Are you looking for an open-source, public blockchain platform that is capable of leveraging the simplicity and security advantages of Bitcoin’s UTXO protocol while integrating the flexibility and convenience offered by smart contracts? If yes, the Qtum Core wallet might be your ideal option. It enables two virtual machines: Qtum’s native x86 VM and Ethereum’s EVM. Note that Qtum Core is the only cryptocurrency wallet that supports the “Send To Smart Contract” feature. Also, if you want to receive MedCoin (MED), you need to have a valid Qtum Core Wallet.

Even so, what are some of its top features? How does it compare to other desktop cryptocurrency wallets in the market? Read on as this review provides you with detailed insight into everything you need to know about Qtum Core. However, before we go into details, let’s first find out some of its key features.

Key features

OS compatibility: Qtum Core wallet can operate across different platforms such as PCs, Macs, and cloud servers. In PCs, it is compatible with several operating systems, including Windows, Linux, and macOS.

Multicurrency: Qtum can securely support 26 coins and ERC20 tokens.

Proof of Stake (PoS): It features a consensus mechanism that significantly helps the network scale on-chain.

State-of-art security: Qtum Core integrates advanced security features such as Decentralized Governance Protocol (DGP) that allows developers to take control of the consensus parameters.

C programming language support: Qtum Core wallet is capable of supporting programming languages for C++, Python, Rust, and many more.

Proprietary account abstract layer (AAL): It makes handling, executing, and creating contract funds possible by supplementing the Bitcoin script with new opcodes.

Smart contracts engine: The feature executes programs on the network and can operate across different platforms.

Easy-to-use: The best thing about the Qtum wallet is its simplicity. It integrates an easy-to-use interface that is suitable for beginners.

Is Qtum Core Wallet Safe?

One of the best things about Qtum Core is that it does not store your private keys. It provides users with complete access and is entirely responsible for their funds and security. They are only required to update their PCs with the latest antivirus and operating system to enjoy the full benefits of the Qtum Core Wallet. Note that the QTUM wallet uses a checksum technique to detect wrong and corrupted numbers.

It also uses the SHA-256 hash algorithm to come up with unique codes for your Wallet Input Format (WIF) private keys. This is done twice for optimum results. Also, for more accurate results, set the SHA-256 hash input to be in the hexadecimal data format and not ASCII text.

How to Set Up QTUM Core Wallet

Step 1: Visit https://github.com/qtumproject/qtum/releases and download QTUM Core’s latest version

QTUM Core is capable of supporting several operating systems, including Windows 32/64-bits and Mac OS.

Step 2: Install

You can install with either dmg file or .exe.

Step 3: Run Qtum Core

After the installation is complete, start the application by pressing “OK.” Note that during the initial run, the application might take some time to synchronize. Wait until it displays the number of blocks left as “0”. Technically, it will take less than the estimated time.

Step 4: Encrypt your wallet

Go to “settings” and tap on “Encrypt Wallet” to set a new passphrase. It is recommended to set a password of ten or more random characters. Alternatively, you can use eight unique words.

Step 5: Backup your wallet

Open “file” and click on “Backup Wallet.” Also, you will be required to set a wallet name in the “settings” section.

Step 6: Done! You can now send and receive Qtum

Click on “File” to get a list of the addresses you will be using to receive and transfer QTUM. Your receiving address can either be one or many. Pick an address of your choice and click on “copy.” Next, you will want to check whether the address is valid. Paste it on the receiving address input window located in MediBloc’s homepage and click on “check” to find out if the address is valid.

How to Send QTUM

You will find the send menu on the left side of the page. Here, you will find different functions that are quite basic and easy to learn to use. Below is an insight on how to go about sending QTUM:

Pay to: Enter the address of the receiver

Label: Although it is optional, it is recommended that you fill in this category with a name or tag for future reference.

Amount: Enter the desired amount of QTUM you want the recipient to receive.

