traders where fast trading and in line with their lifestyle and strategic approach. Samurai Expert Advisor is another night scalper with specialized market scope. It is developed by Maksim Shmyrev from Russia for the MetaTrader 4 platform. The initial version was published on the MQL5 market on the 10th of March 2015. It has never been updated and stayed on version 1.0.

Scalper EAs are popular nowadays, especially among the younger traders where fast trading and in line with their lifestyle and strategic approach. Samurai Expert Advisor is another night scalper with specialized market scope. It is developed by Maksim Shmyrev from Russia for the MetaTrader 4 platform. The initial version was published on the MQL5 market on the 10th of March 2015. It has never been updated and stayed on version 1.0.

Candle pattern is a popular Price Action method for discovering trends and reversals. By discovering patterns traders can predict the price move making this method non-lagging although the reliability is relative. SmartPattern is published on 20th November 2017 with version 2.1 for the MetaTrader 4 platform and not updated meaning this indicator was probably already developed before publishing on the MQL5 market.

Candle pattern is a popular Price Action method for discovering trends and reversals. By discovering patterns traders can predict the price move making this method non-lagging although the reliability is relative. SmartPattern is published on 20th November 2017 with version 2.1 for the MetaTrader 4 platform and not updated meaning this indicator was probably already developed before publishing on the MQL5 market.

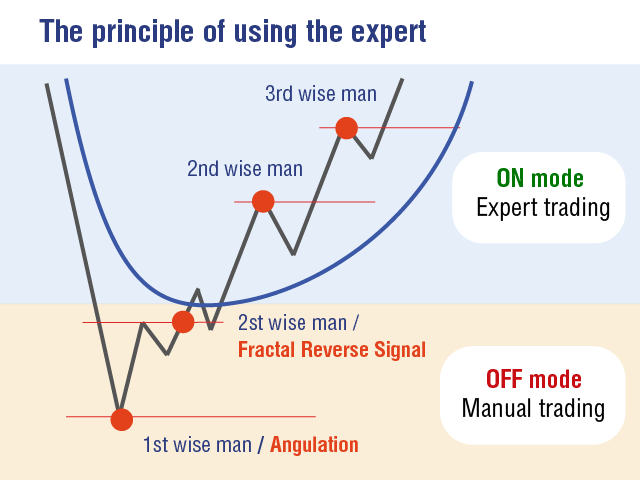

Originally made for the MetaTrader 5 platform, but soon after the updates this Expert Advisor and a manual trading tool are also released for the MetaTrader 4 platform too. Both products are listed on the MQL5 market in late February and March 2020. MAFiA Scalper is a mix of strategies and indicators designed for scalping although no timeframe or currency pairs are suggested. The developer, Andrey Dyachenko from Ukraine, has either just a publisher for another company products or he has invested a lot of time to develop a complex EA with many elements. Most of his 4 released products are related to Fractals method EA and tools, all are new.

Originally made for the MetaTrader 5 platform, but soon after the updates this Expert Advisor and a manual trading tool are also released for the MetaTrader 4 platform too. Both products are listed on the MQL5 market in late February and March 2020. MAFiA Scalper is a mix of strategies and indicators designed for scalping although no timeframe or currency pairs are suggested. The developer, Andrey Dyachenko from Ukraine, has either just a publisher for another company products or he has invested a lot of time to develop a complex EA with many elements. Most of his 4 released products are related to Fractals method EA and tools, all are new.

