VIX is a volatility index used worldwide to measure this parameter crucial to many trading strategies for various tasks. Chicago Board Options Exchange calculates this Index and is available at cboe.com. The author of Modified VIX Fix is Jay Jantz from Canada working at Synapse Investments Research Group, publishing this indicator for the MetaTrader 4 platform on the MQL5 market. It belongs to the paid category, initially uploaded on 25th October 2016, and updated to version 1.1 in March 2017. The updates are minor, mostly visual additions and alert functionalities.

VIX is a volatility index used worldwide to measure this parameter crucial to many trading strategies for various tasks. Chicago Board Options Exchange calculates this Index and is available at cboe.com. The author of Modified VIX Fix is Jay Jantz from Canada working at Synapse Investments Research Group, publishing this indicator for the MetaTrader 4 platform on the MQL5 market. It belongs to the paid category, initially uploaded on 25th October 2016, and updated to version 1.1 in March 2017. The updates are minor, mostly visual additions and alert functionalities.

Jay Jantz has 25 products in total, only one of them received a bit of attention from users. Modified VIX Fix is a very specialized indicator, the author starts the Overview page with a quote by Larry Williams “The VIX Fix is a powerful indicator that detects market bottoms for any asset”. This means this indicator is a long trade after bottom specialist, tending towards the reversal type strategies as it is not lagging.

Overview

Fix in the Modified VIX Fix means the indicator is not only based on the S&P 500 but can be applied to any trading asset. Market bottoms are identified by peaks in the indicator histogram representation after which a bullish trend appears. According to the author, this indicator has two components integrated, standard deviation and stochastics as per Larry Williams VIX application from 2007.

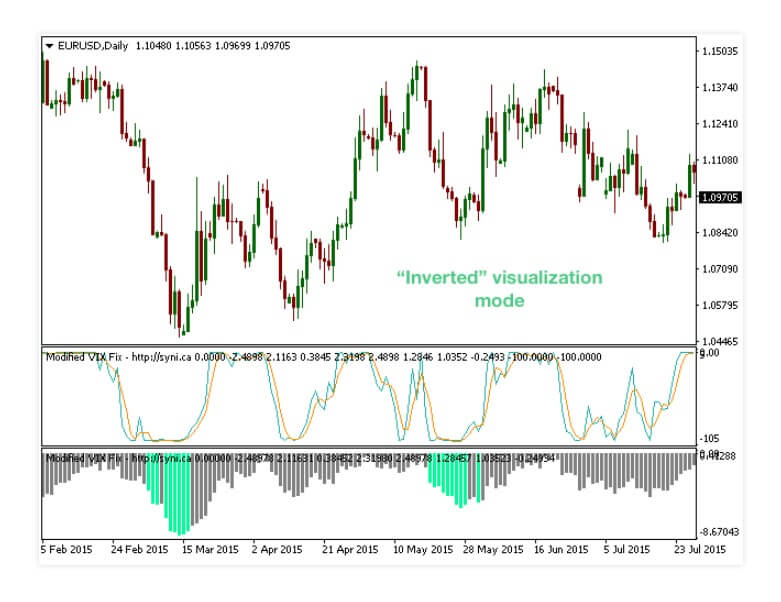

Modified VIX Fix has two modes, both of them can be applied to the same analysis for better precision. The first one is regular VIX standard deviation mode where the market bottoms are identified with a teal-shaded bar by default. Long trade entry is made on the first gray histogram bar. The second mode is using the stochastic oscillator line crossing. When both modes are used, a trader can combine for more reliable trade entries only when the stochastic indicator lines are exiting the “80” range and crossing each other. For all signals, an alert can be set on various conditions.

In the indicator settings panel, traders have a few functional parameters. You will be able to change the modes to regular or stochastic. The regular one uses Bolinger Bands to highlight the bottoms. Standard deviation is included in the Bollinger Bands and can be adjusted. The standard deviation period and the Bollinger Bands length are also optional. Modified VIX Fix is based on percentages, not fixed values, and therefore always has the same range. This range can be modified with the periods and with the threshold for which the signal is regarded as valid.

The stochastic oscillator is adjustable just like the classic one, with the D and K periods. To appear more logically, the histogram and the stochastic oscillator can be inverted, so the signal bottoms appear in the lower part of the indicator window. The rest of the settings are aesthetic.

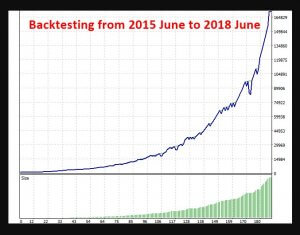

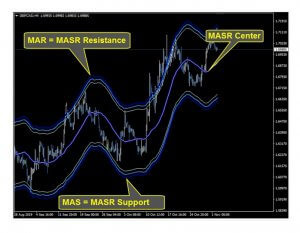

Since the Fix in the Modified VIX does not show exit points or anything other than market bottoms, exit and other supporting indicators are a must. Of course, the developer is suggesting some of his own although we are certain there is an endless number of combinations and systems that can be made with this indicator. The Overview page will give you some screenshots that are easy to understand and will give you the right insight on how the indicator works using both modes. Even the author does not mention it, the points where the bottoms appear can also be used for the Support Line determination meaning this indicator is also good for Price Action strategies.

Service Cost

Modified VIX Fix cost is $49 with 984 activations, $16 to rent for 1 month, and $33 to rent for 3 months. A demo is offered and certainly your first step before the purchase.

Conclusion

Certainly, for scalpers on low timeframes, VIX is not recommended, as most of the market bottoms are defined on higher timeframes such as Daily. Another interesting use for this indicator is the short trade exit marker, using the same logic. This indicator belongs to the specialized and interestingly composed category, it could be the most precise and useful to you or a complete waste of time. Unfortunately, there are no reviews based on which we could say more about users’ success. In the comments section, notably, some want to use it on shorter timeframes than Daily, and this may be the reason why this indicator is not popular. Most of the traders use lower timeframes, especially very popular scalpers.

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/18972