The professional management of asset funds is nothing new. However, the fund management industry is ineffective due to a lack of standardization across-the-board. This makes operations and auditing processes fairly opaque endeavors – and this does no favor to the industry. Another pain point is the usually high cost of setting up an asset management fund, both timewise and financially. And there’s yet another issue – the industry is plagued by outdated infrastructure. This makes room for errors and inefficiencies.

The Melon Protocol is an asset management platform that relies on blockchain technology. Melon grants both fund managers and asset owners a decentralized, fraud-free, and secure asset management environment.

This article delves deeper into how exactly the protocol hopes to achieve this.

Understanding Melon

Melon is a blockchain protocol and a digital asset management platform based on Ethereum. Initially built to support asset management on Ethereum only, the team plans to expand this possibility to other blockchains in the future. It enables asset owners to create and manage pooled digital assets on-chain. Melon supports both traditional and crypto-assets.

Through the deployment of smart contracts, Melon automates the back-office processes that are involved in managing assets in the traditional world. This, and in a decentralized fashion – which means you’re fully in charge of your assets, and no other party can control any aspect of them.

The Melon Protocol allows for the following possibilities:

1. Fund managers can manage assets more cheaply and securely than ever before.

2. Investors are protected from issues like fraud because the management of assets is done within specified parameters. In a way, it’s like a regulated environment, but this time with technology. Blockchain-based smart contracts ensure this. All parties have to adhere to the rules by default.

3. The barrier to entry to professional asset management is lowered. It’s now infinitely simpler and cheaper to set up an asset management fund – on the blockchain. Individuals who would wish to access such a service can now do so. It’s not a preserve for the wealthy any longer.

4. Melon will do standardized fund calculations that will establish a fund manager’s track record. Users will know right off the bat if to trust a service provider or not.

5. Asset owners can have their money professionally managed while preserving their anonymity. Your fund manager does not have to know you or your name. No intrusive KYCs.

6. You can monetize your knowledge in asset management by charging a fee for the services.

Components of the Melon Ecosystem

- The Protocol

This is a set of agreed guidelines that run the system. They comprise a “vault” and a “module” (more on that later).

- The Portal

This is a user interface through which you can access the protocol. It’s also where you interact with the platform.

- Melon Token (MLN)

This is the native cryptocurrency of Melon. It gives users design rights, as well as an incentive for them to keep engaging with the platform.

- The Ecosystem

This is the collective of all current participants and technologies that contribute to and are affected by the platform.

Features of the Melon Ecosystem

#1. Vault

This a digital treasury where fund calculations and audits are conducted. The vault is also the brick on which modules (more on that next) are built. The vault is designed with the highest level of security.

#2. Modules

Modules are ‘specifications’ that allow each fund manager to address the unique needs and requirements of each different fund.

The Melon team breaks down modules into these themes:

- Data feeds: these are ‘conduits’ that supply real-world data for various calculations

- Universe: a system that defines available assets for funds managers, including digital tokens

- Risk management: this is a set of rules to control the behavior of fund managers

- Exchanges: These connect the fund to various external exchanges to facilitate trading

- Rewards: a system for setting various fees for the fund

- Participation: a system that allows various participants to invest and redeem funds

- Compliance: a set of rules that enables funds to operate within the regulations of their jurisdiction

Participants of the Melon Ecosystem

#1. Fund managers

These are individuals/entities that create and manage asset funds. Fund managers can choose the modules that suit their specific use case. They can also compete for a position on the Melon platform’s leaderboard. Fund managers are Melon token holders and can also use those tokens to vote on the direction of the Melon protocol.

#2. Module builders

Module builders create tools for use by the fund managers. These modules could be anyone – including a law firm that develops compliance rules, or one that creates a decentralized asset exchange for users to trade assets.

#3. Related entities

These are individuals or entities that provide various types of support to the Melon ecosystem. An example is a digital wallet, e.g., MetaMask, that would allow Ethereum users to plug their accounts into the protocol. Or a tool/software that monitors the system for security issues.

