BitMEX in-depth guide (part 4/5) – BitMEX’s beginner-friendliness and customer support

This part of our guide will dig deeper into what BitMEX has to offer in terms of customer support and if it is generally a beginner-friendly platform.

Is BitMEX beginner-friendly?

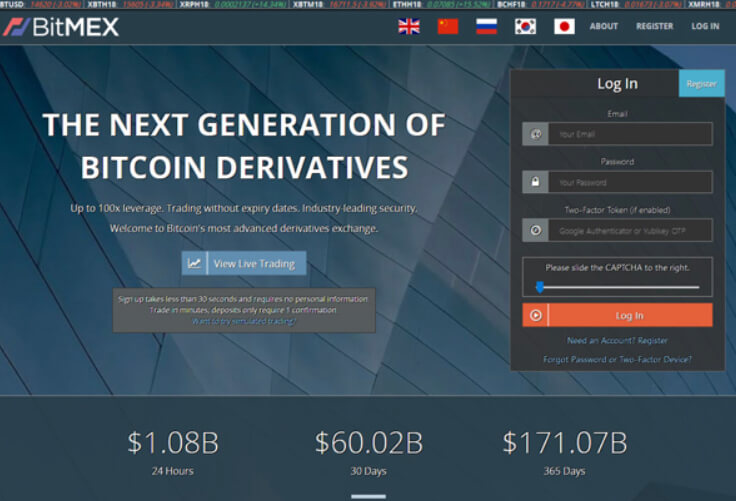

BitMEX attracts a great deal of volume across crypto-to-crypto transfers. This helps maintain BitMEX as a hot topic. On top of that, BitMEX has relatively low trading fees and can be used around the world (except in the US).

![]()

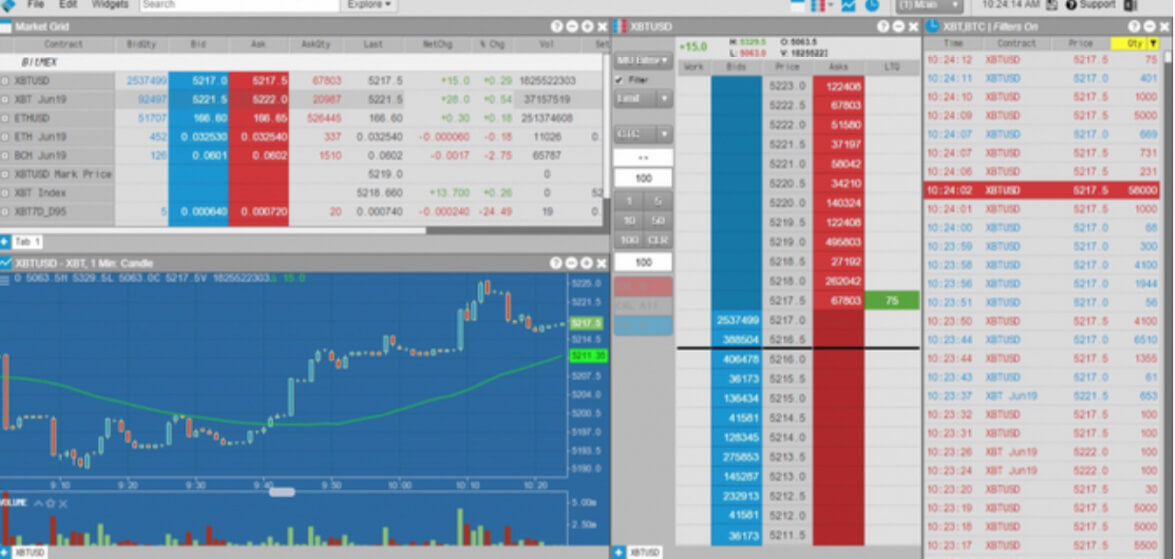

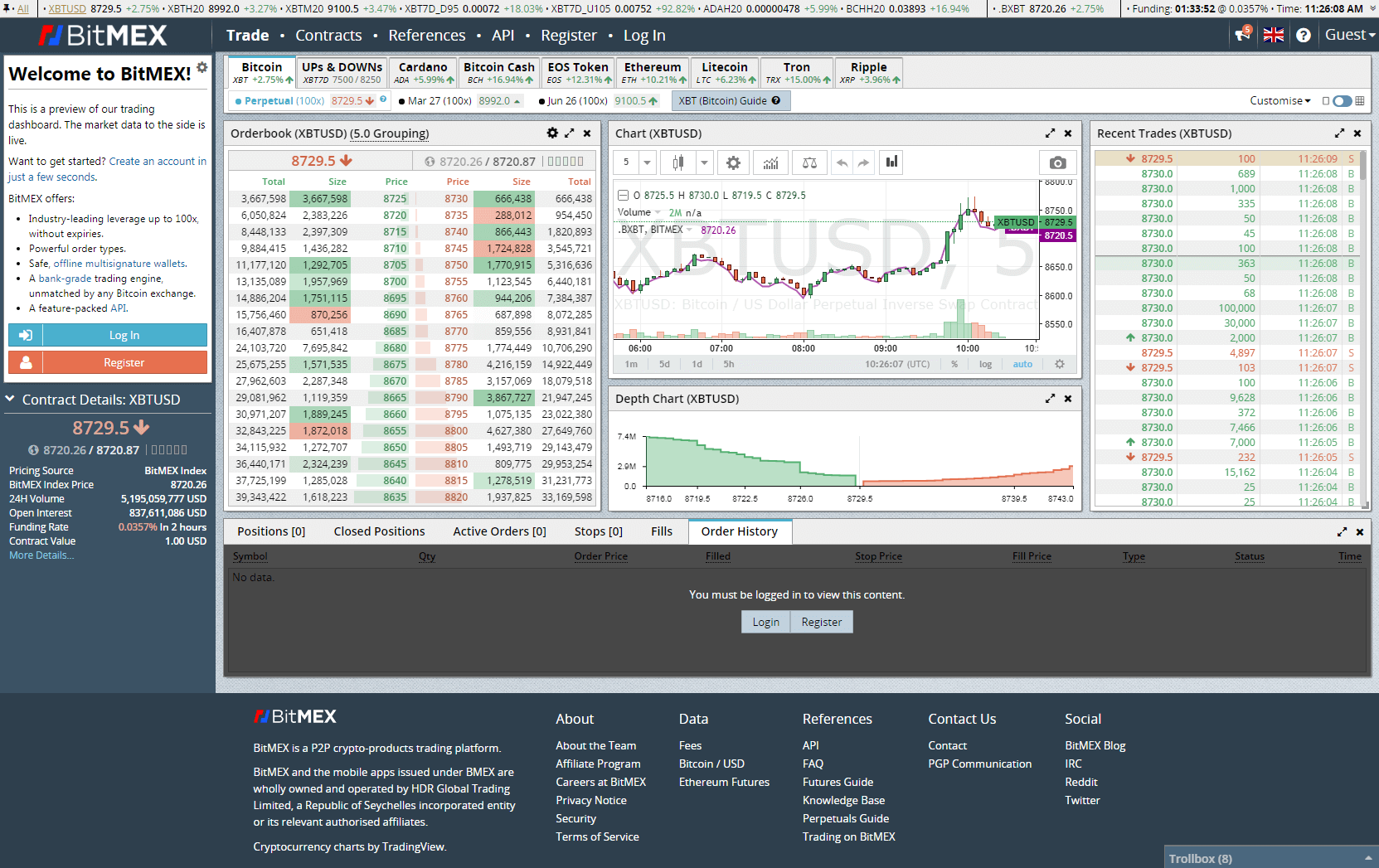

All this helps attract the attention of beginners that want to trade on leverage. When starting, the platform offers 5 to navigate:

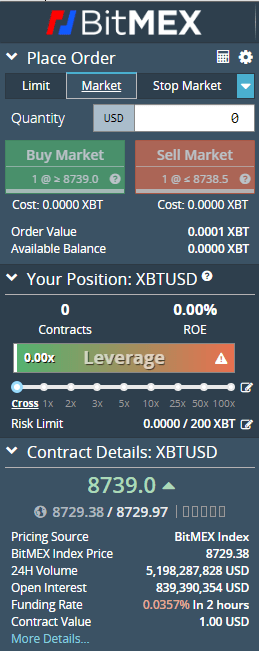

Trade tab: This is the trading part of BitMEX. This tab allows traders to select their preferred trading instrument as well as to choose leverage. They can place and cancel orders in this tab. This tab shows the taken position information as well as other key information in the contract details.

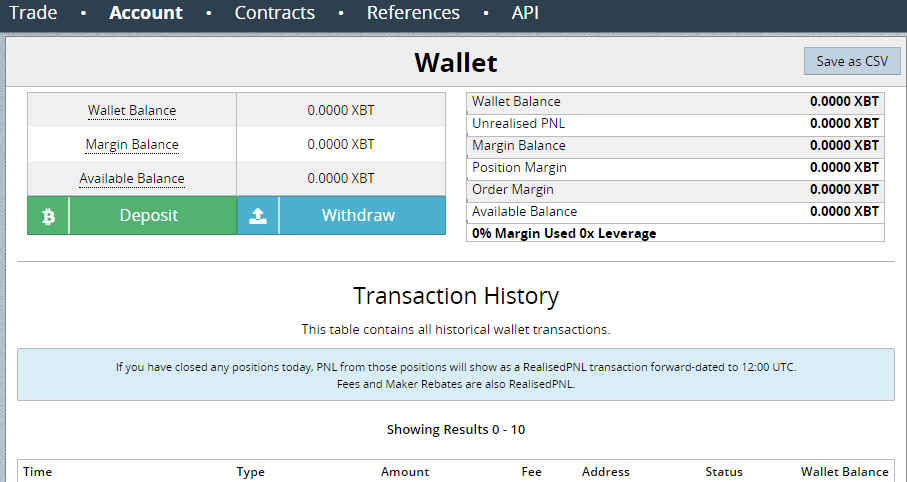

Account tab: This tab shows all the account information. This includes the available Bitcoin margin balances, deposits, withdrawals as well as trade history.

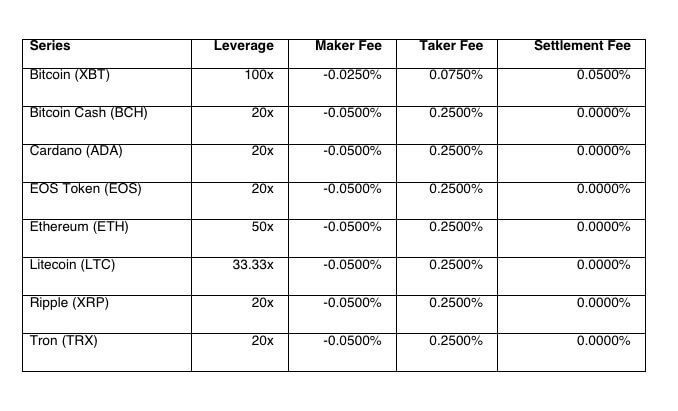

Contracts tab: This tab shows additional instrument information. This includes funding history, contract sizes, leverage, offered expiry, underlying reference Price Index data, and other key features.

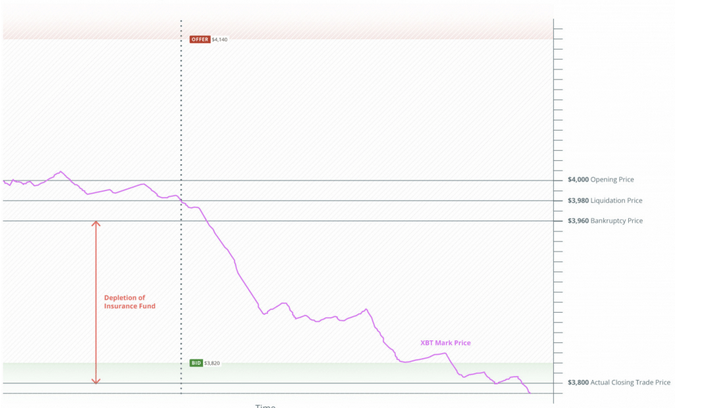

References tab: This tab allows users to learn about futures, perpetual contracts, position marking, as well as and liquidation.

API tab: This tab offers the option to set up an API connection with the BitMEX platform.

BitMEX employs customer support that is available 24/7. The BitMEX team can also be contacted via Twitter or Reddit.

In addition to this, BitMEX offers a variety of educational resources. This includes their FAQ section as well as guides on futures and perpetual contracts.

BitMEX also has a blog that produces high-level descriptions of numerous subjects.

BitMEX offers quite a lot of features, but the truth is that the platform is not exactly suitable for beginners. Margin trading, futures contracts, and swaps are not easily understandable concepts that push beginners away from the platform.

BitMEX Customer Support

As previously mentioned, BitMEX has 24/7 customer support on multiple channels. This includes email support, ticket systems, as well as social media support. The typical response time of their customer support is approximately one hour. Most BitMEX users noted that the customer support service responses are generally helpful and that they are not automatized.

The BitMEX platform also offers a knowledge-base as well as the ‘frequently asked question’ section. These may not always be helpful, but they may offer some assistance when it comes to directing users towards the channels, which will provide further assistance.

Make sure to check out the fifth part of our BitMEX in-depth guide, where we will look into the BitMEX platform’s safety and security.