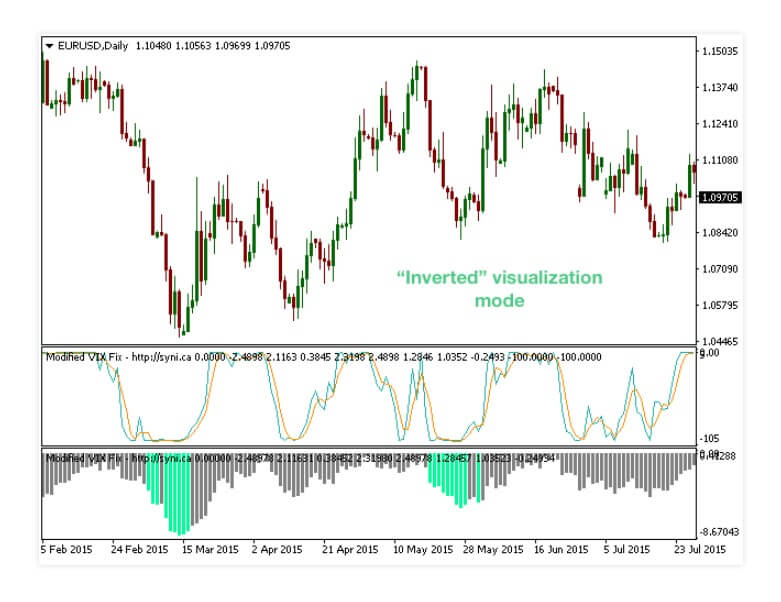

VIX is a volatility index used worldwide to measure this parameter crucial to many trading strategies for various tasks. Chicago Board Options Exchange calculates this Index and is available at cboe.com. The author of Modified VIX Fix is Jay Jantz from Canada working at Synapse Investments Research Group, publishing this indicator for the MetaTrader 4 platform on the MQL5 market. It belongs to the paid category, initially uploaded on 25th October 2016, and updated to version 1.1 in March 2017. The updates are minor, mostly visual additions and alert functionalities.

VIX is a volatility index used worldwide to measure this parameter crucial to many trading strategies for various tasks. Chicago Board Options Exchange calculates this Index and is available at cboe.com. The author of Modified VIX Fix is Jay Jantz from Canada working at Synapse Investments Research Group, publishing this indicator for the MetaTrader 4 platform on the MQL5 market. It belongs to the paid category, initially uploaded on 25th October 2016, and updated to version 1.1 in March 2017. The updates are minor, mostly visual additions and alert functionalities.

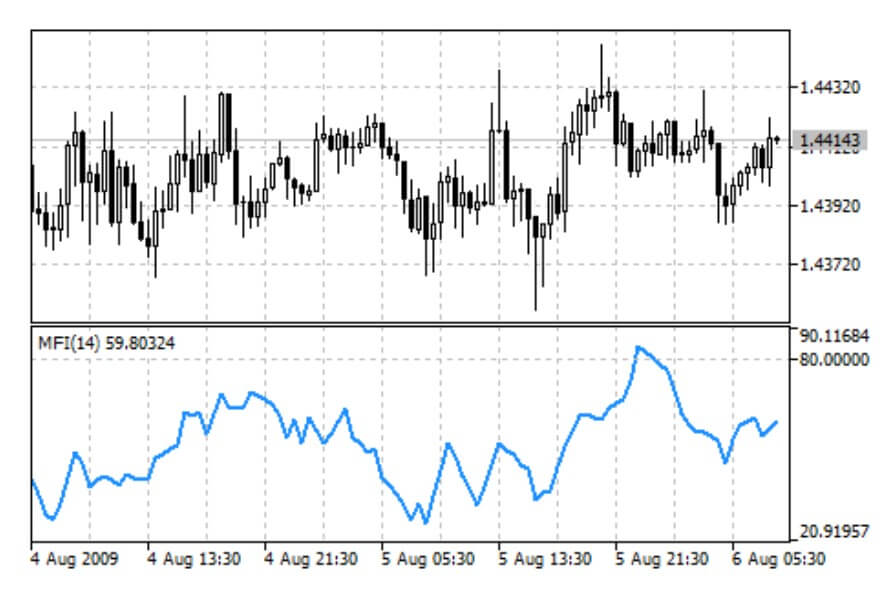

Money Flow Index or MFI is a commonly used oscillator indicator that can generate a few signals for reversals, trend confirmation, and even continuations. The specifics of this MFI is the Multi-timeframe dimension that gives trades more information on the higher timeframe without the need to switch to another chart. This is a very simple indicator modification without any other extras that could make it a versatile tool or an Expert Advisor.

Money Flow Index or MFI is a commonly used oscillator indicator that can generate a few signals for reversals, trend confirmation, and even continuations. The specifics of this MFI is the Multi-timeframe dimension that gives trades more information on the higher timeframe without the need to switch to another chart. This is a very simple indicator modification without any other extras that could make it a versatile tool or an Expert Advisor.