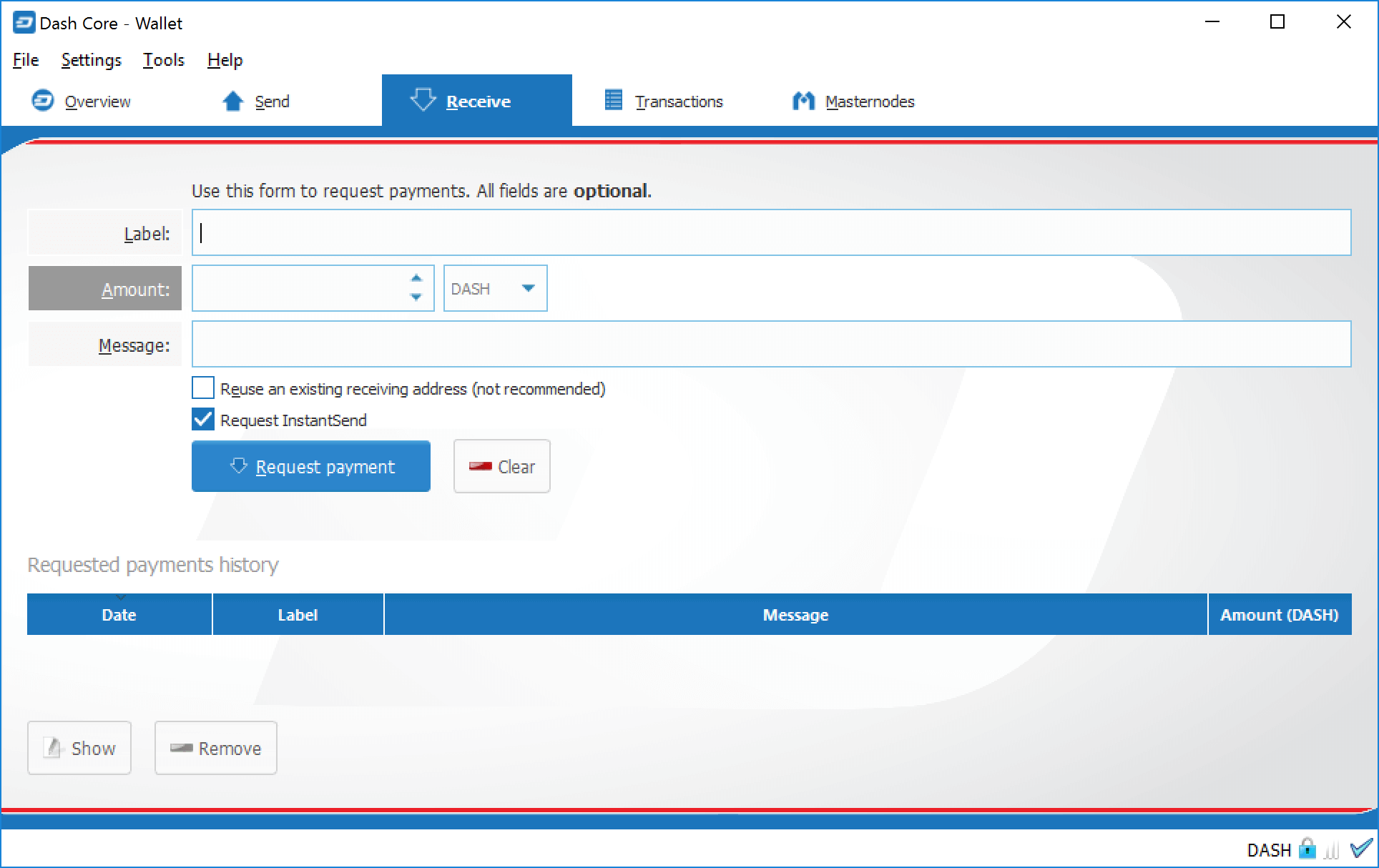

How to Receive QTUM

Before you receive QTUM, you need to know your address. However, the best thing with this crypto wallet is that you can generate new addresses. It is useful for receiving payments from more than one sender. The wallet also helps you keep track of your transactions.

To get your address, simply tap on “request payment” and pop up dialogue will show up with your unique address. You can receive coins from other users or an exchange using the address.