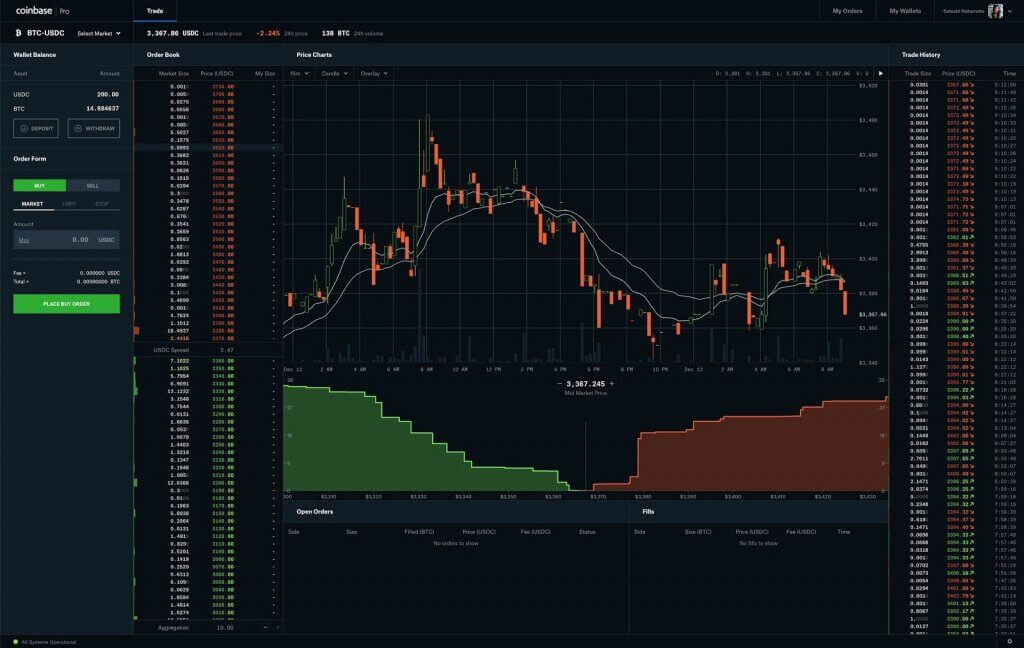

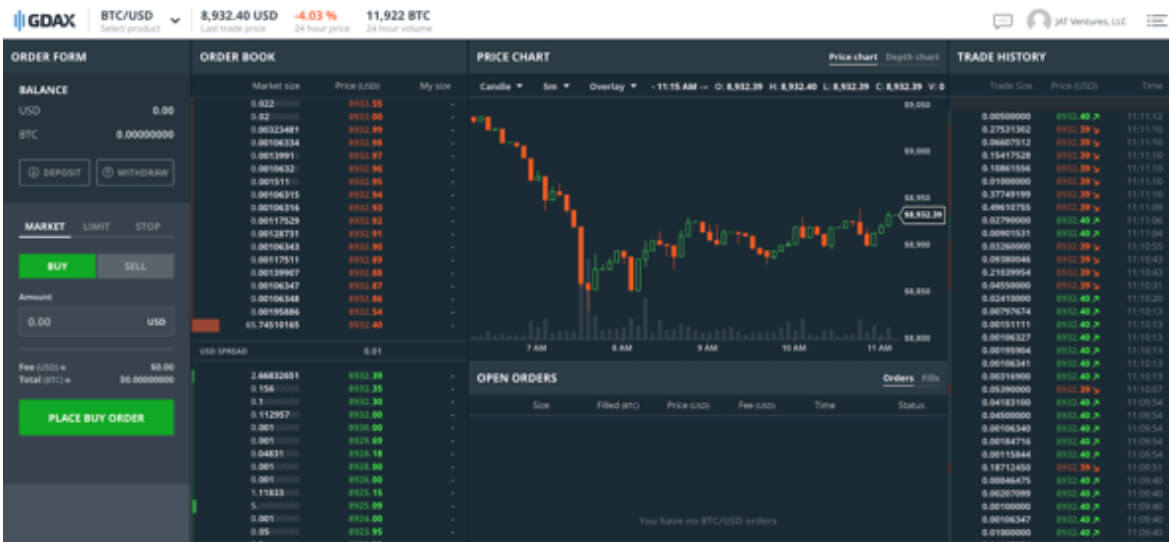

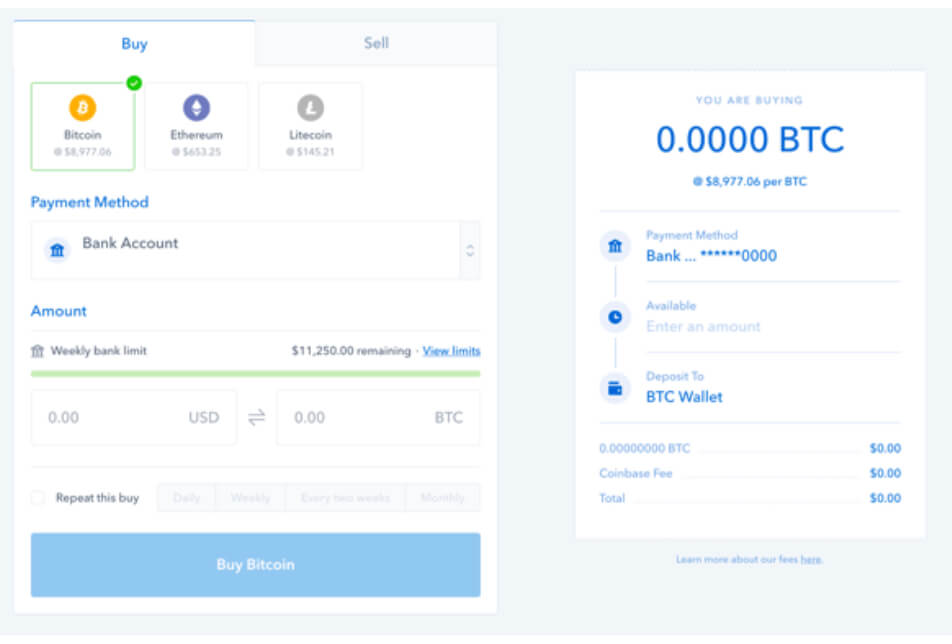

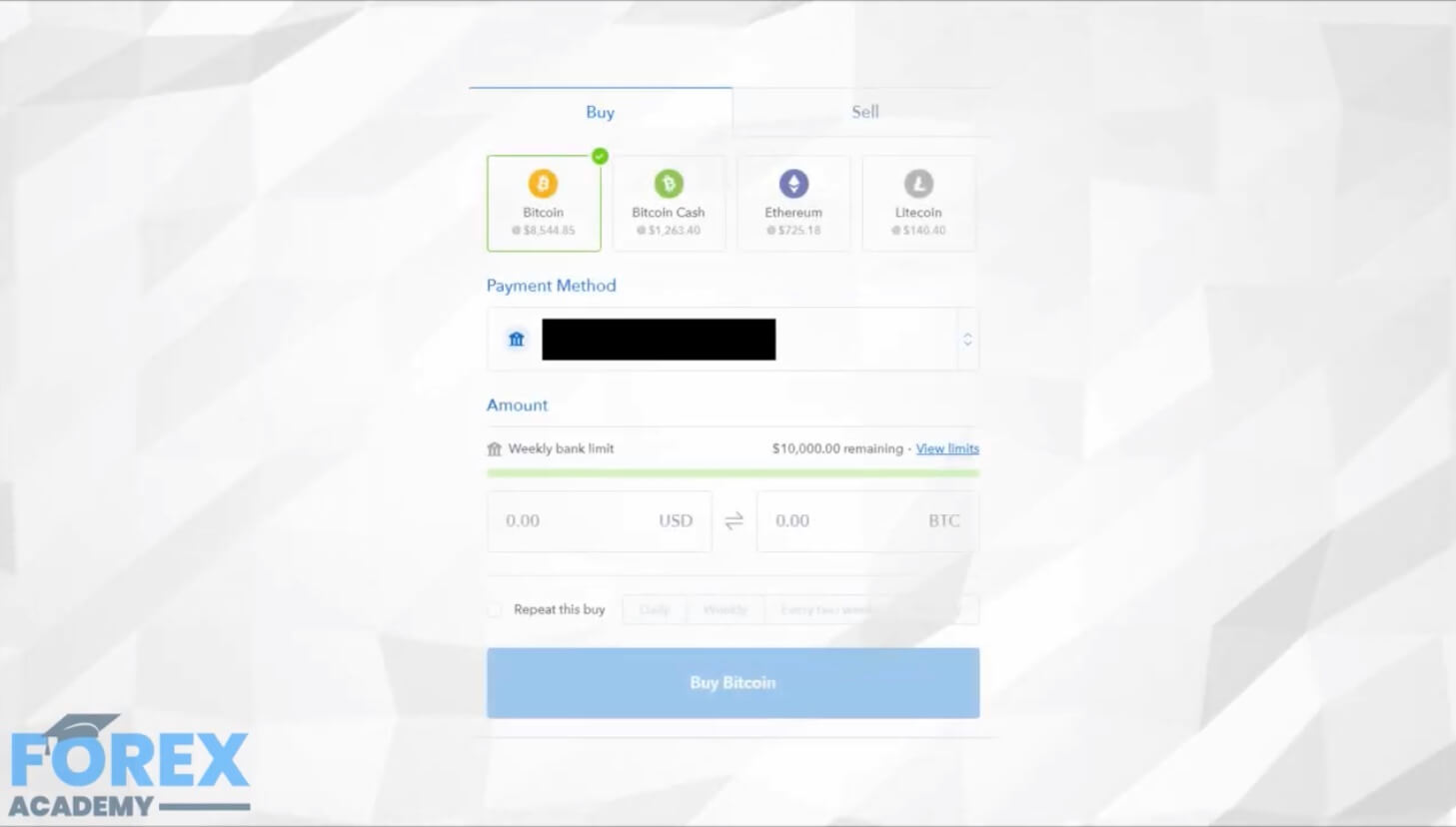

