How many minutes or hours do you spend on your phone every day? What if you could earn extra cash while doing so? It turns out you can, at least on Storm Market.

Storm Market is a blockchain-powered platform that allows millions of people from all over the world to perform small tasks and earn cryptocurrency. All you need to do is sign on the platform, identify tasks you like, and get working.

In this article, we’ll delve deeper into what the Storm project is all about, including how you can start earning tokens!

What is Storm?

Storm is the native currency of StormX, a blockchain project that aims to change how we view work by decentralizing the gig economy. Storm’s platform allows freelancers from all over the world to perform certain ‘microtasks’ and earn cryptocurrency in return through blockchain-based smart contracts. Such microtasks may include watching videos, completing surveys, and trying new products.

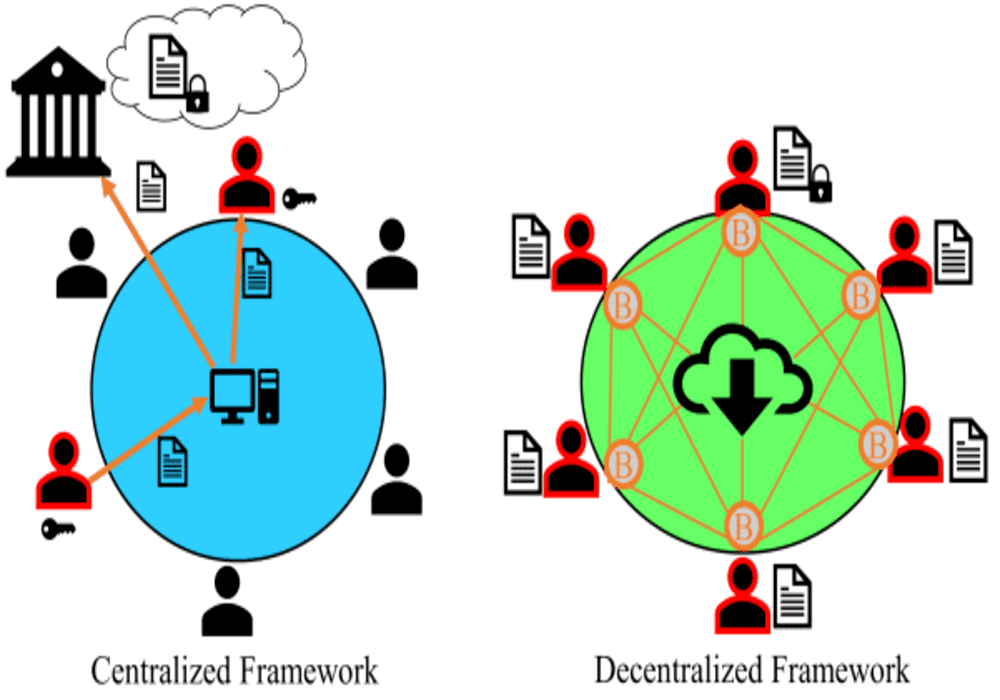

The StormX team believes that the opportunity to earn to get by in life and advance ourselves along with our communities is a need that’s common to us all. It aims to challenge the current freelance industry (e.g., the likes of Upwork, Guru, and Fiverr) that’s not only centralized but also takes a huge cut from freelancers’ earnings.

Storm Market is the place where Storm wants to take the first step to change this problem. Ultimately, users can take part in ‘gamified’ microtasks that allow anyone anywhere to earn money at any time, as long as they’re connected to the internet – no matter what device they are using. And it’s just not about money. Community participants can interact and engage with each other, fostering active participation and a feeling of belonging.

The Storm Market will enable this for users:

- Allow them to find new opportunities easier.

- Make it easier to advance.

- Make it easier to engage with others, no matter their role in a community.

The Principles of StormX

StormX believes in and is guided by these three principles:

- Effective global inclusion is possible if all participants can negotiate and reach an understanding.

- The opportunity to earn and improve one’s condition is a basic human right.

- Efficiency is about respecting time – the most valuable resource.

How can you earn STORM Tokens?

There are three main ways through which users can earn STORM tokens on the Storm Market.