The Melon Token (MLN)

MLN is the cryptocurrency of the Melon protocol and is an essential part of the system that plays several roles. The melon token is an Ethereum-based token. Among other roles, the token serves as a voting mechanism. Melon token holders can vote on the monetary policy of the token, the technical design of the system, and so on. It’s also used to withdraw earnings on the platform.

Key Figures of MLN

As of Aug 09, 2020, Melon is worth $25.89, according to Coinmarketcap. It ranks at #179, with a market cap of $32,111,211, a 24-hour volume of $3,030,829, and a circulating and total supply of 1.25 million. Its highest and lowest ever price was $270.04 (Jan 04, 2018) and $1.80 (Mar 13, 2020), respectively.

Where to Store and Buy

You can trade BTC, USDT, EUR, USD, ETH, WETH, LPT, REQ, UXD, WTBC, AND, or NMR for MLN in any of the following exchanges: Kraken, MXC, Hoo, CoinEx, Bibox, Bitfinex, HotBit, HitBTC, Livecoin, Kyber Network, Balancer, 1inch Exchange, Fatbtc and more.

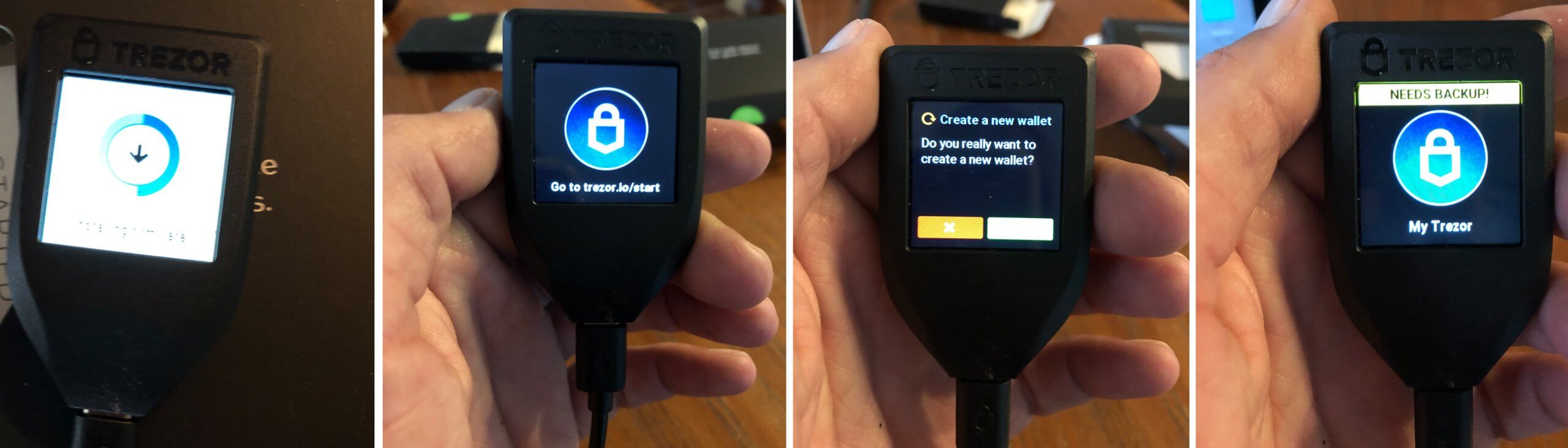

MLN is an ERC20 token, and that means when it comes to possible wallets, you have endless choices. Great options include MyEtherWallet, MetaMask, Exodus, Guarda, Coinomi, and of course, hardware and user faves Trezor and Ledger Nano.

Final Thoughts

Melon hopes to overturn the traditional way of asset management. Thanks to its application of blockchain to the industry, all players can expect more transparency, security, and effectiveness in the future. The Melon Protocol is one to watch.