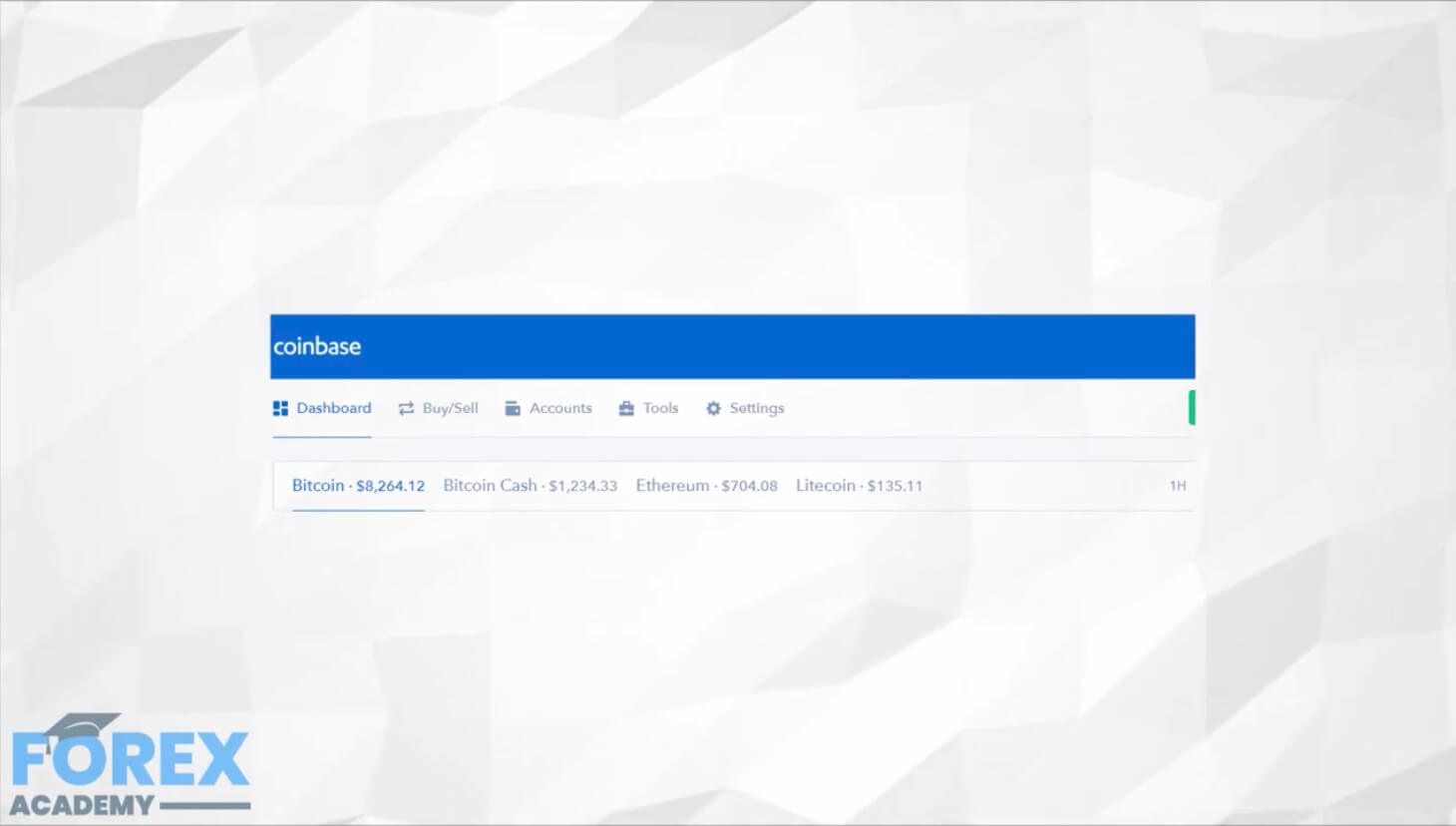

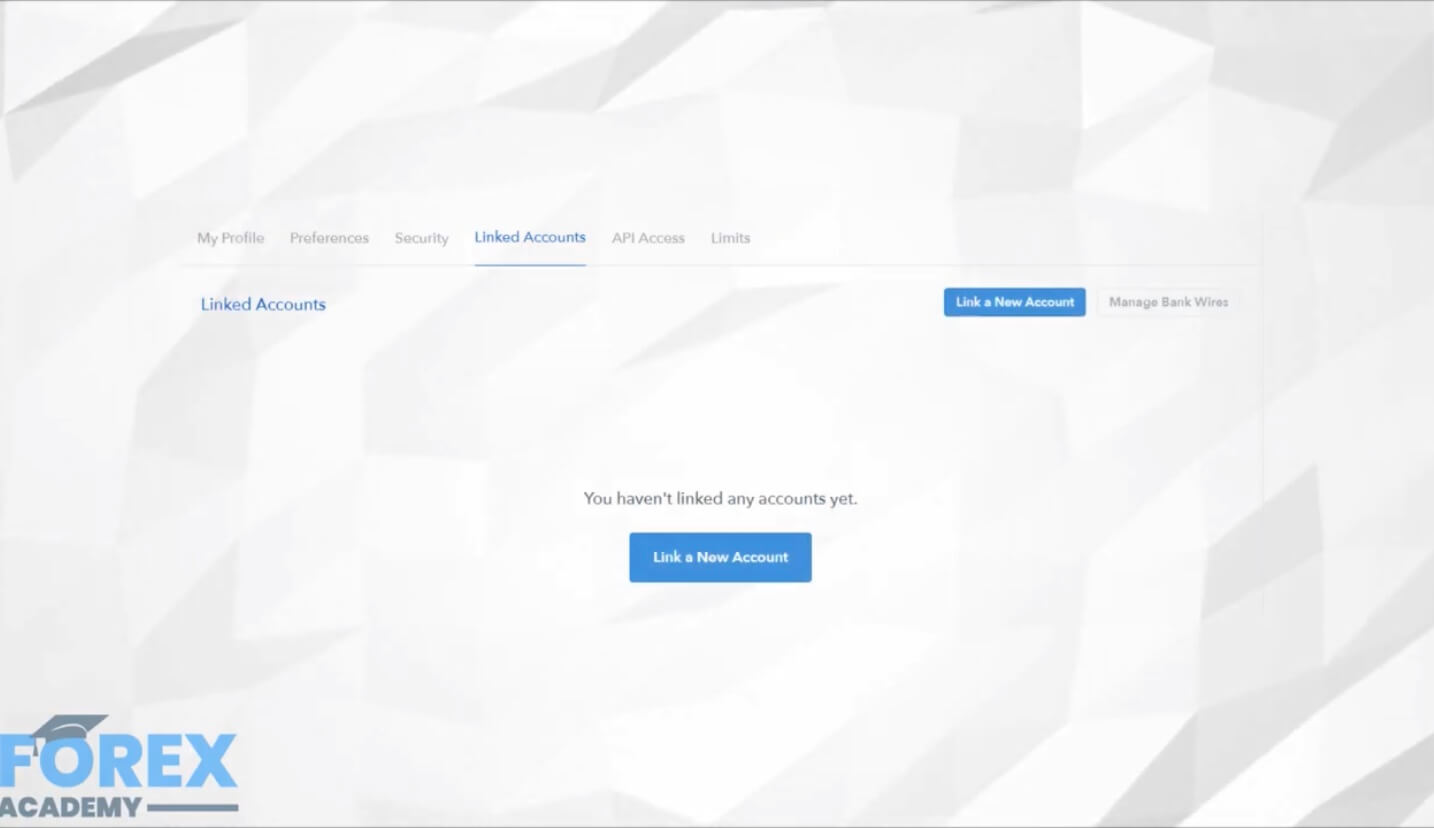

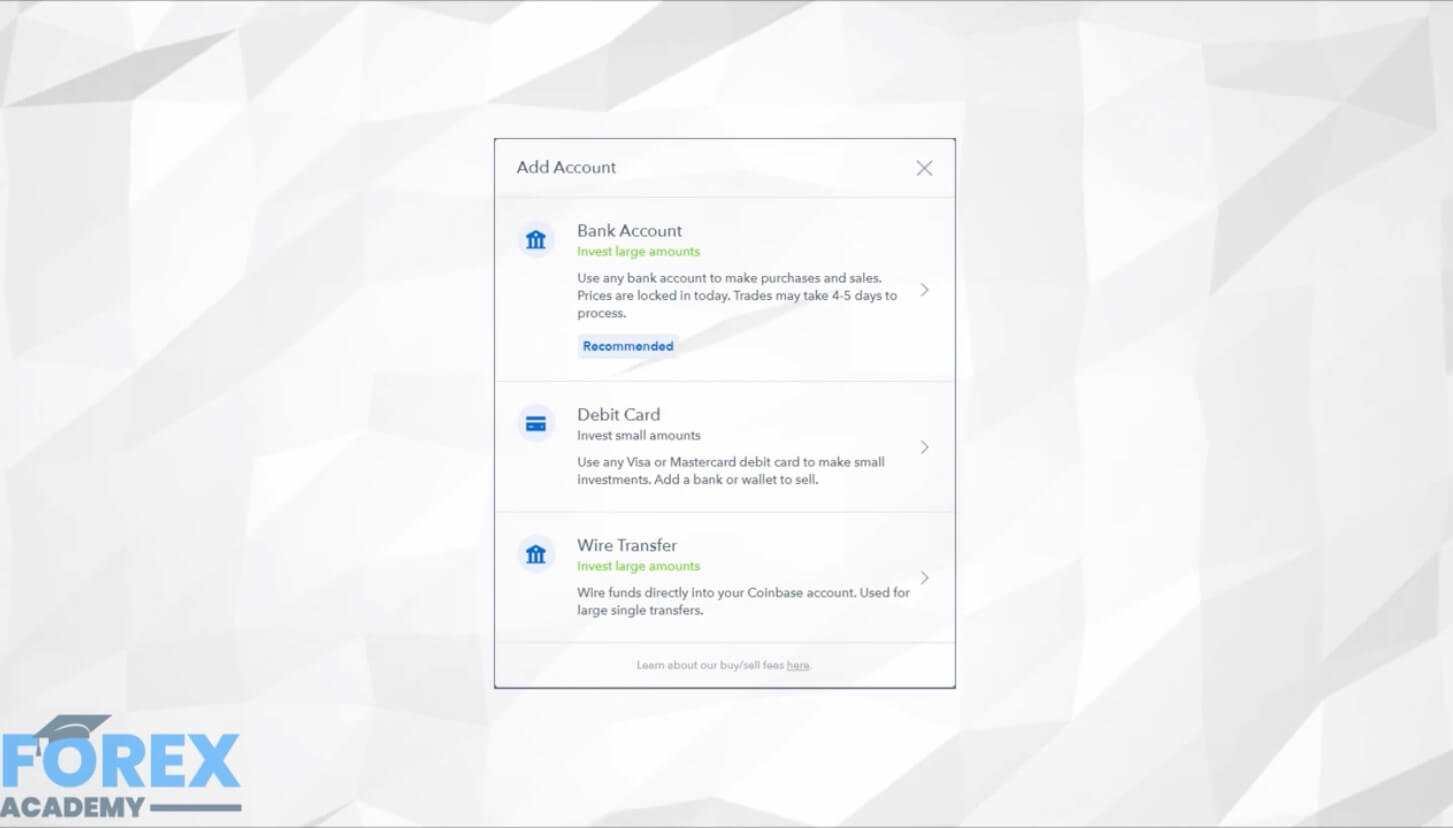

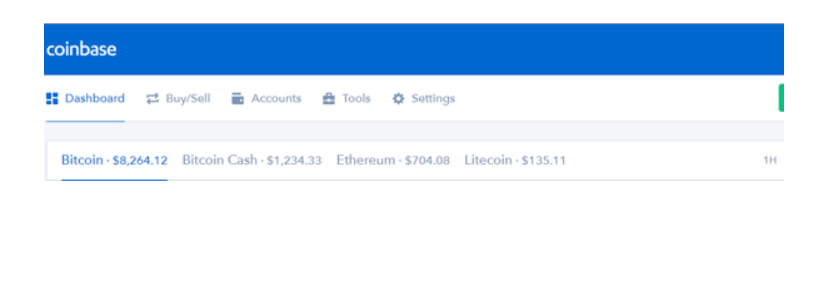