How to Add QRC20 Tokens to Your Qtum Core Wallet

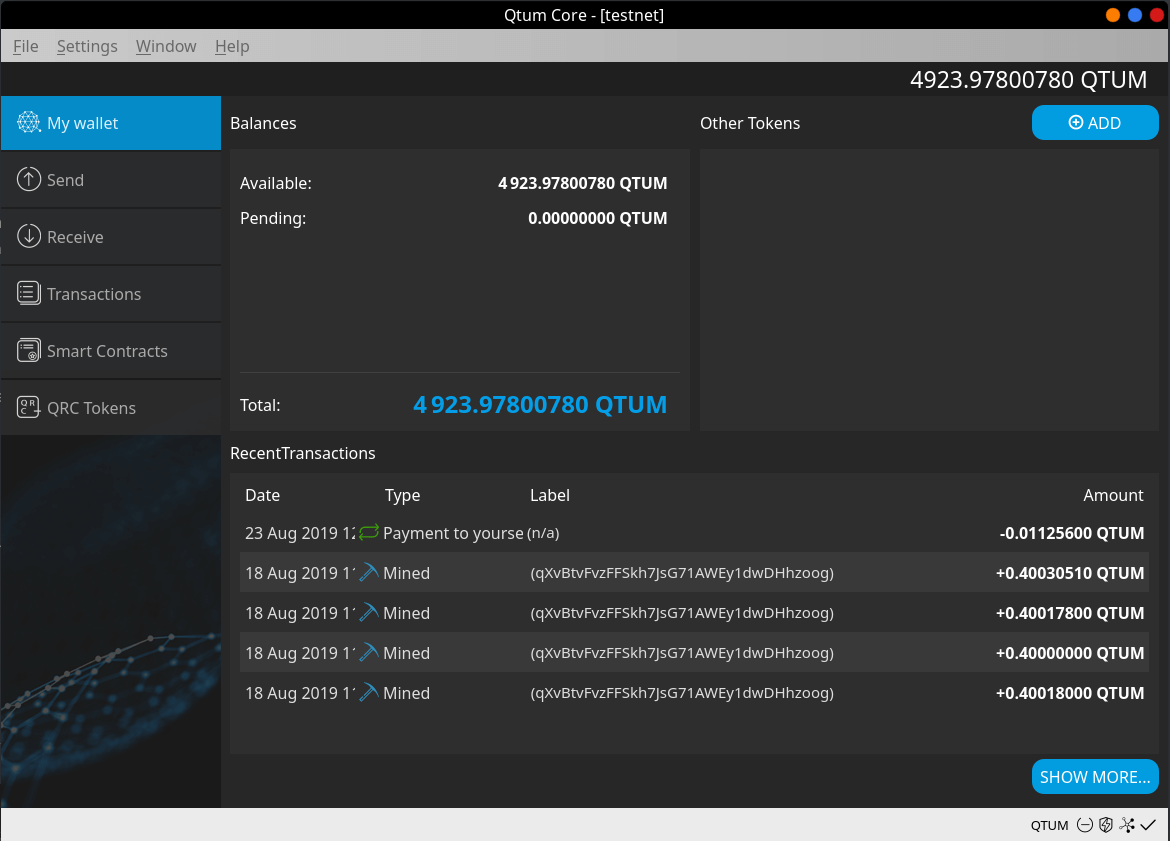

Normally, the Qtum Core wallet is designed to display your current QTUM coin balance. If you want it to also display your token balance, you will be required to bind your existing QTUM address to your desired contract address. After doing so, you should be able to see your QTUM tokens. Below is a step-by-step guide into adding QRC20 tokens to your wallet.

Step 1: Open the app

You should note the “other tokens” section at the right side of your page will be empty if you have never added a token before.

Step 2: Create new QTUM address

Let’s assume you don’t have a QTUM address yet. Click on “File” and choose to receive addresses. Create a new address by selecting NEW. Enter your desired name for your wallet address and select the OK button to create your new address.

Step 3: Add token

Go to the QRC Tokens section located on the left side of the app and choose the “Add Token” option. Once you have added your contact address, the rest of the information will be automatically auto-filled.

Step 4: Bind

Select the QTUM address you want to bind by expanding the “Token Address” list. Immediately after binding the address, the balance of your transaction history should be updated automatically. That is it! You should have your LSTR tokens listed on your wallet.

Qtum Core Security 101

Now that you know how to create and add tokens to your wallet, it is imperative to understand that the security of your funds might not be guaranteed if you don’t do anything to enhance it. Below are some of the key things you should do to improve the security of your QTUM wallet:

- Install the latest antivirus: Hackers are capable of installing malicious software on your computer and use it to access your private keys. Ensure you have the latest antivirus installed on your PC to be safe from phishing activities from hackers.

- Back up your recovery phrases: During registration, you are notified that you will be denied access and risk losing your funds for good if you forget or lose your passwords. For this reason, ensure you keep multiple backups of recovery phrases.

- Keep your private keys safe: Qtum Core provides users with full access to their private keys. However, if they are not properly stored, they might end up in the wrong hands and, therefore, risk losing your funds. The best way to guarantee their safety is to create a cloud backup.

Although all the above factors will help improve the safety of your QTUM coins, you should ensure you update yourself with the latest security features. Hackers are always coming up with new strategies and, therefore, updating your antivirus, and operating system is critical.

Pros and Cons of Qtum Core Wallet

Pros

- Supports sending and receiving QTUM coins

- Supports sending and receiving QRC20 tokens

- Integrates smart contracts creation and interaction

- Features a Regtest mode that enables developers to build their private network

- Has a “prune” to minimize disk usage

- Supports RPC and API commands used in Bitcoin Core

Cons

- Runs in full node

- Requires regular updates

Final Verdict: Is Qtum Core Wallet Worth Your Money?

Well, if you are looking for a desktop wallet to store your QTUM, this might be your best option. Besides being the only QTUM wallet that supports the “Send To Smart Contract” feature, it integrates quite a good number of exceptional security features. Additionally, it is quite easy to use. You will find its interface to be quite appealing to everything strategically placed for your convenience.