Shark is a relatively new Expert Advisor or automated software designed for the MetaTrader 4 platform. It is published on the MQL5 market by Yongzhi Wu from China on 10th December 2019. It has not received any updates yet and is not popular on the scene. Based on the somewhat roughly described Overview page, this EA is a scalper operating on specific currency pairs and timeframes. Even though scalper EAs are popular, this one missed its chance for various reasons. Notably, the developer has only published this product on the market that currently has no success. However, traders will not know how this EA is performing until they test it.

Shark is a relatively new Expert Advisor or automated software designed for the MetaTrader 4 platform. It is published on the MQL5 market by Yongzhi Wu from China on 10th December 2019. It has not received any updates yet and is not popular on the scene. Based on the somewhat roughly described Overview page, this EA is a scalper operating on specific currency pairs and timeframes. Even though scalper EAs are popular, this one missed its chance for various reasons. Notably, the developer has only published this product on the market that currently has no success. However, traders will not know how this EA is performing until they test it.

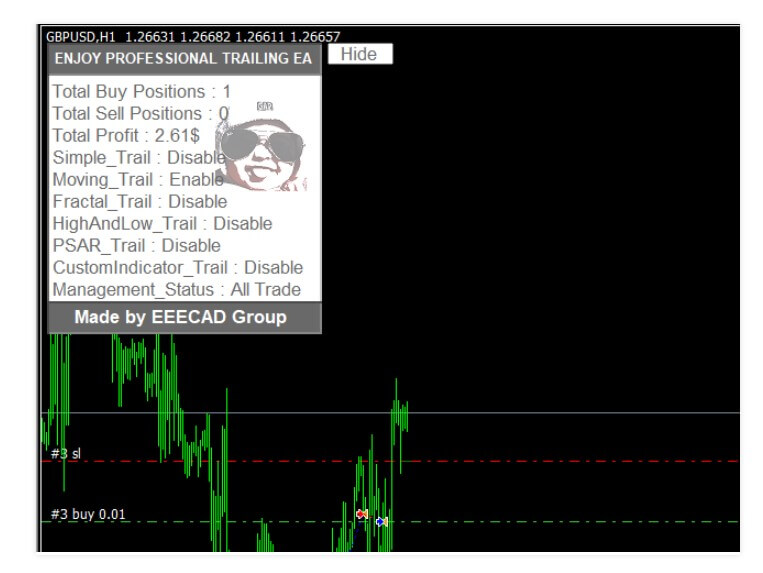

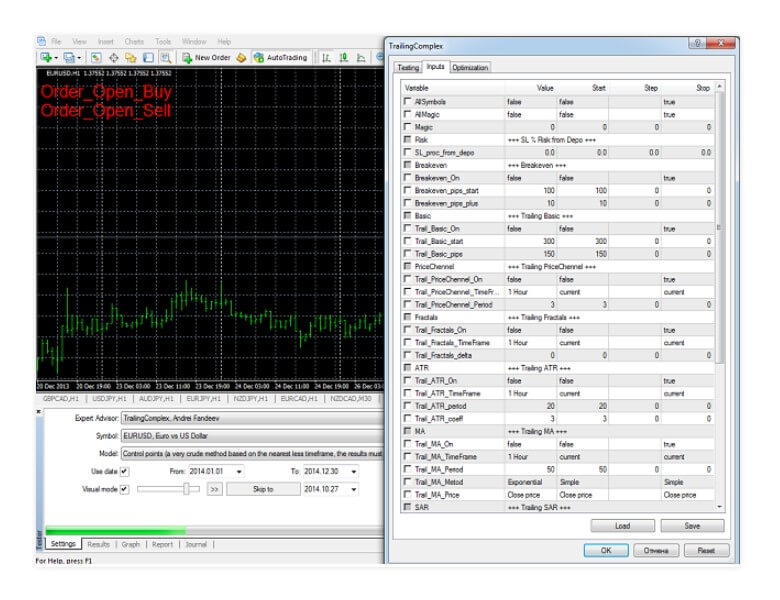

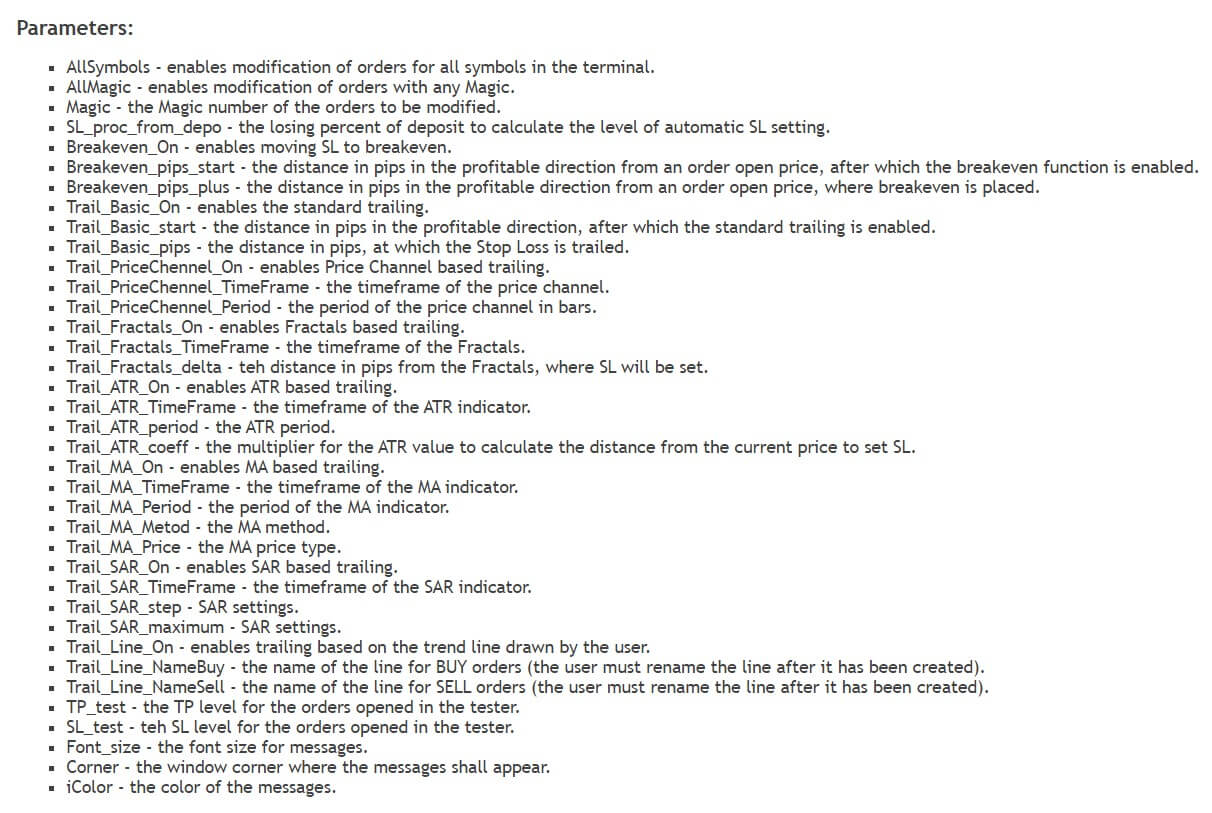