Coinbase users are offered the option to only “buy” or “sell.”

Coinbase users are offered the option to only “buy” or “sell.”

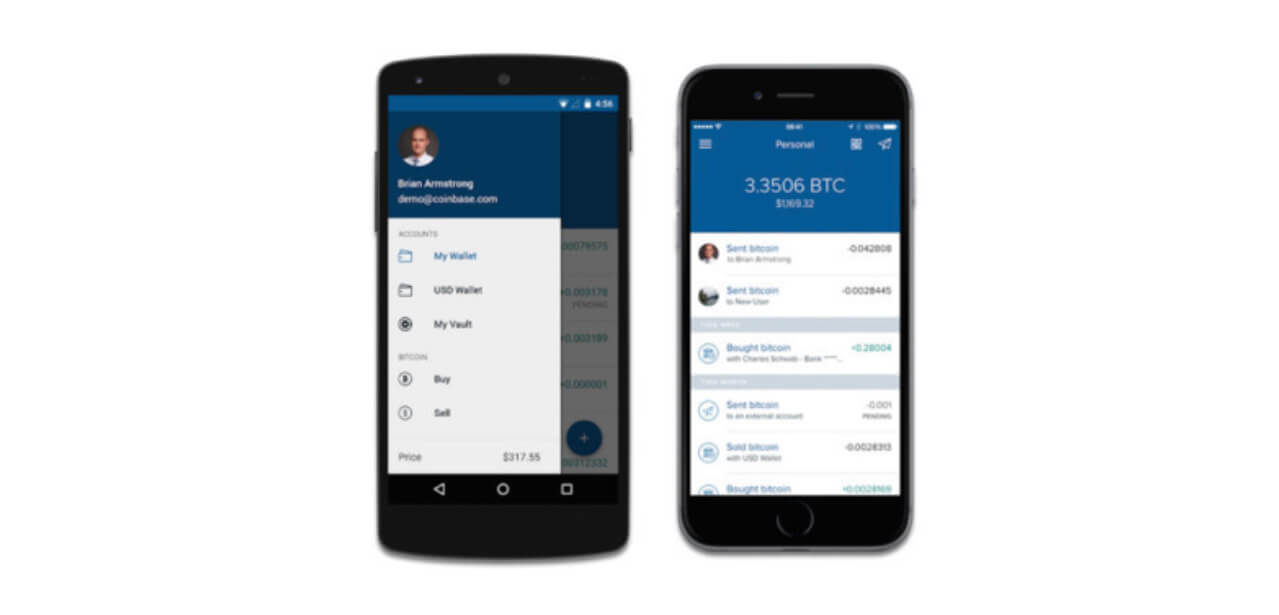

Coinbase can be used on mobile devices as well. It has mobile apps for Android and iOS devices.

Coinbase can be used on mobile devices as well. It has mobile apps for Android and iOS devices.