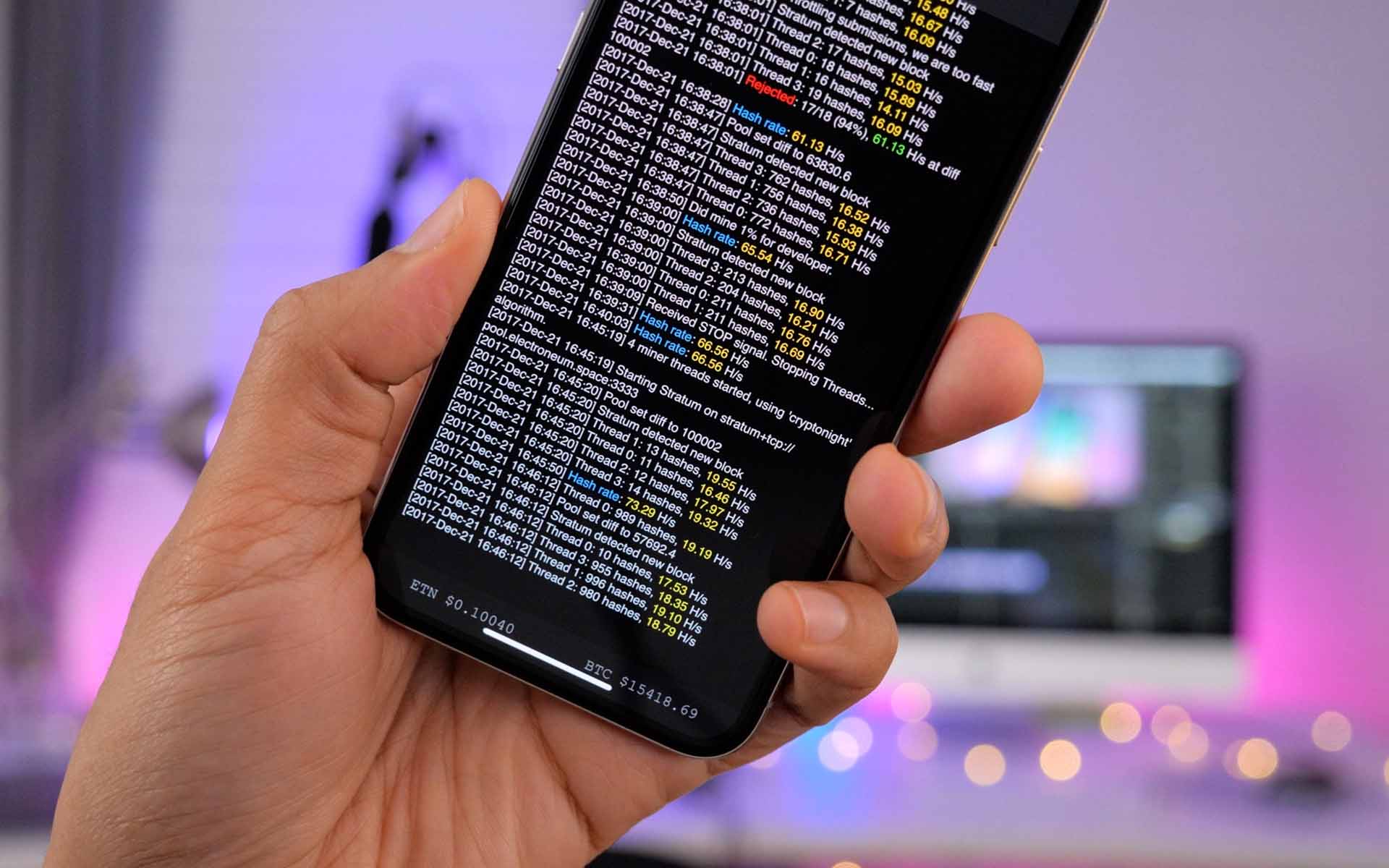

STORM PLAY lets users “play to earn.” They can do this through the Storm Play application on both Android and iOS. ‘Playing’ involves playing videos, filling out surveys, or trying new products and services. Players can earn crypto in the form of Storm Bolts, Bitcoin or Ethereum.

STORM SHOP lets users “shop to earn.” Via this platform, users are rewarded for purchasing certain products and services.

STORM GIGS lets users “perform to earn.” Participants are given the opportunity to earn STORM tokens for performing various micro-tasks such as freelance tasks, quality assurance testing, machine learning tasks, and so on.

Who Can Use the Storm Market?

Anyone from around the world can use the Storm Market. However, the platform is also created with certain categories in mind, and the team has labeled these categories to make it easier for participants to interact with each other.

People who use the platform to make money/take advantage of available opportunities are called Storm Players. Advertisers, gaming platforms, companies, and recruiters and anyone else who can offer opportunities are known as Storm Makers.

Other participants on the platform are:

- Achievers- individuals who like to learn and master new skills, and want to succeed at whatever they do

- Disruptors – individuals who like to challenge existing systems and are inclined towards tasks such as testing, rearranging existing elements and so on

- Explorers – these are free-spirited individuals who like tasks with an exploration and creative element, and are likely to find and complete tasks on the fly

- Socializers – these are people who like interacting and forming connections with others and are likely to check on and complete referral tasks.