The Trailing Complex EA is not related to independent automated trading but to Trailing Stop Loss management with 9 variants and combinations. The tool is designed for the MetaTrader 4 platform that does not feature such advanced options for trailing. Trailing Stop is one of the most sought out and used elements of trading systems using any strategy. There are many similar tools although this one is very affordable.

The Trailing Complex EA is not related to independent automated trading but to Trailing Stop Loss management with 9 variants and combinations. The tool is designed for the MetaTrader 4 platform that does not feature such advanced options for trailing. Trailing Stop is one of the most sought out and used elements of trading systems using any strategy. There are many similar tools although this one is very affordable.

Moving Averages are the elementary indicators with many variations and used almost in every trading system. Adding multiple MAs with different settings and calculations could result in complete trading systems. Triple Moving Average EA MT4 is such an Expert Advisor designed for the MetaTrader 4 platform. It is developed by Jan Flodin from the Czech Republic who has 36 other products published on the MQL5 market, many of them are popular with great ratings.

Moving Averages are the elementary indicators with many variations and used almost in every trading system. Adding multiple MAs with different settings and calculations could result in complete trading systems. Triple Moving Average EA MT4 is such an Expert Advisor designed for the MetaTrader 4 platform. It is developed by Jan Flodin from the Czech Republic who has 36 other products published on the MQL5 market, many of them are popular with great ratings.