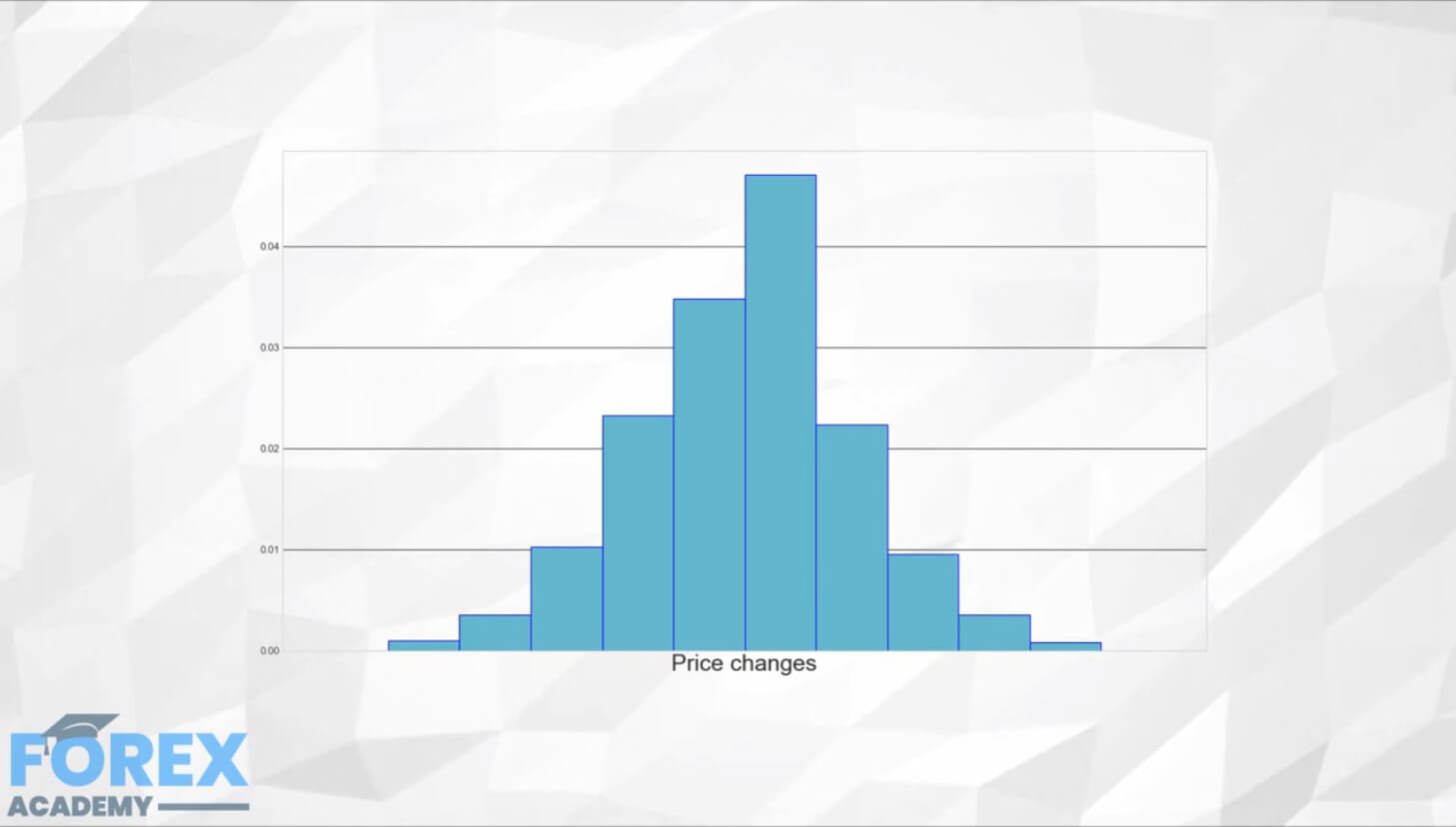

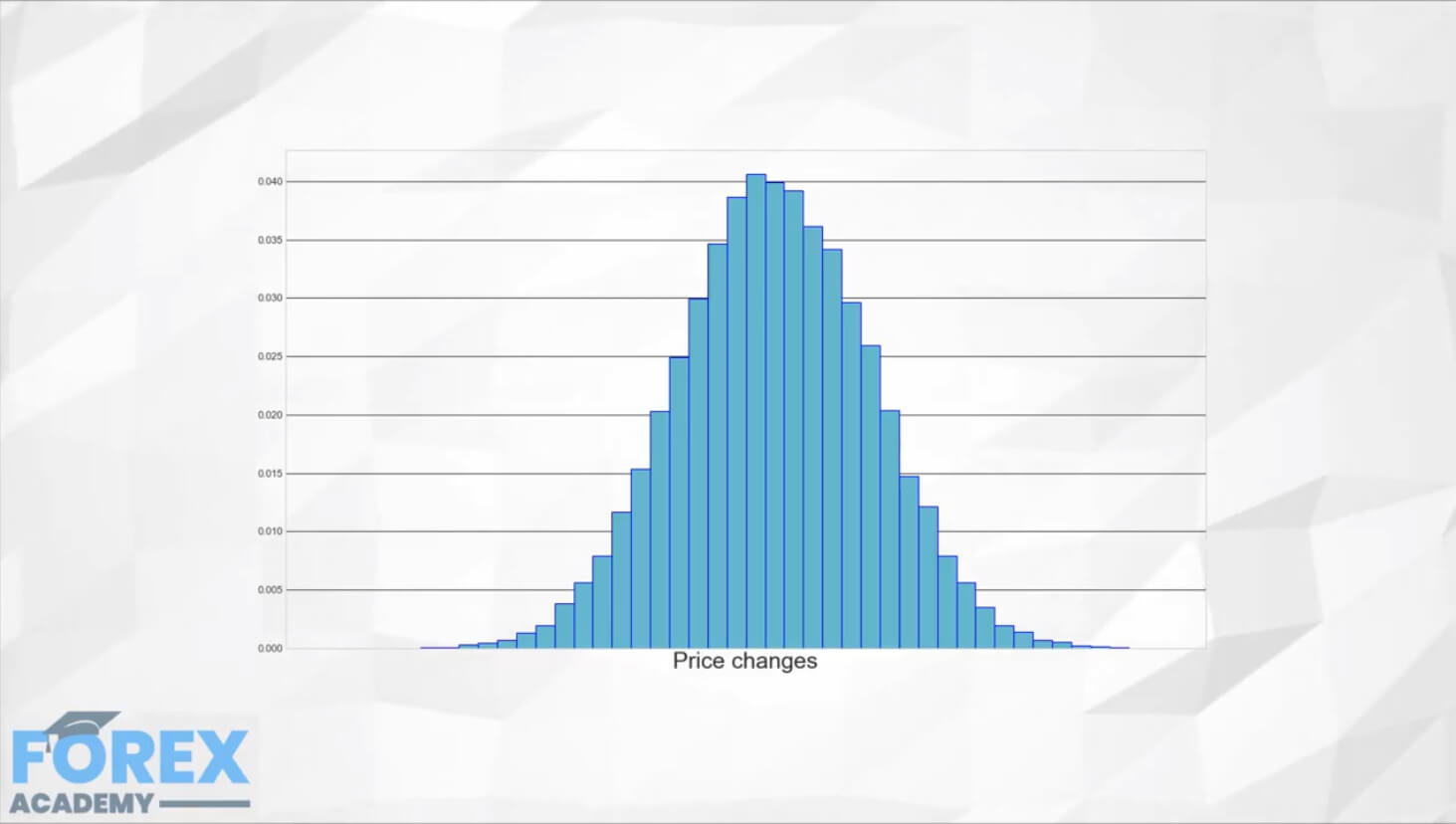

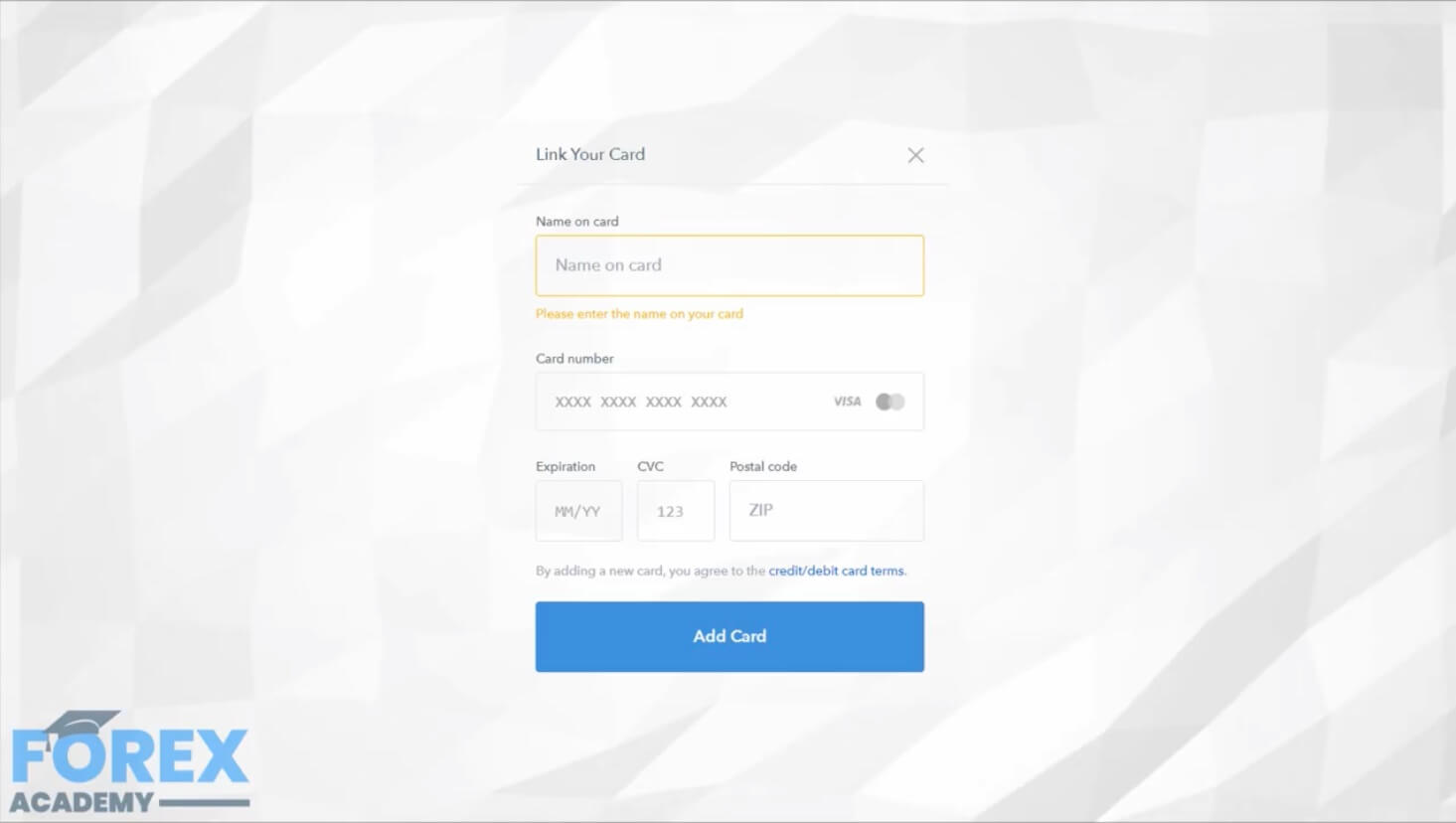