- Philanthropists – these are people who like tasks that are inclined towards contributing to the greater good, and are more likely to seek Storm Makers whose tasks involve acts of altruism

- Players – a general term encompassing all the above, these are individuals who carry out tasks so as to clinch awards and prizes.

How Does Storm Market Use the Blockchain?

The blockchain is a crucial and central part of the Storm Market platform. It facilitates the efficient matching of Storm Makers and Storm Players.

Storm market also utilizes blockchain smart contracts – ‘Storm Contracts’ to automatically enforce the terms of engagement between Players and Makers. The automation and the elimination of human intervention lead to faster processes, high efficiency, and lower fees.

Storm Tokenomics

As of June 10, the price for STORM token was $0.003401. The token held a market position of #154, with a market cap of $26, 644, 398, a 24-hour volume of 8, 856, 343, a circulating supply of 7, 833, 646, 881 and a total supply of 9, 967, 745, 869. STORM’s all-time high was $0.246579 (Jan 09, 2018), while its all-time low was $. 0.000572 (March 13, 2020).

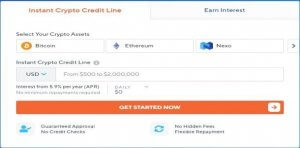

Where to Buy and Store STORM

You can acquire Storm tokens by participating in the Storm Market platform, where you will earn in the form of a currency known as Bolts. You can then convert these into Storm tokens. Additionally, you can get STORM tokens for any of these exchanges: Bittrex, HitBTC, and BitSwap.

STORM token is based on Ethereum’s blockchain, and thus, you can store it on any ERC20/Ethereum-compatible wallets. Popular options include MyEtherWallet, Mist, MetaMask, Jaxx.io, Trust Wallet, Atomic Wallet, Ledger, and Trezor.

Who’s on the Storm Team?

Storm is the brainchild of CEO and Founder Simon Yu, who is a graduate of the Foster School of Business.

Sean Zhong is the Chief Technology Officer, and he has experience working in data warehousing and software engineering.

Tara Nygaard is the chief operating officer, and she has experience in cybersecurity and the Internet of Things (IoT).

Storm also features a strong suit of advisers such as Bancor CEO Guy Benartzi, Bittrex founder and CEO Bill Shihara, as well as Ethereum’s co-founder Anthony Do Iorio.

Final Words

Storm provides a platform for everyone around the world to earn anytime, whether on their mobile devices, tablets, laptops, and so on. With just a click of a button, you can earn extra money by sparing just a few minutes a day. It is a safe and secure platform for people who want to promote products, get small tasks taken care of, and so on. On Storm, individuals can also engage, interact, and be part of a larger community. Storm is a game-changer, and it will be interesting to see how it evolves.

Craig Wright’s legal team seems to have alleged that Wright controls one of the BTC addresses that is affiliated with the Mt. Gox hack.

Craig Wright’s legal team seems to have alleged that Wright controls one of the BTC addresses that is affiliated with the Mt. Gox hack.

Cardano’s smart contract language is Plutus, which is based on Haskell. Cardano is basically written in Haskell. Cardano is designed with the Cardano computational layer, which by default consists of two layers while one allows formally specified languages used for checking the code of the smart contract, and the other is a defined officially virtual machine and language framework. The default layers’ goal is to check the smart contracts to avoid severe vulnerabilities in smart contracts without any additional requirements.

Cardano’s smart contract language is Plutus, which is based on Haskell. Cardano is basically written in Haskell. Cardano is designed with the Cardano computational layer, which by default consists of two layers while one allows formally specified languages used for checking the code of the smart contract, and the other is a defined officially virtual machine and language framework. The default layers’ goal is to check the smart contracts to avoid severe vulnerabilities in smart contracts without any additional requirements. Ethereum has been trying to incorporate formal verification for a long time now since it has many smart contracts functioning on the platforms. They have even come up with a publication called “making smart contracts smarter.” This publication focuses on smart contracts bugs and mainly focuses on ways to mitigate them. This includes the change in operational semantics of Ethereum to inbuilt formal verification.

Ethereum has been trying to incorporate formal verification for a long time now since it has many smart contracts functioning on the platforms. They have even come up with a publication called “making smart contracts smarter.” This publication focuses on smart contracts bugs and mainly focuses on ways to mitigate them. This includes the change in operational semantics of Ethereum to inbuilt formal verification.