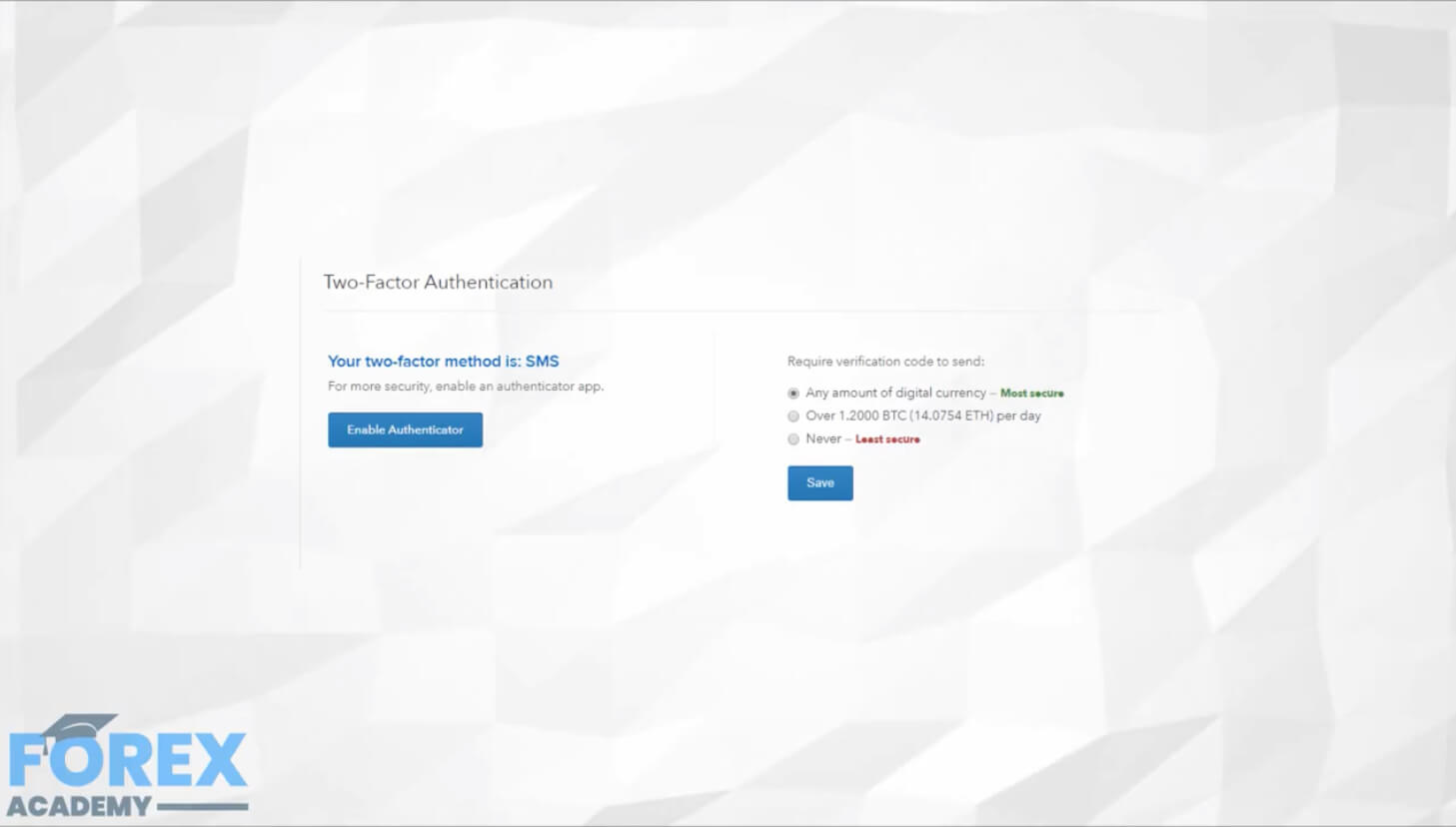

Setting yourself up for success

Setting yourself up for success